2024 Third Quarter Earnings Conference Call October 28, 2024

Forward Looking Statements & Additional Disclosures This presentation contains statements regarding future events or the future financial performance of Hope Bancorp, Inc. (“Company”), including regarding its pending merger with Territorial Bancorp Inc. (“Territorial”), that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Additionally, the forward-looking statements also relate to, among other things, expectations regarding the business and economic environment in which the Company operates, projections of future performance and financial outlook, perceived opportunities in the market, and statements regarding our business strategies, objectives and vision, as well as statements regarding the Company’s strategic reorganization. Forward-looking statements include, but are not limited to, statements preceded by, followed by or that include the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “targets,” or similar expressions. With respect to any such forward-looking statements, the Company claims the protection provided for in the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The Company’s actual results, performance or achievements may differ materially and adversely from the results, performance or achievements expressed or implied in any forward-looking statements. The closing of the pending transaction with Territorial is subject to regulatory approvals, the approval of the shareholders of Territorial, and other customary closing conditions. There is no assurance that such conditions will be met or that the pending merger will be consummated within the expected time frame, or at all. If the transaction is consummated, factors that may cause actual outcomes to differ from what is expressed or forecasted in these forward-looking statements include, among things: difficulties and delays in integrating the Company and Territorial and achieving anticipated synergies, cost savings and other benefits from the transaction; higher than anticipated transaction costs; deposit attrition, operating costs, customer loss and business disruption following the merger, including difficulties in maintaining relationships with employees and customers, may be greater than expected; and required governmental approvals of the merger may not be obtained on its proposed terms and schedule, or without regulatory constraints that may limit growth. Other risks and uncertainties include, but are not limited to: possible further deterioration in economic conditions in the Company’s areas of operation; interest rate risk associated with volatile interest rates and related asset-liability matching risk; liquidity risks; risk of significant non-earning assets, and net credit losses that could occur, particularly in times of weak economic conditions; the failure of or changes to assumptions and estimates underlying the Company’s allowances for credit losses, and regulatory risks associated with current and future regulations. For additional information concerning these and other risk factors, see the Company’s most recent Annual Report on Form 10-K. The Company does not undertake, and specifically disclaims any obligation, to update any forward-looking statements to reflect the occurrence of events or circumstances after the date of such statements except as required by law. Additional Information About the Merger and Where to Find It In connection with the pending merger with Territorial Bancorp Inc., Hope Bancorp, Inc. filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4, which included a Proxy Statement/Prospectus and which was declared effective by the SEC on August 20, 2024, and further supplemented by Hope Bancorp on September 12, 2024. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Territorial Bancorp shareholders are encouraged to read the Registration Statement and the Proxy Statement/Prospectus regarding the merger and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information about the pending merger. Territorial Bancorp shareholders will be able to obtain a free copy of the Proxy Statement/Prospectus, as well as other filings containing information about Hope Bancorp and Territorial Bancorp at the SEC’s Internet site (www.sec.gov). Territorial Bancorp shareholders will also be able to obtain these documents, free of charge, from Territorial Bancorp at https://www.tsbhawaii.bank/tsb/investor-relations/. Participants in Solicitation Hope Bancorp, Inc., Territorial Bancorp and certain of their directors, executive officers, management and employees may be deemed to be participants in the solicitation of proxies in respect of the merger. Information concerning Hope Bancorp, Inc.’s directors and executive officers is set forth in the Proxy Statement, dated April 12, 2024 (as amended and supplemented), for its 2024 annual meeting of stockholders as filed with the SEC on Schedule 14A. Information concerning Territorial Bancorp’s participants is set forth in the Proxy Statement, dated April 16, 2024, for Territorial Bancorp’s 2024 annual meeting of stockholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of those participants in the solicitation of proxies in respect of the merger may be obtained by reading the Registration Statement and Proxy Statement/Prospectus filed with the SEC. 2

Strong Capital & Liquidity • Total capital ratio was 14.80% at 9/30/24, +39bps QoQ. Record risk-based capital ratios since merger with Wilshire • Tangible common equity (“TCE”) ratio(1) was 10.08% at 9/30/24, +36bps QoQ • Strategically compelling acquisition of Hawai`i-based Territorial Bancorp (TBNK) pending Deposits • Deposits of $14.7B at 9/30/24, stable QoQ. Robust customer deposit growth of 11% linked quarter annualized • Customer deposit growth offset planned reduction of brokered deposits (down $351MM QoQ) • End-of-period cost of total deposits at 9/30/24 down -9bps from 6/30/24, indicating inflection in costs by deposit type Loans • Gross loans of $13.6B at 9/30/24 (+$8MM QoQ). Sold $41MM of SBA loans in 3Q24 • Loans receivable (excluding HFS) at 9/30/24 grew +$51MM or 2% linked quarter annualized • Gross loan-to-deposit ratio of 92.6% at 9/30/24 Asset Quality • Nonperforming assets (“NPA”) of $104MM, or 0.60% of total assets • 3Q24 net charge offs of $6MM, equivalent to 0.17% of average loans annualized Earnings • 3Q24 net income: $24.2MM, or $0.20 per diluted share • 3Q24 net income excluding notable items(1): $25.2MM, or $0.21(1) per diluted share • 3Q24 notable items after tax: merger-related expenses of $873K and restructuring-related charges of $139K Q3 2024 Financial Overview Total Capital & TCE Ratio at 9/30/24 14.80% / 10.08% NPA/Total Assets at 9/30/24 0.60% Gross Loans at 9/30/24 $13.6B Total Deposits at 9/30/24 $14.7B 3 3Q24 Net Income & EPS $24.2MM / $0.20 Excluding notable items $25.2MM /$0.21 (1) TCE ratio, net income excluding notable items and earnings per share (“EPS”) excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation.

Strong Capital Ratios 4 Common Equity Tier 1 Capital Ratio • Capital ratios increased QoQ: All regulatory capital ratios meaningfully above requirements for “well-capitalized” financial institutions • Highest risk-based capital ratios for Hope Bancorp since merger with Wilshire in 2016 • Proforma capital very strong: Adjustments for the allowance for credit losses (“ACL”) and hypothetical adjustments for investment security marks not otherwise already reflected in equity, still result in very strong capital ratios • Dividend: Quarterly common stock dividend of $0.14 per share, or $0.56 per share annualized. Equivalent to a dividend yield of 4.46% at 9/30/24 • Strategically compelling merger pending: Fixed exchange ratio: 0.8048x HOPE shares per Territorial Bancorp Inc. (TBNK) share in an all- stock transaction • Equity: Book value per common share of $17.97 & TCE per share(1) of $14.10 at 9/30/24, up $0.48 and $0.49, respectively, QoQ Tangible Common Equity (“TCE”) Ratio(1) Total Capital Ratio Leverage Ratio Well Capitalized Reg. Minimum 6.50% (1) TCE ratio and TCE per share are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. * Proforma ratios at 9/30/24 are non-GAAP financial measures and reflect (a) inclusion of on- and off-balance sheet ACL not already in capital; (b) treatment of held-to-maturity (“HTM”) securities as if they were available- for-sale (“AFS”), with unrealized losses in AOCI; and (c) removal of the AOCI opt-out in calculating regulatory capital. Well Capitalized Reg. Minimum 10.00% Well Capitalized Reg. Minimum 5.00%

