UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A 101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by Registrant [ X ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ X ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

COMMUNITY WEST BANCSHARES

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing Fee (Check all boxes that apply):

[ X ] No fee required.

[ ] Fee paid previously with preliminary materials.

[ ] Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

7100 N. Financial Drive, Suite 101

Fresno, California 93720

April 26, 2024

Dear Shareholder:

In connection with the 2024 Annual Meeting of Shareholders to be held at 3:00 p.m. on Wednesday, May 30, 2024, at Fort Washington Country Club, located at 10272 N. Millbrook Ave, Fresno, California 93730, we are enclosing the following:

1. Notice of Annual Meeting of Shareholders

2. Proxy Statement

3. Proxy Card

4. Company’s Annual Report for the year ended December 31, 2023

It is important that your shares be represented at the Annual Meeting. In order to ensure your shares are voted at the Annual Meeting, whether or not you plan to attend the Annual Meeting, you can vote through the Internet, by telephone, or by mail. This proxy statement, Shareholder Meeting Notice, form of proxy, and the Annual Report of the Company for the year 2023 are first being made available to shareholders on or about May 6, 2024.

We appreciate your support and look forward to seeing you at the Annual Meeting on May 30, 2024.

| | | | | |

| |

| | Cordially, /s/ Daniel J. Doyle Daniel J. Doyle Chairman of the Board /s/ James J. Kim James J. Kim Chief Executive Officer |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING:

THE PROXY STATEMENT AND ANNUAL REPORT TO SHAREHOLDERS, ALONG WITH THE COMPANY’S REPORT ON FORM 10-K TO SHAREHOLDERS ARE AVAILABLE AT: WWW.INVESTORVOTE.COM/CWBC2024

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS OF

COMMUNITY WEST BANCSHARES

TO THE SHAREHOLDERS OF COMMUNITY WEST BANCSHARES:

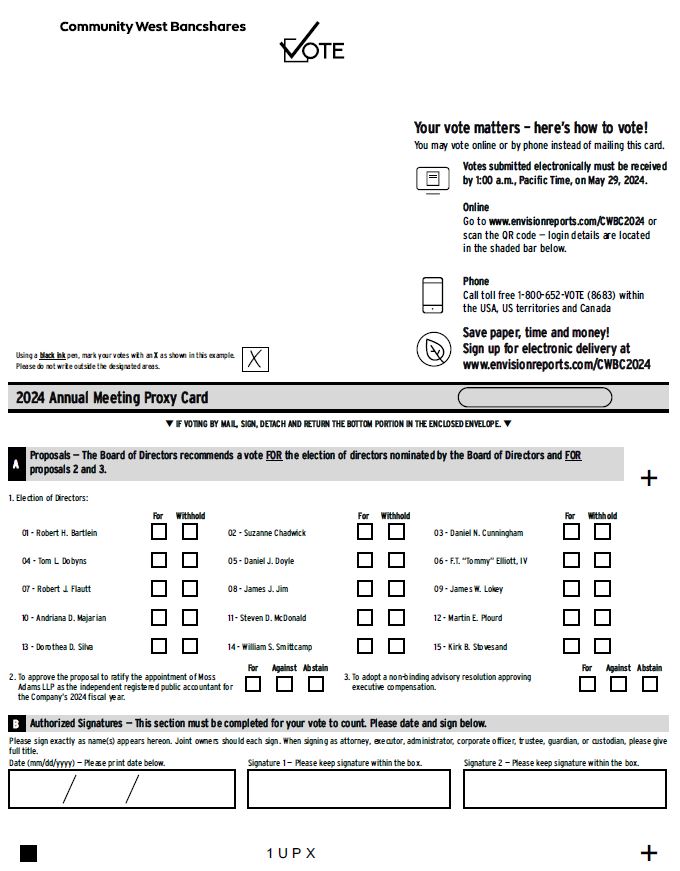

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of the Shareholders of Community West Bancshares will be held at 10272 N. Millbrook Ave, Fresno, California 93730, on Wednesday, May 30, 2024, at 3:00 p.m. for the following purposes:

(1)To elect fifteen (15) directors to the Board of Directors;

(2)To ratify the appointment of Moss Adams LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024;

(3)To adopt a non-binding advisory resolution approving executive compensation; and

(4)To transact such other business as may properly come before the Annual Meeting.

The names of the Board of Directors’ nominees to be directors of Community West Bancshares are set forth in the accompanying Proxy Statement and are incorporated herein by reference.

Only shareholders of record at the close of business on April 25, 2024, are entitled to notice of, and to vote at, the Annual Meeting. Every shareholder is invited to attend the Annual Meeting in person or by proxy. If you do not expect to be present at the Annual Meeting, you can vote through the Internet, by telephone, or by mail. Instructions regarding Internet and telephone voting, as well instructions for requesting printed copies of the meeting materials and a physical proxy card are included in the Shareholder Meeting Notice.

Dated: April 26, 2024

Daniel J. Doyle

/s/ Daniel J. Doyle

Chairman of the Board

WHETHER OR NOT YOU PLAN TO ATTEND THIS ANNUAL MEETING, PLEASE

VOTE THROUGH THE INTERNET, BY TELEPHONE, OR MAIL AS PROMPTLY AS POSSIBLE

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

OF

COMMUNITY WEST BANCSHARES

To Be Held on May 30, 2024

Fort Washington Country Club

10272 N. Millbrook Avenue, Fresno, California 93730

_____________________________________

GENERAL INFORMATION FOR SHAREHOLDERS

The following information is furnished in connection with the solicitation of the accompanying proxy by and on behalf of the Board of Directors of Community West Bancshares (the “Company” or “Community West”) for use at the Annual Meeting of Shareholders to be held at the Fort Washington Country Club, 10272 N. Millbrook Avenue, Fresno, California 93730, on Wednesday, May 30, 2024 at 3:00 p.m. Only shareholders of record at the close of business on April 25, 2024 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, the Company had outstanding and entitled to vote at the Annual Meeting, and any adjournments thereof 18,869,828 shares of its common stock, no par value (“Common Stock”). This proxy statement will be first made available to shareholders on or about May 6, 2024.

Vote By Proxy

As many of the Company’s shareholders are not expected to attend the Annual Meeting in person, the Company solicits proxies so that each shareholder is given an opportunity to vote. Shares represented by a duly executed proxy in the accompanying form, received by the Board of Directors prior to the Annual Meeting, will be voted at the Annual Meeting. A shareholder executing a proxy card through the Internet, by telephone, or by mail may revoke the proxy at any time prior to exercise of the authority granted by the proxy by (i) filing with the secretary of the Company an instrument revoking it or a duly executed proxy card bearing a later date; or (ii) attending the Annual Meeting and voting in person. A proxy is also revoked when written notice of the death or incapacity of the maker of the proxy is received by the Company before the vote is counted. Voting online, by telephone, or by mail will not affect your right to attend the Annual Meeting and vote.

