UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR FISCAL YEAR ENDED: August 31, 2014

OR

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 333-85072

DBMM GROUP

DIGITAL BRAND MEDIA & MARKETING GROUP, INC.

WWW.DBMMGROUP.COM

(Name of small business issuer in its charter)

| |

Florida | 59-3666743 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

747 Third Avenue, 2nd FL., New York, NY 10017

(Address of principal executive offices)

(646) 722-2706

(Issuer’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

| | |

Title of each class | | Name of exchange on which registered |

None | | None |

Securities registered under Section 12(g) of the Exchange Act:

| | |

Title of each class | | Name of exchange on which registered |

None | | None |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [__X_] No [___ ]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.4.05 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [x] |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $708,011 on February 28, 2014.

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date:

Common Stock, par value $.001 per share: Outstanding as of January 30, 2015 4,314,974,767 |

DOCUMENTS INCORPORATED BY REFERENCE

If the following documents are incorporated by reference, briefly describe them and identify the part of the Form 10-K/A (e.g., Part I, Part II, etc.) into which the document is incorporated: (i) any annual report to security holders; (ii) any proxy or information statement; and (iii) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933 (the “Securities Act”). The listed documents should be clearly described for identification purposes (e.g. annual reports to security holders for fiscal year ended December 24, 1980).

None

Transitional Small Business Disclosure Format (Check one): Yes ___ No X.

| | |

FORM 10-K |

For the Fiscal Year Ended August 31, 2014 |

TABLE OF CONTENTS |

| | Page |

PART 1 | | |

| | |

Item 1. | Description of Business | 3 |

Item 1A. | Risk Factors | 7 |

Item 1B. | Unresolved Staff Comments | 7 |

Item 2: | Description of Property | 7 |

Item 3. | Legal Proceedings | 7 |

Item 4. | Mine Safety Disclosures | 7 |

| | |

PART II | | |

| | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 8 |

Item 6. | Selected Financial Data | 9 |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 9 |

Item 8. | Consolidated Financial Statements and Supplementary Data | 22 |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 28 |

Item 9A (T). | Controls and Procedure | 34 |

Item 9B. | Other Information | - |

| | |

PART III | | |

| | |

Item 10. | Directors and Executive Officers of the Registrant | 34 |

Item 11. | Executive Compensation | 36 |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 37 |

Item 13. | Certain Relationships and Related Transactions | 37 |

Item 14. | Principal Accountant Fees and Services | 37 |

| | |

PART IV | | |

| | |

Item 15. | Exhibits | 38 |

| | |

Signatures | | 39 |

Page 2 of 39

PART I

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements. These forward-looking statements are based largely on our expectations and are subject to a number of risks and uncertainties, many of which are beyond our control. Actual results could differ materially from these forward-looking statements as a result of, among other factors, risks related to the large amount of our outstanding term loans; history of net losses and accumulated deficits; reliance on third parties to market, sell and distribute our products; future capital requirements; competition and technical advances; dependence on the oil services market for pipe and well cleaners; ability to protect our patents and proprietary rights; reliance on a small number of customers for a significant percentage of our revenues; and other risks. In light of these risks and uncertainties, there can be no assurance that the forward-looking information contained in this Annual Report will in fact occur.

Item 1. Description of Business

General

Digital Brand Media & Marketing Group, Inc. (“we”, “us”, “our”, “DBMM”, “DBMM Group”, the “Company”) f/k/a RTG Ventures, Inc. (“RTG”) is an OTC:PK listed company. The Company was organized under the laws of the State of Florida on September 29, 1998.

On March 20, 2007, we entered into a Share Exchange Agreement (the “Agreement”) with Atlantic Network Holdings Limited, New Media Television (Europe) Limited (“NMTV”), and Certain Outside Stockholders to acquire all of the outstanding shares of NMTV. Atlantic Network Holdings Limited is a Guernsey company limited by shares and NMTV is a United Kingdom private company limited by shares. The transaction was subject to the fulfillment of certain conditions, including the satisfactory completion of the audit of NMTV’s financial statements for each of its past three fiscal years. The conditions of closing were not met by ANHL and the agreement was rescinded via 8-K/A on March 30, 2010.

DBMM entered into a Share Exchange Agreement (the “Exchange Agreement”), on March 31, 2010, with Cloud Channel Limited which was subsequently re-named as RTG Ventures (Europe) Limited in July 2010 (“RTG Ventures (Europe)”). Pursuant to the Exchange Agreement, the Company acquired 100% of the outstanding capital stock of RTG Ventures (Europe) from its stockholders for consideration consisting of Convertible Preferred Shares of RTG Ventures, Inc. according to the derivative valuation methodologies outlined in the Share Exchange Agreement of Stylar Limited, a/k/a Digital Clarity. RTG Ventures (Europe) has been valued 12 months forward “notionally” one year hence. An 8-K/A was filed in September 2010 containing audited financials of the acquisition of Stylar Limited which completed the transaction. Shareholders converted the preferred shares into common stock using the average share price of the 30 days preceding September 3, 2011 which provided a share price of $0.016083. The methodology provided a valuation of 4X net profit. All preferred stock was held by DBMM’s transfer agent for the 12 month period ending September 3, 2011. All voting shares were held by management.

Subsequent to the close of the fiscal year 2011 following substantial investment, the Company conducted a structural review of its total product and services offering. The review was carried out by the Board of Directors. The result was to bring technology development being outsourced directly into the Company to steward on a daily basis and any activities which were not revenue generating in the near term were eliminated. Certain business lines were eliminated from the Business Plan immediately. In October, 2011 the joint venture with iPayu was mutually withdrawn and in December, 2011 the acquisition of Bitemark Ltd. was rescinded. The companies reverted to the same position each held prior to the contracts. The rescission of the Bitemark Ltd. share purchase agreement was included as an exhibit to the filing for the 2011 fiscal year even though it constituted a subsequent event at the time.

As a further result of the review, the Company also agreed to strategically focus on developing the business of its wholly owned and revenue generating online marketing services company, Digital Clarity. With deep DNA in its operating market, blending the services of an experienced professional workforce, leveraging a technology offering positions the Company in a strong, forward looking structure. Digital Clarity operates in the growing area of digital marketing that helps companies make the most of the digital economy focusing on areas such as Search Page Engine Marketing (Google, Yahoo! & Bing),

Page 3 of 39

Social Media (Twitter, Facebook & LinkedIn) and Internet Strategy Planning including Design, Analytics and Mobile Marketing.

During the last quarter of fiscal 2012, the Company entered into an agreement with BrandEntertain. Digital Brand Media & Marketing Group, Inc. (f/k/a RTG Ventures, Inc.) and Brand Entertain have agreed to restructure their agreement retroactively to June 11, 2012. BrandEntertain is a partnership and there were certain issues with partnership financials which suggested the business combination be construed as a collaboration/cooperative venture, rather than an acquisition. Upon analysis, one year following the initial transaction, the agreement was rescinded and no consideration was received by BrandEntertain.

On March 5, 2013, Digital Brand Media & Marketing Group, Inc. filed a Certificate of Amendment to its Articles of Incorporation to change its name from “RTG Ventures, Inc.” to “Digital Brand Media & Marketing Group, Inc.” In connection with the name change, the Company’s trading symbol changed from “RTGV” to “DBMM” (the “Symbol Change”). The Amendment was effective as of March 20, 2013. The Name Change and Symbol Change have been reflected in the Company’s ticker symbol as of April 8, 2013.

Also on March 5, 2013, Digital Brand Media & Marketing Group, Inc. received approval from the Financial Industry Regulatory Authority (FINRA) for its 100 to 1 reverse stock split.

A summary of the business is: DBMM Group crafts, designs and executes digital marketing strategies across multiple ad platforms and social media networks for a broad array of clients to help each of them establish a uniform brand identity across the digital universe. The product offering is a unique value proposition of intelligent analytics provided by an experienced digital marketing and technology team. Therefore DBMM Group is a blend of data, strategy and creative execution.

Digital Clarity is a trading brand for Stylar Limited, a wholly owned company of DBMM, through its office in London, England. The Company is a multi-service digital marketing agency which specializes in creating effective strategies and campaigns for clients across a range of vertical markets, working in three key areas:

SearchEngine Marketing –for search engines like Google, Yahoo etc.

WebDesign –building sites for web, mobile and tablet devices

SocialMedia –planning and measuring social metrics digitally in order to diagnose strategy

DBMM Group can leverage its team’s experience in digital media and provide leading strategy, deployment and measurement to its core markets in many industry sectors, from creative to traditional corporate. Entertainment, Fashion and Sports industries, as well as Automotive and Ecommerce are target markets.

The Company is rolling out the services of both the technology and marketing service offering of the business from its current base in London, England, and during 2013 into larger markets in the United States, namely Los Angeles and New York. The intent in fiscal year 2015 is to continue to grow into many geographic areas in order to develop additional revenue streams following the model developed this year.

Fiscal year 2014 reflected the Company’s continued progress by being awarded contracts for a number of new clients in the search marketing sector. One of the successful contract models for Digital Clarity strategizes as a full digital marketing and technology consultancy from design following analysis of client’s analytics, then executing and stewarding the evolution of the model. The Company’s mantra is, “ROI is our DNA,” and continues its business development by leveraging those relationships.

