Investor Presentation 2025 Janney CEO Forum January 29-30, 2025 James J. Kim Community West Bancshares, Chief Executive Officer Community West Bank, President & Chief Executive Officer Martin E. Plourd Community West Bancshares, President Shannon R. Livingston Executive Vice President, Chief Financial Officer Jeff M. Martin Executive Vice President, Chief Banking Officer

Forward-Looking Statements 2 Certain matters discussed in this press release constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are forward-looking in nature and involve a number of risks and uncertainties. Such risks and uncertainties include, but are not limited to (1) significant increases in competitive pressure in the banking industry; (2) the impact of changes in interest rates; (3) a decline in economic conditions in the Central Valley and the Greater Sacramento Region, including the impact of inflation; (4) the Company’s ability to continue its internal growth at historical rates; (5) the Company’s ability to maintain its net interest margin; (6) the decline in quality of the Company’s earning assets; (7) a decline in credit quality; (8) changes in the regulatory environment; (9) fluctuations in the real estate market; (10) changes in general economic and business conditions, including inflation; (11) changes and trends in the securities markets (12) risks associated with acquisitions, relating to difficulty in integrating combined operations and related negative impact on earnings, and incurrence of substantial expenses; (13) political developments, uncertainties or instability, acts of war or terrorism, or hostilities; (14) natural disasters, such as earthquakes, drought, fire, pandemic diseases or extreme weather events, any of which may affect services we use or affect our customers, employees or third parties with which we conduct business; (15) risks related to the merger with Community West, including, among others, the expected business expansion may be less successful as projected, deposit attrition, customer or employee loss and/or revenue loss as a result of the merger, and expenses related to the merger may be greater than expected, (16) the other risks set forth in the Company’s reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023. Therefore, the information set forth in such forward-looking statements should be carefully considered when evaluating the business prospects of the Company. Community West Bancshares will undertake no obligation to revise or publicly release any revision or update to the forward looking statements to reflect events or circumstances that occur after the date on which statements were made. When the Company uses in this presentation the words “anticipate,” “estimate,” “expect,” “project,” “intend,” “commit,” “believe,” and similar expressions, the Company intends to identify forward-looking statements. Such statements are not guarantees of performance and are subject to certain risks, uncertainties and assumptions, including those described in this presentation. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated, expected, projected, intended, committed or believed. The future results and shareholder values of the Company may differ materially from those expressed in these forward-looking statements. Many of the factors that will determine these results and values are beyond the Company’s ability to control or predict. For those statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Mission Inspire and empower our team to enrich and invest in every relationship by exceeding expectations. Values Teamwork Accountability Excellence Integrity Caring Inclusivity