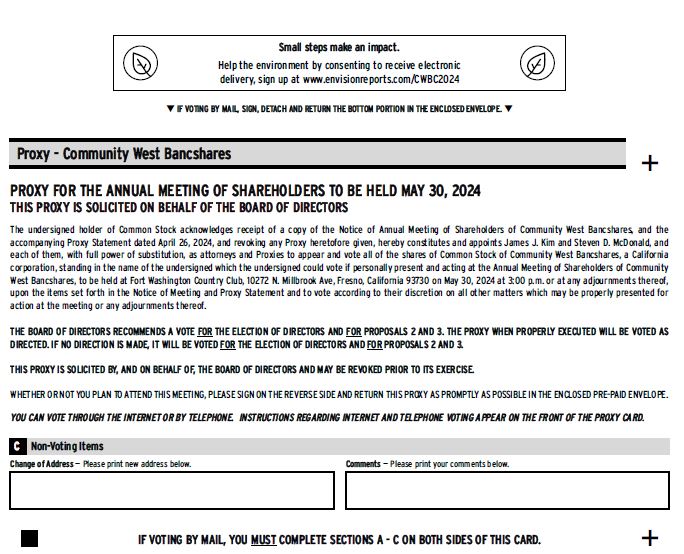

The proxy holders, James J. Kim and Steven D. McDonald, both of whom are directors of the Company, will vote all shares of Common Stock represented by the proxies unless authority to vote such shares is withheld or the proxy is revoked. However, the proxy holders cannot vote the shares of the shareholder unless the shareholder votes their shares online at www.envisionreports.com/CWBC2024, by telephone, or by mail. Online, telephone, or mail voting also confers upon the proxy holders discretionary authority to vote the shares represented thereby on any matter that was not known at the time this Proxy Statement was made available on the Internet, which may properly be presented for action at the Annual Meeting, including a motion to adjourn, and with respect to procedural matters pertaining to the conduct of the Annual Meeting. The total expense of soliciting the proxies in the accompanying form will be borne by the Company. While proxies are normally solicited by mail, proxies may also be solicited directly by officers, directors and employees of the Company or its subsidiary, Community West Bank (the “Bank”). Such officers, directors and employees will not be compensated for this service beyond normal compensation to them. If management determines that the Company should engage proxy solicitation agents to obtain sufficient votes for proposals, the cost of such agents would be borne by the Company.

If you properly vote online, by telephone, or by mail, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. If you do not make specific choices, your proxy will vote your shares as recommended by the Board of Directors as follows:

FOR the election of all nominees for director named herein;

FOR ratification of the selection of Moss Adams LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024; and

FOR ratification of a non-binding advisory resolution approving executive compensation.

For the election of directors (Proposal 1), a shareholder may withhold authority for the proxy holders to vote for any one or more of the nominees by indicating on the proxy card in the manner instructed on the proxy card. Unless authority to vote for the nominees is withheld, the proxy holders will vote the proxies received by them for the election of the nominees listed on the proxy card as directors of the Company. Your proxy does not have an obligation to vote for nominees not identified on the proxy card (that is, write-in candidates). Should any shareholder attempt to “write in” a vote for a nominee

not identified on the card (and described in these proxy materials), your proxy will not vote the shares represented by your proxy card for any such write-in candidate, but will instead vote the shares for any and all other indicated candidates. If any of the nominees should be unable or decline to serve, which is not now anticipated, your proxy will have discretionary authority to vote for a substitute who shall be designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, your proxy intends to vote all of the proxies in such a manner as will assure the election of as many of the nominees identified on the proxy card as possible. In such event, the specific nominees to be voted for will be determined by the proxy holders, in their sole discretion.

Boxes and a designated blank space are provided on the proxy card for shareholders to indicate if they wish either to abstain on one or more of the proposals or to withhold authority to vote for one or more nominees for director.

Shares Held in the Name of Your Broker

If your shares are held by your broker, sometimes called “street name” shares, you must vote your shares through your broker. You should receive a form from your broker asking how you want to vote your shares. Follow the instructions on that form to give voting instructions to your broker. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine, but not on non-routine matters. A “broker non-vote” occurs when your broker does not vote on a particular proposal because the broker does not receive instructions from the beneficial owner and does not have discretionary authority. Proposal 1 (election of directors) and Proposal 3 (executive compensation) are non-routine items on which a broker may vote only if the beneficial owner has provided voting instructions. Proposal 2 (ratification of independent registered public accounting firm) is a routine item.

Procedures For Attending the Annual Meeting

Only shareholders owning the Company’s Common Stock on the Record Date, or their legal proxy holders, are entitled to attend the Annual Meeting. You must present photo identification for admittance. If you are a shareholder of record, your name will be verified against the list of shareholders of record on the Record Date prior to your admission to the Annual Meeting. If you are not a shareholder of record but hold shares through a bank, broker or other nominee, you must provide proof of beneficial ownership on the Record Date, such as your most recent account statement prior to the Record Date, or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above, you will not be admitted to the Annual Meeting.

Quorum for the Meeting

A quorum of shareholders is necessary to hold a valid meeting. The presence at the annual meeting in person or by proxy of the holders of a majority of the outstanding shares of Common Stock entitled to vote shall constitute a quorum for the transaction of business. Proxies marked as abstaining (including proxies containing broker non-votes) on any matter to be acted upon by shareholders will be treated as present at the meeting for purposes of determining a quorum but will not be counted as votes cast on such matters. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

Voting in Person

If you plan to attend the Annual Meeting and desire to vote in person, we will give you a ballot form when you arrive. However, if your shares are held in the name of your broker, bank or other nominee, you must bring a power of attorney from your nominee in order to vote at the Annual Meeting.

Shareholders whose shares are registered in their own names may vote through the Internet, by telephone, or by mail, and instructions are set forth on the Shareholder Meeting Notice. The Internet voting procedures are designed to authenticate the shareholder’s identity and to allow shareholders to vote their shares and confirm that their voting instructions have been properly recorded.

Required Vote for Each Proposal

Approval of Proposal 1 (election of directors) requires a plurality of votes cast for each nominee. This means that the 15 nominees who receive the most votes will be elected. So, if you do not vote for a particular nominee, or you indicate “WITHHOLD AUTHORITY” to vote for a particular nominee on your proxy card, your vote will not count either “for” or “against” the nominee. Abstentions will not have any effect on the outcome of the vote. Broker non-votes will not count as a vote on the proposal and will not affect the outcome of the vote.

Approval of Proposal 2 (ratification of independent registered public accounting firm) and Proposal 3 (executive compensation) require a vote that satisfies two criteria: (i) the affirmative vote for the proposal must constitute a majority of the common shares present or represented by proxy and voting on the proposal at the Annual Meeting; and (ii) the affirmative vote for the proposal must constitute a majority of the common shares required to constitute the quorum. For purposes of Proposals 2 and 3, abstentions and broker non-votes will not affect the outcome under clause (i), which recognizes only actual votes cast. However, abstentions and broker non-votes will affect the outcome under clause (ii) if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the voting power required to

constitute a quorum. The ratification of the appointment of the independent registered public accounting firm for 2024 is a matter on which a broker or other nominee is generally empowered to vote and, therefore, no broker non-votes are expected to exist with respect to Proposal 2.

Shareholders Entitled to Vote

Only shareholders of record at the close of business on April 25, 2024, are entitled to notice of, and to vote at, the Annual Meeting. At the close of business on that date, the Company had outstanding 18,869,828 shares of its Common Stock, no par value.

The Company’s Annual Report to Shareholders and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are included on the Company’s online voting site at www.envisionreports.com/ CWBC2024. A paper copy of these materials may be requested online at www.envisionreports.com/CWBC2024, by calling 1-866-641-4276, or by emailing investorvote@computershare.com.

You can also find out more information about us at our website www.cvcb.com. Our website is available for information purposes only and should not be relied upon for investment purposes, nor is it incorporated by reference into this proxy statement. On our website you can access electronically filed copies of our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Section 16 filings, and amendments to those reports and filings, free of charge. The SEC also maintains a website at www.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including the Company.

SHAREHOLDINGS OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

Management does not know of any person who owns, beneficially or of record, either individually or together with associates, five percent (5%) or more of the outstanding shares of Common Stock, except as set forth in the table below.