Sales and Marketing

Our sales team focuses on adding new advertisers to our business, while our business development and partnership initiatives focuses on adding new reseller partnerships, selectively adding new distribution partnerships and servicing existing partnerships. Our marketing department focuses on promoting our services through online customer acquisition, affiliate relationships, press coverage, strategic marketing campaigns and industry exposure. Advertising and promotion of our services is broken into four main categories: direct sales, reseller partnerships, online acquisition, and referral agreements. The Directors also take an active role in business development

Page 4 of 39

Research and Development

The Company has a strong forward looking focus in building out a robust and lean platform that will provide revenue generation through the business model described.

There is a current need for investment in building out the development team and creating a proprietary infrastructure to scale and evolve the technology platform and to market to end users.

Employees

As of August 31, 2014 the Company had five full-time employees.

Competition

There is strong competition in the digital marketing arena, though with the right level of investment and marketing, Digital Clarity has a confident outlook in using its experience to win new business in both local and international markets. DBMM has significant business relationships in place.

DBMM Group’s Current Markets

Entertainment/Fashion/Sports/Automotive/Ecommerce Technology Solutions

Digital Marketing Strategic Consulting Services

The Growth of Social Technology and Search

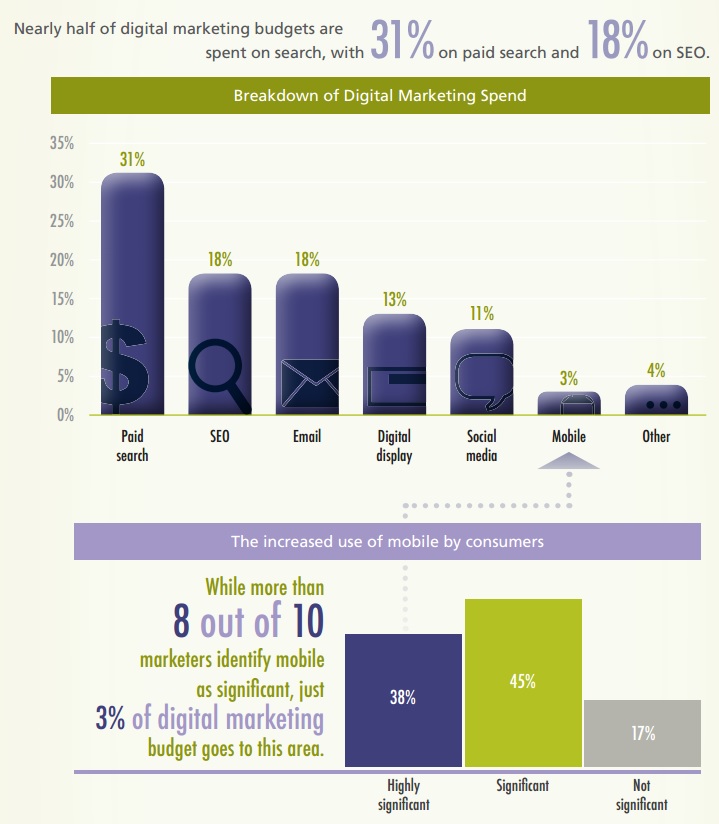

THE MARKET ENVIRONMENT –SEARCH

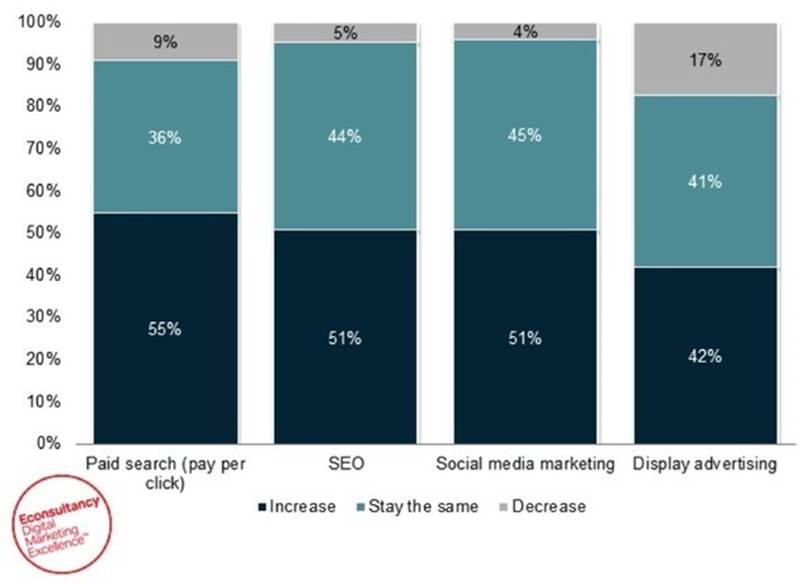

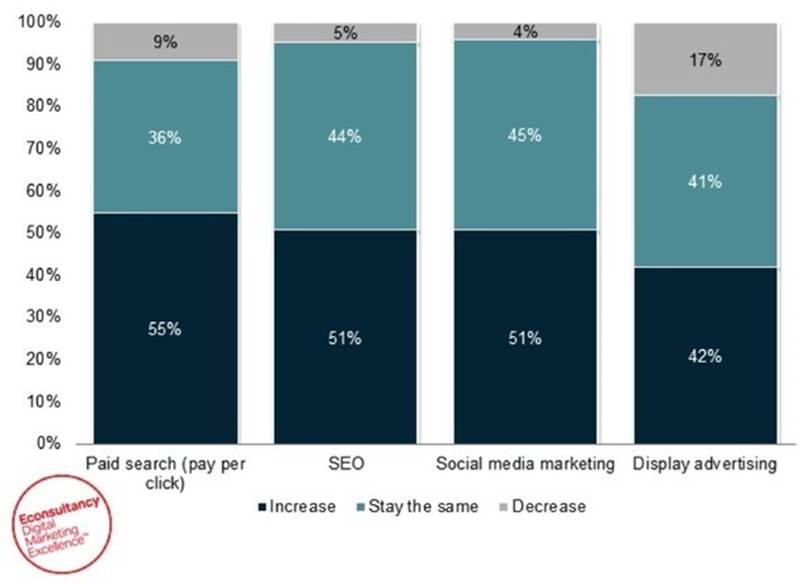

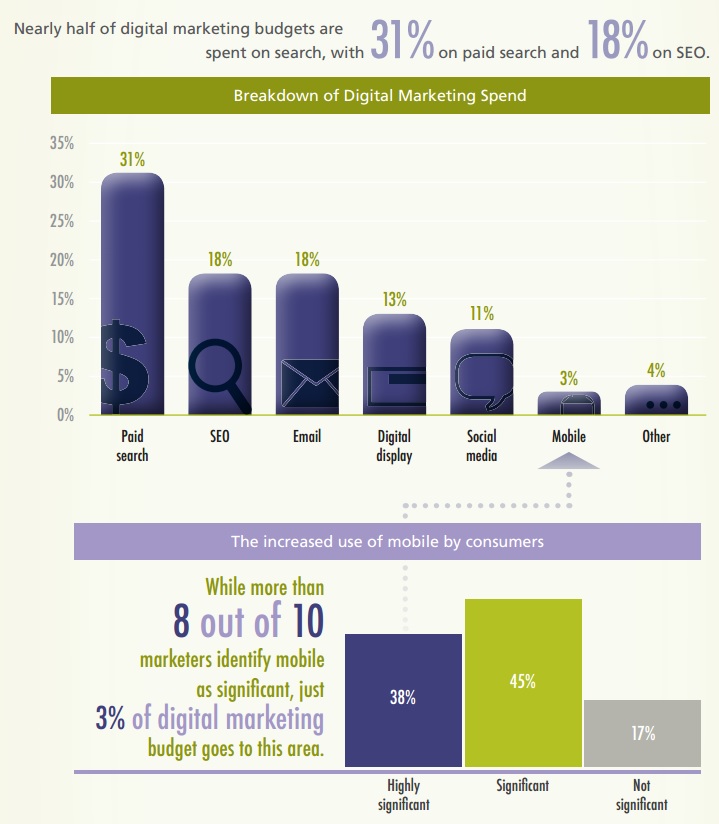

Businesses now spend 37% of total marketing budget on paid search

Page 5 of 39

Digital Marketing Services

Digital Clarity is a specialist Digital Marketing Agency that has been at the forefront of online marketing. The company is a multi-service digital marketing agency who specializes in creating effective strategies and campaigns for clients and agencies across a wide range of verticals.

Specializing in Search Engine Marketing, Web Design, Social Media including Digital Analysis, the company works with both major brands and medium-sized companies to help leverage online brand presence and new customer acquisition strategy. Digital Clarity also delivers consultancy and strategy planning for both client companies and advertising agency partners.

The Company Profile:

Revenue Generating Company

Cash Flow Positive

Experienced Team

Strong Client Base

Centers of Excellence Today –US & Europe

Future Geographic Reach –UAE & Asia

Reach to Celebrity & A-List Performers

Established Relationships with Media Groups like Google

Poised for the Growth in Digital Marketing & Advertising

Services Offered by Digital Clarity continue to grow with client relationships. Led by the Head of US Operations, Steve Baughman, the Company has begun to leverage with an objective to potentially integrate his music and entertainment contacts to help build on its existing service offering.

