1 2018 First Quarter Earnings Conference Call Wednesday, April 18, 2018

2 Forward Looking Statements & Additional Disclosures This presentation may contain statements regarding future events or the future financial performance of the Company that constitute forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements relate to, among other things, expectations regarding the business environment in which we operate, projections of future performance, perceived opportunities in the market, and statements regarding our business strategies, objectives and vision. Forward‐ looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates” or similar expressions. With respect to any such forward‐looking statements, the Company claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The Company’s actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward‐looking statements. The risks and uncertainties include, but are not limited to: possible deterioration in economic conditions in our areas of operation; interest rate risk associated with volatile interest rates and related asset‐liability matching risk; liquidity risks; risk of significant non‐earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; and regulatory risks associated with current and future regulations. For additional information concerning these and other risk factors, see the Company’s most recent Annual Report on Form 10‐K. The Company does not undertake, and specifically disclaims any obligation, to update any forward‐looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law.

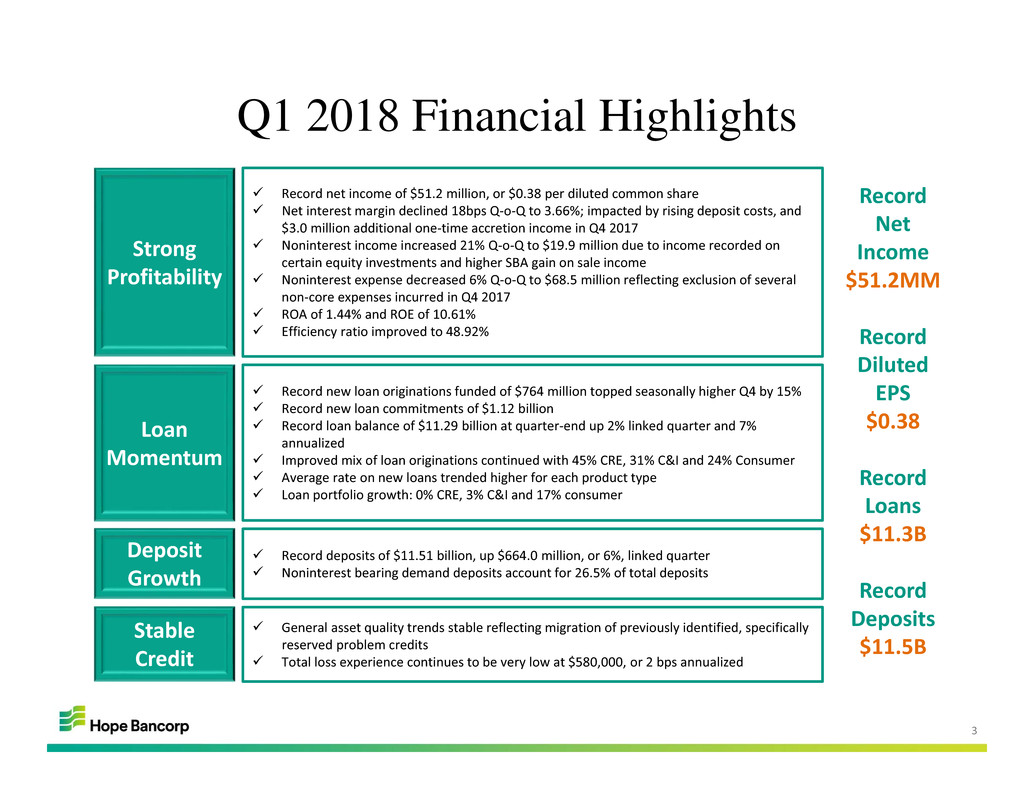

3 Q1 2018 Financial Highlights Strong Profitability Loan Momentum Stable Credit Record net income of $51.2 million, or $0.38 per diluted common share Net interest margin declined 18bps Q‐o‐Q to 3.66%; impacted by rising deposit costs, and $3.0 million additional one‐time accretion income in Q4 2017 Noninterest income increased 21% Q‐o‐Q to $19.9 million due to income recorded on certain equity investments and higher SBA gain on sale income Noninterest expense decreased 6% Q‐o‐Q to $68.5 million reflecting exclusion of several non‐core expenses incurred in Q4 2017 ROA of 1.44% and ROE of 10.61% Efficiency ratio improved to 48.92% Record new loan originations funded of $764 million topped seasonally higher Q4 by 15% Record new loan commitments of $1.12 billion Record loan balance of $11.29 billion at quarter‐end up 2% linked quarter and 7% annualized Improved mix of loan originations continued with 45% CRE, 31% C&I and 24% Consumer Average rate on new loans trended higher for each product type Loan portfolio growth: 0% CRE, 3% C&I and 17% consumer General asset quality trends stable reflecting migration of previously identified, specifically reserved problem credits Total loss experience continues to be very low at $580,000, or 2 bps annualized Deposit Growth Record deposits of $11.51 billion, up $664.0 million, or 6%, linked quarter Noninterest bearing demand deposits account for 26.5% of total deposits Record Net Income $51.2MM Record Diluted EPS $0.38 Record Loans $11.3B Record Deposits $11.5B