Diverse & Granular Deposit Base 5 Noninterest Bearing Demand Deposits 25% Money Market, Interest Bearing Demand & Savings 34% Time Deposits 41% $14.7B Total Deposits (at 9/30/24) • Average commercial account size: approx. $218,000 for 3Q24 • Average consumer deposit account size: approx. $46,000 for 3Q24 • Total deposits of $14.7B at 9/30/24, stable QoQ • Robust growth of customer deposits +11% annualized offset planned reduction of brokered deposits in 3Q24. Brokered deposits decreased -$351MM QoQ • Sale of Virginia branches closed on 10/1/24, approx. ~$129MM of deposits sold Deposit Composition by Product Type Deposit Composition by Customer Type 49% 51% 50% 50% 49% 51% 34% 35% 37% 38% 39% 39% 14% 12% 10% 10% 9% 7% 3% 2% 3% 2% 3% 3% 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Commercial Consumer Brokered Public & Other

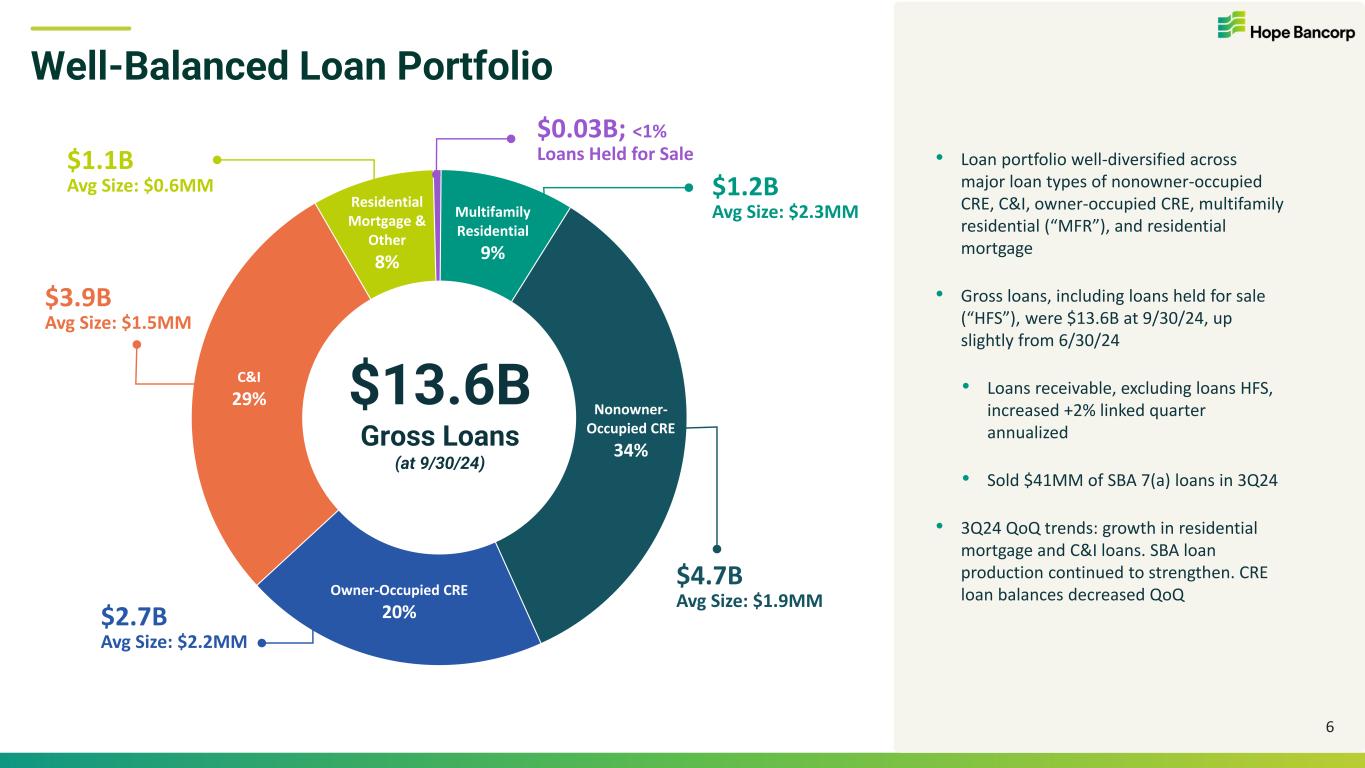

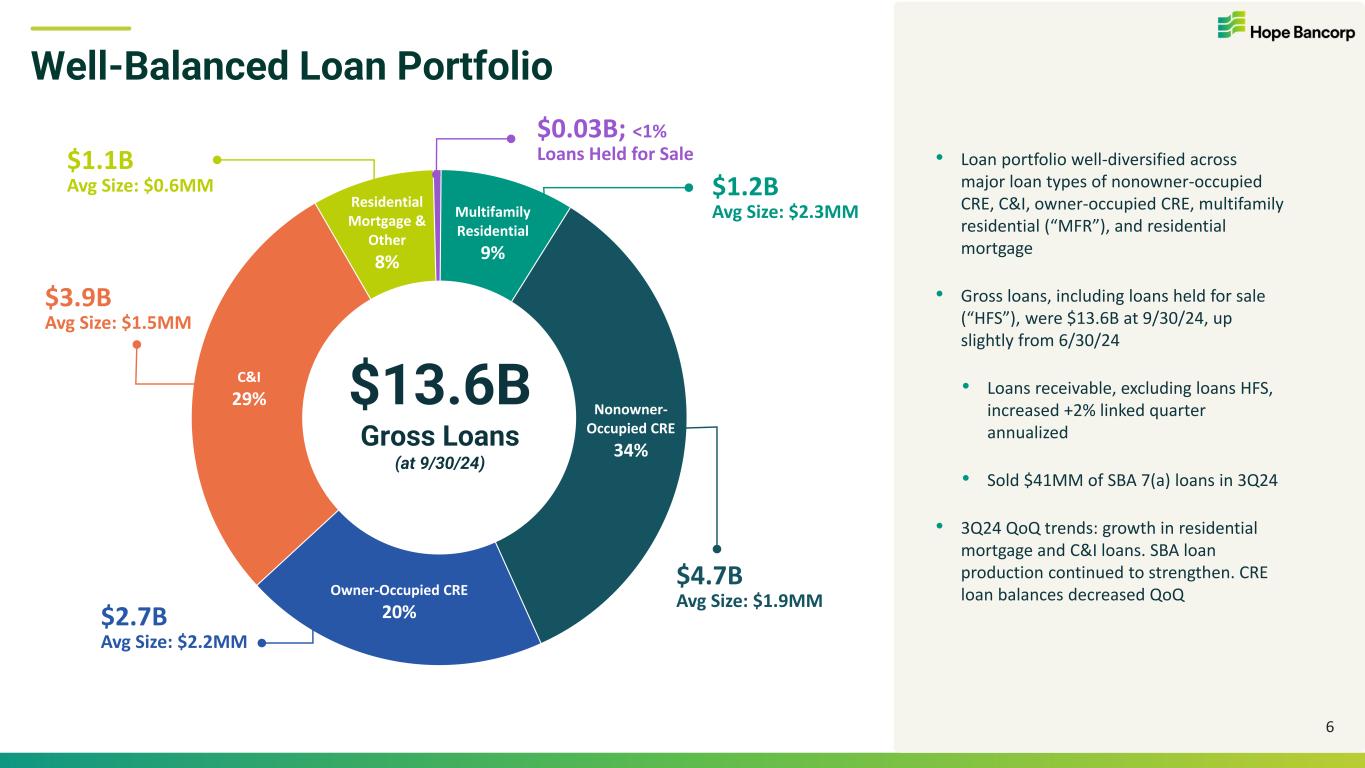

Well-Balanced Loan Portfolio 6 Nonowner- Occupied CRE 34% Owner-Occupied CRE 20% C&I 29% Residential Mortgage & Other 8% Multifamily Residential 9% $13.6B Gross Loans (at 9/30/24) $1.1B Avg Size: $0.6MM $4.7B Avg Size: $1.9MM $2.7B Avg Size: $2.2MM $3.9B Avg Size: $1.5MM $1.2B Avg Size: $2.3MM $0.03B; <1% Loans Held for Sale • Loan portfolio well-diversified across major loan types of nonowner-occupied CRE, C&I, owner-occupied CRE, multifamily residential (“MFR”), and residential mortgage • Gross loans, including loans held for sale (“HFS”), were $13.6B at 9/30/24, up slightly from 6/30/24 • Loans receivable, excluding loans HFS, increased +2% linked quarter annualized • Sold $41MM of SBA 7(a) loans in 3Q24 • 3Q24 QoQ trends: growth in residential mortgage and C&I loans. SBA loan production continued to strengthen. CRE loan balances decreased QoQ

As a % of Total Loans: Avg Loan Size: Weighted Avg LTV(1): 12% Multi-tenant Retail $1,641MM $2.4MM 42.5% 9% Industrial & Warehouse $1,245MM $2.4MM 41.0% 9% Multifamily $1,205MM $2.3MM 61.2% 7% Gas Station & Car Wash $1,021MM $1.7MM 48.2% 6% Mixed Use $826MM $2.0MM 48.0% 6% Hotel/Motel $801MM $2.2MM 43.3% 5% Single-tenant Retail $663MM $1.4MM 46.4% 3% Office $396MM $2.2MM 54.8% 6% All Other $833MM $1.5MM 41.5% Diversified CRE Portfolio with Low LTVs Total CRE: Distribution by LTV (excl. SBA) < 50%: 56% > 50% - 55%: 14% > 55% - 60%: 10% > 60% - 65%: 7% > 65% - 70%: 5% > 70%: 8%$8.6B CRE Portfolio (at 9/30/24) 47% Weighted Avg LTV(1) (1) Weighted average loan-to-value (“LTV”): Current loan balance divided by updated collateral value. Collateral value updates most recent available appraisal by using CoStar market and property-specific data, including submarket appreciation or depreciation, and changes to vacancy, debt service coverage or rent/sq foot. • Total CRE loans of $8.6B at 9/30/24, stable QoQ. Portfolio consists of $4.7B of nonowner-occupied CRE, $2.7B of owner-occupied CRE, and $1.2B of MFR • CRE Office: represented less than 3% of total loans at 9/30/24, with no central business district exposure 7 $8.6B CRE Portfolio (at 9/30/24)

