Exhibit 99

MAGELLAN GP, LLC

CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands)

| | | | | | | | |

| | | December 31,

2008 | | | June 30,

2009 | |

| ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 33,242 | | | $ | 91,204 | |

Accounts receivable (less allowance for doubtful accounts of $462 and $435 at December 31, 2008 and June 30, 2009, respectively) | | | 37,517 | | | | 41,926 | |

Other accounts receivable | | | 11,073 | | | | 13,890 | |

Affiliate accounts receivable | | | 376 | | | | 4,076 | |

Inventory | | | 47,734 | | | | 73,125 | |

Energy commodity derivative contracts | | | 20,200 | | | | — | |

Energy commodity derivatives deposit | | | — | | | | 25,609 | |

Reimbursable costs | | | 8,176 | | | | 13,392 | |

Acquisition-related escrow deposits | | | — | | | | 14,800 | |

Other current assets | | | 7,264 | | | | 10,259 | |

| | | | | | | | |

Total current assets | | | 165,582 | | | | 288,281 | |

Property, plant and equipment | | | 2,891,698 | | | | 2,979,847 | |

Less: accumulated depreciation | | | 529,410 | | | | 570,173 | |

| | | | | | | | |

Net property, plant and equipment | | | 2,362,288 | | | | 2,409,674 | |

Equity investments | | | 23,190 | | | | 22,563 | |

Long-term receivables | | | 7,390 | | | | 6,529 | |

Goodwill | | | 14,766 | | | | 14,766 | |

Other intangibles (less accumulated amortization of $8,290 and $9,133 at December 31, 2008 and June 30, 2009, respectively) | | | 5,539 | | | | 4,696 | |

Debt placement costs (less accumulated amortization of $2,937 and $3,381 at December 31, 2008 and June 30, 2009, respectively) | | | 7,649 | | | | 9,301 | |

Other noncurrent assets | | | 10,217 | | | | 11,359 | |

| | | | | | | | |

Total assets | | $ | 2,596,621 | | | $ | 2,767,169 | |

| | | | | | | | |

| | |

| LIABILITIES AND OWNERS’ EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 39,441 | | | $ | 33,125 | |

Affiliate payroll and benefits | | | 18,119 | | | | 19,499 | |

Accrued interest payable | | | 15,077 | | | | 14,559 | |

Accrued taxes other than income | | | 20,151 | | | | 19,050 | |

Environmental liabilities | | | 19,634 | | | | 17,145 | |

Deferred revenue | | | 21,492 | | | | 23,405 | |

Accrued product purchases | | | 23,874 | | | | 21,395 | |

Energy commodity derivatives contracts | | | — | | | | 17,279 | |

Energy commodity derivatives deposit | | | 18,994 | | | | — | |

Other current liabilities | | | 18,477 | | | | 20,254 | |

| | | | | | | | |

Total current liabilities | | | 195,259 | | | | 185,711 | |

Long-term debt | | | 1,083,485 | | | | 1,314,520 | |

Long-term affiliate pension and benefits | | | 31,787 | | | | 34,381 | |

Other noncurrent liabilities | | | 8,642 | | | | 6,933 | |

Environmental liabilities | | | 22,166 | | | | 21,051 | |

Owners’ equity: | | | | | | | | |

Owners’ equity | | | 69,213 | | | | 42,965 | |

Accumulated other comprehensive loss | | | (340 | ) | | | (328 | ) |

Non-controlling owners’ interests in consolidated subsidiaries | | | 1,186,409 | | | | 1,161,936 | |

| | | | | | | | |

Total owners’ equity | | | 1,255,282 | | | | 1,204,573 | |

| | | | | | | | |

Total liabilities and owners’ equity | | $ | 2,596,621 | | | $ | 2,767,169 | |

| | | | | | | | |

See accompanying notes.

1

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS

| 1. | Organization, Description of Business and Basis of Presentation |

Organization

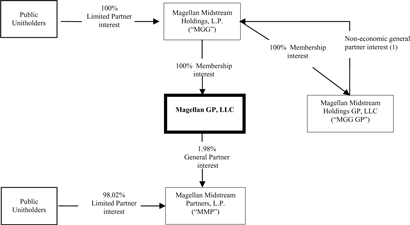

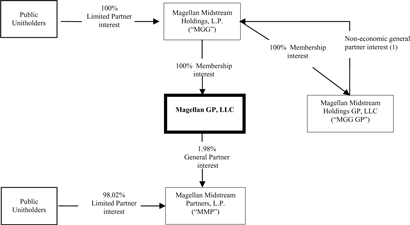

Unless otherwise noted, the terms “we,” “us,” “our” and other similar terms refer to Magellan GP, LLC, a Delaware limited liability company. We were formed in August 2000 to serve as the general partner of Magellan Midstream Partners, L.P. and manage its operations.

Our organizational structure at June 30, 2009 and that of our affiliate entities, as well as how we refer to these entities in our notes to consolidated balance sheets, is provided below:

| (1) | MGG GP is MGG’s general partner, but it does not hold an economic interest in MGG; therefore, MGG GP does not receive any distributions from MGG, nor is MGG GP allocated any of MGG’s net income. |

Basis of Presentation

At December 31, 2008 and June 30, 2009, we had no operating assets other than through our general partner ownership interest and incentive distribution rights in MMP. We control MMP because the limited partner interests of MMP: (i) do not have the substantive ability to dissolve MMP, (ii) can remove us as MMP’s general partner only with a supermajority vote of the MMP limited partner units and the MMP limited partner units which can be voted in such an election are restricted, and (iii) the MMP limited partners do not possess substantive participating rights in MMP’s operations. Therefore, our consolidated balance sheets include the assets and liabilities of MMP.

