Exhibit 99.1

Item 6. Selected Financial Data

The summary selected historical financial data presented below was derived from Magellan Midstream Partners, L.P.’s (“Magellan Partners”) current and historical audited consolidated financial statements and related notes, as revised in this filing. Information concerning significant trends in Magellan Partners’ financial condition and results of operations is contained in Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations,included in this filing.

Magellan Partners’ operating results incorporate a number of significant estimates and uncertainties. Such matters could cause the data included herein not to be indicative of its future financial conditions or results of operations. Note 5—Summary of Significant Accounting Policies under Item 8Financial Statements and Supplementary Data of this report provides descriptions of areas where estimates and judgments could result in different amounts recognized in the accompanying consolidated financial statements.

Management defines EBITDA, which is not a generally accepted accounting principles (“GAAP”) measure, in the following schedules as net income plus provision for income taxes, debt prepayment premium, write-off of unamortized debt placement fees, debt placement fee amortization, interest expense (net of interest income and interest capitalized) and depreciation and amortization. EBITDA should not be considered an alternative to net income, operating profit, cash flow from operations or any other measure of financial performance presented in accordance with GAAP. Because EBITDA excludes some items that affect net income and these items may vary among other companies, the EBITDA data presented may not be comparable to similarly titled measures of other companies. Management uses EBITDA as a performance measure to assess the viability of projects and to determine overall rates of return on alternative investment opportunities. A reconciliation of EBITDA to net income, the nearest comparable GAAP measure, is included in the following schedules.

In addition to EBITDA, the non-GAAP measure of operating margin (in the aggregate and by segment) is presented in the following tables. The components of operating margin have been computed by using amounts that are determined in accordance with GAAP. A reconciliation of operating margin to operating profit, which is its nearest comparable GAAP financial measure, is included in the following tables. See Note 17—Segment Disclosures in the accompanying consolidated financial statements for a reconciliation of segment operating margin to segment operating profit. Management believes that investors benefit from having access to the same financial measures they use. Operating margin is an important measure of the economic performance of Magellan Partners’ core operations. This measure forms the basis of Magellan Partners’ internal financial reporting and is used by management in deciding how to allocate capital resources between segments. Operating profit, alternatively, includes expense items such as depreciation and amortization and affiliate G&A expense, that management does not consider when evaluating the core profitability of an operation.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | |

| | | (in thousands, except per year unit amounts) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | |

Transportation and terminals revenues | | $ | 419,772 | | | $ | 501,324 | | | $ | 559,321 | | | $ | 608,781 | | | $ | 638,810 | |

Product sales revenues | | | 275,769 | | | | 636,209 | | | | 664,569 | | | | 709,564 | | | | 574,095 | |

Affiliate management fee revenues | | | 488 | | | | 667 | | | | 690 | | | | 712 | | | | 733 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 696,029 | | | | 1,138,200 | | | | 1,224,580 | | | | 1,319,057 | | | | 1,213,638 | |

Operating expenses | | | 180,422 | | | | 229,720 | | | | 243,860 | | | | 250,935 | | | | 264,871 | |

Product purchases | | | 255,599 | | | | 582,631 | | | | 605,341 | | | | 633,909 | | | | 436,567 | |

Gain on assignment of supply agreement | | | — | | | | — | | | | — | | | | — | | | | (26,492 | ) |

Equity earnings | | | (1,602 | ) | | | (3,104 | ) | | | (3,324 | ) | | | (4,027 | ) | | | (4,067 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating margin | | | 261,610 | | | | 328,953 | | | | 378,703 | | | | 438,240 | | | | 542,759 | |

Depreciation and amortization expense | | | 57,196 | | | | 71,655 | | | | 76,200 | | | | 79,140 | | | | 86,501 | |

Affiliate G&A expense | | | 54,240 | | | | 61,506 | | | | 69,503 | | | | 74,859 | | | | 73,302 | |

| | | | | | | | | | | | | | | | | | | | |

Operating profit | | | 150,174 | | | | 195,792 | | | | 233,000 | | | | 284,241 | | | | 382,956 | |

Interest expense, net | | | 36,734 | | | | 52,273 | | | | 47,624 | | | | 47,653 | | | | 50,479 | |

Debt prepayment premium | | | 12,666 | | | | — | | | | — | | | | 1,984 | | | | — | |

| | | | | |

Write-off of unamortized debt placement fees | | | 9,820 | | | | 6,413 | | | | — | | | | — | | | | — | |

Debt placement fee amortization | | | 2,568 | | | | 2,247 | | | | 1,925 | | | | 1,554 | | | | 767 | |

Other (income) expense, net | | | (949 | ) | | | (1,312 | ) | | | 653 | | | | 728 | | | | (380 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income before provision for income taxes | | | 89,335 | | | | 136,171 | | | | 182,798 | | | | 232,322 | | | | 332,090 | |

Provision for income taxes (a) | | | — | | | | — | | | | — | | | | 1,568 | | | | 1,987 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 89,335 | | | $ | 136,171 | | | $ | 182,798 | | | $ | 230,754 | | | $ | 330,103 | |

| | | | | | | | | | | | | | | | | | | | |

Basic and diluted net income per limited partner unit | | $ | n/a | | | $ | n/a | | | $ | 0.83 | | | $ | 1.55 | | | $ | 2.21 | |

| | | | | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Working capital (deficit) (b) | | $ | 73,140 | | | $ | 13,783 | | | $ | (310,087 | ) | | $ | (15,609 | ) | | $ | (29,644 | ) |

Total assets | | | 2,282,704 | | | | 2,264,995 | | | | 2,316,508 | | | | 2,416,931 | | | | 2,600,708 | |

Long-term debt (b) | | | 1,062,470 | | | | 787,194 | | | | 518,609 | | | | 914,536 | | | | 1,083,485 | |

Partners’ capital (deficit) | | | (41,703 | ) | | | (213,684 | ) | | | 60,818 | | | | 57,330 | | | | 67,723 | |

| | | | | |

Cash Distribution Data: | | | | | | | | | | | | | | | | | | | | |

Cash distributions declared per unit (c) | | $ | — | | | $ | — | | | $ | 1.44 | | | $ | 1.79 | | | $ | 2.17 | |

Cash distributions paid per unit (c) | | $ | — | | | $ | — | | | $ | 1.05 | | | $ | 1.70 | | | $ | 2.09 | |

| | | | | |

Other Data: | | | | | | | | | | | | | | | | | | | | |

Operating margin (loss): | | | | | | | | | | | | | | | | | | | | |

Petroleum products pipeline system | | $ | 195,092 | | | $ | 250,623 | | | $ | 285,743 | | | $ | 352,715 | | | $ | 426,495 | |

Petroleum products terminals | | | 56,179 | | | | 67,237 | | | | 86,823 | | | | 85,488 | | | | 104,121 | �� |

Ammonia pipeline system | | | 7,310 | | | | 7,687 | | | | 2,554 | | | | (2,995 | ) | | | 8,660 | |

Allocated partnership depreciation costs (d) | | | 3,029 | | | | 3,406 | | | | 3,583 | | | | 3,032 | | | | 3,483 | |

| | | | | | | | | | | | | | | | | | | | |

Operating margin | | $ | 261,610 | | | $ | 328,953 | | | $ | 378,703 | | | $ | 438,240 | | | $ | 542,759 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA: | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 89,335 | | | $ | 136,171 | | | $ | 182,798 | | | $ | 230,754 | | | $ | 330,103 | |

Provision for income taxes (a) | | | — | | | | — | | | | — | | | | 1,568 | | | | 1,987 | |

Debt prepayment premium | | | 12,666 | | | | — | | | | — | | | | 1,984 | | | | — | |

Write-off of unamortized debt placement fees | | | 9,820 | | | | 6,413 | | | | — | | | | — | | | | — | |

Debt placement fee amortization | | | 2,568 | | | | 2,247 | | | | 1,925 | | | | 1,554 | | | | 767 | |

Interest expense, net | | | 36,734 | | | | 52,273 | | | | 47,624 | | | | 47,653 | | | | 50,479 | |

Depreciation and amortization expense | | | 57,196 | | | | 71,655 | | | | 76,200 | | | | 79,140 | | | | 86,501 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 208,319 | | | $ | 268,759 | | | $ | 308,547 | | | $ | 362,653 | | | $ | 469,837 | |

| | | | | | | | | | | | | | | | | | | | |

Operating Statistics: | | | | | | | | | | | | | | | | | | | | |

Petroleum products pipeline system: | | | | | | | | | | | | | | | | | | | | |

Transportation revenue per barrel shipped | | $ | 0.996 | | | $ | 1.025 | | | $ | 1.060 | | | $ | 1.147 | | | $ | 1.193 | |

Volume shipped (million barrels) | | | 256.0 | | | | 298.6 | | | | 309.6 | | | | 307.2 | | | | 295.9 | |

Petroleum products terminals: | | | | | | | | | | | | | | | | | | | | |

Marine terminal average storage utilized (million barrels per month) (e) | | | 18.4 | | | | 20.4 | | | | 20.9 | | | | 21.8 | | | | 23.3 | |

