Second Quarter 2022 September

ProAssurance Overview

ProAssurance Investor Briefing | September 2022 3 Mission, Vision, & Values The ProAssurance Mission We exist to Protect Others. Corporate Values Integrity | Leadership | Relationships | Enthusiasm Our Brand Promise We will honor these values in the execution of treated fairly to perform our mission and realize our vision.

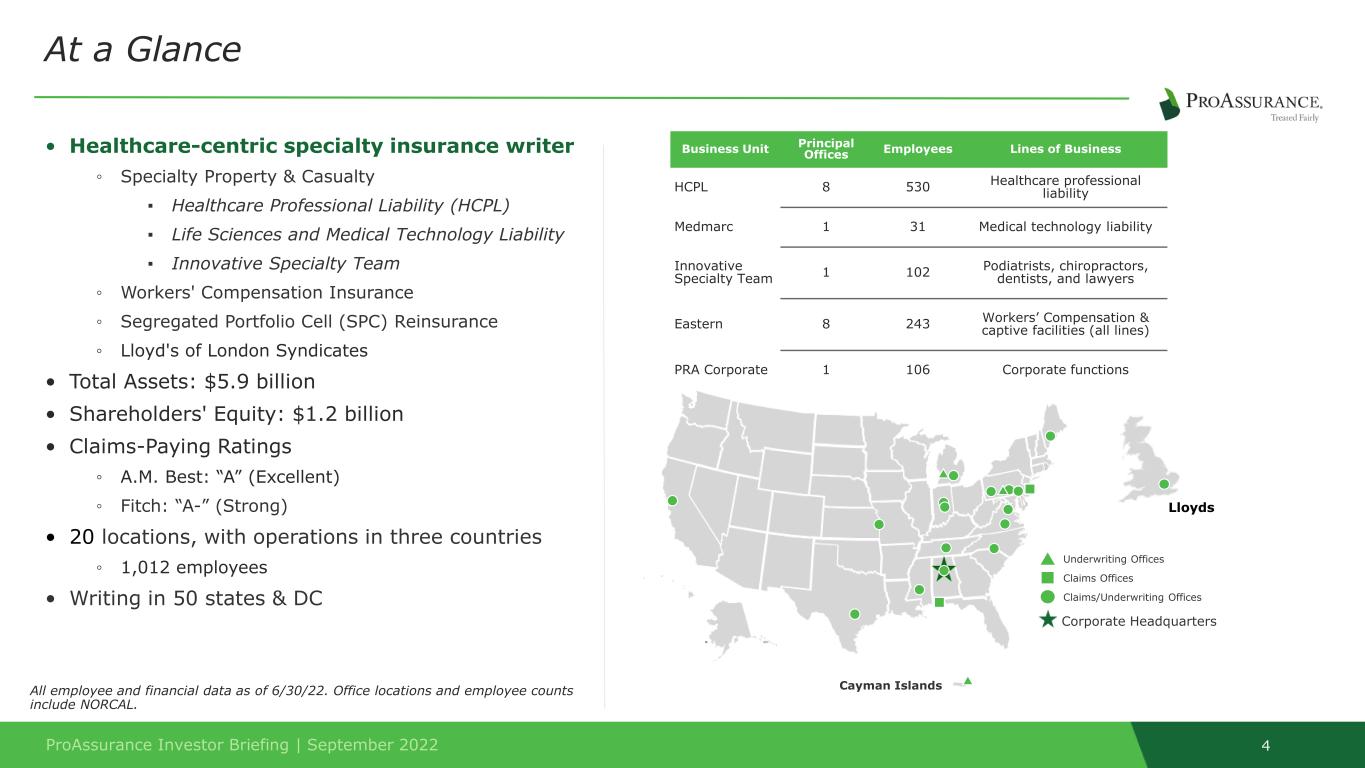

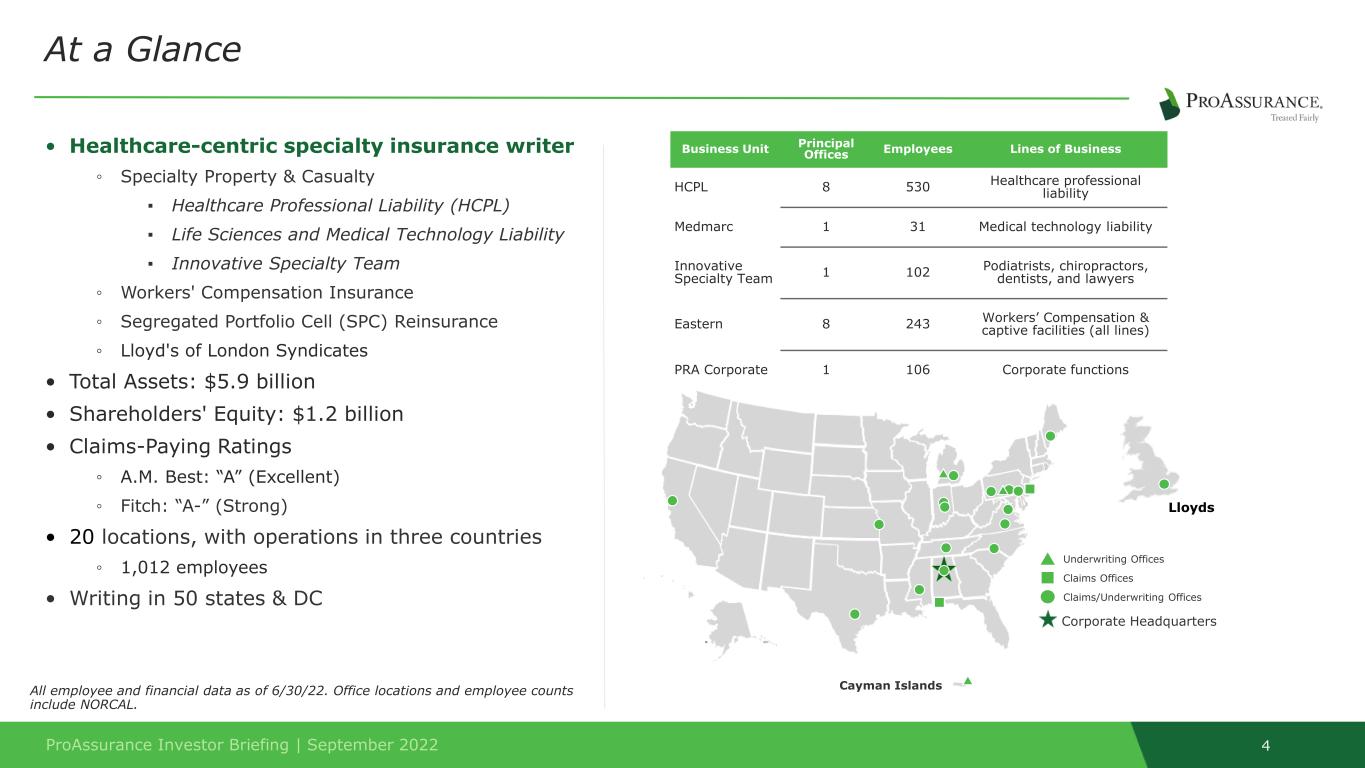

ProAssurance Investor Briefing | September 2022 4 At a Glance All employee and financial data as of 6/30/22. Office locations and employee counts include NORCAL. Business Unit Principal Offices Employees Lines of Business HCPL 8 530 Healthcare professional liability Medmarc 1 31 Medical technology liability Innovative Specialty Team 1 102 Podiatrists, chiropractors, dentists, and lawyers Eastern 8 243 Workers’ Compensation & captive facilities (all lines) PRA Corporate 1 106 Corporate functions • Healthcare-centric specialty insurance writer ◦ Specialty Property & Casualty ▪ Healthcare Professional Liability (HCPL) ▪ Life Sciences and Medical Technology Liability ▪ Innovative Specialty Team ◦ Workers' Compensation Insurance ◦ Segregated Portfolio Cell (SPC) Reinsurance ◦ Lloyd's of London Syndicates • Total Assets: $5.9 billion • Shareholders' Equity: $1.2 billion • Claims-Paying Ratings ◦ A.M. Best: “A” (Excellent) ◦ Fitch: “A-” (Strong) • 20 locations, with operations in three countries ◦ 1,012 employees • Writing in 50 states & DC Corporate Headquarters Claims Offices Claims/Underwriting Offices Underwriting Offices Cayman Islands Lloyds

ProAssurance Investor Briefing | September 2022 5 ProAssurance Executive Leadership Ned Rand - President & Chief Executive Officer Mr. Rand became President and CEO in 2019, after serving as COO, CFO, Executive VP, and Senior VP of Finance at ProAssurance since joining the company in 2004. Prior to joining ProAssurance, he served in a number of financial roles for insurance companies. Mr. Rand is a CPA and graduate of Davidson College (B.A., Economics) Mike Boguski President Specialty P&C Noreen Dishart Executive Vice President & Chief Human Resources Officer Dana Hendricks Executive Vice President & Chief Financial Officer Jeff Lisenby Executive Vice President & General Counsel Kevin Shook President Workers’ Compensation & Segregated Portfolio Cell Reinsurance Executive Team bios available on our website at Investor.ProAssurance.com/OD

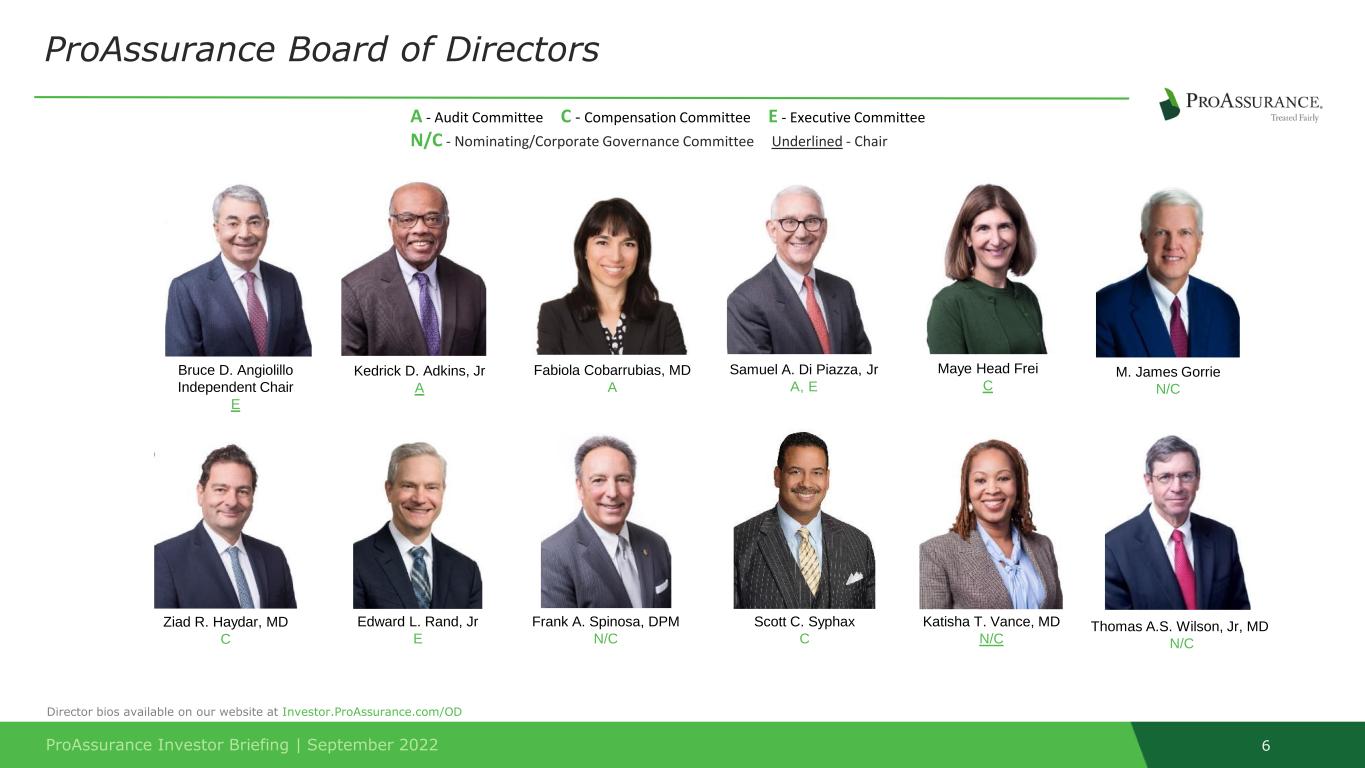

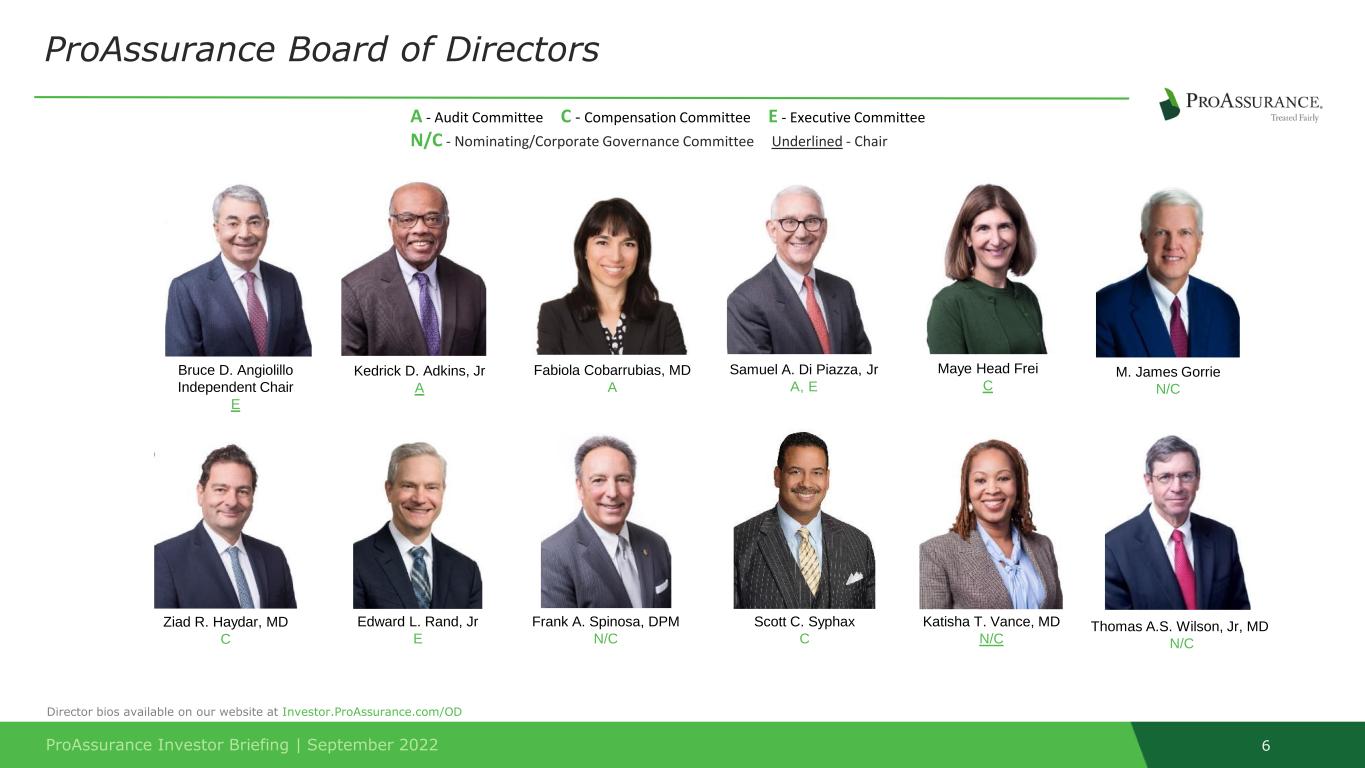

ProAssurance Investor Briefing | September 2022 6 ProAssurance Board of Directors Director bios available on our website at Investor.ProAssurance.com/OD Maye Head Frei C M. James Gorrie N/C Ziad R. Haydar, MD C Edward L. Rand, Jr E Frank A. Spinosa, DPM N/C Katisha T. Vance, MD N/C A - Audit Committee C - Compensation Committee E - Executive Committee N/C - Nominating/Corporate Governance Committee Underlined - Chair Scott C. Syphax C Samuel A. Di Piazza, Jr A, E Fabiola Cobarrubias, MD A Kedrick D. Adkins, Jr A Thomas A.S. Wilson, Jr, MD N/C Bruce D. Angiolillo Independent Chair E

