| | |

Contents |

| 1 | | Financial Summary |

| 3 | | Highlights |

| 4 | | Management’s Discussion and Analysis |

| 37 | | Financial Statements |

| 63 | | Five Year Detailed Statistical Review |

| 65 | | Supplemental Information |

| 66 | | Abbreviations and Definitions |

| 69 | | Board of Directors |

| 70 | | Officers |

| 71 | | Corporate Information |

| | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

SELECTED FINANCIAL RESULTS | December 31, | | December 31, |

| | 2018 | | 2017 | | | 2018 | | 2017 |

Financial (000’s) | | | | | | | | | | | | | |

Net Income | | $ | 249,315 | | $ | 15,272 | | | $ | 378,279 | | $ | 236,998 |

Cash Flow from Operating Activities | | | 221,619 | | | 135,332 | | | | 738,784 | | | 476,125 |

Adjusted Funds Flow(4) | | | 214,285 | | | 199,559 | | | | 753,506 | | | 524,064 |

Dividends to Shareholders - Declared | | | 7,234 | | | 7,264 | | | | 29,256 | | | 29,033 |

Total Debt Net of Cash(4) | | | 333,523 | | | 325,831 | | | | 333,523 | | | 325,831 |

Capital Spending | | | 72,058 | | | 116,827 | | | | 593,876 | | | 458,015 |

Property and Land Acquisitions | | | 9,474 | | | 3,805 | | | | 25,840 | | | 13,276 |

Property Divestments | | | 886 | | | (1,385) | | | | 6,912 | | | 56,196 |

Net Debt to Adjusted Funds Flow Ratio(4) | | | 0.4x | | | 0.6x | | | | 0.4x | | | 0.6x |

| | | | | | | | | | | | | |

Financial per Weighted Average Shares Outstanding | | | | | | | | | | | | | |

Net Income - Basic | | $ | 1.03 | | $ | 0.06 | | | $ | 1.55 | | $ | 0.98 |

Net Income - Diluted | | | 1.02 | | | 0.06 | | | | 1.53 | | | 0.96 |

Weighted Average Number of Shares Outstanding (000’s) - Basic | | | 242,344 | | | 242,129 | | | | 244,076 | | | 241,929 |

Weighted Average Number of Shares Outstanding (000’s) - Diluted | | | 245,242 | | | 248,122 | | | | 247,261 | | | 247,874 |

| | | | | | | | | | | | | |

Selected Financial Results per BOE(1)(2) | | | | | | | | | | | | | |

Oil & Natural Gas Sales(3) | | $ | 45.43 | | $ | 41.72 | | | $ | 47.35 | | $ | 36.93 |

Royalties and Production Taxes | | | (11.58) | | | (10.65) | | | | (11.92) | | | (8.91) |

Commodity Derivative Instruments | | | (0.31) | | | (0.39) | | | | (1.05) | | | 0.28 |

Cash Operating Expenses | | | (6.99) | | | (6.42) | | | | (7.00) | | | (6.39) |

Transportation Costs | | | (3.71) | | | (3.20) | | | | (3.63) | | | (3.60) |

General and Administrative Expenses | | | (1.40) | | | (1.55) | | | | (1.47) | | | (1.63) |

Cash Share-Based Compensation | | | 0.23 | | | (0.01) | | | | (0.01) | | | (0.03) |

Interest, Foreign Exchange and Other Expenses | | | (0.90) | | | (1.17) | | | | (0.92) | | | (1.24) |

Current Income Tax Recovery | | | 3.03 | | | 6.15 | | | | 0.80 | | | 1.55 |

Adjusted Funds Flow(4) | | $ | 23.80 | | $ | 24.48 | | | $ | 22.15 | | $ | 16.96 |

| | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

SELECTED OPERATING RESULTS | December 31, | | December 31, |

| | 2018 | | 2017 | | | 2018 | | 2017 |

Average Daily Production(2) | | | | | | | | | | | | | |

Crude Oil (bbls/day) | | | 49,968 | | | 42,374 | | | | 45,424 | | | 36,935 |

Natural Gas Liquids (bbls/day) | | | 4,483 | | | 4,448 | | | | 4,486 | | | 3,858 |

Natural Gas (Mcf/day) | | | 260,453 | | | 250,607 | | | | 259,837 | | | 263,506 |

Total (BOE/day) | | | 97,860 | | | 88,590 | | | | 93,216 | | | 84,711 |

| | | | | | | | | | | | | |

% Crude Oil and Natural Gas Liquids | | | 56% | | | 53% | | | | 54% | | | 48% |

| | | | | | | | | | | | | |

Average Selling Price(2)(3) | | | | | | | | | | | | | |

Crude Oil (per bbl) | | $ | 64.18 | | $ | 65.91 | | | $ | 74.59 | | $ | 58.69 |

Natural Gas Liquids (per bbl) | | | 26.72 | | | 32.26 | | | | 28.31 | | | 30.01 |

Natural Gas (per Mcf) | | | 4.28 | | | 3.03 | | | | 3.42 | | | 3.21 |

| | | | | | | | | | | | | |

Net Wells Drilled | | | 12 | | | 7 | | | | 61 | | | 46 |

| (1) | | Non‑cash amounts have been excluded. |

| (2) | | Based on Company interest production volumes. See “Basis of Presentation” section in the following MD&A. |

| (3) | | Before transportation costs, royalties and commodity derivative instruments. |

| (4) | | These non‑GAAP measures may not be directly comparable to similar measures presented by other entities. See “Non‑GAAP Measures” section in the following MD&A. |

ENERPLUS 2018 FINANCIAL SUMMARY 1

| | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

| December 31, | | December 31, |

Average Benchmark Pricing | | 2018 | | 2017 | | | 2018 | | 2017 |

WTI crude oil (US$/bbl) | | $ | 58.81 | | $ | 55.40 | | | $ | 64.77 | | $ | 50.95 |

Brent (ICE) crude oil (US$/bbl) | | | 68.08 | | | 61.54 | | | | 71.53 | | | 54.83 |

NYMEX natural gas – last day (US$/Mcf) | | | 3.64 | | | 2.93 | | | | 3.09 | | | 3.11 |

AECO natural gas – monthly index (CDN$/Mcf) | | | 1.90 | | | 1.96 | | | | 1.53 | | | 2.43 |

US/CDN average exchange rate | | | 1.32 | | | 1.27 | | | | 1.30 | | | 1.30 |

| | | | | | |

Share Trading Summary | | CDN(1) – ERF | | U.S.(2) – ERF |

For the twelve months ended December 31, 2018 | | (CDN$) | | (US$) |

High | | $ | 18.04 | | $ | 13.87 |

Low | | $ | 9.65 | | $ | 6.84 |

Close | | $ | 10.62 | | $ | 7.76 |

| (1) | | TSX and other Canadian trading data combined. |

| (2) | | NYSE and other U.S. trading data combined. |

| | | | |

2018 Dividends per Share | | CDN$ | | US$(1) |

First Quarter Total | $ | 0.03 | $ | 0.02 |

Second Quarter Total | $ | 0.03 | $ | 0.02 |

Third Quarter Total | $ | 0.03 | $ | 0.02 |

Fourth Quarter Total | $ | 0.03 | $ | 0.02 |

Total Year to Date | $ | 0.12 | $ | 0.08 |

| (1) | | CDN$ dividends converted at the relevant foreign exchange rate on the payment date. |

2 ENERPLUS 2018 FINANCIAL SUMMARY

Financial and Operational Highlights

| · | | Fourth quarter 2018 production was at the high-end of the Company’s guidance range and modestly higher than the prior quarter. Total fourth quarter production averaged 97,860 BOE per day, including oil and natural gas liquids production of 54,451 barrels per day (92% oil). |

| · | | Full year 2018 production was also at the high-end of the Company’s guidance range, averaging 93,216 BOE per day, including 49,910 barrels per day of crude oil and natural gas liquids (91% oil). Year-over-year, the Company’s 2018 production increased by 10%, with liquids production increasing by 22%. This growth was largely driven by North Dakota production which increased by 42%. |

| · | | Higher realized commodity prices and increased production volumes resulted in significant increases to cash flow from operating activities and adjusted funds flow for 2018 compared to 2017. |

| o | | Fourth quarter cash flow from operating activities increased to $221.6 million from $216.1 million in the third quarter. Full year 2018 cash flow from operating activities was $738.8 million, 55% higher than 2017. |

| o | | Fourth quarter adjusted funds flow increased to $214.3 million from $210.4 million in the third quarter. Fourth quarter adjusted funds flow benefited from a $27.2 million Alternative Minimum Tax (“AMT”) refund expected to be realized in 2019. Enerplus expects to realize the remaining $27.2 million in AMT refund in 2020 and 2021. Full year 2018 adjusted funds flow was $753.5 million, 44% higher than 2017. |

| · | | Fourth quarter net income was $249.3 million ($1.03 per share) compared to $86.9 million ($0.35 per share) in the prior quarter. Full year 2018 net income was $378.3 million ($1.55 per share) compared to $237.0 million ($0.98 per share) in 2017. |

| · | | Fourth quarter adjusted net income was $102.2 million ($0.42 per share) compared to $97.3 million ($0.40 per share) in the prior quarter. Full year 2018 adjusted net income was $344.8 million ($1.41 per share) compared to $132.2 million ($0.55 per share) in 2017. |

| · | | Capital spending was $72.1 million in the fourth quarter of 2018, bringing full year 2018 capital spending to $593.9 million, in-line with the Company’s $585 million 2018 budget. |

| · | | Enerplus remains in a strong financial position. The Company’s net debt at December 31, 2018 was $333.5 million, comprised of $696.8 million of senior notes less $363.3 million in cash. At December 31, 2018, Enerplus was undrawn on its $800 million bank credit facility and had a net debt to adjusted funds flow ratio of 0.4 times. |

| · | | During 2018 Enerplus repurchased 5,925,084 common shares at an average share price of $13.33 and a cost of $79.0 million. |

Reserves Highlights

| · | | Replaced 194% of 2018 production, adding 65.7 MMBOE (51% oil) of 2P reserves from development activities (including revisions and economic factors). |

| · | | Material reserves growth was realized in North Dakota and the Marcellus. The Company replaced 244% of 2018 North Dakota production, adding 35.1 MMBOE of 2P reserves and 247% of 2018 Marcellus production, adding 187.4 Bcf of 2P reserves (including revisions and economic factors). |

| · | | Finding and development (“F&D”) costs were $13.08 per BOE for proved developed producing (“PDP”) reserves, $16.69 per BOE for proved reserves, and $13.74 per BOE for 2P reserves, including future development costs (“FDC”). |

| · | | Three-year average F&D costs were $10.17 per BOE for PDP reserves, $10.27 per BOE for proved reserves, and $10.04 per BOE for 2P reserves, including FDC. |

| · | | Finding, development and acquisition (“FD&A”) costs were $17.42 per BOE for proved reserves and $14.37 per BOE for 2P reserves, including FDC. |

| · | | Three-year average FD&A costs were $7.55 per BOE for proved reserves and $8.26 per BOE for 2P reserves, including FDC. |

| · | | Total 2P reserves were 427.7 MMBOE at year-end 2018, representing an 8% increase from year-end 2017. |

| · | | 2P reserves were comprised of 49% crude oil, 5% natural gas liquids, and 46% natural gas at year-end 2018. |

| · | | Proved developed producing reserves and total proved reserves represent 46% and 70% of 2P reserves, respectively. |

ENERPLUS 2018 FINANCIAL SUMMARY 3

Exhibit 99.3

Management’s Discussion and Analysis (“MD&A”)

The following discussion and analysis of financial results is dated February 21, 2019 and is to be read in conjunction with the audited Consolidated Financial Statements (the “Financial Statements”) of Enerplus Corporation (“Enerplus” or the “Company”), as at December 31, 2018 and 2017 and for the years ended December 31, 2018, 2017 and 2016.

