UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-QSB

(Mark One)

[ X ]QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period endedJanuary 31, 2005

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

COMMISSION FILE NUMBER000-49859

NORMARK VENTURES CORP.

(Exact name of small business issuer as specified in its charter)

| NEVADA | 98 -0233347 |

| (State or other jurisdiction of incorporation or | (IRS Employer Identification No.) |

| organization) | |

2162 Acadia Road

Vancouver, British Columbia, Canada V6T 1R5

(Address of principal executive offices)

(519) 371- 9302

(Issuer's telephone number)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ]No [ X ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes [ X ]No [ ]

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date:As of September 27, 2007, the registrant had 11,500,000 Shares of Common Stock outstanding.

Transitional Small Business Disclosure Format (check one): Yes [ ]No [X]

1

PART I - FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS. |

The accompanying unaudited financial statements have been prepared in accordance with the instructions to Form 10-QSB and Item 310(b) of Regulation S-B, and, therefore, do not include all information and footnotes necessary for a complete presentation of financial position, results of operations, cash flows, and stockholders' equity in conformity with generally accepted accounting principles. In the opinion of management, all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included and all such adjustments are of a normal recurring nature. These financial statements should be read in conjunction with Normark’s audited financial statements and notes for the year ended April 30, 2004, included in the Company’s Annual Report on Form 10-KSB, filed on July 23, 2007, with the Securities and Exchange Commission. Operating results for the nine months ended January 31, 2005, are not necessarily indicative of the results that can be expected for the year ending April 30, 2005.

As used in this Quarterly Report, the terms "we”, "us”, "our”, the “Company” and “Normark” mean Normark Ventures Corp. unless otherwise indicated. All dollar amounts in this Quarterly Report are in U.S. dollars unless otherwise stated.

2

| NORMARK VENTURES CORP. |

| (An Exploration Stage Company) |

| |

| |

| FINANCIAL STATEMENTS |

| (Expressed in United States Dollars) |

| (Unaudited) |

| |

| |

| JANUARY 31, 2005 |

| NORMARK VENTURES CORP. | | | |

| (An Exploration Stage Company) | | | |

| BALANCE SHEETS | | | |

| (Expressed in United States Dollars) | | | |

| | | | |

| | | | |

| | | January 31, | |

| | | 2005 | |

| | | (Unaudited) | |

| | | | |

| | | | |

| | | | |

| ASSETS | | | |

| | | | |

| | | | |

| Current | | | |

| Cash | $ | 13,167 | |

| Deferred tax asset less valuation allowance of $56,083 | | - | |

| | | | |

| Total assets | $ | 13,167 | |

| | | | |

| | | | |

| | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIENCY | | | |

| | | | |

| | | | |

| Current | | | |

| Accounts payable and accrued liabilities | $ | 16,142 | |

| Due to related parties (Note 5) | | 40,319 | |

| | | | |

| Total current liabilities | | 56,461 | |

| | | | |

| Stockholders' deficiency | | | |

| Common stock (Note 6) | | | |

| Authorized | | | |

| 100,000,000 common shares, par value of $0.001 | | | |

| Issued | | | |

| 10,100,000 common shares | | 10,100 | |

| Additional paid-in capital (Note 6) | | 163,100 | |

| Deficit accumulated during the exploration stage | | (216,494 | ) |

| | | | |

| Total stockholders' deficiency | | (43,294 | ) |

| | | | |

| Total liabilities and stockholders' deficiency | $ | 13,167 | |

History and organization of the Company (Note 1)

The accompanying notes are an integral part of these financial statements.

| NORMARK VENTURES CORP. | | | | | | | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | | | | | | | |

| STATEMENTS OF OPERATIONS | | | | | | | | | | | | | | | |

| (Expressed in United States Dollars) | | | | | | | | | | | | | | | |

| (Unaudited) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | | | | | | | | | | | |

| | | Amounts | | | | | | | | | | | | | |

| | | From | | | | | | | | | | | | | |

| | | Incorporation | | | | | | | | | | | | | |

| | | on July 27, | | | Three Month | | | Three Month | | | Nine Month | | | Nine Month | |

| | | 2000 to | | | Period Ended | | | Period Ended | | | Period Ended | | | Period Ended | |

| | | January 31, | | | January 31, | | | January 31, | | | January 31, | | | January 31, | |

| | | 2005 | | | 2005 | | | 2004 | | | 2005 | | | 2004 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| EXPENSES | | | | | | | | | | | | | | | |

| Bank charges | $ | 1,025 | | $ | 14 | | $ | 14 | | $ | 43 | | $ | 89 | |

| Consulting fees | | 8,699 | | | - | | | - | | | - | | | - | |

| Management fees | | 17,655 | | | - | | | - | | | - | | | - | |

| Mineral property costs (Note 4) | | 52,445 | | | - | | | | | | 18,724 | | | 4,550 | |

| Office and general | | 5,554 | | | 80 | | | 109 | | | 855 | | | 456 | |

| Professional fees | | 115,942 | | | 5,747 | | | 3,877 | | | 20,626 | | | 14,855 | |

| Telephone and utilities | | 3,849 | | | - | | | - | | | - | | | - | |

| Travel and promotion | | 12,584 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Loss before other item | | (217,753 | ) | | (5,841 | ) | | (4,000 | ) | | (40,248 | ) | | (19,950 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| OTHER ITEM | | | | | | | | | | | | | | | |

| Interest income | | 1,259 | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net loss before income taxes | | (216,494 | ) | | (5,841 | ) | | (4,000 | ) | | (40,248 | ) | | (19,950 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Provision for income taxes | | - | | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net loss for the period | $ | (216,494 | ) | $ | (5,841 | ) | $ | (4,000 | ) | $ | (40,248 | ) | $ | (19,950 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | | | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.01 | ) |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Weighted average number of shares | | | | | | | | | | | | | | | |

| of common stock outstanding | | | | | 10,100,000 | | | 8,400,000 | | | 9,816,667 | | | 8,400,000 | |

