Exhibit 99.1

MAGELLAN GP, LLC

CONSOLIDATED BALANCE SHEETS

(In thousands)

| | | | | | | | |

| | | December 31,

2007 | | | June 30,

2008 | |

| | | | | | (unaudited) | |

ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Accounts receivable (less allowance for doubtful accounts of $10 and $34 at December 31, 2007 and June 30, 2008, respectively) | | $ | 62,834 | | | $ | 69,133 | |

Other accounts receivable | | | 10,696 | | | | 9,630 | |

Affiliate accounts receivable | | | 208 | | | | 52 | |

Inventory | | | 120,462 | | | | 75,672 | |

Other current assets | | | 10,882 | | | | 20,322 | |

| | | | | | | | |

Total current assets | | | 205,082 | | | | 174,809 | |

Property, plant and equipment | | | 2,603,262 | | | | 2,738,021 | |

Less: accumulated depreciation | | | 455,074 | | | | 493,290 | |

| | | | | | | | |

Net property, plant and equipment | | | 2,148,188 | | | | 2,244,731 | |

Equity investments | | | 24,324 | | | | 23,606 | |

Long-term receivables | | | 7,801 | | | | 7,598 | |

Goodwill | | | 11,902 | | | | 14,766 | |

Other intangibles (less accumulated amortization of $6,743 and $7,516 at December 31, 2007 and June 30, 2008, respectively) | | | 7,086 | | | | 6,313 | |

Debt placement costs (less accumulated amortization of $2,170 and $2,507 at December 31, 2007 and June 30, 2008, respectively) | | | 6,368 | | | | 6,031 | |

Other noncurrent assets | | | 6,322 | | | | 3,220 | |

| | | | | | | | |

Total assets | | $ | 2,417,073 | | | $ | 2,481,074 | |

| | | | | | | | |

LIABILITIES AND OWNER’S EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 39,622 | | | $ | 43,471 | |

Affiliate payroll and benefits | | | 23,364 | | | | 19,516 | |

Accrued interest payable | | | 7,197 | | | | 6,985 | |

Accrued taxes other than income | | | 21,039 | | | | 20,221 | |

Environmental liabilities | | | 36,127 | | | | 24,468 | |

Deferred revenue | | | 20,797 | | | | 23,952 | |

Accrued product purchases | | | 43,230 | | | | 66,107 | |

Other current liabilities | | | 29,268 | | | | 20,563 | |

| | | | | | | | |

Total current liabilities | | | 220,644 | | | | 225,283 | |

Long-term debt | | | 914,536 | | | | 951,917 | |

Long-term affiliate pension and benefits | | | 22,370 | | | | 25,923 | |

Supply agreement deposit | | | 18,500 | | | | — | |

Noncurrent portion of product supply liability | | | 24,348 | | | | — | |

Other deferred liabilities | | | 9,476 | | | | 7,870 | |

Environmental liabilities | | | 21,491 | | | | 20,117 | |

Non-controlling owners’ interests in consolidated subsidiaries | | | 1,131,739 | | | | 1,182,692 | |

Commitments and contingencies | | | | | | | | |

Owner’s equity: | | | | | | | | |

Owner’s equity | | | 58,563 | | | | 71,992 | |

Accumulated other comprehensive loss | | | (4,594 | ) | | | (4,720 | ) |

| | | | | | | | |

Total owner’s equity | | | 53,969 | | | | 67,272 | |

| | | | | | | | |

Total liabilities and owner’s equity | | $ | 2,417,073 | | | $ | 2,481,074 | |

| | | | | | | | |

See accompanying notes.

