Edison Electric Institute Financial Conference November 11‐13, 2018

Management Representatives Susan Hardwick Dave Parker Aaron Musgrave Executive Vice Director, Investor Manager, Investor President & CFO Relations Relations 2 Vectren | EEI Financial Conference | November 2018

Cautionary Statement All statements other than statements of historical fact are forward‐looking statements made in good faith by the company and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. Such statements are based on management’s beliefs, as well as assumptions made by and information currently available to management and include such words as “believe”, “anticipate”, “endeavor”, “estimate”, “expect”, “objective”, “projection”, “forecast”, “goal”, “likely”, and similar expressions intended to identify forward‐looking statements. Vectren cautions readers that the assumptions forming the basis for forward‐looking statements include many factors that are beyond Vectren’s ability to control or estimate precisely and actual results could differ materially from those contained in this document. Forward‐looking statements speak only as of the date on which our statement is made, and we assume no duty to update them. More detailed information about these factors is set forth in Vectren’s filings with the Securities and Exchange Commission, including Vectren’s 2017 annual report on Form 10‐K filed on February 21, 2018. Vectren also uses non‐GAAP measures to describe its financial results. More information can be found in the Appendix related to the use of such measures. Dave Parker –Director, Investor Relations d.parker@vectren.com 812‐491‐4135 Risks Related to the Merger Important factors that could cause actual results to differ materially from those indicated by the provided forward‐looking information include risks and uncertainties relating to: • The risk that CenterPoint or the Company may be unable to obtain governmental and regulatory approvals required for the proposed transaction, or that required governmental and regulatory approvals or agreements with other parties interested therein may delay the proposed transaction or may be subject to or impose adverse conditions or costs. • The occurrence of any event, change or other circumstances that could give rise to the termination of the proposed transaction or could otherwise cause the failure of the proposed transaction to close. • The risk that a condition to the closing of the proposed transaction or the committed financing may not be satisfied. • The outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted relating to the proposed transaction. • The receipt of an unsolicited offer from another party to acquire assets or capital stock of the Company that could interfere with the proposed transaction. • The timing to consummate the proposed transaction. • The costs incurred to consummate the proposed transaction. • The possibility that the expected cost savings, synergies or other value creation from the proposed transaction will not be realized, or will not be realized within the expected time period. • The risk that the companies may not realize fair values from properties that may be required to be sold in connection with the proposed transaction. • The credit ratings of the companies following the proposed transaction. • Disruption from the proposed transaction making it more difficult to maintain relationships with customers, employees, regulators or suppliers. • The diversion of management time and attention on the proposed transaction. 3 Vectren | EEI Financial Conference | November 2018

Cautionary Statement (Continued) Risks Related to the Company Important factors related to the Company, its affiliates, and its and their operations that could cause actual results to differ materially from those indicated by the provided forward‐looking information include risks and uncertainties relating to: Factors affecting utility operations such as unfavorable or unusual weather conditions; catastrophic weather‐related damage; unusual maintenance or repairs; unanticipated changes to coal and natural gas costs; unanticipated changes to gas transportation and storage costs, or availability due to higher demand, shortages, transportation problems or other developments; environmental or pipeline incidents; transmission or distribution incidents; unanticipated changes to electric energy supply costs, or availability due to demand, shortages, transmission problems or other developments; or electric transmission or gas pipeline system constraints. • New or proposed legislation, litigation and government regulation or other actions, such as changes in, rescission of or additions to tax laws or rates, pipeline safety regulation and environmental laws and regulations, including laws governing air emissions, carbon, waste water discharges and the handling and disposal of coal combustion residuals that could impact the continued operation, and/or cost recovery of generation plant costs and related assets. Compliance with respect to these regulations could substantially change the operation and nature of the Company’s utility operations. • Catastrophic events such as fires, earthquakes, explosions, floods, ice storms, tornadoes, terrorist acts, or physical attacks could adversely affect the Company's facilities, operations, financial condition, results of operations, and reputation. • Cyber attacks or similar occurrences may adversely affect the Company's facilities, operations, corporate reputation, financial condition, and results of operations. • Approval and timely recovery of new capital investments related to the electric generation transition plan, discussed further herein, including timely approval to build and own generation, ability to meet capacity requirements, ability to procure resources needed to build new generation at a reasonable cost, ability to appropriately estimate costs of new generation, the effects of construction delays and cost overruns, ability to fully recover the investments made in retiring portions of the current generation fleet, scarcity of resources and labor, and workforce retention, development and training. • Increased competition in the energy industry, including the effects of industry restructuring, unbundling, and other sources of energy. • Regulatory factors such as uncertainty surrounding the composition of state regulatory commissions, adverse regulatory changes, unanticipated changes in rate‐setting policies or procedures, recovery of investments and costs made under regulation, interpretation of regulatory‐related legislation by the IURC and/or PUCO and appellate courts that review decisions issued by the agencies, and the frequency and timing of rate increases. • Financial, regulatory or accounting principles or policies imposed by the Financial Accounting Standards Board; the Securities and Exchange Commission; the Federal Energy Regulatory Commission; state public utility commissions; state entities which regulate electric and natural gas transmission and distribution, natural gas gathering and processing, electric power supply; and similar entities with regulatory oversight. • Economic conditions including the effects of inflation, commodity prices, and monetary fluctuations. • Economic conditions, including increased potential for lower levels of economic activity; uncertainty regarding energy prices and the capital and commodity markets; volatile changes in the demand for natural gas, electricity, and other nonutility products and services; economic impacts of changes in business strategy on both gas and electric large customers; lower residential and commercial customer counts; variance from normal population growth and changes in customer mix; higher operating expenses; and reductions in the value of investments. • Volatile natural gas and coal commodity prices and the potential impact on customer consumption, uncollectible accounts expense, unaccounted for gas and interest expense. • Volatile oil prices and the potential impact on customer consumption and price of other fuel commodities. • Direct or indirect effects on the Company’s business, financial condition, liquidity and results of operations resulting from changes in credit ratings, changes in interest rates, and/or changes in market perceptions of the utility industry and other energy‐related industries. • The performance of projects undertaken by the Company’s nonutility businesses and the success of efforts to realize value from, invest in and develop new opportunities, including but not limited to, the Company’s Infrastructure Services, Energy Services, and remaining ProLiance Holdings assets. 4 Vectren | EEI Financial Conference | November 2018

Cautionary Statement (Continued) Risks Related to the Company (continued) • Factors affecting Infrastructure Services, including the level of success in bidding contracts; fluctuations in volume and mix of contracted work; mix of projects received under blanket contracts; unanticipated cost increases in completion of the contracted work; funding requirements associated with multiemployer pension and benefit plans; changes in legislation and regulations impacting the industries in which the customers served operate; the effects of weather; failure to properly estimate the cost to construct projects; the ability to attract and retain qualified employees in a fast growing market where skills are critical; cancellation and/or reductions in the scope of projects by customers; credit worthiness of customers; ability to obtain materials and equipment required to perform services; and changing market conditions, including changes in the market prices of oil and natural gas that would affect the demand for infrastructure construction. • Factors affecting Energy Services, including unanticipated cost increases in completion of the contracted work; changes in legislation and regulations impacting the industries in which the customers served operate; changes in economic influences impacting customers served; failure to properly estimate the cost to construct projects; risks associated with projects owned or operated; failure to appropriately design, construct, or operate projects; the ability to attract and retain qualified employees; cancellation and/or reductions in the scope of projects by customers; changes in the timing of being awarded projects; credit worthiness of customers; lower energy prices negatively impacting the economics of performance contracting business; and changing market conditions. • Employee or contractor workforce factors including changes in key executives, key business personnel, collective bargaining agreements with union employees, aging workforce issues, work stoppages, or pandemic illness. • Risks associated with material business transactions such as acquisitions and divestitures, including, without limitation, legal and regulatory delays; the related time and costs of implementing such transactions; integrating operations as part of these transactions; and possible failures to achieve expected gains, revenue growth and/or expense savings from such transactions. • Costs, fines, penalties and other effects of legal and administrative proceedings, settlements, investigations, claims, including, but not limited to, such matters involving compliance with federal and state laws and interpretations of these laws. 5 Vectren | EEI Financial Conference | November 2018

Q3 2018 Update 6 Vectren | EEI Financial Conference | November 2018

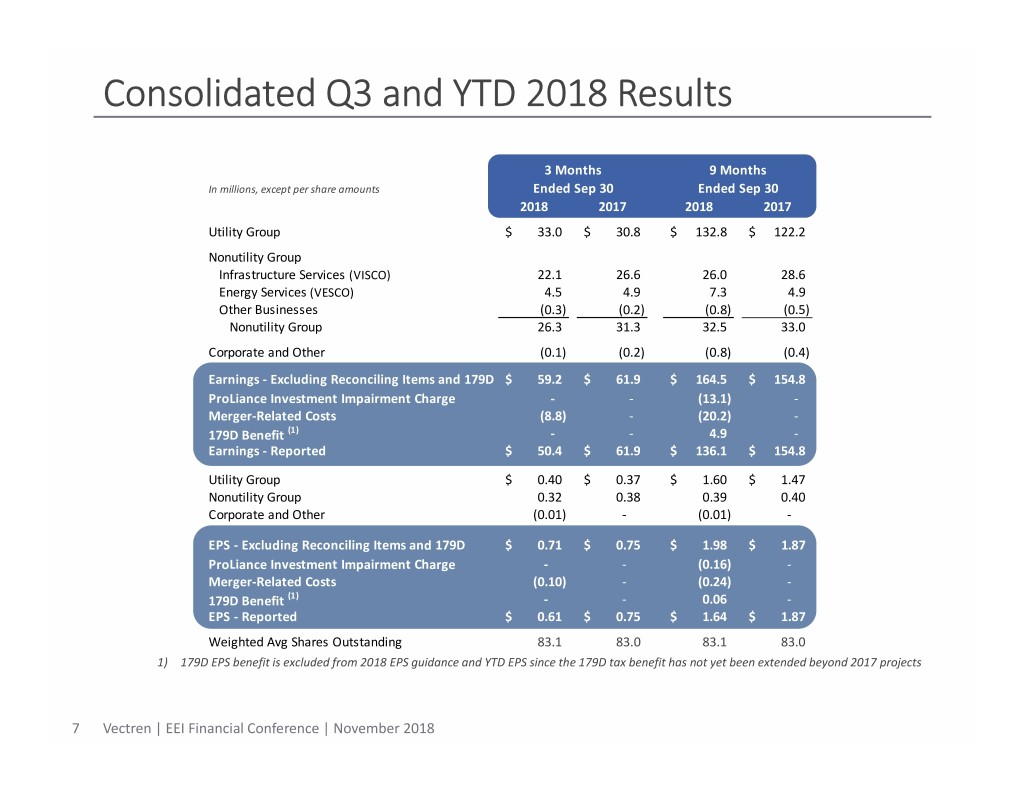

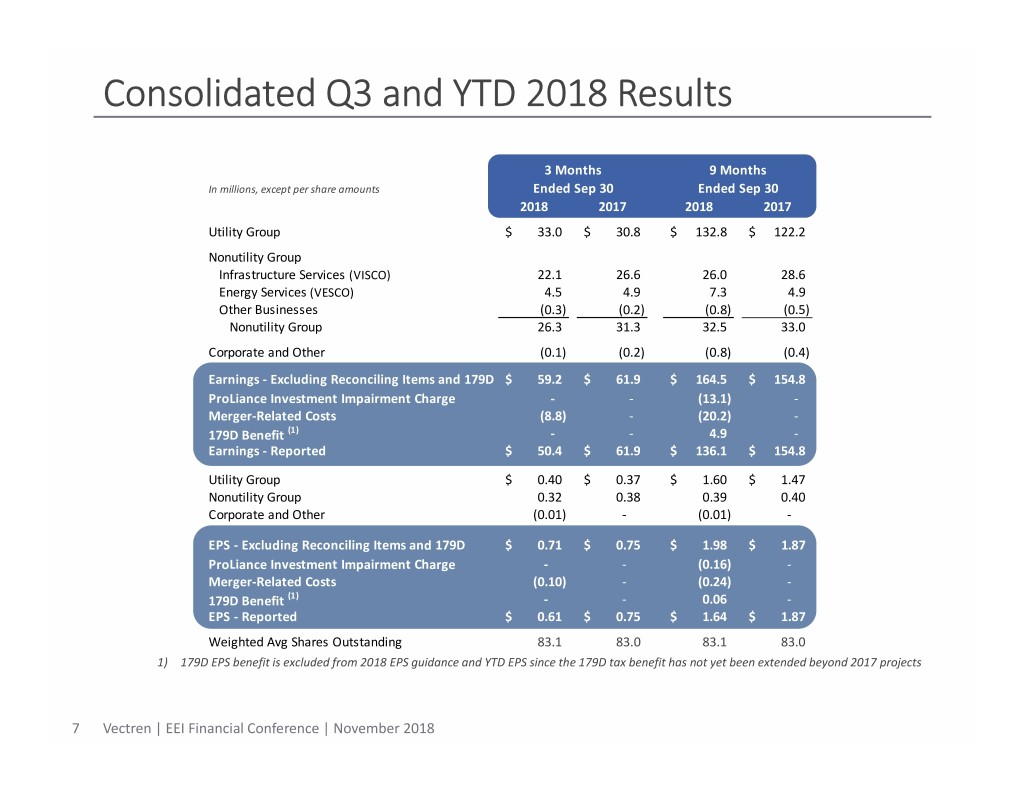

Consolidated Q3 and YTD 2018 Results 3 Months 9 Months In millions, except per share amounts Ended Sep 30 Ended Sep 30 2018 2017 2018 2017 Utility Group$ 33.0 $ 30.8 $ 132.8 $ 122.2 Nonutility Group Infrastructure Services (VISCO) 22.1 26.6 26.0 28.6 Energy Services (VESCO) 4.5 4.9 7.3 4.9 Other Businesses (0.3) (0.2) (0.8) (0.5) Nonutility Group 26.3 31.3 32.5 33.0 Corporate and Other (0.1) (0.2) (0.8) (0.4) Earnings ‐ Excluding Reconciling Items and 179D$ 59.2 $ 61.9 $ 164.5 $ 154.8 ProLiance Investment Impairment Charge ‐ ‐ (13.1) ‐ Merger‐Related Costs (8.8) ‐ (20.2) ‐ 179D Benefit (1) �� ‐ ‐ 4.9 ‐ Earnings ‐ Reported$ 50.4 $ 61.9 $ 136.1 $ 154.8 Utility Group$ 0.40 $ 0.37 $ 1.60 $ 1.47 Nonutility Group (1) 0.32 0.38 0.39 0.40 Corporate and Other (0.01) ‐ (0.01) ‐ EPS ‐ Excluding Reconciling Items and 179D$ 0.71 $ 0.75 $ 1.98 $ 1.87 ProLiance Investment Impairment Charge ‐ ‐ (0.16) ‐ Merger‐Related Costs (0.10) ‐ (0.24) ‐ 179D Benefit (1) ‐ ‐ 0.06 ‐ EPS ‐ Reported$ 0.61 $ 0.75 $ 1.64 $ 1.87 Weighted Avg Shares Outstanding 83.1 83.0 83.1 83.0 1) 179D EPS benefit is excluded from 2018 EPS guidance and YTD EPS since the 179D tax benefit has not yet been extended beyond 2017 projects 7 Vectren | EEI Financial Conference | November 2018

