SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Carolina Bank Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

CAROLINA BANK HOLDINGS, INC.

101 North Spring Street

Greensboro, North Carolina 27401

Notice of Internet Availability of Proxy Materials

and

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE is hereby given that the Annual Meeting of Shareholders of Carolina Bank Holdings, Inc. (the “Company”) will be held as follows:

| Place: | Carolina Bank Corporate Headquarters |

| | 101 North Spring Street, 3rd Floor |

| | Greensboro, North Carolina 27401 |

| | |

| Date: | May 17, 2016 |

| | |

| Time: | 4:00 p.m. |

The purposes of the meeting are:

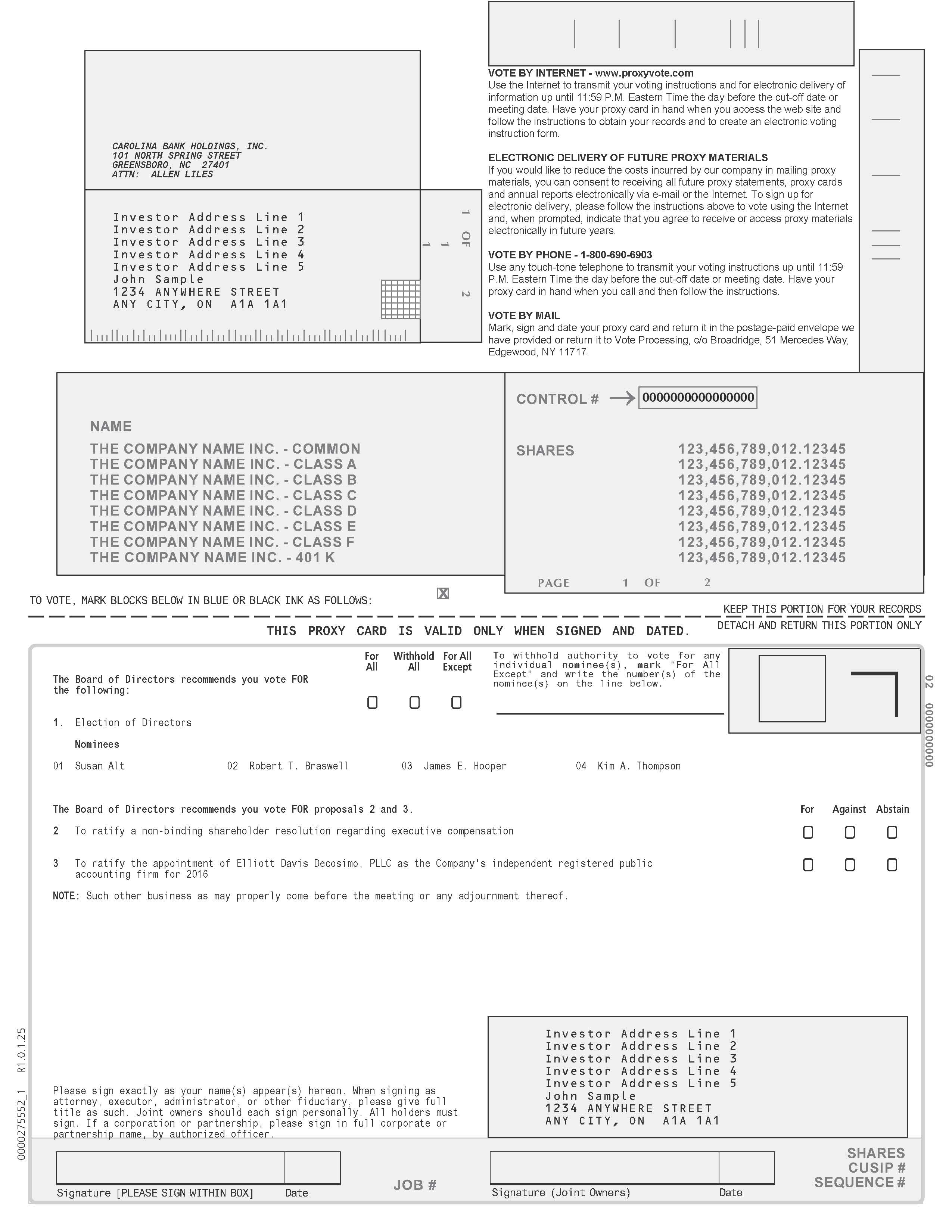

| 1. | To elect four members of the Board of Directors for terms of three years; |

| 2. | To ratify a non-binding shareholder resolution regarding executive compensation; |

| 3. | To ratify the appointment of Elliott Davis Decosimo, PLLC as the Company’s independent registered public accounting firm for 2016; and |

| 4. | To transact such other business as may properly be presented for action at the meeting. |

YOU ARE INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. HOWEVER, EVEN IF YOU PLAN TO ATTEND, YOU ARE REQUESTED TO COMPLETE, SIGN AND DATE THE ENCLOSED APPOINTMENT OF PROXY AND RETURN IT PROMPTLY IN THE ENVELOPE PROVIDED FOR THAT PURPOSE TO ENSURE THAT A QUORUM IS PRESENT AT THE MEETING. THE GIVING OF AN APPOINTMENT OF PROXY WILL NOT AFFECT YOUR RIGHT TO REVOKE IT OR TO ATTEND THE MEETING AND VOTE IN PERSON.

WE HAVE ELECTED TO FURNISH OUR PROXY SOLICITATION MATERIALS VIA U.S. MAIL AND ALSO TO NOTIFY YOU OF THE AVAILABILITY OF OUR PROXY MATERIALS ON THE INTERNET.

THE NOTICE OF ANNUAL MEETING, PROXY STATEMENT, PROXY CARD AND ANNUAL REPORT ARE AVAILABLE AT HTTPS://www.Carolinabank.com.

| | By Order of the Board of Directors |

| | |

| | /s/ Robert T. Braswell |

| | |

| | Robert T. Braswell |

| | President and Chief Executive Officer |

April 7, 2016

CAROLINA BANK HOLDINGS, INC.

101 North Spring Street

Greensboro, North Carolina 27401

PROXY STATEMENT

Mailing Date: On or About April 7, 2016

ANNUAL MEETING OF SHAREHOLDERS

To be Held May 17, 2016

This Proxy Statement is being furnished in connection with the solicitation by the Board of Directors of Carolina Bank Holdings, Inc. (the “Company”) of appointments of proxy for use at the annual meeting of the Company’s shareholders (the “Annual Meeting”) to be held on May 17, 2016, at 4:00 p.m., at Carolina Bank Corporate Headquarters, 101 North Spring Street, 3rd Floor, Greensboro, North Carolina, and at any adjournments thereof. The Company’s proxy solicitation materials are being mailed to shareholders on or about April 7, 2016. In this Proxy Statement, the Company’s subsidiary bank, Carolina Bank, is referred to as the “Bank.”

Voting of Proxies

Persons named in the enclosed appointment of proxy as proxies (the “Proxies”) to represent shareholders at the Annual Meeting are Donald H. Allred, Kevin J. Baker and Abby Donnelly. Shares represented by each appointment of proxy that is properly executed, returned and not revoked, whether by mail or internet, will be voted in accordance with the directions contained therein. If no directions are given, such shares will be voted “FOR” the election of each of the four nominees for director named in Proposal 1 and “FOR” Proposals 2 and 3. If, at or before the time of the Annual Meeting, any nominee named in Proposal 1 has become unavailable for any reason, the Proxies will be authorized to vote for a substitute nominee. On such other matters as may come before the meeting, the Proxies will be authorized to vote in accordance with their best judgment. An appointment of proxy may be revoked by the shareholder giving it at any time before it is exercised by filing with T. Allen Liles, Secretary and Treasurer of the Company, a written instrument revoking it or a duly executed appointment of proxy bearing a later date, or by attending the Annual Meeting and announcing his or her intention to vote in person.

Record Date

The close of business on March 10, 2016 has been fixed as the record date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only those shareholders of record on that date will be eligible to vote on the proposals described herein.