Inland terminal throughput (million barrels) put (million barrels) | | | 93.6 | | | | 101.3 | | | | 110.1 | | | | 117.3 | | | | 108.1 | |

Ammonia pipeline system: | | | | | | | | | | | | | | | | | | | | |

Volume shipped (thousand tons) | | | 765 | | | | 713 | | | | 726 | | | | 716 | | | | 822 | |

| (a) | Beginning in 2007, the state of Texas implemented a partnership-level tax based on a percentage of Magellan Partners’ net revenues apportioned to the state of Texas. Magellan Partners’ estimate of this tax has been reported as provision for income taxes on its consolidated statements of income. |

| (b) | The maturity date of Magellan Partners’ pipeline notes was October 7, 2007. As a result, the $270.8 million carrying value of these notes was classified as a current liability on its December 31, 2006 consolidated balance sheet. This debt was refinanced before its maturity. |

| (c) | Cash distributions declared represent distributions declared associated with each calendar year as restated for the reverse unit split in September 2009 (see Note 2—Simplification Agreement in notes to consolidated financial statements in this filing). Distributions were declared and paid within 45 days following the close of each quarter. Cash distributions paid represent cash payments for distributions during each of the periods presented. |

| (d) | Certain assets were contributed to Magellan Partners and were recorded as property, plant and equipment at the partnership level. The associated depreciation expense was allocated to Magellan Partners’ various business segments, which in turn recognized these allocated costs as operating expense, reducing segment operating margins by these amounts. |

| (e) | For the year ended December 31, 2004, represents the average monthly storage capacity utilized for the three months Magellan Partners owned the East Houston, Texas facility (1.9 million barrels) and the weighted-average storage capacity utilized for the full year at Magellan Partners’ other marine terminals (16.5 million barrels). For the year ended December 31, 2005, represents the average storage capacity utilized for the four months Magellan Partners owned its Wilmington, Delaware terminal (1.8 million barrels) and the average monthly storage capacity utilized for the full year at Magellan Partners’ other marine terminals (18.6 million barrels). |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations

Management believes that investors benefit from having access to the same financial measures they use to evaluate operating results. Operating margin, which is presented in the tables below, is an important measure used by Magellan Midstream Partners, L.P. (“MMP”’s) management to evaluate the economic performance of its core operations. This measure forms the basis of MMP’s internal financial reporting and is used by its management in deciding how to allocate capital resources between segments. Operating margin is not a generally accepted accounting principles (“GAAP”) measure, but the components of operating margin are computed by using amounts that are determined in accordance with GAAP. A reconciliation of operating margin to operating profit, which is its nearest comparable GAAP financial measure, is included in the tables below. Operating profit includes expense items, such as depreciation and amortization and general and administrative (“G&A”) costs, which management does not consider when evaluating the core profitability of an operation. Additionally, product margin, which MMP management primarily uses to evaluate the profitability of its petroleum products blending and fractionation activities, is provided in the tables below. Product margin is a non-GAAP measure; however, its components, product sales and product purchases, are determined in accordance with GAAP.

1

Year Ended December 31, 2007 Compared to Year Ended December 31, 2008

| | | | | | | | | | | | | | | |

| | | Year Ended

December 31, | | | Variance

Favorable (Unfavorable) | |

| | | 2007 | | | 2008 | | | $ Change | | | % Change | |

Financial Highlights ($ in millions, except operating statistics) | | | | | | | | | | | | | | | |

| | | | |

Transportation and terminals revenues: | | | | | | | | | | | | | | | |

Petroleum products pipeline system | | $ | 460.7 | | | $ | 478.5 | | | $ | 17.8 | | | 4 | |

Petroleum products terminals | | | 132.7 | | | | 141.1 | | | | 8.4 | | | 6 | |

Ammonia pipeline system | | | 18.3 | | | | 22.7 | | | | 4.4 | | | 24 | |

Intersegment eliminations | | | (2.9 | ) | | | (3.5 | ) | | | (0.6 | ) | | (21 | ) |

| | | | | | | | | | | | | | | |

Total transportation and terminals revenues | | | 608.8 | | | | 638.8 | | | | 30.0 | | | 5 | |

Affiliate management fee revenues | | | 0.7 | | | | 0.7 | | | | — | | | — | |

Operating expenses: | | | | | | | | | | | | | | | |

Petroleum products pipeline system | | | 178.9 | | | | 197.7 | | | | (18.8 | ) | | (11 | ) |

Petroleum products terminals | | | 56.2 | | | | 59.1 | | | | (2.9 | ) | | (5 | ) |

Ammonia pipeline system | | | 21.3 | | | | 14.1 | | | | 7.2 | | | 34 | |

Intersegment eliminations | | | (5.4 | ) | | | (6.1 | ) | | | 0.7 | | | 13 | |

| | | | | | | | | | | | | | | |

Total operating expenses | | | 251.0 | | | | 264.8 | | | | (13.8 | ) | | (5 | ) |

| | | | |

Product margin: | | | | | | | | | | | | | | | |

Product sales | | | 709.6 | | | | 574.1 | | | | (135.5 | ) | | (19 | ) |

Product purchases | | | 633.9 | | | | 436.6 | | | | 197.3 | | | 31 | |

| | | | | | | | | | | | | | | |

Product margin | | | 75.7 | | | | 137.5 | | | | 61.8 | | | 82 | |

Gain on assignment of supply agreement | | | — | | | | 26.5 | | | | 26.5 | | | N/A | |

Equity earnings | | | 4.0 | | | | 4.1 | | | | 0.1 | | | 3 | |

| | | | | | | | | | | | | | | |

Operating margin | | | 438.2 | | | | 542.8 | | | | 104.6 | | | 24 | |

Depreciation and amortization expense | | | 79.1 | | | | 86.5 | | | | (7.4 | ) | | (9 | ) |

G&A expense | | | 74.9 | | | | 73.3 | | | | 1.6 | | | 2 | |

| | | | | | | | | | | | | | | |

Operating profit | | | 284.2 | | | | 383.0 | | | | 98.8 | | | 35 | |

Interest expense (net of interest income and interest capitalized) | | | 47.7 | | | | 50.5 | | | | (2.8 | ) | | (6 | ) |

Debt placement fee amortization | | | 1.5 | | | | 0.8 | | | | 0.7 | | | 47 | |

Debt prepayment premium | | | 2.0 | | | | — | | | | 2.0 | | | 100 | |

Other (income) expense | | | 0.6 | | | | (0.4 | ) | | | 1.0 | | | 167 | |

| | | | | | | | | | | | | | | |

Income before provision for income taxes | | | 232.4 | | | | 332.1 | | | | 99.7 | | | 43 | |

Provision for income taxes | | | 1.6 | | | | 2.0 | | | | (0.4 | ) | | (25 | ) |

| | | | | | | | | | | | | | | |

Net income | | $ | 230.8 | | | $ | 330.1 | | | $ | 99.3 | | | 43 | |

| | | | | | | | | | | | | | | |

Operating Statistics | | | | | | | | | | | | | | | |

Petroleum products pipeline system: | | | | | | | | | | | | | | | |

Transportation revenue per barrel shipped | | $ | 1.147 | | | $ | 1.193 | | | | | | | | |

Volume shipped (million barrels) | | | 307.2 | | | | 295.9 | | | | | | | | |

Petroleum products terminals: | | | | | | | | | | | | | | | |

Marine terminal average storage utilized (million barrels per month) | | | 21.8 | | | | 23.3 | | | | | | | | |

Inland terminal throughput (million barrels) | | | 117.3 | | | | 108.1 | | | | | | | | |

Ammonia pipeline system: | | | | | | | | | | | | | | | |

Volume shipped (thousand tons) | | | 716 | | | | 822 | | | | | | | | |

2

Transportation and terminals revenues increased by $30.0 million resulting from higher revenues for each of MMP’s business segments as shown below:

| | • | | an increase in petroleum products pipeline system revenues of $17.8 million. Transportation revenues increased as a result of higher average tariffs due in part to MMP’s mid-year 2007 and 2008 tariff escalations, partially offset by shipment disruptions in third and fourth quarter 2008 attributable to Hurricane Ike and weak demand for petroleum products as a result of high product prices during most of 2008. MMP also earned more ancillary revenues related to leased storage, ethanol blending services, capacity leases and facility rentals; |

| | • | | an increase in petroleum products terminals revenues of $8.4 million. Revenues increased at MMP’s marine terminals primarily due to operating results from additional storage tanks at its Galena Park, Texas facility that were placed into service throughout 2007 and 2008. The revenue increase was negatively impacted by lost business due to Hurricane Ike, including lower revenue recognized from MMP’s variable-rate storage agreement. MMP’s inland terminal revenues were essentially flat between periods as higher fees due to ethanol and additive blending offset lower volumes; and |

| | • | | an increase in ammonia pipeline system revenues of $4.4 million primarily due to additional shipments resulting from favorable weather and market conditions and higher average tariff rates charged. |

