SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| | | |

| { } | | REGISTRATION STATEMENT PURSUANT TO SECTION 12 (b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

| | | OR |

|

|

|

|

| {X} | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDEDDECEMBER 31, 2002 |

|

|

|

|

| | | OR |

|

|

|

|

| { } | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER333 — 12714

LUCITE INTERNATIONAL

GROUP HOLDINGS

LIMITED

(Exact Name of Registrant as Specified in Its Charter)

ENGLAND and WALES

(Jurisdiction of incorporation or organisation)

QUEENS GATE, 15-17 QUEENS TERRACE, SOUTHAMPTON SO14 3BP

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12 (b) of the Act:

NONE

Securities registered or to be registered pursuant to Section 12 (g) of the Act:

NONE

Securities for which there is a reporting obligation pursuant to Section 15 (d) of the Act:

10.25% Senior Secured Notes due 2010

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

175,029,700 Ordinary Shares of £1 each

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days:

Indicate by check mark which financial statement items the Registrant has elected to follow:

TABLE OF CONTENTS

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | | | | | | PAGE |

| | | | | | | |

|

| |

PRESENTATION OF INFORMATION | | | 5 | |

| |

|

|

|

|

| | | PART I | | | | |

| |

|

|

|

|

| | ITEM 1 | | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT | | | | |

|

|

|

|

| | | AND ADVISORS | | | 6 | |

| |

|

|

|

|

| | ITEM 2 | | OFFER STATISTICS AND EXPECTED TIMETABLE | | | 6 | |

| |

|

|

|

|

| | ITEM 3 | | KEY INFORMATION | | | 6 | |

| |

|

|

|

|

| | A | | SELECTED FINANCIAL DATA | | | 6 | |

| |

|

|

|

|

| | B | | CAPITALISATION AND INDEBTEDNESS | | | 7 | |

| |

|

|

|

|

| | C | | REASONS FOR THE OFFER AND USE OF PROCEEDS | | | 7 | |

| |

|

|

|

|

| | D | | RISK FACTORS | | | 8 | |

| |

|

|

|

|

| | ITEM 4 | | INFORMATION ON THE COMPANY | | | 15 | |

| |

|

|

|

|

| | A | | HISTORY AND DEVELOPMENT OF THE COMPANY | | | 15 | |

| |

|

|

|

|

| | B | | BUSINESS OVERVIEW | | | 15 | |

| |

|

|

|

|

| | C | | ORGANISATIONAL STRUCTURE | | | 22 | |

| |

|

|

|

|

| | D | | PROPERTY, PLANTS AND EQUIPMENT | | | 23 | |

| |

|

|

|

|

| | ITEM 5 | | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | | 24 | |

| |

|

|

|

|

| | A | | OPERATING RESULTS | | | 27 | |

| |

|

|

|

|

| | B | | LIQUIDITY AND CAPITAL RESOURCES | | | 31 | |

| |

|

|

|

|

| | C | | RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES, ETC. | | | 33 | |

| |

|

|

|

|

| | D | | TREND INFORMATION | | | 34 | |

| |

|

|

|

|

| | ITEM 6 | | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | | 34 | |

| |

|

|

|

|

| | A | | DIRECTORS AND SENIOR MANAGEMENT | | | 34 | |

| |

|

|

|

|

| | B | | COMPENSATION | | | 35 | |

| |

|

|

|

|

| | C | | BOARD PRACTICES | | | 35 | |

| |

|

|

|

|

| | D | | EMPLOYEES | | | 37 | |

| |

|

|

|

|

| | E | | SHARE OWNERSHIP | | | 38 | |

2

TABLE OF CONTENTS Cont:-

| | | | | | | | | | |

| | | | | | | | PAGE |

| | | | | | | |

|

ITEM 7 | | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | | 39 | |

| |

|

|

|

|

| | A. | | MAJOR SHAREHOLDERS | | | 39 | |

| |

|

|

|

|

| | B. | | RELATED PARTY TRANSACTIONS | | | 39 | |

| |

|

|

|

|

| | C. | | INTERESTS OF EXPERTS AND COUNSEL | | | 40 | |

| |

|

|

|

|

ITEM 8 | | FINANCIAL INFORMATION | | | 40 | |

| |

|

|

|

|

| | A. | | CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION | | | 40 | |

| |

|

|

|

|

| | B. | | SIGNIFICANT CHANGES | | | 41 | |

| |

|

|

|

|

ITEM 9 | | THE OFFER AND LISTING | | | 41 | |

| |

|

|

|

|

| | A. | | OFFER AND LISTING DETAILS | | | 41 | |

| |

|

|

|

|

| | B. | | PLAN OF DISTRIBUTION | | | 41 | |

| |

|

|

|

|

| | C. | | MARKETS | | | 41 | |

| |

|

|

|

|

| | D. | | SELLING SHAREHOLDERS | | | 41 | |

| |

|

|

|

|

| | E. | | DILUTION | | | 41 | |

| |

|

|

|

|

| | F. | | EXPENSES OF THE ISSUE | | | 41 | |

| |

|

|

|

|

ITEM 10 | | ADDITIONAL INFORMATION | | | 41 | |

| |

|

|

|

|

| | A. | | SHARE CAPITAL | | | 41 | |

| |

|

|

|

|

| | B. | | MEMORANDUM AND ARTICLES OF ASSOCIATION | | | 41 | |

| |

|

|

|

|

| | C. | | MATERIAL CONTRACTS | | | 42 | |

| |

|

|

|

|

| | D. | | EXCHANGE CONTROLS | | | 42 | |

| |

|

|

|

|

| | E. | | TAXATION | | | 42 | |

| |

|

|

|

|

| | F. | | DIVIDENDS AND PAYING AGENTS | | | 47 | |

| |

|

|

|

|

| | G. | | STATEMENTS BY EXPERTS | | | 47 | |

| |

|

|

|

|

| | H. | | DOCUMENTS ON DISPLAY | | | 47 | |

| |

|

|

|

|

| | I. | | SUBSIDIARY INFORMATION | | | 47 | |

3

TABLE OF CONTENTS Cont:-

| | | | | | | | | |

| | | | | | | PAGE |

| | | | | | |

|

ITEM 11 | | QUANTITATIVE AND QUALITATIVE DISCLOSURES | | | 48 | |

| |

| |

|

|

|

|

ITEM 12 | | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | | | 49 | |

| |

|

|

|

|

| | | PART II | | | | |

| |

|

|

|

|

ITEM 13 | | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | | | 50 | |

| |

|

|

|

|

ITEM 14 | | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | | | 50 | |

| |

|

|

|

|

ITEM 15 | | CONTROLS AND PROCEDURES | | | 50 | |

| |

|

|

|

|

ITEM 16 | | [RESERVED] | | | 50 | |

| |

|

|

|

|

| | | PART III | | | | |

| |

|

|

|

|

ITEM 17 | | FINANCIAL STATEMENTS | | | 50 | |

| |

|

|

|

|

ITEM 18 | | FINANCIAL STATEMENTS | | | 50 | |

| |

|

|

|

|

ITEM 19 | | EXHIBITS | | | 51 | |

4

PRESENTATION OF INFORMATION

The consolidated financial statements and the related notes thereto in this report have been prepared in accordance with UK generally accepted accounting principles ("UK GAAP"). UK GAAP differs in certain material respects from US generally accepted accounting principles ("US GAAP"). For a discussion of the significant differences between UK and US accounting principles with respect to our consolidated financial statements, see Note 27 to the audited financial statements at Item 18.

Unless the context requires otherwise, the terms “Lucite International,” the “Company,” the “group,” “our,” “us” and “we” refer to Lucite International Group Holdings Limited and its subsidiaries as a combined entity. Lucite International Finance plc is the company that issued the notes registered under the U.S. Securities Act of 1933. It is a wholly-owned subsidiary of Lucite International Group Holdings Limited and was formed for the purpose of issuing and selling securities and making the proceeds of those issues available to us. The term “Lucite International Finance” refers to the issuer of the notes.

