Investor Update Accurate as of February 24, 2025 Fourth Quarter and Full Year 2024 Investor Update Learn more: • News release issued February 24 • 10-K filed February 24 • Quarterly investor call February 25

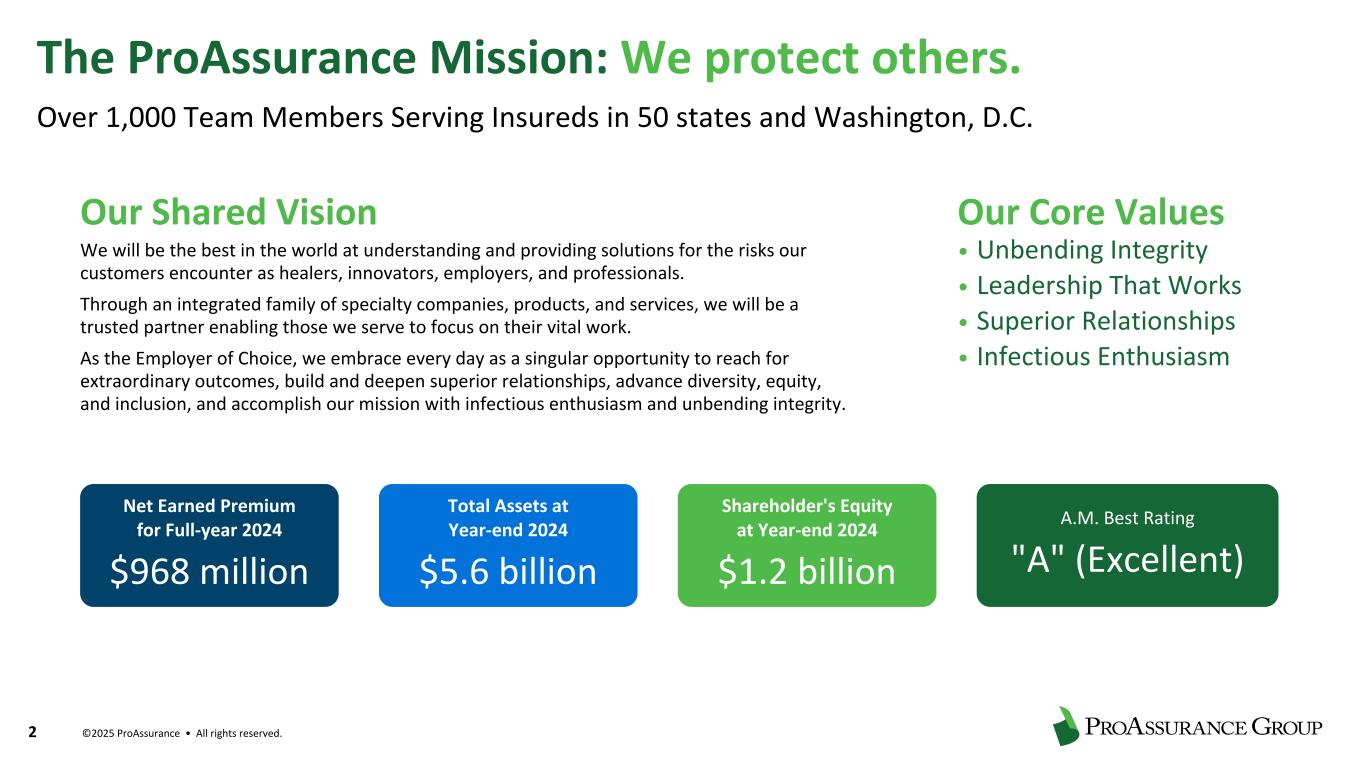

©2025 ProAssurance • All rights reserved. 2 Our Shared Vision We will be the best in the world at understanding and providing solutions for the risks our customers encounter as healers, innovators, employers, and professionals. Through an integrated family of specialty companies, products, and services, we will be a trusted partner enabling those we serve to focus on their vital work. As the Employer of Choice, we embrace every day as a singular opportunity to reach for extraordinary outcomes, build and deepen superior relationships, advance diversity, equity, and inclusion, and accomplish our mission with infectious enthusiasm and unbending integrity. Our Core Values • Unbending Integrity • Leadership That Works • Superior Relationships • Infectious Enthusiasm The ProAssurance Mission: We protect others. Over 1,000 Team Members Serving Insureds in 50 states and Washington, D.C. Net Earned Premium for Full-year 2024 $968 million Total Assets at Year-end 2024 $5.6 billion Shareholder's Equity at Year-end 2024 $1.2 billion A.M. Best Rating "A" (Excellent)

