Exhibit 99.1

September 2013

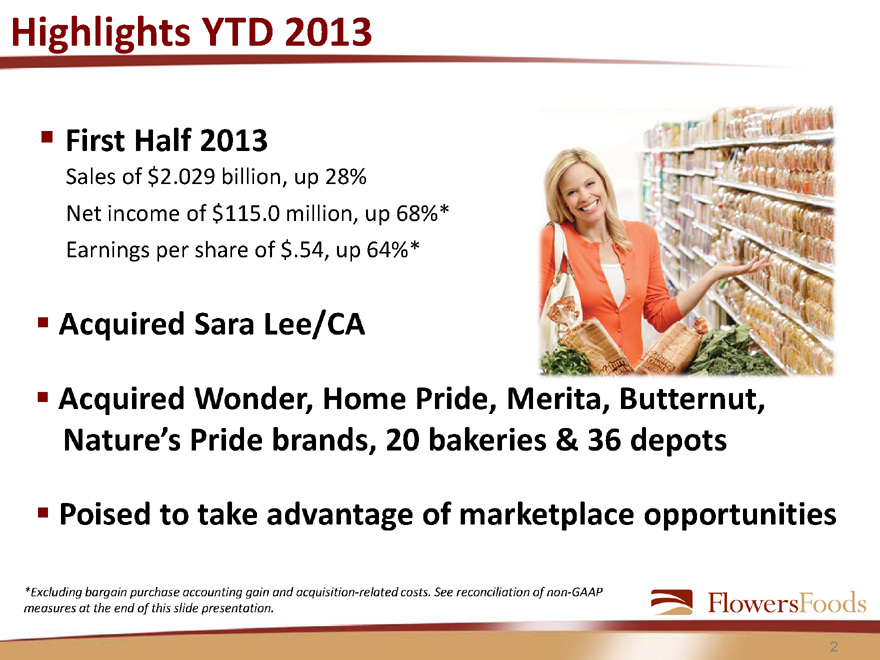

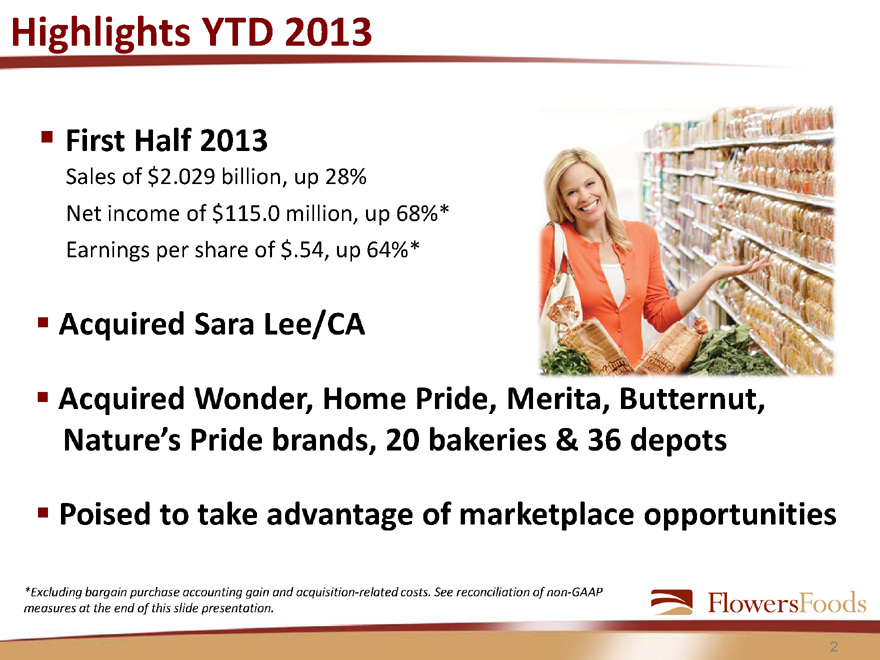

Highlights YTD 2013

First Half 2013

Sales of $2.029 billion, up 28%

Net income of $115.0 million, up 68%* Earnings per share of $.54, up 64%*

Acquired Sara Lee/CA

Acquired Wonder, Home Pride, Merita, Butternut, Nature’s Pride brands, 20 bakeries & 36 depots

Poised to take advantage of marketplace opportunities

*Excluding bargain purchase accounting gain and acquisition-related costs. See reconciliation of non-GAAP measures at the end of this slide presentation.

2

U.S. Fresh Baking Industry

2000: 8 key players

Today: 3 key players

3

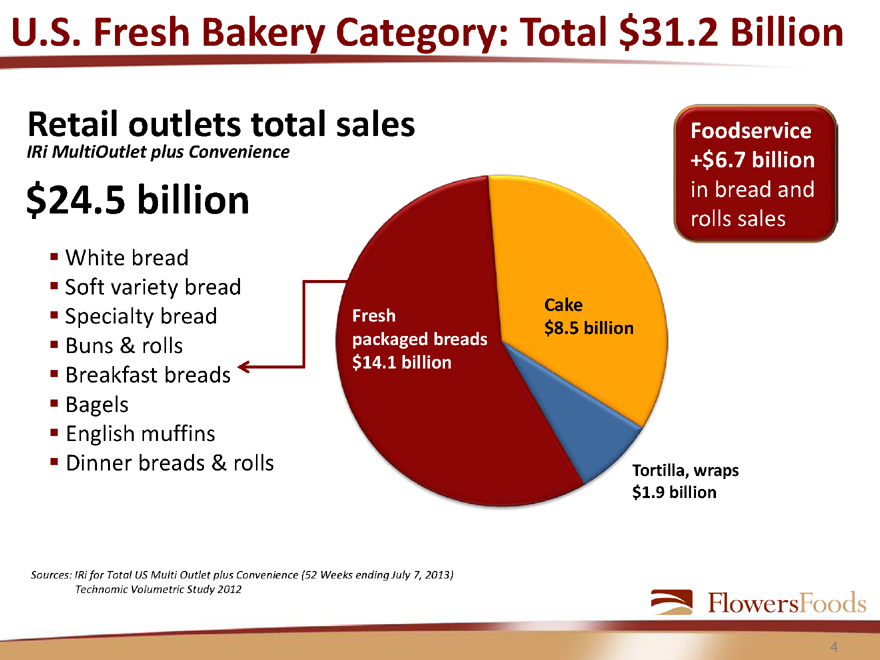

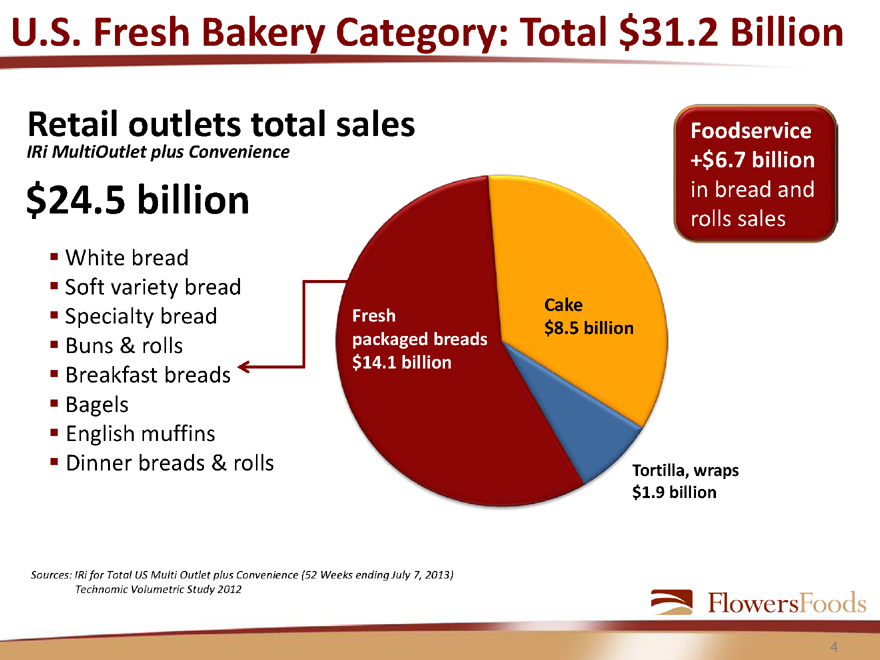

U.S. Fresh Bakery Category: Total $31.2 Billion

Retail outlets total sales

IRi MultiOutlet plus Convenience

$24.5 billion

White bread Soft variety bread Specialty bread Buns & rolls

Breakfast breads

Bagels

English muffins Dinner breads & rolls

Foodservice

+$6.7 billion in bread and rolls sales

Fresh packaged breads

$14.1 billion

Cake

$8.5 billion

Tortilla, wraps

$1.9 billion

Sources: IRi for Total US Multi Outlet plus Convenience (52 Weeks ending July 7, 2013) Technomic Volumetric Study 2012

4

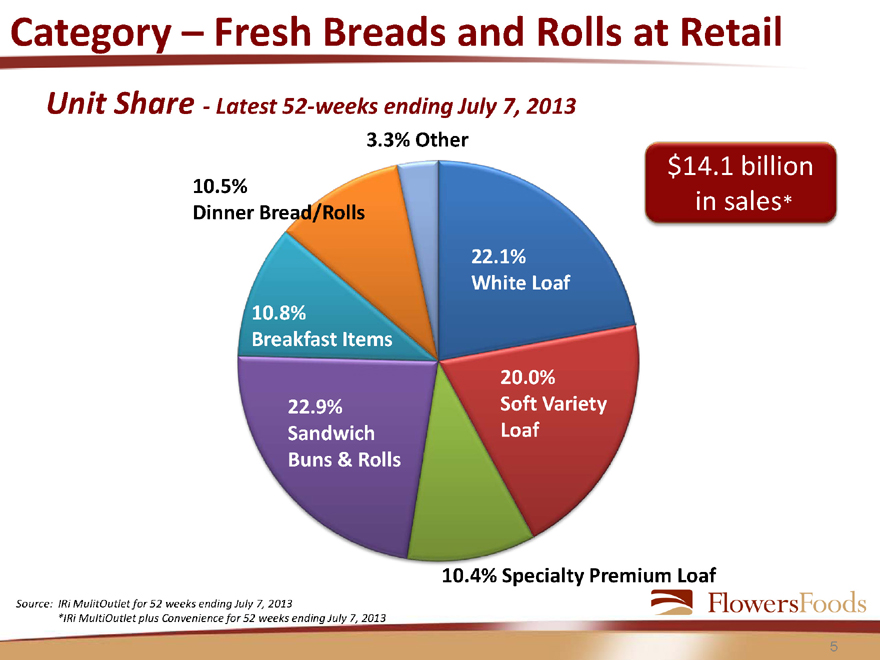

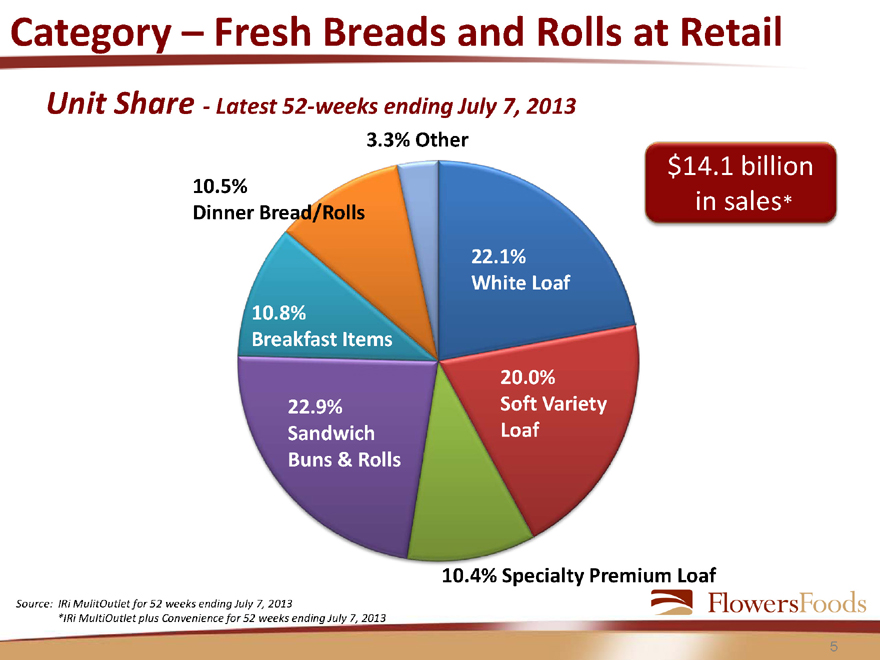

Category – Fresh Breads and Rolls at Retail

Unit Share - Latest 52-weeks ending July 7, 2013

3.3% Other

$14.1 billion in sales*

10.5%

Dinner Bread/Rolls

22.1% White Loaf

10.8%

Breakfast Items

22.9% Sandwich Buns & Rolls

20.0% Soft Variety Loaf

10.4% Specialty Premium Loaf

Source: IRi MulitOutlet for 52 weeks ending July 7, 2013

*IRi MultiOutlet plus Convenience for 52 weeks ending July 7, 2013

5

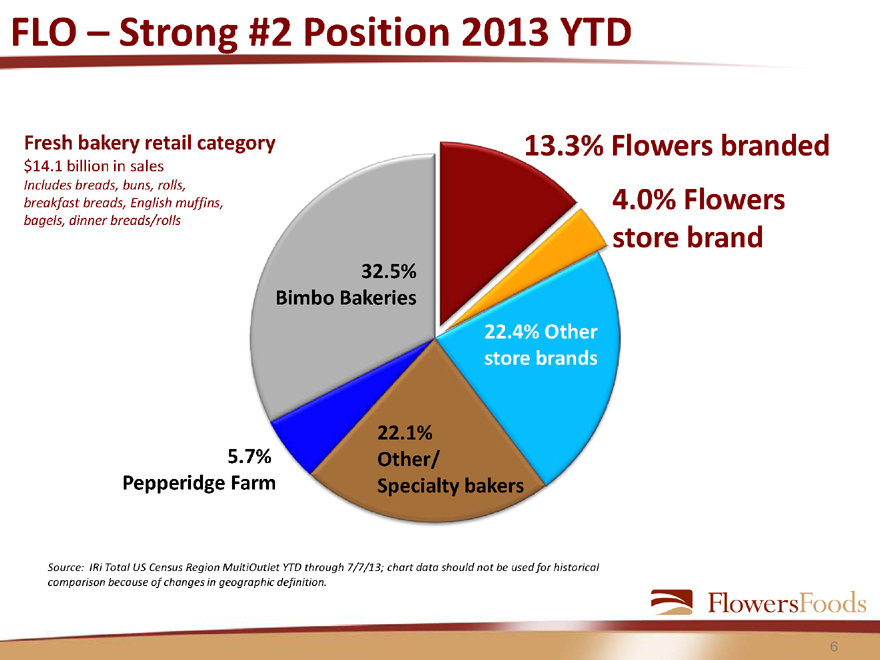

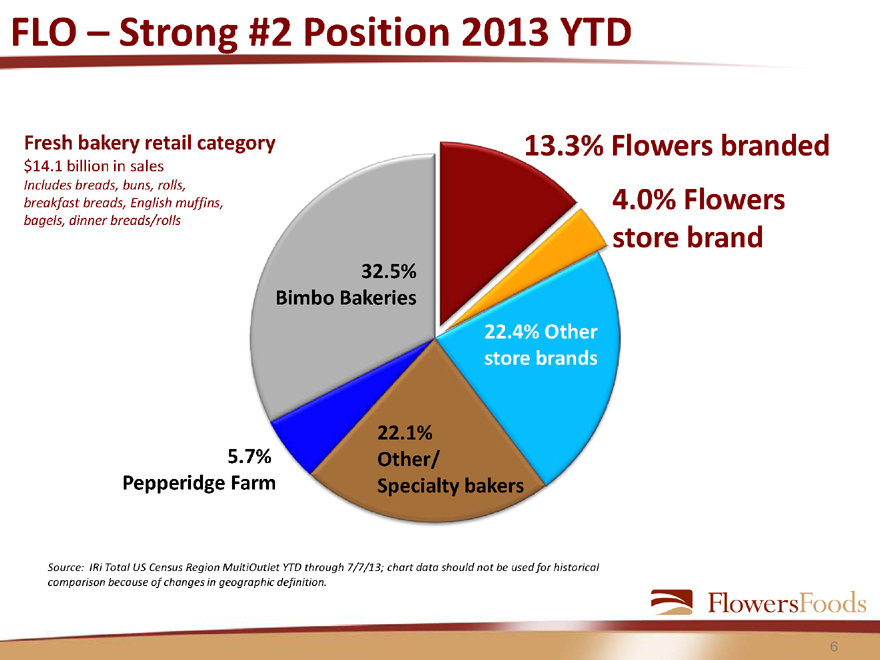

FLO – Strong #2 Position 2013 YTD

Fresh bakery retail category

$14.1 billion in sales

Includes breads, buns, rolls, breakfast breads, English muffins, bagels, dinner breads/rolls

13.3% Flowers branded

4.0% Flowers store brand

32.5%

Bimbo Bakeries

22.4% Other store brands

5.7%

Pepperidge Farm

22.1% Other/

Specialty bakers

Source: IRi Total US Census Region MultiOutlet YTD through 7/7/13; chart data should not be used for historical comparison because of changes in geographic definition.