The following table sets forth, as of the Record Date, the number and percentage of shares of Common Stock beneficially owned, directly or indirectly, by each of the Company’s directors, Named Executive Officers (“NEO”) and principal shareholders and by the directors and executive officers of the Company as a group. The shares “beneficially owned” are determined under Securities and Exchange Commission rules, and do not necessarily indicate ownership for any other purpose. In general, beneficial ownership includes shares over which the director, principal shareholder or executive officer has sole or shared voting or investment power and shares which such person has the right to acquire within 60 days of the Record Date. Shares of restricted stock issued to officers and directors are subject to forfeiture to the Company, but are eligible to vote at the Annual Meeting. Information respecting principal shareholders is presented in reliance on information provided by the principal shareholders. For purposes of the table below, the address for all directors and officers is 7100 N. Financial Drive, Suite 101, Fresno, California 93720. The percentage ownership is calculated based on 18,869,828 shares of Common Stock outstanding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Positions Held With the Company | | Director or Officer Since | | Shares Beneficially Owned as of the Record Date |

| Name | | Age | | | | Number | | Percent of Class |

| Robert H. Bartlein | | 76 | | | Vice Chairman and Director | | 2024 | | 428,056 | | | | | 2.27 | % |

| Suzanne Chadwick | | 76 | | | Director | | 2024 | | 1,403 | | | | | * |

| Daniel N. Cunningham | | 87 | | | Director | | 2000 | | 319,942 | | | (1) | | | 1.70 | % |

| Tom L. Dobyns | | 71 | | | Director | | 2024 | | 12,245 | | | (2) | | | * |

| Daniel J. Doyle | | 77 | | | Chairman of the Board and Director | | 2000 | | 96,358 | | | (3) | | | * |

| F. T. “Tommy” Elliott, IV | | 47 | | | Director | | 2013 | | 86,655 | | | (4) | | | * |

| Robert J. Flautt | | 73 | | | Director | | 2017 | | 30,194 | | | (5) | | | * |

| | | | | | | | | | | | |

| James J. Kim | | 48 | | | Chief Executive Officer and Director ** | | 2018 | | 49,823 | | | (6) | | | * |

| Blaine C. Lauhon | | 61 | | | Executive Vice President and Chief Administrative Officer ** | | 2019 | | 20,273 | | | (7) | | | * |

| Shannon R. Livingston | | 41 | | | Executive Vice President and Chief Financial Officer ** | | 2023 | | 6,989 | | | (8) | | | * |

| James W. Lokey | | 76 | | | Director | | 2024 | | 10,707 | | | | | * |

| Patrick A. Luis | | 63 | | | Executive Vice President and Chief Credit Officer ** | | 2020 | | 25,597 | | | (9) | | | * |

| Andriana D. Majarian | | 51 | | | Director | | 2020 | | 17,229 | | | (10) | | | * |

| Jeffrey M. Martin | | 50 | | | Executive Vice President and Chief Banking Officer ** | | 2022 | | 12,041 | | | (11) | | | * |

| Steven D. McDonald | | 74 | | | Secretary and Director | | 2000 | | 354,470 | | | (12) | | | 1.88 | % |

| Martin E. Plourd | | 66 | | | President and Director | | 2024 | | 228,994 | | | (13) | | | 1.21 | % |

| | | | | | | | | | | | |

| Dorothea D. Silva | | 51 | | | Director | | 2019 | | 9,748 | | | (14) | | | * |

| William S. Smittcamp | | 71 | | | Director | | 2000 | | 168,958 | | | (15) | | | * |

| Kirk B. Stovesand | | 61 | | | Director | | 2024 | | 75,303 | | | (16) | | | * |

| Fourthstone LLC | | | | | | | | 1,786,450 | | | | | 9.47 | % |

| 575 Maryville Centre Drive | | | | | | | | | | | | |

| Suite 110, St. Louis, MO 63141 | | | | | | | | | | | | |

| All directors and executive officers of the Company and the Bank as a group (24 in number) | | | | | | | | 2,104,890 | | | | | 11.15 | % |

* Beneficial ownership does not exceed one percent of Common Stock outstanding.

** As used throughout this Proxy Statement, the term “executive officer” means the president, any executive vice president in charge of a principal business unit or function, and any other officer or person who performs a policy making function for the Company or the Bank. Mr. Lauhon and Mr. Martin are executive officers of the Bank only. Each executive officer serves on an annual basis and must be appointed by the Board of Directors annually pursuant to the Bylaws of the Company (or the Bylaws of the Bank, in the case of Mr. Lauhon and Mr. Martin).

(1)Includes 71,079 shares held by a trust in which Mr. Cunningham is trustee. Includes 87,120 shares held as trustee for the Bradley and Joanne Quinn Living Trust as to which Mr. Cunningham disclaims beneficial ownership, and 122,508 shares held under a power of attorney executed in favor of Mr. Cunningham by Eric Quinn as to which Mr. Cunningham disclaims beneficial ownership. Also includes 2,159 shares of restricted stock that have not vested which Mr. Cunningham has the right to vote.

(2)Includes 8,690 options that are exercisable within 60 days after the Record Date (vested) and treated as issued and outstanding for the purpose of computing the percent of the class owned and the percent of class owned by all Directors and executive officers as a group, but not for the purpose of computing the percent of class owned by any other person.

(3)Includes 90,358 shares held by a trust in which Mr. Doyle is trustee. Also 2,159 shares of restricted stock that have not vested which Mr. Doyle has the right to vote.

(4)Includes 9,210 shares owned of record by Mr. Elliott, IV’s daughter, and 10,000 shares held under a power of attorney executed in favor of Mr. Elliott, IV by F.T. Elliott, III as to which Mr. Elliott, IV disclaims beneficial ownership. Also includes 2,159 shares of restricted stock that have not vested which Mr. Elliott, IV has the right to vote.

(5)Includes 2,159 shares of restricted stock that have not vested which Mr. Flautt has the right to vote.

(6)Includes 9,239 shares of restricted stock that have not vested which Mr. Kim has the right to vote.

(7)Includes 3,073 shares held by a trust in which Mr. Lauhon is trustee and 3,724 shares of restricted stock that have not vested which Mr. Lauhon has the right to vote.

(8)Includes 6,331 shares of restricted stock that have not vested which Ms. Livingston has the right to vote.

(9)Includes 5,882 shares of restricted stock that have not vested which Mr. Luis has the right to vote.

(10)Includes 12,240 shares held by a trust in which Ms. Majarian is trustee, which includes 2,159 shares of restricted stock that have not vested which Ms. Majarian has the right to vote.

(11)Includes 6,280 shares of restricted stock that have not vested which Mr. Martin has the right to vote.

(12)Includes 1,608 shares held by Mr. McDonald’s spouse, and 28,136 shares held by a trust in which Mr. McDonald is a trustee. Also includes 2,159 shares of restricted stock that have not vested which Mr. McDonald has the right to vote.

(13)Includes 137,977 options that are exercisable within 60 days after the Record Date (vested) and treated as issued and outstanding for the purpose of computing the percent of the class owned and the percent of class owned by all Directors and executive officers as a group, but not for the purpose of computing the percent of class owned by any other person.

(14)Includes 4,239 shares held by a trust in which Ms. Silva is trustee. Also includes 2,159 shares of restricted stock that have not vested which Ms. Silva has the right to vote.

(15)Includes 168,958 shares held by a trust in which Mr. Smittcamp is trustee. Also includes 2,159 shares of restricted stock that have not vested which Mr. Smittcamp has the right to vote.

(16)Includes 6,320 options that are exercisable within 60 days after the Record Date (vested) and treated as issued and outstanding for the purpose of computing the percent of the class owned and the percent of class owned by all Directors and executive officers as a group, but not for the purpose of computing the percent of class owned by any other person.

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL NO. 1

ELECTION OF DIRECTORS OF THE COMPANY

The Bylaws of the Company provide a nomination procedure for election of members of the Board of Directors, which procedure is included in the Notice of Annual Meeting of Shareholders accompanying this Proxy Statement. Nominations not made in accordance therewith may, in his or her discretion, be disregarded by the Chairman of the Annual Meeting and, upon his or her instruction, the inspector of election shall disregard all votes cast for such nominee(s).

The Bylaws of the Company provide that the Board of Directors will consist of not less than nine (9) and not more than fifteen (15) directors. The number of directors is set by the Board of Directors and is currently set at fifteen (15). The authorized number of directors to be elected at the Annual Meeting is fifteen (15). Each director will hold office until the next Annual Meeting of Shareholders and until his or her successor is elected and qualified.

All proxies will be voted for the election of the following fifteen (15) nominees recommended by the Board of Directors, all of whom are incumbent directors, unless authority to vote for the election of directors is withheld. If any of the nominees should unexpectedly decline or be unable to act as a director, the proxies may be voted for a substitute nominee to be designated by the Board of Directors. The Board of Directors has no reason to believe that any nominee will become unavailable and has no present intention to nominate persons in addition to or in lieu of those named below. There is no family relationship between any of the directors or principal officers.

