- MPX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Marine Products (MPX) DEF 14ADefinitive proxy

Filed: 25 Mar 03, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

MARINE PRODUCTS CORPORATION | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

MARINE PRODUCTS CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

2170 Piedmont Road, NE, Atlanta, Georgia 30324

TO THE HOLDERS OF THE COMMON STOCK:

PLEASE TAKE NOTICE that the 2003 Annual Meeting of Stockholders of Marine Products Corporation, a Delaware corporation ("Marine Products" or "the Company"), will be held at the Company's offices located at 2170 Piedmont Road, NE, Atlanta, Georgia, on Tuesday, April 22, 2003, at 1:00 P.M., or any adjournment thereof, for the following purposes:

The Proxy Statement dated March 17, 2003 is attached.

The Board of Directors has fixed the close of business on February 24, 2003 as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting.

Stockholders who do not expect to be present at the meeting are urged to complete, date, sign and return the enclosed proxy. No postage is required if the enclosed envelope is mailed in the United States.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Linda H. Graham

Linda H. Graham, Secretary

Atlanta, Georgia

March 17, 2003

This Proxy Statement and a form of proxy were first mailed to stockholders on or about March 21, 2003. The following information concerning the enclosed proxy and the matters to be acted upon at the Annual Meeting of Stockholders to be held on April 22, 2003, is submitted by the Company to the stockholders for their information.

SOLICITATION OF AND POWER TO REVOKE PROXY

A form of proxy is enclosed. Each proxy submitted will be voted as directed, but if not otherwise specified, proxies solicited by the Board of Directors of the Company will be voted in favor of the candidates for election to the Board of Directors.

A stockholder executing and delivering a proxy has power to revoke the same and the authority thereby given at any time prior to the exercise of such authority if he so elects, by contacting either proxyholder at 2170 Piedmont Road, NE, Atlanta, Georgia, 30324.

The outstanding capital stock of the Company on February 24, 2003 consisted of 17,110,603 shares of Common Stock, par value $0.10 per share. Holders of Common Stock are entitled to one vote (non-cumulative) for each share of such stock registered in their respective names at the close of business on February 24, 2003, the record date for determining stockholders entitled to notice of and to vote at the meeting or any adjournment thereof.

A majority of the outstanding shares will constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business. In accordance with General Corporation Law of the state of Delaware, the election of the nominees named herein as Directors will require the affirmative vote of a plurality of the votes cast by the shares of Company Common Stock entitled to vote in the election provided that a quorum is present at the Annual Meeting. In the case of a plurality vote requirement (as in the election of directors), where no particular percentage vote is required, the outcome is solely a matter of comparing the number of votes cast for each nominee, and hence only votes for director nominees (and not abstentions or broker non-votes) are relevant to the outcome.

The executives named in the Summary Compensation Table, all of the directors of the Company and the name and address of each stockholder who owned beneficially five percent (5%) or more of the shares of Common Stock of the Company on February 24, 2003, together with the number of shares by such persons and the percentage of outstanding shares that ownership represents, and information as

2

to Common Stock ownership of the executive officers and directors of the Company as a group (according to information received by the Company), is set out below:

| Name and Address of Beneficial Owner | Amount Beneficially Owned (1) | Percent of Outstanding Shares | ||

|---|---|---|---|---|

| FMR Corporation 82 Devonshire Street Boston, Massachusetts | 1,587,940 | (2) | 9.3 | |

| LOR, Inc. 2170 Piedmont Road Atlanta, GA 30324 | 10,068,569 | (3) | 58.8 | |

| R. Randall Rollins Chairman of the Board 2170 Piedmont Road, NE Atlanta, Georgia | 10,467,076 | (4) | 59.8 | |

| Gary W. Rollins President and Chief Executive Officer, Rollins, Inc. 2170 Piedmont Road, NE Atlanta, Georgia | 10,522,314 | (5) | 60.1 | |

| Henry B. Tippie Chairman of the Board and Chief Executive Officer, Tippie Services, Inc. P.O. Box 26557 Austin, Texas 78755 | 179,376 | (6) | 1.0 | |

| Richard A. Hubbell President and Chief Executive Officer 2170 Piedmont Road, NE Atlanta, Georgia | 457,352 | (7) | 2.6 | |

| James A. Lane, Jr. Executive Vice President and President, Chaparral Boats, Inc. 2170 Piedmont Road, NE Atlanta, Georgia | 97,145 | (8) | ** | |

| Wilton Looney Honorary Chairman of the Board, Genuine Parts Company 2170 Piedmont Road, NE Atlanta, Georgia | 720 | ** | ||

| James B. Williams Chairman of the Executive Committee, SunTrust Banks, Inc. 2170 Piedmont Road, NE Atlanta, Georgia | 24,000 | ** | ||

| Linda H. Graham Vice President and Secretary 2170 Piedmont Road, NE Atlanta, Georgia | 81,916 | (9) | ** | |

| All Directors and Executive Officers as a group (9 persons) | 11,701,379 | (10) | 66.8 |