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS

(Unaudited)

1. Organization and Basis of Presentation

Organization

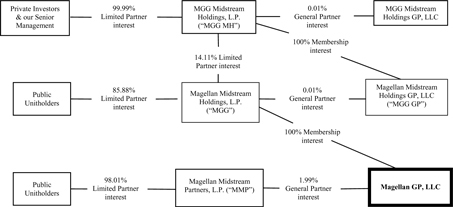

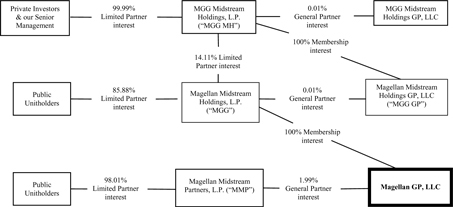

Unless otherwise noted, the terms “we,” “us,” “our” and other similar terms refer to Magellan GP, LLC, a Delaware limited liability company. We were formed in August 2000 to serve as the general partner of Magellan Midstream Partners, L.P. and manage its operations.

Our organizational structure at June 30, 2008 and that of our affiliate entities, as well as how we refer to these entities in our notes to consolidated balance sheets, are provided below.

Basis of Presentation

At December 31, 2007 and June 30, 2008, we had no operating assets other than through our general partner ownership interest and incentive distribution rights in MMP. We control MMP because the limited partner interests of MMP: (i) do not have the substantive ability to dissolve MMP, (ii) can remove us as MMP’s general partner only with a supermajority vote of the MMP limited partner units and the MMP limited partner units which can be voted in such an election are restricted, and (iii) the MMP limited partners do not possess substantive participating rights in MMP’s operations. Therefore, our consolidated balance sheets include the assets and liabilities of MMP.

MMP, a publicly-traded Delaware partnership, together with its subsidiaries, owns and operates a petroleum products pipeline system, petroleum products terminals and an ammonia pipeline system. MMP’s reportable segments offer different products and services and are managed separately as each requires different marketing strategies and business knowledge. In January 2008, MMP acquired a petroleum products terminal in Bettendorf, Iowa for $12.0 million. The results of this facility have been included in MMP’s petroleum products pipeline system segment from the acquisition date.

In the opinion of management, our accompanying consolidated balance sheet as June 30, 2008, which is unaudited, includes all normal and recurring adjustments necessary to present fairly our financial position as of June 30, 2008. The balance sheet as of December 31, 2007 is derived from audited financial statements.

Pursuant to the rules and regulations of the Securities and Exchange Commission, the balance sheets in this report do not include all notes normally included with balance sheets prepared in accordance with accounting principles generally accepted in the United States. These balance sheets should be read in conjunction with the audited consolidated balance sheets and notes thereto included as Exhibit 99.1 in MMP’s Annual Report on Form 10-K for the year ended December 31, 2007.

2

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

2. Inventory

Inventory at December 31, 2007 and June 30, 2008 was as follows (in thousands):

| | | | | | |

| | | December 31,

2007 | | June 30,

2008 |

Refined petroleum products | | $ | 65,215 | | $ | — |

Transmix | | | 32,824 | | | 40,497 |

Natural gas liquids | | | 16,233 | | | 29,686 |

Additives | | | 5,812 | | | 5,489 |

Other | | | 378 | | | — |

| | | | | | |

Total inventory | | $ | 120,462 | | $ | 75,672 |

| | | | | | |

The decrease in inventory between December 31, 2007 and June 30, 2008 was primarily attributable to the sale of refined petroleum products inventory in connection with the assignment of MMP’s product supply agreement to a third-party entity effective March 1, 2008 (see Note 9—Assignment of Supply Agreement).

3. Related Party Transactions

MMP reimburses MGG GP for the costs of employees necessary to conduct its operations and administrative functions. The affiliate payroll and benefits accruals associated with this agreement at December 31, 2007 and June 30, 2008 were $23.4 million and $19.5 million, respectively. The long-term affiliate pension and benefits accruals associated with this agreement at December 31, 2007 and June 30, 2008 were $22.4 million and $25.9 million, respectively. MMP settles its affiliate payroll, payroll-related expenses and non-pension postretirement benefit costs with MGG GP on a monthly basis. MMP settles its long-term affiliate pension liabilities through payments to MGG GP when MGG GP makes contributions to its pension funds.