NOMINEES FOR THE BOARD OF DIRECTORS

The following is a brief account of the business experience for at least the past five years of each nominee to the Board of Directors. The Company, formerly named Central Valley Community Bancorp, completed an acquisition of Community West Bancshares (“CWB”) on April 1, 2024. Effective with the merger, the Company changed its corporate name from Central Valley Community Bancorp to Community West Bancshares on April 1, 2024. In accordance with the terms of the merger Robert H. Bartlein, Suzanne M. Chadwick, Tom L. Dobyns, James W. Lokey, Martin E. Plourd and Kirk B. Stovesand, former directors of CWB were appointed to the Board of Directors effective April 1, 2024. Under the terms of the merger the Company agreed that these six new directors would be included on the list of nominees for directors presented by the Board of Directors for the Annual Meeting.

ROBERT H. BARTLEIN was appointed as director and Vice Chairman of the Company and Bank on April 1, 2024, following the completion of the acquisition of CWB, where he was a founder and director. He is President and CEO of Bartlein & Company Inc., a property management company founded in 1969 with five California offices as well as offices in other states. Mr. Bartlein is a graduate of the University of Wisconsin-Madison with a degree in Finance, Investments and Banking, and did post-graduate study at the University of Wisconsin-Milwaukee. Mr. Bartlein is past President and a Director of the American Lung Association of Santa Barbara and Ventura Counties. As President of Bartlein & Company, Inc., Mr. Bartlein has substantial real estate experience with broad business exposure. He is knowledgeable in real estate transactions, real estate law, credit analysis, accounting, income tax law and finance. Mr. Bartlein is particularly familiar with the Central Coast real estate market and is active in the community. We believe that Mr. Bartlein’s real estate knowledge and experience, as well as his knowledge of coastal markets qualifies him to serve on our Board.

SUZANNE CHADWICK was appointed as director on April 1, 2024, following the completion of the acquisition of CWB, where she was a director since August 2020. She worked for Santa Barbara Bank & Trust for over 20 years as Senior Vice President and Private Client Relationship Manager and was responsible for the bank’s expansion into Ventura County. Ms. Chadwick is a graduate of Pacific Coast Banking School. As a former Regent at California Lutheran University, she continues her involvement there as a member of the Center for Nonprofit Leadership, the School of Management and KCLU Advisory Boards where she has been active since 1995. Ms. Chadwick had an extensive career in banking cultivating business relationships and private client services. Ms. Chadwick is extremely knowledgeable with the Ventura County banking market and the business community. We believe that Ms. Chadwick’s banking experience and knowledge of coastal markets qualifies her to serve on our Board.

DANIEL N. CUNNINGHAM is a founding director of the Company and the Bank. He is also a Director Emeritus of Quinn Group, Inc. and previously served as its Chief Financial Officer. He holds BS and MS degrees in accounting from Fresno State University and is a Certified Public Accountant, which qualifies him as a financial expert on the Company’s Audit Committee. Mr. Cunningham has been a director of the Company since 2000, a director of the Bank since 1979, and has served on the boards of large privately held companies. He has farmed in the San Joaquin Valley for many years and has served in local non-profit organizations. We believe that Mr. Cunningham’s 43 years of board experience in the banking industry, including 15 years as Chairman, along with extensive knowledge of banking laws and regulations combined with his finance and accounting background qualifies him to serve on our Board and as one of our “financial experts”.

TOM L. DOBYNS was appointed as director on April 1, 2024, following the completion of the acquisition of CWB, where he previously served as a director since June 2017. He has more than 40 years of bank management experience, including most recently as Chief Executive Officer of Mission Community Bank and President and Chief Executive Officer of American Security Bank. He founded Enthusiology, a managerial and leadership consulting firm specializing in strategic planning, executive coaching and energizing the sales process for banks, credit unions and nonprofit organizations. He is a graduate of the University of Southern California, earning Bachelor of Business Administration and Master of Business Administration degrees. Mr. Dobyns is active on several community-based not-for-profit boards. We believe that Mr. Dobyns extensive experience in bank management serving in various executive management capacities including as Chief Executive Officer, his history in leadership and executive coaching qualifies him to serve on our Board.

DANIEL J. DOYLE joined the Company in June of 1998, and served as President and CEO until his retirement in January 2015. Since retiring, Mr. Doyle continued with the Company and the Bank as Chairman of the Boards of each. Prior to coming to the Company, Mr. Doyle served as Regional President for US Bank in Washington State and was the first President and CEO of US Bank of California, both greatly successful tenures leading up to his long career at the Company. Under his leadership the Company experienced phenomenal financial success as one of the safest community banks in California’s San Joaquin Valley. Mr. Doyle’s 52 years of banking experience, his educational achievements, including graduate and undergraduate degrees from the University of Washington, and his solid business values, contributed greatly to the Company’s success. Mr. Doyle’s history of service on the many boards and committees of various banking industry groups spans his entire career. He has a reputation throughout the community for his thoughtful leadership, giving nature, and generous community service. We believe Mr. Doyle’s extensive knowledge of the banking regulations and financial markets, including 52 years of banking experience along with a keen understanding of the markets in which the Company serves qualifies him to serve on our Board.

F. T. “TOMMY” ELLIOTT, IV became a Director of the Company and Bank in 2013 following the Company’s acquisition of Visalia Community Bank, where Mr. Elliott served as Chairman of the Board. Mr. Elliott is the owner and Chairman of both Wileman Bros. & Elliott, Inc., a grower, packer and shipper of California fresh citrus, and of Kaweah Container, Inc., a premier independent corrugated manufacturer. Mr. Elliott is a member of the Young Presidents Organization and a former director of the Boys and Girls Clubs of Tulare County. We believe Mr. Elliott’s strong business acumen as well as his banking experience in addition to his knowledge of our geographic markets and our client base well qualifies him to serve on our Board.

ROBERT J. FLAUTT is the retired former President, CEO and a Director of Folsom Lake Bank, culminating his long career in the banking industry upon the acquisition by the Company in 2017 when he was appointed as a director of the Company and the Bank. He is a respected business leader in the Greater Sacramento Region and has a prominent record of service on the boards of, or in executive positions with, many local community service and non-profit organizations. We believe Mr. Flautt’s 43 years of experience in the banking industry, including his keen understanding of banking laws and regulations, his high level of understanding of the Board’s roles and responsibilities based on his service on other bank boards, and his extensive knowledge of the greater Sacramento communities qualifies him to serve on our Board.

JAMES J. KIM has served as Director and Chief Executive Officer of the Company and Bank since November 1, 2021. Mr. Kim had served as Executive Vice President and Chief Operating Officer of the Bank from February 2019 to November 2021. Mr. Kim joined the Bank as Executive Vice President and Chief Administrative Officer in January 2018 with over 20 years of bank leadership expertise, most recently serving in the positions of controller, chief operations officer, chief financial officer and chief executive officer for financial institutions in the Greater Sacramento Region. He began his career working for an international accountancy and business advisory firm in Sacramento. He obtained his BS in Accountancy and MBA from California State University, Sacramento. In addition to his proven leadership of the Company and his extensive experience in banking laws and regulations, we believe Mr. Kim’s extensive knowledge of the financial markets and the markets in which the Company serves qualifies him to serve as President and CEO of our Company and to serve on our Board.

JAMES W. LOKEY was appointed as director on April 1, 2024, following the completion of the acquisition of CWB, where he previously served as a director since 2015. Mr. Lokey has more than 50 years of bank management experience, including Chairman of the Board and Chief Executive Officer of Mission Community Bancorp (2010-2014); President of Rabobank, N.A. (2007-2009); President and Chief Executive Officer of Mid-State Bank & Trust (2000-2007); President and Chief Executive Officer of Downey Savings (1997-1998); Executive Vice President of First Interstate Bank/Wells Fargo Bank (1973-1996) and Past Chairman of California Bankers Association. He has significant ties in the communities of the Central Coast, including serving as a member of the President’s Cabinet at Cal Poly State University in San Luis Obispo; a Director of Cal Poly Corporation and Chairman of its investment committee; and Director of French Hospital Medical Center. Since retiring in 2014, Mr. Lokey has been active as a consultant and featured speaker regarding director education, enterprise risk management and mergers and acquisitions. Mr. Lokey has spent virtually his entire career serving the banking industry, including many years as Chairman and Chief Executive Officer. He is extremely knowledgeable with the San Luis Obispo business community and banking market. We believe that Mr. Lokey’s past banking experience and

knowledge, his leadership advocating on behalf of California Banks, and his deep knowledge of the central coast communities, qualifies him to serve on our Board.