The following MD&A contains forward-looking information and statements. We refer you to the end of the MD&A under “Forward‑Looking Information and Statements” for further information. The following MD&A also contains financial measures that do not have a standardized meaning as prescribed by accounting principles generally accepted in the United States of America (“U.S. GAAP”). See “Non‑GAAP Measures” at the end of this MD&A for further information.

BASIS OF PRESENTATION

The Financial Statements and notes have been prepared in accordance with U.S. GAAP. All amounts are stated in Canadian dollars unless otherwise specified and all note references relate to the notes included with the Financial Statements. Certain prior period amounts have been restated to conform with current period presentation.

Where applicable, natural gas has been converted to barrels of oil equivalent (“BOE”) based on 6 Mcf:1 BOE and oil and natural gas liquids (“NGL”) have been converted to thousand cubic feet of gas equivalent (“Mcfe”) based on 0.167 bbl:1 Mcfe. The BOE and Mcfe rates are based on an energy equivalent conversion method primarily applicable at the burner tip and do not represent a value equivalent at the wellhead. Given that the value ratio based on the current price of natural gas as compared to crude oil is significantly different from the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be misleading as an indication of value. Use of BOE and Mcfe in isolation may be misleading. All production volumes are presented on a Company interest basis, being the Company’s working interest share before deduction of any royalties paid to others, plus the Company’s royalty interests, unless otherwise stated. Company interest is not a term defined in Canadian National Instrument 51‑101– Standards of Disclosure for Oil and Gas Activities (“NI 51‑101”) and may not be comparable to information produced by other entities. All reserves information presented herein has been prepared in accordance with NI 51-101 and is presented at December 31, 2018 unless otherwise stated.

In accordance with U.S. GAAP, oil and natural gas sales are presented net of royalties in the Financial Statements. Under International Financial Reporting Standards, industry standard is to present oil and natural gas sales before deduction of royalties and as such this MD&A presents production, oil and natural gas sales, and BOE measures before deduction of royalties to remain comparable with our Canadian peers.

The following table provides a reconciliation of our production volumes:

| | | | | | |

| | Year ended December 31, |

Average Daily Production Volumes | 2018 | 2017 | 2016 |

Company interest production volumes | | | | | | |

Crude oil (bbls/day) | | 45,424 | | 36,935 | | 38,353 |

Natural gas liquids (bbls/day) | | 4,486 | | 3,858 | | 4,903 |

Natural gas (Mcf/day) | | 259,837 | | 263,506 | | 299,214 |

Company interest production volumes (BOE/day) | | 93,216 | | 84,711 | | 93,125 |

| | | | | | |

Royalty volumes | | | | | | |

Crude oil (bbls/day) | | 9,054 | | 7,531 | | 7,198 |

Natural gas liquids (bbls/day) | | 951 | | 777 | | 932 |

Natural gas (Mcf/day) | | 48,923 | | 47,722 | | 50,270 |

Royalty volumes (BOE/day) | | 18,159 | | 16,262 | | 16,508 |

| | | | | | |

Net production volumes | | | | | | |

Crude oil (bbls/day) | | 36,370 | | 29,404 | | 31,155 |

Natural gas liquids (bbls/day) | | 3,535 | | 3,081 | | 3,971 |

Natural gas (Mcf/day) | | 210,914 | | 215,784 | | 248,944 |

Net production volumes (BOE/day) | | 75,057 | | 68,449 | | 76,617 |

4 ENERPLUS 2018 FINANCIAL SUMMARY

2018 FOURTH QUARTER OVERVIEW

Fourth quarter production averaged 97,860 BOE/day, which was higher than our third quarter production of 96,861 BOE/day. Crude oil and natural gas liquids production increased by 2% to 54,451 bbls/day compared to the third quarter and was at the high end of our fourth quarter liquids production guidance range of 53,500 – 54,500 bbls/day. Our fourth quarter capital spending of $72.1 million was largely focused on drilling in North Dakota in preparation for the 2019 capital program.

We reported net income of $249.3 million in the fourth quarter compared to net income of $86.9 million in the third quarter. The increase is primarily the result of a $253.7 million gain on commodity derivative instruments compared to a $54.1 million loss in the third quarter of 2018 due to crude oil prices falling below the swap and purchased put levels on our three-way collars.

Fourth quarter cash flow from operating activities and adjusted funds flow increased to $221.6 million and $214.3 million, respectively, from $216.1 million and $210.4 million, respectively, in the third quarter. The increases were due to higher realized natural gas prices in the Marcellus, offset by a decrease in crude oil revenue. Adjusted funds flow in the fourth quarter benefited from a $27.2 million Alternative Minimum Tax (“AMT”) refund, expected to be realized in 2019.

During the fourth quarter, we had $142.2 million in free cash flow, enabling our repurchase of 5.4 million common shares for $70.6 million, bringing total repurchases in 2018 to $79.0 million (5.9 million shares), and further enhancing our per share growth and the return of capital to shareholders.

Selected Fourth Quarter Canadian and U.S. Financial Results

| | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | Three months ended |

| | December 31, 2018 | | | December 31, 2017 |

(millions, except per unit amounts) | | Canada | | U.S. | | Total | | | Canada | | U.S. | | Total |

Average Daily Production Volumes(1) | | | | | | | | | | | | | | | | | | | |

Crude oil (bbls/day) | | | 9,237 | | | 40,731 | | | 49,968 | | | | 9,478 | | | 32,896 | | | 42,374 |

Natural gas liquids (bbls/day) | | | 956 | | | 3,527 | | | 4,483 | | | | 1,198 | | | 3,250 | | | 4,448 |

Natural gas (Mcf/day) | | | 23,357 | | | 237,096 | | | 260,453 | | | | 37,265 | | | 213,342 | | | 250,607 |

Total average daily production (BOE/day) | | | 14,086 | | | 83,774 | | | 97,860 | | | | 16,887 | | | 71,703 | | | 88,590 |

| | | | | | | | | | | | | | | | | | | |

Pricing(2) | | | | | | | | | | | | | | | | | | | |

Crude oil (per bbl) | | $ | 33.76 | | $ | 71.07 | | $ | 64.18 | | | $ | 57.05 | | $ | 68.46 | | $ | 65.91 |

Natural gas liquids (per bbl) | | | 39.69 | | | 23.20 | | | 26.72 | | | | 44.07 | | | 27.91 | | | 32.26 |

Natural gas (per Mcf) | | | 3.74 | | | 4.33 | | | 4.28 | | | | 3.01 | | | 3.04 | | | 3.03 |

| | | | | | | | | | | | | | | | | | | |

Capital Expenditures | | | | | | | | | | | | | | | | | | | |

Capital spending | | $ | 13.5 | | $ | 58.6 | | $ | 72.1 | | | $ | 10.9 | | $ | 105.9 | | $ | 116.8 |

Acquisitions | | | 1.2 | | | 8.3 | | | 9.5 | | | | 1.1 | | | 2.7 | | | 3.8 |

Divestments | | | 0.9 | | | (1.8) | | | (0.9) | | | | 0.9 | | | 0.5 | | | 1.4 |

| | | | | | | | | | | | | | | | | | | |

Netback(3) Before Hedging | | | | | | | | | | | | | | | | | | | |

Oil and natural gas sales | | $ | 40.9 | | $ | 368.3 | | $ | 409.2 | | | $ | 64.9 | | $ | 275.2 | | $ | 340.1 |

Royalties | | | (5.4) | | | (77.0) | | | (82.4) | | | | (13.9) | | | (55.1) | | | (69.0) |

Production taxes | | | (0.4) | | | (21.5) | | | (21.9) | | | | (0.7) | | | (17.1) | | | (17.8) |

Cash operating expenses | | | (17.8) | | | (45.1) | | | (62.9) | | | | (18.2) | | | (34.1) | | | (52.3) |

Transportation costs | | | (2.6) | | | (30.8) | | | (33.4) | | | | (2.9) | | | (23.3) | | | (26.2) |

Netback before hedging | | $ | 14.7 | | $ | 193.9 | | $ | 208.6 | | | $ | 29.2 | | $ | 145.6 | | $ | 174.8 |

| | | | | | | | | | | | | | | | | | | |

Other Expenses | | | | | | | | | | | | | | | | | | | |

Commodity derivative instruments loss/(gain) | | $ | (253.7) | | $ | — | | $ | (253.7) | | | $ | 41.0 | | $ | — | | $ | 41.0 |

General and administrative expense(4) | | | 11.6 | | | 7.5 | | | 19.1 | | | | 13.9 | | | 5.8 | | | 19.7 |

Current income tax recovery | | | — | | | (27.4) | | | (27.4) | | | | — | | | (50.2) | | | (50.2) |

(1)Company interest volumes.

(2)Before transportation costs, royalties and the effects of commodity derivative instruments.

(3)See “Non‑GAAP Measures” section in this MD&A.

(4)Includes share‑based compensation.