The accompanying notes are an integral part of these financial statements.

| NORMARK VENTURES CORP. | | | | | | | | | |

| (An Exploration Stage Company) | | | | | | | | | |

| STATEMENTS OF CASH FLOWS | | | | | | | | | |

| (Expressed in United States Dollars) | | | | | | | | | |

| (Unaudited) | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | Cumulative | | | | | | | |

| | | Amounts | | | | | | | |

| | | From | | | | | | | |

| | | Incorporation | | | | | | | |

| | | on July 27, | | | Nine Month | | | Nine Month | |

| | | 2000 to | | | Period Ended | | | Period Ended | |

| | | January 31, | | | January 31, | | | January 31, | |

| | | 2005 | | | 2005 | | | 2004 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net loss for the period | $ | (216,494 | ) | $ | (40,248 | ) | $ | (19,950 | ) |

| Item not affecting cash: | | | | | | | | | |

| Accrued management fees to related party | | 4,420 | | | - | | | - | |

| | | | | | | | | | |

| Change in non-cash working capital item: | | | | | | | | | |

| Increase (decrease) in accounts payable and accrued liabilities | | 16,142 | | | (31,786 | ) | | 14,698 | |

| | | | | | | | | | |

| Net cash used in operating activities | | (195,932 | ) | | (72,034 | ) | | (5,252 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | |

| Issuance of capital stock for cash | | 173,200 | | | 85,000 | | | - | |

| Increase in due to related parties | | 35,899 | | | 186 | | | 5,187 | |

| | | | | | | | | | |

| Net cash provided by financing activities | | 209,099 | | | 85,186 | | | 5,187 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Change in cash during the period | | 13,167 | | | 13,152 | | | (65 | ) |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash, beginning of period | | - | | | 15 | | | 93 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash, end of period | $ | 13,167 | | $ | 13,167 | | $ | 28 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash paid during the period for interest | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash paid during the period for income taxes | $ | - | | $ | - | | $ | - | |

The accompanying notes are an integral part of these financial statements.

| NORMARK VENTURES CORP. |

| NOTES TO THE FINANCIAL STATEMENTS |

| (Expressed in United States Dollars) |

| (Unaudited) |

| JANUARY 31, 2005 |

| 1. | HISTORY AND ORGANIZATION OF THE COMPANY |

| | |

| The Company was incorporated on July 27, 2000 under the Laws of the State of Nevada and is in the business of acquisition and exploration of mineral properties. The Company is considered to be an exploration stage company. |

| | |

| 2. | BASIS OF PRESENTATION |

| | |

| The accompanying interim financial statements have been prepared by the Company in conformity with generally accepted accounting principles in the United States of America for interim financial statements. In the opinion of management, the accompanying interim financial statements contain all adjustments necessary (consisting of normal recurring accruals) to present fairly the financial information contained therein. These interim financial statements do not include all disclosures required by generally accepted accounting principles in the United States of America and should be read in conjunction with the audited financial statements of the Company for the year ended April 30, 2004. The results of operations for the nine month period ended January 31, 2005 are not necessarily indicative of the results to be expected for the year ending April 30, 2005. |

| | |

| 3. | GOING CONCERN |

| | |

| These financial statements have been prepared in conformity with generally accepted accounting principles in the United States of America applicable to a going concern which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The general business strategy of the Company is to acquire and explore mineral properties either directly or through the acquisition of operating entities. The continued operations of the Company and the recoverability of mineral property costs is dependent upon the existence of economically recoverable reserves, confirmation of the Company's interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the exploration and development and upon future profitable production. The Company has incurred operating losses and requires additional funds to meet its obligations and maintain its operations. Management's plan in this regard is to raise equity financing as required. These conditions raise substantial doubt about the Company's ability to continue as a going concern. These financial statements do not include any adjustments that might result from this uncertainty. |

| | | | | |

| | | | January 31, | |

| | | | 2005 | |

| | | | | |

| | Deficit accumulated during the exploration stage | $ | (216,494 | ) |

| | Working capital (deficiency) | | (43,294 | ) |

| NORMARK VENTURES CORP. |

| (An Exploration Stage Company) |

| NOTES TO THE FINANCIAL STATEMENTS |

| (Expressed in United States Dollars) |

| (Unaudited) |

| JANUARY 31, 2005 |

| 4. | MINERAL PROPERTY COSTS |

| | |

| Pursuant to an agreement dated April 30, 2001, the Company acquired a 100% interest in certain mining claims located in the Whitehorse Mining District of the Yukon Territory in Canada for $6,416 (CDN$10,000 - paid). As the claims do not contain any known reserves, the acquisition costs were expensed during the period ended April 30, 2001. The property is subject to a 2% Net Smelter Returns royalty ("NSR") payable to the vendor. If, after commencement of commercial production, the NSR payable to the vendor in any calendar year is less than $12,832 (CDN$20,000), then the Company will be obligated to pay to the vendor the difference between the $12,832 and the actual NSR paid for the year. The royalty will terminate once the vendor receives a total of CDN$1,000,000 in royalty payments. |