Description of Business

MMP, a publicly-traded Delaware partnership, together with its subsidiaries, owns and operates a petroleum products pipeline system, petroleum products terminals and an ammonia pipeline system. MMP’s reportable segments offer different products and services and are managed separately as each requires different marketing strategies and business knowledge.

In the opinion of management, our accompanying consolidated balance sheet as June 30, 2009, which is unaudited, includes all normal and recurring adjustments necessary to present fairly our financial position as of June 30, 2009. The balance sheet as of December 31, 2008 is derived from audited financial statements.

2

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

Pursuant to the rules and regulations of the Securities and Exchange Commission, the balance sheets in this report do not include all notes normally included with balance sheets prepared in accordance with accounting principles generally accepted in the United States. These balance sheets should be read in conjunction with the audited consolidated balance sheets and notes thereto included as Exhibit 99 in MMP’s Annual Report on Form 10-K for the year ended December 31, 2008.

Inventory at December 31, 2008 and June 30, 2009 was as follows (in thousands):

| | | | | | |

| | | December 31,

2008 | | June 30,

2009 |

Refined petroleum products | | $ | 20,917 | | $ | 15,529 |

Transmix | | | 13,099 | | | 19,740 |

Natural gas liquids | | | 7,534 | | | 31,419 |

Additives | | | 6,184 | | | 6,437 |

| | | | | | |

Total inventories | | $ | 47,734 | | $ | 73,125 |

| | | | | | |

The increase in natural gas liquids inventory from December 31, 2008 to June 30, 2009 was primarily attributable to purchases of butane to take advantage of current favorable market pricing for the upcoming blending season.

| 3. | Related Party Transactions |

Under a services agreement between MMP and MGG GP, MMP reimburses MGG GP for the costs of employees necessary to conduct its operations and administrative functions. Current affiliate payroll and benefits accruals associated with this agreement at December 31, 2008 and June 30, 2009 were $18.1 million and $19.5 million, respectively, and long-term affiliate pension and benefits accruals at December 31, 2008 and June 30, 2009 were $31.8 million and $34.4 million, respectively. MMP settles its payroll, payroll-related expenses and non-pension postretirement benefit costs with MGG GP on a monthly basis. MMP funds its long-term affiliate pension liabilities through payments to MGG GP when MGG GP makes contributions to its pension funds.

Because MMP’s distributions have exceeded target levels as specified in its partnership agreement, we receive approximately 50%, including our approximate 2% general partner interest, of any incremental cash distributed per MMP limited partner unit. As of June 30, 2009, our executive officers collectively owned a beneficial interest in MGG of less than 1%; therefore, our executive officers also indirectly benefit from these distributions. Assuming MMP has sufficient available cash to continue to pay distributions on all of its outstanding units for four quarters at its current quarterly distribution level of $0.7100 per unit, we would receive distributions of approximately $93.9 million on our combined general partner interest and incentive distribution rights.

3

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

Consolidated debt at December 31, 2008 and June 30, 2009 was as follows (in thousands):

| | | | | | | | | |

| | | December 31,

2008 | | June 30,

2009 | | Weighted-Average

Interest Rate at

June 30, 2009 (1) | |

Revolving credit facility | | $ | 70,000 | | $ | — | | — | |

6.45% notes due 2014 | | | 249,681 | | | 249,706 | | 6.3 | % |

5.65% notes due 2016 | | | 253,328 | | | 253,113 | | 5.7 | % |

6.40% notes due 2018 | | | 261,555 | | | 260,947 | | 5.9 | % |

6.55% Notes due 2019 | | | — | | | 301,826 | | 5.4 | % |

6.40% notes due 2037 | | | 248,921 | | | 248,928 | | 6.3 | % |

| | | | | | | | | |

Total Debt | | $ | 1,083,485 | | $ | 1,314,520 | | | |

| | | | | | | | | |

| |

| | (1) | Weighted-average interest rate includes the impact of the amortization of discounts and gains and losses realized on various cash flow hedges (see Note 9—Derivative Financial Instruments for detailed information regarding the amortization of these gains and losses). |

MMP’s debt is non-recourse to us. The discounted amounts at issuance of the applicable notes, discussed below, are being accreted to the notes over their respective lives.

Revolving Credit Facility.The total borrowing capacity under MMP’s revolving credit facility, which matures in September 2012, is $550.0 million. Borrowings under the facility are unsecured and bear interest at LIBOR plus a spread ranging from 0.3% to 0.8% based on MMP’s credit ratings and amounts outstanding under the facility. Additionally, a commitment fee is assessed at a rate from 0.05% to 0.125%, depending on MMP’s credit ratings. Borrowings under this facility are used primarily for general purposes, including capital expenditures. As of June 30, 2009, there was no outstanding balance under this facility, and $3.9 million was obligated for letters of credit. Amounts obligated for letters of credit are not reflected as debt on our consolidated balance sheets.

6.45% Notes due 2014.In May 2004, MMP sold $250.0 million aggregate principal of 6.45% notes due 2014 in an underwritten public offering. The notes were issued for the discounted price of 99.8%, or $249.5 million.

5.65% Notes due 2016.In October 2004, MMP issued $250.0 million of 5.65% notes due 2016 in an underwritten public offering. The notes were issued for the discounted price of 99.9%, or $249.7 million. The outstanding principal amount of the notes was increased by $3.5 million and $3.3 million at December 31, 2008 and June 30, 2009, respectively, for the unamortized portion of a gain realized upon termination of a related interest rate swap (see Note 5—Derivative Financial Instruments).

