UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C)

OF THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

[ ] Preliminary Information Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

[X] Definitive Information Statement

THE APPLETON FUNDS

__________________________________________________________

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

(1) Title of each class of securities to which transaction applies: ________________________________

(2) Aggregate number of securities to which transaction applies: ________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction: ________________________________________

(5) Total fee paid: ____________________________________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid: ___________________________________________________________

(2) Form, Schedule or Registration Statement No.: ___________________________________________

(3) Filing Party: _____________________________________________________________________

(4) Date Filed: _______________________________________________________________________

Appleton Equity Growth Fund

The Appleton Funds

One Post Office Square, 6th Floor

Boston Massachusetts 02109

____________________________

INFORMATION STATEMENT

GENERAL

This Information Statement is being furnished to shareholders of the Appleton Equity Growth Fund (the “Acquired Fund”), a series of The Appleton Funds (the “Appleton Trust”), in connection with the solicitation of written consent by the Appleton Trust’s Board of Trustee’s (the “Appleton Board”) for action to be taken by written consent in lieu of a meeting of the shareholders (the “Written Consent”). A form of Written Consent is attached hereto as an Appendix A.

The Appleton Trust is organized as an Ohio business trust and is not required to hold annual meetings of shareholders. Article V, Section 5.5 of the Appleton Trust’s Agreement and Declaration of Trust permits any action to be taken by shareholders to be taken without a meeting if a majority of shareholders entitled to vote on the matter consent to the action in writing and the written consents are filed with the records of the meetings of shareholders. Such consent of shareholders shall be treated for all purposes as a vote at a meeting.

The Appleton Board has fixed the close of business on March 31, 2016 as the record date for determination of shareholders entitled to receive this Information Statement (the “Record Date”). As of the Record Date, the number of shares outstanding for the Fund was 1,680,124 shares.

Shareholders are being provided information regarding the reorganization of the Acquired Fund (the “Proposal”). The Acquired Fund is currently organized as a series of the Appleton Trust and is advised by Appleton Partners, Inc. (the “Adviser”). After completion of the proposed tax-free reorganization, the Acquired Fund will be acquired by a newly established series (the “Acquiring Fund”) of Series Portfolios Trust (“SPT”), an open-end investment company with its principal offices at 615 East Michigan Street, Milwaukee, Wisconsin 53202. This proposed reorganization will not result in a change in the investment adviser to the Acquired Fund, or any material change to the Acquired Fund’s investment objective, strategies or investment policies, or fundamental investment restrictions. This Information Statement is being distributed to shareholders of record on or about May 16, 2016. No action is required on your part.

This Information Statement should be kept for future reference. The Acquired Fund’s most recent annual and semi-annual shareholder reports are available on its website at www.appletonfunds.com. If you would like to receive additional copies of this Information Statement or the shareholder reports, free of charge, please contact the Appleton Trust by writing to The Appleton Funds, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701 or by telephone at 1-877-71-APPLE.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

THIS INFORMATION STATEMENT:

This Information Statement is available at www.appletonfunds.com.

Q & A: Questions and Answers

May 16, 2016

The Appleton Funds

One Post Office Square, 6th Floor

Boston Massachusetts 02109

1-877-71-APPLE

WHAT IS THIS DOCUMENT AND WHY ARE WE SENDING IT TO YOU?

This document is an information statement, and we refer to it as the “Information Statement.” It contains the information that shareholders of the Appleton Equity Growth Fund (the “Acquired Fund”), a series of The Appleton Funds, should know regarding the reorganization of the Acquired Fund (the the “Reorganization”) which has received the consent of the majority shareholders of the Fund (the “Written Consent”) and should be retained for future reference. The corresponding series of Series Portfolios Trust (“SPT”), also named the Appleton Equity Growth Fund, is referred to as the “Acquiring Fund.” Sometimes we refer to the Acquired Fund and the Acquiring Fund together as “the Funds” or individually as “a Fund.” This Information Statement and the accompanying materials are being mailed to shareholders on or about May 16, 2016.

HOW WILL THE REORGANIZATION WORK?

The Reorganization described in this Information Statement will involve three steps:

| · | the transfer of all the assets and liabilities of the Acquired Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund having equivalent value to the net assets transferred; |

| · | the pro rata distribution of shares of the Acquiring Fund to shareholders of record of the Acquired Fund as of the effective date of the Reorganization in full redemption of all shares of the Acquired Fund; and |

| · | the complete liquidation and dissolution of the Acquired Fund and subsequent deregistration of The Appleton Funds under the Investment Company Act of 1940, as amended (the “1940 Act”). |

HOW WILL THE REORGANIZATION AFFECT THE OPERATION OF THE ACQUIRED FUND?

Upon the Reorganization, shareholders of the Acquired Fund will become shareholders of the Acquiring Fund in a tax-fee reorganization. Immediately following the Reorganization, the Acquiring Fund will have the same net asset value (“NAV”) and investments as the Acquired Fund. The shares of each Fund are non-assessable and generally have the same legal rights with respect to voting, share redemptions and shareholder reports. Appleton Partners, Inc. (the “Adviser”), will continue to serve as the investment adviser to the Acquiring Fund. However, the Board of Trustees of SPT has different members than the Board of Trustees of the Appleton Funds (the “Appleton Board”). The Acquiring Fund’s investment objective and the principal investment strategies and investment restrictions are identical to those of the Acquired Fund. Under the proposed Agreement and Plan of Reorganization and Termination (the “Reorganization Plan”) and other relevant documents, the Acquiring Fund will have the same investment adviser, transfer agent, distributor, and other service providers as the Acquired Fund, except that it will have a new Independent Registered Public Accounting Firm, all as more fully discussed below. If approved, the Reorganization is expected to take effect on or about June 30, 2016, although the date may be adjusted in accordance with the Reorganization Plan.

The most recent prospectus and annual or semi-annual report of the Acquired Fund are available free of charge. To request these documents, please contact the Acquired Fund at the address set forth on the first page of this Information Statement or call, toll free, 1-877-71-APPLE and they will be sent to you by first-class mail.

WHO IS PAYING FOR THE EXPENSES RELATED TO THE MEETING AND THE REORGANIZATION?

The Adviser will pay all costs relating to the proposed Reorganization, including the costs relating to the Information Statement. If you hold Fund shares through a financial intermediary, your financial intermediary may charge you processing or other fees in connection with voting your shares in the Reorganization. Please consult your financial intermediary for more information regarding any such fees. The total cost of the proposed Reorganization to be paid by the Adviser is estimated to be approximately $[ ].

HAS THE REORGANIZATION BEEN APPROVED BY THE BOARD?

The Reorganization was approved by the Appleton Board at a meeting held on April 12, 2016. Until the close of the Reorganization, the Acquired Fund will continue to operate, and the Appleton Board may take any further action it deems to be in the best interests of the Acquired Fund and its shareholders, subject to approval by the Acquired Fund’s shareholders if required by applicable law.

IS ADDITIONAL INFORMATION ABOUT THE ACQUIRED FUND AVAILABLE?

Yes, additional information about the Acquired Fund is available in the:

| · | Prospectus for the Acquired Fund; |

| · | Annual and Semi-Annual Reports to Shareholders of the Acquired Fund; and |

| · | Statement of Additional Information, or “SAI,” for the Acquired Fund. |

These documents are on file with the U.S. Securities and Exchange Commission (the “SEC”).

Copies of all of these documents are available to be sent to you by first-class mail upon request without charge by writing to or calling:

The Appleton Funds

One Post Office Square, 6th Floor

Boston Massachusetts 02109

1-877-71-APPLE

You also may view or obtain these documents from the SEC:

| In Person: | At the SEC’s Public Reference Room in Washington, D.C. |

| | |

| By Phone: | 1-202-551-8090 |

| | |

| By Mail: | Public Reference Room |

| | Securities and Exchange Commission 100 F Street, NE |

| | Washington, DC 20002 |

| | (duplicating fee required) |

| | |

| By Email: | publicinfo@sec.gov |

| | (duplicating fee required) |

| | |

| By Internet: | www.sec.gov |

| | (‘The Appleton Fund’ for information on the Acquired Fund) |

WHOM DO I CALL IF I HAVE QUESTIONS?