| | |

| If the Company abandons the property, the Company is obligated to maintain the claims in good standing for a minimum period of one year from the date of abandonment. |

| | |

| Subsequently, the Company renewed the mineral property claims for further terms of one year expiring on November 27, 2007. |

| | |

| 5. | DUE TO RELATED PARTIES |

| | |

| Due to related parties consists of amounts due to a director and to a company controlled by a director of the Company that are non-interest bearing, unsecured and have no fixed terms of repayment. |

| | |

| 6. | COMMON STOCK |

| | |

| On August 15, 2000, the Company issued 4,200,000 shares of common stock for total proceeds of $4,200. |

| | |

| On March 15, 2001, the Company issued 4,200,000 shares of common stock for total proceeds of $84,000. |

| | |

| On June 15, 2004, the Company issued 1,700,000 shares of common stock for total proceeds of $85,000. |

| | |

| Common shares |

| | |

| The common shares of the Company are all of the same class, are voting and entitle stockholders to receive dividends. Upon liquidation or wind-up, stockholders are entitled to participate equally with respect to any distribution of net assets or any dividends which may be declared. |

| | |

| Additional paid-in capital |

| | |

| The excess of proceeds received for shares of common stock over their par value of $0.001, less share issue costs, is credited to additional paid-in capital. |

| NORMARK VENTURES CORP. |

| (An Exploration Stage Company) |

| NOTES TO THE FINANCIAL STATEMENTS |

| (Expressed in United States Dollars) |

| (Unaudited) |

| JANUARY 31, 2005 |

| 7. | FINANCIAL INSTRUMENTS |

| | |

| The Company's financial instruments consist of cash, accounts payable and accrued liabilities and due to related parties. Unless otherwise noted, it is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments. The fair value of these financial instruments approximates their carrying values, unless otherwise noted. |

| | |

| 8. | SEGMENTED INFORMATION |

| | |

| The Company operates in one reportable segment, being the exploration of mineral properties, in Canada. |

| | |

| 9. | SUBSEQUENT EVENT |

| | |

| In April 2005, the Company completed an offering of 1,400,000 shares of common stock at a price of CDN$0.065 per share for proceeds of CDN$91,000. |

| ITEM 2. | MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION. |

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Quarterly Report constitute "forward-looking statements”. These statements, identified by words such as “plan”, "anticipate”, "believe”, "estimate”, "should”, "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the caption "Management's Discussion and Analysis or Plan of Operation" and elsewhere in this Quarterly Report. We advise you to carefully review the reports and documents we file from time to time with the Securities and Exchange Commission (the “SEC”), particularly our Annual Reports on Form 10-KSB and our Current Reports on Form 8-K.

Foreign Currency and Exchange Rates

For purposes of consistency and to express United States dollars throughout this Quarterly Report, Canadian dollars have been converted into United States currency at the rate of US$1.00 being approximately equal to CDN$1.12, which is the approximate average exchange rate during the preceding months.

GENERAL

We were incorporated on July 27, 2000, under the laws of the State of Nevada. We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We own four mineral claims that we refer to as the “Wheaton River” mineral claims, as described below (the “Wheaton River Claims”). We presently plan to complete our preliminary exploration work to search for mineral reserves on these claims. Our current cash reserves are only sufficient to enable us to operate on a short-term basis. We continue to require additional financing if we are to continue as a going concern and to finance our business operations.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our Wheaton River Claims. We are in the process of completing the initial preliminary exploration work. However, we will require additional funds in order to complete the full exploration of the Wheaton River Claims. We can provide no assurance to investors that our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on such work concludes economic feasibility of commercial production of mineral reserves from the claims.

3

Wheaton River Claims Purchase Agreement

We purchased four mineral claims located in the Whitehorse Mining District of the Yukon Territory, Canada pursuant to our purchase agreement with Mr. Glen MacDonald dated April 30, 2001. The purchase price of the Wheaton River Claims consisted of: (i) a cash payment of $8,800 (CDN$10,000); and (ii) a 2% net smelter returns royalty (the “Royalty”) payable to Mr. MacDonald in the event that we enter into commercial mineral production on the Wheaton River Claims. The Royalty consists of 2% of the net smelter returns on the gross proceeds that we earn from the sale of any bullion, concentrates or ore from the mining of the mineral claims, less eligible costs of transportation and smelting and refining charges. If, after commencement of commercial production from the mineral claims, the royalty payable to Mr. MacDonald in any calendar year is less than $17,600 (CDN$20,000), then we will be obligated to pay to Mr. MacDonald the difference between $17,600 (CDN$20,000) and the actual amount of Royalty paid to Mr. MacDonald for the year. The Royalty will terminate once we pay to Mr. MacDonald an aggregate total of $880,000 (CDN$1,000,000) in Royalty payments.