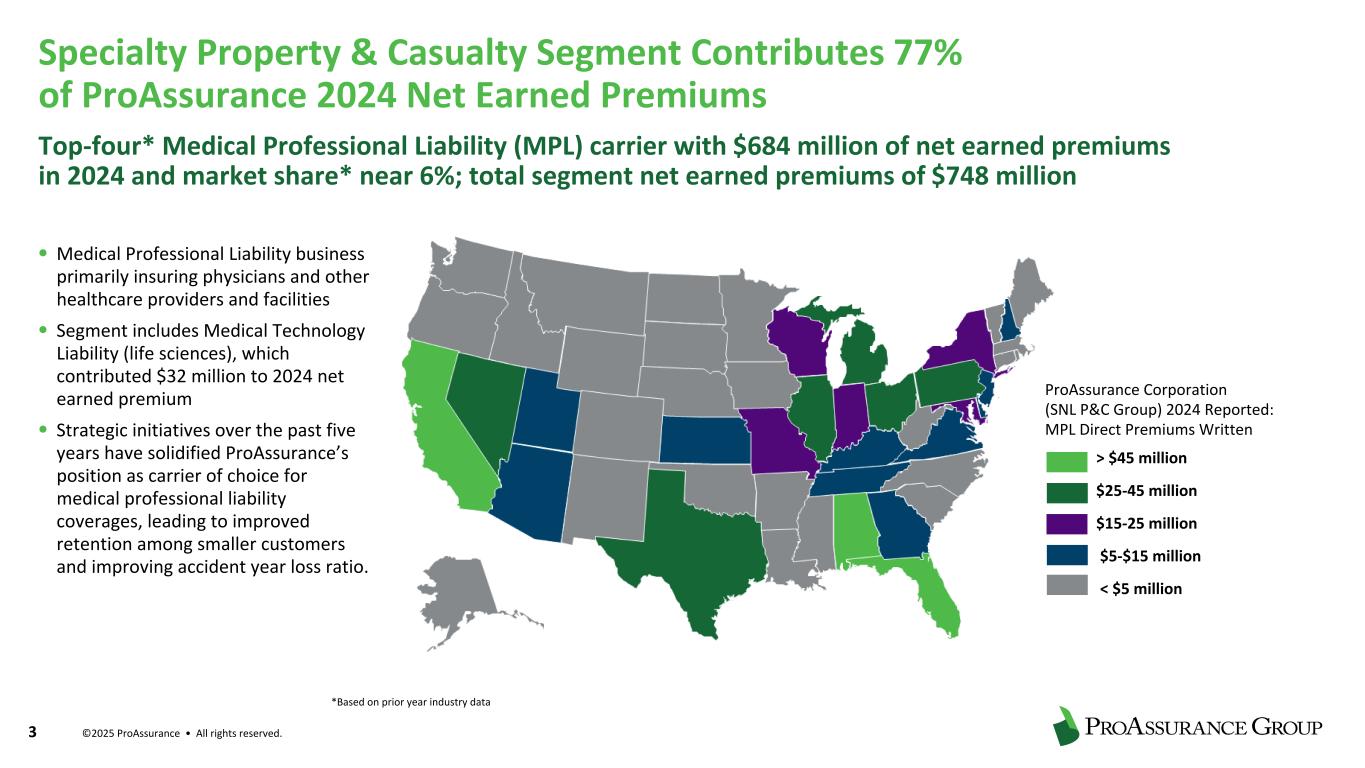

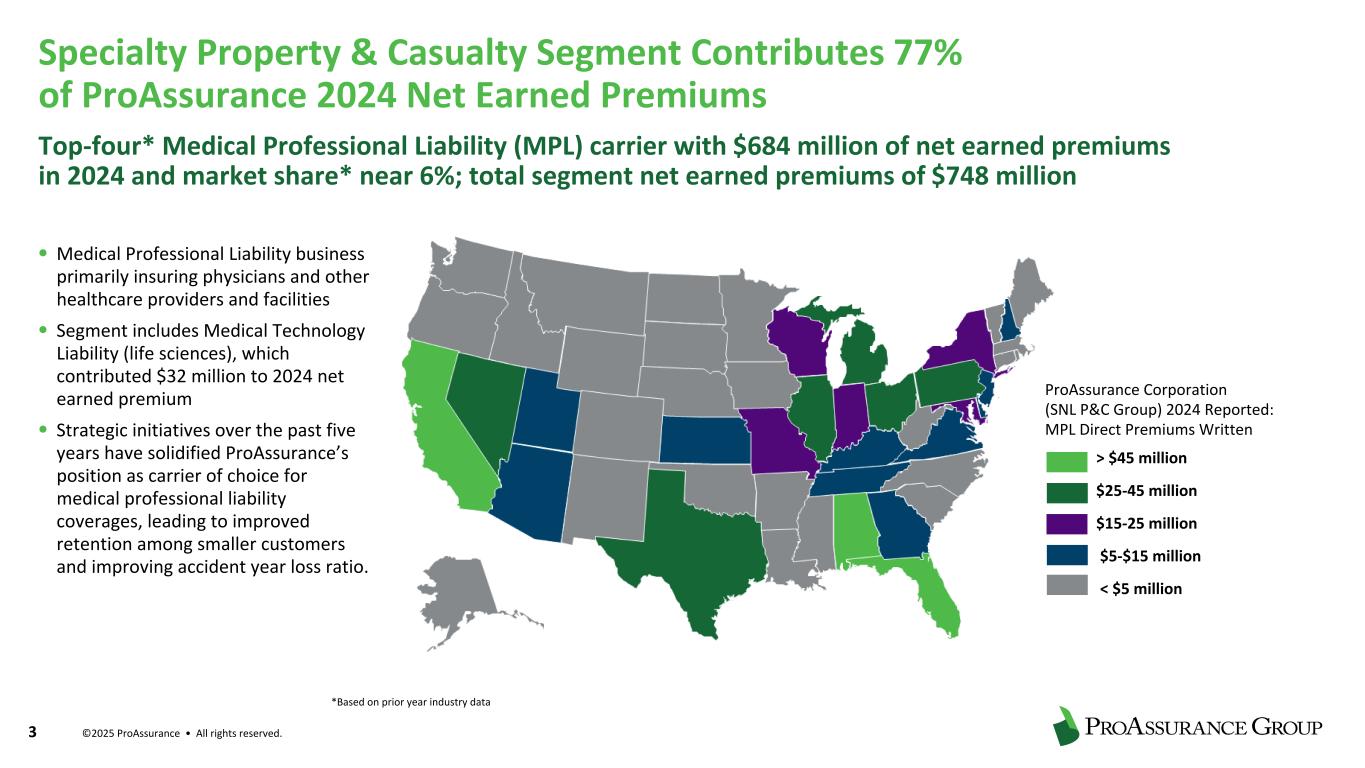

©2025 ProAssurance • All rights reserved. 3 ProAssurance Corporation (SNL P&C Group) 2024 Reported: MPL Direct Premiums Written > $45 million $25-45 million $15-25 million $5-$15 million < $5 million Top-four* Medical Professional Liability (MPL) carrier with $684 million of net earned premiums in 2024 and market share* near 6%; total segment net earned premiums of $748 million Specialty Property & Casualty Segment Contributes 77% of ProAssurance 2024 Net Earned Premiums • Medical Professional Liability business primarily insuring physicians and other healthcare providers and facilities • Segment includes Medical Technology Liability (life sciences), which contributed $32 million to 2024 net earned premium • Strategic initiatives over the past five years have solidified ProAssurance’s position as carrier of choice for medical professional liability coverages, leading to improved retention among smaller customers and improving accident year loss ratio. *Based on prior year industry data