We will be happy to answer your questions about this information statement. Please call the Adviser at 1-877-71-APPLE between 9:00 a.m. and 5:00 p.m., Eastern Time, Monday through Friday.

DISCUSSION OF THE REORGANIZATION

BACKGROUND

The Officers of Appleton Trust (“Appleton Trust Officers”) presented information to the Appleton Board, including its Independent Trustees, seeking approval of a proposed Reorganization Plan, whereby the a newly established series of SPT will acquire all of the assets and liabilities of the Acquired Fund, in exchange for shares of the Acquiring Fund, which the Acquired Fund would in turn distribute pro rata to its shareholders, in complete liquidation and dissolution of the Acquired Fund. The Adviser will continue to advise the Acquiring Fund. The Appleton Board has approved the Reorganization and has obtained the Written Consent of the Fund’s majority shareholders.

Reasons for the Reorganization

The primary purpose of the Reorganization is to provide the shareholders of the Acquired Fund with lower annual operating expenses over time while providing substantially similar or improved shareholder services. SPT is referred to as a “multiple series trust,” that offers a number of mutual funds advised by other investment advisers. SPT’s multiple fund structure thus affords the Acquiring Fund the benefit of certain economies of scale, which are expected to reduce insurance premiums, trustee fees and expenses, legal fees, auditing charges and other expenses, which the Adviser has represented to the Appleton Trust, should result in a savings, over time, to shareholders. In addition, as a series of SPT, the Reorganization provides a robust trust compliance structure in a complex regulatory environment. The Appleton Trust Officers have determined that the Acquired Fund could benefit from the services currently provided to other mutual funds which each comprise a “series” fund of SPT. The Appleton Trust Officers have therefore recommended to the Appleton Board that the Acquired Fund be reconstituted as a new series of SPT.

The Appleton Trust Board, including the Independent Trustees, unanimously concluded that he proposed Reorganization is in the best interests of the Acquired Fund and its shareholders. In reaching that conclusion, the Appleton Trust Board considered, among other things, the following:

| 1. | The Adviser will continue to serve as the investment adviser responsible for the day-to-day investment management activities of the Acquiring Fund. |

| 2. | The continuity of Acquired Fund shareholder expectations because the investment objective of the Acquiring Fund is identical to that of the Acquired Fund and the principal investment strategies and risks of the Acquiring Fund are identical to those of the Acquired Fund. |

| 3. | The Fund’s operating expense ratio is expected to decline over time as a result of the Reorganization because the Acquiring Fund is a series of a trust with multiple series and greater assets. Certain expenses of the Acquiring Fund are expected to decrease due to economies of scale (such as trustee and insurance expenses). |

| 4. | The Reorganization is intended to be a tax-free reorganization for U.S. federal income tax purposes, and the Acquired Fund will receive a legal opinion to that effect prior to the conclusion of the Reorganization. |

| 5. | The Adviser will bear all of the expenses of the Reorganization. |

The Board also concluded that the economic interests of the Acquired Fund shareholders would not be diluted as a result of the proposed Reorganization, because, among other things, the number of Acquiring Fund shares to be issued to Acquired Fund shareholders will be calculated based on the net asset value of the Acquired Fund. For a more complete discussion of the factors considered by the Appleton Trust Board in approving the Reorganization, see the section entitled “Board Consideration of the Reorganization” in this Information Statement.

Comparison of Fees and Expenses

The following chart describes the fees and expenses associated with holding the Acquired Fund and Acquiring Fund shares. In particular, the chart compares the fee and expense information for the shares of the Acquired Fund as of the most recently completed fiscal year ended December 31, 2015 and the pro forma fees and expenses of shares of the Acquiring Fund following the Reorganization. Note that until the Reorganization is complete, the Acquiring Fund is a shell fund which holds no assets. Pro forma expense ratios shown should not be considered an actual representation of future expenses or performance. Such pro forma expense ratios project anticipated asset and expense levels, but actual ratios may be greater or less than those shown.

It is expected that, because the Acquiring Fund is part of a multiple series Trust, certain expenses, such as trustee fees and insurance expense, will be lower. Currently, the Adviser pays the cost of certain professional fees, such as legal fees. After the Reorganization, the Fund will pay the cost of professional fees, including any applicable legal fees.

As discussed further, below, the Adviser has contractually agreed to limit the total annual fund operating expenses (excluding interest, taxes, acquired fund fees and expenses, brokerage commissions and extraordinary expenses) to 1.50% of the average daily net assets of the Fund. After the Reorganization, the contractual expense limitation agreement with the Adviser will continue for at least one year from the effective date of the Acquiring Fund’s registration statement.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | Acquired Fund | Acquiring Fund (Pro Forma) |

| Management Fees | 1.00% | 1.00% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 0.88% | 0.90% |

| Acquired Fund Fees and Expenses | 0.01% | 0.01% |

| Total Annual Fund Operating Expenses | 1.89% | 1.91% |

Less Fee Waiver and/or Expense Reimbursement1 | -0.38% | -0.40% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 1.51% | 1.51% |

| 1 | The Fund’s investment adviser, Appleton Partners, Inc. (“Appleton Partners” or the “Adviser”), has contractually agreed to waive its management fees and/or reimburse expenses of the Acquired Fund until at least April 30, 2017 and of the Acquiring Fund, until a date at least one year from the effective date of its registration statement, to ensure that Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding interest, taxes, acquired fund fees and expenses, brokerage commissions and extraordinary expenses) do not exceed 1.50% of the Fund’s average net assets. The Adviser is permitted to be reimbursed for management fee waivers and/or expense reimbursements made in the prior three fiscal years, subject to the limitation on the Fund’s expenses in effect at the time such reimbursement is paid to the Adviser and at the time such fees were waived and/or expenses were reimbursed. This agreement may be terminated only by, or with the consent of, the Fund’s Board of Trustees. |

Example

This Example is intended to help you compare the cost of investing in the Funds with the cost of investing in other mutual funds. It assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Acquired Fund | $154 | $557 | $986 | $2,181 |

| Acquiring Fund | $154 | $561 | $995 | $2,220 |

Expenses beyond one year do not reflect the fee waiver and expense reimbursement arrangements currently in effect and are based solely on current operating expense ratios.

Comparison of Investment Objectives, Principal Investment Strategies and Principal Risks

If the Reorganization is approved, it is anticipated that continuity of shareholder investment expectations will be maintained because the investment objective of the Funds is identical and the principal investment strategies and risks of the Acquiring Fund will be substantially similar to those of the Acquired Fund.

Comparison of Investment Objectives

The Funds each seek the long-term growth of capital. Each Fund’s investment objective may be changed by the respective Board of Trustees without shareholder approval, but only after shareholders have been notified and after the Prospectus has been revised accordingly. Unless otherwise indicated, all investment practices, strategies and limitations of each Fund are non-fundamental policies that the Funds’ respective Board of Trustees may change without shareholder approval.

Comparison of Principal Investment Strategies and Risks

The principal investment strategies and principal risks of the Funds are identical, and are disclosed below:

Appleton Equity Growth Fund Principal Investment Strategies |

Acquired Fund (series of Appleton Trust) | Acquiring Fund (series of Series Portfolios) |

Under normal circumstances, at least 80% of the Fund’s assets will be invested in common stocks. These securities may be from large-cap, mid-cap or small-cap companies. By combining macro-economic and micro-economic factors, the Fund seeks the best-positioned companies within the fastest growing industries. In pursuing the Fund’s investment objective, the Adviser first employs top-down analysis to select specific industry groups demonstrating growth potential. A bottom-up approach is then used to select particular companies within the industry groups. In selecting specific industry groups, the Adviser looks for industries that it believes will sustain high profit growth given the current and future economic, financial and political conditions. Once industry sectors have been selected, the Adviser’s research process continues with bottom up, or micro-economic analysis, to identify individual stocks that may be placed on the buy list. The Adviser believes that there are certain characteristics that are generally found in growing companies—characteristics that may be unique while giving their shareholders a competitive edge. The Adviser begins by reviewing revenue growth, market share and price control, not only for individual companies, but for their competitors as well. The Adviser considers such factors as a company’s management team, new products and overall financial outlook. This intensive fundamental research narrows the potential portfolio down to a manageable list of 50–70 candidates. Thus, by combining top down and bottom up research, the Adviser will maintain a portfolio of 35-45 stocks that it believes are the best companies within the fastest growing industries. |

The Funds are subject to identical investment risks. As with any mutual fund, there are risks to investing. An investment in a Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Remember, in addition to possibly not achieving your investment goals you could lose all or a portion of your investment in a Fund over short or even long periods of time.