6

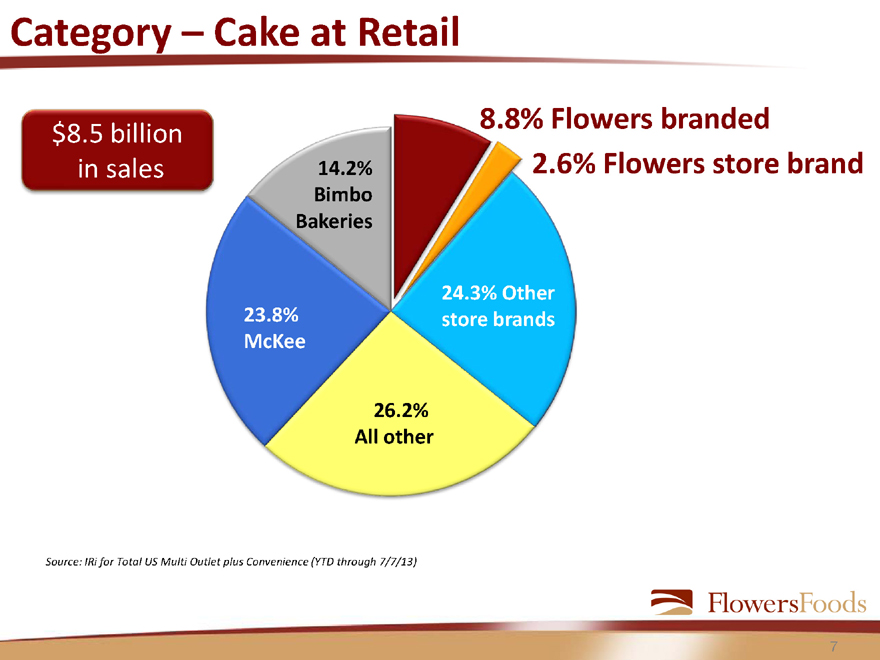

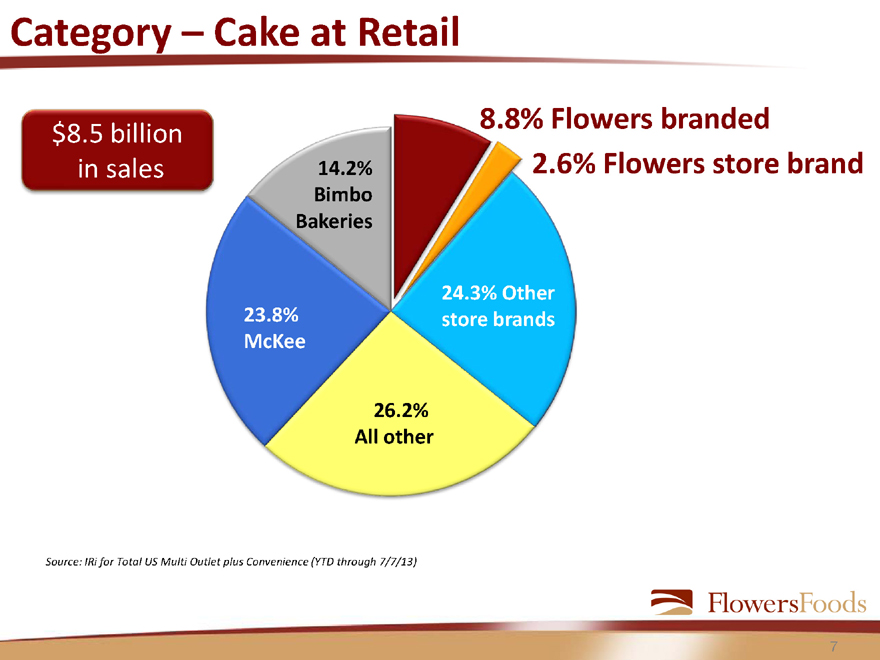

Category – Cake at Retail

$8.5 billion in sales

8.8% Flowers branded

2.6% Flowers store brand

14.2% Bimbo Bakeries

23.8% McKee

24.3% Other store brands

26.2%

All other

Source: IRi for Total US Multi Outlet plus Convenience (YTD through 7/7/13)

7

Flowers Foods

Focused on Fresh Baked Foods for 94 Years

1919

One family-owned bakery in Thomasville, GA

1968

1968 Listed publicly as FLO

1968 to 2013

More than 100 acquisitions

Flowers Foods Today

Proven business model Efficient bakeries/distribution Experienced team

#1 bread in U.S. Strong cake brand Powerful Brand portfolio

45 Operating Bakeries Second-largest baked foods company in U.S.

Note: Wonder was #1 independently owned and distributed white bread brand prior to Hostess’ exit from market

8

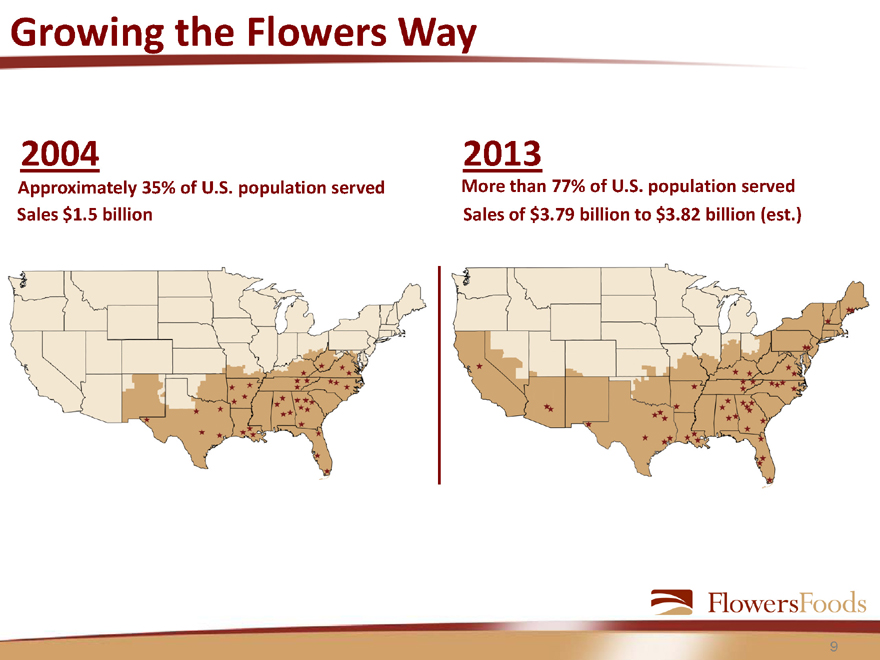

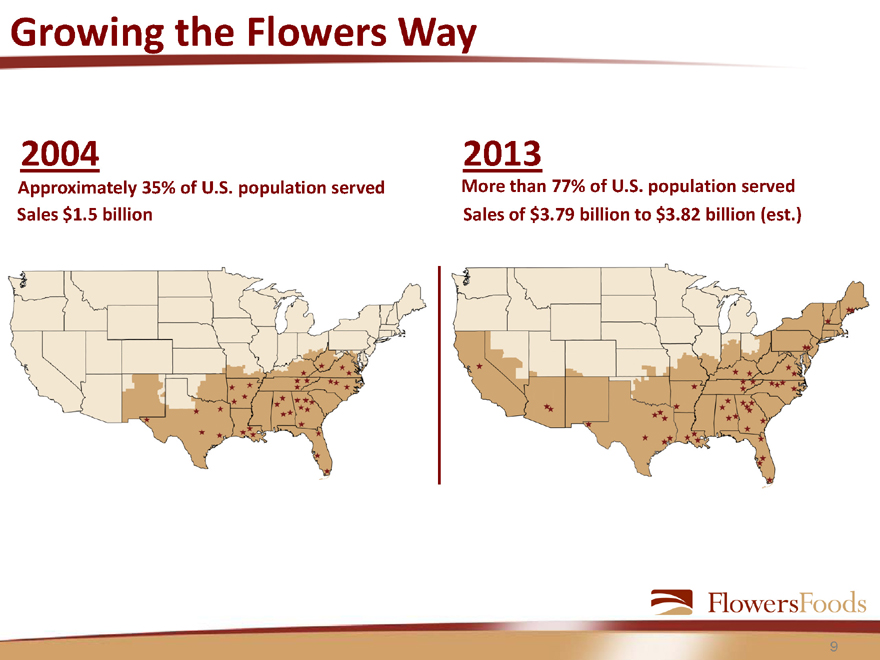

Growing the Flowers Way

2004

Approximately 35% of U.S. population served Sales $1.5 billion

2013

More than 77% of U.S. population served Sales of $3.79 billion to $3.82 billion (est.)

9

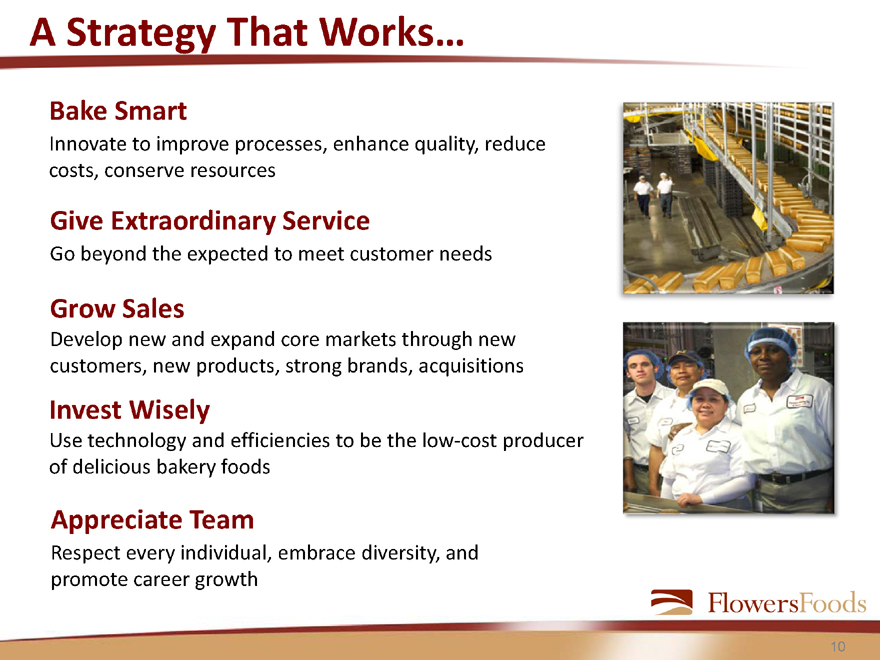

A Strategy That Works…

Bake Smart

Innovate to improve processes, enhance quality, reduce costs, conserve resources

Give Extraordinary Service

Go beyond the expected to meet customer needs

Grow Sales

Develop new and expand core markets through new customers, new products, strong brands, acquisitions

Invest Wisely

Use technology and efficiencies to be the low-cost producer of delicious bakery foods

Appreciate Team

Respect every individual, embrace diversity, and promote career growth

10

Acquisitions since 2001

2004 Sara Lee TX bakery

2005 Royal Cake Co.

2006 Derst Baking Co.

2007 Key Mix

2008 Holsum Bakery

2008 ButterKrust Bakery

2009 Specialty Blending

2009 Leo’s Foods

2011 Tasty Baking

2012 Lepage Bakeries

2013 Sara Lee/CA

2013 Hostess Bread Bakeries/Brands

Approximately $1.7 billion in revenue

11

Successful integration

Lepage Bakeries

July 2012 Acquisition of Lepage Bakeries

Fall 2012 Introduced Tastykake & Nature’s Own

Today Tastykakes in more than 2,700 stores

Nature’s Own in almost 1,900 stores

Sara Lee/California

February 2013 Acquisition of distribution rights in CA

June 2013 Rollout completed

July 2013 Nature’s Own introduced in Northern CA

12

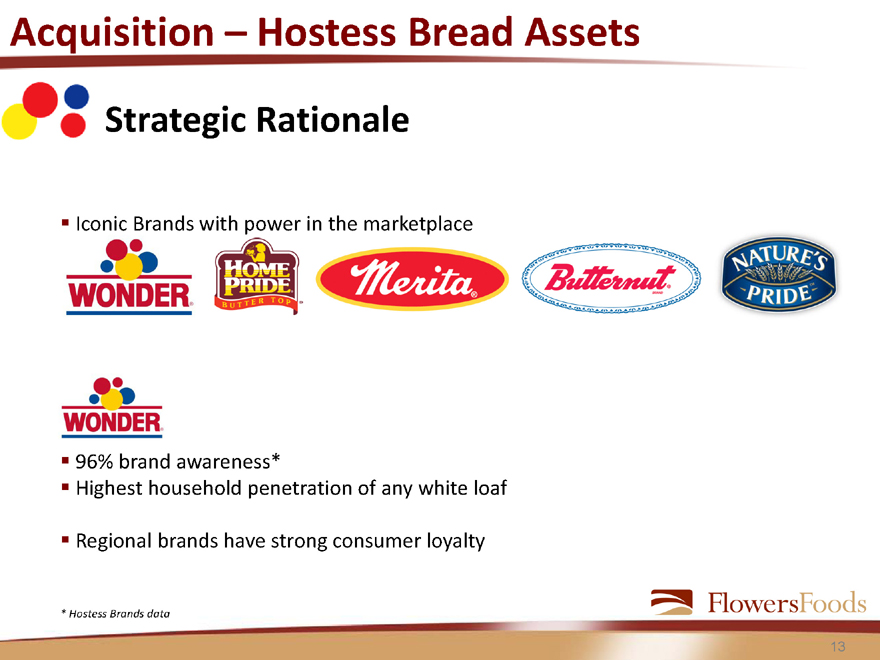

Acquisition – Hostess Bread Assets

Strategic Rationale

Iconic Brands with power in the marketplace

96% brand awareness*

Highest household penetration of any white loaf

Regional brands have strong consumer loyalty

* Hostess Brands data

13

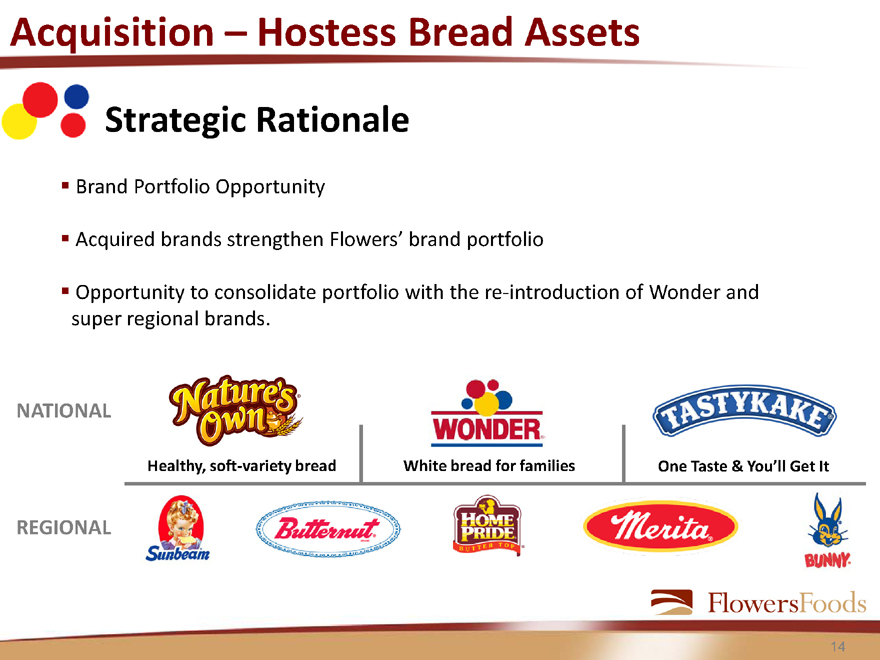

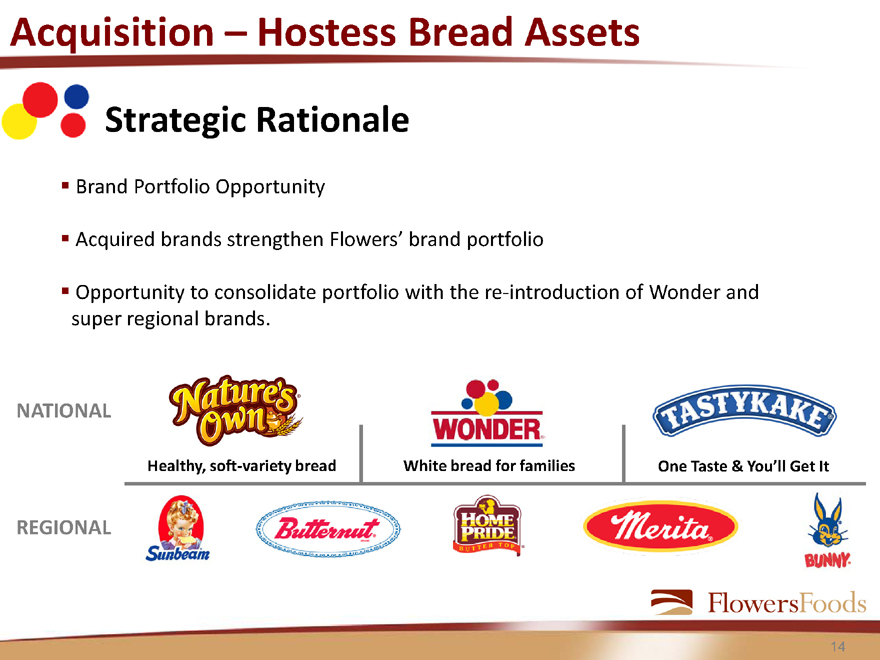

Acquisition – Hostess Bread Assets

Strategic Rationale

Brand Portfolio Opportunity

Acquired brands strengthen Flowers’ brand portfolio

Opportunity to consolidate portfolio with the re-introduction of Wonder and super regional brands.