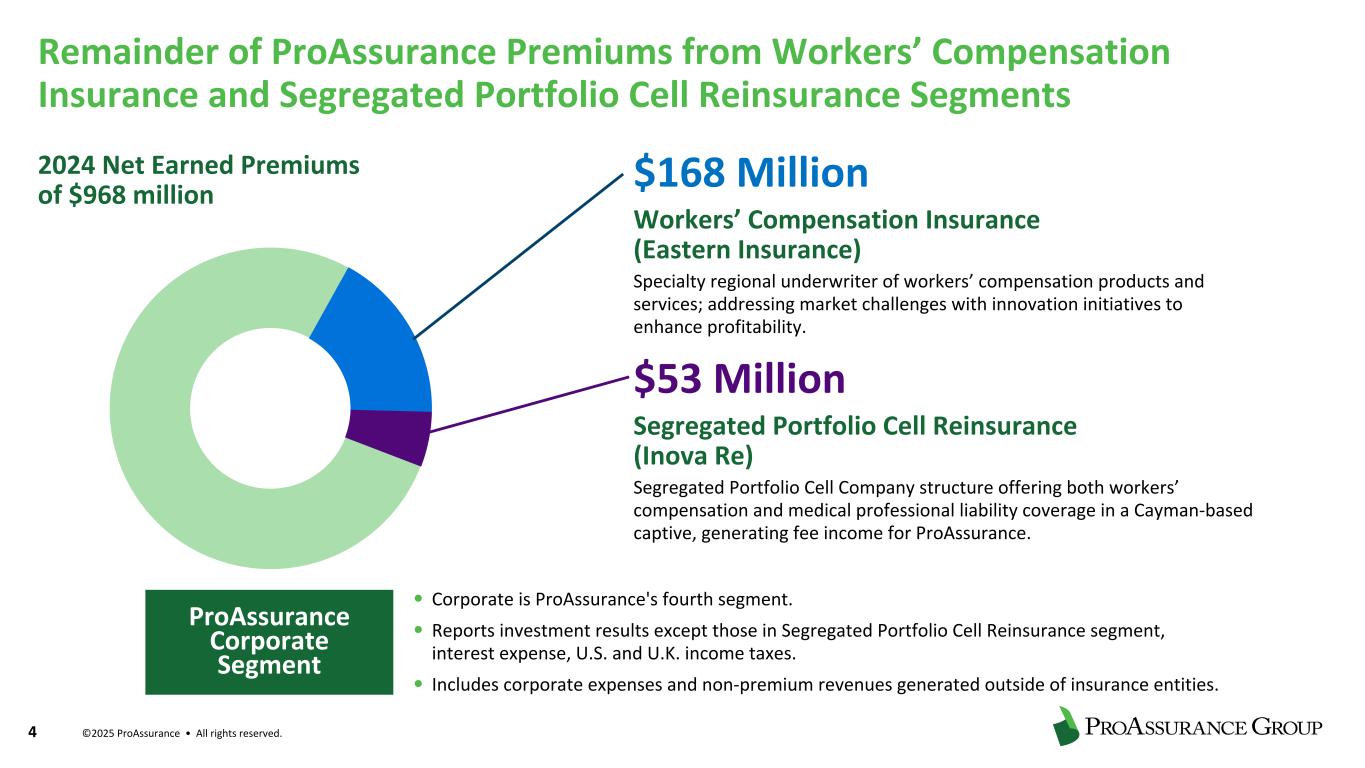

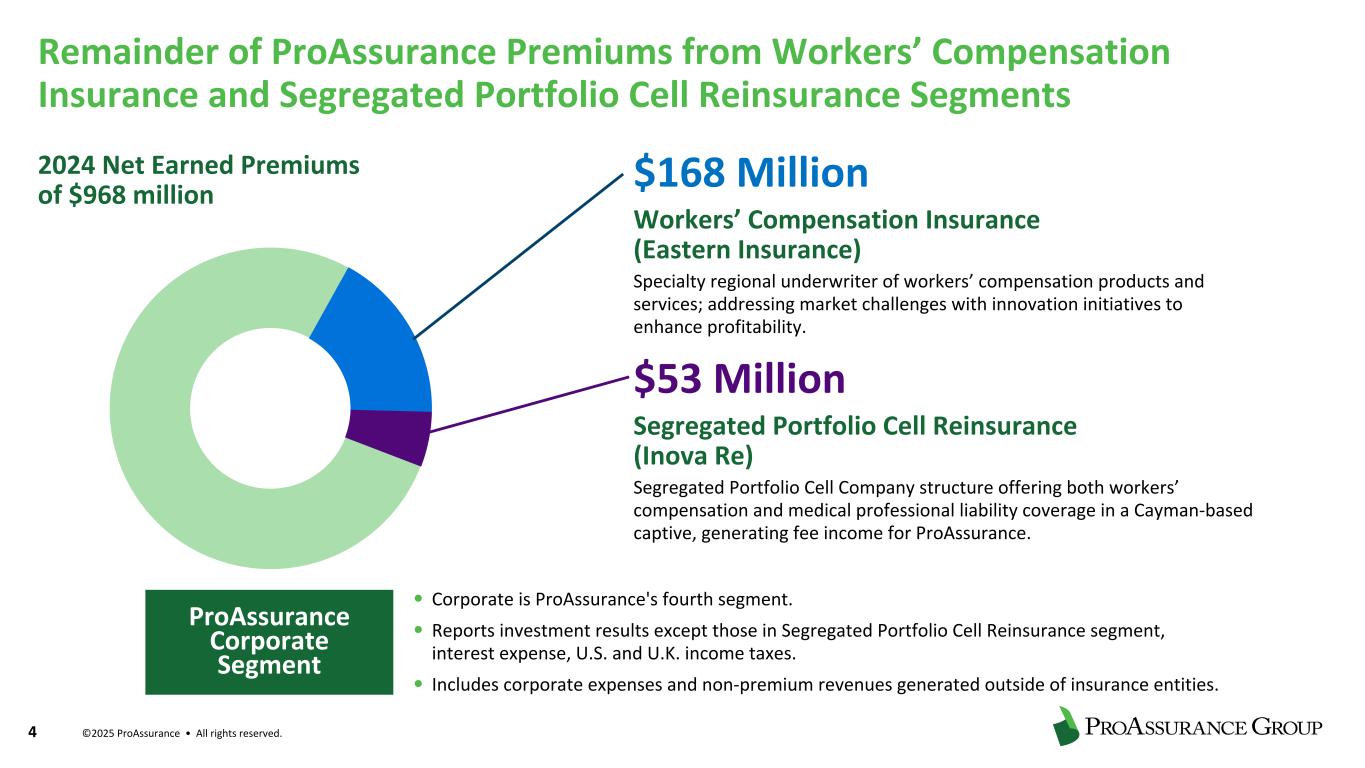

©2025 ProAssurance • All rights reserved. 4 Remainder of ProAssurance Premiums from Workers’ Compensation Insurance and Segregated Portfolio Cell Reinsurance Segments 2024 Net Earned Premiums of $968 million $168 Million Workers’ Compensation Insurance (Eastern Insurance) Specialty regional underwriter of workers’ compensation products and services; addressing market challenges with innovation initiatives to enhance profitability. $53 Million Segregated Portfolio Cell Reinsurance (Inova Re) Segregated Portfolio Cell Company structure offering both workers’ compensation and medical professional liability coverage in a Cayman-based captive, generating fee income for ProAssurance. • Corporate is ProAssurance's fourth segment. • Reports investment results except those in Segregated Portfolio Cell Reinsurance segment, interest expense, U.S. and U.K. income taxes. • Includes corporate expenses and non-premium revenues generated outside of insurance entities. ProAssurance Corporate Segment