5 Executive Officers

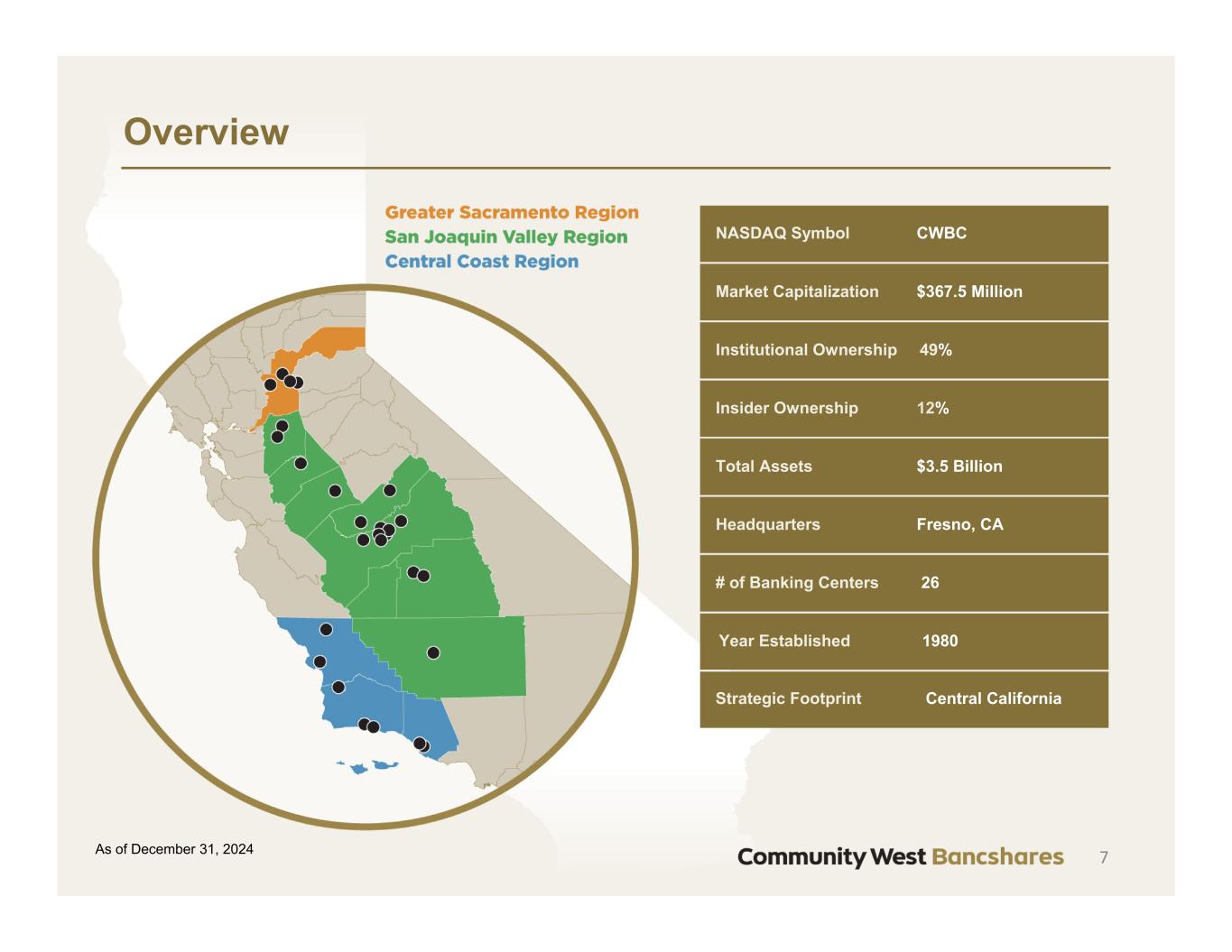

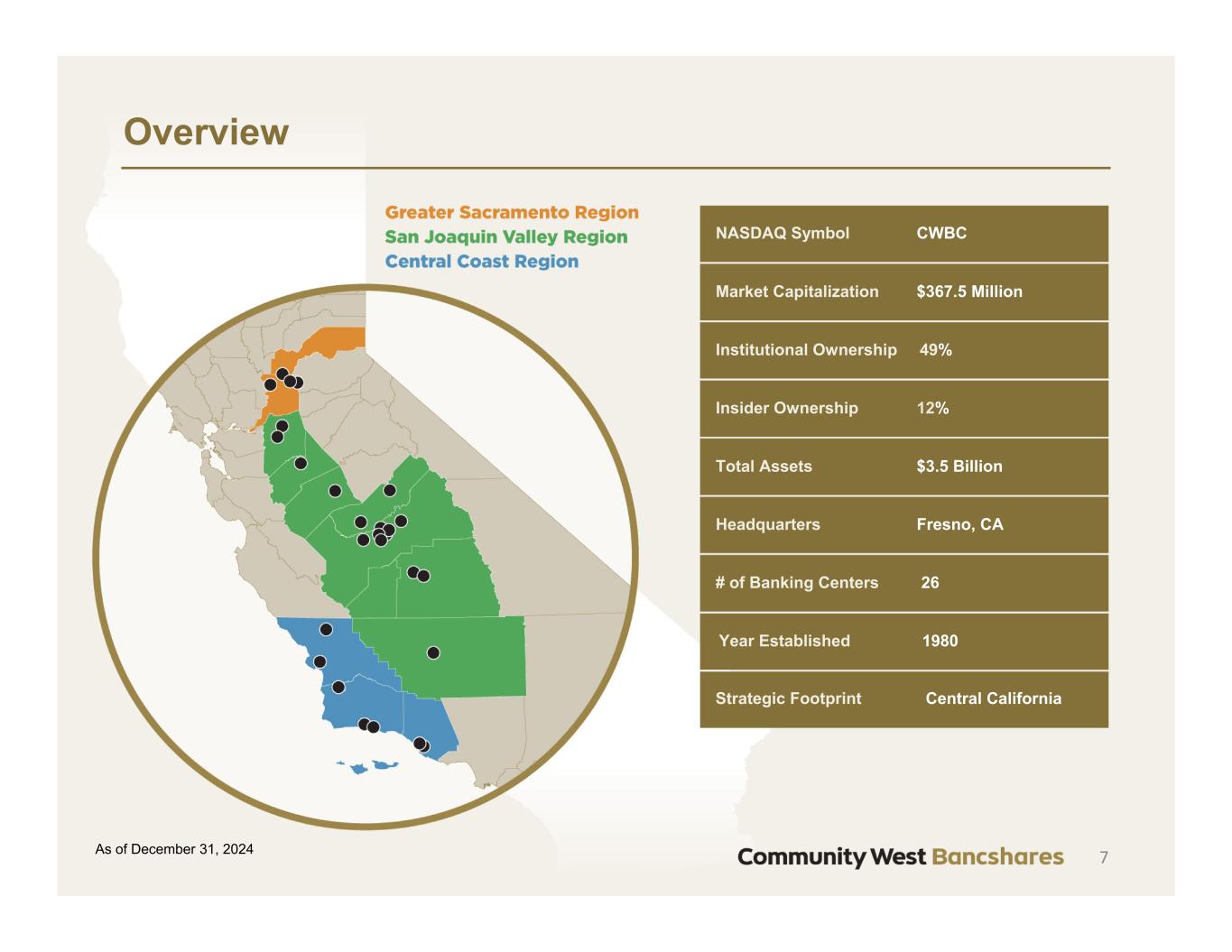

7 NASDAQ Symbol CWBC Market Capitalization $367.5 Million Institutional Ownership 49% Insider Ownership 12% Total Assets $3.5 Billion Headquarters Fresno, CA # of Banking Centers 26 Year Established 1980 Strategic Footprint Central California As of December 31, 2024 Overview