3

At the Annual Meeting, Mr. Richard A. Hubbell and Ms. Linda H. Graham will be nominated to serve as Class II directors. The directors in each class serve for a three year term. The director nominees will serve in their respective class until their successors are elected and qualified. Six other individuals serve as directors but are not standing for re-election because their terms as directors extend past this Annual Meeting pursuant to provisions of the Company's Bylaws that provide for the election of directors for staggered terms, with each director serving a three-year term. Unless authority is withheld, the proxy holders will vote for the election of each nominee named below as directors. Although management does not contemplate the possibility, in the event any nominee is not a candidate or is unable to serve as a director at the time of the election, unless authority is withheld, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill such vacancy.

The name and age of each of the two director nominees, his or her principal occupation, together with the number of shares of Common Stock beneficially owned, directly or indirectly, by him or her and the percentage of outstanding shares that ownership represents, all as of the close of business on February 24, 2003 (according to information received by the Company), are set out below. Similar information is also provided for those directors whose terms expire in future years. Each director was originally elected as a director shortly after incorporation of the Company in February, 2001.

| Names of Nominees | Principal Occupation (1) | Age | Common Stock (2) | Percentage of Outstanding Shares | ||||

|---|---|---|---|---|---|---|---|---|

| Class II (New Term Expires 2006) | ||||||||

| Richard A. Hubbell | President and Chief Executive Officer of the Company since February 2001; President and Chief Operating Officer of RPC, Inc. | 58 | 457,352 | (3) | 2.6 | |||

| Linda H. Graham | Vice President and Secretary of the Company since February 2001; Vice President and Secretary of RPC, Inc. | 66 | 81,916 | (4) | * | |||

4

| | Principal Occupation (1) | Age | Common Stock (2) | Percentage of Outstanding Shares | ||||

|---|---|---|---|---|---|---|---|---|

| Names of Directors Whose Terms Have Not Expired | ||||||||

| Class III (Term Expires 2004) | ||||||||

| Wilton Looney | Honorary Chairman of the Board of Genuine Parts Company (automotive parts distributor). | 83 | 720 | * | ||||

| Gary W. Rollins(5) | President and Chief Executive Officer of Rollins, Inc. (consumer services) since 2001; President and Chief Operating Officer of Rollins, Inc. prior to 2001. | 58 | 10,522,314 | (6) | 60.1 | |||

| James A. Lane, Jr. | Executive Vice President of the Company since February 2001, and President of Chaparral Boats, Inc. | 60 | 97,145 | (7) | * | |||

| Class I (New Term Expires 2005) | ||||||||

| R. Randall Rollins(5) | Chairman of the Board of the Company since February 2001; Chairman of the Board and Chief Executive Officer of RPC, Inc.; Chairman of the Board of Rollins, Inc. (consumer services) since October 1991. | 71 | 10,467,076 | (8) | 59.8 | |||

| Henry B. Tippie | Chairman of the Board and Chief Executive Officer of Tippie Services, Inc. (management services). Chairman of the Board of Dover Downs Gaming and Entertainment, Inc. (operator of multi-purpose gaming and entertainment complex) since January 2002; and Chairman of the Board of Dover Motorsports, Inc. (operator of motorsports tracks). | 76 | 179,376 | (9) | 1.0 | |||

| James B. Williams | Chairman of the Executive Committee, SunTrust Banks, Inc. (bank holding company) since 1998; and Chairman of the Board and Chief Executive Officer of SunTrust Banks, Inc. until 1998. | 69 | 24,000 | * | ||||

5

BOARD OF DIRECTORS COMPENSATION, COMMITTEES AND MEETINGS

During 2002, non-employee Directors received from the Company $1,000 for each meeting of the Board of Directors or committee they attended, plus $10,000 per year.

The Audit Committee of the Board of Directors of the Company consists of Henry B. Tippie, Chairman, Wilton Looney and James B. Williams. The Audit Committee held six meetings during the fiscal year ended December 31, 2002. Its functions are described under the caption, "Report of the Audit Committee." The Compensation Committee of the Board of Directors of the Company consists of Henry B. Tippie, Chairman, Wilton Looney, and James B. Williams. It held one meeting during the fiscal year ended December 31, 2002. The function of the Compensation Committee is to review the base salary and cash based incentive compensation of R. Randall Rollins, Chairman, and Richard A. Hubbell, President and Chief Executive Officer, and to recommend to the Board any changes to insure continued effectiveness, and to administer the compensation of James A. Lane, Jr. in accordance with the Performance-Based Compensation Agreement. The Compensation Committee also administers the Marine Products 2002 Employee Stock Incentive Plan. The function of the Executive Committee is to take all permitted actions of the Board in its stead. The Board of Directors met four times during the fiscal year ended December 31, 2002. No director attended fewer than 75 percent of the Board meetings and meetings of committees on which he or she served during 2002.