ENERPLUS 2018 FINANCIAL SUMMARY 5

Comparing the fourth quarter of 2018 with the same period in 2017:

| · | | Average daily production was 97,860 BOE/day, an increase of 10% from 88,590 BOE/day, primarily due to a 24% increase in U.S. crude oil production as a result of strong well performance and a larger capital spending program in North Dakota in 2018. |

| · | | Our crude oil and natural gas liquids production accounted for 56% of our total production mix in the fourth quarter of 2018, an increase from 53% in 2017. |

| · | | Capital spending decreased to $72.1 million compared to $116.8 million in the fourth quarter of 2017 due to the timing of our 2018 capital program and limited completions activity in the fourth quarter. The majority of our capital investment in the fourth quarter was focused on drilling our U.S. crude oil properties, with spending of $51.7 million. |

| · | | Operating expenses increased to $62.9 million ($6.99/BOE) compared to $52.1 million ($6.39/BOE) in the fourth quarter of 2017 as a result of an increased weighting of crude oil and liquids production with higher associated operating cost metrics. |

| · | | Cash general and administrative (“G&A”) expenses were unchanged but improved on a per BOE basis from $12.6 million ($1.40/BOE) compared to $12.6 million ($1.55/BOE) in 2017 with increased production volumes. |

| · | | During the fourth quarter of 2018, our Bakken crude oil price differential widened to US$5.60/bbl below WTI compared to US$1.61/bbl below WTI for the same period in 2017, as a result of significant refinery maintenance reducing demand in the region. Our Marcellus natural gas differential narrowed in the fourth quarter to US$0.34/Mcf below NYMEX compared to US$0.81/Mcf below NYMEX in 2017, due to additional pipeline capacity that came online during the year. |

| · | | We reported net income of $249.3 million in the fourth quarter of 2018 compared to net income of $15.3 million in the fourth quarter of 2017. Net income increased by $234.0 million primarily due to a $253.7 million gain on commodity derivative instruments in 2018 compared to a $41.0 million loss recorded in 2017. |

| · | | Cash flow from operating activities and adjusted funds flow increased to $221.6 million and $214.3 million, respectively, compared to $135.3 million and $199.6 million, respectively, in the fourth quarter of 2017. The increases were the result of higher production and stronger natural gas prices in the Marcellus offset by wider Bakken crude oil differentials in the fourth quarter of 2018. |

| · | | During the fourth quarter of 2018, we repurchased 5.4 million common shares under our Normal Course Issuer Bid (“NCIB”) for total consideration of $70.6 million, bringing our total repurchases to 5.9 million shares for total consideration of $79.0 million in 2018. |

| · | | Net debt to adjusted funds flow improved to 0.4x compared to 0.6x in the fourth quarter of 2017. |

2018 OVERVIEW AND 2019 OUTLOOK

| | | | | | | |

Summary of Guidance and Results | | Revised 2018 Guidance | | 2018 Results | | 2019 Guidance | |

Capital spending ($ millions) | | $ 585 | | $ 594 | | $565 - $635 | |

Average annual production (BOE/day) | | 92,500 - 93,000 | | 93,216 | | 94,000 – 100,000 | |

Average annual crude oil and natural gas liquids production (bbls/day) | | 49,500 - 50,000 | | 49,910 | | 52,500 – 56,000 | |

Fourth quarter average crude oil and natural gas liquids production (bbls/day) | | 53,500 - 54,500 | | 54,451 | | | |

Average royalty and production tax rate

(% of gross sales, before transportation) | | 25% | | 25% | | 25% | |

Operating expenses (per BOE) | | $ 7.00 | | $ 7.00 | | $ 8.00 | |

Transportation costs (per BOE) | | $ 3.60 | | $ 3.63 | | $ 4.00 | |

Cash G&A expenses (per BOE) | | $ 1.50 | | $ 1.47 | | $ 1.50 | |

| | | | | | | |

2019 Differential/Basis Outlook and Results(1) | | | | | | | |

Average U.S. Bakken crude oil differential (compared to WTI crude oil) | | US$(3.80)/bbl | | US$(3.78)/bbl | | US$(4.00)/bbl | |

Average Marcellus natural gas differential (compared to NYMEX natural gas) | | US$(0.40)/Mcf | | US$(0.43)/Mcf | | US$(0.30)/Mcf | |

| (1) | | Excludes transportation costs |

6 ENERPLUS 2018 FINANCIAL SUMMARY

2018 Overview

In 2018, we continued to focus on maximizing returns, sustainable growth, as well as returning capital to our shareholders. We delivered total production growth of 10% and liquids growth of 22% compared to 2017 and returned $108.3 million of capital to our shareholders through share repurchases and dividends, while maintaining our balance sheet strength.

In 2018, our annual average production was 93,216 BOE/day with crude oil and liquids volumes of 49,910 bbls/day, at the high end of our revised production guidance targets of 92,500 – 93,000 BOE/day and 49,500 – 50,000 bbls/day, respectively. Our capital spending for the year totaled $593.9 million, in line with our guidance of $585 million. The majority of our spending (88%) was focused on our liquids properties, primarily in North Dakota.

Our Bakken sales price differentials remained consistent with the prior year averaging US$3.78/bbl below WTI, which was in line with our revised guidance of US$3.80/bbl below WTI. Our Marcellus differential narrowed to US$0.43/Mcf below NYMEX, a 43% improvement compared to 2017, due to additional pipeline capacity coming into service. Canadian crude oil and natural gas differentials weakened significantly in 2018, averaging US$21.83/bbl below WTI and US$0.81/Mcf below NYMEX, respectively, mainly due to limited pipeline takeaway capacity and storage concerns.

Operating expenses and cash G&A expenses were $7.00/BOE and $1.47/BOE, respectively, consistent with our guidance of $7.00/BOE and $1.50/BOE, respectively.

Net income for 2018 was $378.3 million, an increase from $237.0 million in 2017 primarily due to higher revenue as a result of an increase in production, realized pricing and gains on commodity derivative instruments. The higher production also increased operating, royalty and depletion expenses, which partially offset the higher revenue in 2018 when compared to 2017.

Cash flow from operations and adjusted funds flow increased significantly to $738.8 million and $753.5 million, respectively, from $476.1 million and $524.1 million, respectively, in 2017. Oil and natural gas sales increased by $469.1 million, compared to 2017, largely due to higher realized commodity prices, narrower sales price differentials in the Marcellus and higher production volumes. This increase was partially offset by higher operating and royalty expenses in 2018.

Total debt net of cash at December 31, 2018 was $333.5 million, comprised of $696.8 million of senior notes less $363.3 million in cash. At December 31, 2018, we were undrawn on our $800 million senior unsecured bank credit facility and had a net debt to adjusted funds flow ratio of 0.4x.

2019 Outlook

Our focus in 2019 is to continue to maximize returns, while delivering sustainable liquids production growth, returning capital to shareholders and preserving our balance sheet strength. Our capital budget range for 2019 is between $565 million and $635 million, with the majority of capital being allocated to our North Dakota crude oil properties. As a result, we expect annual liquids production growth of approximately 9% at the mid-point of production guidance in 2019.

Annual 2019 production is expected to average between 94,000 – 100,000 BOE/day, with crude oil and natural gas liquids production expected to average between 52,500 – 56,000 bbls/day. As a result of lower capital spending in the fourth quarter of 2018, we expect the majority of our production growth to occur during the second half of 2019.

We expect our Bakken sales price differential to widen slightly in 2019 to be approximately US$4.00/bbl below WTI, which includes 16,000 bbls/day of fixed price differential sales at approximately US$3.00/bbl below WTI. In the Marcellus, we expect our sales price differential to improve to approximately US$0.30/Mcf below NYMEX as a result of excess pipeline egress out of the region.

To support our 2019 capital program, we have hedged 63% of our 2019 forecasted crude oil production, after royalties, primarily through the use of three-way collar structures. We also have additional natural gas hedges in 2019 for approximately 34% of our forecasted 2019 natural gas production, after royalties.

Operating expenses are expected to average approximately $8.00/BOE in 2019, an increase from 2018, as a result of the increase to our crude oil and liquids weighting throughout 2019, as well as an increase in gas processing costs and the use of electrical submersible pumps in North Dakota. We continue to focus our capital program on crude oil production growth, which has higher operating cost metrics.

We expect cash G&A expenses and transportation costs for 2019 to average approximately $1.50/BOE and $4.00/BOE, respectively. The increase in transportation costs reflects additional transportation commitments that provide access to sell a portion of our production at U.S. gulf coast or Brent pricing.

ENERPLUS 2018 FINANCIAL SUMMARY 7

RESULTS OF OPERATIONS

Production

| | | | | | | | | |

Average Daily Production Volumes | | | 2018 | | | 2017 | | | 2016 |

Crude oil (bbls/day) | | | 45,424 | | | 36,935 | | | 38,353 |

Natural gas liquids (bbls/day) | | | 4,486 | | | 3,858 | | | 4,903 |

Natural gas (Mcf/day) | | | 259,837 | | | 263,506 | | | 299,214 |

Total daily sales (BOE/day) | | | 93,216 | | | 84,711 | | | 93,125 |

Production in 2018 averaged 93,216 BOE/day, in line with our revised guidance range of 92,500 – 93,000 BOE/day and a 10% increase when compared to 2017. Crude oil and liquids production averaged 49,910 BOE/day, meeting our revised guidance of 49,500 – 50,000 bbls/day, as a result of a successful capital program focused on our U.S. crude oil properties.

Our U.S. production volumes increased by 20% to 78,287 BOE/day compared to 2017, mainly due to a 10,743 bbl/day increase in crude oil and natural gas liquids production as a result of strong well performance in North Dakota and an increase to our 2018 capital spending program. Our U.S. natural gas production increased by 7% with no price related curtailments in the Marcellus during the year.

Canadian production volumes decreased by 4,748 BOE/day or 24% compared to the prior year, largely due to the full year impact of non-core asset divestments that occurred throughout 2017.

Our crude oil and natural gas liquids production accounted for 54% of our total average daily production in 2018, a significant increase when compared to 48% in 2017 and 46% in 2016.

Production for 2017 compared to 2016 decreased 9% or 8,414 bbls/day. The decrease was primarily a result of non-core Canadian divestments throughout 2017 and the sale of our U.S. non-operated North Dakota properties, which closed on December 30, 2016. The impact of divestments was somewhat offset by growth in our operated U.S. crude oil production with the additional capital spending on our North Dakota assets.

2019 Guidance

We expect annual average production for 2019 of 94,000 – 100,000 BOE/day, including 52,500 – 56,000 bbls/day of crude oil and natural gas liquids, resulting in year over year production growth of 4% and liquids production growth of 9% based on a WTI price of US$50/bbl – US$55/bbl.