ProAssurance Investor Briefing | September 2022 7 ProAssurance Brand Profile Specialty P&C Healthcare Professional Liability Workers’ Comp Alternative Risk Transfer Medical Technology & Life Sciences Products Liability Legal Professional Liability

ProAssurance Investor Briefing | September 2022 8 ProAssurance Specialty Property & Casualty • Healthcare Professional Liability (HCPL) insures healthcare providers and facilities, including E&S coverages • Innovative Specialty Team (IST) insures podiatrists, chiropractors, dentists, and lawyers • Medmarc insures medical technology and life sciences companies that manufacture or distribute products Eastern Alliance Workers’ Compensation • Specialty underwriter of workers’ compensation products and services • Focused in the East, South, and Midwest regions of the United States • Guaranteed cost, policyholder dividend, retro-rated, deductible, and alternative solutions policies available Inova Re/Eastern Re SPC Reinsurance • Segregated Portfolio Company structure • Workers’ compensation and healthcare professional liability coverage in a Cayman-based captive • Industries include healthcare, forestry, staffing, construction, petroleum, marine and recreation, and social services Lloyd’s Syndicates • The results from our participation in Lloyd's of London Syndicates ProAssurance Corporate • Reports our investment results, interest expense, and U.S. income taxes • Includes corporate expenses and includes non-premium revenues generated outside of our insurance entities • Company-wide administrative departments reside in ProAssurance Corporate ProAssurance Reports Financial Results in Five Segments

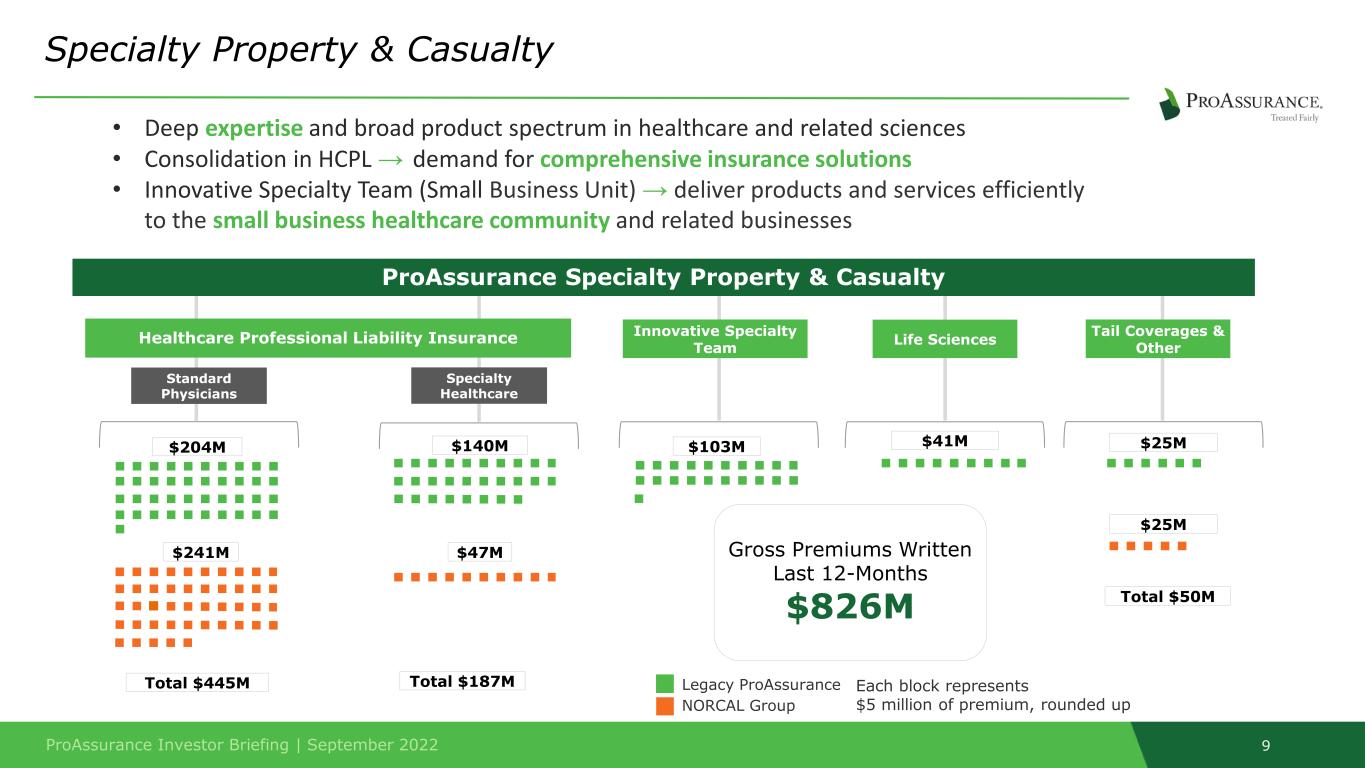

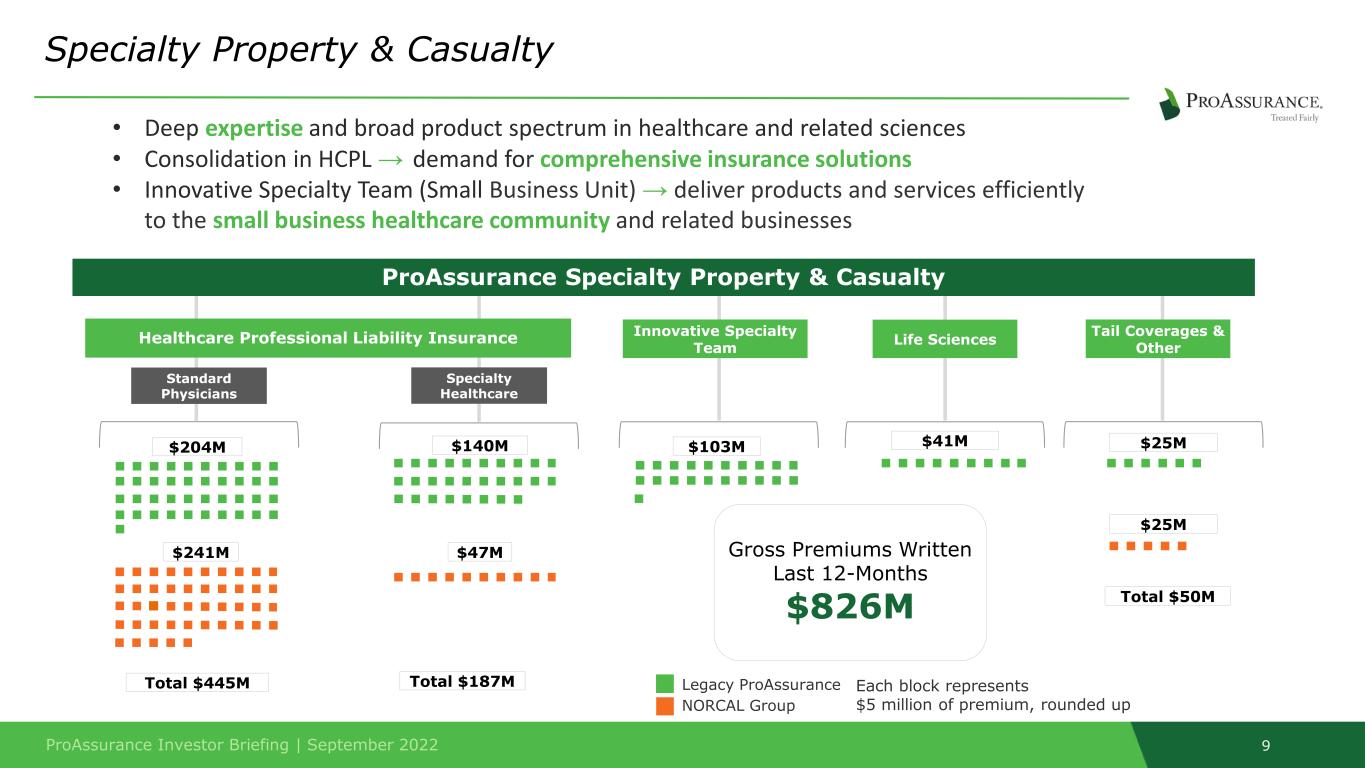

ProAssurance Investor Briefing | September 2022 9 ProAssurance Specialty Property & Casualty Specialty Healthcare Life Sciences Innovative Specialty Team Standard Physicians Healthcare Professional Liability Insurance $204M $241M $41M$103M$140M $47M Each block represents $5 million of premium, rounded up Legacy ProAssurance NORCAL Group Total $445M Total $187M Gross Premiums Written Last 12-Months $826M Specialty Property & Casualty • Deep expertise and broad product spectrum in healthcare and related sciences • Consolidation in HCPL → demand for comprehensive insurance solutions • Innovative Specialty Team (Small Business Unit) → deliver products and services efficiently to the small business healthcare community and related businesses Tail Coverages & Other $25M $25M Total $50M

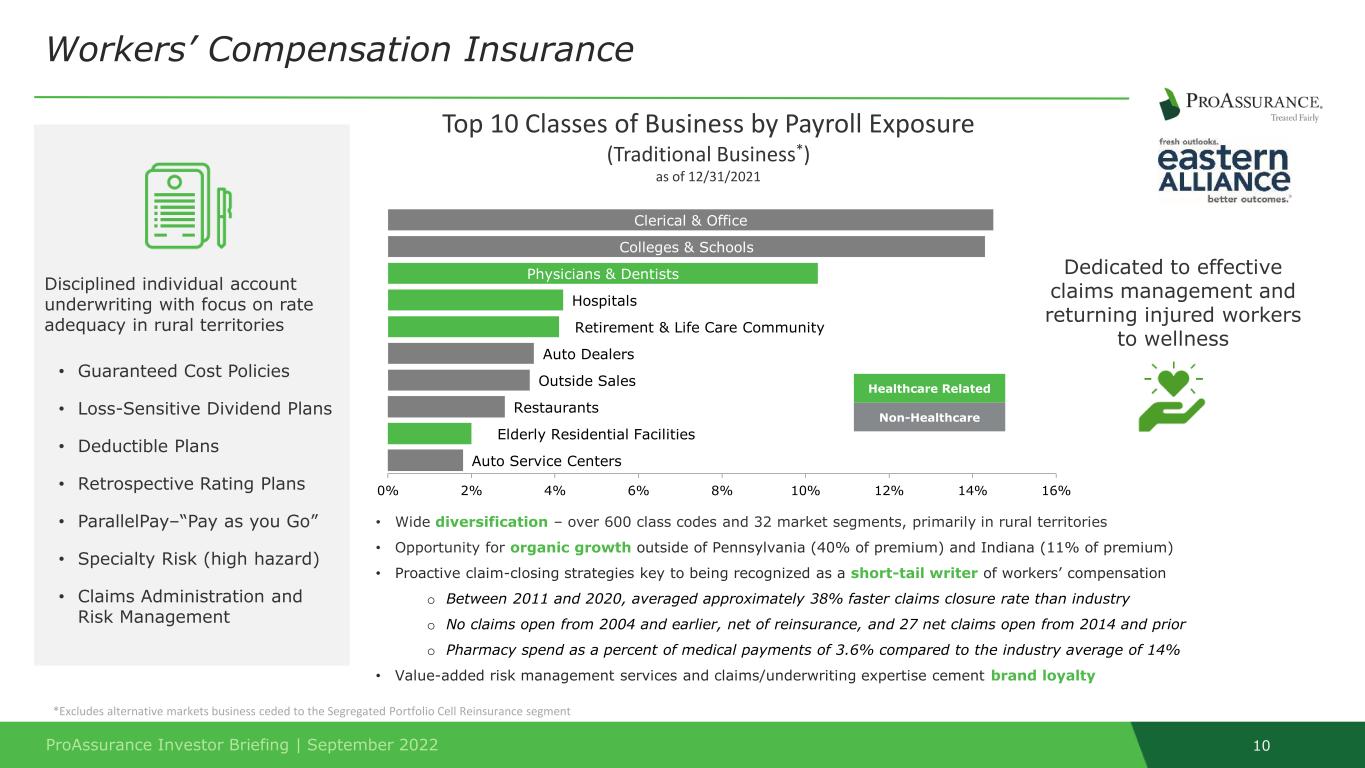

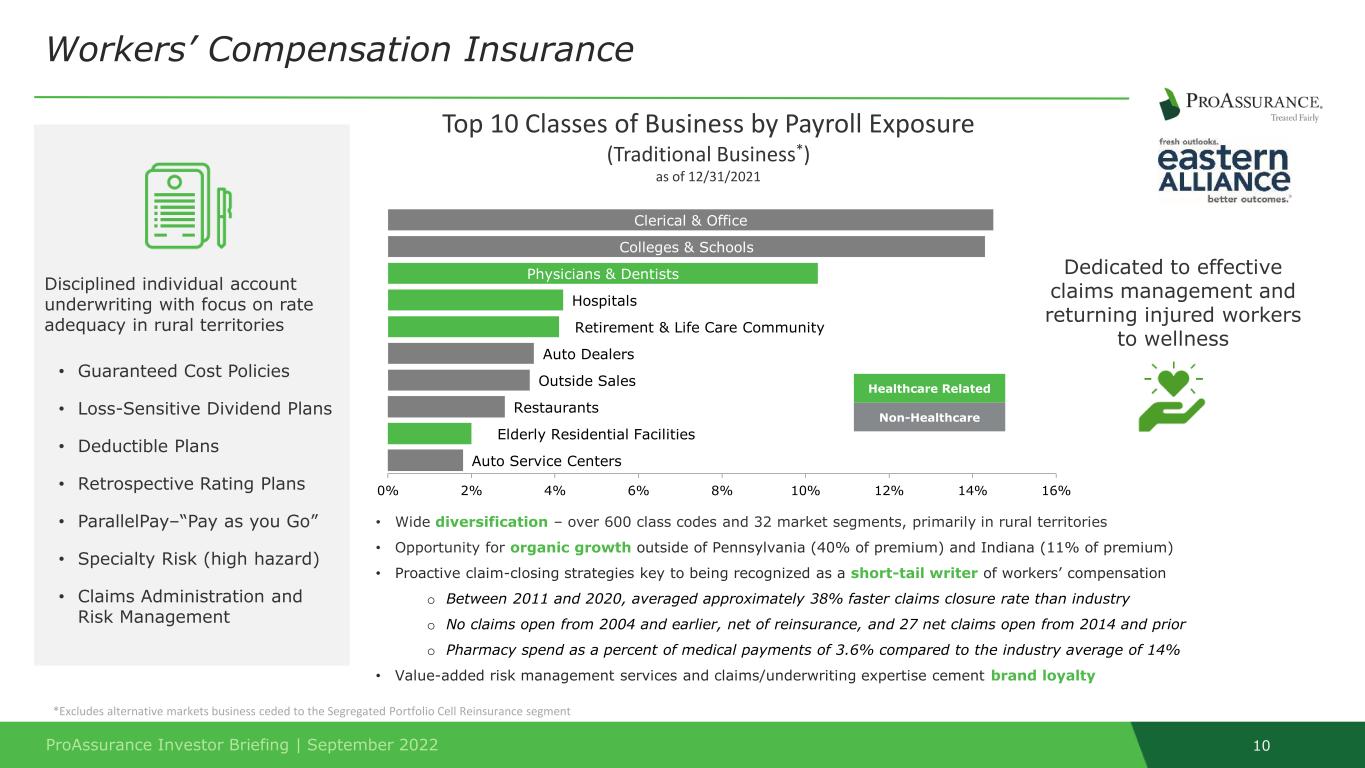

ProAssurance Investor Briefing | September 2022 10 Disciplined individual account underwriting with focus on rate adequacy in rural territories • Guaranteed Cost Policies • Loss-Sensitive Dividend Plans • Deductible Plans • Retrospective Rating Plans • ParallelPay–“Pay as you Go” • Specialty Risk (high hazard) • Claims Administration and Risk Management Workers’ Compensation Insurance • Wide diversification – over 600 class codes and 32 market segments, primarily in rural territories • Opportunity for organic growth outside of Pennsylvania (40% of premium) and Indiana (11% of premium) • Proactive claim-closing strategies key to being recognized as a short-tail writer of workers’ compensation o Between 2011 and 2020, averaged approximately 38% faster claims closure rate than industry o No claims open from 2004 and earlier, net of reinsurance, and 27 net claims open from 2014 and prior o Pharmacy spend as a percent of medical payments of 3.6% compared to the industry average of 14% • Value-added risk management services and claims/underwriting expertise cement brand loyalty Auto Service Centers Elderly Residential Facilities Restaurants Outside Sales Auto Dealers Retirement & Life Care Community Hospitals Physicians & Dentists Colleges & Schools Clerical & Office 0% 2% 4% 6% 8% 10% 12% 14% 16% *Excludes alternative markets business ceded to the Segregated Portfolio Cell Reinsurance segment Dedicated to effective claims management and returning injured workers to wellness Healthcare Related Non-Healthcare Top 10 Classes of Business by Payroll Exposure (Traditional Business*) as of 12/31/2021