Operating expenses increased by $13.8 million as higher expenses at MMP’s petroleum products pipeline system and petroleum products terminals segments were partially offset by lower costs related to MMP’s ammonia pipeline system, as described below:

| | • | | an increase in petroleum products pipeline system expenses of $18.8 million primarily due to less favorable product overages (which reduce operating expenses) in the current period, higher system integrity spending and increased environmental accruals for several historical releases. The higher system integrity spending was due to accelerating work into the current year that was originally planned to occur in 2009. Partially offsetting these items was a $12.1 million reduction to MMP’s operating expenses in second quarter 2008 due to the favorable settlement of a civil penalty related to historical product releases; |

| | • | | an increase in petroleum products terminals expenses of $2.9 million primarily related to higher personnel costs and maintenance spending, including clean-up costs related to Hurricane Ike. These increases were partially offset by gains recognized from insurance proceeds received in 2008 associated with hurricane damages sustained during 2005; and |

| | • | | a decrease in ammonia pipeline system expenses of $7.2 million primarily due to lower environmental expenses and system integrity costs. Environmental expenses were higher in 2007 due primarily to increased accruals related to a 2004 pipeline release. MMP expects system integrity costs to be significantly higher in 2009 due to additional integrity work identified. |

Product sales revenues primarily resulted from MMP’s petroleum products blending activities, terminal product gains and transmix fractionation. Product sales and product purchases were significantly lower during the 2008 year due to MMP’s assignment of a supply agreement during first quarter 2008. Product margin increased $61.8 million primarily due to higher product prices, the sale of additional product overages by MMP’s petroleum products terminals and the sale of unprocessed transmix by MMP’s petroleum products pipeline segment during 2008. Additionally, a $20.2 million unrealized gain was recorded in 2008 related to changes in the fair value of MMP’s NYMEX commodity futures contracts, partially offset by lower-of-average-cost-or-market adjustments of $6.4 million and $3.0 million to its refined petroleum products inventory and transmix inventory, respectively. The gross margin MMP realizes on these activities can be substantially higher in periods when refined petroleum prices increase and substantially lower in periods when product prices decline or stabilize given that MMP follows an average inventory valuation methodology which results in each period’s product purchases being influenced by the value of products held in that period’s beginning inventory. Given the current pricing environment for petroleum products, MMP expects its product margin for 2009 to be substantially lower than 2008.

3

The 2008 period benefited from a $26.5 million gain on the assignment of MMP’s third-party supply agreement during March 2008. The gain resulted from the write-off of the unamortized amount of a liability MMP recognized related to the fair value of the agreement, which it assumed as part of its acquisition of certain pipeline assets in October 2004.

Operating margin increased $104.6 million primarily due to higher gross margin from product sales in 2008 and higher revenues from each of MMP’s business segments.

Depreciation and amortization expense increased by $7.4 million primarily due to capital expansion projects placed into service over the past year.

G&A expense decreased by $1.6 million between periods primarily due to lower equity-based incentive compensation expense, lower bonus accruals and lower allocated compensation expense related to payments made by MGG Midstream Holdings, L.P. (“MGG MH”), a former affiliate, to one of MMP’s executive officers. The reduced equity-based incentive compensation expenses resulted from a lower weighted-average fair value for units awarded to plan participants and lower payout estimates for unvested incentive awards during 2008. Partially offsetting these decreases were increases in personnel, legal and expansion project due diligence costs during 2008. Magellan Midstream Holdings, L.P. (“MGG”) historically reimbursed MMP for its actual G&A costs that exceeded certain amounts as described in the omnibus agreement. The amount of G&A costs reimbursed to MMP for the years ended December 31, 2007 and 2008 was $4.1 million and $1.6 million, respectively. MGG will not reimburse MMP for G&A costs in future periods.

Interest expense, net of interest income and interest capitalized, increased $2.8 million in 2008. During 2007, interest expense was lower due to amortization of a step-up adjustment associated with MMP’s pipeline notes, which MMP repaid in second-quarter 2007. Additionally, interest income was lower because interest income related to the indemnification agreement (which was paid in full in June 2007) was not recognized in 2008. MMP’s average debt outstanding, excluding fair value adjustments for interest rate hedges, increased to $995.1 million for the 2008 period from $887.5 million for the 2007 period principally due to borrowings for expansion capital expenditures; however, the weighted-average interest rate on MMP’s borrowings, after giving effect to the impact of associated fair value hedges, decreased to 5.7% in 2008 from 6.7% in 2007.

MMP incurred debt refinancing expenses of $2.7 million during the 2007 period with no similar expense in 2008. The expenses for 2007 were associated with the early retirement of MMP’s pipeline notes during second quarter 2007, originally due in October 2007, and included a debt prepayment premium of $2.0 million as well as related interest rate hedge settlements of $0.7 million, which were recorded as other expense. Debt placement fee amortization also decreased $0.7 million in 2008 due to debt placement fees being amortized over a significantly longer period of time as a result of new notes being issued to repay MMP’s pipeline notes.

Provision for income taxes increased $0.4 million in 2008 due primarily to a change in MMP’s partnership-level tax rate from 0.5% in 2007 to 1.0% in 2008. This rate increase resulted from MMP’s losing its petroleum product wholesaler status with the state of Texas following its assignment of a supply agreement in March 2008.

4

Year Ended December 31, 2006 Compared to Year Ended December 31, 2007

| | | | | | | | | | | | | | | |

| | | Year Ended

December 31, | | | Variance

Favorable (Unfavorable) | |

| | | 2006 | | | 2007 | | | $ Change | | | % Change | |

Financial Highlights ($ in millions, except operating statistics) | | | | | | | | | | | | | | | |

| | | | |

Transportation and terminals revenues: | | | | | | | | | | | | | | | |

Petroleum products pipeline system | | $ | 420.3 | | | $ | 460.7 | | | $ | 40.4 | | | 10 | |

Petroleum products terminals | | | 125.9 | | | | 132.7 | | | | 6.8 | | | 5 | |

Ammonia pipeline system | | | 16.5 | | | | 18.3 | | | | 1.8 | | | 11 | |

Intersegment eliminations | | | (3.4 | ) | | | (2.9 | ) | | | 0.5 | | | 15 | |

| | | | | | | | | | | | | | | |

Total transportation and terminals revenues | | | 559.3 | | | | 608.8 | | | | 49.5 | | | 9 | |

Affiliate management fee revenues | | | 0.7 | | | | 0.7 | | | | — | | | — | |

Operating expenses: | | | | | | | | | | | | | | | |

Petroleum products pipeline system | | | 189.2 | | | | 178.9 | | | | 10.3 | | | 5 | |

Petroleum products terminals | | | 47.2 | | | | 56.2 | | | | (9.0 | ) | | (19 | ) |

Ammonia pipeline system | | | 13.9 | | | | 21.3 | | | | (7.4 | ) | | (53 | ) |

Intersegment eliminations | | | (6.4 | ) | | | (5.4 | ) | | | (1.0 | ) | | (16 | ) |

| | | | | | | | | | | | | | | |

Total operating expenses | | | 243.9 | | | | 251.0 | | | | (7.1 | ) | | (3 | ) |

| | | | |

Product margin: | | | | | | | | | | | | | | | |

Product sales | | | 664.6 | | | | 709.6 | | | | 45.0 | | | 7 | |

Product purchases | | | 605.3 | | | | 633.9 | | | | (28.6 | ) | | (5 | ) |

| | | | | | | | | | | | | | | |

Product margin | | | 59.3 | | | | 75.7 | | | | 16.4 | | | 28 | |

Equity earnings | | | 3.3 | | | | 4.0 | | | | 0.7 | | | 21 | |

| | | | | | | | | | | | | | | |

Operating margin | | | 378.7 | | | | 438.2 | | | | 59.5 | | | 16 | |

Depreciation and amortization expense | | | 76.2 | | | | 79.1 | | | | (2.9 | ) | | (4 | ) |

Affiliate G&A expense | | | 69.5 | | | | 74.9 | | | | (5.4 | ) | | (8 | ) |

| | | | | | | | | | | | | | | |

Operating profit | | | 233.0 | | | | 284.2 | | | | 51.2 | | | 22 | |

| | | | |

Interest expense (net of interest income and interest capitalized) | | | 47.6 | | | | 47.7 | | | | (0.1 | ) | | — | |

Debt placement fee amortization | | | 1.9 | | | | 1.5 | | | | 0.4 | | | 21 | |

Debt prepayment premium | | | — | | | | 2.0 | | | | (2.0 | ) | | N/A | |

Other expense | | | 0.7 | | | | 0.6 | | | | 0.1 | | | 14 | |

| | | | | | | | | | | | | | | |

Income before provision for income taxes | | | 182.8 | | | | 232.4 | | | | 49.6 | | | 27 | |

Provision for income taxes | | | — | | | | 1.6 | | | | (1.6 | ) | | N/A | |

| | | | | | | | | | | | | | | |

Net income | | $ | 182.8 | | | $ | 230.8 | | | $ | 48.0 | | | 26 | |

| | | | | | | | | | | | | | | |

Operating Statistics | | | | | | | | | | | | | | | |

Petroleum products pipeline system: | | | | | | | | | | | | | | | |

Transportation revenue per barrel shipped | | $ | 1.060 | | | $ | 1.147 | | | | | | | | |