Voting Securities

The Company’s voting securities are the shares of its common stock, par value $1.00 per share, of which 5,037,108 shares were issued and outstanding on March 10, 2016. As of March 10, 2016, there were approximately 1,150 record shareholders of the Company’s common stock.

The Company’s Articles of Incorporation also authorize the issuance of up to 1,000,000 shares of preferred stock, no par value, having such rights, privileges and preferences as the Board of Directors shall from time to time designate. As of March 10, 2016, there were no shares of the Company’s preferred stock issued and outstanding.

Voting Procedures; Quorum; Votes Required for Approval

At the Annual Meeting, each shareholder will be entitled to one vote for each share of common stock held of record on the Record Date on each matter submitted for voting and, in the election of directors, for each director to be elected. Shareholders will not be entitled to vote cumulatively in the election of directors.

A majority of the shares of the Company’s common stock issued and outstanding on the Record Date must be present in person or by proxy to constitute a quorum for the conduct of business at the Annual Meeting.

Assuming a quorum is present, in the case of Proposal 1, the four directors receiving the greatest number of votes shall be elected. In the case of Proposals 2 and 3, for each proposal to be approved, the proposal must be approved by a majority of the votes cast. Abstentions and broker non-votes will have no effect.

Authorization to Vote on Adjournment and Other Matters

Unless the Secretary of the Company is instructed otherwise, by signing an appointment of proxy, shareholders will be authorizing the Proxies to vote in their discretion regarding any procedural motions which may come before the Annual Meeting. For example, this authority could be used to adjourn the Annual Meeting if the Company believes it is desirable to do so. Adjournment or other procedural matters could be used to obtain more time before a vote is taken in order to solicit additional appointments of proxy to establish a quorum or to provide additional information to shareholders.

Appointments of proxy voted against any one of the Proposals will not be used to adjourn the Annual Meeting. The Company does not have any plans to adjourn the Annual Meeting at this time, but intends to do so, if needed, to promote shareholder interests.

Revocation of Appointment of Proxy

Any shareholder who executes an appointment of proxy has the right to revoke it at any time before it is exercised by filing, with the Secretary of the Company, either an instrument revoking it or a duly executed appointment of proxy bearing a later date, or by attending the Annual Meeting and announcing his or her intention to vote in person.

Expenses of Solicitation

The Company will pay the cost of preparing, assembling and mailing this Proxy Statement. Appointments of proxy also may be solicited personally, by mail, internet or telephone by the Company’s and the Bank’s directors, officers and employees without additional compensation. The Company will reimburse banks, brokers, and other custodians, nominees and fiduciaries for their costs in sending the proxy materials to the beneficial owners of the Company’s common stock.

Beneficial Ownership of Common Stock

Principal Shareholders.The following table describes the beneficial ownership of the Company’s common stock on the Record Date by each person or entity known to the Company to be the beneficial owner of more than five percent of the Company’s common stock:

Name and Address

of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percentage

of Class |

| | | | | |

Basswood Capital Management, L.L.C. 645 Madison Avenue, 10th Floor New York, NY 10022 | | | 424,873 | (1) | | 8.43 | |

| | | | | | | | | |

Endicott Opportunity Partners IV, L.P. 570 Lexington Avenue, 37th Floor New York, NY 10022 | | | 256,915 | (2) | | 5.10 | |

| (1) | Based on Schedule 13G/A filed with the Securities and Exchange Commission on February 11, 2016, and the information contained therein. |

| (2) | Based on Schedule 13G filed with the Securities and Exchange Commission on June 5, 2015, and the information contained therein. |

Directors and Executive Officers.The following table lists the individual beneficial ownership of the Company’s common stock, as of the Record Date, by the Company’s current directors, executive officers, and nominees for director, and by all current directors, nominees and executive officers of the Company as a group.

Name and Address

of Beneficial Owner | | Amount and Nature of

Beneficial Ownership(1)(2) | | Percentage

of Class(3) |

| | | | | |

Donald H. Allred

Asheboro, NC

| | | 12,290 | | | | 0.24 | |

| | | | | | | | | |

Susan Alt

High Point, NC

| | | 15,294 | | | | 0.30 | |

| | | | | | | | | |

Kevin J. Baker

Greensboro, NC

| | | 13,643 | | | | 0.27 | |

| | | | | | | | | |

J. Alexander S. Barrett

Greensboro, NC

| | | 35,362 | | | | 0.70 | |

Name and Address

of Beneficial Owner | | Amount and Nature of

Beneficial Ownership(1)(2) | | | Percentage

of Class(3) | |

| | | | | | | |

Robert T. Braswell

Greensboro, NC | | | 94,495 | (4) | | | 1.88 | |

| | | | | | | | | |

Stephen K. Bright

Greensboro, NC | | | 36,373 | | | | 0.72 | |

| | | | | | | | | |

Gary N. Brown

Summerfield, NC | | | 124,714 | | | | 2.48 | |

| | | | | | | | | |

Michael F. Bumpass

Moneta, VA | | | 8,262 | | | | 0.16 | |

| | | | | | | | | |

Phillip B. Carmac

Ramseur, NC | | | 13,277 | | | | 0.26 | |

| | | | | | | | | |

Abby Donnelly

Greensboro, NC | | | 4,331 | | | | 0.09 | |

| | | | | | | | | |

James E. Hooper

Greensboro, NC | | | 105,198 | | | | 2.09 | |

| | | | | | | | | |

Daniel D. Hornfeck

Greensboro, NC | | | 14,014 | | | | 0.28 | |

| | | | | | | | | |

J. Edward Kitchen

Greensboro, NC | | | 15,561 | | | | 0.31 | |

| | | | | | | | | |

T. Allen Liles

Asheboro, NC | | | 49,533 | | | | 0.98 | |

| | | | | | | | | |

J. Richard Spiker, II

Oak Ridge, NC | | | 2,520 | | | | 0.05 | |

| | | | | | | | | |

Kim A. Thompson

Oak Ridge, NC | | | 1,752 | | | | 0.03 | |

| | | | | | | | | |

Directors, Nominees and

Executive Officers as a Group (16 persons) | | | 546,619 | | | | 10.84 | |

| (1) | Except as otherwise noted, to the best knowledge of management of the Company, the individuals named or included in the group above exercise sole voting and investment power over the amount of shares disclosed above except for the following shares over which voting and investment power is shared: Mr. Braswell – 8,452 shares; Mr. Bright – 7,000 shares; and Mr. Hornfeck – 4,733 shares. |

| (2) | Included in the beneficial ownership tabulations are the following options to purchase shares of common stock: Mr. Carmac – 1,000 shares; Mr. Hornfeck – 3,000 shares; and Mr. Liles – 3,000 shares. These options are capable of being exercised within 60 days of the Record Date and therefore, under the beneficial ownership rules of the Securities and Exchange Commission (the “SEC”), are deemed to be owned by the holder. |

| (3) | The calculations of the percentage of class beneficially owned by each individual or group is based, in each case, on the sum of (i) 5,037,108 shares currently outstanding plus (ii) only that individual’s or group’s number of options capable of being exercised within 60 days of the Record Date. |

| (4) | Included 13,545 shares pledged as collateral for a loan with third-party lender. |

Section 16(a) Beneficial Ownership Reporting Compliance

Directors and executive officers of the Company are required by federal law to file reports with the SEC regarding the amount of and changes in their beneficial ownership of the Company’s common stock. To the best knowledge of management of the Company, all such required reports have been filed on a timely basis.

Interest of Certain Persons in Matters to be Acted Upon

The Company’s executive officers have an interest in the advisory vote on executive compensation that is in addition to, and may be different from, any interests they may have as shareholders of the Company generally. Collectively, these officers beneficially own 173,839 shares of the Company’s common stock representing 3.45% of the total number of common shares outstanding as of the Record Date.