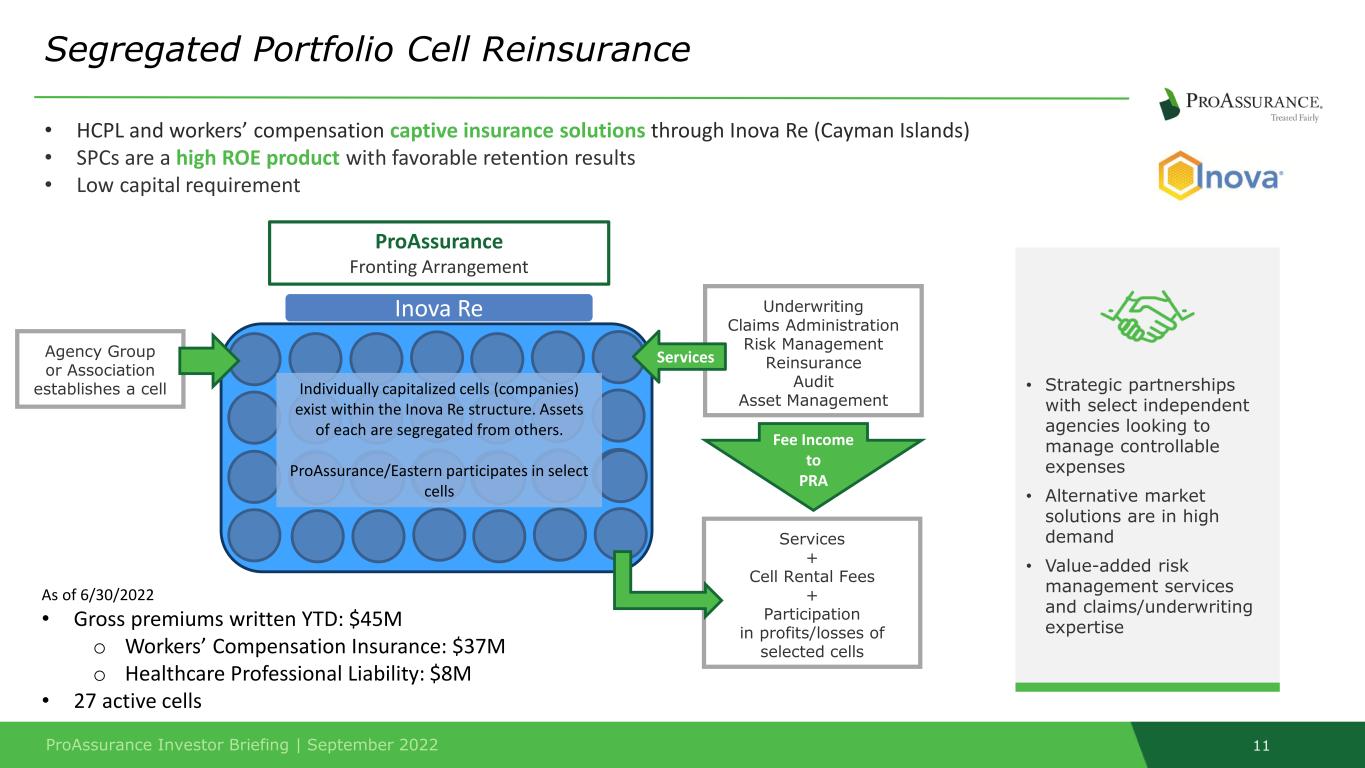

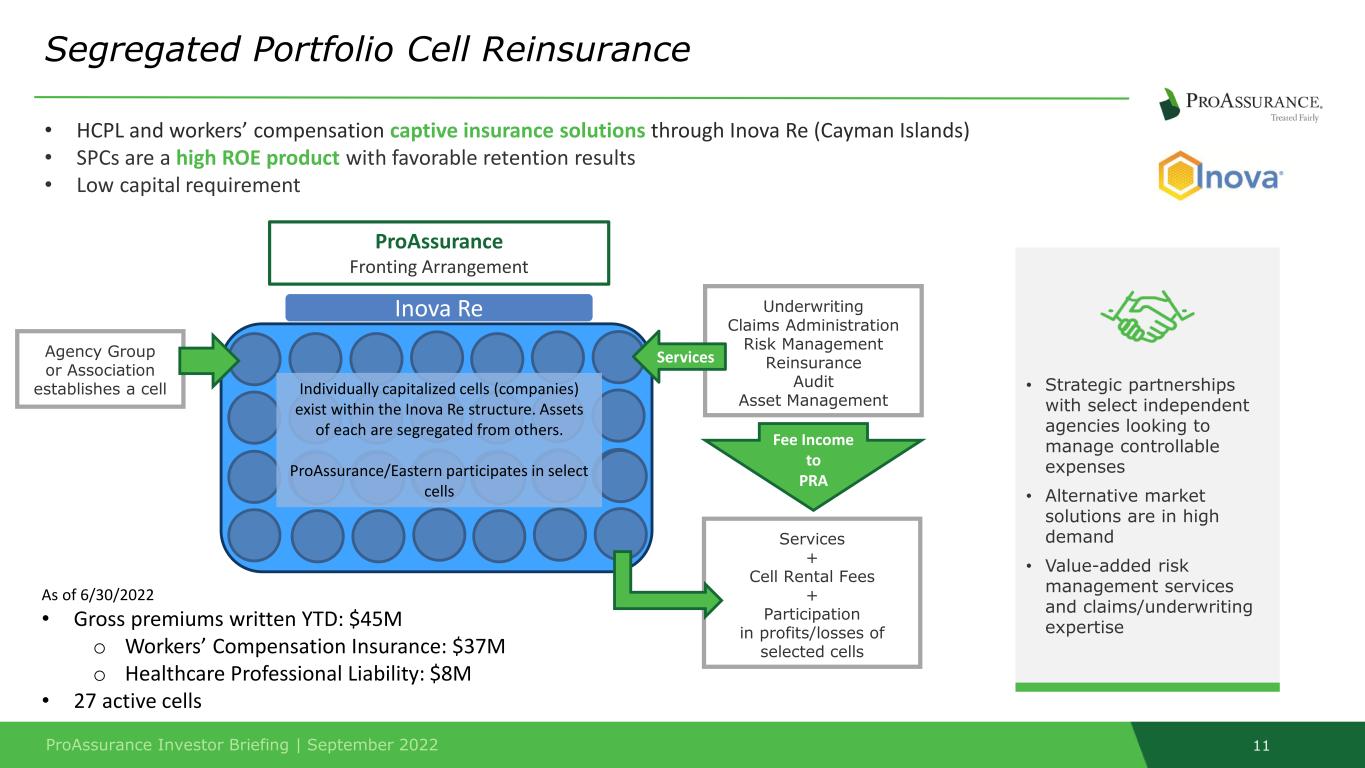

ProAssurance Investor Briefing | September 2022 11 Segregated Portfolio Cell Reinsurance ProAssurance Fronting Arrangement Agency Group or Association establishes a cell Underwriting Claims Administration Risk Management Reinsurance Audit Asset Management Services + Cell Rental Fees + Participation in profits/losses of selected cells Fee Income to PRA • HCPL and workers’ compensation captive insurance solutions through Inova Re (Cayman Islands) • SPCs are a high ROE product with favorable retention results • Low capital requirement • Strategic partnerships with select independent agencies looking to manage controllable expenses • Alternative market solutions are in high demand • Value-added risk management services and claims/underwriting expertise Inova Re Services As of 6/30/2022 • Gross premiums written YTD: $45M o Workers’ Compensation Insurance: $37M o Healthcare Professional Liability: $8M • 27 active cells Individually capitalized cells (companies) exist within the Inova Re structure. Assets of each are segregated from others. ProAssurance/Eastern participates in select cells

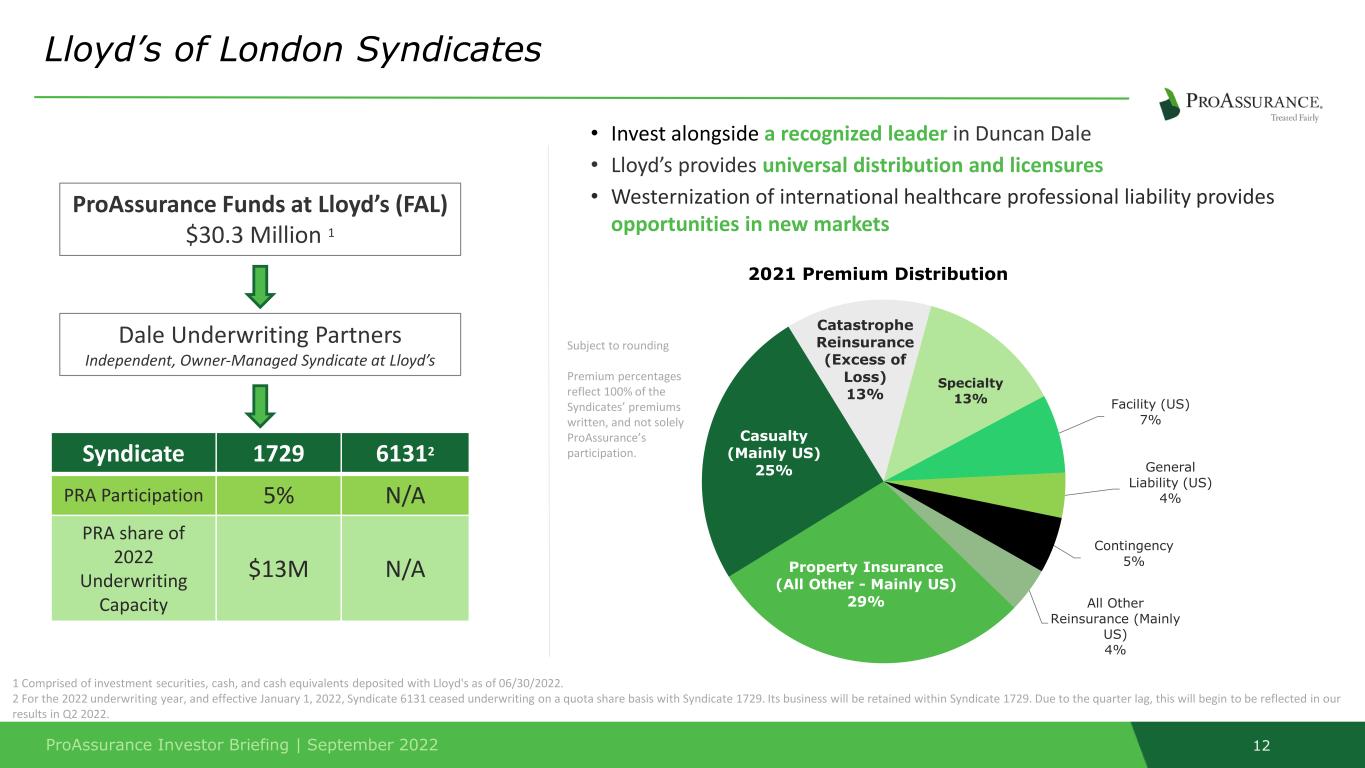

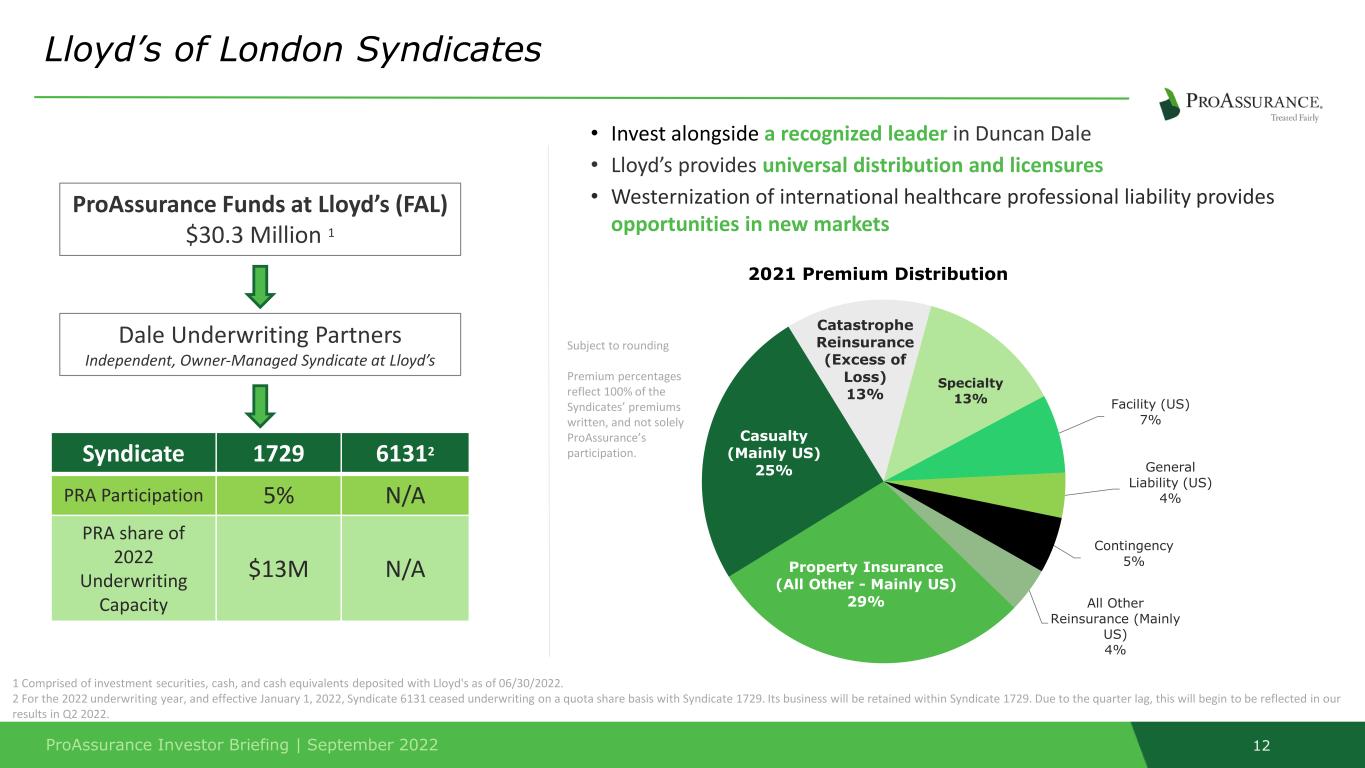

ProAssurance Investor Briefing | September 2022 12 Lloyd’s of London Syndicates ProAssurance Funds at Lloyd’s (FAL) $30.3 Million 1 Property Insurance (All Other - Mainly US) 29% Casualty (Mainly US) 25% Catastrophe Reinsurance (Excess of Loss) 13% Specialty 13% Facility (US) 7% General Liability (US) 4% Contingency 5% All Other Reinsurance (Mainly US) 4% 2021 Premium Distribution Dale Underwriting Partners Independent, Owner-Managed Syndicate at Lloyd’s Syndicate 1729 61312 PRA Participation 5% N/A PRA share of 2022 Underwriting Capacity $13M N/A • Invest alongside a recognized leader in Duncan Dale • Lloyd’s provides universal distribution and licensures • Westernization of international healthcare professional liability provides opportunities in new markets 1 Comprised of investment securities, cash, and cash equivalents deposited with Lloyd's as of 06/30/2022. 2 For the 2022 underwriting year, and effective January 1, 2022, Syndicate 6131 ceased underwriting on a quota share basis with Syndicate 1729. Its business will be retained within Syndicate 1729. Due to the quarter lag, this will begin to be reflected in our results in Q2 2022. Subject to rounding Premium percentages reflect 100% of the Syndicates’ premiums written, and not solely ProAssurance’s participation.