4 Loan Production & Portfolio Trends Total end‐of‐period loans increased $189.9 million or 2% Q‐o‐Q and 7% annualized Record new loan originations funded of $764 million topped seasonally higher Q4 by 15% Record new loan commitments of $1.12 billion, including a large new warehouse line of credit Improved mix of loan originations continued with 45% CRE, 31% C&I and 24% Consumer – First quarter ever where non‐CRE categories accounted for more than 50% of new production $2.67 billion total C&I commitments at 3/31/2018 and 48% utilization vs. 53% Q‐o‐Q – Reduction in utilization reflects a large, new warehouse line that closed quarter‐end with no disbursements as of 3/31/2018 SBA loan production of $78.2 million of which $73.9 million was 7(a) Average rate on new loans increased 22bps to 4.64% and trended higher for each product type Loan portfolio growth Q‐o‐Q: – CRE: +0% – C&I: +3% – Consumer: +17% 75% 18% 7% 77% 19% 4% 9/30/2016 (First quarter after MOE) 3/31/2018 Loan Portfolio Composition $321 $270 $390 $450 $359 $385 $347 $157 $144 $166 $190 $132 $85 $236 $80 $51 $31 $74 $120 $194 $181 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 New Loan Originations Funded CRE C&I Consumer $559 $465 $587 $715 $611 $664 $764 ($ millions) 4.03% 4.15% 4.26% 4.56% 4.40% 4.42% 4.64% 3.96% 4.06% 4.16% 4.26% 4.36% 4.46% 4.56% 4.66% Avg Rate

5 Deposit Growth Trends Total end‐of‐period deposits increased $664.0 million or 6% Q‐o‐Q to a record $11.51 billion Solid growth across all major deposit categories – Demand Deposit: +2% – Money Market & NOW: +4% – Time Deposits: +12% Deposit gathering a top priority for 2018 Proactive effort to raise deposits ahead of expected rate hikes later in the year to support solid loan pipeline $2.90 $2.90 $2.96 $3.02 $3.05 $3.00 $3.05 (26.5%) $3.32 $3.40 $3.48 $3.57 $3.69 $3.33 $3.45 (30.0%) $0.30 $0.30 $0.29 $0.28 $0.24 $0.24 $0.23 (2.0%) $4.18 $4.04 $3.97 $4.10 $4.01 $4.27 $4.77 (41.5%) 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Deposit Composition DDA MMA Savings Time $10.70 $10.64 $10.70 $10.96 $10.99 $10.85 $11.51 DDA = Noninterest bearing demand deposits MMA = Money market account deposits ($ billions) 98.36% 98.41% 97.88% 98.03% 98.94% 101.73% 97.54% $10.0B $10.5B $11.0B $11.5B $12.0B 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Net Loans to Deposits Net Loans Deposits LTD Ratio

