UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

or

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _____________

Commission file number: 001-32034

InterCloud Systems, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 65-0963722 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

2500 N. Military Trail, Suite 275

Boca Raton, FL 33431

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number: (561) 988-1988

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: common stock, par value $0.0001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s)), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o Do not check if a smaller reporting company | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and ask price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $346,144 as of June 30, 2012, based on the closing price of $0.425 of the Company’s common stock on such date.

The number of outstanding shares of the registrant’s common stock on March 28, 2013 was 2,799,565.

Documents Incorporated by Reference: None.

FORM 10-K ANNUAL REPORT

FISCAL YEAR ENDED DECEMBER 31, 2012

TABLE OF CONTENTS

| | | | | PAGE |

| | | | | |

| | | | 4 |

| | | | 12 |

| | Unresolved Staff Comments. | | 25 |

| | | | 25 |

| | | | 26 |

| | | | 26 |

| | | | | |

| | | | |

| | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | | 27 |

| | | | 28 |

| | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | | 28 |

| | Quantitative and Qualitative Disclosures about Market Risk. | | 44 |

| | Financial Statements and Supplementary Data. | | 44 |

| | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | | 44 |

| | | | 44 |

| | | | 45 |

| | | | | |

| | | | |

| | Directors, Executive Officers and Corporate Governance. | | 46 |

| | | | 49 |

| | Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters. | | 52 |

| | Certain Relationships and Related Transactions, and Director Independence. | | 54 |

| | Principal Accountant Fees and Services. | | 55 |

| | | | | |

| | | | |

| | Exhibits, Financial Statement Schedules. | | 56 |

| | | | | |

| | 57 |

| | 58 |

| | F-1 |

FORWARD-LOOKING STATEMENTS

The statements contained in this report with respect to our financial condition, results of operations and business that are not historical facts are “forward-looking statements”. Forward-looking statements can be identified by the use of forward-looking terminology, such as "anticipate", "believe", "expect", "plan", "intend", "seek", "estimate", "project", "could", "may" or the negative thereof or other variations thereon, or by discussions of strategy that involve risks and uncertainties. Management wishes to caution the reader of the forward-looking statements that any such statements that are contained in this report reflect our current beliefs with respect to future events and involve known and unknown risks, uncertainties and other factors, including, but not limited to, economic, competitive, regulatory, technological, key employees, and general business factors affecting our operations, markets, growth, services, products, licenses and other factors, some of which are described in this report including in “Risk Factors” in Item 1A and some of which are discussed in our other filings with the SEC. These forward-looking statements are only estimates or predictions. No assurances can be given regarding the achievement of future results, as actual results may differ materially as a result of risks facing our company, and actual events may differ from the assumptions underlying the statements that have been made regarding anticipated events.

These risk factors should be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. All written and oral forward looking statements made in connection with this report that are attributable to our company or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Given these uncertainties, we caution investors not to unduly rely on our forward-looking statements. We do not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date of this report or to reflect the occurrence of unanticipated events, except as required by applicable law or regulation.

Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. If we are ever considered to be an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

Unless otherwise noted, “we,” “us,” “our,” and the “Company” refer to InterCloud Systems, Inc. and its predecessors and consolidated subsidiaries, including Rives-Monteiro Leasing, LLC, Rives-Monteiro Engineering, LLC, ADEX Corporation, ADEX Puerto Rico, LLC, ADEXCOMM Corporation, T N S, Inc., Tropical Communications, Inc. and Environmental Remediation and Financial Services, LLC

PART I

ITEM 1. BUSINESS

Overview

We are a global single-source provider of value-added services for both corporate enterprises and service providers. We offer cloud and managed services, professional consulting services and voice, data and optical solutions to assist our customers in meeting their changing technology demands. Our cloud solutions offer enterprise and service-provider customers the opportunity to adopt an operational expense model by outsourcing to us rather than the capital expense model that has dominated in recent decades in information technology (IT) infrastructure management. Our professional services groups offer a broad range of solutions, including application development teams, analytics, project management, program management, telecom network management and field services. Our engineering, design, installation and maintenance services support the build- and operation of some of the most advanced enterprise, fiber optic, Ethernet and wireless networks.

We provide the following categories of offerings to our customers:

| | ● | Cloud and Managed Services. Our cloud-based service offerings include platform as a service (PaaS), infrastructure as a service (IaaS), database as a service (DbaaS), and software as a service (SaaS). Our extensive experience in system integration and solutions-centric services helps our customers quickly to integrate and adopt cloud-based services. Our managed-services offerings include network management, 24x7x365 monitoring, security monitoring, storage and backup services. |

| | ● | Applications and Infrastructure. We provide an array of applications and services throughout North America and internationally, including unified communications, interactive voice response (IVR) and SIP-based call centers. We also offer structured cabling and other field installations. In addition, we design, engineer, install and maintain various types of WiFi and wide-area networks, distributed antenna systems (DAS), and small cell distribution networks for incumbent local exchange carriers (ILECs), telecommunications original equipment manufacturers (OEMs), cable broadband multiple system operators (MSOs) and enterprise customers. Our services and applications teams support the deployment of new networks and technologies, as well as expand and maintain existing networks. We also design, install and maintain hardware solutions for the leading OEMs that support voice, data and optical networks. |

| | ● | Professional Services. We provide consulting and professional staffing solutions to the service-provider and enterprise market in support of all facets of the telecommunications business, including project management, network implementation, network installation, network upgrades, rebuilds, maintenance and consulting services. We leverage our international recruiting database, which includes more than 70,000 professionals, for the rapid deployment of our professional services. On a weekly basis, we deploy hundreds of telecommunications professionals in support of our worldwide customers. Our skilled recruiters assist telecommunications companies, cable broadband MSOs and enterprise clients throughout the project lifecycle of a network deployment and maintenance. |

Our Recent and Pending Acquisitions

We have grown significantly and expanded our service offerings and geographic reach through a series of strategic acquisitions.

Since January 1, 2011, we have completed the following acquisitions:

| | ● | ADEX Corporation. In September 2012, we acquired ADEX Corporation, a New York corporation (“ADEX”), an Atlanta-based provider of engineering and installation services and staffing solutions and other services to the telecommunications industry. ADEX’s managed solutions diversified our ability to service our customers domestically and internationally throughout the project lifecycle. |

| | ● | T N S, Inc. In September 2012, we also acquired T N S, Inc., an Illinois corporation (“T N S”), a Chicago-based structured cabling company and DAS installer that supports voice, data, video, security and multimedia systems within commercial office buildings, multi-building campus environments, high-rise buildings, data centers and other structures. T N S extends our geographic reach to the Midwest area and our client reach to end-users, such as multinational corporations, universities, school districts and other large organizations that have significant ongoing cabling needs. |

| | ● | Tropical Communications, Inc. In August 2011, we acquired Tropical Communications, Inc., a Florida corporation (“Tropical”), a Miami-based provider of structured cabling and DAS systems for commercial and governmental entities in the Southeast. |

| | ● | Rives-Monteiro Engineering LLC and Rives-Monteiro Leasing, LLC. In December 2011, we acquired a 49% stake in Rives-Monteiro Engineering, LLC, an Alabama limited liability company (“RM Engineering”), a certified Women Business Enterprise (WBE) cable firm based in Tuscaloosa, Alabama that performs engineering services in the Southeastern United States and internationally, and 100% of Rives-Monteiro Leasing, LLC, an Alabama limited liability company (“RM Leasing”, and together with RM Engineering, “Rives-Monteiro”), an equipment provider for cable-engineering services firms. We have an option to purchase the remaining 51% of RM Engineering for a nominal sum at any time. RM Engineering operates from its headquarters in Tuscaloosa, Alabama and provides services to customers located in the United States and Latin America. |

| | ● | Environmental Remediation and Financial Services, LLC. In December 2012, our ADEX subsidiary acquired Environmental Remediation and Financial Services, LLC, a New Jersey limited liability company (“ERFS”), an environmental remediation and disaster recovery company. The acquisition of this company augmented ADEX’s disaster recovery service offerings. |