Pricing

The prices received for our crude oil and natural gas production directly impact our earnings, cash flow from operating activities, adjusted funds flow and financial condition. The following table summarizes our average selling prices, benchmark prices and differentials:

| | | | | | | | | |

Pricing (average for the period) | | 2018 | | 2017 | | 2016 |

Benchmarks | | | | | | | | | |

WTI crude oil (US$/bbl) | | $ | 64.77 | | $ | 50.95 | | $ | 43.32 |

Brent (ICE) crude oil (US$/bbl) | | | 71.53 | | | 54.83 | | | 45.04 |

NYMEX natural gas – last day (US$/Mcf) | | | 3.09 | | | 3.11 | | | 2.46 |

AECO natural gas – monthly index ($/Mcf) | | | 1.53 | | | 2.43 | | | 2.09 |

US/CDN average exchange rate | | | 1.30 | | | 1.30 | | | 1.32 |

US/CDN period end exchange rate | | | 1.36 | | | 1.26 | | | 1.34 |

| | | | | | | | | |

Enerplus selling price(1) | | | | | | | | | |

Crude oil ($/bbl) | | $ | 74.59 | | $ | 58.69 | | $ | 44.84 |

Natural gas liquids ($/bbl) | | | 28.31 | | | 30.01 | | | 15.29 |

Natural gas ($/Mcf) | | | 3.42 | | | 3.21 | | | 2.06 |

| | | | | | | | | |

Average benchmark differentials | | | | | | | | | |

Brent (ICE) - WTI (US$/bbl) | | $ | 6.77 | | $ | 3.88 | | $ | 1.72 |

MSW Edmonton – WTI (US$/bbl) | | | (11.12) | | | (2.46) | | | (3.21) |

WCS Hardisty – WTI (US$/bbl) | | | (26.31) | | | (11.98) | | | (13.84) |

Transco Leidy monthly – NYMEX (US$/Mcf) | | | (0.64) | | | (0.96) | | | (1.15) |

TGP Z4 300L monthly – NYMEX (US$/Mcf) | | | (0.73) | | | (1.03) | | | (1.21) |

AECO monthly – NYMEX (US$/Mcf) | | | (1.90) | | | (1.26) | | | (0.89) |

| | | | | | | | | |

8 ENERPLUS 2018 FINANCIAL SUMMARY

Enerplus realized differentials(1)(2) | | | | | | | | | |

Bakken crude oil – WTI (US$/bbl) | | $ | (3.78) | | $ | (3.72) | | $ | (7.46) |

Marcellus natural gas – NYMEX (US$/Mcf) | | | (0.43) | | | (0.76) | | | (0.93) |

Canada crude oil – WTI (US$/bbl) | | | (21.83) | | | (10.94) | | | (13.21) |

Canada natural gas – NYMEX (US$/Mcf) | | | (0.81) | | | (0.62) | | | (0.80) |

| (1) | | Excluding transportation costs, royalties and the effects of commodity derivative instruments. |

| (2) | | Based on a weighted average differential for the period. |

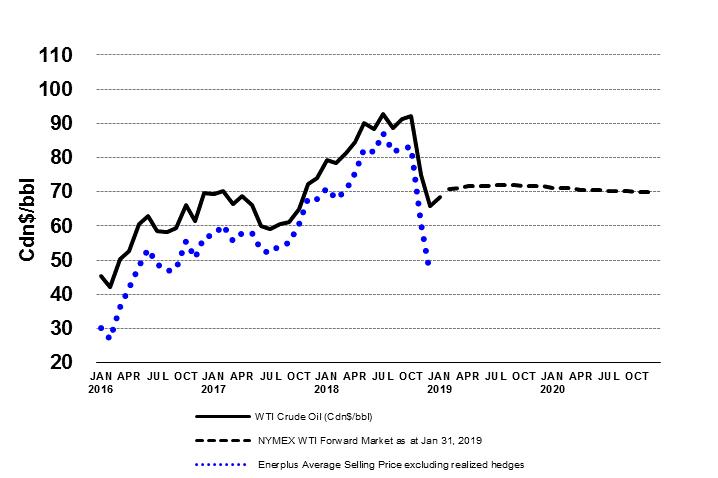

CRUDE OIL AND NATURAL GAS LIQUIDS

Benchmark WTI prices increased by 27% to US$64.77/bbl in 2018 compared to 2017, largely due to lower global inventories as a result of the supply reductions made by the Organization of Petroleum Exporting Countries (“OPEC”). In addition, supply concerns, particularly in Venezuela, and the reimposition of U.S. sanctions on Iran supported global crude oil prices for the majority of the year. However, WTI prices declined significantly during the fourth quarter of 2018, closing at US$45.41/bbl. The decline in oil prices was due to concerns over global trade and ongoing geopolitical issues, which may reduce global demand. Our 2018 realized crude oil price averaged $74.59/bbl, a 27% increase compared to 2017, in line with changes in the underlying benchmark price.

Our Bakken sales price differentials weakened slightly in 2018 compared to the prior year, averaging US$3.78/bbl below WTI, which was in line with our revised guidance of US$3.80/bbl below WTI. Bakken prices were strong during the second and third quarter of 2018 but weakened significantly during the fourth quarter. This was due to a large amount of demand lost during seasonal refinery maintenance and higher than anticipated production increases that put pressure on regional pipeline capacity. Our realized Bakken differentials were somewhat insulated from the weakness in the fourth quarter of 2018 due to a portion of our physical sales being based on term negotiated fixed differentials to WTI. We expect Bakken differentials to widen slightly in 2019 and are guiding to US$4.00/bbl below WTI, which includes 16,000 bbls/day of fixed price differential sales at approximately US$3.00/bbl below WTI.

Canadian crude oil differentials weakened substantially in 2018, with both heavy and light differentials trading at much wider levels compared to the prior year. This was especially evident during the fourth quarter of 2018, as pipeline capacity leaving the region was fully utilized, resulting in a large increase in Canadian crude oil held in storage and a significant volume of production using rail to clear the region. However, differentials have recently strengthened due to Alberta government mandated production curtailments, which were announced in December 2018. Inadequate pipeline takeaway continues to be a major concern throughout the Canadian oil and gas industry.

We realized an average price of $28.31/bbl on our natural gas liquids production in 2018, which represents a 6% decrease in prices when compared to 2017. This decrease was mainly due to lower condensate prices in both Canada and the U.S.

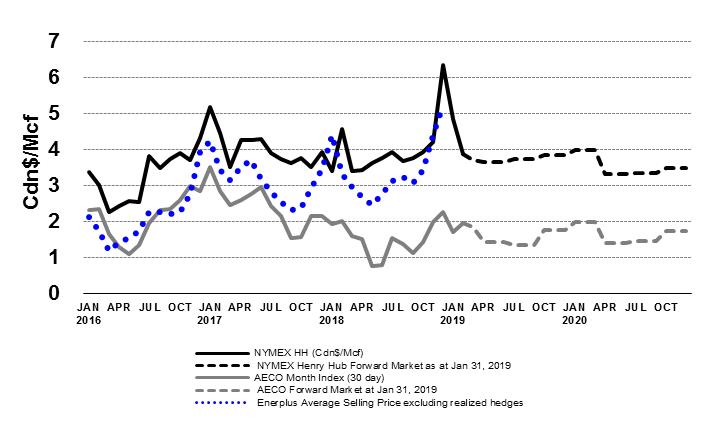

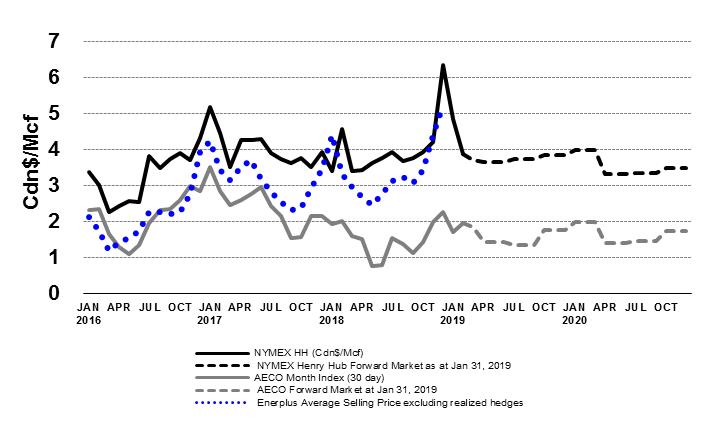

NATURAL GAS

Our realized natural gas price averaged $3.42/Mcf in 2018, a 7% increase from 2017 realized prices, despite NYMEX and AECO prices both declining on a year-over-year basis. Our realized natural gas price outperformed the benchmarks due to stronger Marcellus basis differentials in 2018 and the positive impact of our multi-year term AECO physical sales which had average fixed basis differentials of US$0.64/Mcf below NYMEX.

In the Marcellus, the Tennessee Gas Pipeline Zone 4 - 300 Leg and Transco Leidy monthly benchmark differentials averaged US$0.73/Mcf and US$0.64/Mcf below NYMEX, respectively, compared to US$1.03/Mcf and US$0.96/Mcf, respectively, below NYMEX in 2017. The strengthening in local Marcellus prices was due to additional pipeline capacity coming into service, as well as stronger weather-related demand in the region. As a result, our realized portfolio sales price differential, before transportation costs, averaged US$0.43/Mcf below NYMEX for the year, which was in line with our guidance of US$0.40/Mcf below NYMEX. We expect our Marcellus differential to average US$0.30/Mcf below NYMEX in 2019 as regional prices continue to benefit from excess pipeline takeaway capacity.

In Alberta, congestion on regional and export pipelines and continued production growth resulted in benchmark AECO monthly prices averaging US$1.90/Mcf below NYMEX in 2018 compared to US$1.26/Mcf below NYMEX in 2017. We continue to benefit from our term AECO physical sales.

