Southeast Super-Community Bank

Conference

February 3, 2004

Forward-Looking Statements

This presentation may contain, in addition to historical information, various “forward looking statements” that represent our judgment concerning the future and are subject to risks and uncertainties that could cause Carolina Bank Holdings’ actual operating results and financial position to differ materially from those projected in the forward looking statements. Such forward looking statements can be identified by the use of forward looking terminology, such as, “may,” “will,” “expect,” “anticipate,” “estimate,” or “continue,” or the negative thereof or other variations thereof or comparable terminology. We undertake no obligation to update any forward looking statements to reflect events or circumstances arising after the date of this presentation.

Overview

• Opened in November 1996

• Single bank holding company offering traditional banking to individuals and small to medium sized businesses.

• Four branches (3 in Greensboro, 1 in Asheboro)

• Issued 805,000 shares in December 2002

• 1.873 million shares outstanding

• Stock Symbol CLBH ( Nasdaq Small Cap)

• Inside ownership 12.42%

• Management:

– Robert T. Braswell—CEO

– Allen Liles – CFO

– Gunnar N. R. Fromen—Senior Loan Officer

– Daniel Hornfeck – Chief Credit Officer

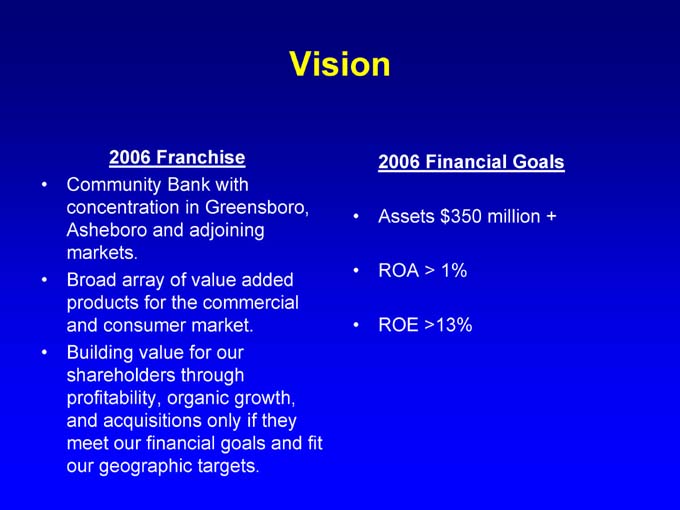

Vision

2006 Franchise

• Community Bank with

concentration in Greensboro,

Asheboro and adjoining

markets.

• Broad array of value added

products for the commercial

and consumer market.

• Building value for our

shareholders through

profitability, organic growth,

and acquisitions only if they

meet our financial goals and fit

our geographic targets.

