- PRA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ProAssurance (PRA) 8-KRegulation FD Disclosure

Filed: 16 Dec 05, 12:00am

| • | Market Cap: $1.6 Billion |

| • | Gross Premiums: $790 million in 2004 |

| • | Assets: $3.8 billion |

| • | Nation’s fourth-largest medical professional liability insurer |

| • | Recently announced acquisition of PIC-Wisconsin |

| • | Geographically diversified |

| • | Experienced, invested management |

| • | Sale of personal lines business expected to be complete in Q1, 2006 |

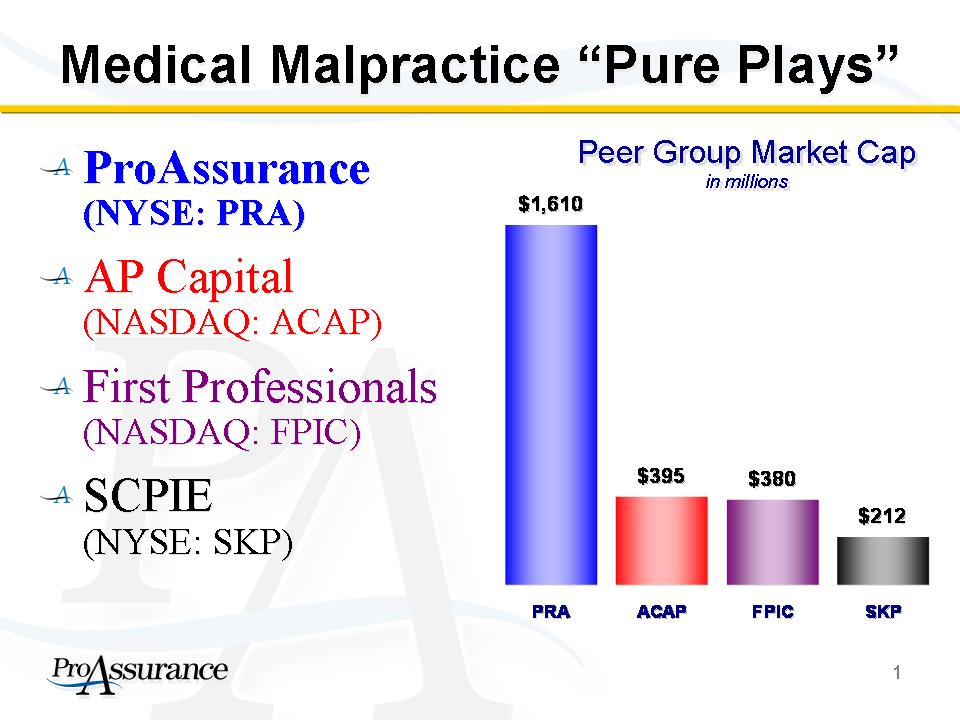

Medical Malpractice "Pure Plays" ProAssurance (NYSE: PRA) AP Capital (NASDAQ: ACAP) First Professionals (NASDAQ: FPIC) SCPIE (NYSE:SKP) Peer Group Market Cap in millions PRA: $1,610 ACAP: $395 FPIC: $380 SKP: $212 |

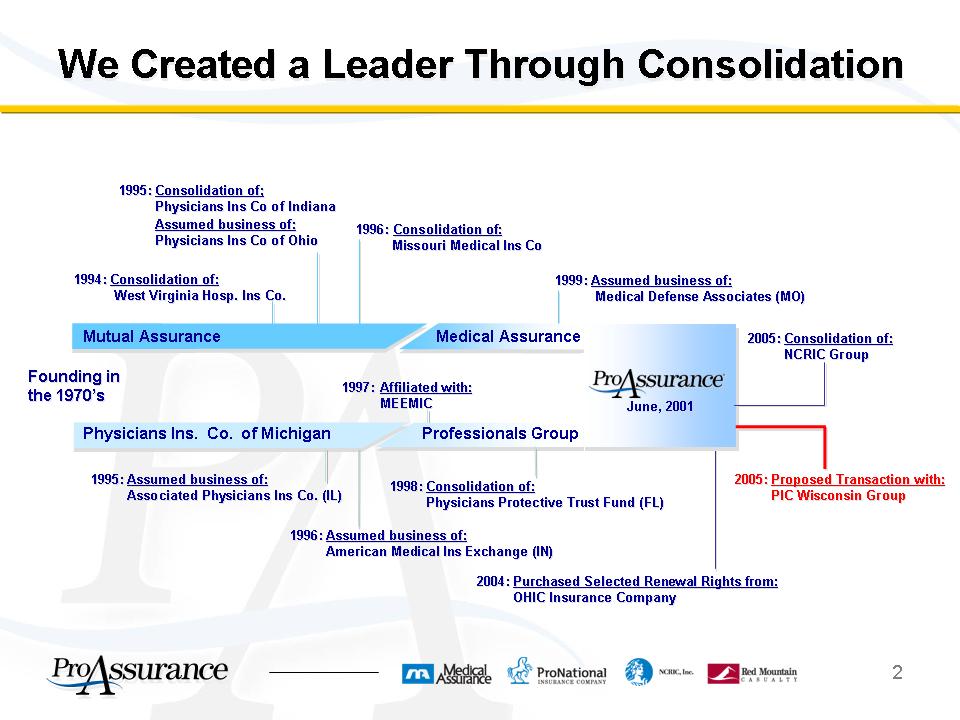

We Created a Leader Through ConsolidationMutual Assurance 1994: Consolidation of: West Virginia Hosp. Ins Co.1996: Consolidation of: Missouri Medical Ins Co Medical Assurance1999: Assumed business of: Medical Defense Associates (MO) Founding in the 1970’s Physicians Ins. Co. of Michigan 1995: Assumed business of: Associated Physicians Ins Co. (IL) 1996: Assumed business of: American Medical Ins Exchange (IN) Professionals Group 1997: Affiliated with: MEEMIC 1998: Consolidation of: Physicians Protective Trust Fund (FL) ProAssurance June 2001 2004: Purchased Selected Renewal Rights from: OHIC Insurance Company 2005: Consolidation of: NCRIC Group 2005: Proposed Transaction with: PIC Wisconsin Group |