The following discussion describes the principal risks that are associated with the Funds.

Appleton Equity Growth Fund Principal Investment Risks |

Acquired Fund (series of Appleton Trust) | Acquiring Fund (series of Series Portfolios Trust) |

Market Risk: The return on and value of an investment in the Fund will fluctuate in response to stock market movements. Stocks are subject to market risks, such as rapid increase or decrease in a stock’s value or liquidity, and fluctuations due to a company’s earnings, economic conditions and other factors beyond the control of the Adviser. As a result, there is a risk that you could lose money by investing in the Fund. Investment Style Risk: Different investment styles, such as growth and value investing, may shift in and out of favor depending upon market and economic conditions, as well as investor sentiment. The Fund may outperform or underperform other funds that have a different investment style. Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions of the issuing company’s growth of earnings potential. Also, since growth companies generally invest a high portion of earnings in their business, growth stocks may lack the dividends of some value stocks that can cushion stock prices in a falling market. Growth oriented funds will typically underperform when value investing is in favor. Small- and Mid-Capitalization Company Risk: Small-cap and mid-cap companies may have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Additionally, securities of small-cap and mid-cap companies may be more thinly traded and may have more frequent and larger price changes than securities of large-cap companies. |

Benchmarks.

The comparative benchmark for each of the Funds is the S&P 500® Index. The Russell 1000® Index is a secondary benchmark for each of the Funds.

Portfolio Managers.

The portfolio managers for the Funds will remain the same. Daniel T. Buckley, CFA, is a senior research analyst and portfolio manager of the Adviser. Geoffrey D. Chamberlain, CFA, is a senior research analyst and portfolio manager of the Adviser.

Comparison of Fundamental Investment Restrictions

The Acquiring Fund’s fundamental investment limitations will not differ from those of the Acquired Fund.

Comparison of Shareholder Services and Procedures

The Funds have similar shareholder services and procedures. The Funds each offer one class of shares.

Neither of the Funds charges any front-end or contingent deferred sales charge or shareholder servicing fees.

Both of the Funds allow shareholders to redeem or purchase their shares by mail, telephone, wire or financial intermediary. The Funds each permit automatic investment and withdrawals.

Each Fund expects to distribute substantially all of its net investment income, if any, on an annual basis. Each Fund expects to distribute any net realized long-term capital gain at least once each year. Management of each Fund will determine the timing and frequency of the distributions of any net realized short-term capital gain.

The Funds each offer a choice between automatically reinvesting distributions in additional shares or receiving distributions by check.

The Acquired Fund’s prospectus and SAI and the Acquiring Fund’s prospectus and SAI contain more detailed discussions of shareholder services and procedures.

Investment Advisory Arrangements and Investment Advisory Fees

The principal office of the Adviser is located at One Post Office Square, Floor Six, Boston, MA 02109. The Adviser presently serves as the investment adviser to the Acquired Fund and will serve as the investment adviser to the Acquiring Fund after the completion of the Reorganization, upon Written Consent of the Acquired Fund’s shareholders. The Adviser is registered as an investment adviser with the SEC. The Adviser is responsible for managing the investment of the Acquired Fund’s portfolio of securities. The Adviser identifies companies for investment, determines when securities should be purchased or sold by the Acquired Fund and selects brokers or dealers to execute transactions for the Acquired Fund’s portfolio.

The Adviser presently serves as the investment adviser to the Acquired Fund pursuant to the Investment Advisory Agreement that was renewed by the Appleton Trust Board at a meeting held on December 8, 2015. The Adviser will enter into an investment advisory agreement with SPT on behalf of the Acquiring Fund and will manage the assets of the Acquiring Fund after completion of the Reorganization, if it is approved by Acquired Fund shareholders.

Upon the commencement of operations of the Acquiring Fund, the Adviser intends to have the same portfolio management personnel that managed the Acquired Fund prior to the Reorganization, be responsible for the day-to-day management activities of the Acquiring Fund. The members of the portfolio management team are Daniel T. Buckley, CFA, and Geoffrey D. Chamberlain, CFA.

Daniel T. Buckley, CFA, is a senior research analyst and portfolio manager of the Fund and currently serves as President of the Appleton Trust. He joined Appleton Partners in November 2003 and is currently one of the Equity portfolio managers responsible for researching equities, preparing proprietary technical and quantitative tools, and presenting to the Equity group. His responsibilities also include the execution of trades and the implementation of overall portfolio allocation and construction. Prior to joining Appleton Partners, Mr. Buckley worked as an Account Manager for State Street Bank. Before State Street Bank, Mr. Buckley worked on the floor of the American Stock Exchange. Mr. Buckley earned his B.A. from Boston College in 1997 and his M.S.I.M. from Boston University in 2006, and holds the Chartered Financial Analyst designation.

Geoffrey D. Chamberlain, CFA, is a senior research analyst and portfolio manager for the Fund. Mr. Chamberlain joined Appleton Partners in July of 2001. Mr. Chamberlain works closely with the Equity portfolio managers and is responsible for researching equities and presenting to the Equity group, as well as executing trades and constructing portfolio allocations. His other responsibilities include client billing and managing client relationships. Mr. Chamberlain earned his B.A. from Bowdoin College, his M.S.I.M. from Boston University, and holds the Chartered Financial Analyst designation.

The annual contractual rate of investment advisory fees paid by each of the Acquired Fund and Acquiring Fund is 1.00% of the respective Fund’s average daily net assets.

Pursuant to a written contract between the Adviser and each respective Fund, the Adviser has agreed to waive a portion of its advisory fees and/or assume certain expenses of a Fund other than interest, taxes, acquired fund fees and expenses, brokerage commissions and extraordinary expenses to the extent annual Fund operating expenses exceed 1.50% of the Fund’s average daily net assets. The Adviser has contractually agreed to maintain these expense limitations with regard to the Acquired Fund through April 30, 2017, and with regard to the Acquiring Fund through at least one year from the effective date of its registration statement.

Comparison of Other Principal Service Providers

The following is a list of principal service providers for the Acquired Fund and the Acquiring Fund:

| Service | Acquired Fund | Acquiring Fund |

| Distributor | Quasar Distributors, LLC 615 East Michigan Street, 4th Floor Milwaukee WI 53202 | Quasar Distributors, LLC 615 East Michigan Street, 4th Floor Milwaukee WI 53202 |

Administrator, Fund Accountant and Transfer Agent | U.S. Bancorp Fund Services, LLC 615 East Michigan Street Milwaukee WI 53202 | U.S. Bancorp Fund Services, LLC 615 East Michigan Street Milwaukee WI 53202 |

| Custodian | U.S. Bank National Association 1555 N. River Center Drive, Ste. 302 Milwaukee, WI 53212 | U.S. Bank National Association 1555 N. River Center Drive, Ste. 302 Milwaukee, WI 53212 |

| Independent Auditors | Baker Tilly Virchow Kraus, LLP 777 E. Wisconsin Avenue, 32nd Floor Milwaukee, WI 53202 | Cohen Fund Audit Services, Ltd. 735 North Water Street, Suite 610 Milwaukee, WI 53202 |

Distributor

Quasar Distributors, LLC (the “Distributor”) acts as both Funds’ distributor, provides certain administration services and promotes and arranges for the sale of Fund shares. The offering of both Funds’ shares is continuous. The Distributor is a registered broker-dealer and member of FINRA.