2006 Financial Goals

• Assets $350 million +

• ROA > 1%

• ROE >13%

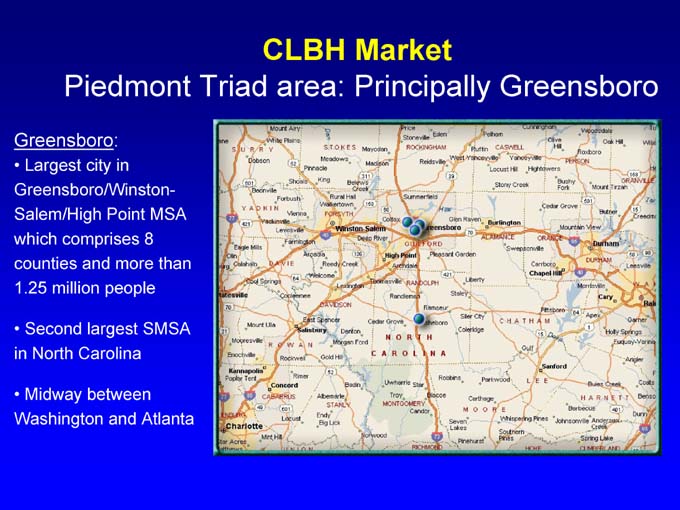

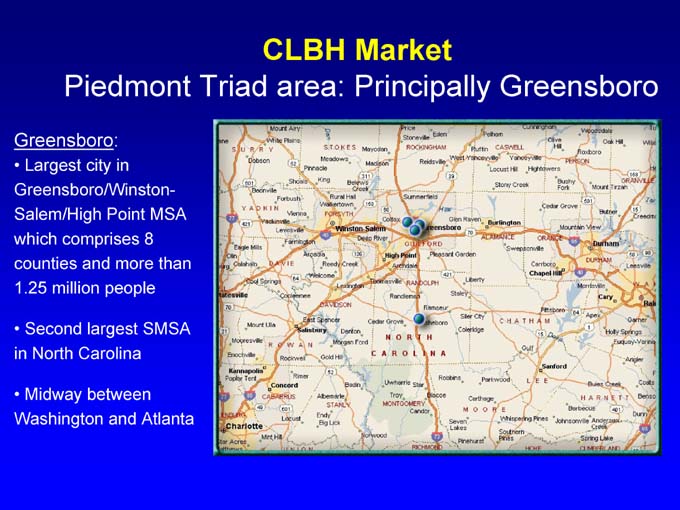

CLBH Market

Piedmont Triad area: Principally Greensboro

Greensboro:

• Largest city in Greensboro/Winston-Salem/High Point MSA which comprises 8 counties and more than 1.25 million people

• Second largest SMSA in North Carolina

• Midway between Washington and Atlanta

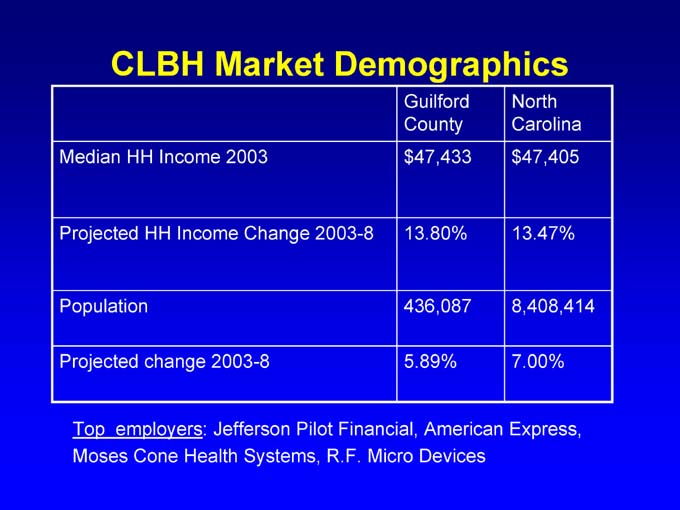

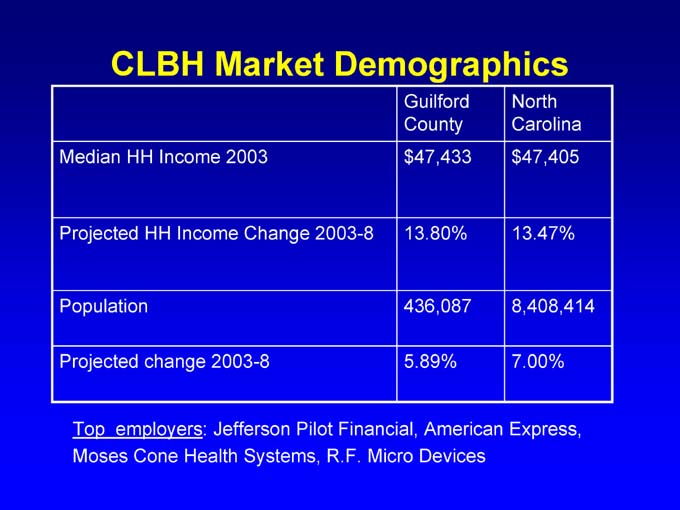

CLBH Market Demographics

Guilford North

County Carolina

Median HH Income 2003 $47,433 $47,405

Projected HH Income Change 2003-8 13.80% 13.47%

Population 436,087 8,408,414

Projected change 2003-8 5.89% 7.00%

Top employers: Jefferson Pilot Financial, American Express, Moses Cone Health Systems, R.F. Micro Devices

