SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

GMX RESOURCES INC.

(Name of Registrant as Specified in its Charter)

NOT APPLICABLE

(Name of Person(s) Filing Proxy Statement if Other Than Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

| 1) | Title of each class of securities to which transaction applies: |

_______________________________________________________________________________________________

| |

| 2) | Aggregate number of securities to which transaction applies: |

_______________________________________________________________________________________________

| |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

_______________________________________________________________________________________________

| |

| 4) | Proposed maximum aggregate value of transaction: |

_______________________________________________________________________________________________

_______________________________________________________________________________________________

| |

| ¨ | Fee paid previously with preliminary materials. |

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| 1) | Amount Previously Paid: |

_______________________________________________________________________________________________

| |

| 2) | Form, Schedule or Registration Statement No.: |

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 16, 2012

TO THE SHAREHOLDERS OF GMX RESOURCES INC.:

The Annual Meeting of Shareholders of GMX RESOURCES INC. (referred to herein as the “Company” or “GMX”), will be held on Wednesday, May 16, 2012, at 10:00 a.m. local time at the Company's principal corporate office, 9400 North Broadway, Suite 600, Oklahoma City, Oklahoma 73114, for the following purposes:

Matters to be voted on by holders of our Common Stock

| |

| 1. | To elect nine directors to serve for the ensuing year and until their successors are elected and qualified; |

| |

| 2. | To approve an amendment to the Company's Certificate of Incorporation to increase the maximum number of authorized shares of Common Stock from 100,000,000 shares to 250,000,000 shares; |

| |

| 3. | To hold an advisory vote on executive compensation; |

| |

| 4. | To ratify the selection of Grant Thornton LLP as the Company's independent registered public accounting firm for the year ending December 31, 2012; and |

| |

| 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Matters to be voted on by holders of our Common Stock and Series B Preferred Stock

| |

| 6. | To approve an amendment to the Certificate of Designation of the 9.25% Series B Cumulative Preferred Stock (“Series B Preferred Stock”) to revise the definition of “Change of Ownership or Control”. |

The meeting may be adjourned from time to time and, at any reconvened meeting, action with respect to the matters specified in this notice may be taken without further notice to the shareholders, unless required by applicable law or the bylaws of the Company.

Shareholders of record of Common Stock and Series B Preferred Stock at the close of business on March 22, 2012, are entitled to notice of, and to vote at, the meeting. A list of such shareholders will be available at the meeting and at the Company's principal corporate office, 9400 North Broadway, Suite 600, Oklahoma City, Oklahoma 73114, for ten days before the meeting.

All shareholders are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. A return envelope (which is postage prepaid if mailed in the United States) is enclosed for that purpose. Even if you have given your proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must bring to the meeting a proxy issued in your name by the record holder.

BY ORDER OF THE BOARD OF DIRECTORS

James A. Merrill, Secretary

Oklahoma City, Oklahoma

April 12, 2012

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 16, 2012 This proxy statement, this notice of annual meeting, a form of proxy and our Annual Report on Form 10-K for the year ended December 31, 2011, are all available free of charge on our website at http://gmxresources.com/pdf's/2012Proxy.pdf

|

IMPORTANT VOTING INFORMATION

If you hold your shares through a broker, bank or other financial institution, a New York Stock Exchange rule may dictate the manner in which your vote in the election of directors will be handled at our upcoming 2012 Annual Meeting. Shareholders who hold shares of our Common Stock or Series B Preferred Stock through a broker, bank or other financial institution receive proxy materials before each shareholder meeting.

Your broker is not permitted to vote on your behalf on the election of directors, unless you provide specific instructions by completing and returning the enclosed proxy.

Your broker is also not permitted to vote on your behalf on (i) the amendment to the Company's Certificate of Incorporation proposal, (ii) the advisory vote on executive compensation or (iii) the amendment to the Certificate of Designation of the Series B Preferred Stock, unless you provide specific instructions and return the enclosed proxy. For your vote to be counted, you will need to communicate your voting decisions to your broker, bank or other financial institution before the date of the shareholder meeting.

Voting your shares is important to ensure that you have a say in the governance of the Company. Please review the proxy materials and follow the instructions on the proxy to vote your shares.

If you have any questions about this NYSE rule or the proxy voting process in general, please contact the broker, bank or financial institution where you hold your shares. The SEC also has a web site (www.sec.gov/spotlight/proxymatters.shtml) with more information about your rights as a shareholder.

TABLE OF CONTENTS

GMX RESOURCES INC.

9400 North Broadway, Suite 600

Oklahoma City, Oklahoma 73114

(405) 600-0711

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 16, 2012

The following information is furnished in connection with the 2012 Annual Meeting of Shareholders (the “Annual Meeting”) of GMX RESOURCES INC., an Oklahoma corporation (“GMX” or the “Company”), to be held on Wednesday, May 16, 2012, at 10:00 a.m. local time at the Company's principal corporate office, 9400 North Broadway, Suite 600, Oklahoma City, Oklahoma 73114. This proxy statement and the enclosed proxy will be mailed on or about April 12, 2012, to both (1) holders of record of shares of our common stock, par value $0.001 per share (“Common Stock”) and (2) holders of record of shares of our 9.25% Series B Cumulative Preferred Stock, par value $0.001 per share (“Series B Preferred Stock”), each as of the record date.

The record date and time for determining shareholders entitled to vote at the Annual Meeting have been fixed at the close of business on March 22, 2012. On that date, the Company had outstanding 68,273,612 shares of Common Stock and 3,176,734 shares of Series B Preferred Stock. Each shareholder of record on the record date holding shares of Common Stock and Series B Preferred Stock is entitled to one vote per share for matters submitted to them for shareholder approval. The only matter being submitted for shareholder approval by the holders of Series B Preferred Stock is Proposal No. 5 - Amendment to Certificate of Description of the 9.25% Series B Cumulative Preferred Stock to revise the definition of “Change of Ownership or Control.”

The enclosed proxy for the Annual Meeting is being solicited by the Company's board of directors (the “Board”). The Company will bear the entire cost of such solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy and any additional information furnished to shareholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of Common Stock and Series B Preferred Stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse such persons representing beneficial owners for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone or personal solicitation by directors, officers or other regular employees of the Company. No additional compensation will be paid to directors, officers or other regular employees for such services. Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted. It may be revoked by filing a written notice of revocation or a duly executed proxy bearing a later date with the Secretary of the Company at the Company's principal corporate office, 9400 North Broadway, Suite 600, Oklahoma City, Oklahoma 73114, or it may be revoked by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

The Board has fixed the number of directors constituting the Board at nine and has nominated the current nine members of the Board for re-election. Currently, directors are elected annually for a term of one year.

Each nominee, if elected, will hold office until the expiration of his term and until his successor is duly elected and qualified, or until such nominee's earlier death, resignation or removal. Each nominee has agreed to serve if elected, and the Company has no reason to believe that any nominee will be unable to serve. Should any of the nominees named below cease to be a nominee at or prior to the Annual Meeting, the shares of Common Stock represented by the enclosed proxy will be voted in favor of the remainder of the nominees named below and for such substitute nominees, if any, as may be designated by the Board and nominated by either of the proxies named in the enclosed proxy. Proxies cannot be voted for a greater number of nominees than the number of nominees named herein.

Election Threshold

The nine nominees for directorships will be elected by a plurality of shares of Common Stock voted at the Annual Meeting.

Recommendation of the Board

The Board recommends that shareholders vote “FOR” the named nominees.

The nominees for election to the Company's Board and their respective business backgrounds are as follows:

|

| | | | | | |

| Name | | Age | | Position(s) Currently Held | | Director of GMX Since |

| Ken L. Kenworthy, Jr. | | 55 | | Chief Executive Officer, Chairman and Director | | 1998 |

| Michael J. Rohleder | | 55 | | President and Director | | 2011 |

| T. J. Boismier | | 77 | | Director | | 2001 |

| Steven Craig | | 55 | | Director | | 2001 |

| Ken L. Kenworthy, Sr. | | 76 | | Director | | 1998 |

| Jon W. “Tucker” McHugh | | 67 | | Director | | 2005 |

| Thomas G. Casso | | 54 | | Director | | 2010 |

| Michael G. Cook | | 67 | | Director | | 2010 |

| J. David Lucke | | 46 | | Director | | 2011 |

Unless otherwise disclosed below, none of the corporations or organizations named below is a parent, subsidiary or other affiliate of GMX.

