2019 D.A. Davidson West Coast Bank Tour Los Angeles August 14, 2019 1

Forward Looking Statements & Additional Disclosures This presentation may contain statements regarding future events or the future financial performance of the Company that constitute forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements relate to, among other things, expectations regarding the business environment in which we operate, projections of future performance and perceived opportunities in the market. Forward‐looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “forecasts” or similar expressions. With respect to any such forward‐looking statements, the Company claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The Company’s actual results, performance or achievements may differ significantly from the results, performance or achievements expressed or implied in any forward‐looking statements. The risks and uncertainties include, but are not limited to: possible deterioration in economic conditions in our areas of operation; interest rate risk associated with volatile interest rates and related asset‐ liability matching risk; liquidity risks; risk of significant non‐earning assets, and net credit losses that could occur, particularly in times of weak economic conditions or times of rising interest rates; and regulatory risks associated with current and future regulations. For additional information concerning these and other risk factors, see the Company’s most recent Annual Report on Form 10‐K and Quarterly Report on Form 10‐Q. The Company does not undertake, and specifically disclaims any obligation, to update any forward‐looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law. 2

Presentation Index Company Overview Slide 4 Financial Highlights & Earnings Performance Slide 10 Loan Trends Slide 17 Asset Quality Slide 23 Deposit Trends Slide 25 Franchise Value Slide 27 Appendix Slide 34 3

Company Overview 4

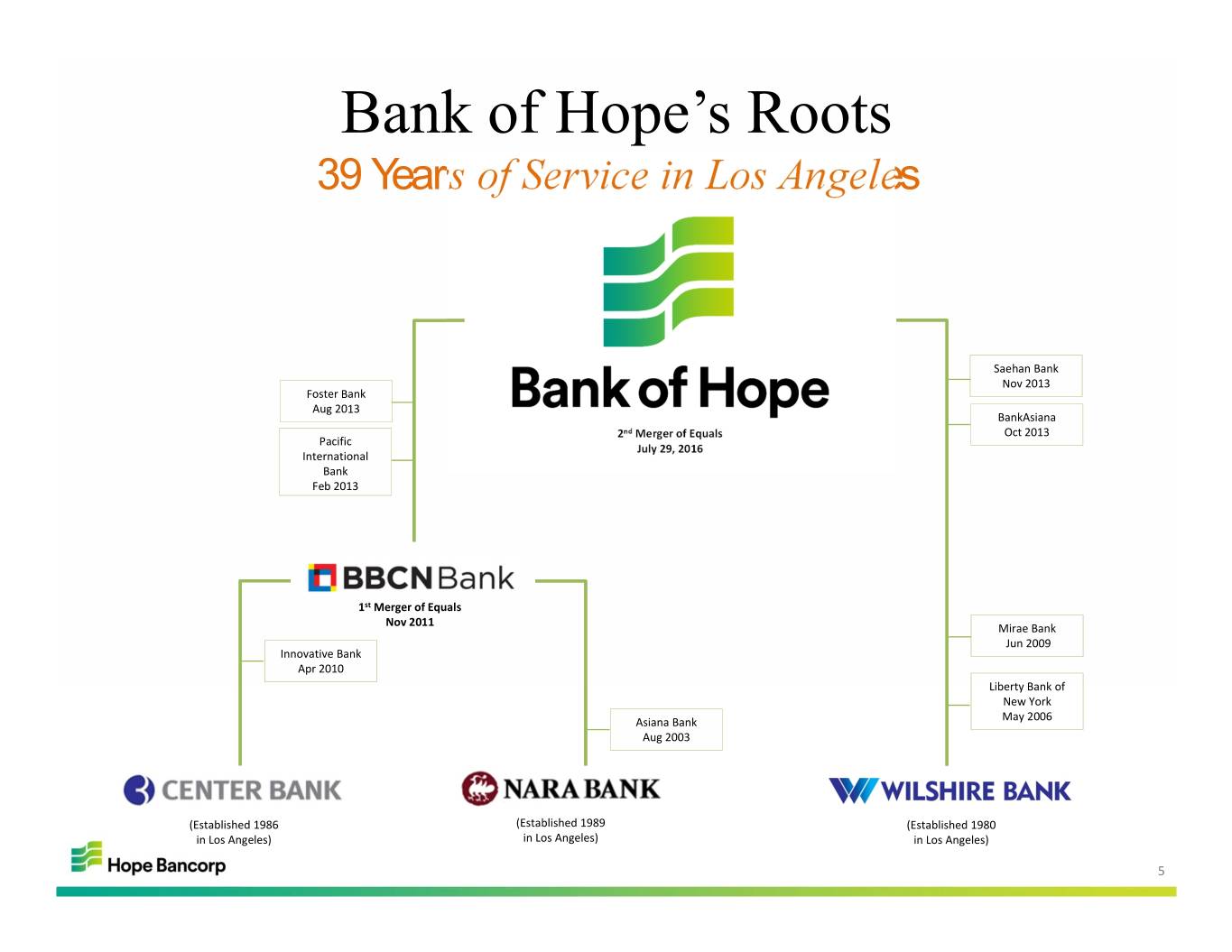

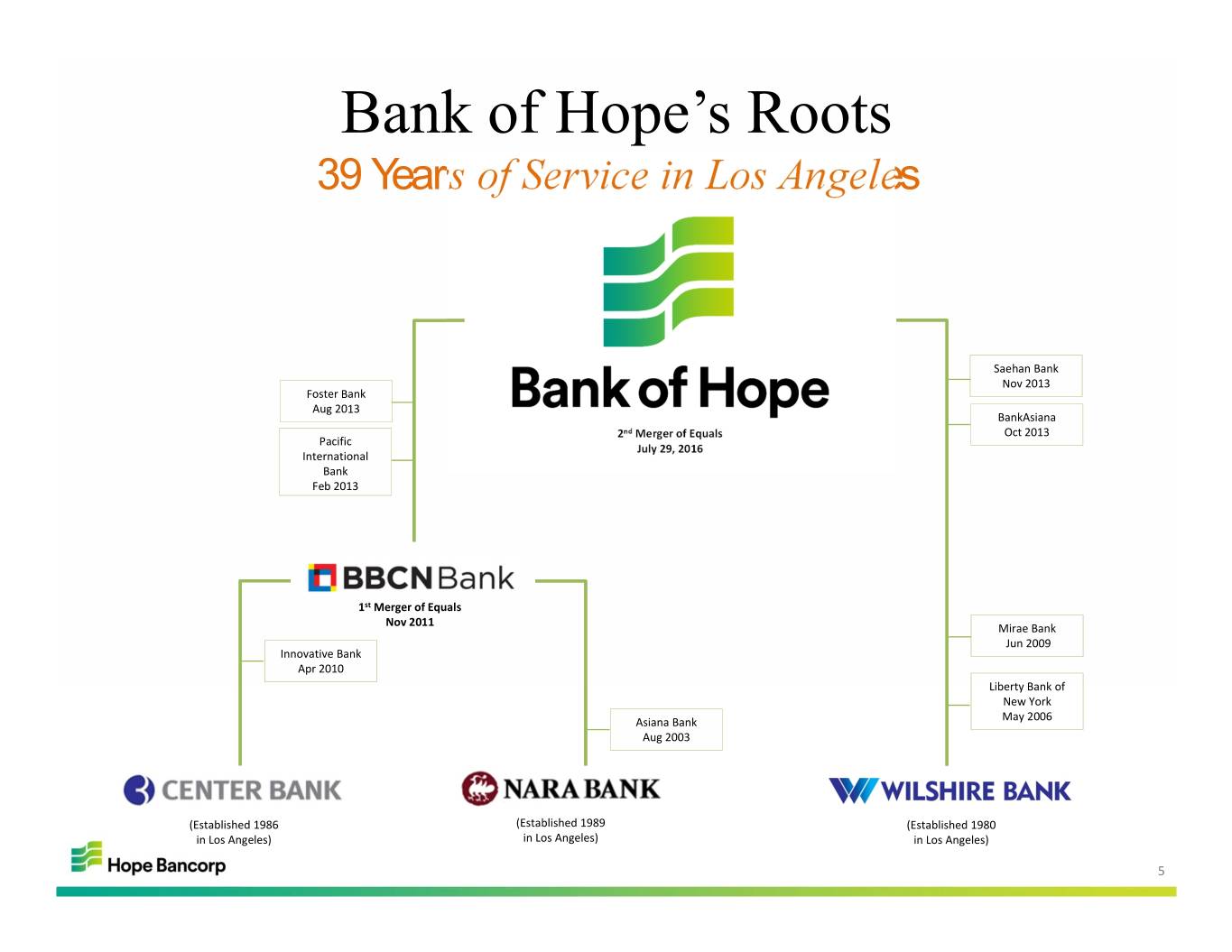

Bank of Hope’s Roots 39 Years of Service in Los Angeles Saehan Bank Nov 2013 Foster Bank Aug 2013 BankAsiana 2nd Merger of Equals Oct 2013 Pacific July 29, 2016 International Bank Feb 2013 1st Merger of Equals Nov 2011 Mirae Bank Jun 2009 Innovative Bank Apr 2010 Liberty Bank of New York Asiana Bank May 2006 Aug 2003 (Established 1986 (Established 1989 (Established 1980 in Los Angeles) in Los Angeles) in Los Angeles) 5

Company Profile Today Only super regional Korean‐American bank in the nation . 3rd largest Asian‐American bank in the U.S.1 . 6th largest bank headquartered in Los Angeles1 . 88th largest financial institution in the U.S.2 . 12th largest SBA lender in the country by volume3 . Only Korean‐American bank with presence in Korea . Only Korean‐American bank (formerly known as BBCN Bank) ever to be listed on Forbes’ list of “Best Banks in America” 2013 2014 2015 2016 2017 2018 2019 “We are committed to Leading national presence with full‐service branch operations in 9 states improving the value of our (strategically located in high density Asian‐American communities) . Presence in 2 additional states with specialized Loan Production Offices services as BANKERS, Seasoned and experienced management and board providing comprehensive financial solutions as Hope Bancorp, Inc. (Holding Company of Bank of Hope as of 6/30/2019) EXPERTS, and being good NEIGHBORS that foster Total Assets $15.3 billion growth for our customers Loans Receivable $12.0 billion and communities.” Total Deposits $12.2 billion 1 Source: S&P Global (formerly SNL) 2 Source: Federal Reserve Statistical Release as of June 30, 2018; Insured U.S.‐chartered commercial banks ranked by consolidated assets 3 Source: SBA national lender rankings as of September 30, 2018 6

