- PRA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

ProAssurance (PRA) 8-KRegulation FD Disclosure

Filed: 13 Feb 06, 12:00am

|

ProAssurance nyssa New York Society of Security Analysts A. Derrill Crowe, M.D. Chairman & CEOEdward L. Rand, Jr., CPA Chief Financial Officer February 13, 2006 A. Derrill Crowe, M.D. Chairman & CEOEdward L. Rand, Jr., CPA Chief Financial Officer February 13, 2006 |

|

Caution Regarding Forward Looking Statements This presentation contains historical information as well as forward-looking statements that are based upon our estimates and anticipation of future events that are subject to certain risks and uncertainties that could cause actual results to vary materially from the expected results described in the forward- looking statements. The words "anticipate," "believe," "estimate," "expect," "hopeful," "intend," "may," "optimistic," "preliminary," "project," "should," "will," and similar expressions are intended to identify these forward-looking statements. There are numerous important factors that could cause our actual results to differ materially from those in the forward-looking statements. Thus, sentences and phrases that we use to convey our view of future events and trends are expressly designated as "forward-looking statements" as are sections of this news release clearly identified as giving our outlook on future business. The principal risk factors that may cause actual results to differ materially from those expressed in the forward-looking statements are described in various documents we file with the Securities and Exchange Commission, including Form 10K/A for the year ended December 31, 2004 and Form 10Q for the most recent quarter. These forward-looking statements are subject to significant risks, assumptions and uncertainties, including, among other things, the following important factors that could affect the actual outcome of future events. Relating to the proposed transaction with PIC Wisconsin, we add the following specific cautions: The business of ProAssurance and PIC Wisconsin may not be combined successfully, or such combination may take longer to accomplish than expected; the cost savings from the merger may not be fully realized or may take longer to realize than expected; operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; restrictions on our ability to achieve continued growth through expansion into other states or through acquisitions or business combinations; and the stockholders of PIC Wisconsin may fail to approve the merger We urge you not to place undue reliance on any such forward-looking statements, which speak only as of the date made, and wish to advise readers that the factors listed above could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to periods in any current statements. We do not undertake and specifically decline any obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to such statements or to reflect the occurrence of anticipated or unanticipated events Financial data for the medical malpractice segment for all periods prior to June, 2001 reflects Medical Assurance, Inc. data only, except where noted. 1 |

|

ProAssurance Overview Market Cap: $1.6 Billion Gross Premiums: $790 million in 2004 Assets: $3.8 billion Nation's fourth-largest medical professional liability insurer Recently announced acquisition of PIC-Wisconsin Sale of personal lines business completed effective January 1, 2006 Geographically diversified within med mal Experienced, invested management 2 |