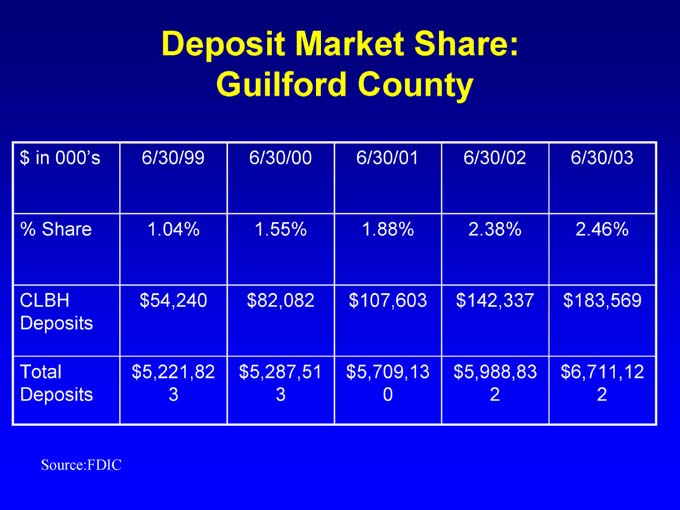

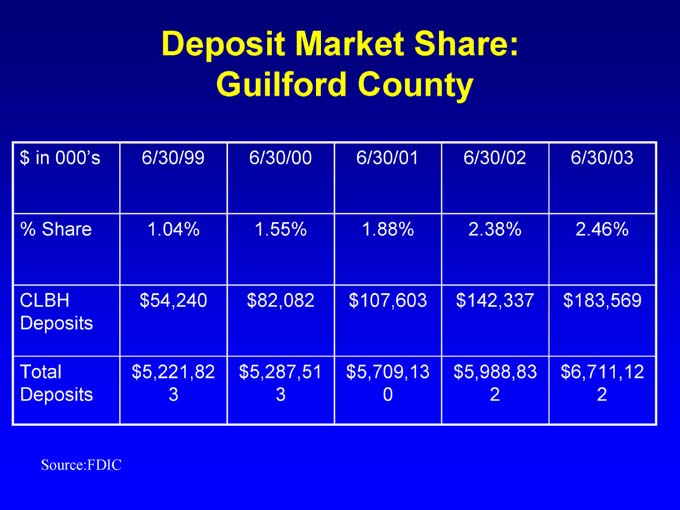

Deposit Market Share: Guilford County

$ in 000’s 6/30/99 6/30/00 6/30/01 6/30/02 6/30/03

% Share 1.04% 1.55% 1.88% 2.38% 2.46%

CLBH $54,240 $82,082 $107,603 $142,337 $183,569

Deposits

Total $5,221,823 $5,287,513 $5,709,130 $5,988,832 $6,711,122

Deposits

Source:FDIC

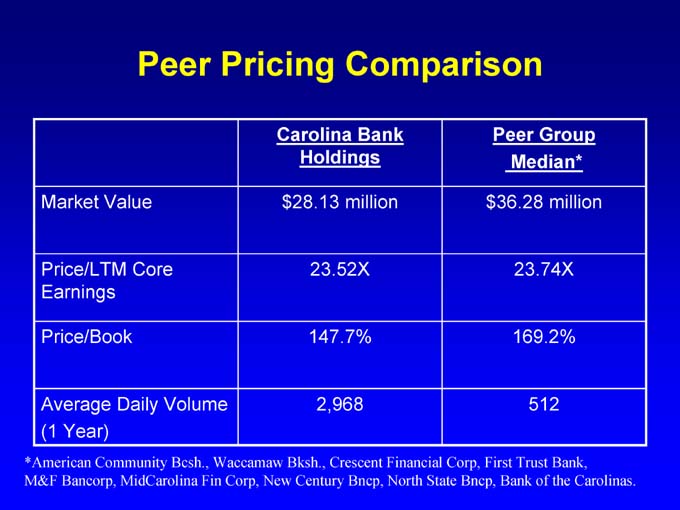

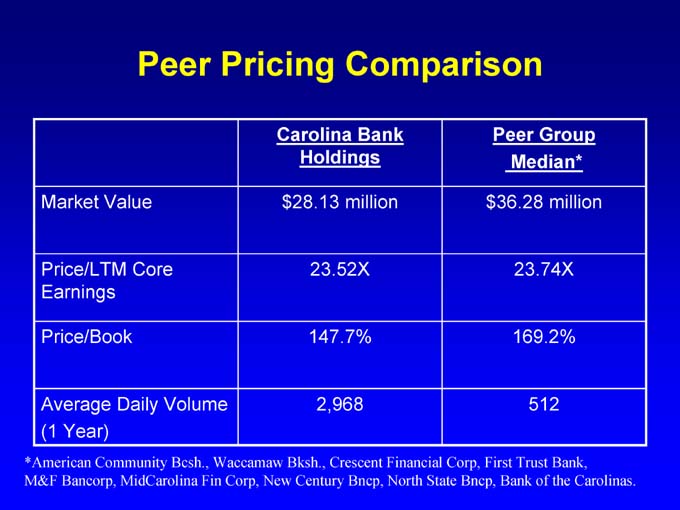

Peer Pricing Comparison

Carolina Bank Peer Group

Holdings Median*

