QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1

CONTACT:

James C. Christodoulou

Chief Financial Officer

General Maritime Corporation

(212) 763-5614

GENERAL MARITIME CORPORATION ANNOUNCES

FOURTH QUARTER AND FULL YEAR 2002 FINANCIAL RESULTS

Receives Commitment For $450 Million In Bank Financing To Acquire 19

Tankers From Metrostar Management Corporation

New York, New York, February 26, 2003—General Maritime Corporation (NYSE: GMR) today reported its financial results for the three months and full year ended December 31, 2002.

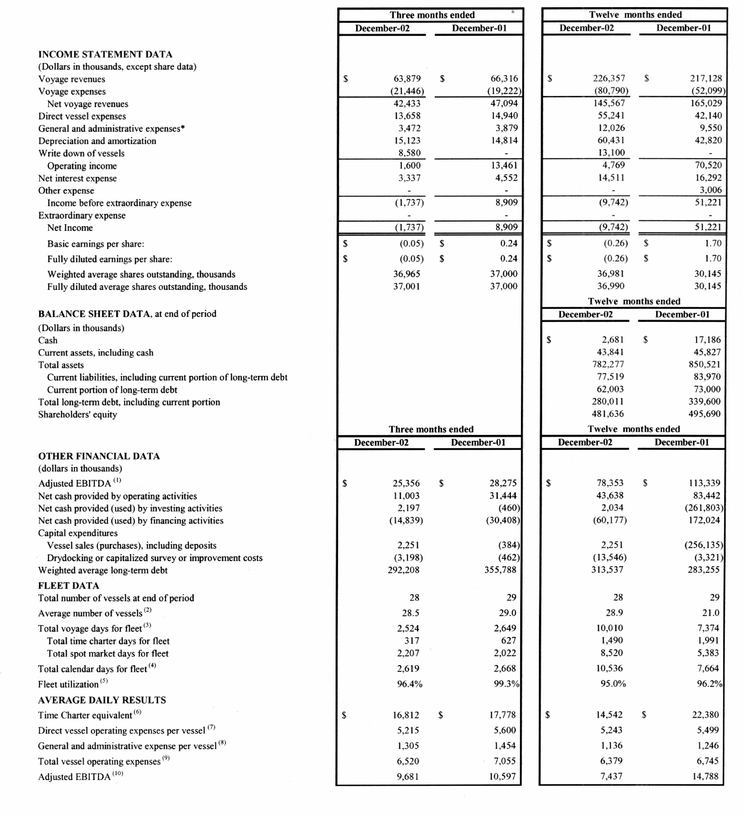

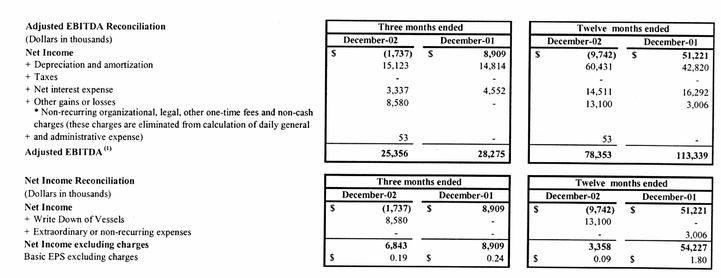

Financial Review: 2002 Fourth Quarter

The Company had a loss of $1.7 million, or $0.05 basic and fully diluted loss per share, for the three months ended December 31, 2002 compared to net income of $8.9 million, or $0.24 basic and fully diluted earnings per share, for the prior year period. This loss is due to a $8.6 million non-cash expense during the fourth quarter 2002 in connection with the Company's decision to write down the book value of two vessels when these vessels were reclassified from long-term assets to available for sale. The expense represents the difference between the book value of the vessels as of December 31, 2002 and the estimated proceeds from their sale anticipated to occur during 2003. Excluding this non-cash expense, the Company would have had net income of $6.8 million, or $0.19 basic earnings per share, for the fourth quarter 2002 (see Summary Consolidated Financial and Other Data). The weighted average number of basic shares used in the computation was 36,964,770 for the three months ended December 31, 2002 and 37,000,000 for the prior year period.

Peter C. Georgiopoulos, Chairman, Chief Executive Officer and President, commented, "General Maritime and the tanker industry were confronted with many challenges in 2002. During the year we continued to make the operational and strategic decisions necessary to position the Company for long-term success and profitability. We operated our vessels and worked diligently to enhance the strength of our balance sheet while maintaining our intense focus on cost containment. Our financial strength and flexibility enabled us, in January 2003, to enter into an agreement to acquire 19 tankers from Metrostar Management Corporation, a world-class quality operator of tankers."