During 2002, the Board passed resolutions authorizing the formation of the Diversity Committee and the Nominating and Governance Committee. The Diversity Committee's function is to monitor compliance with applicable non-discrimination laws. The Nominating and Governance Committee's function is to recommend to the Board of Directors nominees for election as director and to insure that the Company's corporate governance rules are in compliance with the American Stock Exchange and Securities and Exchange Commission rules. Both of these committees consist of Henry B. Tippie, Chairman, Wilton Looney, and James B. Williams. Neither of these committees met during the fiscal year ended December 31, 2002.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the directors named above who serve on the Company's Compensation Committee are or have ever been employees of the Company. R. Randall Rollins, Gary W. Rollins and Richard A. Hubbell serve on the Company's Executive Committee. R. Randall Rollins and Richard A. Hubbell are employees of the Company. R. Randall Rollins and Gary W. Rollins also serve on the Executive Committee of Rollins, Inc. and RPC, Inc. These committees make certain decisions with respect to the compensation of the executive officers of those companies. Except as otherwise noted, no executive officer of the Company serves on a Compensation Committee of another company. R. Randall Rollins, an executive of the Company, serves on the Board of Directors of both SunTrust Banks, Inc. and SunTrust Banks of Georgia, a subsidiary of SunTrust Banks, Inc. Mr. Williams is the Chairman of the Executive Committee, SunTrust Banks, Inc. Mr. Rollins is not on the Compensation Committee of SunTrust Banks, Inc., or SunTrust Banks of Georgia. Marine Products maintains a significant banking relationship with SunTrust Bank of Georgia. All banking services provided to the Company by SunTrust Banks of Georgia are priced at market-competitive rates. Mr. Rollins serves on the Board of Directors and is a member of the Compensation Committee of Dover Downs Gaming and Entertainment, Inc. and Dover Motorsports, Inc.; Mr. Tippie serves as Chairman of both of these companies.

Shown below is information concerning the annual and long-term compensation for services in all capacities to the Company for the calendar years ended December 31, 2002, 2001 and 2000 of those persons who were at December 31, 2002 (i) the Chief Executive Officer and (ii) the most highly

6

compensated executive officers of the Company whose total annual compensation exceeded $100,000 (the "Named Executives").

| | | | | Long-Term Compensation Awards | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | ||||||||||||

| | | Restricted Stock Awards ($)(2) | Securities Underlying Options (#)(2) | | |||||||||||

| Name and Principal Position(1) | | All Other Compensation(3) | |||||||||||||

| Year | Salary | Bonus | |||||||||||||

| R. Randall Rollins Chairman of the Board | 2002 2001 | $ | 150,000 125,000 | $ | 100,000 0 | 0 | 0 | $ | 0 | ||||||

| Richard A. Hubbell President and Chief Executive Officer | 2002 2001 | 200,000 158,333 | 100,000 0 | 0 0 | 100,000 30,000 | 0 0 | |||||||||

| James A. Lane, Jr. Executive Vice President, and President, Chaparral Boats, Inc. | 2002 2001 2000 | 67,841 67,841 67,841 | 2,678,914 2,048,715 3,259,448 | (4) | 0 0 0 | 100,000 0 0 | 21,350 2,040 2,040 | ||||||||

7

OPTION/SAR GRANTS IN FISCAL YEAR 2002

The following table sets forth stock options granted in the fiscal year ending December 31, 2002 to each of the Company's Named Executives. Employees of the Company and its subsidiaries are eligible for stock option grants based on individual performance. The table sets forth the hypothetical gains that would exist for the options at the end of their ten-year term, assuming compound rates of stock appreciation of five percent and ten percent. The actual future value of the option will depend on the market value of the Company's Common Stock. All option exercise prices are based on the market price on the grant date.

| | Individual Grants(1) | | | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Potential Realizable Value At Annual Rates Of Stock Price Appreciation For Option Term (2) | |||||||||||||

| | | Percent Of Total Options Granted To Employees In Fiscal Year | | | |||||||||||

| | Number Of Securities Underlying Options Granted | | | ||||||||||||

| Name | Exercise Or Base Price | Expiration Date | |||||||||||||

| 5% | 10% | ||||||||||||||

| R. Randall Rollins | 0 | 0 | $ | 0 | 0 | $ | 0 | $ | 0 | ||||||

Richard A. Hubbell | 100,000 | (3) | 25.7 | 6.01 | 1/12/12 | 377,966 | 957,389 | ||||||||