Volume shipped (million barrels) | | | 309.6 | | | | 307.2 | | | | | | | | |

Petroleum products terminals: | | | | | | | | | | | | | | | |

Marine terminal average storage utilized (million barrels per month) | | | 20.9 | | | | 21.8 | | | | | | | | |

Inland terminal throughput (million barrels) | | | 110.1 | | | | 117.3 | | | | | | | | |

Ammonia pipeline system: | | | | | | | | | | | | | | | |

Volume shipped (thousand tons) | | | 726 | | | | 716 | | | | | | | | |

5

Transportation and terminals revenues increased by $49.5 million resulting from higher revenues for each of MMP’s business segments as shown below:

| | • | | an increase in petroleum products pipeline system revenues of $40.4 million. Transportation revenues increased as a result of higher average tariffs due in part to MMP’s mid-year 2006 and 2007 tariff escalations, partially offset by slightly lower transportation volumes due to various factors which resulted in several refineries connected to MMP’s system curtailing production during 2007. MMP also earned more ancillary revenues related to higher fees for leased storage as well as additional demand for its terminal, additive and renewable fuels services during 2007; |

| | • | | an increase in petroleum products terminals revenues of $6.8 million due to higher revenues at both MMP’s marine and inland terminals. Marine revenues increased primarily due to operating results from expansion projects, such as construction of additional storage tanks at MMP’s Galena Park, Texas facility that were placed into service beginning in late 2006 and throughout 2007, and more revenue from additive services and higher storage rates. The revenue increase at MMP’s marine terminals was partially offset by lower revenue recognized from variable-rate storage agreements in 2007. Revenues from these agreements are based on MMP’s share of its customer’s net trading profits earned during the agreement term and are recognized at the end of that term. MMP’s 2006 results benefitted from shared profits from two variable-rate storage agreements whereas the 2007 period benefitted from only one contract. Inland terminal revenues also increased in 2007 from record throughput volumes as well as higher additive fees; and |

| | • | | an increase in ammonia pipeline system revenues of $1.8 million primarily due to higher average tariffs. |

Operating expenses increased by $7.1 million as higher expenses at MMP’s petroleum products terminals and ammonia pipeline system were partially offset by lower costs related to its petroleum products pipeline system as described below:

| | • | | a decrease in petroleum products pipeline system expenses of $10.3 million primarily due to more favorable product overages (which reduce operating expenses), lower integrity spending because of maintenance project timing and lower environmental expenses. During the 2006 period, MMP recognized additional expense when it entered into a risk transfer agreement, whereby risks associated with certain known environmental sites were transferred to a contractor in order to mitigate MMP’s future financial exposure relative to those sites. Higher property taxes, asset retirements, power and personnel costs in 2007 partially offset these favorable expense items; |

| | • | | an increase in petroleum products terminals expenses of $9.0 million primarily related to higher personnel costs, in part due to expansion projects, timing of maintenance projects and product downgrade charges resulting from the accidental degradation of small amounts of product during 2007; and |

| | • | | an increase in ammonia pipeline system expenses of $7.4 million primarily due to increased environmental accruals related to a 2004 pipeline release and higher system integrity costs. |

Product margin increased $16.4 million. Product sales revenues primarily resulted from a third-party product supply agreement, MMP’s petroleum products blending activities, petroleum products terminal product gains and transmix fractionation. The increase in 2007 margins was primarily attributable to higher product prices.

Operating margin increased $59.5 million, primarily due to higher revenues from each of MMP’s business segments and higher gross margin from product sales in 2007.

Depreciation and amortization expense increased by $2.9 million related to capital expansion projects over the 2007 year.

6

G&A expense increased by $5.4 million between periods primarily due to higher personnel costs during 2007. For the years ended December 31, 2006 and 2007, MMP was responsible for paying G&A costs of $53.2 million and $57.4 million, respectively. MGG reimbursed MMP for their actual cash G&A costs that exceed these amounts. The amount of G&A cost MGG reimbursed to MMP for the years ended December 31, 2006 and 2007 was $1.7 million and $4.1 million, respectively.

Interest expense, net of interest capitalized and interest income, was $47.7 million for the year ended December 31, 2007 compared to $47.6 million for the year ended December 31, 2006. Average consolidated debt outstanding, excluding fair value adjustments for interest rate hedges, increased to $887.5 million during 2007 from $807.4 million during 2006. However, the weighted-average interest rate on consolidated borrowings, after giving effect to the impact of associated fair value hedges, decreased to 6.1% for the 2007 period from 6.7% for the 2006 period primarily due to the refinancing of MMP’s pipeline notes during second quarter 2007 at a lower interest rate. The amount of interest capitalized increased due to the higher level of capital spending over the last year; however, this increase was largely offset by lower interest income recognized related to the indemnification settlement, which was fully paid in June 2007.

MMP recognized debt refinancing expenses of $2.7 million during the 2007 period with no similar expense in 2006. These expenses were associated with the early retirement of MMP’s pipeline notes during second quarter 2007, originally due in October 2007, and included a debt prepayment premium of $2.0 million as well as related interest rate hedge settlements of $0.7 million, which were recorded as other expense.

Provision for income taxes was $1.6 million during 2007 compared to $0 in 2006. Beginning in 2007, the state of Texas implemented a partnership-level tax based on the financial results of MMP’s net revenues apportioned to the state of Texas.

Liquidity and Capital Resources

Cash Flows and Capital Expenditures

Net cash provided by operating activities was $316.6 million, $293.3 million and $436.0 million for the years ended December 31, 2006, 2007 and 2008, respectively.

| | • | | The $142.7 million increase from 2007 to 2008 was primarily attributable to: |

| | • | | a $60.8 million increase in net income, excluding the $26.5 million non-cash gain on assignment of supply agreement and a $12.1 million non-cash reduction in operating expenses resulting from the favorable settlement of a civil penalty related to historical product releases; |

| | • | | a $101.6 million increase in cash resulting from a $72.7 million decrease in inventory in 2008 versus a $28.9 million increase in inventory in 2007. The decrease in inventory during 2008 is principally due to the sale of petroleum products inventory when MMP assigned its product supply agreement to a third party in March 2008 as well as a significant decrease in product prices during the latter part of 2008; and |

| | • | | a $11.2 million increase in cash resulting from a $0.3 million decrease in accounts payable in 2008 versus a $11.5 million decrease in accounts payable in 2007 due primarily to the timing of invoices received from vendors and suppliers. |

7

These increases were partially offset by an $18.5 million decrease in the supply agreement deposit in 2008. As a result of the assignment of MMP’s product supply agreement to a third party in March 2008, MMP refunded this deposit.

| | • | | The $23.3 million decrease from 2006 to 2007 was primarily attributable to: |

| | • | | a $15.5 million decrease in cash resulting from a $28.9 million increase in inventory in 2007 versus a $13.4 million increase in inventory in 2006. The increase in inventory during 2007 was primarily due to higher product prices; |

| | • | | a $27.3 million decrease in cash resulting from a $11.5 million decrease in accounts payable in 2007 versus a $15.8 million increase in accounts payable in 2006 due primarily to the timing of invoices received from vendors and suppliers; and |

| | • | | a $48.2 million decrease in cash resulting from a $19.9 million decrease in accrued product purchases in 2007 versus a $28.3 million increase in accrued product purchases in 2006 due primarily to the timing of invoices received from vendors and suppliers. |

These decreases were partially offset by:

| | • | | increased net income of $48.0 million in 2007; and |

| | • | | a $15.0 million increase in cash relative to an indemnification settlement with a former affiliate of MMP. During 2007, MMP received $35.0 million as part of this settlement compared to $20.0 million received during 2006. |

Net cash used by investing activities for the years ended December 31, 2006, 2007 and 2008 was $148.3 million, $193.7 million and $305.9 million, respectively. During 2008, MMP spent $272.1 million for capital expenditures, which included $46.9 million for maintenance capital and $225.2 million for expansion capital. Significant expansion capital expenditures during 2008 included new storage tanks at MMP’s Wilmington, Delaware and Galena Park, Texas terminals. Additionally, MMP acquired petroleum products terminals in Bettendorf, Iowa and Wrenshall, Minnesota and a petroleum products terminal in Mount Pleasant, Texas along with a 76-mile petroleum products pipeline for $38.3 million plus related liabilities assumed of $2.6 million. Significant expansion capital expenditures during 2006 and 2007 included new storage tanks, including new tanks at MMP’s Galena Park, Texas terminal, ethanol blending equipment, equipment to comply with ultra low sulfur diesel fuel mandates and additions to delivery racks. During 2007, MMP spent $190.2 million for capital expenditures, of which $39.7 million was for maintenance capital and $150.5 million was for expansion capital. During 2006, MMP spent $168.5 million for capital expenditures, which included $32.9 million for maintenance capital and $135.6 million for expansion capital.