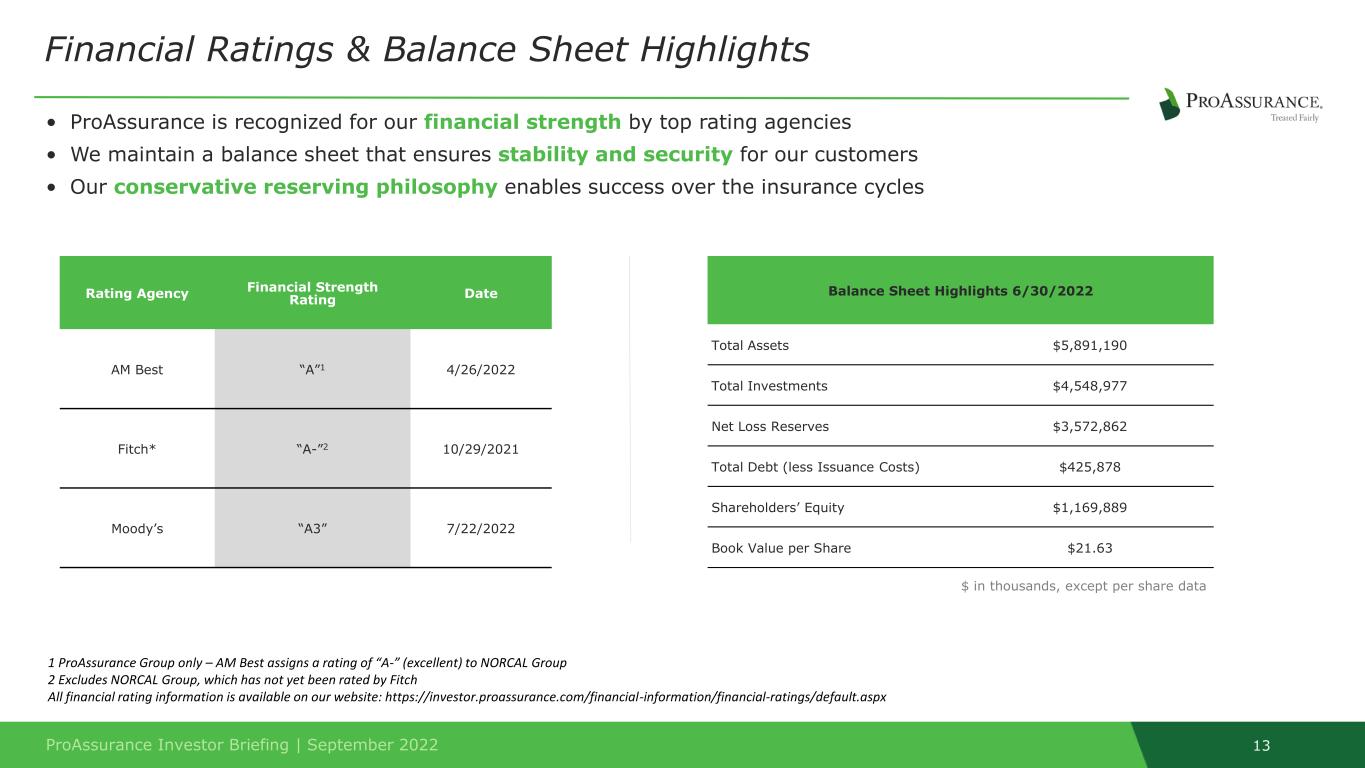

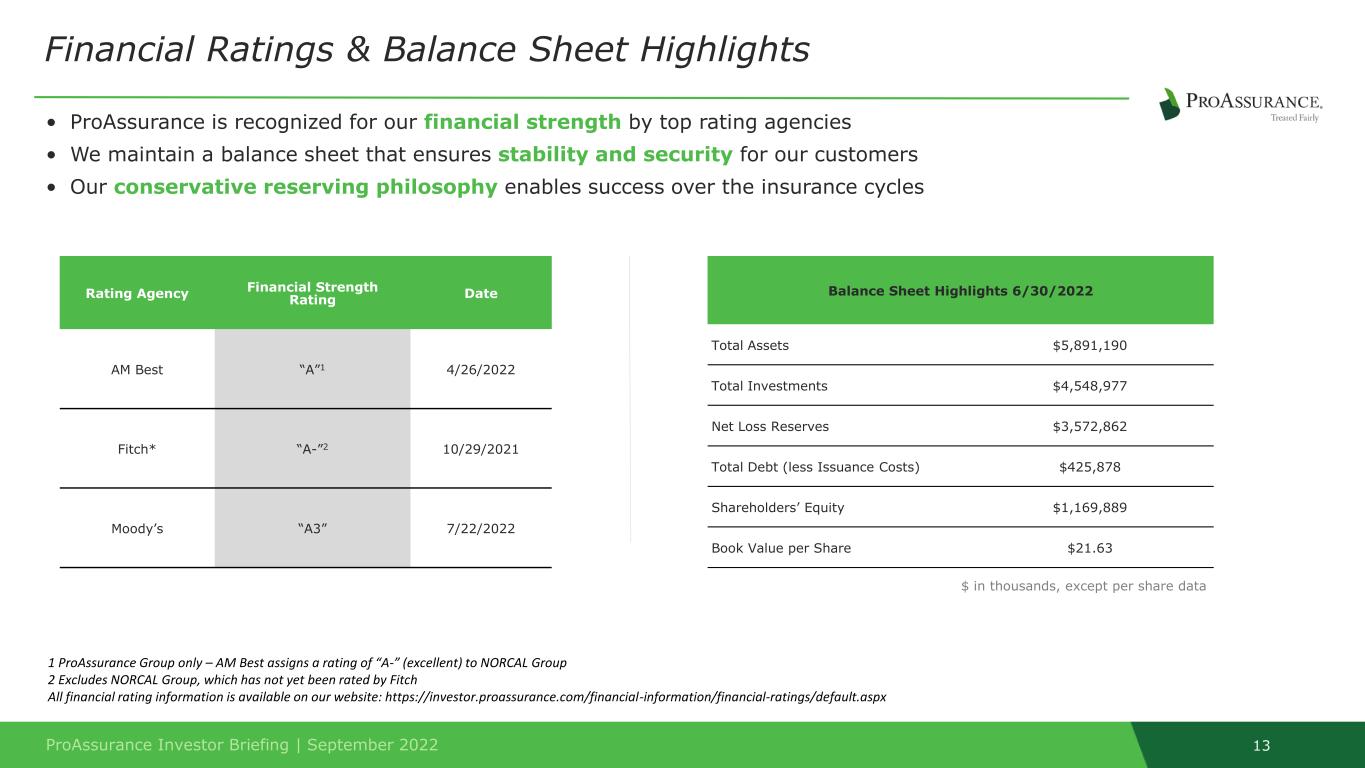

ProAssurance Investor Briefing | September 2022 13 • ProAssurance is recognized for our financial strength by top rating agencies • We maintain a balance sheet that ensures stability and security for our customers • Our conservative reserving philosophy enables success over the insurance cycles Financial Ratings & Balance Sheet Highlights Balance Sheet Highlights 6/30/2022 Total Assets $5,891,190 Total Investments $4,548,977 Net Loss Reserves $3,572,862 Total Debt (less Issuance Costs) $425,878 Shareholders’ Equity $1,169,889 Book Value per Share $21.63 Rating Agency Financial Strength Rating Date AM Best “A”1 4/26/2022 Fitch* “A-”2 10/29/2021 Moody’s “A3” 7/22/2022 $ in thousands, except per share data 1 ProAssurance Group only – AM Best assigns a rating of “A-” (excellent) to NORCAL Group 2 Excludes NORCAL Group, which has not yet been rated by Fitch All financial rating information is available on our website: https://investor.proassurance.com/financial-information/financial-ratings/default.aspx

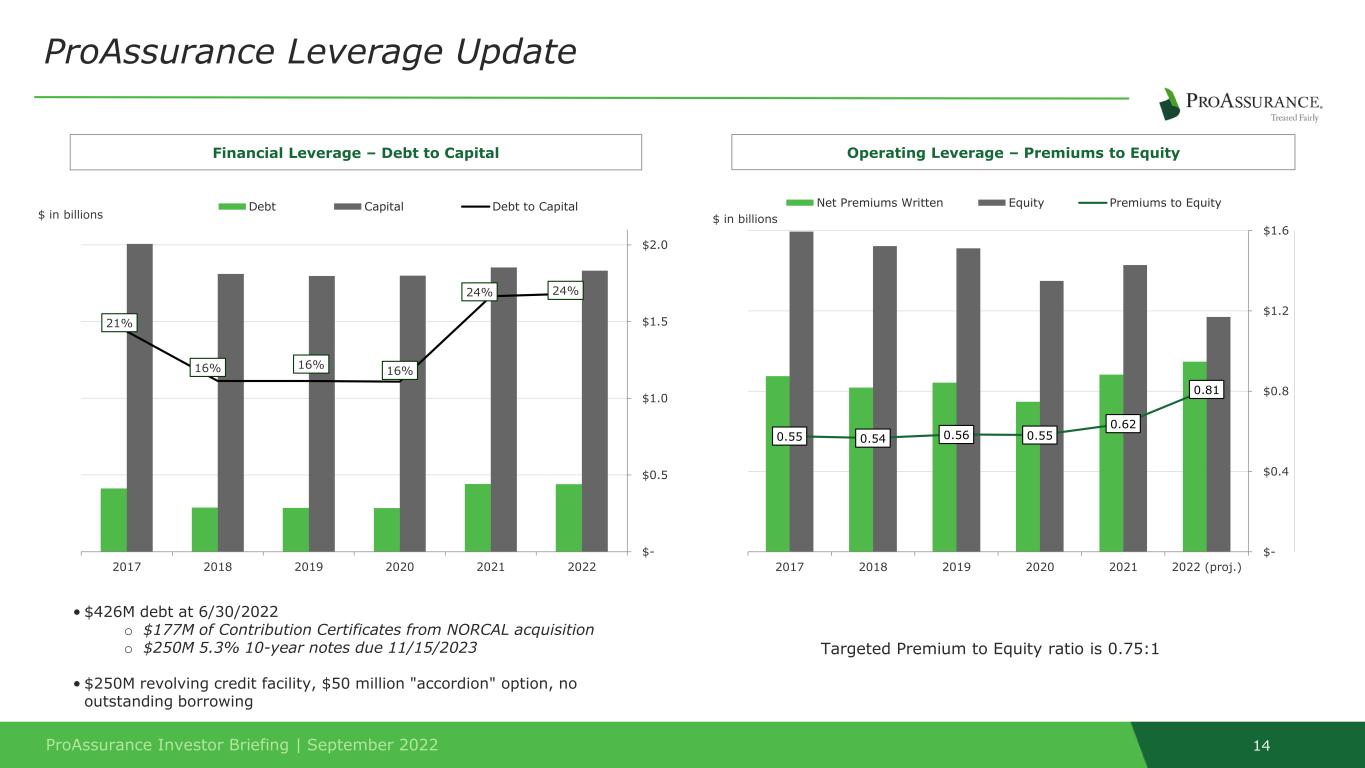

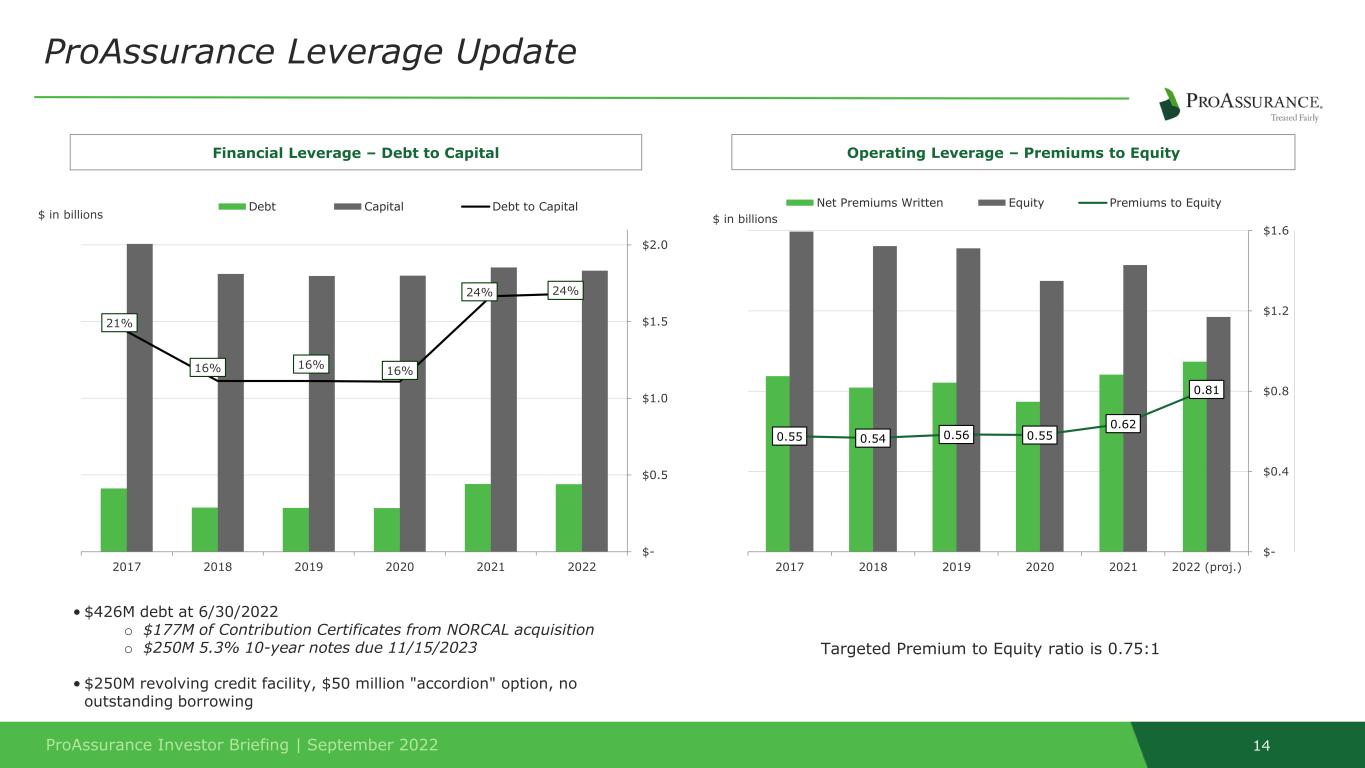

ProAssurance Investor Briefing | September 2022 14 • $426M debt at 6/30/2022 o $177M of Contribution Certificates from NORCAL acquisition o $250M 5.3% 10-year notes due 11/15/2023 • $250M revolving credit facility, $50 million "accordion" option, no outstanding borrowing ProAssurance Leverage Update Targeted Premium to Equity ratio is 0.75:1 Financial Leverage – Debt to Capital Operating Leverage – Premiums to Equity 21% 16% 16% 16% 24% 24% $- $0.5 $1.0 $1.5 $2.0 2017 2018 2019 2020 2021 2022 $ in billions Debt Capital Debt to Capital 0.55 0.54 0.56 0.55 0.62 0.81 $- $0.4 $0.8 $1.2 $1.6 2017 2018 2019 2020 2021 2022 (proj.) $ in billions Net Premiums Written Equity Premiums to Equity

Success in Competitive Markets

ProAssurance Investor Briefing | September 2022 16 A Foundation in Excellence “From our earliest days, we have operated with a strategy both responsive to near-term challenges and proactive to long-term opportunity.” -Ned Rand President & CEO Superior brand identity and reputation in the market Specialization • Deep expertise and commitment to our customers throughout the insurance cycles enable us to outperform our peers over time Experienced & Collaborative Leadership • Average executive leadership tenure of 20 years with PRA or subsidiaries History of Successful M&A • Selective M&A with best-in-class partners, and nearly 20 transactions in our 46 year history Scope & Scale • Regional hubs combined with local knowledge of market dynamics and regulatory environments