We have also entered into definitive agreements for the following acquisitions:

| | ● | Telco. In November 2012, we executed a definitive agreement to acquire the Telco Professional Services and Handset Testing business division (“Telco”) of Tekmark Global Solutions, LLC, a New Jersey limited liability company. We plan to integrate this professional services and telecommunications staffing business into our ADEX subsidiary in order to expand our project staffing business and our access to skilled labor. |

| | ● | IPC. In November 2012, we executed a definitive agreement to acquire Integration Partners-NY Corporation, a New York corporation (“IPC”), a New York-based cloud and managed services business, with professional services and applications capabilities. IPC serves both corporate enterprises and telecommunications service providers. We believe the acquisition of IPC will support our cloud and managed services aspect of our business, as well as improve our systems integration and applications capabilities. |

In connection with the acquisitions of our subsidiaries, we entered into purchase agreements pursuant to which we agreed to certain on-going financial and other obligations. The following is a summary of the material terms of the purchase agreements for our recent and pending acquisitions.

ADEX Corporation. On September 17, 2012, we entered into an Equity Purchase Agreement (the “ADEX Agreement”) with the shareholders of ADEX and acquired all the outstanding capital stock of ADEX and ADEXCOMM Corporation, a New York corporation (“ADEXCOMM”), and all outstanding membership interests of ADEX Puerto Rico LLC, a Puerto Rican limited liability company (“ADEX Puerto Rico,” and together with ADEX and ADEXCOMM, the “ADEX Entities”). Under the terms of the ADEX Agreement, we acquired all of the outstanding equity interests of the ADEX Entities in exchange for the cash payment at closing of $12,819,594, less the amount of debt of the ADEX Entities repaid by us at the closing (approximately $1,241,000). We also issued promissory notes to pay the sellers the aggregate amount of $1,046,000 (the “ADEX Note”), which notes have since been paid in full.

As additional consideration, we agreed to pay the sellers an amount of cash equal to the product of 0.75 (the “Multiplier”) multiplied by the adjusted EBITDA of the ADEX Entities for the 12-month period beginning on October 1, 2012 (the “Forward EBITDA”), provided that if the Forward EBITDA is less than $2,731,243, the Multiplier shall be adjusted to 0.50 and if the Forward EBITDA is greater than $3,431,243, the Multiplier shall be adjusted to 1.0. We also agreed to pay the sellers an amount of cash equal to the amount, if any, by which the Forward EBITDA is greater than $3,081,243. In connection with the obligation to make these payments, we issued to the sellers 2,000 shares of our Series G Preferred Stock, and provided that those shares are redeemable in the event we default on our obligation to make such payments. The shares of Series G Preferred will be automatically cancelled if we make the required payments in cash.

We also agreed to pay the sellers an amount in cash equal to the net working capital of the ADEX Entities as of the closing date. In connection with the obligation to make these payments, we issued to the sellers an aggregate of 3,500 shares of our Series G Preferred Stock, and provided that those shares are redeemable in the event we default on our obligation to make such payment. As of March 28, 2013, 1,500 shares of Series G Preferred Stock have been released to us from escrow and the 2,000 remaining shares of Series G Preferred will be automatically cancelled if we make the remaining required payments.

The ADEX Agreement contains representations, warranties, covenants and on-going indemnification obligations. These covenants include an obligation during the year following the closing to continue to operate the ongoing business of the ADEX Entities in the same manner as previously conducted, and to provide certain of the sellers with substantial control over the business operations of the ADEX Entities.

T N S, Inc. On September 17, 2012, we entered into a Stock Purchase Agreement (the “T N S Agreement”) with the stockholders of T N S pursuant to which we acquired all the outstanding capital stock of T N S for the following consideration paid or issued by us at the closing: (i) cash in the amount of $700,000, (ii) 4,150 shares of our Series F Preferred Stock and (iii) 40,000 shares of our common stock. In the T N S Agreement, we granted the sellers the right to put to us the shares of common stock issued at the closing for $12.50 per share, beginning 18 months after the closing and continuing for 60 days thereafter. In the event the adjusted EBITDA of T N S for the 12 month period beginning October 1, 2012 is greater or less than $1,250,000, we also agreed to issue, or cancel, as appropriate, shares of Series F Preferred Stock based on an agreed-upon formula.

In addition, in the T N S Agreement, we agreed that, upon completion of a public offering of our securities, we will issue to the sellers an aggregate number of shares of common stock equal to (i) $200,000 divided by (ii) the offering price per share of our common stock in such public offering. Finally, as additional consideration, we agreed to pay the sellers an amount equal to 20% of T N S’s adjusted EBITDA in excess of $1,275,000 for each of the three 12-month periods immediately following the closing date. During such 36-month period, we agreed to operate T N S in the ordinary course with the commercially-reasonable objective of maximizing the amount payable to the sellers with respect to such three 12-month periods.

Tropical Communications, Inc. On August 15, 2011, we entered into a Stock Purchase Agreement (the “Tropical Agreement”) with the sole shareholder of Tropical pursuant to which we acquired all of the issued and outstanding stock of Tropical for the following consideration: (i) 8,000 shares of common stock, (ii) the assumption of indebtedness in the aggregate amount of $334,369, (iii) an amount equal to 50% of the net income of Tropical Communications during the 18-month period following closing, of which there was none, and (iv) warrants to purchase up to 4,000 additional shares of common stock at a price equal to the lower of a 25% discount to the market price of the common stock on the date of exercise or $37.50 per share, for each $500,000 of EBITDA earned by Tropical during the 24-month period following closing.