Net cash used by financing activities for the years ended December 31, 2006, 2007 and 2008 was $197.9 million, $105.6 million and $93.2 million, respectively. During 2008, MGG paid distributions of $82.8 million to its unitholders and general partner and MMP paid distributions of $181.5 million to its owners other than MGG. During 2008, borrowings under notes of $250.0 million were used to repay $212.0 million of borrowings on MMP’s revolving credit facility, with the balance used for general purposes. Net borrowings on the revolver during 2008, excluding the repayment, were $118.5 million, which were used for general purposes, including expansion capital expenditures. Cash used during 2007 reflects $67.3 million of distributions by MGG to its unitholders and $165.9 million of distributions by MMP to its owners other than MGG, partially offset by net borrowings on MMP’s revolving credit facility of $143.0 million and $248.9 million from a debt financing. A portion of these borrowings were used to repay the $272.6 million remaining balance of MMP’s pipeline notes. Cash used during 2006 primarily reflects $563.7 million of distributions by MGG to its owners and unitholders and $151.6 million of distributions by MMP to its owners other than MGG, partially offset by $506.8 million of net proceeds from MGG’s initial public offering.

8

Capital Requirements

MMP’s businesses require continual investment to upgrade or enhance existing operations and to ensure compliance with safety and environmental regulations. Capital spending for MMP’s businesses consists primarily of:

| | • | | maintenance capital expenditures, such as those required to maintain equipment reliability and safety and to address environmental regulations; and |

| | • | | expansion capital expenditures to acquire additional complementary assets to grow MMP’s business and to expand or upgrade its existing facilities, which is referred to as organic growth projects in this report. Organic growth projects include capital expenditures that increase storage or throughput volumes or develop pipeline connections to new supply sources. |

During 2008, MMP’s maintenance capital spending was $46.9 million, including $3.6 million of spending that would have been covered by the May 2004 indemnification settlement or for which MMP expects reimbursement. MMP has received the entire $117.5 million under its indemnification settlement agreement. Please see “Environmental” below for additional description of this agreement.

For 2009, MMP expects to incur maintenance capital expenditures for its existing businesses of approximately $42.0 million, including $7.0 million of maintenance capital that has already been reimbursed to MMP through its indemnification settlement or will be reimbursed by third parties.

In addition to maintenance capital expenditures, MMP also incurs expansion capital expenditures at its existing facilities. During 2008, MMP spent $225.2 million for organic growth projects and $40.9 million (including $2.6 million assumed liabilities) to acquire two petroleum products terminals already connected to its petroleum products pipeline system and a petroleum products terminal along with a 76-mile petroleum products pipeline. Based on the progress of expansion projects already underway, MMP expects to spend approximately $215.0 million of growth capital including acquisitions during 2009, with an additional $30.0 million in 2010 to complete these projects.

Liquidity

Cash generated from operations is MMP’s primary source of liquidity for funding debt service, maintenance capital expenditures and quarterly distributions. Additional liquidity for purposes other than quarterly distributions, such as capital expenditures, is available through borrowings under MMP’s revolving credit facility discussed below, as well as from other borrowings or issuances of debt or limited partner units. If any of the banks committed to fund MMP’s revolving credit facility were unable to perform on their commitments, MMP’s liquidity could be impaired, which could reduce its ability to fund growth capital expenditures and acquisitions. Current market conditions have resulted in higher credit spreads on long-term borrowings and significantly reduced demand for new corporate debt issues. Equity prices, including MMP’s unit price, have experienced abnormally high volatility during the current period. If these conditions persist, MMP’s cost of capital could increase and its ability to finance growth capital expenditures or acquisitions in a cost-effective manner could be reduced.

As of December 31, 2008, total debt reported on MMP’s consolidated balance sheet was $1,083.5 million. The difference between this amount and the $1,070.0 million face value of MMP’s outstanding debt results from adjustments related to unamortized discounts on debt issuances and the unamortized portion of gains recognized on derivative financial instruments which had qualified as fair value hedges of MMP’s long-term debt until the hedges were terminated or hedge accounting treatment was discontinued.

MMP Debt

MMP relies on its revolving credit facility as an interim source of financing for capital expansion projects. If any of the banks committed to fund its facility were unable to perform on their commitments, MMP’s liquidity could be impaired, which could reduce its ability to fund growth capital expenditures and acquisitions. Current market conditions have resulted in higher credit spreads on long-term borrowings and significantly reduced demand for new

9

corporate debt issues. Equity prices have experienced abnormally high volatility during the current period. If these conditions persist, MMP’s cost of capital could increase and its ability to finance growth capital expenditures or acquisitions in a cost-effective manner could be reduced.

At December 31, 2008, maturities of MMP’s debt were as follows: $0 each year in 2009, 2010 and 2011; $70.0 million in 2012; $0 in 2013; and $1.0 billion thereafter. MMP’s debt is non-recourse to its general partner and to MGG.

Revolving credit facility. The total borrowing capacity under MMP’s revolving credit facility, which matures in September 2012, is $550.0 million. Borrowings under the facility are unsecured and incur interest at LIBOR plus a spread that ranges from 0.3% to 0.8% based on MMP’s credit ratings and amounts outstanding under the facility. As of December 31, 2008, $70.0 million was outstanding under this facility and $3.9 million was obligated for letters of credit. The obligations for letters of credit were not reflected as debt on MMP’s consolidated balance sheets. As of December 31, 2008, the weighted-average interest rate on borrowings outstanding under this facility was 4.8%. Additionally, a commitment fee is assessed at a rate from 0.05% to 0.125%, depending on MMP’s credit rating.

6.45% notes due 2014.In May 2004, MMP sold $250.0 million aggregate principal of 6.45% notes due 2014 in an underwritten public offering at 99.8% of par. Including the impact of amortizing the gains realized on the hedges associated with these notes, the effective interest rate of these notes is 6.3%.

5.65% notes due 2016.In October 2004, MMP sold $250.0 million of 5.65% notes due 2016 in an underwritten public offering as part of the long-term financing of pipeline assets MMP acquired in October 2004. The notes were issued at 99.9% of par. MMP used an interest rate swap to effectively convert $100.0 million of these notes to floating-rate debt until May 2008 (seeInterest rate derivatives below). Including the amortization of the $3.8 million gain realized from unwinding that interest rate swap and the amortization of losses realized on pre-issuance hedges associated with these notes, the weighted-average interest rate of these notes at December 31, 2008 was 5.7%. The outstanding principal amount of the notes was increased $2.7 million at December 31, 2007 for the fair value of the associated swap-to-floating derivative instrument and $3.5 million at December 31, 2008 for the unamortized portion of the payment received upon termination of the aforementioned swap.

6.40% notes due 2018. In July 2008, MMP issued $250.0 million of 6.40% notes due 2018 in an underwritten public offering. Net proceeds from the offering, after underwriter discounts of $1.6 million and offering costs of $0.4 million, were $248.0 million. The net proceeds were used to repay the $212.0 million of borrowings outstanding under MMP’s revolving credit facility at that time, and the balance was used for general purposes. In connection with this offering, MMP entered into $100.0 million of interest rate swap agreements to hedge against changes in the fair value of a portion of these notes, effectively converting $100.0 million of these notes to floating-rate debt (seeInterest rate derivatives below). These agreements originally expired on July 15, 2018, the maturity date of the 6.40% notes; however, in December 2008 MMP terminated $50.0 million of these agreements and discontinued hedge accounting on the remaining $50.0 million, resulting in it recognizing gains of $11.7 million. The outstanding principal amount of the notes was increased by $11.7 million at December 31, 2008 for the unamortized portion of those gains. Including the amortization of those gains, the weighted-average interest rate of these notes at December 31, 2008 was 5.9%.

6.40% notes due 2037.In April 2007, MMP issued $250.0 million of 6.40% notes due 2037 in an underwritten public offering at 99.6% of par. MMP received net proceeds of approximately $246.4 after underwriter fees and expenses. The net proceeds from the offering of these notes together with borrowing under MMP’s credit facility were used in May 2007 to prepay the $272.6 million of outstanding pipeline notes, as well as a related debt prepayment premium of $2.0 million and a $1.1 million payment in connection with the unwinding of fair value hedges associated with the pipeline notes. Including the impact of amortizing the gains realized on pre-issuance hedges associated with these notes, the effective interest rate of these notes is 6.3%.

The debt instruments described above include various covenants. In addition to certain financial ratio covenants, these covenants limit MMP’s ability to, among other things, incur indebtedness secured by certain liens, encumber its assets, make certain investments, engage in certain sale-leaseback transactions and consolidate, merge or dispose of all or substantially all of its assets. MMP was in compliance with these covenants as of December 31, 2008.

10

The revolving credit facility and notes described above are senior indebtedness.