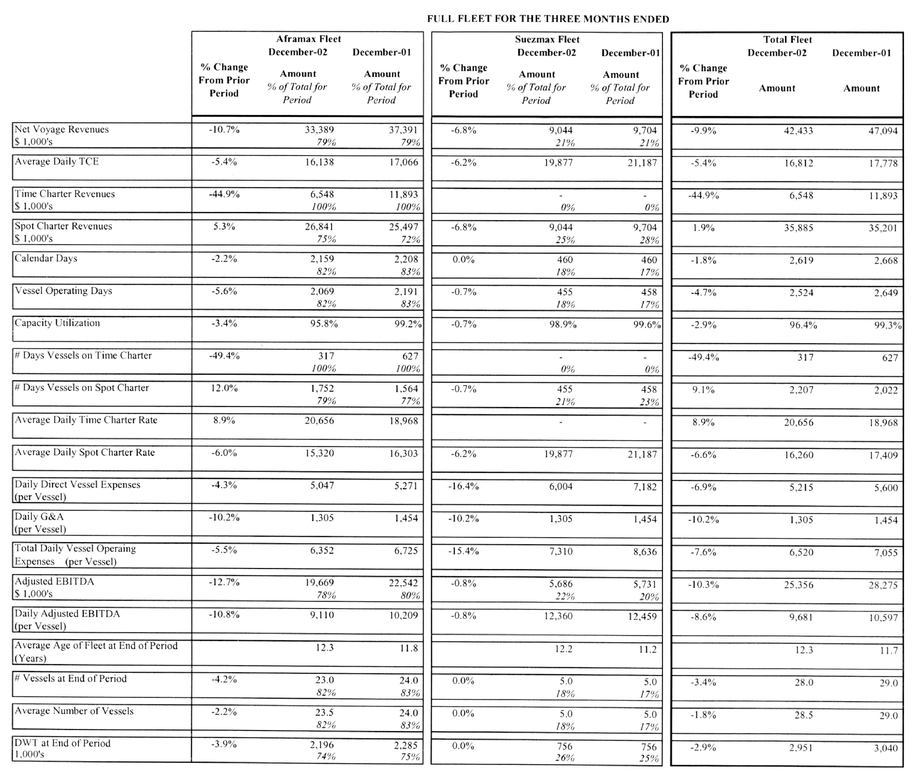

Net voyage revenue, which is gross voyage revenues minus voyage expenses unique to a specific voyage (including port, canal and fuel costs), was $42.4 million for the three months ended December 31, 2002 compared to $47.1 million for the prior year period. Net voyage revenues during the fourth quarter, although weaker than the prior year quarter, improved from the prior quarter and have shown continued strength thus far in 2003. The Company's average time charter equivalent, or TCE6 rate for the fleet was $16,812 per vessel day for the fourth quarter 2002 as compared to $17,778 per vessel day for the prior year quarter.

Total vessel operating expenses, which are vessel operating expenses and general and administrative expenses, decreased 9.0% to $17.1 million for the three months ended December 31, 2002 from $18.8 million for the prior year period. During the same periods, the average size of General

Maritime's fleet decreased 1.8% to 28.5 vessels from 29.0 vessels as a result of our sale of theStavanger Prince during the fourth quarter 2002. Total daily vessel operating expenses decreased to $6,520 per vessel day during the fourth quarter of 2002 from $7,055 per vessel day during the prior year quarter. This decrease is the result of several factors: the timing of purchases, repairs and services during the fourth quarter 2002 compared to the prior year period, the completion of the integration of 10 vessels which the Company acquired after its initial public offering during the third quarter of 2001, and the elimination of many corporate overhead expenses which the company incurred as a result of its initial public offering and vessel acquisitions during the fourth quarter 2001 which were not incurred during the fourth quarter 2002. Adjusted EBITDA1 for the three months ended December 31, 2002 was $25.3 million compared to $28.3 million for the prior year quarter.

James Christodoulou, Vice President and Chief Financial Officer added, "The overall non-cash expense associated with the vessel asset reclassification of theKentucky andWest Virginia and final adjustments to our sale of theStavanger Prince is $8.6 million or $0.23 per share, which is reflected in our fourth quarter 2002 results. This reclassification, which is being done in anticipation of selling the vessels during 2003, will eliminate approximately $9.0 million in depreciation and amortization expenses over their anticipated remaining service life, $3.0 million during 2003, $3.0 million during 2004, $2.9 million during 2005 and $0.1 million during 2006. We will continue to operate these vessels until they are sold and expect that in addition to generating cash flow from their operation, their sale will also have a positive cash flow effect. This positive cash flow effect is based on eliminating the need to pay for the next drydockings of the vessels during 2003 as well as from the proceeds of their sale. In accordance with our current loan agreements, at the time of the sale we will be obliged to repay approximately $3.8 million in long term debt associated with the vessels and reduce the amount we can draw under our revolving credit facility by approximately $2.9 million."