Market Value $28.13 million $36.28 million

Price/LTM Core 23.52X 23.74X

Earnings

Price/Book 147.7% 169.2%

Average Daily Volume 2,968 512

(1 Year)

*American Community Bcsh., Waccamaw Bksh., Crescent Financial Corp, First Trust Bank, M&F Bancorp, MidCarolina Fin Corp, New Century Bncp, North State Bncp, Bank of the Carolinas.

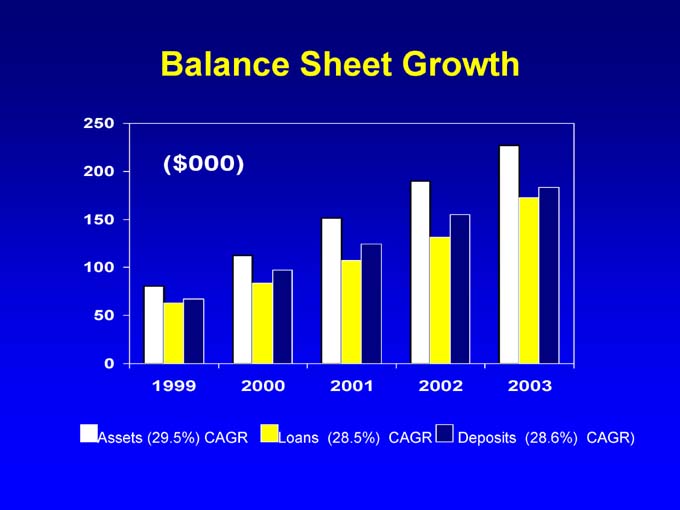

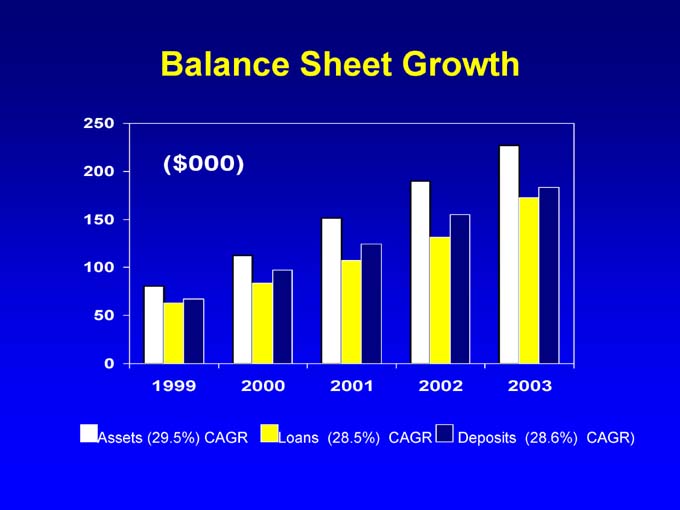

Balance Sheet Growth

Assets (29.5%) CAGR

Loans (28.5%) CAGR

Deposits (28.6%) CAGR)