Rives-Monteiro Engineering LLC and Rives-Monteiro Leasing, LLC. On November 15, 2011, we entered into, and on December 14, 2011 we amended, a Stock Purchase Agreement (the “Rives-Monteiro Agreement”) with the two members of RM Engineering and RM Leasing pursuant to which we acquired 49% of the membership interests of RM Engineering, were granted the right to purchase the remaining 51% of RM Engineering for $1.00 and acquired all of the membership interests of RM Leasing for the following consideration: (i) a cash payment in the amount of $300,000, of which $100,000 was paid on December 29, 2011, the date of consummation of the acquisitions, $100,000 was payable on or before March 29, 2012, and $100,000 was payable on or before June 29, 2012, (ii) 60,000 shares of common stock, (ii) the assumption of indebtedness in the aggregate amount of $211,455, (iii) an amount equal to 50% of the net income of RM Engineering during the 18-month period following date of acquisition of RM Engineering, and (iv) warrants to purchase up to 4,000 additional shares of common stock at a price equal to the lower of a 25% discount to the market price of the common stock on the date of exercise or $37.50 per share, for each $500,000 of EBITDA earned by RM Engineering during the 24-month period following the date of acquisition of RM Engineering. The cash payments in the aggregate amount of $200,000 were not paid when due in March and June 2012, and the parties expect that such payments will be made within 90 days of the date of this report.

The Rives-Monteiro Agreement contains representations, warranties, covenants and on-going indemnification obligations. These covenants include an obligation during the year following the closing to continue to operate the ongoing business of RM Engineering in the same manner as previously conducted.

Environmental Remediation. On November 30, 2012, ADEX entered into an Equity Purchase Agreement (the “Environmental Remediation Agreement”) with ERFS and the sole stockholder of ERFS pursuant to which ADEX acquired all the outstanding equity interests of ERFS for the following consideration paid or issued by us at the closing: (i) a number of shares of our Series I Preferred Stock equal to the quotient obtained by dividing (a) (1) the product of 4.0 and the amount of ERFS’s EBITDA (as defined) for the 12-month period ended November 30, 2012, less (2) the amount of ERFS’s outstanding indebtedness for borrowed money and certain other indebtedness on the date of the closing of the acquisition and (b) the offering price per share of our common stock in our next public offering. In the Environmental Remediation Agreement, we granted the seller the right to put to us up to $750,000 stated amount of the Series I Preferred Shares (less the amount of pre-closing receivables collected and paid to the seller) on and after March 31, 2013.

In addition, in the Environmental Remediation Agreement, as additional consideration, we agreed to pay the seller an amount, payable in cash or common stock, at our election, equal to 1.5 times ERFS’s EBITDA in the 12-month period ending December 31, 2013, provided the EBITDA for such period exceeds the amount of ERFS EBITDA for the 12-month period ended November 30, 2012 by $10,000 or more. In addition, we agreed to cause Environmental Remediation to pay to the seller on a bi-weekly basis an amount of cash equal to the amount of any receivables related to pre-closing activities of ERFS that are collected after the date of the acquisition, up to a maximum of $750,000.

Telco. On November 19, 2012, we entered into an Asset Purchase Agreement (the “Tekmark Agreement”) to acquire all the property, assets and business of Telco from Tekmark Global Solutions LLC. Under the terms of the Tekmark Agreement, at the closing of the acquisition, we will pay the seller an aggregate amount in cash equal to the difference between (i) the product of 5.0 multiplied by the Estimated Closing EBITDA (as defined) of Telco for the 12-month period ending on the last day of the month prior to the closing date (the “Estimated Closing TTM EBITDA”), less (ii) $2,600,000. In addition, we will issue to the seller a number of shares of common stock equal to the product of (i) the Estimated Closing TTM EBITDA, and (ii) the price of the common stock sold in our next public offering, rounded to the nearest whole share. We will also pay the seller additional cash compensation in an amount equal to the EBITDA (as defined) of Telco for the 12-month period beginning on the first day of the first calendar month commencing after the closing date (the “Initial Earnout Period”).

Following the closing, as additional consideration, we will make supplemental payments to the seller in cash for (i) the 12-month period beginning on the first day of the thirteenth calendar month commencing after the closing date (the “First Supplemental Earnout Period”) and (ii) the 12-month period beginning on the first day of the twenty-fifth calendar month commencing after the closing date (the “Second Supplemental Earnout Period”). The payment made for the First Supplemental Earnout Period will be an amount equal to the product of 2.0 multiplied by the positive difference, if any, between (A) the EBITDA of Telco for the First Supplemental Earnout Period, minus (B) the Closing TTM EBITDA (as defined). The payment made for the Second Supplemental Earnout Period will be an amount equal to the product of 2.0 multiplied by the positive difference, if any, between (Y) the EBITDA of Telco for the Second Supplemental Earnout Period, minus (Z) the Closing TTM EBITDA.

The Tekmark Agreement contains customary representations, warranties, covenants and indemnification provisions. The closing of the acquisition remains subject to closing conditions, including the accuracy of representations and warranties of the parties in the Tekmark Agreement and consummation of an equity financing, to secure sufficient funding for the transaction. The Tekmark Agreement may be terminated at any time prior to closing (i) by mutual consent of the parties, (ii) by either party if the closing has not occurred by May 15, 2013, (iii) by either party if the other party has breached any of its representations, warranties or covenants or (iv) by either party if a court or governmental authority has issued a final order or ruling prohibiting the transaction.

IPC. On November 20, 2012, we entered into a Stock Purchase Agreement (the “IPC Agreement”) to acquire all the outstanding capital stock of IPC. Under the terms of the IPC Agreement, at the closing of the acquisition, we will pay the sellers (a) a cash payment in an amount equal to (i) the product of 5.2 multiplied by the TTM EBITDA (as defined), (ii) less Estimated Closing Debt (as defined), (iii) less Estimated Company Unpaid Transaction Expenses (as defined), (iv) plus any Estimated Working Capital Surplus (as defined) or less any Estimated Working Capital Deficiency (as defined), less the Escrow Amount (the “Initial Cash Payment”) and (b) a stock payment consisting of a number of shares of common stock equal to the quotient obtained by dividing (A) (i) the product of 0.2 multiplied by the TTM EBITDA, (ii) less Estimated Closing Debt, (iii) less Estimated Company Unpaid Transaction Expenses, (iv) plus any Estimated Working Capital Surplus or less any Estimated Working Capital Deficiency, by (B) the price of a share of common stock in our next public offering. Each seller may elect to receive a portion of such seller’s pro rata share of the Initial Cash Payment, up to an amount equal to such Seller’s pro rata share of the TTM EBITDA, in shares of common stock in lieu of cash (the “Elected Amount”) provided that such seller (i) provides proper notification of such election and (ii) the number of shares to be so issued shall be determined by dividing such seller’s Elected Amount by the price of a share of common stock in our next public offering.

As additional consideration, following the closing, we will make an additional cash payment in an amount equal to the aggregate amount of (i) the product of 0.6 multiplied by the EBITDA of IPC for the 12-month period beginning on the first day of the first calendar month commencing after the closing date (the “Forward EBITDA”), plus (ii) in the event that the Forward EBITDA exceeds the TTM EBITDA by 5.0% or more, an amount equal to 2.0 multiplied by this difference.

The IPC Agreement contains customary representations, warranties, covenants and indemnification provisions. The closing remains subject to closing conditions, including the accuracy of representations and warranties of the parties in the IPC Agreement and completion of a public offering of our common stock. The IPC Agreement may be terminated at any time prior to closing (i) by mutual consent of the parties, (ii) by either party if the closing has not occurred by May 15, 2013, (iii) by either party if the other party has breached any of its representations, warranties or covenants or (iv) by either party if a court or governmental authority has issued a final order or ruling prohibiting the transaction.