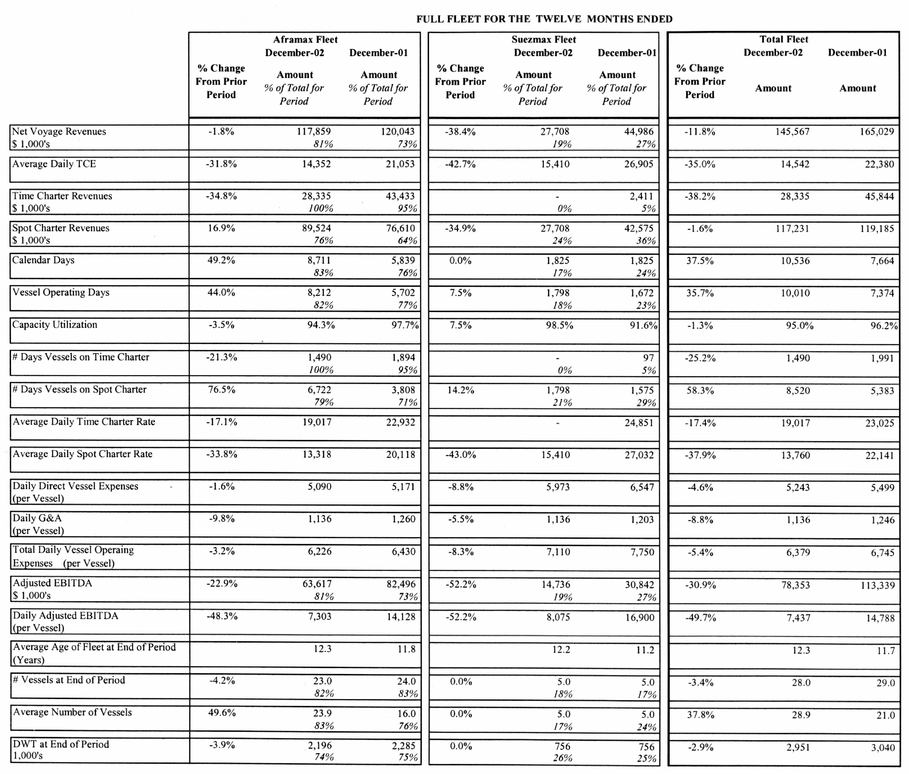

Financial Review: Year 2002

Net loss was $9.7 million, or $0.26 basic loss per share for 2002 compared to net income of $51.2 million, or $1.70 basic earnings per share, for 2001. The 2002 results include a non-cash expense of $4.2 million associated with the write down in book value of theStavanger Prince in connection with the retirement of the vessel and its sale for scrap, and a non-cash expense of $8.9 million associated with the write down in book value of theKentucky andWest Virginia in connection with the Company's reclassification of these vessels from long term assets to available for sale in anticipation for their sale during 2003. The 2001 results include a non-recurring expense of $3.0 million, which occurred during the second quarter of 2001. $1.2 million of this expense is related to the write off of remaining capitalized loan costs associated with prior loans to the Company's predecessors, which were refinanced in connection with the Company's initial public offering in June 2001. $1.8 million of this expense is related to the termination of interest rate swap agreements associated with some of the prior loans to the Company. Excluding the expense associated with theStavanger Prince,Kentucky andWest Virginia and the two expense items incurred during 2001 described above, the Company would have had net income of $3.4 million or $0.09 basic earnings per share for 2002 and $54.2 million or $1.80 basic and fully diluted earnings per share for 2001 (see Summary Consolidated Financial and Other Data). The weighted average number of shares used for the computation was 36,980,600 for 2002 and 30,144,709 for the 2001. Net voyage revenue was $145.6 million for 2002 compared to $165.0 million for 2001. Adjusted EBITDA was $78.4 million for 2002 compared to $113.3 million for 2001.