Interest rate derivatives.MMP uses interest rate derivatives to help manage interest rate risk. As of December 31, 2008, MMP had two offsetting interest rate swap agreements outstanding:

| | • | | In July 2008, MMP entered into a $50.0 million interest rate swap agreement (“Derivative A”) to hedge against changes in the fair value of a portion of the $250.0 million of 6.40% notes due 2018. Derivative A effectively converted $50.0 million of those notes from a 6.40% fixed rate to a floating rate of six-month LIBOR plus 1.83% and terminates in July 2018. MMP originally accounted for Derivative A as a fair value hedge. In December 2008, in order to capture the economic value of Derivative A at that time, MMP entered into an offsetting derivative as described below, and discontinued hedge accounting on Derivative A. The $5.4 million fair value of Derivative A at that time was recorded as an adjustment to long-term debt which is being amortized over the remaining life of the 6.40% fixed-rate notes due 2018. The fair value of Derivative A as of December 31, 2008 was $7.5 million, of which $0.3 million was recorded to other current assets and $7.2 million was recorded to noncurrent assets. The change in fair value of Derivative A from the date MMP discontinued hedge accounting until December 31, 2008, was a gain of $1.9 million, which was recorded to other (income) expense on MMP’s consolidated statement of income. |

| | • | | In December 2008, concurrent with the discontinuance of hedge accounting treatment of Derivative A, MMP entered into an offsetting $50.0 million interest rate swap agreement with a different financial institution pursuant to which MMP pays a fixed rate of 6.40% and receives a floating rate of six-month LIBOR plus 3.23%. This agreement terminates in July 2018. MMP entered into this agreement to offset changes in the fair value of Derivative A, excluding changes due to changes in counterparty credit risks. This agreement was not designated as a hedge for accounting purposes. The fair value of this agreement at December 31, 2008 was $(1.8) million, which was recorded to other deferred liabilities on MMP’s consolidated balance sheet. |

11

Item 8. Financial Statements and Supplementary Data

Report of Independent Registered Public Accounting Firm

The Board of Directors of Magellan GP, LLC

and the Limited Partners of Magellan Midstream Partners, L.P.

We have audited the accompanying consolidated balance sheets of Magellan Midstream Partners, L.P. (formerly “Magellan Midstream Holdings, L.P.”) as of December 31, 2008 and 2007, and the related consolidated statements of income, owners’ equity, and cash flows for each of the three years in the period ended December 31, 2008. These financial statements are the responsibility of Magellan Midstream Partners, L.P.’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Magellan Midstream Partners, L.P. at December 31, 2008 and 2007, and the consolidated results of its operations and its cash flows for each of the three years in the period ended December 31, 2008, in conformity with U.S. generally accepted accounting principles.

As discussed in Note 11 to the consolidated financial statements, effective December 31, 2006, Magellan Midstream Partners, L.P. adopted Accounting Standards Codification 715,Compensation—Retirement Benefits.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Magellan Midstream Partners, L.P.’s internal control over financial reporting as of December 31, 2008, based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 26, 2009 expressed an unqualified opinion thereon.

/s/ Ernst & Young LLP

Tulsa, Oklahoma

November 2, 2009

12

MAGELLAN MIDSTREAM PARTNERS, L.P.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per unit amounts)

| | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | |

| | | |

Transportation and terminals revenues | | $ | 559,321 | | | $ | 608,781 | | | $ | 638,810 | |

Product sales revenues | | | 664,569 | | | | 709,564 | | | | 574,095 | |

Affiliate management fee revenue | | | 690 | | | | 712 | | | | 733 | |

| | | | | | | | | | | | |

Total revenues | | | 1,224,580 | | | | 1,319,057 | | | | 1,213,638 | |

Costs and expenses: | | | | | | | | | | | | |

Operating | | | 243,860 | | | | 250,935 | | | | 264,871 | |

Product purchases | | | 605,341 | | | | 633,909 | | | | 436,567 | |

Depreciation and amortization | | | 76,200 | | | | 79,140 | | | | 86,501 | |

General and administrative | | | 69,503 | | | | 74,859 | | | | 73,302 | |

| | | | | | | | | | | | |

Total costs and expenses | | | 994,904 | | | | 1,038,843 | | | | 861,241 | |

Gain on assignment of supply agreement | | | — | | | | — | | | | 26,492 | |

Equity earnings | | | 3,324 | | | | 4,027 | | | | 4,067 | |

| | | | | | | | | | | | |

Operating profit | | | 233,000 | | | | 284,241 | | | | 382,956 | |

Interest expense | | | 54,786 | | | | 54,956 | | | | 56,764 | |

Interest income | | | (4,791 | ) | | | (2,851 | ) | | | (1,482 | ) |

Interest capitalized | | | (2,371 | ) | | | (4,452 | ) | | | (4,803 | ) |

Debt placement fee amortization | | | 1,925 | | | | 1,554 | | | | 767 | |

Debt prepayment premium | | | — | | | | 1,984 | | | | — | |

Other (income) expense | | | 653 | | | | 728 | | | | (380 | ) |

| | | | | | | | | | | | |

Income before provision for income taxes | | | 182,798 | | | | 232,322 | | | | 332,090 | |

Provision for income taxes | | | — | | | | 1,568 | | | | 1,987 | |

| | | | | | | | | | | | |

Net income | | $ | 182,798 | | | $ | 230,754 | | | $ | 330,103 | |

| | | | | | | | | | | | |

| | | |

Allocation of net income: | | | | | | | | | | | | |

Portion applicable to ownership interests for the period before completion of Magellan Midstream Holdings, L.P.’s initial public offering on February 15, 2006 | | $ | 5,886 | | | $ | — | | | $ | — | |

Portion applicable to partners’ interest for the period after initial public offering | | | 176,912 | | | | 230,754 | | | | 330,103 | |

| | | | | | | | | | | | |

Net income | | $ | 182,798 | | | $ | 230,754 | | | $ | 330,103 | |

| | | | | | | | | | | | |

| | | |

Allocation of net income (loss) applicable to partners’ interest for the period after initial public offering (see Note 7—Allocation of Net Income): | | | | | | | | | | | | |

Noncontrolling owners’ interests | | $ | 148,292 | | | $ | 175,356 | | | $ | 244,430 | |

Limited partners’ interest | | | 33,069 | | | | 61,580 | | | | 87,733 | |

General partner’s interest | | | (4,449 | ) | | | (6,182 | ) | | | (2,060 | ) |

| | | | | | | | | | | | |

Net income | | $ | 176,912 | | | $ | 230,754 | | | $ | 330,103 | |

| | | | | | | | | | | | |

| | | |

Basic and diluted net income per limited partner unit | | $ | 0.83 | | | $ | 1.55 | | | $ | 2.21 | |

| | | | | | | | | | | | |

| | | |

Weighted average number of limited partner units outstanding used for basic and diluted net income per unit calculation | | | 39,624 | | | | 39,626 | | | | 39,630 | |

| | | | | | | | | | | | |

Revised as described in Note 1. See notes to consolidated financial statements.

13

MAGELLAN MIDSTREAM PARTNERS, L.P.

CONSOLIDATED BALANCE SHEETS

(In thousands)

| | | | | | | | |

| | | December 31, | |

| | | 2007 | | | 2008 | |

| ASSETS | | | | | | | | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 938 | | | $ | 37,912 | |

Accounts receivable (less allowance for doubtful accounts of $10 and $462 at December 31, 2007 and 2008, respectively) | | | 62,834 | | | | 37,517 | |

Other accounts receivable | | | 10,700 | | | | 11,747 | |

Affiliate accounts receivable | | | 60 | | | | 58 | |

Inventory | | | 120,462 | | | | 47,734 | |

Energy commodity derivative contracts | | | — | | | | 20,200 | |

Other current assets | | | 10,919 | | | | 15,473 | |

| | | | | | | | |

Total current assets | | | 205,913 | | | | 170,641 | |

Property, plant and equipment | | | 2,602,235 | | | | 2,890,672 | |

Less: accumulated depreciation | | | 455,020 | | | | 529,356 | |

| | | | | | | | |

Net property, plant and equipment | | | 2,147,215 | | | | 2,361,316 | |

Equity investments | | | 24,324 | | | | 23,190 | |

Long-term receivables | | | 7,801 | | | | 7,390 | |

Goodwill | | | 11,902 | | | | 14,766 | |

Other intangibles (less accumulated amortization of $6,743 and $8,290 at December 31, 2007 and 2008, respectively) | | | 7,086 | | | | 5,539 | |

Debt placement costs (less accumulated amortization of $2,170 and $2,937 at December 31, 2007 and 2008, respectively) | | | 6,368 | | | | 7,649 | |

Other noncurrent assets | | | 6,322 | | | | 10,217 | |

| | | | | | | | |

Total assets | | $ | 2,416,931 | | | $ | 2,600,708 | |

| | | | | | | | |

| | |

| LIABILITIES AND OWNERS’ EQUITY | | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 39,643 | | | $ | 40,051 | |

Accrued payroll and benefits | | | 23,623 | | | | 21,884 | |

Accrued interest payable | | | 7,197 | | | | 15,077 | |

Accrued taxes other than income | | | 21,039 | | | | 20,151 | |

Environmental liabilities | | | 36,127 | | | | 19,634 | |

Deferred revenue | | | 20,797 | | | | 21,492 | |

Accrued product purchases | | | 43,230 | | | | 23,874 | |

Energy commodity derivatives deposit | | | — | | | | 18,994 | |

Other current liabilities | | | 29,866 | | | | 19,128 | |

| | | | | | | | |

Total current liabilities | | | 221,522 | | | | 200,285 | |

Long-term debt | | | 914,536 | | | | 1,083,485 | |

Long-term pension and benefits | | | 22,370 | | | | 31,787 | |

Supply agreement deposit | | | 18,500 | | | | — | |

Noncurrent portion of product supply liability | | | 24,348 | | | | — | |

Other non-current liabilities | | | 9,598 | | | | 8,853 | |

Environmental liabilities | | | 21,491 | | | | 22,166 | |

Commitments and contingencies | | | | | | | | |

Owners’ equity: | | | | | | | | |

Partners’ capital: | | | | | | | | |

Common unitholders (39,624 Magellan Midstream Holdings, L.P. units outstanding at December 31, 2007 and 2008) | | | 44,916 | | | | 68,063 | |