PROPOSAL 1: ELECTION OF DIRECTORS

The Board has set the number of directors of the Company at eleven (11) and recommends that shareholders vote for each of the nominees listed below for a term of three years, or until their successors are elected and duly qualified:

| Name and Age | | | Position(s)

Held | | | | Director

Since(1) | | | | Principal Occupation and

Business Experience During the Past Five Years | |

| | | | | | | | | | | | | |

Susan Alt

(50) | | | Director | | | | 2010 | | | | Senior Vice President, Public Affairs of Volvo Group North America, Greensboro, NC | |

| | | | | | | | | | | | | |

Robert T. Braswell

(64)

| | | President, CEO & Director | | | | 1996 | | | | President and Chief Executive Officer of the Company and the Bank | |

| | | | | | | | | | | | | |

James E. Hooper

(58)

| | | Director | | | | 2000 | | | | President and Chief Executive Officer, Staunton Capital, Inc. (manufacturing firm), Greensboro, NC | |

| | | | | | | | | | | | | |

Kim A. Thompson

(57) | | | Director | | | | 2010 | | | | President and Owner of Thompson Consulting, Oak Ridge, NC, providing fractional CFO solutions for manufacturing clients. Former CFO of Abercrombie Textiles, Cliffside, NC, and Longwood Industries, Greensboro, NC. | |

| (1) | Indicates the year in which each individual was first elected a director of the Bank or the Company, as applicable, and does not necessarily reflect a continuous tenure. |

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH OF THE NOMINEES NAMED ABOVE.

Incumbent Directors

The Company’s Board of Directors includes the following directors whose terms will continue after the Annual Meeting. Certain information regarding those directors is set forth in the following table:

| Name and Age | | | Director

Since(1) | | | | Term

Expires | | | | Principal Occupation and

Business Experience During the Past Five Years | |

| | | | | | | | | | | | | |

Donald H. Allred

(69)

| | | 2012 | | | | 2017 | | | | Retired President and Owner, Duel, Inc. (media production company), Asheboro, NC | |

| | | | | | | | | | | | | |

Kevin J. Baker

(50)

| | | 2012 | | | | 2018 | | | | Executive Director and Assistant Secretary of Piedmont Triad Airport Authority (owner and operator of Piedmont Triad International Airport), Greensboro, NC | |

| | | | | | | | | | | | | |

J. Alexander S. Barrett

(58) | | | 2004 | | | | 2017 | | | | Partner, Hagan Barrett & Langley PLLC, Greensboro, NC (practicing in the areas of complex business and commercial litigation and employment law) | |

| | | | | | | | | | | | | |

Stephen K. Bright

(67) | | | 2009 | | | | 2018 | | | | President and Owner, Bright Enterprises, Inc. (plastic injection molding company), Greensboro, NC | |

| | | | | | | | | | | | | |

Michael F. Bumpass

(68) | | | 2012 | | | | 2017 | | | | Retired President and Chief Executive Officer, Guilford Merchants Association and FirstPoint Inc. (debt collection and information resources firm), Greensboro, NC | |

| | | | | | | | | | | | | |

Abby Donnelly

(53) | | | 2014 | | | | 2017 | | | | CEO of The Leadership & Legacy Group (leadership development and succession planning), Greensboro, NC | |

| | | | | | | | | | | | | |

J. Edward Kitchen

(67) | | | 2012 | | | | 2018 | | | | Vice President and Chief Operating Officer of the Joseph M. Bryan Foundation (philanthropic organization), Greensboro, NC | |

| (1) | Indicates the year in which each individual was first elected a director of the Bank or the Company, as applicable, and does not necessarily reflect a continuous tenure. |

Qualifications of Directors

A description of the specific experience, qualifications, attributes, or skills that led to the conclusion that each of the nominees and incumbent directors listed above should serve as a director of the Company is presented below.

Donald H. Allred.Mr. Allred is the Retired President and former owner of Duel, Inc., a media production company located in Asheboro, NC, which specialized in audio and video projects for individuals and businesses. Mr. Allred has served on the Bank’s Asheboro Advisory Board of Directors since 2004. Mr. Allred is very active in the Rotary Club and has volunteered with numerous civic organizations in the Asheboro area. Mr. Allred has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Susan Alt.Ms. Alt is the Senior Vice President of Public Affairs for Volvo Group North America, Greensboro, NC. Her duties have included overseeing the implementation of initiatives designed to improve the company’s financial performance and educate regulators and legislators on business needs. Her experience also includes service on numerous other business, civic and charitable boards. Ms. Alt has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Kevin J. Baker. Mr. Baker is the Executive Director and Assistant Secretary of the Piedmont Triad Airport Authority, which owns, maintains, and operates Piedmont Triad International Airport, the third busiest airport in North Carolina. Prior to 2008, Mr. Baker was Vice President and regional manager of Baker and Associates, a unit of the Michael Baker Corporation, which specializes in Architecture and Engineering. Mr. Baker has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

J. Alexander S. Barrett. Mr. Barrett is currently Chairman of the Bank’s Board of Directors, and has served on the Bank’s Board since 2004. Mr. Barrett is an attorney at law and Partner with Hagan Barrett & Langley PLLC, Greensboro, NC, practicing in the areas of complex business and commercial litigation and employment law. Mr. Barrett has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Robert T. Braswell. Mr. Braswell is currently the Bank’s President and Chief Executive Officer. He was founder and organizer of the Bank and has served as President, Chief Executive Officer and a Director of the Bank since its inception in 1996. Mr. Braswell has over 40 years of banking experience, serving in various capacities at a number of banks in North Carolina, including Senior Vice President and Senior Loan Officer of one bank and President and Chief Executive Officer of another. Mr. Braswell serves on numerous business and civic boards and has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Stephen K. Bright. Mr. Bright is the founder, President, and owner of Bright Enterprises, Inc., a local manufacturing firm in Greensboro, NC. His experience with this company provides him over 20 years of small business exposure. Prior to that, he served in various engineering and management roles with Rubbermaid, Inc. and Burlington Industries. Mr. Bright is active in his church and volunteers his time with various civic organizations, and he has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Michael F. Bumpass. Mr. Bumpass is a consultant in the financial services industry and is the retired President and Chief Executive Officer of Guilford Merchants Association and FirstPoint Inc., Greensboro, NC. Mr. Bumpass has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Abby Donnelly. Ms. Donnelly is founder and Chief Executive Officer of The Leadership & Legacy Group, a consulting practice in leadership development and executive succession. She is the internationally recognized author of Networking Works!, a workbook and training curriculum on building strong business relationships. Ms. Donnelly has been active in volunteering and serving in many leadership roles in various civic organizations in the Greensboro area. She has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

James E. Hooper. Mr. Hooper is President and CEO of Staunton Capital, Inc., a manufacturing firm in Greensboro, NC. He holds a certified public accountant license and serves as the financial expert on the Company’s Audit Committee. He has served on the Bank’s Board since 2000 and has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

J. Edward Kitchen. Mr. Kitchen is Vice President and Chief Operating Officer of the Joseph M. Bryan Foundation, a philanthropic organization with assets of approximately $85 million in Greensboro, NC, and is Chairman of the Board of Directors for Gateway University Research Park, a joint research campus in Greensboro developed in collaboration with two state universities to promote nanoscience and nanoengineering. He also serves on the Board of Directors of Union Square Campus. Mr. Kitchen worked for thirty years in various positions for the City of Greensboro, including City Manager from 1995 to 2005. Mr. Kitchen is active in the community through his affiliation with several civic and professional organizations. Mr. Kitchen has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Kim A. Thompson.Ms. Thompson is President and Owner of Thompson Consulting, Oak Ridge, NC, providing fractional CFO solutions for manufacturing clients. She holds a certified public accountant license and serves on the Company’s Audit Committee. She previously served as CFO for three manufacturing companies from 2004 to 2015. She first served on the Board in 2010 and 2011 and rejoined in 2015. She has attended the North Carolina Bank Directors’ College and the North Carolina Bank Directors’ Assembly.

Director Independence

With the exception of Mr. Braswell, each individual serving as a member of the Company’s Board of Directors during 2015 and each current director and nominee for director is “independent” as defined by NASDAQ listing standards and the regulations promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”).

In making this determination, the Board considered all insider transactions with directors for the provision of goods or services to the Company or the Bank. All such transactions were conducted at arm’s length upon terms no less favorable than those that would be available from an independent third party.

Director Relationships

No director is a director of any other company with a class of securities registered pursuant to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act, or any company registered as an investment company under the Investment Company Act of 1940.