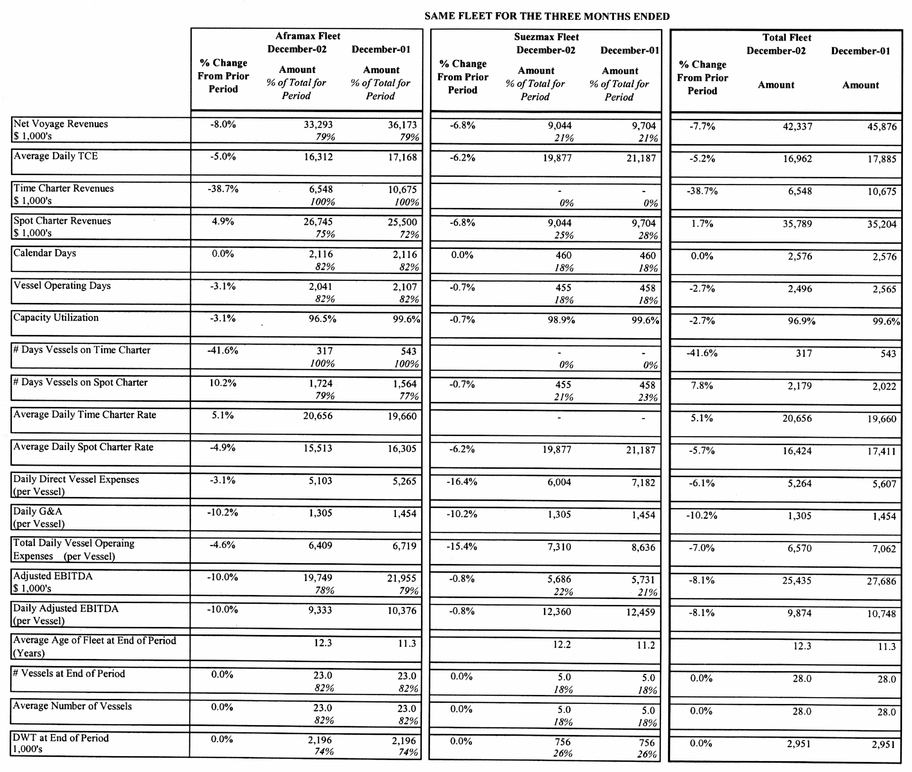

Same Fleet Financial and Operational Review

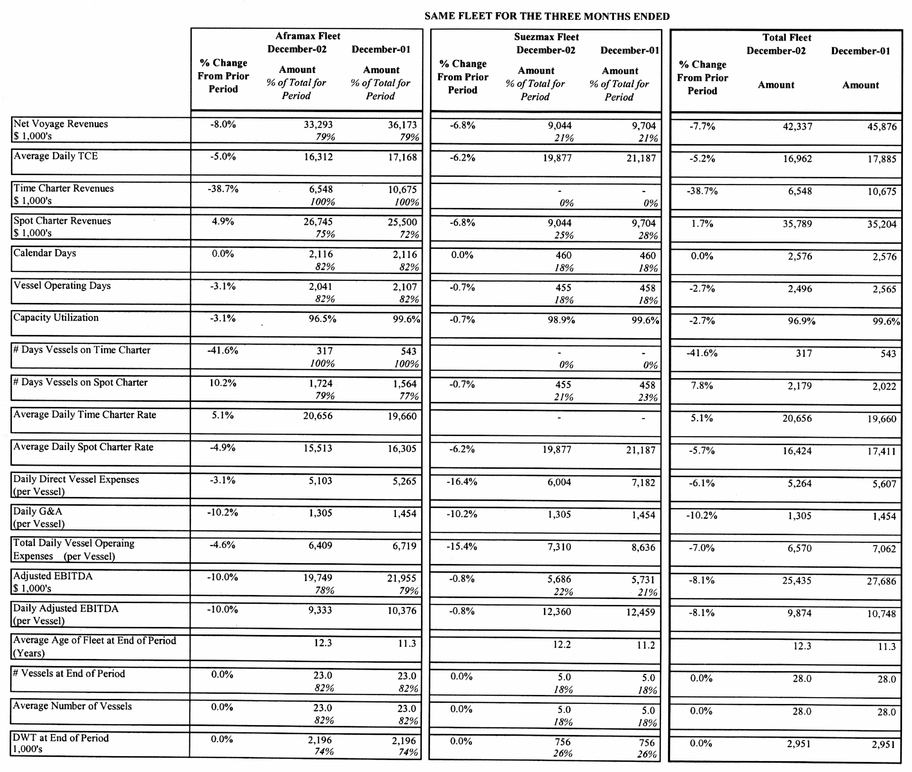

General Maritime Corporation uses "Same Fleet" data to compare financial and operational results from those vessels that were part of the Company's fleet for the complete periods under comparison.

Same Fleet net voyage revenue for the three months ended December 31, 2002 was $42.3 million compared to Same Fleet net voyage revenue of $45.9 million for the prior year period, which reflected lower average tanker spot market rates for the three months ended December 31, 2002 compared to the prior year period. Same Fleet total vessel operating expenses decreased 6.6% to $17.0 million or

$6,560 per vessel day for the three months ended December 31, 2002 compared to $18.2 million or $7,062 per vessel day for the prior year period primarily as a result of the timing of purchases, repairs and services during the fourth quarter 2002 compared to the prior year period. Same Fleet Adjusted EBITDA for the three months ended December 31, 2002 was $25.4 million compared to $27.7 million for the prior year period. The Same Fleet was comprised of 28 vessels, 23 Aframax and 5 Suezmax, for the three months ended December 31, 2002 and 2001.

Same Fleet net voyage revenue for 2002 was $79.8 million compared to Same Fleet net voyage revenue of $124.7 million for 2001, which reflected lower average tanker spot market rates for the 2002 compared to 2001. Same Fleet total vessel operating expenses decreased 3.9% to $34.8 million or $6,801 per vessel day for 2002 compared to $36.2 million or $7,093 per vessel day for 2001 primarily as a result of the timing of purchases, repairs and services during 2002 compared to the prior year. Same Fleet Adjusted EBITDA for 2002 was $45.0 million compared to $88.4 million for 2001. The Same Fleet was comprised of 14 vessels, 9 Aframax and 5 Suezmax, for the years 2002 and 2001.