We have not presented separate financial statements for Lucite International Finance plc or Lucite International Investment Limited because management has determined that this information is not material to holders of the notes.

Market information or other statements presented in this report regarding our position relative to our competition, including market shares and industry statistics, are based upon internal company surveys; there can be no assurance as to the accuracy and completeness of this information. Internal company surveys reflect our best estimates based upon information we have obtained from customers or from trade or business organisations or associations or other contacts within the industries in which we compete. Our market data has not been verified by any independent sources.

The acquisition of a portion of ICI’s interest in Kaohsiung Monomer Co. Ltd (“KMC”) was not completed until September 1, 2001. The historical financial information included under “Selected Financial Data” (Item 3A) and “Operating and Financial Review and Prospects” (Item 5), therefore includes our interest in KMC during the twelve months ended December 31, 2000 and the eight months ended August 31, 2001, on an equity accounting basis. On September 1, 2001, the Company agreed with ICI to acquire the remaining 51% of the shares of the majority shareholder. As from September 1, 2001 KMC was fully consolidated into the results and net assets of the group.

Forward-Looking Statements

This report includes forward-looking statements based on our current expectations and projections about future events, including:

| • | | our high degree of leverage and significant debt service obligations as well as future cash flow and earnings; |

| |

| • | | our sales growth across our principal businesses and our strategy for controlling costs, growing margins, increasing manufacturing capacity and production levels and making capital expenditures; |

| |

| • | | raw material costs or supply arrangements; |

| |

| • | | our technological and manufacturing assets and our ability to utilize them to further increase sales and the profitability of our businesses; |

| |

| • | | our ability to retain existing and obtain new customers; |

| |

| • | | our ability to develop new products and technologies successfully; |

| |

| • | | the cyclical and highly competitive nature of the acrylics industries; |

| |

| • | | risks related to environmental costs, liabilities or claims; and |

| |

| • | | currency fluctuations. |

These forward-looking statements are subject to a number of risks and uncertainties, which could cause our actual results to differ materially from historical results or those anticipated, some of which are beyond our control. The words “believe,” “expect,” “anticipate” and similar expressions identify forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

5

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

NOT APPLICABLE

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

NOT APPLICABLE

ITEM 3 KEY INFORMATION

A. SELECTED FINANCIAL DATA

The selected historical financial information in the table below has been classified between predecessor and successor periods. The predecessor periods represent the financial periods prior to the acquisition of the acrylics division of ICI and the successor periods represent the financial periods subsequent to that acquisition.

The table below sets forth selected historical combined (predecessor) and consolidated financial information for Lucite International as of and for each of the periods indicated. Our financial statements are prepared in accordance with UK GAAP, which differs in certain significant respects from US GAAP. For a discussion of the significant differences between UK and US accounting principles, you should refer to Note 27 to the audited financial statements. You should read the data below in conjunction with the “Operating and Financial Review and Prospects” (Item 5). The information for the year ended December 31, 2000 and December 31, 2001 has been restated for the effects of FRS19 “deferred tax,” which have been extracted from our consolidated financial statements included herein. The information prior to the nine months ended September 30, 1999 has not been restated as it relates to the predecessor period.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Predecessor - Combined | | Successor – Consolidated |

| | | |

| |

|

| | | | Year | | Nine | | For the | | | | | | | | | | | | |

| | | | ended | | months | | period | | | | | | | | | | | | |

| | | | December | | ended | | October 1, | | | | | | | | | | | | |

| | | | 31, | | September | | 1999 to | | | | | | Year ended | | | | |

| | | | | | 30, | | December 31, | | | | | | December 31, | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| In Millions | | 1998 | | 1999 | | 1999 | | 2000 | | 2001 | | 2002 |

| | | | | | | as | | as | | as | | |

| | | | | | | restated | | restated | | restated | | |

| | |

| |

| |

| |

| |

| |

|

Profit and Loss Account Information: | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| Amounts in accordance with UK GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| | Turnover | | | £537 | | | | £379 | | | | £118 | | | | £560 | | | | £577 | | | | £582 | |

|

|

|

|

| | Cost of sales | | | (387 | ) | | | (283 | ) | | | (90 | ) | | | (433 | ) | | | (458 | ) | | | (457 | ) |

|

|

|

|

| | Gross profit | | | 150 | | | | 96 | | | | 28 | | | | 127 | | | | 119 | | | | 125 | |

|

|

|

|

| | Net operating expenses (a)(b) | | | (124 | ) | | | (88 | ) | | | (28 | ) | | | (111 | ) | | | (101 | ) | | | (98 | ) |

|

|

|

|

| | Share of profit from joint venture | | | — | | | | — | | | | — | | | | 2 | | | | 2 | | | | — | |

|

|

|

|

| | Operating profit | | | 26 | | | | 8 | | | | — | | | | 18 | | | | 20 | | | | 27 | |

|

|

|

|

| | Net interest payable | | | (17 | ) | | | (10 | ) | | | (8 | ) | | | (40 | ) | | | (28 | ) | | | (29 | ) |

|

|

|

|

| | (Loss)/profit on ordinary activities after tax | | | 6 | | | | (11 | ) | | | (8 | ) | | | (12 | ) | | | (2 | ) | | | — | |

|

|

|

|

| | Equity minority interest | | | (1 | ) | | | 1 | | | | — | | | | — | | | | (1 | ) | | | (3 | ) |

|

|

|

|

| | (Loss)/profit for the financial year/period | | | 5 | | | | (10 | ) | | | (8 | ) | | | (12 | ) | | | (3 | ) | | | (3 | ) |

|

|

|

|

| Amounts in accordance with US GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| | Profit (loss) for the financial year/period | | | (7 | ) | | | (13 | ) | | | (16 | ) | | | (8 | ) | | | (1 | ) | | | 1 | |

|

|

|

|

Balance Sheet information (at end of period) | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| Amounts in accordance with UK GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| | Current assets | | | 147 | | | | | | | | 181 | | | | 180 | | | | 185 | | | | 182 | |

|

|

|

|

| | Total assets | | | 520 | | | | | | | | 638 | | | | 661 | | | | 663 | | | | 623 | |

|

|

|

|

| | Creditors due after more than one year | | | (6 | ) | | | | | | | (214 | ) | | | (370 | ) | | | (336 | ) | | | (330 | ) |

|

|

|

|

| | Net assets | | | 379 | | | | | | | | 171 | | | | 156 | | | | 168 | | | | 142 | |

|

|

|

|

| Amounts in accordance with US GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| | Shareholder’s equity | | | 373 | | | | | | | | 163 | | | | 172 | | | | 170 | | | | 145 | |

|

|

|

|

Other Financial Information: | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| Amounts in accordance with UK GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

|

| | Depreciation and amortization | | | 38 | | | | 30 | | | | 10 | | | | 39 | | | | 39 | | | | 45 | |

|

|

|

|

| | Capital expenditure and financial investment | | | (19 | ) | | | (10 | ) | | | (7 | ) | | | (28 | ) | | | (26 | ) | | | (28 | ) |