©2024 ProAssurance • All rights reserved. 5 Operational Discipline Designed for Success in Competitive Markets

©2025 ProAssurance • All rights reserved. 6 Operations – Insurance underwriting results for the fourth quarter of 2024 illustrate management’s ongoing actions to achieve sustained profitability • Our expertise in medical professional liability and workers’ compensation means we identified loss trends ahead of peers and have responded appropriately ▪ Medical professional liability market is challenging due to rising severity that reflects social inflation and eroding tort reform, exacerbated by legal system abuse ▪ Workers' compensation market challenged by rising medical costs per claim ▪ We will not grow for growth’s sake - better to shrink to improved profitability; we are not afraid to walk away from underpriced business ▪ New and renewal business is being written at rates we believe will ultimately perform better than the business we are non-renewing Corporate – Non-GAAP adjusted book value per share was $26.86 at December 31, 2024 • There is embedded value in ProAssurance and we will consider repurchasing shares opportunistically ▪ Very strong balance sheet with high quality investment portfolio with over 90% in investment grade fixed maturities and adequate liquidity ▪ Financial leverage stable at 24% ▪ Strong net investment income growth reflects higher new purchase yields and supports return to sustained profitability Returning to Long-Term Sustained Profitability is Our Highest Priority Operating earnings improved sequentially for the fifth consecutive quarter and our confidence continues to grow that actions we have taken over the past several years have us on track to achieve our objectives

©2025 ProAssurance • All rights reserved. 7 Corporate Provide strong net investment income stream to bolster underwriting contribution • Leverage current interest rate environment to increase portfolio yield • Consolidate statutory entities to maximize efficiency and capital utilization • Manage talent-acquisition and retention strategies to maximize value of work force Workers’ Compensation Insurance Minimize impact of medical inflation • Improve efficiency with newly implemented integrated policy, claims, risk management, and billing systems • Reduce loss costs by managing selection of providers and implementing cost management programs ▪ Optimize network and medical management partners • Leverage investments in InsurTech underwriting, AI and claims data analytics to: ▪ Improve penetration in more profitable small account market segment ▪ Improve efficiency by expanding use of AI in underwriting and claims Strategic Initiatives - Addressing Challenging Markets Specialty Property & Casualty Restore profitability and support appropriate growth • Obtain rate beyond loss cost trend • Distinguish ProAssurance as carrier of choice for medical professional liability coverages ▪ Use technology to support superior customer experiences for our distribution partners and policyholders ▪ Prioritize needs of more profitable small to mid-size accounts ▪ Launch state-of-the-art workflow solution and online portal ▪ Implement straight-through processing technologies to reduce costs • Invest in innovation solutions that enhance risk selection, pricing accuracy and workflows ▪ Leverage our data science and predictive analytics capabilities to support growth in appropriate markets and sub-sectors • Assist insureds with strategies to mitigate future losses

©2025 ProAssurance • All rights reserved. 8 Specialty P&C segment combined ratio from ongoing core operations improved 3.9 percentage points* compared to last year’s fourth quarter, while the full-year combined ratio improved 4.8 percentage points*. We are benefiting from our continued focus on price adequacy and disciplined underwriting as well as our ability to target segments within healthcare where there are opportunities to write business that we believe will meet our profitability. • Underwriting and pricing actions taken over the past 12 months had a positive impact on both the fourth quarter and full year 2024 current accident year loss ratios for the Medical Professional Liability business, although fourth quarter benefit was overshadowed by a prior year decrease to our estimate of unallocated loss adjustment expenses, a year-over-year change in premiums ceded to reinsurers as well as recognition of loss severity trends in a few select jurisdictions. Prior accident year reserve development was favorable again for the fourth quarter, improving the full-year net loss ratio due to favorable development by 5.9 percentage points*. This largely reflected favorable claims- closing trends in the Medical Professional Liability business. • Renewal pricing remained strong at 8% for the quarter and 9% for the full-year while retention remained solid. New business was below last year for the quarter and the full-year as we focus on risk selection and pricing levels that support progress toward our profitability targets. Fourth Quarter Operating EPS* of 36 Cents; Full year at 95 Cents Comparisons to fourth quarter 2023 unless otherwise noted . *Represents a Non-GAAP financial measure that excludes certain items that are not indicative of the performance of our ongoing core operations, including net investment gains and losses, foreign currency exchange rate gains and losses, and results of non-core operations. Non-core operations include the net results from our previous participation in Lloyd's Syndicates operations, which is currently in run-off. See a reconciliation to their GAAP counterparts under the heading "Non-GAAP Financial Measures" section in our latest quarterly news release on Form 8-K filed on February 24, 2025. • Specialty P&C segment combined ratio of 100.9%* demonstrates another quarter of progress from management’s ongoing actions focused on achieving sustained profitability • Net investment income rose 9% as we take advantage of the current interest rate environment as our portfolio matures Workers’ Compensation Insurance segment combined ratio improved 17.2 percentage points compared to last year's fourth quarter and improved 7.8 percentage points for the full year. • Current accident year net loss ratio of 77.0% for the fourth quarter and full year improved 4.3 percentage points from 81.3% for full-year 2023. We continue to observe and reflect the higher medical loss cost trends that we initially saw in the second half of 2023, although they have begun to moderate this year. Fourth quarter net favorable prior accident year reserve development was $0.5 million. In 2023, the segment strengthened reserves due to the higher than expected loss trends observed at that time. • Higher audit premiums were the primary reason for the increase in net written premiums for the quarter and year. We continue to carefully manage our underwriting appetite due to market conditions. Retention in the fourth quarter was 83% although we saw improved renewal pricing. New business in our traditional book was $3.0 million, down from $5.0 million in last year’s fourth quarter.

