Exhibit 99.1

AGA Financial Forum May 4, 2009 Douglas H. Yaeger Chairman, President and Chief Executive Officer Chief Financial Officer Mark D. Waltermire

AGA Financial Forum May 4, 2009 This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Future operating results may be affected by various uncertainties and risk factors, many of which are beyond the control of The Laclede Group, Inc., including weather conditions, governmental and regulatory policy and action, the competitive environment and economic factors. For a more complete description of these uncertainties and risk factors, see The Laclede Group’s Form 10-Q for the quarter ended March 31, 2009 filed with the Securities and Exchange Commission. www.thelacledegroup.com NYSE:LG

Company Overview Strong utility platform Public utility holding company formed 2001 Growth components complementary to core Demonstrated strategic execution S&P Small Cap 600 Company

Natural Gas Industry Natural Gas Marketing Producers Pipelines Local Distribution Companies Customers Storage

Natural Gas Industry Producers Pipelines Customers Storage

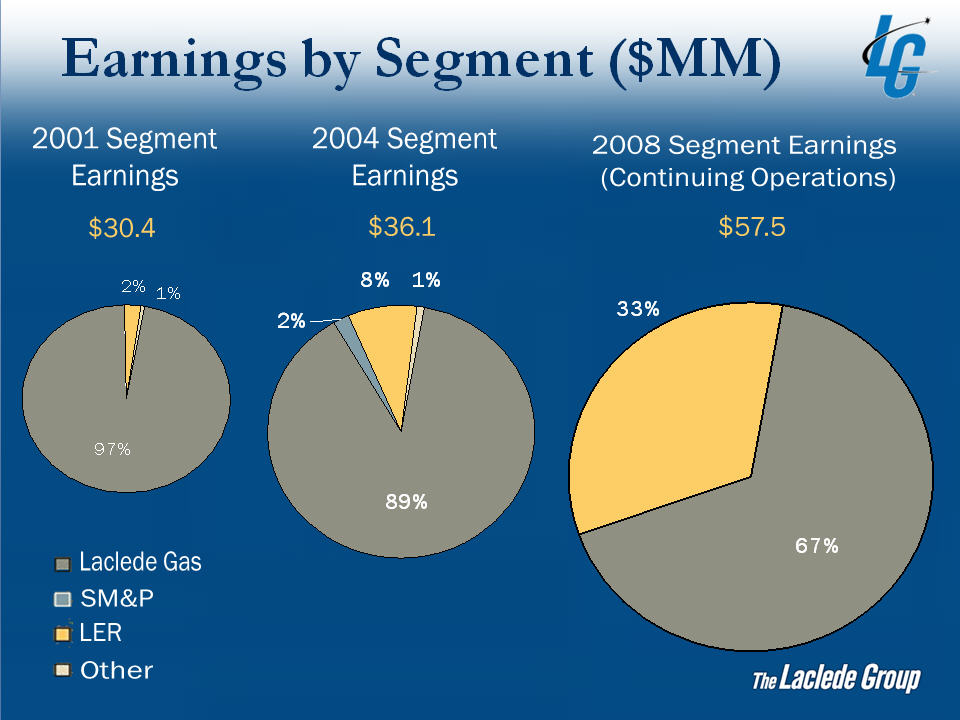

Execution Six consecutive years of record earnings Acquisition and organic growth Utility operations Strong regulatory execution Operational improvements Stability of earnings Non-utility components Logical extension of core utility business Continued growth of Laclede Energy Resources (LER) Developed and sold SM&P Utility Resources, Inc. Ongoing systematic evaluation of new opportunities Experienced management

Strategic Objectives Strengthen and leverage solid performance of utility business Expand LER as an established regional marketer of natural gas and services Pursue further growth opportunities in changing gas supply and pipeline environment Maintain balance between utility and non-utility businesses

Established in 1857

Our System & Strengths Largest LDC in Missouri 630,000 Customers (83% market saturation) Over 16,000 miles of pipe Diversified gas supply Significant storage capacity Market area: ≈5 Bcf natural gas, ≈3 Bcfe liquid propane Upstream system: 23 Bcf