6.40% Notes due 2018. In July 2008, MMP issued $250.0 million of 6.40% notes due 2018 in an underwritten public offering. The outstanding principal amount of the notes was increased by $11.6 million and $11.0 million at December 31, 2008 and June 30, 2009, respectively, for the unamortized portion of gains realized upon termination or discontinuation of hedge accounting treatment of associated interest rate swaps (see Note 5—Derivative Financial Instruments).

6.55% Notes due 2019. In June 2009, MMP issued $300.0 million of 6.55% notes due 2019 in an underwritten public offering. The notes were issued for the discounted price of 99.7%, or $299.0 million. Net proceeds from the offering, after underwriter discounts of $2.0 million and offering costs of $0.1 million that MMP has incurred through June 30, 2009, were $296.9 million. The net proceeds were used to repay the $208.3 million of borrowings outstanding under MMP’s revolving credit facility at that time, and the balance will be used for general purposes, including capital expenditures. In connection with this offering, MMP entered into interest rate swap agreements to effectively convert $150.0 million of these notes to floating-rate debt (see Note 5—Derivative Financial Instruments). The outstanding principal amount of the notes was increased by $2.9 million at June 30, 2009 for the fair value of the associated interest rate swap agreements.

6.40% Notes due 2037.In April 2007, MMP issued $250.0 million of 6.40% notes due 2037 in an underwritten public offering. The notes were issued for the discounted price of 99.6%, or $248.9 million.

4

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

| 5. | Derivative Financial Instruments |

Commodity Derivatives

MMP’s petroleum products blending activities generate gasoline products and MMP can estimate the timing and quantities of sales of these products. MMP uses a combination of forward sales contracts and New York Mercantile Exchange (“NYMEX”) agreements to lock in most of the gross margins realized from its blending activities. MMP accounts for the forward sales contracts as normal sales.

Although the NYMEX contracts represent an economic hedge against price changes on the petroleum products MMP expects to sell in the future, they do not qualify as normal sales or for hedge accounting treatment under Statement of Financial Accounting Standard (“SFAS”) No. 133,Accounting for Derivative Instruments and Hedging Activities (as amended); therefore, MMP recognizes the change in fair value of these contracts currently in earnings. At June 30, 2009, the fair value of MMP’s open NYMEX contracts, representing 1.2 million barrels of petroleum products, was a net loss of $17.3 million, which was recorded as energy commodity derivative contracts on our consolidated balance sheet. These open NYMEX contracts mature between July 2009 and March 2010. At June 30, 2009, MMP had made margin deposits of $25.6 million for these contracts, which was recorded as energy commodity derivatives deposit on our consolidated balance sheet.

Interest Rate Derivatives

MMP uses interest rate derivatives to help manage interest rate risk. As of June 30, 2009, MMP had two offsetting interest rate swap agreements outstanding:

| | • | | In July 2008, MMP entered into a $50.0 million interest rate swap agreement (“Derivative A”) to hedge against changes in the fair value of a portion of the $250.0 million of 6.40% notes due 2018. Derivative A effectively converted $50.0 million of those notes from a 6.40% fixed rate to a floating rate of six-month LIBOR plus 1.83%. Derivative A terminates in July 2018. MMP originally accounted for Derivative A as a fair value hedge. In December 2008, in order to capture the economic value of Derivative A at that time, MMP entered into an offsetting derivative, as described below, and discontinued hedge accounting for Derivative A. The $5.4 million fair value of Derivative A at that time was recorded as an adjustment to long-term debt which is being amortized over the remaining life of the 6.40% fixed-rate notes due 2018. |

| | • | | In December 2008, concurrent with the discontinuance of hedge accounting for Derivative A, MMP entered into an offsetting $50.0 million interest rate swap agreement with a different financial institution pursuant to which MMP pays a fixed rate of 6.40% and receives a floating rate of six-month LIBOR plus 3.23%. This agreement terminates in July 2018. MMP entered into this agreement to offset changes in the fair value of Derivative A, excluding changes due to changes in counterparty credit risks. We did not designate this agreement as a hedge for accounting purposes. |

In addition to the two interest rate swap agreements described above, MMP had the following interest rate swap agreements outstanding as of June 30, 2009:

| | • | | In June 2009, MMP entered into a total of $150.0 million of interest rate swap agreements to hedge against changes in the fair value of a portion of the $300.0 million of 6.55% notes due 2019. MMP has accounted for these agreements as fair value hedges. These agreements effectively convert $150.0 million of MMP’s 6.55% fixed-rate notes issued in June 2009 to floating-rate debt. Under the terms of the agreements, MMP will receive the 6.55% fixed rate of the notes and pay six-month LIBOR in arrears plus 2.18%. The agreements terminate in June 2019, which is the maturity date of the related notes. Payments will settle in January and July each year. During each period, MMP will record the impact of these swaps based on the forward LIBOR curve. Any differences between actual LIBOR determined on the settlement date and MMP’s estimate of LIBOR will result in an adjustment to MMP’s interest expense. |

The interest rate derivatives discussed above contain credit-risk-related contingency features. These features provide that: (i) in the event of MMP’s default on any obligation of $25.0 million or more or, (ii) in certain circumstances a change in control of MMP’s general partner or a merger in which MMP’s credit rating becomes “materially weaker”, which would generally be interpreted as falling below investment grade, the counterparties to MMP’s interest rate derivatives agreements can terminate those agreements and require immediate settlement. None of MMP’s interest rate derivatives were in a liability position as of June 30, 2009.

