February 20, 2020 Acquisition of NORCAL Stronger, Better Positioned HCPL Specialty Insurer

IMPORTANT SAFE HARBOR & NON-GAAP NOTICES Forward Looking Statements This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. Non-GAAP Measures This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in our remarks and discussions with investors. The primary Non-GAAP measure we reference is Non-GAAP operating income, a Non-GAAP financial measure that is widely used to evaluate performance within the insurance sector. In calculating Non-GAAP operating income, we have excluded the after-tax effects of net realized investment gains or losses and guaranty fund assessments or recoupments that do not reflect normal operating results. We believe Non-GAAP operating income presents a useful view of the performance of our insurance operations, but should be considered in conjunction with net income computed in accordance with GAAP. A reconciliation of these measures to GAAP measures is available in our regular reports on Forms 10-Q and 10-K and in our latest quarterly news release, all of which are available in the Investor Relations section of our website, Investor.ProAssurance.com.rd PRA disclaimer 2

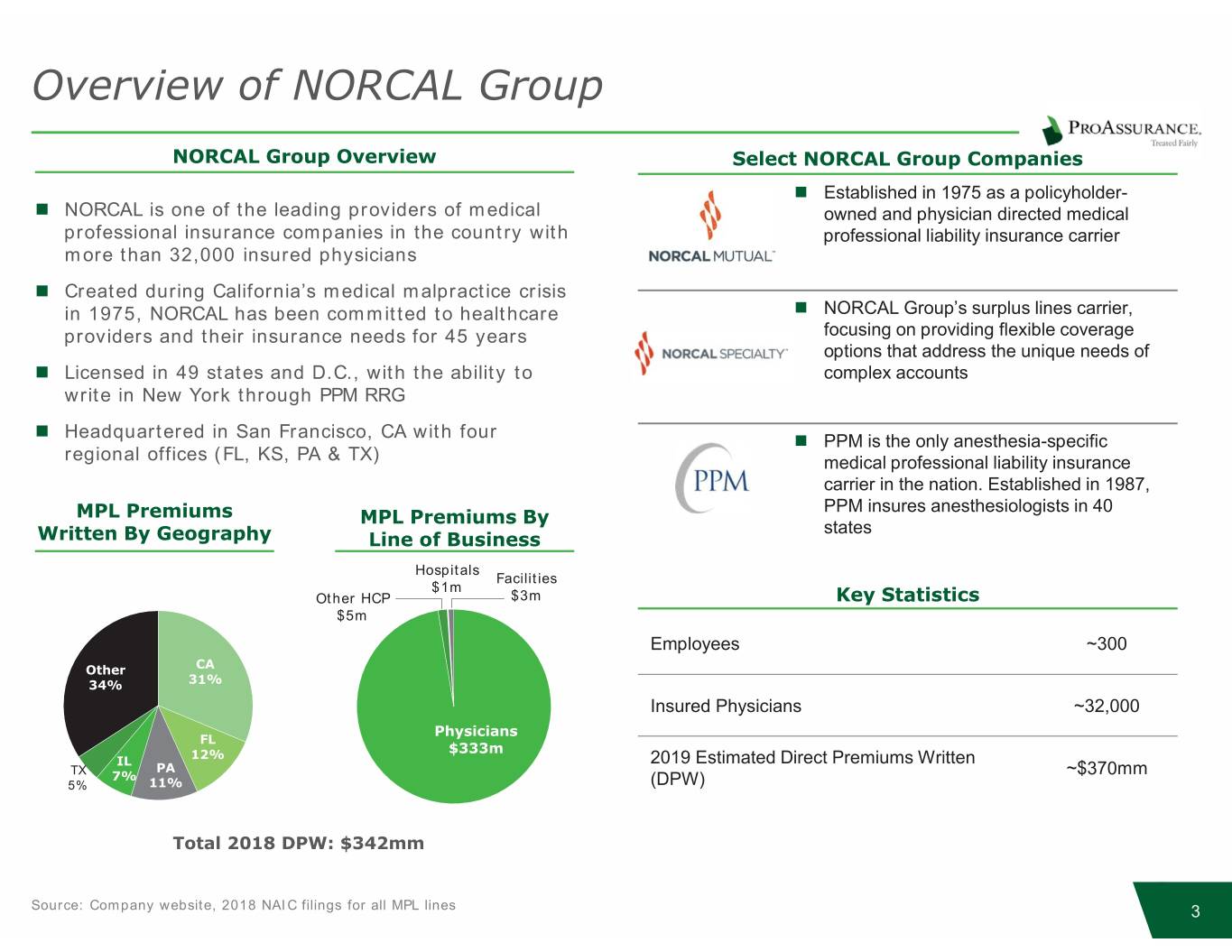

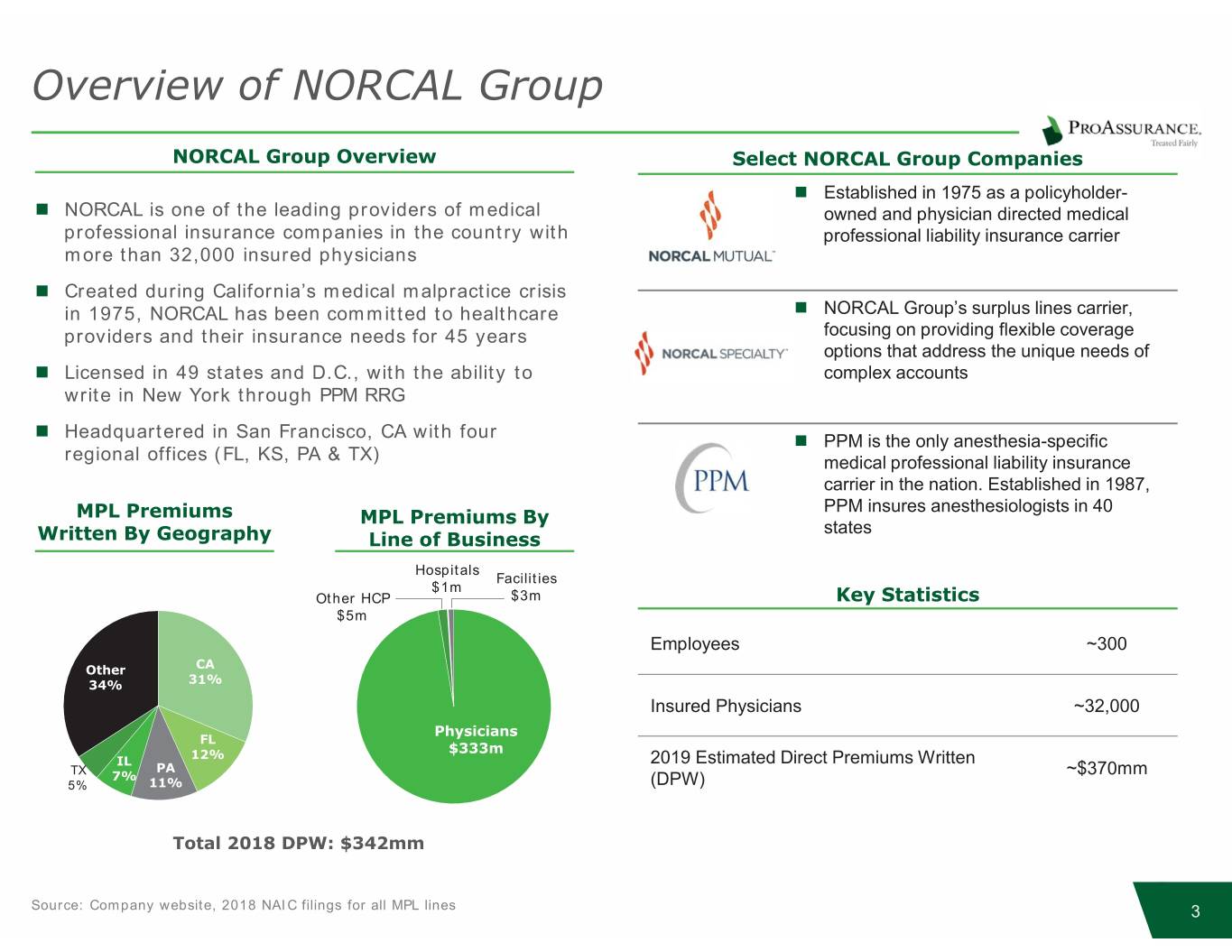

Overview of NORCAL Group NORCAL Group Overview Select NORCAL Group Companies „ Established in 1975 as a policyholder- „ NORCAL is one of the leading providers of medical owned and physician directed medical professional insurance companies in the country with professional liability insurance carrier more than 32,000 insured physicians „ Created during California’s medical malpractice crisis in 1975, NORCAL has been committed to healthcare „ NORCAL Group’s surplus lines carrier, providers and their insurance needs for 45 years focusing on providing flexible coverage options that address the unique needs of „ Licensed in 49 states and D.C., with the ability to complex accounts write in New York through PPM RRG „ Headquartered in San Francisco, CA with four „ PPM is the only anesthesia-specific regional offices (FL, KS, PA & TX) medical