8 Financial Highlights – Second Quarter 2024Financial Highlights – Fourth Quarter 2024

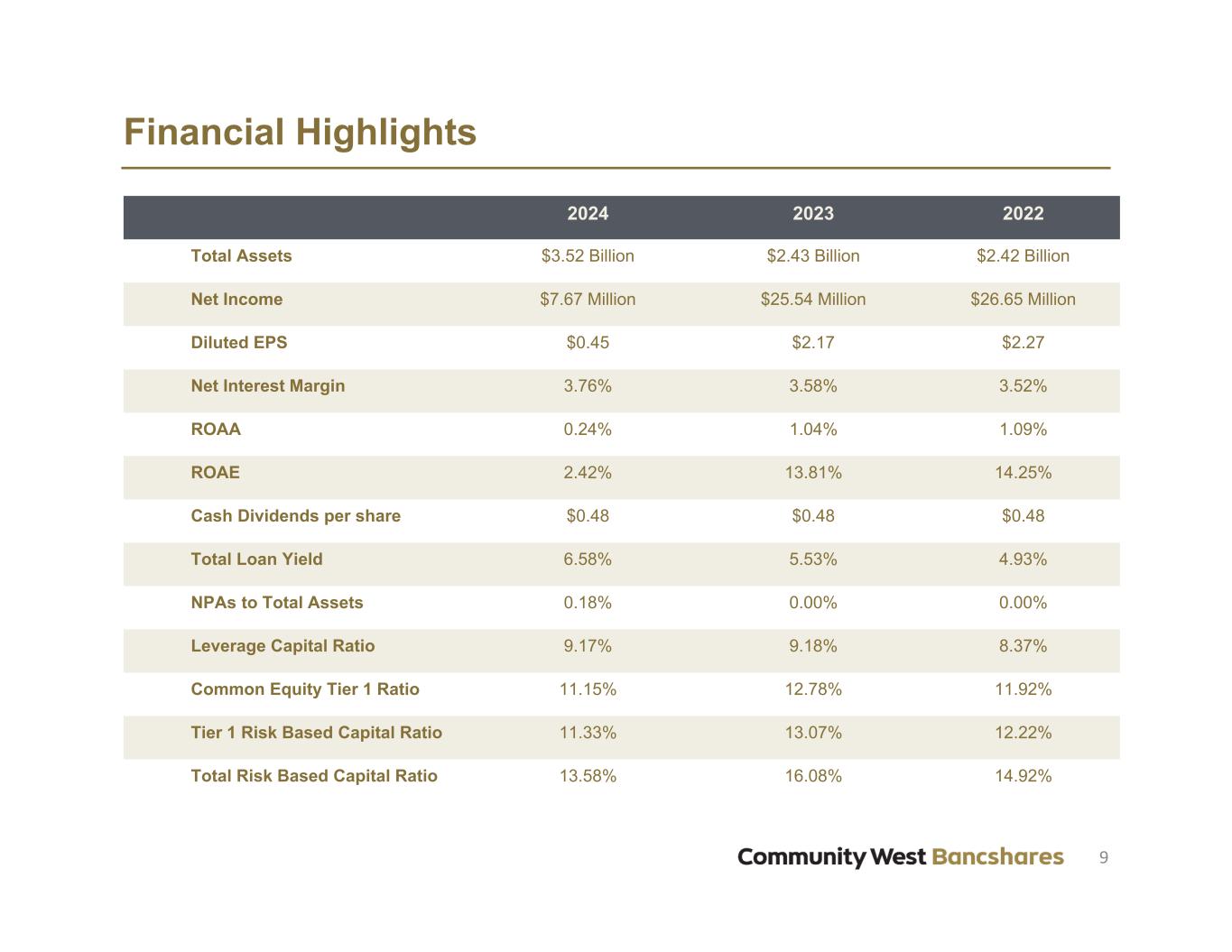

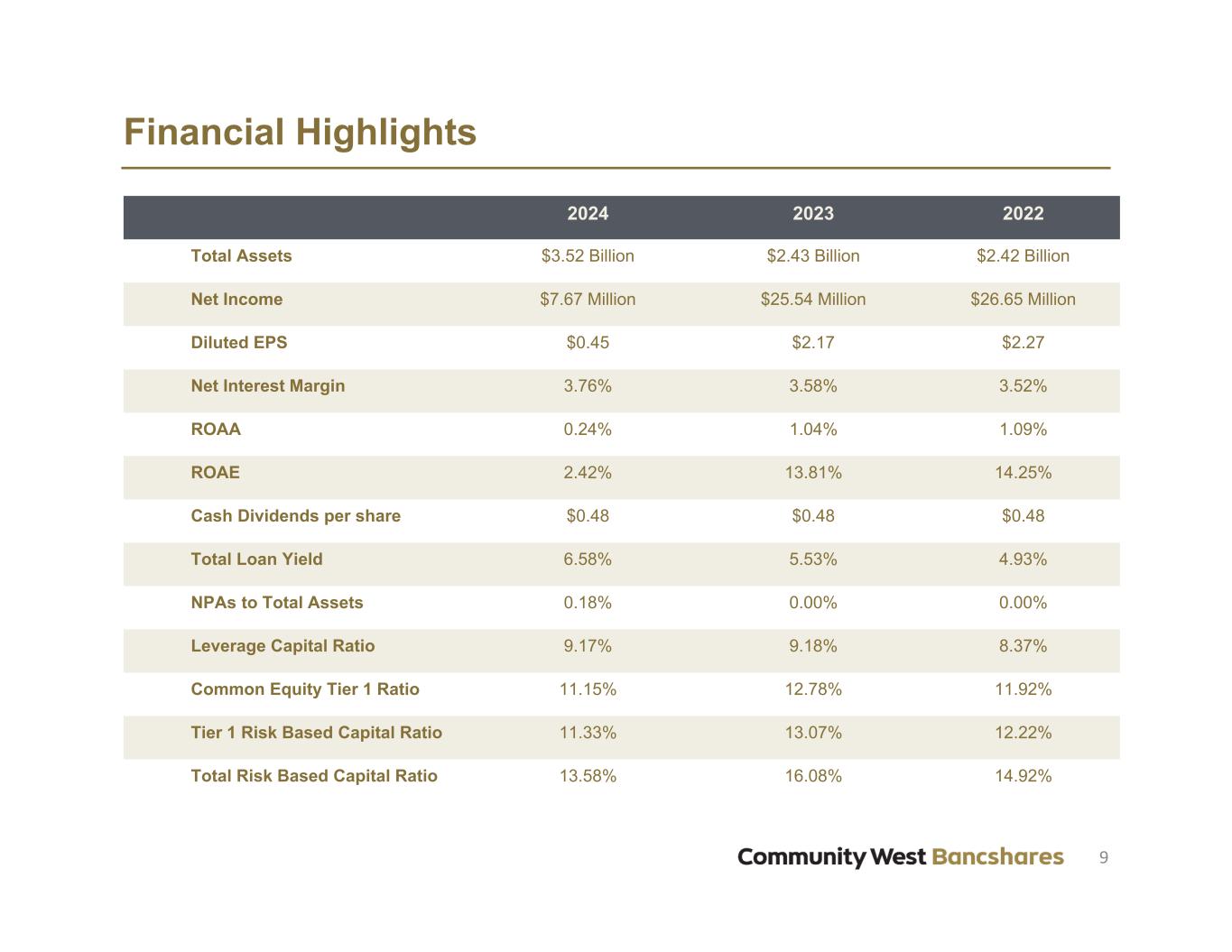

9 2024 2023 2022 Total Assets $3.52 Billion $2.43 Billion $2.42 Billion Net Income $7.67 Million $25.54 Million $26.65 Million Diluted EPS $0.45 $2.17 $2.27 Net Interest Margin 3.76% 3.58% 3.52% ROAA 0.24% 1.04% 1.09% ROAE 2.42% 13.81% 14.25% Cash Dividends per share $0.48 $0.48 $0.48 Total Loan Yield 6.58% 5.53% 4.93% NPAs to Total Assets 0.18% 0.00% 0.00% Leverage Capital Ratio 9.17% 9.18% 8.37% Common Equity Tier 1 Ratio 11.15% 12.78% 11.92% Tier 1 Risk Based Capital Ratio 11.33% 13.07% 12.22% Total Risk Based Capital Ratio 13.58% 16.08% 14.92% Financial Highlights