ENERPLUS 2018 FINANCIAL SUMMARY 9

Monthly Crude Oil Prices

Monthly Natural Gas Prices

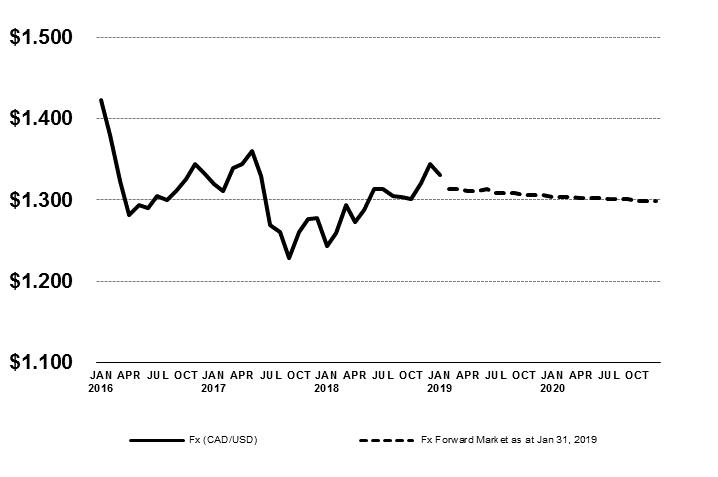

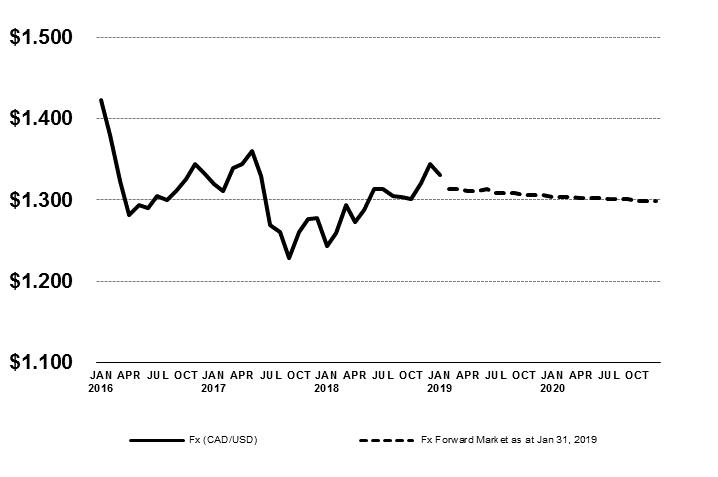

FOREIGN EXCHANGE

Our oil and natural gas sales are impacted by foreign exchange fluctuations as the majority of our sales are based on U.S. dollar denominated benchmark indices. A weaker Canadian dollar increases the amount of our realized sales, as well as the amount of our U.S. denominated costs, such as capital, interest on our U.S. denominated debt, and the value of our outstanding U.S. senior notes.

The Canadian dollar weakened throughout 2018, closing the year at 1.36 US/CDN compared to 1.26 US/CDN at December 31, 2017 and averaging 1.30 US/CDN throughout the year. The weakness in the Canadian dollar was driven by decelerating domestic economic growth, changing U.S. and Canada trade policies including the renegotiation of the North American Free Trade Agreement, as well as interest rates in the U.S. and Canada.

10 ENERPLUS 2018 FINANCIAL SUMMARY

Monthly USD/CDN Exchange Rate

Price Risk Management

We have a price risk management program that considers our overall financial position and the economics of our capital expenditures.

As of February 20, 2019, we have hedged approximately 23,100 bbls/day of our expected crude oil production for 2019, which represents approximately 63% of our 2019 forecasted crude oil production, after royalties. For 2020, we have hedged 16,000 bbls/day, which represents approximately 43% of our 2019 forecasted crude oil production, after royalties. Our crude oil hedges are predominantly three-way collars, which consist of a sold put, a purchased put and a sold call. When WTI prices settle below the sold put strike price, the three-way collars provide a limited amount of protection above the WTI settled price equal to the difference between the strike price of the purchased and sold puts. Overall, we expect our crude oil related hedging contracts to protect a significant portion of our cash flow from operating activities and adjusted funds flow.

As of February 20, 2019, we have hedged approximately 65,700 Mcf/day of our forecasted natural gas production for 2019. This represents approximately 34% of our forecasted natural gas production, after royalties.

The following is a summary of our financial contracts in place at February 20, 2019, expressed as a percentage of our forecasted 2019 net production volumes:

| | | | | | | | | | |

| | WTI Crude Oil (US$/bbl)(1)(2) |

| | Jan 1, 2019 – | | Apr 1, 2019 – | | July 1, 2019 – | | Oct 1, 2019 – | | Jan 1, 2020 – |

| | Mar 31, 2019 | | Jun 30, 2019 | | Sep 30, 2019 | | Dec 31, 2019 | | Dec 31, 2020 |

Swaps | | | | | | | | | | |

Sold Swaps | | $ 53.73 | | - | | - | | - | | - |

% | | 8% | | - | | - | | - | | - |

| | | | | | | | | | |

Three Way Collars | | | | | | | | | | |

Sold Puts | | $ 44.28 | | $ 44.50 | | $ 44.64 | | $ 44.64 | | $ 46.88 |

% | | 46% | | 63% | | 66% | | 66% | | 43% |

Purchased Puts | | $ 54.12 | | $ 54.59 | | $ 54.81 | | $ 54.81 | | $ 57.50 |

% | | 46% | | 63% | | 66% | | 66% | | 43% |

Sold Calls | | $ 64.12 | | $ 65.52 | | $ 65.95 | | $ 65.99 | | $ 72.50 |

% | | 46% | | 63% | | 66% | | 66% | | 43% |

| (1) | | Based on weighted average price (before premiums) assuming average annual production of 97,000 BOE/day, which is the mid-point of our annual 2019 guidance, less royalties and production taxes of 25%. A portion of the sold puts are settled annually rather than monthly. |

| (2) | | The total average deferred premium spent on our three-way collars is US$1.61/bbl from January 1, 2019 to December 31, 2020. |

ENERPLUS 2018 FINANCIAL SUMMARY 11

| | | | | | |

| | | | NYMEX Natural Gas (US$/Mcf)(1) |

| | | | Jan 1, 2019 – | | Apr 1, 2019 – |

| | | | Mar 31, 2019 | | Oct 31, 2019 |

Swaps | | | | | | |

Sold Swaps | | | | $ 4.23 | | $ 2.85 |

% | | | | 26% | | 36% |

| | | | | | |

Collars | | | | | | |

Purchased Puts | | | | $ 3.80 | | - |

% | | | | 26% | | - |

Sold Calls | | | | $ 6.01 | | - |

% | | | | 26% | | - |

| (1) | | Based on weighted average price (before premiums) assuming average annual production of 97,000 BOE/day, which is the mid-point of our annual 2019 guidance, less royalties and production taxes of 25%. |

ACCOUNTING FOR PRICE RISK MANAGEMENT

| | | | | | | | | |

Commodity Risk Management Gains/(Losses) | | | | | | | | | |

($ millions) | | 2018 | | 2017 | | 2016 |

Cash gains/(losses): | | | | | | | | | |

Crude oil | | $ | (52.0) | | $ | 0.9 | | $ | 75.0 |

Natural gas | | | 16.2 | | | 7.7 | | | 5.3 |

Total cash gains/(losses) | | $ | (35.8) | | $ | 8.6 | | $ | 80.3 |

| | | | | | | | | |

Non-cash gains/(losses): | | | | | | | | | |

Crude oil | | $ | 114.8 | | $ | (5.4) | | $ | (96.2) |

Natural gas | | | 9.2 | | | 11.1 | | | (13.5) |

Total non-cash gains/(losses) | | $ | 124.0 | | $ | 5.7 | | $ | (109.7) |

Total gains/(losses) | | $ | 88.2 | | $ | 14.3 | | $ | (29.4) |

| | | | | | | | | |

(Per BOE) | | 2018 | | 2017 | | 2016 |

Total cash gains/(losses) | | $ | (1.05) | | $ | 0.28 | | $ | 2.36 |

Total non-cash gains/(losses) | | | 3.64 | | | 0.18 | | | (3.22) |

Total gains/(losses) | | $ | 2.59 | | $ | 0.46 | | $ | (0.86) |

During 2018, we realized cash losses of $52.0 million on our crude oil contracts and gains of $16.2 million on our natural gas contracts. The realized cash losses were the result of crude oil prices rising above the swap level and the sold call strike price on our three-way collars. Cash gains on our natural gas contracts included a gain of $15.1 million on the unwind of a portion of our AECO-NYMEX basis physical contracts. In 2017, we realized cash gains of $0.9 million on our crude oil contracts and $7.7 million on our natural gas contracts, which included a gain of $8.5 million on the unwind of a portion of our AECO-NYMEX basis physical contracts. During 2016, we realized cash gains of $75.0 million on our crude oil contracts and $5.3 million on our natural gas contracts. The cash gains in 2017 and 2016 were due to contracts which provided floor protection above market prices.

As the forward markets for crude oil and natural gas fluctuate, as new contracts are executed, and as existing contracts are realized, changes in fair value are reflected as either a non‑cash charge or gain to earnings. The fair value of our crude oil contracts and natural gas contracts at December 31, 2018 were in a net asset position of $80.5 million and $10.9 million, respectively (December 31, 2017 – net liability position of $34.3 million and net asset position of $1.7 million, respectively). The change in fair value of our crude oil and natural gas contracts represented gains of $114.8 million and $9.2 million, respectively, during 2018 and losses of $5.4 million and gains of $11.1 million, respectively, during 2017.

Revenues

| | | | | | | | | |

($ millions) | | 2018 | | 2017 | | 2016 |

Oil and natural gas sales | | $ | 1,610.9 | | $ | 1,141.8 | | $ | 882.1 |

Royalties | | | (318.2) | | | (221.1) | | | (159.4) |

Oil and natural gas sales, net of royalties | | $ | 1,292.7 | | $ | 920.7 | | $ | 722.7 |

Oil and natural gas sales revenue for 2018 totaled $1,610.9 million, an increase of 41% from $1,141.8 million in 2017. The increase in revenue was a result of higher liquids production and an improvement in crude oil prices.

In 2017, oil and natural gas sales revenue increased 29% to $1,141.8 million from $882.1 million in 2016. The increase in 2017 is a result of the improvement in commodity prices and realized sales price differentials, along with a higher crude oil and natural gas liquids weighting of 48% compared to 46% in 2016.

12 ENERPLUS 2018 FINANCIAL SUMMARY

Royalties and Production Taxes

| | | | | | | | | | |

($ millions, except per BOE amounts) | | 2018 | | 2017 | | 2016 | |

Royalties | | $ | 318.2 | | $ | 221.1 | | $ | 159.4 | |

Per BOE | | $ | 9.35 | | $ | 7.15 | | $ | 4.67 | |

| | | | | | | | | | |

Production taxes | | $ | 87.3 | | $ | 54.3 | | $ | 37.4 | |

Per BOE | | $ | 2.57 | | $ | 1.76 | | $ | 1.10 | |

Royalties and production taxes | | $ | 405.5 | | $ | 275.4 | | $ | 196.8 | |

Per BOE | | $ | 11.92 | | $ | 8.91 | | $ | 5.77 | |

| | | | | | | | | | |

Royalties and production taxes (% of oil and natural gas sales) | | | 25% | | | 24% | | | 22% | |

Royalties are paid to government entities, land owners and mineral rights owners. Production taxes include state production taxes, Pennsylvania impact fees and freehold mineral taxes. A large percentage of our production is from U.S. properties where royalty rates are generally higher than in Canada and less sensitive to commodity price levels.