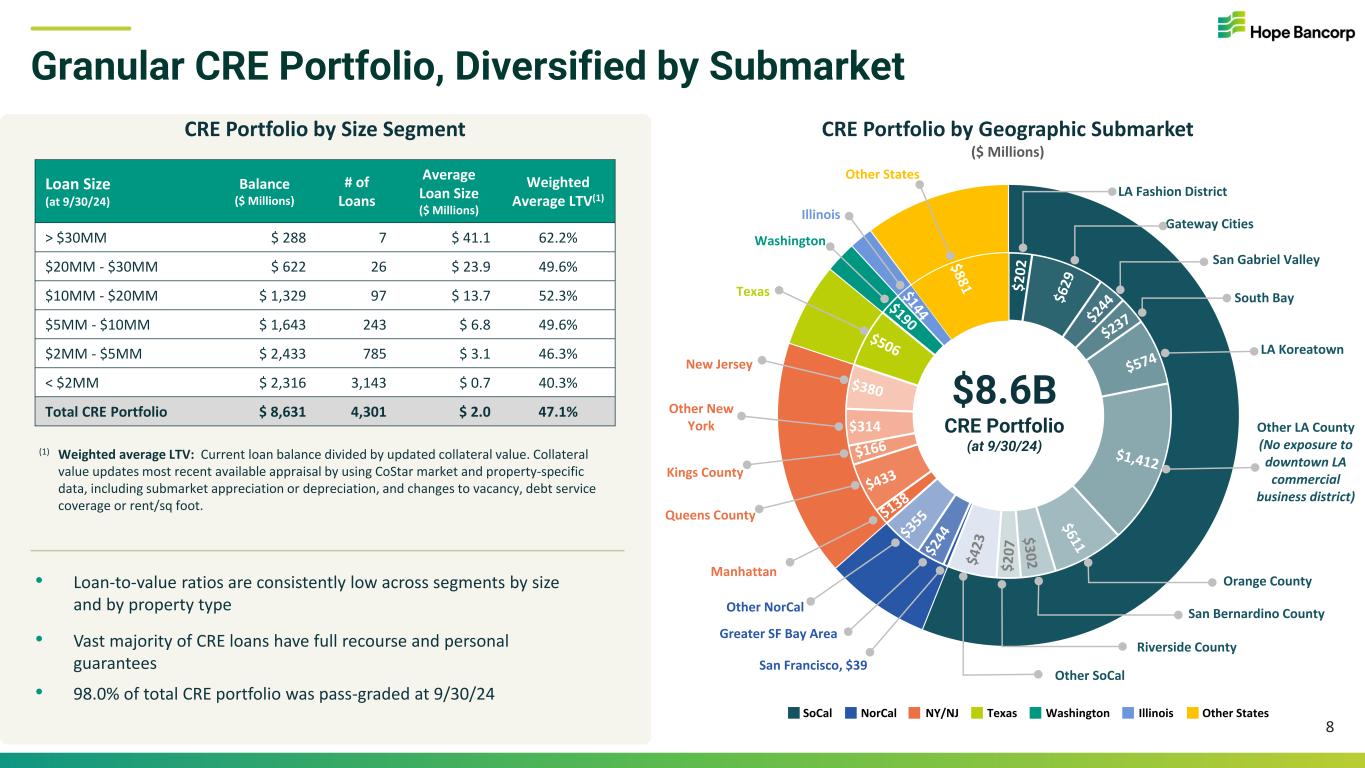

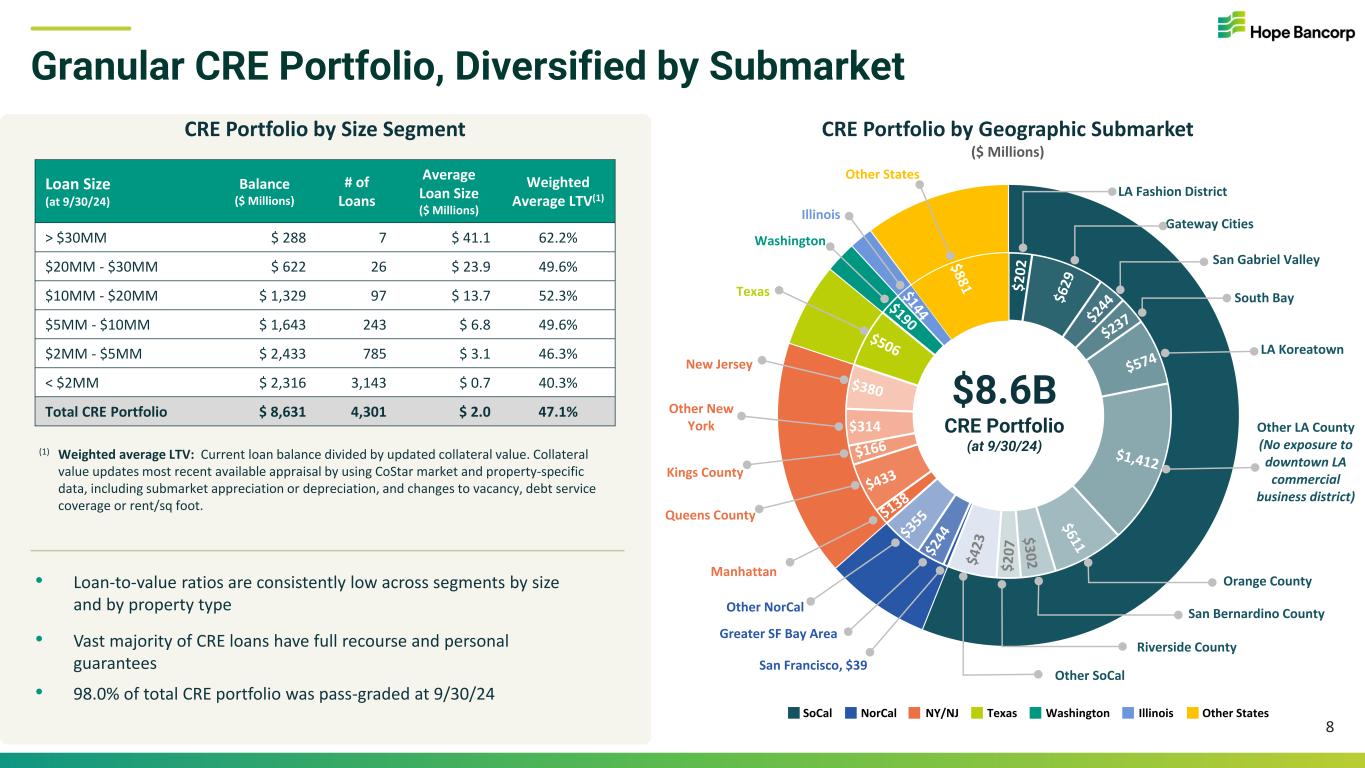

LA Fashion District Gateway Cities San Gabriel Valley South Bay LA Koreatown Other LA County (No exposure to downtown LA commercial business district) Orange County San Bernardino County Riverside County Other SoCal San Francisco, $39 Greater SF Bay Area Other NorCal Manhattan Queens County Kings County Other New York New Jersey Texas Washington Illinois Other States Granular CRE Portfolio, Diversified by Submarket 8 CRE Portfolio by Geographic Submarket ($ Millions) Loan Size (at 9/30/24) Balance ($ Millions) # of Loans Average Loan Size ($ Millions) Weighted Average LTV(1) > $30MM $ 288 7 $ 41.1 62.2% $20MM - $30MM $ 622 26 $ 23.9 49.6% $10MM - $20MM $ 1,329 97 $ 13.7 52.3% $5MM - $10MM $ 1,643 243 $ 6.8 49.6% $2MM - $5MM $ 2,433 785 $ 3.1 46.3% < $2MM $ 2,316 3,143 $ 0.7 40.3% Total CRE Portfolio $ 8,631 4,301 $ 2.0 47.1% • Loan-to-value ratios are consistently low across segments by size and by property type • Vast majority of CRE loans have full recourse and personal guarantees • 98.0% of total CRE portfolio was pass-graded at 9/30/24 CRE Portfolio by Size Segment (1) Weighted average LTV: Current loan balance divided by updated collateral value. Collateral value updates most recent available appraisal by using CoStar market and property-specific data, including submarket appreciation or depreciation, and changes to vacancy, debt service coverage or rent/sq foot. $8.6B CRE Portfolio (at 9/30/24) SoCal NorCal NY/NJ Texas Washington Illinois Other States $314

Net Interest Income & Net Interest Margin 9 Net Interest Income & Net Interest Margin $135 $126 $115 $106 $105 2.83% 2.70% 2.55% 2.62% 2.55% 3Q23 4Q23 1Q24 2Q24 3Q24 2.55% 2.62% Change in cost and balances of borrowings +1bps 3Q24 NIM change: -7bps QoQ Net Interest Income Net Interest Margin (annualized) QoQ Change in Net Interest Margin 2Q24 3Q24 Change in yield & balances of other earning assets +4bps Change in yield & balances of loans -8bps Change in cost and balances of IB deposits -4bps • 3Q24 net interest income of $105MM down -1% QoQ. Growth in interest income offset by increased interest expense • 3Q24 avg. cost of total deposits of 3.44% up +5bps QoQ. End-of-period total deposit costs of 3.34% at 9/30/24, down -9bps QoQ, demonstrating inflection point in deposit costs by deposit type • 3Q24 net interest margin (“NIM”) of 2.55% contracted -7bps QoQ, largely reflecting the changes in cost and balances of interest bearing (“IB”) deposits Quarterly Rate of Change in Avg. Cost of Total Deposits 1bps 9bps 46bps 83bps 75bps 42bps 19bps 17bps 21bps 3bps 5bps 0 10 20 30 40 50 60 70 80 90 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 ($ Millions) -4bps