General partner | | | 12,505 | | | | — | |

Accumulated other comprehensive loss | | | (91 | ) | | | (340 | ) |

| | | | | | | | |

Total partners’ capital | | | 57,330 | | | | 67,723 | |

Non-controlling owners’ interests in consolidated subsidiaries (Magellan Midstream Partners, L.P.’s ownership interest prior to completion of the simplification (see Note 1—Basis of Presentation and Note 2 –Simplification Agreement) | | | 1,127,236 | | | | 1,186,409 | |

| | | | | | | | |

Total owners’ equity | | | 1,184,566 | | | | 1,254,132 | |

| | | | | | | | |

Total liabilities and owners’ equity | | $ | 2,416,931 | | | $ | 2,600,708 | |

| | | | | | | | |

Revised as described in Note 1. See notes to consolidated financial statements.

14

MAGELLAN MIDSTREAM PARTNERS, L.P.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | |

| | | |

Operating Activities: | | | | | | | | | | | | |

Net income | | $ | 182,798 | | | $ | 230,754 | | | $ | 330,103 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | | | | |

Depreciation and amortization expense | | | 76,200 | | | | 79,140 | | | | 86,501 | |

Debt placement fee amortization | | | 1,925 | | | | 1,554 | | | | 767 | |

Debt prepayment premium | | | — | | | | 1,984 | | | | — | |

Loss on sale and retirement of assets | | | 8,031 | | | | 8,548 | | | | 7,180 | |

Gain on interest rate hedge | | | — | | | | (226 | ) | | | — | |

Equity earnings | | | (3,324 | ) | | | (4,027 | ) | | | (4,067 | ) |

Distributions from equity investment | | | 4,125 | | | | 3,800 | | | | 5,200 | |

Equity-based incentive compensation expense | | | 10,820 | | | | 9,994 | | | | 4,751 | |

Pension settlement expense and amortization of prior service cost (credit) and actuarial loss | | | 669 | | | | 1,833 | | | | (88 | ) |

Gain on assignment of supply agreement | | | — | | | | — | | | | (26,492 | ) |

Changes in components of operating assets and liabilities (Note 4) | | | 35,371 | | | | (40,089 | ) | | | 32,167 | |

| | | | | | | | | | | | |

Net cash provided by operating activities | | | 316,615 | | | | 293,265 | | | | 436,022 | |

Investing Activities: | | | | | | | | | | | | |

Property, plant and equipment: | | | | | | | | | | | | |

Additions to property, plant and equipment | | | (168,544 | ) | | | (190,182 | ) | | | (272,083 | ) |

Proceeds from sale of assets | | | 6,313 | | | | 961 | | | | 3,862 | |

Changes in accounts payable | | | 13,934 | | | | (4,434 | ) | | | 661 | |

Acquisitions of business | | | — | | | | — | | | | (38,302 | ) |

| | | | | | | | | | | | |

Net cash used by investing activities | | | (148,297 | ) | | | (193,655 | ) | | | (305,862 | ) |

Financing Activities: | | | | | | | | | | | | |

Distributions paid | | | (715,316 | ) | | | (233,127 | ) | | | (264,310 | ) |

Net borrowings (payments) under revolver | | | 7,500 | | | | 143,000 | | | | (93,500 | ) |

Borrowings under notes | | | — | | | | 248,900 | | | | 249,980 | |

Payments on notes | | | (14,345 | ) | | | (272,555 | ) | | | — | |

Borrowings on affiliate note | | | 1,960 | | | | — | | | | — | |

Payments on affiliate note | | | (1,960 | ) | | | — | | | | — | |

Debt placement costs | | | (426 | ) | | | (2,683 | ) | | | (2,048 | ) |

Payment of debt prepayment premium | | | — | | | | (1,984 | ) | | | — | |

Net receipt from financial derivatives | | | — | | | | 4,556 | | | | 10,312 | |

Capital contributions by affiliate | | | 17,918 | | | | 5,218 | | | | 3,709 | |

Sales of limited partner units to public (less underwriters’ commissions and payment of offering costs) | | | 506,751 | | | | — | | | | — | |

Increase in outstanding checks | | | — | | | | 3,026 | | | | 2,671 | |

Other | | | 14 | | | | — | | | | — | |

| | | | | | | | | | | | |

Net cash used by financing activities | | | (197,904 | ) | | | (105,649 | ) | | | (93,186 | ) |

| | | | | | | | | | | | |

Change in cash and cash equivalents | | | (29,586 | ) | | | (6,039 | ) | | | 36,974 | |

Cash and cash equivalents at beginning of period | | | 36,563 | | | | 6,977 | | | | 938 | |

| | | | | | | | | | | | |

Cash and cash equivalents at end of period | | $ | 6,977 | | | $ | 938 | | | $ | 37,912 | |

| | | | | | | | | | | | |

Supplemental non-cash financing activity: | | | | | | | | | | | | |

Issuance of MMP common units in settlement of MMP’s long-term incentive plan awards | | $ | — | | | $ | 7,406 | | | $ | 8,536 | |

Revised as described in Note 1. See notes to consolidated financial statements.

15

MAGELLAN MIDSTREAM PARTNERS, L.P.

CONSOLIDATED STATEMENT OF OWNERS’ EQUITY

(In thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Partners’ Capital | | | | | | | |

| | | Common | | | General

Partner | | | Partners’

Accumulated

Other

Comprehensive

Loss | | | Non-controlling

Owners’ Interest | | | Total Owners’

Equity | |

Balance, January 1, 2006 | | $ | (213,667 | ) | | $ | 14 | | | $ | (31 | ) | | $ | 1,394,036 | | | $ | 1,180,352 | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | 38,955 | | | | (4,449 | ) | | | — | | | | 148,292 | | | | 182,798 | |

Amortization of net loss on cash flow hedges | | | — | | | | — | | | | 4 | | | | 208 | | | | 212 | |

Net gain on cash flow hedges | | | — | | | | — | | | | 5 | | | | 231 | | | | 236 | |

Adjustment to additional minimum pension liability | | | — | | | | — | | | | 7 | | | | 336 | | | | 343 | |

| | | | | | | | | | | | | | | | | | | | |

Total comprehensive income (loss) | | | 38,955 | | | | (4,449 | ) | | | 16 | | | | 149,067 | | | | 183,589 | |

Adjustment to recognize the funded status of postretirement plans | | | — | | | | — | | | | (186 | ) | | | (9,119 | ) | | | (9,305 | ) |

Issuance of common units to public (22 million units) | | | 506,751 | | | | — | | | | — | | | | — | | | | 506,751 | |

Adjustment to reflect gain on sale of MMP units following the termination of MMP’s subordination period | | | 277,392 | | | | — | | | | — | | | | (277,392 | ) | | | — | |

Affiliate capital contributions | | | — | | | | 17,918 | | | | — | | | | — | | | | 17,918 | |

Distributions | | | (563,678 | ) | | | (3 | ) | | | — | | | | (151,635 | ) | | | (715,316 | ) |

Equity method incentive compensation expense | | | 1,770 | | | | — | | | | — | | | | — | | | | 1,770 | |

Other | | | 18 | | | | (2 | ) | | | — | | | | — | | | | 16 | |

| | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2006 | | | 47,541 | | | | 13,478 | | | | (201 | ) | | | 1,104,957 | | | | 1,165,775 | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | 61,580 | | | | (6,182 | ) | | | — | | | | 175,356 | | | | 230,754 | |

Net gain on cash flow hedges | | | — | | | | — | | | | 100 | | | | 4,918 | | | | 5,018 | |

Amortization of net gain on cash flow hedges | | | — | | | | — | | | | (8 | ) | | | (411 | ) | | | (419 | ) |

Pension settlement expense and amortization of prior service cost and net actuarial loss | | | — | | | | — | | | | 37 | | | | 1,796 | | | | 1,833 | |

Adjustment to recognize the funded status of postretirement plans | | | — | | | | — | | | | (19 | ) | | | (920 | ) | | | (939 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total comprehensive income (loss) | | | 61,580 | | | | (6,182 | ) | | | 110 | | | | 180,739 | | | | 236,247 | |

Affiliate capital contributions | | | — | | | | 5,218 | | | | — | | | | — | | | | 5,218 | |

Distributions | | | (67,252 | ) | | | (9 | ) | | | — | | | | (165,866 | ) | | | (233,127 | ) |

Issuance of MMP common units in settlement of MMP’s long-term incentive plan awards | | | — | | | | — | | | | — | | | | 7,406 | | | | 7,406 | |

Equity method incentive compensation expense | | | 3,076 | | | | — | | | | — | | | | — | | | | 3,076 | |