|

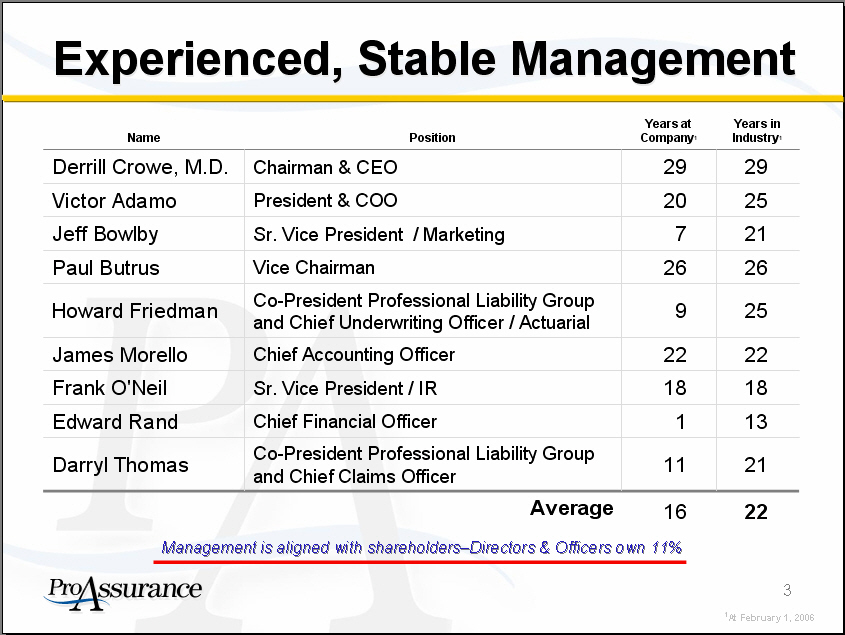

Experienced, Stable Management Years at Years in Name Position Company1 Industry1 Derrill Crowe, M.D. Chairman & CEO 29 29 Victor Adamo President & COO 20 25 Jeff Bowlby Sr. Vice President / Marketing 7 21 Paul Butrus Vice Chairman 26 26 Howard Friedman Co-President Professional Liability Group and Chief Underwriting Officer / Actuarial 9 25 James Morello Chief Accounting Officer 22 22 Frank O'Neil Sr. Vice President / IR 18 18 Edward Rand Chief Financial Officer 1 13 Darryl Thomas Co-President Professional Liability Group and Chief Claims Officer 11 21 Average 16 22 Management is aligned with shareholders-Directors & Officers own 11% 3 |

|

Professional Liability The Core of ProAssurance 4 |

|

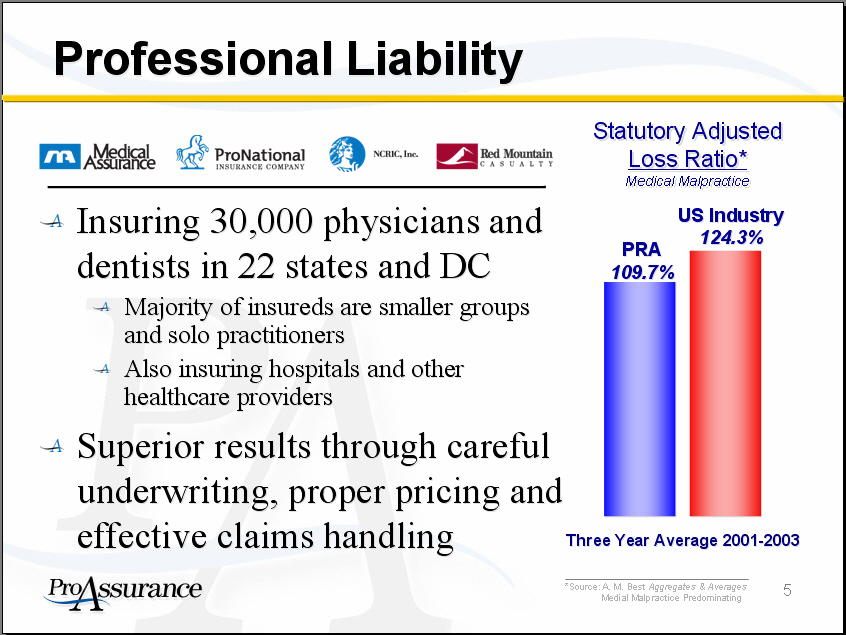

Professional Liability Statutory Adjusted Loss Ratio* Medical Malpractice Insuring 30,000 physicians and US Industry dentists in 22 states and DC PRA 124.3% 109.7% Majority of insureds are smaller groups and solo practitioners Also insuring hospitals and other healthcare providers Superior results through careful underwriting, proper pricing and effective claims handling Three Year Average 2001-2003 5 |