Fund Administrator, Transfer Agent and Fund Accountant

U.S. Bancorp Fund Services, LLC (“USBFS”) acts as the Administrator for both Funds. USBFS provides certain services to both Funds including, among other responsibilities, coordinating the negotiation of contracts and fees with, and the monitoring of performance and billing of, both Funds’ independent contractors and agents; preparation for signature of all documents required to be filed for compliance by both Funds with applicable laws and regulations, excluding those of the securities laws of various states; arranging for the computation of performance data, including NAV per share and yield; responding to shareholder inquiries; and arranging for the maintenance of books and records of both Funds, and providing, at its own expense, office facilities, equipment and personnel necessary to carry out its duties. In this capacity, USBFS does not have any responsibility or authority for the management of the Funds, the determination of investment policy, or for any matter pertaining to the distribution of Fund shares.

Custodian

U.S. Bank National Association (the “Custodian”) serves as the custodian of both Funds’ assets, holds both Funds’ portfolio securities in safekeeping, and keeps all necessary records and documents relating to its duties. The Custodian is compensated with an asset-based fee plus transaction fees and is reimbursed for out-of-pocket expenses.

The Distributor, USBFS, and Custodian are all affiliated companies.

Independent Registered Public Accounting Firm

Baker Tilly Virchow Kraus, LLP (“Baker Tilly”) has been selected as independent registered public accounting firm for the Acquired Fund. Baker Tilly performs an annual audit of the Appleton Trust’s financial statements and advises the Acquired Fund as to certain accounting matters.

Cohen Fund Audit Services, Ltd. serves as the independent registered public accounting firm for the Acquiring Fund, whose services include auditing the Fund’s financial statements and the performance of related tax services.

Fund Expenses

The Acquiring Fund will have the same management and distribution fees as the Acquired Fund. Certain expenses of the Acquiring Fund are expected to decrease and thus reduce the Fund’s operating expense ratio over time.

Comparison of Distribution and Service Fee (12b-1) Fee

Each Fund has adopted a plan of distribution pursuant to Rule 12b-1 under the 1940 Act (the “Plan”), which permits the Fund to pay for expenses incurred in the distribution and promotion of the Fund’s shares including but not limited to, the printing of prospectuses, statements of additional information and reports used for sales purposes, advertisements, expenses of preparation and printing of sales literature, promotion, marketing and sales expenses and other distribution-related expenses, including any distribution fees paid to securities dealers or other firms who have executed a distribution or service agreement with the Trust. Each Plan expressly limits payment of the distribution expenses listed above in any fiscal year to a maximum of 0.25% of the Fund’s average daily net assets. Unreimbursed expenses will not be carried over from year to year. For the fiscal year ended December 31, 2015, the Acquired Fund did not incur distribution expenses under the Plan.

Comparison of Shareholder Services

Purchase and Redemption Procedures

The Acquiring Fund will offer the same or substantially similar shareholder purchase and redemption services as the Acquired Fund, including telephone purchases and redemptions. Shares of each Fund may be purchased and redeemed at the net asset value of the shares as next determined following receipt of a purchase or redemption order, provided the order is received in proper form. Payment of redemption proceeds from the a Fund generally will be sent by mail or wire within three business days after processing by the Fund’s transfer agent after receipt of a redemption request in proper form. Payment of redemption proceeds from a Fund generally will be received within a week after processing by the Funds’ transfer agent after receipt of a redemption request in proper form.

Minimum Initial and Subsequent Investment Amounts

The Acquiring Fund will offer the same account minimums and automatic investment plan as the Acquired Fund. The initial investment in each Fund ordinarily must be at least $1,000 ($500 for tax-deferred retirement accounts and $100 for automatic investment plan accounts).

Each Fund will accept accounts with less than the stated minimum from employees of the Adviser and its affiliates and may, in the Adviser’s sole discretion, accept certain other accounts with less than the stated minimum initial investment.

Both Funds offer an automatic investment plan, which automatically deducts money from your bank account and invests it in a Fund through the use of electronic funds transfers or automatic bank drafts.

Redemptions

You may redeem any or all of your shares in a Fund by writing or telephoning the Fund, as well as by participating in either Fund’s systematic withdrawal plan. Shareholders with a current account value of at least $5,000 may elect to receive, or may designate another person to receive, monthly, quarterly or annual payments in a specified amount of not less than $100 each.

Dividends and Distributions

The Acquiring Fund will have the same dividend and distribution policy as the Acquired Fund. Shareholders who have elected to have dividends and capital gains reinvested in the Acquired Fund will continue to have dividends and capital gains reinvested in the Acquiring Fund’s Shares following the Reorganization.

Fiscal Year

The Acquired Fund currently operates on a fiscal year ending December 31st. Following the Reorganization, the Acquiring Fund will assume the financial history of the Acquired Fund and continue to operate on a fiscal year ending December 31st of each year.

Business Structure

Federal securities laws largely govern the way mutual funds operate, but they do not cover every aspect of a fund’s existence and operation. State law and each Fund’s governing documents create additional operating rules and restrictions that the Funds must follow. The Appleton Trust is organized as an Ohio business trust and SPT is organized as a Delaware statutory trusts. The trusts are governed by their respective Agreement and Declaration of Trust, By-Laws, and applicable state and federal law.

The Appleton Trust and SPT are operated by their respective boards of trustees and officers appointed by each respective board. The composition of the board of trustees and the officers for the Appleton Trust and SPT differ. For more information about the current trustees and officers of the Acquired Fund, you should consult the current SAI for the Acquired Fund. The following is a list of the trustees and executive officers of the Appleton Trust:

| Name | Position with The Appleton Funds |

| John M. Cornish, Esq. | Independent Trustee |

| Grady B. Hedgespeth (a) | Independent Trustee |

| James I. Ladge, CFA | Trustee |

| Daniel T. Buckley, CFA | President |

| Benjamin T. Doherty, Esq. | Chief Compliance Officer and Secretary |

| Brandon Sliga | Assistant Secretary |

(a) Mr. Hedgespeth resigned as a Trustee on April 15, 2016.

The trustees and officers of SPT, their ages, positions with SPT, term of office with SPT and length of time served, business addresses, principal occupations during the past five years, and the trustees’ other directorships held during the past five years, are listed in the table below.

Name and Year of Birth | Positions with the Trust | Term of Office and Length of Time Served | Principal Occupations During Past Five Years | Number of Portfolios in Fund Complex(2) Overseen by Trustees | Other Directorships Held During Past Five Years |

Independent Trustees of the Trust(1) |

Koji Felton (born 1961) | Trustee | Indefinite Term; Since September 2015. | Counsel, Kohlberg Kravis Roberts & Co. L.P. (2013-2015); Counsel, Dechert LLP (2011-2013); Senior Vice President and Deputy General Counsel, Charles Schwab & Co., Inc. (1998-2011). | 1 | None |

Name and Year of Birth | Positions with the Trust | Term of Office and Length of Time Served | Principal Occupations During Past Five Years | Number of Portfolios in Fund Complex(2) Overseen by Trustees | Other Directorships Held During Past Five Years |

Debra McGinty Poteet (born 1956) | Trustee | Indefinite Term; Since September 2015. | Retired. | 1 | Independent Trustee, First Western Funds (May 2015-Present); Inside Trustee, Brandes Investment Trust, Chair and President (2000-2012); Director, Inside Trustee, Brandes Funds LTD (2002-2012). |

Daniel B. Willey (born 1955) | Trustee | Indefinite Term; Since September 2015. | Compliance Officer, United Nations Joint Staff Pension Fund (since 2009) | 1 | None |

| Interested Trustee |

Dana L. Armour (born 1968) | Chair, Trustee | Indefinite Term; Since September 2015. | Executive Vice President, U.S. Bancorp Fund Services, LLC, since 2013; Vice President (2010 – 2013). | 1 | None |

| Officers of the Trust |

John J. Hedrick

(born 1977) | President and Chief Executive Officer | Indefinite Term; Since September 2015 | Vice President, U.S. Bancorp Fund Services, LLC, since 2011; Assistant Vice President (2007 – 2011). | Not Applicable | Not Applicable |