professional liability insurance carrier in the nation. Established in 1987, PPM insures anesthesiologists in 40 MPL Premiums MPL Premiums By states Written By Geography Line of Business Hospitals Facilities $1m Other HCP $3m Key Statistics $5m Employees ~300 Other CA 34% 31% Insured Physicians ~32,000 Physicians FL 12% $333m IL 2019 Estimated Direct Premiums Written PA TX 7% ~$370mm 5% 11% (DPW) Total 2018 DPW: $342mm Source: Company website, 2018 NAIC filings for all MPL lines 3

Stronger, Better Positioned HCPL Specialty Insurer1 1 Enhanced Scale and Capabilities 9 Positions company as #3 player in the industry 9 Enhances ProAssurance’s HCPL business: adds additional scale, capabilities and strong California presence 9 Ability to underwrite larger risks from integrated systems with national footprint 2 Product, Customer, & Geographic Diversification 9 Premier HCPL insurer with nationwide presence 9 Expanded product capabilities with broader geographic scale and efficiencies to address varying client needs (e.g. SPC / ART) 9 High touch model that drives retention using common distribution channels 3 Conservatively Priced and Financed Transaction 9 Attractive purchase price; modest impact to tangible book value per share 9 Additional consideration contingent on favorable reserve development relative to our expectation 9 Financed with a combination of excess capital and incremental debt initially via revolver and / or contribution certificates 4 Value Creation for Customers and All Key Stakeholders 9 Scaled platform to produce strong results driven by disciplined underwriting 9 Clear path to achieving identified expense synergies 9 Facilitates EPS / and ROE accretive transaction beginning in 2022, with meaningful accretion thereafter 5 Strong Strategic Alignment and Rationale 9 A shared commitment to the HCPL industry, provision of affordable coverage and the defense of physicians 9 Best in class talent supporting true nationwide platform 9 Adds attractive customer base and distribution at a time when the HCPL market is beginning to harden ¹ HCPL refers to healthcare professional liability. 4