NATIONAL

REGIONAL

Healthy, soft-variety bread

White bread for families

One Taste & You’ll Get It

14

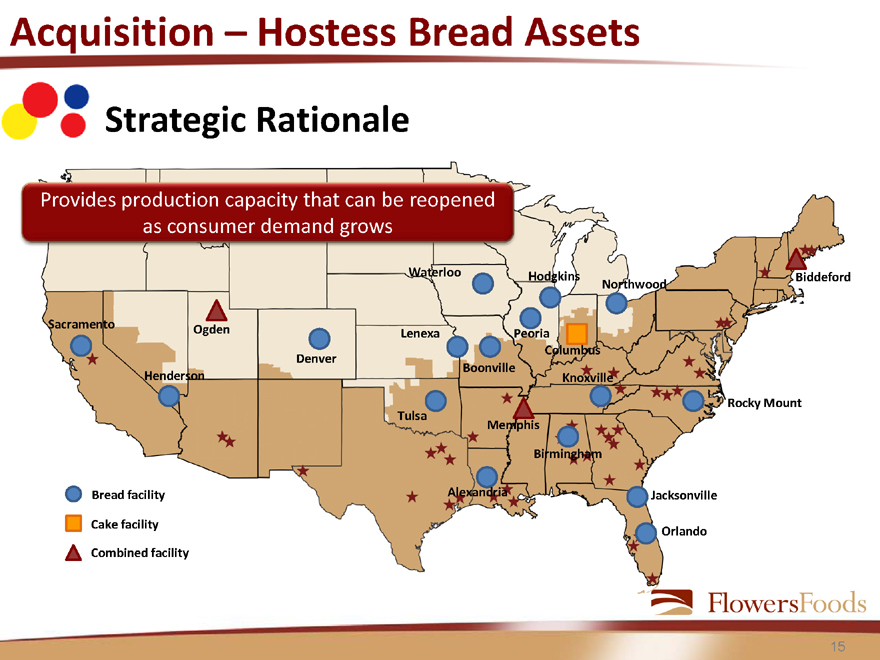

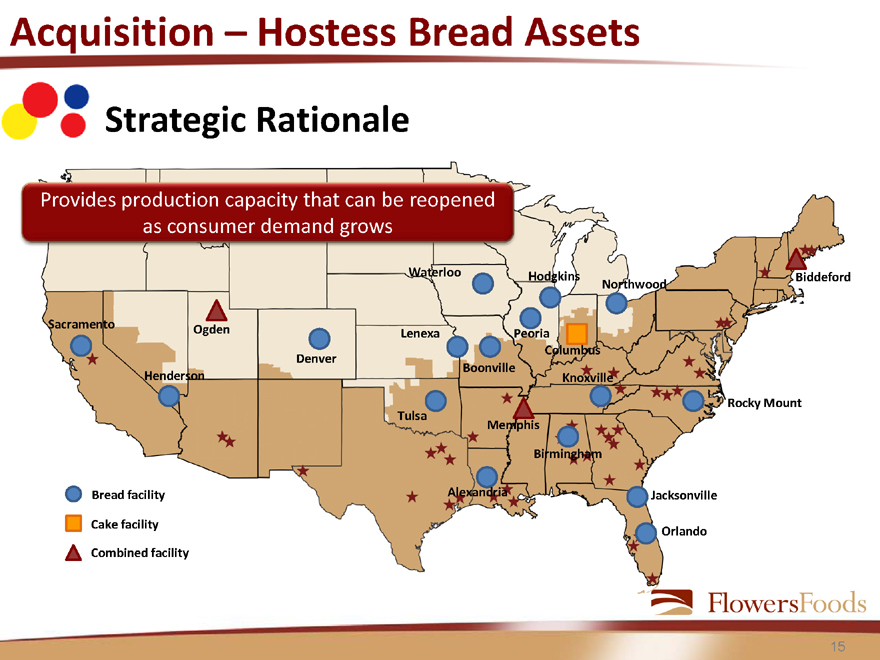

Acquisition – Hostess Bread Assets

Strategic Rationale

Provides production capacity that can be reopened as consumer demand grows

Bread facility

Cake facility Combined facility

15

Strength of Acquired Brands

Sales at retail prior to Hostess’ exit

$397 million

$156 million

$123 million

$109 million

$43 million

Wonder Brand highest household penetration of any white loaf vendor highest white bread branded trial and repeat rate in U.S.

Home Pride Wheat

#4 overall SKU in fresh packaged breads

Source: Symphony IRi Scan data 52 weeks thru 10.28.12

16

Brands Reintroduction – early Fall 2013

17

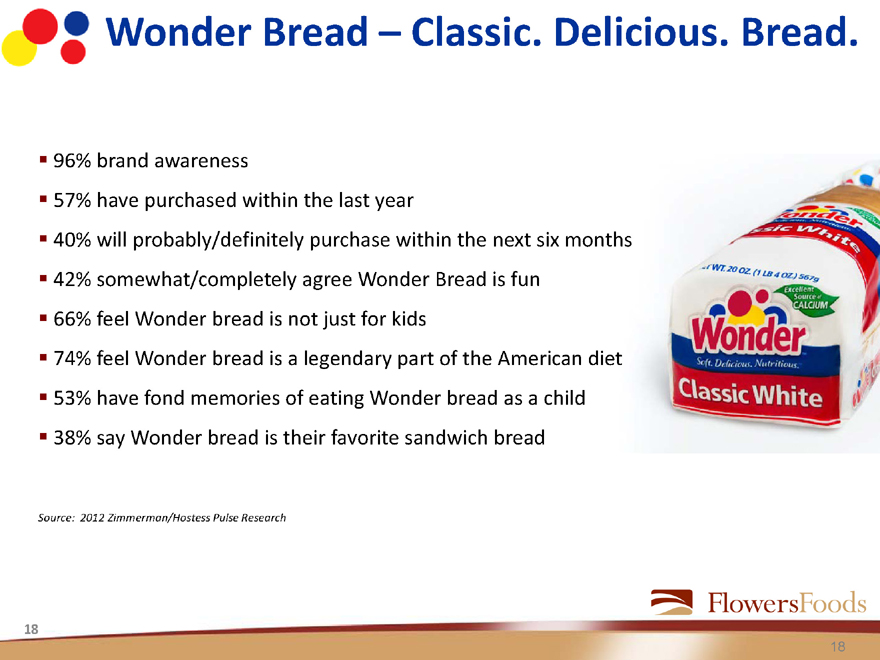

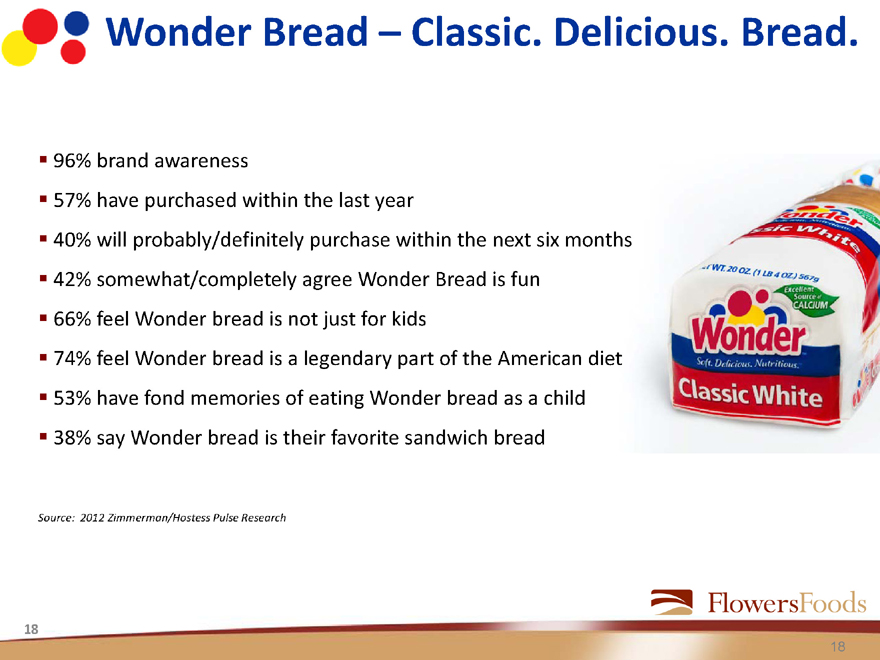

Wonder Bread – Classic. Delicious. Bread.

96% brand awareness

57% have purchased within the last year

40% will probably/definitely purchase within the next six months 42% somewhat/completely agree Wonder Bread is fun 66% feel Wonder bread is not just for kids 74% feel Wonder bread is a legendary part of the American diet 53% have fond memories of eating Wonder bread as a child 38% say Wonder bread is their favorite sandwich bread

Source: 2012 Zimmerman/Hostess Pulse Research

18

18

Marketing Initiative NASCAR Sponsorship

19

Children’s Miracle Network Sponsorship

Wonder’s back—and gives back!

20

Strength of Acquired Brands

Opportunity for growth in FLO expansion markets

Acquired brands dollar share prior to Hostess’ exit

Kansas City 20.1

Cleveland 10.2

Cincinnati/Dayton 10.2

New York 8.6

Columbus 7.1

Indianapolis 6.7

Source: Symphony IRi Scan data 52 weeks thru 10.28.12

21

Strength of Acquired Brands

Opportunity for growth in Flowers’ expansion markets

Acquired brands

dollar share FLO Current

prior to Hostess’ exit Dollar Share

Kansas City 20.1 0

Cleveland 10.2 0

Cincinnati/Dayton 10.2 4.3

New York 8.6 0.5

St. Louis 8.6 7.7

Columbus 7.1 1.3

Indianapolis 6.7 6.2

Source:

Symphony IRi Scan data for Hostess brands 52 weeks thru October 28, 2012 Symphony IRi Scan for FLO brands latest 4 weeks ending August 4, 2013

22

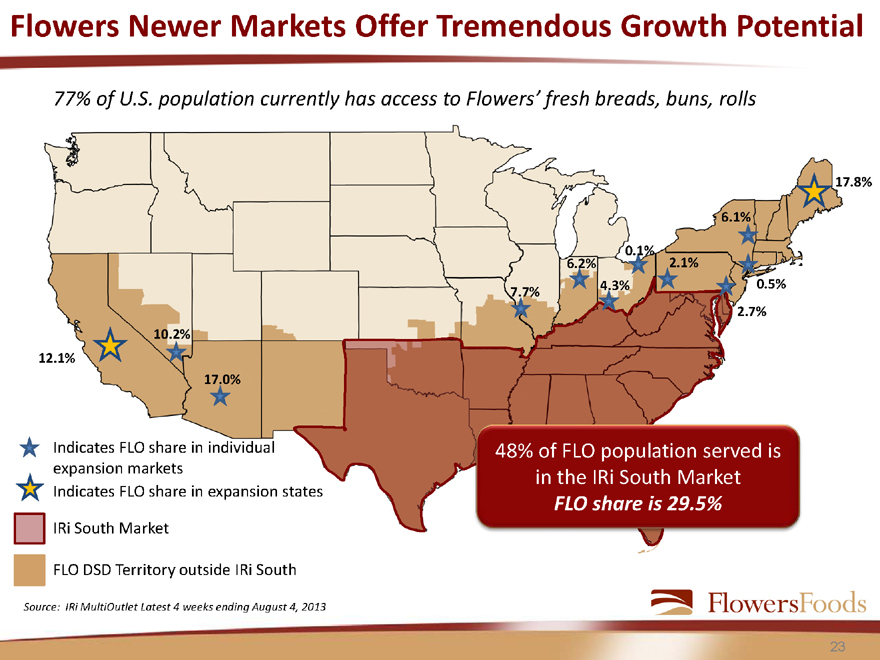

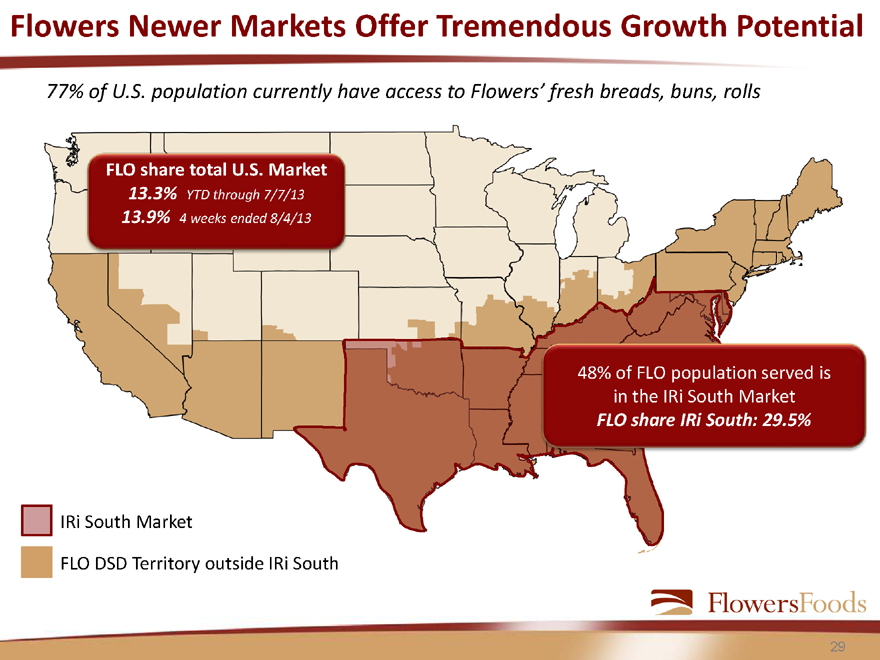

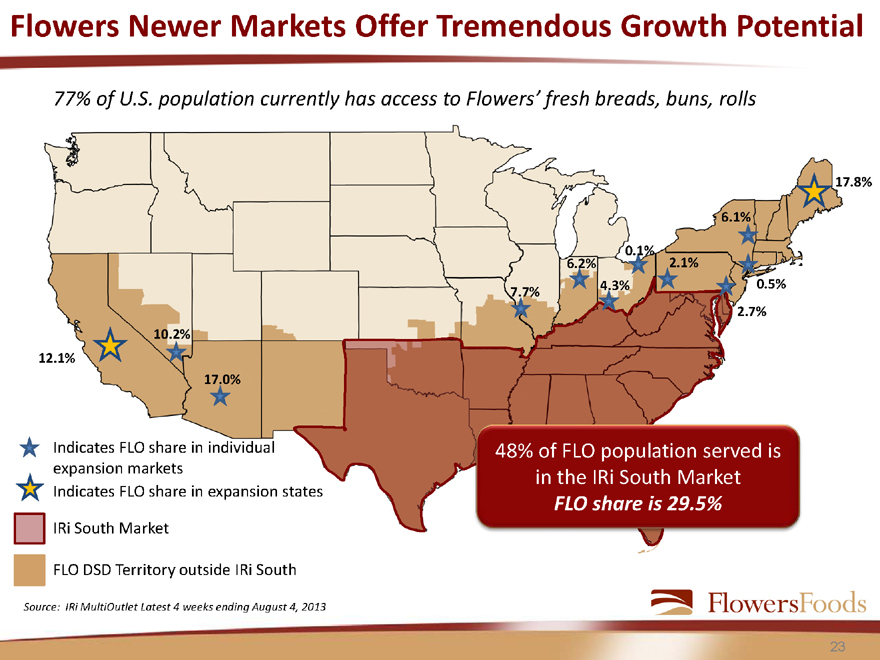

Flowers Newer Markets Offer Tremendous Growth Potential

77% of U.S. population currently has access to Flowers’ fresh breads, buns, rolls