|

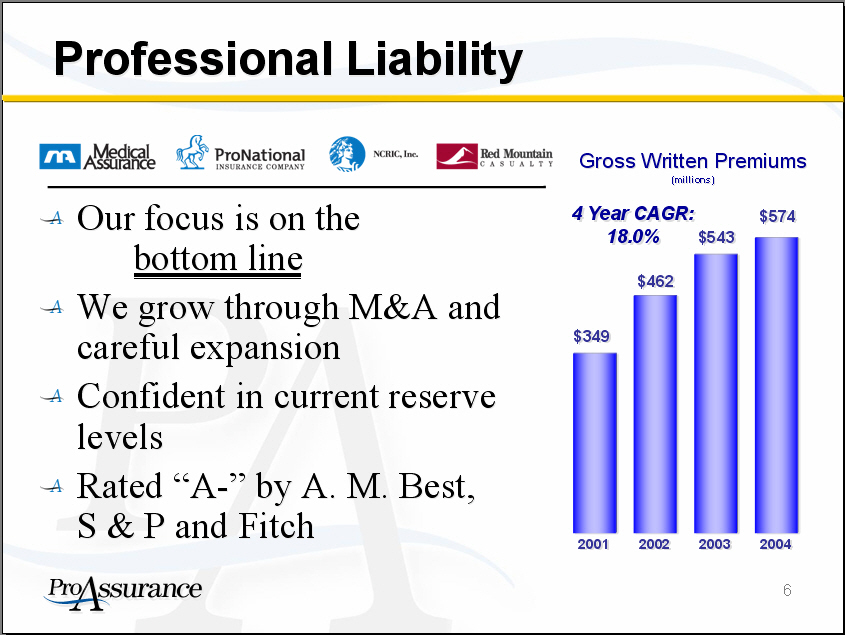

Professional Liability Our focus is on the bottom line We grow through M&A and careful expansion Confident in current reserve levels Rated "A-" by A. M. Best, S & P and Fitch Gross Written Premiums (millions) 4 Year CAGR: $574 18.0% $543 $462 $349 2001 2002 2003 2004 6 |

|

We Created a Leader Through Consolidation 7 |

|

Effective Regional Operations National Scale Regional Orientation Corporate Headquarters Consolidated financial strength is unmatched in our niche Corporate strategy applied locally to underwriting & claims Local knowledge crucial to understanding legal environment Local presence preserves long-term customer relationships 8 |

|

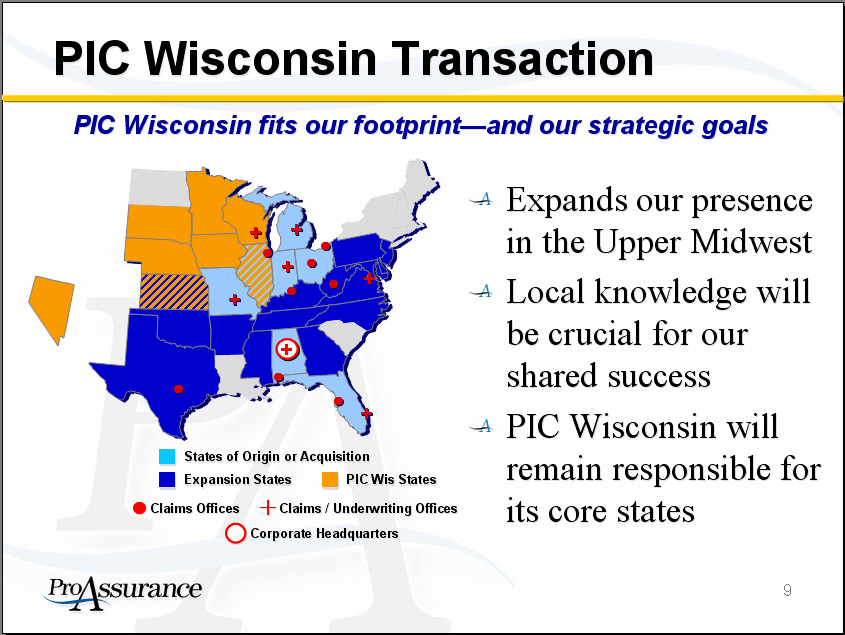

PIC Wisconsin Transaction PIC Wisconsin fits our footprint-and our strategic goals Expands our presence in the Upper Midwest Local knowledge will be crucial for our shared success PIC Wisconsin will remain responsible for States of Origin or Acquisition Expansion States PIC Wis States Claims Offices Claims / Underwriting Offices its core states Corporate Headquarters 9 |

|

Market Leadership We are the foremost writer in our states of operation We are market leaders in AL, DE, DC, OH and VA Opportunities for M&A will present themselves M & A will be our preferred method of growth We continue to grow within our market footprint but will not "force" top line growth 10 |

|

Pricing and Underwriting Review Average renewal rate increase for 2005: 11% Retention rate is slightly higher New insureds balance out non-renewals We are maintaining our margins at levels that meet our ROE targets Premium levels affected by: Purchase of lower limits Change in mix of business--more exposures in lower-cost states 11 |

|

Keys to Success in 2006 Continued attention to adequate pricing and strict underwriting Focus on profitable states in an evolving market Taking advantage of our geographic diversification Keep raising the bar for claims success 2006 is a pivotal year in evaluating frequency and severity data 12 |