5

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

The following is a summary of the current impact of MMP’s historical derivative activity on accumulated other comprehensive loss (“AOCL”) for the six months ended June 30, 2008 and 2009 (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | | | | As of

June 30,

2008 | | | Six Months

Ended

June 30,

2008 | | | As of

June 30,

2009 | | | Six Months

Ended

June 30,

2009 | |

Hedge | | Total Gain

(Loss)

Realized on

Settlement

of Hedge | | | Unamortized

Amount

Recognized in

AOCL | | | Amount

Reclassified to

Interest

Expense from

AOCL | | | Unamortized

Amount

Recognized in

AOCL | | | Amount

Reclassified to

Interest

Expense from

AOCL | |

Cash flow hedges (date executed): | | | | | | | | | | | | | | | | | | | | |

Interest rate swaps 6.40% Notes (April 2007) | | $ | 5,255 | | | $ | 5,044 | | | $ | (88 | ) | | $ | 4,869 | | | $ | (88 | ) |

Interest rate swaps 5.65% Notes (October 2004) | | | (6,279 | ) | | | (4,338 | ) | | | 262 | | | | (3,815 | ) | | | 262 | |

Interest rate swaps and treasury lock 6.45% Notes (May 2004) | | | 5,119 | | | | 3,029 | | | | (256 | ) | | | 2,517 | | | | (256 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total cash flow hedges | | | | | | $ | 3,735 | | | $ | (82 | ) | | $ | 3,571 | | | $ | (82 | ) |

| | | | | | | | | | | | | | | | | | | | |

There was no ineffectiveness recognized on the financial instruments disclosed in the above tables during the six months ended June 30, 2008 and 2009. As of June 30, 2009, the net gain estimated to be reclassified to interest expense over the next twelve months from AOCL is approximately $0.2 million.

The changes in derivative gains (losses) included in AOCL for six months ended June 30, 2008 and 2009 are as follows (in thousands):

| | | | | | | | |

| | | Six Months Ended

June 30, | |

Derivative Gains Included in AOCL | | 2008 | | | 2009 | |

Beginning balance | | $ | 3,817 | | | $ | 3,653 | |

Reclassification of net gain on cash flow hedges to interest expense | | | (82 | ) | | | (82 | ) |

| | | | | | | | |

| | |

Ending balance | | $ | 3,735 | | | $ | 3,571 | |

| | | | | | | | |

The following is a summary of the current impact of MMP’s historical derivative activity on long-term debt resulting from the termination of or the discontinuance of hedge accounting treatment of MMP’s fair value hedges as of and for the six months ended June 30, 2009 (in thousands):

| | | | | | | | | | |

| | | | | As of

June 30, 2009 | | Six Months

Ended

June 30, 2009 | |

Hedge | | Total Gain

Realized | | Unamortized

Amount

Recorded in

Long-term

Debt | | Amount

Reclassified

to Interest

Expense from

Long-term

Debt | |

Fair value hedges (date executed): | | | | | | | | | | |

Interest rate swaps 6.40% Notes (July 2008) | | $ | 11,652 | | $ | 10,966 | | $ | (608 | ) |

Interest rate swap 5.65% Notes (October 2004) | | | 3,830 | | | 3,321 | | | (227 | ) |

| | | | | | | | | | |

Total fair value hedges | | | | | $ | 14,287 | | $ | (835 | ) |

| | | | | | | | | | |

6

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

The following is a summary of the amounts included in our consolidated balance sheet of the fair value of derivatives accounted for under SFAS No. 133 that were designated as hedging instruments as of June 30, 2009 (in thousands):

| | | | | | | | | | |

| | | Asset Derivatives | | Liability Derivatives |

Derivative Instrument | | Balance Sheet Location | | Fair Value | | Balance Sheet Location | | Fair Value |

Interest rate swap agreements, current portion | | Other current assets | | $ | 48 | | Other current liabilities | | $ | — |

Interest rate swap agreements, noncurrent portion | | Other noncurrent assets | | | 2,866 | | Other noncurrent liabilities | | | — |

| | | | | | | | | | |

| | Total | | $ | 2,914 | | Total | | $ | — |

| | | | | | | | | | |

The following is a summary of the amounts included in our consolidated balance sheet of the fair value of derivatives accounted for under SFAS No. 133 that were not designated as hedging instruments as of June 30, 2009 (in thousands):

| | | | | | | | | | |

| | | Asset Derivatives | | Liability Derivatives |

Derivative Instrument | | Balance Sheet Location | | Fair Value | | Balance Sheet Location | | Fair Value |

Interest rate swap agreements, current portion | | Other current assets | | $ | 718 | | Other current liabilities | | $ | 384 |

Interest rate swap agreements, noncurrent portion | | Other noncurrent assets | | | 5,723 | | Other noncurrent liabilities | | | — |

NYMEX commodity contracts | | Energy commodity derivative contracts | | | — | | Energy commodity derivative contracts | | | 17,279 |

| | | | | | | | | | |

| | Total | | $ | 6,441 | | Total | | $ | 17,663 |

| | | | | | | | | | |

| 6. | Commitments and Contingencies |

Environmental Liabilities. Liabilities recognized for estimated environmental costs were $41.8 million and $38.2 million at December 31, 2008 and June 30, 2009, respectively. Environmental liabilities have been classified as current or noncurrent based on management’s estimates regarding the timing of actual payments. Management estimates that expenditures associated with these environmental liabilities will be paid over the next ten years.