2.98% 3.15% 3.36% 3.39% 3.44% 4.10% 4.32% 4.51% 4.54% 4.59% 5.43% 5.50% 5.50% 5.50% 5.43% 3Q23 4Q23 1Q24 2Q24 Q324 Cost of Total Deposits (ann.) Cost of IB Deposits (ann.) Avg Fed Funds Rate Average Loans & Deposits, Yields & Rates 10 Average Deposits Average Loans ($ Billions) ($ Billions) $14.6 $14.1 $13.7 $13.6 $13.6 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 3Q23 4Q23 1Q24 2Q24 3Q24 11.4 11.1 11.1 10.9 11.0 4.3 4.1 3.8 3.7 3.7 3Q23 4Q23 1Q24 2Q24 3Q24 Avg Interest Bearing ("IB") Deposits Avg Non IB Deposits 6.27% 6.24% 6.25% 6.20% 6.16% 5.43% 5.50% 5.50% 5.50% 5.43% 3Q23 4Q23 1Q24 2Q24 3Q24 Avg Loan Yield (annualized) Avg Fed Funds Rate Average Loan-to-Deposit Ratio 93% 92% 92% 94% 92% Average Cost of Deposits Relative to Fed Funds Rate Average Loan Yield Relative to Fed Funds Rate $14.5$14.9$15.3$15.7 $14.7

2.4 2.5 2.6 2.7 2.7 2.0 2.7 5.9 6.8 5.7 6.4 6.5 3Q23 4Q23 1Q24 2Q24 3Q24 Service Fees on Deposit Accounts Net Gains on SBA Loan Sales Other Income & Fees Noninterest Income 11 Noninterest Income ($ Millions) $11.8 $8.3 $9.3 $8.3 $11.1 • 3Q24 noninterest income of $12MM, up +7% from $11MM in 2Q24 • Sold $41MM of the guaranteed portion of SBA 7(a) loans during 3Q24 and recorded a net gain on sale of $3MM vs. $30MM sold during 2Q24 for a net gain on sale of $2MM • 3Q24 other income & fees included $403K BOLI gain, as well as $326K net loss on sales of securities AFS, as Company repositioned some lower-yielding securities

60.4% 73.4% 68.8% 69.3% 69.7% 60.1% 62.2% 66.8% 67.7% 68.4% 3Q23 4Q23 1Q24 2Q24 3Q24 Efficiency Ratio (GAAP) Efficiency Ratio (ex. notable items) 51.0 47.4 47.6 44.1 44.2 12.8 12.5 12.1 12.4 12.3 22.5 24.2 22.7 22.6 23.3 3Q23 4Q23 1Q24 2Q24 3Q24 Salary & Employee Benefits Occupancy & FF&E Other Expenses Efficiency Ratio Noninterest Expense & Efficiency 12 $79.8 $86.3 $84.1 $82.4 $79.1 Noninterest Expense(1) (excluding notable items) ($ Millions) • 3Q24 GAAP noninterest expense of $81MM, stable QoQ and down -6% YoY – 3Q24 notable items (pre-tax): $1.2MM merger-related expenses, and $197K restructuring-related costs • Excluding notable items, 3Q24 noninterest expense of $80MM, vs. $79MM in 2Q24, and down -8% YoY • Salaries & employee benefits expense stable QoQ and down -13% YoY (1) The noninterest expense chart columns present noninterest expense excluding notable items, which is a non-GAAP financial measure. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. Historical noninterest expense excludes provision for unfunded loan commitments, which was reclassified to the provision for credit losses beginning 1Q24. (2) Efficiency ratio excluding notable items is a non-GAAP financial measure. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation. GAAP Noninterest Expense $86.8 $99.2 $84.8 $81.0 (2) $81.3

$159 $159 $159 $156 $153 1.11% 1.15% 1.16% 1.15% 1.13% 3Q23 4Q23 1Q24 2Q24 3Q24 ACL ACL Coverage Ratio • Allowance for credit losses (“ACL”) totaled $153MM at 9/30/24 • ACL coverage ratio: 1.13% of loans receivable as of 9/30/24, vs. 1.15% as of 6/30/24 and 1.11% at 9/30/23. QoQ change: positive impact from improved macroeconomic variables, notably CRE Price Index, partially offset by increased qualitative and individually evaluated loan reserves • Net charge offs (“NCO”): moderate and manageable at $5.7MM, or 17bps of average loans, annualized, in 3Q24 • Nonperforming assets (“NPA”) of $104MM at 9/30/24, up from $67MM at 6/30/24, reflecting migration of one relationship after loans matured. Relationship consists of three CRE loans well-secured by properties in primary locations with minimal to no loss expected. Borrower actively in the process of selling the properties Asset Quality Metrics 13 Provision for Credit Losses & Net Charge Offs Nonperforming Assets RatioAllowance for Credit Losses & Coverage Ratio Criticized Loans Ratio $17 $2 $3 $1 $3 $31 $2 $4 $4 $6 0.85% 0.05% 0.10% 0.13% 0.17% 3Q23 4Q23 1Q24 2Q24 3Q24 Provision for Credit Losses NCO NCO Ratio (ann.) 2.52% 2.33% 3.07% 3.30% 3.71% 3Q23 4Q23 1Q24 2Q24 3Q24 Total Criticized Loans as a % of Total Loans ($ Millions) ($ Millions) 0.31% 0.24% 0.59% 0.39% 0.60% 3Q23 4Q23 1Q24 2Q24 3Q24 NPAs/Total Assets