6 Net Interest Income and Margin Key Net Interest Income Drivers $9.3 $10.4 $10.4 $10.5 $10.7 $10.9 $11.1 4.80% 4.80% 4.82% 4.89% 5.07% 5.12% 5.04% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Average Loans & Yield Avg Loans Yield Net Interest Income & NIM 1Q17 NII decline of $6.3 million due largely to: – 2 fewer days of interest accrual – $3.0 million of additional accretion income related to acquired loans that was one‐time in nature in 4Q17 – 11bps increase in cost of deposits 1Q18 NIM declined 18bps to 3.66% primarily reflecting lower accretion income and higher cost of deposits Remaining discount on acquired portfolios of $80.0 million as of 3/31/2018 Relatively stable NIM in 2018 with rising loan yields largely to be offset by increasing cost of deposits $6.8 $7.8 $7.7 $7.8 $7.8 $7.9 $8.2 0.56% 0.55% 0.55% 0.68% 0.75% 0.80% 0.91% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Interest Bearing Deposits & Cost of Deposits Interest Bearing Deposits Cost of Deposits $103.5 $117.2 $114.9 $116.8 $123.3 $126.4 $120.1 3.77% 3.75% 3.77% 3.75% 3.83% 3.84% 3.66% 3.30% 3.50% 3.70% 3.90% 4.10% 4.30% 4.50% 0 20 40 60 80 100 120 140 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Net Interest Income NIM $20.0 $8.8 $10.0 $8.8 $9.7 $12.1 $8.4 0 5 10 15 20 25 30 35 40 PAA ($ billions) ($ millions) ($ millions) PAA = Purchase accounting adjustments

7 Noninterest Income Total noninterest income increased $3.4 million or 21% Q‐o‐Q to $19.9 million Quarter‐over‐Quarter Difference Other income and fees increased $3.1 million or 43% to $10.4 million – Includes $3.5 million income recorded to reflect change in the value of certain equity investments Gain on sale of SBA loans increased $824,000 or 31% to $3.5 million from $2.6 million – Sold $48.6 million of SBA loans in 1Q18, up from $36.6 million in 4Q17 Gain on sale of other loans declined $112,000 or 9% to $1.2 million$4.78 $5.60 $5.34 $5.18 $5.15 $4.95 $4.80 $0.23 $3.66 $3.25 $3.27 $3.63 $2.63 $3.45 $1.48 $1.40 $0.42 $0.35 $0.85 $1.31 $1.20 $0.95 $0.30 $6.71 $7.53 $8.60 $7.32 $6.62 $7.27 $10.40 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Noninterest Income Service fees on dep accts Gain on sale of SBA loans Gain on sale of other loans Gain on sale of securities Other income and fees $14.15 $10.64 $17.63 $16.12 $16.25 $16.45 $19.85 ($ millions)