6

NOTES TO SELECTED FINANCIAL DATA

| (a) | | Included in net operating expenses under UK GAAP are exceptional operating expenses. These expenses consist of restructuring, severance and relocation costs as follows; £5 million for the year ended December 31, 1998; £5 million for the nine months ended September 30, 1999; £3 million for the period October 1, 1999 to December 31, 1999; £14 million for the year ended December 31, 2000, £4m for the year ended December 31, 2001 and £nil for the year ended December 31, 2002. Further details of these exceptional operating expenses are included in Note 5 to the consolidated financial statements. Additionally, the £3 million and £9 million of severance and relocation cost expensed to the UK GAAP profit and loss account for the period October 1, 1999 to December 31, 1999 and for the year ended December 31, 2000 respectively has been included in the allocation of the costs of the acquisition of ICI Acrylics as a liability assumed under US GAAP. |

| |

| (b) | | Net operating expenses for the year ended December 31, 1998 and for the nine months ended September 30, 1999 include ICI allocated central management expenses of £4 million and £3 million respectively, and ICI allocated pension expenses of £3 million and £3 million, respectively. |

| |

| (c) | | For details of exchange rates for pounds sterling expressed in US dollars per pound sterling please see Item 11, “Quantative and Qualitative Disclosures About Market Risk.” |

Exchange Rate Information

Our reporting currency is the pound sterling. The following table sets forth, for the periods and dates indicated, information regarding the average daily rate for pound sterling, expressed in dollars per £1.00. These rates were not used to prepare the financial statements included in this annual report.

| | | | | | | | | |

| | | High | | Low |

| | |

| |

|

Month | | | | | | | | |

|

|

|

|

| March 2003 | | $ | 1.61 | | | $ | 1.56 | |

|

|

|

|

| February 2003 | | | 1.65 | | | | 1.57 | |

|

|

|

|

| January 2003 | | | 1.65 | | | | 1.60 | |

|

|

|

|

| December 2002 | | | 1.61 | | | | 1.56 | |

|

|

|

|

| November 2002 | | | 1.59 | | | | 1.54 | |

|

|

|

|

| October 2002 | | | 1.57 | | | | 1.54 | |

|

|

|

|

| |

| | | Average | | | | |

| | |

| | | |

Year ended December 31, | | | | | | | | |

|

|

|

|

| 2002 | | $ | 1.50 | | | | | |

|

|

|

|

| 2001 | | | 1.44 | | | | | |

|

|

|

|

| 2000 | | | 1.51 | | | | | |

|

|

|

|

| 1999 | | | 1.61 | | | | | |

|

|

|

|

| 1998 | | | 1.66 | | | | | |

|

|

|

|

| Nine months ended September 30, 1999 | | $ | 1.61 | | | | | |

|

|

|

|

| Three months ended December 31, 1999 | | | 1.62 | | | | | |

B. CAPITALISATION AND INDEBTEDNESS

NOT APPLICABLE

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

NOT APPLICABLE

7

D. RISK FACTORS

Risks Relating to Our Capital Structure

Substantial leverage — Our substantial debt could adversely affect our financial health and prevent us from fulfilling our obligations under these notes.

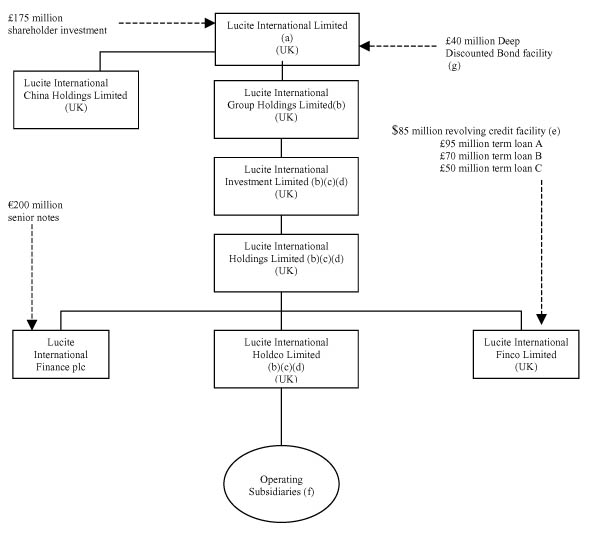

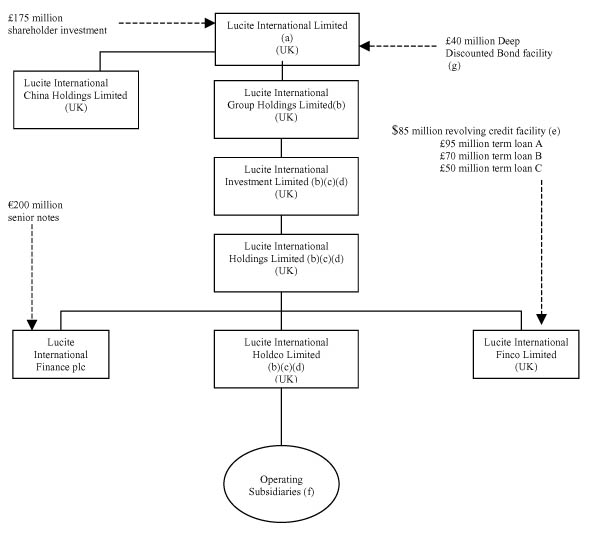

We have a significant amount of debt following the completion of the acquisition of ICI Acrylics and related transactions. The following chart shows total debt and shareholder’s equity as of December 31, 2002.

| | | | | |

| | | As of |

| | | December 31, |

| | | 2002 |

| | |

|

| Total debt (net of debt issuance costs) | | £343 million |

|

|

|

|

| Shareholder’s equity | | £130 million |

Our substantial debt could have important consequences to holders of the notes. For example, it could, amongst other things:

| • | | limit our ability to take advantage of significant business opportunities; |

| |

| • | | make it more difficult for us to satisfy our obligations with respect to the notes; |

| |

| • | | increase our vulnerability to general adverse economic and industry conditions; |

| |

| • | | limit our ability to fund future working capital, capital expenditures, any future acquisitions, research, development and technology process costs and other general business requirements; |

| |

| • | | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and |

| |

| • | | place us at a competitive disadvantage compared to our competitors that have less debt. |

Effective subordination — If our operating subsidiaries are unable to make distributions to us, Lucite International Finance or the guarantors, as the case may be, we may be unable to pay the amounts due on the notes.

We expect to obtain the money to pay the principal and interest on the notes from our operating subsidiaries. However, these subsidiaries may not be able to make distributions to us. For example, any payment of interest, dividends, distributions, loans or advances by our operating subsidiaries to Lucite International Finance and the guarantors could be subject to restrictions on dividends or repatriation of earnings under applicable local law, monetary transfer restrictions and foreign currency exchange regulations in the jurisdictions in which the subsidiaries operate. Moreover, payments to Lucite International Finance and the guarantors by the operating subsidiaries will be contingent upon these subsidiaries’ earnings.

Further, our operating subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due pursuant to the notes or to make any funds available therefor, whether by dividends, loans, distributions or other payments, and do not guarantee the payment of interest on, or principal of, the notes. Any right that Lucite International Finance and the guarantors have to receive any assets of any of the operating subsidiaries upon the liquidation or reorganisation of those subsidiaries, and the consequent right of holders of notes to realise proceeds from the sale of their assets, will be effectively subordinated to the claims of that subsidiary’s creditors, including trade creditors and holders of debt issued by that subsidiary. In particular, some of our subsidiaries are borrowers under, or have guaranteed the obligations of the borrowers under, the senior credit facilities but have not guaranteed the notes. Moreover, any guarantees of the notes by our subsidiaries will be subordinated to any indebtedness of a guarantor, including indebtedness under the senior credit facilities, that is either senior or secured.

8

Contractual subordination —The right to receive payments on the notes are junior to our other borrowings under our senior credit facilities and possibly some or all of our future borrowings and therefore, we may not be able to pay amounts we owe under the notes if we have not or are unable to make payments we owe under our senior debt.

The notes are unsecured obligations. The obligations of the guarantors to us under the subordinated guarantees rank behind their respective obligations to the lending banks under our existing credit facilities and any other senior debt they may incur. In addition, the obligations of the guarantors under the guarantees also rank behind any other debt that they may secure by charging or pledging any of their respective assets. As a result, upon any distribution to the creditors of the subordinated guarantors in a bankruptcy, liquidation, reorganisation or similar proceeding, the holders of their respective senior debt will be entitled to be paid in full in cash before any payment may be made with respect to the guarantees.