Director Compensation

During 2015, each non-employee director was paid a fee of $1,000 for each Board of Directors meeting attended. The Chairman of the Board of Directors received an additional monthly retainer of $3,000 beginning in May 2015 and prior to that, $2,000 per month. Directors also received meeting fees of $600 per committee meeting attended, except for telephone loan committee meetings, for which directors receive a fee of $300 per meeting. The Vice Chairman received an additional monthly retainer of $1,500 beginning May of 2015 The Chairman of the Audit Committee received an additional monthly retainer of $2,000 beginning May 2015 and prior to that, $1,500 per month.

Directors’ fees are eligible for deferral under the Company’s directors’ deferral plan, which invests deferred compensation in shares of the Company’s common stock. The Company matched 25% of meeting attendance fees, committee fees and retainer fees deferred by directors under the deferred compensation plan during 2015. Please refer to the description of the directors’ deferral plan on page 11 for more information.

The following table presents a summary of all compensation paid by the Company to its directors for their service as members of the Board of Directors and of board committees during the year ended December 31, 2015.

DIRECTOR COMPENSATION TABLE

| Name | | Fees Earned

or

Paid in Cash | | | Stock

Awards | | | Option

Awards(1) | | | All Other

Compensation(2) | | | Total | |

| | | | | | | | | | | | | | | | |

| Donald H. Allred | | $ | 25,000 | | | | — | | | | — | | | $ | 6,250 | | | $ | 31,250 | |

| Susan Alt | | | 13,300 | | | | — | | | | — | | | | 3,325 | | | | 16,625 | |

| Kevin J. Baker | | | 21,100 | | | | — | | | | — | | | | 5,275 | | | | 26,375 | |

| J. Alexander S. Barrett | | | 53,000 | | | | — | | | | — | | | | 16,232 | | | | 69,232 | |

| Robert T. Braswell(3) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Stephen K. Bright | | | 22,300 | | | | — | | | | — | | | | 14,990 | | | | 37,290 | |

| Gary N. Brown | | | 50,800 | | | | — | | | | — | | | | 26,611 | | | | 77,411 | |

| Michael F. Bumpass | | | 17,600 | | | | — | | | | — | | | | 4,400 | | | | 22,000 | |

| Abby Donnelly | | | 21,500 | | | | — | | | | — | | | | 5,375 | | | | 26,875 | |

| James E. Hooper | | | 43,100 | | | | — | | | | — | | | | 13,890 | | | | 56,990 | |

| J. Edward Kitchen | | | 27,800 | | | | — | | | | — | | | | 6,950 | | | | 34,750 | |

| Kim A. Thompson | | | 7,800 | | | | — | | | | — | | | | 1,950 | | | | 9,750 | |

| (1) | At March 10, 2016, there were no stock option awards outstanding for the above directors. No stock options were awarded during 2015. |

| (2) | Consists of a 25% premium in connection with the conversion of certain directors’ fees deferred into shares of the Company’s common stock during 2015, retirement account accruals, and the value of certain life insurance benefits. |

| (3) | Compensation paid to Mr. Braswell in connection with his service as President and Chief Executive Officer of the Company and the Bank is presented in the Summary Compensation Table presented on page 19. |

Stock Options for Directors

The Company’s 1997 Nonqualified Stock Option Plan for Directors provided for the issuance of up to 135,420 shares (amount adjusted for 10% stock dividends in 2000 and 2001 and 20% stock dividends in 2004, 2005 and 2007) of the Company’s common stock upon the exercise of options granted under the plan. All options under the Nonqualified Stock Option Plan have been granted.

The shareholders of the Company approved the 2009 Omnibus Stock Ownership and Long-Term Incentive Plan (the “2009 Omnibus Plan”) at the 2009 annual meeting of shareholders to replace the stock option plan of the Company described above. The 2009 Omnibus Plan authorized the issuance of awards covering 500,000 shares of the Company’s common stock. The awards may be issued in the form of incentive stock option grants, non-qualified stock option grants, restricted stock grants, long-term incentive compensation units, or stock appreciation rights.

There were no stock options granted to members of the Company’s Board of Directors during 2015.

Director Retirement Agreements

In 2008 and 2012, the Bank entered into director retirement agreements with certain of its current non-employee directors, including Messrs. Barrett, Bright, Brown, and Hooper. The director retirement agreements are intended to encourage existing directors to remain directors of the Bank, assuring the Bank that it will have the benefit of the directors’ experience and guidance in the years ahead. The director retirement agreements provide for an annual benefit of approximately $10,000. The benefit is payable for ten years beginning with the month immediately after the month in which the director reaches age 70. If a director’s service terminates before age 70 for reasons other than death, disability, or termination for cause, beginning with the month immediately after the month in which the director reaches age 70, he or she will receive, over a ten-year period, a payment based upon the retirement-liability balance accrued by the Bank at the end of the month before the month in which the director’s service terminates. Likewise, if a director’s service terminates because of disability before age 70, beginning with the month immediately after the month in which the director reaches age 70, he or she will receive, over a ten-year period, a payment based upon the retirement-liability balance accrued by the Bank at the end of the month before the month in which the director’s service terminates. If a change-in-control of the Company occurs both before the director reaches age 70 and before the director’s service terminates, then the director will receive a lump-sum payment equal to the retirement-liability balance accrued by the Bank on the date of the change-in-control. For this purpose, the term “change-in-control” means a change-in-control as defined in Internal Revenue Code Section 409A and Internal Revenue Service regulations implementing Section 409A. After a director’s death, an amount equal to the retirement-liability balance on the date of the director’s death will be paid to his or her beneficiary in a single lump sum. A director will forfeit all benefits under the director retirement agreement if he is not nominated for re-election because of the director’s gross negligence or gross neglect of duties, commission of a felony or misdemeanor involving moral turpitude, acts of fraud, disloyalty, or willful violation of any law or significant Bank policy, a breach of the director’s fiduciary duties for personal profit, or if the director is removed by order of the FDIC. The Bank has also agreed to pay legal fees incurred by the director if his director retirement agreement is challenged following a change-in-control, up to a maximum of $125,000 for each director.

Directors’ Deferral Plan

Effective March 10, 2003, directors of the Bank may defer the payment of annual fees, meeting fees, committee fees, and/or retainers pursuant to the Bank’s directors’ deferral plan. Each of the Company’s non-employee directors participated in the directors’ deferral plan during 2015. Each director may elect to defer up to 100% of his or her compensation from retainers and meeting fees. During 2015, the Bank made a matching contribution equal to 25% of the director’s compensation deferred under the plan. The deferred fees are converted into a number of shares of the Company’s common stock with a fair market value equal to the value of the fees deferred, and the number of shares is then credited to the director’s account. A director is 100% vested in the director’s account and in the Bank’s contributions at all times. The Bank uses a Rabbi Trust to hold the Company’s common stock to satisfy the Bank’s obligations under the directors’ deferral plan, and the directors are general creditors of the Bank in the event the Bank becomes insolvent. Upon termination of service as a director or in the event of death, shares of the Company’s common stock, or cash equivalents from liquidation of common stock, will be distributed in a lump sum or extended payment to the director or a designated beneficiary. In 2008 and 2013, the Bank amended the directors’ deferral plan to ensure that benefits under the plan are paid in a manner and at a time that are consistent with Section 409A, a provision of the Internal Revenue Code governing non-qualified deferred compensation. Internal Revenue Code Section 409A affects non-qualified retirement plans and other deferred compensation arrangements by regulating election timing, distribution timing, and the ability to take accelerated payments under such plans. Internal Revenue Code Section 409A provides that, unless certain requirements are met, amounts deferred under a non-qualified deferred compensation plan will be immediately includable in income and subject to an additional 20% excise tax.

Board Leadership Structure

The Board of Directors appoints a Chairman, who presides at meetings of the Board and performs such other duties as may be directed by the Board. The Board may select any of its members as its Chairman, and it has no formal policy as to whether the Company’s Chief Executive Officer will serve as Chairman or whether any other director, including a non-employee or independent director, may be elected to serve as Chairman. At present, the positions of Chief Executive Officer and Chairman are held by different persons. At this time, the Board has determined that separating these roles and having an independent director serve as Chairman of the Board is in the best interests of our shareholders. The Board believes this division of responsibility facilitates communication between the Board and executive management and is appropriate given the legal and regulatory requirements applicable to the Company.