James A. Lane, Jr. | 100,000 | (4) | 25.7 | 6.01 | 1/12/12 | 377,966 | 957,389 | ||||||||

AGGREGATED OPTION/SAR EXERCISES IN FISCAL YEAR 2002 AND YEAR-END

OPTION/SAR VALUES

| Name | Shares Acquired on Exercise | Value Realized | Number of Securities Underlying Unexercised Options/SARs at FY-End(#) Exercisable/Unexercisable | Value of Unexercised In-the-Money Options/SARs At FY-End($)(1) Exercisable/Unexercisable | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| R. Randall Rollins | 0 | $ | 0 | 0/0 | $ | 0/0 | ||||

| Richard A. Hubbell | 0 | 0 | 297,580/69,895 | 2,463,156/533,649 | ||||||

| James A. Lane, Jr. | 0 | 0 | 0/100,000 | 0/384,000 | ||||||

8

REPORTS OF THE AUDIT, COMPENSATION AND EXECUTIVE COMMITTEES AND PERFORMANCE GRAPH

Notwithstanding anything to the contrary set forth in any of the Company's filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate other Company filings, including this Proxy Statement, in whole or in part, the following Report of the Audit Committee, Report of the Compensation Committee and Executive Committee on Executive Compensation and the Performance Graph included herein shall not be incorporated by reference into any such filings.

The Audit Committee of the Board of Directors is established pursuant to the Company's Bylaws and the Audit Committee Charter, as amended and adopted by the Board of Directors on January 28, 2003. A copy of the Audit Committee Charter is attached to this Proxy Statement as Appendix A.

Management is responsible for the Company's internal controls and the financial reporting process. The Company's independent public accountants are responsible for performing an independent audit of the Company's consolidated financial statements in accordance with auditing standards generally accepted in the United States of America and for issuing a report thereon. The Audit Committee's responsibility is generally to monitor and oversee these processes, as described in the Audit Committee Charter. It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles; that is the responsibility of management and the Company's independent public accountants.

Each member of the Audit Committee is independent in the judgment of the Company's Board of Directors and as required by the listing standards of the American Stock Exchange.

In fulfilling its oversight responsibilities with respect to the year ended December 31, 2002, the Audit Committee:

Based upon the review and discussions referred to above, the Committee recommended to the Board of Directors that the audited consolidated financial statements of the Company and subsidiaries as of December 31, 2002 and 2001 and for the three years then ended, be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2002 and for filing with the Securities and Exchange Commission.

In giving its recommendation to the Board of Directors, the Audit Committee has relied on (i) management's representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of

9

America and (ii) the report of the Company's independent public accountants with respect to such financial statements.

Submitted by the Audit Committee of the Board of Directors.

AUDIT COMMITTEE

Henry B. Tippie, Chairman

Wilton Looney

James B. Williams

REPORT OF THE COMPENSATION COMMITTEE AND EXECUTIVE COMMITTEE ON EXECUTIVE COMPENSATION

Overview

During the fiscal year 2002, the members of the Compensation Committee of the Board of Directors held primary responsibility for determining the compensation for R. Randall Rollins, Chairman of the Board, and Richard A. Hubbell, President and Chief Executive Officer, for administering the compensation of James A. Lane, Jr. in accordance with the Performance-Based Compensation Agreement, and for determining the stock based incentives for all the executive officers. The Compensation Committee is comprised of outside directors who are not eligible to participate in the Company's compensation plans.

The Company is engaged in a highly competitive industry. The actions of the executive officers have a profound impact on the short-term and long-term profitability of the Company; therefore, the design of the executive officer compensation package is very important. In order to retain key employees, the Company has an executive compensation package that is driven by an increase in shareholder value, the overall performance of the Company, and the individual performance of the executive. The measures of the Company's performance include net sales and net income.

Pursuant to the above compensation philosophy, the three main components of the executive compensation package are base salary, cash based incentive plans, and stock based incentive plans.

In connection with the spin-off of the Company in February 2001 from RPC, Inc., initial compensation packages were established for the Chairman of the Board by the Compensation Committee and for the Chief Executive Officer by the Executive Committee based on evaluation of the responsibilities of these executive officers. The Committees considered, among other things, that the Chairman of the Board and the Chief Executive Officer are employees of both the Company and RPC, Inc. and are paid compensation directly from the Company and RPC, Inc. The Chief Executive Officer did not consult with the Executive Committee when his compensation was discussed or participate in the vote with respect to his compensation. The Compensation Committee determined in connection with the spin-off that no changes to the compensation package of Mr. Lane were necessary.

Base Salary

The factors subjectively used in determining base salary include the recent profit performance of the Company, the magnitude of responsibilities, the scope of the position, individual performance, and the salary received by peers in similar positions in the same geographic area. These factors are not used in any specific formula or weighting. The salaries of the Named Executives are reviewed annually. There were no changes in the base salary during 2002.