Indicates FLO share in individual expansion markets Indicates FLO share in expansion states

IRi South Market

FLO DSD Territory outside IRi South

48% of FLO population served is in the IRi South Market

FLO share is 29.5%

Source: IRi MultiOutlet Latest 4 weeks ending August 4, 2013

23

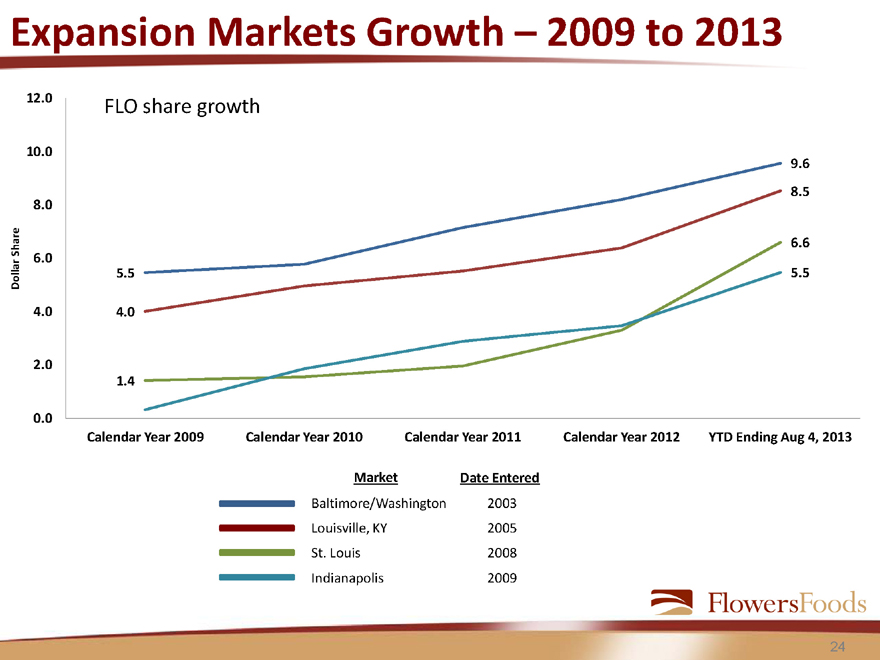

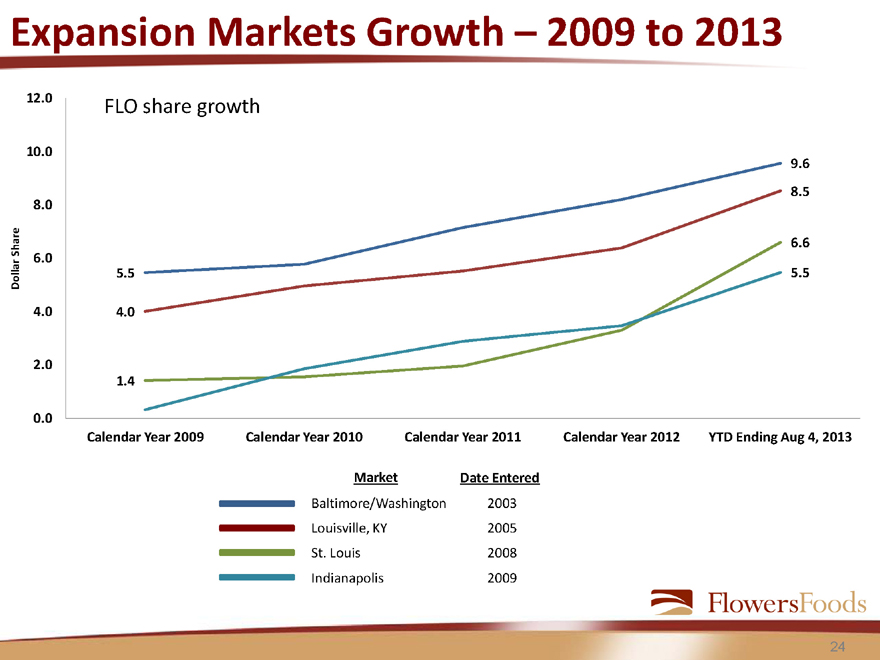

Expansion Markets Growth – 2009 to 2013

FLO share growth

12.0

10.0

8.0

6.0

4.0

2.0

0.0

Calendar Year 2009 Calendar Year 2010 Calendar Year 2011 Calendar Year 2012 YTD Ending Aug 4, 2013

Market Date Entered

Baltimore/Washington 2003

Louisville, KY 2005

St. Louis 2008

Indianapolis 2009

24

Brand Strength

Sales at Retail Value

$343 million

2003 2013

Projected

Sales estimated using internal sales data. All dollars shown as retail; includes Whitewheat

25

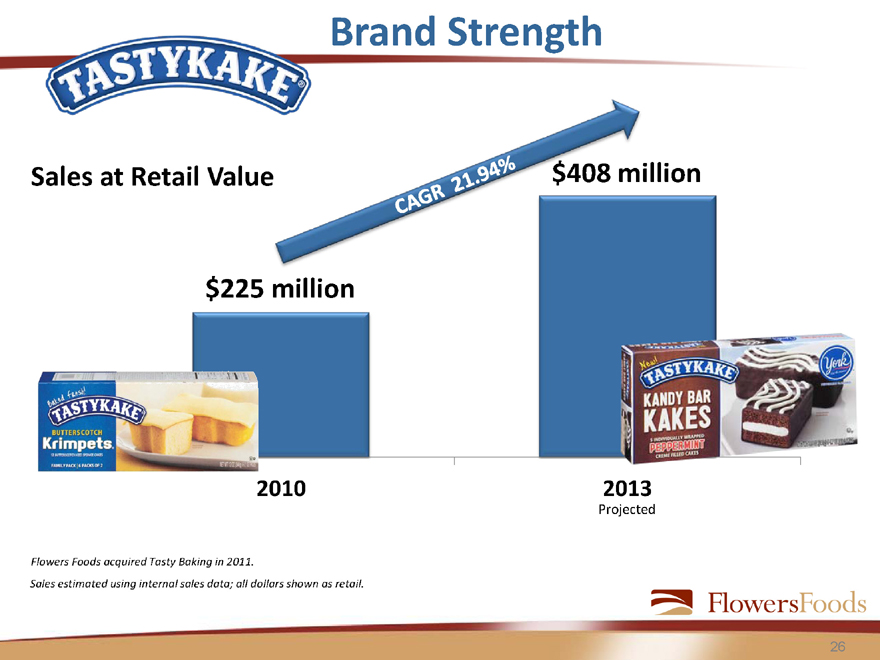

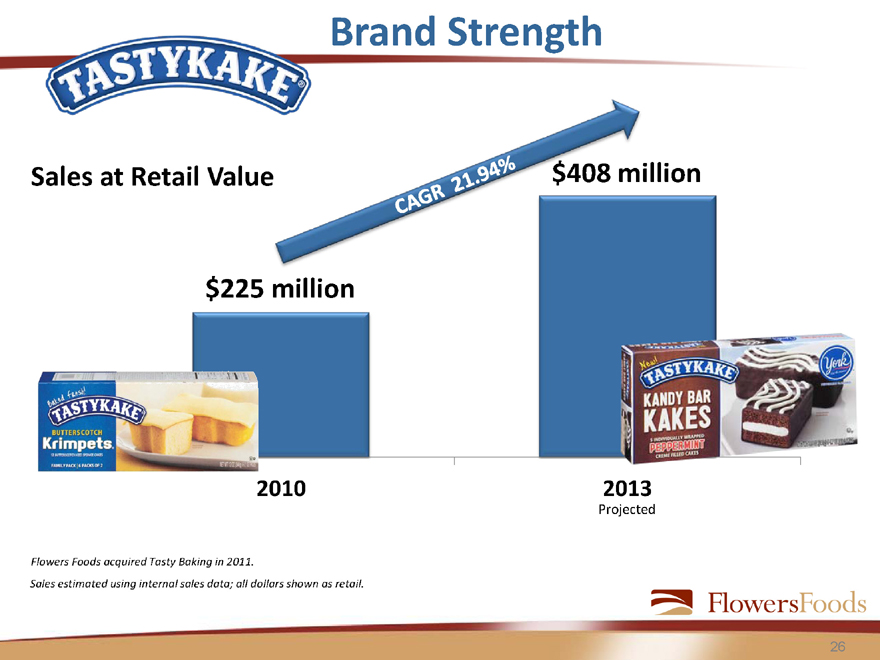

Brand Strength

Sales at Retail Value

$408 million

$225 million

2010

2013

Projected

Flowers Foods acquired Tasty Baking in 2011.

Sales estimated using internal sales data; all dollars shown as retail.

26

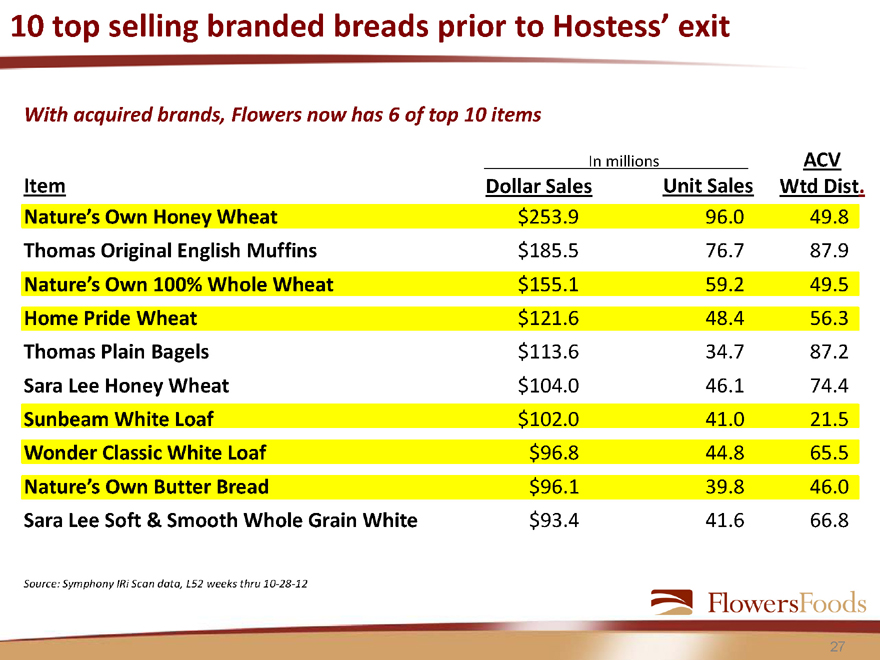

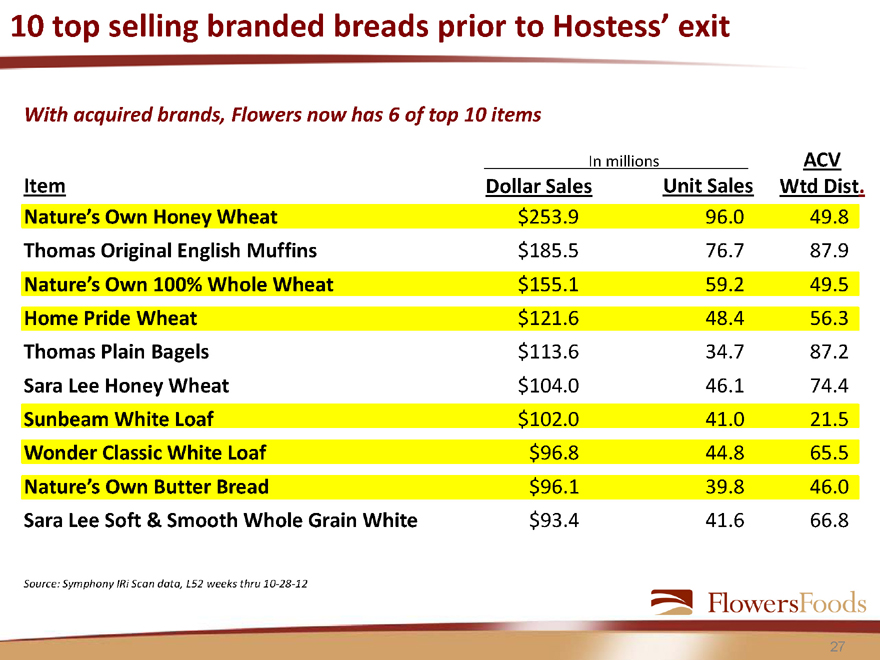

10 top selling branded breads prior to Hostess’ exit

With acquired brands, Flowers now has 6 of top 10 items

In millions ACV

Item Dollar Sales Unit Sales Wtd Dist.

Nature’s Own Honey Wheat $253.9 96.0 49.8

Thomas Original English Muffins $185.5 76.7 87.9

Nature’s Own 100% Whole Wheat $155.1 59.2 49.5

Home Pride Wheat $121.6 48.4 56.3

Thomas Plain Bagels $113.6 34.7 87.2

Sara Lee Honey Wheat $104.0 46.1 74.4

Sunbeam White Loaf $102.0 41.0 21.5

Wonder Classic White Loaf $96.8 44.8 65.5

Nature’s Own Butter Bread $96.1 39.8 46.0

Sara Lee Soft & Smooth Whole Grain White $93.4 41.6 66.8

Source: Symphony IRi Scan data, L52 weeks thru 10-28-12

27

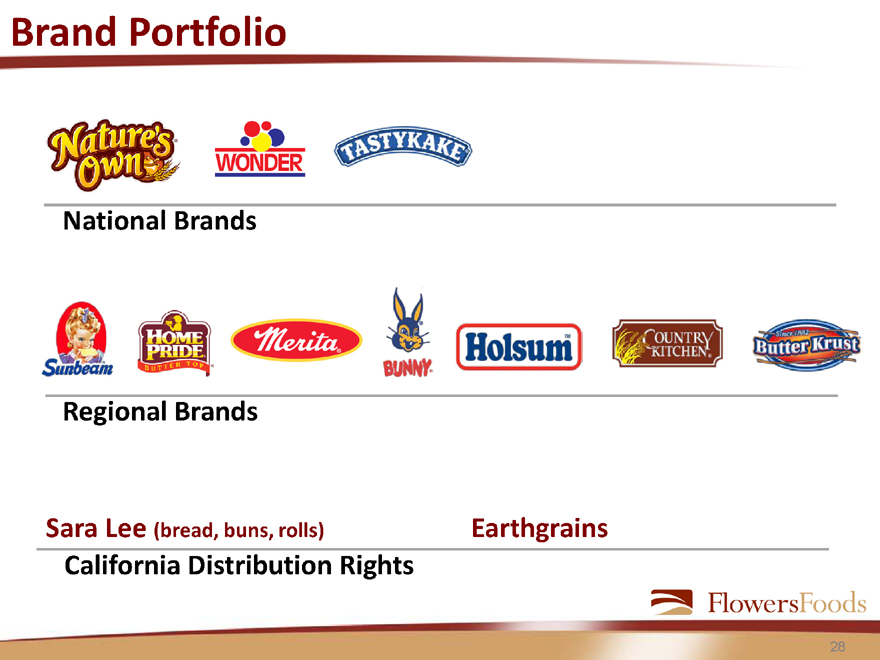

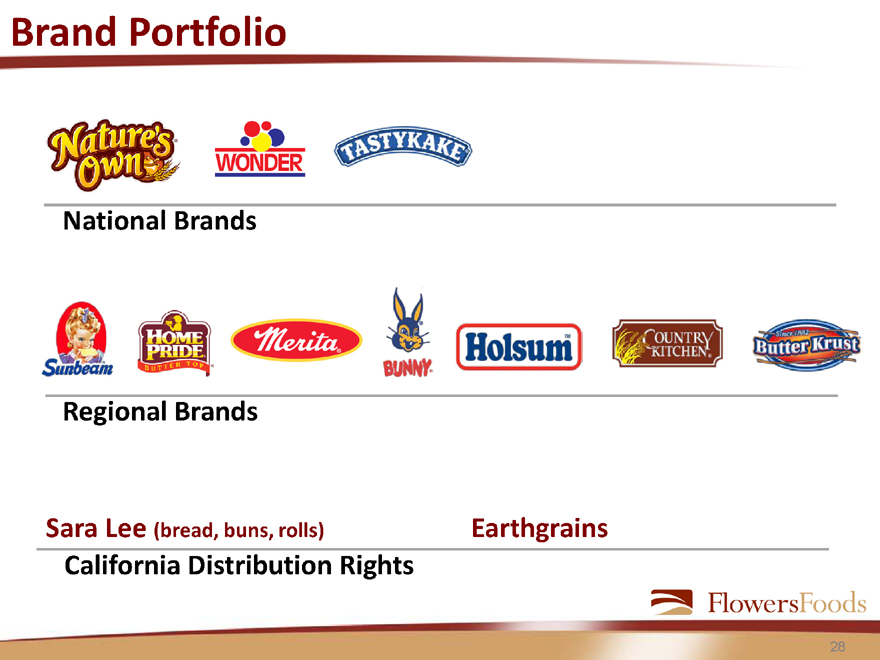

Brand Portfolio

National Brands

Regional Brands

Sara Lee (bread, buns, rolls) Earthgrains

California Distribution Rights

28

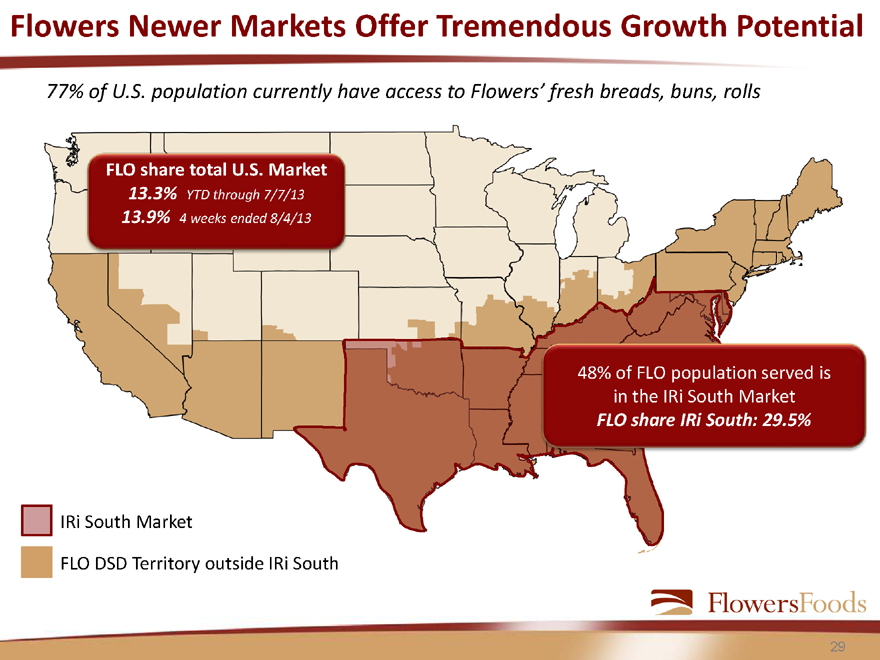

Flowers Newer Markets Offer Tremendous Growth Potential

77% of U.S. population currently have access to Flowers’ fresh breads, buns, rolls