MMP’s environmental liabilities include, among other items, accruals for an ammonia environmental protection agency (“EPA”) issue. In February 2007, MMP received notice from the Department of Justice (“DOJ”) that the EPA had requested the DOJ to initiate a lawsuit alleging violations of Sections 301 and 311 of the Clean Water Act (“the Act”) with respect to two releases of anhydrous ammonia from MMP’s ammonia pipeline system that was operated by a third party at the time of the releases. The DOJ stated that the maximum statutory penalty for alleged violations of the Act for both releases combined was approximately $13.2 million. The DOJ also alleged that the third-party operator of MMP’s ammonia pipeline was liable for penalties pursuant to Section 103 of the Comprehensive Environmental Response, Compensation and Liability Act for failure to report the releases on a timely basis, with the statutory maximum for those penalties as high as $4.2 million for which the third-party operator has requested indemnification. In March 2007, MMP also received a demand from the third-party operator for defense and indemnification in regards to a DOJ criminal investigation regarding whether certain actions or omissions of the third-party operator constituted violations of federal criminal statutes. The third-party operator has subsequently settled this criminal investigation with the DOJ by paying a $1.0 million fine. The DOJ stated in its notice to us that it does not expect MMP or the third-party operator to pay the penalties at the statutory maximum; however, it may seek injunctive relief if the parties cannot agree on any necessary corrective actions. MMP has accrued an amount for these matters based on its best estimates that is less than the maximum statutory penalties. MMP is currently in discussions with the EPA, DOJ and the third-party operator regarding these two releases.

Environmental Receivables. Receivables from insurance carriers related to environmental matters were $4.5 million and $3.9 million at December 31, 2008 and June 30, 2009, respectively.

7

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

Unrecognized Product Gains. MMP’s petroleum products terminals operations generate product overages and shortages that result from metering inaccuracies, product evaporation or expansion, product releases and product contamination. Most of the contracts MMP has with its customers state that MMP bears the risk of loss (or gain) from these conditions. When MMP’s petroleum products terminals experience net product shortages, it recognizes expense for those losses in the periods in which they occur. When MMP’s petroleum products terminals experience net product overages, it has product on hand for which it has no cost basis. Therefore, these net overages are not recognized in MMP’s or our financial statements until the associated barrels are either sold or used to offset product losses. The net unrecognized product overages for MMP’s petroleum products terminals operations had a market value of approximately $3.6 million as of June 30, 2009. However, the actual amounts MMP will recognize in future periods will depend on product prices at the time the associated barrels are either sold or used to offset future product losses.

Other. We and MMP are parties to various other claims, legal actions and complaints arising in the ordinary course of business. In the opinion of management, the ultimate resolution of these claims, legal actions and complaints after consideration of amounts accrued, insurance coverage or other indemnification arrangements, will not have a material adverse effect on our financial position, results of operations or cash flows.

| 7. | Long-Term Incentive Plan |

MMP has a long-term incentive plan (“LTIP”) for certain of MGG GP employees who perform services for MMP and our directors. The LTIP primarily consists of MMP phantom units and permits the grant of awards covering an aggregate of 3.2 million MMP limited partner units. The remaining units available under the LTIP at June 30, 2009 total 1.3 million. The compensation committee of our board of directors (the “Compensation Committee”) administers the LTIP and has approved the unit awards discussed below:

Vested Unit Awards

| | | | | | | | | | | | | |

Grant Date | | Unit Awards

Granted | | Forfeitures | | Adjustments to Unit

Awards for

Attaining Above-

Target Financial

Results | | Units Paid

Out on

Vesting Date | | Vesting

Date | | Value of Unit

Awards on

Vesting Date

(Millions) |

February 2005 | | 160,640 | | 11,348 | | 149,292 | | 298,584 | | 12/31/07 | | $ | 12.9 |

June 2006 | | 1,170 | | — | | 1,170 | | 2,340 | | 12/31/07 | | $ | 0.1 |

February 2006 | | 168,105 | | 13,730 | | 154,143 | | 308,518 | | 12/31/08 | | $ | 9.3 |

Various 2006 | | 9,201 | | 2,640 | | 6,561 | | 13,122 | | 12/31/08 | | $ | 0.4 |

March 2007 | | 2,640 | | — | | — | | 2,640 | | 12/31/08 | | $ | 0.1 |

In January 2008, MMP settled the cumulative amounts of the February 2005 and June 2006 award grants by issuing 196,856 MMP limited partner units and distributing those units to the participants. The difference between the MMP limited partner units issued to the participants and the total units accrued represented the minimum tax withholdings associated with this award settlement. MMP paid associated tax withholdings and employer taxes totaling $5.1 million in January 2008.

In January 2009, MMP settled the cumulative amounts of the remaining 2006 and March 2007 award grants by issuing 209,321 MMP limited partner units and distributing those units to the participants. The difference between the MMP limited partner units issued to the participants and the total units accrued represented the minimum tax withholdings associated with this award settlement. MMP paid associated tax withholdings and employer taxes totaling $4.0 million in January 2009.

Performance-Based Unit Awards

The incentive awards discussed below are subject to forfeiture if employment is terminated for any reason other than retirement, death or disability prior to the vesting date. If an award recipient retires, dies or becomes disabled prior to the end of the vesting period, the recipient’s award grant is prorated based upon the completed months of employment during the vesting period and the award is settled at the end of the vesting period. MMP’s agreement with the LTIP participants requires the LTIP awards described below to be paid out in MMP limited partner units. The award grants do not have an early vesting feature except under certain circumstances following a change in control of us.

On December 3, 2008, MGG purchased its general partner from MGG MH. When this transaction closed, a change in control occurred as defined in MMP’s LTIP. Even though a change in control has occurred, participants in the LTIP must resign voluntarily for good reason or be terminated involuntarily for other than performance reasons within two years of December 3, 2008 in order to receive enhanced LTIP payouts.

8

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

For each of the award grants listed below, the payout calculation for 80% of the unit awards will be based solely on the attainment of a financial metric established by the Compensation Committee. This portion of the award grants has been accounted for as equity. The payout calculation for the remaining 20% of the unit awards will be based on both the attainment of a financial metric and the individual employee’s personal performance as determined by the Compensation Committee. This portion of the award grants has been accounted for as a liability.