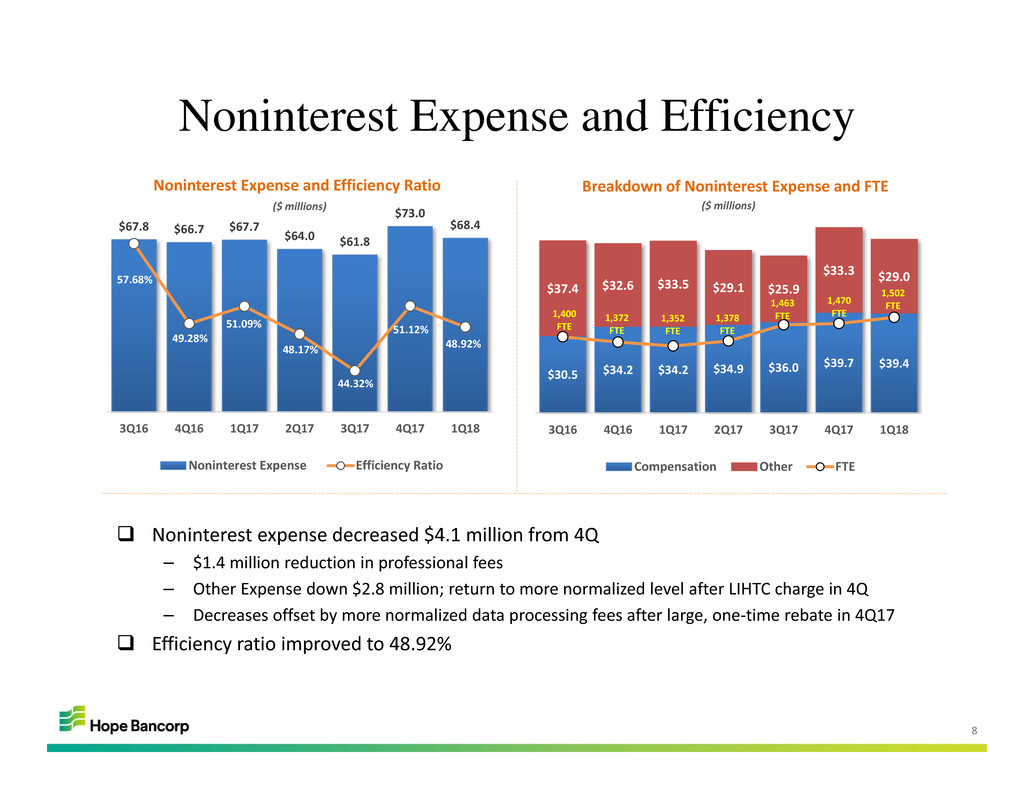

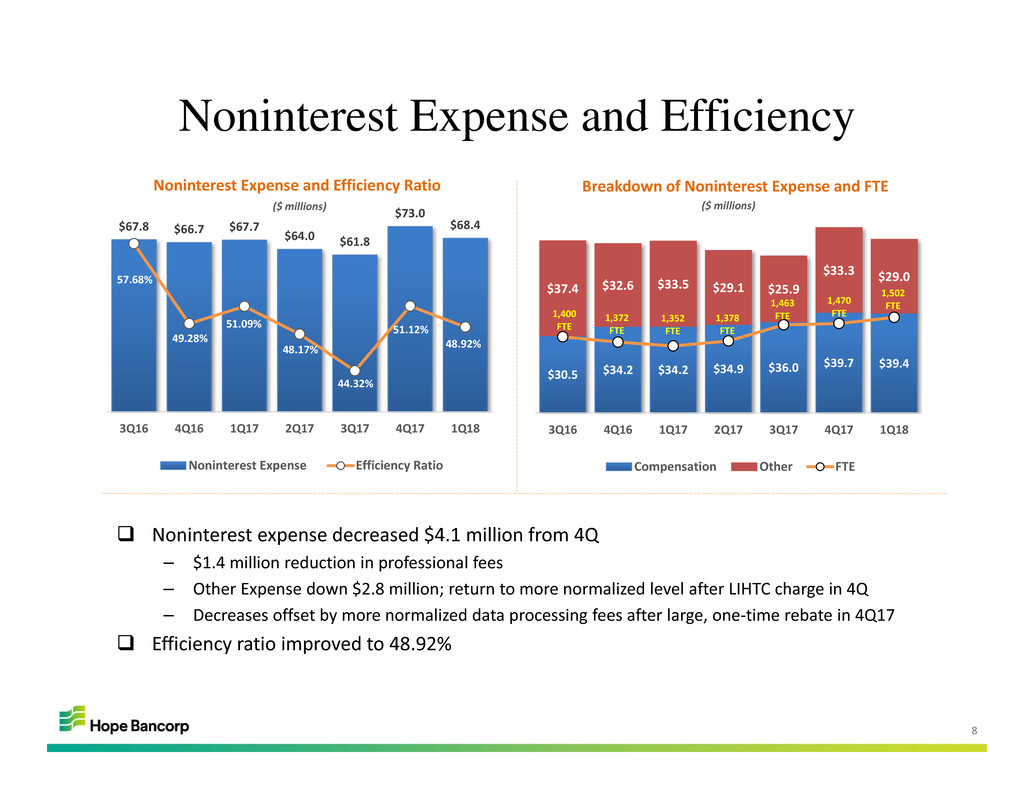

8 $30.5 $34.2 $34.2 $34.9 $36.0 $39.7 $39.4 $37.4 $32.6 $33.5 $29.1 $25.9 $33.3 $29.0 1,400 FTE 1,372 FTE 1,352 FTE 1,378 FTE 1,463 FTE 1,470 FTE 1,502 FTE 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Breakdown of Noninterest Expense and FTE Compensation Other FTE Noninterest Expense and Efficiency $67.8 $66.7 $67.7 $64.0 $61.8 $73.0 $68.4 57.68% 49.28% 51.09% 48.17% 44.32% 51.12% 48.92% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Noninterest Expense and Efficiency Ratio Noninterest Expense Efficiency Ratio ($ millions) Noninterest expense decreased $4.1 million from 4Q – $1.4 million reduction in professional fees – Other Expense down $2.8 million; return to more normalized level after LIHTC charge in 4Q – Decreases offset by more normalized data processing fees after large, one‐time rebate in 4Q17 Efficiency ratio improved to 48.92% ($ millions)