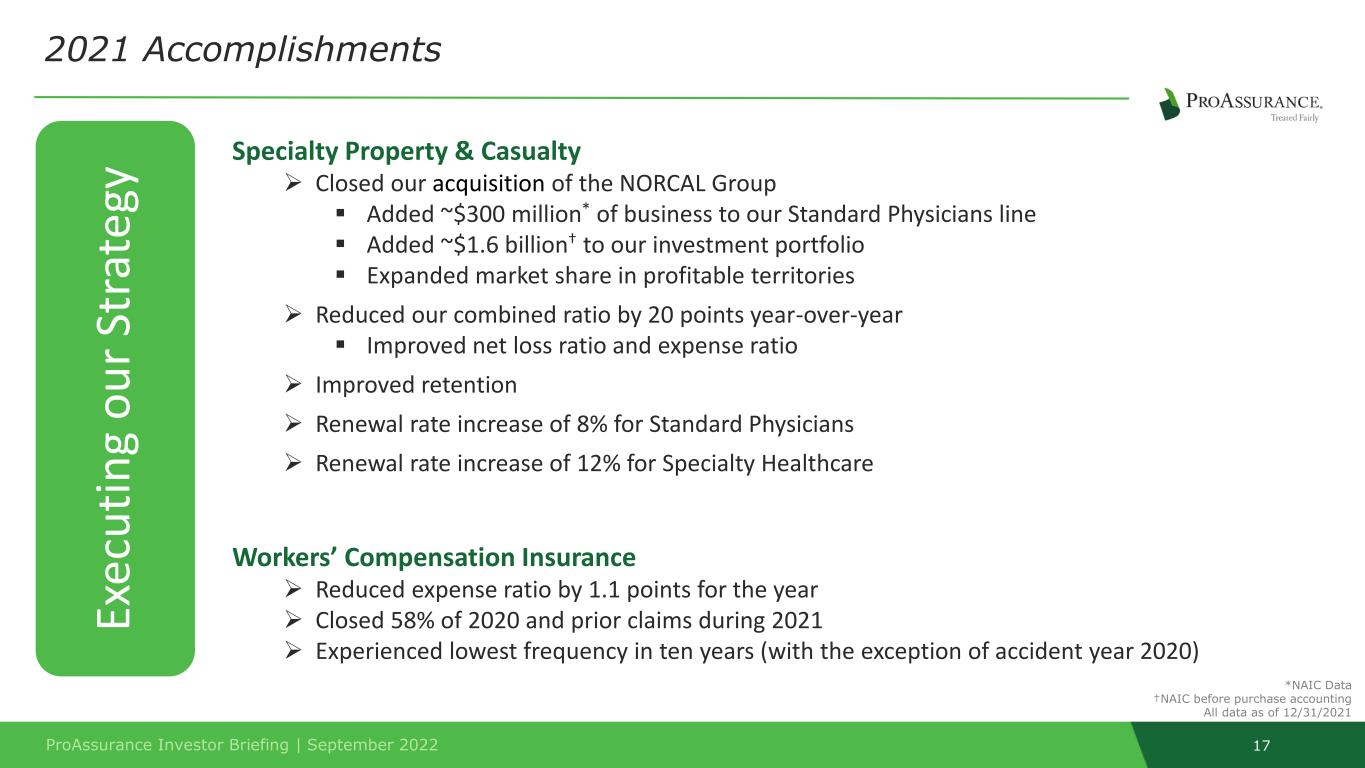

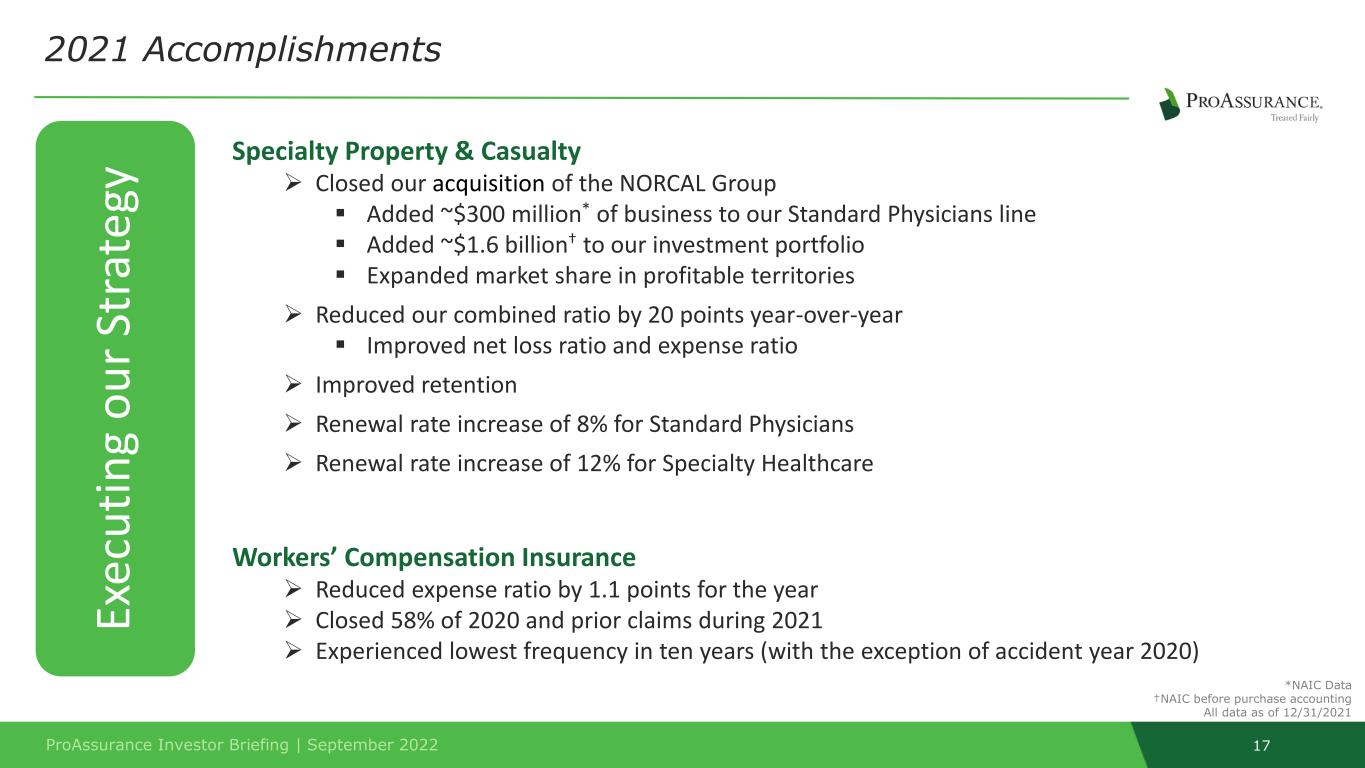

ProAssurance Investor Briefing | September 2022 17 Ex ec u ti n g o u r St ra te gy *NAIC Data †NAIC before purchase accounting All data as of 12/31/2021 Specialty Property & Casualty ➢ Closed our acquisition of the NORCAL Group ▪ Added ~$300 million* of business to our Standard Physicians line ▪ Added ~$1.6 billion† to our investment portfolio ▪ Expanded market share in profitable territories ➢ Reduced our combined ratio by 20 points year-over-year ▪ Improved net loss ratio and expense ratio ➢ Improved retention ➢ Renewal rate increase of 8% for Standard Physicians ➢ Renewal rate increase of 12% for Specialty Healthcare Workers’ Compensation Insurance ➢ Reduced expense ratio by 1.1 points for the year ➢ Closed 58% of 2020 and prior claims during 2021 ➢ Experienced lowest frequency in ten years (with the exception of accident year 2020) 2021 Accomplishments

Appendix

ProAssurance Investor Briefing | September 2022 19 Income Statement Highlights (6/30/22) Three Months Ended Six Months Ended June 30 2022 2021 2022 2021 Gross Premiums Written $ 235.5 $ 208.5 $ 571.1 $ 433.2 Net Premiums Earned $ 247.3 $ 239.0 $ 513.0 $ 426.4 Net Investment Result $ 27.1 $ 29.3 $ 55.2 $ 51.1 Net Investment Gains (Losses) $ (23.9) $ 10.8 $ (37.4) $ 19.7 Total Revenues $ 255.8 $ 281.6 $ 538.9 $ 501.6 Net Losses and Loss Adjustment Expenses $ 177.7 $ 181.9 $ 387.1 $ 331.6 Underwriting, Policy Acquisition & Operating Expenses $ 77.3 $ 77.2 $ 149.1 $ 133.6 Gain on bargain purchase $ — $ 74.4 $ — $ 74.4 Net Income (Loss) (Includes Realized Investment Gains & Losses) $ (1.7) $ 92.1 $ (5.2) $ 99.8 Non-GAAP Operating Income (Loss) $ 16.3 $ 26.6 $ 24.0 $ 28.7 Non-GAAP Operating Income (Loss) per Diluted Share $ 0.30 $ 0.49 $ 0.44 $ 0.53 In millions, except per share data | Subject to rounding

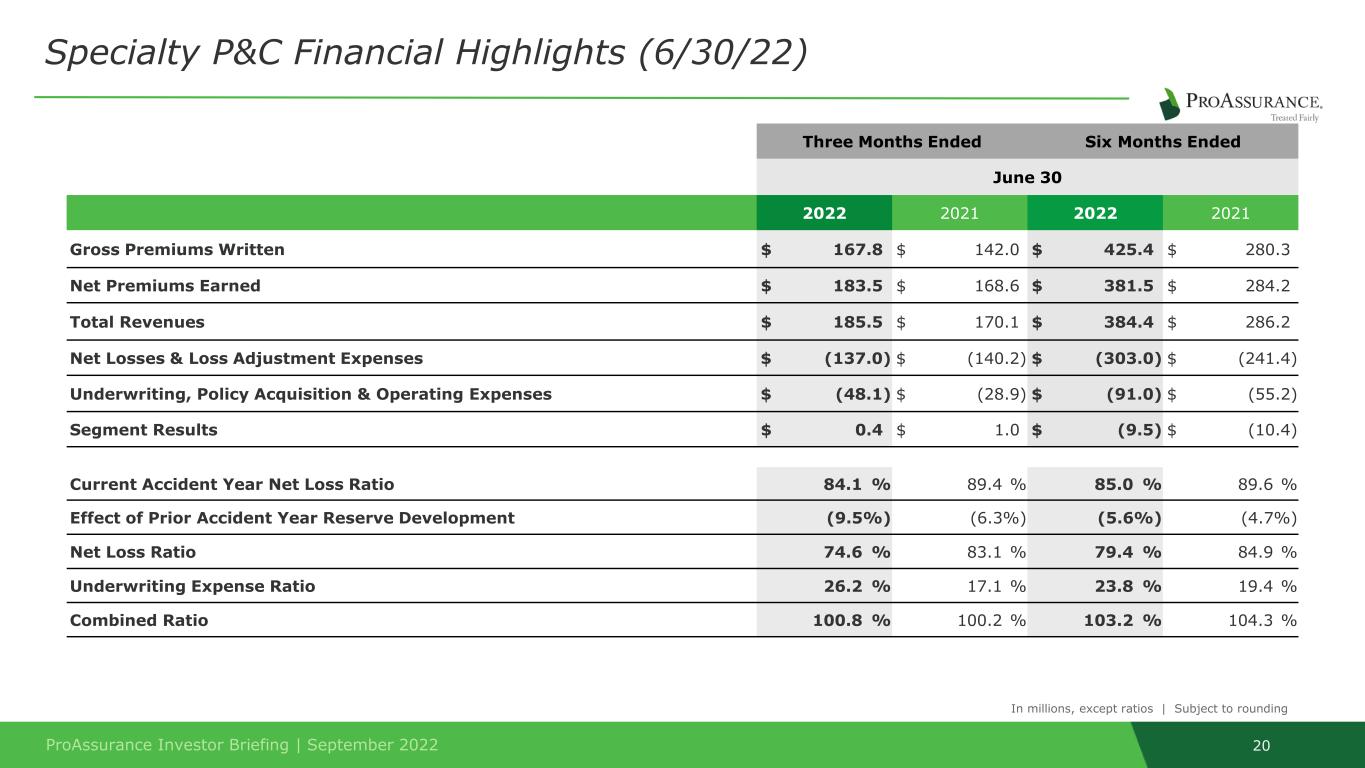

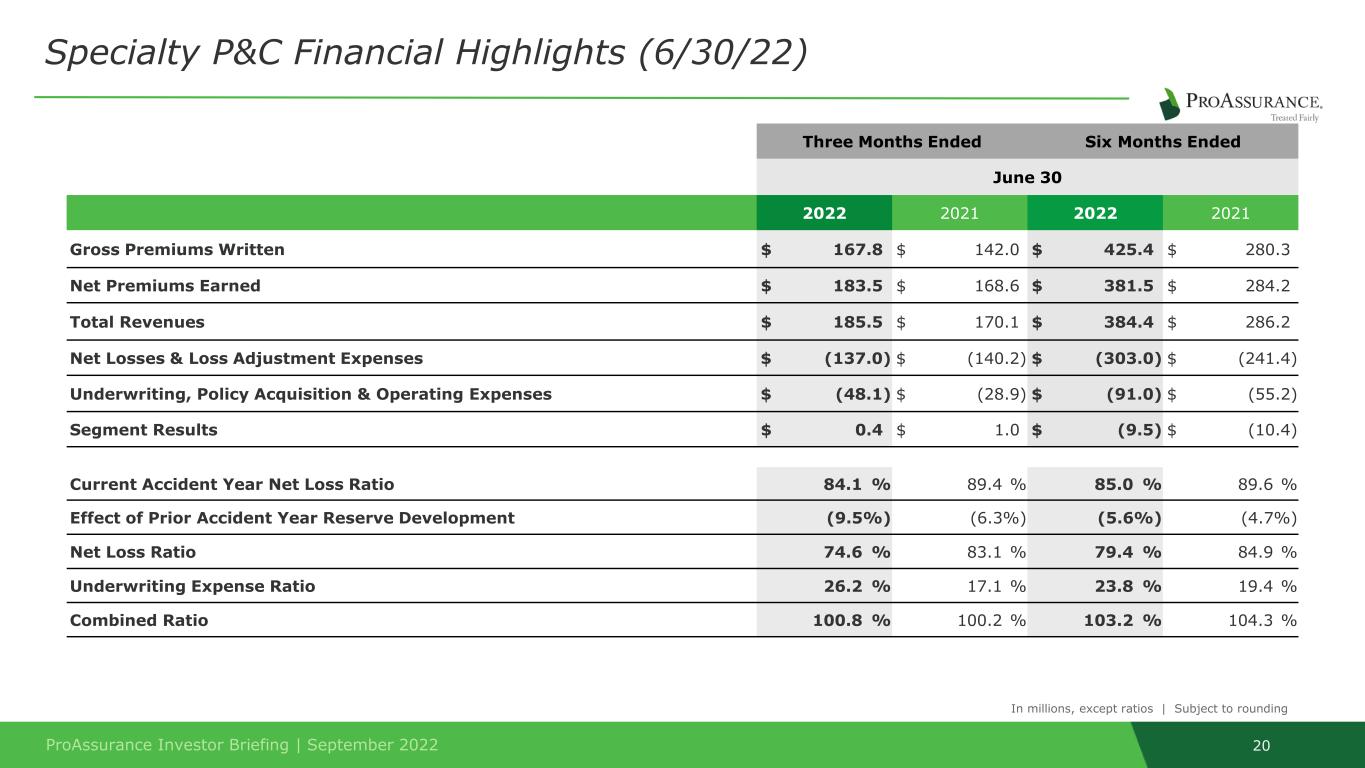

ProAssurance Investor Briefing | September 2022 20 Current Accident Year Net Loss Ratio 84.1 % 89.4 % 85.0 % 89.6 % Effect of Prior Accident Year Reserve Development (9.5%) (6.3%) (5.6%) (4.7%) Net Loss Ratio 74.6 % 83.1 % 79.4 % 84.9 % Underwriting Expense Ratio 26.2 % 17.1 % 23.8 % 19.4 % Combined Ratio 100.8 % 100.2 % 103.2 % 104.3 % Specialty P&C Financial Highlights (6/30/22) Three Months Ended Six Months Ended June 30 2022 2021 2022 2021 Gross Premiums Written $ 167.8 $ 142.0 $ 425.4 $ 280.3 Net Premiums Earned $ 183.5 $ 168.6 $ 381.5 $ 284.2 Total Revenues $ 185.5 $ 170.1 $ 384.4 $ 286.2 Net Losses & Loss Adjustment Expenses $ (137.0) $ (140.2) $ (303.0) $ (241.4) Underwriting, Policy Acquisition & Operating Expenses $ (48.1) $ (28.9) $ (91.0) $ (55.2) Segment Results $ 0.4 $ 1.0 $ (9.5) $ (10.4) In millions, except ratios | Subject to rounding