Cash Based Incentive Plans

The annual cash based incentive compensation packages for the executive officers, other than Mr. Lane, are based upon performance objectives for the ensuing fiscal year. The executive officers

10

participate in a variety of individualized performance bonus plans designed to encourage achievement of short-term objectives. These plans all have payouts subjectively based on net income, budget objectives, and other individual specific performance objectives. The specific performance objectives relate to each executive improving the contribution of his functional area of responsibility to further enhance the earnings of the Company.

One of the Named Executives, James A. Lane, Jr., has an employment agreement with the Company. Under this agreement, Mr. Lane receives an annual cash incentive bonus of 10 percent of pretax profit, as defined, of Chaparral Boats, Inc. This incentive payment was approximately 97 percent of the total cash compensation paid to this executive in 2002. During 2002, Mr. Lane received in excess of $1 million in aggregate compensation (the maximum amount for which an employer may claim a compensation deduction, pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, unless certain performance related compensation exemptions are met, during any one fiscal year.) The Company obtained stockholder approval of this agreement at the April 23, 2002 Stockholders' meeting.

Stock Based Incentive Plans

Awards under the Company's 2002 Employee Stock Incentive Plan are purely discretionary, and are not based on any specific formula and may or may not be granted in any given fiscal year. Grants are made under the Plan, and the Plan is administered, by non-employee directors within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. When considering the grant of stock options, the Compensation Committee gives consideration to the overall performance of the Company and the performance of individual employees. During the fiscal year 2002, two of the Named Executives were granted 100,000 stock options each. In general, these grants were based upon the scope of the position and performance of this individual.

Except for Mr. Lane, the Compensation and Executive Committees currently believe that no other employees' total compensation, including option grants under the Company's 2001 Employee Stock Incentive Plan, will materially exceed the $1 million deductibility limit of Section 162(m) of the Internal Revenue Code of 1986, as amended. Therefore the Committees have determined that the Company will not change its various compensation plans, or otherwise meet the requirements of such exemption, at this time in order to exempt other types of compensation under section 162(m).

11

Chief Executive Officer Compensation

The Chief Executive Officer's compensation is determined by the Compensation Committee. For fiscal year 2002, the cash compensation of Richard A. Hubbell, President and Chief Executive Officer, was $300,000, $100,000 of which was cash based incentive compensation. The Chief Executive Officer's compensation is based upon the long-term growth in net income, stockholder value improvements and the Chief Executive Officer's individual performance. The decision of the Committee is subjective and is not based upon any specific formula or guidelines. On January 22, 2002, the Chief Executive Officer was granted a total of 100,000 stock options priced at $6.01 per share which represented the fair market value of the common stock on that date. No member of the Compensation Committee nor any non-employee member of the Executive Committee participates in any Company incentive program.

COMPENSATION COMMITTEE

Henry B. Tippie, Chairman

Wilton Looney

James B. Williams

EXECUTIVE COMMITTEE

R. Randall Rollins

Gary W. Rollins

Richard A. Hubbell

12

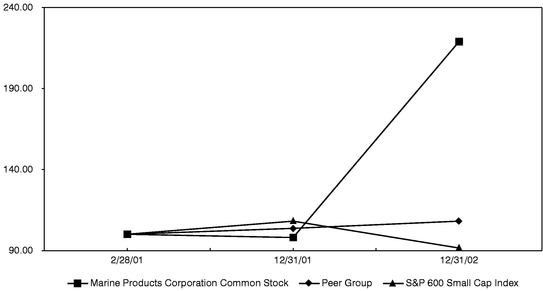

As part of the executive compensation information presented in this Proxy Statement, the Securities and Exchange Commission requires a 5-year comparison of the cumulative total stockholder return based on the performance of the stock of the Company, assuming dividend reinvestment, as compared with both a broad equity market index and an industry or peer group index. However, if the Company's stock has traded for a shorter period of time, the period covered by the comparison may correspond to that time period. The indices included in the following graph are the S & P 600 Small Cap Index and a peer group which includes companies that are considered peers of the Company. The companies included in the peer group have been weighted according to each respective issuer's stock market capitalization at the beginning of each year. The companies are Brunswick Corporation, MarineMax, Inc., and Travis Boats and Motors, Inc. The graph below assumes the value of $100.00 invested on February 28, 2001, the date of the Company's spin-off from RPC, Inc.