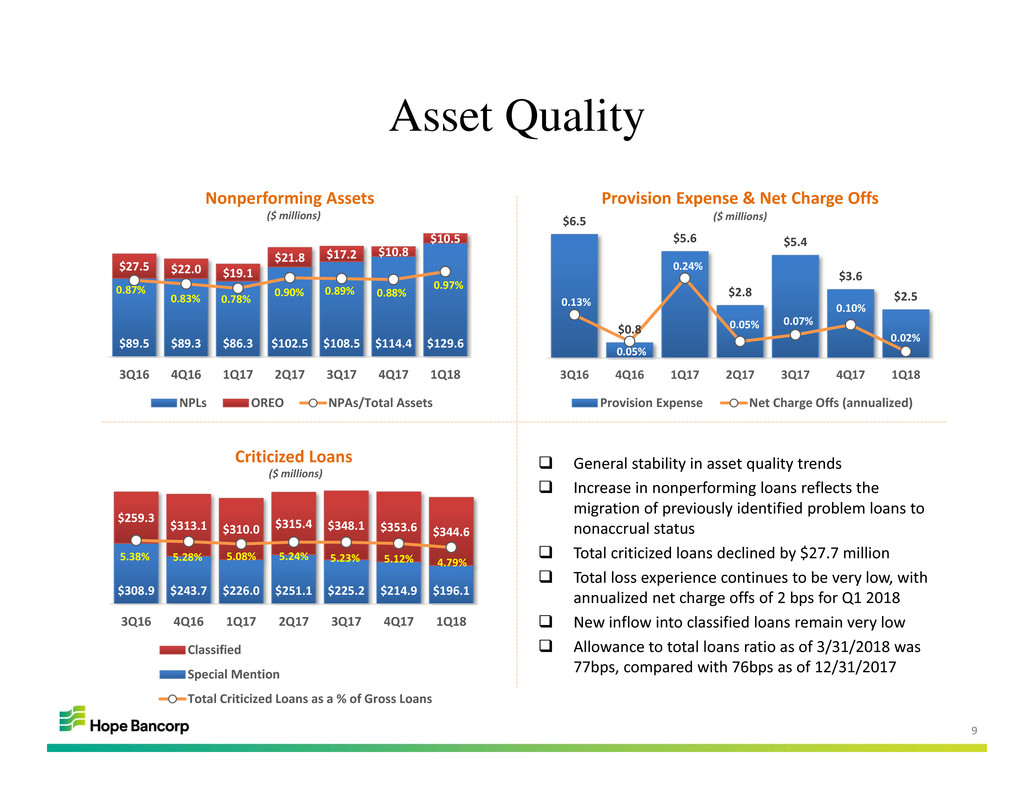

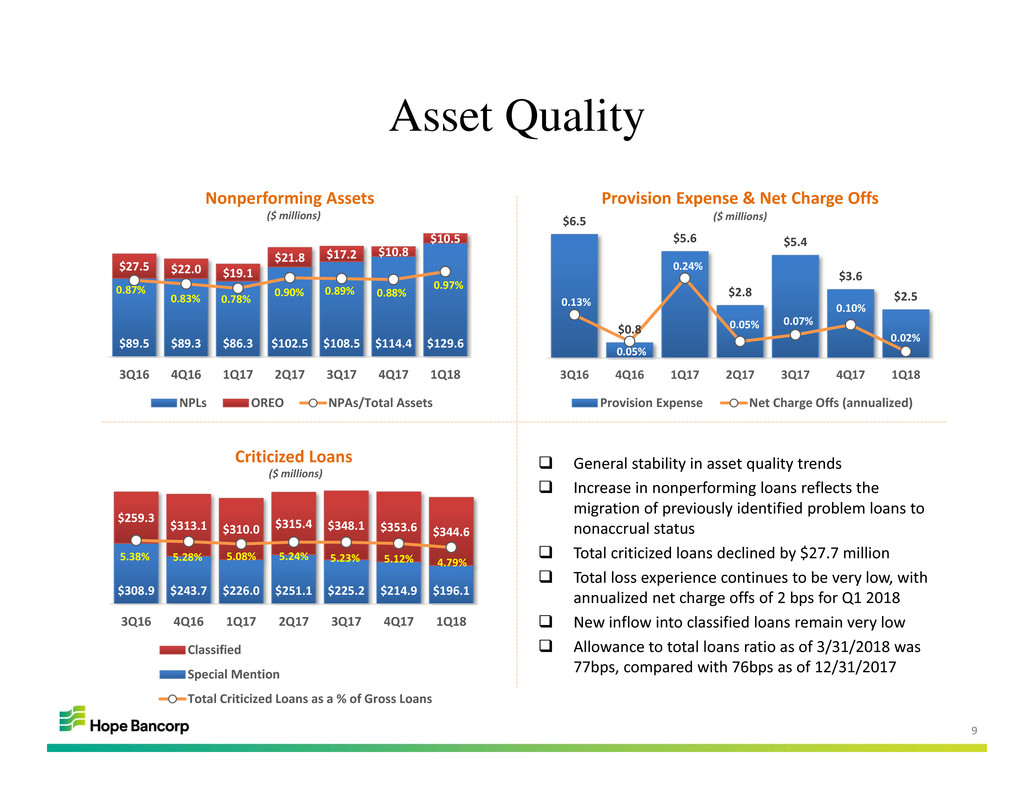

9 Asset Quality General stability in asset quality trends Increase in nonperforming loans reflects the migration of previously identified problem loans to nonaccrual status Total criticized loans declined by $27.7 million Total loss experience continues to be very low, with annualized net charge offs of 2 bps for Q1 2018 New inflow into classified loans remain very low Allowance to total loans ratio as of 3/31/2018 was 77bps, compared with 76bps as of 12/31/2017 $6.5 $0.8 $5.6 $2.8 $5.4 $3.6 $2.50.13% 0.05% 0.24% 0.05% 0.07% 0.10% 0.02% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Provision Expense & Net Charge Offs Provision Expense Net Charge Offs (annualized) ($ millions) $89.5 $89.3 $86.3 $102.5 $108.5 $114.4 $129.6 $27.5 $22.0 $19.1 $21.8 $17.2 $10.8 $10.5 0.87% 0.83% 0.78% 0.90% 0.89% 0.88% 0.97% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Nonperforming Assets NPLs OREO NPAs/Total Assets $308.9 $243.7 $226.0 $251.1 $225.2 $214.9 $196.1 $259.3 $313.1 $310.0 $315.4 $348.1 $353.6 $344.6 5.38% 5.28% 5.08% 5.24% 5.23% 5.12% 4.79% 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 Criticized Loans Classified Special Mention Total Criticized Loans as a % of Gross Loans ($ millions) ($ millions)

10 Near-Term Outlook & Strategies Loan growth guidance of 6‐8% for 2018 supported by: – Strong pipeline entering the second quarter – Expansion of residential mortgage originations through branch network across the U.S. contributing to double‐digit range growth for 2018 – Expansion of SBA loan production team and platform supporting low to mid‐teen growth for 2018 Managing deposit costs will be key challenge for 2018 – Addition of liquidity in Q1, ahead of additional rate hikes, provides opportunity to be more conservative in pricing going forward – Remaining flexible with deposit strategy and will implement additional campaigns to fund good lending opportunities Well positioned to build on momentum of strong first quarter and continue driving earnings growth Committed to Building on Foundation for Sustained Growth and Value Creation

11 2018 First Quarter Earnings Conference Call Q&A