Because MMP’s distributions have exceeded target levels as specified in its partnership agreement, we receive approximately 50% of any incremental cash distributed per limited partner unit. As of June 30, 2008, certain of our executive officers collectively owned approximately 5% of MGG MH, which owned 14% of MGG. Therefore, certain of our executive officers also benefit from these distributions. Assuming MMP has sufficient available cash to continue to pay distributions on all of its outstanding units for four quarters at its current quarterly distribution level of $0.6875 per unit, we would receive distributions of approximately $87.6 million on our combined general partner interest and incentive distribution rights.

4. Debt

MMP’s consolidated debt at December 31, 2007 and June 30, 2008 was as follows (in thousands):

| | | | | | |

| | | December 31,

2007 | | June 30,

2008 |

Revolving credit facility | | $ | 163,500 | | $ | 199,800 |

6.45% Notes due 2014 | | | 249,634 | | | 249,657 |

5.65% Notes due 2016 | | | 252,494 | | | 253,546 |

6.40% Notes due 2037 | | | 248,908 | | | 248,914 |

| | | | | | |

Total debt | | $ | 914,536 | | $ | 951,917 |

| | | | | | |

MMP’s debt is non-recourse to us.

Revolving Credit Facility. The total borrowing capacity under MMP’s revolving credit facility, which matures in September 2012, is $550.0 million. Borrowings under the facility are unsecured and incur interest at LIBOR plus a spread ranging from 0.3% to 0.8% based on MMP’s credit ratings and amounts outstanding under the facility. Additionally, a commitment fee is assessed at a rate from 0.05% to 0.125%, depending on MMP’s credit rating. As of June 30, 2008, $199.8 million was outstanding under this facility,

3

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

and $3.3 million was obligated for letters of credit. Amounts obligated for letters of credit are not reflected as debt on MMP’s consolidated balance sheets. The weighted-average interest rate on borrowings outstanding under the facility at December 31, 2007 and June 30, 2008 was 5.4% and 2.9%, respectively. The borrowings outstanding under this facility were repaid with the net proceeds from MMP’s debt offering of 10-year senior notes completed in July 2008 (see Note 10—Subsequent Events).

6.45% Notes due 2014.In May 2004, MMP sold $250.0 million aggregate principal of 6.45% notes due 2014 in an underwritten public offering. The notes were issued for the discounted price of 99.8%, or $249.5 million, and the discount is being accreted over the life of the notes. Including the impact of amortizing the gains realized on the interest hedges associated with these notes (see Note 5–Derivative Financial Instruments), the effective interest rate of these notes is 6.3%.

5.65% Notes due 2016.In October 2004, MMP issued $250.0 million of 5.65% senior notes due 2016 in an underwritten public offering. The notes were issued for the discounted price of 99.9%, or $249.7 million, and the discount is being accreted over the life of the notes. MMP used an interest rate swap to effectively convert $100.0 million of these notes to floating-rate debt until May 2008 (see Note 5—Derivative Financial Instruments). Including the impact of that swap, and the amortization of losses realized on pre-issuance hedges associated with these notes, the weighted average interest rate of these notes at June 30, 2007 was 6.0%. MMP received a payment of $3.8 million when it terminated the swap-to-floating derivative instrument in May 2008. Including the amortization of that payment and the losses realized on pre-issuance hedges associated with these notes, the weighted average interest rate at December 31, 2007 and June 30, 2008 was 5.5% and 5.7%, respectively. The outstanding principal amount of the notes was increased by $2.7 million at December 31, 2007 for the fair value of the associated swap-to-floating derivative instrument and by $3.8 million at June 30, 2008 for the unamortized portion of the payment received upon termination of that swap.