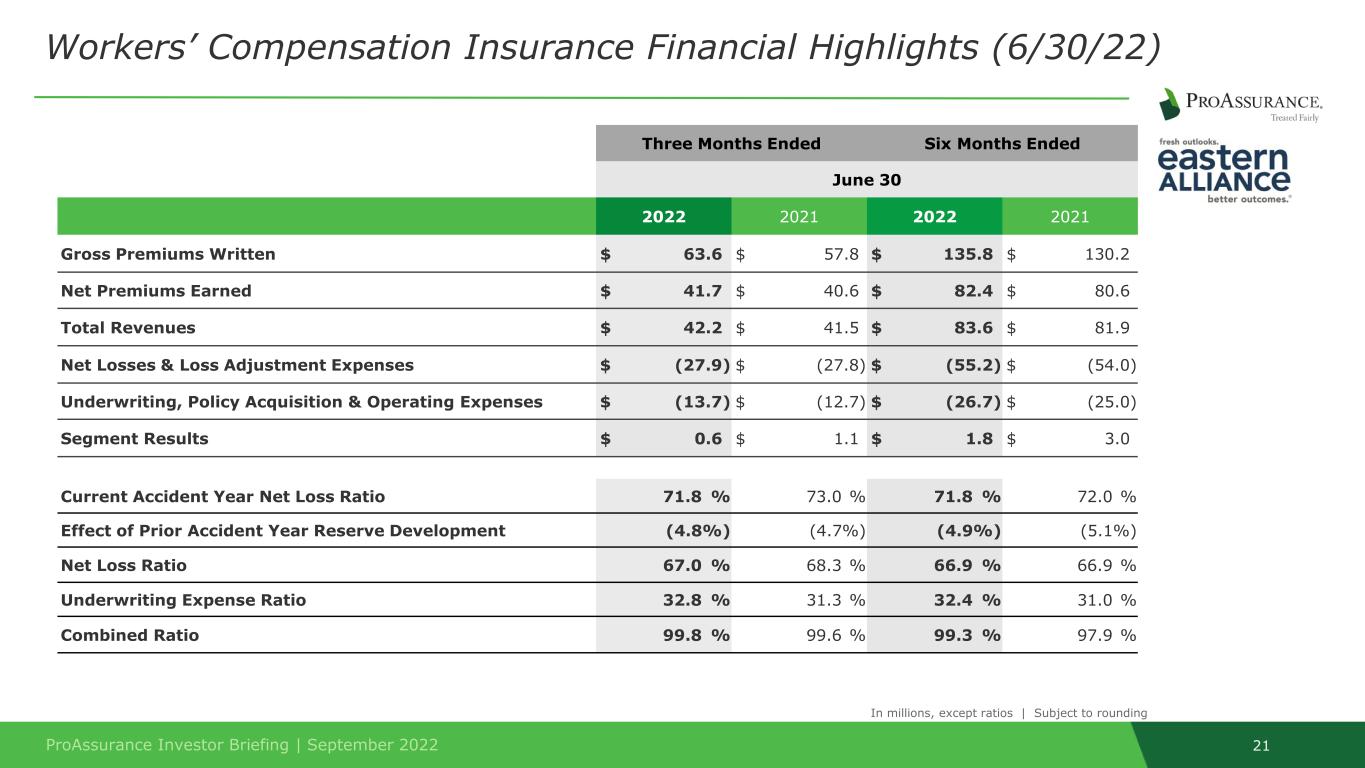

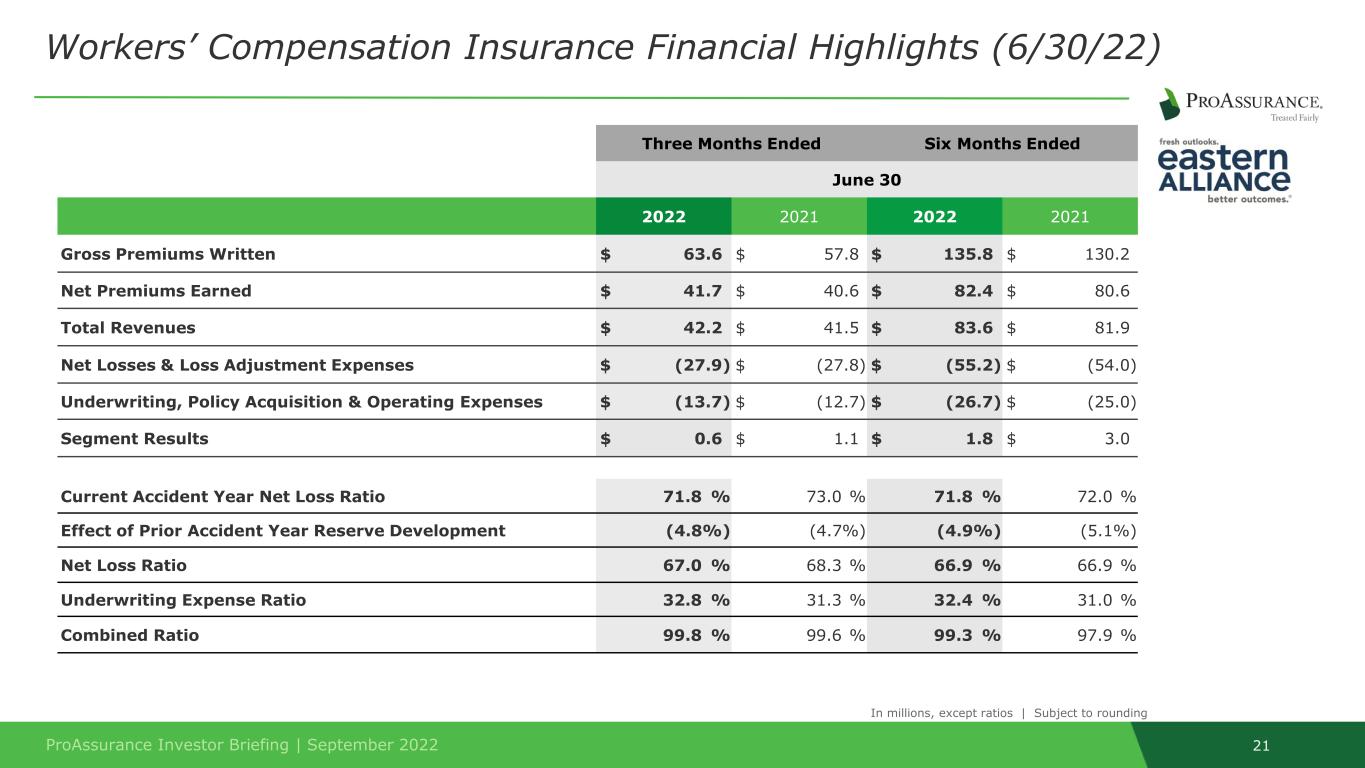

ProAssurance Investor Briefing | September 2022 21 Workers’ Compensation Insurance Financial Highlights (6/30/22) Three Months Ended Six Months Ended June 30 2022 2021 2022 2021 Gross Premiums Written $ 63.6 $ 57.8 $ 135.8 $ 130.2 Net Premiums Earned $ 41.7 $ 40.6 $ 82.4 $ 80.6 Total Revenues $ 42.2 $ 41.5 $ 83.6 $ 81.9 Net Losses & Loss Adjustment Expenses $ (27.9) $ (27.8) $ (55.2) $ (54.0) Underwriting, Policy Acquisition & Operating Expenses $ (13.7) $ (12.7) $ (26.7) $ (25.0) Segment Results $ 0.6 $ 1.1 $ 1.8 $ 3.0 Current Accident Year Net Loss Ratio 71.8 % 73.0 % 71.8 % 72.0 % Effect of Prior Accident Year Reserve Development (4.8%) (4.7%) (4.9%) (5.1%) Net Loss Ratio 67.0 % 68.3 % 66.9 % 66.9 % Underwriting Expense Ratio 32.8 % 31.3 % 32.4 % 31.0 % Combined Ratio 99.8 % 99.6 % 99.3 % 97.9 % In millions, except ratios | Subject to rounding

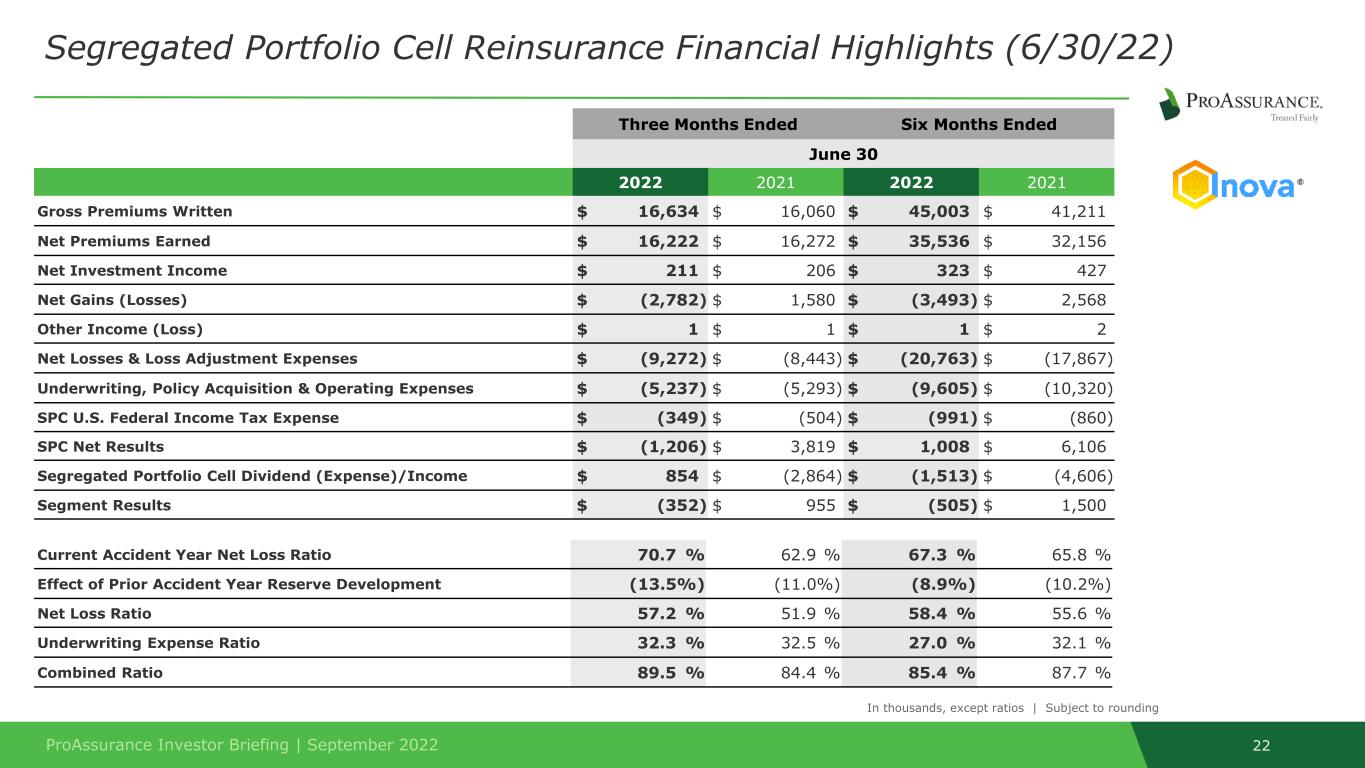

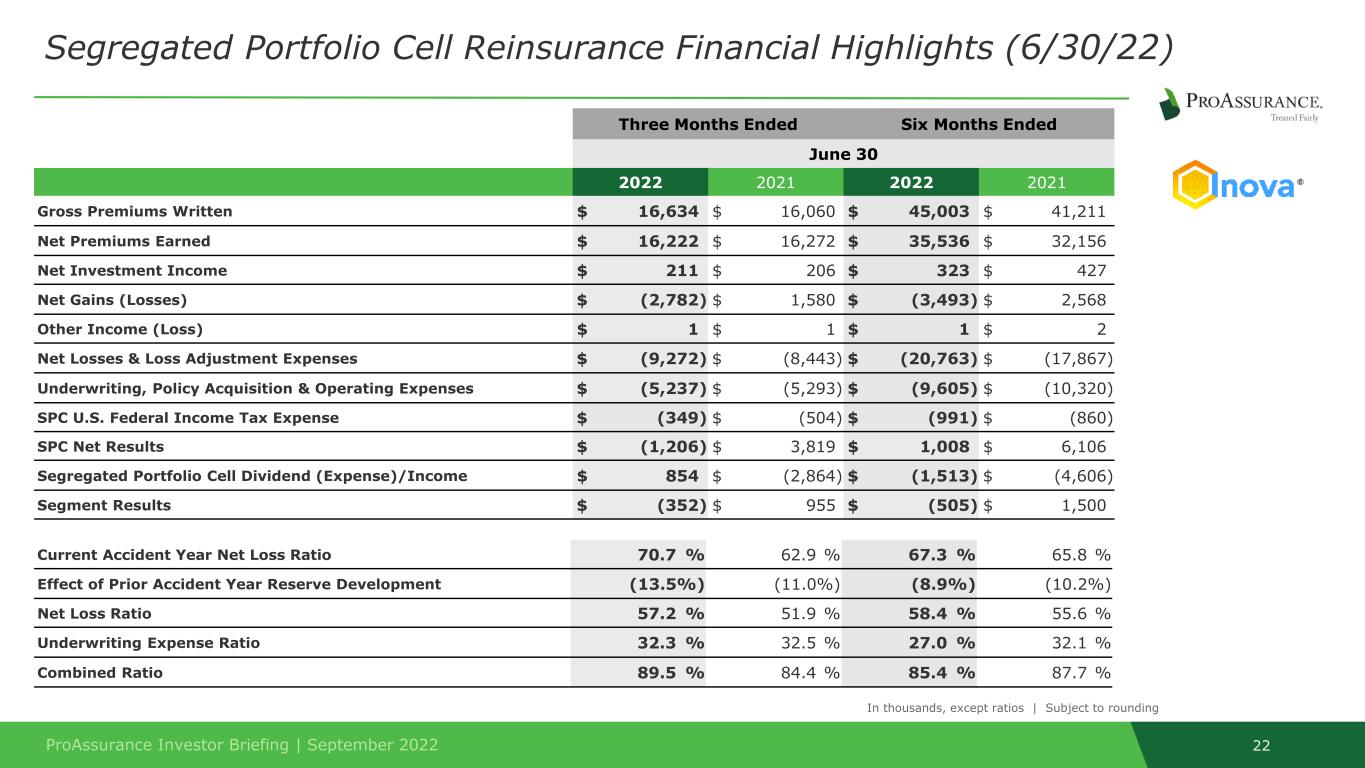

ProAssurance Investor Briefing | September 2022 22 Segregated Portfolio Cell Reinsurance Financial Highlights (6/30/22) Three Months Ended Six Months Ended June 30 2022 2021 2022 2021 Gross Premiums Written $ 16,634 $ 16,060 $ 45,003 $ 41,211 Net Premiums Earned $ 16,222 $ 16,272 $ 35,536 $ 32,156 Net Investment Income $ 211 $ 206 $ 323 $ 427 Net Gains (Losses) $ (2,782) $ 1,580 $ (3,493) $ 2,568 Other Income (Loss) $ 1 $ 1 $ 1 $ 2 Net Losses & Loss Adjustment Expenses $ (9,272) $ (8,443) $ (20,763) $ (17,867) Underwriting, Policy Acquisition & Operating Expenses $ (5,237) $ (5,293) $ (9,605) $ (10,320) SPC U.S. Federal Income Tax Expense $ (349) $ (504) $ (991) $ (860) SPC Net Results $ (1,206) $ 3,819 $ 1,008 $ 6,106 Segregated Portfolio Cell Dividend (Expense)/Income $ 854 $ (2,864) $ (1,513) $ (4,606) Segment Results $ (352) $ 955 $ (505) $ 1,500 In thousands, except ratios | Subject to rounding Current Accident Year Net Loss Ratio 70.7 % 62.9 % 67.3 % 65.8 % Effect of Prior Accident Year Reserve Development (13.5%) (11.0%) (8.9%) (10.2%) Net Loss Ratio 57.2 % 51.9 % 58.4 % 55.6 % Underwriting Expense Ratio 32.3 % 32.5 % 27.0 % 32.1 % Combined Ratio 89.5 % 84.4 % 85.4 % 87.7 %