©2024 ProAssurance • All rights reserved. 9 ProAssurance Overview

©2025 ProAssurance • All rights reserved. 10 A Foundation in Excellence SUPERIOR BRAND IDENTITY AND REPUTATION IN THE MARKET SCOPE & SCALE Regional hubs combined with local knowledge of market dynamics and regulatory environments HISTORY OF SUCCESSFUL MERGERS & ACQUISITIONS Selective M&A with best-in-class partners, and nearly 20 transactions in our 47-year history EXPERIENCED & COLLABORATIVE LEADERSHIP Average executive leadership tenure of 20 years with PRA or subsidiaries SPECIALIZATION Deep expertise and commitment to our customers throughout the insurance cycles enable us to outperform our peers over time “Our long history in our markets makes us confident that the cyclical lines of insurance where we do business will respond to our focused efforts.” -Ned Rand, President & CEO

©2025 ProAssurance • All rights reserved. 11 • Deep expertise and broad product spectrum in healthcare and related sciences • Consolidation in MPL → demand for comprehensive insurance solutions • Life Sciences → offer liability solutions to companies that develop, test, and deliver healthcare products in the U.S. and worldwide • Business mix shift since 2019 reflects continued focus on price adequacy and disciplined underwriting as well as our ability to target segments within healthcare where there are opportunities to write business profitability Specialty Property & Casualty Segment $ in millions Medical Professional Liability Coverages Accounted for over 90% of the Segment’s $807 Million of Gross Written Premiums in 2024

©2025 ProAssurance • All rights reserved. 12 2019 2020 2021 2022 2023 2024 Cumulative +65% Renewal Pricing* Change Since 2018 • Medical professional liability market facing increasingly unfavorable legal environment exacerbated by legal system abuse • ProAssurance focus on underwriting discipline has constrained growth ▪ Select competitors have been operating with capital levels that have allowed them to compete with pricing and underwriting standards that we believe are unsustainable ▪ ProAssurance has maintained retention levels in the mid-80s over the past five years, despite the competitive environment • Continue to rely on claims management expertise honed over nearly 50 years in this market ▪ We spend more on defense preparation than other carriersAnnual Renewal Pricing Change 8.9% 11.9% 7.7% 7.2% 7.8% 11.0% Reflects early recognition of shift in Medical Professional Liability market cycle Annual renewal pricing changes with benefit of cumulative prior year actions 8.9% 21.9% 31.3% 40.7% 51.6% 68.2% * Renewal pricing reflects changes in our exposure base, deductibles, self-insurance retention limits and other policy terms and conditions.

©2025 ProAssurance • All rights reserved. 13 Managing Risk While Enhancing Competitive Posture • Limit growth except in appropriate markets and subsectors ▪ Consider specialty and venue severity when establishing underwriting appetite ▪ Continue strategic shift toward small to midsize accounts and less risky Specialty accounts ▪ When appropriate, apply more restrictive terms and/or E&S solutions • Continue ongoing efforts to enhance our risk selection, pricing decisions and workflows: ▪ Bringing data science, predictive analytics, workflow solutions and other tools on line ▪ Utilizing data analytics to establish multi-tier risk models and improve retention of higher performing business • Focus on being Carrier of Choice via underwriting flexibility, product innovation, responsiveness, consistency and excellent customer experience; price is not the only criteria ▪ Launched new web portal to promote full agency partner and insured self service options – December 2024 ▪ Continuing enhancements of new business and renewal work flows using new system functionality and automation – 2025 ▪ In process of filing fully revised policy form and manuals for use nationwide for all legacy NORCAL and legacy ProAssurance Standard business - two- to three-year filing and approval process $793.7 $789.8 $754.7 $800.3 $823.9 $813.8 $804.1 $769.8 $742.3 $741.8 85.0% 93.5% 91.1% 101.3% 104.0% 102.4% 85.6% 81.5% 84.5% 81.9% NEP Net Loss & LAE 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 More than 20 Point Improvement in Net Loss and LAE Ratio for Specialty P&C* Since 2019 Reflects Benefits of Premium Increases and Strategic Initiatives * Accident Year Schedule P data including ULAE for combined ProAssurance Group excluding Workers' Compensation subsidiaries. Data excludes large account loss from 2019 and 2020.