|

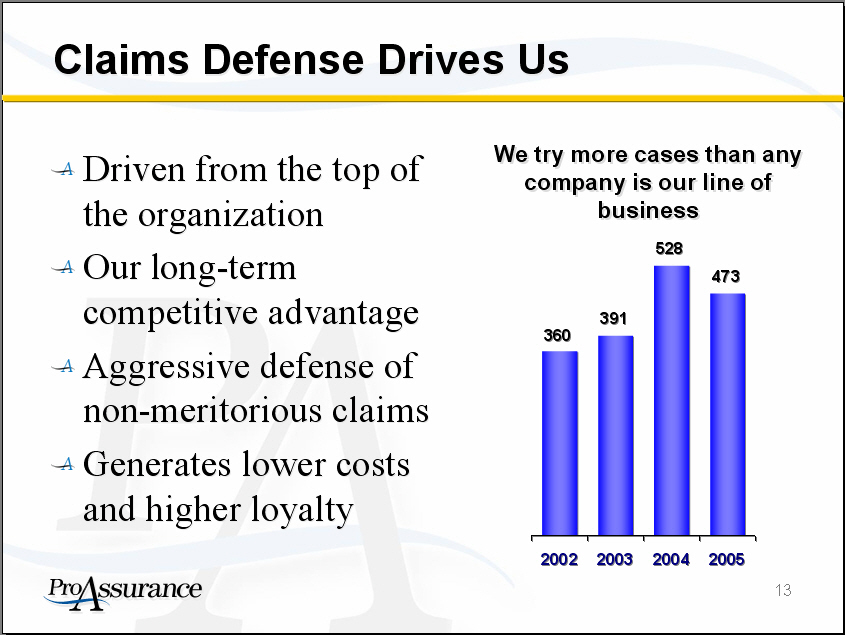

Claims Defense Drives Us Driven from the top of the organization Our long-term competitive advantage Aggressive defense of non-meritorious claims Generates lower costs and higher loyalty We try more cases than any company is our line of business 528 473 391 360 2002 2003 2004 2005 13 |

|

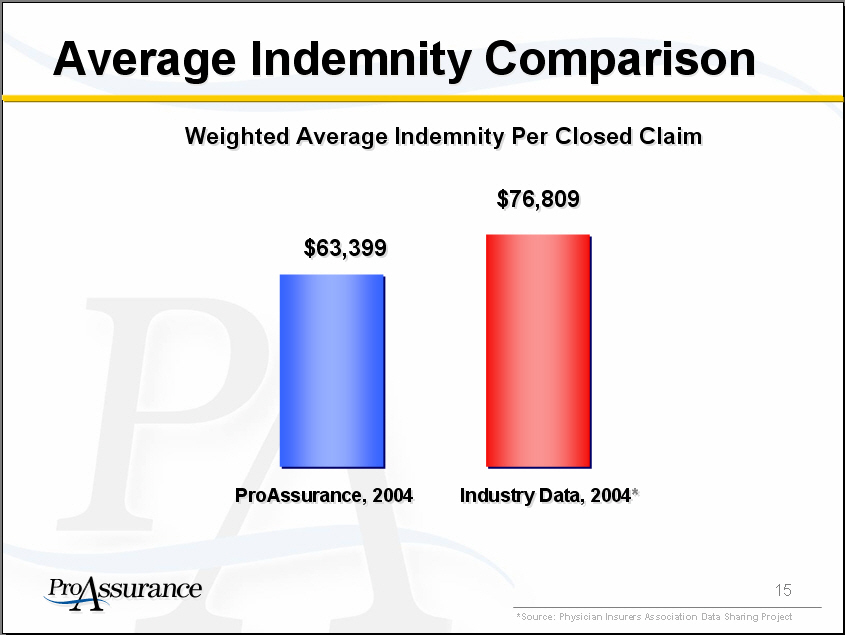

Closed Claim Outcome Comparison Dropped or Dismissed Plaintiff Verdict Defense Verdict Settled 1.1% 4.4% ProAssurance, 2004 Industry Data, 2004* Industry Data, 2004* *Source: Physician Insurers Association Data Sharing Project Average Indemnity Comparison 14 |

|

Weighted Average Indemnity Per Closed Claim $76,809 $63,399 ProAssurance, 2004 Industry Data, 2004* Industry Data, 2004* *Source: Physician Insurers Association Data Sharing Project 15 |