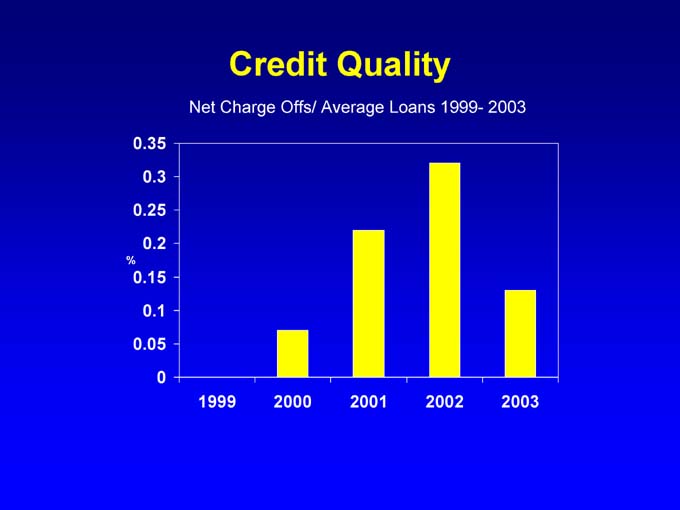

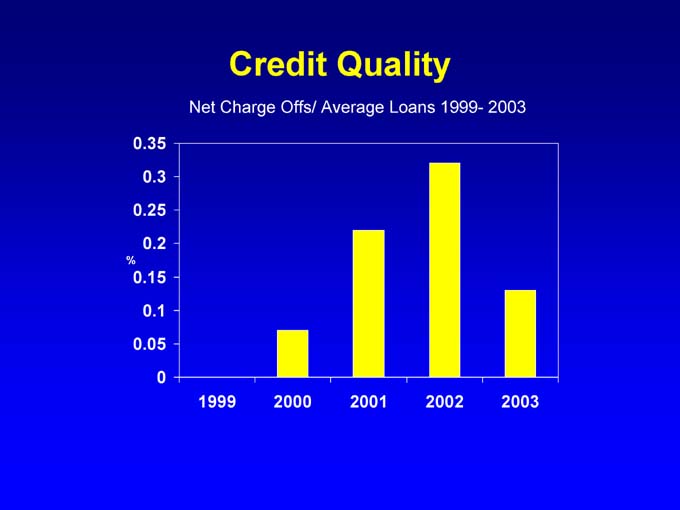

Credit Quality

Net Charge Offs/ Average Loans 1999- 2003

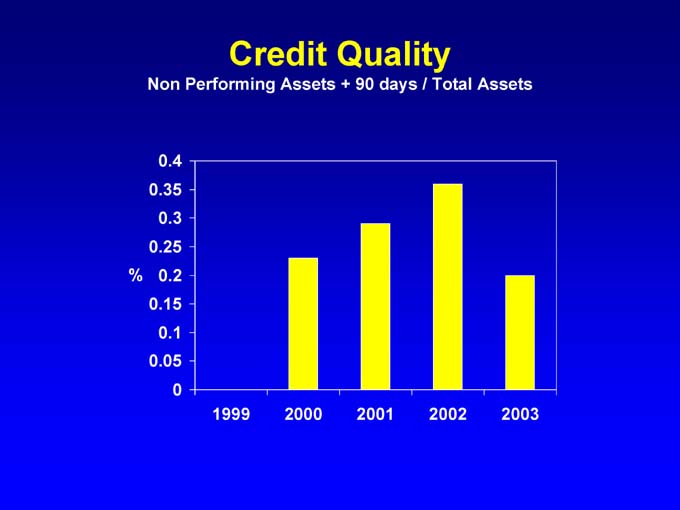

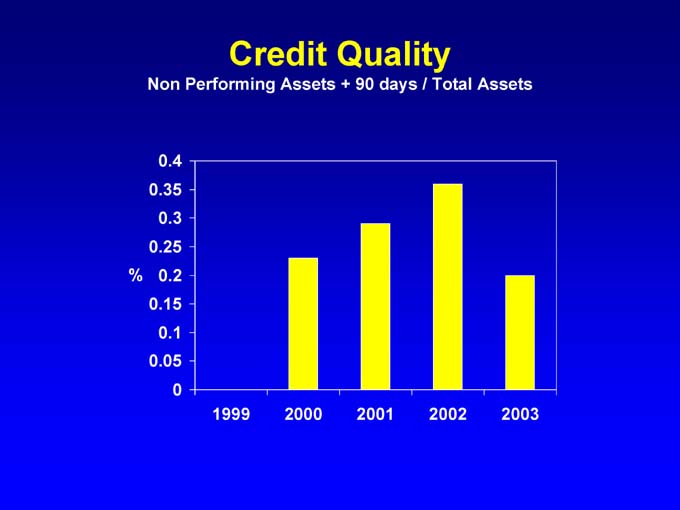

Credit Quality

Non Performing Assets + 90 days / Total Assets