Upstream Pipeline Transportation Network Access Flexibility Reliability Peak day 1.1 Bcf Flowing gas capacity: .7 Bcf Unionville Storage

Regulation and Rate DesignRate design largely decoupled Mitigates exposure to weather and customer conservation Shifts recovery from usage to customer charge Infrastructure System Replacement Surcharge (ISRS) Allows recovery between rate cases of facility-related expenditures Recovers depreciation, property taxes, and rate of return Long-established Purchased Gas Adjustment (PGA) clause Recovers hedging and storage carrying costs

Advocacy Missouri Energy Development Association (MEDA) Missouri investor-owned natural gas, electric, and water utilities Advocates measures to support utility infrastructure and services to benefit Missouri citizens and businesses Current Chairman Legislative achievements Fuel Adjustment Clause for Electric Utilities Weather and Conservation Rider Environmental Cost Recovery Mechanism Missouri Utility Shareholders Association

Operational and Customer Focus Field Technology Continuous Improvement Project Green Building Initiatives Automated Meter Reading GIS System Enhanced Communication

Laclede Energy Resources Pipeline Transportation Services Natural Gas Suppliers Industrial Businesses Utilities and Municipalities Wholesale Customers Non-regulated natural gas marketer Organically grown Large retail and wholesale customer base Flexible pricing alternatives Risk management utilizing financial markets Lock in margins Experienced management

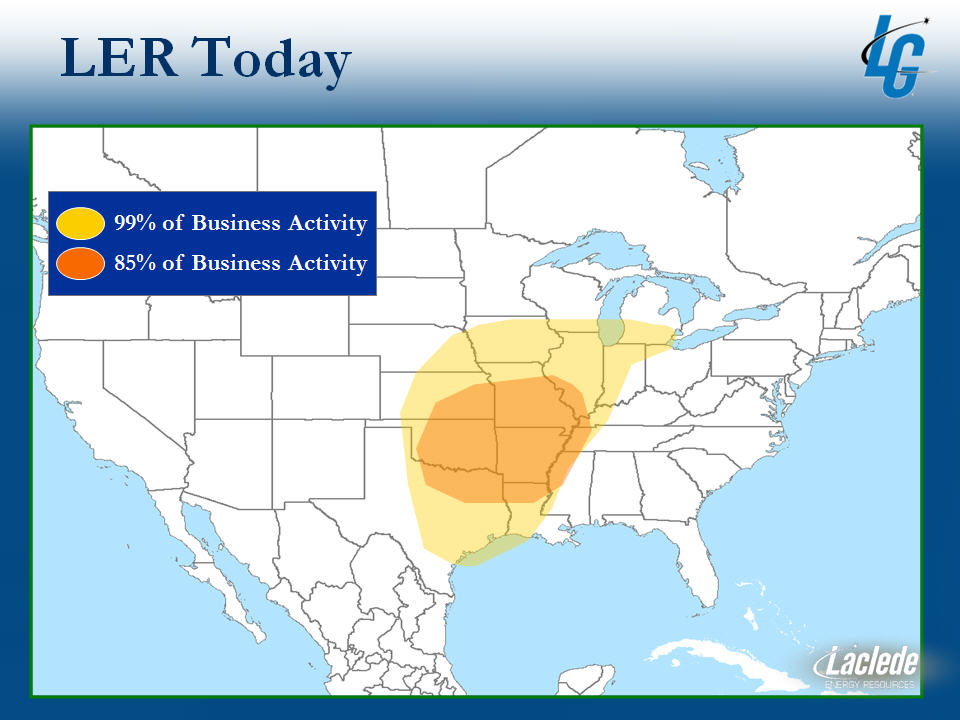

LER Today 99% of Business Activity 85% of Business Activity

LER TodaySold 123 Bcf in Fiscal 2008 Sources of supply 13 interstate pipelines 66 suppliers Market Profile Retail Natural gas marketing services for large industrial customers Wholesale Buying and selling natural gas to other marketers, producers, LDCs, pipelines, and municipalities

LER Today Physical purchase and sale approach Basis differential Regional supply/demand opportunity Leverage ample pipeline capacity Focus on longer-term relationships Disciplined growth and risk management