Ken L. Kenworthy, Jr. is a co-founder of GMX and has been Chairman and Chief Executive Officer since the Company's inception in 1998. Mr. Kenworthy, Jr. also served as the Company's President from the Company's inception in 1998 until the appointment of Michael J. Rohleder to fill such position effective June 1, 2009. Prior to the founding of GMX, in 1982 he founded OEXCO Inc., a privately held oil and gas company, which he managed until 1995 when the company was sold. From 1995 until he founded GMX in 1998, Mr. Kenworthy, Jr. was a private investor. From 1980 to 1984, he was a partner in Hunt-Kenworthy Exploration, which was formed to share drilling and exploration opportunities in different geological regions. Prior to 1980, he held various geology positions with Lone Star Exploration (also known as Ensearch Exploration), Cities Service Gas Co., Nova Energy, and Berry Petroleum Corporation. He also served as a director of Nichols Hills Bank, a commercial bank in Oklahoma City, Oklahoma for ten years before it was sold in 1996 to what is now Bank of America. He has been a member of the American Association of Petroleum Geologists for 34 years.

Michael J. Rohleder became a director in April 2011 and has been our President since June 2009. Prior to being named to that position, Mr. Rohleder was employed by the Company as its Executive Vice President, Corporate Development and Investor Relations, a position he had held since joining the Company in March 2008. Prior to joining the Company, Mr. Rohleder served as the Sr. Vice President of Worldwide Sales and Marketing for ON Semiconductor, a semiconductor manufacturer (formerly the Motorola Semiconductor Components Division). From 1991 to 1999 he was Chief Executive Officer of MEMEC North America, which was a division of VEBA AG. During his tenure at MEMEC, the company grew from $18 million in annual sales to over $2.5 billion.

T. J. Boismier is founder, President and Chief Executive Officer of T. J. Boismier Co., Inc., a privately held mechanical contracting company that designs and installs plumbing, heating, air conditioning and utility systems in commercial buildings, a position he has held since 1961. He became a director in February 2001 simultaneously with the completion of the Company's

initial public offering.

Steven Craig is the Chief Energy Analyst for Elliott Wave International, a securities market research and advisory company located in Gainesville, Georgia, which is one of the world's largest independent providers of market research and technical analysis. As Chief Energy Analyst, Mr. Craig provides in-depth analysis and price forecasts of the major NYMEX energy markets to an institutional clientele that spans the gamut of the energy industry. Prior to joining Elliott Wave International in January 2001, he provided risk management services to Central and South West, one of the largest natural gas consumers in the U.S. prior to its merger with American Electric Power in June 2000, and former independent oil and gas producer Kerr-McGee. He became a director in August 2001.

Ken L. Kenworthy, Sr. is a co-founder of GMX and was its Executive Vice President and Chief Financial Officer from the Company's inception in 1998 until his retirement in 2008. Mr. Kenworthy, Sr. has been a director of the Company since 1998. From 1993 to 1998, he was principal owner and Chairman of Granita Sales Inc., a privately-held frozen beverage manufacturing and distribution company. Prior to that time, he held various financial positions with private and public businesses, including from 1970 to 1984, as vice president, secretary-treasurer, chief financial officer and a director of CMI Corporation, a company that manufactured and sold road-building equipment and was listed on the New York Stock Exchange prior to its acquisition by Terex Corporation in 2001. He has held several accounting industry positions including past president of the Oklahoma City Chapter, National Association of Accountants, past vice president of the National Association of Accountants and past officer and director of the Financial Executives Institute.

Ken Kenworthy, Sr. is the father of Ken Kenworthy, Jr.

Jon W. “Tucker” McHugh became a director of the Company in January 2005. Since 1997, Mr. McHugh has been Senior Vice President Commercial Lending at First Commercial Bank in Edmond, Oklahoma. He has over 38 years banking experience in commercial lending. He holds an undergraduate degree from Oklahoma State University and a Masters of Business Administration from the University of Oklahoma. He is an independent financial consultant advising small business startups, existing, emerging and seasoned for profit private companies that are in need of financial assistance. He is a veteran and retired U. S. Naval Officer.

Thomas G. Casso became a director of the Company in April 2010. Mr. Casso presently serves as a senior officer of Toni Brattin & Co., Inc., a privately held international marketing firm. He previously served as the Executive Director of the Catholic Foundation of Oklahoma, a philanthropic foundation supporting the Archdiocese of Oklahoma City, from 2005 to 2009. Prior to serving in this position, Mr. Casso was Executive Vice President/General Manager and co-owner of Bryson, Inc., an Anheuser-Busch beer wholesaler with approximately $75 million of annual sales. As a result of these positions, Mr. Casso has significant experience in operations, administration and finance. Mr. Casso holds a Bachelor's degree in marketing and a Master's degree in Business Administration - Finance from the University of Missouri - St. Louis.

Michael G. Cook became a director of the Company in March 2010. Mr. Cook is the principal owner of Cook Energy LLC, a privately held energy investment firm. He has extensive experience with oil and natural gas firms, including prior employment as an executive officer of three different exploration and production companies with responsibilities in administration, finance, operations and engineering. Mr. Cook received a Bachelor's degree in geology from the University of Iowa in 1969.

J. David Lucke became a director of the Company in April 2011. Mr. Lucke currently serves as Chief Financial Officer of Sabco Oil & Gas Corporation, a private company located in Houston, Texas. Prior to joining Sabco Oil & Gas Corporation, Mr. Lucke worked nineteen years as an investment banker focused in the energy industry. Most recently, Mr. Lucke was a Managing Director in the investment banking group of Jefferies & Company/Randall & Dewey from 2003-2010. Mr. Lucke received an MBA from The University of Texas at Austin and a BA from Duke University. Mr. Lucke is a certified public accountant.

Specific Attributes, Experience, Qualifications and Skills of Directors

The Board has determined that, given the business of the Company and the issues that the Company confronts, it needs several core competencies among the directors, including the following: current or prior experience as a senior officer or director of a public company or other substantial management or risk management experience; expertise in petroleum geology, engineering or other relevant experience in the oil and natural gas industry; and finance and accounting experience.

The Nominating/Corporate Governance Committee has reviewed with the Board the specific attributes, experience, qualifications and skills of each of the directors, all of whom are nominees for reelection as a director at the Annual Meeting. The Nominating/Corporate Governance Committee has concluded that each director has the appropriate characteristics and skills required for Board membership and that each director possesses an in-depth knowledge of the Company's business and strategy. The Nominating/Corporate Governance Committee further believes that our Board is composed of well-qualified and well-respected individuals who, as a whole, cover the core competencies that our Board has identified. The experience and the key competencies of our directors, as considered and reviewed by the Nominating/Corporate Governance Committee, are as

follows:

Management Experience: We believe that each of Messrs. Kenworthy, Jr., Boismier, Casso, Cook, Craig, Kenworthy, Sr., Lucke, McHugh and Rohleder have appropriate current or prior management or risk management experience, as described in more detail in their respective biographical information above.

Oil and Natural Gas Industry Experience: We believe that each of Messrs. Kenworthy, Jr., Cook, Craig, Kenworthy, Sr., Lucke and Rohleder have appropriate qualifications relating to the oil and natural gas industry, as described in more detail in their respective biographical information above.

Finance and Accounting Experience: We believe that each of Messrs. Cook, Casso, McHugh, Kenworthy, Sr., Lucke and Rohleder have appropriate finance or accounting experience, as described in more detail in their respective biographical information above.