Our Industry

Global Internet traffic is expected to continue to grow rapidly, driven by factors such as the increased use of smart phones, tablets and other internet devices, the proliferation of social networking and the increased adoption of cloud-based services. Corporate enterprises are increasingly adopting cloud-based services, which enable them and other end users to rapidly deploy applications without building out their own expensive infrastructure and to minimize the growth in their own IT departments.

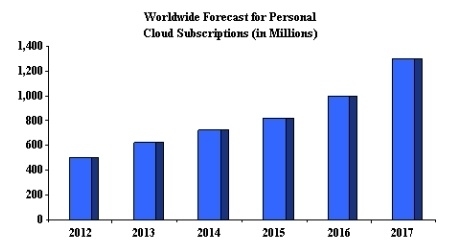

Global Internet traffic is expected to quadruple from 2011 to 2016 according to a 2012 white paper prepared by Cisco Systems, Inc. (Cisco). Global data traffic (including as a result of the use of smartphones, tables, laptops and other mobile telecommunications devices) is expected to increase 18 times from 2011 to 2016, according to the same report. Subscriptions to either free or paid cloud services are expected to continue to increase from 500 million consumers worldwide in 2012, to an estimated 625 million in 2013, and then double over the course of four years to reach 1.3 billion by 2017, according to the IHS iSuppli Mobile & Wireless Communications service report.

Source: IHS iSuppli Research, October 2012

Corporate enterprises are increasingly adopting cloud-based services to integrate applications, decrease capital and operational expense and create business agility by taking advantage of accelerated time to market dynamics. Demand for cloud-based services creates demand for both providing solutions to end-user corporate enterprises as well as augmenting the offerings of telecommunications service providers.

The rapid increase in data traffic, usage of wireless networks and evolution of services and technology are also driving telecommunications providers to undertake a number of initiatives to increase coverage, capacity and performance of their existing networks, including adding and upgrading cell sites nationwide.

To remain competitive and meet the rapidly-growing demand for state-of-the-art mobile data services, telecommunications and cable companies rely on outsourcing to provide a wide range of network and infrastructure services, as well as project staffing services, to help build out and maintain their networks. OEMs supplying equipment to those telecommunications and cable service providers also frequently rely on outsourced solutions for project management and network deployment. Demand for these services is expected to grow rapidly. According to the Telecommunications Industry Association 2012 ICT Market Review, the wireless telecommunications and network infrastructure outsourcing market has grown 9.5% per year since 2004 and is expected to continue to grow at a 5.9% rate through 2014, becoming a $21.6 billion market in 2014.

Technological convergence of voice, video and data, as well as competitive pressures, are driving consolidation in the telecommunications industry and cable broadband marketplace. Because of the immense integration challenges, merging entities rely in part on specialty solutions providers to efficiently integrate different technologies and networks into a single network.

In building out and managing telecommunications networks, service providers and enterprise customers face many challenges, including difficulty locating, recruiting, hiring and retaining skilled labor, significant capital investment requirements and competitive pressures on operating margins. In response to these ongoing challenges, telecommunications providers and enterprise customers continue to seek and outsource solutions in order to reduce their investment in capital equipment, provide flexibility in workforce sizing and expand product offerings without large increases in incremental hiring. Outsourcing professional services also allows telecommunications providers and enterprise customers to focus on those competencies they consider core to their business success.

Our Solution

We seek to become the single-source provider of choice of end-to-end outsourced cloud and managed services, network infrastructure and project staffing solutions, to corporate enterprises and telecommunications and broadband service providers. We believe that our strengths described below will enable us to continue to compete effectively and to take advantage of anticipated growth in our target markets.

Our Competitive Strengths

Single-Source Provider of End-to-End Network Infrastructure, Cloud and Managed Services and Project Staffing Needs, Applications and Infrastructure to Enterprise and Service Providers. We believe our ability to address a wide range of end-to-end network solutions, infrastructure and project staffing needs for our clients is a key competitive advantage. Our ability to offer diverse technical capabilities (including design, engineering, construction, deployment, installation and integration services) allows customers to turn to a single source for these specific specialty services, as well as to entrust us with the execution of entire turn-key solutions.

Established Customer Relationships With Leading Infrastructure Providers. We have established relationships with many leading wireless and wireline telecommunications providers, cable broadband MSOs, OEMs and others. We have over 30 master service agreements with service providers and OEMs. Our current customers include Ericsson Inc., Verizon Communications Inc., Alcatel-Lucent USA Inc., Century Link, Inc., AT&T Inc. and Hotwire Communications. Our relationships with our customers and existing master service agreements position us to continue to capture existing and emerging opportunities, both domestically and internationally. We believe the barriers are extremely high for new entrants to obtain master service agreements with service providers and OEMs unless there are established relationships and a proven ability to execute.

Proven Ability to Recruit, Manage and Retain High Quality Telecommunications Personnel. Our ability to recruit, manage and retain skilled labor is a critical advantage in an industry in which a shortage of skilled labor is often a key limitation for our customers and competitors alike. We own and operate an actively-maintained database of more than 70,000 telecom personnel. We also employ highly-skilled recruiters and utilize an electronic hiring process that we believe expedites deployment of personnel and reduces costs. Our staffing capabilities allow us to efficiently locate and engage skilled personnel for projects, helping ensure that we do not miss out on opportunities due to a lack of skilled labor. We believe this access to a skilled labor pool gives us a competitive edge over our competitors as we continue to expand.

Strong Senior Management Team with Proven Ability to Execute. Our highly-experienced management team has deep industry knowledge and a strong track record of successful execution in major corporations, as well as startup ventures. Our senior management team brings an average of over 25 years of individual experience across a broad range of disciplines. We believe our senior management team is a key driver of our success and is well-positioned to execute our strategy.

Scalable and Capital Efficient Business Model. We typically hire workers to staff projects on a project-by-project basis and we believe this business model enables us to staff our business efficiently to meet changes in demand. Our operating expenses, other than staffing, are primarily fixed; we are generally able to deploy personnel to infrastructure projects in the United States and beyond with incremental increases in operating costs.