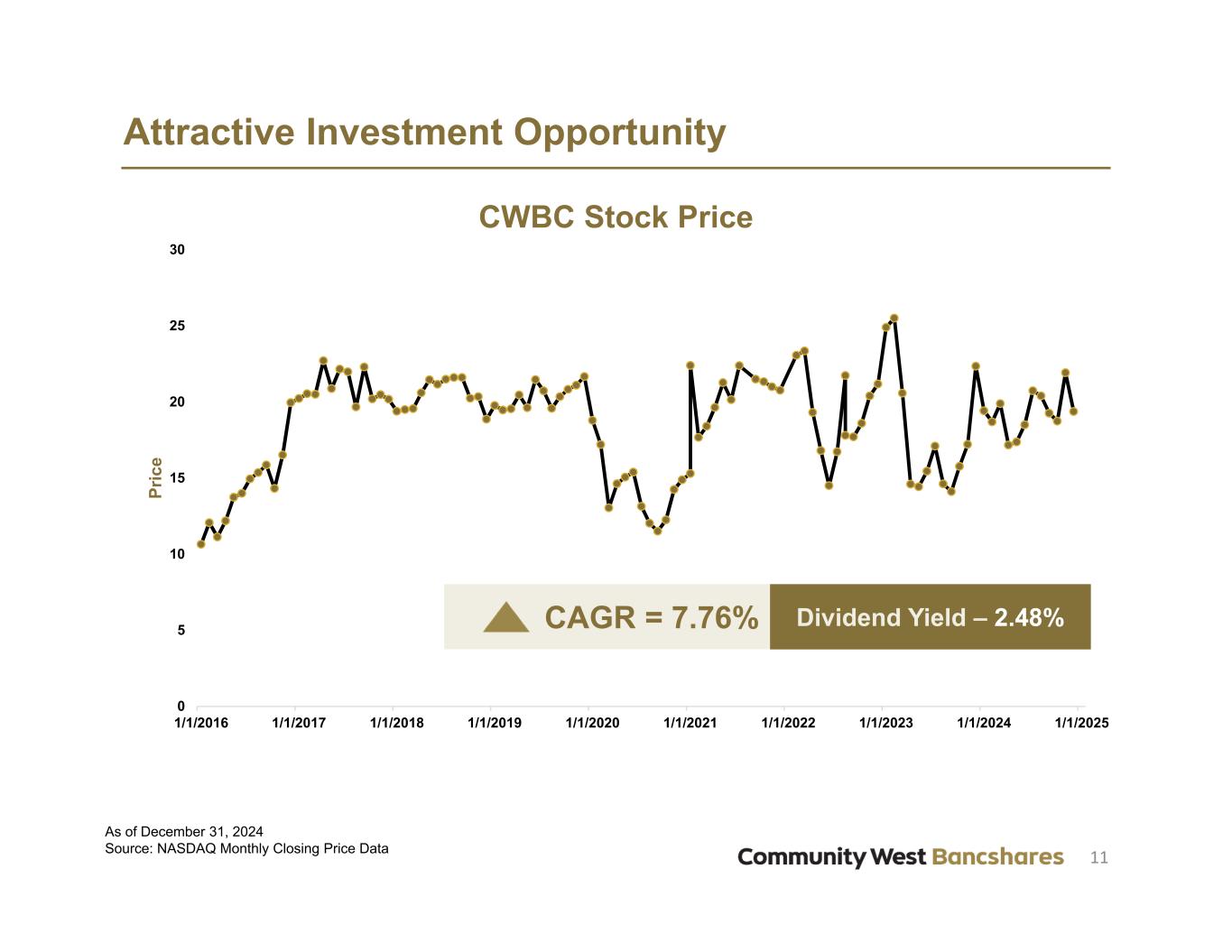

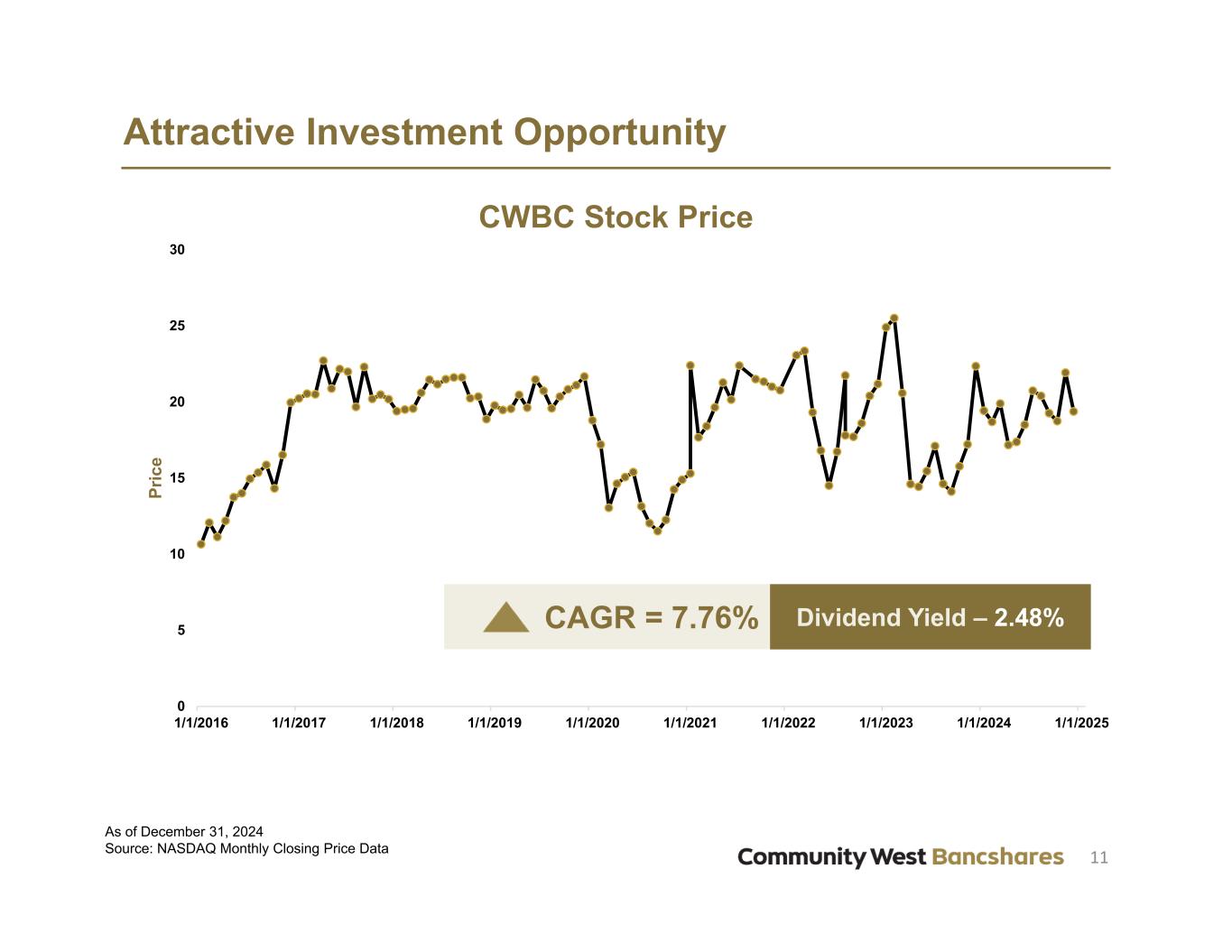

0 5 10 15 20 25 30 1/1/2016 1/1/2017 1/1/2018 1/1/2019 1/1/2020 1/1/2021 1/1/2022 1/1/2023 1/1/2024 1/1/2025 Pr ic e CWBC Stock Price CAGR = 7.76% 11 As of December 31, 2024 Source: NASDAQ Monthly Closing Price Data Attractive Investment Opportunity Dividend Yield – 2.48%

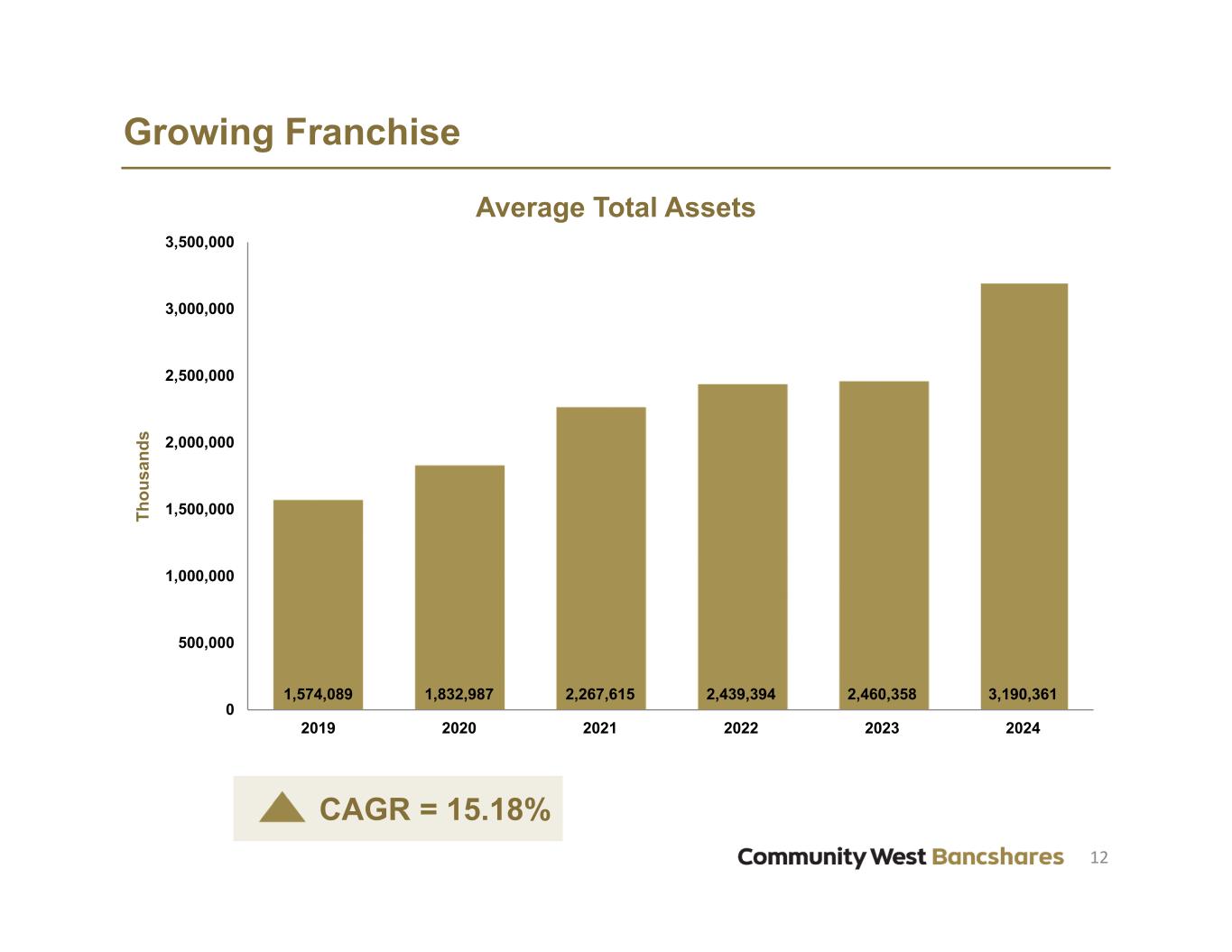

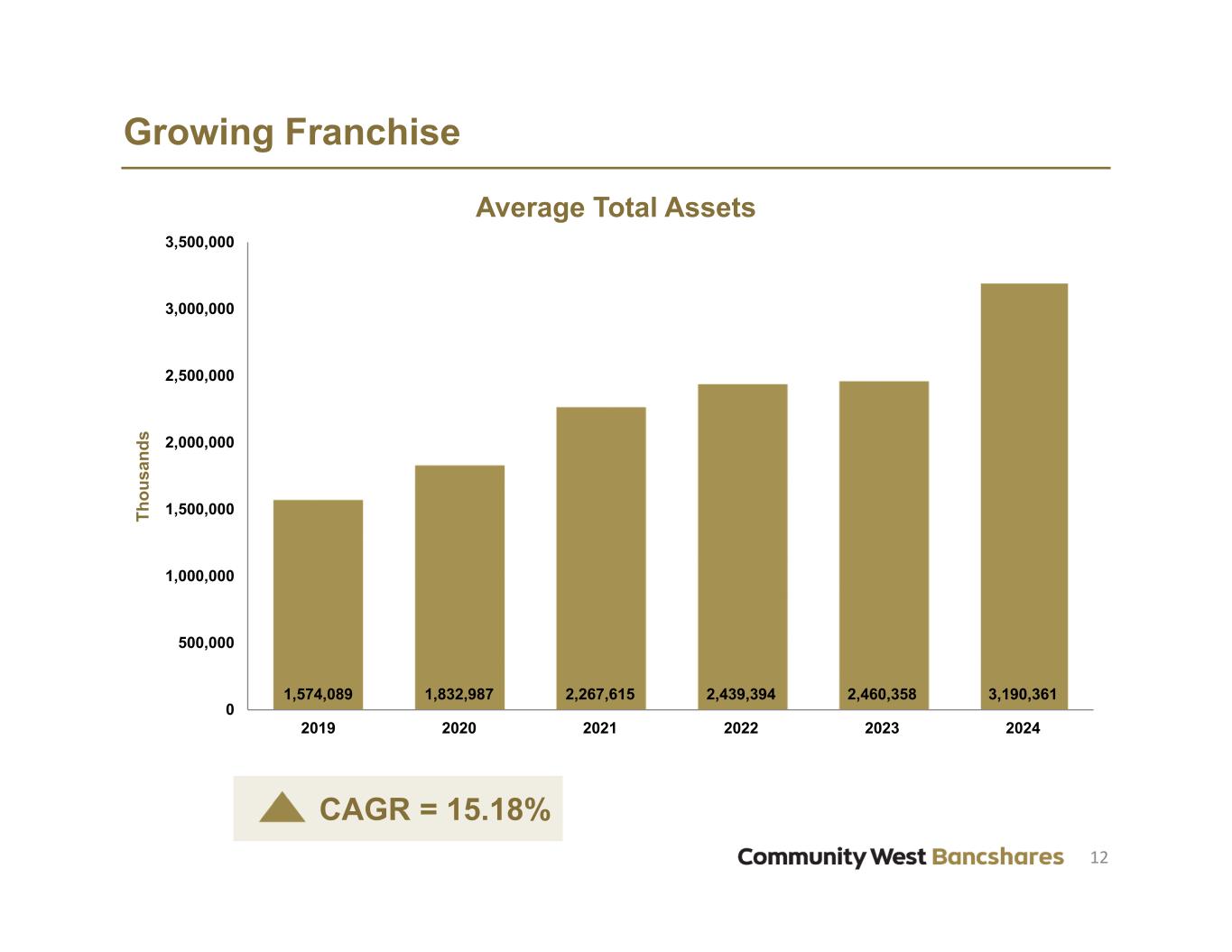

12 Growing Franchise CAGR = 15.18% 1,574,089 1,832,987 2,267,615 2,439,394 2,460,358 3,190,361 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 2019 2020 2021 2022 2023 2024 Th ou sa nd s Average Total Assets