David A. Cox

(born 1982) | Treasurer and Chief Financial Officer | Indefinite Term; Since January 2016. | Assistant Vice President, U.S. Bancorp Fund Services, LLC (since 2011). | Not Applicable | Not Applicable |

Name and Year of Birth | Positions with the Trust | Term of Office and Length of Time Served | Principal Occupations During Past Five Years | Number of Portfolios in Fund Complex(2) Overseen by Trustees | Other Directorships Held During Past Five Years |

Michael R. McVoy

(born 1957) | Chief Compliance Officer and Anti-Money Laundering Officer | Indefinite Term; Since September 2015. | Executive Vice President, U.S. Bancorp Fund Services, LLC, since 2005. | Not Applicable | Not Applicable |

Alia M. Vasquez (born 1980) | Secretary | Indefinite Term; Since September, 2015 | Vice President, U.S. Bancorp Fund Services, LLC, since 2015, Assistant Vice President 2010-2015. | Not Applicable | Not Applicable |

| (1) | The Trustees of the Trust who are not “interested persons” of the Trust as defined under the 1940 Act (“Independent Trustees”). |

| (2) | The term “Fund Complex” includes all series of the Trust as of the date of this SAI. The Fund does not hold itself out as related to any other series within the Trust for investment purposes, nor does it share the same investment adviser with any other series. |

The address of each trustee and officer is c/o U.S. Bancorp Fund Services, LLC, 615 E. Michigan Avenue, Milwaukee, Wisconsin 53202.

More information about the SPT trustees, as well as the role of the SPT Board and its structure will be available in the statement of additional information for the Acquired Fund; such information will be made available upon request.

Terms of the Reorganization

Upon completion of the Reorganization the Acquiring Fund will acquire all of the assets and assume all of the liabilities of the Acquired Fund in exchange for shares of the Acquiring Fund.

The Reorganization Plan provides that the number of full and fractional shares to be issued by the Acquiring Fund in connection with the Reorganization will be the same as the number of shares owned by Acquired Fund shareholders at the effective time of the Reorganization. The Reorganization Plan also provides that the net asset value of shares of the Acquiring Fund will be the same as the net asset value of the shares of the Acquired Fund. The value of the assets to be transferred by the Acquired Fund to the Acquiring Fund will be determined using the valuation procedures used by the Acquired Fund in determining its daily net asset value. The parties to the Reorganization Plan have agreed to use commercially reasonable efforts to resolve, prior to the effective time of the Reorganization, any material pricing differences for prices of portfolio securities that might arise from use of the Acquired Fund’s valuation procedures. The valuation will be calculated at the time of day the Acquired Fund and Acquiring Fund ordinarily calculate their net asset values (i.e. as of the close of the regular session of trading on the New York Stock Exchange, typically 4:00 p.m. Eastern Time) and will take place simultaneously with the completion of the Reorganization. If the Acquired Fund shareholders approve the Reorganization, it is expected to be completed on or about June 30, 2016.

The Acquired Fund will distribute the Acquiring Fund shares it receives in the Reorganization to its shareholders. Shareholders of record of the Acquired Fund will be credited with shares of the Acquiring Fund having an aggregate value equal to the Acquired Fund shares that the shareholders hold of record at the effective time of the Reorganization. At that time, the Acquired Fund will redeem and cancel its outstanding shares and will liquidate as soon as is reasonably practicable after the Reorganization.

The Reorganization Plan may be terminated by resolution of the Appleton Board or the Board of Trustees of SPT on behalf of the Acquired Fund or the Acquiring Fund, respectively, under certain circumstances. In addition to approval of the Acquired Fund’s shareholders, completion of the Reorganization is subject to numerous conditions set forth in the Reorganization Plan. An important condition to closing is that the Acquired Fund receives a tax opinion to the effect that the Reorganization will qualify as a “reorganization” for U.S. federal income tax purposes, subject to certain qualifications. Lastly, the completion of the Reorganization is conditioned upon both the Acquired Fund and Acquiring Fund receiving the necessary documents to transfer Acquired Fund assets and liabilities in exchange for shares of the Acquiring Fund.

The foregoing brief summary of the Reorganization Plan is qualified in its entirety by the terms and provisions of the form of Agreement and Plan of Reorganization and Termination, a copy of which is attached hereto as Appendix B and incorporated herein by reference.

Appleton Board Consideration of the Reorganization

The Appleton Board considered the proposed Reorganization at a special meeting held on April 12, 2016, at which the Appleton Trust Officers provided materials and made presentations to the Board on the proposed Reorganization. The materials which the Appleton Trust Officers prepared and provided to the Appleton Board included, among other things, information on the investment objectives and strategies of the Acquiring Fund, comparative operating expense ratios, and an analysis of the projected benefits to the Acquired Fund’s shareholders from the proposed Reorganization. At meeting, the Appleton Board considered the proposed Reorganization and approved the Reorganization Plan, determining that it would be in the best interests of the Acquired Fund and its shareholders, and that such shareholders’ interests would not be diluted as a result of the Reorganization.

In determining whether to approve the Reorganization Plan and to recommend approval of the Reorganization to shareholders of the Acquired Fund, the Appleton Board (including the Independent Trustees) made inquiries into a number of matters and considered the following factors, among others:

| i. | the potential benefits to the Acquired Fund and its shareholders from the Reorganization both in the short-term and over a longer period; |

| ii. | the fact that the portfolio managers presently responsible for managing the day-to-day investments of the Acquired Fund would be responsible for managing the Acquiring Fund after the Reorganization, which will provide continuity of asset management for current Acquired Fund shareholders; |

| iii. | the anticipated effect of the Reorganization on per-share expenses of the Acquired Fund over time; |

| iv. | the expense ratios and available information regarding the fees and expenses of the Acquiring Fund; |

| v. | the terms and conditions of the Reorganization and whether the Reorganization would result in dilution of shareholder interests; |

| vi. | the comparability of the investment objectives, strategies and risks of the Acquired Fund and the Acquiring Fund; |

| vii. | the reputation, financial strength and resources of Appleton Partners, Inc.; |

| viii. | that the expenses of the Reorganization would not be borne by the Acquired Fund’s shareholders; |

| ix. | the expected U.S. federal tax consequences of the Reorganization; and |

| x. | the possible alternatives to the Reorganization. |

In reaching the decision to approve the Reorganization and to recommend that shareholders approve the Reorganization, the Appleton Board including the Independent Trustees, concluded that the participation of the Acquired Fund in the Reorganization is in the best interests of the shareholders of the Acquired Fund and would not result in dilution of such shareholder’s interests. Their conclusion was based on a number of factors, including the following considerations:

Investment Objectives and Strategies

The investment objective of the Acquiring Fund is identical to the investment objective of the Acquired Fund and the Acquiring Fund has principal investment strategies and principal risks that are identical to those of the Acquired Fund. These similarities should allow for continuity of shareholder investment expectations.

Portfolio Management

The current portfolio managers of the Acquired Fund will serve as the portfolio managers of the Acquiring Fund, promoting continuity of asset management and investment expectations for Acquired Fund shareholders.

Operating Expenses of the Funds

The Appleton Board also considered the operating expense ratios for the Acquired Fund and Acquiring Fund. The Acquiring Fund is expected to have a lower gross operating expense ratio, over time, than the Acquired Fund.

Expected Tax-Free Conversion of the Acquired Fund’s Shares

The Appleton Board also considered the expected tax-free nature of the Reorganization. If a shareholder were to redeem such shareholder’s investment in the Acquired Fund and invest the proceeds in another mutual fund or other investment product, the shareholder generally would recognize gain or loss for U.S. federal income tax purposes upon the redemption of the shares. By contrast, upon completion of the Reorganization, it is intended that: (1) the shareholder will not recognize a taxable gain or a loss on the transfer of such shareholder’s investment to the Acquiring Fund; (2) the shareholder will have the same tax basis in the Acquiring Fund shares as in the Acquired Fund shares for U.S. federal income tax purposes; and (3) assuming that the shareholder held Acquired Fund shares as a capital asset, such shareholder will have the same holding period for the Acquiring Fund shares as for the Acquired Fund shares. As a shareholder of an open-end fund, shareholders will continue to have the right to redeem any or all of their shares at net asset value at any time. At that time, shareholders generally would recognize a gain or loss for U.S. federal income tax purposes.