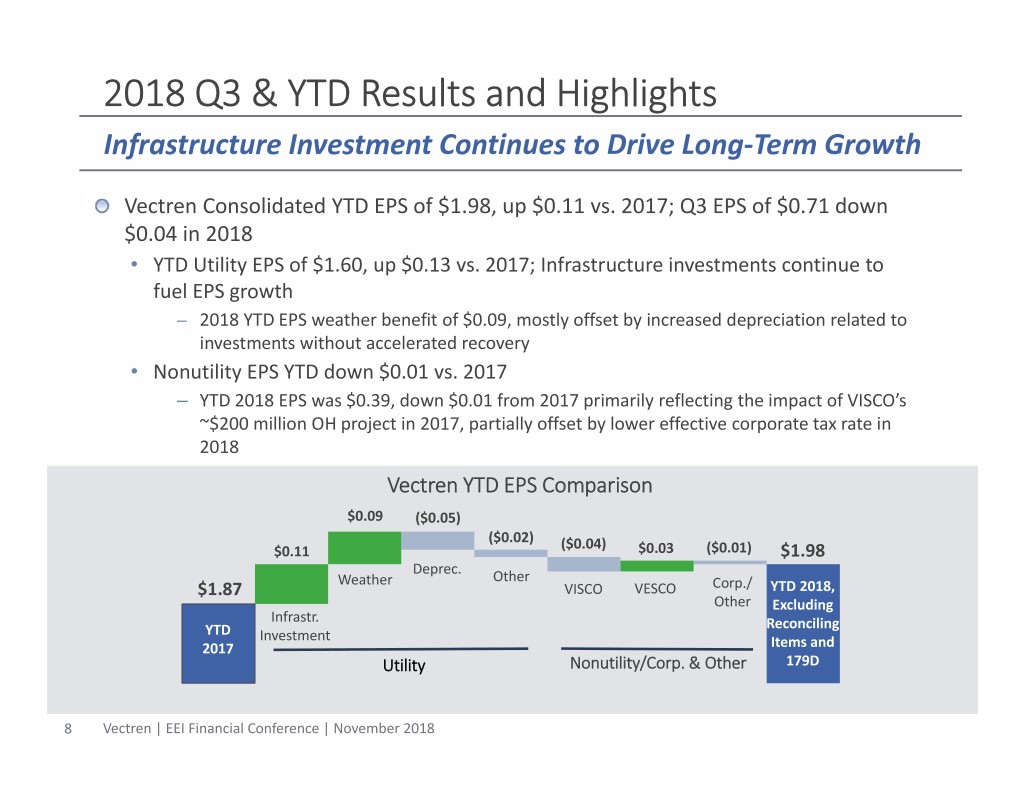

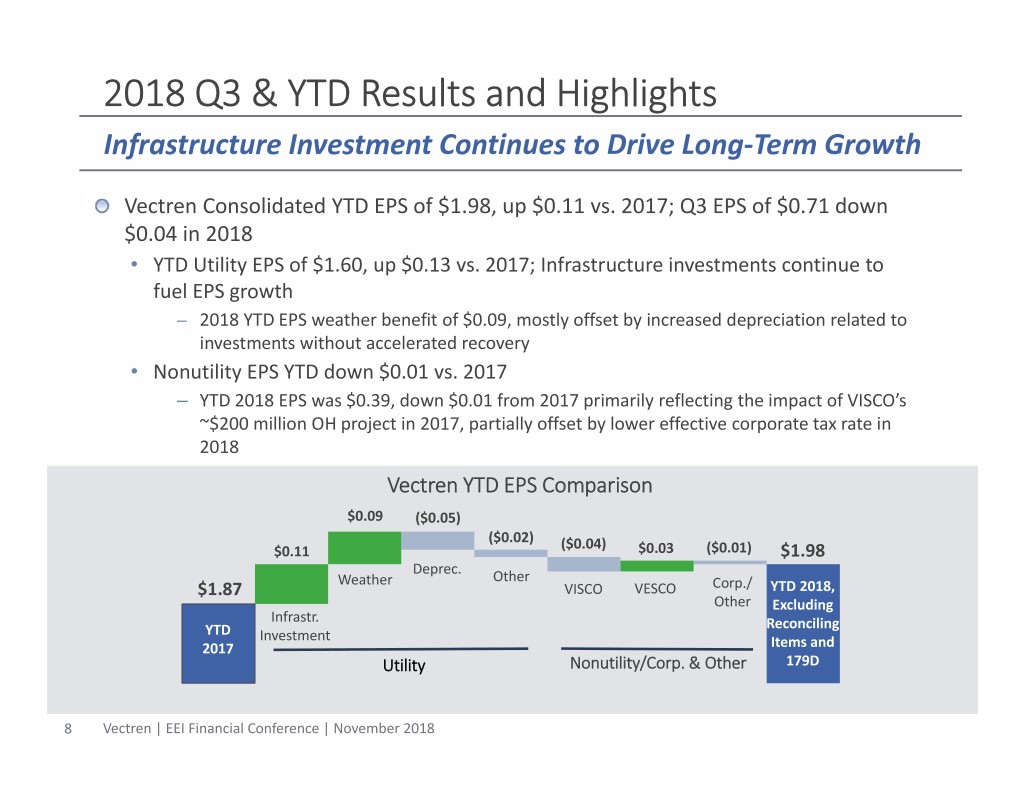

2018 Q3 & YTD Results and Highlights Infrastructure Investment Continues to Drive Long‐Term Growth Vectren Consolidated YTD EPS of $1.98, up $0.11 vs. 2017; Q3 EPS of $0.71 down $0.04 in 2018 • YTD Utility EPS of $1.60, up $0.13 vs. 2017; Infrastructure investments continue to fuel EPS growth – 2018 YTD EPS weather benefit of $0.09, mostly offset by increased depreciation related to investments without accelerated recovery • Nonutility EPS YTD down $0.01 vs. 2017 – YTD 2018 EPS was $0.39, down $0.01 from 2017 primarily reflecting the impact of VISCO’s ~$200 million OH project in 2017, partially offset by lower effective corporate tax rate in 2018 Vectren YTD EPS Comparison $0.09 ($0.05) ($0.02) $0.11 ($0.04) $0.03 ($0.01) $1.98 Deprec. Weather Other $1.87 VISCO VESCO Corp./ YTD 2018, Other Excluding Infrastr. Reconciling YTD Investment 2017 Items and Utility Nonutility/Corp. & Other 179D 8 Vectren | EEI Financial Conference | November 2018

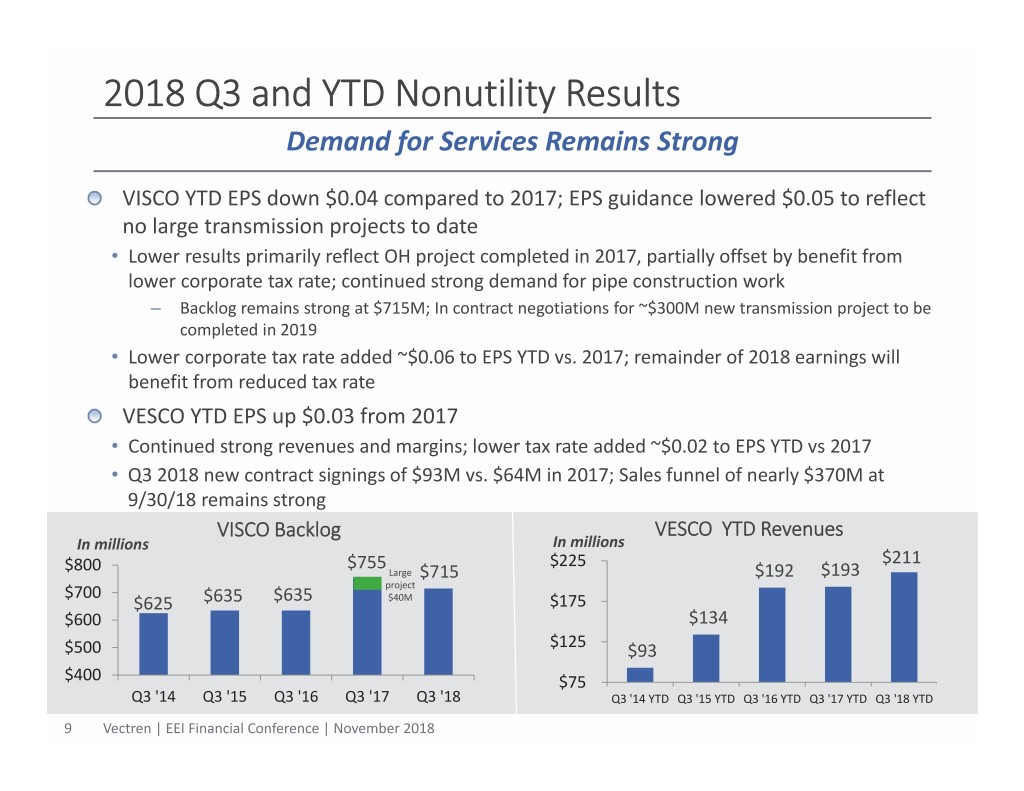

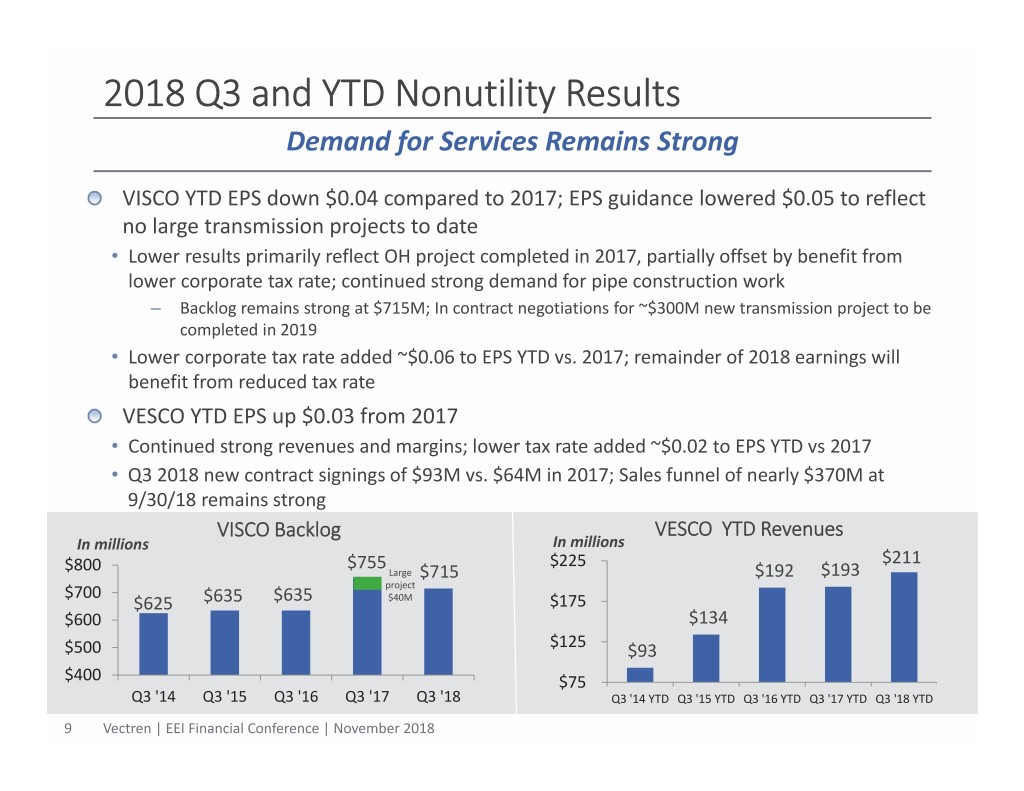

2018 Q3 and YTD Nonutility Results Demand for Services Remains Strong VISCO YTD EPS down $0.04 compared to 2017; EPS guidance lowered $0.05 to reflect no large transmission projects to date • Lower results primarily reflect OH project completed in 2017, partially offset by benefit from lower corporate tax rate; continued strong demand for pipe construction work – Backlog remains strong at $715M; In contract negotiations for ~$300M new transmission project to be completed in 2019 • Lower corporate tax rate added ~$0.06 to EPS YTD vs. 2017; remainder of 2018 earnings will benefit from reduced tax rate VESCO YTD EPS up $0.03 from 2017 • Continued strong revenues and margins; lower tax rate added ~$0.02 to EPS YTD vs 2017 • Q3 2018 new contract signings of $93M vs. $64M in 2017; Sales funnel of nearly $370M at 9/30/18 remains strong VISCO Backlog VESCO YTD Revenues In millions In millions $800 $755 $225 $211 Large $715 $192 $193 $700 project $625 $635 $635 $40M $175 $600 $134 $500 $125 $93 $400 $75 Q3 '14 Q3 '15 Q3 '16 Q3 '17 Q3 '18 Q3 '14 YTD Q3 '15 YTD Q3 '16 YTD Q3 '17 YTD Q3 '18 YTD 9 Vectren | EEI Financial Conference | November 2018

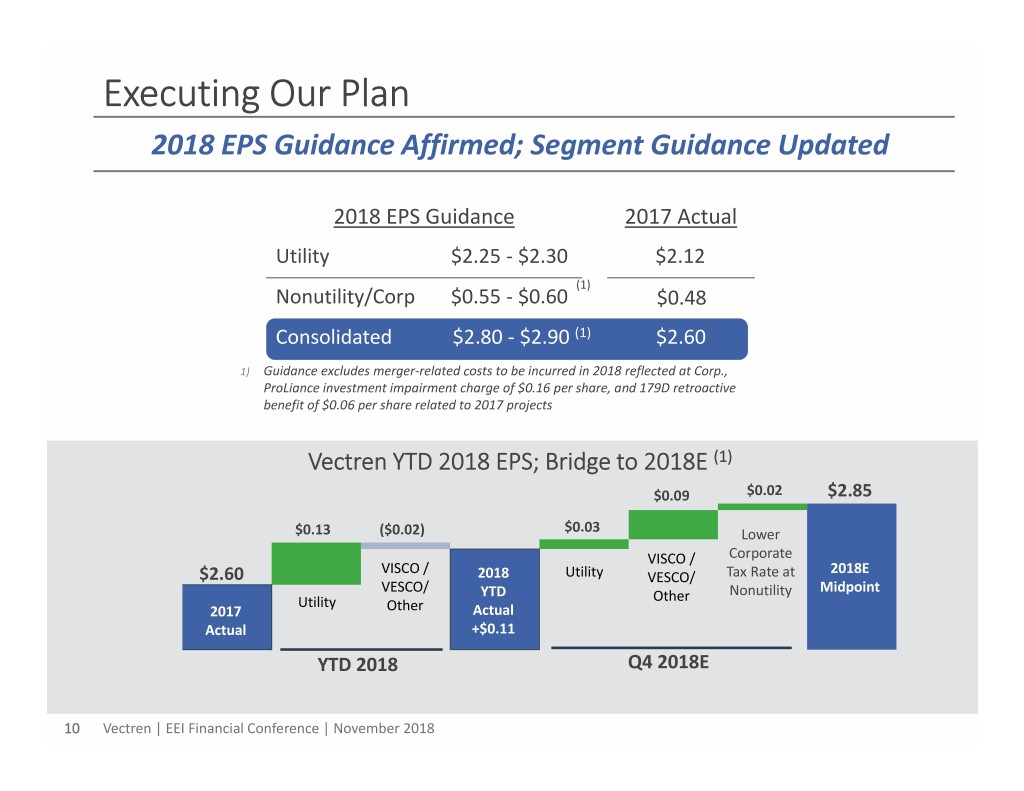

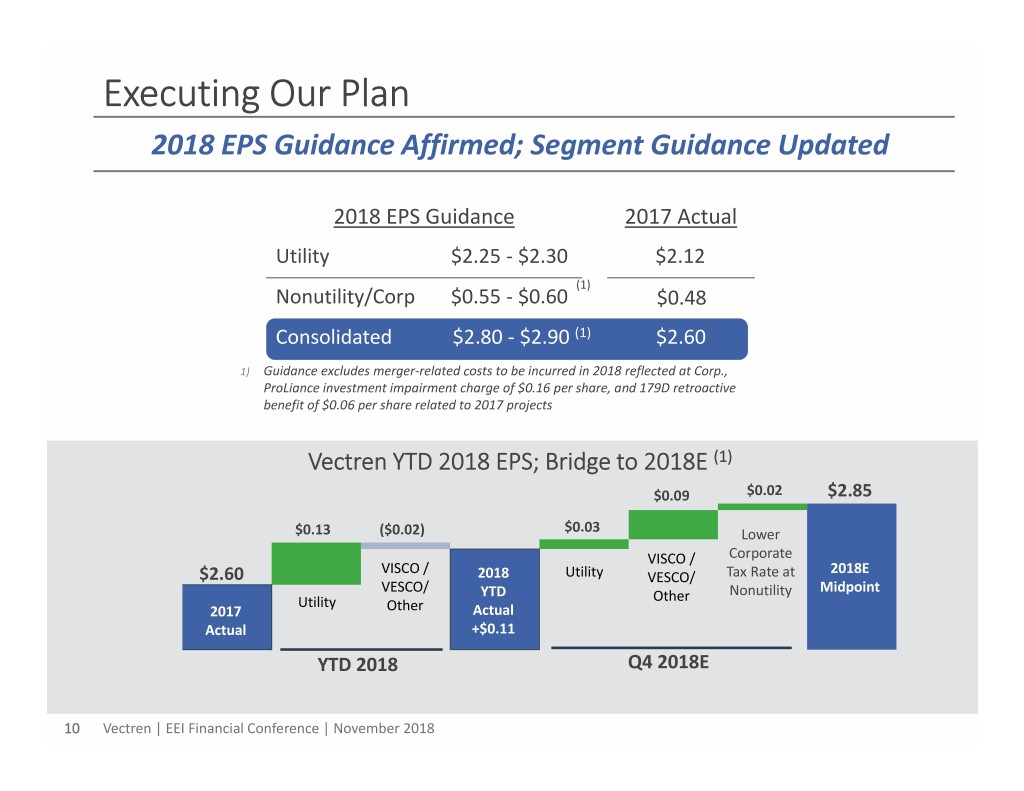

Executing Our Plan 2018 EPS Guidance Affirmed; Segment Guidance Updated 2018 EPS Guidance 2017 Actual Utility $2.25 ‐ $2.30 $2.12 (1) Nonutility/Corp $0.55 ‐ $0.60 $0.48 Consolidated $2.80 ‐ $2.90 (1) $2.60 1) Guidance excludes merger‐related costs to be incurred in 2018 reflected at Corp., ProLiance investment impairment charge of $0.16 per share, and 179D retroactive benefit of $0.06 per share related to 2017 projects Vectren YTD 2018 EPS; Bridge to 2018E (1) $0.09 $0.02 $2.85 $0.13 ($0.02) $0.03 Lower VISCO / Corporate VISCO / 2018E $2.60 2018 Utility VESCO/ Tax Rate at VESCO/ YTD Nonutility Midpoint Utility Other 2017 Other Actual Actual +$0.11 YTD 2018 Q4 2018E 10 Vectren | EEI Financial Conference | November 2018