Board’s Role in Risk Oversight

Risk is inherent in any business, and, as is the case with other management functions, the Company’s senior management has primary responsibility for managing the risks faced by the Company. However, as a financial institution, the Company’s business involves financial risks that do not exist, or that are more extensive than the risks that exist, in some other types of businesses. The Company and the Bank are subject to extensive regulation that requires us to assess and manage those risks, and during their periodic examinations our regulators assess our performance in that regard. As a result, the Board is actively involved in overseeing our risk management programs. The Board administers its oversight function primarily through committees. Additional information regarding the Board’s committees appears below. The Board approves and periodically reviews the Bank’s operating policies and procedures. We believe the Board’s involvement in our risk management results in Board committees that are more active than those of corporations that are not financial institutions or that are not regulated as extensively as financial institutions. We believe this committee activity enhances our Board’s effectiveness and leadership structure by providing opportunities for non-employee directors to become familiar with the Bank’s critical operations and actively involved in the Board’s oversight role with respect to risk management, as well as its other oversight functions.

Meetings and Committees of the Board of Directors

The Board of Directors of the Company held twelve regular board meetings and one strategic board retreat during 2015. Each current director attended 75% or more of the aggregate number of meetings of the Board of Directors and committees on which he or she served. Company policy states that attendance at the annual meeting of shareholders by members of the Board of Directors is expected. Ten of the Company’s eleven directors attended the 2015 Annual Meeting of Shareholders. The Company’s Board of Directors has several standing committees, including an Executive Committee, an Audit Committee, a Loan Committee, a Governance Committee (which performs the duties of a Nominating Committee) and a Compensation Committee.

Executive Committee.The Executive Committee is empowered to act for the entire Board during intervals between Board meetings. The members of the Executive Committee are Messrs. Barrett, Brown, Braswell, Hooper, and Kitchen. The Executive Committee met nine times during 2015.

Audit Committee. The Audit Committee is a separately designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the Audit Committee are Ms. Thompson and Messrs. Hooper, Allred, Brown, Bumpass and Kitchen. The Audit Committee met four times during 2015. The Audit Committee has in place pre-approval policies and procedures that involve an assessment of the performance and independence of the Company’s independent auditors, an evaluation of any conflicts of interest that may impair the independence of the independent auditors and pre-approval of an engagement letter that outlines all services to be rendered by the independent auditors. The Report of the Audit Committee is included on page 23 of this proxy statement. The Audit Committee has adopted a formal written charter, which is available on the Company’s website at http://www.carolinabank.com.

The Company’s common stock is listed on, and the members of the Company’s Audit Committee meet the requirements of, the NASDAQ Global Market. The Audit Committee members are financially literate and “independent” as defined by NASDAQ’s applicable listing standards. The Board of Directors has determined that James E. Hooper, a member of the Audit Committee, meets the requirements adopted by the SEC for qualification as an “audit committee financial expert.” An audit committee financial expert is defined as a person who has the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of generally accepted accounting principles in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the Company’s financial statements, or experience supervising people engaged in such activities; (iv) an understanding of internal control over financial reporting; and (v) an understanding of audit committee functions.

Loan Committee. The members of the Loan Committee are Messrs. Allred, Baker, Braswell, and Bright. The Loan Committee met twenty-seven times in 2015. The Loan Committee is responsible for assisting the Board of Directors and management in establishing loan policy, oversight of quality and productivity of the loan portfolio and for approving or disapproving loans exceeding the limits of individual loan officers or the officer loan committee. The Loan Committee is required by charter to consist of the President and Chief Executive Officer and a minimum of three independent directors.

Governance Committee.The members of the Governance Committee are Ms. Donnelly and Messrs. Kitchen, Barrett, and Brown. The Governance Committee met six times in 2015. The Governance Committee is responsible for developing and maintaining the corporate governance policy. The Governance Committee also performs the duties of a Nominating Committee. The Governance Committee has adopted a formal written charter, which is available on the Company’s website at http://www.carolinabank.com. The members of the Governance Committee are “independent” as defined by NASDAQ listing standards and applicable rules promulgated under the Exchange Act. Although there is not currently a formal policy requiring that the Governance Committee consider diversity in its identification of nominees to the Board of Directors, the committee values diversity, including diversity of background, experience and expertise. The Company’s bylaws permit any shareholder entitled to vote at the Annual Meeting to nominate candidates for election to the Board of Directors. Any shareholder nominations must be submitted in writing at least 120 days prior to the meeting of shareholders at which the nominee is to stand for election to the Board of Directors. It is the policy of the Governance Committee to consider all shareholder nominations.

Compensation Committee. The members of the Compensation Committee are Ms. Donnelly and Messrs. Barrett, Bumpass, Hooper and Kitchen. Each member of the Compensation Committee is independent under the listing standards of the NASDAQ Global Market and the committee has a formal committee charter, which is available on the Company’s website athttps://www.carolinabank.com. The Compensation Committee meets on an as needed basis to conduct the chief executive officer’s annual review and recommend all forms of his compensation as well as compensation for the Board of Directors and board committee members. The committee approves the compensation of other senior officers as requested by the chief executive officer or as otherwise required by law and administers the management incentive compensation plan. The Compensation Committee met four times during 2015.

The salary of each of the Company’s executive officers is determined based upon the executive officer’s experience, managerial effectiveness, contribution to the Company’s overall profitability, maintenance of regulatory compliance standards and professional leadership. The Committee also compares the compensation of the Company’s executive officers with compensation paid to executives of similarly situated bank holding companies, other businesses in the Company’s market area and appropriate state and national salary data. All executive officers of the Company, including Mr. Braswell, are eligible to receive discretionary bonuses declared by the Board of Directors. The amount of such bonuses and incentive payments is based upon the Company’s budget and the attainment of corporate goals and objectives. The interests of the Company’s executive officers are aligned with those of its shareholders through the use of equity-based compensation, specifically the grant of stock options with exercise prices established at the fair market value of the Company’s common stock at the time of grant.

Executive Officers

The following table contains information about certain executive officers of the Company and the Bank.

| Name | | Age | | Position With

Company/Bank | | Business Experience |

| | | | | | | |

| Robert T. Braswell | | 64 | | Director, President and Chief Executive Officer of the Company and the Bank | | President and Chief Executive Officer of the Bank since June 1996 |

| | | | | | | |

| T. Allen Liles | | 63 | | Treasurer and Secretary of the Company; Executive Vice President, Chief Financial Officer and Secretary of the Bank | | Executive Vice President, Chief Financial Officer and Secretary of the Bank since July 2001; Senior Vice President, Secretary, Treasurer and CFO of American National Bankshares, Inc., Danville, VA, from January 1998 to July 2001 |

| | | | | | | |

| Daniel D. Hornfeck | | 48 | | Executive Vice President and Chief Credit Officer of the Bank | | Executive Vice President and Chief Credit Officer of the Bank since December 2003; Vice President and Risk Management Officer, Wachovia Bank, N.A. from June 1995 to December 2003 |

| Name | | Age | | Position With

Company/Bank | | Business Experience |

| | | | | | | |

| J. Richard Spiker, II | | 49 | | Executive Vice President and Senior Lending Officer of the Bank | | Executive Vice President and Senior Lending Officer of the Bank since February 2014 and Senior Vice President of the Bank since October 2013; Greensboro City Executive and Senior Vice President of High Point Bank from July 2007 to October 2013; President of Spiker Construction from August 2005 to July 2007; Group Vice President of South Trust Bank from June 2000 to August 2005 |

| | | | | | | |

| Phillip B. Carmac | | 62 | | President, Carolina Bank Wholesale Mortgage; Senior Vice President of the Bank | | President, Carolina Bank Wholesale Mortgage and Senior Vice President of the Bank since 2007; Senior Vice President, Mortgage Simple, from 2004 to 2007; Senior Vice President, Coastal Funding, from 1999 to 2004. |

Employment Agreements. The Board of Directors approved employment agreements with Messrs. Robert T. Braswell, T. Allen Liles, and Daniel D. Hornfeck in 2008 and J. Richard Spiker, II in 2014. The discussion that follows summarizes the terms of these agreements.