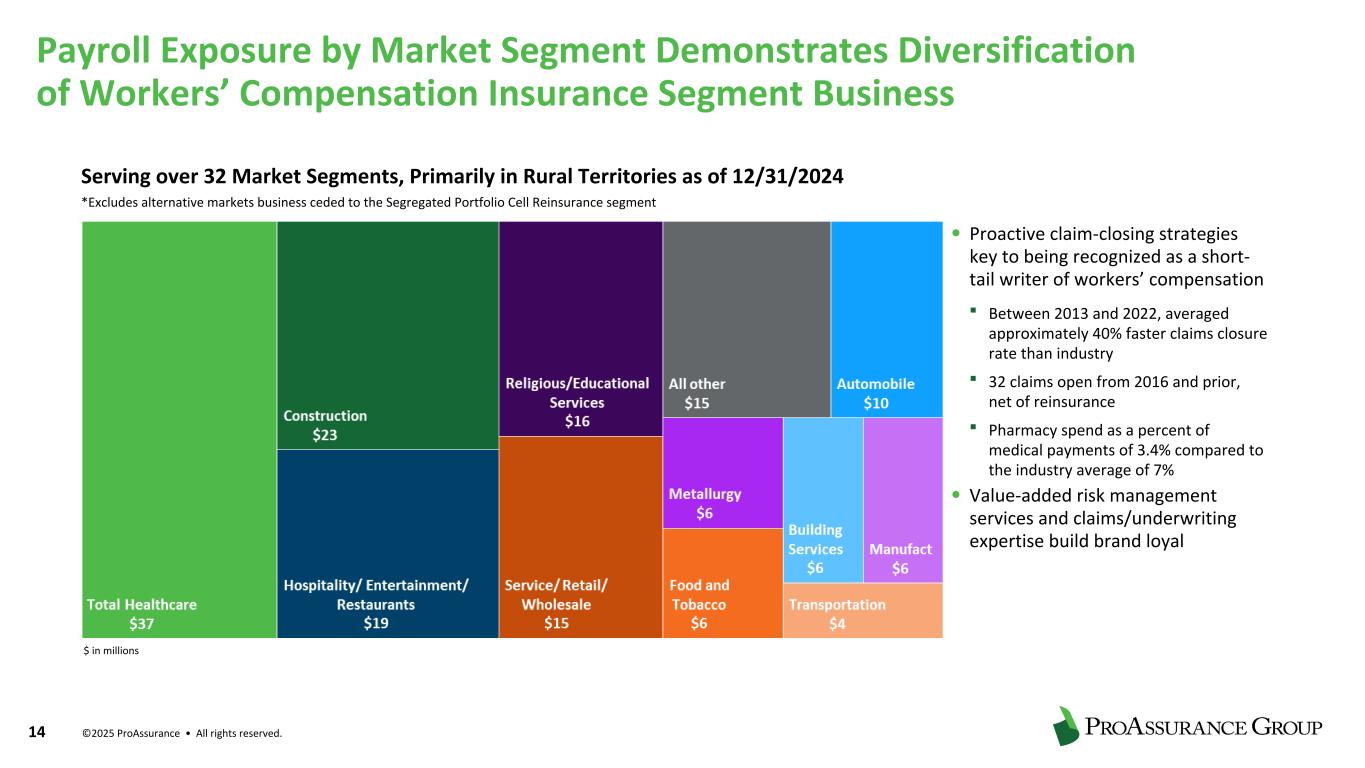

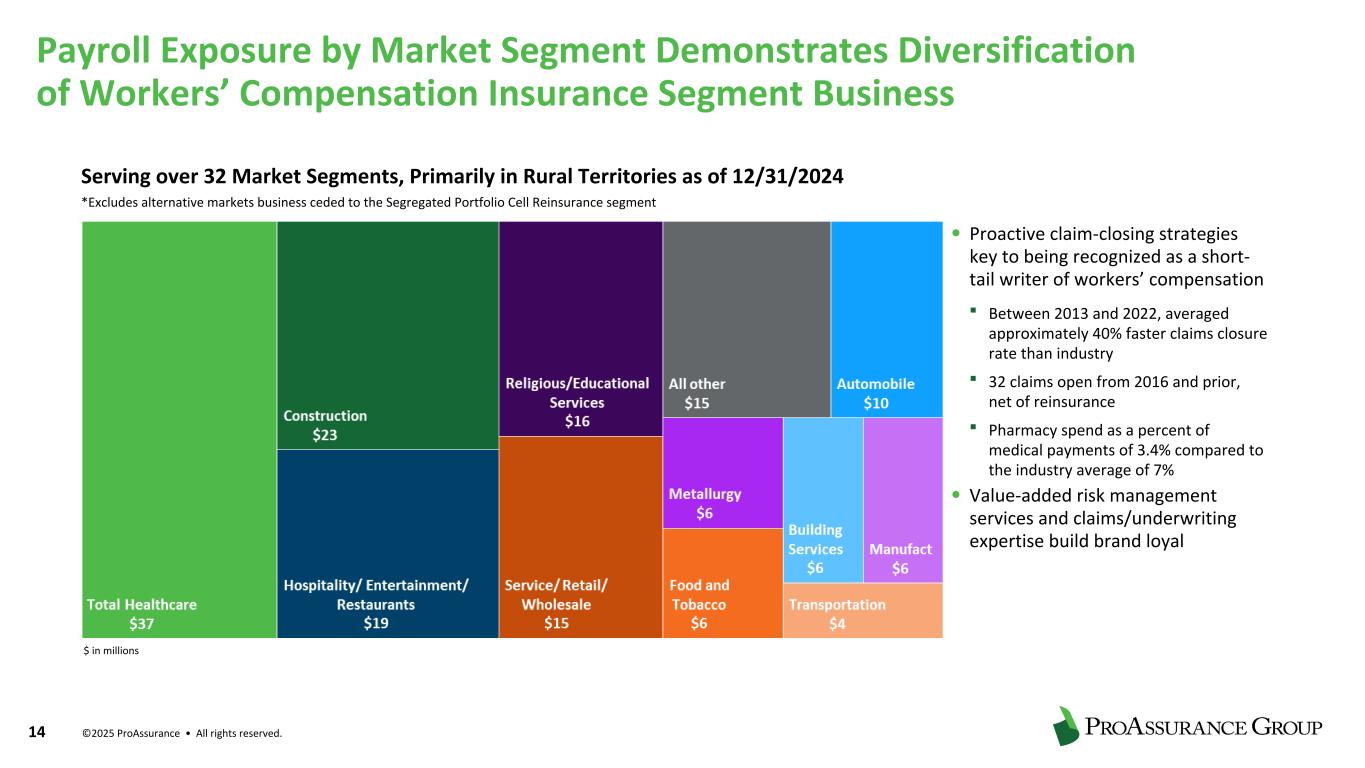

©2025 ProAssurance • All rights reserved. 14 Payroll Exposure by Market Segment Demonstrates Diversification of Workers’ Compensation Insurance Segment Business Serving over 32 Market Segments, Primarily in Rural Territories as of 12/31/2024 *Excludes alternative markets business ceded to the Segregated Portfolio Cell Reinsurance segment $ in millions • Proactive claim-closing strategies key to being recognized as a short- tail writer of workers’ compensation ▪ Between 2013 and 2022, averaged approximately 40% faster claims closure rate than industry ▪ 32 claims open from 2016 and prior, net of reinsurance ▪ Pharmacy spend as a percent of medical payments of 3.4% compared to the industry average of 7% • Value-added risk management services and claims/underwriting expertise build brand loyal

©2025 ProAssurance • All rights reserved. 15 Workers’ Compensation Insurance Segment Addressing Market Challenges With Innovation Initiatives • Implemented new integrated policy, claims, risk management and billing systems, paving the way for innovation initiatives • Expand use of data analytics to guide and support operational decisions in underwriting and claims, focusing on improving ease of doing business for agency partners and insureds • Capitalize on InsurTech investments, including AI, underwriting and claims data analytics, to enhance profitability, productivity and efficiency ▪ Adopted Clara Analytics AI Platform to lower medical costs and achieve better outcomes ▪ Implemented GuideWire for underwriting of more profitable small account business ▪ Added Roots Automation “digital co-workers” capabilities to improve efficiency and effectiveness of underwriting and claims teams Use cases for Clara Analytics, a real-time augmented intelligence partner with workers’ comp expertise focused on providing optimal insurance claims outcomes, include: • Lower medical and indemnity costs with the best providers • Predict severity and balance adjuster caseload at first notice of loss • Gain insights and save expense by collating, searching and analyzing claim medical bills and records with treatment timelines and smart alerts • Grading defense and plaintiff attorneys on their outcomes in past similar claims

©2025 ProAssurance • All rights reserved. 16 Agency group or association establishes a cell SERVICES INCLUDE • Underwriting • Claims Administration • Risk Management • Reinsurance • Audit • Asset Management Services + Cell Rental Fees + Participation in profits/losses of selected cells Fee Income to PRA • Strategic partnerships with select independent agencies looking to manage controllable expenses • Alternative market solutions are in high demand • Value-added risk management services and claims/underwriting expertise • 2024 gross premiums written of $58 million ▪ Workers’ Compensation Insurance: $55 million ▪ Medical Professional Liability: $3 million ▪ 20 active cells Individually capitalized cells (companies) exist within the Inova Re structure. Assets and liabilities of each are segregated from others. Workers’ Comp and Medical Professional Liability businesses participate in select cells. ProAssurance Front Arrangement Through Inova Segregated Portfolio Cell Reinsurance Segment Segregated portfolio cells for medical professional liability and workers’ compensation provide captive insurance solutions that generate fee income with low capital requirements