The right to receive payments on the notes depends upon Lucite International Finance’s ability to receive funds from the other subsidiaries of Lucite International and the guarantors and the guarantors’ ability to honour their guarantee obligations. Since the intercompany loan and the subordinated guarantees rank behind the guarantors’ senior debt, including their respective obligations under our senior credit facilities, claims under the notes will be junior to those of the lending banks under our senior credit facilities.

Restrictive covenants in our senior credit facilities — If we default, we will not be able to meet our payment obligations to holders of the notes.

Our ability to continue to comply with the covenants and restrictions contained in our senior credit facilities may be affected by events beyond our control. These include prevailing economic, financial and industry conditions. If we breach any of these covenants or restrictions, we could be in default under our senior credit facilities. This would, as well as other risks described in this section, permit the lending banks to declare all amounts that we have borrowed under our senior credit facilities to be due and payable, together with accrued and unpaid interest. This could prevent us from meeting our payment obligations under the notes. The lending banks could also refuse to extend further credit under the senior credit facilities. If we are unable to repay our debt to the lending banks, they could proceed against the collateral that secured the debt.

The significant covenants in our senior credit facilities, referred to in the preceding paragraph, restrict our ability to:

| • | | dispose of assets, |

| |

| • | | grant security interests, |

| |

| • | | make loans, |

| |

| • | | acquire assets, |

| |

| • | | enter into agreements of merger or consolidation, |

| |

| • | | incur additional debt, |

| |

| • | | incur guarantee obligations, |

| |

| • | | conduct specified investment activities, |

| |

| • | | declare or pay dividends or redeem or purchase capital stock, |

| |

| • | | make capital expenditures and |

| |

| • | | prepay debt. |

In addition, our senior credit facilities require us to comply with specified financial ratios and tests.

Financing change of control offer — We may not be able to raise the funds necessary to finance a change of control offer required by the indenture to the notes and, if this occurs, we would be in default under the indenture.

Under the terms of the notes, we are required to offer to repurchase the notes if a change of control occurs. However, our obligations under our senior credit facilities could be accelerated upon the occurrence of a change of control offer, and we would have to satisfy those obligations prior to purchasing the notes. Therefore, it is possible that we may not have sufficient funds at the time of the change of control to make the required repurchase of notes or that the restrictions in our credit facility will not allow repurchases. Our failure to repurchase the notes would be an event of default under the indenture governing the notes.

The change of control provisions contained in the indenture may not protect holders of notes in the event of highly leveraged transactions, including reorganisations, restructuring or mergers, because these transactions may not involve a change in voting power or beneficial interest of the magnitude required to trigger the change of control provisions.

9

Ability to service debt — To pay the amounts due on the notes, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control.

We may not have sufficient cash to pay our obligations under the notes due to a number of factors we cannot control. We expect to obtain the money to make the payments that we owe under the notes from our operating subsidiaries. However, the ability of our subsidiaries to upstream monies to Lucite International Finance or the guarantors of the notes as described above as well as to pay operating expenses and to fund planned capital expenditures, any future acquisitions and research and development efforts will depend on our businesses’ ability to generate cash in the future. This, to an extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

The cash flow from the operations of these subsidiaries might not be adequate to enable these subsidiaries to upstream sufficient monies to enable Lucite International Finance and the guarantors of the notes to meet our debt service obligations and other liquidity needs for the foreseeable future. Further, if the subsidiaries are unable to generate sufficient cash flow to meet their payment obligations, they may be forced to reduce or delay planned expansions or capital expenditures, sell significant assets, discontinue specified operations, obtain additional equity capital or attempt to restructure or refinance all or a portion of their indebtedness on or before maturity.

Additional borrowings available — Despite current debt levels, we may still be able to incur substantially more debt. This could further exacerbate the risks described above.

We may be able to incur substantial additional debt in the future. If new debt is added to our current debt levels, the risks that we now face could intensify. The terms of the indenture governing the notes permit us to borrow more money, subject to limitations. As of December 31, 2002, £220 million was outstanding under our senior credit facilities, and these borrowings are senior to the notes and guarantees. Additionally, our revolving credit facility would permit additional borrowing of up to $34 (£21) million and all of those borrowings would be contractually or structurally senior to the notes and the guarantees.

Control by funds managed by Charterhouse Development Capital Limited (“Charterhouse”) — Our principal investors may have interests that conflict with the interests of holders of the notes and can take actions that prevent or hinder us from making payments on the notes.

In the event of a conflict of interest between holders of our notes and our principal investors, their actions could affect our ability to meet our payment obligations. Charterhouse and some of the directors of Ineos Capital have invested in the equity of Lucite International Limited, the holding company that owns Lucite International, and ultimately control the voting stock of all the companies that together conduct our business.

Charterhouse owns 78% of our common stock. This ownership gives Charterhouse significant control over our operations. Furthermore, Charterhouse has the power to elect all of the directors of our companies, to change their management, to approve any changes to their documents and to approve any mergers.

Goodwill — A change in the estimated useful life, or a write-off, of goodwill could negatively affect operating results and net worth.

A change in the estimated useful life of goodwill or the write-off of a portion of goodwill could negatively affect operating results and net worth. The acquisition of the acrylics business of ICI resulted in the recognition of a substantial amount of goodwill. At December 31, 2002, goodwill totalled £83 million in accordance with U.K. GAAP, compared to U.K. GAAP net assets of £142 million. We have estimated the useful life associated with positive goodwill to be 20 years. However, subsequent changes in the acrylics industry, including competition and advances in technology, may in the future shorten the estimated useful life of goodwill or result in the write-off of a portion of goodwill. A shortening of the useful life or a write-off of a portion of goodwill could further decrease our earnings or increase our net losses in future periods.

10

Risks Relating to Business Operations

The chemicals industry is cyclical — Changing market demands and prices may negatively affect our operating margins and impair our cash flow, which in turn could affect our ability to make payments due under the notes.

Cyclicality and volatility in the chemical industry, market supply and demand and prices for raw materials may negatively impact our operating margins and cash flow. This, in turn, may impair our ability to make payments due under the notes.

Substantially all of our revenue is attributable to sales of methyl methacrylate (“MMA”) and MMA-related products, the prices of which have been historically cyclical and sensitive to relative changes in supply and demand, the availability and price of feedstocks and general economic conditions. Historically, the markets for some of our products have experienced alternating periods of tight supply, causing prices and margins to increase, followed by periods of capacity additions, resulting in oversupply and declining prices and margins. The MMA industry experienced increases in capacity through new production facilities coming on line and reduced demand in 1998, primarily because of economic uncertainty in Asia. Both of these factors combined to reduce prices for MMA and negatively affected our business, financial condition and results of operations for the latter half of 1998 and into 1999. The market demand recovered strongly from late 1999 through 2000 with some weakening in 2001 through to 2002 due primarily to a slowing of the US industrial based economy. Demand in the latter part of 2002 has recovered strongly. We do not know if prices will remain firm or decrease. In addition, we do not know if future growth in demand for MMA and MMA-related products will be sufficient to alleviate any existing or future conditions of excess industry capacity or that these conditions will not be sustained or further aggravated by anticipated or unanticipated capacity additions or other events. See the risk described under the caption “ The significant competition in the chemicals industry, whether through efforts of new and current competitors, or through consolidation of existing customers, may adversely affect our competitive position, sales and overall operations.”

Further, the prices for a large portion of our raw materials are similarly cyclical. Our ability to pass on increases in the cost of raw materials to our customers is, to a large extent, dependent upon market conditions. There may be periods of time in which we are not able to recover increases in the cost of raw materials due to weakness in demand or an oversupply of our products.