6.40% Notes due 2037.In April 2007, MMP issued $250.0 million of 6.40% notes due 2037 in an underwritten public offering. The notes were issued for the discounted price of 99.6%, or $248.9 million, and the discount is being accreted over the life of the notes. Including the impact of amortizing the gains realized on the interest hedges associated with these notes (see Note 5—Derivative Financial Instruments), the effective interest rate of these notes is 6.3%.

5. Derivative Financial Instruments

MMP uses interest rate derivatives to help manage interest rate risk. As of June 30, 2008, MMP had no interest rate swap agreements outstanding. See Note 10—Subsequent Events for additional information related to interest rate swap agreements entered into subsequent to June 30, 2008.

In October 2004, MMP entered into an interest rate swap agreement to hedge against changes in the fair value of a portion of the $250.0 million of senior notes due 2016, which were issued in October 2004. MMP accounted for this agreement as a fair value hedge. The notional amount of this agreement was $100.0 million and effectively converted $100.0 million of its 5.65% fixed-rate senior notes issued in October 2004 to floating-rate debt. In May 2008, MMP terminated this interest rate swap agreement and received $3.8 million, which was recorded as an adjustment to long-term debt and is being amortized over the remaining life of the 5.65% fixed-rate senior notes due 2016.

In January 2008, MMP entered into a total of $200.0 million of forward starting interest rate swap agreements to hedge against the variability of future interest payments on debt that it anticipated issuing no later than June 2008. Proceeds of the anticipated debt issuance were expected to be used to refinance borrowings on MMP’s revolving credit facility. In April 2008, MMP terminated these interest rate swap agreements and received $0.2 million, which was recorded to other income.

4

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

The following is a summary of the current impact of MMP’s historical derivative activity as of June 30, 2008 (in thousands):

| | | | | | | | | | | | |

| | | Effective Portion of Gains and Losses | |

| | | | | | Amount

Reclassified to

Earnings from

Accumulated Other

Comprehensive Income

(“AOCI”) | |

Hedge | | Unamortized

Amount

Recognized in

AOCI | | | Three Months

Ended

June 30, 2008 | | | Six Months

Ended

June 30, 2008 | |

Cash flow hedges (date executed): | | | | | | | | | | | | |

Interest rate swaps 6.40% Notes (April 2007) | | $ | 5,044 | | | $ | (44 | ) | | $ | (88 | ) |

Interest rate swaps 5.65% Notes (October 2004) | | | (4,338 | ) | | | 131 | | | | 262 | |

Interest rate swaps and treasury lock 6.45% Notes (May 2004) | | | 3,029 | | | | (128 | ) | | | (256 | ) |

| | | | | | | | | | | | |

Total cash flow hedges | | $ | 3,735 | | | $ | (41 | ) | | $ | (82 | ) |

| | | | | | | | | | | | |

There was no ineffectiveness recognized on the financial instruments disclosed in the above table during the three or six months ended June 30, 2008.

6. Commitments and Contingencies

Environmental Liabilities. Liabilities recognized for estimated environmental costs were $57.6 million and $44.6 million at December 31, 2007 and June 30, 2008, respectively. Environmental liabilities have been classified as current or noncurrent based on management’s estimates regarding the timing of actual payments. Management estimates that expenditures associated with these environmental liabilities will be paid over the next ten years.

MMP’s environmental liabilities include, among other items, accruals for the items discussed below:

Petroleum Products EPA Issue.In July 2001, the Environmental Protection Agency (“EPA”), pursuant to Section 308 of the Clean Water Act (the “Act”), served an information request to a former affiliate of MMP with regard to petroleum discharges from its pipeline operations. That inquiry primarily focused on the petroleum products pipeline system that MMP subsequently acquired. The response to the EPA’s information request was submitted during November 2001. In March 2004, MMP received an additional information request from the EPA and notice from the U.S. Department of Justice (“DOJ”) that the EPA had requested the DOJ to initiate a lawsuit alleging violations of Section 311(b) of the Act in regards to 32 releases. The DOJ stated that the maximum statutory penalty for the releases was in excess of $22.0 million, which assumed that all of the releases were violations of the Act and that the EPA would impose the maximum penalty. The EPA further indicated that some of those releases may have also violated the Spill Prevention Control and Countermeasure requirements of Section 311(j) of the Act and that additional penalties could be assessed. The DOJ and EPA added to their original demand a release that occurred in the second quarter of 2005 from MMP’s petroleum products pipeline near its Kansas City, Kansas terminal and a release that occurred in the first quarter of 2006 from MMP’s petroleum products pipeline near Independence, Kansas.

MMP reached an agreement with the EPA and DOJ to settle these matters in June 2008. Under the terms of the settlement agreement, MMP will pay a penalty of $5.3 million and will perform certain operational enhancements resulting in a reduction of its environmental liability for these matters from $17.4 million to $5.3 million and a reduction to its operating expenses of $12.1 million.

Ammonia EPA Issue. In February 2007, MMP received notice from the DOJ that the EPA had requested the DOJ to initiate a lawsuit alleging violations of Sections 301 and 311 of the Act with respect to two releases of anhydrous ammonia from the ammonia pipeline owned by MMP and, at the time of the releases, operated by a third party. The DOJ stated that the maximum statutory penalty for alleged violations of the Act for both releases combined was approximately $13.2 million. The DOJ also alleged that the third-party operator of MMP’s ammonia pipeline was liable for penalties pursuant to Section 103 of the Comprehensive Environmental Response, Compensation and Liability Act for failure to report the releases on a timely basis, with the statutory

5

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

maximum for those penalties as high as $4.2 million for which the third-party operator has requested indemnification. In March 2007, MMP also received a demand from the third-party operator for defense and indemnification in regards to a DOJ criminal investigation regarding whether certain actions or omissions of the third-party operator constituted violations of federal criminal statutes. The third-party operator has subsequently settled this criminal investigation with the DOJ by paying a $1.0 million fine. MMP believes that it does not have an obligation to indemnify or defend the third-party operator for the DOJ criminal fine settlement. The DOJ stated in its notice to MMP that it does not expect MMP or the third-party operator to pay the penalties at the statutory maximum; however, it may seek injunctive relief if the parties cannot agree on any necessary corrective actions. MMP has accrued an amount for these matters based on its best estimates that is less than the maximum statutory penalties. MMP is currently in discussions with the EPA, DOJ and the third-party operator regarding these two releases but is unable to determine what its ultimate liability could be for these matters.

Indemnification Settlement. Prior to May 2004, a former affiliate had agreed to indemnify MMP against, among other things, certain environmental losses associated with assets that were contributed to MMP at the time of its initial public offering or which MMP subsequently acquired from this former affiliate. In May 2004, MGG and MMP GP entered into an agreement under which the former affiliate agreed to pay MMP $117.5 million to release it from these indemnifications. MMP received the final installment payment associated with this agreement in 2007. At December 31, 2007 and June 30, 2008, known liabilities that would have been covered by this indemnity agreement were $42.9 million and $29.4 million, respectively. Through June 30, 2008, MMP has spent $50.8 million of the $117.5 million indemnification settlement amount for indemnified matters, including $21.9 million of capital costs. The cash MMP has received from the indemnity settlement is not reserved and has been used by MMP for its various other cash needs, including expansion capital spending.

Environmental Receivables. MMP had recognized receivables from insurance carriers and other entities related to environmental matters of $6.9 million and $5.5 million at December 31, 2007 and June 30, 2008, respectively.