Royalties and production taxes were in line with our guidance for 2018, averaging 25% of oil and natural gas sales, before transportation. Royalties and production taxes increased to $405.5 million in 2018 from $275.4 million in 2017 and $196.8 million in 2016, mainly due to a larger portion of production volumes coming from our U.S. properties, as well as higher crude oil and natural gas realized prices.

2019 Guidance

We expect royalty and production taxes in 2019 to average 25% of our oil and gas sales before transportation, which is consistent with 2018 levels.

Operating Expenses

| | | | | | | | | |

($ millions, except per BOE amounts) | | 2018 | | 2017 | | 2016 |

Cash operating expenses | | $ | 238.3 | | $ | 197.7 | | $ | 249.0 |

Non-cash (gains)/losses(1) | | | - | | | (0.6) | | | (1.1) |

Total operating expenses | | $ | 238.3 | | $ | 197.1 | | $ | 247.9 |

Per BOE | | $ | 7.00 | | $ | 6.37 | | $ | 7.27 |

| (1) | | Non-cash (gains)/losses on fixed price electricity swaps. |

Operating expenses for 2018 were $238.3 million or $7.00/BOE, consistent with our revised guidance of $7.00/BOE and representing an increase of $41.2 million ($0.63/BOE) from the prior year. The increase is mainly attributable to our higher liquids production as our liquids weighting increased to 54% from 48% in the prior year. Our liquids production has higher associated operating cost metrics, which was partially offset by the divestment of higher operating cost Canadian properties during 2017.

Operating expenses during 2017 were $197.1 million or $6.37/BOE compared to $247.9 million or $7.27/BOE in 2016. The improvement was mainly the result of cost savings initiatives combined with the divestment of higher operating cost Canadian properties.

2019 Guidance

We expect operating expenses of $8.00/BOE in 2019. The increase from 2018 is primarily a result of our liquids growth contributing to a higher proportion of our total production, as well as an increase in gas processing costs and use of electrical submersible pumps in North Dakota.

Transportation Costs

| | | | | | | | | |

($ millions, except per BOE amounts) | | 2018 | | 2017 | | 2016 |

Transportation costs | | $ | 123.5 | | $ | 111.3 | | $ | 107.1 |

Per BOE | | $ | 3.63 | | $ | 3.60 | | $ | 3.14 |

ENERPLUS 2018 FINANCIAL SUMMARY 13

Transportation costs in 2018 were in line with our guidance of $3.60/BOE averaging $3.63/BOE, and similar to $3.60/BOE in 2017. Transportation costs increased to $3.60/BOE in 2017, compared to $3.14/BOE in 2016 due to additional transportation commitments in the Marcellus that commenced in August 2016 and our growing U.S. production volumes which have higher associated transportation costs.

2019 Guidance

We expect transportation costs to increase to $4.00/BOE in 2019, due to additional crude oil firm transportation commitments that provide access to sell a portion of our production at U.S. gulf coast or Brent pricing.

Netbacks

The crude oil and natural gas classifications below contain properties according to their dominant production category. These properties may include associated crude oil, natural gas or natural gas liquids volumes which have been converted to the equivalent BOE/day or Mcfe/day and as such, the revenue per BOE or per Mcfe may not correspond with the average selling price under the “Pricing” section of this MD&A.

| | | | | | | | | |

| Year ended December 31, 2018 |

Netbacks by Property Type | | Crude Oil | | Natural Gas | | Total |

Average Daily Production | | | 53,294 BOE/day | | | 239,532 Mcfe/day | | | 93,216 BOE/day |

Netback(1) $ per BOE or Mcfe | | | (per BOE) | | | (per Mcfe) | | | (per BOE) |

Oil and natural gas sales | | $ | 67.43 | | $ | 3.42 | | $ | 47.35 |

Royalties and production taxes | | | (17.90) | | | (0.65) | | | (11.92) |

Cash operating expenses | | | (10.54) | | | (0.38) | | | (7.00) |

Transportation costs | | | (2.40) | | | (0.88) | | | (3.63) |

Netback before hedging | | $ | 36.59 | | $ | 1.51 | | $ | 24.80 |

Cash gains/(losses) | | | (2.67) | | | 0.19 | | | (1.05) |

Netback after hedging | | $ | 33.92 | | $ | 1.70 | | $ | 23.75 |

Netback before hedging ($ millions) | | $ | 711.7 | | $ | 131.9 | | $ | 843.6 |

Netback after hedging ($ millions) | | $ | 659.7 | | $ | 148.1 | | $ | 807.8 |

| | | | | | | | | |

| Year ended December 31, 2017 |

Netbacks by Property Type | | Crude Oil | | Natural Gas | | Total |

Average Daily Production | | | 44,496 BOE/day | | | 241,290 Mcfe/day | | | 84,711 BOE/day |

Netback(1) $ per BOE or Mcfe | | | (per BOE) | | | (per Mcfe) | | | (per BOE) |

Oil and natural gas sales | | $ | 53.38 | | $ | 3.12 | | $ | 36.93 |

Royalties and production taxes | | | (13.89) | | | (0.57) | | | (8.91) |

Cash operating expenses | | | (10.20) | | | (0.36) | | | (6.39) |

Transportation costs | | | (2.21) | | | (0.86) | | | (3.60) |

Netback before hedging | | $ | 27.08 | | $ | 1.33 | | $ | 18.03 |

Cash gains/(losses) | | | 0.06 | | | 0.09 | | | 0.28 |

Netback after hedging | | $ | 27.14 | | $ | 1.42 | | $ | 18.31 |

Netback before hedging ($ millions) | | $ | 439.8 | | $ | 117.6 | | $ | 557.4 |

Netback after hedging ($ millions) | | $ | 440.7 | | $ | 125.2 | | $ | 566.0 |

| | | | | | | | | |

| Year ended December 31, 2016 |

Netbacks by Property Type | | Crude Oil | | Natural Gas | | Total |

Average Daily Production | | | 47,206 BOE/day | | | 275,538 Mcfe/day | | | 93,125 BOE/day |

Netback(1) $ per BOE or Mcfe | | | (per BOE) | | | (per Mcfe) | | | (per BOE) |

Oil and natural gas sales | | $ | 37.86 | | $ | 2.26 | | $ | 25.88 |

Royalties and production taxes | | | (9.38) | | | (0.34) | | | (5.77) |

Cash operating expenses | | | (10.29) | | | (0.72) | | | (7.31) |

Transportation costs | | | (1.97) | | | (0.72) | | | (3.14) |

Netback before hedging | | $ | 16.22 | | $ | 0.48 | | $ | 9.66 |

Cash gains/(losses) | | | 4.34 | | | 0.05 | | | 2.36 |

Netback after hedging | | $ | 20.56 | | $ | 0.53 | | $ | 12.02 |

Netback before hedging ($ millions) | | $ | 280.4 | | $ | 48.8 | | $ | 329.2 |

Netback after hedging ($ millions) | | $ | 355.3 | | $ | 54.2 | | $ | 409.5 |

| (1) | | See “Non‑GAAP Measures” in this MD&A. |

14 ENERPLUS 2018 FINANCIAL SUMMARY

Crude oil and natural gas netbacks per BOE before hedging were higher during 2018 compared to 2017 and 2016 primarily due to higher realized crude oil prices. During 2018, our crude oil properties accounted for 84% and 82% of our netback before and after hedging, respectively. During 2017, our crude oil properties accounted for 79% and 78% of our netback before and after hedging, respectively.

General and Administrative Expenses

Total G&A expenses include cash G&A expenses and share‑based compensation (“SBC”) charges related to our long‑term incentive plans (“LTI plans”). See Note 10, Note 13 and Note 14 to the Financial Statements for further details.

| | | | | | | | | |

($ millions) | | 2018 | | 2017 | | 2016 |

Cash: | | | | | | | | | |

G&A expense | | $ | 50.0 | | $ | 50.5 | | $ | 59.8 |

Share-based compensation expense | | | 0.1 | | | 1.0 | | | 3.1 |

| | | | | | | | | |

Non-Cash: | | | | | | | | | |

Share-based compensation expense | | | 25.9 | | | 22.6 | | | 27.0 |

Equity swap loss/(gain) | | | (0.2) | | | 0.2 | | | (3.6) |

Total G&A expenses | | $ | 75.8 | | $ | 74.3 | | $ | 86.3 |

| | | | | | | | | |

(Per BOE) | | 2018 | | 2017 | | 2016 |

Cash: | | | | | | | | | |

G&A expense | | $ | 1.47 | | $ | 1.63 | | $ | 1.75 |

Share-based compensation expense | | | 0.01 | | | 0.03 | | | 0.09 |

| | | | | | | | | |

Non-Cash: | | | | | | | | | |

Share-based compensation expense | | | 0.76 | | | 0.73 | | | 0.80 |

Equity swap loss/(gain) | | | (0.01) | | | 0.01 | | | (0.11) |

Total G&A expenses | | $ | 2.23 | | $ | 2.40 | | $ | 2.53 |

Cash G&A expenses in 2018 totaled $50.0 million ($1.47/BOE), beating our guidance of $1.50/BOE and consistent with $50.5 million ($1.63/BOE) in 2017.

During the year, we reported cash SBC on our Deferred Share Unit (“DSU”) plan of $0.1 million, compared to $1.0 million in 2017 due to a decrease in our share price at December 31, 2018 on outstanding deferred share units. We recorded non‑cash SBC of $25.9 million ($0.76/BOE) in 2018 compared to $22.6 million ($0.73/BOE) in 2017. The increase in non-cash SBC in 2018 was a result of a recovery recorded in 2017 due to the forfeiture of units that were previously expensed.

Cash G&A expenses in 2017 were $50.5 million ($1.63/BOE), a decrease of 16% from $59.8 million ($1.75/BOE) in 2016. Cash SBC expense was $1.0 million ($0.03/BOE) in 2017 compared to an expense of $3.1 million ($0.09/BOE) in 2016. We recorded non‑cash SBC of $22.6 million ($0.73/BOE) in 2017 compared to $27.0 million ($0.80/BOE) in 2016. The decrease in non-cash SBC was a result of the increased forfeiture of units in 2017.