ANDRIANA D. MAJARIAN has served as a director of the Company and Bank since 2020. Ms. Majarian is an Executive Director of Valley Children’s Healthcare Foundation. Prior to her current role at Valley Children’s Healthcare Foundation, she was Global Head of Customer Success of TELUS Agriculture. TELUS is recognized as one of the largest and most-profitable Ag technology companies in the world. Ms. Majarian oversaw all aspects of TELUS Agriculture’s global business operations throughout North America, South America, Australia, and Europe. Her experience and leadership at TELUS was focused in developing and delivering technology-driven business services and solutions, building globally-connected capabilities across the agricultural, food, and packaged goods industries. For nearly 17 years, Ms. Majarian has been driving organizational growth, leading cross-function teams, and developing a software-as-a-service model, earning the trust of her team and clients as a creative and bottom-line motivated leader. An alumna of California State University, Fresno, she believes in giving back to her community and mentoring the next generation of leaders. She is a past president of the Big Fresno Fair and the Friends of the Fair. We believe that Ms. Majarian’s extensive knowledge and leadership experience within the Agricultural industry, combined with her professional expertise, technology-driven business solutions, and sales and agribusiness background qualifies her to serve on our Board.

STEVEN D. McDONALD has served as a director for the Company since its inception in 2000, the Bank since 1990 and currently serves as the Secretary of the Boards of Directors of the Company and the Bank. Mr. McDonald is President of McDonald Properties, Inc., with interests in cattle ranching, mobile home park management and other real estate investments. Mr. McDonald is also the owner/broker of SDM Realty, specializing in ranch brokerage. Mr. McDonald serves his industry and community through many non-profit offices and directorships, both locally and state wide. We believe that Mr. McDonald’s extensive management and leadership experience in the cattle ranching and the real estate industries, his expertise and his experience as a non-profit director, as well as his audit committee leadership qualifies him to serve on our Board.

MARTIN E. PLOURD was appointed as a director for the Company and Bank and President of the Company on April 1, 2024, following the completion of the acquisition of CWB, where he previously served as a director since 2011. Mr. Plourd has been in banking for 44 years. From July 2009 to 2011, he has worked as a consultant on engagements with bank strategic planning, acquisitions, and compliance. From July 2005 to July 2009, Mr. Plourd served first as Chief Operating Officer and then President and Director of Temecula Valley Bank, Temecula, California. Prior to that, Mr. Plourd spent 18 years with Rabobank/Valley Independent Bank, El Centro, California. Mr. Plourd is a graduate of Stonier Graduate School of Banking and California State Polytechnic University. He has served on several community/non-profit organizations. Currently serving as a Trustee for the Foundation for Cottage Rehabilitation & Goleta Valley Cottage Hospitals, serving on the Finance, Audit, and Investment committees. Mr. Plourd is a board member for the Scholarship Foundation of Santa Barbara and a member of the Rotary Club of Goleta. He is also an executive board member of California Bankers Association and is an advisory board member for the College of Agriculture at California State Polytechnic University, Pomona (Cal Poly). Through his numerous executive positions Mr. Plourd, he has a substantial financial services’ background, including management, lending, marketing and bank operations. We believe that Mr. Plourd’s experiences qualifies him to serve on our Board and to provide the Company with effective leadership in the conduct of its business and strategic initiatives.

DOROTHEA D. SILVA has served as a director for the Company and Bank since 2020. Ms. Silva is a partner with BPM LLP and a certified public accountant (CPA) with over 20 years of tax and accounting experience. Prior to her position with BPM LLP, she was a partner with Avaunt and Chavez Silva & Co. She also held positions at Williams & Olds CPA and Arthur Andersen. Her strengths abound in the diverse industry knowledge of the clients she serves, including financial services, construction, real estate, food processing, manufacturing, retail, professional services and an array of nonprofits. We believe that Ms. Silva’s extensive knowledge and leadership experience combined with her finance and accounting background qualifies her to serve on our Board, the Audit Committee, and as one of our “financial experts.”

WILLIAM S. SMITTCAMP has served as a director for the Company since its inception in 2000 and the Bank since 1987. Mr. Smittcamp is President and owner of Wawona Frozen Foods and is involved as a principle in other family related businesses. Wawona Frozen Foods, located in the San Joaquin Valley grows, processes and supplies over 125 million pounds of frozen fruit products worldwide. Mr. Smittcamp is a graduate of California State University, Fresno, and has given major grants to the Honors College, CSUF Ag and the Food Sciences Departments. Mr. Smittcamp serves on and was past chair of the Board of Trustees for Children’s Hospital Central California, is a member of the Board of Governors of Fresno State, and is a Board member of the Garfield Water District. He has also been a leader in state and national organizations such as California League of Food Processors and the American Frozen Food Institute. Mr. Smittcamp is a long-standing member of the Board of Directors of our Company and Bank. We believe Mr. Smittcamp’s strong business experience and leadership, his extensive network of business relationships within our market area, his understanding of the agricultural and food service industries, and his high level of understanding of the Board’s roles and responsibilities based on his service on our Board, qualifies him to serve on our Board.

KIRK B. STOVESAND was appointed as director on April 1, 2024, following the completion of the acquisition of CWB, where he previously served as a director since 2003. He is a partner of Walpole & Co., a Certified Public Accounting

and Consulting firm founded in 1974. Mr. Stovesand received a Bachelors Degree in Business Economics from the University of California Santa Barbara, a Masters Degree in Taxation from Golden Gate University, and a Master Certificate in Global Business Management from George Washington University. He is also a Certified Financial Planner and has been on the boards of many profit and nonprofit organizations. Mr. Stovesand is a member of the American Institute of Certified Public Accountants. Mr. Stovesand has a broad financial background and serves as a partner of an accounting and consulting firm. He has a CPA, a CFP, and a Masters in taxation. Mr. Stovesand is active on boards of for-profit and not-for-profit organizations. We believe that Mr. Stovesand’s background qualifies him to serve on our Board, the Audit Committee, and as one of our “financial experts.”

The Board of Directors recommends the election of each nominee. The proxy holders intend to vote all proxies they hold in favor of the election of each of the nominees. If no instruction is given, the proxy holders intend to vote FOR each nominee listed.

The following table provides information regarding the members of our Board of Directors, including certain types of knowledge, skills, experiences or attributes possessed by one or more of our directors which our Board of Directors believes are relevant to our business or industry. The table does not encompass all of the knowledge, skills, experiences or attributes of our directors, and the fact that a particular knowledge, skill, experience or attribute is not listed does not mean that a director does not possess it. In addition, that absence of a particular knowledge, skill, experience or attribute with respect to any of our directors does not mean that the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill, experience or attribute listed below may vary among the directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Bartlein | Chadwick | Cunningham | Dobyns | Doyle | Elliott | Flautt | Kim | Lokey | Majarian | McDonald | Plourd | Silva | Smittcamp | Stovesand |

| Knowledge, Skills, and Experience |

| Public Company Board Experience | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X |

| Financial | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X |

| Risk Management | X | | X | X | X | X | X | X | X | | X | X | | X | X |

| Accounting | X | | X | | X | X | | X | X | X | X | X | X | | X |

| Corporate Governance/Ethics | X | | X | X | X | X | X | X | X | X | X | X | X | X | X |

| Legal/Regulatory Compliance | X | | X | X | X | | X | X | X | X | X | X | X | | X |