Our relationship with DuPont is critical to our business and if this relationship were to cease, our cash flow, margins and competitive position could be materially and adversely affected.

DuPont is our largest supplier and our largest customer and we rely on DuPont for various manufacturing services. If DuPont were to cease to be our supplier or our customer or were to cease sharing site services with us, our cash flow, margins and competitive position could be materially and adversely affected.

DuPont is our only supplier of hydrocyanic acid (“HCN”) in the United States. DuPont produces HCN for its own internal use and we are the only unaffiliated purchaser of its production. Our current HCN supply contract with DuPont expires in June 2003; however, we have agreed terms for the continuation of supply for a further five years following this date.

DuPont is also our largest customer, generating approximately 8% of our total revenues. Several of our U.S. facilities are located within DuPont chemical complexes and are operated by DuPont under our direction and we share supplies and services at those sites with DuPont.

International operations — We are exposed to economic downturns and local business risks in several different countries, particularly in the United States, and they could adversely affect our profitability.

We derive substantial revenues from international operations, particularly the United States. If there is a further economic downturn in the United States and/or other countries in which we operate, our profitability may be adversely affected. Further, our subsidiaries have interests in substantial physical assets in several countries, including England, France, Japan, Mexico, The Netherlands, Taiwan, Thailand and the United States. Accordingly, our business is subject to risks inherent in international operations and we may experience reduced profitability from these operations. These risks include:

| • | | political and economic conditions; |

| |

| • | | differences and unexpected changes in regulatory environments; |

11

| • | | varying tax regimes; |

| |

| • | | exposure to different legal standards, including insolvency regimes; and |

| |

| • | | difficulties in staffing and managing operations. |

Currency fluctuations — Our exposure to currency fluctuation risks in many countries may adversely affect our turnover and operating margins.

Because we generate a significant percentage of our revenues and a substantially lower percentage of our operating expenses in currencies other than the pound sterling (including the U.S. dollar), fluctuations in the value of the pound sterling against other currencies have had in the past, and may have in the future, a material effect on our turnover and operating margins. Our operations are conducted in over 100 countries. The results of operations and the financial position of these subsidiaries are reported in the relevant foreign currencies and then translated into pounds sterling at the applicable exchange rates for inclusion in our combined (predecessor) and consolidated financial statements. The exchange rates between these currencies and the pound sterling in recent years have fluctuated significantly and may in the future fluctuate substantially.

In addition, because our financial statements are stated in pounds sterling, the translation effect of these fluctuations have had in the past, and may have in the future, a material effect on our business, financial condition or results of operations and may significantly affect the comparability of our results between financial periods. For additional related disclosure, see Item 11 under the caption “Quantitative and Qualitative Disclosures about Market Risks.”

Key suppliers — If we are unable to retain or replace our key suppliers, especially our external HCN suppliers, each of whom is exclusive in a given region, our results of operations may be negatively affected.

We rely on DuPont in the Americas, BASF in Europe and China Petrochemical Development Corporation in Asia, our three main suppliers of HCN, for all of the HCN that we obtain from external sources. HCN is crucial to our MMA manufacturing process; there is only one external HCN supplier for each of our plants, with no ready alternative supplier. If any of these suppliers is unable to meet its obligations under present supply agreements, we may not be able to find alternative suppliers. In addition, some of the raw materials we use may become unavailable within the geographic area from which we now source our raw materials and there can be no assurance that we will be able to obtain suitable and cost effective substitutes. Any interruption of supply or any price increase of HCN or other raw materials could disrupt production or reduce our operating margins and thus have a material adverse effect on our business, financial condition or results of operations.

The significant competition in the chemicals industry, whether through efforts of new and current competitors, or through consolidation of existing customers, may adversely affect our competitive position, sales and overall operations.

The markets for some of our products are highly competitive. We are exposed to the competitive characteristics of several different geographic markets and industries. In addition, we believe that rapid identification of substitutes for existing products, new product applications and the ability to supply commercial quantities of products that enable these applications are important competitive factors. Some of our competitors have greater financial, technical and marketing resources than we do. As the markets for our products expand, we expect that additional competition will emerge and that existing competitors may commit more resources to the markets in which we participate. We may not be able to compete effectively in these various areas in the future and our competitive position and results or operations may suffer as a result. Because we have business operations in the upstream and downstream markets, we compete and have competed in the downstream market with many of the customers who purchase from us. Although this has not been a problem in the past, this relationship creates the potential for conflicting interests and our competitive relationship with some of our customers may adversely affect our sales to those customers.

In addition, the methacrylate industry may consolidate further in which case we may lose customers if the customers merge with competing producers and no longer require our output. In such a situation, if the customers were large enough, our sales may be materially and adversely affected.

Our principal competitors vary from business to business and range from large international companies, such as Rohm & Haas, Degussa-Hüels AG (including Rohm GmbH), AtoFina, and Mitsubishi Rayon Co. Ltd., to a large number of smaller regional companies of varying sizes.

12

Continued technological innovation and the successful commercial introduction of products are important for our future growth and our failure in these areas could negatively impact our profit margins and competitive position.

We will have to continue to identify, develop and market innovative products on a timely basis to replace existing products in order to maintain our profit margins and our competitive position. All of our businesses experience periodic technological change and ongoing product improvements and obsolescence of existing products. Manufacturers periodically introduce new generations of products or require new technological capacity to develop customised products. In the past we have benefited from our ability to operate at the forefront of certain markets and our future growth will depend on our continued ability to gauge the direction of the commercial and technological progress in all key markets and upon our ability to successfully develop, manufacture and market products in these changing markets.

Our future growth will depend on our ability to meet the technological and production requirements involved in producing large quantities of high-purity chemicals and complex chemical intermediates. For example, we use the acetone cyanohydrin (“ACH”) process to produce MMA, which may or may not be more cost-effective than competing processes, such as the isobutylene/tertiary butyl alcohol process and the ethylene process, depending on raw material costs. We may fail in developing new products and/or technology or in gaining acceptance of these products by our customers. If we fail to keep pace with the evolving technological innovations in our markets, then our business, financial condition and results of operations may be materially and adversely affected.

The failure of our trademarks, patents and confidentiality agreements to protect our intellectual property could adversely affect our business.

The failure of our patents, trademarks or confidentiality agreements to protect our processes, apparatuses, technology, trade secrets or proprietary know-how could lead to increased competition and thus have a material adverse effect on our business, financial condition or results of operations. Proprietary protection of our processes, apparatuses and other technology is important to our business. We rely upon unpatented proprietary know-how and continuing technological innovation and other trade secrets to develop and maintain our competitive position. While it is our policy to enter into confidentiality agreements with our employees and third parties to protect our intellectual property, there can be no assurances that our confidentiality agreements will not be breached, that they will provide meaningful protection for our trade secrets or proprietary know-how, or that adequate remedies will be available in the event of an unauthorised use or disclosure of these trade secrets and know-how. In addition, there can be no assurances that others will not obtain knowledge of these trade secrets through independent development or other access by legal means.

Our actions to protect our proprietary rights may be insufficient to prevent others from developing similar products to ours. In addition, the laws of many foreign countries do not protect our intellectual property rights to the same extent as the laws of the United States or United Kingdom.

Environmental matters — We will have ongoing costs and may have additional costs, obligations and liabilities.

The chemicals business is highly regulated in many countries. Increasingly stringent regulations govern our manufacturing processes, wastes and emissions in all of the jurisdictions in which we do business and will continue to require material ongoing costs. Given the nature of our business, violations of environmental laws may result in substantial fines, penalties, damages or other costs, restrictions or civil or criminal sanctions imposed on our operating activities. In addition, potentially significant expenditures could be necessary in order to comply with existing or future environmental laws. For additional related disclosure, see Item 4 under the caption “Information on the Company — Business Overview” and Item 5 under the caption “Operating and Financial Review and Prospects.”