COMPARISON OF CUMULATIVE TOTAL RETURN *

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Effective February 28, 2001, RPC, Inc. began providing certain administrative services to the Company. The service agreements between RPC and the Company provide for the provision of services on a cost reimbursement basis and are terminable on six months' notice. The services covered by these agreements include administration of certain employee benefit programs and other administrative services. Charges from RPC, Inc. (or from corporations that are subsidiaries of RPC, Inc.) for such services aggregated approximately $454,000 in 2002. During 2002, the Company paid $332,000 to a division of RPC for the purchase, installation and service of overhead cranes. The Company believes the charges paid by its subsidiary are at least as favorable as the charges that would have been incurred for similar services from unaffiliated third parties.

13

Effective February 28, 2001, the Company became an adopting employer of the RPC, Inc. Retirement Income Plan, a trusteed defined benefit pension plan, that provides monthly benefits upon retirement at age 65 to eligible employees. In the first quarter of 2002, the Boards of Directors of the Company and RPC, Inc. joined in approving resolutions to cease all future retirement benefit accruals under the Retirement Income Plan effective March 31, 2002. Retirement income benefits are based on the average of the employee's compensation from the Company and RPC for the five consecutive complete calendar years of highest compensation during the last ten consecutive complete calendar years ("final average compensation") immediately preceding March 31, 2002. Accordingly the pension plan table has not been presented under this section. Mr. Lane has one year of credited service under the Plan following the spin-off of the Company from RPC, and 13 years of credited service prior to the spin-off. The estimated annual benefit payable at the later of retirement or age 65 for Mr. Lane is $48,400. The Plan also provides reduced early retirement benefits under certain conditions. In accordance with the Internal Revenue Code ("Code"), the maximum annual benefit that could be payable to a Retirement Income Plan beneficiary in 2002 was $160,000. In accordance with the Code (as amended by the Economic Growth and Tax Relief Reconciliation Act of 2001), the maximum compensation recognized by the Retirement Income Plan was $200,000 in 2002. Retirement benefits accrued at the end of any calendar year will not be reduced by any subsequent changes in the maximum compensation limit.

Effective February 28, 2001, the Company began participating in a defined contribution 401(k) Plan sponsored by RPC, Inc., which is available to substantially all employees with more than six months of service. The Company makes matching contributions of fifty cents ($0.50) for each dollar ($1.00) of a participant's contribution to the 401(k) Plan, that does not exceed six percent of his or her annual compensation. The only form of benefit payment under the 401(k) Plan is a single lump-sum payment equal to the vested balance in the participant's account on the date the distribution is processed. Under the 401(k) Plan, the full amount of a participant's vested accrued benefit is payable upon his termination of employment, retirement, total and permanent disability, or death. Also under the 401(k) Plan, the pre-tax account is payable upon attainment of age 591/2 or in the event of certain specified instances of financial hardship. Amounts contributed by the Company to the accounts of the Named Executives for 2002 under this plan are reported in the "All Other Compensation" column of the Summary Compensation Table on page 7.

INDEPENDENT PUBLIC ACCOUNTANTS

The independent public accounting firm of Arthur Andersen LLP ("Andersen") was initially engaged as the Company's auditors for the fiscal year ended December 31, 2002. Effective subsequent to the filing of the Company's Quarterly report on Form 10-Q for the quarter ended March 31, 2002, the Board of Directors, upon recommendation of the Audit Committee, decided on July 23, 2002 to terminate Andersen as the Company's independent public accountants, and to appoint Ernst &Young LLP ("Ernst & Young") as its independent public accountants for the year ended December 31, 2002. Representatives of Ernst & Young are expected to be present at the Annual Meeting and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions. No representative of Andersen is expected to attend the meeting.

During the Company's fiscal years ended December 31, 2001 and 2000, and the subsequent interim period through July 23, 2002, there were no disagreements between the Company and Andersen on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to Andersen's satisfaction would have caused them to make reference to the subject matter of the disagreement in connection with their reports.

14

None of the reportable events described under Item 304(a)(1)(v) of Regulation S-K occurred within the Company's fiscal years ended December 31, 2001 and 2000 (during which the Company was operated as a part of RPC, Inc.) or during any subsequent interim period through July 23, 2002. The Company did not consult Ernst & Young on the application of accounting principles to a specified transaction, or the type of audit opinion that might be rendered on its financial statements during the fiscal years ended December 31, 2001 and 2000 or any subsequent interim period.

The audit reports of Andersen on the consolidated financial statements of the Company and subsidiaries as of and for the two fiscal years ended December 31, 2001 and 2000 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles. The Company filed a Report on Form 8-K with the SEC on July 24, 2002 regarding the change in accountants.

The aggregate fees billed by Andersen and Ernst & Young for the year ended December 31, 2002 were as follows:

| | Arthur Andersen LLP | Ernst & Young LLP | ||||

|---|---|---|---|---|---|---|

| Audit and quarterly reviews | $ | 4,000 | $ | 65,000 | ||

| All other services | $ | 25,000 | $ | 7,000 | ||

Andersen and Ernst & Young did not provide any services related to financial information systems design and implementation during 2002. All other services include tax planning and preparation of tax returns of the Company.