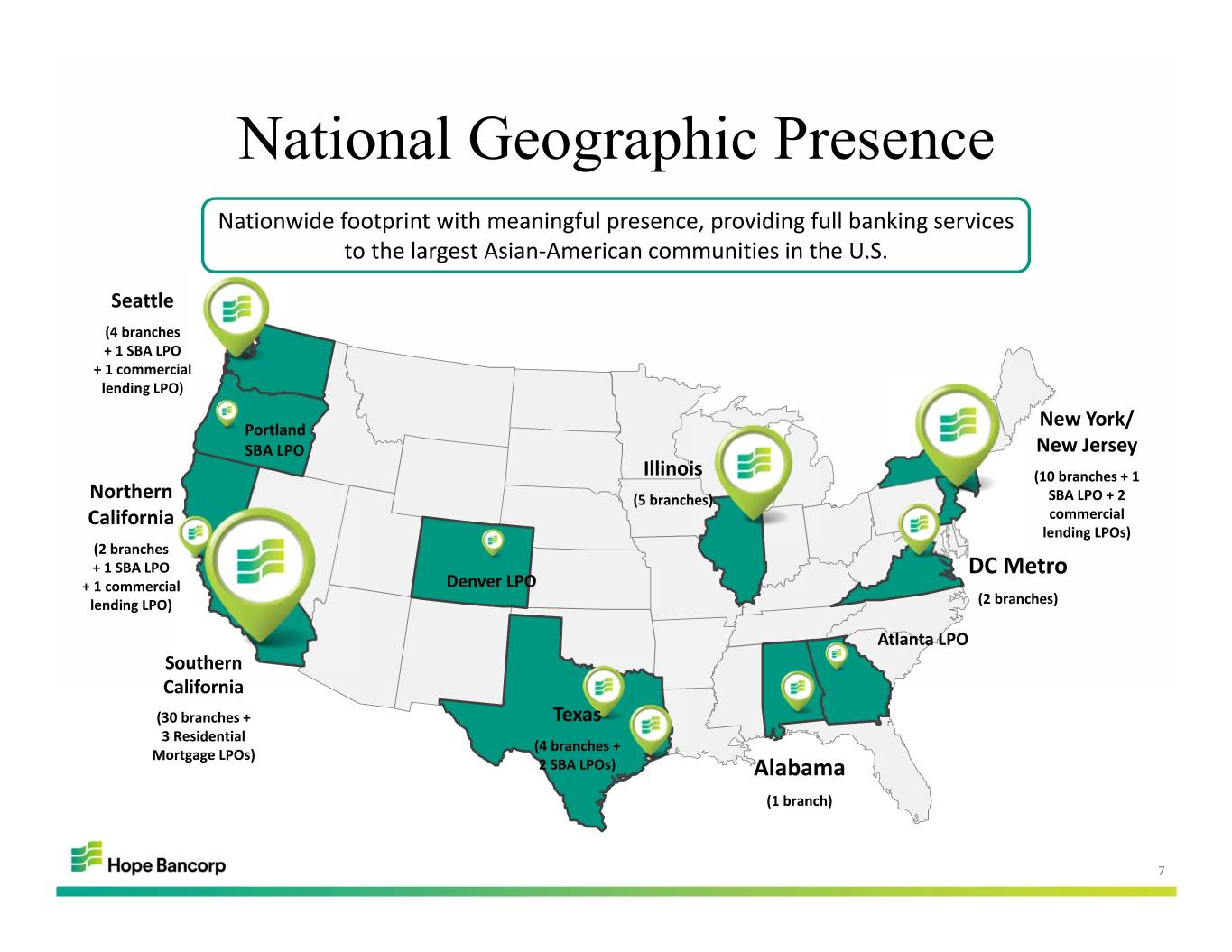

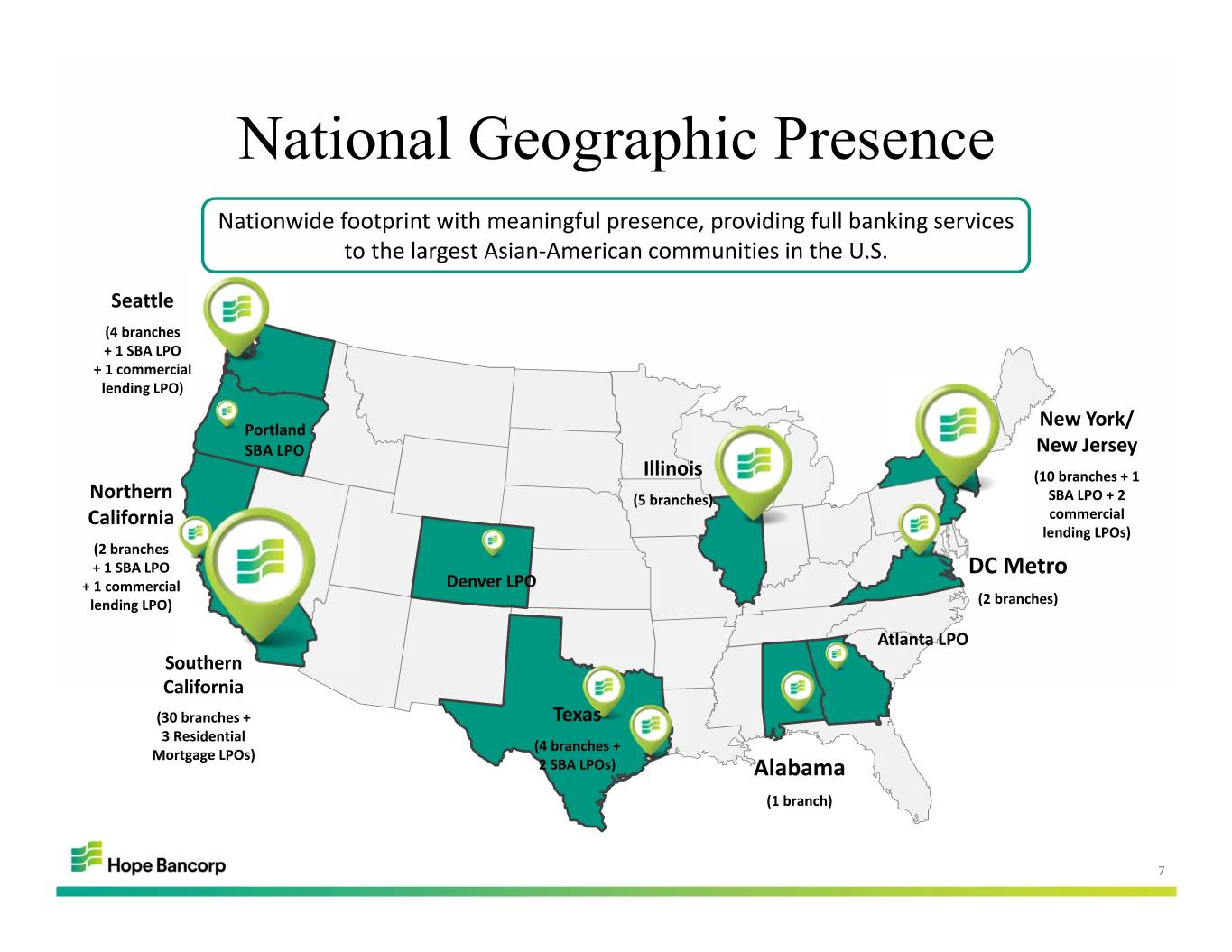

National Geographic Presence Nationwide footprint with meaningful presence, providing full banking services to the largest Asian‐American communities in the U.S. Seattle (4 branches + 1 SBA LPO + 1 commercial lending LPO) Portland New York/ SBA LPO New Jersey Illinois (10 branches + 1 Northern (5 branches) SBA LPO + 2 California commercial lending LPOs) (2 branches + 1 SBA LPO DC Metro + 1 commercial Denver LPO lending LPO) (2 branches) Atlanta LPO Southern California (30 branches + Texas 3 Residential (4 branches + Mortgage LPOs) 2 SBA LPOs) Alabama (1 branch) 7

Corporate Social Responsibility Highlights 1 OUT OF 2 1200 HOURS $3.01 BILLION 1 out of 2 Bank of Hope branches Nearly 1200 hours of $3.01 billion located in low‐to‐moderate CRA‐reportable of loans funded income areas volunteer hours in 2018 $500 MILLION $10 MILLION $2.0 MILLION $500 million of $10 million of $2.0 million of contributions CRA‐reportable small business donations and sponsorships to the Hope Scholarship lending in 2018 over last 10 years Foundation since 2001 In addition to financing economic growth, we believe our responsibilities include helping the communities in which we live and work to grow and flourish through volunteerism and philanthropy. 8

Executive Leadership We are proud to have one of the strongest leadership teams among Leadership Asian‐American banks. Risk Operations Business Management Oversight Leadership Peter Koh Thomas Stenger Daniel H. Kim David P. Malone Kyu S. Kim David Song David W. Kim Kevin S. Kim EVP, Chief Credit EVP, Chief Risk EVP, Chief Strategy President & Chief Senior EVP, Eastern EVP, Credit EVP, Midwest Chairman & Chief Officer Officer & Administrative Operating Officer Regional President Administration Regional President Executive Officer Officer Richard Marshall Lisa K. Pai Alex Ko Janette Mah Jason Kim EVP, Credit EVP, General Young K. Lee EVP, Chief Financial EVP, Chief EVP, Western Administration Counsel EVP, Chief Human Officer Mortgage Banking Regional President Resource Officer Officer Karen Craigmile Hung Van Kenneth Logan EVP, Chief EVP, Chief Information EVP & Head of Internal Audit Officer Residential Finance Executive 9

Financial Highlights & Earnings Performance 10

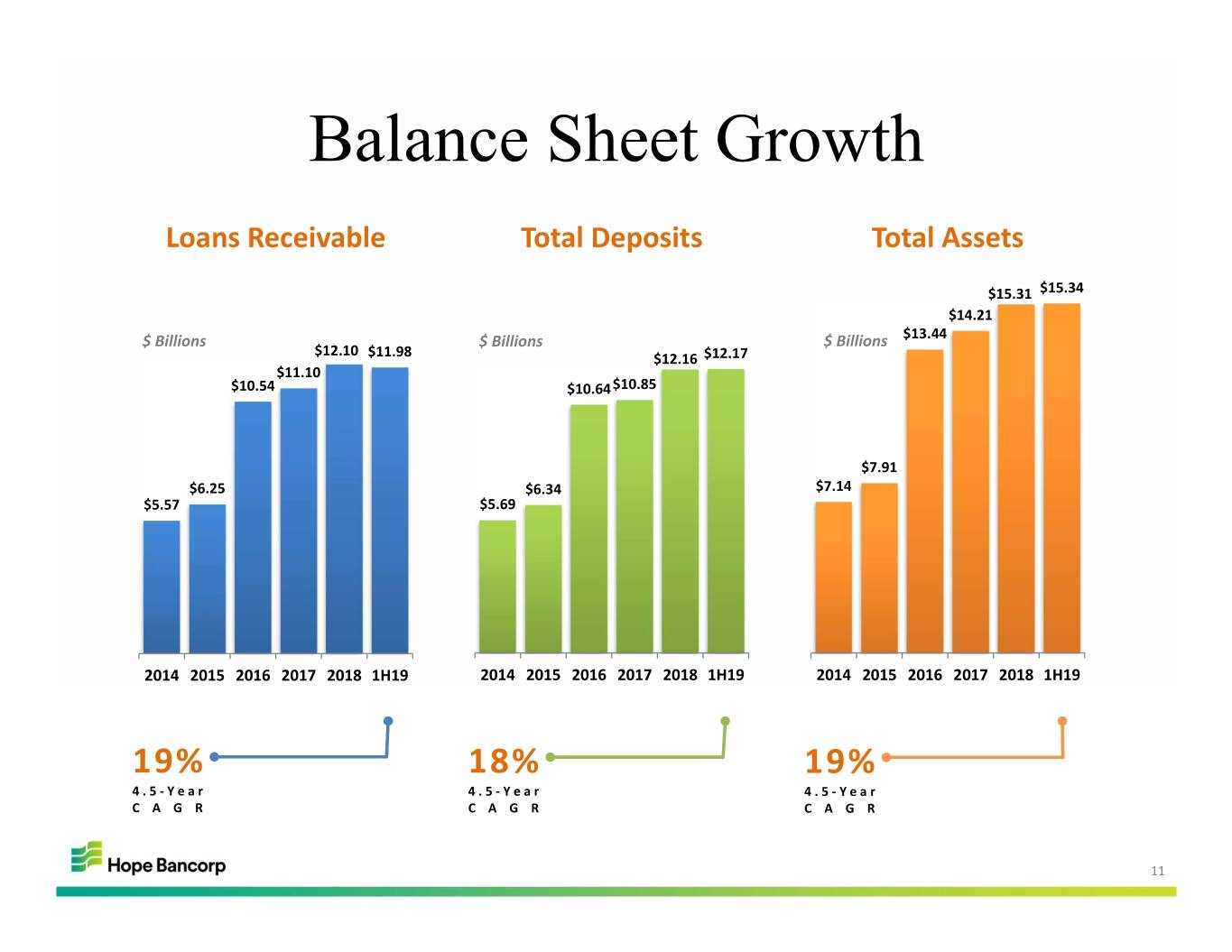

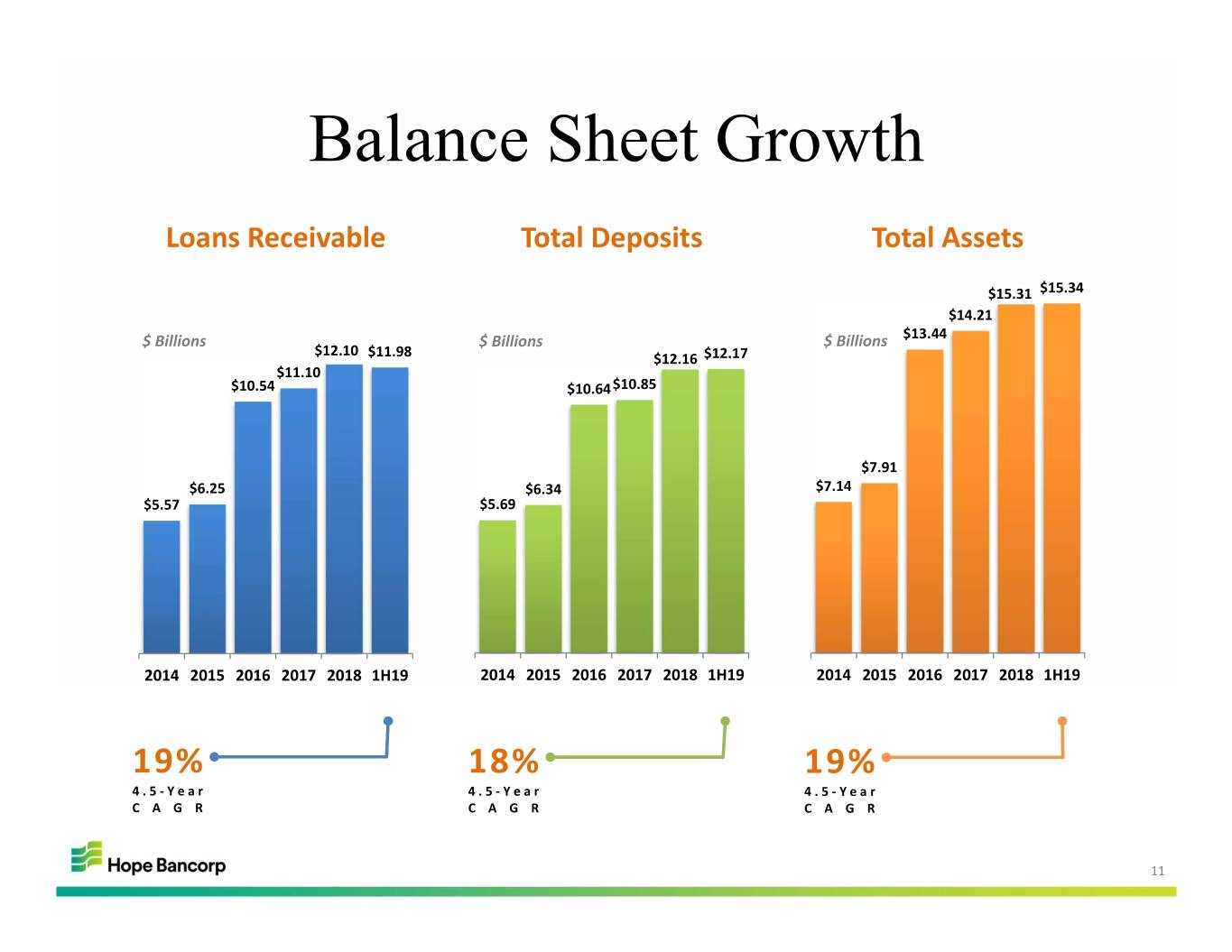

Balance Sheet Growth Loans Receivable Total Deposits Total Assets $15.31 $15.34 $14.21 $ Billions $ Billions $ Billions $13.44 $12.10 $11.98 $12.16 $12.17 $11.10 $10.54 $10.64$10.85 $7.91 $6.25 $6.34 $7.14 $5.57 $5.69 2014 2015 2016 2017 2018 1H19 2014 2015 2016 2017 2018 1H19 2014 2015 2016 2017 2018 1H19 19% 18% 19% 4.5‐Year 4.5‐Year 4.5‐Year CAGR CAGR CAGR 11