Pay per Click Advertising (PPC)

Pay per click (PPC) (also called Cost per click) is an Internet advertising model used to direct traffic to websites, where advertisers pay the publisher (typically a website owner) when the ad is clicked. With search engines, advertisers typically bid on keyword phrases relevant to their target market. Content sites commonly charge a fixed price per click rather than use a bidding system. PPC “display” advertisements are shown on web sites with related content that have agreed to show ads.

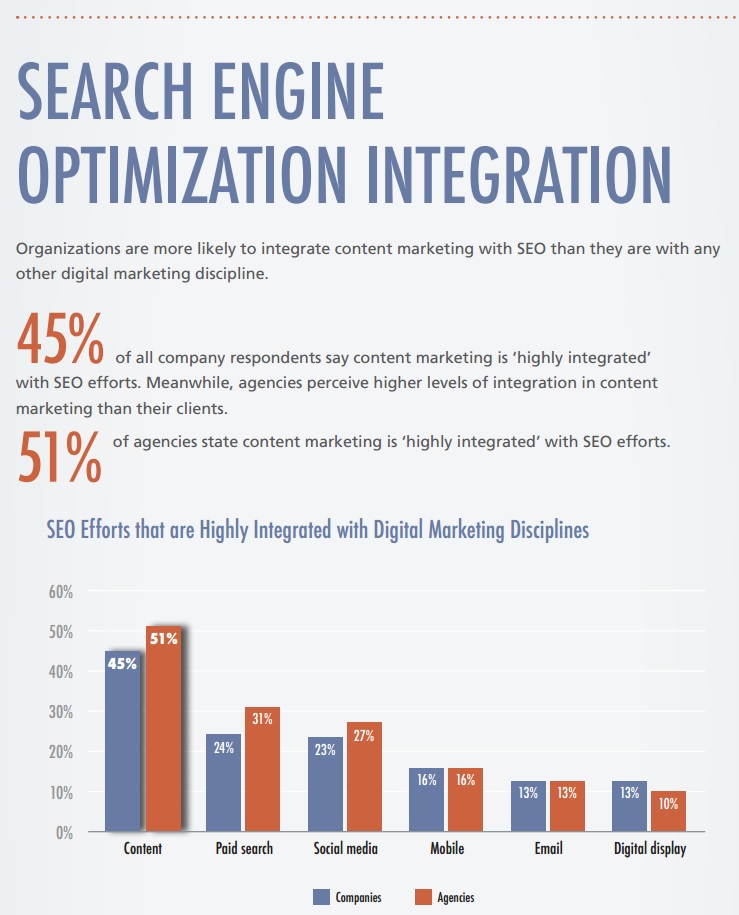

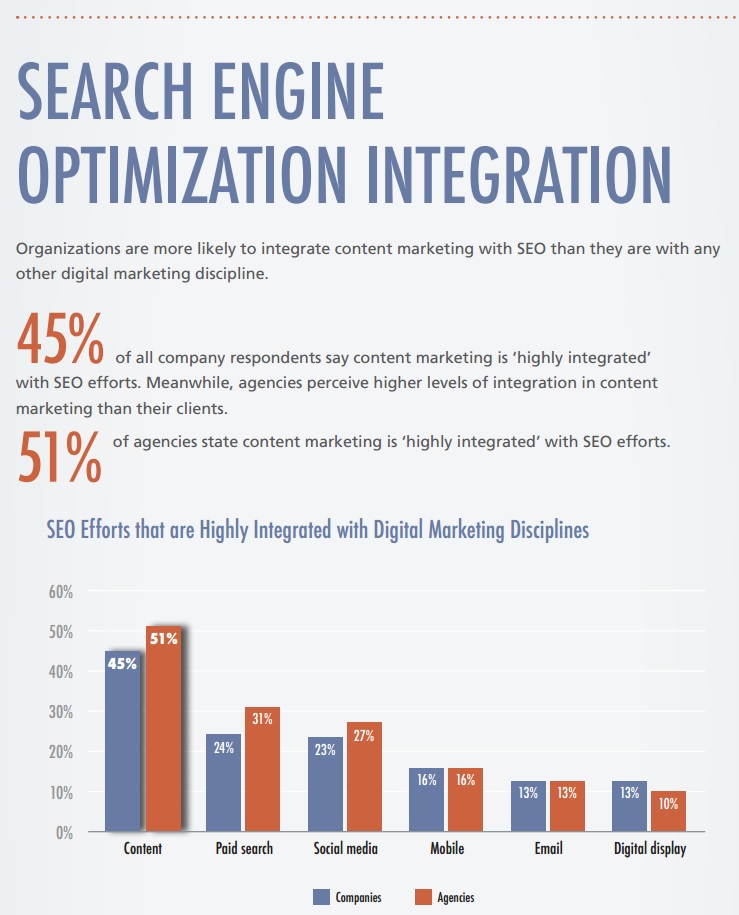

Search Engine Optimization (SEO)

Search engine optimization (SEO) is the process of improving the visibility of a website or a web page in search engines via the “natural” or un-paid (“organic” or “algorithmic”) search results. In general, the earlier (or higher ranked on the search results page), and more frequently a site appears in the search results list, the more visitors it will receive from the search engine’s users. SEO may target different kinds of search, including image search, local search, video search, academic search, news search and industry-specific vertical search engines.

As stated in Eric Siu, “24 Eye Popping SEO Statistics” in searchenginejournal.com and the Interactive Advertising Bureau’s “IAB Advertising Report” of October 2013, search engines are the most important tool today in website optimization. 93% of online experiences begin with a search engine and 82.6% of internet users use search. Furthermore, 88.1% of US internet users ages 14+ researched products online in 2012 and there are over 100 billion global searches being conducted each month.

Analytics

The measurement, collection, analysis and reporting of internet data for purposes of understanding and optimizing web usage.

Page 6 of 39

Email Marketing

Description: Email marketing is a form of direct marketing which uses email as a means of communicating commercial or fund-raising messages to an audience. In its broadest sense, every email sent to a potential or current customer could be considered email marketing.

SMS Marketing

Users of an SMS service can exchange text messages either from mobile to mobile or through a specialist internet website to a handset about anything from promotional offers, to general information regarding a product or service. Messages are usually sent using a short code system. Short codes are around 5 or 6 digits in length and work by asking customers to text a certain keyword to a specific code. E.g. ‘Text WIN to 84841’.

Web Design & Development

To lead a highly competitive environment, the process of planning and creating a website requires both art and technology prowess. Text, images, digital media and interactive elements are used by Digital Clarity’s designers to produce the page seen on the web browser. As a whole, the process of web design can include conceptualization, planning, producing, post-production, research, and advertising. The site itself can be divided into pages. The site is navigated by using hyperlinks; commonly these are blue and underlined but can be made to look like anything the client wishes.

ITEM 1A. RISK FACTORS

Smaller reporting companies are not required to provide the information required by this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. DESCRIPTION OF PROPERTY

DBMM’s corporate address is 747 Third Avenue, 2nd Floor, New York, NY 10017. The Company has an annual renewable lease. In April 2012, Stylar Limited (a//k/a Digital Clarity) entered in to a 5 year lease. Under the terms of the current lease the annual base rent is approximately $17,000. This office is located in the UK.

ITEM 3. LEGAL PROCEEDINGS

The Company is involved in a litigation, Asher Enterprises, Inc. v. Digital Brand Media & Marketing Group, Inc. and Linda Perry, Index No. 600717/2014, in the Supreme Court of the State of New York, sitting in the County of Nassau. The Plaintiff alleges $337,500 in damages based on breach of contract allegations arising from the Company’s untimely periodic filings in December 2013. On September 18, 2014, the Court declined to grant the plaintiff’s application for default judgment. The cross-motion for the Company was granted and the lender was directed to file a verified answer in the form submitted within 20 days. The Company plans on vigorously defending the litigation.

ITEM 4. MINE SAFETY DISCLOSURES

N/A

Page 7 of 39

PART II

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is currently listed for quotation on the OTC:PK under the symbol “DBMM”.

Per Share Market Price Data

The following table sets forth, for the fiscal quarters indicated, the high and low closing bid prices per share for our common stock, as reported by on PinkSheets.com. Such quotations reflect inter-dealer prices, without retail markup, markdown or commission and may not represent actual transactions.

| | |

Year Ended August 31, 2014: | High | Low |

First Quarter | $0.0249 | $0.0007 |

Second Quarter | $0.0018 | $0.0002 |

Third Quarter | $0.0009 | $0.0002 |

Fourth Quarter | $0.0003 | $0.0001 |

|

|

|

Year Ended August 31, 2013: | High | Low |

First Quarter | $0.06 | $0.05 |

Second Quarter | $0.035 | $0.035 |

Third Quarter | $0.02 | $0.02 |

Fourth Quarter | $0.018 | $0.01 |

| | |

The last reported sale price of our common stock on the OTC Electronic Bulletin Board on August 31, 2013 and August 31, 2014 was $0.018 and $0.0001 per share respectively. As of August 31, 2013,and August 31, 2014 there were 187 and 125 holders of record of our common stock, respectively as well as over 1,200 shareholders under beneficial ownership through brokerage firms.

