The revolving credit facilities are committed and available for general corporate purposes. These credit facilities also provide 100% back-stop support for our commercial paper program, of which we had $200.0 million and $0.0 million outstanding balances as of March 31, 2022 and December 31, 2021, respectively. Most of the banks supporting the credit facilities have other relationships with us. Due to the financial strength and the strong relationships we have with these providers, we are comfortable we have very low risk the financial institutions would be unable or unwilling to fund these facilities.

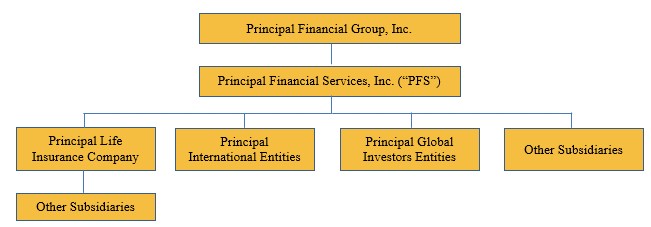

The Holding Companies: PFG and PFS. The principal sources of funds available to our parent holding company, PFG, are dividends from subsidiaries as well as its ability to borrow funds at competitive rates and raise capital to meet operating and growth needs. These funds are used by PFG to meet its obligations, which include the payment of dividends on common stock, debt service and the repurchase of stock. The declaration and payment of common stock dividends is subject to the discretion of our Board and will depend on our overall financial condition, results of operations, capital levels, cash requirements, future prospects, receipt of dividends or other distributions from Principal Life (as described below), risk management considerations and other factors deemed relevant by the Board. No significant restrictions limit the payment of dividends by PFG, except those generally applicable to corporations incorporated in Delaware.

Dividends or other distributions from Principal Life, our primary subsidiary, are limited by Iowa law. Under Iowa law, Principal Life may pay dividends or make other distributions only from the earned surplus arising from its business and must receive the prior approval of the Commissioner of Insurance of the State of Iowa (the “Commissioner”) to pay stockholder dividends or make any other distribution if such distribution would exceed certain statutory limitations. Iowa law gives the Commissioner discretion to disapprove requests for distributions in excess of these limitations. Extraordinary dividends include those made, together with dividends and other distributions, within the preceding twelve months that exceed the greater of (i) 10% of statutory policyholder surplus as of the previous year-end or (ii) the statutory net gain from operations from the previous calendar year, not to exceed earned surplus. Based on statutory results for the year ended December 31, 2021, the ordinary stockholder dividend limitation for Principal Life is approximately $961.7 million in 2022. However, because the dividend test is based on dividends previously paid over rolling 12-month periods, if paid before a specified date during 2022, some or all of such dividends may be extraordinary and require regulatory approval.

Total stockholder dividends paid by Principal Life to its parent for the three months ended March 31, 2022, were $400.0 million, all of which was extraordinary and approved by the Commissioner. As of March 31, 2022, we had $1,849.1 million of cash and liquid assets held in our holding companies and other subsidiaries, which is available for corporate purposes. Corporate balances held in foreign holding companies meet the indefinite reinvestment exception.

Operations. Our primary consolidated cash flow sources are premiums from insurance products, pension and annuity deposits, asset management fee revenues, administrative services fee revenues, income from investments and proceeds from the sales or maturity of investments. Cash outflows consist primarily of payment of benefits to policyholders and beneficiaries, income and other taxes, current operating expenses, payment of dividends to policyholders, payments in connection with investments acquired, payments made to acquire subsidiaries, payments relating to policy and contract surrenders, withdrawals, policy loans, interest payments and repayment of short-term debt and long-term debt. Our investment strategies are generally intended to provide adequate funds to pay benefits without forced sales of investments. For a discussion of our investment objectives and strategies, see “Investments.”

Cash Flows. All cash flow activity, as reported in our consolidated statements of cash flows, provides relevant information regarding our sources and uses of cash. The following discussion of our operating, investing and financing portions of the cash flows excludes cash flows attributable to the separate accounts.

Net cash provided by operating activities was $31.5 million and $140.8 million for the three months ended March 31, 2022 and 2021, respectively. Our insurance business typically generates positive cash flows from operating activities, as premiums collected from our insurance products and income received from our investments exceed acquisition costs, benefits paid, redemptions and operating expenses. These positive cash flows are then invested to support the obligations of our insurance and investment products and required capital supporting these products. Our cash flows from operating activities are affected by the timing of premiums, fees and investment income received and benefits and expenses paid. The decrease in cash provided by operating activities was primarily due to fluctuations in receivables and payables associated with the timing of settlements in 2022 as compared to 2021.

Net cash provided by investing activities was $126.8 million for the three months ended March 31, 2022, compared to net cash used in investing activities of $1,019.2 million for the three months ended March 31, 2021. The increase in cash provided in investing activities was primarily due to increased sales and maturities, net of purchases, of available-for-sale securities in 2022 as compared to 2021.