We have hedged a portion of the outstanding cash‑settled units under our LTI plans. We recorded a non‑cash mark‑to‑market gain of $0.2 million on these hedges in 2018 (2017 – $0.2 million loss; 2016 – $3.6 million gain), which included the settlement of a portion of our equity swaps. As of December 31, 2018, we have 195,000 units hedged at a weighted average price of $20.60 per share.

2019 Guidance

We expect our cash G&A expense to be $1.50/BOE in 2019, which is consistent with 2018.

Interest Expense

Interest on our senior notes and bank credit facility in 2018 totaled $36.8 million compared to $38.7 million in 2017 and $45.4 million in 2016. Interest expense decreased 5% in 2018 when compared to 2017 primarily due to the repayment of a portion of our 2009 senior notes which carry a higher coupon rate.

Interest expense decreased 15% in 2017 when compared to 2016 due to our undrawn bank credit facility, the impact of the strengthening Canadian dollar on our U.S. denominated interest payments and the payment of the first of five annual principal instalments on our 2009 senior notes.

ENERPLUS 2018 FINANCIAL SUMMARY 15

At December 31, 2018, we were undrawn on our $800 million bank credit facility and our debt consisted of fixed interest rate senior notes with a weighted average interest rate of 4.8%. See Note 7 to the Financial Statements for further details on our outstanding notes.

Foreign Exchange

| | | | | | | | | |

($ millions) | | 2018 | | 2017 | | 2016 |

Realized: | | | | | | | | | |

Foreign exchange loss/(gain) on settlements | | $ | 0.5 | | $ | 1.5 | | $ | 0.1 |

Translation of U.S. dollar cash held in Canada loss/(gain) | | | (19.6) | | | 11.0 | | | — |

Unrealized loss/(gain) | | | 58.6 | | | (42.6) | | | (40.6) |

Total foreign exchange loss/(gain) | | $ | 39.5 | | $ | (30.1) | | $ | (40.5) |

US/CDN average exchange rate | | | 1.30 | | | 1.30 | | | 1.32 |

US/CDN period end exchange rate | | | 1.36 | | | 1.26 | | | 1.34 |

We recorded a net foreign exchange loss of $39.5 million in 2018 compared to gains of $30.1 million and $40.5 million in 2017 and 2016, respectively. Realized gains and losses relate primarily to day-to-day transactions recorded in foreign currencies, along with the translation of our U.S. dollar denominated cash held in Canada, while unrealized gains and losses are recorded on the translation of our U.S. dollar denominated debt and working capital at each period-end.

In 2018, we recorded a realized foreign exchange gain of $19.1 million, due to the weakening Canadian dollar compared to a loss of $12.5 million and $0.1 million in 2017 and 2016, respectively.

Comparing December 31, 2018 to December 31, 2017, the Canadian dollar weakened relative to the U.S. dollar, resulting in an unrealized loss of $58.6 million. See Note 11 to the Financial Statements for further details.

Capital Investment

| | | | | | | | | |

($ millions) | | 2018 | | 2017 | | 2016 |

Capital spending | | $ | 593.9 | | $ | 458.0 | | $ | 209.1 |

Office capital | | | 6.5 | | | 2.7 | | | 1.5 |

Sub-total | | | 600.4 | | | 460.7 | | | 210.6 |

Property and land acquisitions | | $ | 25.8 | | $ | 13.3 | | $ | 126.1 |

Property divestments | | | (6.9) | | | (56.2) | | | (670.4) |

Sub-total | | | 18.9 | | | (42.9) | | | (544.3) |

Total(1) | | $ | 619.3 | | $ | 417.8 | | $ | (333.7) |

| (1) | | Excludes changes in non-cash investing working capital. See Note 17(b) of the Consolidated Financial Statements for additional information. |

2018

Capital spending in 2018 totaled $593.9 million, in line with our guidance of $585 million. Our capital spending in 2018 was 30% higher than 2017, as we continued to execute on our growth plans. In 2018, we spent $474.4 million on our U.S. crude oil properties, $46.3 million on our Canadian crude oil properties, and $66.2 million on our Marcellus natural gas assets. Through our capital program in 2018, we added 65.7 MMBOE of gross proved plus probable reserves, replacing 194% of our 2018 production, before accounting for acquisitions and divestments.

Property and land acquisitions in 2018 totaled $25.8 million and included land acquisitions in Colorado and a property swap in North Dakota. We recorded net divestments of $6.9 million in 2018, primarily related to a property swap in North Dakota.

2017

Capital spending in 2017 totaled $458.0 million and was more than twice our spending levels in 2016, as we repositioned ourselves for growth. In 2017 we spent $343.0 million on our U.S. crude oil properties, $55.3 million on our Canadian crude oil properties, and $58.5 million on our Marcellus natural gas assets. In 2017, we added 58.0 MMBOE of gross proved plus probable reserves, replacing 189% of our 2017 production, before accounting for acquisitions and divestments.

We recorded net divestment proceeds of $56.2 million in 2017 consisting mainly of our second quarter sale of our Brooks waterflood property and Canadian shallow gas assets. Total divestments had combined production of 7,700 BOE/day and resulted in a $72.3 million reduction to future asset retirement obligations. Property and land acquisitions in 2017 totaled $13.3 million and included additional leases and minor undeveloped land.

16 ENERPLUS 2018 FINANCIAL SUMMARY

2016

Capital spending in 2016 totaled $209.1 million and was focused on our core areas with spending of $136.4 million on our North Dakota crude oil properties, $44.4 million on our Canadian crude oil waterflood properties and $24.3 million on our Marcellus natural gas assets.

We recorded net divestment proceeds of $670.4 million in 2016. In Canada, we sold properties consisting mainly of natural gas assets, which included certain Deep Basin natural gas properties and non-core properties in northwest Alberta with combined production of approximately 8,500 BOE/day. On December 30, 2016, we closed the sale of our non-operated assets in North Dakota with production of approximately 5,000 BOE/day for proceeds of $392.0 million. Through our capital program in 2016 we added 43 MMBOE of gross proved plus probable reserves, replacing 126% of our 2016 production, before accounting for acquisitions and divestments.

Property and land acquisitions in 2016 totaled $126.1 million, largely due to our acquisition of a Canadian waterflood property for a purchase price of $110.3 million, net of closing adjustments.

2019 Guidance

Our capital spending guidance for 2019 is between $565 million and $635 million, and is expected to deliver annual liquids production growth of 9%. Our spending is focused on our core areas, with approximately $480 million allocated to North Dakota, $45 million to our Marcellus gas properties, $45 million to our Canadian crude oil waterflood properties, and $30 million allocated to the DJ Basin.

Gain on Asset Sales and Note Repurchases

Under full cost accounting rules, divestments of oil and natural gas properties are generally accounted for as adjustments to the full cost pool with no recognition of a gain or loss. However, if not recognizing a gain or loss on the transaction would significantly alter the relationship between a cost centre’s capitalized costs and proved reserves, then a gain or loss must be recognized. No gains or losses were recorded on asset sales in 2018. We recorded gains of $78.4 million during 2017 related to the divestment of our Brooks waterflood property and Canadian shallow gas assets. In 2016, a gain of $559.2 million was recorded on asset divestments, which included a gain of $339.4 million on the fourth quarter sale of our non-operated North Dakota property. Gains and losses are evaluated on a case by case basis for each asset sale, and future sales may or may not result in such treatment.

During 2018 and 2017 we did not repurchase any of our senior notes. During the first half of 2016, we recorded a total gain of $19.3 million on the repurchase of US$267 million of outstanding senior notes at prices between 90% of par and par value.

Depletion, Depreciation and Accretion (“DD&A”)

| | | | | | | | | |

($ millions, except per BOE amounts) | | 2018 | | 2017 | | 2016 |

DD&A expense | | $ | 304.3 | | $ | 250.8 | | $ | 329.0 |

Per BOE | | $ | 8.94 | | $ | 8.11 | | $ | 9.65 |

DD&A of property, plant and equipment (“PP&E”) is recognized using the unit‑of‑production method based on proved reserves. Total DD&A in 2018 increased from 2017 mainly due to a 10% percent increase in overall production. On a per BOE basis, DD&A for 2018 increased as a result of higher capital spending and additional future development capital associated with undeveloped reserve additions. In 2017, DD&A decreased from the prior year mostly due to asset impairments recorded during 2016 under the U.S. GAAP full cost ceiling test methodology.

Impairments

PP&E

| | | | | | | | | |

($ millions) | | 2018 | | 2017 | | 2016 |

Canada cost centre | | $ | — | | $ | — | | $ | 89.4 |

U.S. cost centre | | | — | | | — | | | 211.8 |

Total Impairments | | $ | — | | $ | — | | $ | 301.2 |

Under U.S. GAAP, the full cost ceiling test is performed on a country‑by‑country cost centre basis using estimated after‑tax future net cash flows discounted at 10% from proved reserves (“Standardized Measure”), using constant prices as defined by the U.S. Securities and Exchange Commission (“SEC”). SEC constant prices are calculated as the unweighted average of the trailing twelve first‑day‑of‑the‑month commodity prices. Standardized Measure is not related to our capital spending investment criteria and is not a fair value-based measurement, but rather a prescribed accounting calculation. Under U.S. GAAP impairments are not reversed in future periods.

ENERPLUS 2018 FINANCIAL SUMMARY 17

The trailing twelve-month average crude oil and natural gas prices generally improved throughout 2018 and 2017 and no impairments were recorded. In comparison, trailing twelve-month average commodity prices weakened significantly in 2016, resulting in non‑cash impairments totaling $301.2 million (before taxes).

The following table outlines the twelve-month average trailing benchmark prices and exchange rates used in our ceiling test at December 31, 2018, 2017 and 2016:

| | | | | | | | | | | | | | |

| | WTI Crude Oil | | Exchange Rate | | Edm Light Crude | | U.S. Henry Hub | | AECO Natural Gas |

Year | | US$/bbl | | US/CDN | | CDN$/bbl | | Gas US$/Mcf | | Spot CDN$/Mcf |

2018 | | $ | 65.56 | | 1.28 | | $ | 69.58 | | $ | 3.10 | | $ | 1.67 |

2017 | | $ | 51.34 | | 1.30 | | $ | 63.57 | | $ | 2.98 | | $ | 2.32 |

2016 | | $ | 42.75 | | 1.32 | | $ | 52.26 | | $ | 2.49 | | $ | 2.17 |

Many factors influence the allowed ceiling value versus our net capitalized cost base, making it difficult to predict with reasonable certainty the value of impairment losses from future ceiling tests. For the next year, the primary factors include future first‑day‑of‑the‑month commodity prices, reserves revisions, our capital expenditure levels and timing, acquisition and divestment activity, as well as production levels, which affect DD&A expense. There is the potential for trailing twelve-month average commodity prices to decline, impacting the ceiling value which could result in non-cash impairments.