Our Growth Strategy

Under the leadership of our senior management team we intend to build out sales, marketing and operations groups to support our rapid growth while focusing on increasing operating margins. While organic growth will be a main focus in driving our business forward, acquisitions will play a strategic role in augmenting existing product and service lines and cross selling opportunities. We are pursuing several strategies, including:

| | · | Grow Revenues and Market Share through Selective Acquisitions. We plan to continue to acquire private companies that enhance our earnings and offer complementary services or expand our geographic reach. We believe such acquisitions will help us to accelerate our revenue growth, leverage our existing strengths, and capture and retain more work in-house as a prime contractor for our clients, thereby contributing to our profitability. We also believe that increased scale will enable us to bid and take on larger contracts. We believe there are many potential acquisition candidates in the high-growth cloud computing space, the fragmented professional services markets, and in the applications and infrastructure arena. |

| | · | Deepen Our Relationships With Our Existing Customer Base. Our customers include many leading wireless and wireline telecommunications providers, cable broadband MSOs, OEMs and enterprise customers. As we have expanded the breadth of our service offerings through both organic growth and selective acquisitions, we believe we have opportunities to expand revenues with our existing clients by marketing additional service offerings to them, as well as by extending services to existing customers in new geographies. |

| | · | Expand Our Relationships with New Service Providers. We plan to expand new relationships with smaller cable broadband providers, competitive local exchange carriers (CLECs), integrated communication providers (IC’s), competitive access providers (CAPs), network access point providers (NAPs) and integrated communications providers (ICPs). We believe that the business model for the expansion of these relationships, leveraging our core strength and array of service solutions, will support our business model for organic growth. |

| | · | Increase Operating Margins by Leveraging Operating Efficiencies. We believe that by centralizing administrative functions, consolidating insurance coverages and eliminating redundancies across our newly-acquired businesses, we will be positioned to offer more integrated end-to-end solutions and improve operating margins. |

Our Services

We provide cloud- and managed-service-based platforms, professional services, applications and infrastructure to both the telecommunications industry and corporate enterprises. Our cloud-based and managed services and our engineering, design, construction, installation, maintenance and project staffing services support the build-out, maintenance, upgrade and operation of some of the most advanced fiber optic, Ethernet, copper, wireless and satellite networks. Our breadth of services enables our customers to selectively augment existing services or to outsource entire projects or operational functions. We divide our service offerings into the following categories of services:

| | ● | Cloud and Managed Services. We provide integrated cloud-based solutions that allow organizations around the globe to integrate their applications on various services into a web-hosted environment. We combine engineering expertise with service and support to maintain and support telecommunications networks. We provide hardware solutions and applications, as well as professional services, that work as a seamless extension of a telecommunications service provider or enterprise end user. |

| | ● | Applications and Infrastructure. We provide an array of applications and services, including unified communications, voice recognition and call centers, as well as structured cabling, field installations and other infrastructure solutions. Our design, engineering, installation and maintenance of various types of local and wide-area networks, DAS systems, and other broadband installation and maintenance services augment ILECs, telecommunications OEMs, cable broadband MSOs and large end-users. Our services and applications support the deployment of new networks and technologies, as well as expand and maintain existing networks. We also sell hardware and applications for the leading OEMs that support voice, data and optical networks. |

| | ● | Applications. We apply our expertise in networking, converged communications, security, data center solutions and other technologies utilizing our skills in consulting, integration and managed services to create customized solutions for our enterprise customers. We provide applications for managed data, converged services (single and multiple site); voice recognition, session initiation protocol (SIP trunking-Voice Over IP, streaming media, UC) collocation services and others. |

| | ● | Wireless and Wireline Installation, Commission and Integration. We provide a full-range of solutions to OEMs, wireless carriers and enterprise customers throughout the United States, including structured cabling, wiring and field installation of various types of local and wide-area networks and DAS systems, and outside plant work. Our technicians construct, install, maintain and integrate wireless communications and data networks for some of the largest cellular broadband and digital providers in the United States. Our projects include services to Verizon Communications and Ericsson in connection with their 4G/LTE network deployments throughout the United States. |

| | ● | Turn-Key Communications Services. Our telecom and broadband services group addresses the growing demand for broadband-based unified communications and structured cabling. Our services include switch conditioning, switch re-grooming, cable splicing and grounding audits. Our premise wiring services include design, engineering, installation, integration, maintenance and repair of telecommunications networks for voice, video and data inside various corporate enterprises, as well as state and local government properties. Additionally, we provide maintenance and installation of electric utility grids and water and sewer utilities. We provide outside plant telecommunications services primarily under hourly and per-unit-basis contracts to local telephone companies. We also provide these services to U.S. corporations, long distance telephone companies, electric utility companies, local municipalities and cable broadband MSOs. |

| | ● | Disaster Recovery. Our disaster recovery services provide emergency network restoration services and environmental remediation services to leading telecommunications carriers throughout the United States, including projects for Hurricane Sandy relief, Hurricane Katrina relief, Alabama Tornado relief and Southern California flood assistance. Customers include AT&T, Verizon Wireless and Century Link/Quest. |

| | ● | Professional Services. As a result of our acquisition of ADEX, we have a proprietary international recruiting database of more than 70,000 telecom professionals, the majority of which are well-qualified engineering professionals and experienced project managers. We believe our skilled recruiters, combined with an entirely electronic staffing process, reduce our overall expenses for any project because of our efficient recruiting and deployment techniques. On a weekly basis, we deploy hundreds of telecommunications professionals in support of network infrastructure deployments worldwide. |

Customers

Our customers include many leading corporate enterprises, wireless and wireline telecommunications providers, cable broadband MSOs and OEMs and small independent phone companies. Our enterprise solutions are provided to small businesses and Fortune 500 companies. Our current service provider and OEM customers include leading telecommunications companies, such as Ericsson, Inc., Verizon Communications, Sprint Nextel Corporation and AT&T.

Our top two customers, Verizon Communications and Danella Construction, accounted for approximately 73% of our total revenues in the year ended December 31, 2011. Our top four customers, Nexlink, Ericsson, Inc., Verizon Communications and Ericsson Caribbean, accounted for approximately 59% of our total revenues in the year ended December 31, 2012. Ericsson, as an OEM provider for seven different carrier projects, represented approximately 33% of our total revenues in the year ended December 31, 2012.

A substantial portion of our revenue is derived from work performed under multi-year master service agreements and multi-year service contracts. We have entered into master service agreements (MSAs) with numerous service providers and OEMs, and generally have multiple agreements with each of our customers. MSAs are awarded primarily through a competitive bidding process based on the depth of our service offerings, experience and capacity. MSAs generally contain customer-specified service requirements, such as discrete pricing for individual tasks, but do not require our customers to purchase a minimum amount of services. To the extent that such contracts specify exclusivity, there are often a number of exceptions, including the ability of the customer to issue work orders valued above a specified dollar amount to other service providers, perform work with the customer’s own employees and use other service providers. Most of our MSAs may be cancelled by our customers upon minimum notice (typically 60 days), regardless of whether we are then in default. In addition, many of these contracts permit cancellation of particular purchase orders or statements of work without any prior notice. Our cloud-managed service offerings have multi-year agreements and provide the customers with service level commitments. This is one of the fastest growing portions of our business.

Suppliers and Vendors

We have agreements with major telecommunications vendors such as Ericsson. For a majority of the contract services we perform, our customers supply the necessary materials. We expect to continue to further develop these relationships and to broaden our scope of work with each of our partners. In many cases, our relationships with our partners have extended for over a decade, which we attribute to our commitment to excellence. It is our objective to selectively expand our partnerships moving forward in order to expand our service offerings.

Competition

The business of providing infrastructure and managed services to telecommunications companies and enterprise clients is highly fragmented and the business is characterized by a large number of participants, including several large companies, as well as a significant number of small, privately-held, local competitors.