FLO share total U.S. Market

13.3% YTD through 7/7/13

13.9% 4 weeks ended 8/4/13

48% of FLO population served is in the IRi South Market

FLO share IRi South: 29.5%

IRi South Market

FLO DSD Territory outside IRi South

29

Growing

THE FLOWERS WAY

30

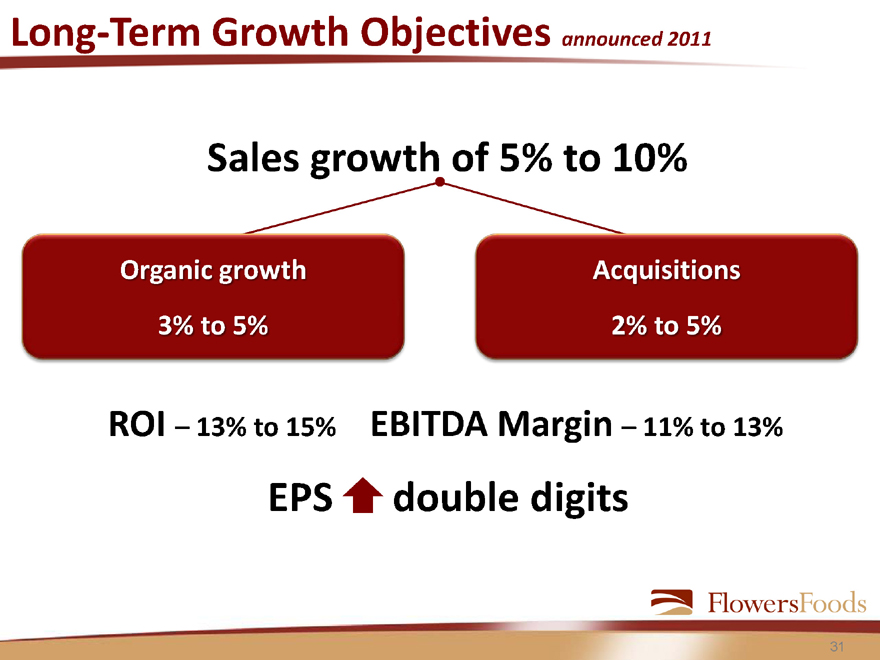

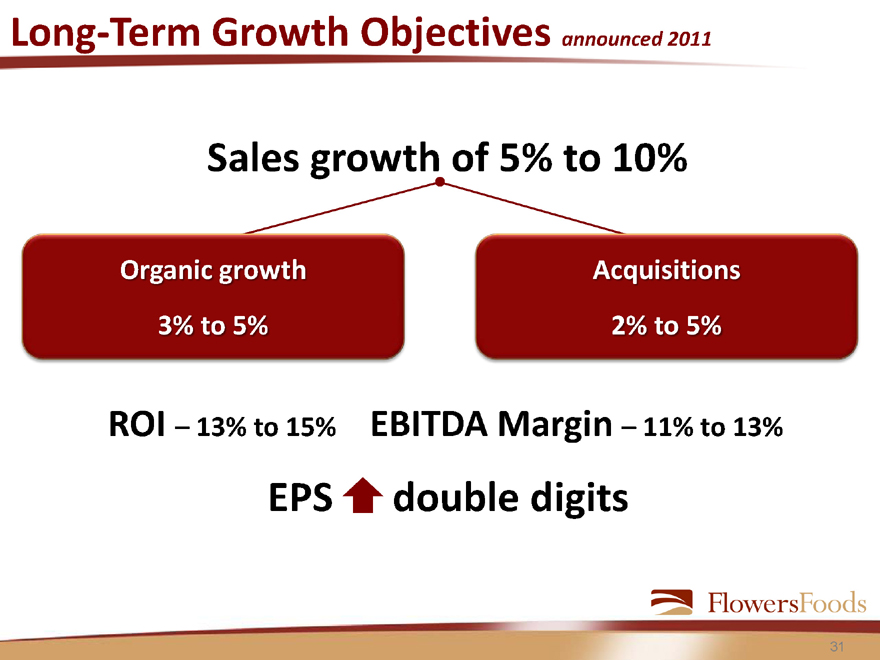

Long-Term Growth Objectives announced 2011

Sales growth of 5% to 10%

Organic growth

3% to 5%

Acquisitions

2% to 5%

ROI – 13% to 15% EBITDA Margin – 11% to 13%

EPS

double digits

31

Revenue Drivers

Volume from acquired brands

Volume from core brands

Price/Mix

32

Financial Update

Sales 10-year CAGR: 8.65%

EBITDA*

10-year CAGR: 10.44%

In billions

$3.05

$1.33

In millions

$330.8

$122.6

2002 2012

2002 2012(1)

(1)Adjusted EBITDA excluding acquisition-related charges

*Earnings before interest, taxes, depreciation, and amortization. See reconciliation of non-GAAP measures at the end of this slide presentation.

33

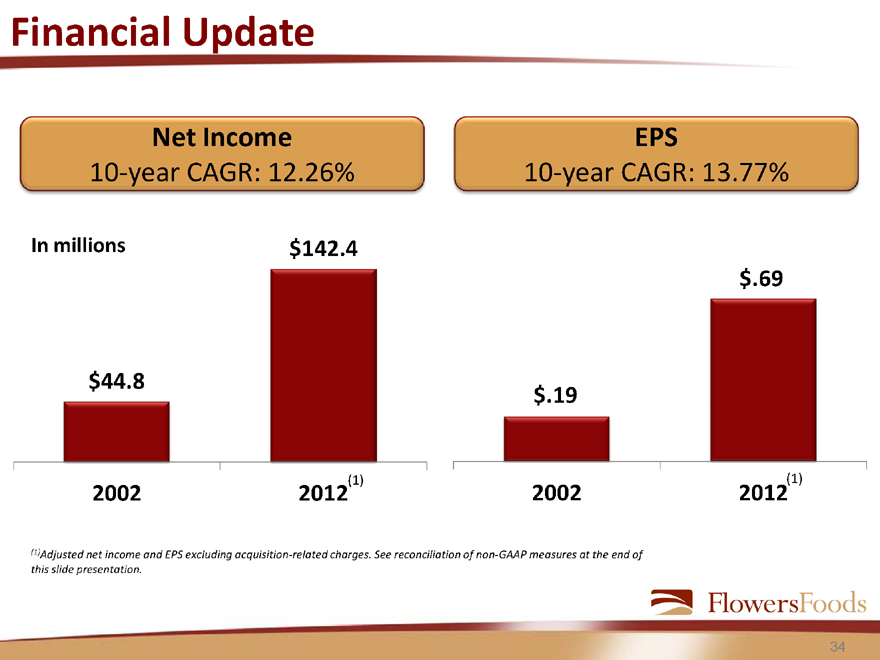

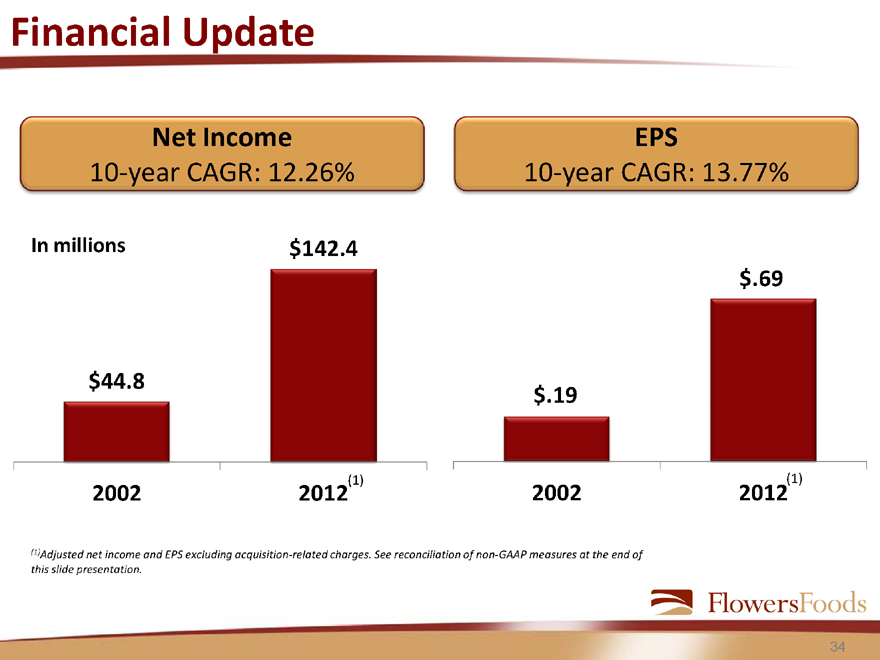

Financial Update

Net Income

10-year CAGR: 12.26%

EPS

10-year CAGR: 13.77%

In millions

$44.8

$142.4

$.19

$.69

2002

2012(1)

2002

(1)

2012

(1)Adjusted net income and EPS excluding acquisition-related charges. See reconciliation of non-GAAP measures at the end of this slide presentation.

34

Gross Margin(1)

In thousands

$334,774

$358,776

$545,512

$426,539

Gross Margin Drivers

Efficiencies Volume Commodities Revenue

3Q12 4Q12 1Q13 (3) 2Q13

Margin2 46.7% 47.9% 48.2% 47.5%

1Gross margin is defined as sales less materials, supplies, labor, and other production costs, excluding depreciation and amortization. See reconciliation of non-GAAP measures at the end of this slide presentation.

2Gross margin as a % of net sales

316 weeks; all other quarters include 12 weeks

35

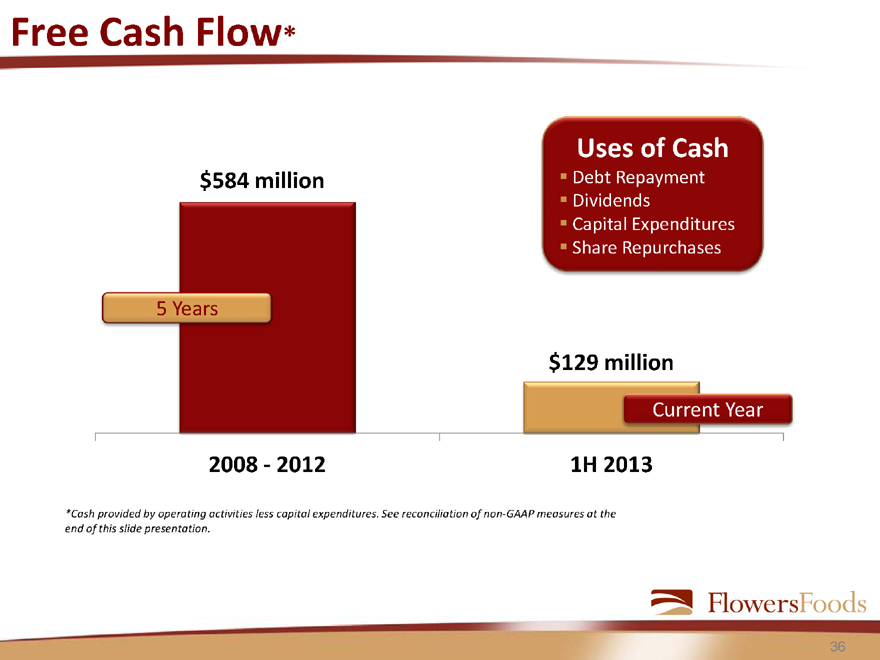

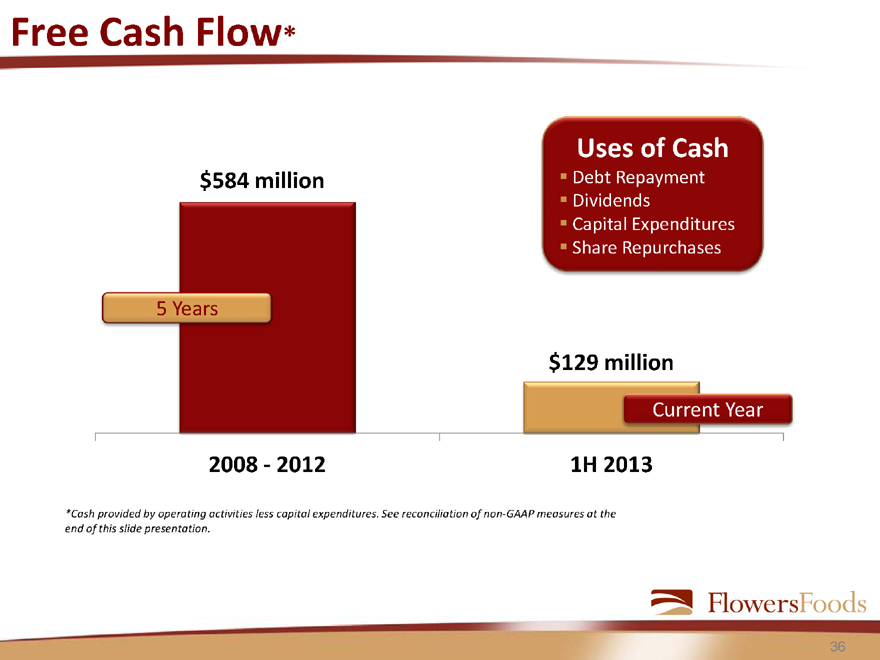

Free Cash Flow*

$584 million

5 Years

2008 - 2012

Uses of Cash

Debt Repayment Dividends Capital Expenditures Share Repurchases

$129 million

Current Year

1H 2013

*Cash provided by operating activities less capital expenditures. See reconciliation of non-GAAP measures at the end of this slide presentation.