CORPORATE GOVERNANCE MATTERS

The Board uses the independence standards of The New York Stock Exchange (“NYSE”) corporate governance standards for determining whether directors are independent. The Board additionally follows federal securities laws and the rules of the Securities and Exchange Commission (“SEC”) and the NYSE in determining independence for Audit Committee members. The Board has determined that each of Messrs. Boismier, Casso, Cook, Craig, Lucke and McHugh are independent under both the NYSE and SEC rules for purposes of service on the Board and on each of the Audit, Compensation and Nominating/Corporate Governance Committees. Members of each committee are elected annually by the Board and serve one-year terms and until their successors are elected and qualified.

During the year ended December 31, 2011, the Board held 6 meetings. All directors attended all of the meetings of the Board held during 2011. The Company does not have a specific policy regarding Board members' attendance at annual meetings of shareholders, although, as a general rule, all directors usually attend such meetings. At the 2011 annual meeting of shareholders, all directors then serving on the Board attended the meeting.

Board Committees

The Company's Board has established an Audit Committee, a Compensation Committee and a Nominating/Corporate Governance Committee. In April 2011, Mr. Casso was appointed Chairman of the Audit Committee. The Audit Committee consisted of Messrs. McHugh, Cook and Casso for all of 2011, and Mr. Lucke, who joined the Audit Committee in the second quarter of 2011. In April 2011, Michael G. Cook was appointed Chairman of the Compensation Committee. The Compensation Committee consisted of Messrs. Boismier, Craig and Cook for all of 2011, and Mr. Lucke, who joined the Board in April 2011 and the Compensation Committee during the second quarter of 2011. The Nominating /Corporate Governance Committee consisted of Messrs. McHugh, Craig and Casso for all of 2011. In April 2011, Mr. McHugh was appointed chairman of the Nominating/Corporate Governance Committee. All committee members attended all of the meetings of such committees held during 2011.

The Audit Committee's functions include approving the engagement of the Company's independent registered public accounting firm, reviewing with such firm the results and scope of its auditing engagement, establishing procedures for the treatment of complaints regarding accounting, internal accounting control or auditing matters, and various other matters. This committee met or acted by unanimous consent six times in 2011. The Board has determined that Mr. Casso qualifies as a “financial expert” as defined by the rules of the SEC based on his experience and education.

The Nominating/Corporate Governance Committee's function is to assist the Board in selecting and screening nominees for the Board and to oversee various corporate governance matters as described in more detail below. This committee held three meetings in 2011.

The Compensation Committee is responsible for the annual review and approval of corporate goals and objectives relevant to the compensation of our chief executive officer (“CEO”), evaluation of the performance of the CEO in light of these goals and objectives and approval of the amounts and individual elements of total compensation for the CEO based on this evaluation. In addition to determining the total compensation of the CEO, the Compensation Committee also approves the compensation of the Company's other executive officers. Our CEO makes recommendations to the Compensation Committee with respect to the CEO's own compensation as well as the compensation of the Company's other executive officers, but the final decisions with respect to such compensation are made by the Compensation Committee. During 2011, the Compensation Committee met or acted by unanimous consent five times.

In addition to its role in determining the compensation of our CEO and our other executive officers, the Compensation Committee has the authority to:

| |

| • | periodically evaluate, in conjunction with the CEO, and make recommendations to the Board regarding the terms and administration of our annual and long-term incentive plans to assure that they are structured and administered in a manner consistent with our compensation objectives as to participation, annual incentive awards, corporate financial goals, actual awards paid to our executive officers, and total funds reserved for payment under the compensation plans, if any; |

| |

| • | periodically evaluate, in conjunction with the CEO, existing equity-related executive compensation plans as well as potential equity-related plans and make recommendations to the Board based on the committee's evaluation; and |

| |

| • | periodically evaluate and make recommendations to the Board regarding annual retainer and meeting fees for members of the Board and committees of the Board and the terms and awards of any stock compensation to members of the Board. |

If the Board so approves, the Compensation Committee has the sole authority to retain or terminate consultants, including the authority to approve the consultants' fees and other retention terms. During 2011, the Compensation Committee continued

its use of Longnecker & Associates as a compensation consultant. For information about the role of Longnecker & Associates in evaluating our executive compensation, see “Compensation Discussion and Analysis - Compensation Processes.”

Compensation Committee Interlocks and Insider Participation

As stated above, Messrs. Boismier, Craig, Cook and Lucke served as members of our Compensation Committee during all or a portion of 2011. None of these individuals has ever been an officer or employee of the Company or any subsidiary. Additionally, none of our executive officers serves on the compensation committee or board of directors of any entity that has one or more of such entity's executive officers serving on our Board.

Corporate Governance Guidelines and Communications with the Board

The Company has adopted a Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics is applicable to all employees and directors, including the Company's principal executive, financial and accounting officers. The Company has also adopted Corporate Governance Guidelines that apply to all directors. A copy of the Code of Business Conduct and Ethics and the Corporate Governance Guidelines as well as the charters for the Audit, Compensation and Nominating/Corporate Governance Committees are available at the Company's web site, www.gmxresources.com. The Company intends to disclose amendments to, or waivers from, its Code of Business Conduct and Ethics and its Corporate Governance Guidelines by posting to its web site.

NYSE rules require that the Company's non-management directors meet in executive session on a regular schedule. The Company provides the non-management directors with the opportunity to meet in executive session before or after every Board meeting. Mr. McHugh presides at all of these executive sessions. The independent directors also meet in executive session once per fiscal year. Interested parties may contact Mr. McHugh by e-mail through our website at www.gmxresources.com.

The Company's Nominating/Corporate Governance Committee Charter provides that any person, including any shareholder, desiring to communicate with, or make any concerns known to, the Company, directors generally, non-management directors or an individual director only, may do so by submitting them in writing to the Company's Corporate Secretary, with information to identify the person submitting the communication or concern, including the name, address, telephone number and an e-mail address (if applicable), together with information indicating the relationship of such person to the Company. The Company's Corporate Secretary is responsible for maintaining a record of any such communications or concerns and submitting them to the appropriate addressee(s) for potential action or response. The Company will establish the authenticity of any communication or concern before forwarding it to the addressee. Under the Nominating/Corporate Governance Committee Charter, the Company is not obligated to investigate or forward any anonymous submissions from persons who are not employees of the Company.

The Company's Nominating/Corporate Governance Committee Charter provides that the Nominating/Corporate Governance Committee is responsible for assessing the skills and characteristics of Board members and for screening potential Board candidates. The criteria for nomination of directors are set forth in the Nominating/Corporate Governance Committee Charter, and the Charter does not address specific minimum qualifications or skills that a nominee or Board member must have. The Nominating/Corporate Governance Committee considers the diversity of our incumbent directors as well as the diversity of any director nominees, including diversity of background and experience as well as ethnic and other forms of diversity. We do not, however, have any formal policy regarding diversity in identifying nominees for directorships, but rather, we consider it among the various factors relevant to any particular nominee. The process used by the Nominating/Corporate Governance Committee for identifying and evaluating nominees for the Company's Board consists of reviewing qualifications of candidates suggested by management, other Board members or shareholders.

Under the Nominating/Corporate Governance Committee Charter, the Nominating/Corporate Governance Committee will consider recommendations from shareholders for nomination as a Board member. Any such recommendation should be addressed to the Company's Corporate Secretary and should contain (i) the name, address and telephone number and number of shares owned by the shareholder making the recommendation and a statement that the shareholder has a good faith intent to remain as a shareholder until the Company's next annual meeting of shareholders; (ii) the information about the proposed nominee that would be required to be disclosed by the applicable rules of the SEC if the nominee were nominated; (iii) a description of any relationship between the nominee and the shareholder making the recommendation; (iv) any additional information that the shareholder desires to submit addressing the reasons that the nominee should be nominated for election as a director; and (v) a consent of the nominee to be interviewed by the Nominating/Corporate Governance Committee if requested and to serve on the Board if nominated and elected. Any recommendation should be submitted at least 120 days prior to the first anniversary of the mailing date of the proxy statement for the prior annual meeting of shareholders. There are no specific minimum qualifications for shareholder nominees. The Company has not previously received nominees from shareholders and, accordingly, is unable to determine whether the process for evaluation of shareholder nominees differs from the process for evaluation of other nominees. We anticipate, however, that the Nominating/Corporate Governance Committee would evaluate all nominees in the same manner regardless of the source of the recommendation.