For the year ended December 31, 2002, the Company's Audit Committee has considered and determined that the provision of non-audit services is compatible with maintaining auditor independence.

As is its policy, upon the recommendation of the Audit Committee, the Board of Directors shall select a firm of independent public accountants for fiscal year 2003.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The Company has completed a review of Forms 3, 4 and 5 and amendments thereto furnished to the Company by all Directors and Officers subject to the provisions of Section 16 of the Securities Exchange Act of 1934, as amended. In addition, the Company has a written representation from all Directors, Officers and greater than 10 percent stockholders from whom no Form 5 was received, indicating that no Form 5 filing was required. Based solely on this review, the Company believes that filing requirements of such persons under Section 16 for the fiscal year ended December 31, 2002 have been satisfied.

Appropriate proposals of stockholders intended to be presented at the Company's 2004 Annual Meeting of Stockholders pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), must be received by the Company by December 24, 2003 for inclusion in its Proxy Statement and form of proxy relating to that meeting. With respect to the Company's annual meeting of the stockholders to be held in 2004, all stockholder proposals submitted outside of the stockholder proposal rules contained in Rule 14a-8 promulgated under the Exchange Act must be received by the Company by March 8, 2004 in order to be considered timely. With regard to such stockholder proposals, if the date of the next annual meeting of stockholders is advanced or delayed by more than 30 calendar days from April 22, 2004, the Company will, in a timely manner, inform stockholders of the change and the date by which proposals must be received.

15

Marine Products will bear the cost of soliciting proxies. Upon request, we will reimburse brokers, dealers and banks, or their nominees, for reasonable expenses incurred in forwarding copies of the proxy material to their beneficial shareholders of record. Solicitation of proxies will be made principally by mail. Proxies also may be solicited in person or by telephone, facsimile or other means by our directors, officers and regular employees. These individuals will receive no additional compensation for these services. The Company has retained Georgeson Shareholder Communications, Inc. to conduct a broker search and to send proxies by mail for an estimated fee of $4,500 plus shipping expenses.

The Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2002 is being mailed to stockholders with this proxy statement.

Management knows of no business other than the matters set forth herein that will be presented at the Annual Meeting. In as much as matters not known at this time may come before the Annual Meeting, the enclosed proxy confers discretionary authority with respect to such matters as may properly come before the Annual Meeting; and it is the intention of the persons named in the proxy to vote in accordance with their best judgment on such matters.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Linda H. Graham

Linda H. Graham, Secretary

Atlanta, Georgia

March 17, 2003

16

MARINE PRODUCTS CORPORATION

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

PURPOSE

The Audit Committee (the "Committee") is appointed by the Board of Directors (the "Board") to assist the Board in fulfilling its oversight responsibilities. The Committee's primary purpose is to monitor the integrity of the Company's financial reporting process, including (by overseeing the financial reports and other financial information provided by the Company to any governmental or regulatory body, the public or other users thereof) the Company's systems of internal accounting and financial controls, the performance of the Company's internal audit function, the independent auditor's qualifications and independence, the Company's compliance with ethics policies and legal and regulatory requirements statements, and the annual independent audit of the Company's financial statements. The Committee will monitor the independence, performance, and qualifications of the Company's independent auditors.

In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company. The Committee is authorized to retain outside counsel, auditors or other experts and professionals for this purpose. The Board and the Committee are in place to represent the Company's shareholders; accordingly, the outside auditor is ultimately accountable to the Board and the Committee.

MEMBERSHIP

The Committee shall be comprised of not less than three members of the Board, and the Committee's composition shall meet all requirements of the Audit Committee policy of the American Stock Exchange.

Accordingly, all of the members must be directors:

KEY RESPONSIBILITIES

The Committee's primary responsibility is to oversee the Company's financial reporting process on behalf of the Board and report results of their activities to the Board. While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for the preparation, presentation, and integrity of the Company's financial statements and for the appropriateness of the accounting principles and reporting policies that are used by the Company as well as the Company's internal controls. The independent auditors are responsible for performing an independent audit of the Company's financial statements in accordance with auditing standards generally accepted in the United States and for issuing a report hereon.

A-1

The Committee, in carrying out its responsibilities, believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances. The Committee should take appropriate actions to set the overall corporate "tone" for quality financial reporting, sound business risk practices, and ethical behavior. The following shall be the principal duties and responsibilities of the Committee. These functions are set forth as a guide with the understanding that the Committee may diverge from this guide as appropriate under the circumstances.