Core Transport Capacity Centerpoint Energy Primarily long-term, firm transport Major markets Perryville Hub – 240,000 Dth/D St. Louis – 60,000 Dth/D Market opportunities between PRVL, Ozark, Tetco and NGPL pipelines Provides diversity in supply basins to enhance overall delivery reliability Perryville Hub Firm Deliveries Texas Gas Columbia Gulf Trunkline Gas ANR SESH

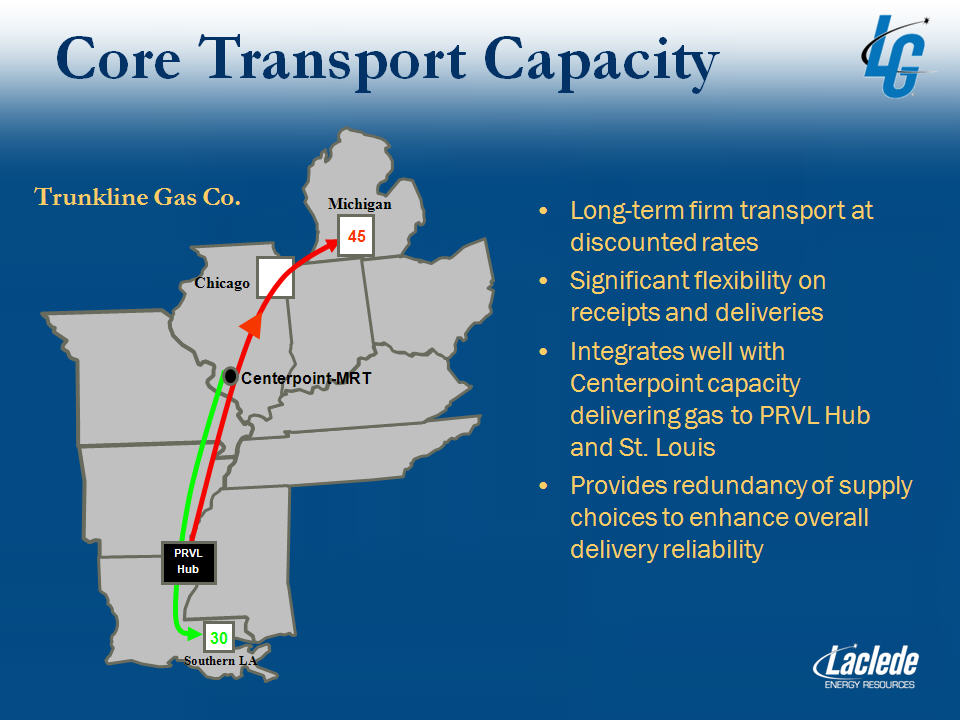

Core Transport Capacity Long-term firm transport at discounted rates Significant flexibility on receipts and deliveries Integrates well with Centerpoint capacity delivering gas to PRVL Hub and St. Louis Provides redundancy of supply choices to enhance overall delivery reliability Trunkline Gas Co.

Target Customer Profile High-quality, credit-worthy customers Longer-term relationships Three major customer groups Utilities for system supply Marketing affiliates of utilities and producers Customers behind the city gate

Volumes Sold CAGR: 25.9%

Risk Management Price volatility Formal risk management policy Lock in margins Counterparty credit In-house credit review Laclede Group credit policy

Laclede Energy Resources Strong performance 15% increase in 2008 sales volumes over 2007 69% increase in 2009 YTD sales volumes over 2008 first half 2008 volumes delivered similar to Laclede Gas Company (123 Bcf) Six months ended March 2009 strongest in history 121% increase in net income over 2008 first-half results Growth in overall portfolio Additional long-term transportation capacity and gas supplies Increased number of counterparties Growth in sales base New retail / wholesale customers Producer services Customer asset management