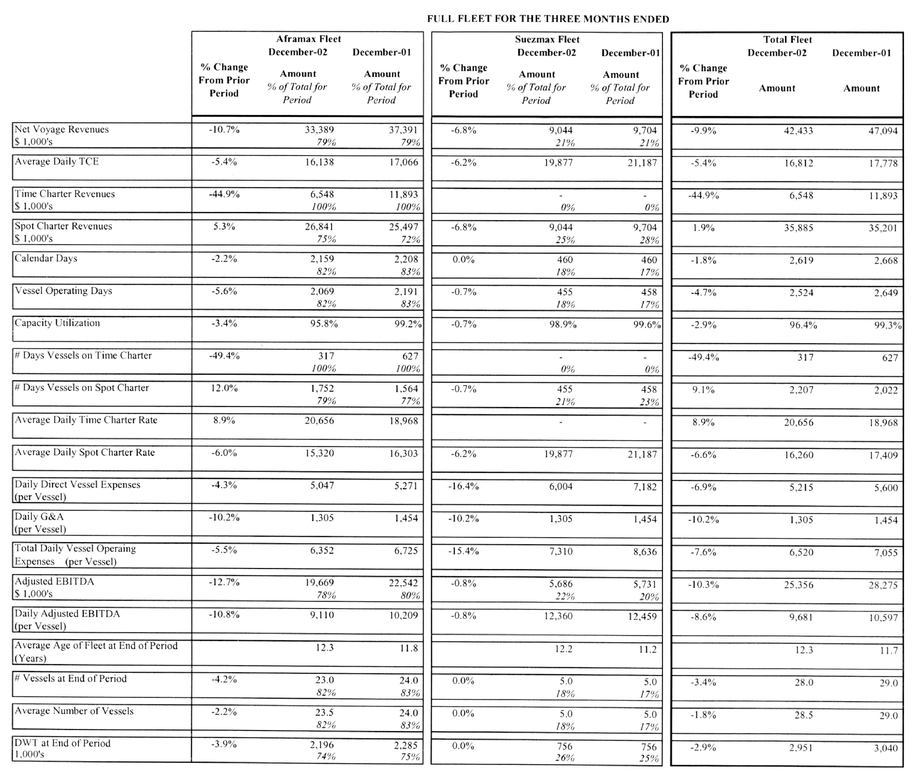

Average Daily Time Charter and Spot Rate Review

The average daily time charter equivalent, or TCE, rates obtained by the Company's full fleet decreased by 5.4% to $16,812 per day for the three months ended December 31, 2002 from $17,778 for the prior year period. Average daily rates for vessels on time charter decreased 8.9% to $20,656 and average daily rates for vessels on spot market voyage charters decreased by 6.6% to $16,260 for the three months ended December 31, 2002 compared to $18,968 and $17,409 respectively for the prior year period.

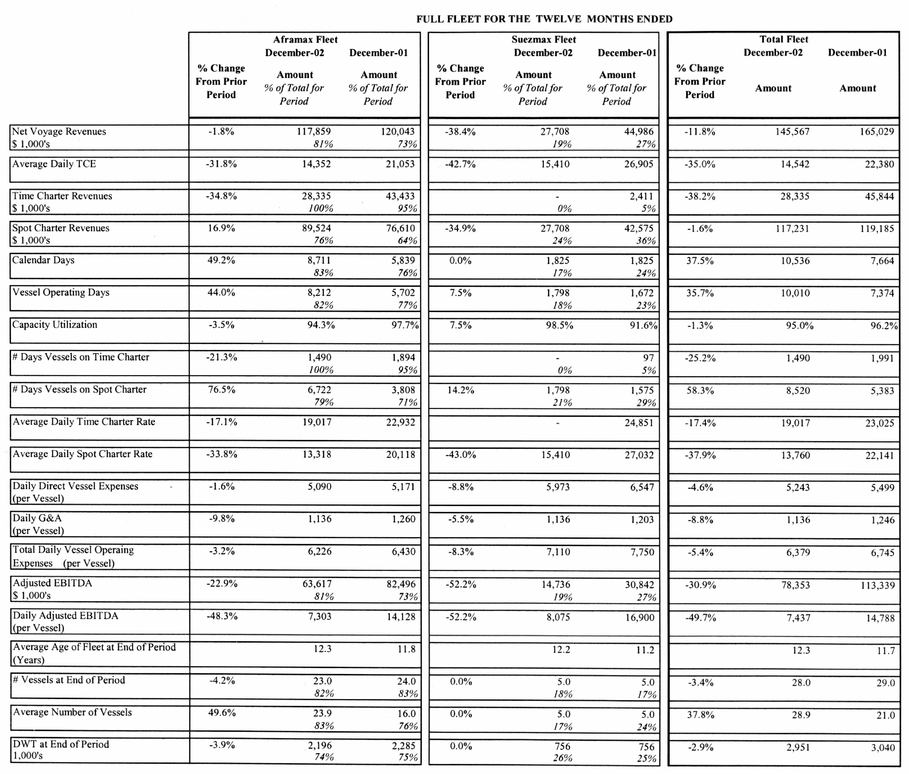

TCE rates obtained by the Company's full fleet decreased by 35.0% to $14,542 per day for 2002 from $22,380 for 2001. Average daily rates for vessels on time charter decreased 17.4% to $19,017 and average daily rates for vessels on spot market voyage charters decreased by 37.9% to $13,760 for 2002 compared to $23,025 and $22,141 respectively for 2001.