Board Leadership Structure and Role in Risk Oversight

There are currently nine members of the Board. Mr. Ken Kenworthy, Jr. currently serves as Chairman of the Board and Chief Executive Officer. We do not have a lead independent director. We believe that the number of independent, experienced directors that make up our Board benefits the Company and its shareholders.

We recognize that different board leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. We believe our current Board leadership structure is optimal for us because it demonstrates to our employees, suppliers, customers, and other stakeholders that the Company is under strong leadership, with a single person setting the tone and having primary responsibility for managing our operations. Having a single leader for both the Company and the Board eliminates the potential for confusion or duplication of efforts, and provides clear leadership for the Company. We believe GMX, like many U.S. companies, has been well-served by this leadership structure.

In accordance with NYSE requirements, our Audit Committee is responsible for overseeing risk analysis and risk management procedures. The Audit Committee reviews guidelines and policies on enterprise risk management, including risk assessment and risk management related to our major financial risk exposures and the steps management has taken to monitor and control such exposures. At each meeting of the Audit Committee, the officers of the Company provide information to the Audit Committee addressing issues related to risk analysis and risk management. In addition to the risk oversight exercised by the Audit Committee of the Board, the Compensation Committee and the Nominating/Corporate Governance Committee both regularly exercise oversight related to risks associated with responsibilities of the respective Committee. For example, the Compensation Committee has reviewed what risks, if any, could arise from the Company's compensation policies and practices, and strives to create incentives that are not reasonably likely to have a material adverse effect on the Company. Likewise, the Nominating/Corporate Governance Committee periodically provides oversight respecting risks associated with the Company's corporate governance policies and practices. The Board believes that the risk management processes in place for the Company are appropriate.

Director Compensation

The following table summarizes the compensation of non-employee directors in 2011. Mr. Lucke was not a director of the Company during all of 2011, and therefore the fees and compensation for him reflect only amounts earned or paid.

|

| | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash(1) | | Stock Awards(2) | | All Other Compensation(3) | | Total |

| T.J. Boismier | | $ | 196,767 |

| | $ | 95,565 |

| | $ | — |

| | $ | 292,332 |

|

| Steve Craig | | 199,767 |

| | 95,565 |

| | — |

| | 295,332 |

|

| Ken L. Kenworthy, Sr. | | 201,767 |

| | 95,565 |

| | 43,521 |

| | 340,853 |

|

| Jon W. "Tucker" McHugh | | 212,267 |

| | 95,565 |

| | 10,961 |

| | 318,793 |

|

| Thomas Casso | | 222,267 |

| | 95,565 |

| | — |

| | 317,832 |

|

| Michael G. Cook | | 211,767 |

| | 95,565 |

| | — |

| | 307,332 |

|

| J. David Lucke | | 170,767 |

| | 145,568 |

| | — |

| | 316,335 |

|

| |

(1) | Standard compensation for non-employee directors in 2011 consisted of payments made to such directors for each Board and committee meeting attended and attendance at the 2011 annual meeting of shareholders. The payments consisted of a $3,500 monthly retainer for the first five months of 2011 and a $4,167 monthly retainer for the remainder of 2011, $2,000 for each Board meeting attended, $1,500 for each Audit Committee meeting attended, $1,000 for each Compensation or Nominating/Corporate Governance Committee meeting attended, and $1,000 for each consent executed in lieu of a meeting. The chairman of the Audit Committee received $2,000 for each Audit Committee meeting that he attended. The chairman of the Nominating/Corporate Governance Committee received $500 for each Nominating/Corporate Governance Committee that he attended in the first six months of 2011 and $1,000 for each Nominating/Corporate Governance Committee meeting attended thereafter. The chairman of the Compensation Committee received $500 for each Compensation Committee meeting that he attended in the first six months of 2011 and $1,000 for each Compensation Committee meeting attended thereafter. In addition to regular meeting fees, the chairmen of the Audit, Compensation and Nominating Committees received an annual retainer of $15,000, $7,500 and $5,000, respectively. Directors who are also our employees receive no additional compensation for their services as directors. For all non-employee directors, fees earned or paid in cash includes a cash bonus award of $122,100 as a result of each director receiving limited restricted stock grants in August 2011, which is to be paid in four quarterly installments beginning March 2014. The amount of restricted stock granted in 2011 was limited due to a reduced number of common shares |

being available under the 2008 Long-Term Incentive Plan.

| |

(2) | The amount set forth is the aggregate grant date fair value attributable to restricted stock granted to the directors pursuant to Financial Accounting Standards Board Accounting Standards Codification Topic 718, “Compensation - Stock Compensation” (“FASB ASC Topic 718”). For a discussion of the assumptions made in the valuation of these grants of restricted stock, please see Note J to our financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2011. The numbers in the table are not adjusted for subsequent changes in our stock price and do not represent the intrinsic or “in-the-money” value of the awards. Annual stock and option awards are typically granted on July 1st of each year. However, in August 2011 a stock award of 19,868 shares was made to each non-employee Director that vest on July 1, 2012. Additionally, Mr. Lucke was awarded 8,052 shares in April 2011 upon his addition to the Board of Directors with pro rata vesting in April 2012 and 2013. |

| |

(3) | For Mr. Kenworthy, Sr., all other compensation represents $11,225 for the personal use of the company aircraft and $32,296 for country club dues and related meals and entertainment. For Mr. McHugh, the amount shown as all other compensation represents personal use of the company aircraft. |

INFORMATION CONCERNING INDEPENDENT ACCOUNTANTS

The Audit Committee has approved Grant Thornton LLP (“Grant Thornton”) as the Company’s independent registered public accounting firm for the year ending December 31, 2012. Representatives of Grant Thornton are expected to be present at the Annual Meeting with the opportunity to make a statement if they so desire, and will be available to the shareholders to respond to appropriate questions.

The Company has provided Grant Thornton with a copy of the disclosures made in this proxy statement.

Audit and Other Fees

The following table sets forth the fees billed by our independent auditor, Grant Thornton, for each of the last two years:

|

| | | | | | | | |

| Type | | 2011 | | 2010 |

| Audit fees | | $ | 741,335 |

| | $ | 551,165 |

|

| Audit-related fees | | 22,108 |

| | 21,000 |

|

| Tax fees | | 15,845 |

| | 18,000 |

|

| All other fees | | — |

| | — |

|

| Total | | $ | 779,288 |

| | $ | 590,165 |

|

As necessary, the Audit Committee considers whether the provision of non-audit services by our independent auditors is compatible with maintaining auditor independence. The Audit Committee has adopted a policy that requires pre-approval of all audit and non-audit services, and the Audit Committee pre-approved all audit and non-audit services performed by our independent auditors in 2011.

Audit fees. Fees for audit services include fees associated with our annual consolidated audits, and the review of our quarterly reports on Form 10-Q. Audit fees also include fees for services associated with the preparation of comfort letters, consents and review of documents filed with the SEC.

Audit-related fees. Audit-related fees principally include fees for subsidiary audit services.

Tax fees. Tax fees principally include fees related to federal and state tax compliance services.

All other fees. None

Report of the Audit Committee

The Audit Committee has reviewed and discussed the audited consolidated financial statements of the Company to be set forth in the Company's 2011 Annual Report on Form 10-K with management and the Company's independent registered public accounting firm. Management represented to the Audit Committee that the Company's audited consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the Company's independent registered public accounting firm. The Audit Committee discussed with the Company's independent registered public accounting firm matters required to be discussed by Statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board.

The Audit Committee has received the written disclosures and the letter from its independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding that firm's communications with the Audit Committee concerning independence, and the Audit Committee has discussed with such independent registered public accounting firm that firm's independence.

Based on the review and discussion with management and the Company's independent registered public accounting firm referred to above, we recommended to the Board that the Company include the audited financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2011, for filing with the SEC.