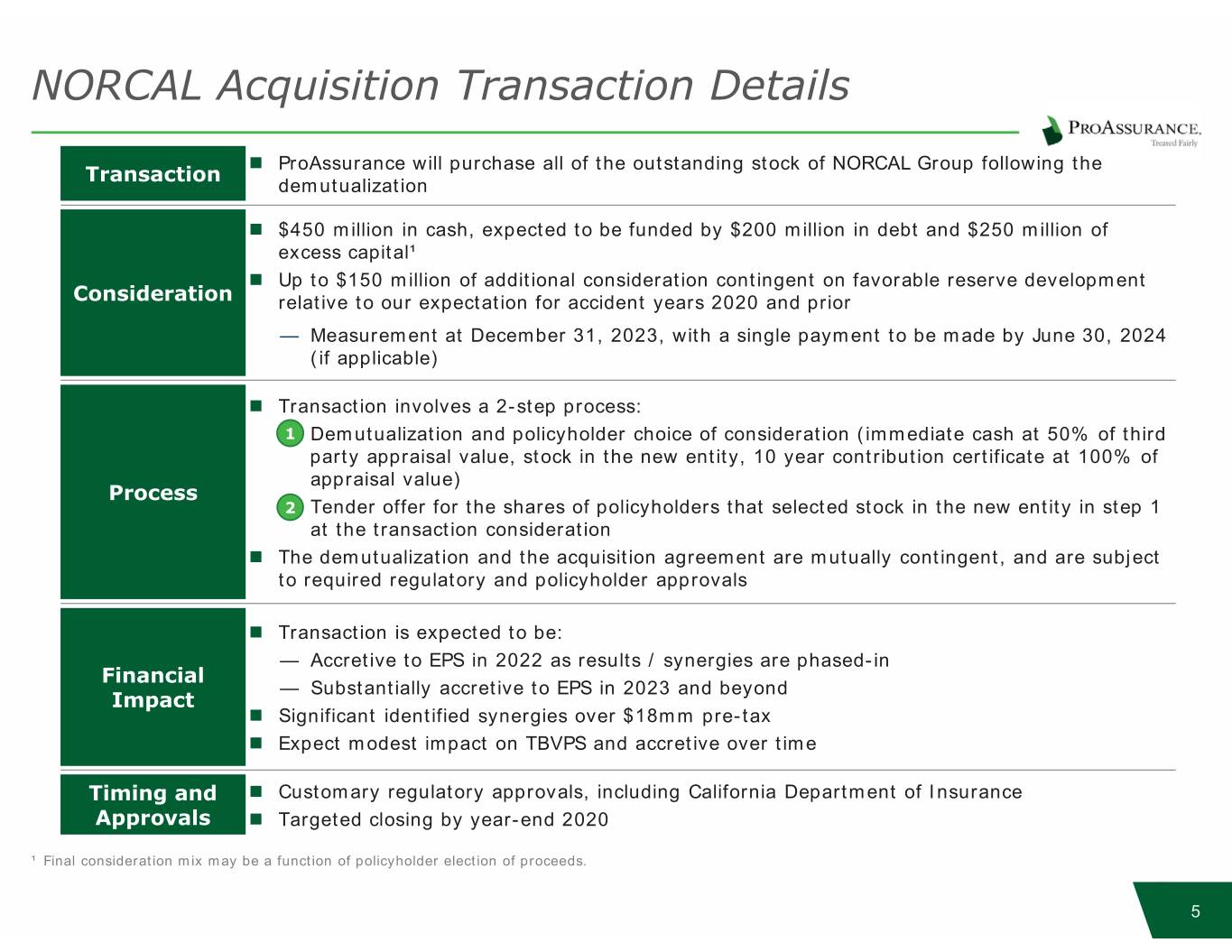

NORCAL Acquisition Transaction Details „ ProAssurance will purchase all of the outstanding stock of NORCAL Group following the Transaction demutualization „ $450 million in cash, expected to be funded by $200 million in debt and $250 million of excess capital¹ „ Up to $150 million of additional consideration contingent on favorable reserve development Consideration relative to our expectation for accident years 2020 and prior — Measurement at December 31, 2023, with a single payment to be made by June 30, 2024 (if applicable) „ Transaction involves a 2-step process: —1 Demutualization and policyholder choice of consideration (immediate cash at 50% of third party appraisal value, stock in the new entity, 10 year contribution certificate at 100% of appraisal value) Process —2 Tender offer for the shares of policyholders that selected stock in the new entity in step 1 at the transaction consideration „ The demutualization and the acquisition agreement are mutually contingent, and are subject to required regulatory and policyholder approvals „ Transaction is expected to be: — Accretive to EPS in 2022 as results / synergies are phased-in Financial — Substantially accretive to EPS in 2023 and beyond Impact „ Significant identified synergies over $18mm pre-tax „ Expect modest impact on TBVPS and accretive over time Timing and „ Customary regulatory approvals, including California Department of Insurance Approvals „ Targeted closing by year-end 2020 ¹ Final consideration mix may be a function of policyholder election of proceeds. 5