36

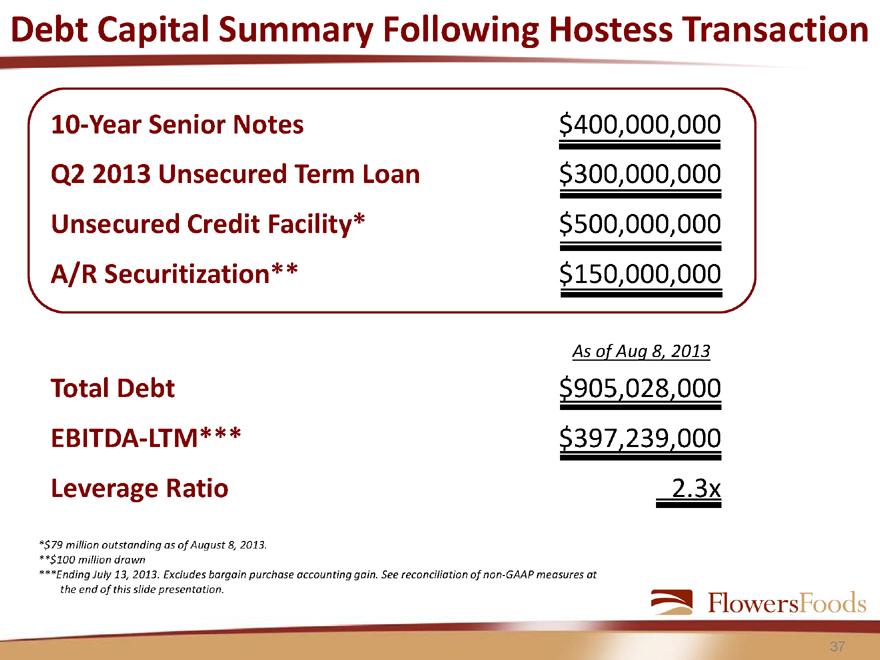

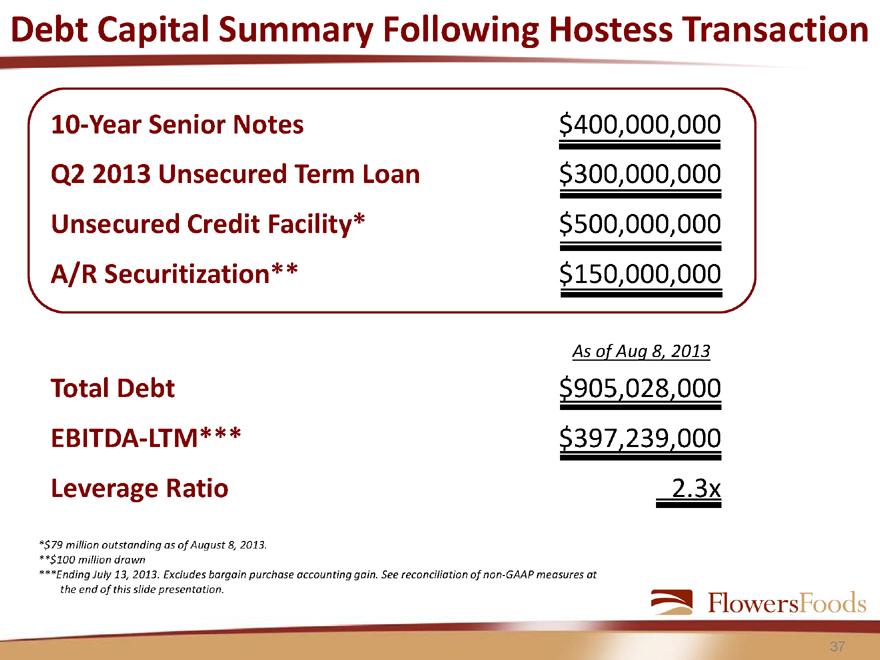

Debt Capital Summary Following Hostess Transaction

10-Year Senior Notes $400,000,000

Q2 2013 Unsecured Term Loan $300,000,000

Unsecured Credit Facility* $500,000,000

A/R Securitization** $150,000,000

As of Aug 8, 2013

Total Debt $905,028,000

EBITDA-LTM*** $397,239,000

Leverage Ratio 2.3x

*$79 million outstanding as of August 8, 2013.

**$100 million drawn

***Ending July 13, 2013. Excludes bargain purchase accounting gain. See reconciliation of non-GAAP measures at the end of this slide presentation.

37

Cash Deployment

2008 to 2012 (millions)

Return to Shareholders 33%

Share repurchases $169.0

Dividends $351.8

Invested in Growth 67%

Acquisitions $677.5

Capital expenditures $404.2

38

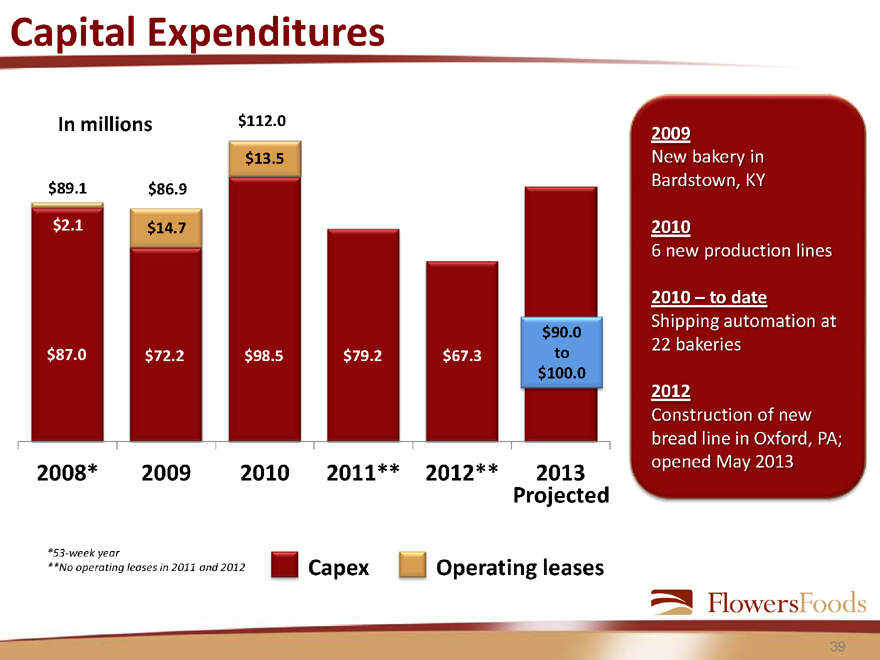

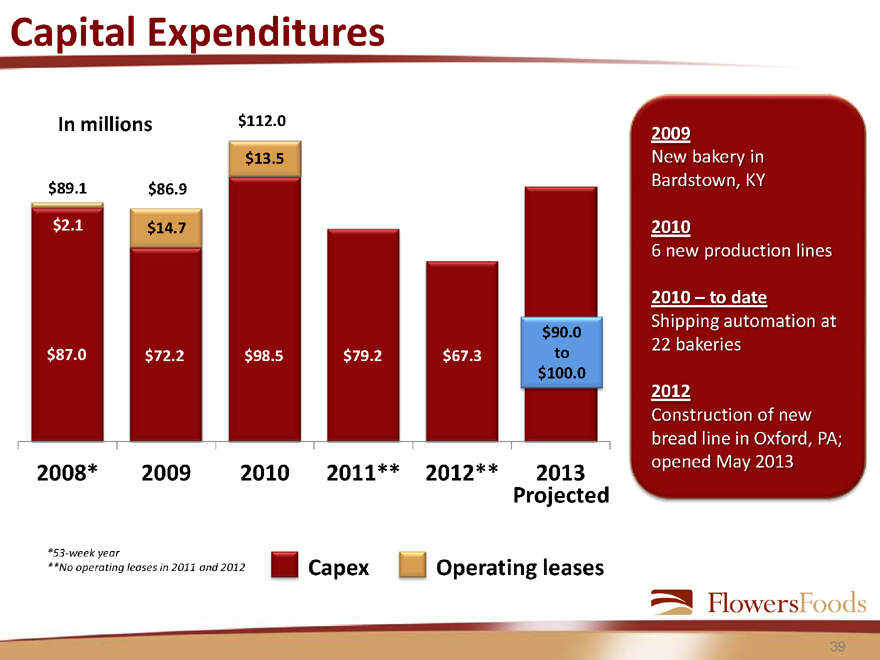

Capital Expenditures

In millions

$89.1

$2.1

$87.0

$86.9

$14.7

$72.2

$112.0

$13.5

$98.5

$79.2

$67.3

$90.0 to $100.0

2008* 2009 2010 2011** 2012** 2013

Projected

2009

New bakery in

Bardstown, KY

2010

6 new production lines

2010 – to date

Shipping automation at

22 bakeries

2012

Construction of new

bread line in Oxford, PA;

opened May 2013

*53-week year

**No operating leases in 2011 and 2012

Capex

Operating leases

39

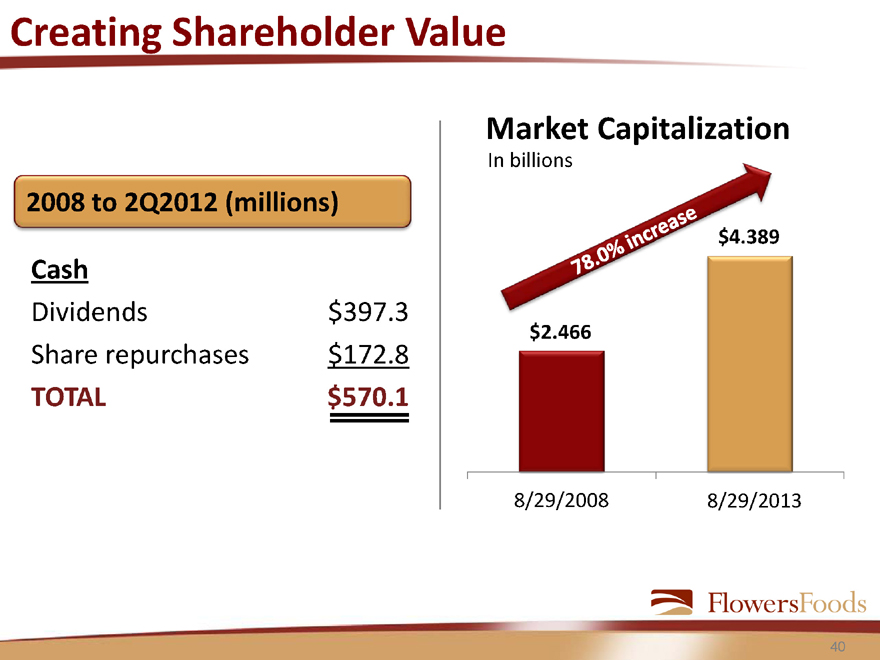

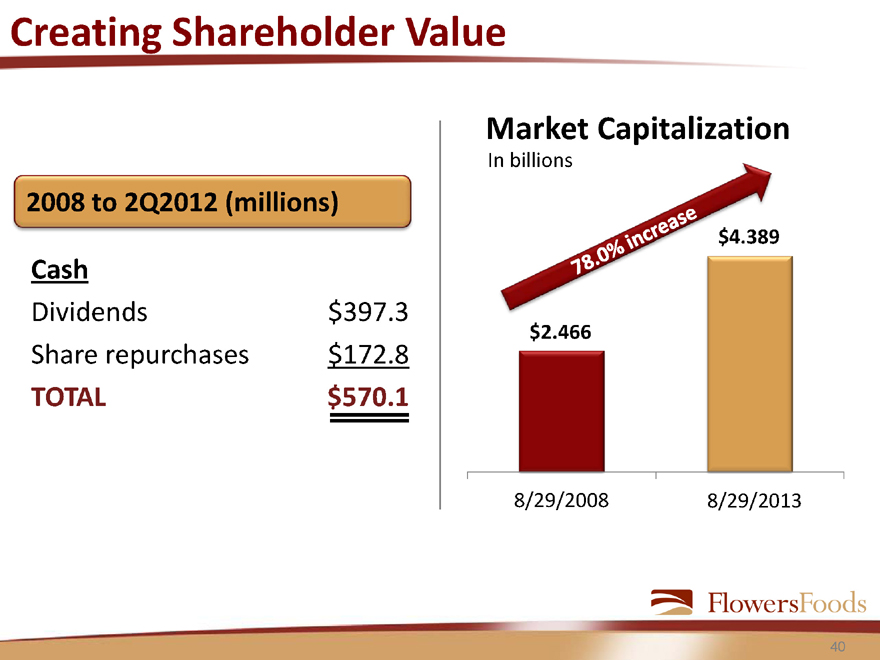

Creating Shareholder Value

2008 to 2Q2012 (millions)

Cash

Dividends $397.3

Share repurchases $172.8

TOTAL $570.1

Market Capitalization

In billions

78.0% increase

$2.466

8/29/2008

8/29/2013

40

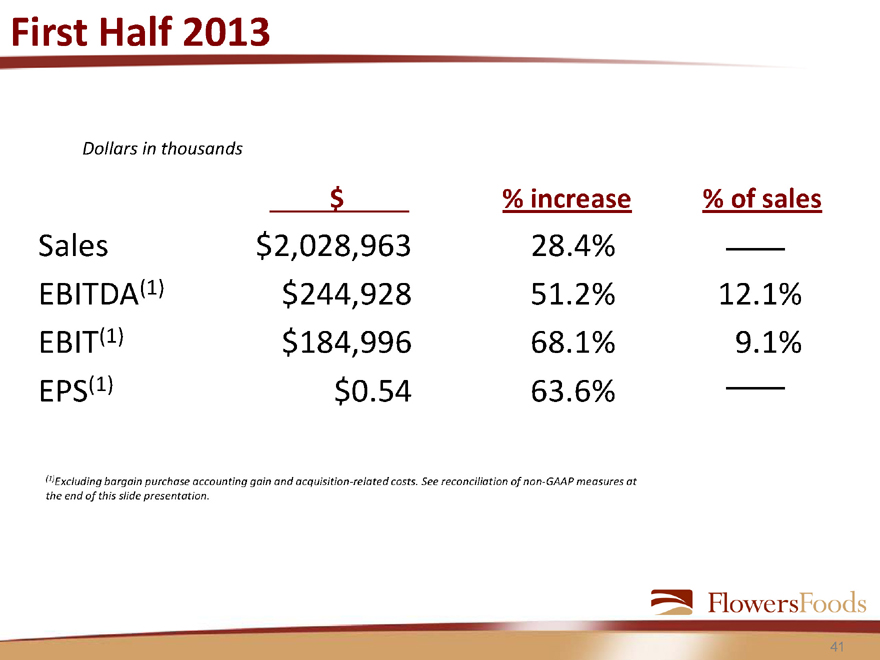

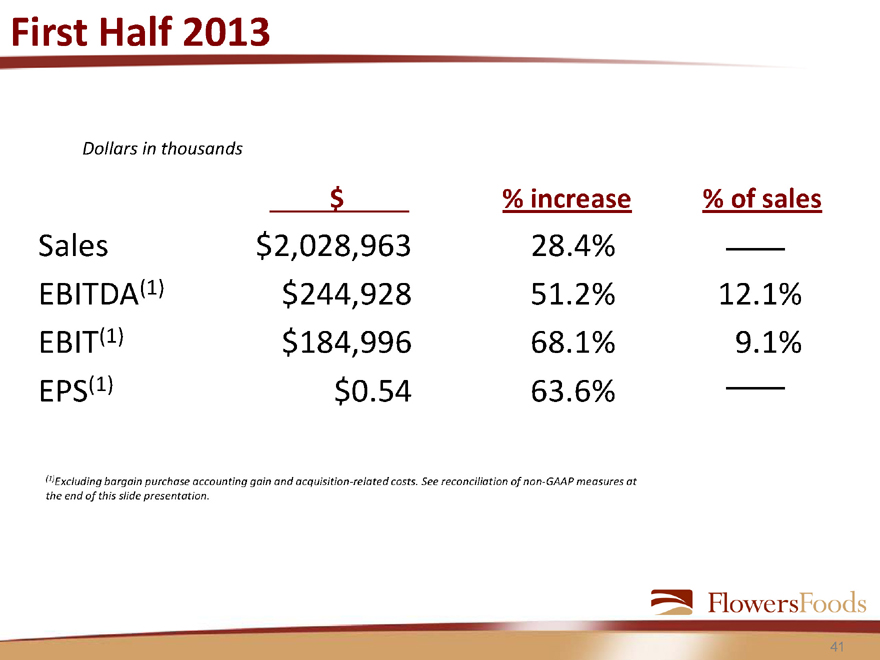

First Half 2013

Dollars in thousands

$ % increase % of sales

Sales $2,028,963 28.4%

EBITDA(1) $244,928 51.2% 12.1%

EBIT(1) $184,996 68.1% 9.1%

EPS(1) $0.54 63.6%

(1)Excluding bargain purchase accounting gain and acquisition-related costs. See reconciliation of non-GAAP measures at the end of this slide presentation.