- Submitted by Thomas G. Casso, Michael G. Cook, J. David Lucke and Jon W. "Tucker" McHugh, members of the Audit Committee

PROPOSAL NO. 2:

AMENDMENT OF THE CERTIFICATE OF INCORPORATION

TO INCREASE THE AUTHORIZED NUMBER OF SHARES OF COMMON STOCK

The Board has approved and recommended that the shareholders approve an amendment of Article FOURTH of the Company's Certificate of Incorporation to increase the maximum number of authorized shares of Common Stock from 100,000,000 shares to 250,000,000 shares (the “Certificate Amendment”). A copy of the proposed Certificate Amendment is attached to this proxy statement as Appendix A and is considered a part of this proxy statement. If approved, the Certificate Amendment will be filed to take effect immediately following the Annual Meeting.

Our Certificate of Incorporation currently authorizes us to issue up to a total of 110,000,000 shares of capital stock, 100,000,000 of which is designated for Common Stock, and 10,000,000 of which is designated for preferred stock, par value $0.001 per share (“Preferred Stock”). If the Certificate Amendment is approved, our Certificate of Incorporation will authorize us to issue a total of 260,000,000 shares of capital stock, 250,000,000 of which will be designated for Common Stock, and 10,000,000 of which will be designated for Preferred Stock. As of March 22, 2012, 68,273,612 shares of Common Stock were issued and outstanding, 6,553,600 were reserved for issuance under our securities convertible or exercisable into shares of Common Stock and 526,089 were reserved for issuance in future awards under our LTIP and Stock Option Plan, leaving 24,646,699 shares of Common Stock unissued and unreserved.

All shares of our Common Stock, including those currently authorized and those that would be authorized by the proposed Certificate Amendment, are equal in rank and have the same voting, dividend and liquidation rights. There are no preemptive rights associated with these shares. The issuance of additional shares of Common Stock might dilute, under certain circumstances, the ownership and voting rights of existing shareholders of GMX.

Reasons for the Increase

The Board believes that the Certificate Amendment is desirable to increase the number of authorized shares of Common Stock available for issuance from time to time, without further action or authorization by the shareholders (except as may be required by applicable law or the rules of the New York Stock Exchange or any stock exchange on which the Company's Common Stock is then listed), for corporate needs such as equity financing, retirement of outstanding indebtedness, stock splits and stock dividends, employee benefit plans, or other corporate purposes as may be deemed by the Board to be in the best interests of the Company and its shareholders.

The Company will require and expects to issue additional shares in order to repay or satisfy obligations under the Company's outstanding indebtedness, including its 5.00% convertible notes due in February 2013, and to fund future capital expenditures. The proposed increase in the number of authorized shares of Common Stock will give the Company flexibility to raise this necessary additional capital for these short-term and near-term needs. It will also provide the Company with greater flexibility to respond to advantageous business opportunities. Except as noted above or in other SEC filings, we have no immediate plans, understandings, agreements or commitments to issue additional shares of Common Stock for any purpose.

We believe that the increase in authorized Common Stock will make a sufficient number of shares available, should the Company decide to use its shares for one or more of such previously mentioned purposes or otherwise. The increased capital will provide the Board with the ability to issue additional shares of stock without further vote of the shareholders of the Company, except as provided under Oklahoma corporate law or under the rules of any national securities exchange on which shares of stock of the Company are then listed.

Effects of the Increase

If the Certificate Amendment is approved, the number of authorized but unissued shares of Common Stock relative to the number of issued shares of Common Stock will be increased. This increased number of authorized but unissued shares of Common Stock could be issued by the Board without further shareholder approval, which could result in dilution to the holders of Common Stock.

The increased proportion of unissued authorized shares to issued shares could also, under certain circumstances, have an anti-takeover effect. For example, the issuance of a large block of Common Stock could dilute the ownership of a person seeking to effect a change in the composition of our Board or contemplating a tender offer or other transaction. However, the increase in authorized capital stock has not been proposed in response to any effort of which the Company is aware to accumulate shares of Common Stock or obtain control of the Company. The Board does not currently contemplate recommending the adoption of any other amendments to our Certificate of Incorporation that could be construed to reduce or interfere with the ability of third parties to take over or change the control of the Company.

Because neither our Certificate of Incorporation nor the Oklahoma General Corporation Act affords the Company's shareholders preemptive rights to subscribe to additional securities that may be issued by the Company, our shareholders will

not have a prior right to purchase any new issue of capital stock of the Company in order to maintain their proportionate ownership of the Company's stock.

Approval Threshold

To be effective, the Certificate Amendment must be approved at the Annual Meeting by the holders of a majority of the Company's outstanding Common Stock.

Recommendation of the Board

The Board recommends that shareholders vote “FOR” the approval of the Certificate Amendment.

PROPOSAL NO. 3:

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Our shareholders voted in a non-binding, advisory vote, at our 2011 Annual Meeting of Shareholders in favor of the submission of the Company's executive compensation annually to our shareholders on an advisory, non-binding basis. In accordance with that vote and as required by Section 14A of the Securities Exchange Act of 1934, we are including in this proxy statement for our shareholders an advisory (non-binding) vote on the Company's executive compensation as reported in this proxy statement (sometimes referred to as “say on pay”).

We urge shareholders to read “Compensation Discussion and Analysis” beginning on page 16 of this proxy statement, which describes in more detail how our executive compensation policies and procedures operate and are designed to achieve our compensation objectives, as well as “Executive Compensation Matters” and related compensation tables and narrative beginning on page 27, which provide detailed information on the compensation of our named executive officers. The Compensation Committee and the Board of Directors believe that the policies and procedures articulated in “Compensation Discussion and Analysis” are effective in achieving our goals and that the compensation of our named executive officers reported in this proxy statement has and will contribute to the Company's recent and long-term success.

In accordance with Section 14A of the Exchange Act, and as a matter of good corporate governance, we are asking shareholders to approve the following advisory resolution at the 2012 Annual Meeting of Shareholders:

RESOLVED, that the shareholders of GMX Resources Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company's named executive officers disclosed pursuant to Item 402 of Regulation S-K, including in the Compensation Discussion and Analysis and Executive Compensation Matters sections and the related compensation tables, notes and the related narrative discussion, in the Proxy Statement for the Company's 2012 Annual Meeting of Shareholders.

This is an advisory vote, and is not binding on the Company or the Board of Directors. Although non-binding, the Board and the Compensation Committee will review and consider the voting results when making future decisions regarding our executive compensation program.

The Board of Directors unanimously recommends that you vote “FOR” this proposal. Proxies given without instruction will be voted FOR approval of this resolution.

PROPOSAL NO. 4:

RATIFICATION OF THE SELECTION OF THE COMPANY'S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has directed the Company to submit the selection of Grant Thornton as the Company's independent registered public accounting firm for the year ending December 31, 2012 for ratification by the shareholders at the Annual Meeting. Neither the Company's bylaws nor other governing documents or law require shareholder ratification of the selection of Grant Thornton as the Company's independent registered public accounting firm. However, the Audit Committee is submitting the selection of Grant Thornton to the shareholders for ratification as a matter of good corporate practice, consistent with the Corporate Governance Policy of ISS Corporate Services. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee may in its discretion direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

Approval Threshold

The selection of Grant Thornton as the Company's independent registered public accounting firm for the year ending December 31, 2012 will be ratified if holders of a majority of shares of Common Stock voted at the Annual Meeting vote in favor of the proposal.

Recommendation of the Board

The Board recommends that shareholders vote “FOR” the ratification of Grant Thornton as the Company's independent registered public accounting firm for the year ending December 31, 2012.

PROPOSAL NO. 5

AMENDMENT TO CERTIFICATE OF DESIGNATION OF THE 9.25% SERIES B CUMULATIVE

PREFERRED STOCK TO REVISE THE DEFINITION OF “CHANGE OF OWNERSHIP OR CONTROL”

The Board has authorized, and recommends for your approval an amendment (the “Amendment”) to the Certificate of Designation of the Company's 9.25% Series B Cumulative Preferred Stock, $0.001 par value per share (the “Series B Preferred Stock”). A copy of the Amendment is attached to this Proxy Statement as Appendix B.