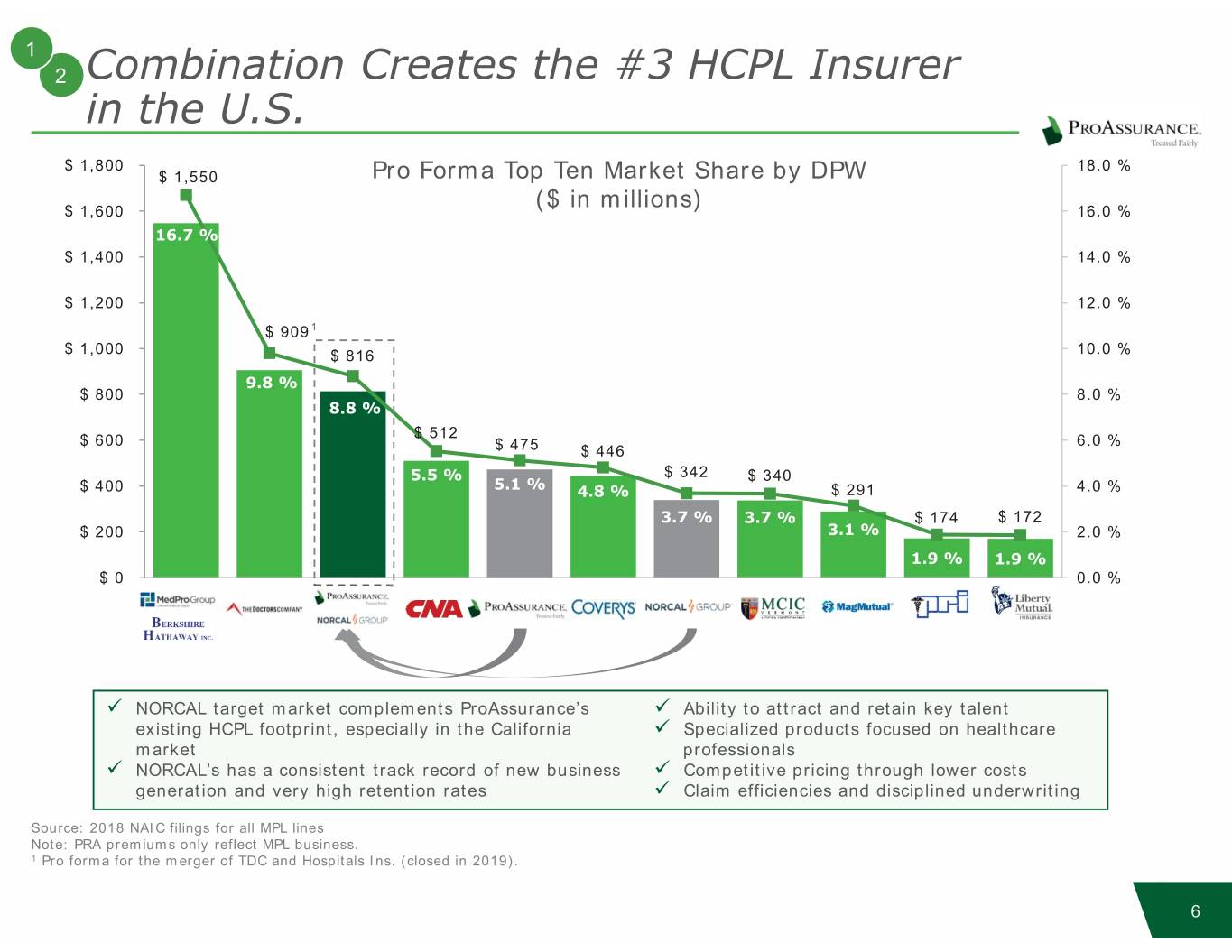

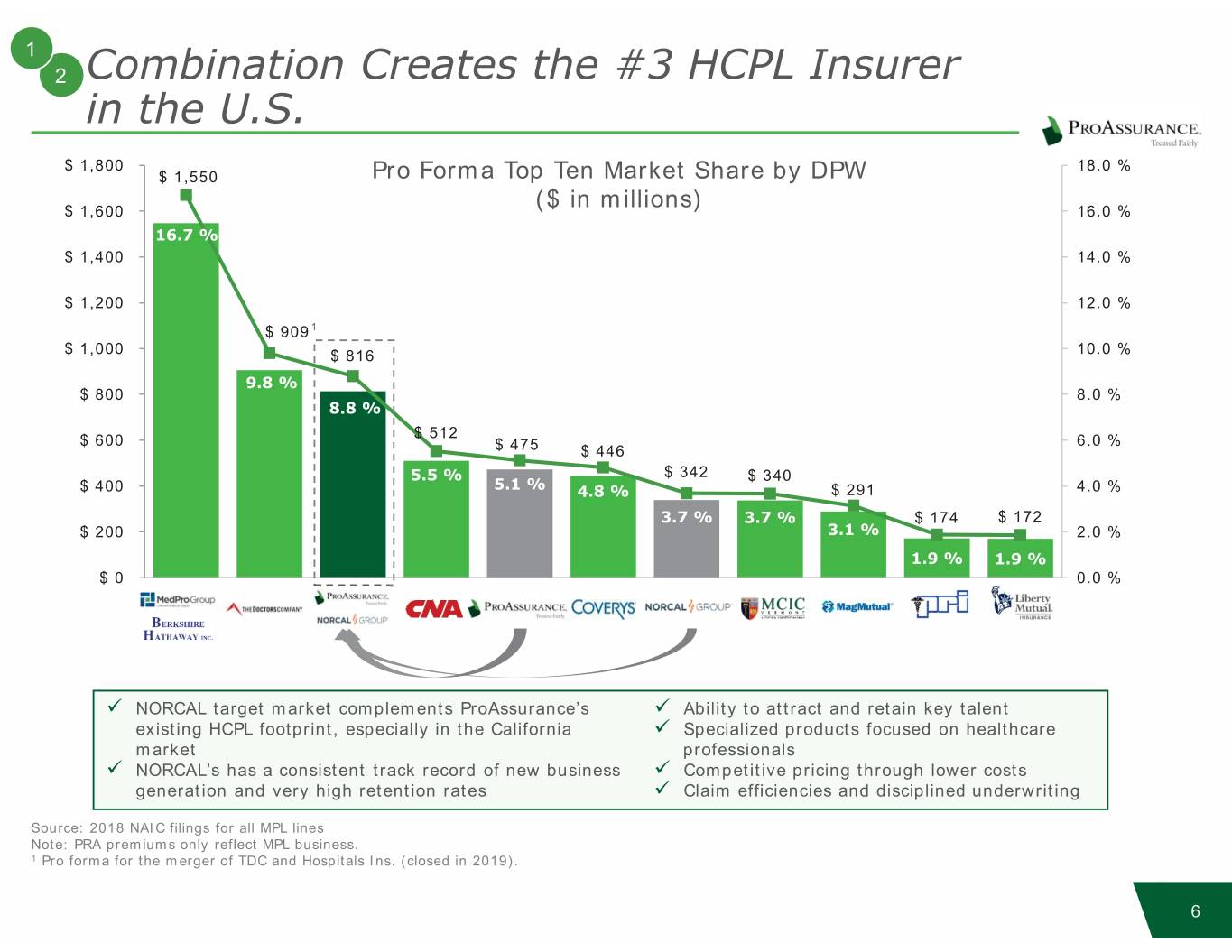

1 2 Combination Creates the #3 HCPL Insurer in the U.S. $ 1,800 18.0 % $ 1,550 Pro Forma Top Ten Market Share by DPW $ 1,600 ($ in millions) 16.0 % 16.7 % $ 1,400 14.0 % $ 1,200 12.0 % $ 909 1 $ 1,000 $ 816 10.0 % 9.8 % $ 800 8.0 % 8.8 % $ 600 $ 512 6.0 % $ 475 $ 446 5.5 % $ 342 $ 340 $ 400 5.1 % 4.8 % $ 291 4.0 % 3.7 % 3.7 % $ 174 $ 172 $ 200 3.1 % 2.0 % 1.9 % 1.9 % $ 0 0.0 % 12345678910113 4 5 8 9 9 NORCAL target market complements ProAssurance’s 9 Ability to attract and retain key talent existing HCPL footprint, especially in the California 9 Specialized products focused on healthcare market professionals 9 NORCAL’s has a consistent track record of new business 9 Competitive pricing through lower costs generation and very high retention rates 9 Claim efficiencies and disciplined underwriting Source: 2018 NAIC filings for all MPL lines Note: PRA premiums only reflect MPL business. 1 Pro forma for the merger of TDC and Hospitals Ins. (closed in 2019). 6