41

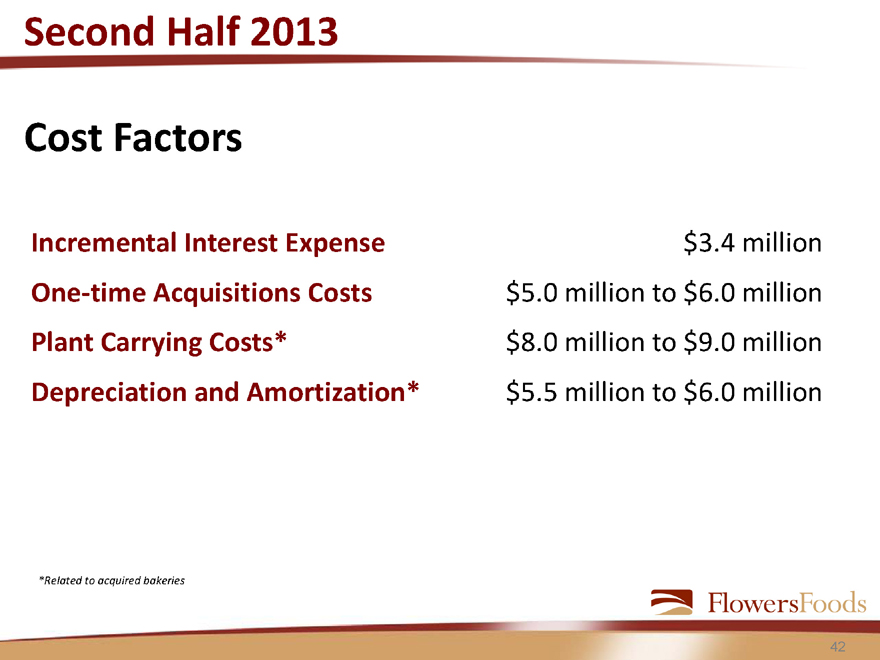

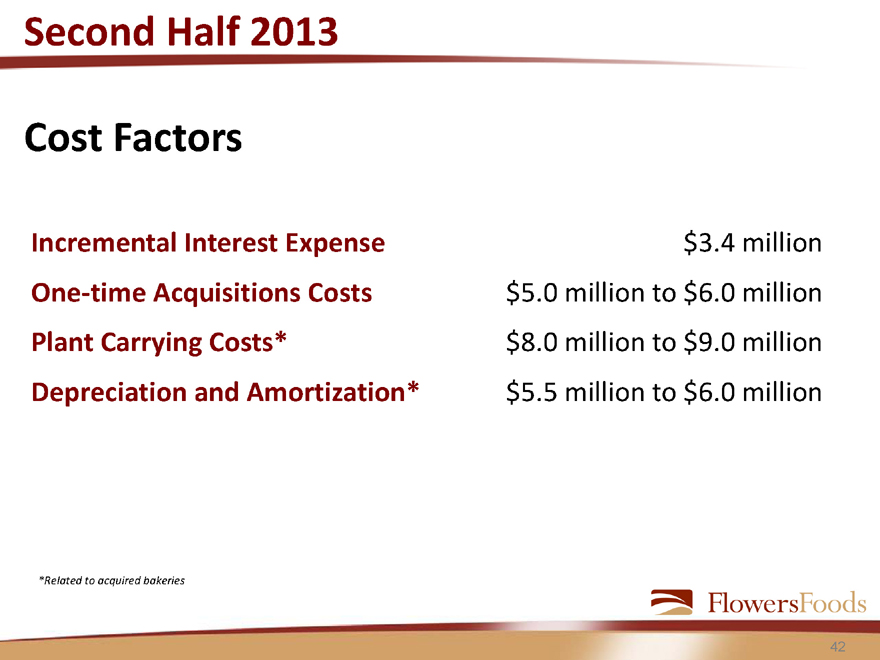

Second Half 2013

Cost Factors

Incremental Interest Expense One-time Acquisitions Costs Plant Carrying Costs* Depreciation and Amortization*

$3.4 million

$5.0 million to $6.0 million

$8.0 million to $9.0 million

$5.5 million to $6.0 million

*Related to acquired bakeries

42

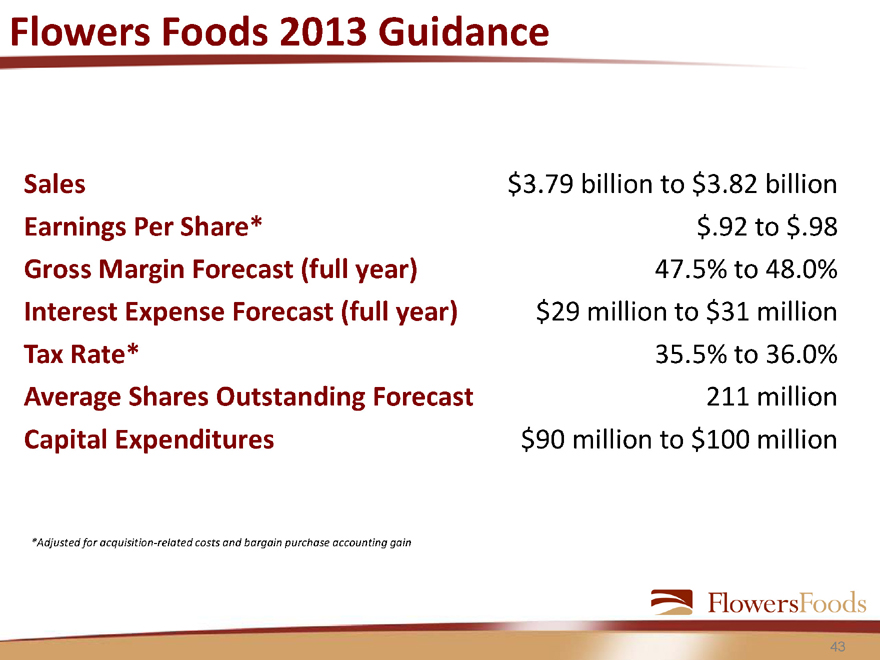

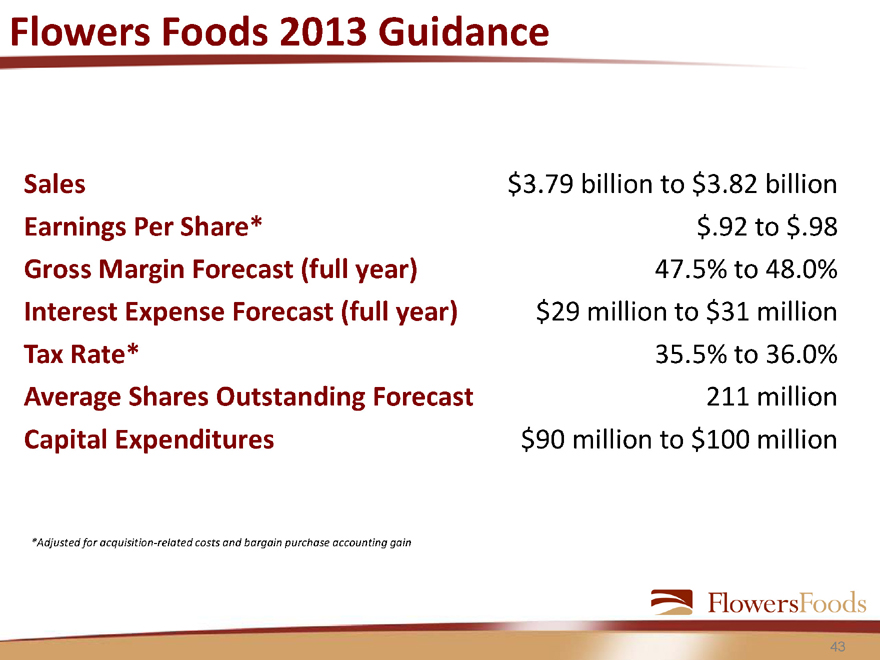

Flowers Foods 2013 Guidance

Sales $3.79 billion to $3.82 billion

Earnings Per Share* $.92 to $.98 Gross Margin Forecast (full year) 47.5% to 48.0% Interest Expense Forecast (full year) $29 million to $31 million

Tax Rate* 35.5% to 36.0%

Average Shares Outstanding Forecast 211 million

Capital Expenditures $90 million to $100 million

*Adjusted for acquisition-related costs and bargain purchase accounting gain

43

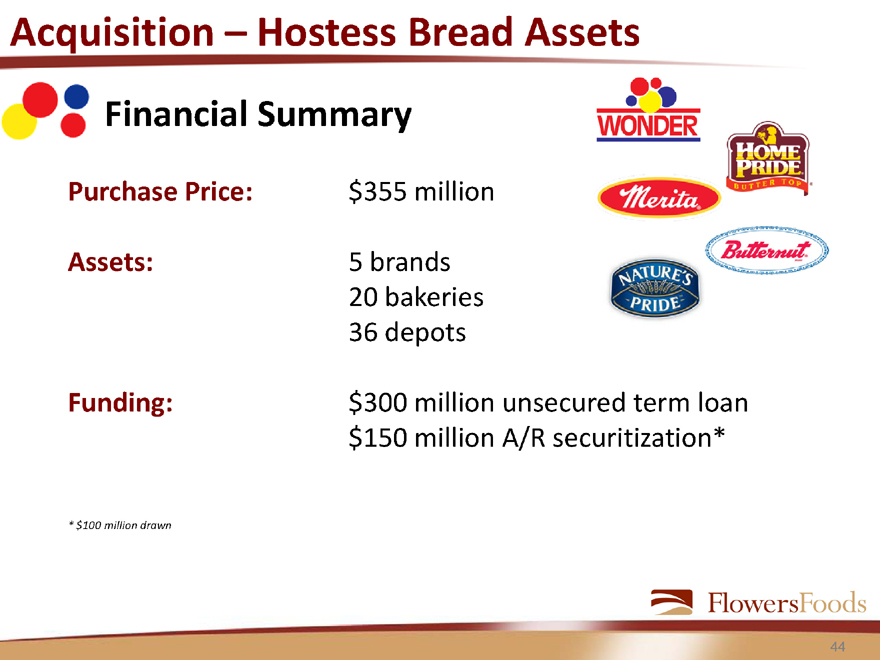

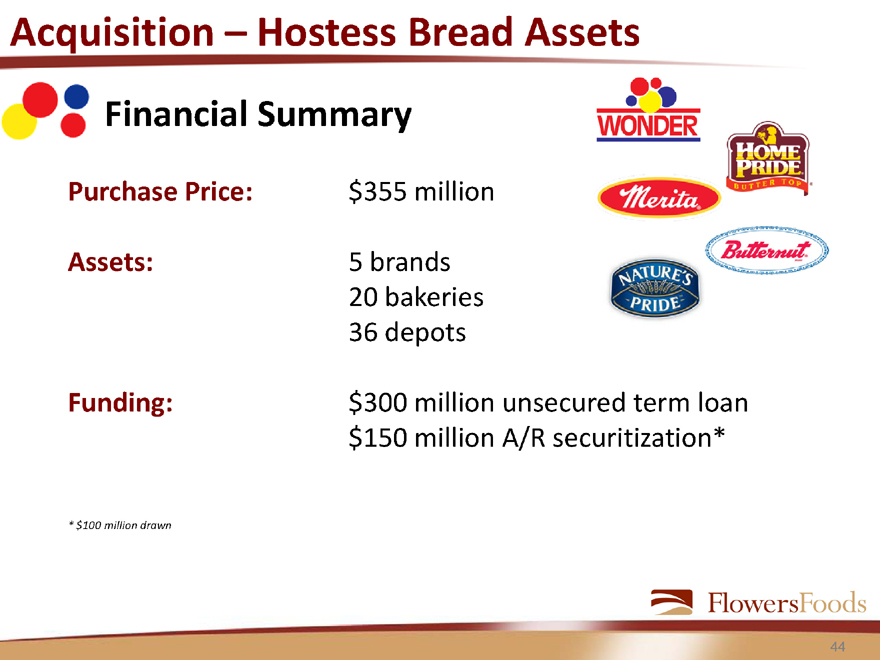

Acquisition – Hostess Bread Assets

Financial Summary

Purchase Price: $355 million

Assets: 5 brands

20 bakeries

36 depots

Funding: $300 million unsecured term loan

$150 million A/R securitization*

* $100 million drawn

44

Financial View

Hostess acquisition differs from traditional acquisitions

—Idled assets

—Exited market prior to acquisition

—Financial aspects

Opportunities for growth with Hostess acquisition

Leverage assets and brands

—Incremental revenue growth

—Margin expansion

Capacity utilization

Logistics improvement

Leverage overhead

Focus on debt repayment

45

Flowers Foods Strengths

Clear strategy for growth

Proven ability to execute, create value

Strong brands, delicious products

Efficient bakeries, effective distribution

Outstanding team

Culture and leadership continuity

46

Growing

THE FLOWERS WAY

47

Safe Harbor

Today’s presentation includes forward-looking statements within the meaning of the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995, particularly statements regarding future financial and operating results of Flowers Foods and its business. These statements are based on management’s current expectations or beliefs, and are subject to uncertainty and changes in circumstances.

Actual results may vary materially from those expressed or implied by the statements, due to changes in economic, business, competitive, strategic, or regulatory factors, and factors affecting the operation of the business of Flowers Foods. Those factors could include, among others, our ability to successfully integrate recent acquisitions, such as the acquisition of certain Hostess bread brands, our ability to achieve expected sales of acquired Hostess products as a result of Hostess’ extended liquidation and the absorption of demand for Hostess products by our competitors, and our ability to realize other expected benefits from recent acquisitions, including the acquisition of certain Hostess bread brands.

More detailed information about these factors may be found in filings by Flowers Foods with the Securities and Exchange Commission, especially its Form 10-K, in the sections entitled “Forward Looking Statements.” Flowers Foods is under no obligation and expressly disclaims any such obligation to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

48

Information Regarding Non-GAAP Financial Measures

The company prepares its consolidated financial statements in accordance with U.S. Generally Accepted Accounting Principles (GAAP). However, from time to time, the company may present in its public statements, press releases, and SEC filings, non-GAAP financial measures such as EBITDA. The company defines EBITDA as earnings from continuing operations before interest, income taxes, depreciation, amortization, and income attributable to non-controlling interest. The company believes that EBITDA is a useful tool for managing the operations of its business and is an indicator of the company’s ability to incur and service indebtedness and generate free cash flow. The company also believes that EBITDA measures are commonly reported and widely used by investors and other interested parties as measures of a company’s operating performance and debt servicing ability because EBITDA measures assist in comparing performance on a consistent basis without regard to depreciation or amortization, which can vary significantly depending upon accounting methods and non-operating factors (such as historical cost). EBITDA is also a widely-accepted financial indicator of a company’s ability to incur and service indebtedness. Adjusted EBITDA, adjusted net income, adjusted diluted earnings per share, and adjusted EBIT margin excludes additional costs that we consider important to present to investors. These include, but are not limited to, the costs of closing a plant or costs associated with merger-related activities. We believe that financial information excluding certain transactions not considered to be part of the ongoing business improves the comparability of earnings results. We believe investors will be able to better understand our earnings results if these transactions are excluded from the results. These non-GAAP financial measures are measures of performance not defined by accounting principles generally accepted in the Unites States and should be considered in addition to, not in lieu of, GAAP reported measures. EBITDA should not be considered an alternative to (a) income from operations or net income (loss) as a measure of operating performance; (b) cash flows provided by operating, investing, and financing activities (as determined in accordance with GAAP) as a measure of the company’s ability to meet its cash needs; or (c) any other indicator of performance or liquidity that has been determined in accordance with GAAP. Our method of calculating EBITDA, adjusted EBITDA, adjusted net income, adjusted diluted earnings per share, and adjusted EBIT margin may differ from the methods used by other companies, and, accordingly, may not be comparable to similarly titled measures used by other companies. Gross margin excluding depreciation and amortization is used as a performance measure to provide additional transparent information regarding our results of operations on a consolidated and segment basis. Changes in depreciation and amortization are separately discussed and include depreciation and amortization for materials, supplies, labor and other production costs and operating activities. Presentation of gross margin includes depreciation and amortization in the materials, supplies, labor, and other production costs according to GAAP. Our method of presenting gross margin excludes the depreciation and amortization components, as discussed above. This presentation may differ from the methods used by other companies and may not be comparable to similarly titled measures used by other companies. Free cash flow (operating cash flow less capital expenditures) is presented because it represents cash available to pursue opportunities that enhance shareholder value, such as developing new products, making acquisitions, paying dividends, and reducing debt. The following reconciliations provide a reconciliation of our net income, the most comparable GAAP financial measure to EBITDA and adjusted EBITDA, a reconciliation of adjusted diluted earnings per share, a reconciliation of adjusted net income, a reconciliation of our gross margin excluding depreciation and amortization to GAAP gross margin, a reconciliation of adjusted EBIT, and a reconciliation of free cash flow.