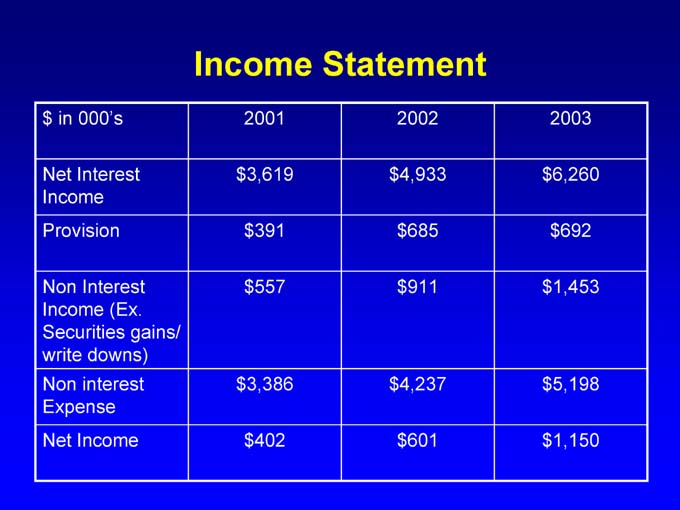

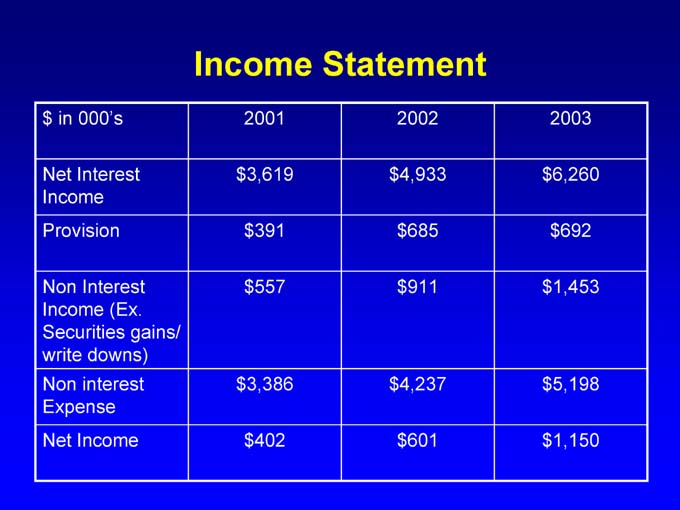

Income Statement

$ in 000’s 2001 2002 2003

Net Interest $3,619 $4,933 $6,260

Income

Provision $391 $685 $692

Non Interest $557 $911 $1,453

Income (Ex.

Securities gains/

write downs)