Our current and potential larger competitors include Arrow Electronics, Inc., Black Box Corporation Dimension Data, Dycom Industries, Inc., Goodman Networks, Inc., MasTec, Inc., TeleTech Holdings, Inc., Unisys Corporation, Unitek Global Services, Inc., Tech Mahindra and Volt Information Sciences, Inc. A significant portion of our services revenue is currently derived from MSAs and price is often an important factor in awarding such agreements. Accordingly, our competitors may underbid us if they elect to price their services aggressively to procure such business. Our competitors may also develop the expertise, experience and resources to provide services that are equal or superior in both price and quality to our services, and we may not be able to maintain or enhance our competitive position. The principal competitive factors for our services include geographic presence, breadth of service offerings, worker and general public safety, price, quality of service and industry reputation. We believe we compete favorably with our competitors on the basis of these factors.

Safety and Risk Management

We require our employees to participate in internal training and service programs from time to time relevant to their employment and to complete any training programs required by law. We review accidents and claims from our operations, examine trends and implement changes in procedures to address safety issues. Claims arising in our business generally include workers’ compensation claims, various general liability and damage claims, and claims related to vehicle accidents, including personal injury and property damage. We insure against the risk of loss arising from our operations up to certain deductible limits in substantially all of the states in which we operate. In addition, we retain risk of loss, up to certain limits, under our employee group health plan. We evaluate our insurance requirements on an ongoing basis to help ensure we maintain adequate levels of coverage.

We carefully monitor claims and actively participate with our insurers in determining claims estimates and adjustments. The estimated costs of claims are accrued as liabilities, and include estimates for claims incurred but not reported. Due to fluctuations in our loss experience from year to year, insurance accruals have varied and can affect the consistency of our operating margins. If we experience insurance claims in excess of our umbrella coverage limit, our business could be materially and adversely affected.

Employees

As of March 28, 2013, we had 449 full-time employees and six part-time employees, of whom 52 were in administration and corporate management, ten were accounting personnel and 390 were technical and project managerial personnel.

In general, the number of our employees varies according to the level of our work in progress. We maintain a core of technical and managerial personnel to supervise all projects and add employees as needed to complete specific projects. Because we also provide project staffing, we are well-positioned to respond to changes in our staffing needs.

Environmental Matters

A portion of the work we perform is associated with the underground networks of our customers. As a result, we are potentially subject to material liabilities related to encountering underground objects that may cause the release of hazardous materials or substances. We are subject to federal, state and local environmental laws and regulations, including those regarding the removal and remediation of hazardous substances and waste. These laws and regulations can impose significant fines and criminal sanctions for violations. Costs associated with the discharge of hazardous substances may include clean-up costs and related damages or liabilities. These costs could be significant and could adversely affect our results of operations and cash flows.

Regulation

Our operations are subject to various federal, state, local and international laws and regulations, including licensing, permitting and inspection requirements applicable to electricians and engineers; building codes; permitting and inspection requirements applicable to construction projects; regulations relating to worker safety and environmental protection; telecommunication regulations affecting our fiber optic licensing business; labor and employment laws; and laws governing advertising.

We believe that we have all the licenses required to conduct our operations. Our failure to comply with applicable regulations could result in substantial fines or revocation of our operating licenses.

ITEM 1A. RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this report before purchasing our securities. If any of the following risks occur, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that case, the market price of our common stock could decline, and you could lose some or all of your investment.

Risks Related to Our Business

A failure to successfully execute our strategy of acquiring other businesses to grow our company could adversely affect our business, financial condition, results of operations and prospects.

We intend to continue pursuing growth through the acquisition of companies or assets to expand our project skill-sets and capabilities, enlarge our geographic markets, add experienced management and increase critical mass to enable us to bid on larger contracts. However, we may be unable to find suitable acquisition candidates or to complete acquisitions on favorable terms, if at all. Moreover, any completed acquisition may not result in the intended benefits and involves a number of risks, including:

| | ● | We may have difficulty integrating the acquired companies; |

| | ● | Our ongoing business and management’s attention may be disrupted or diverted by transition or integration issues and the complexity of managing geographically or culturally diverse enterprises; |

| | ● | We may not realize the anticipated cost savings or other financial benefits we anticipated; |

| | ● | We may have difficulty applying our expertise in one market to another market; |

| | ● | We may have difficulty retaining or hiring key personnel, customers and suppliers to maintain expanded operations; |

| | ● | Our internal resources may not be adequate to support our operations as we expand, particularly if we are awarded a significant number of contracts in a short time period; |

| | ● | We may have difficulty retaining and obtaining required regulatory approvals, licenses and permits; |

| | ● | We may not be able to obtain additional equity or debt financing on terms acceptable to us or at all, and any such financing could result in dilution to our stockholders, impact our ability to service our debt within the scheduled repayment terms and include covenants or other restrictions that would impede our ability to manage our operations; |

| | ● | We may have failed to, or were unable to, discover liabilities of the acquired companies during the course of performing our due diligence; and |

| | ● | We may be required to record additional goodwill as a result of an acquisition, which will reduce our tangible net worth. |

Any of these risks could prevent us from executing our acquisition growth strategy, which could adversely affect our business, financial condition, results of operations and prospects.

We may be unable to successfully integrate our recent and future acquisitions, which could adversely affect our business, financial condition, results of operations and prospects.

We recently acquired a number of companies, including ADEX and T N S in September 2012 and ERFS in December 2012, and have entered into definitive agreements for the acquisition of two additional companies. The operation and management of recent acquisitions, or any of our future acquisitions, may adversely affect our existing income and operations or we may not be able to effectively manage any growth resulting from these transactions. Before we acquired them, these companies operated independently of one another. Until we establish centralized financial, management information and other administrative systems, we will rely on the separate systems of these companies, including their financial reporting systems.

Our success will depend, in part, on the extent to which we are able to merge these functions, eliminate the unnecessary duplication of other functions and otherwise integrate these companies (and any additional businesses with which we may combine in the future) into a cohesive, efficient enterprise. This integration process may entail significant costs and delays could occur. Our failure to integrate the operations of these companies successfully could adversely affect our business, financial condition, results of operations and prospects. To the extent that any acquisition results in additional goodwill, it will reduce our tangible net worth, which might adversely affect our business, financial condition, results of operations and prospects, as well as our credit and bonding capacity.

We derive a significant portion of our revenue from master service agreements that may be cancelled by customers on short notice, or which we may be unable to renew on favorable terms or at all.

During the years ended December 31, 2012 and 2011, we derived approximately 60% and 59%, respectively, of our revenues from master service agreements and long-term contracts, none of which require our customers to purchase a minimum amount of services. The majority of these contracts may be cancelled by our customers upon minimum notice (typically 60 days), regardless of whether or not we are in default. In addition, many of these contracts permit cancellation of particular purchase orders or statements of work without any notice.

These agreements typically do not require our customers to assign a specific amount of work to us until a purchase order or statement of work is signed. Consequently, projected expenditures by customers are not assured until a definitive purchase order or statement of work is placed with us and the work is completed. Furthermore, our customers generally require competitive bidding of these contracts. As a result, we could be underbid by our competitors or required to lower the price charged under a contract being rebid. The loss of work obtained through master service agreements and long-term contracts or the reduced profitability of such work could adversely affect our business or results of operations.