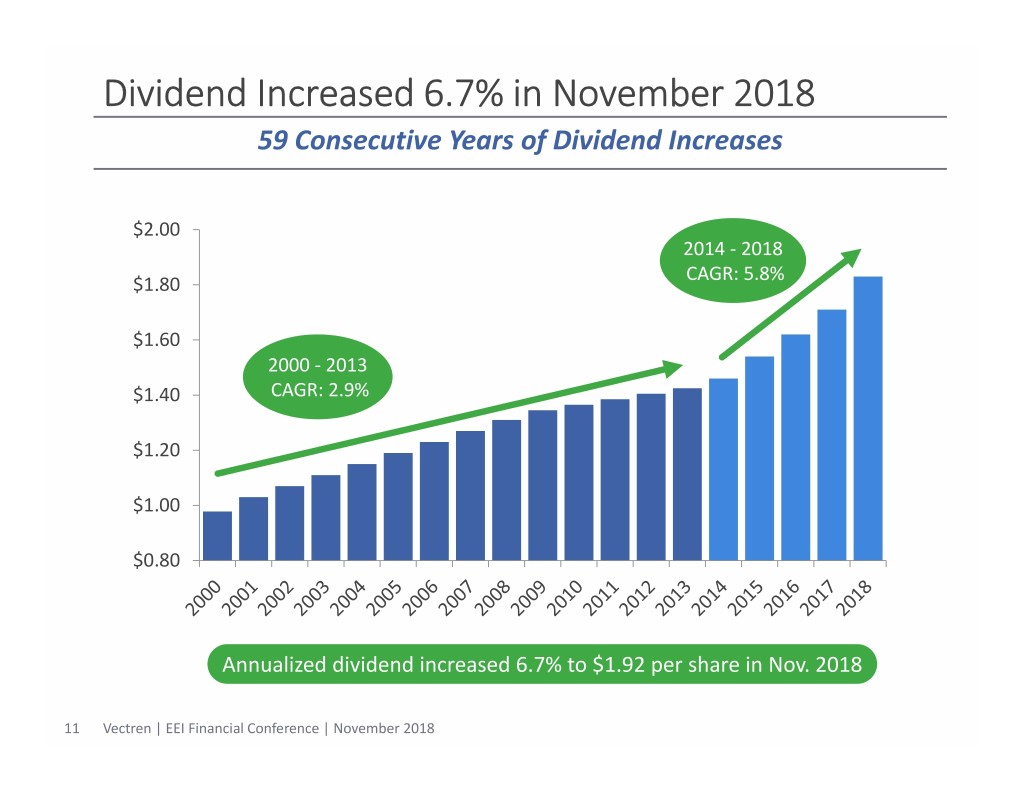

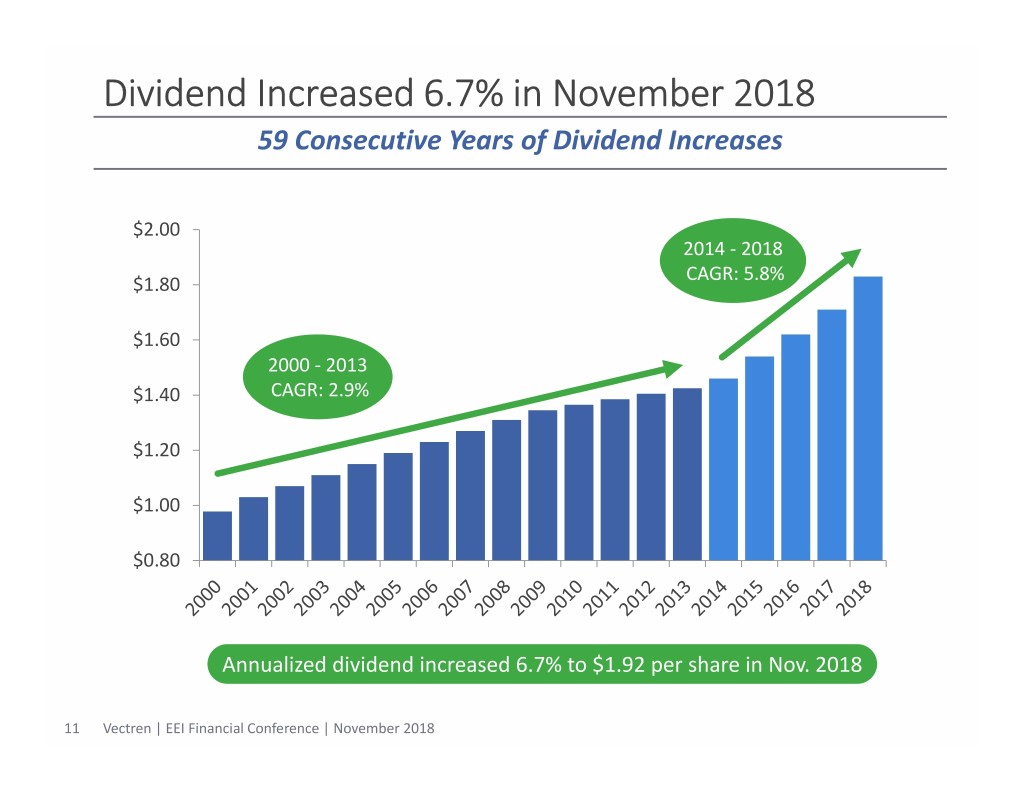

Dividend Increased 6.7% in November 2018 59 Consecutive Years of Dividend Increases $2.00 2014 ‐ 2018 CAGR: 5.8% $1.80 $1.60 2000 ‐ 2013 $1.40 CAGR: 2.9% $1.20 $1.00 $0.80 Annualized dividend increased 6.7% to $1.92 per share in Nov. 2018 11 Vectren | EEI Financial Conference | November 2018

Merger Update

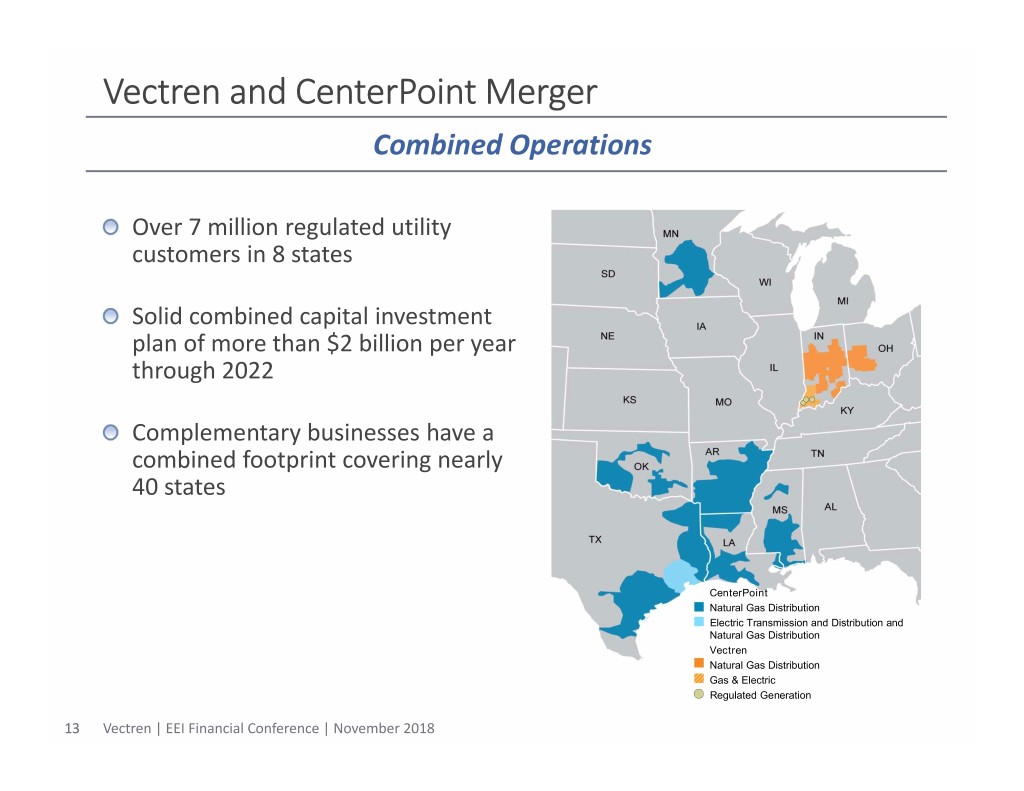

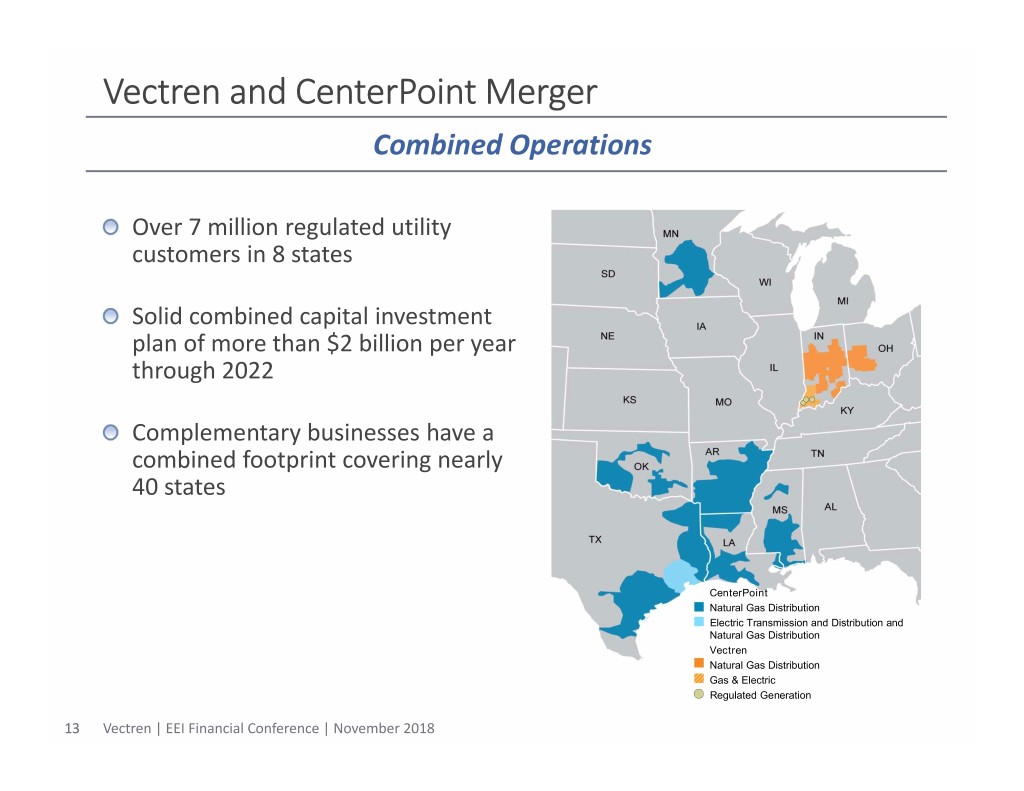

Vectren and CenterPoint Merger Combined Operations Over 7 million regulated utility customers in 8 states Solid combined capital investment plan of more than $2 billion per year through 2022 Complementary businesses have a combined footprint covering nearly 40 states CenterPoint Natural Gas Distribution Electric Transmission and Distribution and Natural Gas Distribution Vectren Natural Gas Distribution Gas & Electric Regulated Generation 13 Vectren | EEI Financial Conference | November 2018

Vectren, CenterPoint Merger Update Subject to closure of Indiana and Ohio informational dockets, continue to anticipate merger closing will occur no later than Q1 of 2019 Informational filings were made in mid June in both IN and OH; State change of control filings are not required Indiana hearing held October 17 – Final briefs in Indiana to be filed December 21, 2018; Final order expected in early 2019 – OH commission hearing not anticipated; Final order expected in early 2019 • Integration work continues; Design phase began in September Merger related accomplishments to date FERC merger approval received October 5 Vectren shareholders approved proposed merger on August 28 Receipt of FCC final approvals on July 24 for the transfer of control of the Company’s subsidiaries which hold radio licenses Receipt of early termination of the waiting period under the Hart Scott Rodino Act on June 26 14 Vectren | EEI Financial Conference | November 2018

Vectren Energy Delivery of Indiana– North (Gas) Vectren Energy Delivery of Indiana– South (Gas & Electric) Vectren Energy Delivery of Ohio (Gas) 1.2M Utility Customers Utility Operations

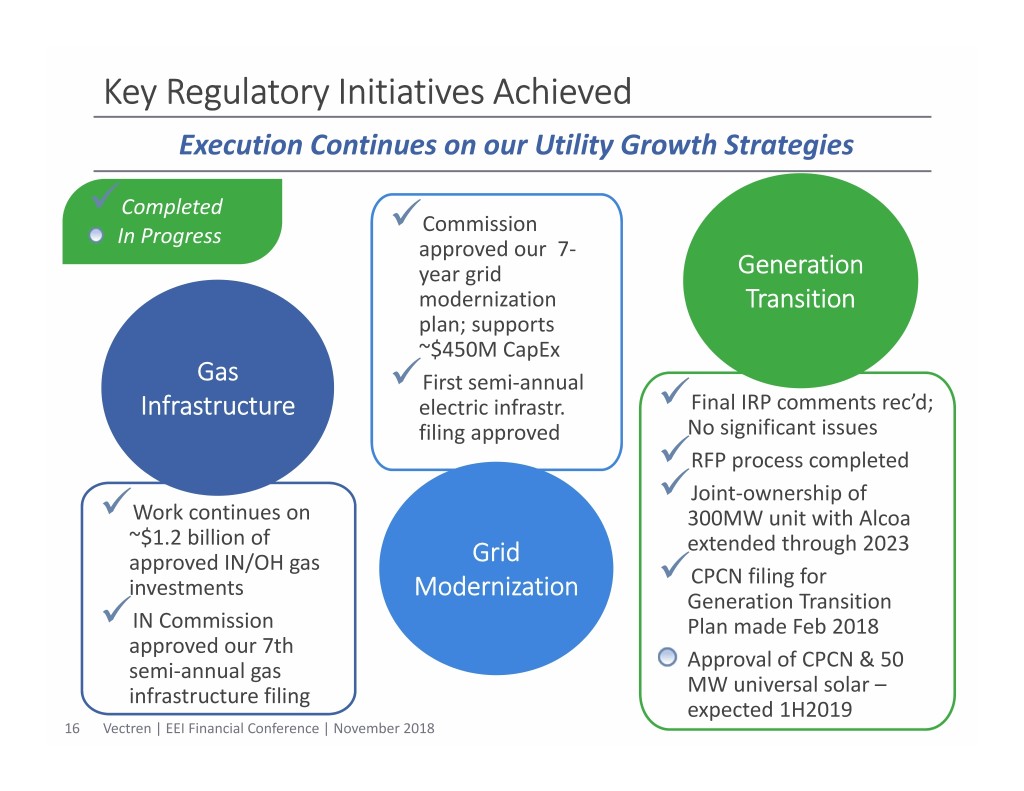

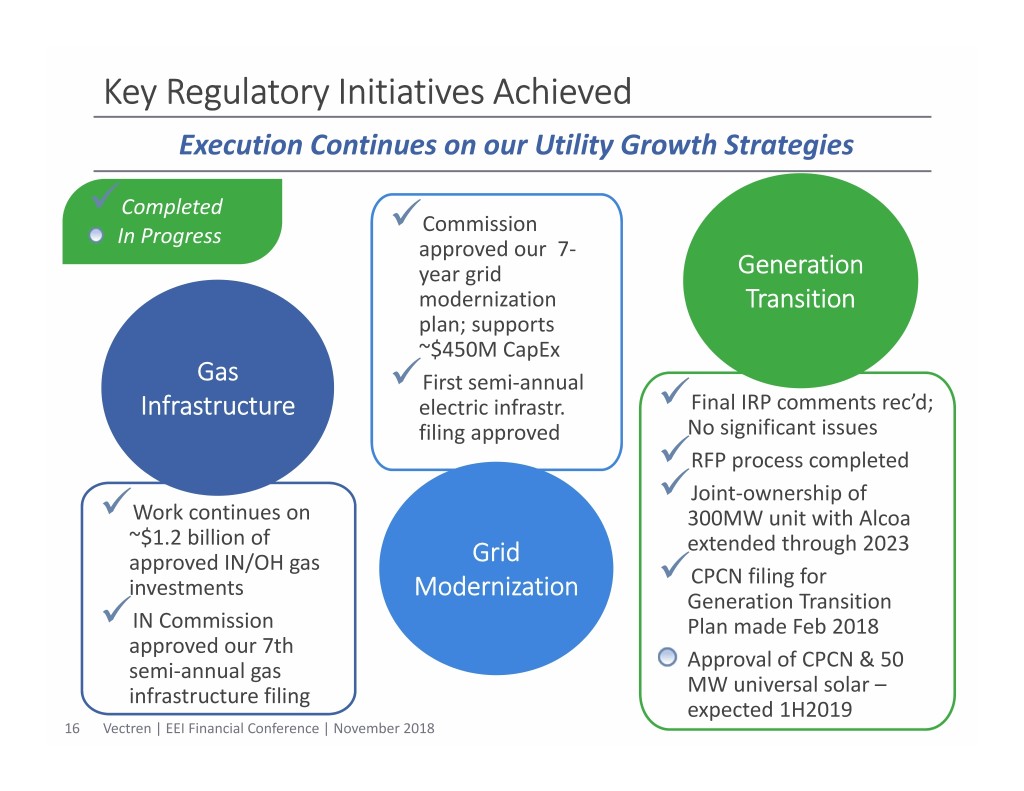

Key Regulatory Initiatives Achieved Execution Continues on our Utility Growth Strategies Completed Commission In Progress approved our 7‐ year grid Generation modernization Transition plan; supports ~$450M CapEx Gas First semi‐annual Infrastructure electric infrastr. Final IRP comments rec’d; filing approved No significant issues RFP process completed Joint‐ownership of Work continues on 300MW unit with Alcoa ~$1.2 billion of extended through 2023 approved IN/OH gas Grid investments Modernization CPCN filing for Generation Transition IN Commission Plan made Feb 2018 approved our 7th semi‐annual gas Approval of CPCN & 50 infrastructure filing MW universal solar – expected 1H2019 16 Vectren | EEI Financial Conference | November 2018

