Exhibit 99.2

March 6, 2018 Edward L. Rand, Jr. Chief Operating Officer & Chief Financial Officer Frank B. O’Neil Senior Vice President & Chief Communications Officer 2018 INSTITUTIONAL INVESTOR CONFERENCE

1 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 Forward Looking Statements Non - GAAP Measures This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8 - K, and our regular reports on Forms 10 - Q and 10 - K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. This presentation contains Non - GAAP measures, and we may reference Non - GAAP measures in our remarks and discussions with investors. The primary Non - GAAP measure we reference is operating income, a non - GAAP financial measure that is widely used to evaluate performance within the insurance sector. In calculating operating income, we have excluded the after - tax effects of net realized investment gains or losses and guaranty fund assessments or recoupments that do not reflect normal operating results. We believe operating income presents a useful view of the performance of our insurance operations, but should be considered in conjunction with net income computed in accordance with GAAP. A reconciliation of these measures to GAAP measures is available in our regular reports on Forms 10 - Q and 10 - K and in our latest quarterly news release, all of which are available in the Investor Relations section of our website, Investor.ProAssurance.com. IMPORTANT SAFE HARBOR & NON - GAAP NOTICES

Financial Update Recap of 2017 Results Reported February 21, 2018

3 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 2017 Highlights: Profitability Premium Growth in all operating segments Solid New Business Writing s Includes $16.3 million of new business from our coordinated sales & marketing efforts Broker submissions up 22% over 2016 — we are penetrating that target market Strong Reserve Development Tempered somewhat in the fourth quarter as we responded to signs of a possible uptick in loss trends Excellent Retention and Renewal Premiums Showcases the strength of the services we deliver We retained business at strong pricing levels