| HR/Compensation | X | X | X | X | X | X | | X | | X | | X | X | | |

| Executive Experience | X | X | X | X | X | X | X | X | X | X | X | X | | X | |

| Banking Operations | X | X | | X | X | X | X | X | X | | | X | X | | |

| Strategic Planning/Oversight | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X |

| Technology | X | | | X | X | X | | X | | X | | X | X | | |

| Mergers and Acquisitions | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X |

| Board Tenure | | | | | | | | | | | | | | | |

| Years | * | * | 24 | * | 24 | 11 | 6 | 3 | * | 4 | 24 | * | 4 | 24 | * |

| * Directors were appointed on April 1, 2024 | | | | | | |

| | | | | | | | | | | | | | | | |

| The following table summarizes the diversity of our Board. |

| Demographics | | | | | | | | | | | | | | | |

| Race/Ethnicity | | | | | | | | | | | | | | | |

| African American | | | | | | | | | | | | | | | |

| Asian/Pacific Islander | | | | | | | | X | | | | | X | | |

| White/Caucasian | X | X | X | X | X | X | X | | X | X | X | X | | X | X |

| Hispanic/Latino | | | | | | | | | | | | | | | |

| Native American | | | | | | | | | | | | | | | |

| Gender | | | | | | | | | | | | | | | |

| Female | | X | | | | | | | | X | | | X | | |

| Male | X | | X | X | X | X | X | X | X | | X | X | | X | X |

EXECUTIVE OFFICERS OF THE COMPANY AND THE BANK

The following is a brief account of the business experience for at least the past five years of each of the executive officers of the Company and the Bank.

Biographical information for James J. Kim is found under “Nominees for the Board of Directors.”

DAWN M. CAGLE became Executive Vice President and Chief Human Resources Officer of the Bank in November 2021. Prior to that time, Ms. Cagle served as Senior Vice President, Human Resources Manager since joining the Bank in 2018. Prior to joining the Bank, Ms. Cagle had over 30 years of experience in Human Resources, most recently as the Chief Human Resources Officer at a large non-profit organization. Ms. Cagle has a Bachelor’s degree in Business Administration with an emphasis in Human Resources from California State University, Fresno and has professional certifications in Human Resources through the Society of Human Resources Management.

WILLIAM F. FILIPPIN was named Executive Vice President, Regional Executive of the Bank on April 1, 2024. Mr. Filippin was previously President of Community West Bank, N.A., which was acquired by the Bank on April 1, 2024. He was with Community West Bank, N.A. since June 2015 and served as a Director since 2022. Prior to joining Community West Bank, N.A. in 2015, Mr. Filippin served at Heritage Oaks Bank (and Mission Community Bank until it was merged into Heritage Oaks Bank in February 2014) as Market Area President from March 2012 to May 2015; Executive Vice President and Chief Credit Officer from August 2010 to March 2012; and, Senior Vice President and Credit Administrator from April 2009 to August 2010. Mr. Filippin is a founding member of the Paso Robles Optimist Club, served as President of the Paso Robles Kiwanis Club, and Chairman of the Arroyo Grande Chamber of Commerce. He holds degrees in Agriculture Business Management from Cal Poly San Luis Obispo and from The Graduate School of Banking at the University of Wisconsin-Madison.

TERESA GILIO was named Executive Vice President of the Bank in February 2019. Prior to that time, Ms. Gilio served as Senior Vice President, Central Operations since joining the Bank in 2009. Prior to joining the Bank, Ms. Gilio served in leadership positions for three major financial institutions as branch manager, senior lender, and senior vice president and sales manager for a California statewide branch network overseeing small business lending. She began her career at one of the top three banks in Ontario, Canada and is a graduate from the management training program through the Bank of Nova Scotia.

BLAINE C. LAUHON was named Executive Vice President, Chief Administrative Officer on April 1, 2024, previously serving as Executive Vice President, Chief Banking Officer of the Bank since November 2021. Mr. Lauhon served as Executive Vice President, Market Executive of the Bank from July 2019 until November 2021. Mr. Lauhon joined the Bank in 2017 as Senior Vice President, Senior Credit Officer with over three decades of financial experience. Mr. Lauhon has extensive bank leadership, and commercial and agribusiness lending expertise. He holds educational degrees from Dartmouth College Graduate School of Credit and Financial Management, University of Colorado Graduate School of Banking, and a B.S. in Agricultural Business from California State University, Chico.

SHANNON R. LIVINGSTON was named Executive Vice President and Chief Financial Officer of the Company and Bank in February 2023. Ms. Livingston joined the Company as an accomplished finance and accounting expert serving financial institutions with assets up to $18 billion, including 10 years with Moss Adams LLP in corporate strategic planning, financial management, accounting, risk management, auditing and regulatory reporting. Immediately prior to joining the Company, she served in the roles of Executive Vice President, Chief Financial Officer; Vice President, Controller; and Vice President, Internal Controls and Financial Reporting Manager for California financial institutions with asset sizes ranging from $200 million to $18 billion. She is a certified public accountant (CPA). Ms. Livingston graduated from Stanford University with a Bachelor of Arts, Economics degree.

PATRICK A. LUIS was named Executive Vice President and Chief Credit Officer of the Company and Bank in August 2020. Mr. Luis joined the Company with over 35 years of bank credit management expertise, most recently serving as Chief Risk Officer of an agricultural lending cooperative. For over 30 years prior to that time, Mr. Luis served as Executive Vice President and Division Manager for Wells Fargo Bank, NA. Mr. Luis received his B.S. in Agricultural Business from California State University, Fresno, and is a graduate of the Banking and Finance program from Pacific Coast Banking School

JEFFREY M. MARTIN was named Executive Vice President, Chief Banking Officer on April 1, 2024. Mr. Martin served as Executive Vice President, Market Executive from April 2022 until April 2024. Mr. Martin joined the Bank with over 20 years leadership expertise, proven industry growth results, a drive for high client satisfaction and successful team development, most recently with a California community bank where he was a regional president, covering a similar northern area territory in the state. He received his Bachelor of Science degree from California State University, Sacramento, and as a community steward, he has served and assisted numerous nonprofit organizations throughout his career.

A. KENNETH RAMOS was named Executive Vice President, Regional Executive on April 1, 2024. Mr. Ramos served as Executive Vice President, Market Executive of the Bank from July 2019 until April 2024. Mr. Ramos is a seasoned banker who joined the Bank with nearly two decades of bank leadership, agribusiness and commercial banking experience, most recently with a major commercial bank as the Business Banking President overseeing the Central Valley region. He

received his B.S. in Agricultural Business, Finance from California Polytechnic State University, San Luis Obispo, and is a graduate of the Banking and Finance program from Pacific Coast Banking School.

TIMOTHY J. STRONKS was named Executive Vice President and Chief Risk Officer of the Bank on April 1, 2024. Mr. Stronks previously served as Executive Vice President, Chief Operating Officer and Chief Risk Officer of Community West Bank, N.A, which was acquired by the Bank on April 1, 2024. Mr. Stronks prior roles included Senior Vice President, Deputy Director of Operations with Rabobank and prior to that as Executive Vice President for Pacific Premier Bank and Executive Vice President, Chief Information Officer of Heritage Oaks Bank (which was acquired by Pacific Premier Bank in March 2017). Mr. Stronks also previously held various positions at Business First National Bank (acquired by Heritage Oaks Bank) in Santa Barbara, CA and Santa Barbara Bank and Trust. Mr. Stronks is a Certified Information Security Manager and serves on the board of the Science and Engineering Council of Santa Barbara. Mr. Stronks is a graduate of Pacific Coast Banking School, holds a Bachelor of Arts degree in International Political Science and Slavic Languages and Literatures from the University of California at Santa Barbara, and an MBA in IT Management from Western Governors University.

Director Independence

The Board of Directors has determined that each of the following members are “independent” under the standards of the Nasdaq Stock Market: Robert H. Bartlein, Suzanne Chadwick, Daniel N. Cunningham, Tom L. Dobyns, Daniel J. Doyle, F.T. “Tommy” Elliott, IV, Robert J. Flautt, James W. Lokey, Adriana D. Majarian, Steven D. McDonald, Dorothea D. Silva, William S. Smittcamp, and Kirk B. Stovesand.