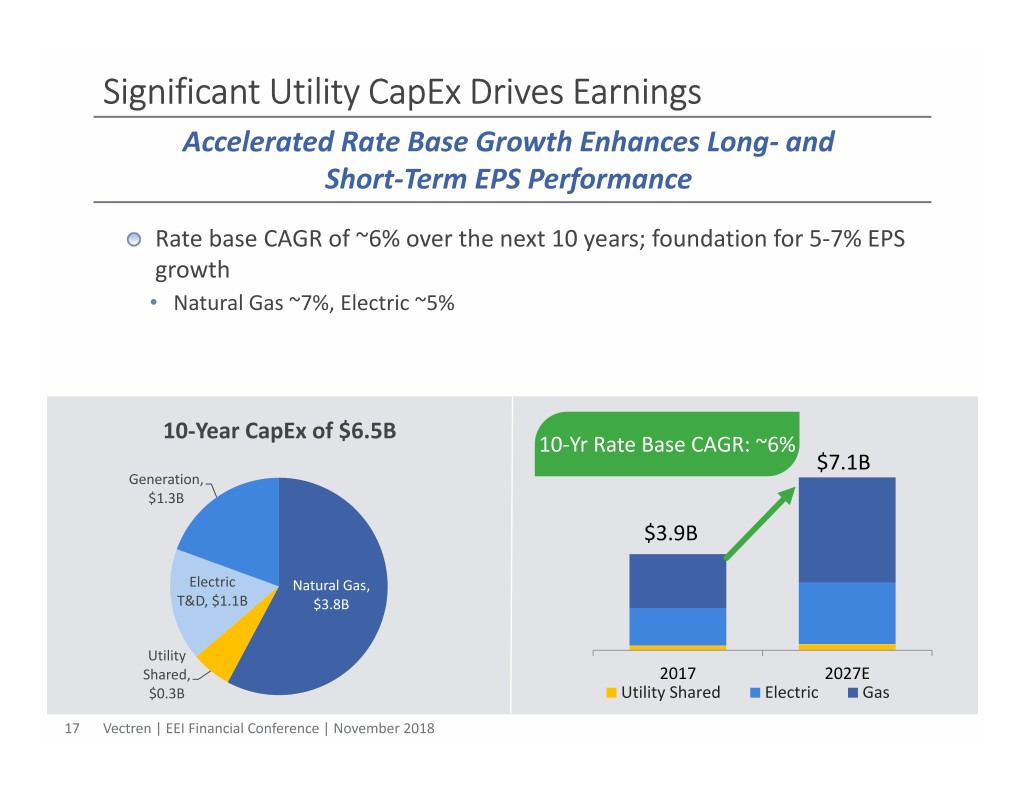

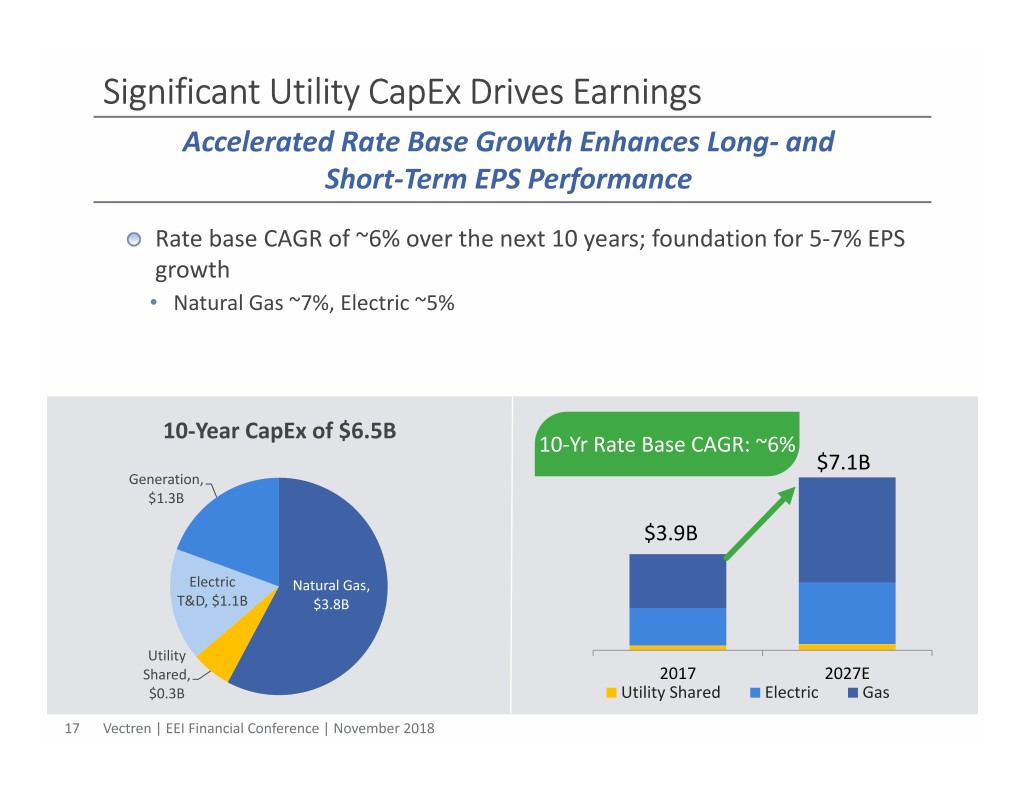

Significant Utility CapEx Drives Earnings Accelerated Rate Base Growth Enhances Long‐ and Short‐Term EPS Performance Rate base CAGR of ~6% over the next 10 years; foundation for 5‐7% EPS growth • Natural Gas ~7%, Electric ~5% 10‐Year CapEx of $6.5B 10‐Yr Rate Base CAGR: ~6% $7.1B Generation, $1.3B $3.9B Electric Natural Gas, T&D, $1.1B $3.8B Utility Shared, 2017 2027E $0.3B Utility Shared Electric Gas 17 Vectren | EEI Financial Conference | November 2018

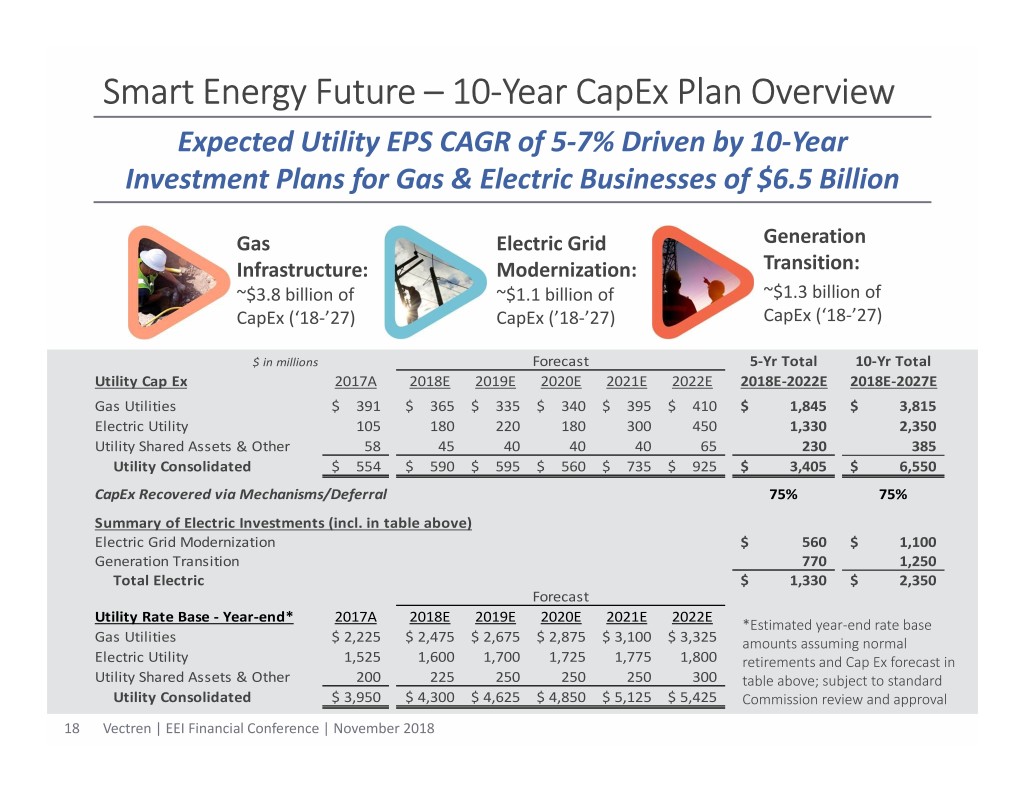

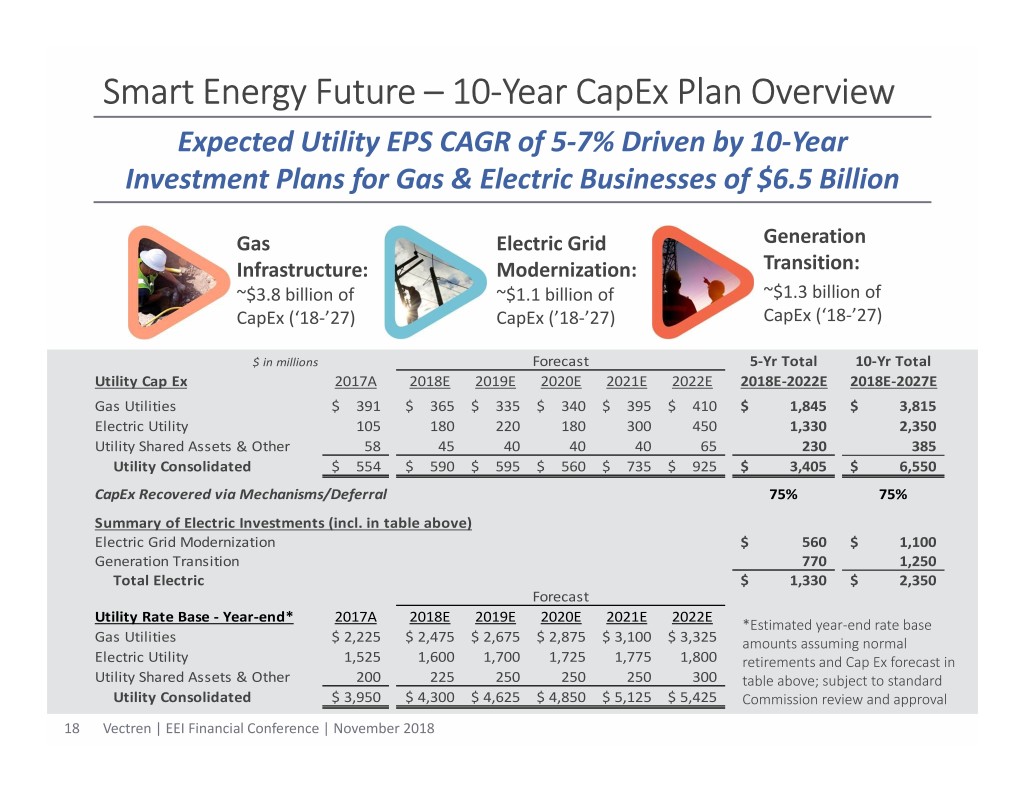

Smart Energy Future –10‐Year CapEx Plan Overview Expected Utility EPS CAGR of 5‐7% Driven by 10‐Year Investment Plans for Gas & Electric Businesses of $6.5 Billion Gas Electric Grid Generation Infrastructure: Modernization: Transition: ~$3.8 billion of ~$1.1 billion of ~$1.3 billion of CapEx (‘18‐’27) CapEx (’18‐’27) CapEx (‘18‐’27) Forecast $ in millions 5‐Yr Total 10‐Yr Total Utility Cap Ex 2017A 2018E 2019E 2020E 2021E 2022E 2018E‐2022E 2018E‐2027E Gas Utilities$ 391 $ 365 $ 335 $ 340 $ 395 $ 410 $ 1,845 $ 3,815 Electric Utility 105 180 220 180 300 450 1,330 2,350 Utility Shared Assets & Other 58 45 40 40 40 65 230 385 Utility Consolidated $ 554 $ 590 $ 595 $ 560 $ 735 $ 925 $ 3,405 $ 6,550 CapEx Recovered via Mechanisms/Deferral 75% 75% Summary of Electric Investments (incl. in table above) Electric Grid Modernization $ 560 $ 1,100 Generation Transition 770 1,250 Total Electric $ 1,330 $ 2,350 Forecast 2017A 2018E 2019E 2020E 2021E 2022E Utility Rate Base ‐ Year‐end* *Estimated year‐end rate base Gas Utilities$ 2,225 $ 2,475 $ 2,675 $ 2,875 $ 3,100 $ 3,325 amounts assuming normal Electric Utility 1,525 1,600 1,700 1,725 1,775 1,800 retirements and Cap Ex forecast in Utility Shared Assets & Other 200 225 250 250 250 300 table above; subject to standard Utility Consolidated $ 3,950 $ 4,300 $ 4,625 $ 4,850 $ 5,125 $ 5,425 Commission review and approval 18 Vectren | EEI Financial Conference | November 2018