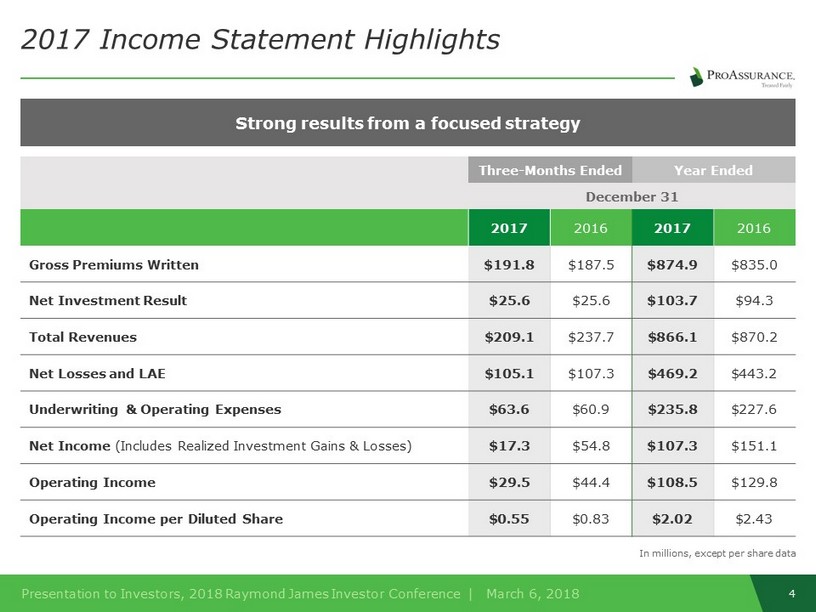

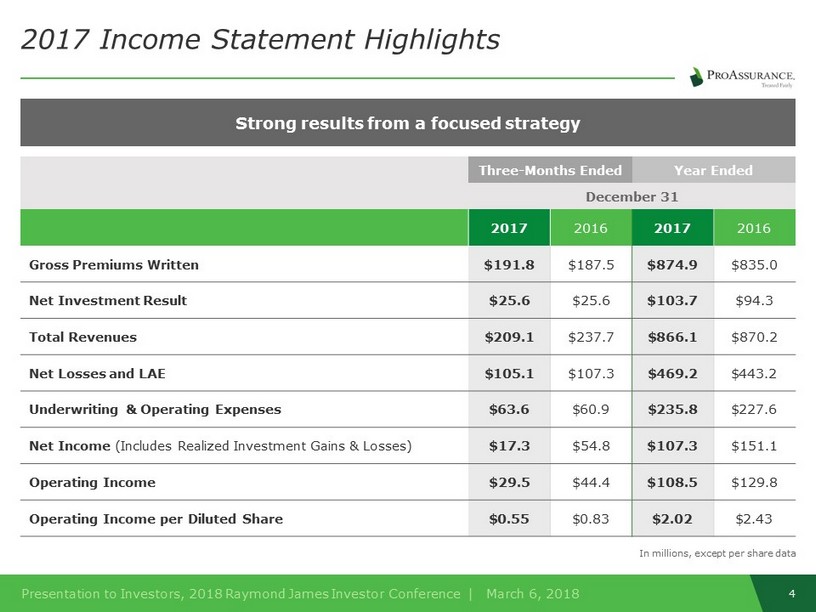

4 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 2017 Income Statement Highlights Strong results from a focused strategy Three - Months Ended Year Ended December 31 2017 2016 2017 2016 Gross Premiums Written $191.8 $187.5 $874.9 $835.0 Net Investment Result $25.6 $ 25.6 $103.7 $94.3 Total Revenues $ 209.1 $237.7 $ 866.1 $870.2 Net Losses and LAE $ 105.1 $107.3 $ 469.2 $ 443.2 Underwriting & Operating Expenses $ 63.6 $ 60.9 $ 235.8 $ 227.6 Net Income (Includes Realized Investment Gains & Losses) $17.3 $54.8 $107.3 $151.1 Operating Income $29.5 $44.4 $108.5 $129.8 Operating Income per Diluted Share $ 0.55 $ 0.83 $ 2.02 $ 2.43 In millions, except per share data