Solid Earnings Performance Revenues Net Income $189.6 $547.8 $548.1 $ millions $ millions $139.4 $415.2 $113.7 $98.8 1 $88.6 $92.3 2 $310.8 $316.7 $85.4 $278.0 1 $260.5 2 2014 2015 2016 2017 2018 6 Mos 6 Mos 2014 2015 2016 2017 2018 6 Mos 6 Mos 2018 2019 2018 2019 15% 21% 4‐Year 4‐Year CAGR CAGR 1 6 Mos 2018 Revenues and Net Income include pre‐tax gain on sales of SBA loans of $6.9 million. 2 6 Mos 2019 Revenues and Net Income includes $0 of gain on sales of SBA loans. 12

Q2 2019 Financial Highlights Net income of $42.7 million, or $0.34 per diluted common share Net interest margin declined 8bps Q‐o‐Q to 3.31%; compression of core net interest margin Earnings & excluding purchase accounting adjustments moderated to a 6bps decrease from a 7bps decrease in Net 1Q19 Income Profitability Noninterest expense fairly consistent with prior quarters, notwithstanding ongoing long‐term investments in the organization $42.7MM New loan originations funded of $504 million exemplify Company’s targeted mix of higher‐yielding Loan loans CRE loans accounted for 50% of new loan production; C&I 35%; and residential mortgage 15% Diluted Production Average rate on new loans was 5.46%, representing a 6bps decrease from 1Q19 as a result of the EPS lower rate environment $0.34 Total deposits declined 1% Q‐o‐Q but demonstrated a favorable mix shift to lower‐cost deposits Increases in noninterest bearing demand deposits, savings and MMAs, offset by decreases in higher‐cost time deposits Gross Deposits Increase in cost of deposits moderated significantly, up 5bps in 2Q19 versus 17bps in 1Q19, reflecting progress with deposit initiatives Loans Positively trending repricing gap on time deposit renewals, 18bps in 2Q19 versus 50bps in 1Q19 $12.0B Net loans‐to‐deposits stable at 97.7% as of 6/30/2019 Across‐the‐board improvement in all asset quality categories highlighted by a 25% decrease in nonaccrual loans and a 9% reduction in total criticized loans Deposits Improvements driven by active resolution of problem credits identified in 1Q19 and fiercer Asset Quality competitive environment enabling the payoff of some lower‐rated credits $12.2B Credit losses remain minimal with net charge offs of $1.4 million, or 5bps of average loans annualized 13

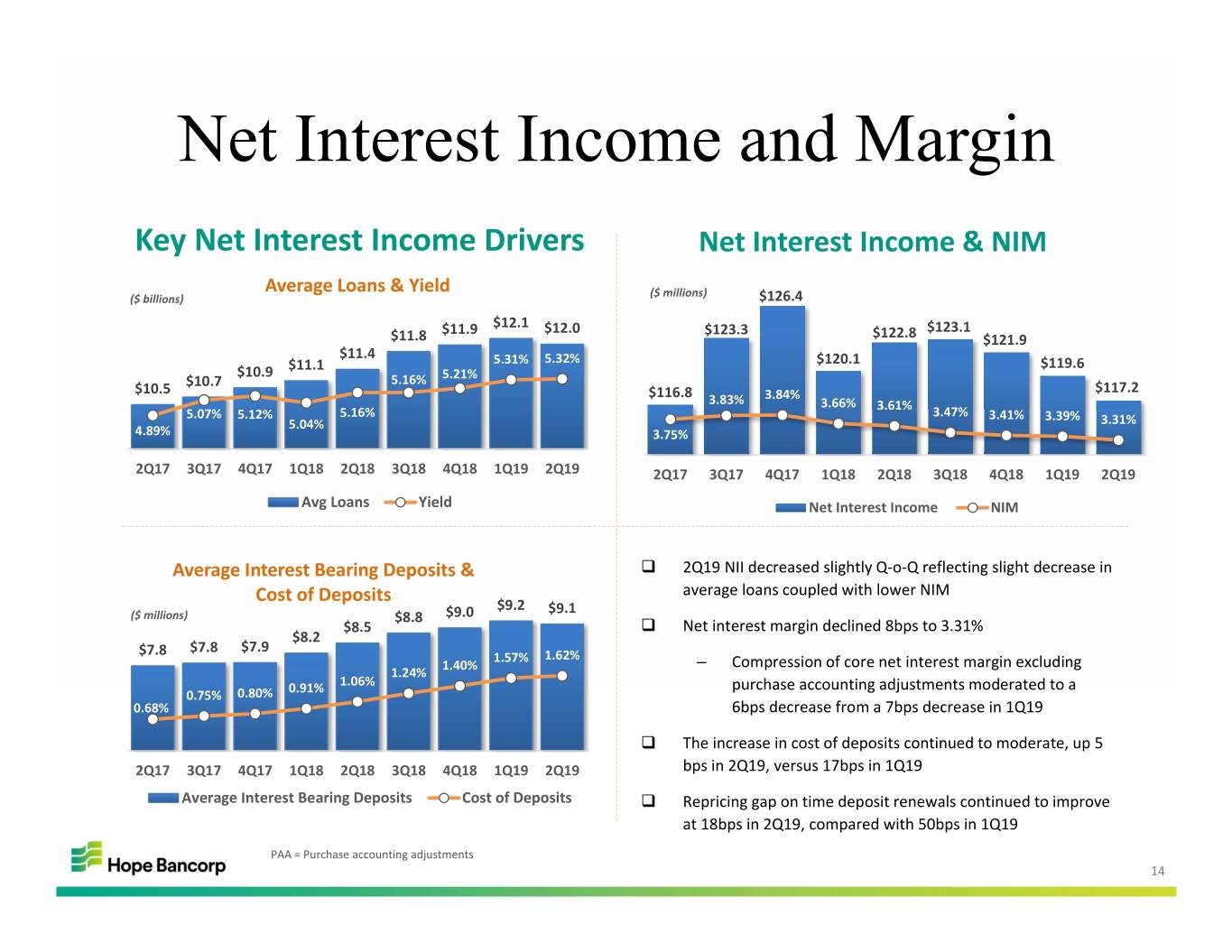

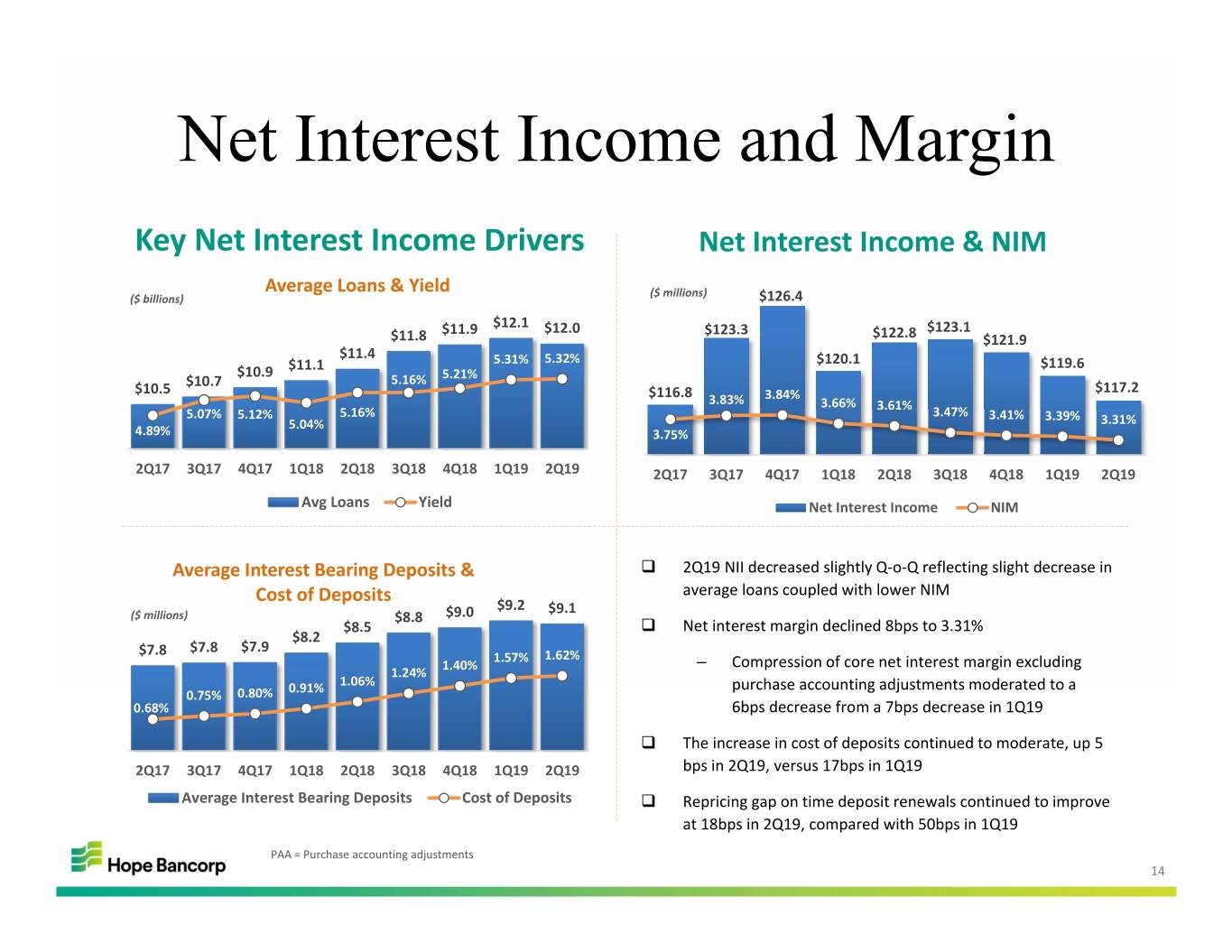

Net Interest Income and Margin Key Net Interest Income Drivers Net Interest Income & NIM Average Loans & Yield ($ millions) ($ billions) $126.4 $11.9 $12.1 $12.0 $123.3 $123.1 $11.8 $122.8 $121.9 $11.4 5.31% 5.32% $120.1 $119.6 $10.9 $11.1 $10.7 5.16% 5.21% $10.5 $116.8 3.84% $117.2 3.83% 3.66% 3.61% 5.07% 5.12% 5.16% 3.47% 3.41% 3.39% 5.04% 3.31% 4.89% 3.75% 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Avg Loans Yield Net Interest Income NIM Average Interest Bearing Deposits & 2Q19 NII decreased slightly Q‐o‐Q reflecting slight decrease in Cost of Deposits average loans coupled with lower NIM $9.2 $9.1 ($ millions) $8.8 $9.0 $8.5 Net interest margin declined 8bps to 3.31% $8.2 $7.8 $7.9 $7.8 1.57% 1.62% 1.40% – Compression of core net interest margin excluding 1.24% 0.91% 1.06% purchase accounting adjustments moderated to a 0.75% 0.80% 0.68% 6bps decrease from a 7bps decrease in 1Q19 The increase in cost of deposits continued to moderate, up 5 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 bps in 2Q19, versus 17bps in 1Q19 Average Interest Bearing Deposits Cost of Deposits Repricing gap on time deposit renewals continued to improve at 18bps in 2Q19, compared with 50bps in 1Q19 PAA = Purchase accounting adjustments 14