Expenses of the Reorganization

The Adviser will bear all of the Acquired Fund’s Reorganization expenses and will also bear all expenses of Managed Portfolio Series and the Acquiring Fund that are directly related to the Reorganization. In no event will the Acquired Fund or its shareholders bear any expenses associated with the Reorganization.

Performance

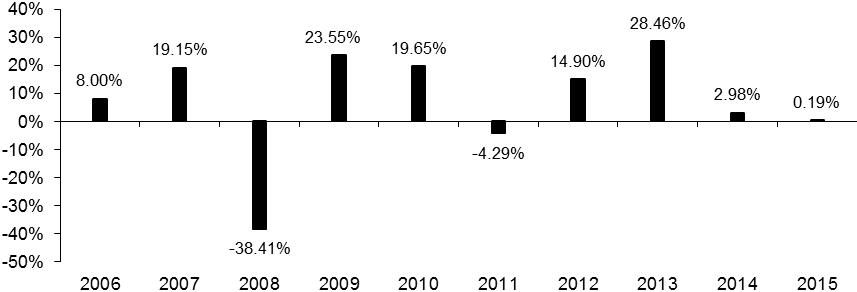

Upon completion of the Reorganization, the Acquired Fund will be reorganized into the Acquiring Fund which will receive the assets and assume the liabilities of the Acquired Fund. The Acquired Fund will be the accounting survivor of the Reorganization, and the Acquiring Fund will assume the performance history of the Acquired Fund at the completion of the Reorganization. The following bar chart and table show changes in the Acquired Fund’s performance from year to year and how the Acquired Fund’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance. The Acquired Fund’s past performance (before and after taxes) is not necessarily an indication of how the Acquired Fund or Acquiring Fund will perform in the future.

Annual Total Returns as of 12/31

During the period shown in the bar chart, the highest and lowest quarterly returns were as follows:

Highest Quarterly Return | Lowest Quarterly Return |

15.00% (Quarter Ended Sept 30, 2010) | -24.73% (Quarter Ended Dec 31, 2008) |

Average Annual Total Returns for Periods Ended December 31, 2015

| | One

Year | Five

Year | Ten

Year |

| Return Before Taxes | 0.19% | 7.83% | 5.50% |

| Return After Taxes on Distributions | -1.54% | 7.10% | 5.13% |

Return After Taxes on Distributions and Sale of Fund Shares | 1.52% | 6.16% | 4.41% |

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 1.38% | 12.57% | 7.31% |

Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) | 5.67% | 13.53% | 8.53% |

Material U.S. Federal Income Tax Consequences

The following discussion summarizes the material U.S. federal income tax consequences of the Reorganization that are applicable Acquired Fund shareholders. It is based on the Internal Revenue Code (the “Code”), applicable Treasury regulations, judicial authority, and administrative rulings and practice, all as of the date of this Information Statement and all of which are subject to change, including changes with retroactive effect. The discussion below does not address any state, local or foreign tax consequences of the Reorganization. A shareholder’s tax treatment may vary depending upon such shareholder’s particular situation. Shareholders also may be subject to special rules not discussed below if they are a certain kind of Acquired Fund shareholder, including, but not limited to: an insurance company; a tax-exempt organization; a financial institution or broker- dealer; a person who is neither a citizen nor resident of the United States or an entity that is not organized under the laws of the United States or political subdivision thereof; a holder of Acquired Fund shares as part of a hedge, straddle or conversion transaction; a person that does not hold Acquired Fund shares as a capital asset at the time of the Reorganization; or an entity taxable as a partnership for U.S. federal income tax purposes.

Neither the Acquired Fund nor the Acquiring Fund has requested or will request an advance ruling from the Internal Revenue Service as to the U.S. federal income tax consequences of the Reorganization or any related transaction. The Internal Revenue Service could adopt positions contrary to those discussed below and such positions could be sustained. Shareholders are urged to consult with their own tax advisors and financial planners as to the particular tax consequences of the Reorganization, including the applicability and effect of any state, local or foreign laws, and the effect of possible changes in applicable tax laws.

The obligation of the Funds to consummate the Reorganization is conditioned upon their receipt of an opinion of counsel to the Acquiring Fund generally to the effect that the Reorganization should qualify as a “reorganization” under Section 368(a) of the Code, and the Acquiring Fund and the Acquired Fund should each be a “party to a reorganization” under Section 368(b) of the Code. Provided that the Reorganization so qualifies and the Funds are so treated, for U.S. federal income tax purposes, generally and subject to the qualifications set forth below:

| • | Neither the Acquiring Fund nor the Acquired Fund will recognize any gain or loss as a result of the Reorganization. |

| • | Acquired Fund shareholders will not recognize any gain or loss as a result of the receipt of Acquiring Fund shares in exchange for such shareholder’s Acquired Fund shares pursuant to the Reorganization. |

| • | An Acquired Fund shareholder’s aggregate tax basis in the Acquiring Fund shares received pursuant to the Reorganization will equal such shareholder’s aggregate tax basis in Acquired Fund shares held immediately before the Reorganization. |

| • | An Acquired Fund shareholder’s holding period for the Acquiring Fund shares received pursuant to the Reorganization will include the period during which the shareholder held Acquired Fund shares, provided that the Acquiring Fund shareholders held their Acquired Fund shares as capital assets. |

No opinion will be expressed as to the effect of the Reorganization on (i) the Acquired Fund or the Acquiring Fund with respect to any asset as to which any unrealized gain or loss is required to be recognized for federal income tax purposes at the end of a taxable year (or on the termination or transfer thereof) under a mark-to-market system of accounting and (ii) any Acquired Fund or Acquiring Fund shareholder that is required to recognize unrealized gains and losses for federal income tax purposes under a mark-to-market system of accounting.

The tax opinion described above will be based upon facts, representations and assumptions to be set forth or referred to in the opinion and the continued accuracy and completeness of representations made by the Acquired Fund and Acquiring Fund, including representations in a certificate to be delivered by the management of the Acquired Fund and Acquiring Fund. Counsel rendering the opinion will not independently investigate or verify the validity of such facts, representations and assumptions, and its opinion may be jeopardized if any of these facts, representations or assumptions is incorrect in any material respect.

Since its formation, the Acquired Fund believes it has qualified as a separate “regulated investment company” (or “RIC”) under the Code. The Acquiring Fund is a new entity that will elect RIC status under the Code following the Reorganization. The Acquired Fund believes that it has been, and expects to continue to be, relieved of U.S. federal income tax liability to the extent that it makes distributions of its taxable income and gains to its shareholders. Prior to the Reorganization, the Acquired Fund must continue to make timely distributions of its previously undistributed net investment income and realized net capital gains, including capital gains on any securities disposed of in connection with the Reorganization. Acquired Fund shareholders must include any such distributions in such shareholder’s taxable income.

Fees and Expenses of the Reorganization

The Adviser will bear all of the Reorganization expenses and will also bear all expenses of SPT and the Acquiring Fund that are directly related to the Reorganization.

Capitalization

The following table sets forth as of the Record Date, the capitalizations of the Acquired Fund and of the Acquiring Fund. Pro forma capitalization information is not included for the Reorganization because the shares of the Acquired Fund are being reorganized into the shares of the Acquiring Fund, which is a shell fund that currently has no assets.

| Fund | Total Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Acquired Fund | $ 16,537,389 | 1,680,124 | $ 9.84 |

| Acquiring Fund | $ 0 | 0 | $ 0 |

THE TRUSTEES, INCLUDING ALL OF THE INDEPENDENT TRUSTEES OF

THE APPLETON FUNDS, HAVE APPROVED THE PROPOSAL.

ADDITIONAL INFORMATION

Shareholder Proposals

The Fund is not required to hold regular meetings of shareholders each year. Meetings of shareholders are held from time to time and shareholder proposals intended to be presented at future meetings must be submitted in writing to the Fund in reasonable time prior to the solicitation of proxies for the meeting.

Cost of Solicitation

The Adviser will bear the expenses incurred with drafting, printing, mailing and filing this Information Statement.