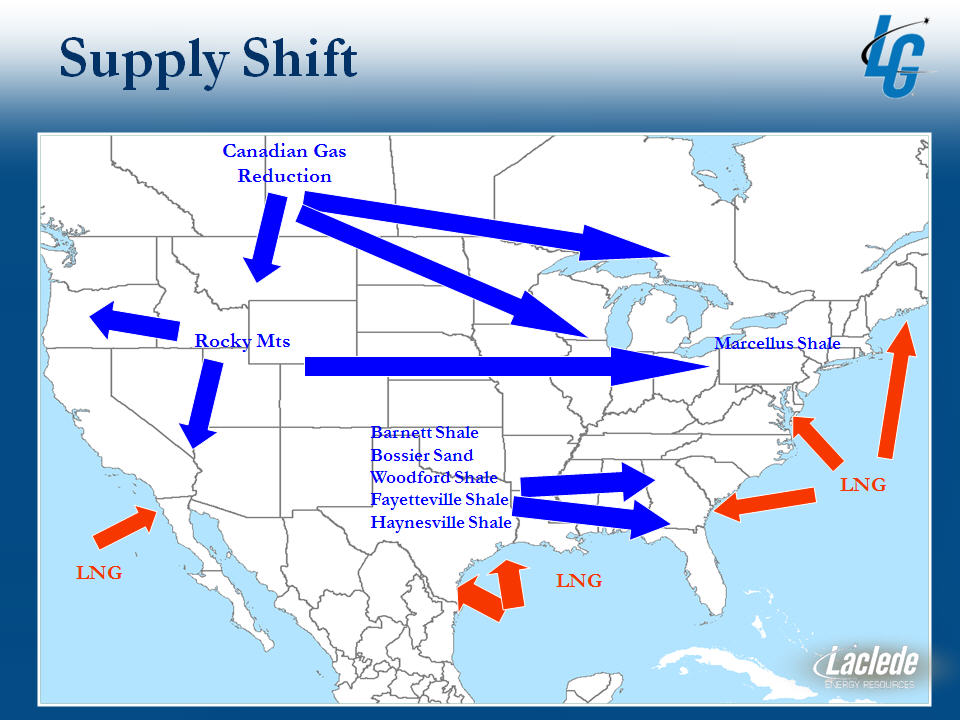

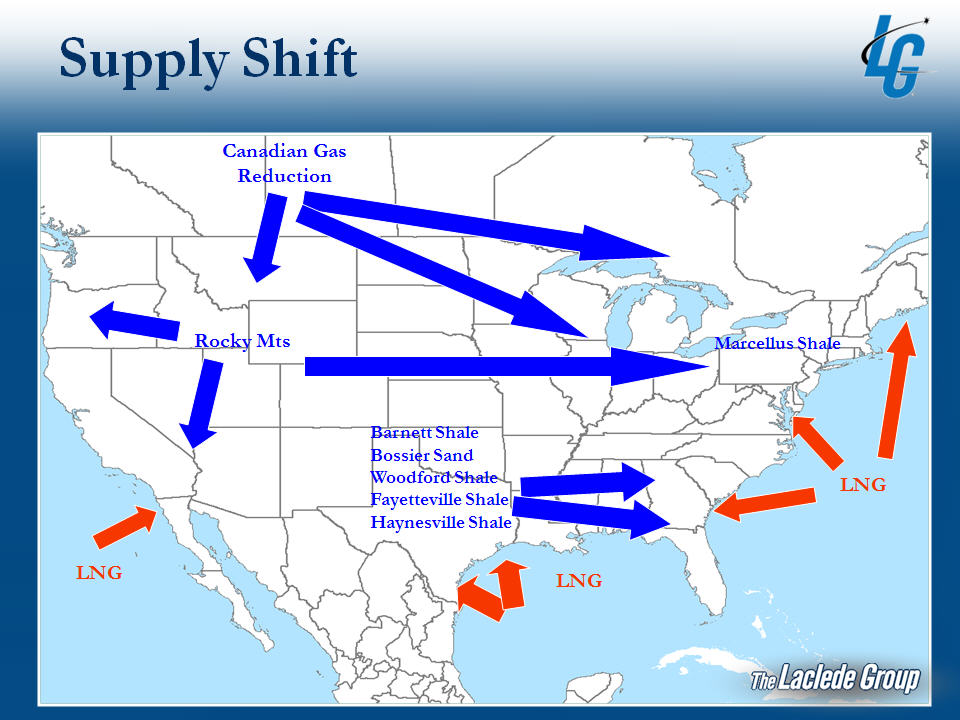

Supply Shift Canadian Gas Reduction Rocky Mts LNG Barnett Shale Bossier Sand Woodford Shale Fayetteville Shale Haynesville Shale Marcellus Shale LNG LNG