The employment agreements have three-year terms, with automatic one-year extensions on the anniversary of each agreement, unless the Board of Directors acts to terminate an agreement earlier. The agreements establish the terms and conditions of the employment relationship and the executives’ initial base salary, and also grant miscellaneous fringe benefits such as use of an automobile (in the case of Mr. Braswell), payment of club dues (for Messrs. Braswell, Spiker, and Liles), and reimbursement of reasonable business expenses. The 2015 base salaries specified in the agreements are $346,800 for Mr. Braswell, $178,193 for Mr. Spiker, $198,901 for Mr. Liles, and $174,828 for Mr. Hornfeck.

The employment agreements may be terminated by the Company or the Bank with or without cause and terminate automatically when the executive attains age 65. The agreements provide for severance benefits after involuntary termination without cause and after voluntary termination with good reason, as well as benefits that become payable after a change-in-control. Severance benefits are not payable in the event of involuntary termination with cause or voluntary termination without good reason. For termination because of death, the Company and the Bank would provide, without cost, continued health care coverage to the executive’s family for one year. For termination because of disability, the executive would be entitled to (x) base salary through the date on which termination becomes effective, any unpaid bonus or incentive compensation for the year before the year in which termination becomes effective, any payments the executive is entitled to under any disability insurance program in which the executive participates, and such other benefits to which he may be entitled under any other benefit arrangements of the Company or the Bank, and (y) continued medical and dental insurance coverage for up to three years. If the executive’s employment terminates involuntarily but without cause or voluntarily but with good reason, he will receive a single lump sum cash payment equal to two times his base salary, plus, for Mr. Braswell, any bonus earned or accrued on his behalf through the date employment termination becomes effective (including any amounts awarded but that have not vested when termination becomes effective) and a pro rata share of any bonus for the year in which termination becomes effective. Good reason for voluntary termination will exist if specified adverse changes in the executive’s employment circumstances occur without the executive’s consent, such as a material reduction in pay, benefits or responsibilities or a material change in the geographic location at which the executive must perform services for the Company. Whether termination is involuntary but without cause or voluntary but with good reason, the executive also will continue to receive medical and dental insurance benefits for a period that may be as long as the remaining term of the employment agreement.

Under the terms of his specific employment agreement, each of Messrs. Braswell and Liles is entitled to an undiscounted lump-sum cash payment equal to his annual compensation multiplied by a factor of three upon the occurrence of a change in control, with such benefit payable regardless of whether the executive’s employment terminated after the change-in-control. In contrast, each of Messrs. Spiker and Hornfeck is entitled, under his specific employment agreement, to an undiscounted lump-sum cash payment equal to his annual compensation multiplied by three if and only if his employment is terminated involuntarily but without cause or voluntarily but with good reason within 24 months after a change-in-control occurs. Mr. Hornfeck’s lump sum cash payment is equal to three times his annual compensation. Mr. Spiker’s lump sum cash payment is equal to 2.99 times his “base amount,” as such term is defined in Section 280G(b)(3)(A) of the Internal Revenue Code. The Bank would also reimburse Mr. Spiker his actual cost of continuing his group health and dental insurance until the earlier of (1) one year from his last day of employment with the Bank, (2) the date on which he is eligible for comparable benefits from a subsequent employer, or (3) the date on which he is no longer eligible for continuation of such benefits under federal law. As of December 31, 2015, the value of the lump sum payment that would have been payable to Messrs. Braswell, Spiker, Liles and Hornfeck upon the occurrence of a “change in control” followed by a termination event would have been approximately $1,040,400, $534,579, $596,703 and $524,484, respectively.

Employment Agreement with Phillip B. Carmac.The Bank entered into an employment agreement with Phillip B. Carmac on April 9, 2010. The agreement provides that Mr. Carmac will serve as Senior Vice President of the Bank and President of the Bank’s wholesale mortgage division. The agreement provides that Mr. Carmac serves at the will of the Bank’s President and Chief Executive Officer and contains a covenant not to compete, which restricts Mr. Carmac’s ability to compete against the Bank during the term of his employment and for a period of one year following his employment with the Bank. Pursuant to the terms of the agreement, Mr. Carmac was paid consideration of $5,000 upon execution of the agreement and is paid commission income based on the performance of the Bank’s wholesale mortgage loan division.

Salary Continuation and Endorsement Split Dollar Agreements. The Bank entered into a salary continuation agreement, or “SERP”, with Mr. Spiker in October 2014 and amended or entered into new salary continuation agreements with Messrs. Braswell, Hornfeck and Liles in May 2008. The Bank is party to endorsement split dollar agreements with Messrs. Braswell and Liles dating from 2003. These salary continuation agreements and 2003 endorsement split dollar agreements are summarized below.

The SERPs promise a specified annual retirement benefit to each executive when he attains the normal retirement age of 65 or a reduced annual benefit if the executive’s employment terminates before age 65, whether termination occurs because of involuntary termination without cause, voluntary termination for any reason, or termination because of disability. An executive forfeits his SERP benefits if his employment terminates involuntarily for cause. Benefits for termination before age 65 are determined solely by the amount of the liability accrual balance maintained by the Bank. The Bank’s liability accrual balance increases incrementally each month so that the final liability accrual balance at the executive’s normal retirement age equals the then present value of the specified normal retirement benefit. If an executive’s employment terminates before the normal retirement age of 65, he will receive a reduced annual benefit that is based on the amount of the Bank’s liability accrual balance when employment termination occurs. The reduced benefit would not be payable until the executive attains age 65. Annual SERP benefits are payable for 15 years. The annual normal retirement age benefits payable under the SERPs are $200,000 for Mr. Braswell and $125,000 for Messrs. Liles, Spiker, and Hornfeck.

The original terms of the SERPs also provided for a lump-sum cash benefit payable after a change-in-control. In the case of each of Messrs. Braswell and Liles, the SERP lump-sum change-in-control benefit is payable regardless of whether the officer’s employment also terminates (but is payable on no more than one change-in-control occasion) and the benefit consists of the liability accrual balance projected to exist at normal retirement age. In the case of all other executives who are parties to SERPs, the lump-sum change-in-control benefit would have been equal to the SERP liability accrual balance existing if and when employment termination occurs within 24 months after the change-in-control, however that benefit would only have been payable if employment termination occurred involuntarily but without cause or voluntarily but with good reason within 24 months after a change-in-control. For this purpose, the term “good reason” is defined in the same manner as the term is defined in the employment agreements. The original terms of the SERPs also provided that if a change-in-control occurred while the executive is receiving or is entitled at age 65 to receive retirement benefits under the SERP, the executive would instead receive an immediate lump-sum payment consisting of the liability accrual balance.

Messrs. Braswell and Liles are also parties to split dollar agreements with the Bank that were entered into in 2003, granting to these executives the right to designate the beneficiary of a portion of the death benefits payable under certain Bank-owned insurance policies on their lives. The designated beneficiaries of Messrs. Braswell and Liles will be entitled to 80% of the net death benefit payable under the insurance policies, which is payable directly by the insurer to the designated beneficiary. The term “net death benefit” means the total life insurance policy death benefit proceeds minus the policy cash surrender value. The policy cash surrender value and the portion of the net death benefit not payable to the executive’s beneficiary are payable in their entirety to the Bank. The Financial Accounting Standards Board clarified in late 2006 that a split dollar arrangement providing post-retirement death benefits requires the employer to recognize compensation expense during an employee’s working years to account for the split dollar insurance obligation, even though the split dollar benefit will ultimately be paid by the insurance company and not the employer. Because these split dollar arrangements provide for post-retirement death benefits payable to the designated beneficiaries of Messrs. Braswell and Liles, the Bank recognizes compensation expense associated with this post-retirement split dollar insurance arrangement.