If we do not accurately estimate the overall costs when we bid on a contract that is awarded to us, we may achieve a lower than anticipated profit or incur a loss on the contract.

A significant portion of our revenues from our engineering and professional services offerings are derived from fixed unit price contracts that require us to perform the contract for a fixed unit price irrespective of our actual costs. We bid for these contracts based on our estimates of overall costs, but cost overruns may cause us to incur losses. The costs incurred and any net profit realized on such contracts can vary, sometimes substantially, from the original projections due to a variety of factors, including, but not limited to:

| | ● | onsite conditions that differ from those assumed in the original bid; |

| | ● | delays in project starts or completion, including as a result of weather conditions; |

| | ● | fluctuations in the cost of materials to perform under a contract; |

| | ● | contract modifications creating unanticipated costs not covered by change orders; |

| | ● | changes in availability, proximity and costs of construction materials, as well as fuel and lubricants for our equipment; |

| | ● | availability and skill level of workers in the geographic location of a project; |

| | ● | our suppliers’ or subcontractors’ failure to perform due to various reasons, including bankruptcy; |

| | ● | fraud or theft committed by our employees; |

| | ● | mechanical problems with our machinery or equipment; |

| | ● | citations or fines issued by any governmental authority; |

| | ● | difficulties in obtaining required governmental permits or approvals or performance bonds; |

| | ● | changes in applicable laws and regulations; and |

| | ● | claims or demands from third parties alleging damages arising from our work or from the project of which our work is a part. |

These factors may cause actual reduced profitability or losses on projects, which could adversely affect our business, financial condition, results of operations and prospects.

Our contracts may require us to perform extra or change order work, which can result in disputes and adversely affect our business, financial condition, results of operations and prospects.

Our contracts generally require us to perform extra or change order work as directed by the customer, even if the customer has not agreed in advance on the scope or price of the extra work to be performed. This process may result in disputes over whether the work performed is beyond the scope of the work included in the original project plans and specifications or, if the customer agrees that the work performed qualifies as extra work, the price that the customer is willing to pay for the extra work. Even when the customer agrees to pay for the extra work, we may be required to fund the cost of such work for a lengthy period of time until the change order is approved by the customer and we are paid by the customer.

We generally recognize revenues when services are invoiced. To the extent that actual recoveries with respect to change orders or amounts subject to contract disputes or claims are less than the estimates used in our financial statements, the amount of any shortfall will reduce our future revenues and profits, and this could adversely affect our reported working capital and results of operations. In addition, any delay caused by the extra work may adversely impact the timely scheduling of other project work and our ability to meet specified contract milestone dates.

We derive a significant portion of our revenue from a few customers and the loss of one of these customers, or a reduction in their demand for our services, could adversely affect our business, financial condition, results of operations and prospects.

Our customer base is highly concentrated. Due to the size and nature of our construction contracts, one or a few customers have represented a substantial portion of our consolidated revenues and gross profits in any one year or over a period of several consecutive years. Verizon Communications accounted for approximately 7% of our total revenues in the year ended December 31, 2012 and 56% of our total revenue in the year ended December 31, 2011. Our top four customers, Nexlink, Ericsson, Inc., Verizon Communications and Ericsson Caribbean, accounted for approximately 59% of our total revenues in the year ended December 31, 2012. Our top two customers, Verizon Communications and Danella Construction, accounted for approximately 73% of our total revenues in the year ended December 31, 2011. Revenues under our contracts with significant customers may continue to vary from period to period depending on the timing or volume of work that those customers order or perform with their in-house service organizations. A limited number of customers may continue to comprise a substantial portion of our revenue for the foreseeable future. Because we do not maintain any reserves for payment defaults, a default or delay in payment on a significant scale could adversely affect our business, financial condition, results of operations and prospects. We could lose business from a significant customer for a variety of reasons, including:

| | ● | the consolidation, merger or acquisition of an existing customer, resulting in a change in procurement strategies employed by the surviving entity that could reduce the amount of work we receive; |

| | ● | our performance on individual contracts or relationships with one or more significant customers are impaired due to another reason, which may cause us to lose future business with such customers and, as a result, our ability to generate income would be adversely impacted; |

| | ● | the strength of our professional reputation; and |

| | ● | key customers could slow or stop spending on initiatives related to projects we are performing for them due to increased difficulty in the credit markets as a result of the recent economic crisis or other reasons. |

Since many of our customer contracts allow our customers to terminate the contract without cause, our customers may terminate their contracts with us at will, which could impair our business, financial condition, results of operations and prospects.

Our business is labor intensive and if we are unable to attract and retain key personnel and skilled labor, or if we encounter labor difficulties, our ability to bid for and successfully complete contracts may be negatively impacted.

Our ability to attract and retain reliable, qualified personnel is a significant factor that enables us to successfully bid for and profitably complete our work. Our future success depends on our ability to attract, hire and retain project managers, estimators, supervisors, foremen, equipment operators, engineers, linemen, laborers and other highly-skilled personnel. Our ability to do so depends on a number of factors, such as general rates of employment, competitive demands for employees possessing the skills we need and the level of compensation required to hire and retain qualified employees. We may also spend considerable resources training employees who may then be hired by our competitors, forcing us to spend additional funds to attract personnel to fill those positions. Competition for employees is intense, and we could experience difficulty hiring and retaining the personnel necessary to support our business. Our labor expenses may also increase as a result of a shortage in the supply of skilled personnel. If we do not succeed in retaining our current employees and attracting, developing and retaining new highly-skilled employees, our reputation may be harmed and our future earnings may be negatively impacted.

If we are unable to attract and retain qualified executive officers and managers, we will be unable to operate efficiently, which could adversely affect our business, financial condition, results of operations and prospects.

We depend on the continued efforts and abilities of our executive officers, as well as the senior management of our subsidiaries, to establish and maintain our customer relationships and identify strategic opportunities. The loss of any one of them could negatively affect our ability to execute our business strategy and adversely affect our business, financial condition, results of operations and prospects. Competition for managerial talent with significant industry experience is high and we may lose access to executive officers for a variety of reasons, including more attractive compensation packages offered by our competitors. Although we have entered into employment agreements with certain of our executive officers and certain other key employees, we cannot guarantee that any of them or other key management personnel will remain employed by us for any length of time.

Because we maintain a workforce based upon current and anticipated workloads, we may incur significant costs in adjusting our workforce demands, including addressing understaffing of contracts, if we do not receive future contract awards or if these awards are delayed.

Our estimates of future performance depend, in part, upon whether and when we will receive certain new contract awards. Our estimates may be unreliable and can change from time to time. In the case of larger projects, where timing is often uncertain, it is particularly difficult to project whether and when we will receive a contract award. The uncertainty of contract award timing can present difficulties in matching workforce size with contractual needs. If an expected contract award is delayed or not received, we could incur significant costs resulting from retaining more staff than is necessary. Similarly, if we underestimate the workforce necessary for a contract, we may not perform at the level expected by the customer and harm our reputation with the customer. Each of these may negatively impact our business, financial condition, results of operations and prospects.