Board Leadership Structure

The position of Chairman of the Board is separate from the position of Chief Executive Officer for each of the Company and the Bank. Our Chairman of the Board, Daniel J. Doyle, became President and Chief Executive Officer of the Company upon its organization in 2000, and served as Chief Executive Officer of the Bank since June 1998. He retired as CEO and President of the Company and the Bank in January 2015. We believe this leadership structure enables separation of duties and independent oversight of the operating organization. According to the NASDAQ listing requirements, Mr. Doyle was considered an independent director beginning on January 1, 2019.

On April 1, 2024, the Company established an executive committee, consisting of the following members: Daniel J. Doyle (Chair), Robert H. Bartlein, James W. Lokey, Andriana D. Majarian and Steve D. McDonald. James J. Kim and Martin E. Plourd will serve as the initial advisors to the Executive Committee. The Executive Committee will possess and exercise such powers and functions of the Board of Directors as may be delegated by the Board of Directors subject to the Company’s articles of incorporation and bylaws and applicable law.

Role of Board of Directors in Risk Oversight

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. The Company faces a number of risks, including interest rate risk, economic risks, environmental, cybersecurity, and regulatory risks, and others, such as the impact of competition. Management is responsible for the day-to-day identification and management of risks the Company faces, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed.

The Board believes that establishing the right “tone at the top” and that full and open communication between management and the Board of Directors is essential for effective risk management and oversight. The Company’s Chairman meets regularly with the Chief Executive Officer and other senior officers to discuss strategy and risks facing the Company. Senior management is available to address any questions or concerns raised by the Board on risk management and any other matters. Periodically, the Board of Directors receives presentations from senior management on strategic matters involving the Company’s operations. The Board holds strategic planning sessions with senior management to discuss strategies, key challenges and risks and opportunities for the Company.

While the Board is ultimately responsible for risk oversight at the Company, the Board’s various standing committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls, credit risk, liquidity risk, reputation risk, compliance with legal and regulatory requirements, and cybersecurity and discusses policies with respect to risk assessment and risk management. Risk assessment reports are regularly provided by management to the Audit Committee or the Board. The Compensation Committee of the Board assists the Board in fulfilling its oversight responsibilities with respect to the management of risks arising from compensation policies and programs. The Nominating

and Corporate Governance Committee of the Board assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with Board organization, membership and structure, succession planning for the Company’s Directors and executive officers and corporate governance.

Board Stock Ownership Policy

During 2020, the Board of Directors adopted a resolution to require directors and executive management committee members to each own a minimum of 2,000 shares of Common Stock, separate and apart from any grants of Common Stock or Restricted Stock provided to them by the Company, for directors within the later of two years of director appointment, and for executives within the later of five years of adoption of the policy or executive appointment. As of December 31, 2023, all directors and named executive officers were in compliance with the Company stock-ownership requirements.

Board and Committee Meeting Attendance

During the fiscal year ended December 31, 2023, our Board of Directors held a total of 14 meetings, which included ten regularly scheduled meetings and four special meetings. Each incumbent director who was a director during 2023 attended at least 75% of the aggregate of (a) the total number of such meetings and (b) the total number of meetings held by the standing committees of the Board on which such director served.

Director Attendance at Shareholder Meetings

The Company does not have a policy which specifically addresses director attendance at shareholder meetings. However, 11 of the 12 directors were in attendance at the 2023 Annual Meeting of Shareholders on May 17, 2023.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors maintains the following standing committees: Compensation Committee, Nominating Committee, Strategic Planning Committee and Audit/Compliance Committee.

Compensation Committee

The Compensation Committee performs the function of a compensation committee for the Company and the Bank. All of the members of the Compensation Committee are independent directors as defined under the rules of the Nasdaq Stock Market as currently in effect. The Committee is composed of Robert H. Bartlein as Chairman, and Messrs. Cunningham, Dobyns, Elliott, and Smittcamp. The Committee has adopted a charter that outlines its policy with respect to executive and directors’ compensation and equity awards and incentive compensation awards and plans.

A copy of the Compensation Committee Charter may be accessed electronically at the Company website at www.cvcb.com or by writing Le-Ann Ruiz, Assistant Corporate Secretary, Community West Bancshares, 7100 N. Financial Drive, Suite 101, Fresno, California 93720.

The Committee held five meetings during 2023. The Committee (1) oversees matters relating to employment, compensation and management performance of key executive officers; (2) formally evaluates the performance of the President/CEO annually; (3) reviews and approves the compensation of executive officers; (4) approves incentive compensation and other benefits, including incentives, deferred compensation plans and equity compensation for the President/CEO and other key executive officers; (5) reviews and makes recommendations to the Board of Directors regarding retirement policies or any other compensation policies relating to the Board of Directors; (6) makes recommendations regarding fees, stock option grants and other benefits for the directors; and (7) in consultation with management, oversees regulatory compliance with respect to compensation matters.

Nominating Committee

The Nominating Committee is composed of Mr. Smittcamp as Chairman, Ms. Majarian, and Messrs. Bartlein, McDonald and Stovesand. All of the members of the Committee are independent directors as defined under the rules of the Nasdaq Stock Market as currently in effect.

The Committee held four meetings during 2023. The Committee annually makes recommendations for the nomination of directors to the full Board of Directors. All of the nominees for the Board of Directors were approved by the Nominating Committee.

The Committee adopted a charter which outlines its policy with respect to considering director candidates. A copy of the Nominating Committee Charter may be accessed electronically at the Company website at www.cvcb.com or by writing Le-Ann Ruiz, Assistant Corporate Secretary, Community West Bancshares, 7100 N. Financial Drive, Suite 101, Fresno, California 93720.

Nominations for election of members of the Board of Directors may be made by the Board of Directors or by any shareholder of any outstanding class of voting stock of the Company entitled to vote for election of directors. Notice of intention to make any nominations, other than by the Board of Directors, shall be made in writing and shall be received by the Chief Executive Officer or President of the Company not less than twenty-one (21) days nor more than sixty (60) days prior to any meeting of shareholders called for the election of directors; provided, however, that if less than 21 days’ notice of the meeting is given to shareholders, such notice of intention to nominate shall be mailed or delivered to the Chief Executive Officer or President of the Company not later that the close of business on the tenth day following the day on which the notice of meeting is mailed. Such notification shall contain the following information to the extent known to the notifying shareholder: (a) the name and address of each proposed nominee; (b) the principal occupation of each proposed nominee; (c) the number of shares of voting stock of the Company owned by each proposed nominee; (d) the name and residence address of the notifying shareholder; and (e) the number of shares of voting stock of the Corporation owned by the notifying shareholder. Nominations not made in accordance with these provisions shall be disregarded by the chairman of the meeting, and the inspectors of election shall then disregard all votes cast for each such nominee.

The Committee considers suggestions from many sources, including shareholders, regarding possible candidates for director. In order for shareholder suggestions regarding possible candidates for director to be considered by the Committee, such information should be provided to the Committee in writing as specified by the bylaws of Community West Bancshares. Shareholders should include in such communications the name and biographical data of the individual who is the subject of the communication and the individual’s relationship to the shareholder. The Committee does not set specific criteria for directors but believes the Company is well served when its directors bring to the Board of Directors a variety of experience and backgrounds, evidence leadership in their particular fields, demonstrate the ability to exercise sound business judgment and have substantial experience in business and outside the business community in, for example, the academic or public communities. Each of the individuals nominated to serve as a director has been determined by the Committee to meet such qualifications. The Committee considers shareholder nominees for director in the same manner as nominees for director from other sources.

Consideration of Diversity of the Board of Directors. In considering diversity of the Board (in all aspects of that term) as a criteria for selecting nominees in accordance with its charter, the Corporate Governance and Nominating Committee takes into account various factors and perspectives, including differences of viewpoint, high quality business and professional experience, education, skills and other individual qualities and attributes that contribute to Board heterogeneity, as well as race, gender and national origin. The Nominating Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees.