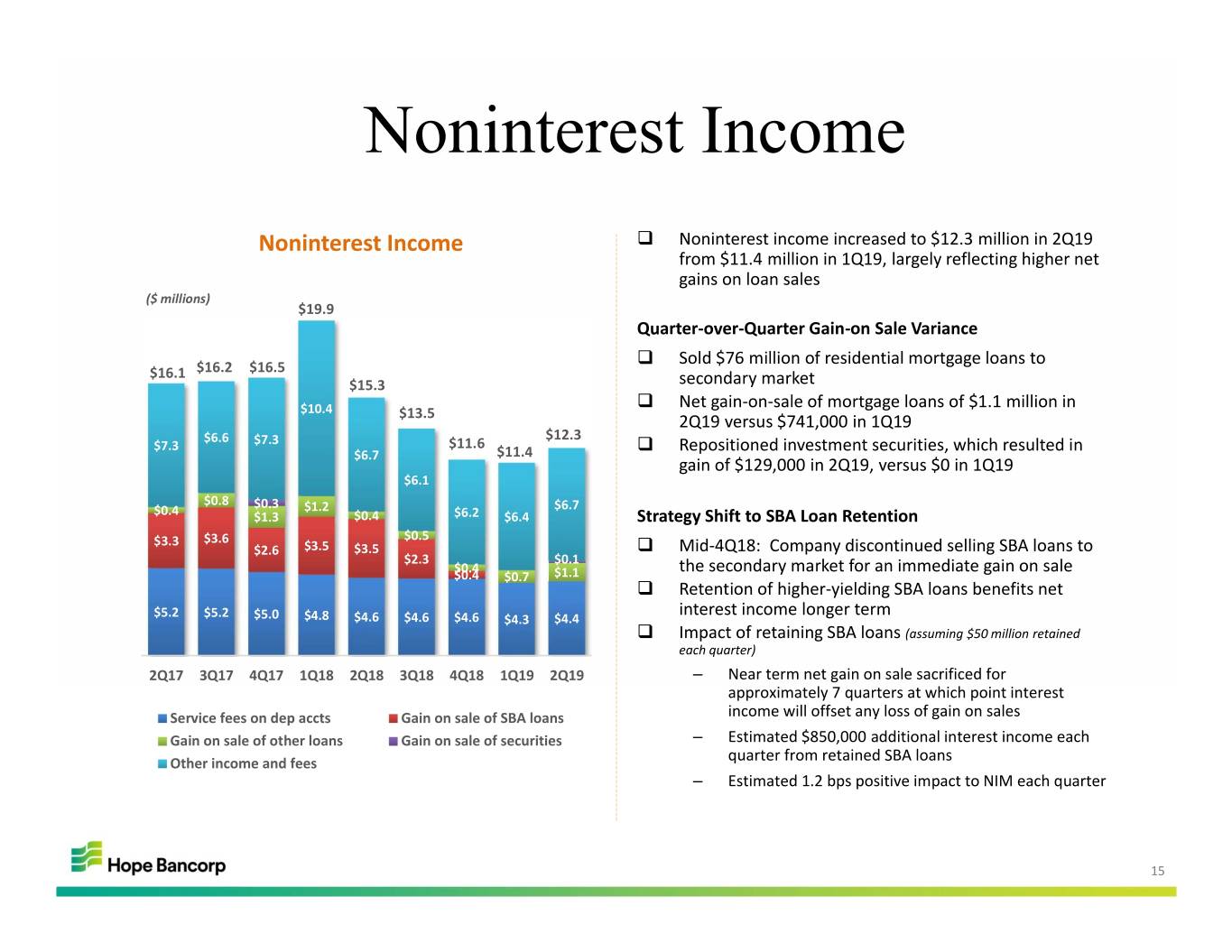

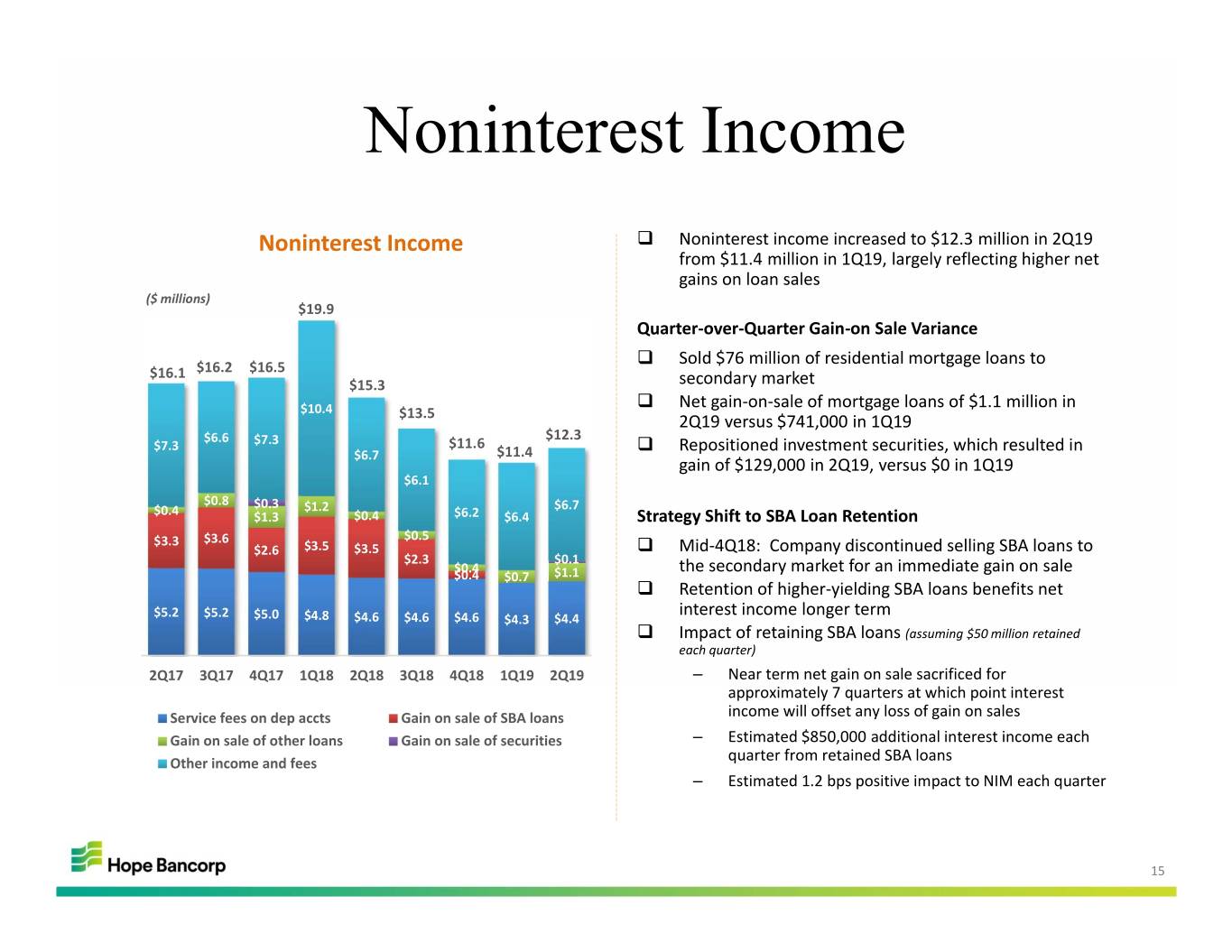

Noninterest Income Noninterest Income Noninterest income increased to $12.3 million in 2Q19 from $11.4 million in 1Q19, largely reflecting higher net gains on loan sales ($ millions) $19.9 Quarter‐over‐Quarter Gain‐on Sale Variance Sold $76 million of residential mortgage loans to $16.1 $16.2 $16.5 $15.3 secondary market $10.4 Net gain‐on‐sale of mortgage loans of $1.1 million in $13.5 2Q19 versus $741,000 in 1Q19 $6.6 $12.3 $7.3 $7.3 $11.6 Repositioned investment securities, which resulted in $6.7 $11.4 gain of $129,000 in 2Q19, versus $0 in 1Q19 $6.1 $0.8 $0.3 $1.2 $6.7 $0.4 $1.3 $0.4 $6.2 $6.4 Strategy Shift to SBA Loan Retention $3.3 $3.6 $0.5 $2.6 $3.5 $3.5 Mid‐4Q18: Company discontinued selling SBA loans to $2.3 $0.1 $0.4 the secondary market for an immediate gain on sale $0.4 $0.7 $1.1 Retention of higher‐yielding SBA loans benefits net $5.2 $5.2 interest income longer term $5.0 $4.8 $4.6 $4.6 $4.6 $4.3 $4.4 Impact of retaining SBA loans (assuming $50 million retained each quarter) 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 – Near term net gain on sale sacrificed for approximately 7 quarters at which point interest Service fees on dep accts Gain on sale of SBA loans income will offset any loss of gain on sales Gain on sale of other loans Gain on sale of securities – Estimated $850,000 additional interest income each Other income and fees quarter from retained SBA loans – Estimated 1.2 bps positive impact to NIM each quarter 15

Noninterest Expense and Efficiency Noninterest Expense and Efficiency Ratio Breakdown of Noninterest Expense and FTE ($ millions) ($ millions) $73.0 $71.6 $70.8 $71.4 $68.5 $67.5 $70.2 $64.0 $61.8 $33.3 $29.1 $31.1 $33.6 $30.4 $32.1 $29.1 $30.5 $25.9 1,502 1,491 1,512 1,494 1,463 1,470 1,468 1,446 FTE FTE FTE FTE 54.06% 55.11% 1,378 FTE FTE FTE FTE 51.12% 51.87% 52.57% FTE 48.17% 48.92% 49.38% 44.32% $34.9 $36.0 $39.7 $39.4 $40.6 $37.0 $36.6 $40.4 $39.3 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Noninterest Expense Efficiency Ratio Compensation Other FTE Noninterest Expense to Average Assets Noninterest expense increased slightly to $71.4 million in ($ billions) $15.3 $15.0 $15.2 $15.2 2Q19 from $70.8 million in 1Q19 $14.6 – $14.0 $14.2 Compensation expenses declined by 3% Q‐o‐Q $13.7 $13.5 – Professional fees increased by $600,000 reflecting higher CECL implementation fees and ongoing investments – $900,000 increase in credit‐related expenses, which 1.90% 2.08% 1.96% 1.80% 1.93% 1.80% 1.85% 1.85% 1.88% tends to be volatile and included forced insurance and higher legal collection fees in 2Q19 Annualized noninterest expense to average assets of 1.88% in 2Q19, up 3bps from 1.85% in 1Q19 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Average Assets NIE to Avg Assets Annualized 16

Loan Trends 17

Loan Production & Portfolio Trends New Loan Originations Funded New loan originations funded increased to $504 million; new loan commitments of $597 million 5.52% 5.46% ($ millions) 5.22% 4.97% 4.79% Lower Y‐o‐Y new loan volumes reflect more selective 4.56% 4.64% 4.40% 4.42% stance on CRE originations, focus on growing C&I and SBA loan portfolios, and shift in strategy to originating $764.3 $792.3 $784.1 $725.1 residential mortgage loans for sale $663.5 $182 $667.3 $85 $610.9 $181 $168 $167 Well diversified mix of loan originations representing $190 $120 $194 $138 $503.9 $236 $285 $442.0 $75 targeted mix of higher‐yielding loans $132 $85 $155 $71 $176 $135 50% CRE $450 $478 $359 $385 $347 $325 $346 $236 $253 35% C&I 15% Consumer 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 C&I production of $176 million reflects continued success in CRE C&I Consumer Average Rate banking middle‐market commercial borrowers Loan Portfolio Composition Significantly higher payoffs and pay downs of $599 million versus $364 million in 1Q19, with higher payoffs largely driven by very aggressive pricing as probability increased for 4% 8% 19% lower interest rates and workout of problem credits 20% identified in preceding quarter 77% 72% SBA loan production of $37 million of which $32 million was 7(a) 9/30/2016 6/30/2019 (First quarter after MOE) Residential mortgage originations of $74 million, up from $64 million in 1Q19 18