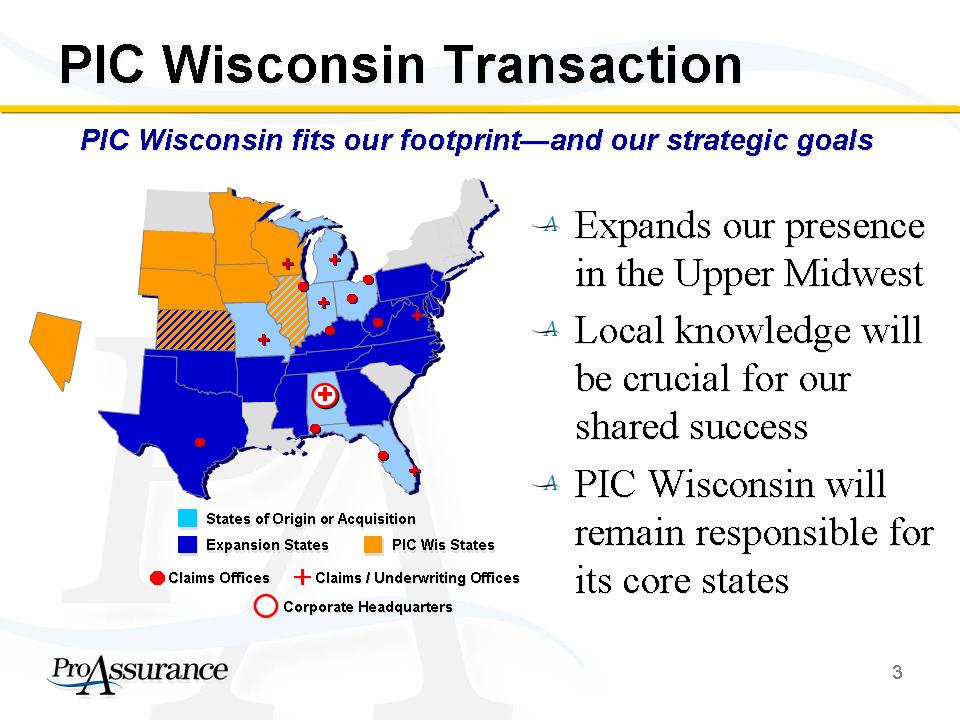

PIC Wisconsin Transaction PIC Wisconsin fits our footprint—and our strategic goals Expands our presence in the Upper Midwest Local knowledge will be crucial for our shared success PIC Wisconsin will remain responsible for its core states |

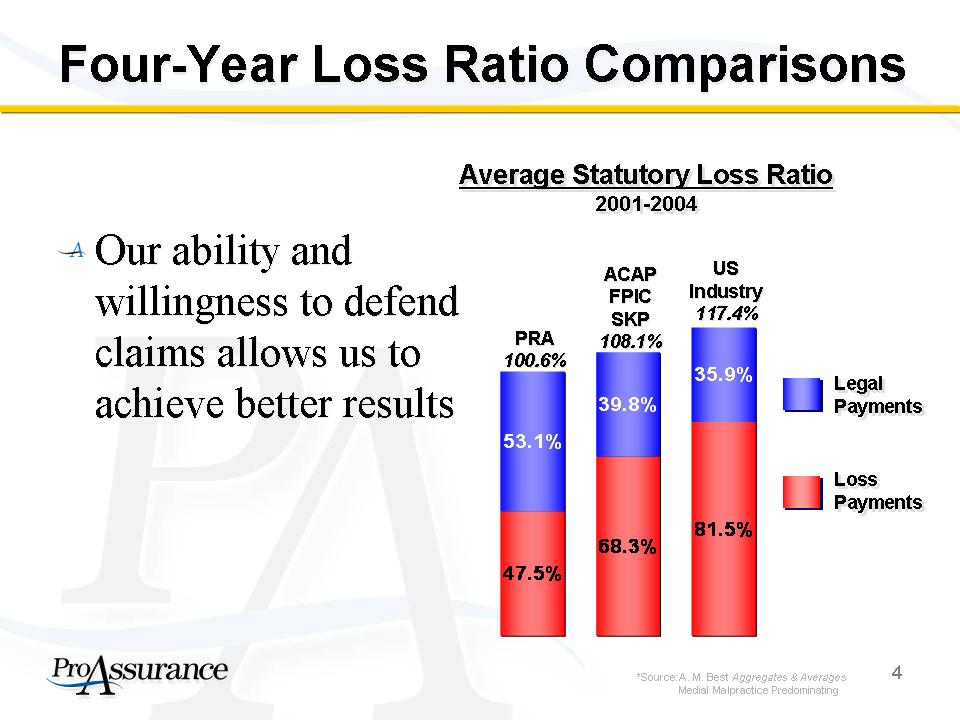

Four-Year Loss Ratio Comparisons Our ability and willingness to defend claims allows us to achieve better results Average Statutory Loss Ratio 2001-2004 PRA 100.6%: Legal Payments 53.1%, Loss Payments 47.5% ACAP FPIC SKP: Legal Payments 39.8%, Loss Payments 68.3% US Industry: Legal Payments 35.9%, Loss Payments 81.5% Source: A. M. Best Aggregates & Averages Medial Malpractice Predominating |