Recording of the Wheaton River Claims

The Wheaton River Claims consist of four mineral claims located in the Whitehorse Mining District of the Yukon Territories, Canada. Mr. MacDonald recorded the mineral claims on November 27, 2000, pursuant to the Yukon Quartz Mining Act. The mineral claims have the following legal description:

| Name of Mining Claim | Grant Number | Claim Sheet Number |

| AVA 1 | YC18994 | 105D03 |

| AVA 2 | YC18995 | 105D03 |

| AVA 3 | YC18996 | 105D03 |

| AVA 4 | YC18997 | 105D03 |

The Wheaton River Claims were staked in November 2000 by Mr. MacDonald to cover the area of potential gold mineralization. Our mineral claims will expire on November 27, 2007. We intend to extend our claims on this expiration date. We are the beneficial owner of title to the Wheaton River Claims subject to our agreement to pay the Royalty.

In order to maintain our mineral claims in good standing, we must complete exploration work on the mineral claims and file confirmation of the completion of work on the mineral claims with the applicable mining recording office of the Yukon Territory. Currently, exploration work with a minimum value of $88 (CDN$100) per claim is required during each year. If we do not complete this minimum amount of exploration work, we may pay a fee of $88 (CDN$100) per claim each year and meet this requirement. The completion of mineral exploration work or payment in lieu of exploration work in any year will extend the existence of our mineral claims for one additional year. As our mineral claims are effective until November 27, 2007, we must file confirmation of the completion of exploration work in the minimum amount of $352 (CDN$400) or make a payment in lieu or exploration work in the amount of $352 (CDN$400) by November 27, 2007. If we fail to complete the minimum required amount of exploration work or fail to make a payment in lieu of this exploration work, then our mineral claims will lapse on November 27, 2007, and we will lose all interest that we have in these mineral claims.

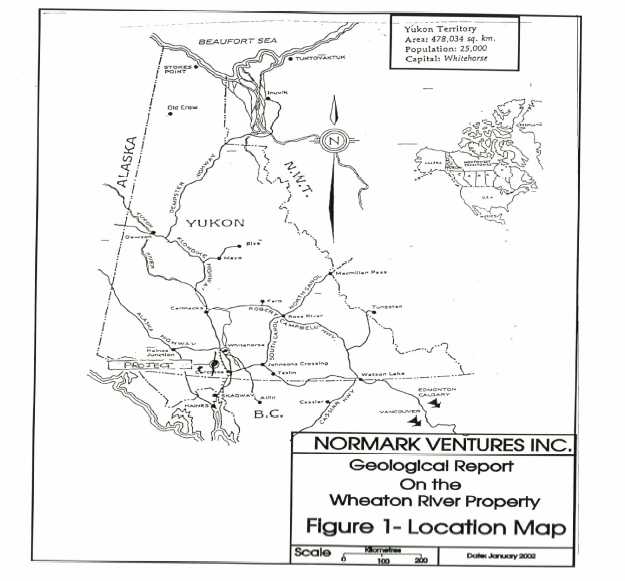

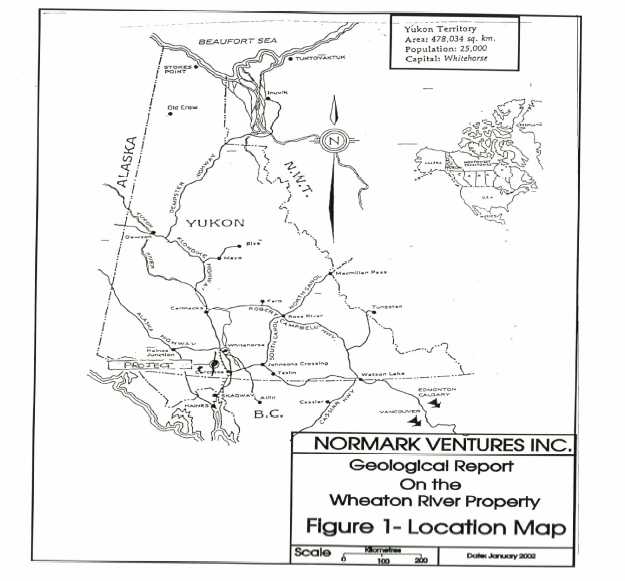

Location of the Wheaton River Claims

The Wheaton River Claims are located approximately 50 kilometers (31 miles) south of the city of Whitehorse in the Yukon Territory, Canada, see Figure 1 below. Access to the Wheaton River Claims is by the Alaska and Klondike highways and by gravel roads requiring a vehicle with four-wheel drive capability.

4

Figure 1 - Claim Map

PLAN OF OPERATION

Our plan of operation is to proceed with the exploration of the Wheaton River Claims to determine whether there are commercially exploitable reserves of gold and silver. Our Wheaton River Claims presently do not have any proven mineral reserves. The property that is the subject of our mineral claims is undeveloped and does not contain any open-pit or underground mines. The status of our planned exploration program is discussed in detail below.

Phase I

We accepted the recommendations of our initial geological report of W.G. Timmins, P.Eng. in 2001 and proceeded with the first phase of the recommended geological exploration program in fiscal 2002. The work involved in completing this initial phase of exploration included a detailed geological survey and a visit to the site of the mineral claims by two geotechnicians in the fall of 2002. A review of the available geological and

5

geophysical data was conducted by Laurence Stephenson, P. Eng with Mr. Timmins, our consulting engineer. The geologists concluded that the data had revealed zones of interest, similar to properties in the region that were being explored and developed, and recommended proceeding with the planning of a drilling program.