Dividends

We have never declared any cash dividends with respect to our common stock. Future payment of dividends is within the discretion of our board of directors and will depend on our earnings, capital requirements, financial condition and other relevant factors. Although there are no material restrictions limiting, or that are likely to limit our ability to pay dividends on our common stock, we presently intend to retain future earnings, if any, for use in our business and have no present intention to pay cash dividends on our common stock.

Recent issuances of Unregistered Securities

| | | | | |

Period | Class | Shares | Consideration | Use of Proceeds | Exemption from Registration |

| | | | |

2013-2014 Q4 | Investors | 1,824,026,503 | $89,396 | Reduction of Outstanding Debt | §4 (a) (2) |

| | | | |

Page 8 of 39

ITEM 6. SELECTED FINANCIAL DATA

As a “smaller reporting company”, as defined by Rule 10(f)(1) of Regulation S-K, the Company is not required to provide this information.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Readers are cautioned that certain statements contained herein are forward-looking statements and should be read in conjunction with our disclosures under the heading "Forward-Looking Statements" above. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. This discussion also should be read in conjunction with the notes to our consolidated financial statements contained in Item 8. "Financial Statements and Supplementary Data" of this Report.

Background

DBMM is an OTCPK listed company. Subsequent to the close of the fiscal year 2011 following substantial investment, the Company conducted a structural review of its total product and services offering. The review was carried out by the Board of Directors. The result was to bring technology development being outsourced directly into the Company to steward on a daily basis and any activities which were not revenue generating in the near term were eliminated. It was unanimously agreed that the company would adopt a lean approach that focused on the relationships and partnerships. To that end, the Company has added significant partnerships through Letters of Intent, Joint Ventures and various collaborative structures involving revenue sharing arrangements.

Operations Overview/Outlook

Operationally, 2014 has been important in continuing the direction of the Company and steering it toward a scaled, sustainable growth plan. The model developed in fiscal 2013 has been reinforced and is differentiating to clients, therefore, the model will continue into fiscal 2015.

Entertainment/Fashion/Sports/Automotive/Ecommerce Solutions

DBMM is taking its strengths including its relationships to build its business focus on a wide array of industries. The Company, under very competitive global market conditions and growing development needs, continues to identify partnership opportunities. Utilizing successful models with existing clients, the outlook remains strong for the future.

The heart of the business is the marketing consultancy. Understanding each client and developing the model to individualize the outlook has been essential. This kind of close relationship with the client resulted in Digital Clarity being considered a close professional advisor.

In fiscal year 2015, the Company will continue to focus on the positive results of the last year and use that model to expand geographic reach with existing and new partners.

Digital Marketing Services

2014 continues to see exponential growth in the adoption of Social Media as communication, marketing and engagement avenues. An acceptance of change is driving revenue. The future growth in mobile search is one of the fastest growing ancillary businesses. It was clear that the direction, talent and growth of the Company is in its human capital and outside relationships which must be proactive in order to differentiate itself from competition

The clear opportunity is at the foundation of the Company, namely the need to expedite and encourage development in the digital marketing services sector. The marketing services product is labor intensive and thus the Company must jumpstart the growth by significant capital infusion in fiscal year 2015 to grow simultaneously in multiple geographies.

As a foundation, the financial review showed that Digital Clarity continued to be revenue generating and remained cash flow positive.

Key Milestones

During 2014, Digital Clarity continued to make inroads into established and emerging markets. In the latter part of 2014, American Green (OTC:PK:ERBB) became a new client as a market leader as one of the fastest-growing companies in the marijuana industry.

American Green was the first publicly-traded company medical marijuana dispensary brand in the world and currently has over 50,000 shareholders. It is now embarking on the strategy to become a major participant in the expanding medical and adult use cannabis market on a national scale.

American Green continues to offer retailing, branding and cultivating strategies in conjunction with its ongoing business with various licensed medical marijuana medical and retail dispensaries. The company has consulted with dispensary operators in California, Colorado, Washington and Arizona. Being located in Arizona, a very effectively regulated medical marijuana (MMJ) market, American Green is focusing on providing goods and services that operators of licensed non-profit MMJ dispensaries in regulated environments require. This strategy will allow American Green to further penetrate the market and to leverage its existing brands, products and services. As a result, the ZaZZZ™ network is being adapted to sell non MMJ products to customers of MMJ dispensaries; lines of non-MMJ, hemp-based products are in development; online communities, products and services are being created; and consulting opportunities involving compliance, business development and financial services have been identified.

American Green Clothing: The Company is currently selling clothing and accessories under the American Green brand. The Company is working toward developing a full line of clothing and accessories under the American Green brand for traditional brick and mortar sales, as well as through ZaZZZ™ and MMJ dispensary networks. All products are available through web-based purchase at www.AmericanGreen.com.

Another example is representative of the diversity of client base, DBMM's approach using a client's analytics, and executing an individualized model to increase ROI as the prime objective.

Tutti Dynamics developed an interactive media player that enables audiences to engage with the world's masters in the arts and sciences. Tutti represents the future of next-generation media. More information about Tutti's immersive media player can be found at www.tuttidynamics.com.

In 2013, DBMM identified a collaboration with Video Media Holdings, Inc. (VMS) to become its reseller in Europe with other revenue streams being explored as well. The value proposition for VMS strengthens DBMM's offering to its clients. VMS Holdings, Inc. develops a mobile application for sharing videos. Its mobile application allows companies and users to send and receive video content to and from a mobile phone; subscribe for a favorite celebrity, actor, TV channel, or team and get video updates; and create your own channel and become a broadcaster, as well as serves as a tool for mobile marketing and sales. The company's mobile application is available for Android, BlackBerry, iPhone, and Symbian devices. It distributes its mobile application through distributors, and mobile device and application stores in Africa, Europe, Asia, North America, and South Africa. It serves mobile operators and media companies, government organizations and law enforcement agencies, premium content providers and retailers, sports clubs, and celebrities worldwide.

Page 9 of 39

DBMM finalized an agreement with New York based digital marketing automation platform, BRANDmini LLC, to strategically broaden BRANDmini's delivery of its Saas (Software as a Service) application; primarily looking after those larger clients seeking to leverage a more bespoke digital marketing service abroad. BRANDmini is a transactional marketing automation platform for creating, serving, and measuring marketing campaigns across multiple online channels and mobile devices. Our platform is integrated with leading ad networks, publishers, mobile platforms and social sites. BRANDmini's innovative In-Page technology empowers brands to engage and transact with consumers while they are browsing. Now anyone can build branded transactional ads, gadgets, social landing pages and run campaigns anywhere your customers are.

These client relationships illustrate the execution of DBMM's strategic direction which strengthens then the Company through its revenue-sharing strategic alliances resulting in additional revenue streams.

Many clients such as Mercedes Benz, UK, Wharfside and Duvet & Pillow Warehouse have experienced increases in revenue and increases in conversion as a result of Digital Clarity's strategic direction. These case studies are excellent resources for new clients and illustrate the mantra of "ROI is our DNA".

“DBMM’s Digital Clarity Selected to Conduct Survey” – Results Reported by BBC & Huffington Post

Huffington Post Article Entitled: “Internet Addiction Disorder – Yes, It’s a Real Thing.” (http://huff.to/1rSyzSX)

Digital Clarity Named in Top Ten Best Social Media Marketing Firms in the UK for 2013

“Topseos.co.uk , an independent research firm, revealed the listing of the top 10 best social media marketing agencies in the UK based on their strength and competitive advantage. Social media marketing companies are put through a methodical analysis to ensure the rankings contain the absolute best companies the search marketing industry has to offer.”

Digital Clarity was awarded a spot in the top 10. The process for researching and declaring social media marketing agencies in the UK is based on the use of a set of analysis criteria and learning more about their solutions and their communications with their customers through references. The teso.co.uk independent analysis team communicates directly with the clients in order to inquire about the solutions and achievement from the client’s perspective.

Key Differentiators

2014 has been about establishing strong foundations by continuing to streamline operations and assessing activities on a cost benefit basis while developing new client relationships and revenue streams to be a differentiating digital marketing and technology provider. This focus has allowed the Company to enhance brand value for its clients. 2015 will continue to be about growth and outreach utilizing five key differentiators:

Brand enhancement

Search

PPC

SEO

Design

Social media

Analytics

1. STRENGTHS: BRAND ENHANCEMENT

Digital Clarity is an evolving Strategic Brand Consultancy that crafts, designs and executes digital marketing strategies across multiple ad platforms and social media networks for a broad array of clients to help each of them establish a uniform brand identity across the digital universe.

As the online world becomes more sophisticated and complex, Digital Clarity concentrates on core areas that help business navigate through an often confusing mosaic choice of systems and platforms. Focusing on the areas of Search, Social Media and Design, all of Digital Clarity work is underpinned by a unique understanding of Analytics. This aspect is often a missed piece of the jigsaw that makes up the digital marketing mix. The five differentiators, presented to clients as an integrated model, result in being selected over competition in the majority of presentations.