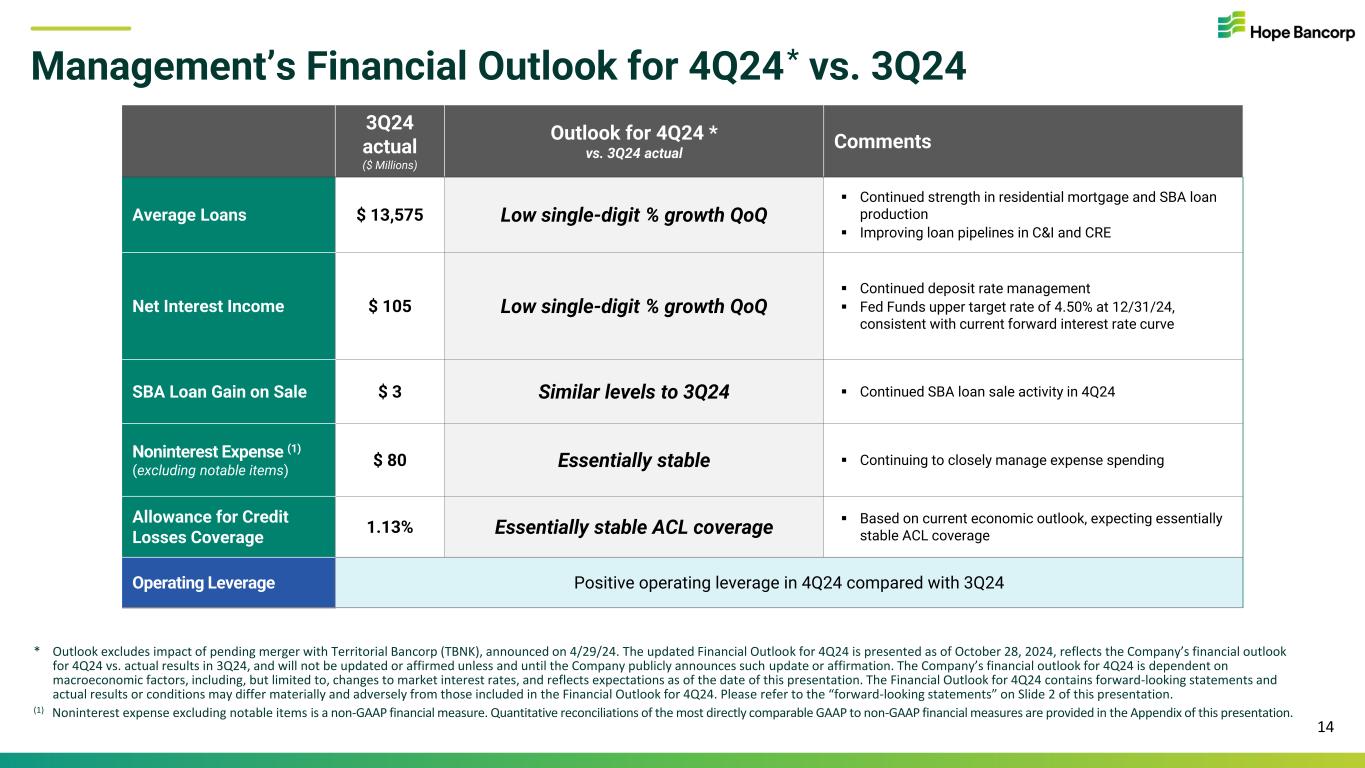

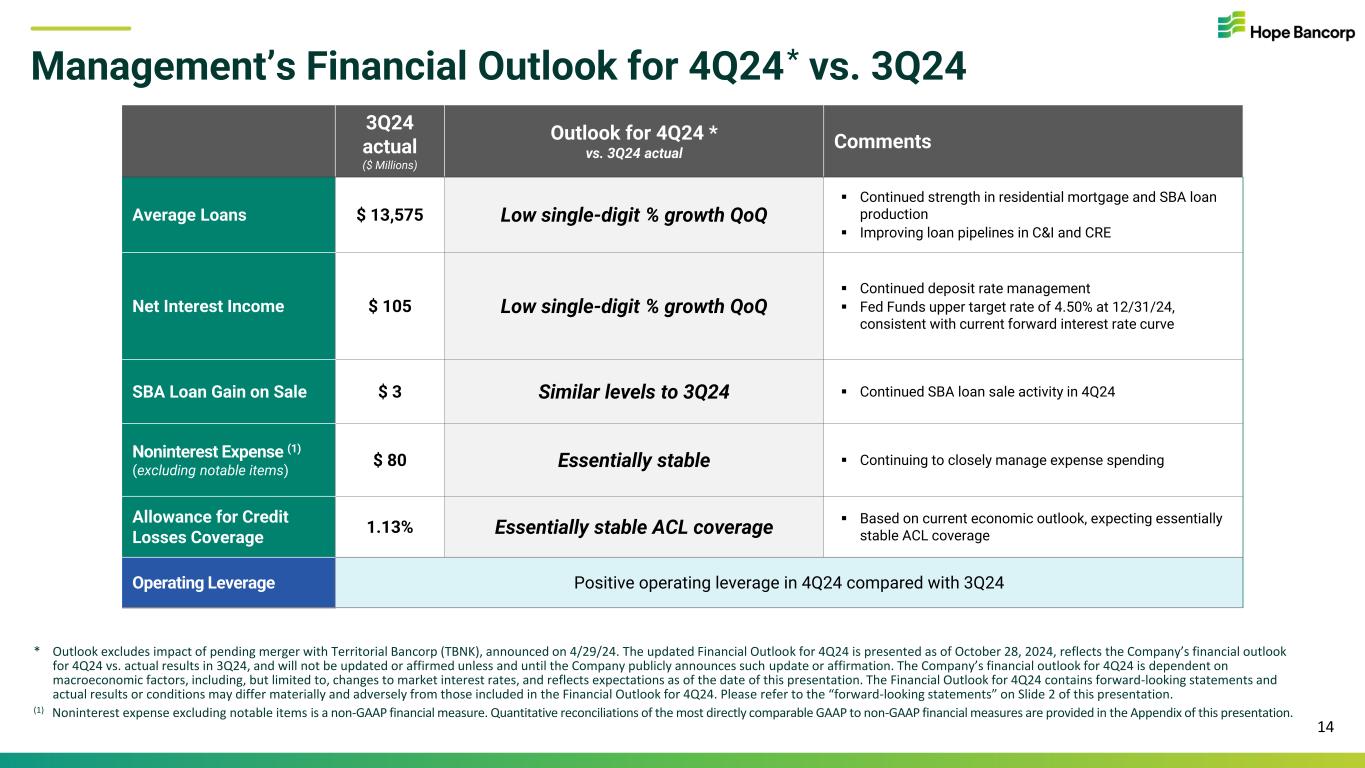

Management’s Financial Outlook for 4Q24* vs. 3Q24 14 3Q24 actual ($ Millions) Outlook for 4Q24 * vs. 3Q24 actual Comments Average Loans $ 13,575 Low single-digit % growth QoQ ▪ Continued strength in residential mortgage and SBA loan production ▪ Improving loan pipelines in C&I and CRE Net Interest Income $ 105 Low single-digit % growth QoQ ▪ Continued deposit rate management ▪ Fed Funds upper target rate of 4.50% at 12/31/24, consistent with current forward interest rate curve SBA Loan Gain on Sale $ 3 Similar levels to 3Q24 ▪ Continued SBA loan sale activity in 4Q24 Noninterest Expense (1) (excluding notable items) $ 80 Essentially stable ▪ Continuing to closely manage expense spending Allowance for Credit Losses Coverage 1.13% Essentially stable ACL coverage ▪ Based on current economic outlook, expecting essentially stable ACL coverage Operating Leverage Positive operating leverage in 4Q24 compared with 3Q24 * Outlook excludes impact of pending merger with Territorial Bancorp (TBNK), announced on 4/29/24. The updated Financial Outlook for 4Q24 is presented as of October 28, 2024, reflects the Company’s financial outlook for 4Q24 vs. actual results in 3Q24, and will not be updated or affirmed unless and until the Company publicly announces such update or affirmation. The Company’s financial outlook for 4Q24 is dependent on macroeconomic factors, including, but limited to, changes to market interest rates, and reflects expectations as of the date of this presentation. The Financial Outlook for 4Q24 contains forward-looking statements and actual results or conditions may differ materially and adversely from those included in the Financial Outlook for 4Q24. Please refer to the “forward-looking statements” on Slide 2 of this presentation. (1) Noninterest expense excluding notable items is a non-GAAP financial measure. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation.