Mr. Georgiopoulos continued, "General Maritime's strategic decision in early 2002 to accelerate our drydocking schedule underscores our commitment to effectively manage the Company's fleet. The drydocking decision was driven by the goal of making a greater number of our tankers available for utilization later in the year, in anticipation of a market recovery and higher spot rates. With a majority of our vessels trading in the spot market, we were well positioned to take advantage of the stronger rate environment that developed in the fourth quarter of 2002."

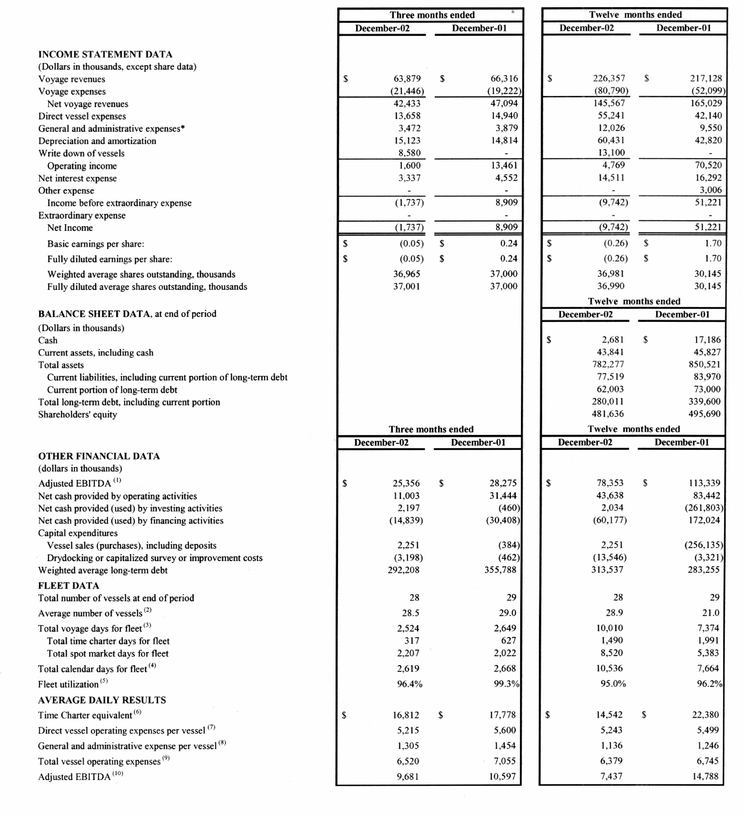

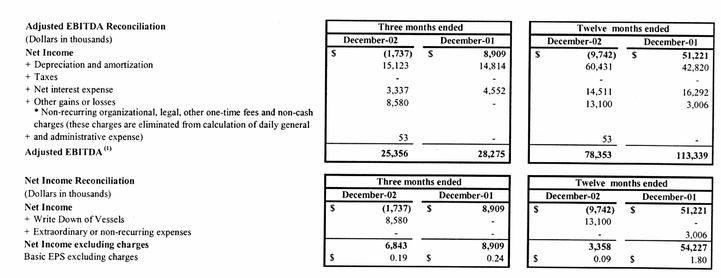

Summary Consolidated Financial and Other Data

The following table summarizes General Maritime Corporation's selected consolidated financial and other data for the three months and year ended December 31, 2002 and 2001. Attached to this press release is an Appendix, which contains additional financial, operational and other data for the three months and year ended December 31, 2002 and 2001.

- (1)

- Adjusted EBITDA represents net voyage revenues less direct vessel expenses and general and administrative expenses excluding non-cash or one-time charges as well as other income or expenses. Adjusted EBITDA is included because it is used by certain investors to measure a company's financial performance. Adjusted EBITDA is not an item recognized by GAAP, and should not be considered as an alternative to net income or any other indicator of a company's performance required by GAAP. The definition of Adjusted EBITDA used here may not be comparable to that used by other companies.

- (2)

- Average number of vessels is the number of vessels that constituted our fleet for the relevant period, as a measured by the sum of the number of days each vessels was part of our fleet during the period divided by the number of calendar days in that period.

- (3)

- Voyage days for fleet are the total days our vessels were in our possession for the relevant period net of off hire days associated with major repairs, drydocks or special or intermediate surveys.

- (4)

- Calendar days are the total days the vessels were in our possession for the relevant period including off hire days associated with major repairs, drydockings or special or intermediate surveys.

- (5)

- Fleet utilization is the percentage of time that our vessels were available for revenue generating voyage days, and is determined by dividing voyage days by calendar days for the relevant period.

- (6)

- Time Charter Equivalent, or TCE, is a measure of the average daily revenue performance of a vessel on a per voyage basis. Our method of calculating TCE is consistent with industry standards and is determined by dividing net voyage revenue by voyage days for the relevant time period. Net voyage revenues are voyage revenues minus voyage expenses. Voyage expenses primarily consist of port, canal and fuel costs that are unique to a particular voyage, which would otherwise be paid by the charterer under a time charter contract.