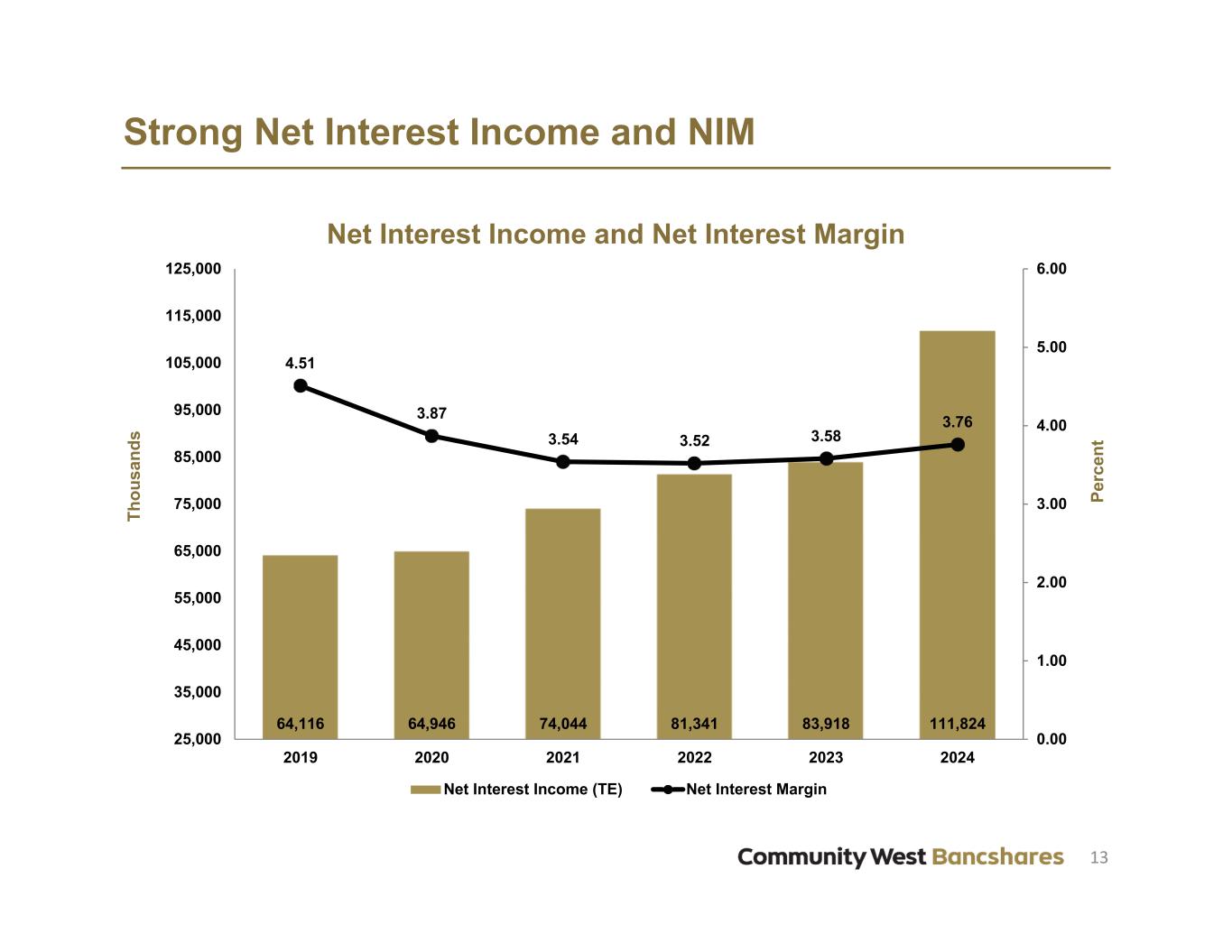

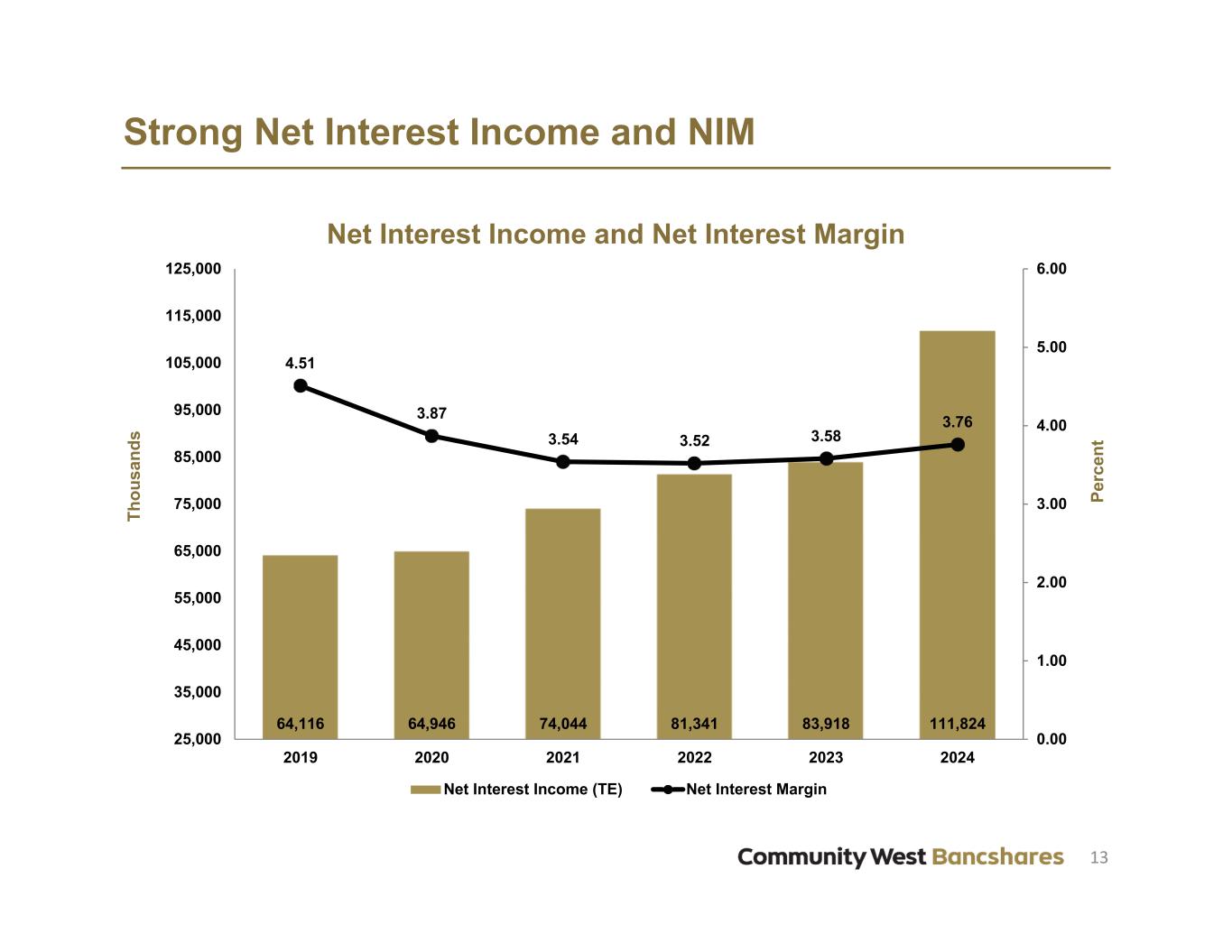

13 Strong Net Interest Income and NIM 64,116 64,946 74,044 81,341 83,918 111,824 4.51 3.87 3.54 3.52 3.58 3.76 0.00 1.00 2.00 3.00 4.00 5.00 6.00 25,000 35,000 45,000 55,000 65,000 75,000 85,000 95,000 105,000 115,000 125,000 2019 2020 2021 2022 2023 2024 Pe rc en t Th ou sa nd s Net Interest Income and Net Interest Margin Net Interest Income (TE) Net Interest Margin