The table below summarizes the performance based unit awards granted by the Compensation Committee that have not vested as of June 30, 2009. There was no impact to MMP’s or our cash flows associated with these award grants for the periods presented in this report.

| | | | | | | | | | | | | | | | | |

Grant Date | | Unit

Awards

Granted | | Estimated

Forfeitures | | Adjustment to

Unit Awards in

Anticipation of

Achieving Above/

(Below) Target

Financial Results | | | Total Unit

Award

Accrual | | Vesting

Date | | Unrecognized

Compensation

Expense

(Millions) (1) | | Intrinsic Value of

Unvested Awards

at June 30, 2009

(Millions) |

2007 awards: | | | | | | | | | | | | | | | | | |

Tranche 1: | | 53,230 | | 1,597 | | 51,633 | | | 103,266 | | 12/31/09 | | $ | 0.6 | | $ | 3.6 |

Tranche 2: | | 53,230 | | 1,597 | | (40,430 | ) | | 11,203 | | 12/31/09 | | | 0.1 | | | 0.4 |

Tranche 3: | | 53,230 | | 1,597 | | 8,624 | | | 60,257 | | 12/31/09 | | | 0.9 | | | 2.1 |

2008 awards | | 189,832 | | 5,695 | | — | | | 184,137 | | 12/31/10 | | | 2.6 | | | 6.4 |

2009 awards | | 275,994 | | 8,281 | | — | | | 267,713 | | 12/31/11 | | | 4.7 | | | 9.3 |

| | | | | | | | | | | | | | | | | |

| | | | | | | |

Total | | 625,516 | | 18,767 | | 19,827 | | | 626,576 | | | | $ | 8.9 | | $ | 21.8 |

| | | | | | | | | | | | | | | | | |

| (1) | Unrecognized compensation expense will be recognized over the remaining vesting periods of the awards. |

The unit awards approved during 2007 are broken into three equal tranches, with each tranche vesting on December 31, 2009. MMP began accruing for Tranche 1 in the first quarter of 2007, Tranche 2 in the first quarter of 2008 and Tranche 3 in the first quarter of 2009, when the Compensation Committee established the financial metric associated with each respective tranche. The unit awards allocated to each tranche are expensed over their respective vesting periods. As of June 30, 2009, the accruals for the payout of Tranches 1, 2 and 3 were 200%, 22% and 117%, respectively.

At its February 2009 meeting, the Compensation Committee adjusted the threshold, target and stretch performance levels for the 2008 awards to reflect the downturn in the economic environment. The Compensation Committee felt that the modifications were necessary to ensure that the awards continued to provide a motivational and retention feature in the current economic environment and maintain the link necessary to encourage its key employees to maximize its long-term financial results. At December 31, 2008, the accrual for the payout of the 2008 awards was 30%. As a result of the adjustment made by the MMP Compensation Committee to the 2008 performance metric, the accrual for the estimated payout of the adjusted 2008 unit awards at June 30, 2009 was 100%.

9

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

Retention Awards

The retention awards below are subject to forfeiture if employment is terminated or the employee resigns from their current position for any reason prior to the applicable vesting date. These award grants do not have an early vesting feature. The award grants listed below have been accounted for as equity.

| | | | | | | | | | | | | | |

Grant Date | | Unit Awards

Granted | | Estimated

Forfeitures | | Total Unit

Award Accrual | | Vesting Date | | Unrecognized

Compensation

Expense

(Millions) (1) | | Intrinsic Value of

Unvested Awards

at June 30, 2009

(Millions) |

Various | | 14,248 | | 428 | | 13,820 | | 12/31/10 | | $ | 0.2 | | $ | 0.5 |

Various | | 41,688 | | 1,876 | | 39,812 | | 12/31/11 | | | 0.7 | | | 1.4 |

| | | | | | | | | | | | | | |

| | 55,936 | | 2,304 | | 53,632 | | | | $ | 0.9 | | $ | 1.9 |

| | | | | | | | | | | | | | |

| (1) | Unrecognized compensation expense will be recognized over the remaining vesting periods of the respective awards. |

Fair Value of Unit Awards

| | | | | | | | | | | | |

| | | 2007 Awards | | 2008 Awards | | 2009 Awards | | Retention

Awards |

Weighted-average per unit grant date fair value of equity awards (1) | | $ | 32.30 | | $ | 27.77 | | $ | 19.61 | | $ | 24.11 |

June 30, 2009 per unit fair value of liability awards (2) | | $ | 33.34 | | $ | 30.49 | | $ | 27.56 | | | n/a |

|

| | (1) | Except for the retention awards, approximately 80% of the unit awards are accounted for as equity. Fair value is calculated as MMP’s unit price on the grant date less the present value of estimated cash distributions during the vesting period. |

| | (2) | Approximately 20% of the unit awards are accounted for as liabilities. Fair value is calculated as MMP’s unit price at the end of each accounting period less the present value of estimated cash distributions during the remaining portion of the vesting period. |