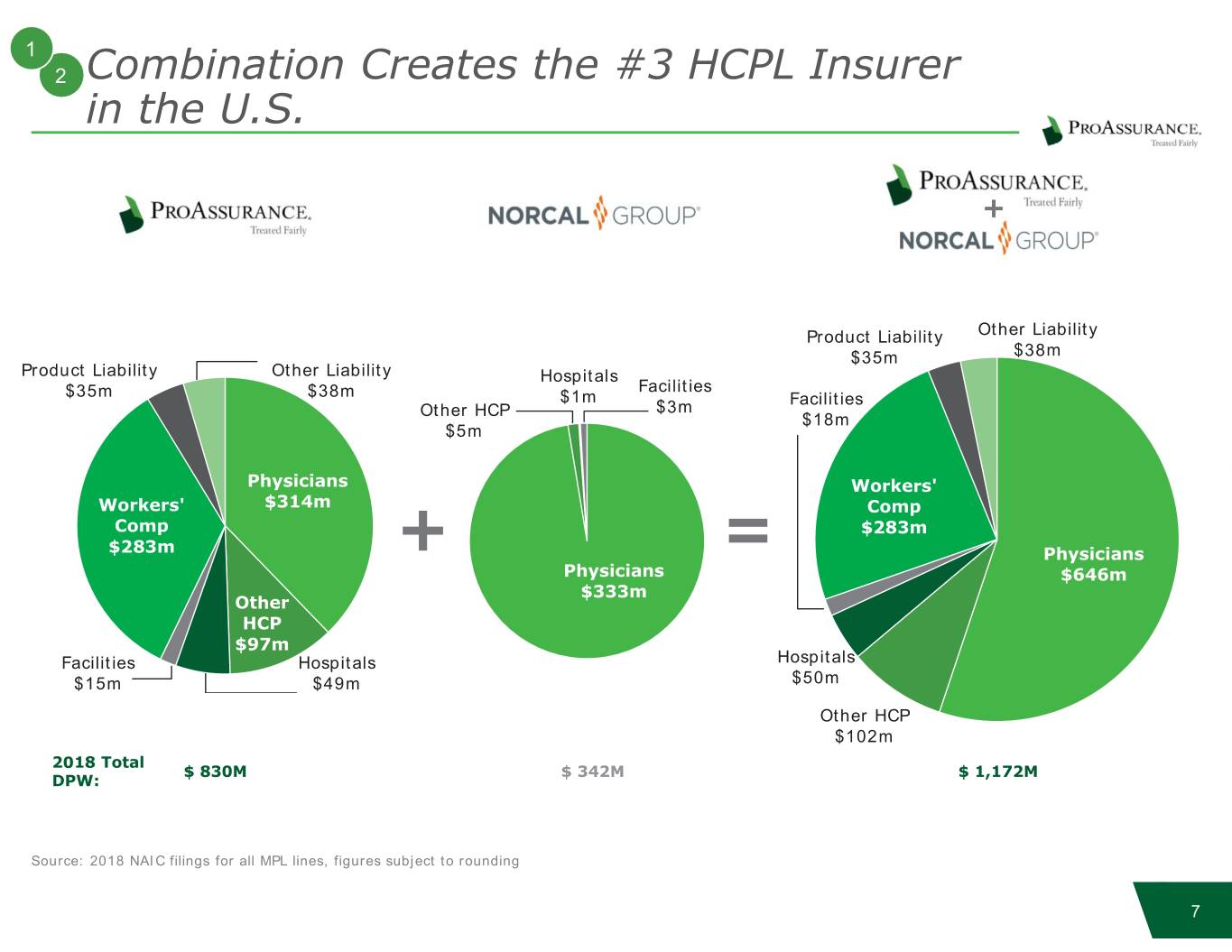

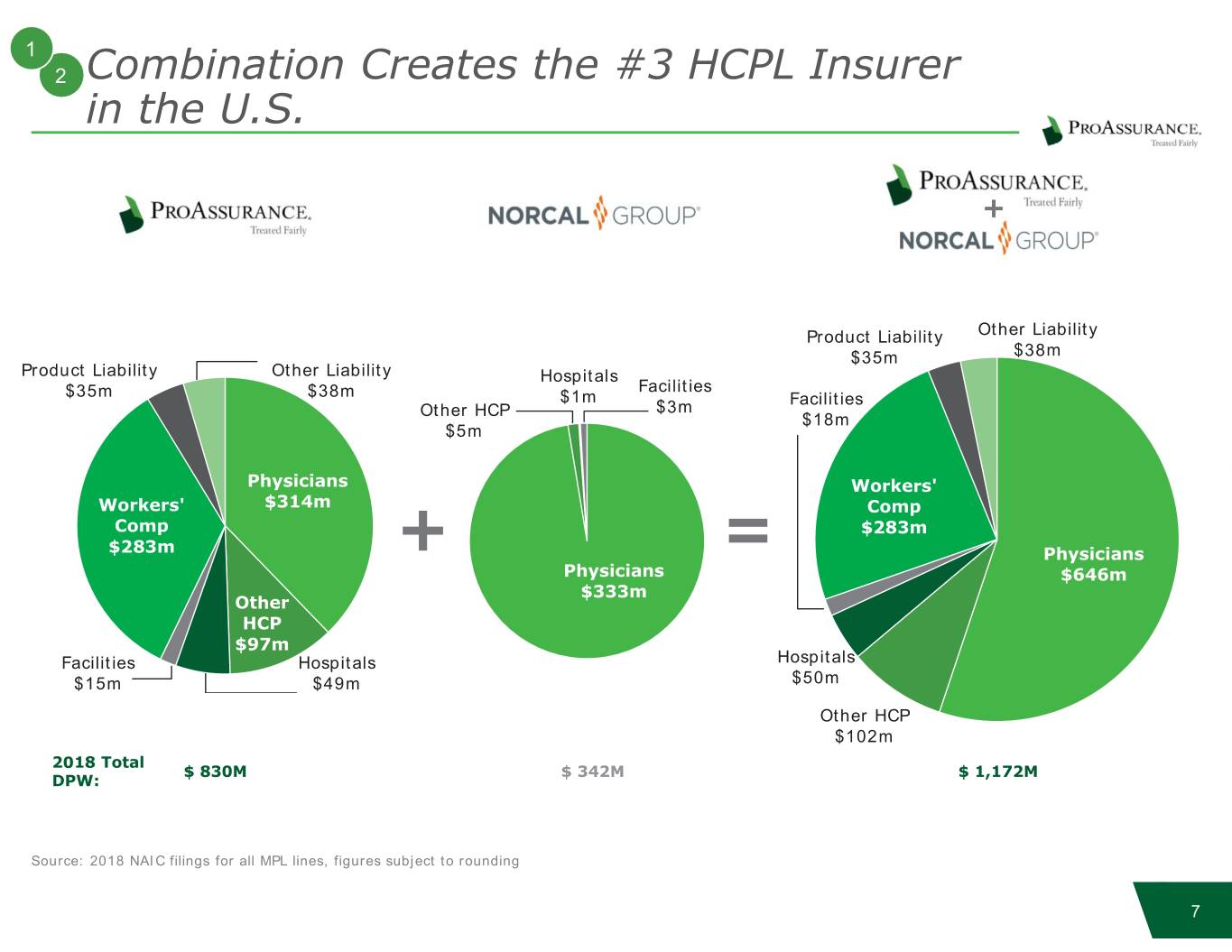

1 2 Combination Creates the #3 HCPL Insurer in the U.S. + Product Liability Other Liability $35m $38m Product Liability Other Liability Hospitals Facilities $35m $38m $1m Facilities Other HCP $3m $18m $5m Physicians Workers' Workers' $314m Comp Comp $283m $283m + = Physicians Physicians $646m $333m Other HCP $97m Facilities Hospitals Hospitals $15m $49m $50m Other HCP $102m 2018 Total $ 830M $ 342M $ 1,172M DPW: Source: 2018 NAIC filings for all MPL lines, figures subject to rounding 7