Appendix 15

Summary Balance Sheet 16 ($ in millions, except per share data) 9/30/24 6/30/24 QoQ % change 9/30/23 YoY % change Cash and due from banks $ 680.9 $ 654.0 4.1 % $ 2,500.3 (72.8)% Investment securities 2,177.3 2,172.9 0.2 % 2,260.8 (3.7)% Federal Home Loan Bank (“FHLB”) stock and other investments 57.2 61.5 (7.1)% 60.4 (5.4)% Gross loans 13,643.7 13,635.3 0.1 % 14,325.7 (4.8)% Allowance for credit losses (153.3) (156.0) (1.8)% (158.8) (3.5)% Goodwill and intangible assets 467.2 467.6 (0.1) % 468.8 (0.4) % Other assets 481.2 539.8 (10.8)% 619.2 (22.3)% Total assets $ 17,354.2 $ 17,375.1 (0.1)% $ 20,076.4 (13.6)% Deposits $ 14,729.5 $ 14,711.5 0.1 % $ 15,739.9 (6.4)% Borrowings & other debt 209.2 278.9 (25.0)% 1,903.7 (89.0)% Other liabilities 245.7 273.4 (10.2)% 402.4 (39.0)% Total liabilities $ 15,184.4 $ 15,263.8 (0.5)% $ 18,046.0 (15.9)% Total stockholders’ equity $ 2,169.8 $ 2,111.3 2.8 % $ 2,030.4 6.9 % Book value per share $17.97 $17.49 2.7 % $16.92 6.2 % Tangible common equity (“TCE”) per share(1) $14.10 $13.61 3.6 % $13.01 8.4 % Tangible common equity ratio(1) 10.08% 9.72% 7.96% Loan-to-deposit ratio 92.6% 92.7% 91.0% (1) TCE per share and TCE ratio are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation.

Summary Income Statement 17 ($ in thousands, except per share and share data) 3Q24 1Q24 QoQ % change 3Q23 YoY % change Net interest income before provision for credit losses $ 104,809 $ 105,860 (1)% $ 135,378 (23)% Provision for credit losses 3,280 1,400 134 % 16,862 (81)% Net interest income after provision for credit losses 101,529 104,460 (3)% 118,516 (14)% Noninterest income 11,839 11,071 7 % 8,305 (43)% Noninterest expense 81,268 80,987 —% 86,811 (6)% Noninterest expense excluding notable items(1) 79,835 79,131 1 % 86,311 (8)% Income before income taxes 32,100 34,544 (7)% 40,010 (20)% Income tax provision 7,941 9,274 (14)% 9,961 (20)% Net income $ 24,159 $ 25,270 (4)% $ 30,049 (20)% Net income excluding notable items(1) $ 25,171 $ 26,579 (5)% $ 30,402 (17)% Earnings Per Common Share - Diluted $0.20 $0.21 $0.25 Earnings Per Common Share excluding notable items(1) - Diluted $0.21 $0.22 $0.25 Weighted Average Shares Outstanding - Diluted 121,159,977 120,939,429 120,374,618 (1) Noninterest expense excluding notable items, net income excluding notable items, and diluted earnings per common share excluding notable items are non-GAAP financial measures. Quantitative reconciliations of the most directly comparable GAAP to non-GAAP financial measures are provided in the Appendix of this presentation.

Appendix: Non-GAAP Financial Measures Reconciliation Management reviews select non-GAAP financial measures in evaluating the Company’s and the Bank’s financial performance and in response to market participant interest. Reconciliations of the most directly comparable GAAP to non-GAAP financial measures utilized by management are provided below. Tangible Common Equity (TCE) 18 Return on Average Tangible Common Equity (ROTCE) ($ in thousands, except per share info) 3Q24 2Q24 3Q23 Total stockholders’ equity $ 2,169,785 $ 2,111,282 $ 2,030,424 Less: Goodwill and core deposit intangible assets, net (467,182) (467,583) (468,832) TCE $ 1,702,603 $ 1,643,699 $ 1,561,592 Total assets $ 17,354,189 $ 17,375,091 $ 20,076,364 Less: Goodwill and core deposit intangible assets, net (467,182) (467,583) (468,832) Tangible assets $ 16,887,007 $ 16,907,508 $ 19,607,532 TCE ratio 10.08% 9.72% 7.96% Common shares outstanding 120,737,908 120,731,342 120,026,220 TCE per share $ 14.10 $ 13.61 $ 13.01 ($ in thousands) 3Q24 2Q24 3Q23 Average stockholders’ equity $ 2,139,861 $ 2,097,108 $ 2,072,092 Less: Average goodwill and core deposit intangible assets, net (467,419) (467,822) (469,079) Average TCE $ 1,672,442 $ 1,629,286 $ 1,610,013 Net income $ 24,159 $ 25,270 $ 30,049 ROTCE (annualized) 5.78% 6.20% 7.47%