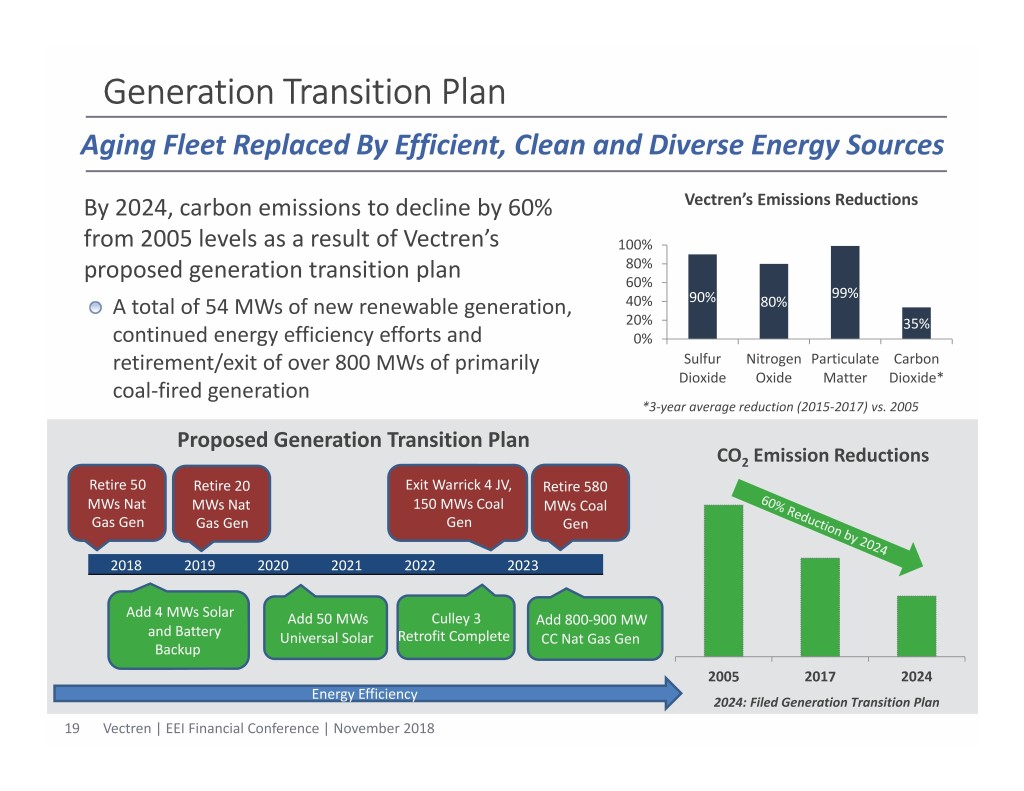

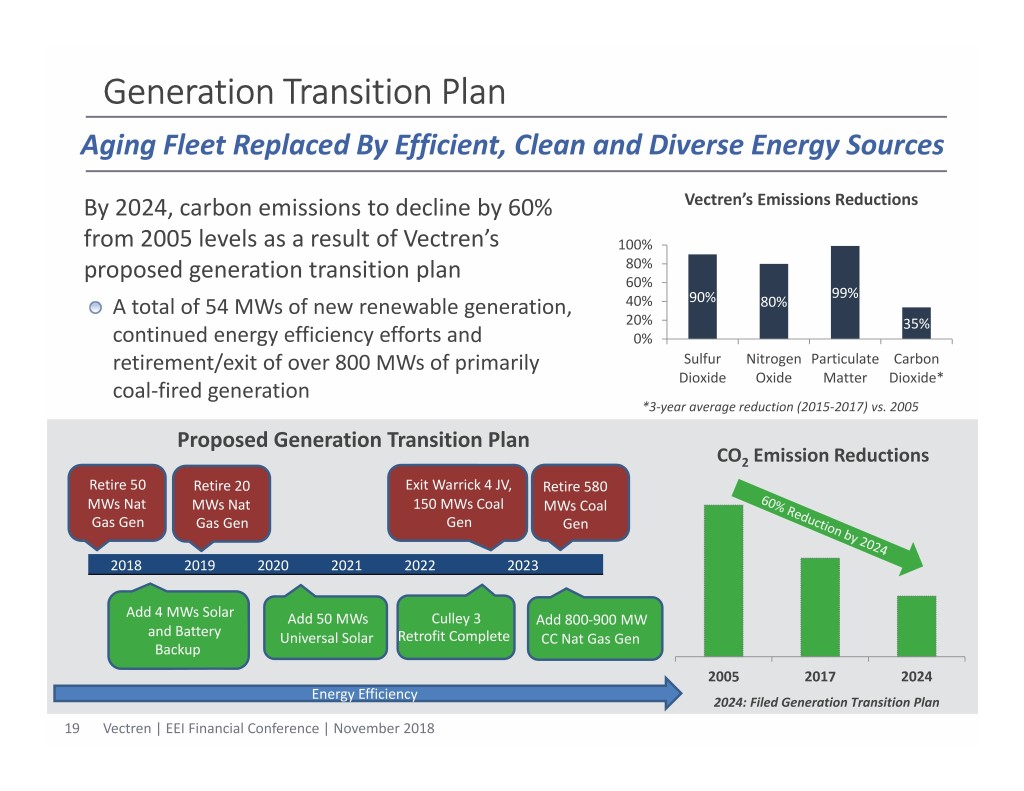

Generation Transition Plan Aging Fleet Replaced By Efficient, Clean and Diverse Energy Sources By 2024, carbon emissions to decline by 60% Vectren’s Emissions Reductions from 2005 levels as a result of Vectren’s 100% 80% proposed generation transition plan 60% 99% A total of 54 MWs of new renewable generation, 40% 90% 80% 20% 35% continued energy efficiency efforts and 0% retirement/exit of over 800 MWs of primarily Sulfur Nitrogen Particulate Carbon Dioxide Oxide Matter Dioxide* coal‐fired generation *3‐year average reduction (2015‐2017) vs. 2005 Proposed Generation Transition Plan CO2 Emission Reductions Retire 50 Retire 20 Exit Warrick 4 JV, Retire 580 MWs Nat MWs Nat 150 MWs Coal MWs Coal Gas Gen Gas Gen Gen Gen 2018 2019 2020 2021 2022 2023 Add 4 MWs Solar Add 50 MWs Culley 3 Add 800‐900 MW and Battery Universal Solar Retrofit Complete CC Nat Gas Gen Backup 2005 2017 2024 Energy Efficiency 2024: Filed Generation Transition Plan 19 Vectren | EEI Financial Conference | November 2018

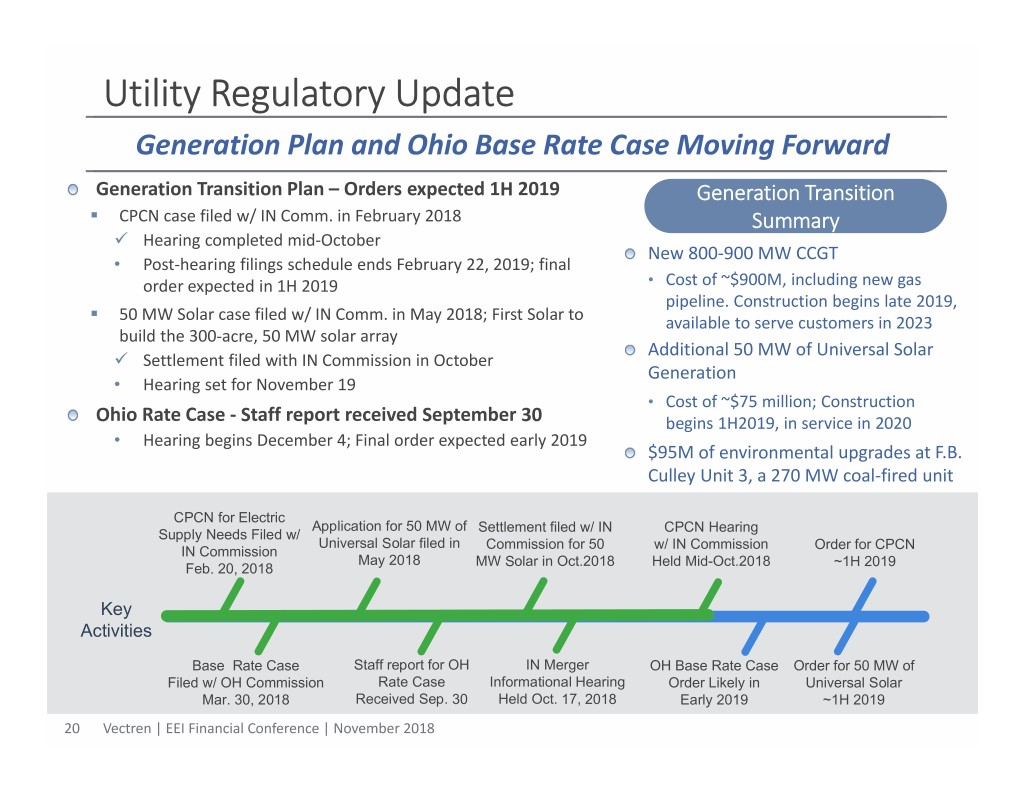

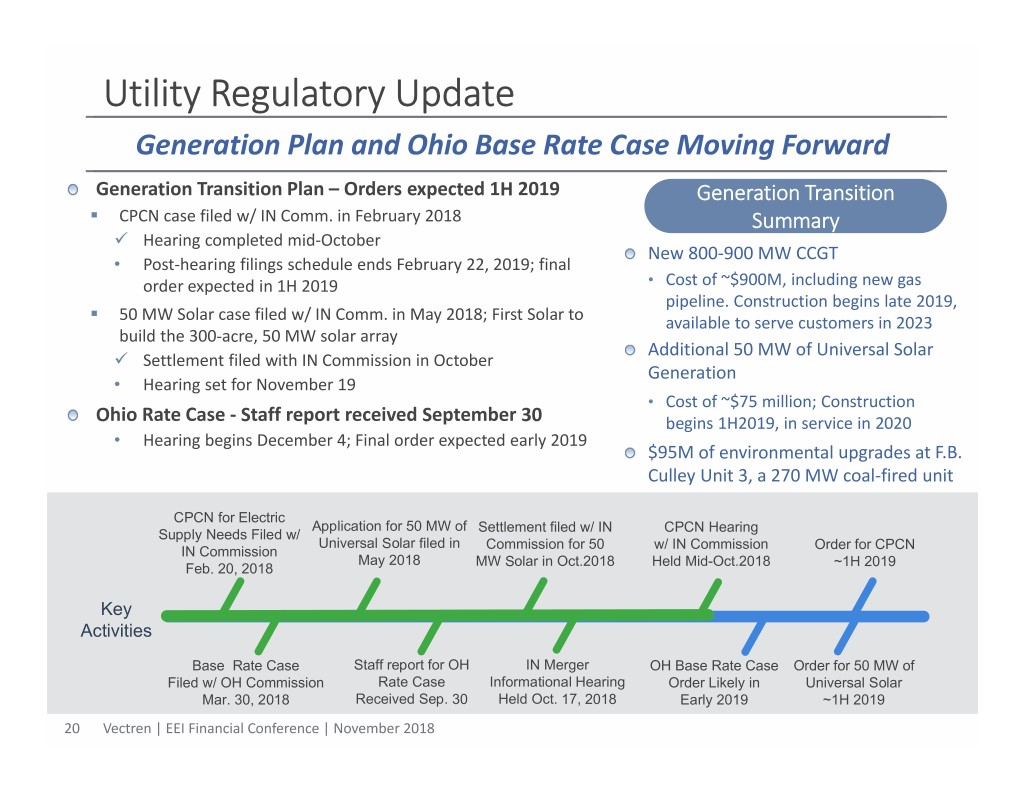

Utility Regulatory Update Generation Plan and Ohio Base Rate Case Moving Forward Generation Transition Plan –Orders expected 1H 2019 Generation Transition . CPCN case filed w/ IN Comm. in February 2018 Summary Hearing completed mid‐October New 800‐900 MW CCGT • Post‐hearing filings schedule ends February 22, 2019; final order expected in 1H 2019 • Cost of ~$900M, including new gas pipeline. Construction begins late 2019, . 50 MW Solar case filed w/ IN Comm. in May 2018; First Solar to available to serve customers in 2023 build the 300‐acre, 50 MW solar array Additional 50 MW of Universal Solar Settlement filed with IN Commission in October Generation • Hearing set for November 19 • Cost of ~$75 million; Construction Ohio Rate Case ‐ Staff report received September 30 begins 1H2019, in service in 2020 • Hearing begins December 4; Final order expected early 2019 $95M of environmental upgrades at F.B. Culley Unit 3, a 270 MW coal‐fired unit CPCN for Electric Application for 50 MW of Settlement filed w/ IN CPCN Hearing Supply Needs Filed w/ Universal Solar filed in Commission for 50 w/ IN Commission Order for CPCN IN Commission May 2018 MW Solar in Oct.2018 Held Mid-Oct.2018 ~1H 2019 Feb. 20, 2018 Key Activities Base Rate Case Staff report for OH IN Merger OH Base Rate Case Order for 50 MW of Filed w/ OH Commission Rate Case Informational Hearing Order Likely in Universal Solar Mar. 30, 2018 Received Sep. 30 Held Oct. 17, 2018 Early 2019 ~1H 2019 20 Vectren | EEI Financial Conference | November 2018

Nonutility Energy Infrastructure Services Services (VESCO) (VISCO) Distribution Performance Pipeline Contracting Construction Sustainable Transmission Infrastructure Pipeline Projects Construction Nonutility Operations 21 Vectren | EEI Financial Conference | November 2018

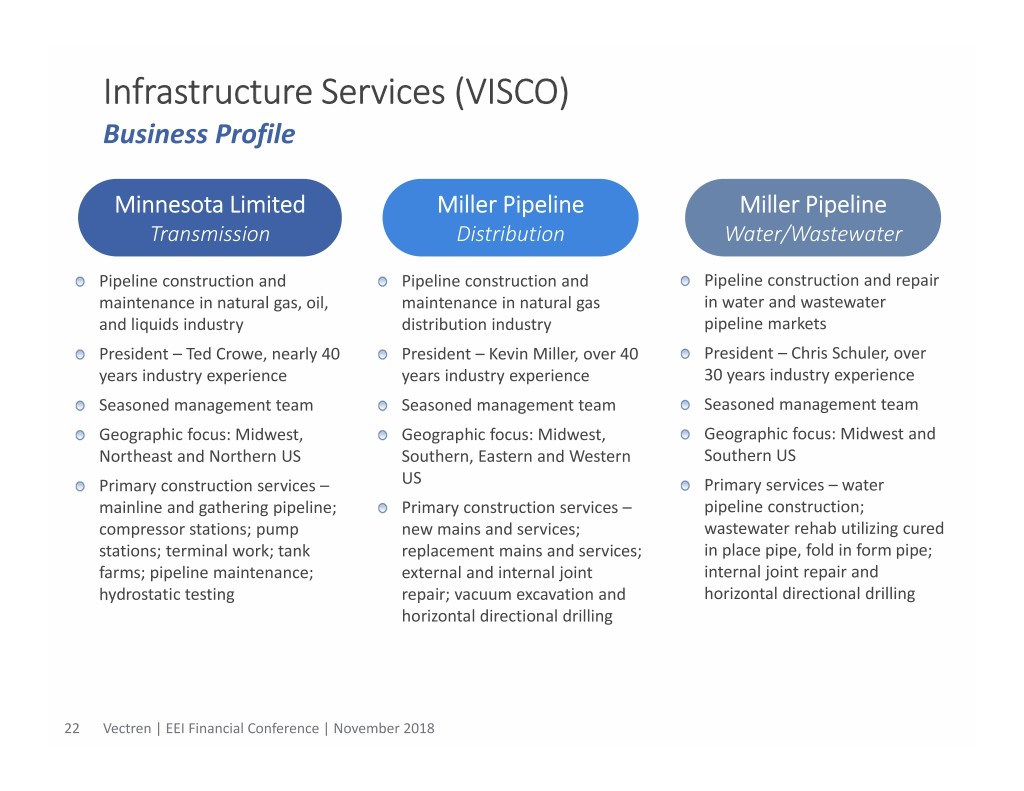

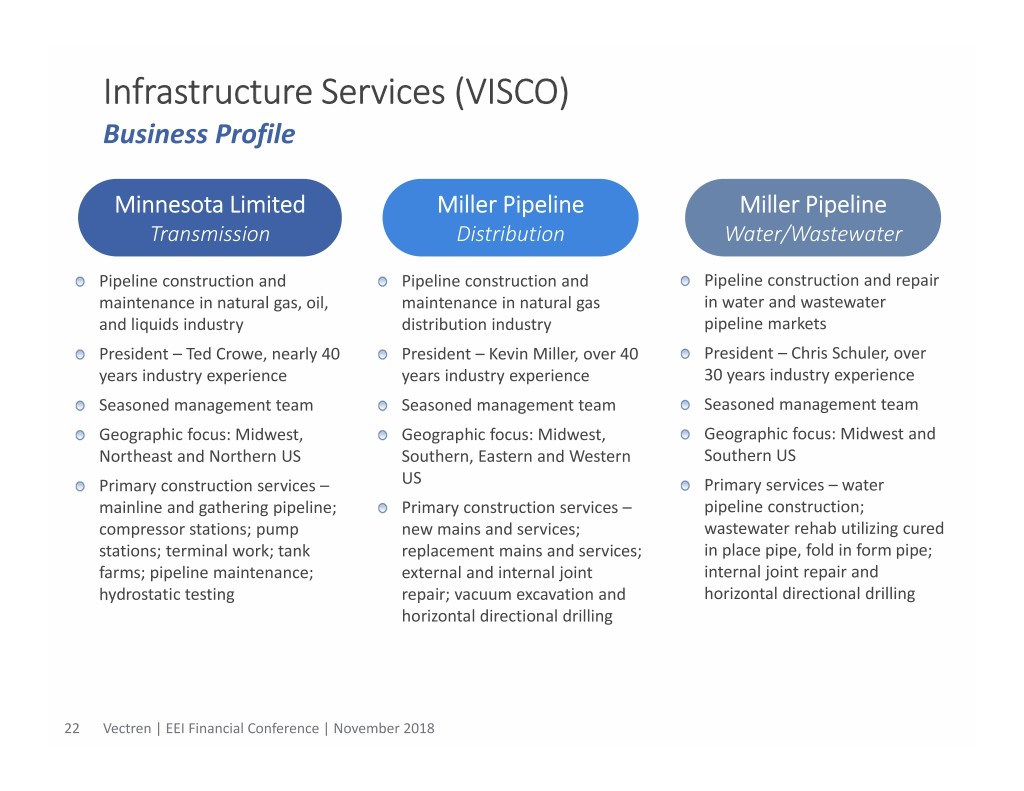

Infrastructure Services (VISCO) Business Profile Minnesota Limited Miller Pipeline Miller Pipeline Transmission Distribution Water/Wastewater Pipeline construction and Pipeline construction and Pipeline construction and repair maintenance in natural gas, oil, maintenance in natural gas in water and wastewater and liquids industry distribution industry pipeline markets President –Ted Crowe, nearly 40 President –Kevin Miller, over 40 President –Chris Schuler, over years industry experience years industry experience 30 years industry experience Seasoned management team Seasoned management team Seasoned management team Geographic focus: Midwest, Geographic focus: Midwest, Geographic focus: Midwest and Northeast and Northern US Southern, Eastern and Western Southern US Primary construction services – US Primary services –water mainline and gathering pipeline; Primary construction services – pipeline construction; compressor stations; pump new mains and services; wastewater rehab utilizing cured stations; terminal work; tank replacement mains and services; in place pipe, fold in form pipe; farms; pipeline maintenance; external and internal joint internal joint repair and hydrostatic testing repair; vacuum excavation and horizontal directional drilling horizontal directional drilling 22 Vectren | EEI Financial Conference | November 2018