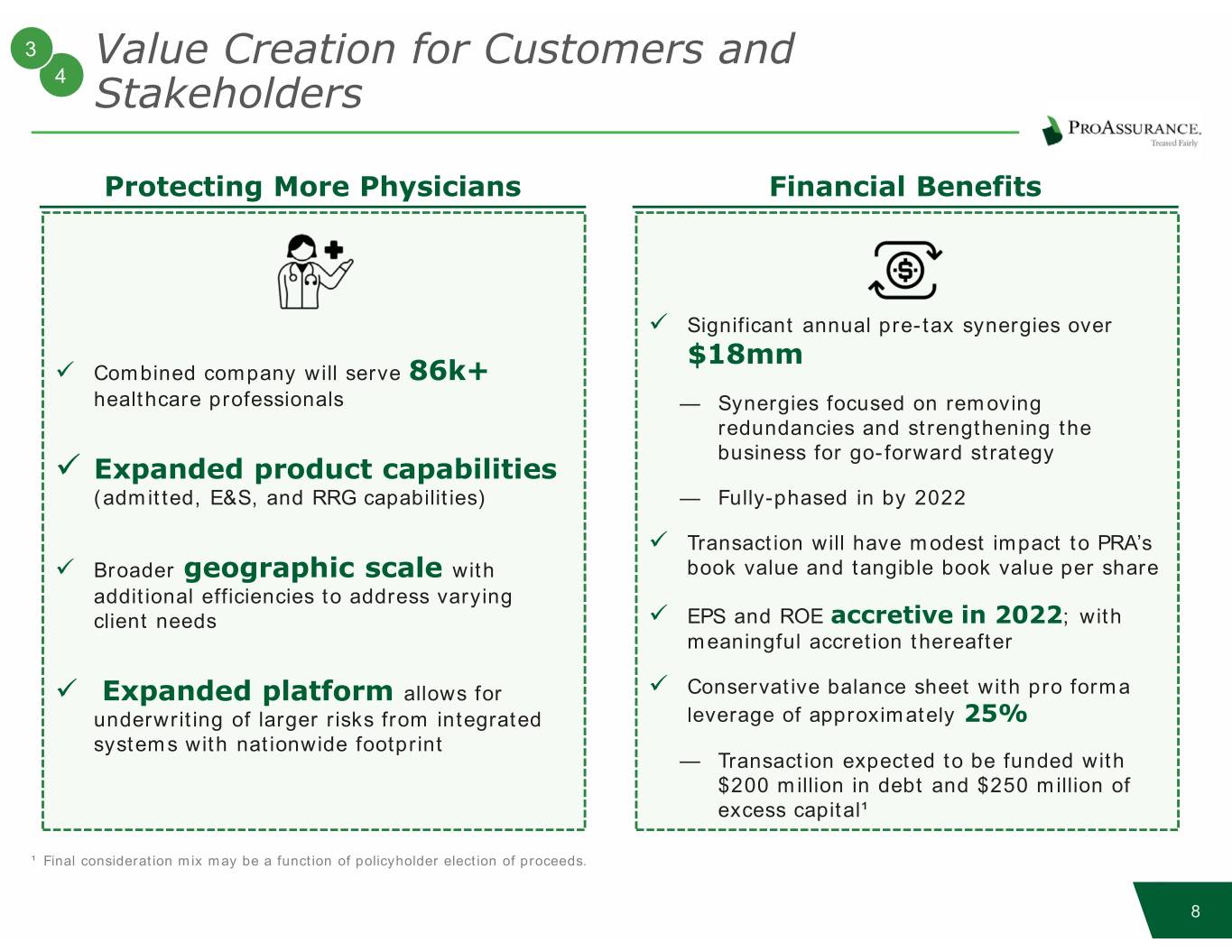

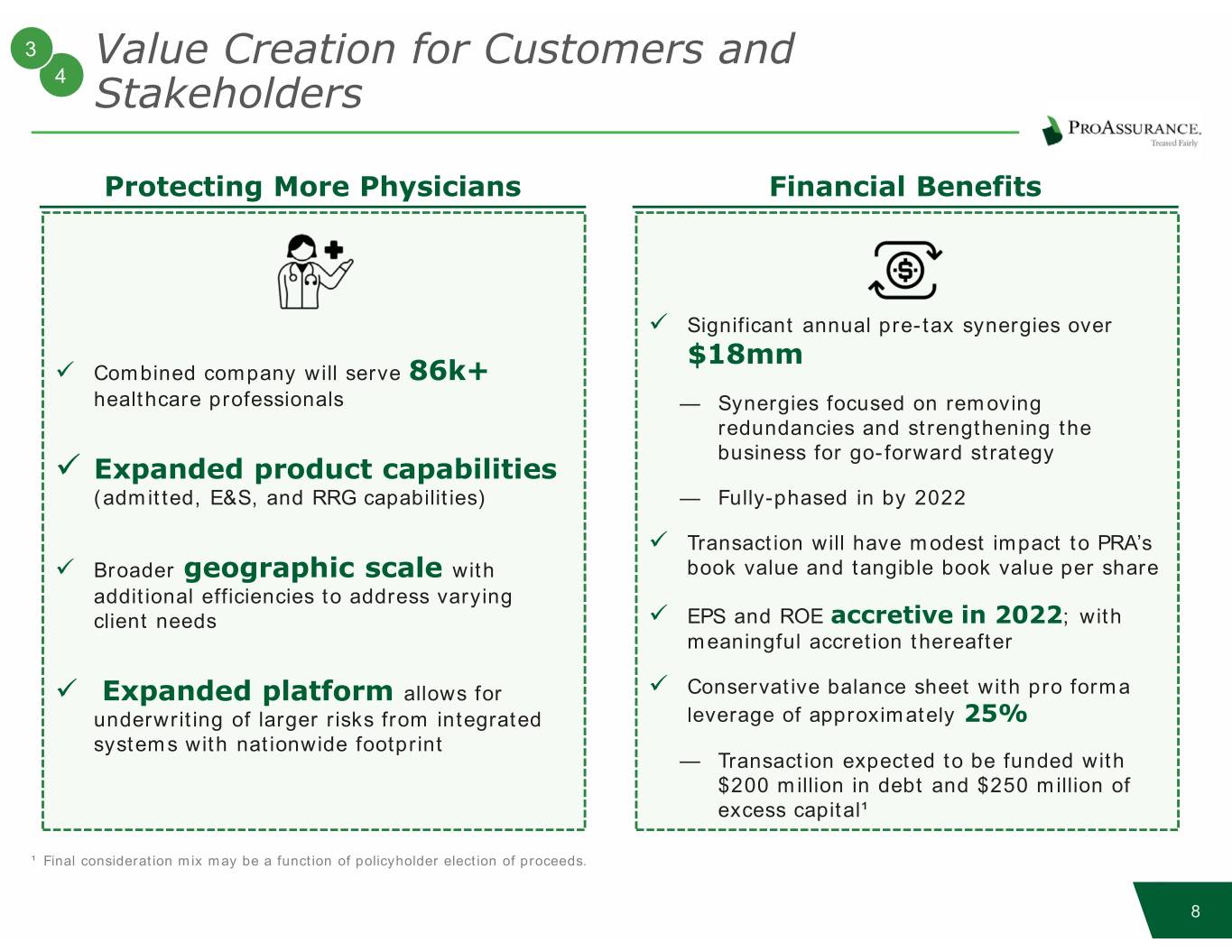

3 Value Creation for Customers and 4 Stakeholders Protecting More Physicians Financial Benefits 9 Significant annual pre-tax synergies over $18mm 9 Combined company will serve 86k+ healthcare professionals — Synergies focused on removing redundancies and strengthening the business for go-forward strategy 9 Expanded product capabilities (admitted, E&S, and RRG capabilities) — Fully-phased in by 2022 9 Transaction will have modest impact to PRA’s 9 Broader geographic scale with book value and tangible book value per share additional efficiencies to address varying client needs 9 EPS and ROE accretive in 2022; with meaningful accretion thereafter 9 Expanded platform allows for 9 Conservative balance sheet with pro forma underwriting of larger risks from integrated leverage of approximately 25% systems with nationwide footprint — Transaction expected to be funded with $200 million in debt and $250 million of excess capital¹ ¹ Final consideration mix may be a function of policyholder election of proceeds. 8