Goodwill

Goodwill is tested for impairment annually or more frequently if events or changes in circumstances indicate that goodwill may be impaired. We first perform a qualitative assessment of goodwill by evaluating potential indicators of impairment, and if it is more likely than not that the fair value of the reporting unit is less than its carrying value we perform a quantitative impairment test. If the carrying value of the reporting unit exceeds its fair value, goodwill is written down to its implied fair value with an offsetting charge to earnings in the Consolidated Statements of Income/(Loss) in the Financial Statements.

Our annual goodwill impairment assessments at December 31, 2018, 2017, and 2016 resulted in no impairment.

Asset Retirement Obligation

In connection with our operations, we incur abandonment, reclamation and remediation costs related to assets, such as surface leases, wells, facilities and pipelines. Total asset retirement obligations included on our balance sheet are based on management’s estimate of our net ownership interest, costs to abandon, reclaim and remediate and the timing of the costs to be incurred in future periods.

We have estimated the net present value of our asset retirement obligation to be $126.1 million at December 31, 2018, compared to $117.7 million at December 31, 2017. The increase was largely due to an increase in expected remediation and reclamation estimates and a decrease in our weighted average credit-adjusted risk-free rate used to determine the net present value of the liability. See Note 8 to the Financial Statements for further information.

We take an active approach to managing our abandonment, reclamation and remediation obligations. During 2018, we spent $11.3 million (2017 – $12.9 million) on our asset retirement obligations and we expect to spend approximately $12.0 million in 2019. The majority of our abandonment, reclamation and remediation costs are expected to be incurred between 2025 and 2055. We do not reserve cash or assets for the purpose of funding our future asset retirement obligations. Any abandonment, reclamation and remediation costs are anticipated to be funded out of cash flow and available credit facilities.

Income Taxes

| | | | | | | | | |

($ millions) | | 2018 | | 2017 | | 2016 |

Current tax expense/(recovery) | | $ | (27.1) | | $ | (48.0) | | $ | (2.4) |

Deferred tax expense/(recovery) | | | 130.3 | | | 129.9 | | | (234.8) |

Total tax expense/(recovery) | | $ | 103.2 | | $ | 81.9 | | $ | (237.2) |

Our current tax recovery in 2018 was $27.1 million compared to $48.0 in 2017. The recoveries primarily related to the reclassification of AMT refunds from our deferred income tax asset in the amounts of $27.2 million and $50.1 million, respectively. The remaining $27.2 million in AMT refunds are expected to be reclassified to current tax in 2019 and 2020.

18 ENERPLUS 2018 FINANCIAL SUMMARY

The total tax expense in 2018 was $103.2 million compared to $81.9 in 2017 primarily due to higher overall income in 2018. The deferred tax expense in 2017 included $46.2 million from the remeasurement of our U.S. deferred income tax assets for the federal income tax rate reduction from 35% to 21% after enactment of the U.S. Tax Cuts and Jobs Act, offset by the reversal of the valuation allowance previously recorded on our AMT refund. We assess the recoverability of our deferred income tax assets each period to determine whether it is, more likely than not, all or a portion of our deferred income tax assets will be realized. We consider available positive and negative evidence including future taxable income and reversing existing temporary differences in making this assessment. Our overall deferred income tax asset, net of valuation allowance, was $465.1 million as at December 31, 2018 (2017 - $569.9 million). Our remaining valuation allowance is primarily related to our net capital loss carryforward balance. We do not anticipate future capital gains that will allow us to utilize these losses.

Our estimated tax pools at December 31, 2018 are as follows:

| | | |

Pool Type ($ millions) | | 2018 |

Canada | | | |

Canadian oil and gas property (“COGPE”) | | $ | 6 |

Canadian development expenditures (“CDE”) | | | 91 |

Canadian exploration expenditures (“CEE”) | | | 238 |

Undepreciated capital costs (“UCC”) | | | 149 |

Non-capital losses and other credits | | | 428 |

| | $ | 912 |

U.S. | | | |

Alternative minimum tax credit (“AMT”) | | $ | 58 |

Net operating losses | | | 1,052 |

Depletable and depreciable assets | | | 870 |

| | $ | 1,980 |

Total tax pools and credits | | $ | 2,892 |

Capital losses | | $ | 1,226 |

LIQUIDITY AND CAPITAL RESOURCES

There are numerous factors that influence how we assess our liquidity and leverage, including commodity price cycles, capital spending levels, acquisition and divestment plans, hedging, share repurchases and dividend levels. We also assess our leverage relative to our most restrictive debt covenant, which is a maximum senior debt to earnings before interest, taxes, depreciation, amortization, impairment and other non-cash charges (“adjusted EBITDA”) ratio of 3.5x for a period of up to six months, after which it drops to 3.0x. Our senior debt to adjusted EBITDA ratio decreased to 0.9x at December 31, 2018 from 1.2x at December 31, 2017 as a result of an increase in our trailing twelve-month EBITDA, which benefited from increased revenue in 2018. Our net debt to adjusted funds flow ratio improved to 0.4x at December 31, 2018 from 0.6x at December 31, 2017 as a result of the significant increase in our adjusted funds flow in 2018. Although it is not included in our debt covenants, the net debt to adjusted funds flow ratio is often used by investors and analysts to evaluate our liquidity.

Total debt, net of cash at December 31, 2018 increased slightly to $333.5 million compared to $325.8 million at December 31, 2017. Total debt was comprised of $696.8 million in senior notes less $363.3 million in cash. The increase compared to the prior year was a result of the impact of a weaker Canadian dollar at December 31, 2018 on our U.S. dollar denominated senior notes, which more than offset a $16.8 million increase in cash. Our next scheduled senior note repayments of $30 million and US$22 million are due in May and June 2019, respectively, with remaining maturities extending to 2026. At December 31, 2018, we were undrawn on our $800 million bank facility.

Our adjusted payout ratio, which is calculated as cash dividends plus capital and office expenditures divided by adjusted funds flow, was 84% for 2018 compared to 93% in 2017. After adjusting for net acquisition and divestment proceeds, our funding surplus for the year ended December 31, 2018 was $104.9 million compared to $77.2 million in 2017. A portion of the funding surplus in 2018 was used to return approximately $79.0 million of capital to shareholders through repurchasing 5,925,084 common shares under the NCIB at an average price of $13.33 per share. The Company also paid $29.3 million in dividends in 2018. We expect to continue to pay monthly dividends to our shareholders of $0.01 per share, however, if economic conditions change we may make adjustments.

Our working capital deficiency, excluding cash and cash equivalents and current derivative assets and liabilities, increased to $143.1 million at December 31, 2018 from $107.6 million at December 31, 2017. We expect to finance our working capital deficit and our ongoing working capital requirements through cash, adjusted funds flow and our bank credit facility. In addition, we have sufficient liquidity to meet our financial commitments for the near term, as disclosed under “Commitments” below.

ENERPLUS 2018 FINANCIAL SUMMARY 19

During the fourth quarter, we completed a one-year extension of our $800 million senior, unsecured, covenant‑based bank credit facility, which now matures on October 31, 2021. There were no significant amendments to the agreement terms or debt covenants. Drawn fees on our bank credit facility range between 125 and 315 basis points over Banker’s Acceptance rates, with current drawn fees of 125 basis points over Banker’s Acceptance rates based on our current reported senior net debt to adjusted EBITDA ratio. The bank credit facility ranks equally with our senior unsecured covenant‑based notes.

At December 31, 2018 we were in compliance with all covenants under our bank credit facility and outstanding senior notes. Our bank credit facility and senior note purchase agreements have been filed as material documents on our SEDAR profile at www.sedar.com.

The following table lists our financial covenants at December 31, 2018:

| | | | |

Covenant Description | | | | December 31, 2018 |

Bank Credit Facility: | | Maximum Ratio | | |

Senior debt to adjusted EBITDA (1) | | 3.5x | | 0.9x |

Total debt to adjusted EBITDA (1) | | 4.0x | | 0.9x |

Total debt to capitalization | | 50% | | 19% |

| | | | |

Senior Notes: | | Maximum Ratio | | |

Senior debt to adjusted EBITDA (1)(2) | | 3.0x – 3.5x | | 0.9x |

Senior debt to consolidated present value of total proved reserves (3) | | 60% | | 21% |

| | | | |

| | Minimum Ratio | | |

Adjusted EBITDA to interest (1) | | 4.0x | | 21.3x |

Definitions

“Senior Debt” is calculated as the sum of drawn amounts on our bank credit facility, outstanding letters of credit and the principal amount of senior notes.

“Adjusted EBITDA” is calculated as net income less interest, taxes, depletion, depreciation, amortization, and other non‑cash gains and losses. Adjusted EBITDA is calculated on a trailing twelve-month basis and is adjusted for material acquisitions and divestments. Adjusted EBITDA for the three months and the trailing twelve months ended December 31, 2018 were $209.7 million and $782.8 million, respectively.

“Total Debt” is calculated as the sum of senior debt plus subordinated debt. Enerplus currently does not have any subordinated debt.

“Capitalization” is calculated as the sum of total debt and shareholder’s equity plus a $1.1 billion adjustment related to our adoption of U.S. GAAP.

Footnotes

| (1) | | See “Non-GAAP Measures” in this MD&A for a reconciliation of adjusted EBITDA to net income. |

| (2) | | Senior debt to adjusted EBITDA for the senior notes may increase to 3.5x for a period of 6 months, after which the ratio decreases to 3.0x. |

| (3) | | Senior debt to consolidated present value of total proved reserves is calculated annually on December 31 based on before tax reserves at forecast prices discounted at 10%. |

Counterparty Credit

OIL AND NATURAL GAS SALES COUNTERPARTIES

Our oil and natural gas receivables are with customers in the oil and gas industry and are subject to normal credit risks. Concentration of credit risk is mitigated by marketing production to numerous purchasers under normal industry sale and payment terms. A credit review process is in place to assess and monitor our counterparties’ creditworthiness on a regular basis. This process involves reviewing and ratifying our corporate credit guidelines, assessing the credit ratings of our counterparties and setting exposure limits. When warranted, we obtain financial assurances such as letters of credit, parental guarantees or third-party insurance to mitigate a portion of our credit risk. This process is utilized for both our oil and natural gas sales counterparties as well as our financial derivative counterparties.

FINANCIAL DERIVATIVE COUNTERPARTIES