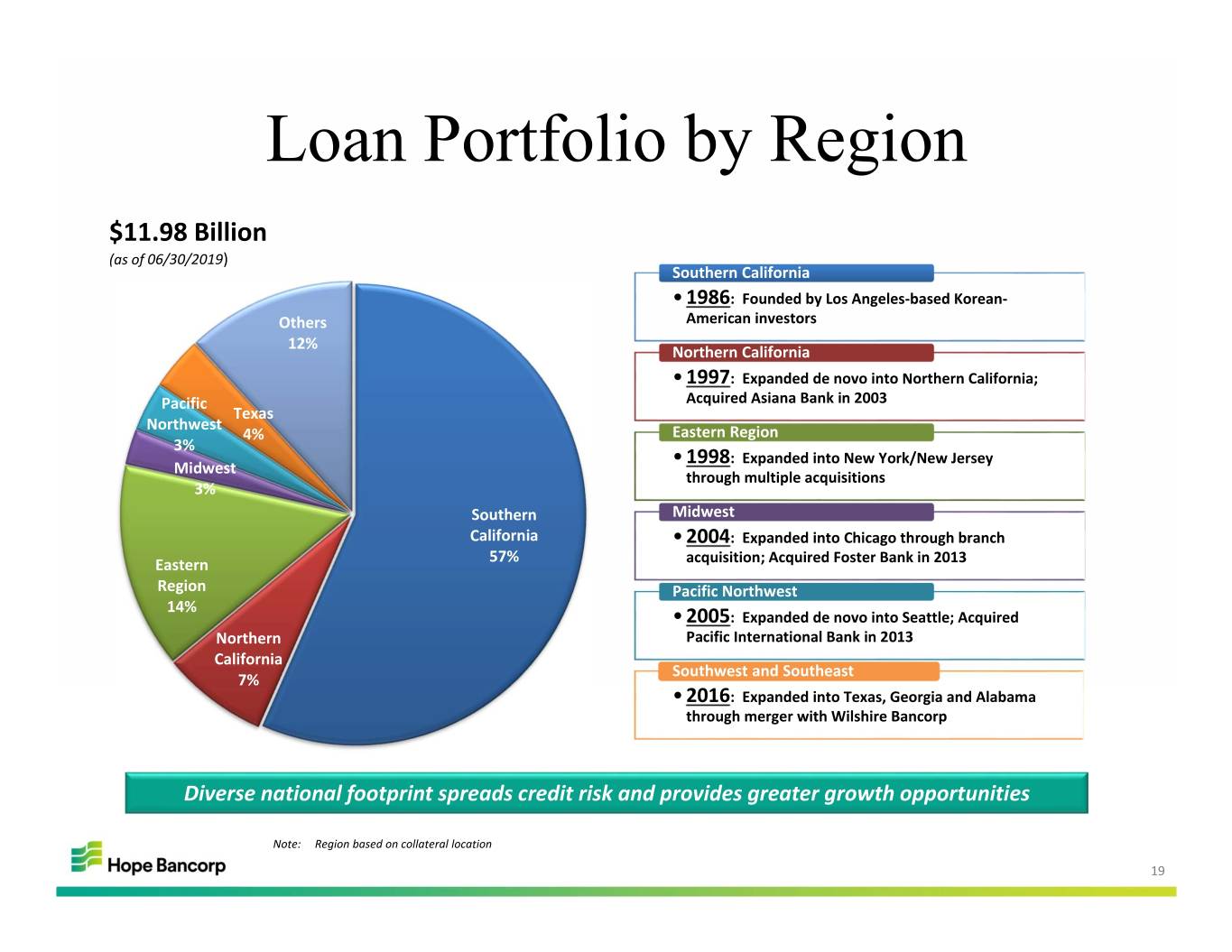

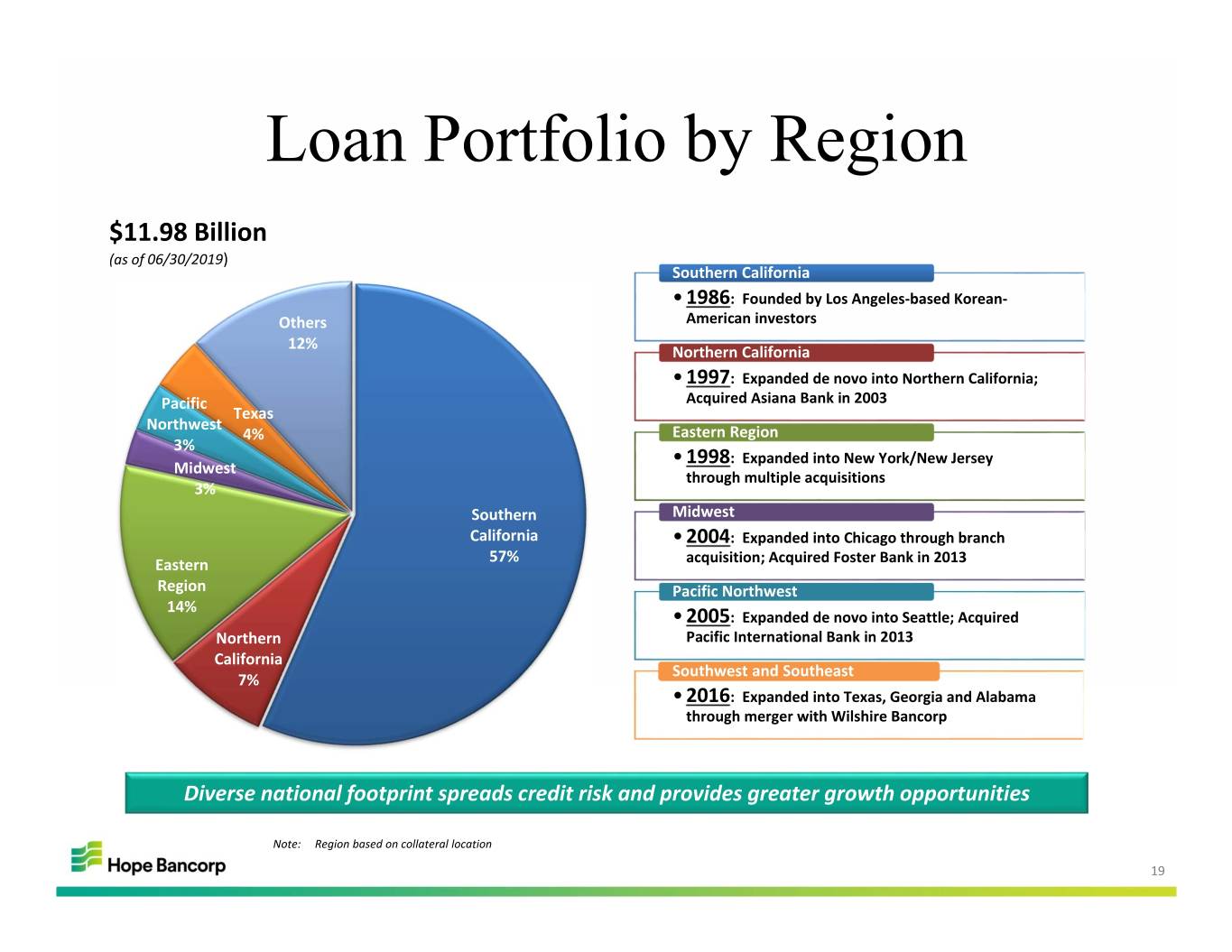

Loan Portfolio by Region $11.98 Billion (as of 06/30/2019) Southern California • 1986: Founded by Los Angeles‐based Korean‐ Others American investors 12% Northern California • 1997: Expanded de novo into Northern California; Pacific Acquired Asiana Bank in 2003 Texas Northwest 4% Eastern Region 3% • 1998: Expanded into New York/New Jersey Midwest through multiple acquisitions 3% Southern Midwest California • 2004: Expanded into Chicago through branch 57% Eastern acquisition; Acquired Foster Bank in 2013 Region Pacific Northwest 14% • 2005: Expanded de novo into Seattle; Acquired Northern Pacific International Bank in 2013 California Southwest and Southeast 7% • 2016: Expanded into Texas, Georgia and Alabama through merger with Wilshire Bancorp Diverse national footprint spreads credit risk and provides greater growth opportunities Note: Region based on collateral location 19

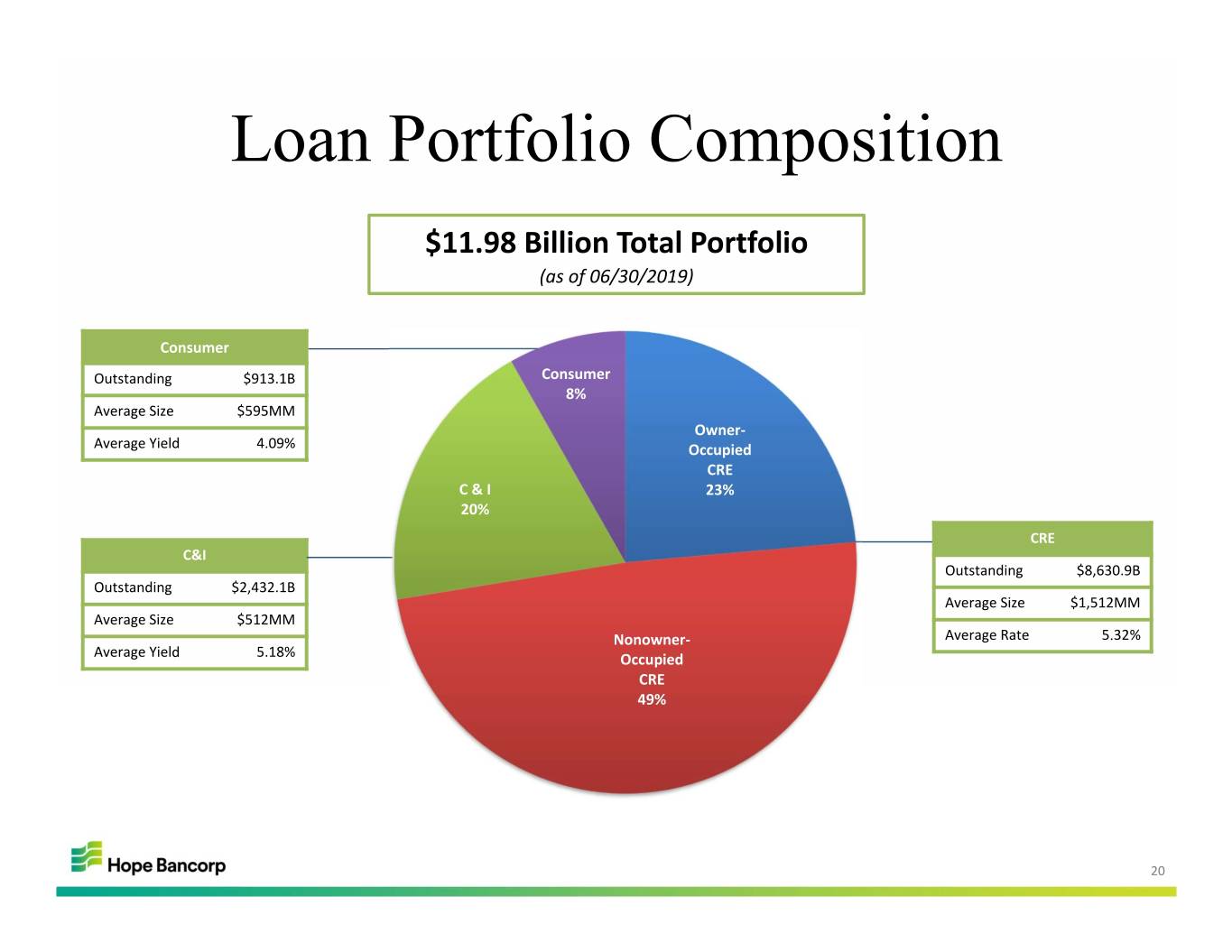

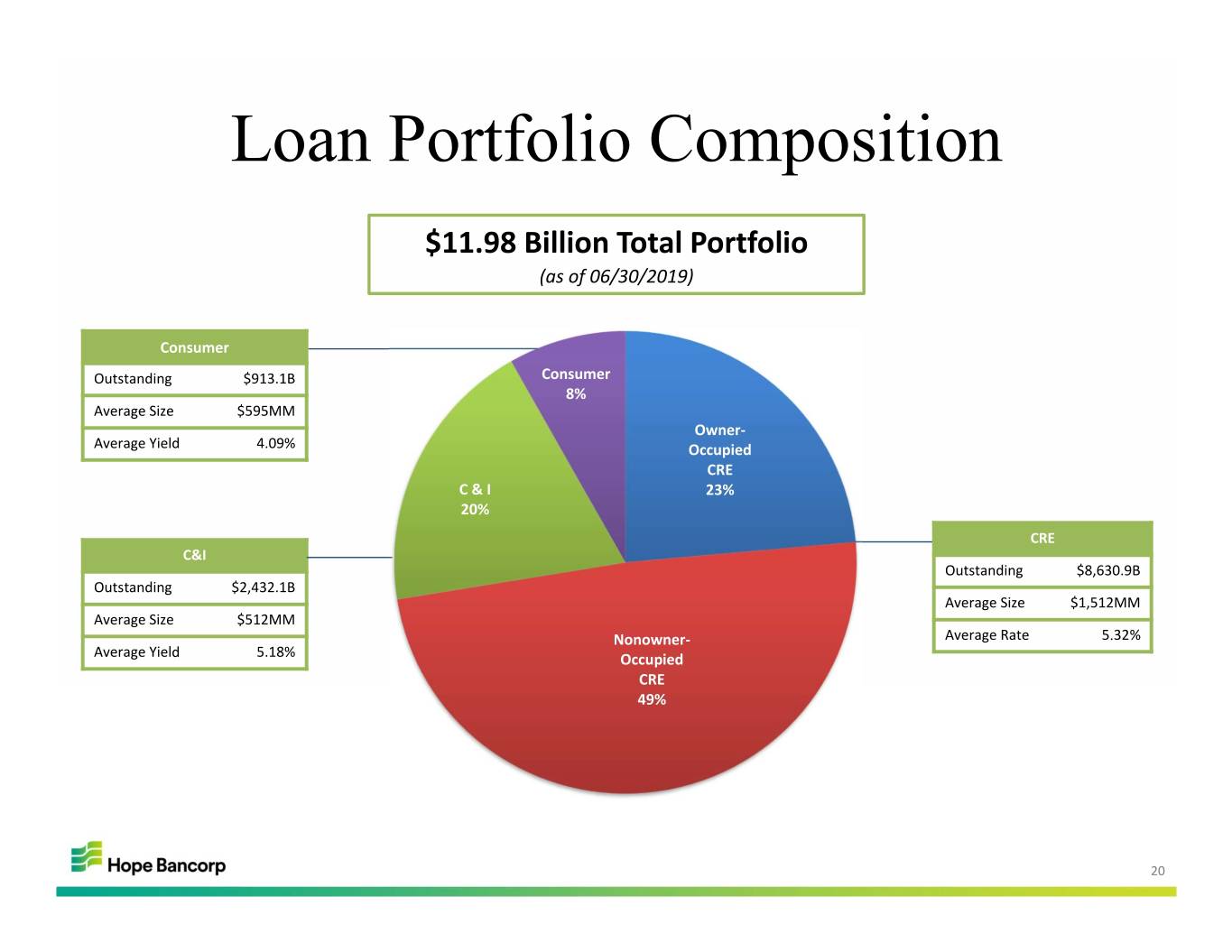

Loan Portfolio Composition $11.98 Billion Total Portfolio (as of 06/30/2019) Consumer Outstanding $913.1B Consumer 8% Average Size $595MM Owner‐ Average Yield 4.09% Occupied CRE C & I 23% 20% CRE C&I Outstanding $8,630.9B Outstanding $2,432.1B Average Size $1,512MM Average Size $512MM Nonowner‐ Average Rate 5.32% Average Yield 5.18% Occupied CRE 49% 20

Portfolio Diversification as of 06/30/2019 CRE Portfolio C&I Portfolio $8.63 Billion $2.43 Billion Hotel & Manufacturing Motel All Others 14% 19% 23% All Others 30% Wholesale Trade 23% Mixed Use Retail ‐ Multi 9% 20% Gasoline Stations 5% Office Building Health Care & Social 7% Assistance Supermarkets Gas Station Industrial & 5% 6% & Car Wash Warehouse Restaurant Warehouse 11% 11% 5% Line 12% Note: All Others includes property types representing less than 7% of total CRE portfolio, Note: All Others includes business types representing less than 5% of total C&I portfolio, including: 5+ Residential, Church, Golf Course, Retail‐Single, and Other smaller segments. including: Hotel/Motel, Information, Laundries & Drycleaners, Liquor Store, RE and Leasing, Retail, Services, Transportation and Other smaller segments. 21