Unrecognized Product Gains. MMP’s petroleum products terminals operations generate product overages and shortages. When MMP’s petroleum products terminals experience net product shortages, MMP recognizes expense for those losses in the periods in which they occur. When MMP’s petroleum products terminals experience net product overages, MMP has product on hand for which it has no cost basis. Therefore, these net overages are not recognized in MMP’s financial statements until the associated barrels are either sold or used to offset product losses. The net unrecognized product overages for MMP’s petroleum products terminals operations had a market value of approximately $11.4 million as of June 30, 2008. However, the actual amounts MMP will recognize in future periods will depend on product prices at the time the associated barrels are either sold or used to offset future product losses.

Other. MMP is a party to various other claims, legal actions and complaints arising in the ordinary course of business. In the opinion of management, the ultimate resolution of these claims, legal actions and complaints after consideration of amounts accrued, insurance coverage or other indemnification arrangements will not have a material adverse effect on our financial position.

7. Long-Term Incentive Plan

MMP has a long-term incentive plan (“MMP LTIP”) for certain MGG GP employees who perform services for MMP and our independent directors. The MMP LTIP primarily consists of phantom units and permits the grant of awards covering an aggregate of 3.2 million common units. The compensation committee of our board of directors (the “Compensation Committee”) administers the MMP LTIP and has approved the unit awards discussed below.

The MMP LTIP awards discussed below are subject to forfeiture if employment is terminated for any reason other than retirement, death or disability prior to the vesting date. If an award recipient retires, dies or becomes disabled prior to the end of the vesting period, the recipient’s award grant is prorated based upon the completed months of employment during the vesting period and the award is settled at the end of the vesting period. The award grants do not have an early vesting feature except under certain circumstances following a change in control in us.

The table below summarizes the MMP LTIP awards granted by the Compensation Committee that have not vested as of June 30, 2008.

6

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

| | | | | | | | | | | | | | | | | | | |

Grant Date | | Unit

Awards

Granted | | Estimated

Forfeitures | | Adjustment to

Unit Awards in

Anticipation of

Achieving

Above/(Below)

Target Financial

Results | | | Total Unit

Award

Accrual | | Vesting

Date | | Unrecognized

Compensation

Expense

(Millions) | | Period Over

Which the

Unrecognized

Expense Will Be

Recognized | | Intrinsic Value of

Unvested Awards

at June 30, 2008

(Millions) |

February 2006 | | 168,105 | | 12,607 | | 139,948 | | | 295,446 | | 12/31/08 | | $ | 1.4 | | Next 6 months | | $ | 10.5 |

Various 2006 | | 9,201 | | 3,132 | | 5,462 | | | 11,531 | | 12/31/08 | | | 0.1 | | Next 6 months | | | 0.4 |

March 2007 | | 2,640 | | — | | — | | | 2,640 | | 12/31/08 | | | 0.1 | | Next 6 months | | | 0.1 |

Various 2007: | | | | | | | | | | | | | | | | | | | |

– Tranche 1 | | 53,230 | | 2,396 | | 50,834 | | | 101,668 | | 12/31/09 | | | 1.7 | | Next 18 months | | | 3.6 |

– Tranche 2 | | 53,230 | | 2,396 | | (28,721 | ) | | 22,113 | | 12/31/09 | | | 0.6 | | Next 18 months | | | 0.8 |

– Tranche 3 | | 53,230 | | — | | — | | | — | | 12/31/09 | | | — | | — | | | — |

January 2008 | | 184,340 | | 8,295 | | — | | | 176,045 | | 12/31/10 | | | 4.9 | | Next 30 months | | | 6.3 |

Various 2008 | | 2,890 | | — | | — | | | 2,890 | | 12/31/10 | | | 0.1 | | Next 30 months | | | 0.1 |

| | | | | | | | | | | | | | | | | | | |

Total | | 526,866 | | 28,826 | | 167,523 | | | 612,333 | | | | $ | 8.9 | | | | $ | 21.8 |

| | | | | | | | | | | | | | | | | | | |

2008 Activity

MMP settled its 2005 award grants in January 2008 by issuing 196,856 MMP limited partner units and distributing those units to the participants. MMP paid associated minimum tax withholdings and employer taxes totaling $5.1 million in January 2008.