Non interest $3,386 $4,237 $5,198

Expense

Net Income $402 $601 $1,150

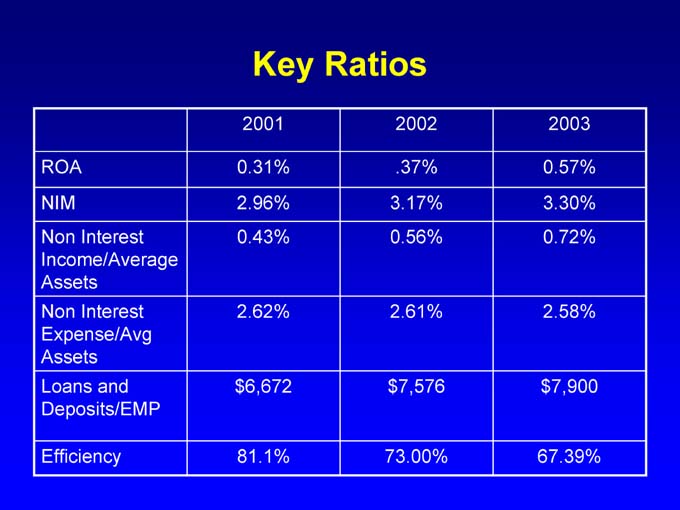

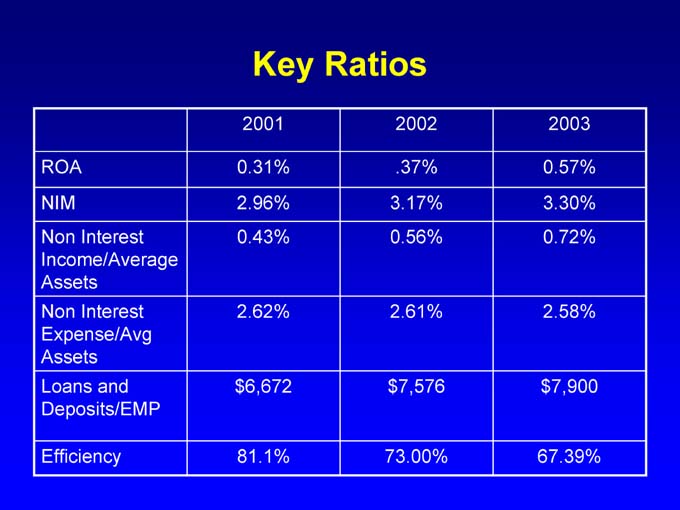

Key Ratios

2001 2002 2003

ROA 0.31% .37% 0.57%

NIM 2.96% 3.17% 3.30%

Non Interest 0.43% 0.56% 0.72%

Income/Average

Assets

Non Interest 2.62% 2.61% 2.58%

Expense/Avg

Assets

Loans and $6,672 $7,576 $7,900

Deposits/EMP

Efficiency 81.1% 73.00% 67.39%

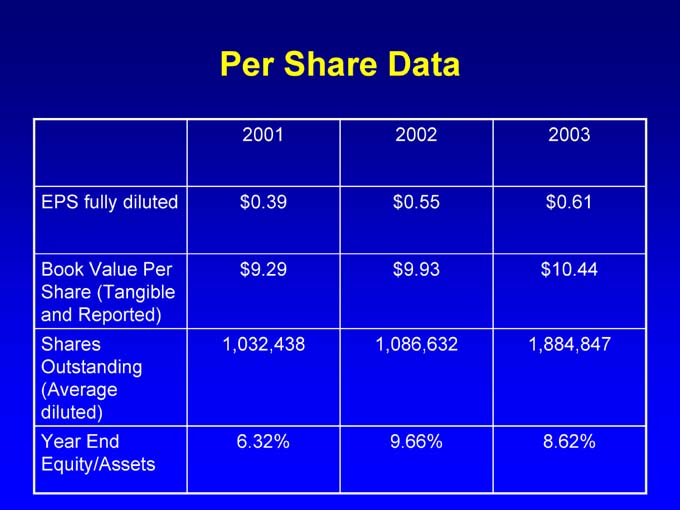

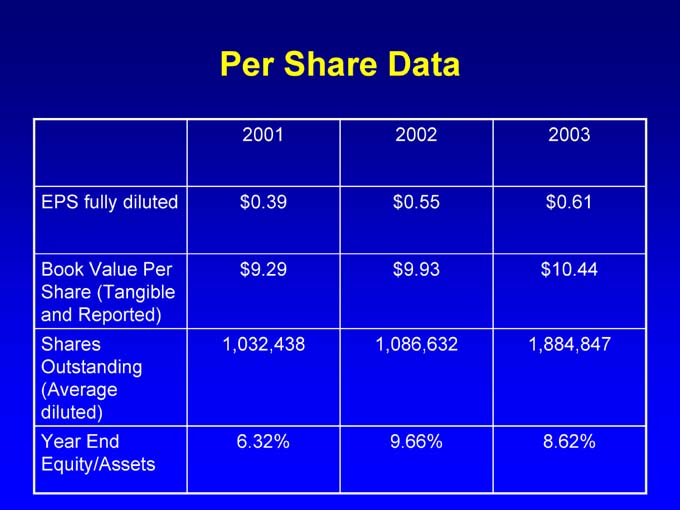

Per Share Data

2001 2002 2003

EPS fully diluted $0.39 $0.55 $0.61

Book Value Per $9.29 $9.93 $10.44

Share (Tangible

and Reported)

Shares 1,032,438 1,086,632 1,884,847

Outstanding

(Average

diluted)

Year End 6.32% 9.66% 8.62%

Equity/Assets

Summary

• Located in the second largest SMSA in North Carolina

• Targeting the most attractive communities for future growth

• Despite the demise of traditional industries in our area, we have achieved strong growth, excellent credit quality and improving profitability.

• Highly attractive well-capitalized community bank

• Strong, seasoned management team (101 years of experience)

• Significant growth potential in EPS and market share