Under the terms of the Certificate of Designation, the Company is required to offer to purchase all of the shares of Series B Preferred Stock outstanding following any event that constitutes a “Change of Ownership or Control” (as defined in the Certificate of Designation) of the Company. Under the current terms of the Certificate of Designation, a Change of Ownership or Control occurs, among other events, when the Company permits or suffers a change in its key management, meaning the continued active full time employment of each of Ken Kenworthy, Jr. (as Chief Executive Officer) and Ken Kenworthy, Sr. (as Chief Financial Officer); provided, however, that the cessation of active employment of one such officer due to death or disability, or the retirement of Ken Kenworthy, Sr. (as Chief Financial Officer), shall not be a Change of Ownership or Control so long as the Company hires or promotes a replacement officer within four months.

Due to the retirement of Ken Kenworthy, Sr. from his position as our Chief Financial Officer in February 2008, the Board believes it is in the best interests of the Company and the shareholders to revise the definition of Change of Ownership or Control to allow Ken Kenworthy, Jr. to terminate his active full time employment with the Company without effecting a Change of Ownership or Control for purposes of the Certificate of Designation if the Company appoints a new Chief Executive Officer within a certain period of time. Therefore, as provided in the Amendment, the Board proposes that the definition of Change of Ownership or Control be revised and shall occur when:

the Corporation permits or suffers a change in its key management, meaning the continued active full time employment of Ken Kenworthy, Jr. as Chief Executive Officer; provided, that the termination of active employment of Ken Kenworthy, Jr. as Chief Executive Officer shall not constitute a “Change of Ownership or Control” so long as the Corporation hires or promotes a replacement officer within four months after such termination.

Provisions substantially identical to the current definition of Change of Ownership or Control in the Certificate of Designation described above were present in the Company's revolving bank credit facility when the Series B Preferred Stock was issued in 2006. Similar provisions were also included in the terms of the Company's Series A Senior Secured Notes issued in 2007. As a result of the retirement of Mr. Kenworthy, Sr. as our CFO in February 2008, the terms of the bank credit facility and Series A Senior Secured Notes then outstanding were amended to be substantially similar to the proposed terms provided in the Amendment to avoid triggering a default or offer to purchase requirement if Mr. Kenworthy, Jr. terminates active employment and a suitable replacement is hired within four months. Each of these bank credit facility and the Series A Senior Secured Notes have been canceled and are no longer outstanding. None of our other senior or secured indebtedness has this Change of Ownership or Control provision. Accordingly, repayment of our other indebtedness would not be accelerated due to this Change of Ownership or Control.

Reasons for Shareholder Approval; Threshold

An amendment to the Certificate of Designation is considered to be an amendment to the Company's Certificate of Incorporation. Section 1077.B of the Oklahoma General Corporation Act requires shareholder approval for an amendment to our Certificate of Incorporation that has the effect of changing the rights of shareholders with respect to shares of our capital stock. Because the proposed Amendment changes the rights of holders of shares of our Series B Preferred Stock, the Amendment will be approved if: (i) the holders of a majority of the Company's outstanding shares of Common Stock, voting separately as a class, vote in favor of the Amendment; and (ii) the holders of at least two-thirds of the outstanding Series B Preferred Stock, voting separately as a class, also vote in favor of the Amendment.

Recommendation of the Board

The Board recommends that the shareholders vote “FOR” the proposed amendment to the Certificate of Designation for the 9.25% Series B Cumulative Preferred Stock.

EXECUTIVE OFFICERS, COMPENSATION AND OTHER INFORMATION

Executive Officers

Our current executive officers are named below:

|

| | | | |

| Name | | Age | | Position |

| Ken L. Kenworthy, Jr. | | 55 | | Chief Executive Officer |

| Michael J. Rohleder | | 55 | | President |

| James A. Merrill | | 44 | | Chief Financial Officer, Executive Vice President, Secretary and Treasurer |

| Gary D. Jackson | | 61 | | Executive Vice President, Land |

| Timothy L. Benton | | 55 | | Executive Vice President, Geosciences |

| Harry C. Stahel, Jr. | | 48 | | Executive Vice President, Finance |

For a description of the business background and other information concerning Mr. Ken L. Kenworthy, Jr., and Michael J. Rohleder, see “Election of Directors” above. All executive officers and significant employees serve at the discretion of the Board. Unless otherwise noted below, none of the corporations or organizations named below is a parent, subsidiary or other affiliate of GMX.

James A. Merrill became our Chief Financial Officer, Secretary and Treasurer in February 2008, and Executive Vice President in April 2011. Prior to being named to such positions, Mr. Merrill was employed by the Company as its Controller, a position he had held since joining the Company in August 2006. Prior to such time, Mr. Merrill was Controller of National American Insurance Company from 1998 to 2006. National American is a privately-held multi-state property and casualty insurer based in Chandler, Oklahoma, which had net written premiums of $65 million in 2006. Prior to that time, Mr. Merrill was employed by Deloitte & Touche LLP. Mr. Merrill is a certified public accountant and has bachelor's degrees in finance and accounting from the University of Oklahoma.

Gary D. Jackson became our Vice President, Land in 2005 and was promoted to Executive Vice President in April 2011. During 2004 and 2005 prior to joining the Company, he was an independent petroleum landman, performing and directing contract land services for other oil and gas companies for CLS Group, Edmond, Oklahoma. Prior to that time, he was President of SAI Consulting, which provided professional services for oil and gas and natural resources asset acquisition and management.

Timothy L. Benton became our Vice President, Geosciences in June 2009 and was promoted to Executive Vice President in April 2011. Prior to such appointment, Mr. Benton had been responsible for the engineering and geological characterization work relating to our assets since 2005. Before joining the Company, Mr. Benton worked in reservoir, completion and production positions with Gulf Oil Corporation, Texas Pacific Oil Company, Long, Atteberry & Associates and as an independent consultant. Mr. Benton is a Registered Professional Engineer in the State of Oklahoma. He has a bachelor's degree in petroleum engineering from the University of Oklahoma.

Harry C. Stahel, Jr. became our Vice President, Finance in June 2009 and was promoted to Executive Vice President, Finance in April 2011. Prior to joining the Company, Mr. Stahel was Director of Business Development Finance for Enogex LLC (a gas gathering and transportation company owned by OGE Energy Corp.) since 2003. From 1991 to 2003, Mr. Stahel served in many roles at Aquila Inc. including Director of Finance in London, and Director of Finance working on domestic business projects. Prior to that time, Mr. Stahel spent five years in public accounting and is a certified public accountant. Mr. Stahel received his bachelor's degree in finance from Washington and Lee University.

Significant Employees

The following individuals are significant employees:

Keith Leffel, age 62, has been employed as our natural gas marketer and pipeline operations manager since November 2001 and serves as President of Endeavor Pipeline Inc., a wholly owned subsidiary of the Company. Since 1986, Mr. Leffel formed and operated GKL Energy Services Company, a company that assists producers with gas marketing services.

Compensation Discussion and Analysis

Summary

Prior to 2011, our Company focus was on economically developing our Haynesville/Bossier (“H/B”) Gas Shale resource play and increasing our production and proved H/B reserves. In late 2010, we made a strategic decision to begin looking for properties that would expand our assets and development into other basins, to diversify our Company's concentrated natural gas focus and to provide the company more liquids-rich hydrocarbon opportunities. We hired several key employees to aid in this expansion. These efforts led to acquisitions of core positions in two oil resource plays in the U.S. During 2011, we acquired approximately 35,000 acres of undeveloped leasehold in the Williston Basin of North Dakota/Montana, targeting the Bakken and Three Forks Formations, and approximately 40,000 acres of undeveloped leasehold in the oil window of the Denver Julesburg Basin (the “DJ Basin”) of Wyoming, targeting the emerging Niobrara Formation. During 2011, we began the deployment of our capital and resources into these oil development opportunities. With the acquisition of the liquids-rich (estimated 90% oil) Bakken and Niobrara acreage, we now have the flexibility to deploy capital based on a variety of economic and technical factors, including wells costs, service availability, take-away capacity and commodity prices (including differentials applicable to the basins). We believe this flexibility will enable us to generate higher cash flow growth to fund our future capital expenditure program.