Delivery of Shareholder Documents

Only one copy of this Information Statement and other documents related to the Fund, such as annual reports, proxy materials, quarterly statements, etc. are being delivered to multiple shareholders sharing an address, unless the Appleton Trust has received contrary instructions in writing at the Appleton Funds, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701 or by telephone at 1-877-71-APPLE.

Record of Beneficial Ownership

A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding shares of the Fund. A control person is one who owns beneficially or through controlled companies more than 25% of the voting securities of a company or acknowledges the existence of control. Shareholders with a controlling interest could affect the outcome of voting or the direction of management of the Fund. For each control person listed that is a company, the jurisdiction under the laws of which the company is organized (if applicable) and the company’s parent entity are listed. As of the Record Date, the following shareholders were considered to be either a control person or principal shareholder of the Fund:

Name and Address | Percent of Fund | Nature of Ownership |

Bowdoin & Company* c/o Maria Harrington Cambridge Appleton Trust One Post Office Square, 6th Floor Boston, MA 02109 | 73.01% | Record |

| | | |

Appleton Partners, Inc. 401K Plan c/o Douglas Chamberlain & Kathleen Burge One Post Office Square, 6th Floor Boston, MA 02109 ————— | 15.69% | Record |

*May be deemed to “control” the Fund, as that term is defined in the 1940 Act, due to ownership of greater than 25% of the Fund’s shares. Bowdoin & Company is a nominee for Cambridge Appleton Trust, N.A., which holds the shares of record in various fiduciary capacities.

APPENDIX A

THE APPLETON FUNDS

Written Consent to Action in Lieu of a Meeting of the Shareholders

Appleton Equity Growth Fund

THE UNDERSIGNED, being the holder of 73.01% of outstanding shares of the Appleton Equity Growth Fund (the “Acquired Fund”), a series of the Appleton Funds, an Ohio business trust (the “Trust”), and acting by written consent in lieu of a meeting, pursuant to authority contained in Article V, Section 5.5 of the Trust’s Agreement and Declaration of Trust, hereby consents and agrees, by signing this written consent, to the adoption of the following resolutions and the filing of the same with the minutes of proceedings of the shareholders of the Fund, with the same effect as if such action had been taken by vote at a meeting of the shareholders duly called and held.

WHEREAS, Appleton Partners, Inc. (the “Adviser”), adviser to the Acquired Fund, has recommended that the Acquired Fund, as series of the Trust, be reorganized into a new series (the “Acquiring Fund”) of Series Portfolios Trust (the “Reorganization”); and

WHEREAS, the Board of Trustees (the “Board”) of the Trust has reviewed such information and has considered a variety of factors related to the Reorganization including, but not limited to: (i) the anticipated effect of the Reorganization on per share expenses and costs of the Acquired Fund; (ii) whether the Reorganization will achieve economies of scale for the Acquired Fund and benefit shareholders by promoting efficient operations; (iii) the terms and conditions of the Reorganization; (iv) the fact that the Acquiring Fund will have the same or substantially similar investment objectives, strategies, policies and restrictions as the Acquired Fund; (v) that the Adviser will continue to provide investment advisory and portfolio management services to the Acquiring Fund; (vi) that the expense of the Reorganization will not be borne by shareholders of the Acquired Fund or the Acquiring Fund; and (vii) that the Reorganization will not result in the recognition of any gain or loss for federal income tax purposes to the Acquired Fund or its shareholders; and

WHEREAS, the Board has consulted with legal counsel regarding the Board’s responsibilities in considering the approval of the Reorganization; and

WHEREAS, that the Board, including a majority of the Independent Trustees, determined that the Reorganization would be in the best interests of the Acquired Fund and its shareholders and that the interests of the Acquired Fund’s shareholders will not be diluted as a result of the Reorganization; it is now, therefore

RESOLVED, that the Agreement and Plan of Reorganization and Termination, and the transactions contemplated thereunder, is hereby approved, with such changes as may be considered necessary or advisable by the officers of the Trust, upon advice of counsel; and it is

FURTHER RESOLVED, that the appropriate officers of the Trust be, and each of them hereby is, authorized to take any and all actions any of them may deem necessary or appropriate to implement the foregoing resolution.

| By: | /s/ Danielle Jennings |

| | |

| Name: | /s/ Danielle Jennings |

| | |

| Title: | Authorized Agent, Bowdoin &. Co. |

Written Consent to Action in Lieu of a Meeting of the Shareholders

Appleton Equity Growth Fund

THE UNDERSIGNED, being the holder of 15.69% of outstanding shares of the Appleton Equity Growth Fund (the “Acquired Fund”), a series of the Appleton Funds, an Ohio business trust (the “Trust”), and acting by written consent in lieu of a meeting, pursuant to authority contained in Article V, Section 5.5 of the Trust’s Agreement and Declaration of Trust, hereby consents and agrees, by signing this written consent, to the adoption of the following resolutions and the filing of the same with the minutes of proceedings of the shareholders of the Fund, with the same effect as if such action had been taken by vote at a meeting of the shareholders duly called and held.

WHEREAS, Appleton Partners, Inc. (the “Adviser”), adviser to the Acquired Fund, has recommended that the Acquired Fund, as series of the Trust, be reorganized into a new series (the “Acquiring Fund”) of Series Portfolios Trust (the “Reorganization”); and

WHEREAS, the Board of Trustees (the “Board”) of the Trust has reviewed such information and has considered a variety of factors related to the Reorganization including, but not limited to: (i) the anticipated effect of the Reorganization on per share expenses and costs of the Acquired Fund; (ii) whether the Reorganization will achieve economies of scale for the Acquired Fund and benefit shareholders by promoting efficient operations; (iii) the terms and conditions of the Reorganization; (iv) the fact that the Acquiring Fund will have the same or substantially similar investment objectives, strategies, policies and restrictions as the Acquired Fund; (v) that the Adviser will continue to provide investment advisory and portfolio management services to the Acquiring Fund; (vi) that the expense of the Reorganization will not be borne by shareholders of the Acquired Fund or the Acquiring Fund; and (vii) that the Reorganization will not result in the recognition of any gain or loss for federal income tax purposes to the Acquired Fund or its shareholders; and

WHEREAS, the Board has consulted with legal counsel regarding the Board’s responsibilities in considering the approval of the Reorganization; and

WHEREAS, that the Board, including a majority of the Independent Trustees, determined that the Reorganization would be in the best interests of the Acquired Fund and its shareholders and that the interests of the Acquired Fund’s shareholders will not be diluted as a result of the Reorganization; it is now, therefore

RESOLVED, that the Agreement and Plan of Reorganization and Termination, and the transactions contemplated thereunder, is hereby approved, with such changes as may be considered necessary or advisable by the officers of the Trust, upon advice of counsel; and it is

FURTHER RESOLVED, that the appropriate officers of the Trust be, and each of them hereby is, authorized to take any and all actions any of them may deem necessary or appropriate to implement the foregoing resolution.

| By: | /s/ Kathleen M. Burge |

| | |

| Name: | /s/ Kathleen M. Burge |

| | |

| Title: | Executive Vice President, Treasurer |

APPENDIX B

THIS AGREEMENT AND PLAN OF REORGANIZATION AND TERMINATION (“Agreement”) is made as of this 16 day of May, 2016, by and among SERIES PORTFOLIOS TRUST, a Delaware statutory trust, with its principal place of business at 615 E. Michigan Street, Milwaukee, Wisconsin 53202 (“New Trust”), on behalf of its series, Appleton Equity Growth Fund (“New Fund”); The Appleton Funds, an Ohio business trust with its principal place of business at One Post Office Square, 6th Floor, Boston, MA 02109 (“Old Trust”), on behalf of its series, Appleton Equity Growth Fund (“Old Fund”); and, solely for purposes of paragraph 6, Appleton Partners, Inc., the investment adviser to the Old Fund and the New Fund (“Appleton Partners”) with its principal place of business at One Post Office Square, 6th Floor, Boston, MA 02109. (Each of New Trust and Old Trust is sometimes referred to herein as an “Investment Company,” and each of the New Fund and the Old Fund are sometimes referred to herein as a “Fund.”) Notwithstanding anything to the contrary contained herein, (1) the agreements, covenants, representations, warranties, actions, and obligations of and by each Fund, and of and by each Investment Company, as applicable, on behalf of its Fund, shall be the agreements, covenants, representations, warranties, actions, and obligations of that Fund only, (2) all rights and benefits created hereunder in favor of each Fund shall inure to and be enforceable by the Investment Company of which that Fund is a series on that Fund’s behalf, and (3) in no event shall any other series of an Investment Company or the assets thereof be held liable with respect to the breach or other default by an obligated Fund or Investment Company of its agreements, covenants, representations, warranties, actions, and obligations set forth herein.