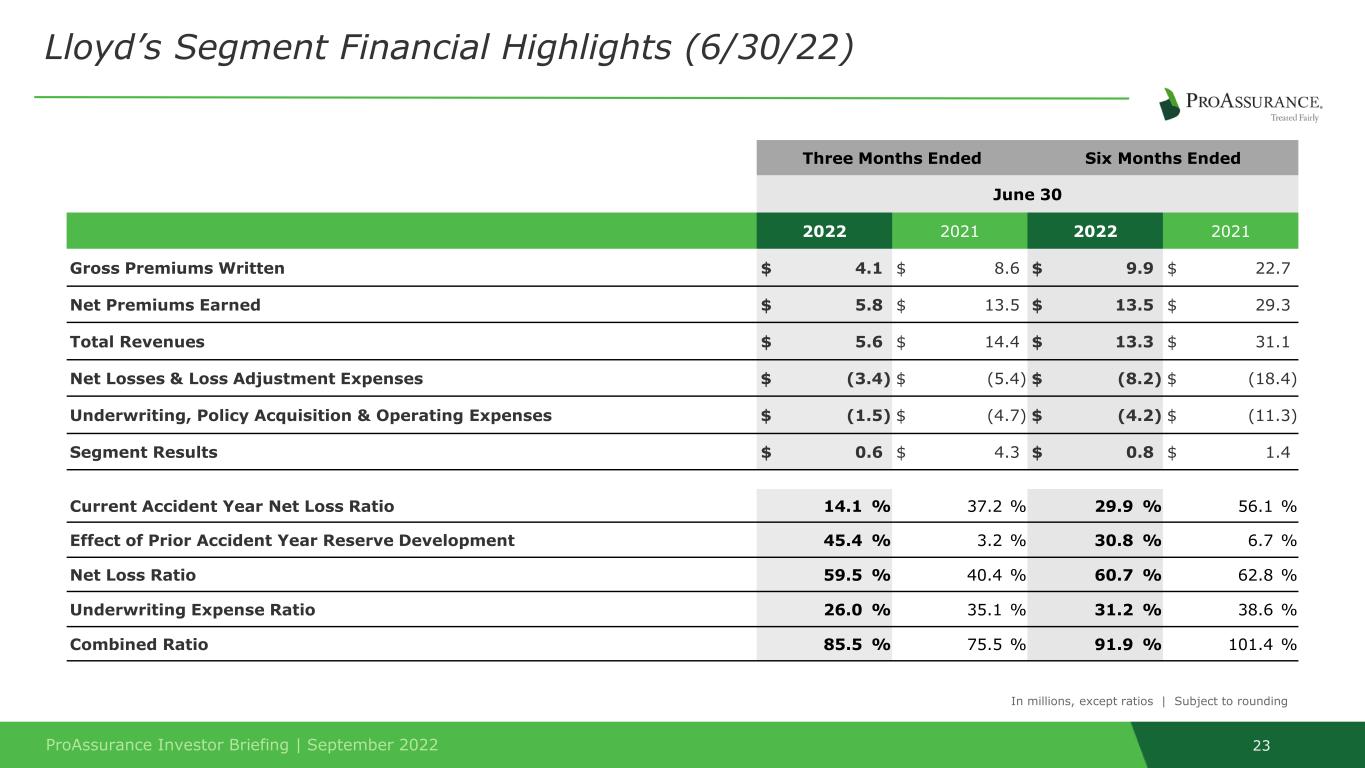

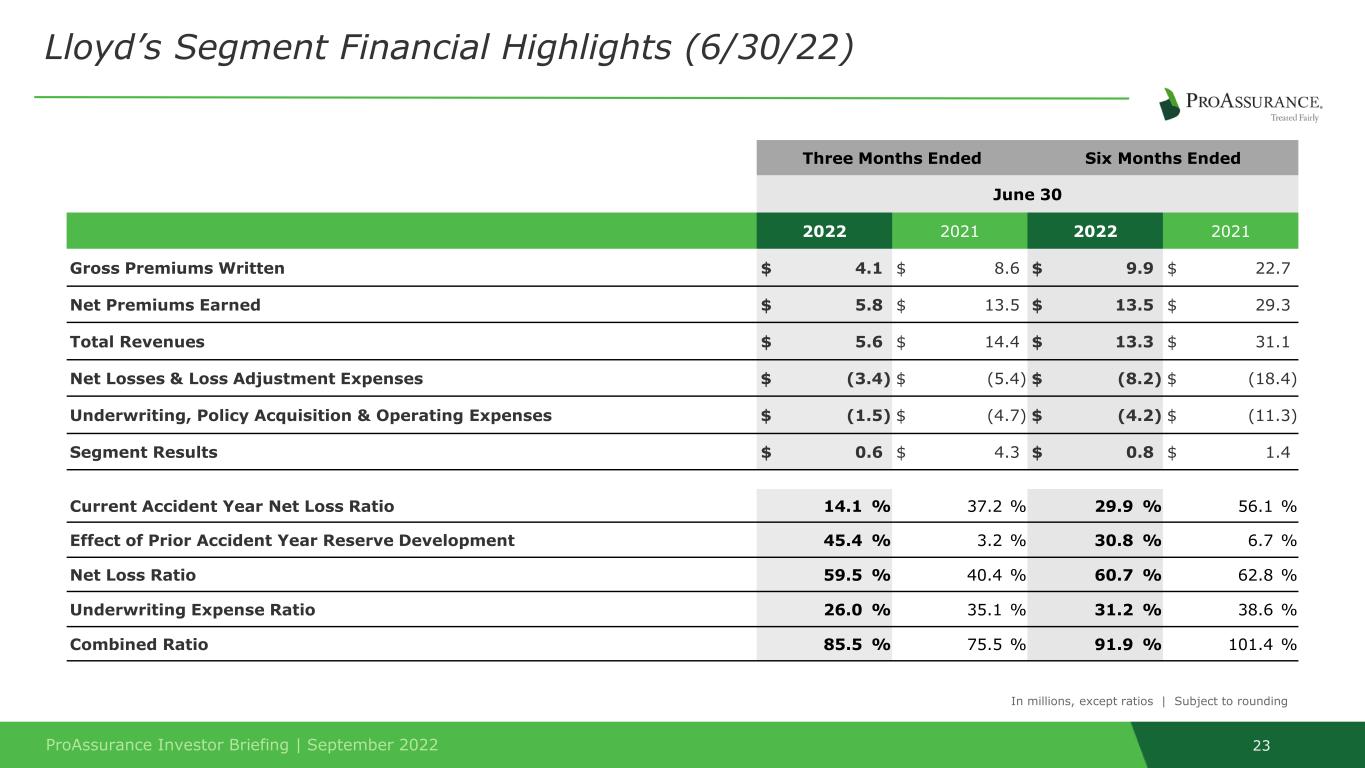

ProAssurance Investor Briefing | September 2022 23 Lloyd’s Segment Financial Highlights (6/30/22) Three Months Ended Six Months Ended June 30 2022 2021 2022 2021 Gross Premiums Written $ 4.1 $ 8.6 $ 9.9 $ 22.7 Net Premiums Earned $ 5.8 $ 13.5 $ 13.5 $ 29.3 Total Revenues $ 5.6 $ 14.4 $ 13.3 $ 31.1 Net Losses & Loss Adjustment Expenses $ (3.4) $ (5.4) $ (8.2) $ (18.4) Underwriting, Policy Acquisition & Operating Expenses $ (1.5) $ (4.7) $ (4.2) $ (11.3) Segment Results $ 0.6 $ 4.3 $ 0.8 $ 1.4 Current Accident Year Net Loss Ratio 14.1 % 37.2 % 29.9 % 56.1 % Effect of Prior Accident Year Reserve Development 45.4 % 3.2 % 30.8 % 6.7 % Net Loss Ratio 59.5 % 40.4 % 60.7 % 62.8 % Underwriting Expense Ratio 26.0 % 35.1 % 31.2 % 38.6 % Combined Ratio 85.5 % 75.5 % 91.9 % 101.4 % In millions, except ratios | Subject to rounding

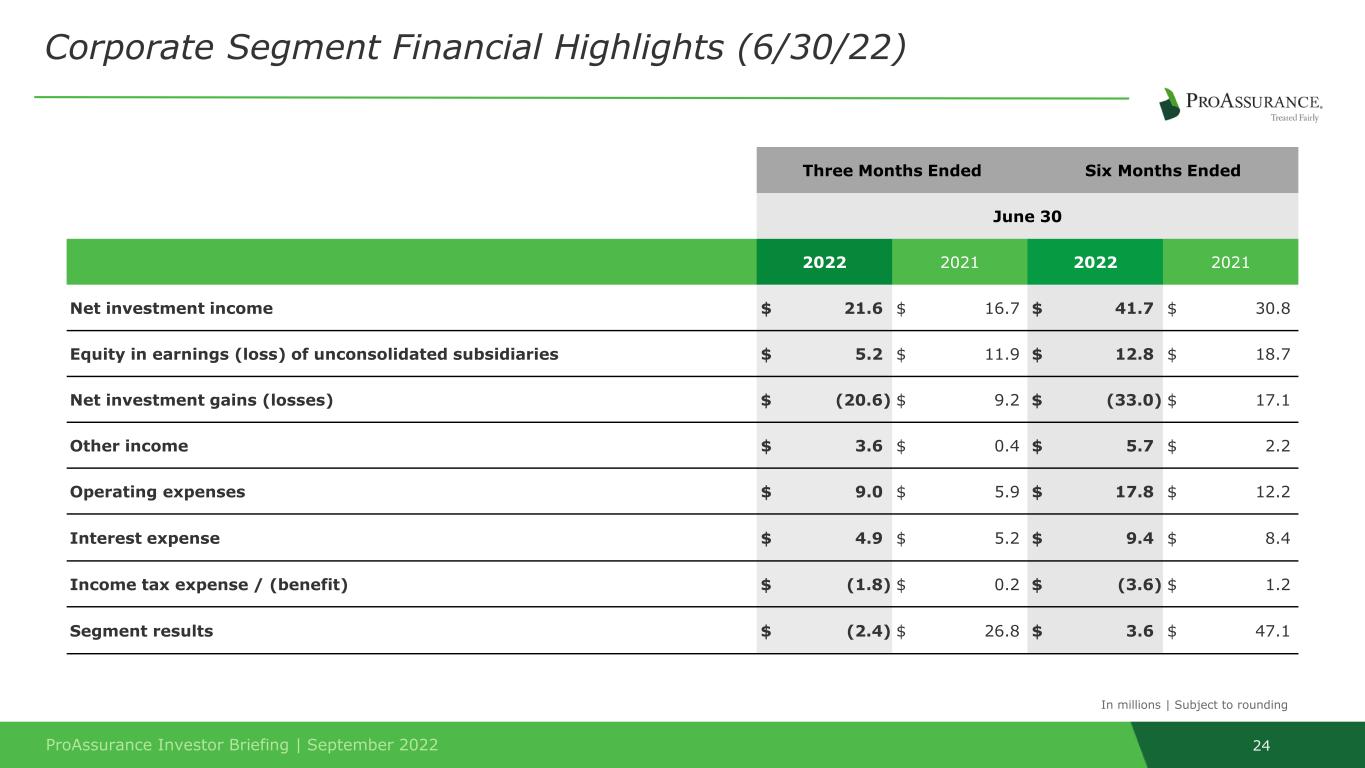

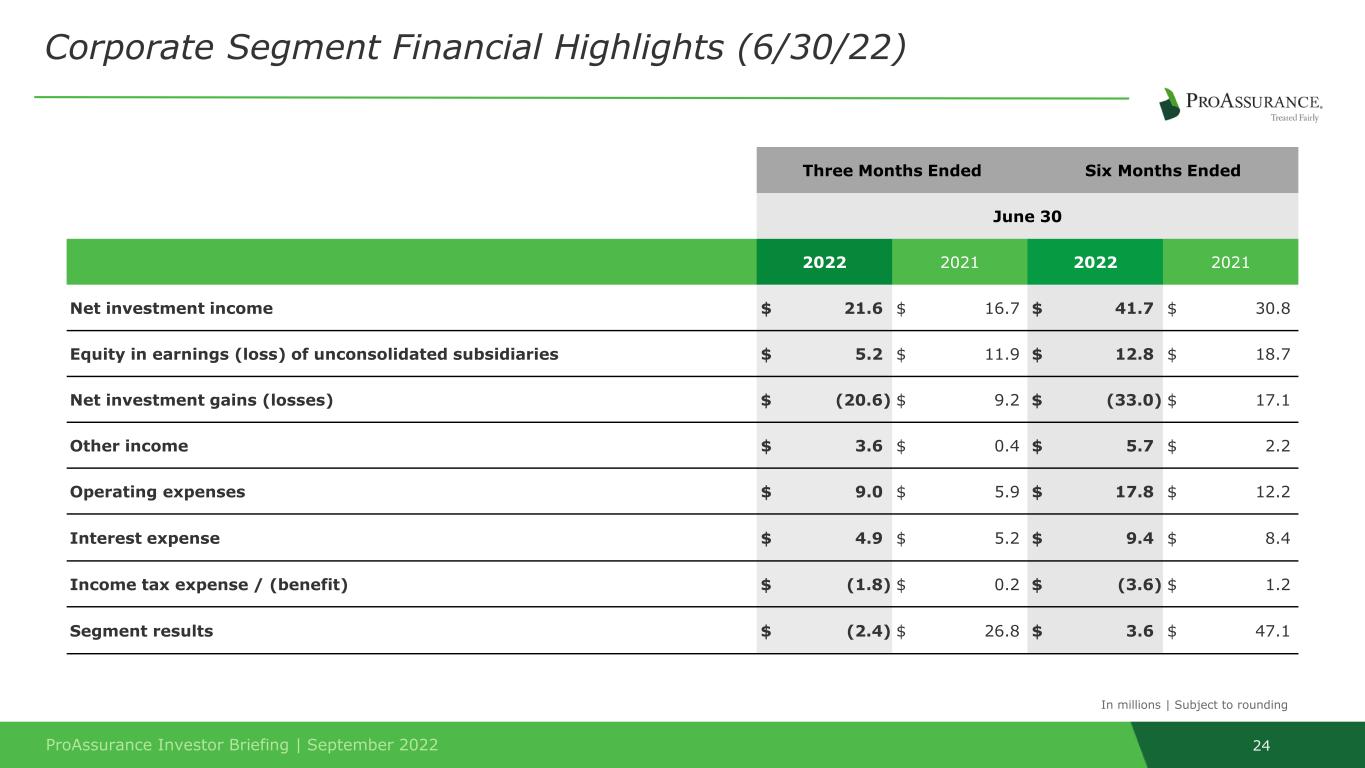

ProAssurance Investor Briefing | September 2022 24 Corporate Segment Financial Highlights (6/30/22) Three Months Ended Six Months Ended June 30 2022 2021 2022 2021 Net investment income $ 21.6 $ 16.7 $ 41.7 $ 30.8 Equity in earnings (loss) of unconsolidated subsidiaries $ 5.2 $ 11.9 $ 12.8 $ 18.7 Net investment gains (losses) $ (20.6) $ 9.2 $ (33.0) $ 17.1 Other income $ 3.6 $ 0.4 $ 5.7 $ 2.2 Operating expenses $ 9.0 $ 5.9 $ 17.8 $ 12.2 Interest expense $ 4.9 $ 5.2 $ 9.4 $ 8.4 Income tax expense / (benefit) $ (1.8) $ 0.2 $ (3.6) $ 1.2 Segment results $ (2.4) $ 26.8 $ 3.6 $ 47.1 In millions | Subject to rounding