Unlike companies that have a greater percentage of their production and proved reserves in oil, we faced continued lower natural gas prices in 2011, as a result of an over supplied natural gas market and a continued weak domestic economy. Even though we have taken steps to transition the Company's production mix to more liquids-rich hydrocarbons, natural gas accounted for almost 90% of our production in 2011. The disparity between oil and natural gas prices creates a challenging environment for natural gas companies to attract and retain qualified employees that are also being recruited by established oil producers.

We compete for talent in a highly competitive energy market, and a hyper-competitive Oklahoma City energy market. The compensation programs in the Oklahoma City energy market have escalated the past five years and increasingly pay key employees retention-oriented compensation like restricted stock. This is an industry reaction to a true shortage of skilled employees that understand the highly technical aspects of oil and gas exploration and development, independent of discrimination towards oil compared to natural gas.

At our 2011 annual meeting of shareholders, our advisory vote on executive compensation ("Say On Pay") was approved, receiving approximately 60% of the votes. In response to the results of the Say on Pay vote, the Company's stock performance and liquidity restraints, the Compensation Committee of the Board of Directors along with executive management of the Company took the following actions:

1. Executive management did not receive salary increases in 2011. Prior increase in salary for executive management was in July 2010.

2. Executive management did not receive the discretionary portion of the 2011 annual incentive award, which has historically represented 40% of the total available annual incentive award. The remaining 60% of the annual incentive award was based on performance metrics established by the Compensation Committee at the beginning of 2011.

3. The Chief Executive Officer ("CEO"), President, and Chief Financial Officer ("CFO") received reductions of 61%, 74%, and 72%, respectively, in their targeted long-term incentive cash component that was awarded in lieu of restricted stock awards. In addition, the cash award was deferred and will not vest or be paid until 2014.

4. The Company has or will be reaching out to various institutional shareholders of the Company to explain the Company's compensation philosophy.

As a result of the above actions, total 2011 compensation for the CEO, President, and CFO was near the 60th percentile of the Company's peer group. In addition, 2011 cash compensation for the CEO, President and CFO decreased from 2010 by the following amounts:

|

| | | | | | | | | | | | | | | | |

| Executive Officer | | Position | | 2011 Cash Compensation (1) | | 2010 Cash Compensation | | Decrease ($) | | Decrease (%) |

| Ken Kenworthy, Jr. | | Chief Executive Officer | | $ | 1,337,609 |

| | $ | 2,138,935 |

| | $ | 801,326 |

| | 37% |

| Michael J. Rohleder | | President | | 708,168 |

| | 1,151,909 |

| | 443,741 |

| | 39% |

| James A. Merrill | | Chief Financial Officer | | 630,842 |

| | 993,847 |

| | 363,005 |

| | 37% |

| | | | | $ | 2,676,619 |

| | $ | 4,284,691 |

| | $ | 1,608,072 |

| | 38% |

(1) Cash compensation table above includes salary, bonus, and non-equity incentive plan cash compensation and is not a substitute for the Summary Compensation table. Cash compensation for 2011 includes $445,919, $148,231, and $143,760, for CEO, President, and CFO that has been deferred and remains subject to vesting until 2014.

Pay for Performance

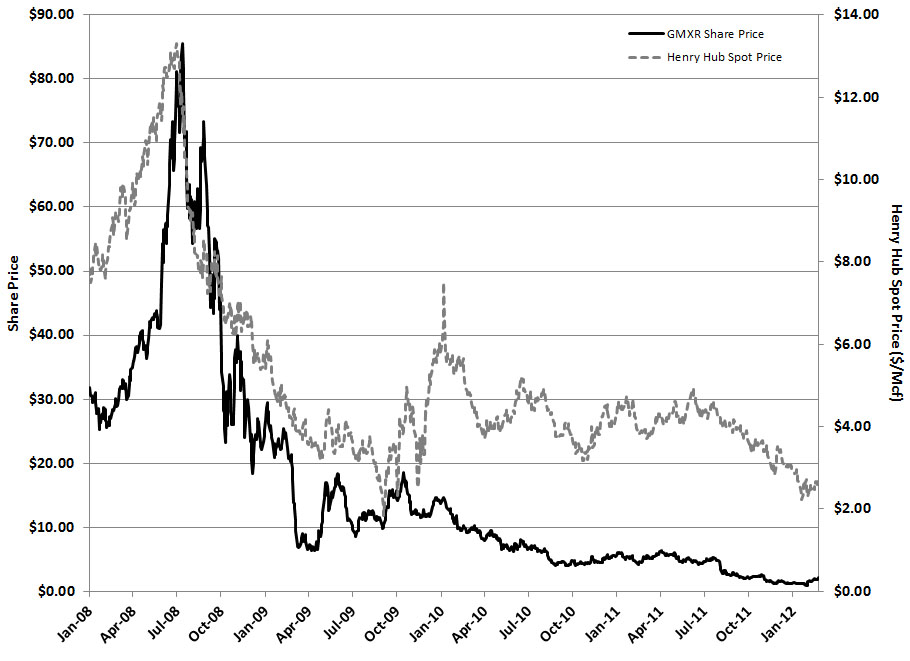

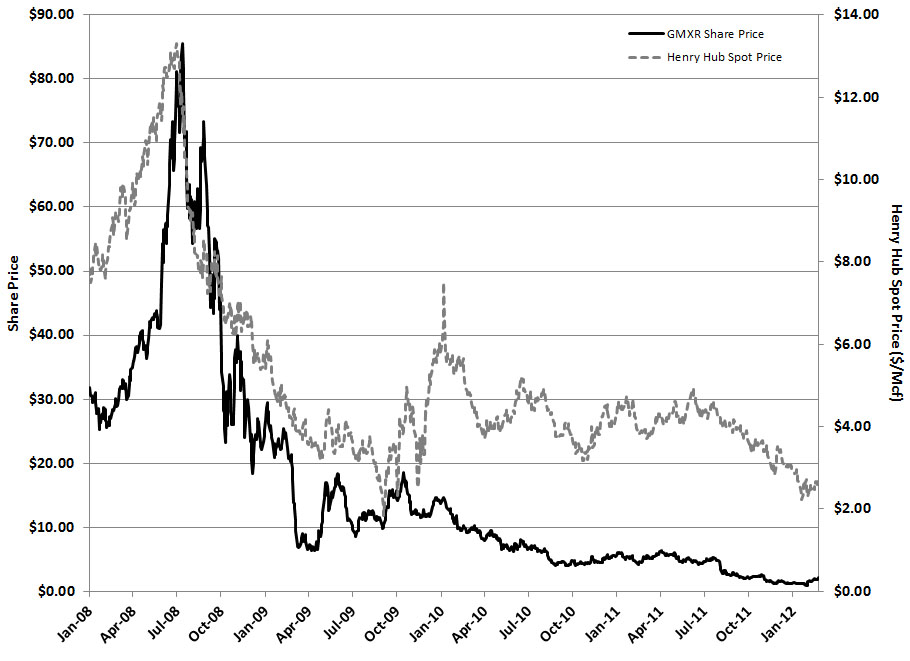

Until early 2011, the Company's primary focus was on developing its natural gas resources in the Haynesville/Bossier and Cotton Valley Sands reservoirs in Harrison and Panola Counties of East Texas. As of December 31, 2011, natural gas represented 96% of our total proved reserves and nearly 90% of our production for the year then ended. Our stock performance has been highly correlated to the price of natural gas. In 2011, the Company began a transition from being primarily a natural gas producer to a company that is more balanced between oil and natural gas production. As the transition continues in 2012, we expect the correlation between our stock price and the price of natural gas to dissipate and to provide total shareholder returns similar to our internal peer group and to other externally selected peer groups that may have similar market capitalization and revenues, but have a higher percentage of their revenues and reserves associated with oil.

We continue to emphasize stock compensation to encourage retention and long-term shareholder value. Due to a limited number of shares being available under our long-term incentive plan, only a portion of the recommended restricted stock grants were awarded in 2011. To make up for the short-fall in available restricted stock awards, certain executives received a deferred cash award that will be paid quarterly in 2014. In addition, the Chief Executive Officer, President, and Chief Financial Officer received reductions of 61%, 74%, and 72%, respectively, in their targeted cash awards that were paid in lieu of a restricted stock award.