49

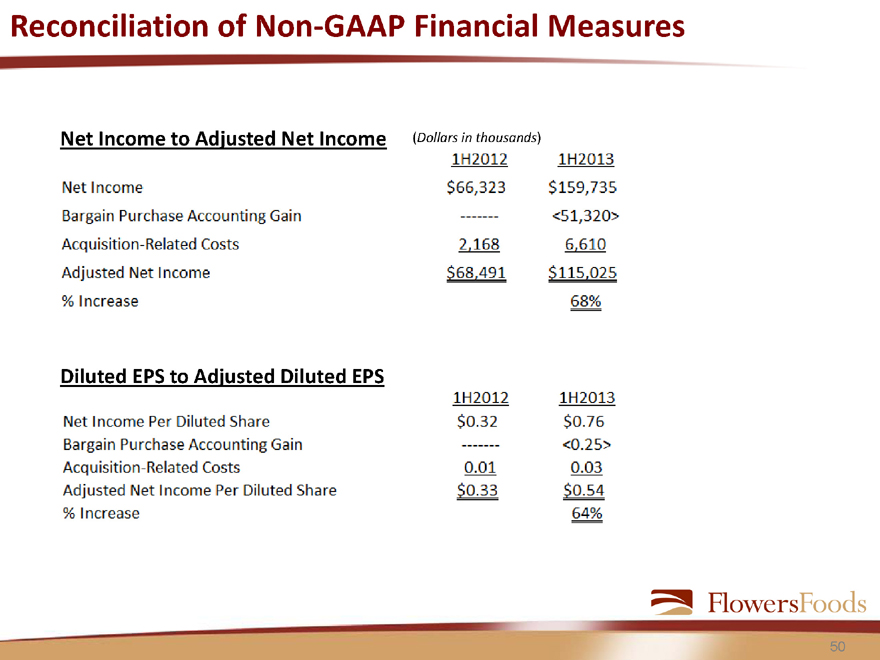

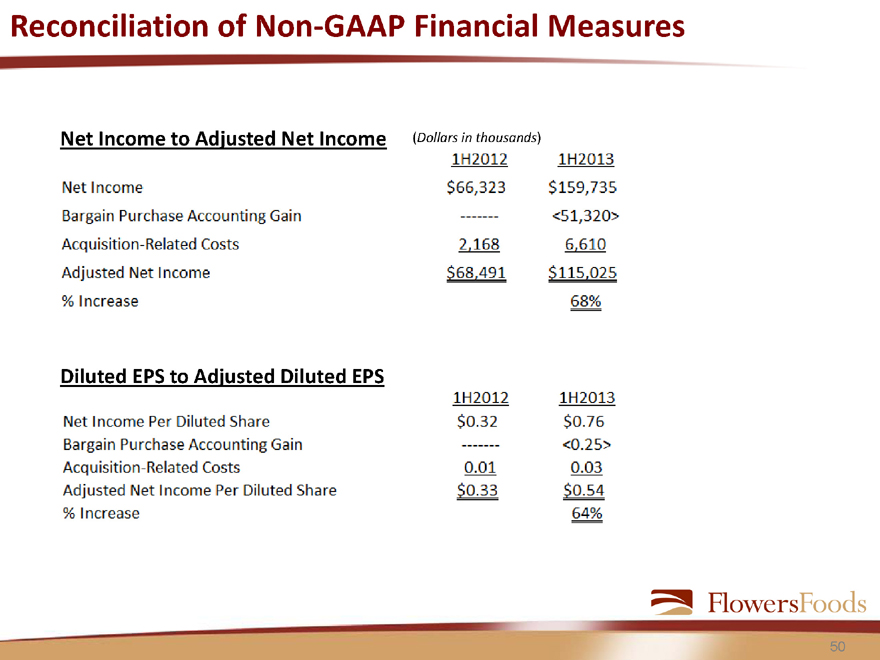

Reconciliation of Non-GAAP Financial Measures

Net Income to Adjusted Net Income (Dollars in thousands)

1H2012 1H2013

Net Income $66,323 $159,735

Bargain Purchase Accounting Gain ------- <51,320>

Acquisition-Related Costs 2,168 6,610

Adjusted Net Income $68,491 $115,025

% Increase 68%

Diluted EPS to Adjusted Diluted EPS

1H2012 1H2013

Net Income Per Diluted Share $0.32 $0.76

Bargain Purchase Accounting Gain ------- <0.25>

Acquisition-Related Costs 0.01 0.03

Adjusted Net Income Per Diluted Share $0.33 $0.54

% Increase 64%

50

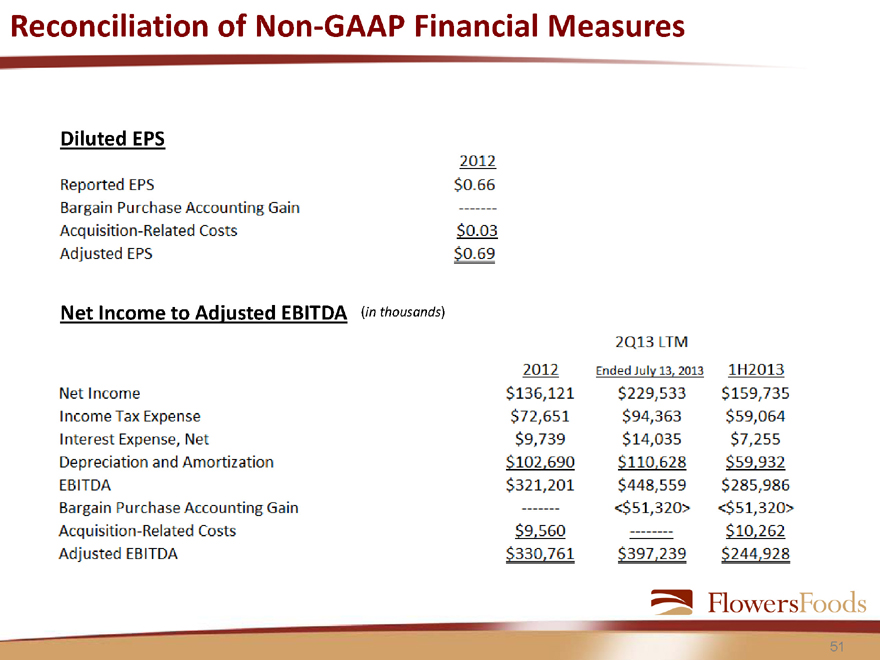

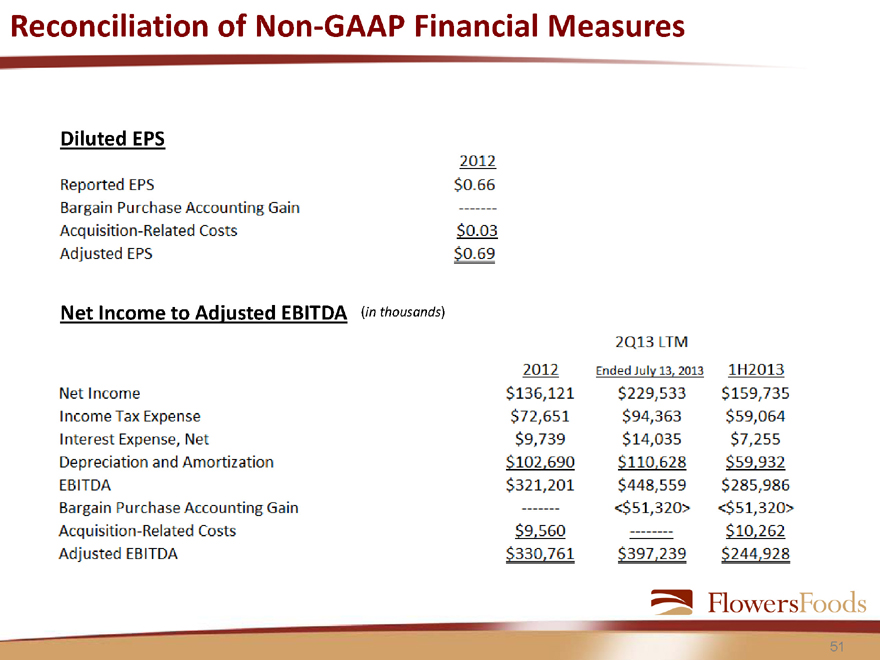

Reconciliation of Non-GAAP Financial Measures

Diluted EPS

2012

Reported EPS $0.66

Bargain Purchase Accounting Gain -------

Acquisition-Related Costs $0.03

Adjusted EPS $0.69

Net Income to Adjusted EBITDA (in thousands)

2Q13 LTM

2012 Ended July 13, 2013 1H2013

Net Income $136,121 $229,533 $159,735

Income Tax Expense $72,651 $94,363 $59,064

Interest Expense, Net $9,739 $14,035 $7,255

Depreciation and Amortization $102,690 $110,628 $59,932

EBITDA $321,201 $448,559 $285,986

Bargain Purchase Accounting Gain ------- <$51,320> <$51,320>

Acquisition-Related Costs $9,560 ------- $10,262

Adjusted EBITDA $330,761 $397,239 $244,928

51

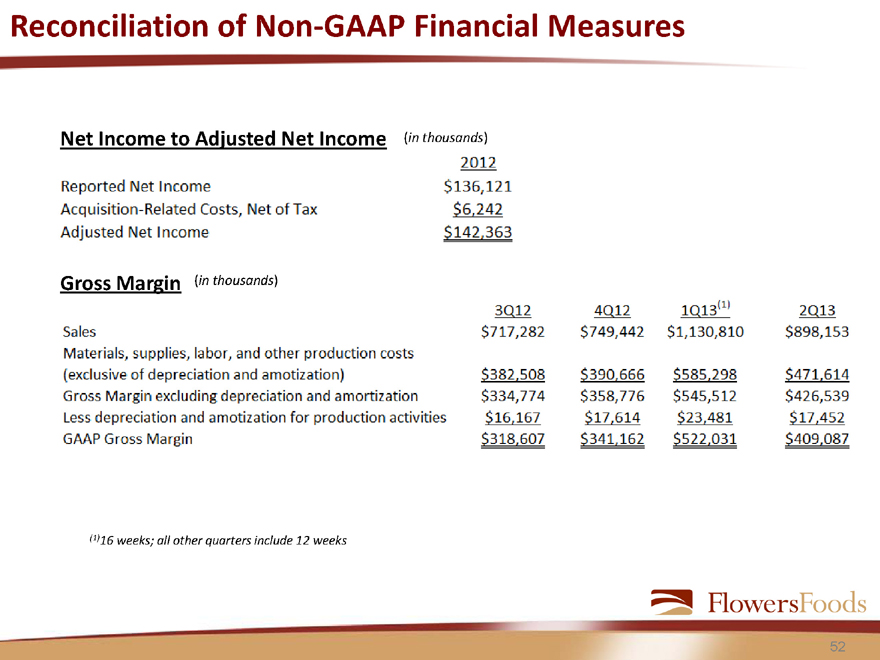

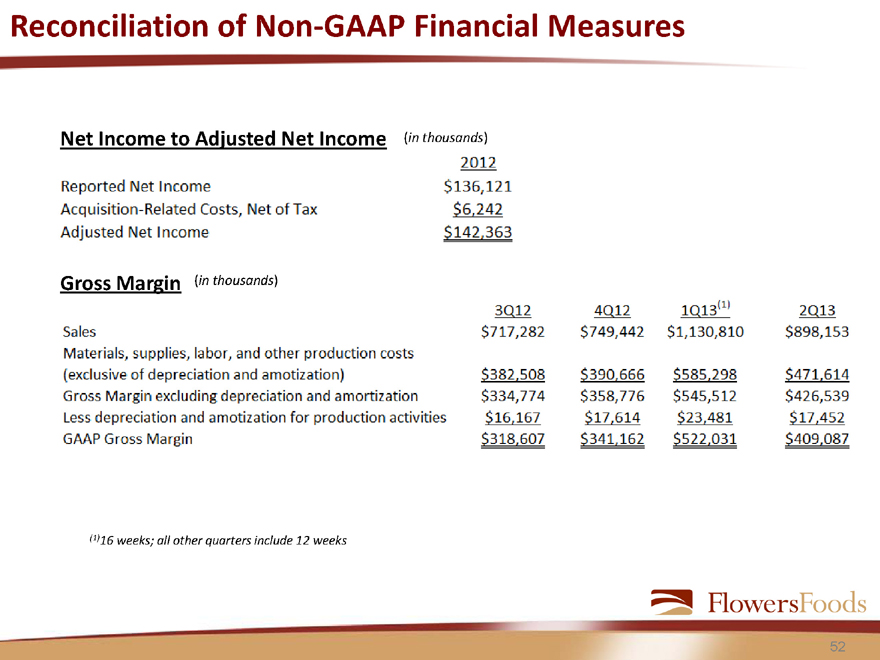

Reconciliation of Non-GAAP Financial Measures

Net Income to Adjusted Net Income (in thousands)

2012

Reported Net Income $136,121

Acquisition-Related Costs, Net of Tax $6,242

Adjusted Net Income $142,363

Gross Margin (in thousands)

3Q12 4Q12 1Q13(1) 2Q13

Sales $717,282 $749,442 $1,130,810 $898,153

Materials, supplies, labor, and other production costs (exclusive of depreciation and amotization) $382,508 $390,666 $585,298 $471,614

Gross Margin excluding depreciation and amortization $334,774 $358,776 $545,512 $426,539

Less depreciation and amotization for production activities $16,167 $17,614 $23,481 $17,452

GAAP Gross Margin $318,607 $341,162 $522,031 $409,087

(1)16 weeks; all other quarters include 12 weeks

52

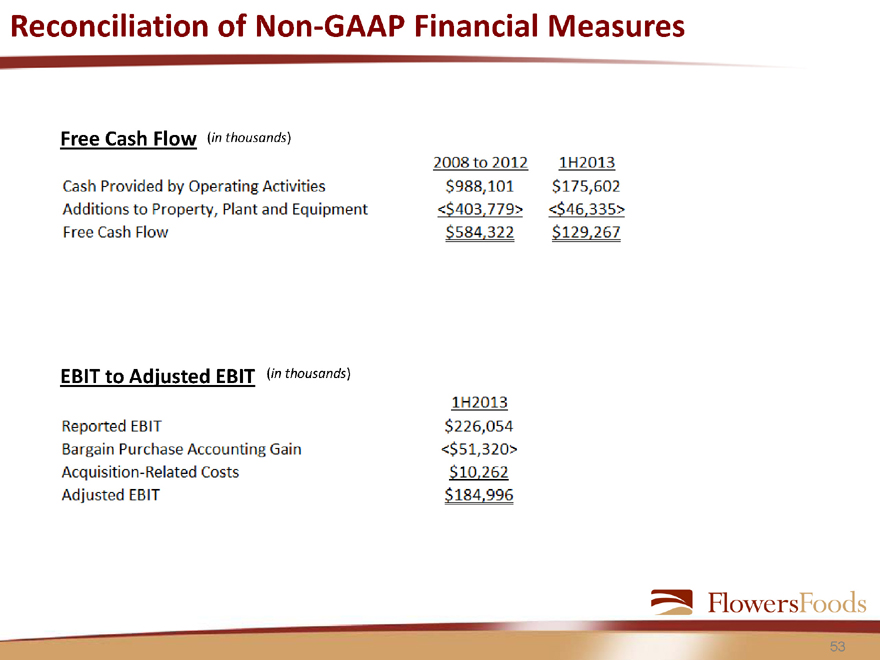

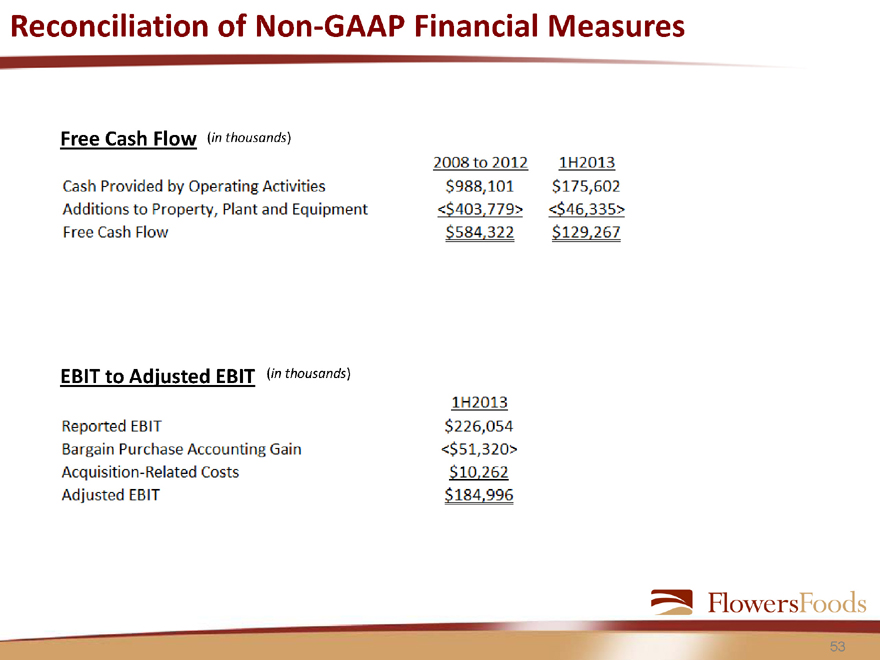

Reconciliation of Non-GAAP Financial Measures

Free Cash Flow (in thousands)

2008 to 2012 1H2013

Cash Provided by Operating Activites $988,101 $175,602

Additions to Property, Plant and Equipment <$403,779> <$46,335>

Free Cash Flow $584,322 $129,267

EBIT to Adjusted EBIT (in thousands)

1H2013

Reported EBIT $226,054

Bargain Purchase Accounting Gain <$51,320>

Acquisition-Related Costs $10,262

Adjusted EBIT $184,996

53