Timing of the award and performance of new contracts could adversely affect our business, financial condition, results of operations and prospects.

It is generally very difficult to predict whether and when new contracts will be offered for tender because these contracts frequently involve a lengthy and complex design and bidding process, which is affected by a number of factors, such as market conditions, financing arrangements and governmental approvals. Because of these factors, our results of operations and cash flows may fluctuate from quarter to quarter and year to year, and the fluctuation may be substantial. Such delays, if they occur, could adversely affect our operating results for current and future periods until the affected contracts are completed.

Our operating results may fluctuate due to factors that are difficult to forecast and not within our control.

Our past operating results may not be accurate indicators of future performance, and you should not rely on such results to predict our future performance. Our operating results have fluctuated significantly in the past, and could fluctuate in the future. Factors that may contribute to fluctuations include:

| | ● | changes in aggregate capital spending, cyclicality and other economic conditions, or domestic and international demand in the industries we serve; |

| | ● | our ability to effectively manage our working capital; |

| | ● | our ability to satisfy consumer demands in a timely and cost-effective manner; |

| | ● | pricing and availability of labor and materials; |

| | ● | our inability to adjust certain fixed costs and expenses for changes in demand; |

| | ● | shifts in geographic concentration of customers, supplies and labor pools; and |

| | ● | seasonal fluctuations in demand and our revenue. |

Unanticipated delays due to adverse weather conditions, global climate change and difficult work sites and environments may slow completion of our contracts, impair our customer relationships and adversely affect our business, financial condition, results of operations and prospects.

Because some of our work is performed outdoors, our business is impacted by extended periods of inclement weather and is subject to unpredictable weather conditions, which could become more frequent or severe if general climatic changes occur. Generally, inclement weather is more likely to occur during the winter season, which falls during our second and third fiscal quarters. Additionally, adverse weather conditions can result in project delays or cancellations, potentially causing us to incur additional unanticipated costs, reductions in revenues or the payment of liquidated damages. In addition, some of our contracts require that we assume the risk that actual site conditions vary from those expected. Significant periods of bad weather typically reduce profitability of affected contracts, both in the current period and during the future life of affected contracts, which can negatively affect our results of operations in current and future periods until the affected contracts are completed.

Some of our projects involve challenging engineering, procurement and construction phases that may occur over extended time periods, sometimes up to several years. We may encounter difficulties in engineering, delays in designs or materials provided by the customer or a third party, equipment and material delivery delays, schedule changes, delays from customer failure to timely obtain rights-of-way, weather-related delays, delays by subcontractors in completing their portion of the project and other factors, some of which are beyond our control, but which may impact our ability to complete a project within the original delivery schedule. In some cases, delays and additional costs may be substantial, and we may be required to cancel a project and/or compensate the customer for the delay. We may not be able to recover any of these costs. Any such delays, cancellations, defects, errors or other failures to meet customer expectations could result in damage claims substantially in excess of revenue associated with a project. These factors could also negatively impact our reputation or relationships with our customers, which could adversely affect our ability to secure new contracts.

Environmental and other regulatory matters could adversely affect our ability to conduct our business and could require expenditures that could adversely affect our business, financial condition, results of operations and prospects.

Our operations are subject to laws and regulations relating to workplace safety and worker health that, among other things, regulate employee exposure to hazardous substances. While immigration laws require us to take certain steps intended to confirm the legal status of our immigrant labor force, we may nonetheless unknowingly employ illegal immigrants. Violations of laws and regulations could subject us to substantial fines and penalties, cleanup costs, third-party property damage or personal injury claims. In addition, these laws and regulations have become, and enforcement practices and compliance standards are becoming, increasingly stringent. Moreover, we cannot predict the nature, scope or effect of legislation or regulatory requirements that could be imposed, or how existing or future laws or regulations will be administered or interpreted, with respect to products or activities to which they have not been previously applied. Compliance with more stringent laws or regulations, as well as more vigorous enforcement policies of the regulatory agencies, could require us to make substantial expenditures for, among other things, pollution control systems and other equipment that we do not currently possess, or the acquisition or modification of permits applicable to our activities.

If we fail to maintain qualifications required by certain governmental entities, we could be prohibited from bidding on certain contracts.

If we do not maintain qualifications required by certain governmental entities, such as low voltage electrical licenses, we could be prohibited from bidding on certain governmental contracts. A cancellation of an unfinished contract or our exclusion from the bidding process could cause our work crews to be idled for a significant period of time until other comparable work becomes available, which could adversely affect our business and results of operations. The cancellation of significant contracts or our disqualification from bidding for new contracts could reduce our revenues and profits and adversely affect our business, financial condition, results of operations and prospects.

Fines, judgments and other consequences resulting from our failure to comply with regulations or adverse outcomes in litigation proceedings could adversely affect our business, financial condition, results of operations and prospects.

From time to time, we may be involved in lawsuits and regulatory actions, including class action lawsuits, that are brought or threatened against us in the ordinary course of business. These actions may seek, among other things, compensation for alleged personal injury, workers’ compensation, violations of the Fair Labor Standards Act and state wage and hour laws, employment discrimination, breach of contract, property damage, punitive damages, civil penalties, consequential damages or other losses, or injunctive or declaratory relief. Any defects or errors, or failures to meet our customers’ expectations could result in large damage claims against us. Claimants may seek large damage awards and, due to the inherent uncertainties of litigation, we cannot accurately predict the ultimate outcome of any such proceedings. Any failure to properly estimate or manage cost, or delay in the completion of projects, could subject us to penalties.

The ultimate resolution of these matters through settlement, mediation or court judgment could have a material impact on our financial condition, results of operations and cash flows. Regardless of the outcome of any litigation, these proceedings could result in substantial cost and may require us to devote substantial resources to defend ourselves. When appropriate, we establish reserves for litigation and claims that we believe to be adequate in light of current information, legal advice and professional indemnity insurance coverage, and we adjust such reserves from time to time according to developments. If our reserves are inadequate or insurance coverage proves to be inadequate or unavailable, our business, financial condition, results of operations and prospects may suffer.

We employ and assign personnel in the workplaces of other businesses, which subjects us to a variety of possible claims that could adversely affect our business, financial condition, results of operations and prospects.

We employ and assign personnel in the workplaces of other businesses. The risks of these activities include possible claims relating to:

| | ● | discrimination and harassment; |

| | ● | wrongful termination or denial of employment; |

| | ● | violations of employment rights related to employment screening or privacy issues; |

| | ● | classification of employees, including independent contractors; |

| | ● | employment of illegal aliens; |

| | ● | violations of wage and hour requirements; |

| | ● | retroactive entitlement to employee benefits; and |

| | ● | errors and omissions by our temporary employees. |

Claims relating to any of the above could subject us to monetary fines or reputational damage, which could adversely affect our business, financial condition, results of operations and prospects.

If we are required to reclassify independent contractors as employees, we may incur additional costs and taxes which could adversely affect our business, financial condition, results of operations and prospects.