Bank-Owned Life Insurance. Bank-owned life insurance or “BOLI” is an insurance company-issued product. The BOLI that has been purchased and which may be purchased by the Bank is intended to earn sufficient income on the insurance policies’ cash surrender value such that this income might offset, at least to a certain extent, the financial obligation to pay retirement benefits to directors and the Bank’s after-income tax expense of the accrual for certain benefits under the above-mentioned director retirement agreements and to executives under the above-mentioned salary continuation agreements.

The BOLI is also intended to increase the Bank’s non-interest income in future operating periods. At December 31, 2015, the bank owned BOLI having an aggregate cash surrender value for all insured directors and officers of approximately $11.8 million.

Because it is the intention of the Bank to hold the BOLI until the death of the applicable insured director or officer, the increase of cash surrender value may be tax-free income under current federal income tax law. This compares to the taxable gain the Bank would recognize for assets in traditional taxable investments such as U.S. Treasury or agency securities. The death benefits payable under the BOLI policies, which is likewise tax free under current federal income tax law, is intended to further enhance the Bank’s return. However, certain aspects of the BOLI, including death benefits, will be taken into account in computing any applicable federal alternative minimum tax under current applicable federal tax law.

The following table shows all cash and non-cash compensation paid to or received or deferred by Robert T. Braswell, J. Richard Spiker, T. Allen Liles, Daniel D. Hornfeck and Phillip B. Carmac for services rendered in all capacities during the fiscal years ended December 31, 2015 and 2014. Such compensation was comprised of base salary, 401(k) matching contributions, incentive compensation, insurance premiums paid under life insurance arrangements and compensation expense incurred for the SERPs.

SUMMARY COMPENSATION TABLE

Name and Principal Position | | Year | | | Salary | | | Bonus | | | Option

Awards | | | Non-Equity

Incentive Plan

Compensation | | | Non-Qualified

Deferred

Compensation

Earnings(1) | | | All Other

Compensation(2) | | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Robert T. Braswell, | | | 2015 | | | $ | 346,800 | | | $ | 204,480 | | | | — | | | | — | | | $ | 288,296 | | | $ | 42,220 | | | $ | 881,796 | |

| President and Chief Executive Officer of the Company and the Bank | | | 2014 | | | | 334,800 | | | | 76,729 | | | $ | 21,539 | (3) | | | — | | | | 271,422 | | | | 45,183 | | | | 749,673 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| T. Allen Liles, | | | 2015 | | | | 198,901 | | | | 74,588 | | | | — | | | | — | | | | 156,614 | | | | 23,554 | | | | 453,657 | |

| Treasurer, Secretary and Chief Financial Officer of the Company and the Bank; Executive Vice President of the Bank | | | 2014 | | | | 190,180 | | | | 59,138 | | | | — | | | | — | | | | 147,136 | | | | 19,735 | | | | 416,189 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Daniel D. Hornfeck, | | | 2015 | | | | 174,828 | | | | 51,137 | | | | — | | | | — | | | | 32,684 | | | | 13,201 | | | | 271,850 | |

| Executive Vice President and Chief Credit Officer of the Bank | | | 2014 | | | | 167,316 | | | | 48,540 | | | | — | | | | — | | | | 30,029 | | | | 10,555 | | | | 256,440 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| J. Richard Spiker, II(4) | | | 2015 | | | | 178,193 | | | | 45,439 | | | | — | | | | — | | | | 35,847 | | | | 20,197 | | | | 279,675 | |

| Executive Vice President and Senior Lending Officer of the Bank | | | 2014 | | | | 170,096 | | | | 64,809 | | | | — | | | | — | | | | 8,403 | | | | 30,168 | | | | 273,476 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Phillip B. Carmac, | | | 2015 | | | | 168,000 | | | | — | | | | — | | | | — | | | | — | | | | 222,778 | | | | 390,778 | |

| President, Carolina Bank Wholesale Mortgage and Senior Vice President of the Bank | | | 2014 | | | | 168,000 | | | | — | | | | — | | | | — | | | | — | | | | 12,346 | | | | 180,346 | |

| (1) | Consists of compensation expense incurred pursuant to participation by Messrs. Braswell, Spiker, Hornfeck and Liles in the Company’s Executive Supplemental Retirement Plan. |

| (2) | Consists of 401(k) matching contributions, the value of certain premiums paid by the Company under life insurance arrangements, country club dues and, for Mr. Braswell, pay for unused vacation. Amounts reported for Mr. Carmac include consideration for commissions based on the performance of the Bank’s wholesale mortgage loan division. |

| (3) | The assumptions used in estimating the fair value of option awards are set forth in Note 1(k) to the Company’s audited consolidated financial statements as of December 31, 2015 and 2014. Additional information regarding outstanding option awards is contained in the table entitled “Outstanding Equity Awards at Fiscal Year-End” on page 20 of this Proxy Statement. |

| (4) | Mr. Spiker was appointed Executive Vice President and Senior Lending Officer of the Bank in May 2014. |

Stock Options

The shareholders of the Bank approved the 1997 Incentive Stock Option Plan at the 1997 Annual Meeting of Shareholders (the “1997 ISO Plan”). The 1997 ISO Plan originally provided for the issuance of options to purchase up to 135,418 shares (amount adjusted for 10% stock dividends in 2000 and 2001 and 20% stock dividends in 2004, 2005 and 2007) of the Bank’s common stock. Upon the formation of the Company as the holding company for the Bank during the fourth quarter of 2000, the Company adopted the 1997 ISO Plan. All options to purchase shares of the Bank’s common stock outstanding at the time of the Company’s formation were converted into options to purchase shares of the common stock of the Company. At the 2003 annual meeting, the shareholders approved an amendment to the 1997 ISO Plan that authorized the grant of options on an aggregate of 172,800 additional shares (amount adjusted following 20% stock dividends in 2004, 2005 and 2007) of the common stock of the Company. No further options to purchase shares of the Company’s Common Stock may be granted pursuant to the 1997 ISO Plan. At the 2007 Annual Meeting of Shareholders, the shareholders of the Company approved the 2007 Incentive Stock Option Plan (the “2007 ISO Plan”). The 2007 ISO Plan originally provided for the issuance of options to purchase up to 36,420 shares (amount adjusted for 20% stock dividend in 2007) of the Company’s common stock. The 2007 Incentive Stock Option Plan expired on April 17, 2008. Upon expiration of the 2007 Incentive Stock Option Plan no further options to purchase shares of the Company’s common stock may be granted pursuant to such plan.

The shareholders of the Company approved the 2009 Omnibus Stock Ownership and Long-Term Incentive Plan (the “2009 Omnibus Plan”) at the 2009 annual meeting of shareholders to replace the stock option plans of the Company described above. The 2009 Omnibus Plan authorized the issuance of awards covering 500,000 shares of the Company’s common stock. The awards may be issued in the form of incentive stock option grants, non-qualified stock option grants, restricted stock grants, long-term incentive compensation units, or stock appreciation rights. There were 10,000 incentive stock options granted to Robert T. Braswell, President and CEO, under this plan in 2014.

The following table sets forth information regarding vested and unvested incentive stock options granted to the named executive officers and outstanding as of December 31, 2015.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| Name | | No. of Securities

Underlying

Unexercised Options

Exercisable (1.) | | | No. of Securities

Underlying Unexercised Options

Unexercisable | | | Equity Incentive Plan

Awards; No. of

Securities Underlying

Unexercised

Unearned Options | | | Option

Exercise

Price | | | Option Expiration Date |

| Robert T. Braswell | | | 4,920 | | | | -0- | | | | — | | | $ | 11.65 | | | Dec. 18, 2017 |

| | | | 10,000 | | | | -0- | | | | — | | | | 9.86 | | | July 1, 2019 |

| T. Allen Liles | | | 3,000 | | | | -0- | | | | — | | | | 11.65 | | | Dec. 18, 2017 |

| Daniel D. Hornfeck | | | 3,000 | | | | -0- | | | | — | | | | 11.65 | | | Dec. 18, 2017 |

| J. Richard Spiker, II | | | — | | | | — | | | | — | | | | — | | | — |

| Phillip B. Carmac | | | 1,000 | | | | -0- | | | | — | | | | 11.65 | | | Dec. 18, 2017 |

| (1) | All stock options were vested as of December 31, 2015 |

Transactions with Management

The Bank has had, and expects to have in the future, banking transactions in the ordinary course of business with certain of the Company’s and the Bank’s directors and executive officers and their associates. All loans included in such transactions were made on substantially the same terms, including interest rates, repayment terms and collateral, as those prevailing at the time for comparable transactions with other persons, and do not involve more than the normal risk of collectability or present other unfavorable features.