VISCO Long‐Term Customer Relationships Long‐Term Customers Long‐term customer relationships are key Relationship with top 10 distribution customers averages ~20 years Reputation for high quality construction work and customer service Shared culture of commitment to safety with our customers Building on our history and reputation, added several significant new customers over the past few years 23 Vectren | EEI Financial Conference | November 2018

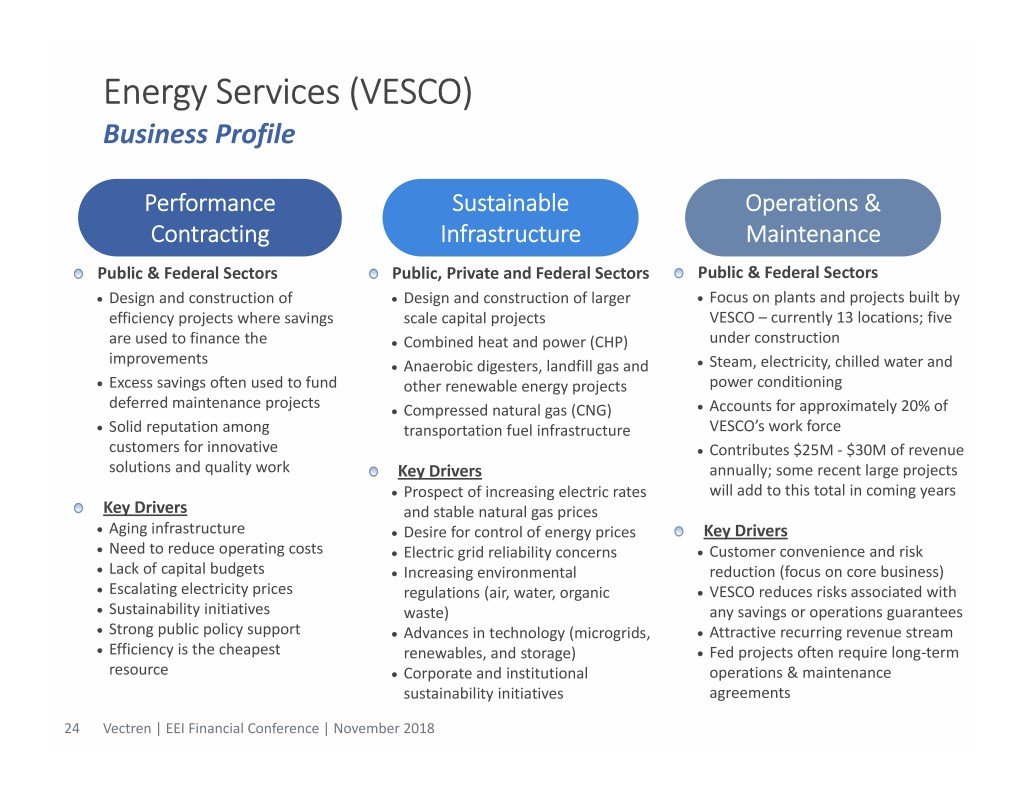

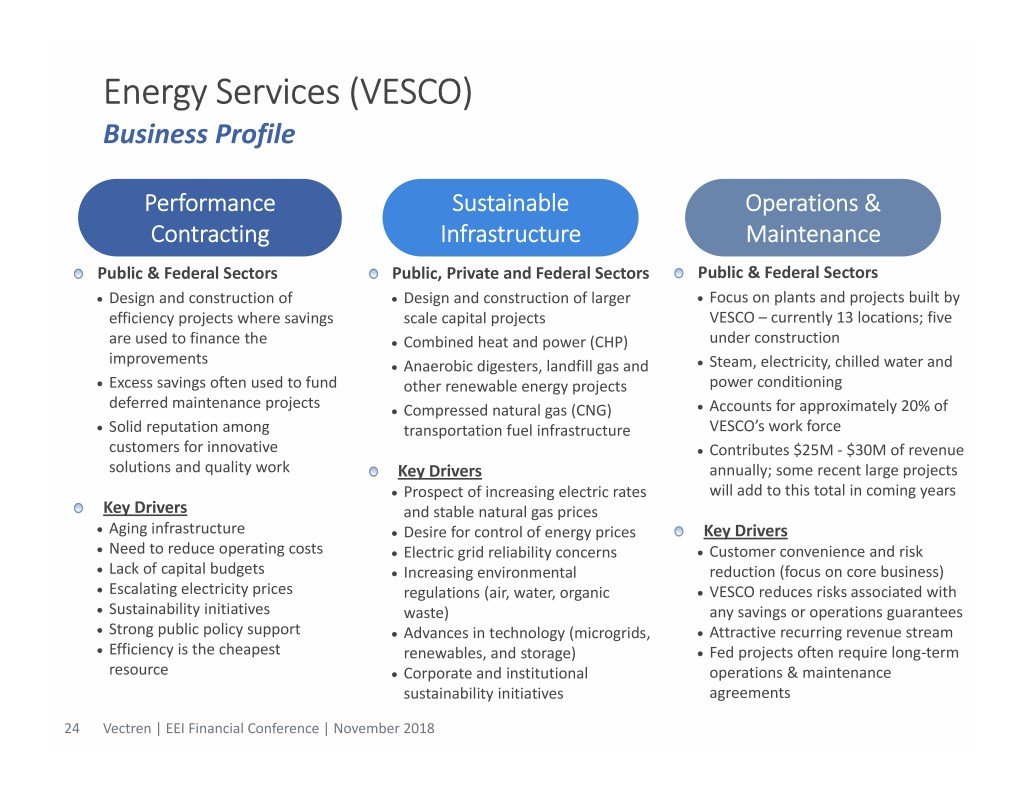

Energy Services (VESCO) Business Profile Performance Sustainable Operations & Contracting Infrastructure Maintenance Public & Federal Sectors Public, Private and Federal Sectors Public & Federal Sectors Design and construction of Design and construction of larger Focus on plants and projects built by efficiency projects where savings scale capital projects VESCO –currently 13 locations; five are used to finance the Combined heat and power (CHP) under construction improvements Anaerobic digesters, landfill gas and Steam, electricity, chilled water and Excess savings often used to fund other renewable energy projects power conditioning deferred maintenance projects Compressed natural gas (CNG) Accounts for approximately 20% of Solid reputation among transportation fuel infrastructure VESCO’s work force customers for innovative Contributes $25M ‐ $30M of revenue solutions and quality work Key Drivers annually; some recent large projects Prospect of increasing electric rates will add to this total in coming years Key Drivers and stable natural gas prices Aging infrastructure Desire for control of energy prices Key Drivers Need to reduce operating costs Electric grid reliability concerns Customer convenience and risk Lack of capital budgets Increasing environmental reduction (focus on core business) Escalating electricity prices regulations (air, water, organic VESCO reduces risks associated with Sustainability initiatives waste) any savings or operations guarantees Strong public policy support Advances in technology (microgrids, Attractive recurring revenue stream Efficiency is the cheapest renewables, and storage) Fed projects often require long‐term resource Corporate and institutional operations & maintenance sustainability initiatives agreements 24 Vectren | EEI Financial Conference | November 2018

VESCO Market Sectors and Customers • Municipalities • 26 UESC partners (util. energy service contract), incl. 3 pending renewals •Water and Wastewater Utilities • One of 21 DOE qualified ESCOs •Electric and Gas Utilities • One of 15 USACE* qualified ESCOs (1) • Solid Waste Authorities • Department of Energy • K‐12 Schools • Department of Defense • State Agencies • Department of Veterans Affairs • Colleges / Universities Performance Contracting • Department of Agriculture • Correctional Facilities • General Services Administration •Highway Departments • Utilities • Hospitals / Healthcare Public Federal Sector Sector * US Army Corps of Engineers (1) Awarded in 2015 after undergoing a re‐compete process. Operations & Sustainable Maintenance Infrastructure • Department of Veterans Affairs • Municipalities • Department of Defense •Water and Wastewater Utilities • Colleges / Universities •Solid Waste Authorities • Colleges / Universities • Municipal Utilities • Hospitals / Healthcare • Hospitals / Healthcare • Commercial & Industrial • Federal 25 Vectren | EEI Financial Conference | November 2018

Appendix

Appendix Use of Non‐GAAP Performance Measures and Per Share Measures Contribution to Vectren's EPS Per share earnings contributions of the Utility Group, Nonutility Group, and Corporate and Other are presented and are non‐GAAP measures. Such per share amounts are based on the earnings contribution of each group included in the Company’s consolidated results divided by the Company’s basic average shares outstanding during the period. The earnings per share of the groups do not represent a direct legal interest in the assets and liabilities allocated to the groups; instead they represent a direct equity interest in the Company's assets and liabilities as a whole. These non‐GAAP measures are used by management to evaluate the performance of individual businesses. In addition, other items giving rise to period over period variances, such as weather, may be presented on an after tax and per share basis. These amounts are calculated at a statutory tax rate divided by the Company’s basic average shares outstanding during the period. Accordingly, management believes these measures are useful to investors in understanding each business’ contribution to consolidated earnings per share and in analyzing consolidated period to period changes and the potential for earnings per share contributions in future periods. Per share amounts of the Utility Group and the Nonutility Group are reconciled to the GAAP financial measure of basic EPS by combining the GAAP earnings per share of Utility Group, Nonutility Group, and Corporate and Other. The non‐GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP. 27 Vectren | EEI Financial Conference | November 2018

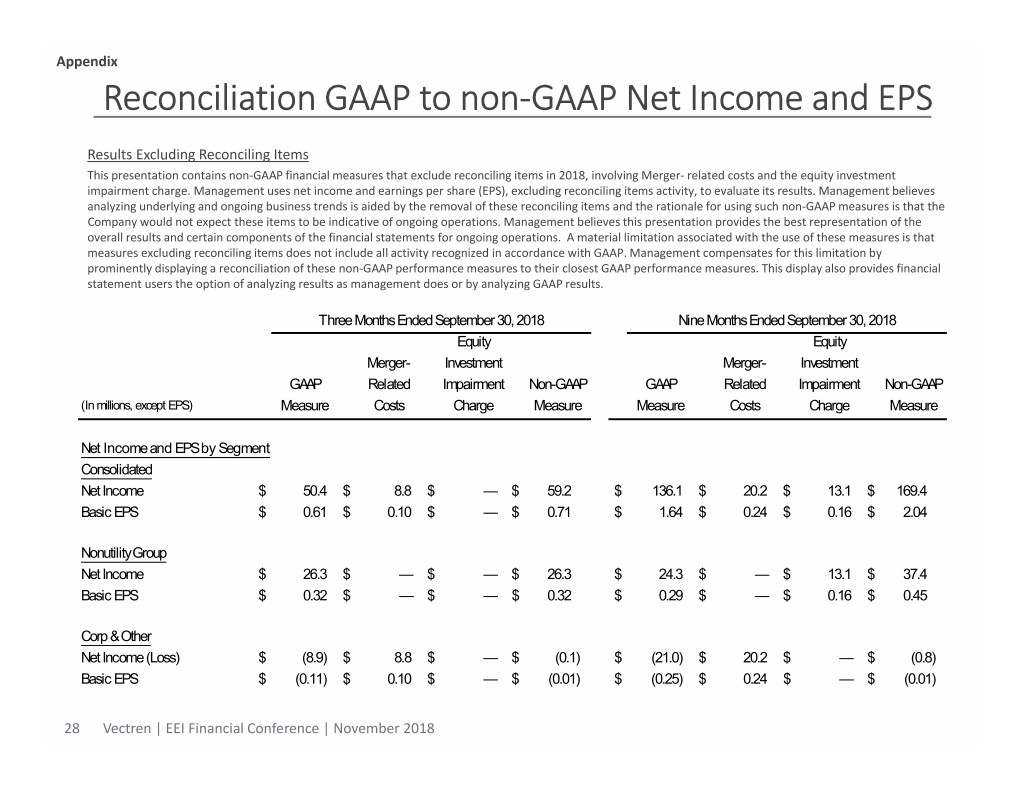

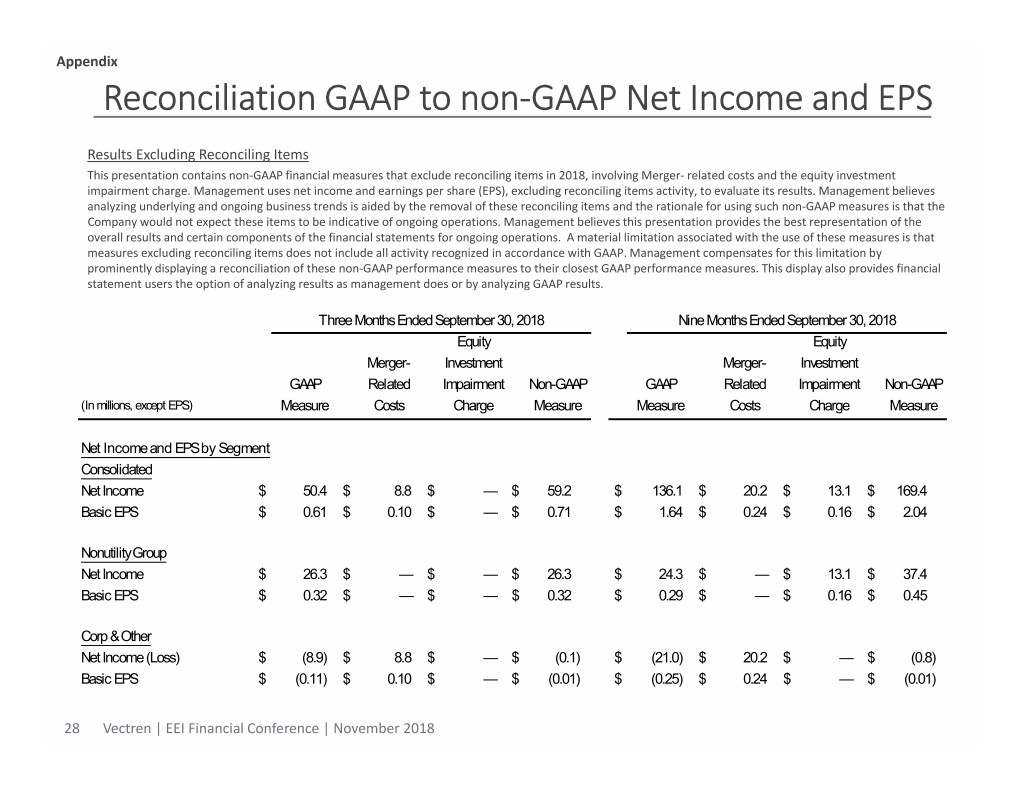

Appendix Reconciliation GAAP to non‐GAAP Net Income and EPS Results Excluding Reconciling Items This presentation contains non‐GAAP financial measures that exclude reconciling items in 2018, involving Merger‐ related costs and the equity investment impairment charge. Management uses net income and earnings per share (EPS), excluding reconciling items activity, to evaluate its results. Management believes analyzing underlying and ongoing business trends is aided by the removal of these reconciling items and the rationale for using such non‐GAAP measures is that the Company would not expect these items to be indicative of ongoing operations. Management believes this presentation provides the best representation of the overall results and certain components of the financial statements for ongoing operations. A material limitation associated with the use of these measures is that measures excluding reconciling items does not include all activity recognized in accordance with GAAP. Management compensates for this limitation by prominently displaying a reconciliation of these non‐GAAP performance measures to their closest GAAP performance measures. This display also provides financial statement users the option of analyzing results as management does or by analyzing GAAP results. Three Months Ended September 30, 2018 Nine Months Ended September 30, 2018 Equity Equity Merger- Investment Merger- Investment GAAP Related Impairment Non-GAAP GAAP Related Impairment Non-GAAP (In millions, except EPS) Measure Costs Charge Measure Measure Costs Charge Measure Net Income and EPS by Segment Consolidated Net Income $ 50.4 $ 8.8 $ — $ 59.2 $ 136.1 $ 20.2 $ 13.1 $ 169.4 Basic EPS $ 0.61 $ 0.10 $ — $ 0.71 $ 1.64 $ 0.24 $ 0.16 $ 2.04 Nonutility Group Net Income $ 26.3 $ — $ — $ 26.3 $ 24.3 $ — $ 13.1 $ 37.4 Basic EPS $ 0.32 $ — $ — $ 0.32 $ 0.29 $ — $ 0.16 $ 0.45 Corp & Other Net Income (Loss) $ (8.9) $ 8.8 $ — $ (0.1) $ (21.0) $ 20.2 $ — $ (0.8) Basic EPS $ (0.11) $ 0.10 $ — $ (0.01) $ (0.25) $ 0.24 $ — $ (0.01) 28 Vectren | EEI Financial Conference | November 2018