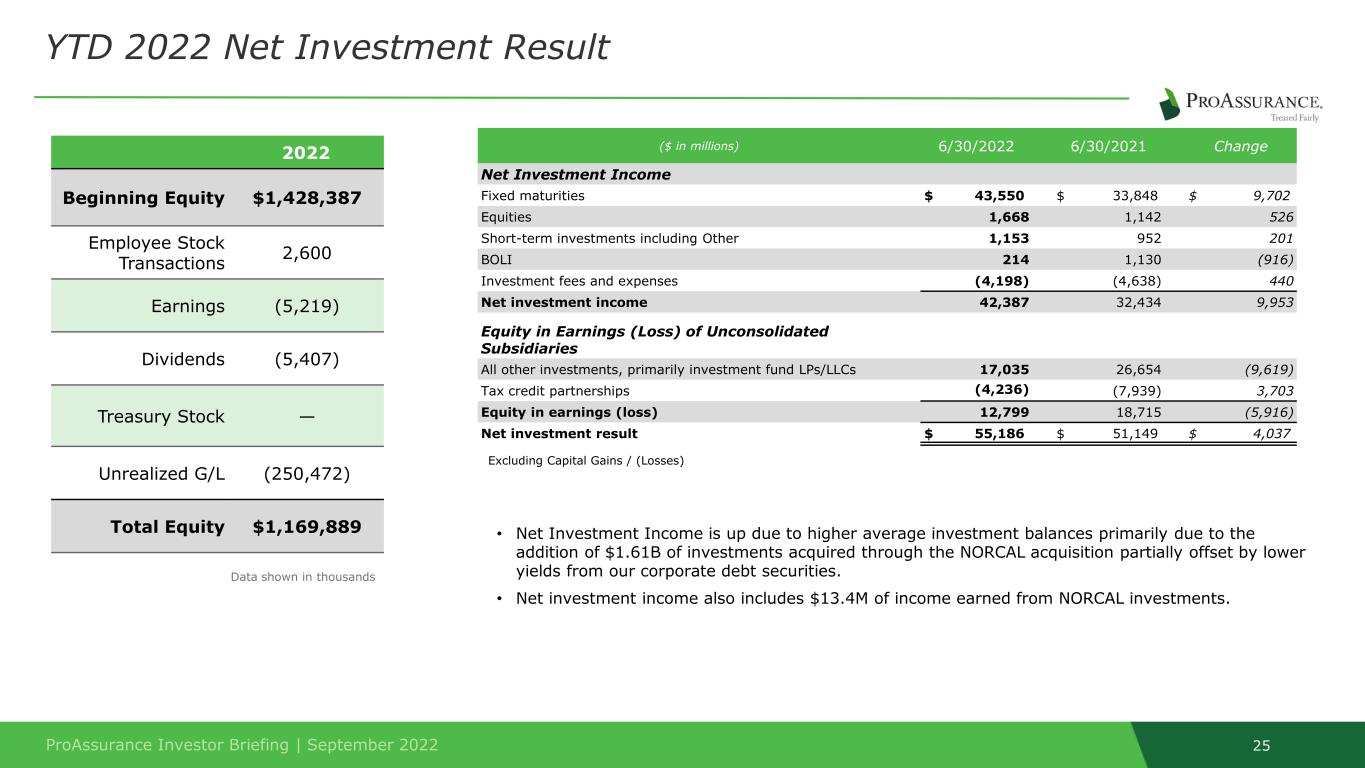

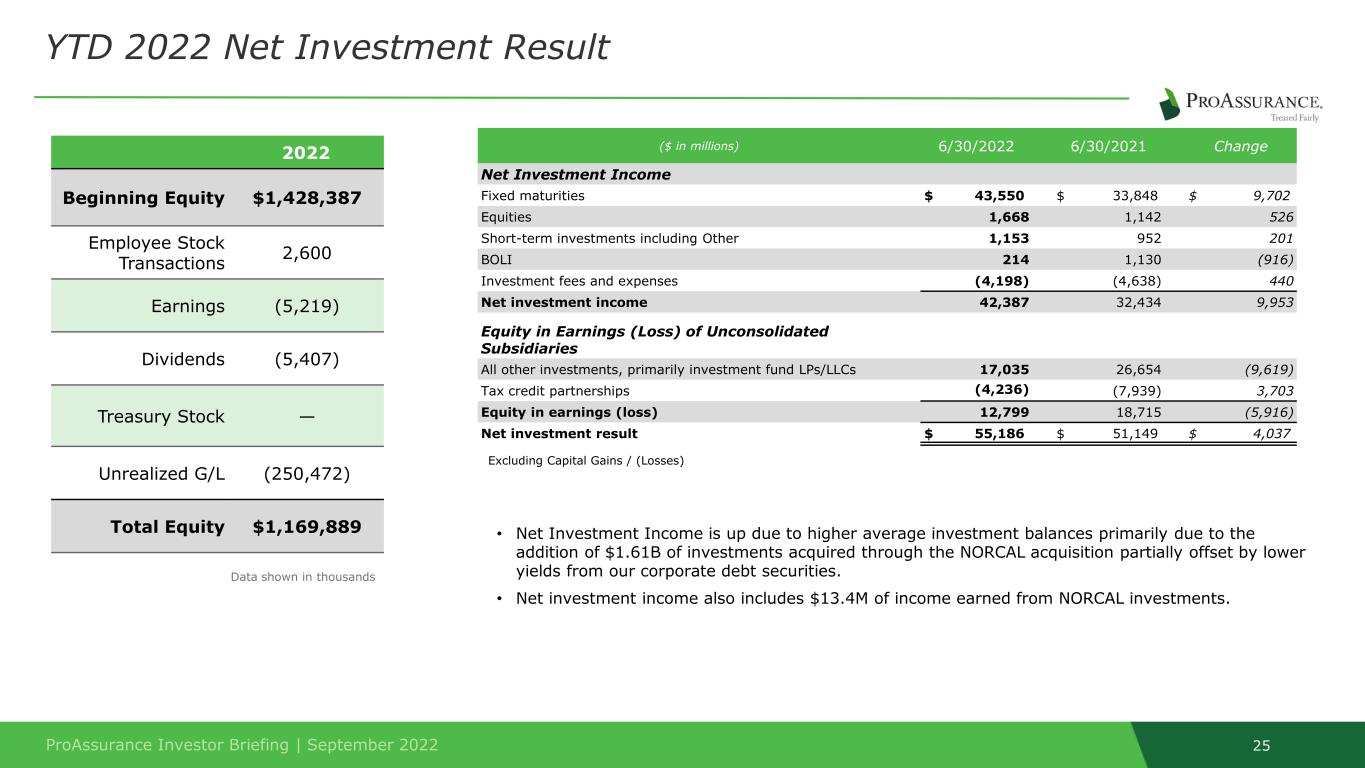

ProAssurance Investor Briefing | September 2022 25 ($ in millions) 6/30/2022 6/30/2021 Change Net Investment Income Fixed maturities $ 43,550 $ 33,848 $ 9,702 Equities 1,668 1,142 526 Short-term investments including Other 1,153 952 201 BOLI 214 1,130 (916) Investment fees and expenses (4,198) (4,638) 440 Net investment income 42,387 32,434 9,953 Equity in Earnings (Loss) of Unconsolidated Subsidiaries All other investments, primarily investment fund LPs/LLCs 17,035 26,654 (9,619) Tax credit partnerships (4,236) (7,939) 3,703 Equity in earnings (loss) 12,799 18,715 (5,916) Net investment result $ 55,186 $ 51,149 $ 4,037 YTD 2022 Net Investment Result • Net Investment Income is up due to higher average investment balances primarily due to the addition of $1.61B of investments acquired through the NORCAL acquisition partially offset by lower yields from our corporate debt securities. • Net investment income also includes $13.4M of income earned from NORCAL investments. Excluding Capital Gains / (Losses) Data shown in thousands 2022 Beginning Equity $1,428,387 Employee Stock Transactions 2,600 Earnings (5,219) Dividends (5,407) Treasury Stock — Unrealized G/L (250,472) Total Equity $1,169,889

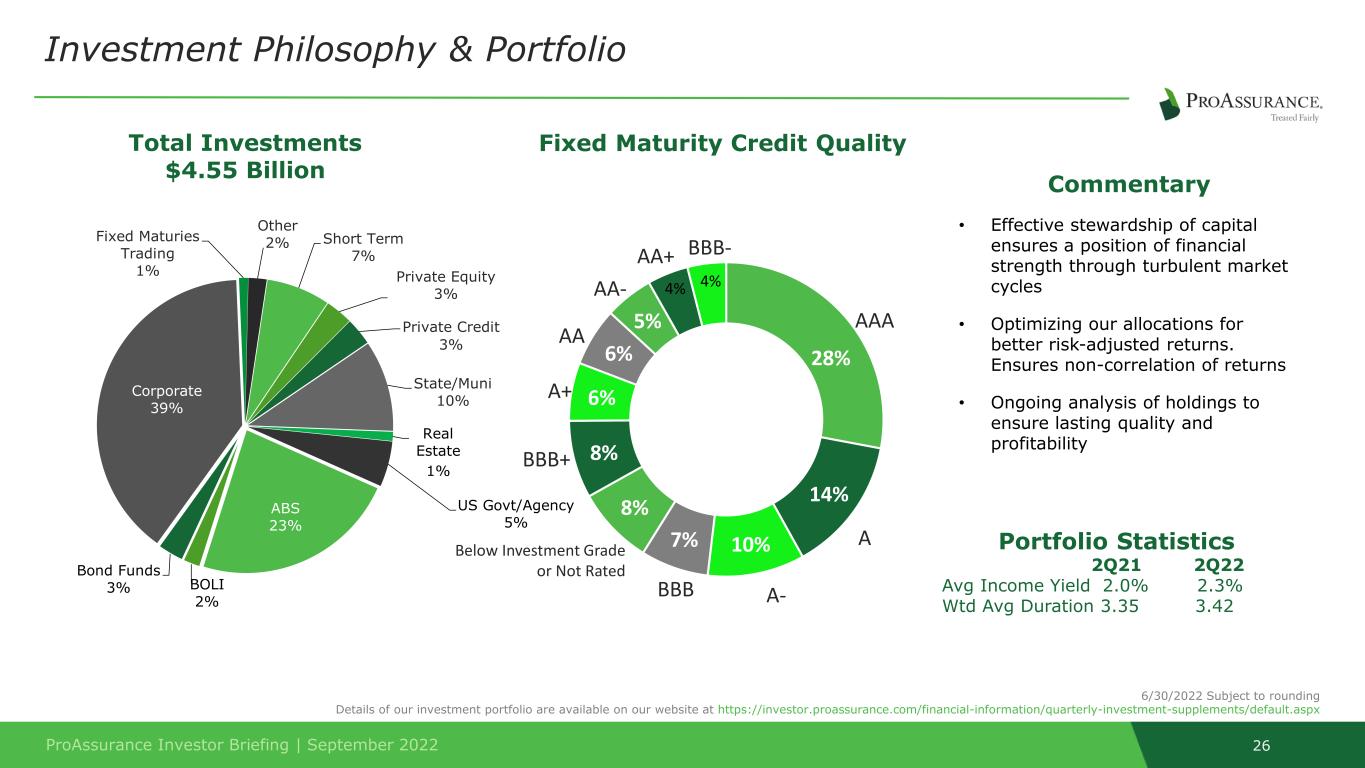

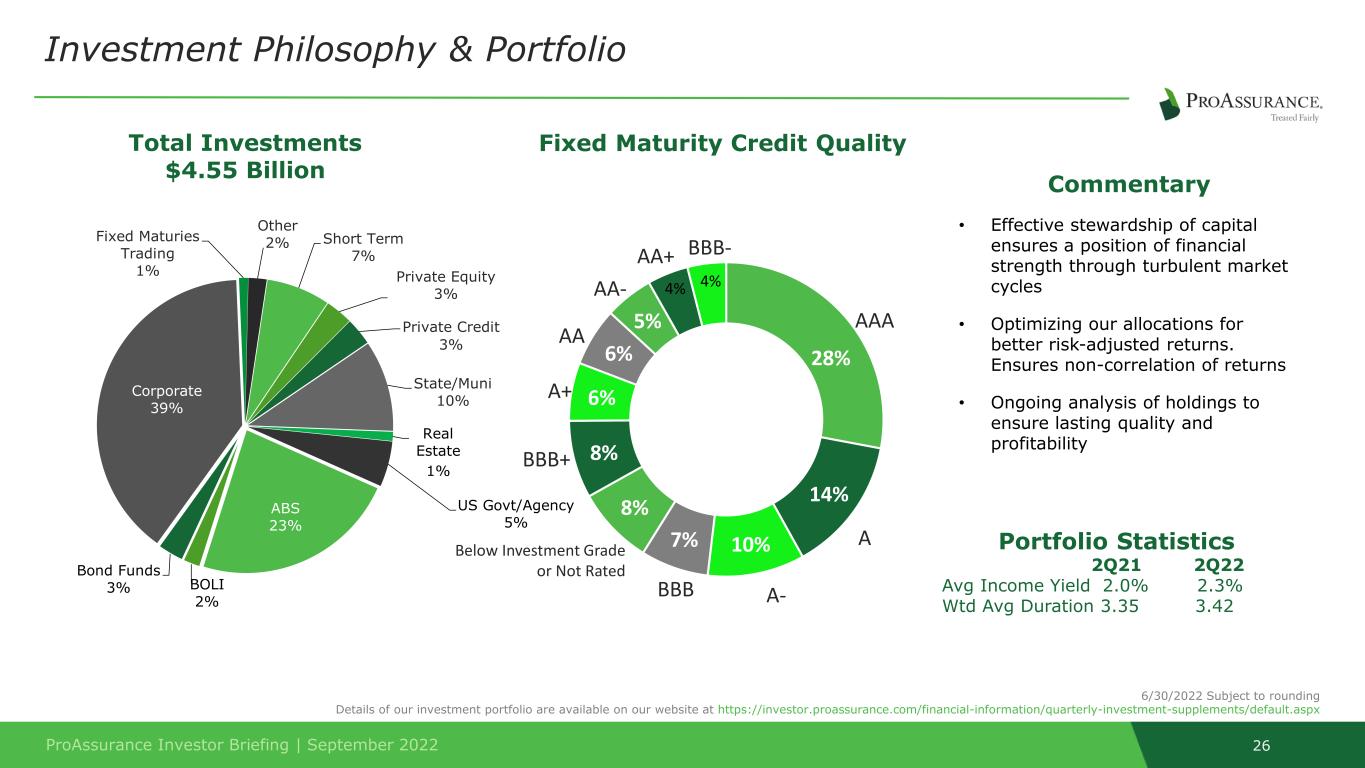

ProAssurance Investor Briefing | September 2022 26 Investment Philosophy & Portfolio Total Investments $4.55 Billion 6/30/2022 Subject to rounding Details of our investment portfolio are available on our website at https://investor.proassurance.com/financial-information/quarterly-investment-supplements/default.aspx 28% 14% 10%7% 8% 8% 6% 6% 5% 4% 4% AAA A A+ BBB+ Below Investment Grade or Not Rated BBB A- AA- AA AA+ BBB- ABS 23% BOLI 2% Bond Funds 3% Corporate 39% Fixed Maturies Trading 1% Other 2% Short Term 7% Private Equity 3% Private Credit 3% State/Muni 10% Real Estate 1% US Govt/Agency 5% Fixed Maturity Credit Quality Commentary • Effective stewardship of capital ensures a position of financial strength through turbulent market cycles • Optimizing our allocations for better risk-adjusted returns. Ensures non-correlation of returns • Ongoing analysis of holdings to ensure lasting quality and profitability Portfolio Statistics 2Q21 2Q22 Avg Income Yield 2.0% 2.3% Wtd Avg Duration 3.35 3.42

ProAssurance Investor Briefing | September 2022 27 Combined Tax Credits Portfolio Detail & Projections This column represents our current estimated schedule of tax credits that we expect to receive from our tax credit partnerships. The actual amounts of credits provided by the tax credit partnerships may prove to be different than our estimates. These tax credits are included in our Tax Expense (Benefit) on our Income Statement (below the line) and result in a Tax Receivable (or a reduction to a Tax Liability) on our Balance Sheet. Year GAAP Income/(Loss) from Operations, Disposition & Impairment Total Credits Tax Provision after Impairment Impact on Earnings 2022 $ 283,415 (8,599,079) (5,006,484) (6,812,290) (1,786,789) 2023 $ 51,338 (3,007,165) (170,597) (802,102) (2,205,063) 2024 $ 51,338 (1,430,145) (36,830) (337,161) (1,092,984) 2025 $ 41,159 (1,011,810) (19,116) (231,597) (780,213) 2026 $ 25,734 (17,202) (2,940) (6,552) (10,649) 2027 $ - 180,182 (79) 37,759 142,423 2028 $ - - - - - Capital Contributions

ProAssurance Investor Briefing | September 2022 28 Forward Looking Statements Non-GAAP Measures This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in our remarks and discussions with investors. The primary Non-GAAP measure we reference is Non-GAAP operating income, a Non-GAAP financial measure that is widely used to evaluate performance within the insurance sector. In calculating Non-GAAP operating income, we have excluded the after-tax effects of net realized investment gains or losses and guaranty fund assessments or recoupments that do not reflect normal operating results. We believe Non-GAAP operating income presents a useful view of the performance of our insurance operations, but should be considered in conjunction with net income computed in accordance with GAAP. A reconciliation of these measures to GAAP measures is available in our regular reports on Forms 10-Q and 10-K and in our latest quarterly news release, all of which are available in the Investor Relations section of our website, Investor.ProAssurance.com. IMPORTANT SAFE HARBOR & NON-GAAP NOTICES

© ProAssurance Corporation. All rights reserved. MAILING ADDRESS: ProAssurance Corporation 100 Brookwood Place Birmingham, AL 35209 CONTACT: Jason Gingerich VP of Investor Relations 512.879.5101 JasonGingerich@ProAssurance.com