15 Investment Portfolio 470,746 710,092 1,109,208 648,825 597,196 477,113 305,107 302,442 301,359 3.11% 2.61% 2.31% 2.51% 3.00% 2.99% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 2019 2020 2021 2022 2023 2024 Th ou sa nd s AFS Securities HTM Securities Yield on Investments (TE)

17 Deposit Mix Non-Interest Bearing 34% Now/Savings 22% Money Market 29% TCDs 15% As of December 31, 2024 Total Deposits = $2.9 Billion

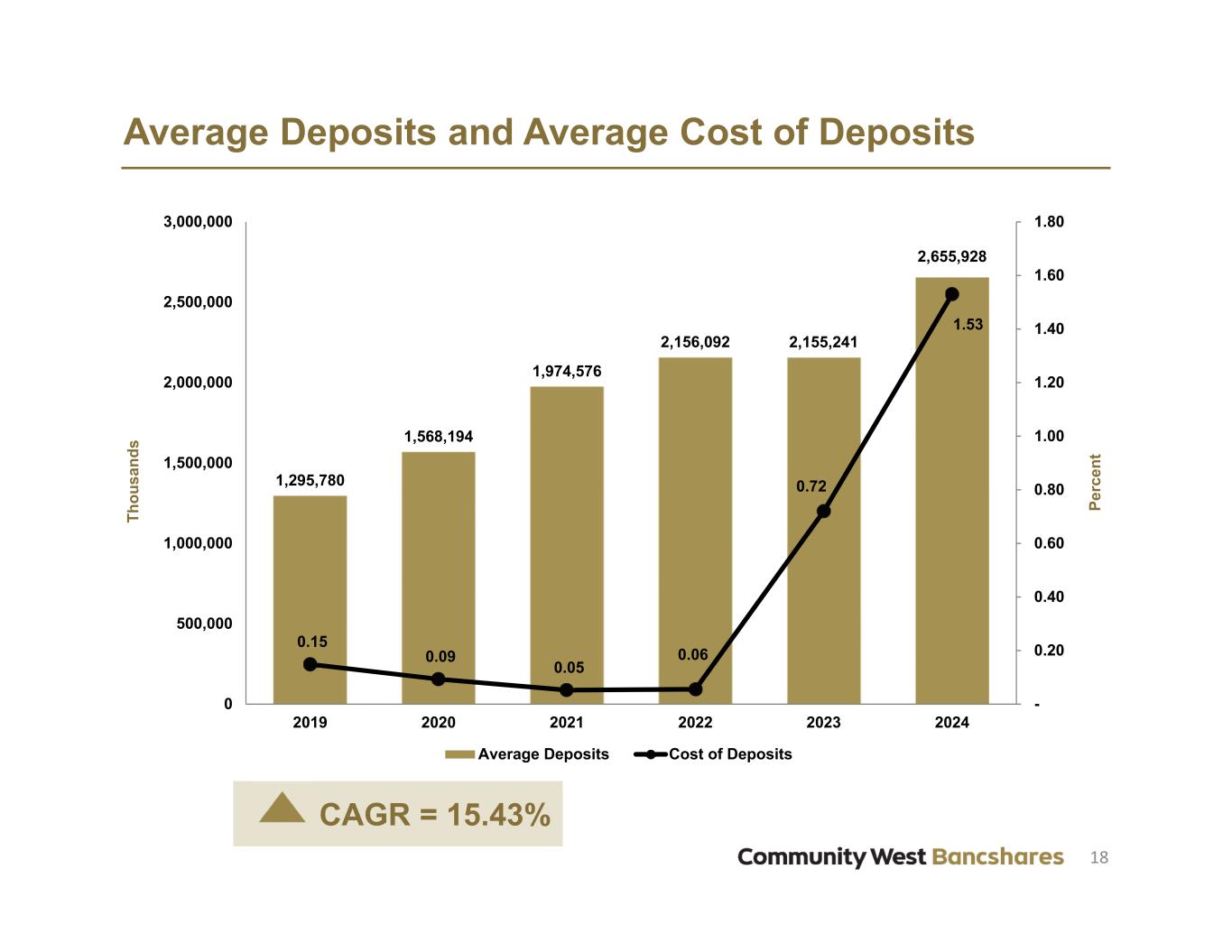

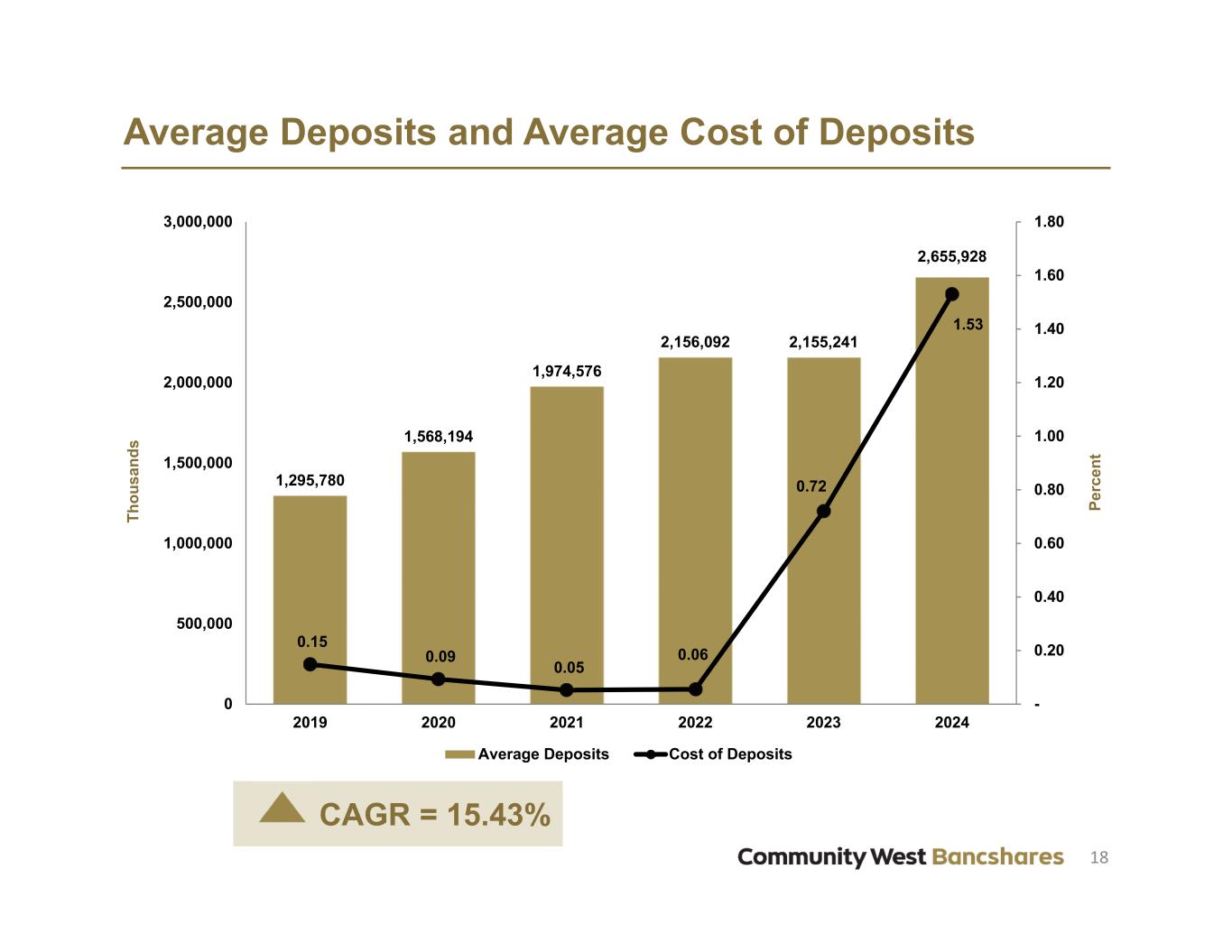

18 Average Deposits and Average Cost of Deposits CAGR = 15.43% 1,295,780 1,568,194 1,974,576 2,156,092 2,155,241 2,655,928 0.15 0.09 0.05 0.06 0.72 1.53 - 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60 1.80 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 2019 2020 2021 2022 2023 2024 Pe rc en t Th ou sa nd s Average Deposits Cost of Deposits

