MANAGEMENT INFORMATION CIRCULAR

On a quarterly basis, the Board receives and reviews a risk dashboard, prepared by the Company’s Enterprise Risk Management Committee. The risk dashboard identifies strategic risks, and includes management action plans for the highest risks. Further, a comprehensive and ongoing risk assessment is part of every project the Company undertakes. The Board is also responsible for reviewing Emera’s annual insurance program, its uninsured exposure, and its business continuity and disaster recovery plans.

The Board also annually evaluates the operation and effectiveness of the Board of Directors, its Committees and the Chair of the Board. In the course of that evaluation, the question of whether the Board has examined the key risks to the Company’s strategy and business plan is assessed. More information about this process is set forth underBoard and Director Performance Assessments in the Circular.

The Board has delegated certain risk oversight to the Committees as set forth in their Charters. Notwithstanding such delegation, the Board retains its oversight function and ultimate responsibility for these delegated functions.

Nominating and Corporate Governance Committee (NCGC)

The NCGC has responsibility for overseeing the development of a risk management framework and assisting the Board in determining the proper and effective allocation of risk oversight responsibilities.

Management Resources and Compensation Committee (MRCC)

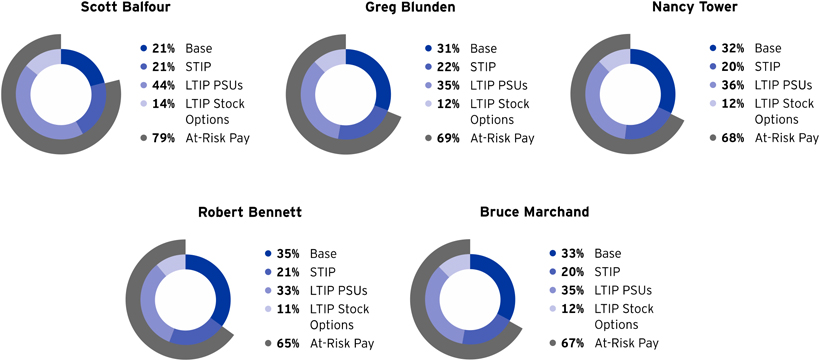

The MRCC is responsible for evaluating the compensation programs to determine that they do not reward executive officers for taking inappropriate risks that may harm the interests of the Company and its Shareholders. The Committee conducts a compensation risk review annually to ensure that the compensation policies are designed to take account of and mitigate (a) the incentive opportunities that inadvertently encourage excessive and unnecessary risk taking, (b) pay structures that inadvertently encourage behaviour that destroys long-term value, (c) pay and performance not appropriately aligned, and (d) payouts which are not aligned with Emera’s business strategy.

Audit Committee

The Audit Committee of the Board of Directors assists the Board in discharging its oversight responsibilities concerning the integrity of Emera’s financial statements, its internal control systems, the internal audit and assurance process, the external audit process and its compliance with legal and regulatory requirements. The Audit Committee has oversight responsibilities for trading and credit risk. It receives the annual update on trading and credit risk activities, and reports to the Board.

Health, Safety and Environment Committee (HSEC)

The HSEC is mandated to review actions taken by the Company to identify and manage risks related to health, safety and environmental matters which may have the potential to adversely impact the Company’s operations, employees, strategy or reputation.

Operating Subsidiaries Boards of Directors

Oversight of risk management also occurs at the level of operating subsidiary boards of directors, most of which include independent directors that are not part of Emera’s or the operating subsidiary’s management team.

Committees of the Board of Directors

The Board is committed to effectively and efficiently carrying out its oversight responsibilities. As such, it strongly supports the work of its four standing Committees, to which certain functions are delegated as set forth in the written charters. The Board Committees are:

| (b) | the Health, Safety and Environment Committee (“HSEC”); |

| (c) | the Management Resources and Compensation Committee (“MRCC”); and |

| (d) | the Nominating and Corporate Governance Committee (“NCGC”). |

From time to time the Board may establish ad hoc committees.

Audit Committee

The Audit Committee is comprised of:

Chair:Ms. Rosen

Members:Mr. Eisenhauer, Mr. Harvey, Ms. Loewen and Mr. Tilk

The Audit Committee assists the Board in discharging its oversight responsibilities concerning the integrity of Emera’s financial statements, its internal control systems, the internal audit and assurance process, the external audit process and its compliance with legal and regulatory requirements.

The Committee consists of independent Directors only, who each have a high degree of financial acumen. The Committee is responsible for reviewing and recommending to the Board the annual and interim financial statements and all related management discussion and analysis.

The Committee evaluates and recommends to the Board the appointment of the external auditors and the compensation of such external auditors. Once appointed, the external auditors report directly to the Committee, and the Committee oversees the work of the external auditors concerning the preparation or issuance of the Auditors’ Report or the performance of other audit, review or attest services for Emera.

The Committee reviews and discusses Emera’s major financial risk exposures and the policy steps management has taken to monitor and control such exposures, including the use of financial derivatives, hedging activities, credit and trading risks, and cybersecurity.

The Committee reviews management controls and processes concerning the administration of investment activities, financial reporting, and financial performance and funding of the pension plans. The Company’s internal auditor also reports directly to the Audit Committee, and the Committee oversees the appointment, replacement or termination of the internal auditor.

For the full text of the Audit Committee Charter, visit www.emera.com/governance.

Emera Inc. — Management Information Circular 2019 33