Other | | | (29 | ) | | | — | | | | — | | | | — | | | | (29 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2007 | | | 44,916 | | | | 12,505 | | | | (91 | ) | | | 1,127,236 | | | | 1,184,566 | |

Comprehensive income: | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | 87,733 | | | | (2,060 | ) | | | — | | | | 244,430 | | | | 330,103 | |

Amortization of net gain on cash flow hedges | | | — | | | | — | | | | (3 | ) | | | (161 | ) | | | (164 | ) |

Amortization of prior service credit and net actuarial loss | | | — | | | | — | | | | (2 | ) | | | (86 | ) | | | (88 | ) |

Adjustment to recognize the funded status of postretirement plans | | | — | | | | — | | | | (244 | ) | | | (12,028 | ) | | | (12,272 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total comprehensive income (loss) | | | 87,733 | | | | (2,060 | ) | | | (249 | ) | | | 232,155 | | | | 317,579 | |

Affiliate capital contributions | | | — | | | | 3,709 | | | | — | | | | — | | | | 3,709 | |

Distributions | | | (82,756 | ) | | | (12 | ) | | | — | | | | (181,542 | ) | | | (264,310 | ) |

Equity method incentive compensation expense | | | 4,138 | | | | — | | | | — | | | | — | | | | 4,138 | |

Issuance of MMP common units in settlement of MMP’s long-term incentive plan awards | | | — | | | | — | | | | — | | | | 8,536 | | | | 8,536 | |

Acquisition of general partner | | | 14,142 | | | | (14,142 | ) | | | — | | | | — | | | | — | |

Other | | | (110 | ) | | | — | | | | — | | | | 24 | | | | (86 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance, December 31, 2008 | | $ | 68,063 | | | $ | — | | | $ | (340 | ) | | $ | 1,186,409 | | | $ | 1,254,132 | |

| | | | | | | | | | | | | | | | | | | | |

Revised as described in Note 1. See notes to consolidated financial statements.

16

MAGELLAN MIDSTREAM PARTNERS, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

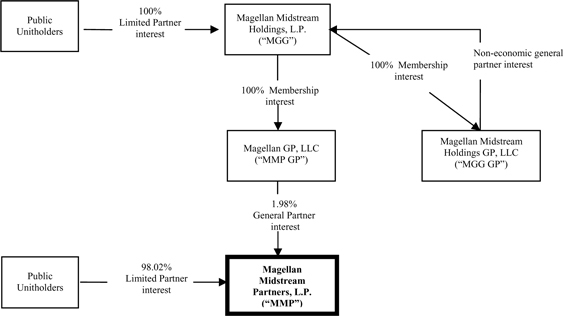

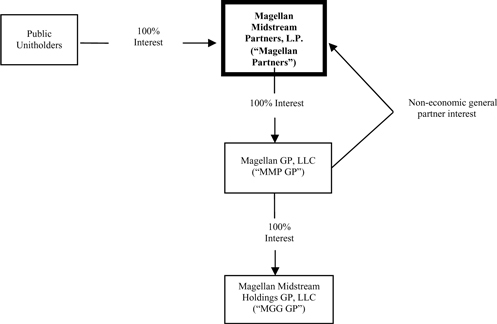

These financial statements were originally the financial statements of Magellan Midstream Holdings, L.P. (“MGG”), prior to the completion of the Simplification (See Note 2—Simplification Agreement below) on September 28, 2009. The Simplification was accounted for in accordance with Accounting Standards Codification (“ASC”) 810-10-45; Paragraphs 22 and 23, Consolidation—Overall—Changes in Parent’s Ownership Interest in a Subsidiary. Under ASC 810, the exchange of MGG units for Magellan Midstream Partners, L.P. (“MMP”) units was accounted for as an MGG equity issuance and MGG was the surviving entity. Although MGG was the surviving entity for accounting purposes, MMP was the surviving entity for legal purposes as provided for by the Simplification Agreement; consequently, the name on these financial statements was changed from “Magellan Midstream Holdings, L.P.” to “Magellan Midstream Partners, L.P.”

Historically, MGG’s sole ownership of MMP’s general partner, Magellan GP, LLC (“MMP GP”), provided MGG with an approximate 2% general partner interest in MMP. MGG’s ownership of MMP’s general partner interest gave it control of MMP as the limited partner interests of MMP (i) did not have the substantive ability to dissolve MMP, (ii) could remove MMP GP as MMP’s general partner only with a supermajority vote of MMP’s common units representing limited partner interest in it (“ MMP limited partner units”) and the MMP limited partner units which could be voted in such an election were restricted, and (iii) did not possess substantive participating rights in MMP’s operations. As a result, MGG’s consolidated financial statements included the assets, liabilities and cash flows of MMP and MMP GP.

At December 31, 2008, MGG had no substantial assets and liabilities other than those of MMP, which MGG consolidated. Historically, MGG’s consolidated balance sheet included non-controlling owners’ interests of consolidated subsidiaries, which reflected the proportion of MMP owned by its partners other than MGG. MMP’s outside ownership interest was approximately 98% at December 31, 2006, 2007 and 2008. (See Note 24—Subsequent Events for a discussion of changes in MGG’s ownership interest in MMP, which occurred after December 31, 2008.) In addition, MGG’s consolidated balance sheet reflected adjustments to the historical amounts reported on MMP’s balance sheet for the fair value of MGG’s proportionate share of MMP’s assets and liabilities at the time of its acquisition of interest in MMP and Magellan GP, LLC. Historically, MGG’s only cash-generating asset was its ownership interest in Magellan GP, LLC, which owned the general partner interest and incentive distribution rights in MMP. Therefore, MGG’s operating cash flows were dependent upon MMP’s ability to make cash distributions and the distributions it received were subject to MMP’s cash distribution policies.

Because of the changes the Simplification Agreement has had on these financial statements and MMP’s organizational structure, and because the nature of the pre-simplification and post-simplification Magellan entities are significantly different, management believed the use of the terms “we,” “our,” “us” and similar language would be confusing. Therefore, these notes to consolidated financial statements refer to specific Magellan entities, with Magellan Midstream Partners, L.P. prior to the simplification referred to as “MMP” and after the simplification as “Magellan Partners”.

| 2. | Simplification Agreement |

In March 2009, MMP and its general partner and MGG and its general partner entered into an Agreement Relating to Simplification of Capital Structure (the “Simplification Agreement” or “the simplification”). Pursuant to the Simplification Agreement, which was approved by both MMP’s and MGG’s unitholders on September 25, 2009, MMP amended and restated its existing partnership agreement to provide for the transformation of the incentive distribution rights and approximate 2% general partner interest owned by MMP GP into common units in MMP and a non-economic general partner interest (the “transformation”). Once the transformation was completed, MMP GP distributed the common units of MMP that it received in the transformation to MGG (the “unit distribution”). Once the transformation and unit distribution were completed, pursuant to a Contribution and Assumption Agreement: (i) MGG contributed 100% of its member interests in Magellan Midstream Holdings GP, LLC (“MGG GP”), its general partner, to MMP GP; (ii) MGG contributed 100% of its member interests in MMP GP to MMP; (iii) MGG contributed to MMP all of its cash and assets, other than the common units of MMP it received in the unit distribution; and (iv) MMP assumed all of MGG’s liabilities (collectively, the “contributions”). Once the transformation, unit distribution and contributions were completed, MGG distributed the common units in MMP it received in the unit distribution to its unitholders (the “redistribution”) and was dissolved. The transformation of the general partner interest and incentive distribution rights into common units in Magellan Partners occurred on September 28, 2009 and the Simplification Agreement closed on September 30, 2008.

17

MAGELLAN MIDSTREAM PARTNERS, L.P.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Pursuant to the Simplification Agreement, MGG received approximately 39.6 million of MMP’s common units in the transformation and unit distribution and each of MGG’s unitholders received 0.6325 of MMP common units in the redistribution for each MGG common unit they owned. As a result, the number of limited partner units outstanding increased from 67.0 million units (MMP pre-simplification) to 106.6 million units (Magellan Partner post-simplification). However, for historical reporting purposes, the impact of this change resulted in a reverse unit split of 0.6325 to 1.0. Therefore, the weighted average units outstanding used for basic and diluted earnings per unit calculations are MGG’s historical weighted average units outstanding adjusted for the retrospective application of the reverse unit split. Amounts reflecting historical MGG limited partner unit or phantom units included in this report, have been retrospectively adjusted, as applicable, for the reverse units split.

The reconciliation of MMP’s historical net income to the net income reported in these financial statements is as follows (in thousands):

| | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2006 | | | 2007 | | | 2008 | |

Net income, as previously reported | | $ | 192,728 | | | $ | 242,790 | | | $ | 346,613 | |

Depreciation expense | | | (15,348 | ) | | | (15,348 | ) | | | (15,348 | ) |

Other adjustments | | | 5,418 | | | | 3,312 | | | | (1,162 | ) |

| | | | | | | | | | | | |

Net income | | $ | 182,798 | | | $ | 230,754 | | | $ | 330,103 | |

| | | | | | | | | | | | |