The Committee shall be directly responsible for the appointment and termination (subject, if applicable, to shareholder ratification), compensation, and oversight of the work of the independent auditors, including resolution of disagreements between management and the auditor regarding financial reporting. The Committee shall pre-approve all audit and non-audit services provided by the independent auditors and shall not engage the independent auditors to perform the specific non-audit services proscribed by law or regulation. The Committee may delegate pre-approval authority to a member of the Committee. The decisions of any Committee member to whom pre-approval authority is delegated must be presented to the full Committee at its next scheduled meeting.

At least annually, the Committee shall obtain and review a report by the independent auditors describing:

In addition, the Committee shall set clear hiring policies for employees or former employees of the independent auditors that meet the SEC regulations and the American Stock Exchange listing standards.

The Committee shall discuss with the internal auditors and the independent auditors the overall scope and plans for their respective audits, including the adequacy of staffing and compensation. Also, the Committee shall discuss with management, the internal auditors, and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Company's policies and procedures to assess, monitor, and manage business risk, and legal and ethical compliance programs (e.g., Company's Code of Conduct).

The Committee shall meet separately periodically with management, the internal auditors, and the independent auditors to discuss issues and concerns warranting committee attention. The Committee shall provide sufficient opportunity for the internal auditors and the independent auditors to meet privately with the members of the Committee. The Committee shall review with the independent auditor any audit problems or difficulties and management's response.

The Committee shall receive regular reports from the independent auditor on the critical policies and practices of the Company, and all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management.

The Committee shall review management's assertion on its assessment of the effectiveness of internal controls as of the end of the most recent fiscal year and the independent auditors' report on management's assertion.

The Committee shall review and discuss earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies.

A-2

The Committee shall review the interim financial statements and disclosures under Management's Discussion and Analysis of Financial Condition and Results of Operations with management and the independent auditors prior to the filing of the Company's Quarterly Report on Form 10-Q. Also, the Committee shall discuss the results of the quarterly review and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards. The chair of the Committee may represent the entire Committee for the purposes of this review.

The Committee shall review with management and the independent auditors the financial statements and disclosures under Management's Discussion and Analysis of Financial Condition and Results of Operations to be included in the Company's Annual Report on Form 10-K (or the annual report to shareholders if distributed prior to the filing of Form 10-K), including their judgment about the quality, not just the acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the Committee shall discuss the results of the annual audit and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards.

The Committee shall establish procedures for the receipt, retention, and treatment of complaints received by the issuer regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of the issuer of concerns regarding questionable accounting or auditing matters.

The Committee shall receive corporate attorneys' reports of evidence of a material violation of securities laws or breaches of fiduciary duty.

The Committee also prepares its report to be included in the Company's annual proxy statement, as required by SEC regulations.

The Committee shall perform an evaluation of its performance at least annually to determine whether it is functioning effectively.

A-3

Marine Products Corporation

Proxy Solicited by the Board of Directors of Marine Products Corporation

for Annual Meeting of Stockholders on Tuesday, April 22, 2003, 1:00 P.M.

The undersigned hereby constitutes and appoints GARY W. ROLLINS and R. RANDALL ROLLINS, and each of them, jointly and severally, proxies, with full power of substitution, to vote all shares of Common Stock which the undersigned is entitled to vote at the Annual Meeting of Stockholders to be held on April 22, 2003, at 1:00 P.M. at 2170 Piedmont Road, NE, Atlanta, Georgia, or any adjournment thereof.

The undersigned acknowledges receipt of Notice of Annual Meeting of Stockholders and Proxy Statement, each dated March 17, 2003, grants authority to said proxies, or either of them, or their substitutes, to act in the absence of others, with all the powers which the undersigned would possess if personally present at such meeting and hereby ratifies and confirms all that said proxies or their substitutes may lawfully do in the undersigned's name, place and stead. The undersigned instructs said proxies, or either of them, to vote as follows:

| 1. | o | FOR Richard A. Hubbell and Linda H. Graham, as Class II Directorsexcept as indicated below | o | ABSTAIN from voting for the election of all Class II nominees |

INSTRUCTIONS: To refrain from voting for any individual nominee, write that nominee's name in the space provided below:

(over)

MARINE PRODUCTS CORPORATION

ALL PROXIES SIGNED AND RETURNED WILL BE VOTED OR NOT VOTED IN ACCORDANCE WITH YOUR INSTRUCTIONS, BUT THOSE WITH NO CHOICE WILL BE VOTED "FOR" THE ABOVE-NAMED NOMINEES FOR DIRECTOR. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF THE COMPANY.

| PROXY Please sign below, date and return promptly. | |||||

Signature | |||||

Dated: | , 2003 | ||||

| (Signature should conform to name and title stenciled hereon. Executors, administrators, trustees, guardians and attorneys should add their title upon signing) | |||||

NO POSTAGE REQUIRED IF THIS PROXY IS RETURNED IN THE ENCLOSED ENVELOPE AND MAILED IN THE UNITED STATES.