New Fund and Old Fund wish to effect a reorganization described in section 368(a)(1)(F) of the Internal Revenue Code of 1986, as amended (“Code”) (all “section” references are to the Code, unless otherwise noted), and intend this Agreement to be, and adopt it as, a “plan of reorganization” within the meaning of Treasury Regulations (“Regulations”) Section 1.368-2(g). The reorganization will involve Old Fund (1) transferring all its assets to New Fund (which is being established solely for the purpose of acquiring those assets and continuing Old Fund’s business) in exchange solely for voting shares of beneficial interest (“shares”) in New Fund and New Fund’s assumption of all of Old Fund’s liabilities, (2) distributing those shares pro rata to Old Fund’s shareholders in exchange for their shares therein and in complete liquidation thereof, and (3) terminating Old Fund, all on the terms and conditions set forth herein (all the foregoing transactions involving Old Fund and New Fund being referred to herein collectively as the “Reorganization”).

Each Investment Company’s board of trustees (each, a “Board”), in each case including a majority of its members who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended (“1940 Act”)) (“Non-Interested Persons”) of such Investment Company, (1) has duly adopted and approved this Agreement and the transactions contemplated hereby, (2) has duly authorized performance thereof on its Fund’s behalf by all necessary Board action, and (3) has determined that participation in the Reorganization is in the best interests of the Fund that is a series thereof and, in the case of Old Fund, that the interests of the existing shareholders thereof will not be diluted as a result of the Reorganization.

Old Fund currently offers one class of shares (“Old Fund Shares”). New Fund will offer one class of shares, which will be designated Institutional Class shares (“New Fund Shares”). The Old Fund Shares have substantially similar characteristics to the New Fund Shares.

In consideration of the mutual promises contained herein, the Investment Companies agree as follows:

1. PLAN OF REORGANIZATION AND TERMINATION

1.1. Subject to the requisite approval of Old Fund’s shareholders and the terms and conditions set forth herein, Old Fund shall assign, sell, convey, transfer, and deliver all of its assets described in paragraph 1.2 (“Assets”) to New Fund. In exchange therefore, New Fund shall:

| (a) | Issue and deliver to Old Fund the number of full and fractional New Fund Shares equal in value to the value of full and fractional Old Fund Shares then outstanding (all references herein to “fractional” shares meaning fractions rounded to the third decimal place); and |

| (b) | Assume all of Old Fund’s liabilities as described in paragraph 1.3 (“Liabilities”). |

Those transactions shall take place at the Closing (as defined in paragraph 2.1).

1.2 The Assets shall consist of all assets and property of every kind and nature of Old Fund at the Effective Time (as defined in paragraph 2.1), including, without limitation, all cash, cash equivalents, securities, commodities, futures interests, receivables (including interest and dividends receivable), claims and rights of action, rights to register shares under applicable securities laws, books and records and any deferred and prepaid expenses shown as assets on Old Fund’s books. Old Fund has no unamortized or unpaid organizational fees or expenses that have not previously been disclosed in writing to New Trust.

1.3 The Liabilities shall consist of all of Old Fund’s liabilities, debts, obligations, and duties existing at the Effective Time, whether known or unknown, contingent, accrued, or otherwise, excluding Reorganization Expenses (as defined in paragraph 3.3(f)) borne by Appleton Partners pursuant to paragraph 6. Notwithstanding the foregoing, Old Fund will, to the extent permissible and consistent with its investment objectives and policies, endeavor to discharge all its known liabilities, debts, obligations, and duties before the Effective Time (other than the obligations set forth in this Agreement and certain investment contracts, including options, futures, forward contracts, and swap agreements).

1.4 At or before the Closing, New Fund shall redeem the Initial Shares (as defined in paragraph 5.5) for the amount at which they are issued pursuant to that paragraph. At the Effective Time (or as soon thereafter as is reasonably practicable), Old Fund shall distribute all the New Fund Shares it receives pursuant to paragraph 1.1(a) to its shareholders of record determined at the Effective Time (each, a “Shareholder”), in each case in constructive exchange therefor, and shall completely liquidate. That distribution shall be accomplished by New Trust’s transfer agent opening accounts on New Fund’s shareholder records in the Shareholders’ names and transferring those New Fund Shares thereto. Pursuant to that transfer, each Shareholder’s account shall be credited with the number of full and fractional New Fund Shares equal in value to the value of full and fractional Old Fund Shares held by such Shareholder at the Effective Time. All issued and outstanding Old Fund Shares, including any represented by certificates, shall simultaneously be canceled on Old Fund’s shareholder records. New Trust shall not issue certificates representing the New Fund Shares issued in connection with the Reorganization.

1.5 Any transfer taxes payable on the issuance and transfer of New Fund Shares in a name other than that of the registered holder on Old Fund’s shareholder records of the Old Fund Shares actually or constructively exchanged therefor shall be paid by the transferee thereof, as a condition of that issuance and transfer.

1.6 Any reporting responsibility of Old Fund to a public authority, including the responsibility for filing regulatory reports, tax returns, and other documents with the Securities and Exchange Commission (“Commission”), any state securities commission, any federal, state, and local tax authorities, and any other relevant regulatory authority, is and shall remain the responsibility of Old Fund, up to and including the Effective Time and such later date on which the Old Fund is dissolved, provided, however, that New Fund shall be responsible for filing any tax return covering a period that includes any period after the date of the Closing.

1.7 After the Effective Time, Old Fund shall not conduct any business except in connection with its dissolution and liquidation. As soon as reasonably practicable after distribution of the New Fund Shares pursuant to paragraph 1.4, but in all events within six months after the Effective Time, Old Fund shall be terminated as a series of Old Trust.

2. CLOSING AND EFFECTIVE TIME

2.1 Unless the Investment Companies agree otherwise, all acts necessary to consummate the Reorganization (“Closing”) shall be deemed to take place simultaneously as of immediately after the close of business (4:00 p.m., Eastern time) on June 30, 2016 (“Effective Time”). The Closing shall be held at New Trust’s offices or at such other place as to which the Investment Companies agree.

2.2 Old Trust shall cause the custodian of Old Fund’s assets (“Old Custodian”) (a) to make Old Fund’s portfolio securities available to New Trust (or to its custodian (“New Custodian”), if New Trust so directs), for examination, no later than five business days preceding the Effective Time and (b) to transfer and deliver the Assets at the Effective Time to the New Custodian for New Fund’s account, as follows: (1) duly endorsed in proper form for transfer in such condition as to constitute good delivery thereof in accordance with the custom of brokers, (2) by book entry, in accordance with the customary practices of Old Custodian and any securities depository (as defined in Rule 17f-4 under the 1940 Act) in which Old Fund’s assets are deposited, in the case of Old Fund’s portfolio securities and instruments deposited with those depositories, and (3) by wire transfer of federal funds in the case of cash. Old Trust shall also direct the Old Custodian to deliver at the Closing an authorized officer’s certificate (a) stating that pursuant to proper instructions provided to the Old Custodian by Old Trust, the Old Custodian has delivered all of Old Fund’s portfolio securities, cash, and other Assets to the New Custodian for New Fund’s account and (b) attaching a schedule setting forth information (including adjusted basis and holding period, by lot) concerning the Assets. The New Custodian shall certify to New Trust that such information, as reflected on New Fund’s books immediately after the Effective Time, does or will conform to that information as so certified by the Old Custodian.