|

Four-Year Loss Ratio Comparisons Average Statutory Loss Ratio Our ability and willingness to defend claims allows us to achieve better results Legal Payments Loss Payments *Source: A. M. Best Aggregates & Averages Medial Malpractice Predomininating 16 |

|

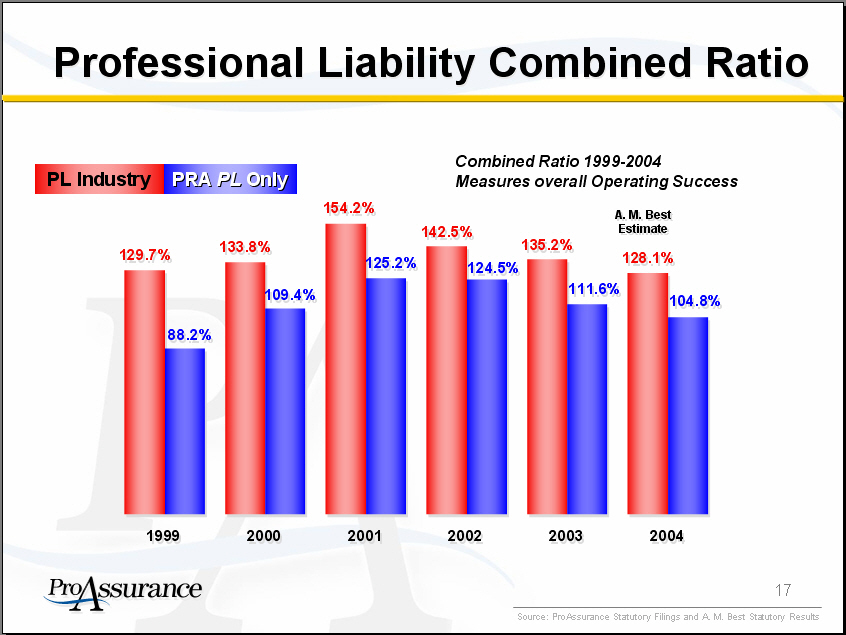

Professional Liability Combined Ratio PL Industry PRA PL Only Combined Ratio 1999-2004 measures overall Operating Success 17 |

|

What About Tort Reform? Federal tort reform remains uncertain State-by-state reforms Passed in many forms in many states GA, FL, OH, MO, PA, TX & WV Long-term effectiveness yet to be proven No judicial review yet-could be found unconstitutional Wisconsin's were recently struck down after ten years Reforms under discussion in many states ProAssurance's business plans do not depend on tort reform 18 |

|

Financial Overview The Heart of ProAssurance |

|

Financial Highlights Cash Flow from Operations $373.5 Consolidated Combined Ratio Operations continues to decrease Professional Liability: 99.1% YTD1 $282.8 Return on Equity exceeding our targets $177.0 15.6% YTD1 (includes Personal Lines) $61.3 $36.3 Solid bottom line growth and strong cash flows 2000 2001 2002 2003 2004 Merger Created ProAssurance in June 2 2001 (1)At September 30, 2005 20 |