20 Well Diversified Loan Portfolio Commercial & Industrial, 6% Agriculture Production & Land, 8% Owner Occupied Real Estate, 14% Construction & other land loans, 3% Non-Owner Occupied Commerical Real Estate, 39% Multi-family residential, 6% 1-4 family, 7% Manufactured housing, 14% Other consumer, 4% As of December 31, 2024 Excludes Deferred Loan Fees Total Gross Loans = $2.3 Billion

21 Average Loan Totals & Yield CAGR = 16.36% 928,560 1,053,450 1,067,316 1,133,461 1,263,226 1,980,807 5.54 4.94 5.07 4.93 5.53 6.58 3 3.5 4 4.5 5 5.5 6 6.5 7 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 2019 2020 2021 2022 2023 2024 Pe rc en t Th ou sa nd s Average Gross Loans Loan Yield

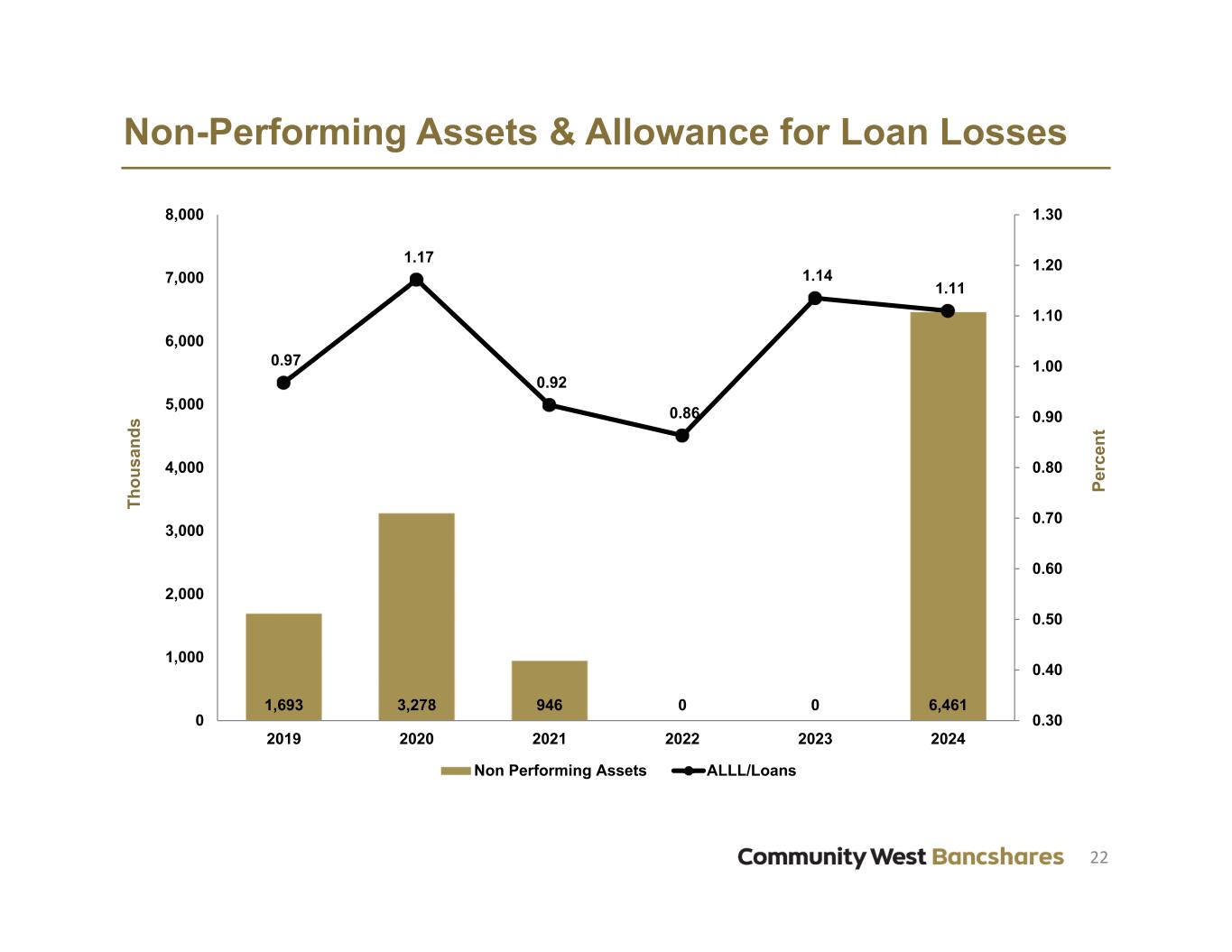

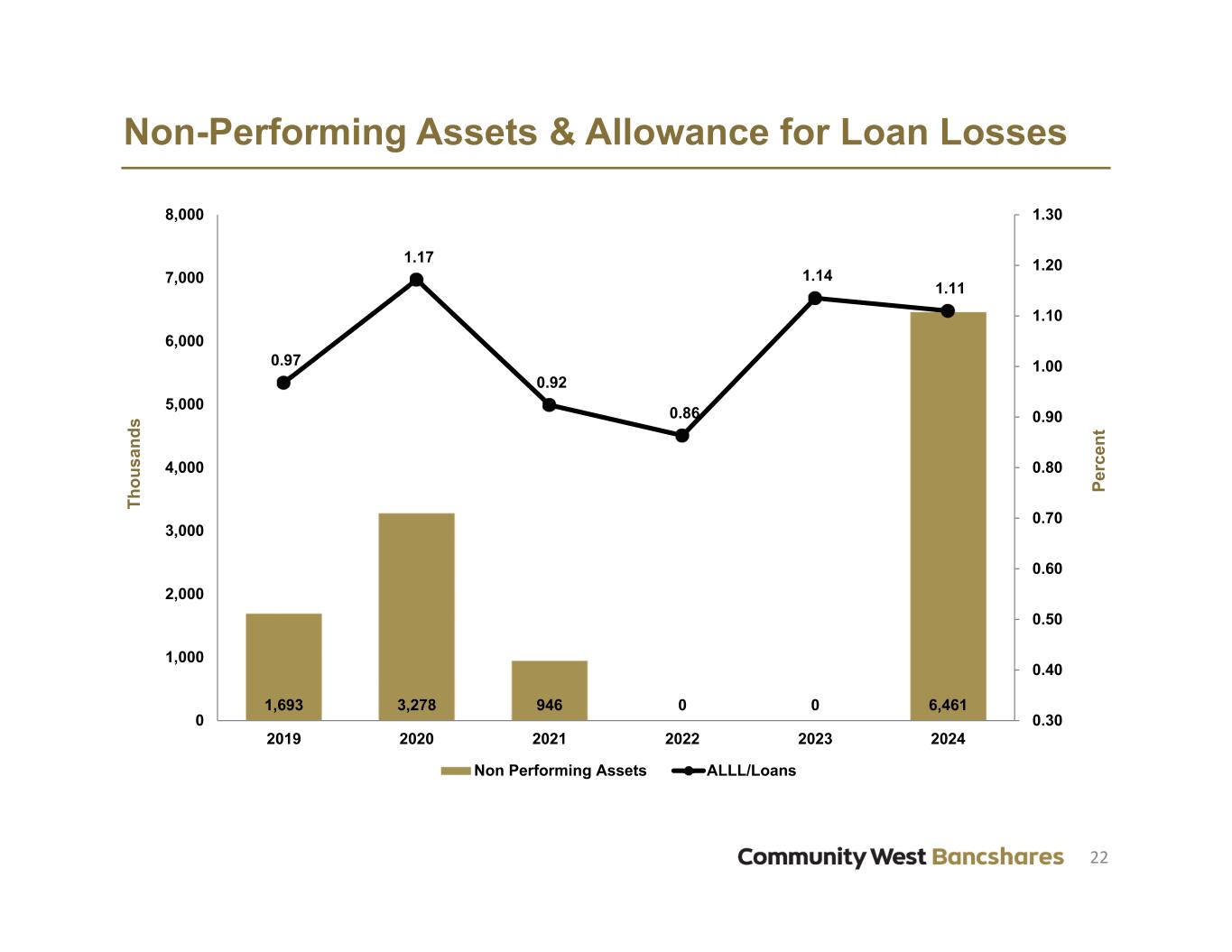

22 Non-Performing Assets & Allowance for Loan Losses 1,693 3,278 946 0 0 6,461 0.97 1.17 0.92 0.86 1.14 1.11 0.30 0.40 0.50 0.60 0.70 0.80 0.90 1.00 1.10 1.20 1.30 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2019 2020 2021 2022 2023 2024 Pe rc en t Th ou sa nd s Non Performing Assets ALLL/Loans