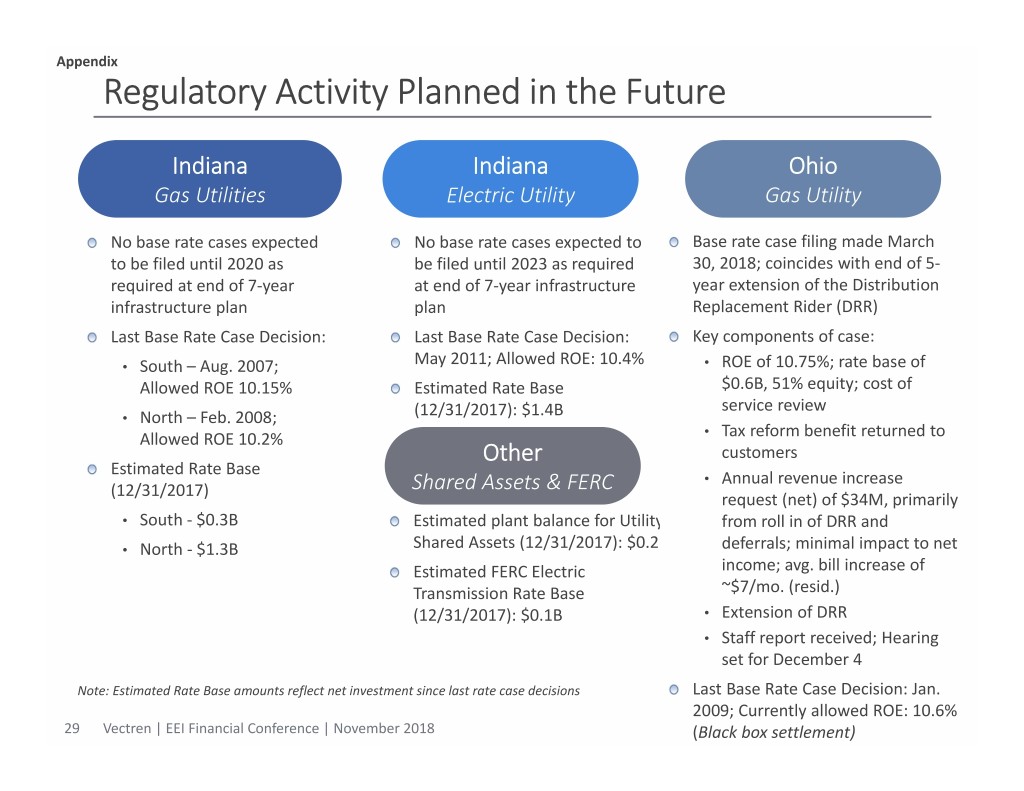

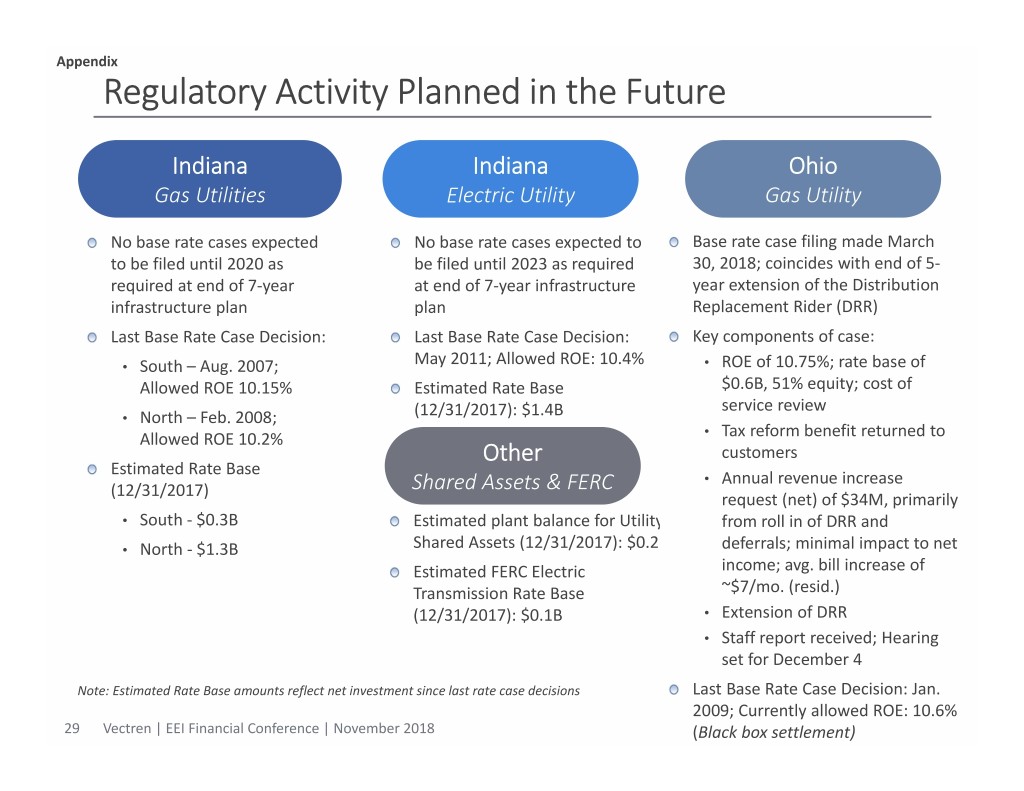

Appendix Regulatory Activity Planned in the Future Indiana Indiana Ohio Gas Utilities Electric Utility Gas Utility No base rate cases expected No base rate cases expected to Base rate case filing made March to be filed until 2020 as be filed until 2023 as required 30, 2018; coincides with end of 5‐ required at end of 7‐year at end of 7‐year infrastructure year extension of the Distribution infrastructure plan plan Replacement Rider (DRR) Last Base Rate Case Decision: Last Base Rate Case Decision: Key components of case: • South –Aug. 2007; May 2011; Allowed ROE: 10.4% • ROE of 10.75%; rate base of Allowed ROE 10.15% Estimated Rate Base $0.6B, 51% equity; cost of service review • North –Feb. 2008; (12/31/2017): $1.4B Allowed ROE 10.2% • Tax reform benefit returned to Other customers Estimated Rate Base • Annual revenue increase (12/31/2017) Shared Assets & FERC request (net) of $34M, primarily • South ‐ $0.3B Estimated plant balance for Utility from roll in of DRR and • North ‐ $1.3B Shared Assets (12/31/2017): $0.2B deferrals; minimal impact to net Estimated FERC Electric income; avg. bill increase of Transmission Rate Base ~$7/mo. (resid.) (12/31/2017): $0.1B • Extension of DRR • Staff report received; Hearing set for December 4 Note: Estimated Rate Base amounts reflect net investment since last rate case decisions Last Base Rate Case Decision: Jan. 2009; Currently allowed ROE: 10.6% 29 Vectren | EEI Financial Conference | November 2018 (Black box settlement)

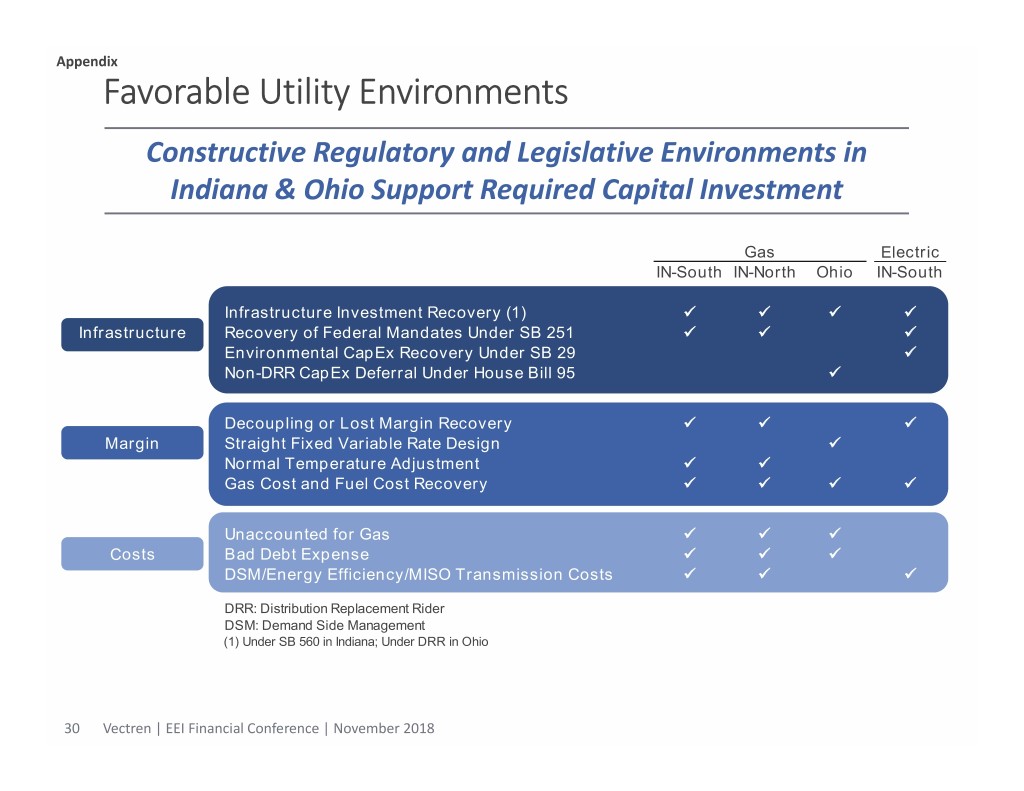

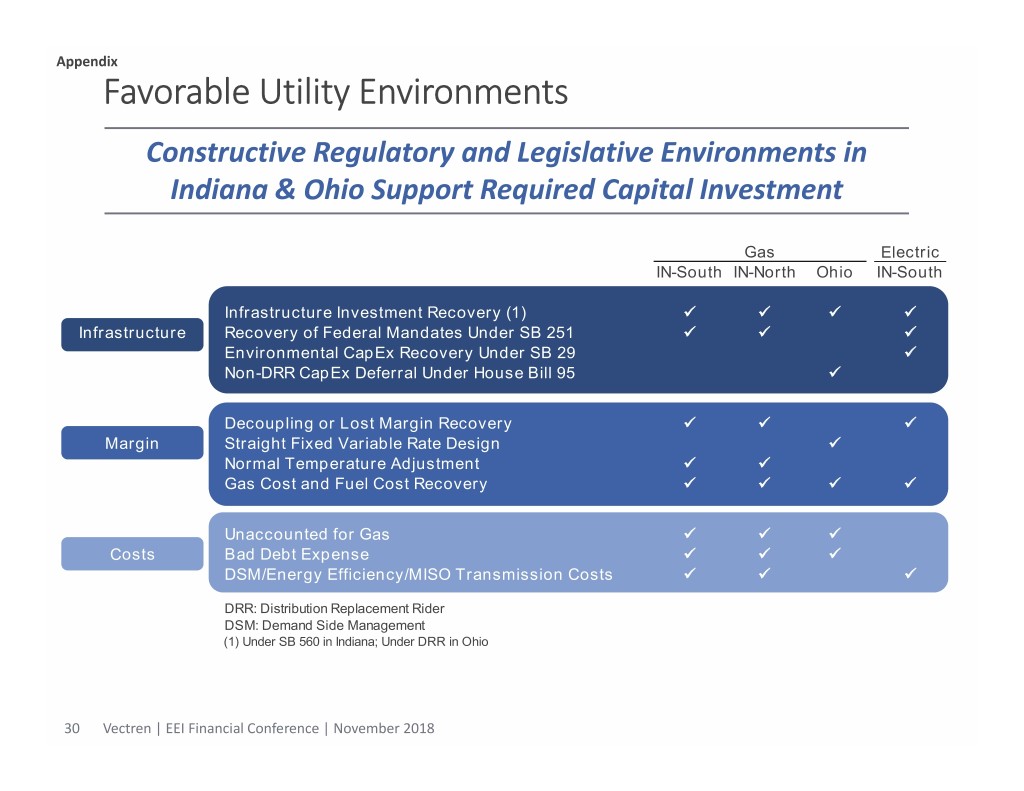

Appendix Favorable Utility Environments Constructive Regulatory and Legislative Environments in Indiana & Ohio Support Required Capital Investment Gas Electric IN-South IN-North Ohio IN-South Infrastructure Investment Recovery (1) Infrastructure Recovery of Federal Mandates Under SB 251 Environmental CapEx Recovery Under SB 29 Non-DRR CapEx Deferral Under House Bill 95 Decoupling or Lost Margin Recovery Margin Straight Fixed Variable Rate Design Normal Temperature Adjustment Gas Cost and Fuel Cost Recovery Unaccounted for Gas Costs Bad Debt Expense DSM/Energy Efficiency/MISO Transmission Costs DRR: Distribution Replacement Rider DSM: Demand Side Management (1) Under SB 560 in Indiana; Under DRR in Ohio 30 Vectren | EEI Financial Conference | November 2018