CORE AREAS:

Page 10 of 39

.

2. STRENGTHS: SEARCH:

– PPC

Definition:

PPC stands for Pay-per-Click Advertising. It is an abbreviation for a number of search advertising platforms, of which the mostly widely used is Google AdWords. PPC is one of the most effective online marketing services available, generating instant activity and instant results for new or existing websites.

The real beauty of PPC is that you only pay for an ad when a potential customer clicks on it, meaning you can bring people to your site for mere pennies while ensuring your traffic is relevant and targeted at people who are looking for your service or product. Additionally, PPC is highly measurable and can be closely monitored, allowing your business to keep a close eye on return-on-investment (ROI).

The major platforms used for PPC are:

Google AdWords (Global)

· Microsoft Bing (Yahoo & Bing)

Yandex (Russia)

Baidu (China)

AdWords Audit

Key Areas of Service:

Budget Management

Keyword Research

Conversion Rate Optimization

Bid Optimization

Dedicated PPC Management

As an elite consultancy, Digital Clarity has extensive experience of running PPC management and implementation ranging from small independent businesses with one or two ad campaigns to multi-national ecommerce websites which utilize hundreds of ads and thousands of keywords. Whatever the nature and size of the account, Digital Clarity understands the importance of utilizing a programmatic, well-defined approach:

Strategy. By understanding your business, demographics and audience, Digital Clarity can help to make sure that campaigns hit the ground running from day one.

Implementation. Digital Clarity uses experience to put in place the best structure, keywords, ad copy and bidding strategies to maximize the effectiveness of your account.

Optimization. Digital Clarity rigorously interrogates and checks our client accounts to ensure optimal performance, with regular reviews of all aspects of your campaigns.

Reporting. By defining and explaining the numbers of your account, Digital Clarity provides the information needed to steer things in the right direction for business.

2. STRENGTHS: SEARCH:

– SEO

Definition:

When customers look for service on Google or another search engine, they might find a client company’s business – or they might find a competitor. SEO (Search Engine Optimization) is the process by which you can help ensure that your site appears first in the rankings. These rankings are determined by the search engine’s algorithms: programs which trawl the internet indexing details about each site, in order to deliver relevant results when people search. If your website does not perform well according to the algorithm’s criteria, your rank will be lower, and people will not be able to find your site; this is what makes partnering with the right SEO agency such a crucial part of your digital marketing activity.

Digital Clarity is at the vanguard of this sector, having implemented countless SEO plans for a broad array of clients in a number of different industries. These plans included:

Page 11 of 39

Search Algorithms

SEO strategy is changing all the time, and the rate of change has picked up dramatically in the last 12-18 months. Changes to the Google algorithm in particular have shifted the landscape of search optimization, including named updates such as Penguin, Panda, and Hummingbird. These changes can have huge consequences: well-performing sites can lose visibility and poor performers can gain it, literally overnight. It is therefore absolutely essentially that a website’s SEO is closely curated and managed, making sure one is always ahead of the curve.

SEO Can Deliver Results for Business

By applying website optimization to your site for better search engine performance, you will gain more traffic and brand recognition as more and more people are able to find you online. This in turn allows more sales and conversions, leading to higher profits and better return on your digital investment. Contact our team today to find out how we can improve your performance.

3. STRENGTHS: DESIGN:

Definition:

Web design encompasses many different skills and disciplines in the production and maintenance of websites.

A site can be the most functional, user-friendly and search-optimized in the world; if people don't like the look of it, they will counce off your page and never come back. Making sure a site looks good and that it reflectes your brand company identity is the difference between success and failure, and having a goo web design agency on your side is more important than ever.

Web Design Services:

e-Commerce

Device Compatibility

Web Development

Mobile Compatibility

Process & Planning

Content Management System (CMS)

Version Control

Changes in the Last Few Years

With the rise of mobile devices and tablets, the game has changed. It’s no longer enough for your site to look great on a PC; it has to be able to scale from a widescreen view of a modern flat screen monitor to the narrow portrait of an Android mobile screen; it has to spin and rotate with the movements of an iPad. This aspect of website design is called ‘responsiveness,’ and in the last few years has gone from being ‘nice to have’ to absolutely essential, necessitating a complete website redesign in many cases. Digital Clarity have years of experience in building functional, beautiful websites which work across all devices.

Digital Clarity’s Unique Proposition

Specialist creative agencies are great at making things pretty and applying their own methodologies and ideas to client websites. Digital Clarity takes a different approach: combining a client’s ideas, vision and brand identity with our experience and expertise to produce sites which perfectly blend form and functionality. Additionally, Digital Clarity does not design in a bubble; the sites built integrate seamlessly with PPC campaigns, SEO activity, and are fully optimized to perform as part of a greater whole. Digital Clarity does not just build websites; the company’s role as a website design agency is part of a holistic approach which will help achieve the overall business goal.

Page 12 of 39

4. STRENGTHS: SOCIAL MEDIA:

Definition

Social media refers to sites where users interact with each other on a large scale, including Facebook, Twitter, LinkedIn, Pinterest, Imgur, Tumblr and many others. Begun as a social phenomenon, the growth in use of social media sites over the past decade has made it impossible to ignore for any brand or business.

Social Media Audit

Content Creation

Social Media Management

Social Media Set Up

Reporting

Blog Writing

Content Strategy

Reputation Management

Social Media Advertising

The Need for Social

Social media can help achieve business goals by allowing greater engagement with your customer base, audience and stakeholders. Your company doesn’t just need a brand anymore: it needs a face, a voice, and maybe even a heart. As well as being a central component of how your customers see you, it can also yield other opportunities: Promotions, customer feedback, and even just having a little fun can all be used to bring you closer to your clients and users, informing strategy, guiding your product offering and in the long term, increasing sales and profits.

Digital Clarity’s Proposition

As a Digital Marketing and Technology Agency, Digital Clarity has been helping brands manage their social presence since before ‘social media’ had been coined as a phrase. Using our holistic methodology, we will incorporate your social presence as part of an overall offering, utilizing the platforms which are most appropriate to your business in the best possible way. Whether you need from-scratch implementation, or just want a social media audit to benchmark your activity, Digital Clarity have the expertise to deliver the results you need.

Digital Clarity have a strong track record of increasing membership numbers, creating deeper engagement, and measuring the success of your activity to help inform social media marketing strategy and guide development.

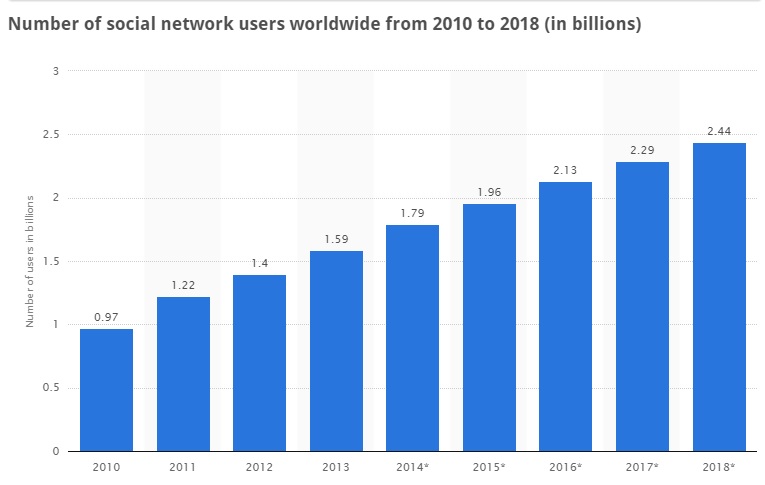

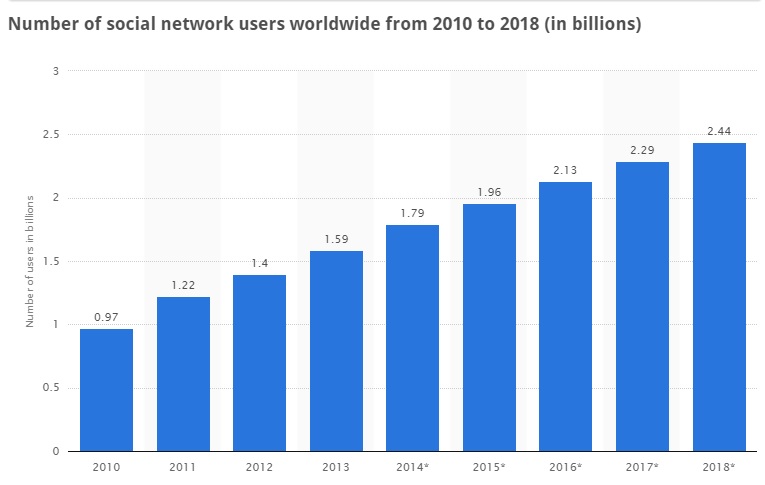

The Market for Growth in Social

Social-media advertising spend will grow rapidly through 2018. It’s up 40% this year and will top $8.5 billion, growing to nearly $14 billion in 2018, a five-year compound annual growth rate (CAGR) of 18%.