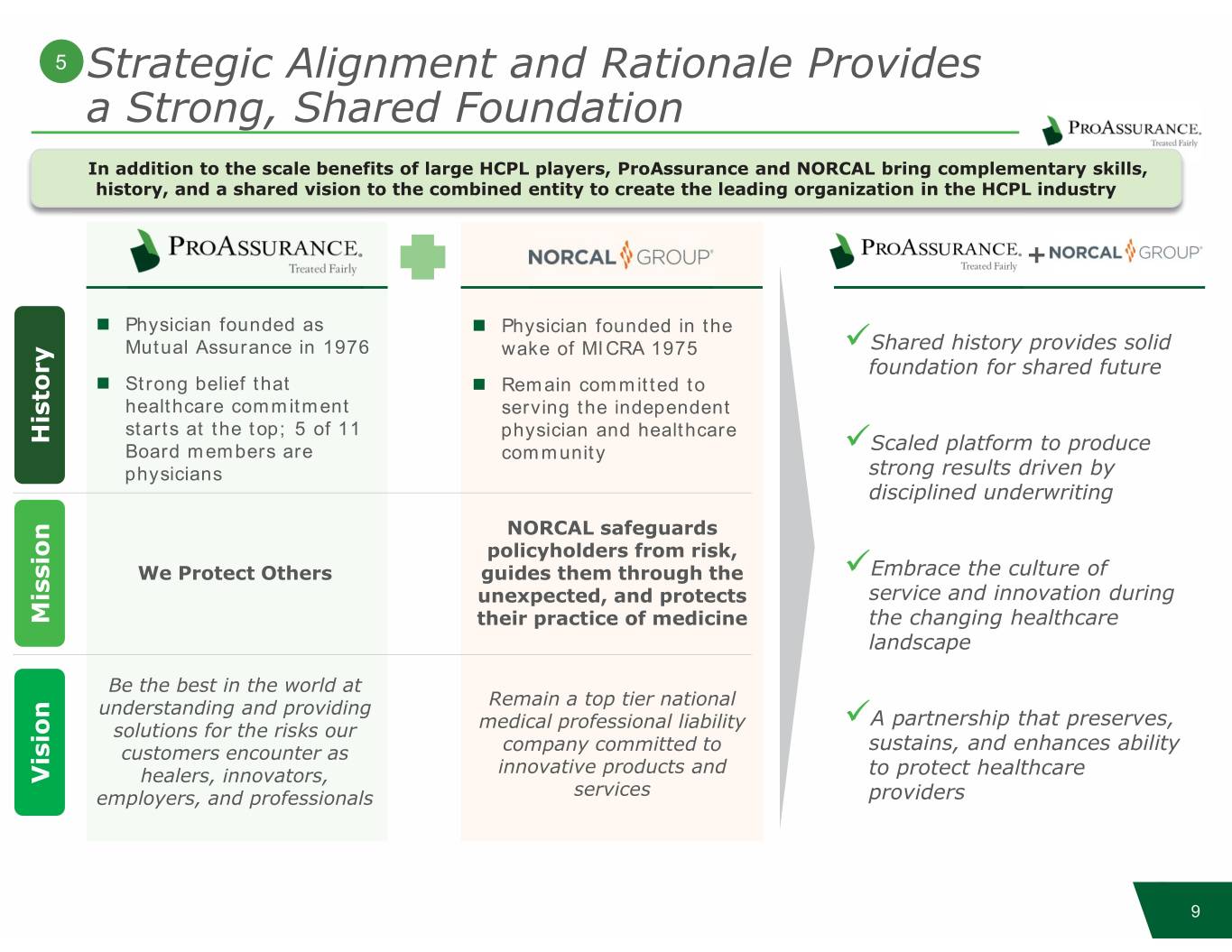

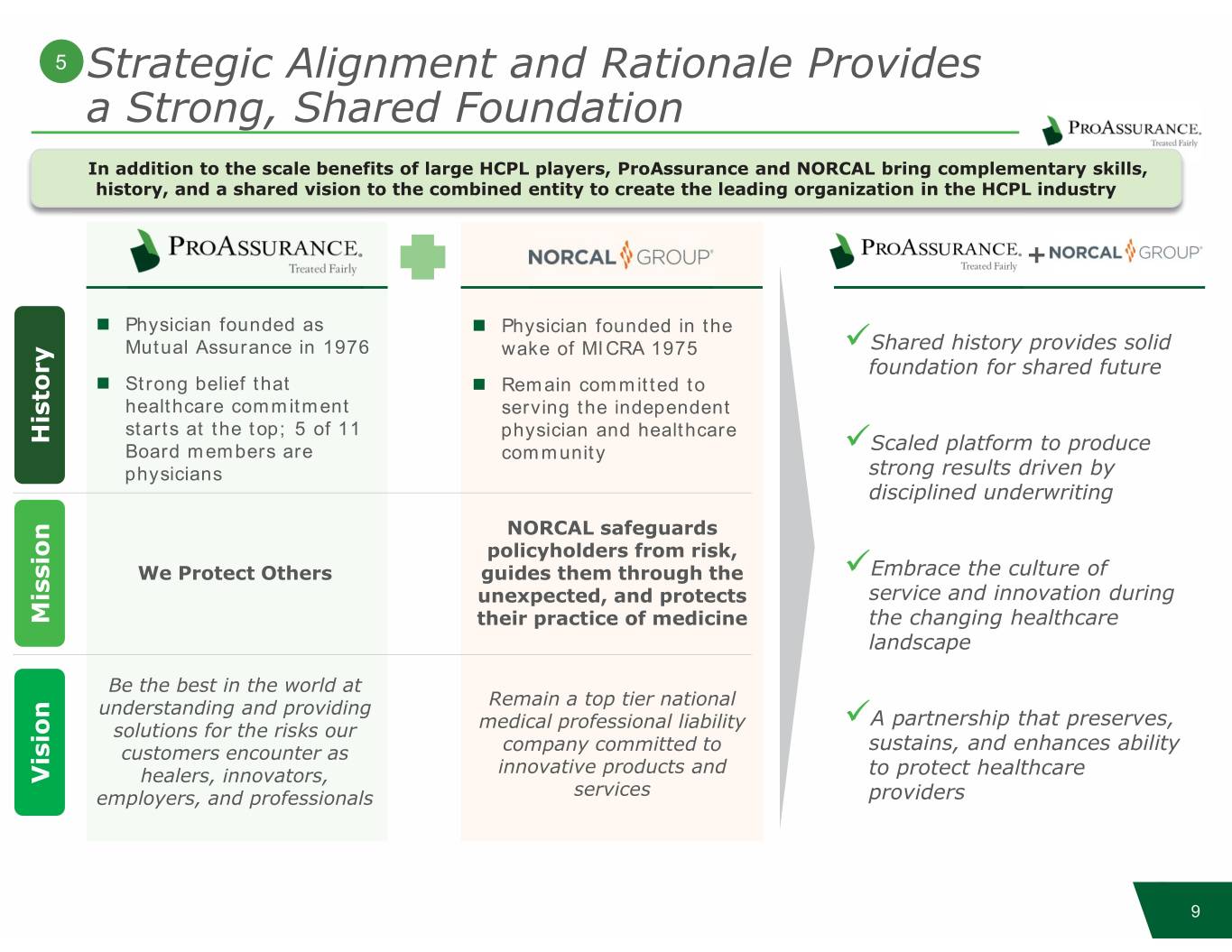

5 Strategic Alignment and Rationale Provides a Strong, Shared Foundation In addition to the scale benefits of large HCPL players, ProAssurance and NORCAL bring complementary skills, history, and a shared vision to the combined entity to create the leading organization in the HCPL industry + „ Physician founded as „ Physician founded in the Mutual Assurance in 1976 wake of MICRA 1975 9Shared history provides solid foundation for shared future „ Strong belief that „ Remain committed to healthcare commitment serving the independent starts at the top; 5 of 11 physician and healthcare History History Board members are community 9Scaled platform to produce physicians strong results driven by disciplined underwriting NORCAL safeguards policyholders from risk, We Protect Others guides them through the 9Embrace the culture of unexpected, and protects service and innovation during Mission Mission their practice of medicine the changing healthcare landscape Be the best in the world at understanding and providing Remain a top tier national A partnership that preserves, solutions for the risks our medical professional liability 9 customers encounter as company committed to sustains, and enhances ability innovative products and to protect healthcare Vision Vision healers, innovators, employers, and professionals services providers 9

5 ProAssurance’s Proven History of Successful Acquisitions 1995 Acquisition 2005 Acquisition 2009 Acquisition & 2014 Acquisition 1998 Demutualization/Merger 2008 Acquisition Forms ProNational 1996 Acquisition 2012 Acquisition 2001 ProNational & Medical Assurance Merge to Form ProAssurance& OHiC 1995 Acquisitions 2004 Hospital 2008 Acquisition 2020 Renewal Rights Acquisition Purchase 2013 Acquisition 1999 Acquisition 1996 Acquisition 2010 Acquisition 1994 Acquisition 2006 Acquisition 10

Acquisition of NORCAL: Stronger, Better Positioned HCPL Specialty Insurer 1 Enhanced Scale and Capabilities 2 Product, Customer, & Geographic Diversification 3 Conservatively Priced and Financed Transaction 4 Value Creation for Customers and All Key Stakeholders 5 Strong Strategic Alignment and Rationale 11