©2025 ProAssurance • All rights reserved. 17 Details of our investment portfolio are available on our website at https://investor.proassurance.com/financial-information/quarterly-investment-supplements More than 90% Fixed Maturity Portfolio in Investment Grade Bonds • New money yield of 5.8% in fourth quarter • Effective stewardship of capital ensures a position of financial strength through turbulent market cycles • Optimizing our allocations for better risk- adjusted returns. Ensures non-correlation of returns • Ongoing analysis of holdings to ensure lasting quality and profitability Total Investments of $4.4 billion (full-year 2024) Consolidated Portfolio Statistics 4Q24 4Q23 Average Income Yield 3.5% 3.1% Weighted Average Duration 3.22 3.25 Fixed Maturity Credit Quality (at year-end 2024) Fixed Maturities Trading, 1% Other Invested Assets, 1% Short Term, 5%State/Muni, 10% Unconsolidated Subs, 6% US Govt/Agency, 6% Asset-backed Securities, 26% BOLI, 2% Common Stock - Trading, 3% Corporate, 40% AA+ 20% AA 6% AA- 5% A+ 7% A 11% A- 11% BBB+ 5%BBB 8% BBB- 4% Below IG or Not Rated 7% AAA 16%

©2025 ProAssurance • All rights reserved. 18 Contribution of Net Investment Results Rose 23% in 2024 ($ in thousands) 2024 Beginning Equity $ 1,111,980 Employee Stock Transactions 4,927 Earnings 52,744 OCI 32,098 Total Equity $ 1,201,749 Net Investment Income ($ in millions) 12/31/2024 12/31/2023 Change Fixed maturities $133,577 $113,721 $19,856 Equities 4,758 4,610 148 Short-term investments including Other 12,463 15,476 (3,013) BOLI 2,316 2,489 (173) Investment fees and expenses (8,576) (7,877) (699) Net investment income $144,538 $128,419 $16,119 Equity in earnings (loss) of unconsolidated subsidiaries 22,203 6,791 15,412 Net investment result $166,741 $135,210 $31,531