Drivers of Growth Pipeline expansion projects Additional marketing opportunities Storage expansion Growing gas supply basins Shale plays Producer services Additional markets Power generation LDCs

Laclede Pipeline Company

Laclede Pipeline Company Uniquely situated LPG pipeline Market crossroads location Only U.S. interstate LPG pipeline with LDC customer FERC jurisdiction Allows transport of various liquids Creates opportunity to grow customer base beyond Laclede Gas Preserves historic role re: Laclede Gas Company peaking needs

Supply Shift Canadian Gas Reduction Marcellus Shale Rocky Mts LNG Barnett Shale Bossier Sand Woodford Shale Fayetteville Shale Haynesville Shale LNG LNG

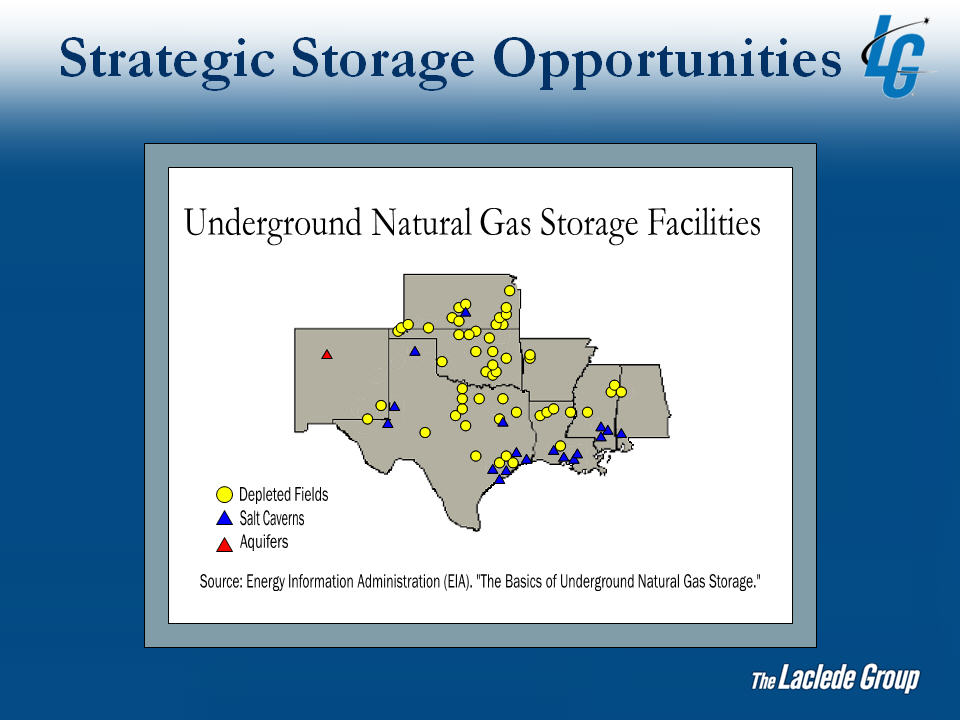

Strategic Storage Opportunities Underground Natural Gas Storage Facilities Depleted Fields Salt Caverns Aquifers Source: Energy Information Administration (EIA). "The Basics of Underground Natural Gas Storage."