Loan Portfolio Rate Mix as of 06/30/2019 Fixed / Variable Breakdown Variable Rate Loan Base Index Other * Libor Based 10% 27% Variable @4.53% 2 Hybrid 1 38% @4.63% 2 37% @5.72% 2 @4.55% 2 Prime Fixed Based 25% 63% @4.67% 2 @6.38% 2 1 Hybrid loans have fixed interest rates for a specified period and then convert to variable interest rates (fixed as of 06/30/2019) * Other consists of loans with indexes based on FHLB, FRB, US Treasury rates or other 2 The weighted average rate as presented excludes loan discount accretion and interest interest rate indexes rates on nonaccrual loans New Loan Fixed/Variable Maturity and Repricing Schedule and Average Rate 5.52% Fixed Maturity Hybrid Repricing 5.22% 5.46% 4.86% 4.79% 4.97% $1,730 4.56% 4.40% 4.64% $1,407 $1,476 42% 34% $1,143 $1,165 40% $1,074 43% 26% 31% $726 49% $1,000 42% $550 $661 $792 41% 74% 58% 66% 69% $246 57% 60% $680 $655 51% 59% 58% $303 $482 $476 $373 2019 2020 2021 2022 2023 > 2023 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Fixed Variable Avg Rate 22

Asset Quality 23

Asset Quality Nonperforming Assets Provision Expense & Net Charge Offs ($ millions) ($ millions) $7.3 $137.9 $138.5 $125.7 $125.2 $129.1 $5.4 $124.3 $8.3 $118.2 $6.3 $17.2 $10.8 $8.7 $113.0 $111.7 $21.8 $129.6 $9.0 $7.8 $132.2 $5.6 $2.8 $3.6 0.22% $114.4 $120.4 $2.8 $3.0 $102.5 $108.5 $109.2 $105.2 $106.0 $2.5 $2.3 $1.2 0.95% 0.03% 0.02% 0.90% 0.89% 0.87% 0.90% 0.10% 0.02% 0.88% 0.07% ‐0.04% 0.05% 0.78% 0.74% 0.73% 0.05% 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Provision Expense NPLs OREO NPAs/Total Assets Net Charge Offs (Recoveries) (annualized) Criticized Loans Across‐the‐board improvements in all asset quality ($ millions) categories – $566.5 $573.3 $568.5 25% decline in nonaccrual loans led to 20% decrease $540.7 $520.5 $558.6 $497.2 $481.4 $510.3 in total nonperforming loans $315.4 $348.1 $353.6 $353.2 $344.6 $302.7 – Total criticized loans down 9% Q‐o‐Q $357.7 $318.3 $323.8 Improvements driven by payoffs of lower‐rated credits 5.24% 5.23% 5.12% 4.79% 4.63% 4.26% 4.36% 3.98% 4.26% and workout efforts of problem loans identified in 1Q19 $251.1 $225.2 $214.9 $196.1 $139.5 $217.8 $163.1 $205.4 $186.5 Any potential loss exposure from problem credits identified in 1Q19 remain minimal 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Credit losses continued to be minimal, with net charge Classified offs of $1.4 million, or 5bps of average loans on an Special Mention annualized basis in 2Q19 Total Criticized Loans as a % of Gross Loans Underlying health of broader portfolio remains solid 24

Deposit Trends 25

Deposit Trends Deposit Composition Total end‐of‐period deposits decreased 1% Q‐o‐Q ($ billions) Favorable shift in deposit mix with increases in lower‐cost $11.51 $11.73 $12.05 $12.16 $12.25 $12.17 deposits and decreases in time deposits $10.96 $10.99 $10.85 – 2% increase in noninterest bearing deposits Q‐o‐Q $4.10 $4.01 $4.27 $4.77 $5.18 $5.55 $5.87 $5.99 $5.68 – 5% increase in MMA balances Q‐o‐Q $0.24 $0.28 $0.24 $0.23 $0.23 $0.23 $0.23 $0.22 $0.24 Net loan‐to‐deposits stable at 97.7% at 6/30/19, versus $3.57 $3.69 $3.33 $3.45 $3.28 $3.25 $3.04 $3.09 $3.24 97.6% as of 3/31/19 $3.02 $3.05 $3.00 $3.05 $3.04 $3.02 $3.02 $2.95 $3.01 Repricing gap on time deposit renewals continued to improve at 18bps in 2Q19, compared with 50bps in 1Q19 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Deposit gathering and cost containment strategies remain a DDA MMA Savings Time top priority Net Loans to Deposits CD Renewal Repricing Gap $12.5B 0.25% 101.85% 98.97% 97.64%97.68% 98.16% 99.07% 98.92% 98.39% 0.22% 0.22% $12.0B 97.65% 0.19% 0.13% $11.5B 0.10% 0.10% $11.0B $10.5B 0.33% 0.51% 0.65% 0.85% 0.69% 0.50% 0.18% $10.0B 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 CD Renewal Repricing Gap QTD Change in Avg CD Rate Net Loans Deposits LTD Ratio DDA = Noninterest bearing demand deposits MMA = Money market account deposits 26

Franchise Value 27

The Representative Bank of the Korean-American Community Total Assets Net Loans Total Deposits $29.73 Billion $23.12 Billion $24.58 Billion As of 6/30/2019 As of 6/30/2019 As of 6/30/2019 52% 51% 50% Bank of Hope Hanmi Bank Pacific City Bank Metro City Bank Commonwealth Business Bank Open Bank First IC Bank Noah Bank US Metro Bank NewBank NOA Bank New Millennium Bank UniBank Ohana Pacific Bank 28

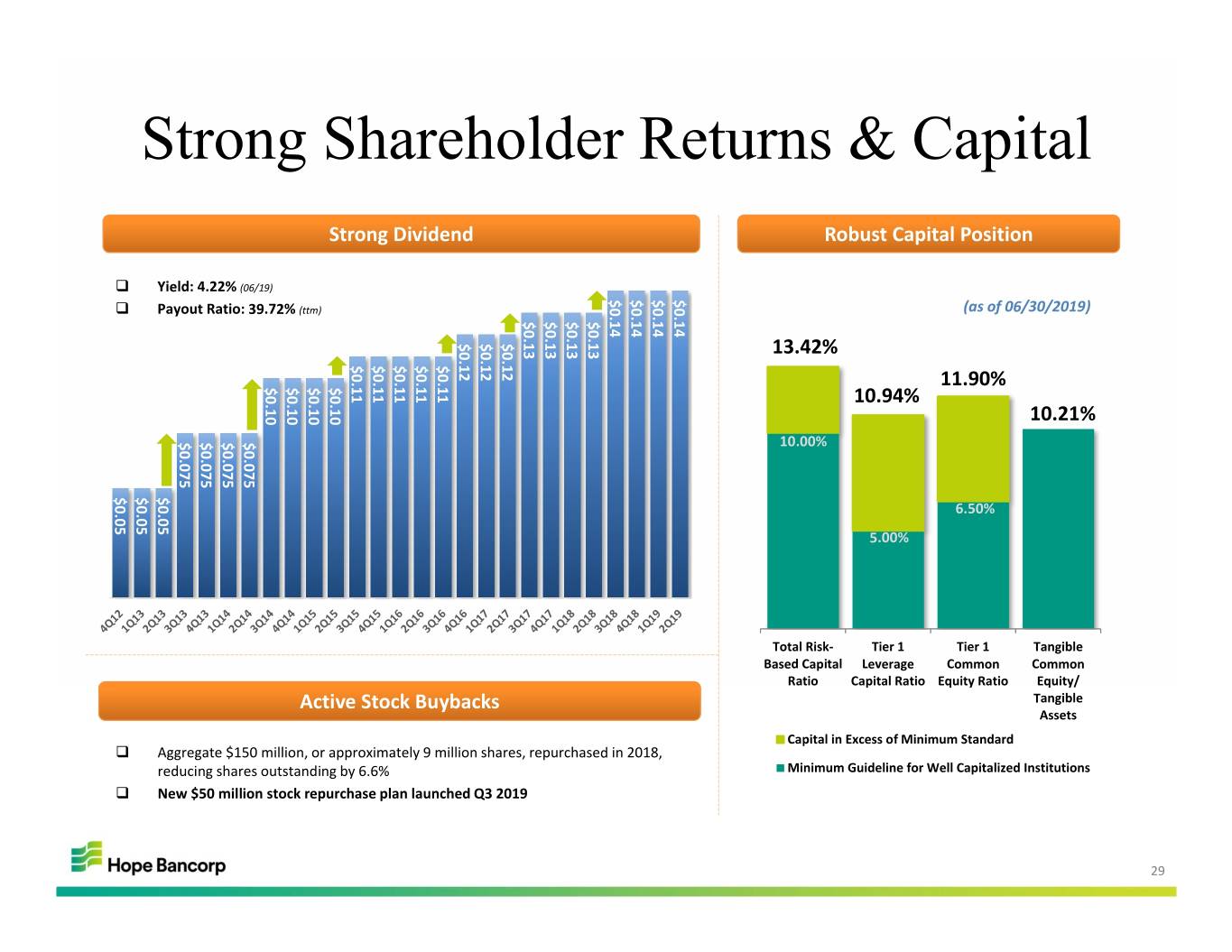

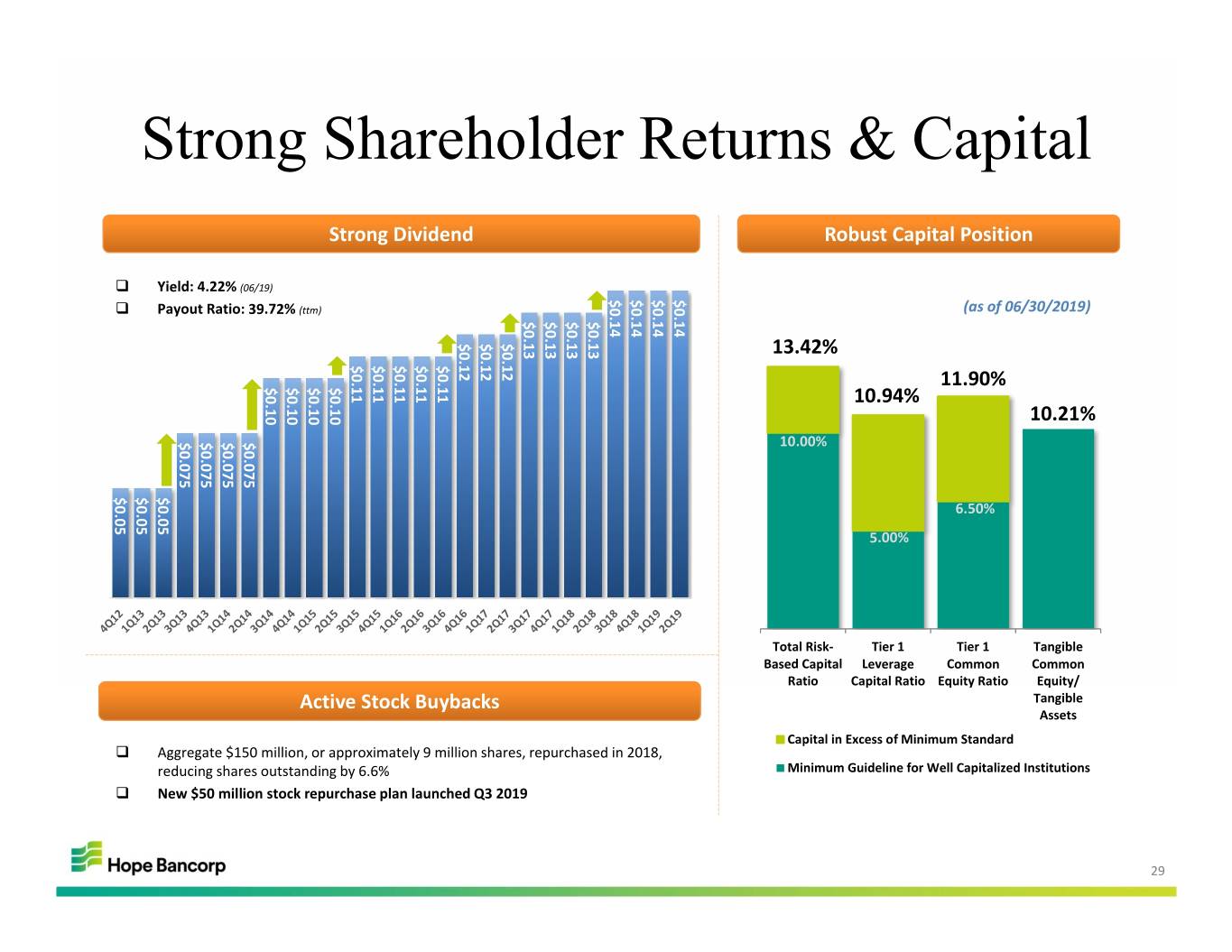

Strong Shareholder Returns & Capital Strong Dividend Robust Capital Position Yield: 4.22% (06/19) $0.14 $0.14 $0.14 $0.14 Payout Ratio: 39.72% (ttm) (as of 06/30/2019) $0.13 $0.13 $0.13 $0.13 $0.12 $0.12 $0.12 13.42% $0.11 $0.11 $0.11 $0.11 $0.11 $0.10 $0.10 $0.10 $0.10 11.90% 10.94% 10.21% $0.075 $0.075 $0.075 $0.075 10.00% $0.05 $0.05 $0.05 6.50% 5.00% Total Risk‐ Tier 1 Tier 1 Tangible Based Capital Leverage Common Common Ratio Capital Ratio Equity Ratio Equity/ Active Stock Buybacks Tangible Assets Capital in Excess of Minimum Standard Aggregate $150 million, or approximately 9 million shares, repurchased in 2018, reducing shares outstanding by 6.6% Minimum Guideline for Well Capitalized Institutions New $50 million stock repurchase plan launched Q3 2019 29