Social media ad spend has reached the mobile-tipping point. Spending on mobile social-media ads, including mobile app-install ads, will surpass non-mobile spend by the end of this year in the US. In 2018, two-thirds of social-media ad spend will go to mobile, creating a $9.1 billion social-mobile market.

Mobile app-install ads and programmatic buying are also growth drivers. Analyses suggest that mobile app-install ads could account for anywhere from one-quarter to more than one-half of Facebook’s mobile ad revenues.

Social programmatic ad platforms are also growth engines. Spending on FBX, Facebook’s programmatic platform, increased by 150% year-over-year globally during the second quarter of 2014, based on a sample of advertisers compiled by Ignition One.

Prices are increasing as performance and targeting improve, even as ad loads stay steady on the established platforms. Facebook, for example, is not likely to increase the amount of in-feed native ads an average user will see.

The market is expanding with the introduction of paid ad units at Pinterest and Instagram.

Page 13 of 39

5. STRENGTHS: ANALYTICS

Definition:

Analytics is the act of analyzing data from your website, marketing campaigns and user activity. It can include everything from what time of day people are most likely to click on your PPC ads, right down to how long users are spending on individual pages on your site. Analytics can help you locate problems, find areas for improvement, form projections for the future and help you get the best out of your marketing budget.

Google Analytics

Goal Setting

Tag Management

3rd Party Analytics

Funnel Planning

Attribution Modelling

Path Analysis

Link Testing

Why Analytics Are Important

Knowing how to identify trends and interrogate data is of paramount importance to any marketing department. Analytics gives you answers to some of the most important questions you should be asking about your campaigns, maximizing effectiveness when things go well and providing solutions when things go wrong. Without this information, what appears to be a successful campaign could be failing to achieve its full potential, and there may be critical problems of which many companies may not be aware.

Digital Clarity’s Unique Proposition

What really sets Digital Clarity apart is the company’s ability to translate numbers into action. Analytics is extremely important, but for many, it is difficult to draw meaningful conclusions from the data, or to know how to act on the knowledge gained from this analysis. Online marketing is a sea of numbers, data and statistics; Digital Clarity turns this information into actionable insights for business.

Digital Clarity’s knowledge of analytics methodologies puts us at the forefront of our industry. We can use this experience to help guide strategy and deliver action points with recommendations, rather than just presenting you with meaningless statistics. With this knowledge in hand, you can implement solutions which will help you get the most out of your online presence. Digital Clarity also offers Google Analytics training to help businessess get the most out of this powerful tool independently.

Source:

SEMPO State of Search Report 2014

As the internet and mobile arena continues to mature, the need to make sense of and manage companies through this often complex market is clearly an area of massive growth. The company is confident that the talent and experience within the digital marketing team is poised for a major springboard in 2015, but must be expanded significantly in order to support the global reach intended.

Artist Collaboration, driven by Co-Chief Operating Officer and Head, US Operations, Steve Baughman, is an area that will see exponential growth in the coming 12 months and beyond. Artists and brands that look to leverage their celebrity status will look to companies such as Digital Clarity to help drive and develop their brand in the growing and complex arena of social media.

Page 14 of 39

Market Reach

The Company has reach and experience across a large number of vertical markets including, but not limited to: Entertainment/Fashion/Sports/Automotive/Ecommerce.

Relationships and Industry Contacts

The team at Digital Clarity have professional and personal contacts, including some long-term relationships, at companies such as Google, Microsoft and Facebook, often being invited to attend strategic market briefings and insights.

Partnerships, strategic alliances and agency management have allowed Digital Clarity to work on some of the biggest brands, sitting behind the agencies as a support and resource to deliver very high quality service and results to their clients.

TEAM EXPERTISE

COMPANY KEY ASSETS

Examples:

PPC campaign experience especially Google AdWords existed

SEO evolution from aggressive link building and onsite SEO through to strategic marketing and integration of inbound marketing

Website design and development based on results driven design and planning

Brand consultancy

Social media management and advertising. Several clients have been “won” directly via Digital Clarity’s internal social media strategy

Sales and account management experience from multi-disciplined backgrounds

Evolution and Flexibility

The market is continually changing. Digital Clarity has always remained ahead of the curve and given their clients peace of mind by remaining a true strategic partner.

Creative, Individualized Solutions and Customer Service

Case Studies and testimonials reflect the client-centric approach of Digital Clarity. Being selected over larger more established firms, support that we provide the client with skills that are differentiating. The Digital Clarity Brand is being established positively.

Growth Opportunities in the Market

As the use of web mobile sites and applications grow, so do the complexities and challenges of using these sites and platforms commercially. Digital Clarity directs business through the maze of an often confusing and sophisticated set of barriers, to create a clear path for the customer to our client’s product or service. As this market matures, the need for companies to rely on the services from Digital Clarity can only grow. Specifically, B2B relationships represent 69% of all U.S. e-commerce transactions (Forrester 2013). Here we look at some of the growth areas in Digital Clarity’s arsenal integrating the key trends for 2015:

More Mobile

More Social

More Informed

More Experiential

More Real-Time

More Global

More Multichannel

These trends translate to being “always on.”

Page 15 of 39

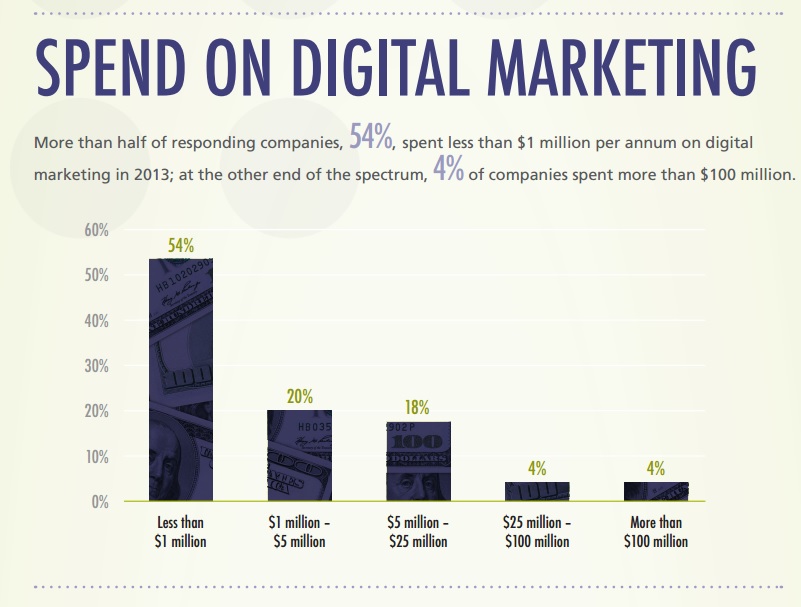

Growth & Opportunities in Search

Search remains the foundation of digital marketing. Businesses now spend 24% of total marketing budget on paid search.

The North American Search industry grew from $19 bn in 2011 to $27 bn in 2013 – SEMPO

Revenue from Localized Mobile Ads to Reach $5.8 Billion in U.S. by 2016 – BIA/Kelsey

U.S. search spend grew by 11 percent Year over Year, while ROI improved by 26 percent – Adobe

72% of Consumers Want Mobile-Friendly Sites – Google Research

2 million search queries are made on Google, every minute – Google

Growth in Corporate Search – 50% of Fortune 100 Companies have a Google Plus Account

Growth & Opportunities in Social Media

“Social Media is a great platform for ‘getting the word out’ and generating leads. Active listening and data analytics can help companies find out what customers want, not just from products or services, but also in terms of an ongoing relationship.”

– Cap Gemini 2014 – “Generation Connected”

The algorithms developed by Digital Clarity include all social media platforms as they develop, and technology partners coupled with the client’s analytics provide ROI positive results within a quarter.

Social media platforms have more user accounts than ever before:

284 million Twitter accounts

1.35 billion Facebook accounts

70 million Pinterest accounts

Page 16 of 39

The need for DBMM to reach Global Markets

In 2015, it is expected that the U.S. economy will continue its recovery while the global economy is lagging behind. As the markets remain volatile, the opportunity for a company like DBMM to approach new business with its proven track record increases. The core markets remain US and English speaking European markets. Emerging markets are a target for 2015. BRIC countries (Brazil, Russia, India and China) will be key targets from the emerging markets.

Internet usage is poised for explosive growth across Asia, driving massive consumer demand for digital content and services. The biggest challenge for businesses hoping to meet this demand is how to make money will while creating low-cost content. According to McKinsey & Co, India and China are driving an emerging digital revolution via new mobile devices.

The Company intends to further extend its services in the Middle Eastern market initially then review the successes using a lean methodology and continuous improvement along the way, and then roll out to the BRIC markets.

US

The US remains the center of the entertainment, technology and digital industries and as such the emphasis looking forward to 2015 and building on the recent success in the last quarter of the 2014 calendar year means that DBMM and its agency Digital Clarity are perfectly positioned to spring board into this market using the successful models established over the last two years.