Value of Restricted Stock Award Pay Table

The table below supplements the Summary Compensation Table that appears on page 27. This table compares the value of previously granted restricted stock awards at the common stock price of $1.25 per share at December 31, 2011 to the "Stock Award" compensation shown in the Summary Compensation Table. The Company began granting restricted awards in July

2008 and since this time, no member of executive management has sold any of their restricted shares that have vested.

The primary difference between this supplemental table and the standard Summary Compensation Table is the method used to value stock awards. SEC rules require that the grant date fair value of stock awards be reported in the Summary Compensation Table for the year that they were granted. As a result, a significant portion of the total compensation amounts reported in the Summary Compensation Table relate to stock awards that have not vested and for which the value thereof is uncertain. In contrast, the supplemental table below includes stock awards granted during the applicable fiscal year valued at our December 31, 2011 common stock price of $1.25. The year-end stock price was used due to the fact that all our executives still hold their restricted stock awards. It should be noted that there is no assurance that the executives will actually realize the value attributed to these awards even in this supplemental table, since the ultimate value of the restricted stock awards will depend on when the restricted shares are liquidated.

|

| | | | | | | | | | | | | | | | | |

| Name and Position | | Year | | Number of Restricted Shares Awarded | | Total of Stock Awards per Summary Compensation Table (1) | | Pro Forma Value of Stock Awards Based on YE2011 Stock Price of $1.25 | | Change in Value of Stock Awards |

| K. Kenworthy, Jr., CEO | | 2011 | | 204,838 |

| | $ | 985,271 |

| | $ | 256,048 |

| | $ | (729,223 | ) |

| | | 2010 | | 87,906 |

| | 557,324 |

| | 109,883 |

| | (447,441 | ) |

| | | 2009 | | 64,259 |

| | 1,187,506 |

| | 80,324 |

| | (1,107,182 | ) |

| | | 2008 | | 15,477 |

| | 1,187,500 |

| | 19,346 |

| | (1,168,154 | ) |

| | | | | 372,480 |

| | $ | 3,917,601 |

| | $ | 465,601 |

| | $ | (3,452,000 | ) |

| | | | | | | | | | | |

| M. Rohleder, President | | 2011 | | 102,959 |

| | $ | 495,233 |

| | $ | 128,699 |

| | $ | (366,534 | ) |

| | | 2010 | | 40,322 |

| | 255,641 |

| | 50,403 |

| | (205,238 | ) |

| | | 2009 | | 50,000 |

| | 924,000 |

| | 62,500 |

| | (861,500 | ) |

| | | 2008 | | 5,377 |

| | 412,500 |

| | 6,721 |

| | (405,779 | ) |

| | | | | 198,658 |

| | $ | 2,087,374 |

| | $ | 248,323 |

| | $ | (1,839,051 | ) |

| | | | | | | | | | | |

| J. Merrill, CFO | | 2011 | | 83,423 |

| | $ | 401,265 |

| | $ | 104,279 |

| | $ | (296,986 | ) |

| | | 2010 | | 35,801 |

| | 226,978 |

| | 44,751 |

| | (182,227 | ) |

| | | 2009 | | 50,000 |

| | 924,000 |

| | 62,500 |

| | (861,500 | ) |

| | | 2008 | | 5,377 |

| | 412,500 |

| | 6,721 |

| | (405,779 | ) |

| | | | | 174,601 |

| | $ | 1,964,743 |

| | $ | 218,251 |

| | $ | (1,746,492 | ) |

| | | | | | | | | | | |

| T. Benton, EVP - Geosciences | | 2011 | | 55,877 |

| | $ | 268,768 |

| | $ | 69,846 |

| | $ | (198,922 | ) |

| | | 2010 | | 23,980 |

| | 152,033 |

| | 29,975 |

| | (122,058 | ) |

| | | 2009 | | 30,303 |

| | 560,000 |

| | 37,879 |

| | (522,121 | ) |

| | | 2008 | | 3,650 |

| | 280,065 |

| | 4,563 |

| | (275,502 | ) |

| | | | | 113,810 |

| | $ | 1,260,866 |

| | $ | 142,263 |

| | $ | (1,118,603 | ) |

| | | | | | | | | | | |

| G. Jackson, EVP - Land | | 2011 | | 48,427 |

| | $ | 232,934 |

| | $ | 60,534 |

| | $ | (172,400 | ) |

| | | 2010 | | 20,783 |

| | 131,764 |

| | 25,979 |

| | (105,785 | ) |

| | | 2009 | | 50,000 |

| | 924,000 |

| | 62,500 |

| | (861,500 | ) |

| | | 2008 | | 5,377 |

| | 412,500 |

| | 6,721 |

| | (405,779 | ) |

| | | | | 124,587 |

| | $ | 1,701,198 |

| | $ | 155,734 |

| | $ | (1,545,464 | ) |

(1) Amounts shown equal the amounts reported in the "Stock Awards" column of the Summary Compensation Table.

Compensation Philosophy

For 2011, we generally targeted total compensation for our management and employees at approximately the 75th percentile of our compensation peer group. We established compensation at this level to attract and retain talented employees capable of executing our rapid growth business plan and managing our business in a hyper-competitive industry environment. Attracting and retaining talented, entrepreneurial management is vital to successfully navigate the Company through difficult periods of commodity price volatility and service availability, and position the Company for creating substantial shareholder value through our diversification to oil. As we expanded the geographical footprint of the Company into areas with more oil opportunities and added additional managerial employees, we strategically targeted new hires with significant experience in our new areas of operations and that had managerial experience in much larger companies. Our philosophy of compensating management and employees at the 75th percentile allows us to attract these types of employees in a hyper-competitive environment. We are a forward-looking entrepreneurial Company with employees that are focused on creating and growing shareholder value over the long term. Reflecting our entrepreneurial philosophy, we have historically avoided rewarding or motivating our executives with defined benefit pension or supplemental retirement plans, as they are typically less performance-based, are not necessarily aligned with shareholders' interests and can be very costly to a company regardless of its success. It's important to note that while we target the market 75th percentile in total compensation, the actual delivery of total compensation has fallen well below that level due to the performance of our stock price as a result of the declining natural gas prices over the past three years.

In response to the continued low natural gas prices, we continued to limit executive and significant employee base pay with exceptions for promotion or increased responsibility in an effort to contain costs and to preserve capital. In 2011, we retained Longnecker and Associates (“Longnecker”) for advice on executive compensation. Based on Longnecker's review, the executive officers did not receive salary increases for 2011. Prior to 2012, the most recent increase in salaries for the executive officers was in July 2010 which was based on a review of peer salaries performed by Longnecker. Annual Incentive compensation for 2011 was based on a formulaic approach utilizing metrics that the Board and management of the Company believed important components of growing long-term shareholder value. Executive management did not receive a discretionary annual incentive award in 2011, which was targeted to be 40% of the annual incentive award.

Despite the downturn in the economy and continued depressed natural gas prices, the competition for competent, qualified employees in our industry and especially within our new operating areas in the Williston and DJ Basins and East Texas continues to be strong. Our executive compensation program described below, is designed to address the continuing competition for talent in the industry as it impacts our ability to attract necessary talent, general sensitivity to investor concerns regarding executive compensation, and the need to continue to motivate, reward, and retain the best people possible to manage through these difficult times in natural gas and to expand the footprint of the Company into new basins focused on oil.

Overview and Objectives

We believe our success is dependent on the continued contributions of our senior management team and other key employees and the addition of new talent as our Company grows. The goal of our executive compensation program is to attract, motivate, reward and retain executives of high integrity and exceptional entrepreneurial skill who are capable of leading our Company in achieving our business objectives and strategies. Our ultimate goal is to create exceptional long-term value for our shareholders. Additionally, we periodically review the Company's compensation programs to ensure that they do not create risks that have or are reasonably likely to have a material adverse effect on the Company. Our compensation committee has presented its review and its conclusions to this effect to our entire Board.