The total cost for Phase I of our exploration program was $13,650. Following the completion of Phase I, our geologist recommended that we complete a second phase consisting of geological prospecting, geological outcrop mapping, and detailed soil sampling in areas of interest.

Phase II

Phase II was completed in April, 2003, at a cost of $11,355. Prospecting and geological mapping during Phase II was significant in finding new areas and possible extensions of known mineralization. Samples were taken during the field operations from the intrusive granodiorite south and west of the main showings. The samples were taken from zones that were related to untested geophysical anomalies. Due to the nature of the field program, extensive investigation was not able to be conducted at that time but the sampling was as representative of the potential of these anomalies as possible. Mr. Timmins reviewed the results of the Phase II exploration program and prepared an updated geological report based on the results thereof in December, 2003. Based on his review of the Phase II results, Mr. Timmins recommended continued exploration of our mineral claims. Mr. Timmins proposed a budget for Phase III of the exploration program consisting of $17,543 for bulldozer trenching and $4,386 for engineering and sampling, with drilling costs contingent upon the results of trenching and sampling.

Phase III

During the 2004 summer exploration season, we completed Phase III of our recommended work program, which involved bulldozer trenching of geophysical anomalies defined in the vicinity of known mineralization and to sample bedrock exposures. We received a geological report on Phase III of the work program in February, 2005. Pursuant to Phase III of our work program, we contracted a bulldozer to repair the main access road to the claims and excavate trenches to bedrock at locations selected by our consulting engineers. Rock units exposed by the trenching were sampled where quartz veining was located. Sampling results confirmed that the geophysical anomalies are caused by structurally controlled silicified zones containing gold mineralization. The Phase III report recommended further prospecting, geological mapping and further sampling be conducted on the Wheaton River Claims prior to drill testing of vein systems.

Phase IV

We determined to proceed with further prospecting, geological mapping and sampling pursuant to Phase IV of the exploration program based on the results of Phase III of our work program. We completed Phase IV of our exploration program in October, 2005, at a cost of $21,929. Samples were taken from quartz veins on the Wheaton River Claims. Sampling results indicated that gold and silver are present in the quartz veins and that platinum group elements are not present in the quartz veins. Mr. Timmins reviewed the results of the Phase IV exploration program and prepared an updated geological report based on the results thereof in May, 2006. Based on a review of the Phase IV results, Mr. Timmins recommended continued exploration of the claims with a proposed budget of $4,386 for further preparatory exploration surveying.

6

Phase V

In the summer season of 2006, we completed the Phase V recommendations by Mr. Timmins, at a cost of approximately $5,000. Sampling was done on the bedrock exposures of the basic to ultra-basic rocks with significant sulphide content to determine if platinum group elements could be present on the Wheaton River Claims. The sampling results concluded that significant platinum group element content is unlikely to occur at the Wheaton River Claim. Mr. Glen MacDonald, P. Geo, prepared a summary report on the 2006 exploration program in February 2007. Mr. MacDonald previously sold the Wheaton River Claims to Normark in April, 2001. Pursuant to his report, Mr. MacDonald recommended a further exploration program consisting of prospecting, geological mapping and sampling be conducted on the Wheaton River Claims before the vein systems are drill tested at an estimated cost of $21,929.

Phase VI

We have determined to proceed with the Phase VI exploration program recommended by Mr. MacDonald. We have completed Phases I, II, III, IV and V of our exploration program on the Wheaton River Claims at a total cost of $73,863. Based on the results of our exploration program, we determined to proceed with Phase VI subject to obtaining additional financing. We intend to commence the Phase VI program during mid to late 2007.

Cash Requirements for Next Twelve Months

We anticipate that we will incur over the next twelve months $30,000 for operating expenses, including professional legal and accounting expenses associated with our reporting obligations under the Exchange Act and the estimated costs of Phase VI of our anticipated work program. Based on our cash position of approximately $500 as of April 30, 2007, we will require additional financing to enable us to pay for our operating expenses over the next twelve months. We anticipate that additional funding will be in the form of equity financing from the sale of our common stock. We do not have any arrangements in place for any future equity financing.

If we determine not to proceed with further exploration of our mineral claims due to a determination that the results of our initial geological program do not warrant further exploration or due to an inability to finance further exploration, we plan to pursue the acquisition of interests in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration.

RESULTS OF OPERATIONS

Third Quarter and Nine Month Summary

| | | Third Quarter Ended January 31 | | | | Nine Months Ended January 31 | |

| | | | | | | | | Percentage | | | | | | | | | | Percentage | |

| | | 2005 | | | 2004 | | | Increase / | | | | 2005 | | | 2004 | | | Increase / | |

| | | | | | | | | (Decrease) | | | | | | | | | | (Decrease) | |

| Revenue | $ | - | | $ | - | | | n/a | | | $ | - | | $ | - | | | n/a | |

| | | | | | | | | | | | | | | | | | | | |

| Expenses | | (5,841 | ) | | (4,000 | ) | | 46% | | | | (40,248 | ) | | (19,950 | ) | | 101.7% | |

| | | | | | | | | | | | | | | | | | | | |

| Net Loss | $ | (5,841 | ) | $ | (4,000 | ) | | 46% | | | $ | (40,248 | ) | $ | (19,950 | ) | | 101.7% | |

Revenue

We have incurred a net loss of $216,494 since inception and have not earned any revenues since our inception. We do not anticipate earning revenues until such time as we have entered into commercial

7

production of our mineral properties. We are currently in the exploration stage of our business and we can provide no assurances that we will discover commercially exploitable mineral deposits on our properties, or if such resources are discovered, that we will be able to enter into commercial production of our mineral claims.