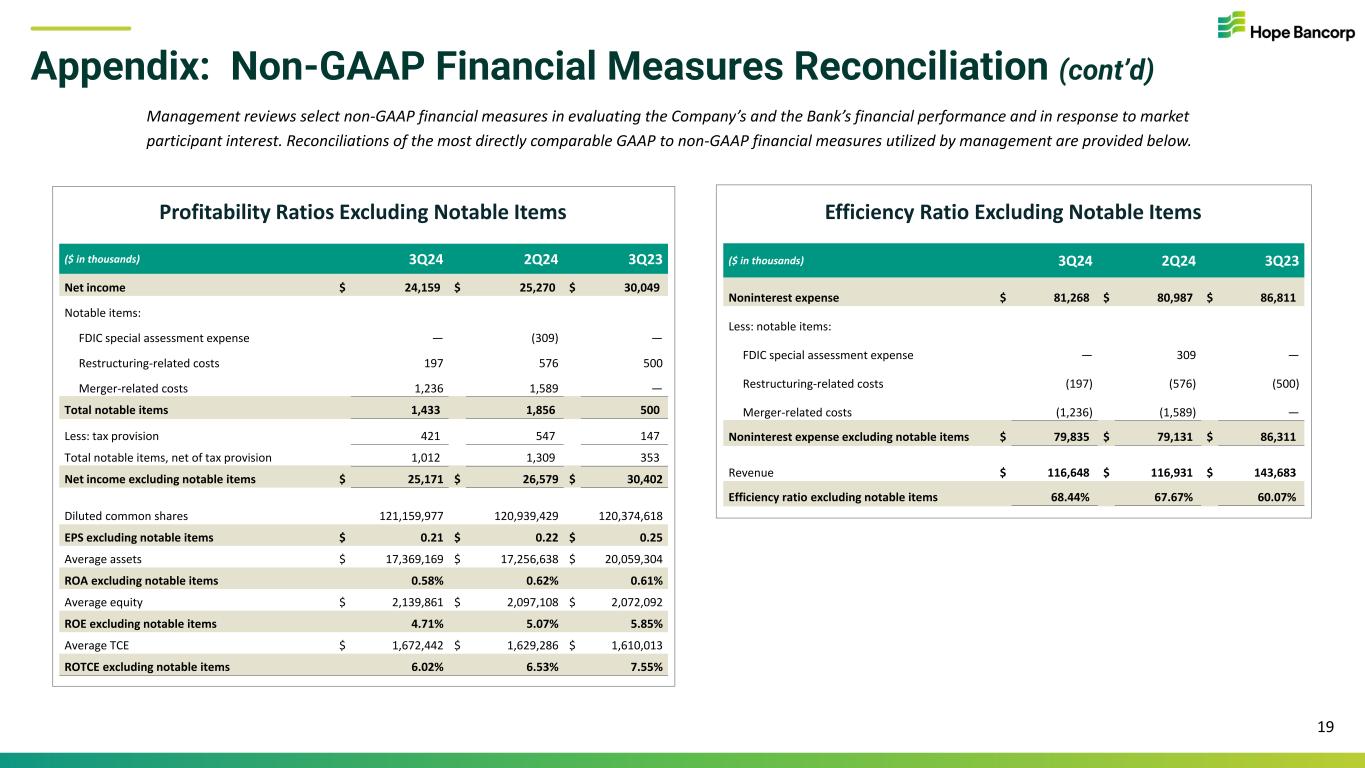

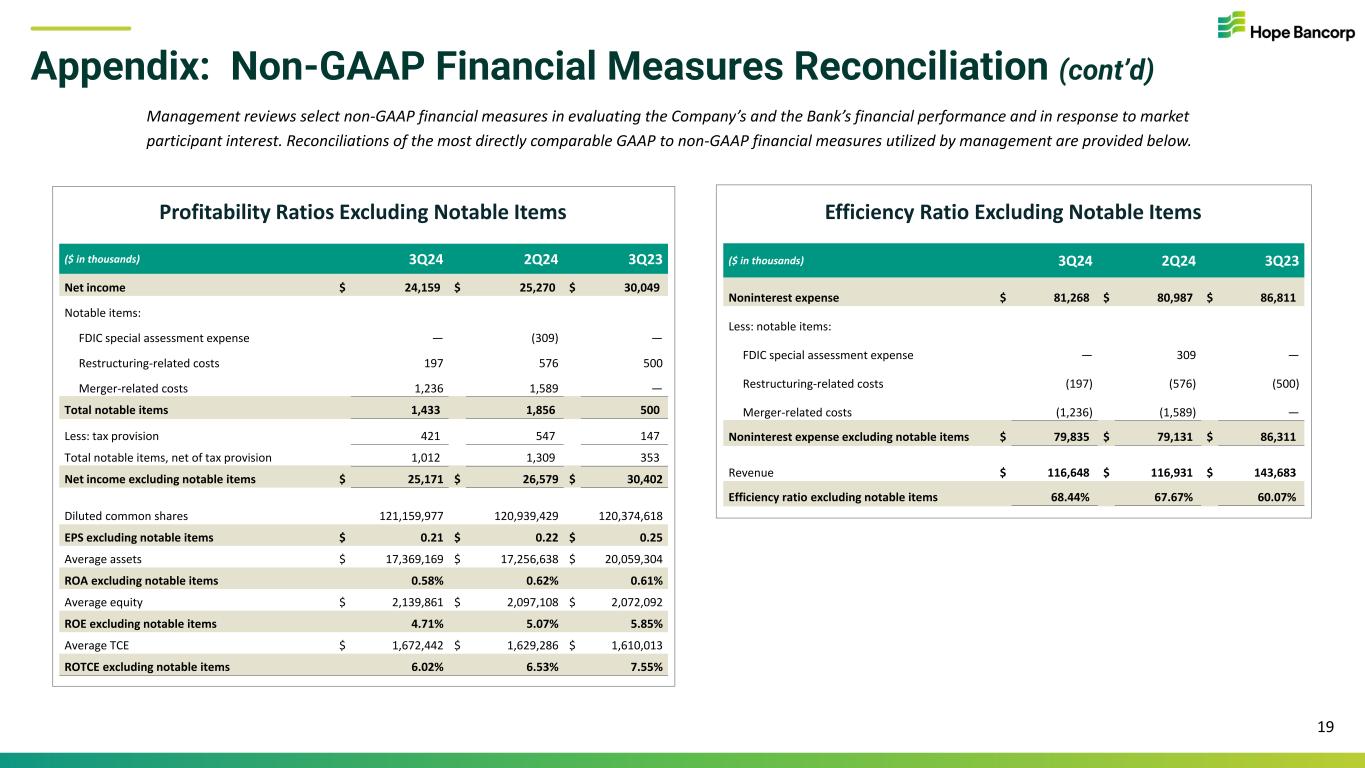

Appendix: Non-GAAP Financial Measures Reconciliation (cont’d) Management reviews select non-GAAP financial measures in evaluating the Company’s and the Bank’s financial performance and in response to market participant interest. Reconciliations of the most directly comparable GAAP to non-GAAP financial measures utilized by management are provided below. 19 ($ in thousands) 3Q24 2Q24 3Q23 Noninterest expense $ 81,268 $ 80,987 $ 86,811 Less: notable items: FDIC special assessment expense — 309 — Restructuring-related costs (197) (576) (500) Merger-related costs (1,236) (1,589) — Noninterest expense excluding notable items $ 79,835 $ 79,131 $ 86,311 Revenue $ 116,648 $ 116,931 $ 143,683 Efficiency ratio excluding notable items 68.44% 67.67% 60.07% Efficiency Ratio Excluding Notable Items ($ in thousands) 3Q24 2Q24 3Q23 Net income $ 24,159 $ 25,270 $ 30,049 Notable items: FDIC special assessment expense — (309) — Restructuring-related costs 197 576 500 Merger-related costs 1,236 1,589 — Total notable items 1,433 1,856 500 Less: tax provision 421 547 147 Total notable items, net of tax provision 1,012 1,309 353 Net income excluding notable items $ 25,171 $ 26,579 $ 30,402 Diluted common shares 121,159,977 120,939,429 120,374,618 EPS excluding notable items $ 0.21 $ 0.22 $ 0.25 Average assets $ 17,369,169 $ 17,256,638 $ 20,059,304 ROA excluding notable items 0.58% 0.62% 0.61% Average equity $ 2,139,861 $ 2,097,108 $ 2,072,092 ROE excluding notable items 4.71% 5.07% 5.85% Average TCE $ 1,672,442 $ 1,629,286 $ 1,610,013 ROTCE excluding notable items 6.02% 6.53% 7.55% Profitability Ratios Excluding Notable Items