|

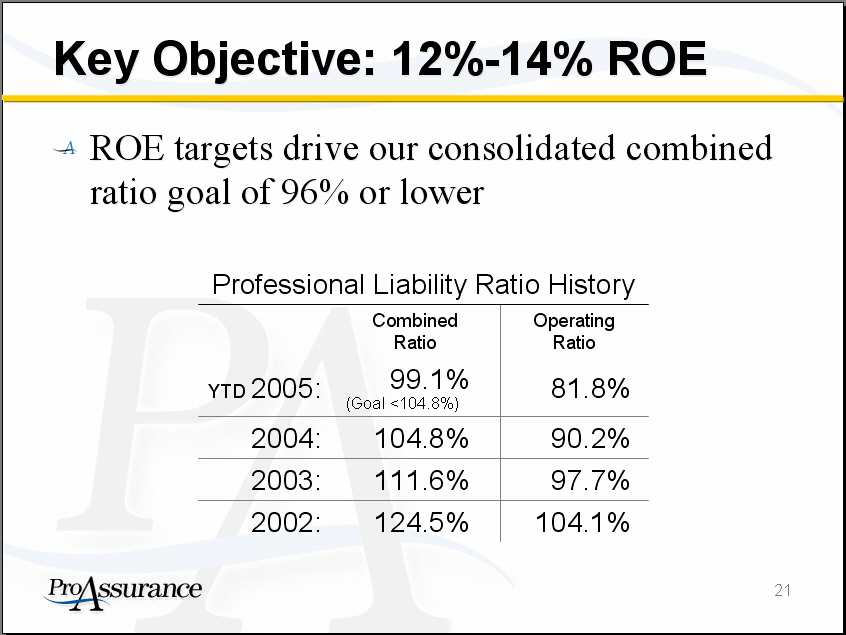

Key Objective: 12%-14% ROE ROE targets drive our consolidated combined ratio goal of 96% or lower Professional Liability Ratio History Combined Ratio Operating Ratio YTD 2005: 99.1% (Goal <104.8%) 81.8% 2004: 104.8% 90.2% 2003: 111.6% 2002: 124.5% 97.7% 104.1% 21 |

|

Combined Ratio Returning to Historic Norms Underwriting Profitability in Q3, 2005 Results First Reflect Dramatic Increases in Losses and Loss Costs Year-to-Date at each quarter-end, Medical Assurance, Inc. Data Prior to Q3, 2001 22 |

|

Consistent Growth in Book Value per Share Annual stock price performance of PRA and predecessors is 18.9% since inception in September, 1991 23 |