Operating Expenses

Our operating expenses for the nine-month periods ended January 31, 2005 and 2004 included the following expenses:

| | | Third Quarter Ended January 31 | | | Nine Months Ended January 31 | |

| | | | | | | | | Percentage | | | | | | | | | Percentage | |

| | | 2005 | | | 2004 | | | Increase / | | | 2005 | | | 2004 | | | Increase / | |

| | | | | | | | | (Decrease) | | | | | | | | | (Decrease) | |

| Bank Charges | $ | 14 | | $ | 14 | | | n/a | | $ | 43 | | $ | 89 | | | (51.7 )% | |

| Mineral Property Costs | | - | | | - | | | n/a | | | 18,724 | | | 4,550 | | | 311.5% | |

| Office and General | | 80 | | | 109 | | | (26.6 | )% | | 855 | | | 456 | | | 87.5% | |

| Professional Fees | | 5,747 | | | 3,877 | | | 48.2% | | | 20,626 | | | 14,855 | | | 38.8% | |

| Total Expenses | $ | 5,841 | | $ | 4,000 | | | 46% | | $ | 40,248 | | $ | 19,950 | | | 101.7% | |

We anticipate that our operating expenses will increase significantly as we proceed with further exploration of our Wheat River Claims.

LIQUIDITY AND FINANCIAL CONDITION

| Working Capital | | | | | | | | | |

| | | | | | | | | Percentage | |

| | | At January 31, 2005 | | | At April 30, 2004 | | | Increase / (Decrease) | |

| Current Assets | $ | 13,167 | | $ | 15 | | | 87,680% | |

| Current Liabilities | | (56,461 | ) | | (88,061 | ) | | (35.9 )% | |

| Working Capital (Deficit) | $ | (43,294 | ) | $ | (88,046 | ) | | (50.8 )% | |

| Cash Flows | | | | | | |

| | | Nine Months Ended | | | Nine Months Ended | |

| | | January 31, 2005 | | | January 31, 2004 | |

| Cash Flows used in Exploration Stage Activities | $ | (72,034 | ) | $ | (5,252 | ) |

| Cash Flows from (used in) Investing Activities | | -- | | | -- | |

| Cash Flows from Financing Activities | $ | 85,186 | | $ | 5,187 | |

| Net Increase (Decrease) in Cash During Period | $ | 13,152 | | $ | (65 | ) |

The decline in our cash reserves and working capital is reflective of the current state of our business development. We completed the following equity financings to provide us with the funds necessary to proceed with the preliminary stages of our mineral exploration programs:

| | 1. | On April 21, 2005, we completed an offering of 1,400,000 shares of our common stock at a price of $0.05 (CDN $0.065) per share to a total of three purchasers pursuant to Regulation |

8

| | | S of the Securities Act. The total amount we received from this offering was $79,824 (CDN $91,000). |

| | | |

| | 2. | On June 15, 2004 we completed an offering of 1,700,000 shares of our common stock at a price of $0.05 per share to a total of four purchasers pursuant to Regulation S of the Securities Act. The total amount we received from this offering was $85,000. |

These equity financings consisted of sales of our common stock. Since our inception we have funded our business from sales of our common stock and loans from Mr. G.W. Norman Wareham, our president, treasurer and sole director.

Future Financing Requirements

We require additional financing if we are to continue as a going concern and to finance our business operations. We anticipate that any additional financing would be through the sales of our common stock or other equity-based securities. We are presently in the process of negotiating private placements of securities to raise working capital to finance our operations. However, we do not have any arrangements in place for the sale of any of our securities and there is no assurance that we will be able to raise the additional capital that we require to continue operations. In the event that we are unable to raise additional financing on acceptable terms, we intend to reduce our exploration expenditures and may implement additional actions to reduce general and administrative expenditures. We anticipate that our working capital will continue to decline as we complete further work on our exploration programs. As disclosed above under the heading “Plan of Operation”, we will require further financing to meet our operating expenses for the next twelve months.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

CRITICAL ACCOUNTING POLICIES

We have identified certain accounting policies, described below, that are the most important to the portrayal of our current financial condition and results of operations.

Foreign Currency Translation

Transaction amounts denominated in foreign currencies are translated at exchange rates prevailing at transaction dates. Carrying values of monetary assets and liabilities are adjusted at each balance sheet date to reflect the exchange rate at that date. Non-monetary assets and liabilities are translated at the exchange rate on the original transaction date. Revenues and expenses are translated at the rates of exchange prevailing on the dates such items are recognized in the statements of operations.

Mineral Properties

Costs of acquisition, exploration, carrying, and retaining unproven properties are expensed as incurred.