- (7)

- Daily direct vessel operating expenses, or DVOE, is calculated by dividing DVOE, which includes crew costs, provisions, deck and engine stores, lubricating oil, insurance, maintenance and repairs, by calendar days for the relevant time period.

- (8)

- Daily general and administrative expense is calculated by dividing general and administrative expenses, adjusted to exclude non-recurring organizational, legal, other one-time fees and non-cash expenses, by calendar days for the relevant time period.

- (9)

- Total Vessel Operating Expenses, or TVOE, is a measurement of our total expenses associated with operating our vessels. Daily TVOE is the sum of daily direct vessel operating expenses, or DVOE, and daily general and administrative expenses, or G&A, adjusted to exclude certain expenses. Our method of calculating daily DVOE is dividing DVOE, which include crew costs, provisions, deck and engine stores, lubricating oil, insurance, maintenance and repairs, by calendar

days for the relevant time period. Our method of calculating daily G&A is dividing general and administrative expenses adjusted to exclude non-recurring organizational, legal, other one-time fees and non-cash expenses, by calendar days for the relevant time period.

- (10)

- Adjusted EBITDA per vessel is Adjusted EBITDA divided by calendar days for the relevant time period.

General Maritime Corporation's Fleet

As of December 31, 2002 General Maritime Corporation's fleet was comprised of 28 wholly owned tankers, consisting of 23 Aframax and 5 Suezmax tankers, with a total of approximately 3.0 million deadweight tons. The average age of the Company's fleet as of December 31, 2002, was 12.6 years per dwt. On the same basis the average age of the Company's Aframax tankers was 12.3 years and the average age of the Company's Suezmax tankers was 12.7 years.

18 of General Maritime Corporation's Aframax tankers and all 5 of its Suezmax tankers are currently operating on the spot market. Five of the Company's Aframax tankers are currently under time charter contracts. The table below shows the vessels, expiration dates and daily rates associated with those contracts.

Vessel

| | Expiration Date

| | Average Daily Rate(1)

|

|---|

| Genmar Alexandra | | February 20, 2004(2) | | Market Rate(3) |

| Genmar George* | | May 24, 2003(4) | | $200,000 |

| Genmar Ajax* | | August 12, 2003 | | $23,000 |

| Genmar Constantine(5) | | March 1, 2004(2) | | Market Rate(3) |

| Genmar Star(5) | | March 1, 2004 | | $19,000 |

| Genmar Endurance(5) | | March 1, 2004 | | $19,000 |

- *

- "Same Fleet" vessel

- (1)

- Includes brokers' commissions of 1.25%

- (2)

- Termination date is plus or minus 15 days

- (3)

- The charter provides for a floating rate based on weekly spot market rates which can be no less than $16,000 per day and no more than $22,000 per day.

- (4)

- Termiantion is plus or minus 30 days

- (5)

- Time charter expected to begin March 1, 2003

The Company's primary area of operation is the Atlantic basin, and the Company also currently has vessels employed in the Black Sea. The Company also operates vessels in other regions to take advantage of market opportunities and to position vessels in anticipation of drydockings.

Internal Corporate Restructuring

On December 31, 2002, the Company implemented an internal corporate restructuring intended to simplify its corporate structure, achieve tax efficiencies and promote regulatory compliance. The key elements of this plan include reducing the number of subsidiaries of the Company and the number of jurisdictions in which Company subsidiaries are organized and separating the Company's ship owning and ship managing subsidiaries.

As part of the separation of the Company's management operations, John Tavlarios has become President and Chief Executive Officer of General Maritime Management LLC, the subsidiary responsible for the commercial and technical management of the Company's fleet. Mr. Tavlarios remains a member of the Company's Board of Directors and a key employee of the Company's consolidated group. Peter Georgiopoulos, the Company's CEO, has assumed the title of President of General Maritime Corporation.

Board of Directors Composition

Andrew Cazalet has been elected as an independent director to General Maritime's board as of February 20, 2003. Andrew replaces Sir Peter Cazalet, who is retiring as of February 20, 2003. Andrew has more than 20 years of capital markets and energy related experience. Currently, Andrew is a Managing Director with Citation Capital Management, a London based investment advisory firm. At Citation, Andrew provides corporate finance advisory services to companies in the financial services and energy sectors. Prior to joining Citation in 1999, Andrew held senior positions at various global financial services institutions. Andrew Cazalet is the son of Sir Peter Cazalet.

Metrostar Vessel Acquisition

On January 29, 2003 the Company agreed to acquire for $525 million 19 tankers consisting of 5 Aframax and 14 Suezmax vessels from Metrostar Management Corporation, a world-class quality operator of tankers based in Athens, Greece. The acquisition of the vessels is expected to commence on March 1, and to be concluded by April 30, 2003 during which time the vessels will be integrated into General Maritime's fleet operations as they conclude their existing voyages. The acquisition of the tankers will be made for cash and is subject to the customary conditions of delivery, including our right to reject a vessel after inspection.