Payout for the unit awards approved during February 2006 are based eighty percent on the attainment of performance metrics and are being accounted for as equity and twenty percent on personal performance in addition to the company’s performance metrics and are being accounted for as liabilities.

The unit awards approved during 2007, except the March 2007 unit awards, are broken into three equal tranches, with each tranche vesting on December 31, 2009. MMP began accruing for the first tranche of the 2007 awards in the first quarter of 2007 and began accruing for the second tranche in the first quarter of 2008, when the MMP Compensation Committee established the performance metrics associated with each respective tranche. MMP will begin accruing costs for the third tranche when the Compensation Committee establishes the associated performance metrics for that tranche, which we expect to happen in the first quarter of 2009. Eighty percent of these unit awards are based on the attainment of performance metrics and are being accounted for as equity and twenty percent of these unit awards are based on personal performance in addition to the company’s performance metrics and are being accounted for as liabilities.

The unit awards approved in January 2008 will vest on December 31, 2010. Eighty percent of these unit awards are based on the attainment of performance metrics and are being accounted for as equity and twenty percent of these unit awards are based on personal performance in addition to the company’s performance metrics and are being accounted for as liabilities. The other various unit awards approved in 2008 will also vest on December 31, 2010. There are no performance metrics associated with these awards and they are being accounted for as equity.

Weighted Average Fair Value

The weighted-average fair value of the unit awards is as follows (per unit):

| | | | | | |

| | | Grant Date Fair

Value of Equity

Awards | | June 30, 2008

Fair Value of

Liability Awards |

2006 Awards | | $ | 25.23 | | $ | 34.21 |

2007 Awards | | $ | 33.62 | | $ | 31.32 |

2008 Awards | | $ | 33.28 | | $ | 28.28 |

7

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

8. Distributions

Distributions paid by MMP, including amounts paid to us during 2007 and 2008, are detailed in the schedule below (in thousands, except per unit amounts). We distributed all funds received from MMP to our owner, MGG.

| | | | | | | | | | | | |

Date Cash Distribution Paid | | Per Unit Cash

Distribution

Amount | | Common

Units | | Distributions

Paid to Us | | Total Cash

Distribution |

02/14/07 | | $ | 0.60250 | | $ | 40,094 | | $ | 16,197 | | $ | 56,291 |

05/15/07 | | | 0.61625 | | | 41,009 | | | 17,112 | | | 58,121 |

| | | | | | | | | | | | |

Through 6/30/07 | | | 1.21875 | | | 81,103 | | | 33,309 | | | 114,412 |

08/14/07 | | | 0.63000 | | | 41,924 | | | 18,027 | | | 59,951 |

11/14/07 | | | 0.64375 | | | 42,839 | | | 18,942 | | | 61,781 |

| | | | | | | | | | | | |

Total | | $ | 2.49250 | | $ | 165,866 | | $ | 70,278 | | $ | 236,144 |

| | | | | | | | | | | | |

| | | | |

02/14/08 | | $ | 0.65750 | | $ | 43,884 | | $ | 19,909 | | $ | 63,793 |

05/15/08 | | | 0.67250 | | | 44,885 | | | 20,910 | | | 65,795 |

| | | | | | | | | | | | |

Through 6/30/08 | | | 1.33000 | | | 88,769 | | | 40,819 | | | 129,588 |

08/14/08 (a) | | | 0.68750 | | | 45,886 | | | 21,911 | | | 67,797 |

| | | | | | | | | | | | |

Total | | $ | 2.01750 | | $ | 134,655 | | $ | 62,730 | | $ | 197,385 |

| | | | | | | | | | | | |

| (a) | Our board of directors declared this cash distribution in July 2008 to be paid on August 14, 2008 to unitholders of record at the close of business on August 6, 2008. |