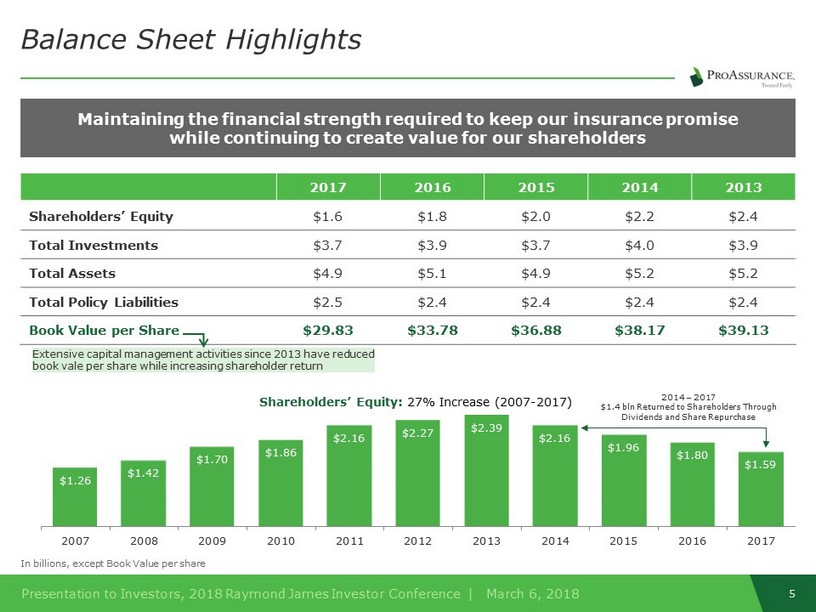

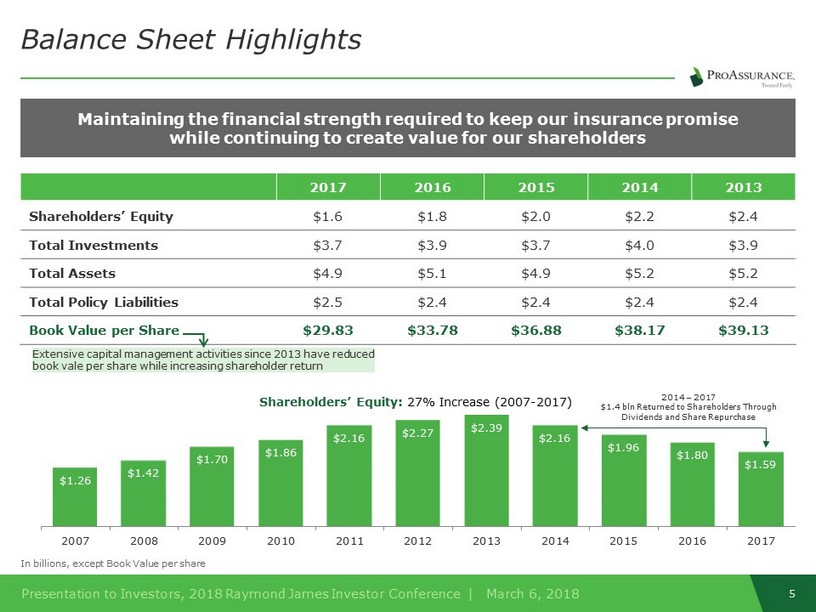

5 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 Balance Sheet Highlights Maintaining the financial strength required to keep our insurance promise while continuing to create value for our shareholders 2017 2016 2015 2014 2013 Shareholders’ Equity $1.6 $1.8 $2.0 $2.2 $2.4 Total Investments $ 3.7 $ 3.9 $3.7 $4.0 $3.9 Total Assets $4.9 $ 5.1 $4.9 $5.2 $5.2 Total Policy Liabilities $2.5 $2.4 $2.4 $2.4 $2.4 Book Value per Share $29.83 $33.78 $36.88 $38.17 $39.13 In billions, except Book Value per share $1.26 $1.42 $1.70 $1.86 $2.16 $2.27 $2.39 $2.16 $1.96 $1.80 $1.59 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2014 – 2017 $1.4 bln Returned to Shareholders Through Dividends and Share Repurchase Extensive capital management activities since 2013 have reduced book vale per share while increasing shareholder return Shareholders’ Equity: 27% Increase (2007 - 2017)

6 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 Strong Operational Results / Consistent Profitability Combined ratio average 2009 - 2017: 75.2% Operating ratio average 2009 - 2017: 53.8% Combined Ratio and Operating Ratio History 69.1% 68.0% 52.5% 57.3% 70.6% 82.1% 90.5% 91.4% 95.4% 38.8% 39.8% 27.6% 32.6% 46.1% 64.2% 74.8% 77.8% 82.4% 0.0% 25.0% 50.0% 75.0% 2009 2010 2011 2012 2013 2014 2015 2016 2017 Combined Ratio Operating Ratio

Key Themes for ProAssurance

8 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 Key Themes Long Term Success Consistent & disciplined focus on profitability Demonstrated track record of value creation for shareholders Proven Strategy World class knowledge & expertise Superior brand identity and reputation in the market Broad range of coverages address every significant need in our target markets Strong claims advocacy continues to differentiate Forward Thinking Successfully adapting to serve evolving risks through new distribution partners Coverages that span the broad spectrum of healthcare and related risks Dedicated to creating future value

9 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 Specialty P&C Strategy & Outlook Profitability across the market cycles Average Combined Ratio since 1991: 87.2% vs. industry 106.7% Increasing premium retention and higher pricing on renewals may signal a shift in market dynamics Addressing the consolidation in healthcare by leveraging our balance sheet, deep expertise and broad geographic reach Most competitors are small mutual companies with limited scope and size Successfully penetrating the broker market to unlock opportunities in larger complex risks Benefiting from coordinated marketing efforts that leverage the strength of our HCPL and Workers’ Compensation businesses Signs of possible severity increases in the broader market — not evident in our book of business We will take a cautious approach in evaluating and responding to trends

10 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 Workers’ Compensation Strategy & Outlook Continuing profitability in a challenging market Average Combined Ratio 2008 - 2017: 88.5% Solid retention despite price competition reflects Eastern’s success in service delivery Consistent early claims resolution eliminates long - tail risk associated with workers’ compensation Demonstrated success in adding new business reflects Eastern’s focus on specific geographies Additional growth opportunities unfolding Eastern Specialty Risk -- higher hazard, not high hazard Great Falls renewal rights transaction expands Eastern into New England and provides small business growth opportunities Captive capabilities through Eastern Re enhance ProAssurance’s overall appeal to larger/complex risks