Loans made by the Bank to directors and executive officers are subject to the requirements of Regulation O of the Board of Governors of the Federal Reserve System. Regulation O requires, among other things, prior approval of the Board of Directors with any “interested director” not participating, dollar limitations on amounts of certain loans and prohibits any favorable treatment being extended to any director or executive officer in any of the Bank’s lending matters.

Proposal 2: Advisory Vote on Executive Compensation

As part of implementing the “say-on-pay” requirements of Section 14A of the Securities Exchange Act of 1934, as amended, the SEC requires a non-binding advisory shareholder vote at the Annual Meeting to approve the Company’s compensation of the named executive officers as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC. Such a proposal, commonly known as a “say-on-pay” proposal, gives shareholders the opportunity to endorse or not to endorse the Company’s executive pay program. Accordingly, in this Proposal 2 our shareholders are given the opportunity to cast an advisory vote on the Company’s executive compensation as described above in this proxy statement. At the 2013 Annual Meeting, the Board of Directors recommended, and the shareholders approved, a non-binding vote in favor of holding an advisory vote on executive compensation every three years. As a result, the Board of Directors determined that the Company will hold an advisory vote on executive compensation every three years. After this year, the next such vote will occur at the 2019 Annual Meeting.

Our Board of Directors has proposed the following resolution for shareholder consideration:

Resolved, that the compensation paid or provided to executive officers of Carolina Bank Holdings, Inc. (the “Company”) and its subsidiary, and the Company’s and its subsidiary’s executive compensation policies and practices, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission in the tabular and narrative compensation disclosures contained in the Company’s proxy statement for the 2016 Annual Meeting, hereby are ratified and approved.

The vote by our shareholders will be a non-binding, advisory vote. The vote will not be binding on our Board of Directors and our Compensation Committee and will not overrule or affect any previous action or decision by the Board or Committee or any compensation previously paid or awarded, and it will not create or imply any additional duty on the part of the Board or Committee. However, the Board and the Compensation Committee will take the voting results on the proposed resolution into account when considering future executive compensation matters.

THEBoard of Directors believes that THE COMPANY’S executive compensation policies and practices are aligned with our shareholders’ interestS and recommends that SHAREHOLDERS vote “For” RATIFICATION OF THE RESOLUTION REGARDING EXECUTIVE COMPENSATION.

PROPOSAL 3: RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has appointed the firm of Elliott Davis Decosimo, PLLC, Certified Public Accountants, as the Company’s independent registered public accounting firm for 2016. The following table sets forth the aggregate fees billed for professional services rendered by Elliott Davis Decosimo, PLLC in connection with the annual audit of the Company’s financial statements for 2015 and 2014 and the aggregate fees billed in 2015 and 2014 for certain other professional services.

AUDIT FEES

| Category | | 2015 | | | 2014 | |

| Audit Fees(1): | | $ | 86,290 | | | $ | 83,750 | |

| Audit-Related Fees(2): | | | 6,700 | | | | 6,700 | |

| Tax Fees(3): | | | 18,305 | | | | 21,040 | |

| All Other Fees(4): | | | 6,020 | | | | — | |

| Total Fees Paid: | | $ | 117,315 | | | $ | 111,490 | |

| (1) | Includes fees associated with the Company’s annual audit and quarterly reviews. |

| (2) | Includes fees associated with the Company’s HUD audit. |

| (3) | Includes fees associated with tax planning, preparation of tax returns, tax research, tax audits and review of other tax-related documents. |

| (4) | Includes fees associated with the Company’s S-1 filing, consultations regarding disclosures and research related to derivatives. |

All services rendered by Elliott Davis Decosimo during 2015 and 2014 were subject to prior approval by the Audit Committee.

A representative of Elliott Davis Decosimo is expected to be present at the Annual Meeting and will have the opportunity to make a statement if they desire to do so and is expected to be available to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” RATIFICATION OFELLIOTT DAVIS DECOSIMO, PLLC AS THE COMPANY’S INDEPENDENT PUBLIC ACCOUNTANTS FOR 2016.

Report of the Audit Committee

The Audit Committee of the Company is responsible for receiving and reviewing the annual audit report of the Company’s independent auditors and reports of examinations by bank regulatory agencies, and helping to formulate, implement, and review the Company’s internal audit programs. The Audit Committee assesses the performance and independence of the Company’s independent auditors and recommends their appointment and retention.

During the course of its examination of the Company’s audit process in 2015, the Audit Committee reviewed and discussed the audited financial statements with management. The Audit Committee also discussed with the independent auditors, Elliott Davis Decosimo, all matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 16,Communication with Audit Committees. Furthermore, the Audit Committee received from Elliott Davis Decosimo written disclosures and correspondence regarding their independence required by applicable requirements of the Public Company Accounting Oversight Board and discussed with Elliott Davis Decosimo their independence with regard to the Company and the Bank.

Based on the review and discussions above, the Audit Committee: (i) recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, for filing with the SEC; and (ii) recommended that shareholders ratify the appointment of Elliott Davis Decosimo, PLLC as auditors for 2016. The Audit Committee has considered whether the principal accountant’s provision of certain non-audit services to the Company is compatible with maintaining the independence of Elliott Davis Decosimo. The Audit Committee has determined that the provision of such services is compatible with maintaining the independence of Elliott Davis Decosimo, PLLC.

This report is submitted by the Audit Committee:

James E. Hooper

Donald H. Allred

Gary N. Brown

Michael F. Bumpass

J. Edward Kitchen

Kim A. Thompson

OTHER MATTERS

The Board of Directors knows of no other business that will be brought before the Annual Meeting. Should other matters be properly presented for action at the Annual Meeting, the Proxies, or their substitutes will be authorized to vote shares represented by appointments of proxy according to their best judgment.

PROPOSALS FOR 2017 ANNUAL MEETING

It is anticipated that the 2017 Annual Meeting will be held on a date during May 2017. Any proposal of a shareholder which is intended to be presented at the 2017 Annual Meeting must be received by the Company at its main office in Greensboro, North Carolina no later than December 8, 2016, in order that such proposal be timely received for inclusion in the proxy statement and appointment of proxy to be issued in connection with that meeting. If a proposal for the 2017 Annual Meeting is not expected to be included in the proxy statement for that meeting, the proposal must be received by the Company by February 21, 2017, for it to be timely received for consideration. The Company will use its discretionary authority for any proposals received thereafter.

Internet and Electronic Availability of Proxy Materials

As required by applicable SEC rules and regulations, the Company has furnished a notice of internet availability of proxy materials to all shareholders as part of this Proxy Statement and all shareholders will have the ability to access this Proxy Statement and the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2015, as filed with the SEC, by logging on at https://www.carolinabank.com.

SHAREHOLDER COMMUNICATIONS

The Company does not currently have a formal policy regarding shareholder communications with the Board of Directors; however, any shareholder may submit written communications to T. Allen Liles, Secretary and Treasurer, Carolina Bank Holdings, Inc., 101 North Spring Street, Greensboro, North Carolina 27401, and such communications will be forwarded to the Board of Directors as a group or to the individual director or directors addressed.

ADDITIONAL INFORMATION

A COPY OF THE COMPANY’S 2015 ANNUAL REPORT ON FORM 10-K WILL BE PROVIDED WITHOUT CHARGE TO ANY SHAREHOLDER ENTITLED TO VOTE AT THE ANNUAL MEETING UPON THAT SHAREHOLDER’S WRITTEN REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO T. ALLEN LILES, SECRETARY AND TREASURER, CAROLINA BANK HOLDINGS, INC.,101 North SPRING STREET, GREENSBORO, NORTH CAROLINA 27401.