The digital market continues to be focused on London, New York and Los Angeles; therefore, DBMM’s same triangle of London/New York/LA is strategically sound. We are establishing a strong digital marketing presence in the Los Angeles area to cover the entertainment and music market and then plan to have the same model in New York. Our corporate offices are located in New York, however Los Angeles remains a key regional base from which to build and expand relationships, while a New York presence is equally important to serve and build relationships in the largest advertising market in the US.

Page 17 of 39

The Asian-American Market - An Unusually Attractive Opportunity

Fast Growing: -Current Population - 13+ Million - 49% population growth 1990-2000; 29% growth 2000-2008. More Asians are emigrating to the U.S. than any other ethnic group.

Educated & Affluent: -44% holding BA degree - vs. 28% of Non-Hispanic Whites -Median HH income almost $10K greater than Non-Hispanic Whites

Geographically Concentrated: -More than 50% reside in 3 states alone: CA, NY, and TX.

Money to Spend: $509 billion in annual purchasing power.

Entrepreneurial and Driven -Own and operate 1.1 million business nationally, generating $343 billion in annual revenue.

Cost Efficient Reach -Almost 1,000 targeted media outlets reaching Asians nationally, with lowest CPMs of all consumer segments.

Europe

As the current operations base of the digital marketing agency is in London England, it is perfectly placed to reach out to the broader European market to replicate the Company’s model in the stronger economies in this region. As with the relationships mentioned in the US, opportunities were advanced with US partners to leverage Digital Clarity’s reach in this region and help take established US agencies into the European region.

2014 saw new clients emerge from Europe, as well as expansion of global reach of new U.S. clients.

In 2013, the execution of this aspect of the business plan is illustrated by the agreements with VMS and Brandmini to represent them outside the United States, initially in Europe.

Middle East

The Middle East is a fertile market for heritage based US and European brands looking for entry into this lucrative market. The fastest area for growth in this sector is to leverage on the luxury arena. Digital Clarity has developed new business in a number of different luxury brands.

Given the complexity of the region as well as the enormous potential, it is important that Digital Clarity aligns itself with established players in local markets. With this in mind, Digital Clarity will look to collaborate with some digital agency partners where there is already a relationship and create a strategy that allows the company to look at the breakdown of current digital competence of these brands focusing on various touch points such as tablets, sites, mobile & social reach in the Middle East.

Our value proposition is very much about creating digital penetration of the Middle Eastern market for a particular group and how those brands would be positioned to create brand value – a byproduct of which would be sales.

Support for growth in the Middle East

Worldwide luxury goods continues double-digit annual growth; global market now tops €200 billion

Dubai commands around 30 per cent of Middle East luxury market and around 60 per cent of the UAE’s luxury market

The Dubai Mall accounts for around 50 per cent of Dubai’s luxury purchases

Each year, more “HENRYs”(High Earnings, Not Rich Yet) become potential customers, with ten times as many HENRYs as ultra-affluent individuals

The rise of the middle class in emerging countries is polarizing the competitive arena, becoming a “new baby-boom sized generation” for luxury brands to target.

Page 18 of 39

Financial Overview/Outlook

DBMM began the 2014 fiscal year with significant challenges, all of which were addressed and became a strong foundation for future growth. The focus remains on the growth of digital marketing services and technology driven through Digital Clarity. The cost of sales has decreased by 5% while gross profit increased by 12%. DBMM is a marketing services company which is labor intensive in order to provide a differentiating product to its clients. As such, it is imperative to raise a significant amount of capital to hire professionals who can deliver profit to the Company within a quarter. The proven model carried in our financials is each new hire/client averages a margin of 35%-55%, straight line and simple. On that basis, our target is to recruit 10-20 new staff to represent a critical mass and scale up our revenues proportionately.

Digital Clarity has a differentiating approach to its products and services by providing brand enhancement and increased ROI through a strategic alignment with its clients from content design through execution and stewardship. By providing a 360-degree product, we reinforce the relationship with the clients and become key advisors – a seat at the table, as it were. That translates to a consistent 35-55% margin and long-term clients.

However, the weakened share price remains a challenge to the Company. On that basis, in the last two years having revenues of approximately $400,000 to $500,000 would suggest a conservative market multiple of x10-x16, the latter being the manufacturing average, the market cap of DBMM should be a minimum of $5,000,000. The multiples for media tend to be at the higher end of the spectrum; therefore, compared to other companies in this sector, DBMM is significantly undervalued. The issue will be addressed as a priority early in the 2015 fiscal year.

In summary, DBMM’s financing efforts have always been in short term, small amounts of working capital. That is going to change in 2015. Going forward, DBMM intends to embark on a significant capital raise to allow the Company to scale up geographically and maximize our global reach through strategic relationships. This model is the most efficient and effective path to grow DBMM quickly into multiple revenue streams. We have proven the model in the last two years. Our marketing services’ offering is a labor intensive endeavor, wherein human capital is a key differentiator of knowledge and/or relationships. What we have discussed here is organic growth which will be conducted in conjunction with concluding an acquisition in the digital technology/marketing services sector.

After a very difficult year, fraught with challenges and hurdles, we see 2015 as poised for growth on multiple fronts. With capital infusion, which will allow us to bring in new clients, grow existing successful clients and service them accordingly, coupled with an offer of a deferred tax asset to attract partners with significant revenue and expansion patterns, we will have a model in place which will be sustainable.

Off-Balance Sheet Arrangements

We are not currently a party to, or otherwise involved with, any off-balance sheet arrangements that have or are reasonably likely to have a current or future material effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources.

Recently Issued Accounting Pronouncements

Management does not believe that any recently issued, but not yet effective, accounting standards, if currently adopted, could have a material effect on the accompanying financial statements.

Significant and Critical Accounting Policies

Our discussion of the financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in conformity with accounting principles generally accepted in the United States. The preparation of our consolidated financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, revenues and expenses, and related disclosure of any contingent assets and liabilities at the date of the financial statements. Management regularly reviews its estimates and assumptions, which are based on historical factors and other factors that are believed to be relevant under the circumstances. Actual results may differ from these estimates under different assumptions, estimates or conditions.

Critical accounting policies are defined as those that are reflective of significant judgments and uncertainties, and potentially result in materially different results under different assumptions and conditions. See “Notes to Consolidated Financial Statements” for additional disclosure of the application of these and other accounting policies

Page 19 of 39

.

LIQUIDITY AND CAPITAL RESOURCES

We are concentrating on activities which will grow Digital Clarity organically and by acquisition. We have spent the last two fiscal years establishing a client model for existing and new customers which can be exported geographically.

Fiscal Year 2014

We had approximately $53,000 in cash and our working capital deficiency amounted to approximately $1.9 million at August 31, 2014.

During the year ended August 31, 2014, we used cash in our operating activities amounting to approximately $382,000. Our cash used in operating activities was comprised of our net loss of approximately $740,000 adjusted primarily for the following:

Fair value of preferred shares issued of $144,985;

Change in fair value of derivative liability of $89,147;

Amortization of debt discount of $434,579;

Gain on cancellation of accrued compensation of $ 390,462

Additionally, the following variations in operating assets and liabilities during the year ended August 31, 2014 impacted our cash used in operating activity:

In our accounts payable and accrued expenses, including accrued compensation, of approximately $156,000, resulting from a short fall in liquidity and capital resources.

During the year ended August 31, 2014, we generated cash from financing activities of $429,450 which primarily consists of the proceeds from the issuance of loans and convertible debt aggregating $522,600 offset by principal repayments of loans payable of $70,000.

Fiscal Year 2013

We had $18,015 cash at August 31, 2013. Our working capital deficit amounted to approximately $2.1 million at August 31, 2013.

During fiscal 2013, we used cash in our operating activities amounting to approximately $334,000. Our cash used in operating activities was comprised of our net loss of approximately $677,000 adjusted for the following:

Fair value of shares issued of approximately $107,000;

Amortization of debt discount of approximately $178,000;

Change in fair value of derivative liability of approximately $51,000;

Bad debt expense of approximately $7,000;

Depreciation of approximately $3,000;

Additionally, the following variations in operating assets and liabilities impacted our cash used in operating activity:

An increase in our accounts payable and accrued expenses of approximately $116,000, resulting from slower payment processing due to our financial condition.

An increase in our accrued salaries of approximately $72,000, resulting from partial payments made due to ur financial condition.

A decrease in our accounts receivable of $14,000 resulting from a decrease in sales coupled with the Company's ability to successfully collect its fees.

During fiscal 2013, we used cash from investing activities of $611, for purchase of property and equipment.

During fiscal 2013, we generated cash from financing activities of $275,000, which consist of the proceeds from the issuance of loans and convertible notes of approximately $307,000 and a bank overdraft of approximately $23,000 offset by principal repayments on such debt amounting to approximately $55,000.