Strategic Storage Opportunities Assessing and evaluating natural gas storage assets Rational, disciplined approach Opportunity for sustainable, long-term growth

Financial Overview

Earnings by Segment ($MM) 2001 Segment Earnings 2004 Segment Earnings 2008 Segment Earnings (Continuing Operations) Laclede Gas SM&P LER Other

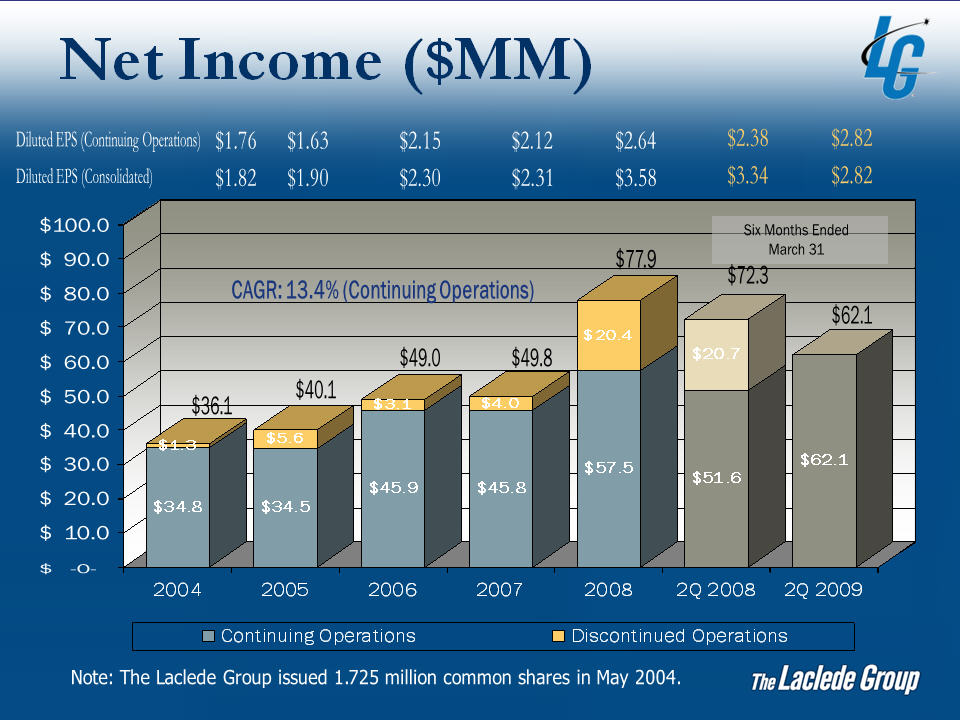

Net Income ($MM) Six Months Ended March 31 Note: The Laclede Group issued 1.725 million common shares in May 2004.

Improving Cash Flow $(MM) 2006 2007 2008 Operating Cash Flow from Continuing Operations (excluding Working Capital) $ 78.5 $ 81.9 $ 96.1 Dividends Paid (29.8) (31.2) (32.4) Capital Expenditures – Continuing Operations (58.5) (56.4) (55.4) Free Cash Flow $ (9.8) $ (5.7) $ 8.3 % of Capital Expenditures Internally Generated 83% 90% 115%