Under some environmental laws, we may be liable for the costs of investigating and cleaning up environmental contamination on or from our properties or at off-site locations where, for example, we disposed of or arranged for the disposal or treatment of hazardous wastes. We are aware that there is or may be soil or groundwater contamination at some of our facilities resulting from past operations at these or neighbouring facilities. We may need to remediate soil and groundwater contaminated with hazardous substances to ensure that they pose no unacceptable risk to human health and the environment. The acquisition agreement relating to the acquisition of ICI Acrylics provides for indemnification of Lucite International Investment Limited by ICI and specified affiliated companies for some of these environmental liabilities, costs, and other matters, provided that various requirements and procedures specified in the acquisition agreement are satisfied. The extent of the indemnification depends on the nature of the matter being indemnified, the time from the closing of the

13

acquisition at which the indemnification claim is made, and other considerations and may be subject to certain deductibles and maximum amounts, such as an aggregate deductible of £1 million and an aggregate cap of £94 million, both of which apply to certain claims that would otherwise be indemnifiable. The indemnity covers historical environmental claims for ten years from the date of the acquisition provided that notice of a potential claim is given within that ten-year period. Our costs for any environmental liabilities may be material and our indemnity from ICI might not sufficiently cover those liabilities. For additional related disclosure, see Item 4 under the caption “Information on the Company —Business Overview—Environmental Regulations.”

Our operations are subject to hazards, which could result in significant liability to us.

We are not fully insured against all potential hazards incident to our business and the occurrence of any of these events could result in significant liability to us. Our operations are subject to the usual hazards associated with chemical manufacturing and the related storage and transportation of feedstocks, products and wastes. These hazards can cause personal injury and loss of life, severe damage to or destruction of property and equipment and environmental damage, and may result in suspension of operations and the imposition of civil and criminal liabilities. These hazards include:

| • | | explosions, |

| |

| • | | fires, |

| |

| • | | inclement weather, |

| |

| • | | natural disasters including earthquakes, |

| |

| • | | mechanical failure, |

| |

| • | | unscheduled downtime, |

| |

| • | | transportation interruptions, |

| |

| • | | remediation, and |

| |

| • | | chemical spills, discharges or releases of toxic or hazardous substances or gases and other environmental risks. |

We may face capacity constraints that would make us unable to meet increased product demands resulting from our growth and, consequently, our revenues and profits may suffer.

Our future growth and financial performance are dependent, in part, on our ability to increase our production capacity. We have no current plans to construct additional facilities. However, we are planning to expand the total production capacity of our plants through de-bottlenecking and modernising production technology but some of these capacity increases will not be in place in the near term. We may not be able to complete our planned capacity expansion at that time or at all, which could cause our revenues and profits to suffer.

Insurance cover – changes in the insurance market have resulted in the risk borne by the group increasing.

Due to ongoing changes in the insurance markets during the last two years the uninsured portions of our risks with respect to property damage and business interruption have increased compared with the period prior to December 31, 2001. The limit of self-insured excess for most forms of property damage increased from £250,000 in the earlier period to £1,250,000 now. Similarly business interruption excess has increased from 15 days in the earlier period to 60 days now.

14

ITEM 4 INFORMATION ON THE COMPANY

A. HISTORY AND DEVELOPMENT OF THE COMPANY

Lucite International Group Holdings Limited, known commercially as Lucite International, was incorporated and registered in England and Wales on August 23, 1999 as a private limited company. Lucite International Finance plc, the issuer of the notes, is a public limited company incorporated and registered in England and Wales. It was incorporated on August 24, 1999.

The Company changed its name in 2002 from Ineos Acrylics Group Holdings Limited to Lucite International Group Holdings Limited. Henceforth the group has been known commercially as Lucite International.

The registered offices of both companies are located at Queens Gate, 15-17 Queens Terrace, Southampton S014 3BP, United Kingdom and our telephone number is +44–23–8024-8150. Our agent in the United States is Lucite International, Inc., which is located at The Lucite® Centre, 7275 Goodlett Farms Parkway, Cordova, Tennessee, 38018, USA.

B. BUSINESS OVERVIEW

We are the leading global producer and seller of methyl methacrylate (“MMA”), the principal building block of Acrylic materials, with approximately a quarter of the world market, by volume. We classify this market as our “upstream” business. We also have leading positions in producing and selling acrylic-based polymers, resins, sheet and composites. We classify these markets as our “downstream” businesses. We are the only company in the methacrylates business to have production, research, marketing and selling facilities in the three principal acrylic markets: the Americas, Europe and Asia.

A network of 16 manufacturing facilities, which are located in nine countries, supports our upstream and downstream businesses. In 2002, our upstream business had £315 million in external sales (2001: £279 million) and our downstream business had £267 million in external sales (2001: £298 million), representing 54% and 46% of our total sales respectively (2001: 48% and 52% respectively). For additional disclosure regarding our sales, including a description of revenues in each of our main geographic markets, please see Note 3 to the financial statements of Lucite International Group Holdings Limited accompanying this report.

Products

Upstream Business

The principal products of our upstream business are methyl methacrylates, or MMA, and speciality methacrylates (“SpMAs”). Approximately 80% of sales by our upstream business are attributable to MMA. We also produce a limited range of high-value and high-volume SpMAs, which impart specific high performance properties to its end products, such as gloss and adhesion. We also sell liquid sodium cyanide mainly in the United Kingdom, which is used to produce detergents and as an ingredient in pharmaceuticals and agrochemicals.

| • | | MMA.We are the largest producer of MMA in the world.MMA is produced in liquid form and is the main building block of acrylic materials. Its commercial value derives from its ability to form resins with excellent transparency and colourability, strength and weatherability and recyclability. MMA in liquid form is used in a wide range of applications from paints and coatings to lubricants and textiles. We sell MMA to third party manufacturers and we also utilize it in our own downstream business. In 2002, we used approximately 27% of our MMA in our own downstream production. |

| |

| • | | SpMA.We have a leading position in the SpMAs market in the sectors in which we operate.SpMAs are usually manufactured by chemically modifying MMA to achieve specific desirable performance characteristics in their end uses. The majority of our SpMA production is used in the surface coating and automotive industry with the balance being used in the lubricants, inks and adhesives industries. |

15

Downstream Business

Our downstream business uses the MMA we manufacture to produce and sell methacrylate-based polymers, resins, sheet and composites in thousands of variations.

Our production knowledge and expertise allows us to manufacture products with a large variety of aesthetic effects and functional properties for different customers, markets and applications.

Our main downstream product categories are the following:

| • | | Polymers:Polymers consist principally of MMA and are used to provide clarity, transparency, colourability, impact resistance and recyclability in end products. Although we focus on higher margin applications, such as architectural applications, films and optics, we also supply most of the key application segments, including automotive, construction, lighting, extrusion and housewares. |

| |

| • | | Resins:Resins are composed of MMA, SpMAs and other additives to provide weatherability, formability, gloss and toughness in end uses. Resins are produced in a variety of liquid and solid formats, including beads. We manufacture only bead resins. In 2002, we were one of the leading producers of bead resins. We supply most of the key product areas, including marine and container coatings, inks, adhesives and electronics. |

| |

| • | | Acrylic Sheet:Acrylic sheet’s characteristics of optical transparency, good impact strength and resistance to weathering make it suitable for a wide range of applications including glazing, do-it-yourself, transportation, acoustics and lighting. The main variants for customising acrylic sheet are size, thickness, colour and surface effects. In baths, kitchens, and spas, we have a leading global position, with high-quality customers and premier brands in this market. We invented the acrylic bath concept in the early 1950s. |

| |

| • | | Composites:Composites are manufactured from a selection of MMA, polymers, aluminium trihydride, quartz and silica. We sell composites in the form of a liquid dispersion which can then be moulded and cured at high temperatures for durability and desired aesthetic effects. We have a leading position in the kitchen sink market in Europe, and in the bath and vanity basin market in Japan. |

