| |

| Page 7 | |

| |

| limitation: adverse capital and credit market conditions may significantly affect the company’s ability to meet |

| liquidity needs, access to capital and cost of capital; continued difficult conditions in the global capital markets |

| and the economy generally; continued volatility or further declines in the equity markets; changes in interest |

| rates or credit spreads; the company’s investment portfolio is subject to several risks that may diminish the value |

| of its invested assets and the investment returns credited to customers; the company’s valuation of securities may |

| include methodologies, estimations and assumptions that are subject to differing interpretations; the |

| determination of the amount of allowances and impairments taken on the company’s investments requires |

| estimations and assumptions that are subject to differing interpretations; gross unrealized losses may be realized |

| or result in future impairments; competition from companies that may have greater financial resources, broader |

| arrays of products, higher ratings and stronger financial performance; a downgrade in the company’s financial |

| strength or credit ratings; inability to attract and retain sales representatives and develop new distribution |

| sources; international business risks; the company’s actual experience could differ significantly from its pricing |

| and reserving assumptions; the company’s ability to pay stockholder dividends and meet its obligations may be |

| constrained by the limitations on dividends or distributions Iowa insurance laws impose on Principal Life; the |

| pattern of amortizing the company’s DPAC and other actuarial balances on its universal life-type insurance |

| contracts, participating life insurance policies and certain investment contracts may change; the company may |

| need to fund deficiencies in its “Closed Block” assets that support participating ordinary life insurance policies |

| that had a dividend scale in force at the time of Principal Life’s 1998 conversion into a stock life insurance |

| company; the company’s reinsurers could default on their obligations or increase their rates; risks arising from |

| acquisitions of businesses; changes in laws, regulations or accounting standards; a computer system failure or |

| security breach could disrupt the company’s business, and damage its reputation; results of litigation and |

| regulatory investigations; from time to time the company may become subject to tax audits, tax litigation or |

| similar proceedings, and as a result it may owe additional taxes, interest and penalties in amounts that may be |

| material; fluctuations in foreign currency exchange rates; and applicable laws and the company’s stockholder |

| rights plan, certificate of incorporation and by-laws may discourage takeovers and business combinations that |

| some stockholders might consider in their best interests. |

| |

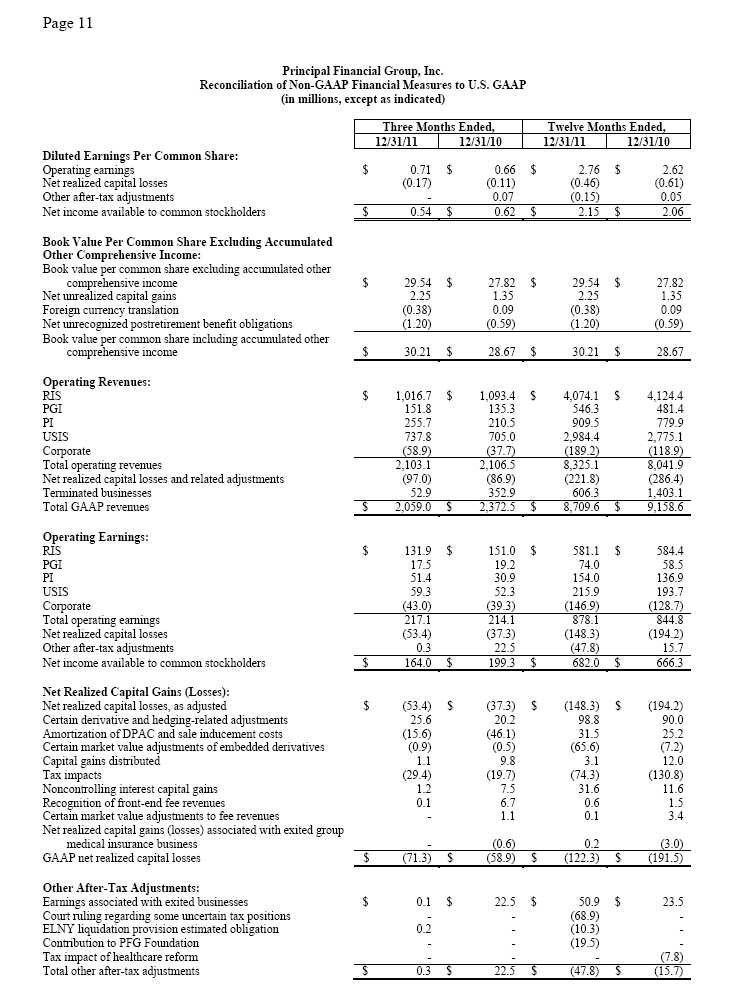

| Use of Non-GAAP Financial Measures |

| The company uses a number of non-GAAP financial measures that management believes are useful to investors |

| because they illustrate the performance of normal, ongoing operations, which is important in understanding and |

| evaluating the company’s financial condition and results of operations. They are not, however, a substitute for |

| U.S. GAAP financial measures. Therefore, the company has provided reconciliations of the non-GAAP |

| measures to the most directly comparable U.S. GAAP measure at the end of the release. The company adjusts |

| U.S. GAAP measures for items not directly related to ongoing operations. However, it is possible these |

| adjusting items have occurred in the past and could recur in the future reporting periods. Management also uses |

| non-GAAP measures for goal setting, as a basis for determining employee and senior management |

| awards and compensation, and evaluating performance on a basis comparable to that used by investors |

| and securities analysts. |

| |

| Earnings Conference Call |

| On Friday, Feb. 3, 2012 at 10:00 a.m. (ET), Chairman, President and Chief Executive Officer Larry |

| Zimpleman and Senior Vice President and Chief Financial Officer Terry Lillis will lead a discussion of |

| results, asset quality and capital adequacy during a live conference call, which can be accessed as follows: |

| • | Via live Internet webcast. Please go towww.principal.com/investor at least 10-15 minutes prior to the |

| | start of the call to register, and to download and install any necessary audio software. |

| • | Via telephone by dialing 800-374-1609 (U.S. and Canadian callers) or 706-643-7701 (International |

| | callers) approximately 10 minutes prior to the start of the call. The access code is 39011663. |

| • | Replay of the earnings call via telephone is available by dialing 855-859-2056 (U.S. and Canadian |

| | callers) or 404-537-3406 (International callers). The access code is 39011663. This replay will be |

| | available approximately two hours after the completion of the live earnings call through the end of day |

| | Feb. 10, 2012. |