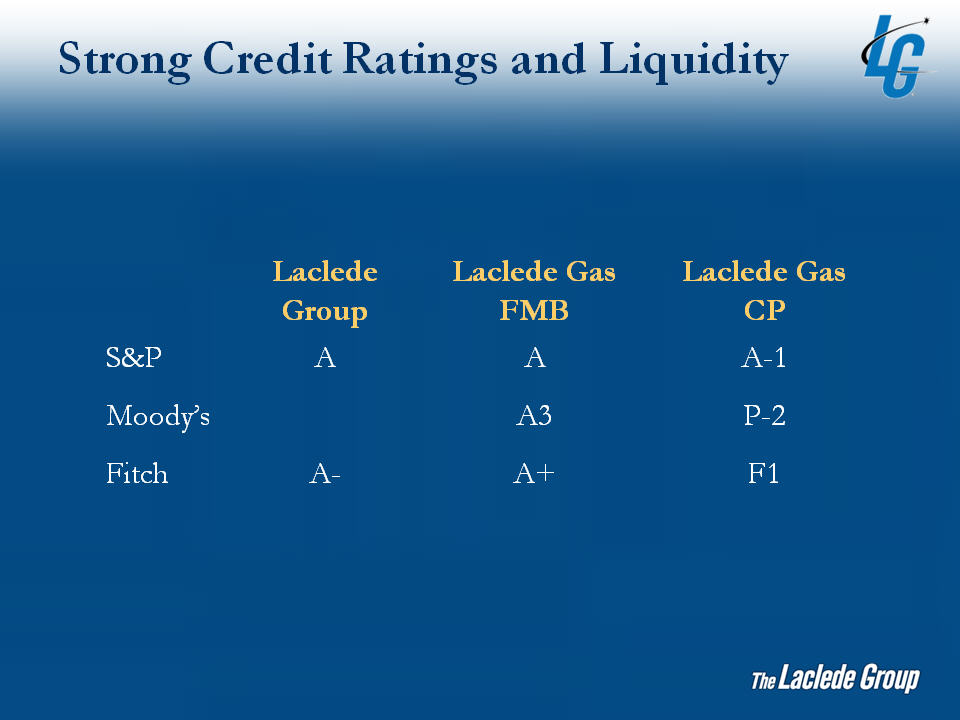

Strong Credit Ratings and Liquidity Laclede Group Laclede Gas FMB Laclede Gas CP S&P A A A-1 Moody’s A3 P-2 Fitch A- A+ F1

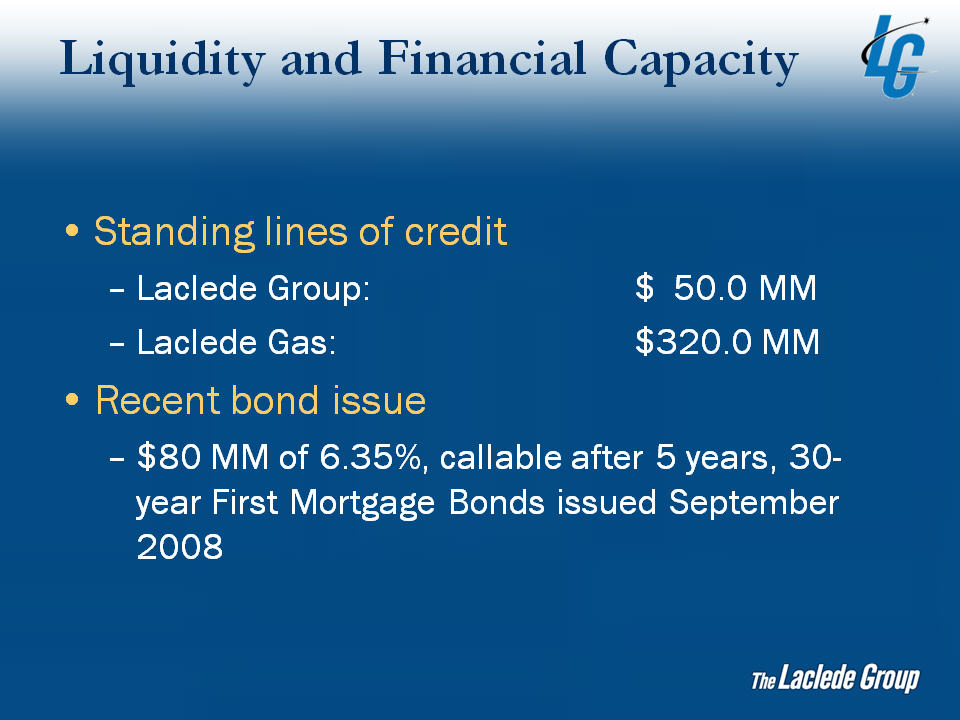

Liquidity and Financial Capacity Standing lines of credit Laclede Group: $ 50.0 MM Laclede Gas: $320.0 MM Recent bond issue $80 MM of 6.35%, callable after 5 years, 30-year First Mortgage Bonds issued September 2008

Earnings and Dividends Per Share Paid Continuously Since: 1946 Recent Increase: November 2008 Dividend Yield: 4.4% Current Annual Rate: $1.54 Diluted EPS – Consolidated Diluted EPS – Continuing Dividends Per Share

Key Takeaways Strong core gas distribution business Stable earnings platform Dedicated customer service initiatives Focus on internal improvements Synergistic growth components LER and Laclede Pipeline expansion opportunities Asset-based opportunities complementary to core Focus on shareholder value Strengthening of balance sheet Earnings and dividend growth

Q & A Reliable Return Rational Growth Strong Dividends