On a combined basis, the Company's new fleet will be composed of a total of 47 tankers including 28 Aframax and 19 Suezmax tankers, making General Maritime the second largest mid-sized tanker operator in the world. The combined fleet will have a total of 5.6 million deadweight tons, only 23% of which will be single hull compared to a worldwide average of 40% single-hull tankers. The acquisition of the 19 tankers will provide General Maritime with an additional 2.7 million deadweight tons, with an average age as of December 31, 2002 of 9.8 years per deadweight ton.

The Company believes the acquisition of the tankers and the economies of scale associated with operating a larger fleet will enable the Company to substantially reduce general and administrative costs per vessel day and achieve greater long-term profitability. The larger fleet, which will initially operate predominantly on the spot market, will also enhance the Company's ability to benefit from changes in the spot tanker market.

Mr. Georgiopoulos, continued, "Our disciplined and diligent approach to operating and growing General Maritime enabled us to seize this unique opportunity that meets our stringent acquisition criteria. The acquisition of 19 tankers will allow General Maritime to further consolidate the mid-sized tanker industry in a manner that will reduce our fleet's age profile, and is expected to lower our daily per vessel overhead costs, further diversify our operations into areas of global expansion and provide earnings accretion. We will concentrate on successfully integrating these new vessels into our fleet, maintaining our focus on cost containment, and preserving the financial strength of the Company. During 2003, we will build on this success and continue to operate General Maritime to create long-term shareholder value."

Bank Financing

The Company has secured a commitment, subject to commercial terms and conditions, for $450 million in senior secured bank financing with J.P. Morgan plc and Nordea acting as Joint Lead Arrangers for the proposed acquisition financing. The $450 million financing is comprised of a 5-year $350 million term loan and an 18-month $100 million term loan. In addition, J.P. Morgan and Nordea are pleased to confirm that Bank of Scotland and Hamburgische Landesbank Girozentrale are acting as Co-Arrangers with respect to the proposed financing. General Maritime has already made a $52.5 million down payment for the vessels and intends to finance the balance of the acquisition through the proceeds of this secured bank financing, the use of cash on hand, and the additional cash generated from operations.

Mr. Georgiopoulos, concluded, "We are very pleased to have the support and backing of four of the leading banks in ship finance, who have provided us with the financing to complete this important

acquisition. The financing allows us to take advantage of the current environment of low interest rates and maintain our financial strength and flexibility."

About General Maritime Corporation

General Maritime Corporation is a provider of international seaborne crude oil transportation services principally within the Atlantic basin. General Maritime Corporation currently owns and operates 28 tankers—23 Aframax and 5 Suezmax tankers—making it one of the world's largest mid-sized tanker companies. After giving effect to the acquisition of all of the Metrostar vessels, General Maritime Corporation would own and operate a 47 tanker fleet—28 Aframax and 19 Suezmax tankers—and would become the second largest mid-sized tanker company in the world with more than 5.6 million dwt.

Conference Call Announcement

General Maritime Corporation announced that it will hold a conference call on Thursday, February 27, 2003 at 8:30 a.m. Eastern Daylight Time to discuss its 2002 fourth quarter and full year financial results. To access the conference call, dial (913) 981-5572 and ask for the General Maritime Corporation conference call. A replay of the conference call can also be accessed until March 13, 2003 by dialing (888) 203-1112 for US callers and (719) 459-0820 for non-US callers, and entering the passcode 580884. The conference call will also be simultaneously webcast and will be available on the Company's website, www.GeneralMaritimeCorp.com.

"Safe Harbor" Statement Under the Private Securities Litigation Reform Act of 1995

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward looking statements are based on management's current expectations and observations. Included among the factors that, in the company's view, could cause actual results to differ materially from the forward looking statements contained in this press release are the following: failure of one or more of the contemplated acquisitions to close; inability of the company to obtain financing for the acquisitions at all or on favorable terms; changes in demand; a material decline or prolonged weakness in rates in the tanker market; changes in production of or demand for oil and petroleum products, generally or in particular regions; greater than anticipated levels of tanker newbuilding orders or lower than anticipated rates of tanker scrapping; changes in rules and regulations applicable to the tanker industry, including, without limitation, legislation adopted by international organizations such as the International Maritime Organization and the European Union or by individual countries; actions taken by regulatory authorities; changes in trading patterns significantly impacting overall tanker tonnage requirements; changes in the typical seasonal variations in tanker charter rates; changes in the cost of other modes of oil transportation; changes in oil transportation technology; increases in costs including without limitation: crew wages, insurance, provisions, repairs and maintenance; changes in general domestic and international political conditions; changes in the condition of the company's vessels or applicable maintenance or regulatory standards (which may affect, among other things, the company's anticipated drydocking or maintenance and repair costs); and other factors listed from time to time in the company's filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K for the year ended December 31, 2001 and its Quarterly Reports on Form 10-Q for the three months ended March 31, 2002, June 30, 2002 and September 30, 2002.

QuickLinks

Summary Consolidated Financial and Other DataGeneral Maritime Corporation's FleetBoard of Directors CompositionAbout General Maritime Corporation"Safe Harbor" Statement Under the Private Securities Litigation Reform Act of 1995