Loss Per Share

Basic net loss per share is computed by dividing the net loss attributable to common stockholders by the weighted average number of shares of common stock outstanding in the year. Diluted net loss per share takes into consideration shares of common stock outstanding (computed under basic loss per share) and potentially dilutive shares of common stock. In periods where losses are reported, the

9

weighted average number of common shares outstanding excludes common stock equivalents, because their inclusion would be anti-dilutive.

Income Taxes

A deferred tax asset or liability is recorded for all temporary differences between financial and tax reporting and net operating loss carryforwards. Deferred tax expenses (benefits) result from the net change during the period of deferred tax assets and liabilities.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

RISKS AND UNCERTAINTIES

If We Do Not Obtain Additional Financing, Our Business Will Fail.

Our current operating funds are inadequate to complete the exploration of the Wheaton River Claims. Our business plan calls for significant expenses in connection with the exploration of our mineral claims and the development of these mineral claims if our exploration indicates that our mineral claims possess commercially exploitable mineral reserves. As a result, we require additional financing to complete our exploration program. Also, we will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. Obtaining additional financing would be subject to a number of factors, the known material factors being market prices for gold and silver, investor acceptance of our mineral claims, and investor sentiment. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

If We Complete A Financing Through The Sale Of Additional Shares Of Our Common Stock, Then Shareholders Will Experience Dilution.

The most likely source of future financing presently available to us is through the sale of shares of our common stock. Any sale of share capital will result in dilution to existing shareholders. The only other anticipated alternative for the financing of further exploration would be the offering by us of an interest in our mineral claims to be earned by another party or parties carrying out further exploration, which is not presently contemplated.

If We Do Not Conduct Mineral Exploration On Our Mineral Claims Or Pay Fees In Lieu Of Mineral Exploration, Then Our Mineral Claims Will Lapse.

We must complete mineral exploration work on our Wheaton River Claims and make filings with the mining recording office of the Yukon Territory regarding the work completed or pay filing fees in lieu of completing work on our claims. The expiry date of our mineral claims is currently November 27, 2007. We intend to make the required filings with the applicable mining recording office of the Yukon Territory. If we do not conduct any mineral exploration on our claims or make the required payments in lieu of completing mineral exploration, then our claims will lapse and we will lose all interest that we have in these mineral claims.

Because We Anticipate Our Operating Expenses Will Increase Prior To Our Achieving Revenues, We Expect Significant Losses Prior To Any Profitability.

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the

10

exploration of the Wheaton River Claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful. We may not generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because Of The Speculative Nature Of Exploration Of Mining Properties, There Is Substantial Risk That No Commercially Exploitable Minerals Will Be Found And Our Business Will Fail.

You should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If no funding is available, we may be forced to abandon our operations.

Because Of The Inherent Dangers Involved In Mineral Exploration, There Is A Risk That We May Incur Liability Or Damages As We Conduct Our Business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards. Typically, these hazards concern pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Even If We Discover Commercial Reserves Of Precious Metals On Our Mineral Claims, We May Not Be Able to Successfully Obtain Commercial Production.

Our Wheaton River Claims do not contain any known mineral reserves. If our exploration programs are successful in establishing reserves of commercial tonnage and grade, we will require additional funds in order to place the mineral claims into commercial production. We may not be able to obtain these additional funds needed to begin commercial production.

If We Are Unable To Hire And Retain Key Personnel, We May Not Be Able To Implement Our Business Plan And Our Business Will Fail.

Our success will be largely dependent on our ability to hire highly qualified personnel with experience in geological exploration. These individuals may be in high demand and we may not be able to attract the staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Currently, we have not hired any key personnel. Our failure to hire key personnel when needed would have a significant negative effect on our business.

Because Our Executive Officers Do Not Have Formal Training Specific To The Technicalities Of Mineral Exploration, There Is A Higher Risk Our Business Will Fail.

Our executive officers do not have formal training specific to the technicalities of mineral exploration. While Mr. Wareham, our president, treasurer and sole director, has experience as a director of several mineral exploration companies, he does not have formal training as a geologist or in the technical aspects of management of a mineral exploration company. As a result of this inexperience, there is a higher risk of our being unable to complete our business plan for the exploration of our mineral claims. In addition, we will have to rely on the technical services of others with expertise in geological exploration in order for us to carry our planned exploration program. If we are unable to contract for the

11

services of such individuals, it will make it difficult and maybe impossible to pursue our business plan. There is thus a higher risk of business failure.

Because Our President Has Other Business Interests, He May Not Be Able Or Willing To Devote A Sufficient Amount Of Time To Our Business Operations, Causing Our Business To Fail.

Mr. Wareham, our president, treasurer and sole director, presently spends approximately 25% of his business time on business management services for Normark. While Mr. Wareham presently possesses adequate time to attend to our interests, it is possible that the demands on Mr. Wareham from his other obligations could increase with the result that he would no longer be able to devote sufficient time to the management of our business. In addition, Mr. Wareham may not possess sufficient time for our business if the demands of managing our business increased substantially beyond current levels.

Because We Will Be Subject To Compliance With Government Regulation, Our Anticipated Cost Of Our Exploration Program May Increase.