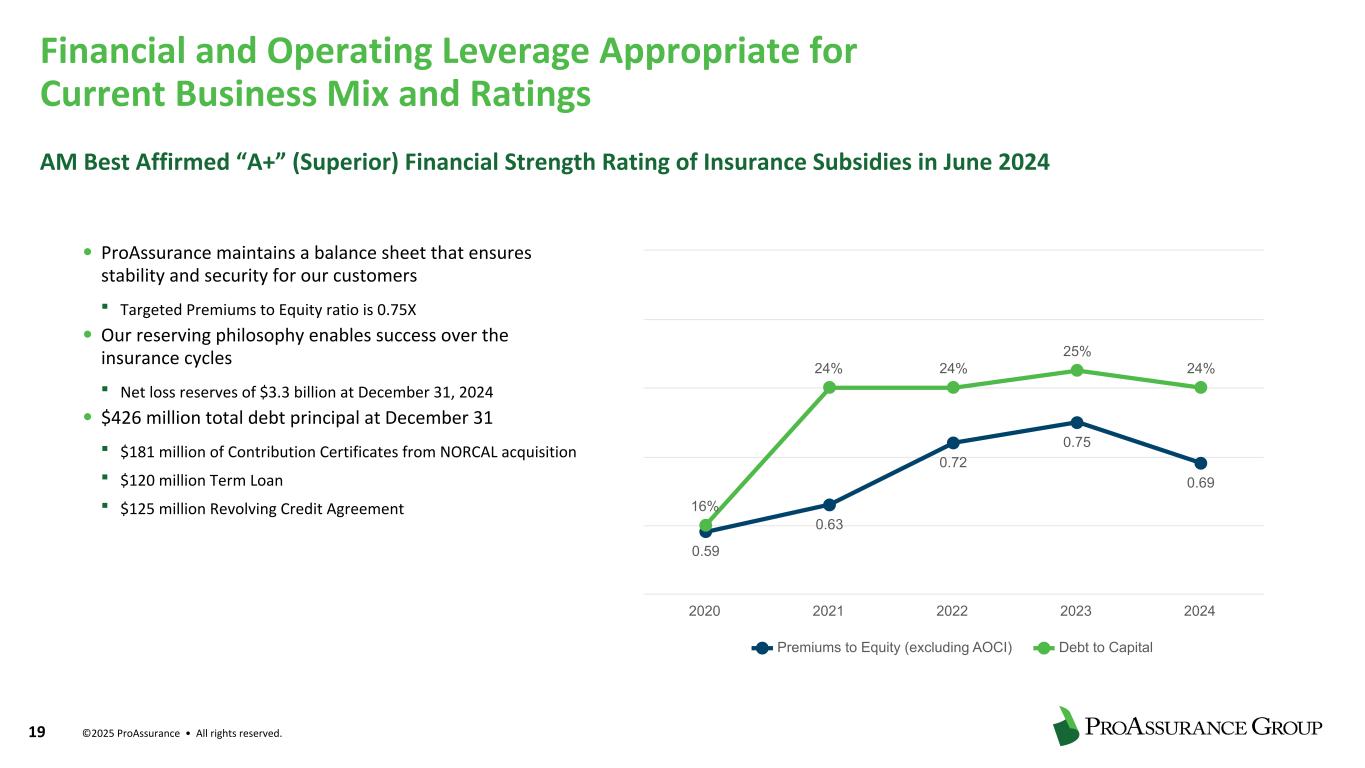

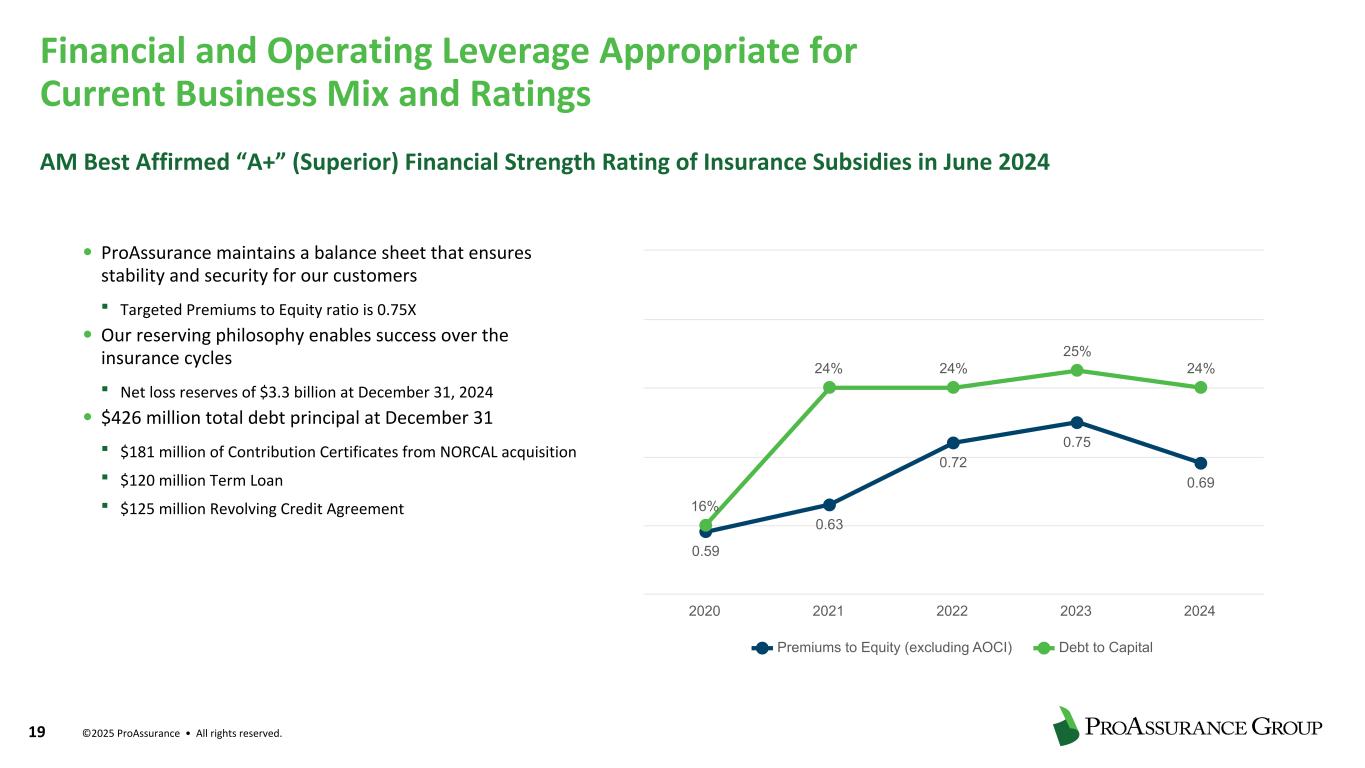

©2025 ProAssurance • All rights reserved. 19 • ProAssurance maintains a balance sheet that ensures stability and security for our customers ▪ Targeted Premiums to Equity ratio is 0.75X • Our reserving philosophy enables success over the insurance cycles ▪ Net loss reserves of $3.3 billion at December 31, 2024 • $426 million total debt principal at December 31 ▪ $181 million of Contribution Certificates from NORCAL acquisition ▪ $120 million Term Loan ▪ $125 million Revolving Credit Agreement Financial and Operating Leverage Appropriate for Current Business Mix and Ratings AM Best Affirmed “A+” (Superior) Financial Strength Rating of Insurance Subsidies in June 2024 0.59 0.63 0.72 0.75 0.69 16% 24% 24% 25% 24% Premiums to Equity (excluding AOCI) Debt to Capital 2020 2021 2022 2023 2024

©2024 ProAssurance • All rights reserved. 20 Appendix

©2025 ProAssurance • All rights reserved. 21 ProAssurance Executive Leadership Executive Team bios available on our website at Investor.ProAssurance.com/OD Ned Rand - President & Chief Executive Officer Mr. Rand became President and CEO in 2019, after serving as COO, CFO, Executive VP, and Senior VP of Finance at ProAssurance since joining the company in 2004. Prior to joining ProAssurance, he served in a number of financial roles for insurance companies. Mr. Rand is a CPA and graduate of Davidson College (B.A., Economics) Dana Hendricks Executive Vice President & Chief Financial Officer Jeff Lisenby Executive Vice President & General Counsel Rob Francis President Medical Professional Liability Kevin Shook President, Workers’ Compensation & Segregated Portfolio Cell Reinsurance Karen Murphy President Life Sciences Insurance Noreen Dishart Executive Vice President & Chief Human Resources Officer

©2025 ProAssurance • All rights reserved. 22 ProAssurance Board of Directors Director bios available on our website at Investor.ProAssurance.com/OD Maye Head Frei Compensation Committee Chair Katisha T. Vance, MD Nominating/Corporate Governance Committee Chair Samuel A. Di Piazza, Jr Compensation Committee and Executive Committee Kedrick D. Adkins, Jr Audit Committee Chair Bruce D. Angiolillo, J.D. Independent Chair Executive Committee Chair Scott C. Syphax Nominating/Corporate Governance Committee Fabiola Cobarrubias, MD Audit Committee and Nominating/Corporate Governance Committee Edward L. Rand, Jr Executive Committee Richard J. Bielen Audit Committee Staci M. Pierce, J.D. Compensation Committee

©2025 ProAssurance • All rights reserved. 23 ProAssurance Group Brands Alternative Risk Transfer Workers’ CompensationSpecialty Property & Casualty MEDICAL PROFESSIONAL LIABILITY INSURANCE FOR ANESTHESIOLOGISTS

©2025 ProAssurance • All rights reserved. 24 Forward Looking Statements This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. Non-GAAP Measures This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in our remarks and discussions with investors. The primary Non-GAAP measure we reference is Non-GAAP operating income (loss), a Non-GAAP financial measure that is widely used to evaluate performance within the insurance sector. In calculating Non- GAAP operating income (loss), we have excluded the after-tax effects of net realized investment gains or losses, foreign currency exchange gains or losses, non-core operations and guaranty fund assessments or recoupments that do not reflect normal operating results. We believe Non-GAAP operating income presents a useful view of the performance of our core insurance operations, but should be considered in conjunction with net income (loss) computed in accordance with GAAP. A reconciliation of these measures to GAAP measures is available in our regular reports on Forms 10-Q and 10-K and in our latest quarterly news release, all of which are available in the Investor Relations section of our website, Investor.ProAssurance.com. Important Safe Harbor and Non-GAAP Notices

25 Contact: Heather J. Wietzel SVP, Investor Relations 205-776-3028 InvestorRelations@ProAssurance.com Investor.ProAssurance.com Mailing Address: ProAssurance Corporation 100 Brookwood Place Birmingham, AL 35209