Unique Growth Opportunities Increasing Korean Investment South Korean Companies Among in the U.S. Top Foreign Investors in the U.S. • Hyundai Motor and Kia Motors announced Jan 2017 ($ billions) plans to spend $3.1 billion in U.S. in the next 5 years $103.2 – 250‐plus Korean‐national companies in Hyundai and (2017) Kia supply chains with operations in Georgia and Alabama – 28 Tier‐1 Hyundai/KIA suppliers with $1MM‐$2MM in DDA $50.3 • Lotte Chemical investing $3.1 billion in (2016) petrochemical facility in Louisiana 2 • Hankook Tire building new $800 million factory in $30.8 Tennessee (2015) • LG Electronics – $250 million investment to build U.S. Home Appliance Factory in Tennessee – $300 million LG North American Headquarters in Englewood Cliffs, NJ As the only super regional Korean‐American bank, Bank of Hope is uniquely positioned to provide banking services to a growing number of South Korean companies operating in the U.S. 30

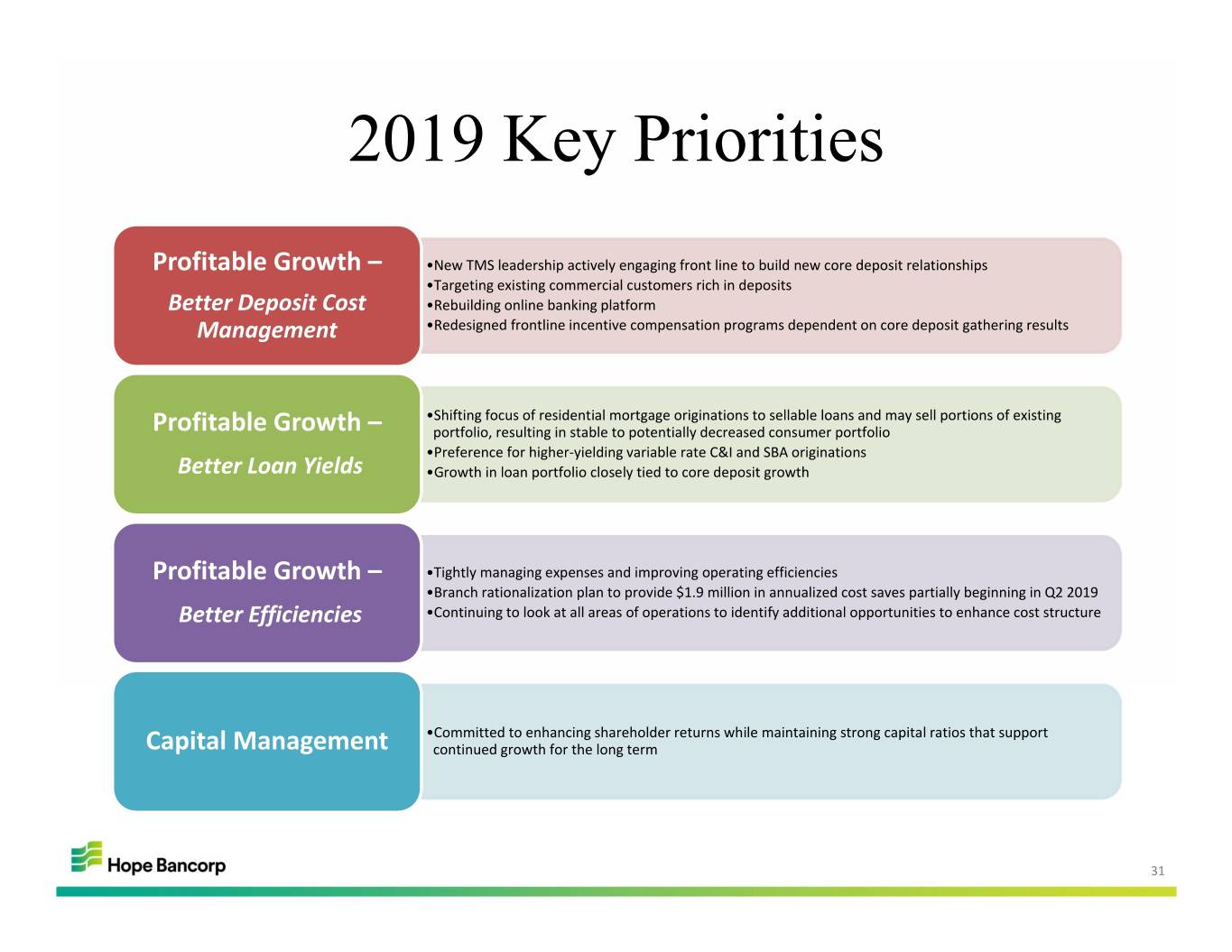

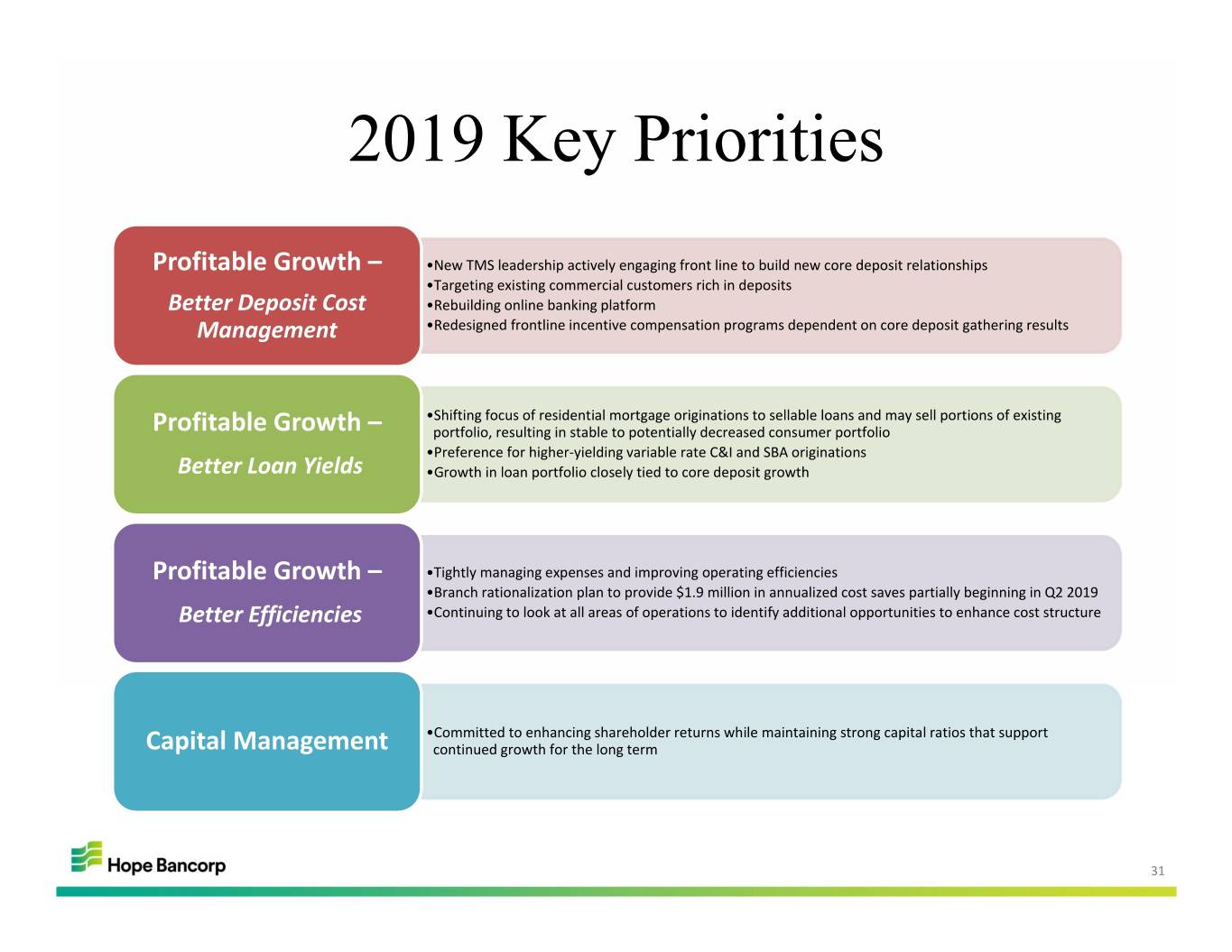

2019 Key Priorities Profitable Growth – •New TMS leadership actively engaging front line to build new core deposit relationships •Targeting existing commercial customers rich in deposits Better Deposit Cost •Rebuilding online banking platform Management •Redesigned frontline incentive compensation programs dependent on core deposit gathering results •Shifting focus of residential mortgage originations to sellable loans and may sell portions of existing Profitable Growth – portfolio, resulting in stable to potentially decreased consumer portfolio •Preference for higher‐yielding variable rate C&I and SBA originations Better Loan Yields •Growth in loan portfolio closely tied to core deposit growth Profitable Growth – •Tightly managing expenses and improving operating efficiencies •Branch rationalization plan to provide $1.9 million in annualized cost saves partially beginning in Q2 2019 Better Efficiencies •Continuing to look at all areas of operations to identify additional opportunities to enhance cost structure •Committed to enhancing shareholder returns while maintaining strong capital ratios that support Capital Management continued growth for the long term 31

Near-Term Outlook & Strategies Continuation of positive trends from first half of 2019 Favorable shift in mix of new loan production favoring higher‐yielding loans Gaining more traction with deposit gathering initiatives, leading to improved deposit mix and better deposit cost management Stable asset quality, supported by disciplined underwriting, constant monitoring and proactive action Improved expense management Full‐year loan growth guidance revised to 2‐3% for 2019, reflecting stronger headwinds with projection for lower interest rates and an even fiercer competitive landscape NIM guidance updated to reflect rapidly evolving rate environment and high probability for lower rates 25bps decline in interest rates expected to impact NIM by 5‐8bps 2019 Key Priorities remain in focus relative to the rapidly changing rate environment Profitable Growth – Better deposit cost management Profitable Growth – Better loan yields Profitable Growth – Better efficiencies Capital Management Committed to Building on Strong Foundation and Enhancing Long‐Term Shareholder Value 32

Investment Opportunity The Only Super Regional Korean‐American Bank in the Nation Definitive leadership position as the representative bank of the Korean‐American community National platform and solid presence across all geographic markets with largest populations of Asian Americans Strong, sustainable core earnings power and capital Diversified financial institution with comprehensive offering of products and services for commercial and consumer clients Well positioned to progressively transition to less CRE‐focused portfolio Only Korean‐American bank with presence in Korea Proven history of driving consolidation in the Korean‐American banking industry 33