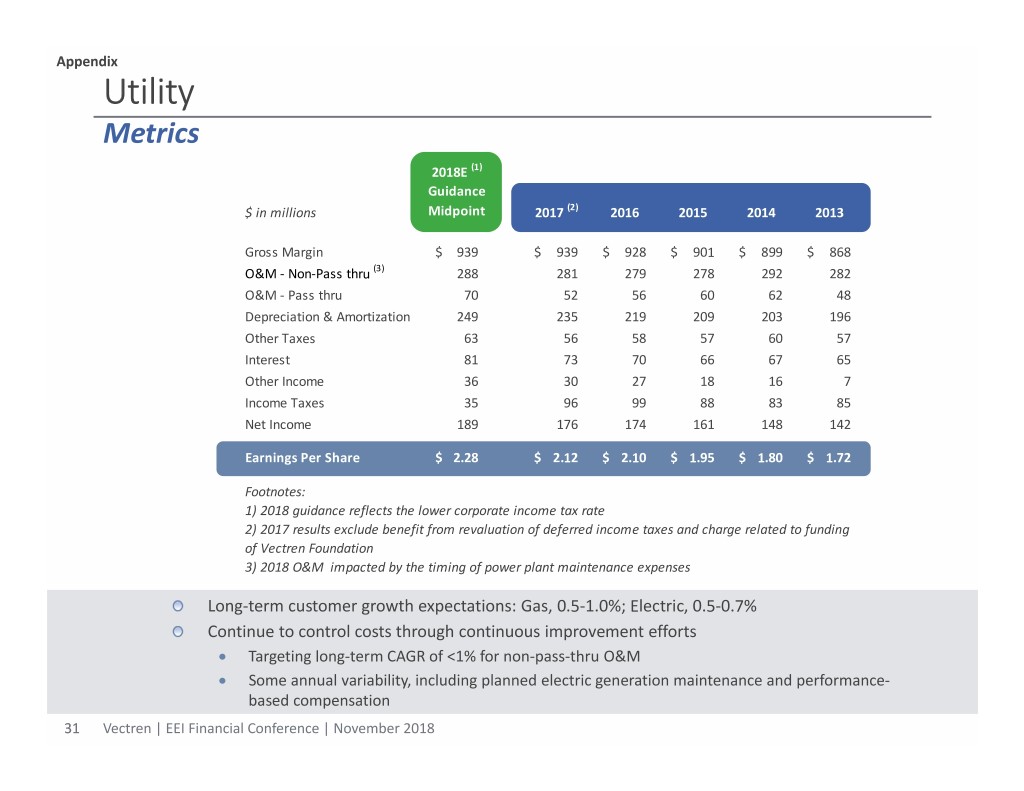

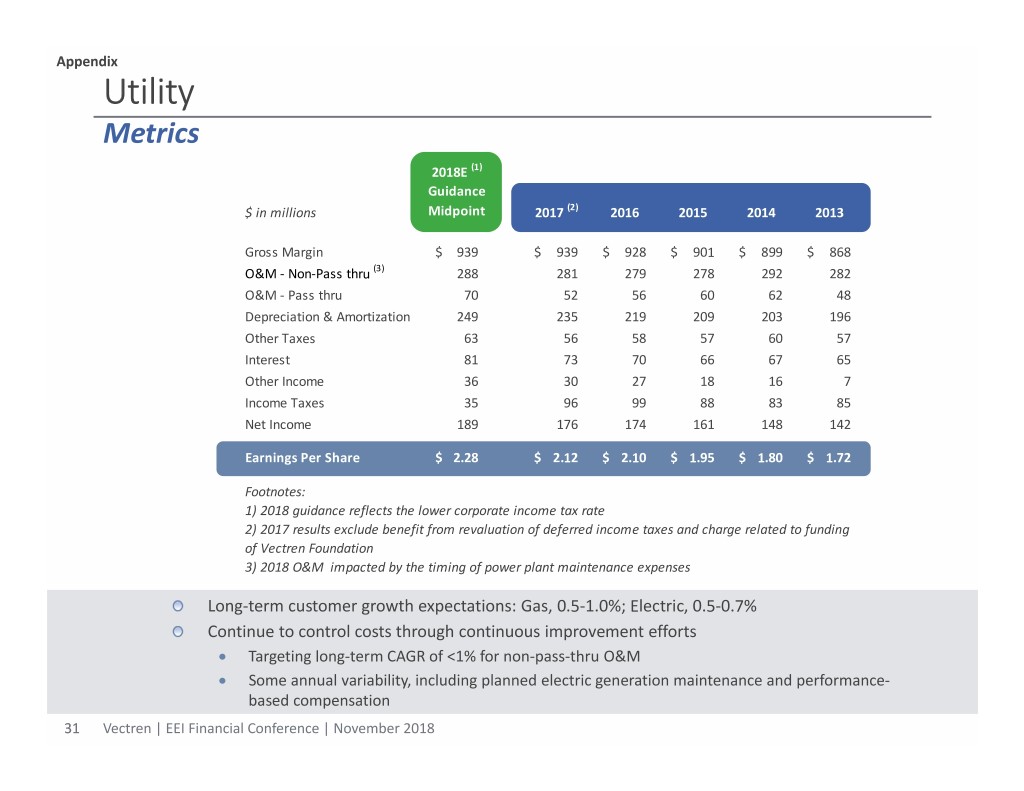

Appendix Utility Metrics 2018E (1) Guidance $ in millions Midpoint 2017 (2) 2016 2015 2014 2013 Gross Margin$ 939 $ 939 $ 928 $ 901 $ 899 $ 868 O&M ‐ Non‐Pass thru (3) 288 281 279 278 292 282 O&M ‐ Pass thru 70 52 56 60 62 48 Depreciation & Amortization 249 235 219 209 203 196 Other Taxes 63 56 58 57 60 57 Interest 81 73 70 66 67 65 Other Income 36 30 27 18 16 7 Income Taxes 35 96 99 88 83 85 Net Income 189 176 174 161 148 142 Earnings Per Share$ 2.28 $ 2.12 $ 2.10 $ 1.95 $ 1.80 $ 1.72 Footnotes: 1) 2018 guidance reflects the lower corporate income tax rate 2) 2017 results exclude benefit from revaluation of deferred income taxes and charge related to funding of Vectren Foundation 3) 2018 O&M impacted by the timing of power plant maintenance expenses Long‐term customer growth expectations: Gas, 0.5‐1.0%; Electric, 0.5‐0.7% Continue to control costs through continuous improvement efforts Targeting long‐term CAGR of <1% for non‐pass‐thru O&M Some annual variability, including planned electric generation maintenance and performance‐ based compensation 31 Vectren | EEI Financial Conference | November 2018

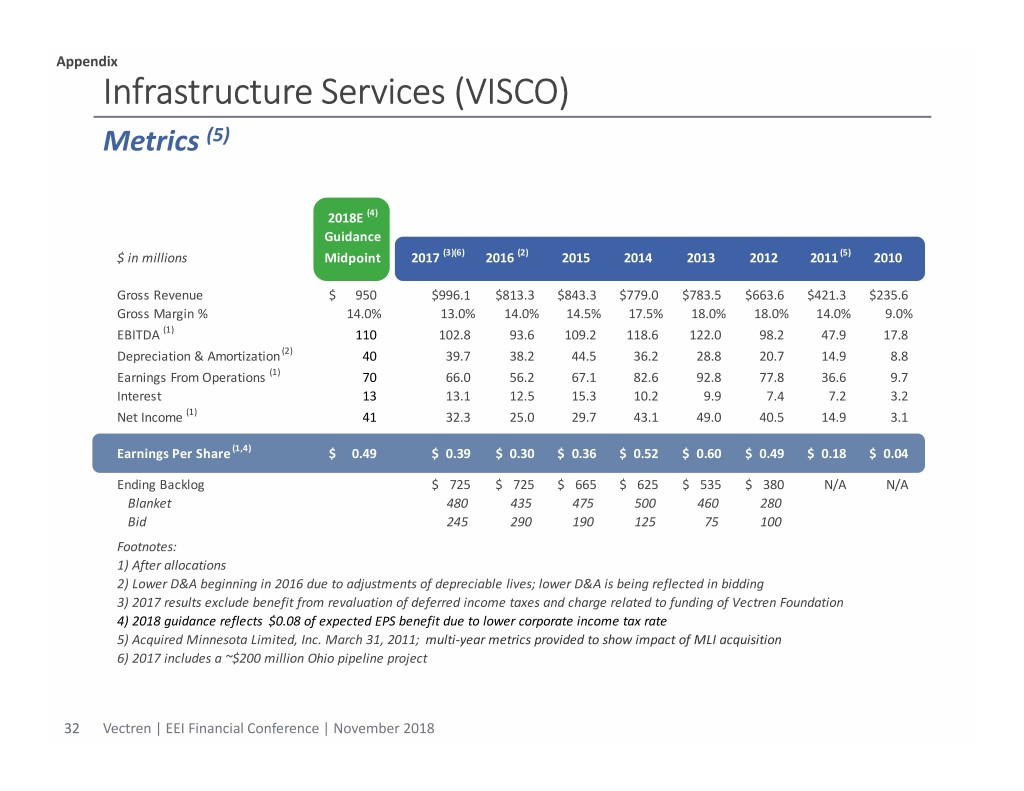

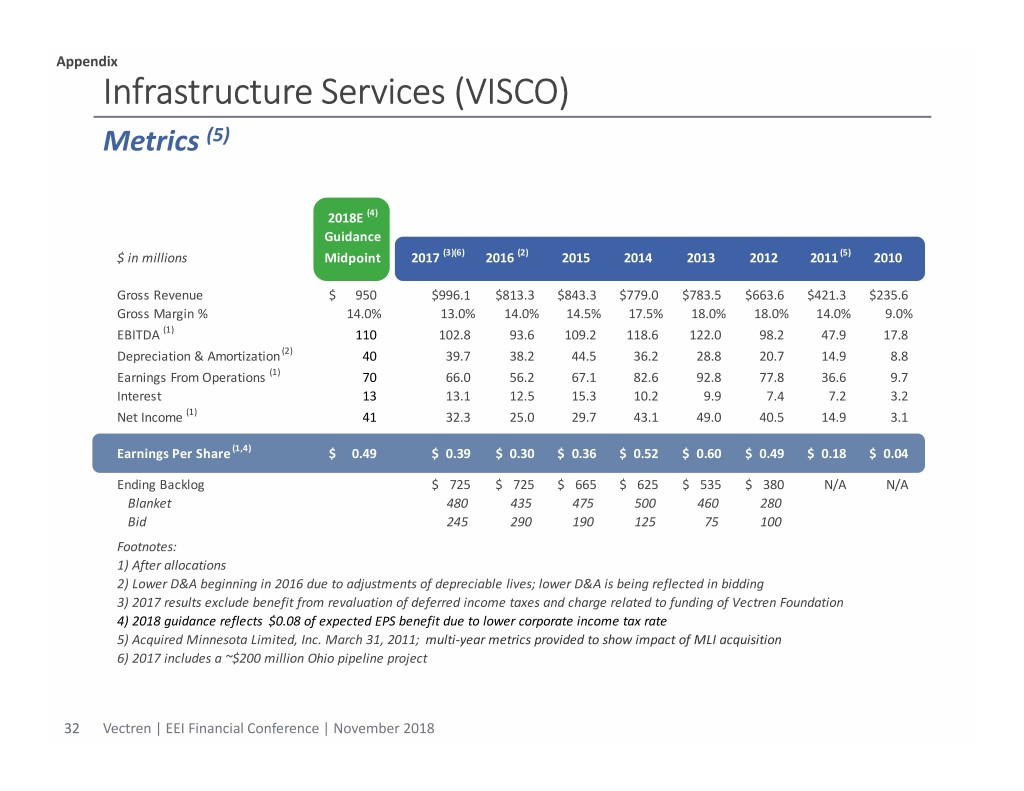

Appendix Infrastructure Services (VISCO) Metrics (5) 2018E (4) Guidance $ in millions Midpoint 2017 (3)(6) 2016 (2) 2015 2014 2013 2012 2011 (5) 2010 Gross Revenue$ 950 $996.1 $813.3 $843.3 $779.0 $783.5 $663.6 $421.3 $235.6 Gross Margin % 14.0% 13.0% 14.0% 14.5% 17.5% 18.0% 18.0% 14.0% 9.0% EBITDA (1) 110 102.8 93.6 109.2 118.6 122.0 98.2 47.9 17.8 Depreciation & Amortization (2) 40 39.7 38.2 44.5 36.2 28.8 20.7 14.9 8.8 Earnings From Operations (1) 70 66.0 56.2 67.1 82.6 92.8 77.8 36.6 9.7 Interest 13 13.1 12.5 15.3 10.2 9.9 7.4 7.2 3.2 Net Income (1) 41 32.3 25.0 29.7 43.1 49.0 40.5 14.9 3.1 Earnings Per Share (1,4) $ 0.49 $ 0.39 $ 0.30 $ 0.36 $ 0.52 $ 0.60 $ 0.49 $ 0.18 $ 0.04 Ending Backlog$ 725 $ 725 $ 665 $ 625 $ 535 $ 380 N/A N/A Blanket 480 435 475 500 460 280 Bid 245 290 190 125 75 100 Footnotes: 1) After allocations 2) Lower D&A beginning in 2016 due to adjustments of depreciable lives; lower D&A is being reflected in bidding 3) 2017 results exclude benefit from revaluation of deferred income taxes and charge related to funding of Vectren Foundation 4) 2018 guidance reflects $0.08 of expected EPS benefit due to lower corporate income tax rate 5) Acquired Minnesota Limited, Inc. March 31, 2011; multi‐year metrics provided to show impact of MLI acquisition 6) 2017 includes a ~$200 million Ohio pipeline project 32 Vectren | EEI Financial Conference | November 2018

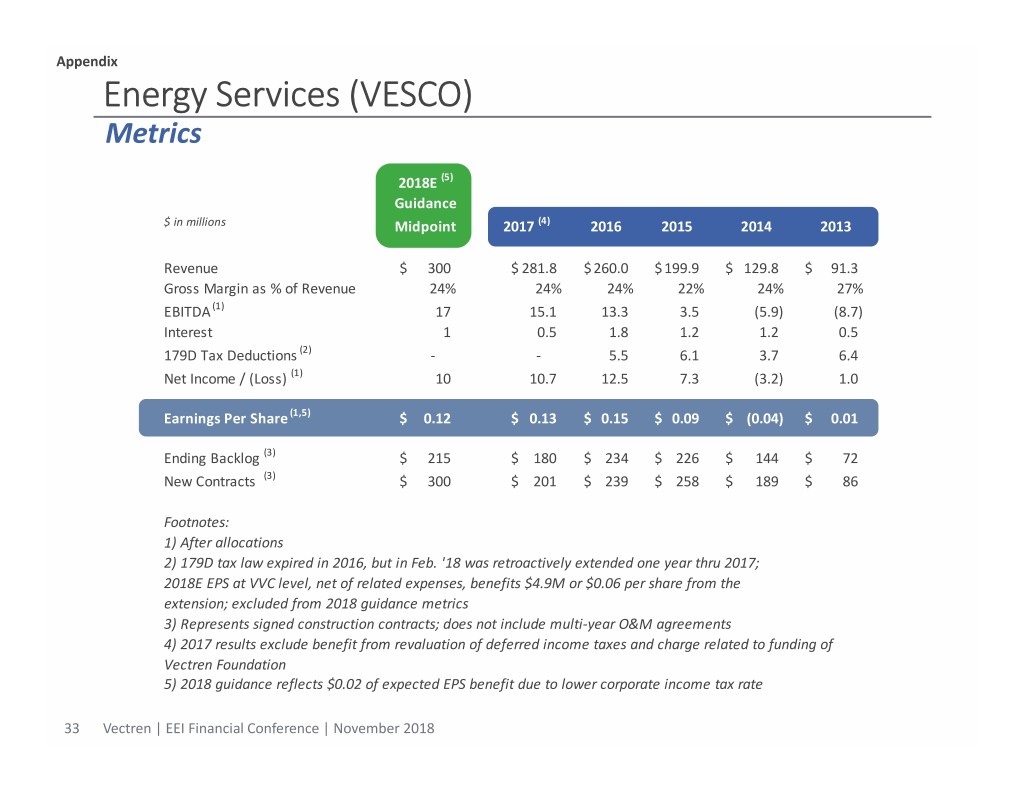

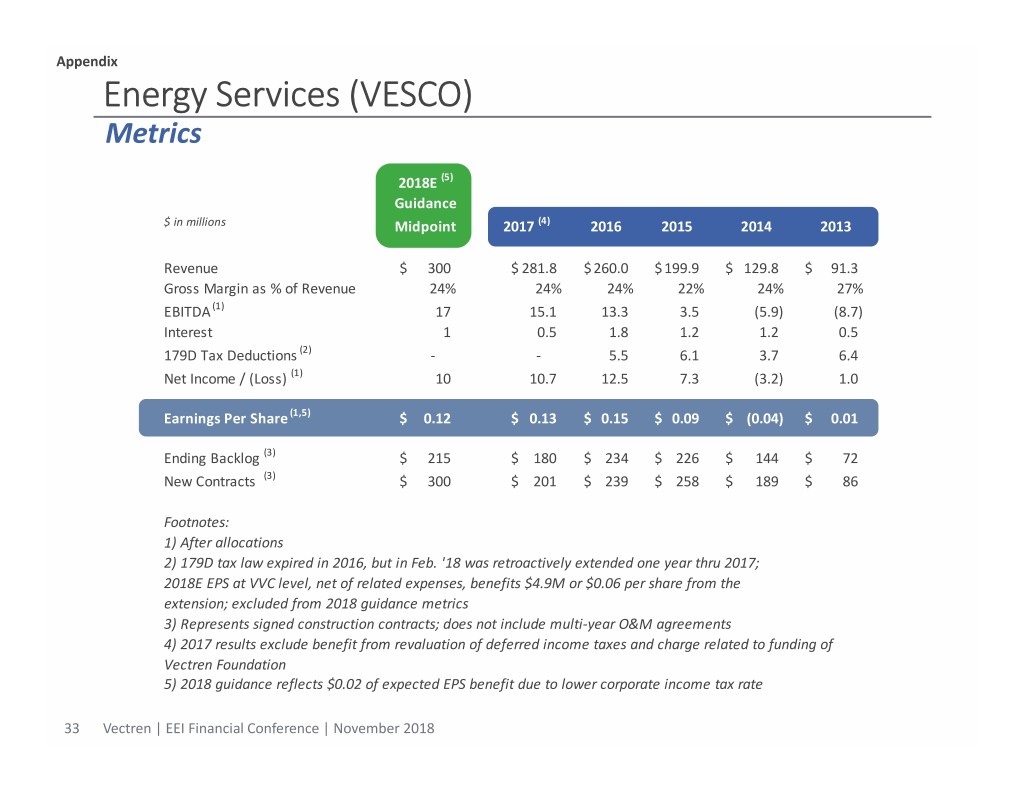

Appendix Energy Services (VESCO) Metrics 2018E (5) Guidance $ in millions Midpoint 2017 (4) 2016 2015 2014 2013 Revenue$ 300 $ 281.8 $ 260.0 $ 199.9 $ 129.8 $ 91.3 Gross Margin as % of Revenue 24% 24% 24% 22% 24% 27% EBITDA (1) 17 15.1 13.3 3.5 (5.9) (8.7) Interest 1 0.5 1.8 1.2 1.2 0.5 179D Tax Deductions (2) ‐ ‐ 5.5 6.1 3.7 6.4 Net Income / (Loss) (1) 10 10.7 12.5 7.3 (3.2) 1.0 Earnings Per Share (1,5) $ 0.12 $ 0.13 $ 0.15 $ 0.09 $ (0.04) $ 0.01 Ending Backlog (3) $ 215 $ 180 $ 234 $ 226 $ 144 $ 72 New Contracts (3) $ 300 $ 201 $ 239 $ 258 $ 189 $ 86 Footnotes: 1) After allocations 2) 179D tax law expired in 2016, but in Feb. '18 was retroactively extended one year thru 2017; 2018E EPS at VVC level, net of related expenses, benefits $4.9M or $0.06 per share from the extension; excluded from 2018 guidance metrics 3) Represents signed construction contracts; does not include multi‐year O&M agreements 4) 2017 results exclude benefit from revaluation of deferred income taxes and charge related to funding of Vectren Foundation 5) 2018 guidance reflects $0.02 of expected EPS benefit due to lower corporate income tax rate 33 Vectren | EEI Financial Conference | November 2018