Strategic Planning Committee

The Strategic Planning Committee develops, along with the Board of Directors and management, the Company’s Strategic Plan. It also is responsible for reviewing potential locations for offices of the Bank, overseeing premises-related matters, and reviewing feasibility of potential mergers/acquisitions. Members of the Strategic Planning Committee are Mses. Chadwick, Majarian, and Silva, and Messrs. Bartlein, Cunningham, Dobyns, Doyle, Elliott IV, Flautt, Kim, Lokey, McDonald, Plourd, Smittcamp, and Stovesand. The Committee met two times in 2023.

Audit/Compliance Committee

The Audit/Compliance Committee of the Company’s Board of Directors is composed of Mr. McDonald as Chairman, Mses. Chadwick and Silva, and Messrs. Cunningham, Dobyns, and Stovesand. In accordance with its charter, all of the members of the Audit/Compliance Committee are independent directors as defined under the rules of the SEC and the Nasdaq Stock Market as currently in effect. The Board of Directors has determined that Mr. Cunningham, Ms. Silva and Mr. Stovesand are the “audit committee financial experts” as defined under applicable SEC rules.

The Company’s Audit/Compliance Committee held eight meetings during 2023. The functions of the Audit/ Compliance Committee are to recommend the appointment of and to oversee the independent registered public accounting firm who audits the books and records of the Company for the fiscal year for which they are appointed, to approve each professional service rendered by such accountants and to evaluate the possible effect of each such service on the independence of the Company’s accountants. The Audit/Compliance Committee also reviews internal controls and reporting procedures of the Bank’s branch offices, periodically consults with the independent registered public accounting firm with regard to the adequacy of internal controls, and reviews and recommends inclusion of the audited consolidated financial statements in regulatory reports, and reviews and discusses with management the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies.

Report of Audit/Compliance Committee

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933, as amended (the “Securities Act”) or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the following report of the Audit/Compliance Committee shall not be incorporated by reference into any such filings and shall not otherwise be deemed filed under such acts, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act or the Exchange Act.

The Audit/Compliance Committee of the Community West Bancshares Board of Directors (the Audit Committee) is composed of independent directors and operates pursuant to a Charter adopted by the Board of Directors. A copy of the Company’s Audit Committee charter may be accessed electronically at the Company website at www.cvcb.com or by writing Le-Ann Ruiz, Assistant Corporate Secretary, Community West Bancshares, 7100 N. Financial Drive, Suite 101, Fresno, California 93720. The Audit Committee recommends to the Board of Directors, subject to shareholder ratification, the selection of the Company’s independent registered public accounting firm, Moss Adams LLP.

The function of the Audit Committee is to assist the Board of Directors in its oversight of the Company’s financial reporting process. As set forth in the Charter, management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements, and maintaining appropriate accounting and financial reporting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm is responsible for planning and carrying out appropriate audits and reviews, auditing the Company’s consolidated financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America.

In the performance of its oversight function, the Committee has considered and discussed the consolidated audited financial statements with management, and the independent registered public accounting firm, with, and without, management present. The Committee has also discussed with the independent registered public accounting firm the matters required to be discussed by Public Company Accounting Oversight Board (PCAOB) Auditing Standards No. 16, Communication with Audit Committees, as currently in effect. The Committee has also discussed with management and the independent registered public accounting firm the quality and adequacy of the internal controls of the Company.

Finally, the Committee has received the written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as currently in effect, and has discussed with them their independent status. The independent registered public accounting firm did not perform any prohibited services for the Company.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect to auditor independence. Members of the Committee rely without independent verification on the information provided to them and on the representations made by management and the independent accountants. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions referred to above do not assure that the audit of the Company’s financial statements has been carried out in accordance with auditing standards generally accepted in the United States of America, that the financial statements are presented in accordance with accounting principles generally accepted in the United States of America, or that the Company’s independent registered public accounting firm are in fact “independent”.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Committee referred to above and in its Charter, the Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 to be filed with the Securities and Exchange Commission.

SUBMITTED BY THE AUDIT/COMPLIANCE COMMITTEE OF THE COMPANY’S BOARD OF DIRECTORS

Steven D. McDonald (Chairman)

Daniel N. Cunningham

Robert J. Flautt

Gary D. Gall*

Dorothea D. Silva

William S. Smittcamp March 13, 2024

*Retired from the board effective April 1, 2024.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

This Compensation Discussion & Analysis (“CD&A”) explains our executive compensation program for our named executive officers (“NEOs”) listed below. This CD&A also describes the Compensation Committee’s process for making pay decisions, as well as its rationale for specific decisions related to fiscal 2023.

| | | | | | | | |

| NEO | | Title |

| James J. Kim | | President and Chief Executive Officer (“CEO”) |

| Shannon R. Livingston | | Executive Vice President and Chief Financial Officer (“CFO”) |

| Blaine C. Lauhon | | Executive Vice President, Chief Banking Officer |

| Patrick A. Luis | | Executive Vice President, Chief Credit Officer |

| Jeffrey M. Martin | | Executive Vice President, Market Executive |

Executive Summary

Business Highlights

The Company generated solid financial results for 2023. The Company’s core business continued to expand, benefiting from our nearly 44-year community bank relationship model that’s consistently delivered throughout our territory. In October 2023, the Company, formerly named Central Valley Community Bancorp announced an acquisition of Community West Bancshares. The acquisition was completed on April 1, 2024, at which time the Company assumed the name Community West Bancshares. Specific financial highlights include:

•Net income of $25.5 million, and diluted earnings per common share of $2.17 for the year ended December 31, 2023, compared to $26.6 million and $2.27 per diluted common share for the year ended December 31, 2022.

•Net loans increased $30.7 million or 2.5%, and total assets increased $10.9 million or 0.5% at December 31, 2023, compared to December 31, 2022.

•Total deposits decreased 2.8% to $2.04 billion at December 31, 2023, compared to December 31, 2022.

•Total cost of deposits increased to 0.72% for the year ended December 31, 2023 from 0.06% for 2022.

•Capital positions remain strong at December 31, 2023 with an 9.18% Tier 1 Leverage Ratio; a 12.78% Common Equity Tier 1 Ratio; a 13.07% Tier 1 Risk-Based Capital Ratio; and a 16.08% Total Risk-Based Capital Ratio.

2023 Compensation Highlights

The Compensation Committee took the following compensation-related actions for fiscal 2023:

•Base Salaries: The Compensation Committee approved base salary adjustments (other than promotional-related increases). Increases for the year ranged from 6.9% to 23.5%. These adjustments were made to better align base salaries with market competition and to align with responsibilities as assigned. See Base Salary discussion below for more information.

•Annual Incentives: The Compensation Committee approved annual cash and stock incentive awards based on the achievement of specific financial, strategic and operational objectives. Based on 2023 actual results, annual incentives for NEOs ranged from $82,250 to $262,353, or 35.0% to 53.0% of base salary, based on an incentive plan whereby predetermined performance goals were achieved.

•Long-Term Incentives: Per the terms of Mr. Kim’s employment agreement, Mr. Kim was awarded a restricted stock grant equal to twenty-five percent of his salary on February 2, 2023. The other NEOs were awarded restricted stock grant awards on May 17, 2023 with fair value ranging from $30,000 to $88,000. See the Equity Compensation section below for further detail.

For more information, refer to the section entitled “Components of Executive Officer Compensation.”

Role of Shareholder Input and Say-on-Pay

The Compensation Committee has been mindful of the strong support our shareholders expressed for our compensation program when making executive compensation decisions. The Compensation Committee will continue to consider our shareholders’ views when making executive compensation decisions in the future. Last year, our non-binding shareholder advisory vote on executive compensation (“say-on-pay”) was approved with approximately 95% of voting shareholders casting their votes in favor of the say-on-pay resolution.

Good Compensation Governance Practices and Policies

Our executive compensation program is designed to support our pay-for-performance culture and have strong alignment with the interests of our shareholders. We believe the following policies and practices within our executive compensation program promote strong governance principles and are in the best interests of our shareholders:

| | | | | | | | | | | |

| What We Do | What We Don’t Do |