11 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 Lloyd’s Syndicate Strategy & Outlook Special Purpose Arrangement (SPA) began writing business in 2 018 as Syndicate 6131 Business written through Syndicate 1729, 60% ceded to the SPA Planned premium is $22 million Business focus is contingency & specialty property Four experienced underwriters with established books of business Growing success in international healthcare professional liability Highly - experienced underwriting team with e xtensive experience in Canada, Australia, South America & Middle East ProAssurance provides 62% of capital to Syndicate 1729 — an investment in the future that broadens our capabilities Provid es potential exposure to global professional liability opportunities Especially relevant to Medmarc for medical technology and products liability as more testing and development moves offshore

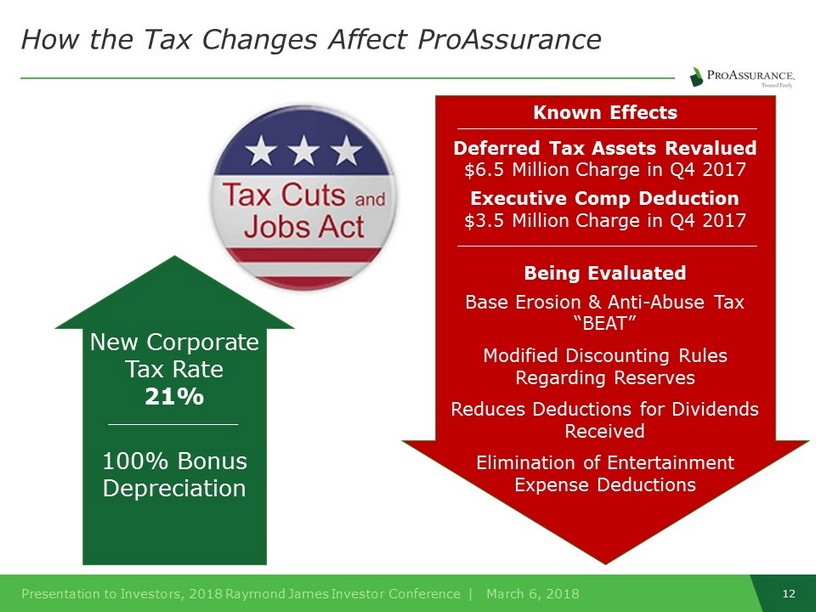

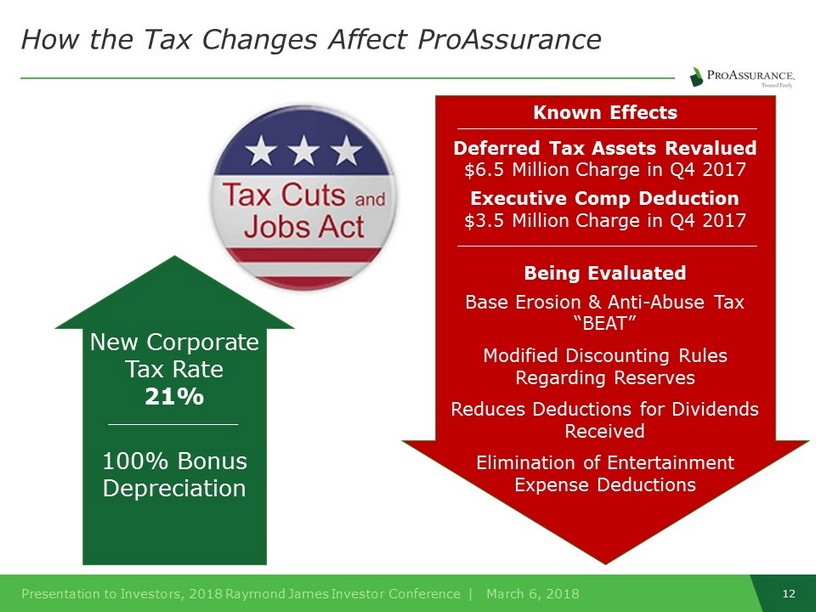

12 Presentation to Investors, 2018 Raymond James Investor Conference | March 6, 2018 How the Tax Changes Affect ProAssurance New Corporate Tax Rate 21% 100% Bonus Depreciation Known Effects Deferred Tax Assets Revalued $6.5 Million Charge in Q4 2017 Executive Comp Deduction $3.5 Million Charge in Q4 2017 Being Evaluated Base Erosion & Anti - Abuse Tax “BEAT ” Modified Discounting Rules Regarding Reserves Reduces Deductions for Dividends Received Elimination of Entertainment Expense Deductions