Appendix 34

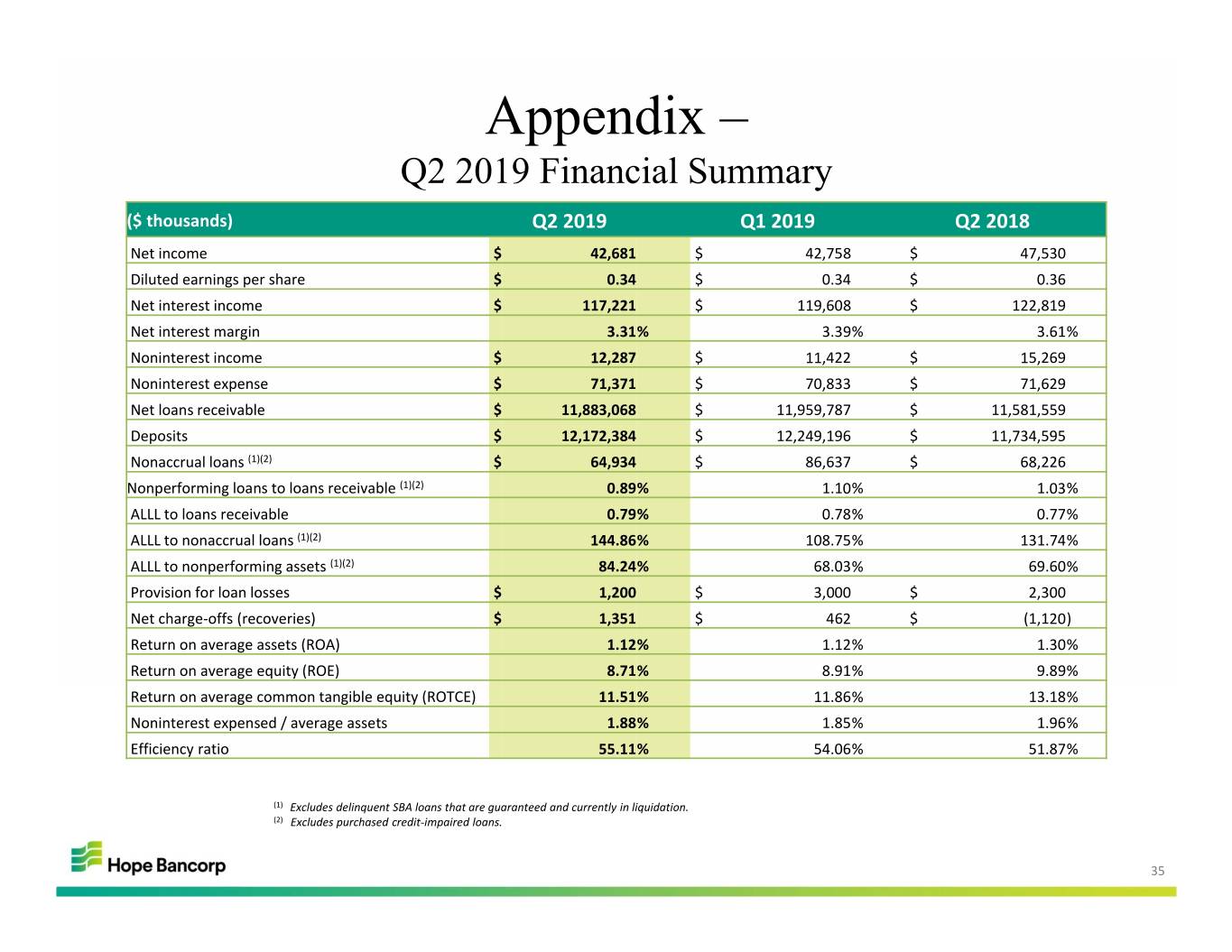

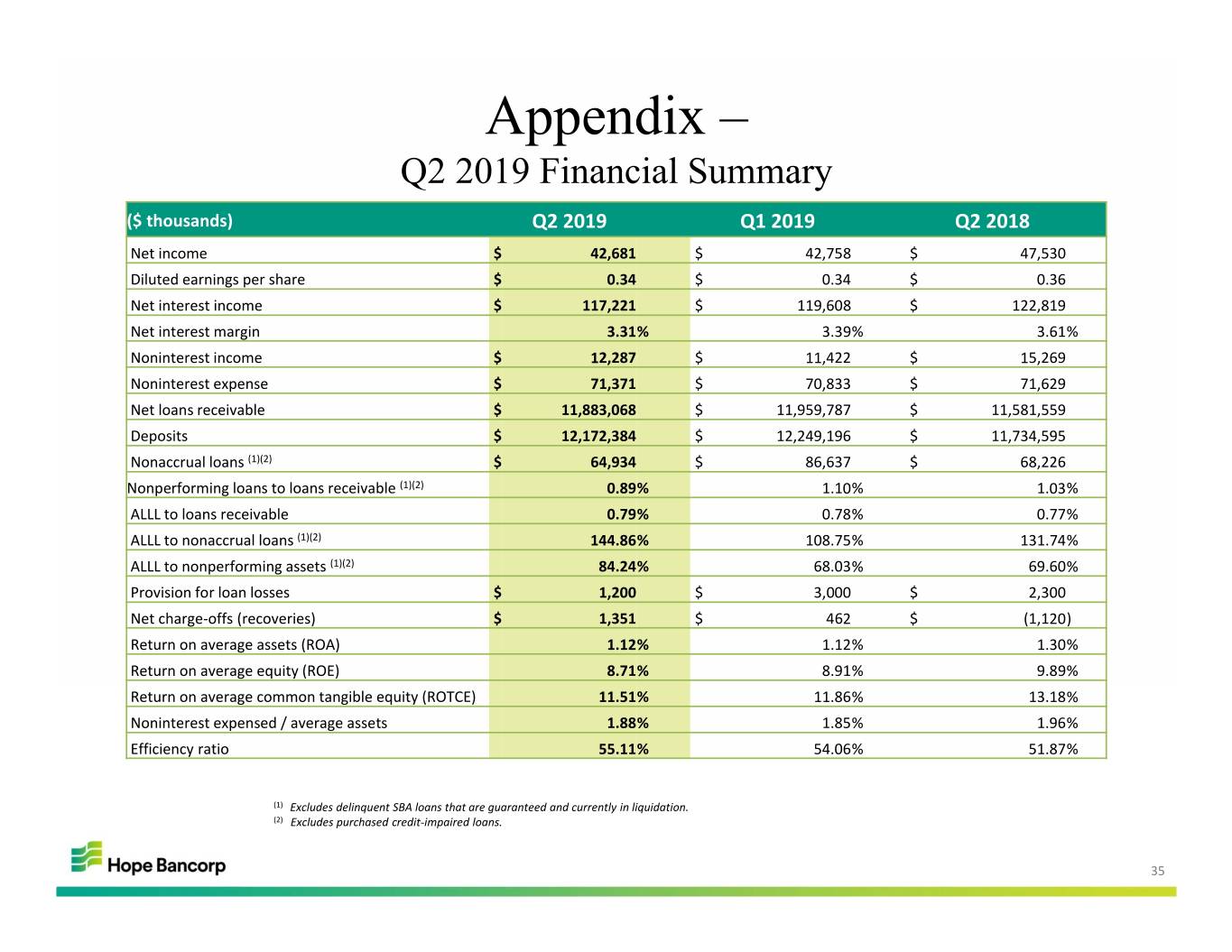

Appendix – Q2 2019 Financial Summary ($ thousands) Q2 2019 Q1 2019 Q2 2018 Net income $ 42,681 $ 42,758 $ 47,530 Diluted earnings per share $ 0.34 $ 0.34 $ 0.36 Net interest income $ 117,221 $ 119,608 $ 122,819 Net interest margin 3.31% 3.39% 3.61% Noninterest income $ 12,287 $ 11,422 $ 15,269 Noninterest expense $ 71,371 $ 70,833 $ 71,629 Net loans receivable $ 11,883,068 $ 11,959,787 $ 11,581,559 Deposits $ 12,172,384 $ 12,249,196 $ 11,734,595 Nonaccrual loans (1)(2) $ 64,934 $ 86,637 $ 68,226 Nonperforming loans to loans receivable (1)(2) 0.89% 1.10% 1.03% ALLL to loans receivable 0.79% 0.78% 0.77% ALLL to nonaccrual loans (1)(2) 144.86% 108.75% 131.74% ALLL to nonperforming assets (1)(2) 84.24% 68.03% 69.60% Provision for loan losses $ 1,200 $ 3,000 $ 2,300 Net charge‐offs (recoveries) $ 1,351 $ 462 $ (1,120) Return on average assets (ROA) 1.12% 1.12% 1.30% Return on average equity (ROE) 8.71% 8.91% 9.89% Return on average common tangible equity (ROTCE) 11.51% 11.86% 13.18% Noninterest expensed / average assets 1.88% 1.85% 1.96% Efficiency ratio 55.11% 54.06% 51.87% (1) Excludes delinquent SBA loans that are guaranteed and currently in liquidation. (2) Excludes purchased credit‐impaired loans. 35

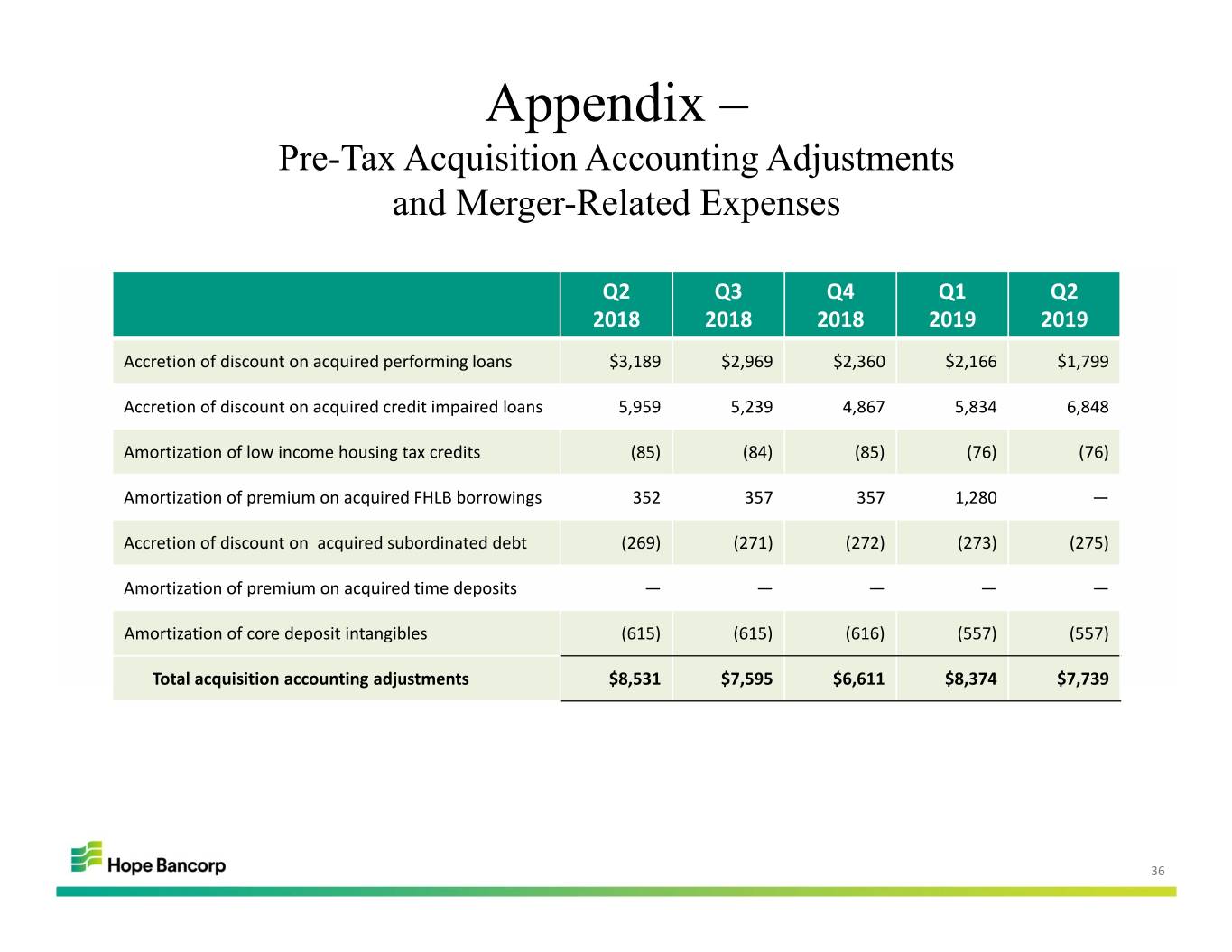

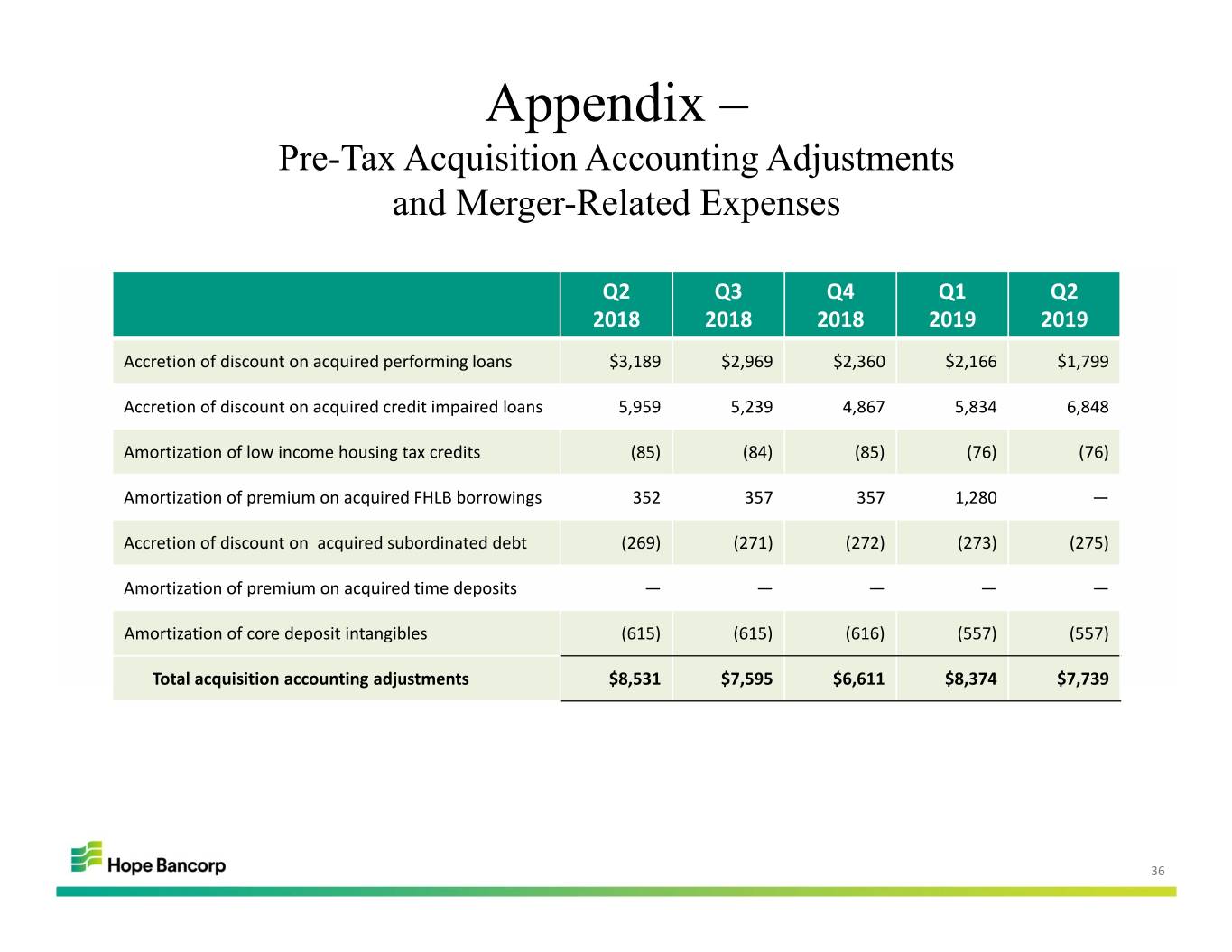

Appendix – Pre-Tax Acquisition Accounting Adjustments and Merger-Related Expenses Q2 Q3 Q4 Q1 Q2 2018 2018 2018 2019 2019 Accretion of discount on acquired performing loans $3,189 $2,969 $2,360 $2,166 $1,799 Accretion of discount on acquired credit impaired loans 5,959 5,239 4,867 5,834 6,848 Amortization of low income housing tax credits (85) (84) (85) (76) (76) Amortization of premium on acquired FHLB borrowings 352 357 357 1,280 — Accretion of discount on acquired subordinated debt (269) (271) (272) (273) (275) Amortization of premium on acquired time deposits————— Amortization of core deposit intangibles (615) (615) (616) (557) (557) Total acquisition accounting adjustments $8,531 $7,595 $6,611 $8,374 $7,739 36