Distributions paid by MMP, including amounts paid to us during 2008 and 2009 were as follows (in thousands, except per unit amounts):

| | | | | | | | | | | | |

Date Cash Distribution Paid | | Per Unit Cash

Distribution

Amount | | Common

Units | | General

Partner (a) | | Total Cash

Distribution |

02/14/08 | | $ | 0.65750 | | $ | 43,884 | | $ | 19,909 | | $ | 63,793 |

05/15/08 | | | 0.67250 | | | 44,885 | | | 20,910 | | | 65,795 |

08/14/08 | | | 0.68750 | | | 45,886 | | | 21,911 | | | 67,797 |

11/14/08 | | | 0.70250 | | | 46,887 | | | 22,912 | | | 69,799 |

| | | | | | | | | | | | |

Total | | $ | 2.72000 | | $ | 181,542 | | $ | 85,642 | | $ | 267,184 |

| | | | | | | | | | | | |

| | | | |

02/13/09 | | $ | 0.71000 | | $ | 47,537 | | $ | 23,478 | | $ | 71,015 |

05/15/09 | | | 0.71000 | | | 47,537 | | | 23,478 | | | 71,015 |

| | | | | | | | | | | | |

Through 6/30/09 | | | 1.42000 | | | 95,074 | | | 46,956 | | | 142,030 |

08/14/09 (b) | | | 0.71000 | | | 47,537 | | | 23,478 | | | 71,015 |

| | | | | | | | | | | | |

Total | | $ | 2.13000 | | $ | 142,611 | | $ | 70,434 | | $ | 213,045 |

| | | | | | | | | | | | |

|

| | (a) | Includes amounts we were paid for our incentive distribution rights. |

| | (b) | Our board of directors declared this cash distribution in July 2009 to be paid on August 14, 2009 to unitholders of record at the close of business on August 7, 2009. |

We paid the same amounts paid to us by MMP to our owner, MGG, on the same dates listed in the above tables.

10

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

Fair Value of Financial Instruments

We used the following methods and assumptions in estimating our fair value disclosure for financial instruments:

Cash and cash equivalents.The carrying amounts reported in the balance sheet approximate fair value due to the short-term maturity or variable rates of these instruments.

Energy commodity derivatives deposit. This asset (liability) represents a short-term deposit MMP paid (held) associated with its energy commodity derivative contracts. The carrying amount reported in the balance sheet approximates fair value due to the short-term maturity of the underlying contracts.

Acquisition-related escrow deposits.This asset represents various short-term escrow deposits MMP paid. The carrying amount reported in the balance sheet approximates fair value due to the short-term maturity of the instruments.

Long-term receivables. Fair value was determined by discounting estimated future cash flows by the rates inherent in the long-term instruments adjusted for the change in the risk-free rate since inception of the instrument.

Energy commodity derivative contracts. The carrying amounts reported in the balance sheet represent fair value of the asset (liability). See Note 9—Derivative Financial Instruments.

Debt.The fair value of MMP’s publicly traded notes, excluding the value of interest rate swaps qualifying as fair value hedges, was based on the prices of those notes at December 31, 2008 and June 30, 2009. The carrying amount of borrowings under MMP’s revolving credit facility at December 31, 2008 approximates fair value due to the variable rates of that instrument.

Interest rate swaps.Fair value was determined based on an assumed exchange, at each year end, in an orderly transaction with the financial institution counterparties of the interest rate derivative agreements.

The following table reflects the carrying amounts and fair values of our financial instruments as of December 31, 2008 and June 30, 2009 (in thousands):

| | | | | | | | | | | | | | | | |

| | | December 31, 2008 | | | June 30, 2009 | |

| | | Carrying

Amount | | | Fair

Value | | | Carrying

Amount | | | Fair

Value | |

Cash and cash equivalents | | $ | 33,241 | | | $ | 33,241 | | | $ | 91,203 | | | $ | 91,203 | |

Energy commodity derivatives deposit | | | (18,994 | ) | | | (18,994 | ) | | | 25,609 | | | | 25,609 | |

Acquisition-related escrow deposits | | | — | | | | — | | | | 14,800 | | | | 14,800 | |

Long-term receivables | | | 7,119 | | | | 5,249 | | | | 6,270 | | | | 5,739 | |

Energy commodity derivative contracts | | | 20,200 | | | | 20,200 | | | | (17,279 | ) | | | (17,279 | ) |

Debt | | | (1,083,485 | ) | | | (934,975 | ) | | | (1,314,520 | ) | | | 1,303,380 | |

Interest rate swaps: | | | | | | | | | | | | | | | | |

$50.0 million (July 2008) | | | 7,542 | | | | 7,542 | | | | 3,876 | | | | 3,876 | |

$50.0 million (December 2008) | | | (1,770 | ) | | | (1,770 | ) | | | 2,181 | | | | 2,181 | |

$75.0 million (June 2009) | | | — | | | | — | | | | 1,457 | | | | 1,457 | |

$75.0 million (June 2009) | | | — | | | | — | | | | 1,457 | | | | 1,457 | |

11

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

Fair Value Measurements

The following tables summarize the fair value measurements of MMP’s NYMEX commodity contracts and interest rate swap agreements as of December 31, 2008 and June 30, 2009, based on the three levels established by SFAS No. 157,Fair Value Measurements (in thousands):

| | | | | | | | | | | | | | |

| | | | | | Asset Fair Value Measurements as of

December 31, 2008 using: |

| | | Total | | | Quoted Prices in

Active Markets

for Identical

Assets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | | Significant

Unobservable

Inputs

(Level 3) |

NYMEX commodity contracts | | $ | 20,200 | | | $ | 20,200 | | $ | — | | | $ | — |

Interest rate swap agreements (date executed): | | | | | | | | | | | | | | |

$50.0 million (July 2008) | | | 7,542 | | | | — | | | 7,542 | | | | — |

$50.0 million (December 2008) | | | (1,770 | ) | | | — | | | (1,770 | ) | | | — |

| | | | | | | | | | | | | | |

| | | | | | Asset Fair Value Measurements as of

June 30, 2009 using: |

| | | Total | | | Quoted Prices in

Active Markets

for Identical

Assets

(Level 1) | | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) |

NYMEX commodity contracts: | | $ | (17,279 | ) | | $ | (17,279 | ) | | $ | — | | $ | — |