|

Consistent Growth in Our Asset Base Total Assets in millions Adds NCRIC 24 |

|

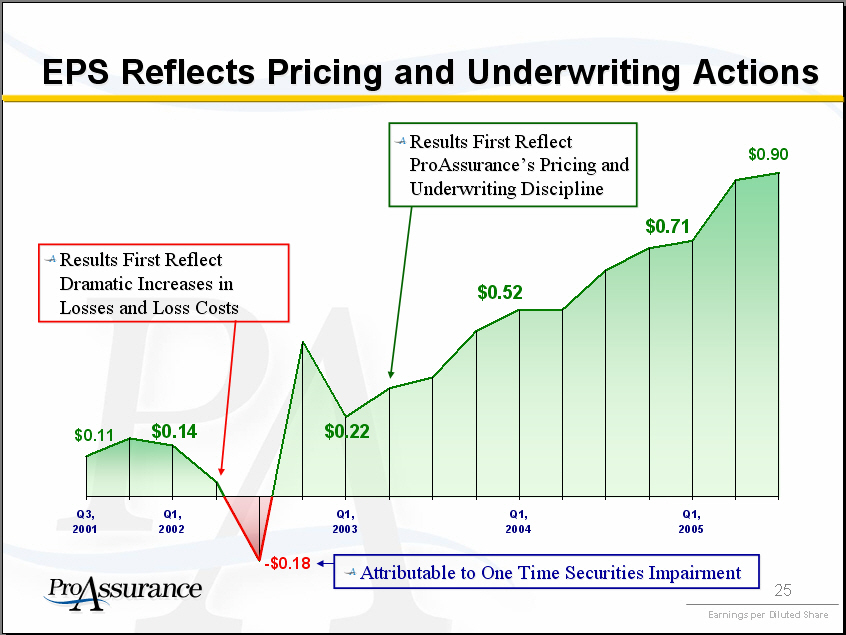

EPS Reflects Pricing and Underwriting Actions 25 |

|

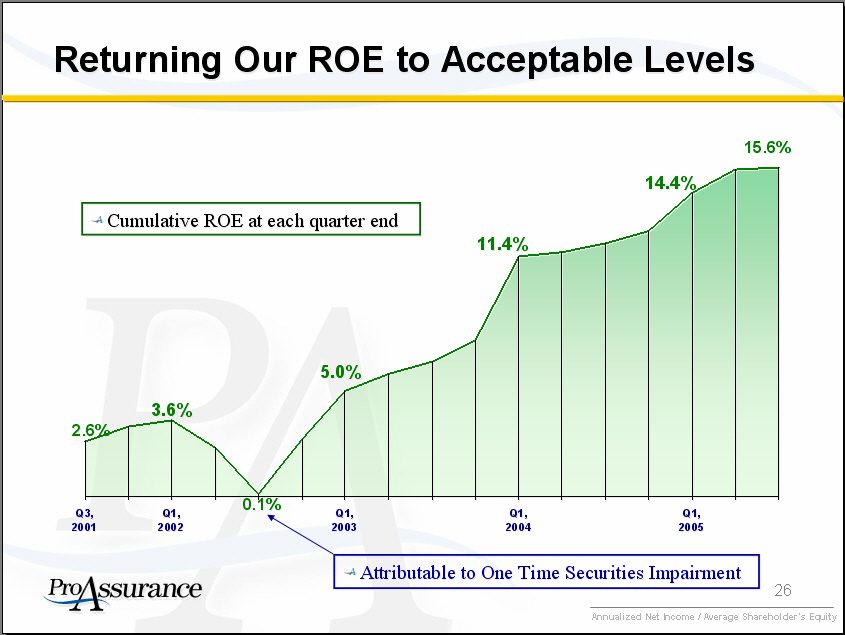

Returning Our ROE to Acceptable Levels Cumulative ROE at each quarter end 15.6% 0.1% Q3, Q1, Q1, Q1, Q1, 2001 2002 2003 2004 2005 Annualized Net Income / Average Shareholder's Equity 26 |

|

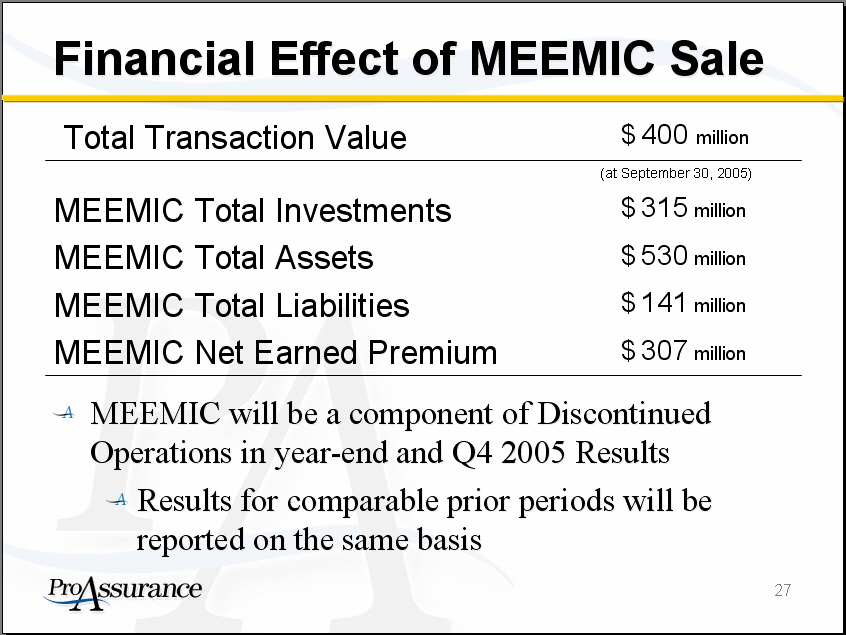

Financial Effect of MEEMIC Sale Total Transaction Value $ 400 million (at September 30, 2005) MEEMIC Total Investments $ 315 million MEEMIC Total Assets $ 530 million MEEMIC Total Liabilities $ 141 million MEEMIC Net Earned Premium $ 307 million MEEMIC will be a component of Discontinued Operations in year-end and Q4 2005 Results Results for comparable prior periods will be reported on the same basis 27 |

|

PIC Wisconsin Overview Total Transaction Value ~ $ 100 million (at 12/31/04--Statutory Basis) PIC Wis Total Investments1 $ 248 million PIC Wis Total Assets1 $ 275 million PIC Wis Policyholder Surplus1 $89 million PIC Wis Net Written Premium1 $57 million PIC Wisconsin is Rated "A-" (Excellent) by A. M. Best 1Source: A. M. Best 28 |

|

Our Opportunities Leader in medical malpractice industry Organic growth and M&A expansion Proven platform with regional operating approach Divesting niche personal lines business in a $400 million transaction Experienced management team focused on driving returns Conservative financial position 29 |

|

ProAssurance nyssa New York Society of Security Analysts A. Derrill Crowe, M.D. Chairman & CEOEdward L. Rand, Jr., CPA Chief Financial Officer February 13, 2006 |