9. Assignment of Supply Agreement

As part of its acquisition of a pipeline system in October 2004, MMP assumed a third-party supply agreement. Under this agreement, MMP was obligated to supply petroleum products to one of its customers until 2018. At that time, MMP believed that the profits it would receive from the supply agreement were below the fair value of its tariff-based shipments on this pipeline and, therefore, MMP established a liability for the expected shortfall. On March 1, 2008, MMP assigned this supply agreement and sold related inventory of $47.6 million to a third-party entity. Further, MMP returned its former customer’s cash deposit, which was $16.5 million at the time of the assignment. During the first quarter 2008, MMP obtained a full release from its supply customer; therefore, MMP has no future obligation to perform under this supply agreement, even in the event the third-party assignee is unable to perform its obligations under the agreement. MMP will continue to earn transportation revenues for the product it ships related to this supply agreement but will no longer hold related inventories or recognize associated product sales and purchases. As part of this assignment, MMP agreed with the assignee that if the pricing under the supply agreement does not exceed MMP’s full tariff charge, then MMP will share in 50% of any shortfall versus its full tariff, and similarly, MMP will be entitled to 50% of any excess above a certain threshold that includes its tariff charge.

10. Recent Accounting Standard

The Financial Accounting Standards Board has issued Statement of Financial Accounting Standard (“SFAS”) No. 160, “Non-Controlling Interest in Consolidated Financial Statements—an amendment of ARB No. 51.” SFAS No. 160 will require us, effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008, to reclassify noncontrolling owners’ interest in consolidated subsidiaries as a component of equity. Earlier adoption of SFAS No. 160 is prohibited.

8

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

11. Subsequent Events

In July 2008, MMP issued $250.0 million of 6.40% notes due 2018 in an underwritten public offering. Net proceeds from the offering, after underwriter discounts of $1.6 million and estimated offering costs of $0.5 million, were $247.9 million. The net proceeds were used to repay the $212.0 million of borrowings outstanding under MMP’s revolving credit facility at that time, with the balance to be used for general partnership purposes. In connection with this offering, MMP entered into $100.0 million of interest rate swap agreements to hedge against changes in the fair value of a portion of these notes. These agreements effectively change the interest rate on $100.00 million of these notes from 6.40% to a floating rate of six month LIBOR plus 1.83%. The swap agreements expire on July 15, 2018, the maturity date of the 6.40% notes.

SemGroup, L.P. and several of its subsidiaries (“SemGroup”) filed for chapter 11 bankruptcy protection during July 2008. Amounts owed to MMP by SemGroup at the time of their bankruptcy filing were insignificant.

MMP is party to several commercial arrangements with SemGroup for the purchase and sale of petroleum products and natural gas liquids (“NGLs”), transportation of petroleum products and NGLs, lease storage and capacity leases for petroleum products and NGLs and leasing of terminal and tank facilities to and from SemGroup. Under bankruptcy laws, SemGroup has the ability to cancel all of the existing contracts it has with MMP. If they do so, MMP believes it will be able to replace those contracts with other counterparties on terms similar to those in its contracts with SemGroup. On July 31, 2008, MMP exercised its right to cancel forward petroleum product sales contracts with SemGroup pursuant to which MMP had agreed to sell to SemGroup petroleum products at various dates between August 2008 and April 2009. MMP believes it will be able to replace these contracts with new forward sales contracts with other counterparties or with New York Mercantile Exchange contracts that hedge against changes in product prices.

MMP does not expect a material adverse effect on its financial position from the SemGroup bankruptcy. However, bankruptcy proceedings are inherently unpredictable and decisions of the bankruptcy court that MMP cannot foresee at this time could result in a material adverse effect on its financial position.

In July 2008, our board of directors declared a distribution of $0.6875 per limited partner unit to be paid on August 14, 2008 to MMP unitholders of record as of August 6, 2008. Total distributions to be paid under this declaration are $67.8 million, including $21.9 million to be paid to us.

9