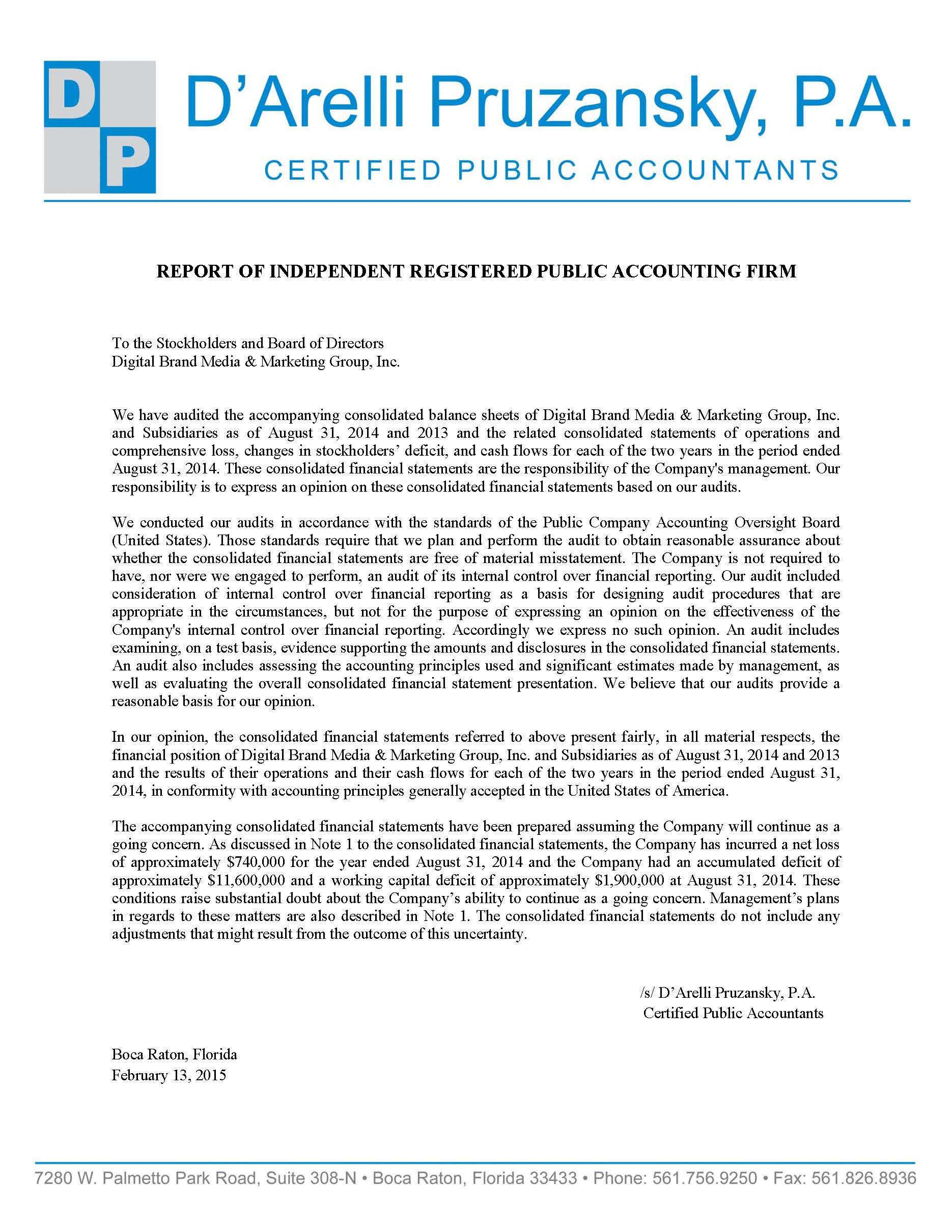

Going Concern

The report of independent registered public accounting firm accompanying our August 31, 2014 and 2013 audited consolidated financial statements contains an explanatory paragraph expressing substantial doubt about our ability to continue as a going concern. The consolidated financial statements have been prepared “assuming that the Company will continue as a going concern.” Our ability to continue as a going concern is dependent on raising additional capital to fund our operations and ultimately on generating future profitable operations. There can be no assurance that we will be able to raise sufficient additional capital or eventually have positive cash flow from operations to address all of our cash flow needs. If we are not able to find alternative sources of cash or generate positive cash flow from operations, our business and shareholders will be materially and adversely affected.

These consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should the Company be unable to continue as a going concern.

Page 20 of 39

RESULTS OF OPERATIONS

Comparison of the Results for the Years Ended August 31, 2014 and 2013

Consolidated Operating Results |

| | | | | | | |

| | | | | | | |

| For the Year Ended August 31, | | Increase/ (Decrease) | | Increase/ (Decrease) |

| 2014 | | 2013 | | $ 2014 vs 2013 | | % 2014 vs 2013 |

| | | | | | | |

SALES | $ 417,607 | | $ 408,505 | | $ 9,102 | | 2% |

| | | | | | | |

COST OF SALES | 222,583 | | 234,369 | | (11,786) | | -5% |

| | | | | | | |

GROSS PROFIT | 195,024 | | 174,136 | | 20,888 | | 12% |

| | | | | | | |

COSTS AND EXPENSES | | | | | | | |

General and administrative | 203,431 | | 211,320 | | (7,889) | | -4% |

Compensation Expense | 381,220 | | 311,160 | | 70,060 | | 23% |

Legal and professional fees | 276,958 | | 55,748 | | 221,210 | | 397% |

Gain on cancellation of accrued compensation | (390,462) | | - | | - | | - |

| | | | | | | |

TOTAL OPERATING EXPENSES | 472,799 | | 581,210 | | (108,411) | | -19% |

| | | | | | | |

OPERATING LOSS | (277,775) | | (407,074) | | (129,299) | | -32% |

| | | | | | | |

OTHER INCOME (EXPENSE) | | | | | | | |

Interest expense | (550,906) | | (282,701) | | (268,205) | | 95% |

Gain on derivative liability | 89,147 | | 50,499 | | 38,648 | | 77% |

Loss on extinguishment of debt | - | | (37,279) | | 37,279 | | 100% |

| | | | | | | |

TOTAL OTHER INCOME (EXPENSE) | (461,759) | | (269,481) | | 192,278 | | NM |

| | | | | | | |

NET LOSS | $ (739,534) | | $ (676,555) | | $ 62,979 | | NM |

| | | | | | | |

NM: Not meaningful | | | | | | | |

We currently generate revenue through our Pay-Per-Click Advertising, Search Engine Marketing, Search Engine Optimization Services, Web Design, Social Media, Digital analytics and Advisory Services.

For the year ended August 31, 2014 our primary sources of revenue are the Per-Click Advertising, Web Design, and Search Engine Optimization Services. These primary sources amounted to 31%, 19% and 43% of our revenues during the year ended August 31, 2014. Our secondary sources of revenue are our Social Media and Email Media. These secondary sources amounted to approximately 6% our revenues during fiscal 2014.

We recognize revenue upon the completion of our performance obligation, provided that: (1) evidence of an arrangement exists; (2) the arrangement fee is fixed and determinable; and (3) collection is reasonably assured.

The increase in our revenues during fiscal 2014, when compared to the prior year period, is primarily attributable to an increase in volume of transactions from Search Engine Optimization and Web Design Services during fiscal 2014.

Cost of sales during fiscal 2014 and 2013 is correlated to our revenues for the respective periods.

In 2014 and 2013, cost of sales consisted of advertising, salaries and media spend. This resulted in gross margins of approximately $195,000 and $174,000 for the fiscal year 2014 and 2013, respectively.

The general and administrative costs during fiscal 2014, remains at comparable levels when compared to the prior year period.

The increase in compensation expense during the fiscal 2014 is primarily attributable to a grant of preferred shares as bonus to certain of its officers which occurred during the first quarter of fiscal 2014 and which value was higher than the one granted in fiscal year 2013.

The increase in legal and professional fees in fiscal 2014 when compared to the comparable prior year period is primarily due to the non-recurring de-recognition of the consideration associated with the Brand Entertain agreement in fiscal 2013.

Interest expense, which include interest accrued on certain notes, as well as amortization of debt discount and the fair value of shares issued pursuant to embedded conversion features of certain convertible promissory notes, increased during fiscal 2014 is primarily attributable to the amortization of debt discount, during fiscal 2014, when compared to the comparable prior year periods. The increase in amortization of debt discount is primarily due to the issuance of a larger amount of convertible debt with beneficial conversion features and embedded conversion features during fiscal 2014 than the prior year periods.

Gain on cancellation of accrued compensation amounted to $390,462 during fiscal 2014. There were no such gains during fiscal 2013.

The increase on derivative liabilities is primarily attributable to a change in fair value of derivative liabilities between measurement dates.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

As a “smaller reporting company”, as defined by Rule 10(f)(1) of Regulation S-K, the Company is not required to provide this information.

Page 21 of 39

ITEM 8. CONSOLIDATED FINANCIAL STATEMENTS

| | |

|

|

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS |

| Page |

Report of Independent Registered Public Accounting Firm | F- | 1 |

| | |

Consolidated Balance Sheets as of August 31, 2014 and 2013 | F- | 2 |

| | |

Consolidated Statements of Operations and Comprehensive Loss for the years ended August 31, 2014 and 2013 | F- | 3 |

| | |

Consolidated Statements of Changes in Stockholders’ Deficit for the years ended August 31, 2014 and 2013 | F- | 4 |

| | |

Consolidated Statements of Cash Flows for the years ended August 31, 2014 and 2013 | F- | 5 |

| | |

Notes to Consolidated Financial Statements | F- | 6 |

Page 22 of 39