Exhibit 5.1

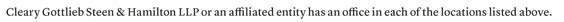

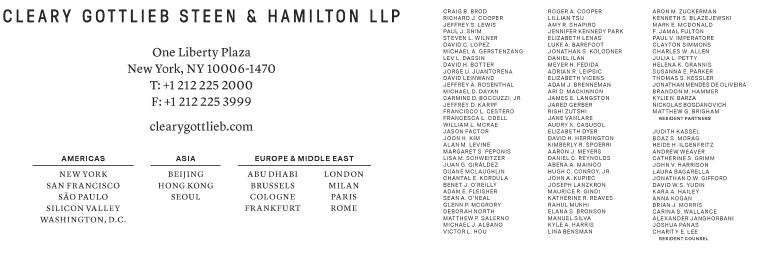

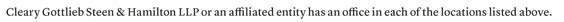

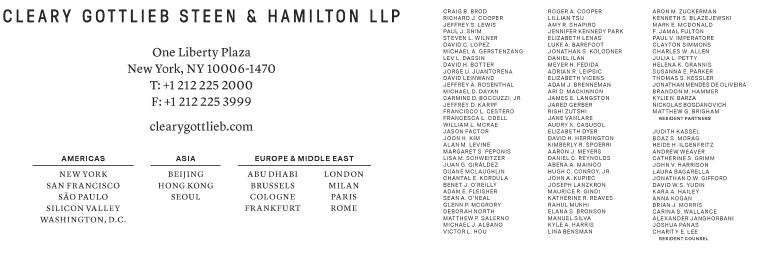

D: +1 212 225 2106

dmclaughlin@cgsh.com

February 1, 2024

América Móvil, S.A.B. de C.V.

Lago Zurich 245

Plaza Carso / Edificio Telcel

Colonia Ampliación Granada

Miguel Hidalgo

11529, Mexico City, Mexico

Ladies and Gentlemen:

We have acted as special United States counsel to América Móvil, S.A.B. de C.V. (the “Company”), a corporation (sociedad anónima bursátil de capital variable) organized under the laws of the United Mexican States, in connection with the Company’s offering pursuant to a registration statement on Form F-3 (File No. 333-259910) (the “Registration Statement”) of Ps.20,000,000,000 aggregate principal amount of its 10.300% Senior Notes due 2034 (the “Securities”), to be issued under an indenture, dated as of October 1, 2018 (the “Base Indenture”), among the Company, Citibank, N.A., as trustee (the “Trustee”), registrar and transfer agent, and Citibank, N.A., London Branch, as paying agent (the “Paying Agent”), as supplemented by the Seventh Supplemental Indenture, dated as of February 1, 2024 the (the “Seventh Supplemental Indenture”) among the Company, the Trustee and the Paying Agent.

In arriving at the opinion expressed below, we have reviewed the Registration Statement, including the Base Indenture, which is filed as an exhibit thereto, and we have reviewed the Seventh Supplemental Indenture and the global notes representing the Securities, as executed by the Company and authenticated by the Trustee. In addition, we have reviewed the originals or copies certified or otherwise identified to our satisfaction of all such corporate records of the Company and such other documents, and we have made such investigations of law, as we have deemed appropriate as a basis for the opinion expressed below.