Interest rate swap agreements (date executed): | | | | | | | | | | | | | | |

$50.0 million (July 2008) | | | 3,876 | | | | — | | | | 3,876 | | | — |

$50.0 million (December 2008) | | | 2,181 | | | | — | | | | 2,181 | | | — |

$75.0 million (June 2009) | | | 1,457 | | | | — | | | | 1,457 | | | — |

$75.0 million (June 2009) | | | 1,457 | | | | — | | | | 1,457 | | | — |

| 10. | Assignment of Supply Agreement |

As part of MMP’s acquisition of a pipeline system in October 2004, MMP assumed a third-party supply agreement. Under this agreement, MMP was obligated to supply petroleum products to one of its customers until 2018. At the time of this acquisition, management believed that the profits MMP would receive from the supply agreement were below the fair value of its tariff-based shipments on this pipeline and MMP established a liability for the expected shortfall. On March 1, 2008, MMP assigned this supply agreement and sold related inventory of $47.6 million to a third-party entity. Further, MMP returned its former customer’s cash deposit, which was $16.5 million at the time of the assignment. During first quarter 2008, MMP obtained a full release from the supply customer; therefore, it has no future obligation to perform under this supply agreement, even in the event the third-party assignee is unable to perform its obligations under the agreement. As a result, MMP wrote off the unamortized amount of the liability and recognized a gain of $26.5 million.

| 11. | Simplification Agreement |

In March 2009, we and MMP and MGG and its general partner entered into an Agreement Relating to Simplification of Capital Structure (the “Simplification Agreement”). Pursuant to the Simplification Agreement, if approved by both MMP’s and MGG’s unitholders, MMP will amend and restate its existing partnership agreement to provide for the transformation of the incentive distribution rights and approximate 2% general partner interest that we currently own into common units in MMP and a non-economic general partner interest (the “transformation”). Once the transformation is complete, we will distribute the MMP common units that we receive in the transformation to MGG (the “unit distribution”). Once the transformation and unit distribution are complete, pursuant to a Contribution and Assumption Agreement among MGG, MGG MH (MGG’s general partner), MMP and us: (i) MGG will contribute 100% of its member interests in its general partner to us; (ii) MGG will contribute 100% of the member interests in us to MMP; (iii) MGG will contribute to MMP all of its cash and assets, other than the common units in MMP it receives

12

MAGELLAN GP, LLC

NOTES TO CONSOLIDATED BALANCE SHEETS (Continued)

in the unit distribution; and (iv) MMP will assume all of MGG’s liabilities (collectively, the “contributions”). Once the transformation, unit distribution and contributions are complete, MGG will dissolve and wind-up and distribute the common units in MMP it receives in the unit distribution to its unitholders (the “redistribution”).

Pursuant to the Simplification Agreement, MGG will receive approximately 39.6 million of MMP’s common units in the transformation and unit distribution and each of MGG’s unitholders will receive 0.6325 of MMP common units in the redistribution for each MGG common unit. MMP’s unitholders will continue to own their existing common units.

Currently, MMP is a consolidated subsidiary of MGG. MGG controls and operates MMP through its 100% ownership interest in us. Assuming the simplification of the capital structure as described above is approved by both MMP’s and MGG’s unitholders, we and MGG’s general partner will legally become MMP’s wholly-owned subsidiaries and MGG will be dissolved. For accounting purposes, however, MGG will be considered the accounting acquirer of its non-controlling interest. Therefore, in accordance with Statement of SFAS No. 160,Non-Controlling Interests in Consolidated Financial Statements, the changes in MGG’s ownership interest of MMP will be accounted for as an equity transaction and no gain or loss will be recognized as a result of the simplification of the capital structure.

We will continue to manage MMP after the simplification and MMP’s management team will continue in their respective roles. Additionally, three of the four members of MGG’s general partner’s board of directors will join our board of directors following completion of the simplification. The other member of MGG’s general partner’s board of directors, Patrick C. Eilers, also serves as an independent member of our board of directors.

The terms of the Simplification Agreement were unanimously approved by the conflicts committee of our board of directors the board of directors of MGG’s general partner. Each conflicts committee is comprised solely of independent directors and was previously delegated authority by the board of directors to negotiate and authorize the terms of the simplification.

During the three and six months ended June 30, 2009, we incurred $0.9 million and $3.8 million, respectively, of costs associated with the simplification of our capital structure. In accordance with SFAS No. 160, these costs were charged to equity.

The reimbursable costs reported as current assets on our consolidated balance sheets were $8.2 million and $13.4 million at December 31, 2008 and June 30, 2009, respectively. These balances primarily represent costs we have incurred related to claims we have not yet filed with our insurance carriers but for which we expect to be reimbursed.

We evaluated subsequent events through August 4, 2009, the date we issued our consolidated balance sheets as of December 31, 2008 and June 30, 2009. No recognizable subsequent events occurred during this period.

The following non-recognizable events occurred during the period in which we evaluated subsequent events:

| | • | | On July 29, 2009, MMP acquired substantially all of the assets of Longhorn Partners Pipeline, L.P. (“Longhorn”) for $250.0 million plus the fair market value of the line fill of $86.1 million. The assets of Longhorn include an approximate 700-mile common carrier pipeline system that transports refined petroleum products from Houston to El Paso, Texas, a terminal in El Paso, Texas comprised of a 5-bay truck loading rack and over 900,000 barrels of storage. |

| | • | | On July 27, 2009, our board of directors declared a quarterly distribution of $0.71 per MMP unit to be paid on August 14, 2009, to MMP unitholders of record at the close of business on August 7, 2009. The total distributions to be paid will be $71.0 million, of which $1.4 million will be paid to us on our approximate 2% general partner interest and $22.1 million on our incentive distribution rights (see Note 8—Distributions for details). |

13