23 Special Mention Loans 28,183 36,406 40,845 31,024 9,000 17,384 2.99 3.30 3.93 2.47 0.70 0.74 - 1.00 2.00 3.00 4.00 5.00 6.00 - 10,000 20,000 30,000 40,000 50,000 2019 2020 2021 2022 2023 2024 Pe rc en t Th ou sa nd s Special Mention Loans SM Loans/Gross Loans

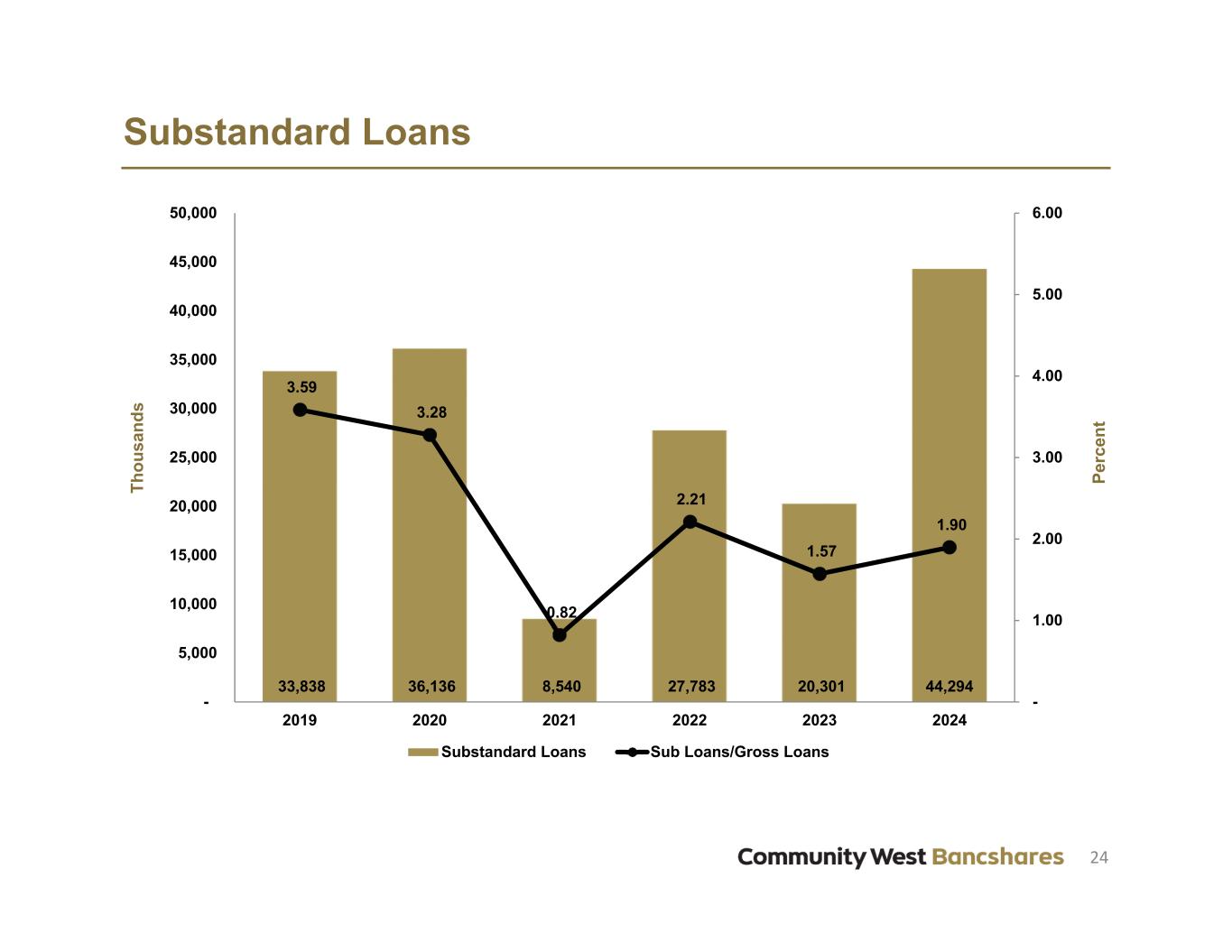

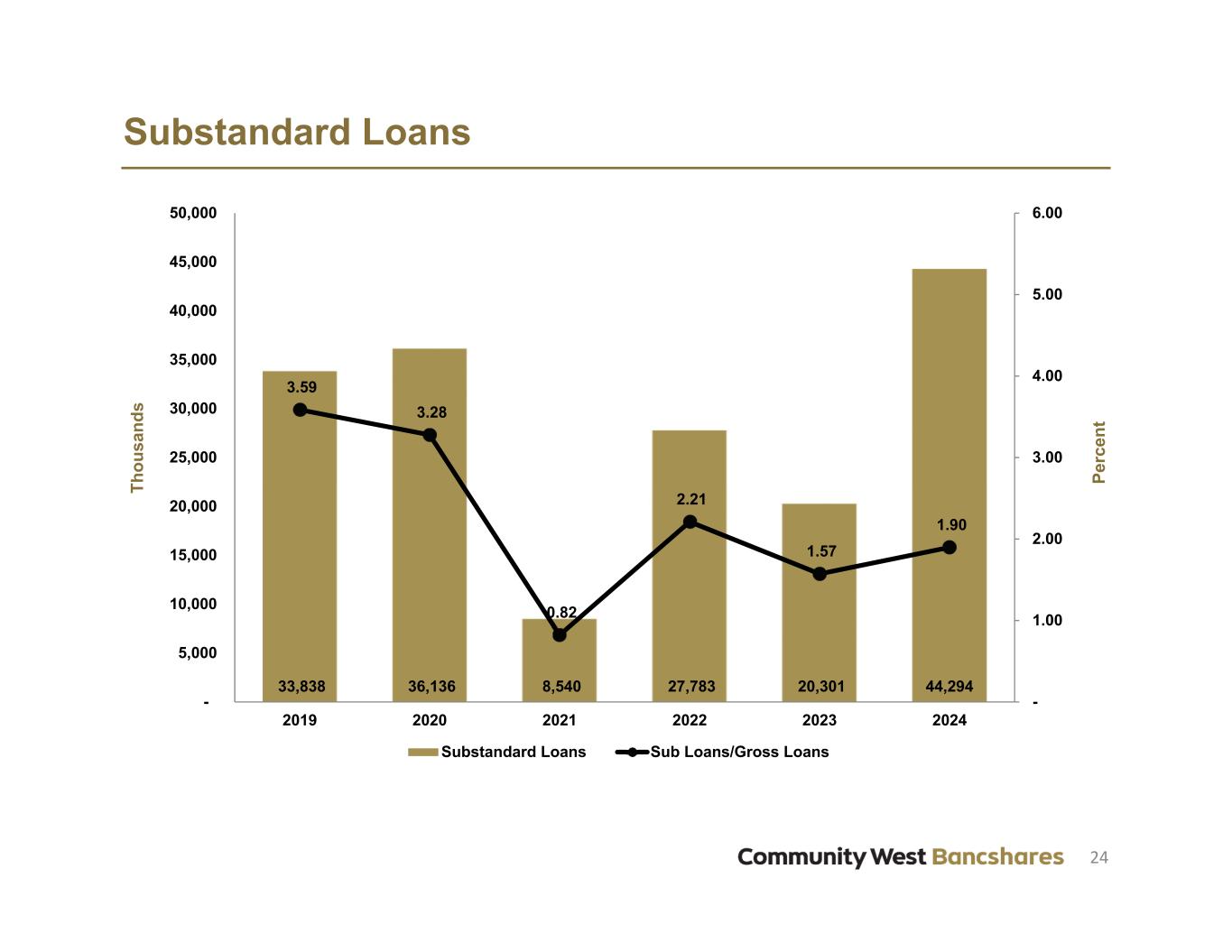

24 Substandard Loans 33,838 36,136 8,540 27,783 20,301 44,294 3.59 3.28 0.82 2.21 1.57 1.90 - 1.00 2.00 3.00 4.00 5.00 6.00 - 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 2019 2020 2021 2022 2023 2024 Pe rc en t Th ou sa nd s Substandard Loans Sub Loans/Gross Loans

25