Many of our downstream products are sold under brand names and trademarks that are well known globally. Our best-known brands and trademarks include:

| • | | Lucite®, used especially in the bath and spa market. Lucite® was established more than 50 years ago by DuPont and enjoys particularly high brand recognition in the United States. |

| |

| • | | Perspex®, a long-established European brand used for signs and corporate imaging. |

| |

| • | | Diakon®, a polymer primarily used in Europe in the automotive and appliance industries. |

| |

| • | | UltraQuartz®, a new brand that we believe has growth potential in the composites-based kitchen sink market. |

| |

| • | | Elvacite®, a well-recognised brand in the bead resins industry. |

16

Customers, Sales, Marketing and Distribution

Our customers include some of the largest paints and resins producers in the world, such as PPG, Sherwin-Williams, DuPont, Akzo Nobel and ICI, including National Starch; major manufacturers of kitchen, bath and spa products, such as American Standard, Whirlpool and US Industries (which owns Spring Ram and Jacuzzi); do-it-yourself retailers, such as Home Depot and Lowe’s; and entrepreneurial sheet producers including Plaskolite (US) and Barlo (Europe). In 2002, we sold our products to more than 3,000 customers. During 2002, our 20 largest customers accounted for approximately 39% of our total turnover.

Our major customers typically purchase MMA from us under multi-year contracts, with prices reset periodically based on general market conditions including raw material prices. Furthermore, most of these contracts grant us the right to sell a minimum percentage of the customer’s MMA requirements. Pricing for MMA is generally related to the market price for acetone, the principal raw material, and HCN, as well as to demand. Customers generally negotiate on the basis of volume discounts, contract length and global reach.

Customers purchase most downstream products from us under short to mid-term contracts, each with individual customer specifications. Pricing for downstream products is generally related to demand for the end use applications, quality, service innovation and brand needs.

For major markets and key product lines, we sell through our global network of sales and marketing personnel. For our general-purpose sheet, polymer and resin products and, including sales into developing markets and regions, we often use independent distributors. Distributors typically manage a range of sheet products and provide a service, such as selling our products in smaller quantities and cutting acrylic sheet, to the customers’ particular requirements. Our sales force is generally organised along upstream and downstream product categories.

Customer service operations are spread over the geographic regions of our customer base. Customer service representatives process orders to customer specifications, determine product availability and schedule deliveries. Customer service centres are located in Memphis, Tennessee for the US market, in Darwen and Cassel, UK and Rozenburg, Netherlands for the European market and in Bangkok, Thailand, Kaohsiung, Taiwan, Singapore and Tokyo, Japan sites for the Asian market. We also have customer service in South Africa.

Manufacturing Process

We produce MMA using the acetone cyanohydrin three-step process, commonly referred to in the chemicals industry as the “ACH” process, which is used for most of the production in the Americas and Europe. The primary alternative methacrylate production is the C4 process, a direct two-step oxidation of a C4 raw material, favoured by Japanese producers. In 2002, we produced approximately 500 kilotonnes of MMA including our subsidiary (previously joint venture), KMC.

We have found that our three-step process of producing MMA is cost-effective, relative to other processes, especially when low-cost acetone and hydrocyanic acid are available locally in sufficient quantities. Our method has advantages over the C4 method including requiring our competitors to achieve greater economies of scale to efficiently compete.

We have patents to produce MMA using methods other than our three-step process. We have developed a two-stage process to synthesise MMA from ethylene and methyl propionate, which we refer to as our “Alpha” technology and which would enable us to produce MMA in quantities greater than 100 kilotonnes per year at attractive cost levels. The pilot of this technology was commenced in 2001 and was completed at the end of 2002. We purchased patents for an MMA process, which we refer to as our “Beta” technology, from Shell in 1997. Applying this process, we have the ability to convert methyl propadiene into MMA in a one-step process. With this technology, we could produce MMA in quantities from 40 to 50 kilotonnes per year at attractive cost levels

We use the continuous and batch processes to manufacture polymers, the batch process to manufacture resins and continuous cast, cell cast and extruded processes to manufacture acrylic sheet.

17

Raw Materials and Suppliers

We purchase goods and services from a wide range of suppliers. In 2002, the top ten suppliers accounted for approximately 46% of supplies by value (2001: 48%).

Prices of each of our raw materials depend on different factors. For example, the pricing of methanol is very competitive, because it is readily available from a number of suppliers. By contrast, the price of HCN has been the least susceptible to fluctuations in economic conditions, as it is determined by long-term contracts with each of our three external suppliers. However this is affected by, for example, natural gas prices. The price of acetone is closely linked to the demand for phenol, as acetone is a by-product of phenol production.

Intellectual Property Rights

Proprietary protection of our processes, apparatuses and other technology and inventions is important to our business. We own approximately 80 patent families and we have approximately 300 pending patent applications. We also rely upon un-patented proprietary know-how and continuing technological innovation and other trade secrets to develop and maintain our competitive position.

We believe that branding in the downstream businesses is important and we currently own over 30 active brands. Our key brands and trademarks include: Lucite®, Perspex®, Elvacite®, Colacryl®, Diakon®, Asterite®, Prismex® (which we market under license), UltraQuartz® and ModenGlas®, for which we have US or foreign trademark rights.

Competition

The MMA business is characterised by a small number of major competitors, most of whose MMA production is for internal use. We believe that we have the largest market share and none of our competitors presently has a comparable MMA production capacity or geographic spread. Our competitors include Rohm & Haas, Degussa-Hüls AG, Mitsubishi Rayon Co., Ltd., Asahi Kasei, Sumitomo and Kuraray. Moreover, there are only a few volume SpMAs producers, including Rohm & Haas and Mitsubishi Rayon Co., Ltd. The primary factors for competition in the production of MMA and SpMAs are price, quality, service and reliability of supply.

Competition in the downstream market is fragmented and there are many non-vertically integrated manufacturers. Our main competitors in the polymer, resins and composites market include AtoFina, Degussa-Hüls AG, Mitsubishi Rayon Co. Ltd., Sumitomo, and Avecia and other non integrated producers. Our competitors in the acrylic sheet market include integrated manufacturers such as AtoFina and Degussa-Hüls AG, Mitsubishi Rayon Co Ltd. and several major independent manufacturers such as Plaskolite Inc, Aristech Acrylics LLC and Barlo. In our downstream acrylic business, we compete based on price, product innovation and service.

Relationship with DuPont

Since 1993, when ICI Acrylics acquired DuPont’s US acrylics business, including an MMA plant in Beaumont, Texas, an MMA acrylic continuous cast sheet plant in Memphis, Tennessee, and an MMA and SpMA plant in Belle, West Virginia, DuPont has been a major customer of and supplier to our business. Under the 1993 acquisition agreement, DuPont is required to supply 100% of our requirement for HCN in the manufacture of ACH and MMA at our Memphis and Beaumont facilities and 100% of our requirement for ACH at our Belle facility until June 30, 2003. The supply prices are calculated according to a formula negotiated by ICI as part of the overall acquisition. All of the HCN we purchase from DuPont is manufactured at these shared complexes. We have agreed terms for the continued supply of HCN from DuPont for a further five years following the expiration of the current agreement in June 2003.

In addition, DuPont supplies methanol, natural gas and other goods and services to our Beaumont and Memphis facilities.