There are several governmental regulations that materially restrict the use of ore. We will be subject to the Quartz Mining Act of the Yukon Territory and the Canada Department of Indian and Northern Affairs – Land Use Branch as we carry out our exploration program. We may be required to obtain land use permits and perform remediation work for any physical disturbance to the land in order to comply with these regulations. There is also a risk that new regulations could increase our costs of doing business and prevent us from carrying our exploration program.

If We Receive Positive Results From Our Exploration Program And We Determine To Pursue Commercial Production, Then We May Be Subject To An Environmental Review Process That May Delay Or Prohibit Our Proceeding To Commercial Production.

If the results of our geological exploration program indicate commercially exploitable reserves and we determine to pursue commercial production of our mineral claims, we may be subject to an environmental review process under Canadian environmental assessment legislation. Compliance with an environmental review process may be costly and may delay commercial production. Furthermore, there is the possibility that we would not be able to proceed with commercial production upon completion of the environmental review process if government authorities did not approve our mine or if the costs of compliance with government regulation adversely affected the commercial viability of the proposed mine.

If A Market For Our Common Stock Does Not Develop, Our Investors Will Be Unable To Sell Their Shares.

There is currently no market for our common stock and a market may never develop. We plan to apply for quotation of our common stock on the over-the-counter bulletin board (the “OTC Bulletin Board”) over the next twelve months. However, our common stock may never be quoted on the OTC Bulletin Board or, if quoted, a public market may not materialize. If our common stock is not quoted on the OTC Bulletin Board or if a public market for our common stock does not develop, then investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If A Market For Our Common Stock Develops, Our Stock Price May Be Volatile.

There is currently no market for our common stock. If a market for our common stock develops, we anticipate that the market price of our common stock will be subject to wide fluctuations in response to the following known material factors:

| | (1) | the results of geological exploration program; |

12

| | (2) | our ability or inability to achieve financing; |

| | (3) | increased competition; and |

| | (4) | conditions and trends in the mineral exploration industry. |

Other factors, either unknown at this time or less material, may also affect our stock price. Further, if our common stock is quoted on the OTC Bulletin Board, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, interest rates or international currency fluctuations, may adversely affect the market price of our common stock.

Because Our Stock Is Penny Stock, Shareholders Will Be Limited In Their Ability To Sell Their Stock.

Our common stock is considered to be a “penny stock” since it does not qualify for one of the exemptions from the definition of “penny stock” under Section 3a51-1 of the Securities Exchange Act for 1934 (the “Exchange Act”). Our common stock is a “penny stock” because it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Stock Market, or even if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor's account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor's financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

| ITEM 3. | CONTROLS AND PROCEDURES. |

Under the supervision and with the participation of our management, including the Chief Executive Officer and Chief Financial Officer, we have evaluated the effectiveness of our disclosure controls and procedures as required by Exchange Act Rule 13a-15(b) as of the end of the period covered by this report. Based on that evaluation, the Chief Executive Officer and Chief Financial Officer have concluded that these disclosure controls and procedures are effective.

There were no changes in our internal control over financial reporting during the quarter ended January 31, 2005, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

13

PART II - OTHER INFORMATION

| ITEM 1. | LEGAL PROCEEDINGS. |

None.

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. |

We did not complete any unregistered sales of shares of our common stock during the fiscal quarter ended January 31, 2005.

Since our fiscal quarter ended January 31, 2005, we completed an offering of 1,400,000 restricted shares of our common stock at a price of $0.05 (CDN $0.065) per share to a total of three purchasers on April 21, 2005. The total amount we received from this offering was $79,824 (CDN $91,000). We completed the offering pursuant to Regulation S of the Securities Act. Each purchaser represented to us that they were a non-US person as defined in Regulation S. We did not engage in a distribution of this offering in the United States. Each purchaser represented his intention to acquire the securities for investment only and not with a view toward distribution. Appropriate legends were affixed to the stock certificate issued to each purchaser in accordance with Regulation S. None of the securities were sold through an underwriter and accordingly, there were no underwriting discounts or commissions involved. No registration rights were granted to any of the purchasers. Proceeds of the offering were used for exploration of the Wheaton River Claim and working capital purposes to fund our current operations.

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES. |

None.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

None.

| ITEM 5. | OTHER INFORMATION. |

None.

| Exhibit | |

| Number | Description of Exhibits |

| 3.1 | Articles of Incorporation.(1) |

| 3.2 | By-Laws, as amended.(1) |

| 4.1 | Share Certificate.(1) |

| 10.1 | Management Agreement with Wareham Management Ltd. dated September 15, 2000.(1) |

| 10.2 | Mining Property Purchase Agreement with Glen MacDonald dated April 30, 2001.(1) |

14

Notes:

| (1) | Previously filed as an exhibit to our Form SB-2 registration statement originally filed with the SEC on November 21, 2001, as amended through May 16, 2002. |

| (2) | Previously filed as an exhibit to our Annual Report on Form 10-KSB for the year ended April 30, 2003, filed with the SEC on July 8, 2005. |

15

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | NORMARK VENTURES CORP. |

| | | | | |

| | | | | |

| Date: | September 28, 2007 | | By: | /s/ G.W. Norman Wareham |

| | | | | G.W. NORMAN WAREHAM |

| | | | | Chief Executive Officer and Chief Financial Officer |

| | | | | (Principal Executive Officer and |

| | | | | Principal Accounting Officer) |

16