All of the facilities acquired from DuPont remain located within shared chemicals complexes. Our facilities rely on services provided by DuPont pursuant to service agreements. Supplies and services, which are integral to the complex, are contracted until June 30, 2003. We are actively negotiating a new service contract with DuPont on similar performance, service and financial terms as the existing contract for a length of time yet to be agreed. These supplies and services include utilities, steam, natural gas, nitrogen, plant protection, water, fire protection and railroads. In addition, DuPont operates some of our facilities on our behalf, providing all

18

site services and labour. We believe that we have good relationships with DuPont and currently intend to continue all of our existing arrangements with DuPont.

We currently supply 100% of DuPont’s MMA needs for the production of DuPont’s Corian® product and Finishes business in the United States.

We also have a contract with DuPont to supply a range of products, including MMA, methacrylic acid, SpMAs and resins to DuPont in the United States until June 30, 2003. Both parties have signed a letter of intent with regard to a new three-year contract; the terms of this contract are still in negotiation.

Employees

As of December 31, 2002 we employed approximately 1993 people. Approximately 27% of our employees work in the United States, 41% in Europe, 23% in Asia and 9% in the rest of the world. Some of our employees are subject to collective bargaining agreements. Overall, we believe that our relations with our employees are good.

Seasonality

Taken as a whole there are no material seasonal factors in business performance.

Environmental Regulations

National and international laws regulate the production and marketing of chemical substances, however every country has its own legal procedures for registration and import. Laws and regulations in the European Union, the United States and Japan are most significant to our business. This includes the European inventory of existing commercial chemical substances, the European list of notified chemical substances, the U.S. Toxic Substances Control Act and the chemical list of the Japanese Ministry of Trade and Industry.

In the ordinary course of business, we are subject to continual environmental inspections and monitoring by governmental enforcement authorities. We may incur substantial costs, including fines, damages and criminal or civil sanctions, for actual or alleged violations arising under applicable environmental laws. In addition, our production facilities require operating permits that are subject to renewal, modification and, in some circumstances, revocation. Violations of permit requirements can also result in restrictions or prohibitions on plant operations, substantial fines and civil or criminal sanctions. Our operations involve the generation, handling, transportation, use and disposal of numerous hazardous substances. Changes in regulations regarding the generation, handling, transportation, use and disposal of hazardous substances could inhibit or interrupt our operations and thus have a negative impact on our results of operations. From time to time, these operations may result in violations under environmental laws, including spills or other releases of hazardous substances to the environment. We could incur material costs to address catastrophic incidents that may occur as well as to implement measures to prevent such incidents. In addition, catastrophic incidents could result in public outrage, which may have a significant negative impact on our reputation and results of operations. Adverse reactions may be significantly influenced by public perception of the issues, irrespective of whether actual or potential significant harm is caused to human health or the environment.

Under some environmental laws, we may be jointly and severally liable for the costs of environmental contamination on or from our properties and at off-site locations where we dispose or arrange for disposal or treatment of hazardous wastes. For example, in the United States, under the Comprehensive Environmental Response, Compensation and Liability Act of 1980 and similar state laws, a current owner or operator of real property may be liable for these costs regardless of whether the owner or operator owned or operated the real property at the time of the release of the hazardous substances and regardless of whether the release or disposal was in compliance with law at the time it occurred. In addition, under the Resource Conservation and Recovery Act of 1976 and similar state laws, as the holder of permits to treat or store hazardous wastes, we may, under some circumstances, be required to remediate contamination at our properties regardless of when the contamination occurred. Similar laws are being developed or are in effect to varying degrees in other parts of the world, most notably in the European Union. We cannot assess any third-party claims that may arise under these laws at the present time.

We may also incur costs for capital improvements and general compliance under applicable environmental laws, including costs to acquire, maintain and repair pollution control equipment. Capital expenditures are planned, for example, under national legislation implementing the European Union Directive on Integrated Pollution Prevention and Control (“IPPC”). Under this directive, the majority of our plants will, over the next few years, be required to obtain IPPC authorisations which will regulate air and water discharges, waste

19

management and other matters relating to the impact of operations on the environment, and to conduct site assessments to evaluate environmental conditions. Although the implementing legislation in most member states is not yet in effect, it is likely that additional expenditures may be necessary in some cases to meet the requirements of IPPC authorisations.

Capital expenditures and costs and operating expenses relating to environmental matters will be subject to evolving regulatory requirements and will depend on the timing of the promulgation and enforcement of specific standards that impose requirements on our operations. Therefore, we cannot assure you that material capital expenditures, costs or operating expenses beyond those currently anticipated will not be required under applicable environmental laws.

Our operations are experienced and effective in containing and handling a range of chemicals that can have serious impacts on human health and the environment including hydrocyanic acid, sodium cyanide and ammonia. We are aware that there is or may be soil or groundwater contamination at some of our facilities, former facilities, and offsite locations resulting from past operations at these or neighbouring facilities. We may need to remediate soil and groundwater contaminated with hazardous substances to protect against unacceptable risk to human health and the environment. We may incur significant costs for any investigation and remediation. Based on available information, we believe that the costs we may need to incur to investigate and remediate any contamination will not have a material adverse effect on our business, financial condition or results of operations.

We have indemnification rights, including indemnities from ICI, for the facilities transferred in connection with the acquisition and related transactions. We discuss these rights under “Risk Factors — Environmental matters.” We cannot give any assurance that these indemnities will fully cover the costs of any investigation and remediation that may be required and that we will not be required to bear some or all of these costs or that these costs will not be material.

U.K. Insolvency Laws

Each of the guarantors and Lucite International Finance is an English company. Therefore, any insolvency proceedings by or against Lucite International Finance or the guarantors would likely be based on English insolvency laws. The procedural and substantive provisions of English insolvency laws generally are more favourable to secured creditors than comparable provisions of US law and afford debtors and unsecured creditors only limited protection from secured creditors. Due to the nature of English insolvency laws and the unsecured nature of the claims of holders of these notes against us, the ability of holders of the notes to protect their interests will be more limited than would be the case under US bankruptcy laws. The lenders under our senior credit facility have first ranking security on all the assets of the guarantors of the notes, other than Lucite International Group Holdings Limited, and many of their subsidiaries. As a result, after the enforcement of the collateral, the security agent under the credit facility will have effective control of and the right to direct the disposition of the assets of the guarantors and their affiliates. In addition, under English insolvency law, in the event of a winding up, our liabilities under these notes will be paid after certain of our other debts which are entitled to priority under English law, such as money owed to the UK Inland Revenue for income tax deducted at source, value added tax and certain other taxes and duties owed to the UK Customs and Excise, social security contributions, occupational pension scheme contributions and salaries owed to employees.

In any insolvency proceedings by or against Lucite International Group Holdings Limited or Lucite International Investment Limited, each of which has guaranteed the notes on a senior basis, the guarantee will rank as an unsecured debt of the guarantor behind the claims of secured creditors of the guarantor. The ability of holders of the notes to recover from that guarantor will be subject to the same principles as set out in the preceding paragraph resulting from the application of English insolvency laws.

In any insolvency proceedings by or against any of the subordinated guarantors, each of which has guaranteed the notes on a subordinated basis, the subordinated guarantees will rank behind all of the current and future indebtedness. This will include indebtedness under the senior credit facilities of the subordinated guarantors (other than trade payables), except indebtedness that expressly provides that it is not senior to the guarantees and other types of indebtedness. In addition, the ability of holders of the notes to recover from a subordinated guarantor will be subject to the same principles as set out in the second preceding paragraph resulting from the application of English insolvency laws.

20

Insurance

We insure our plant, equipment and other assets for property damage in the amount of approximately€1.6 billion with an insurance policy, which we believe to be in accordance with customary industry practices, including deductibles and coverage amounts. We also carry a business interruption policy in the amount of€600 million for specified events for up to 18 months. In addition, we carry third party liability insurance. We remain subject to significant increased coverage excesses (deductibles) and additional exclusions for risks such as terrorism and earthquake loss.

Legal Matters