Exhibit 99.1

1 “To Serve All People During the End of Life’s Journey”

2 FORWARD-LOOKING STATEMENTS Certain statements contained in this presentation are forward-looking statements within the meaning of the federal securities laws. Such forward-looking statements are based on management’s current expectations and are subject to known and unknown risks, uncertainties and assumptions which may cause the forward-looking events and circumstances discussed in this presentation to differ materially from those anticipated or implied by the forward-looking statements. Additional risks, uncertainties and assumptions include, but are not limited to, general market conditions; adverse changes in reimbursement levels under Medicare and Medicaid programs; adverse changes in the Medicare payment cap limits and increases in the Company’s estimated Medicare cap contractual adjustment; our ability to complete and successfully integrate the acquisition of VistaCare, Inc.; decline in patient census growth; increases in inflation including inflationary increases in patient care costs; challenges inherent in and potential changes in the Company’s growth and development strategy; our ability to effectively implement the Company’s 2008 operations and development initiatives; the Company’s dependence on patient referral sources and potential adverse changes in patient referral practices of those referral sources; our ability to implement a new integrated billing and clinical management and electronic medical records system; the ability to attract and retain healthcare professionals; increases in the Company’s bad debt expense due to various factors including an increase in the volume of pre-payment reviews by the Company’s Medicare fiscal intermediaries; adverse changes in the state and federal licensure and certification laws and regulations; adverse results of regulatory surveys; delays in licensure and/or certification; government and private party, legal proceedings and investigations; cost of complying with the terms and conditions of our corporate integrity agreement; adverse changes in the competitive environment in which the Company operates; changes in state or federal income, franchise or similar tax laws and regulations; adverse impact of natural disasters; changes in our estimate of additional compensation costs under FASB Statement No. 123(R); and the disclosures contained under the headings “Government Regulation and Payment Structure” in “Item 1. Business” and “Item 1A. Risk Factors” of Odyssey’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 9, 2007, and its most recent report on Form 10-Q and in its other filings with the Securities and Exchange Commission. Many of these factors are beyond the ability of the Company to control or predict. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements, which reflect management’s views only as of the date hereof. The Company undertakes no obligation to revise or update any of the forward-looking statements or publicly announce any updates or revisions to any of the forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions, circumstances or assumptions underlying such statements.

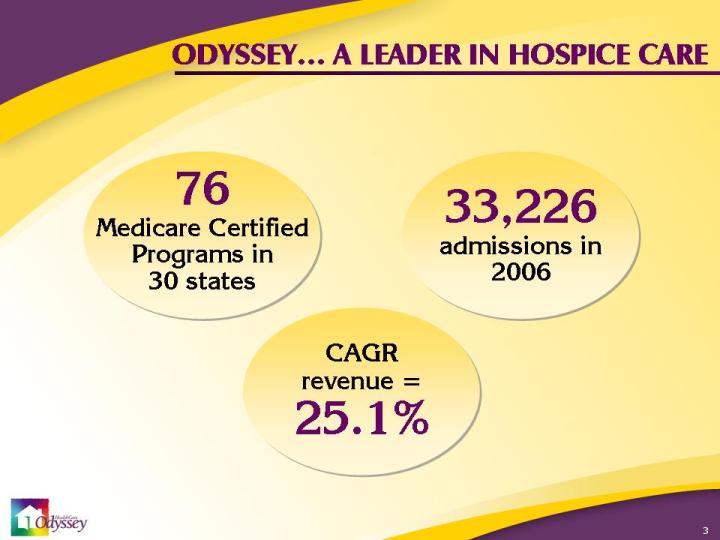

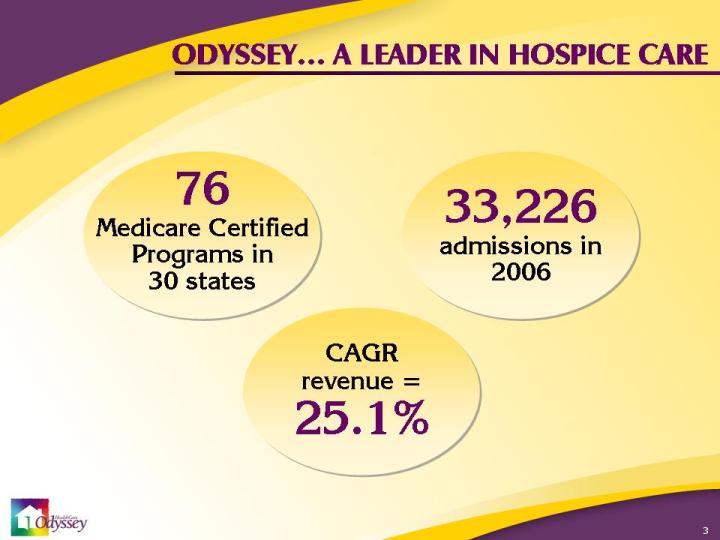

3 ODYSSEY… A LEADER IN HOSPICE CARE 76 Medicare Certified Programs in 30 states 33,226 admissions in 2006 CAGR revenue = 25.1%

4 Growing recognition of end of life services Aging population assures increased demand VistaCare acquisition adds scale and expands leadership position Strong balance sheet/cash surplus Compelling operating/growth strategy Experienced management team with strong integration and operating background VALUE PROPOSITION

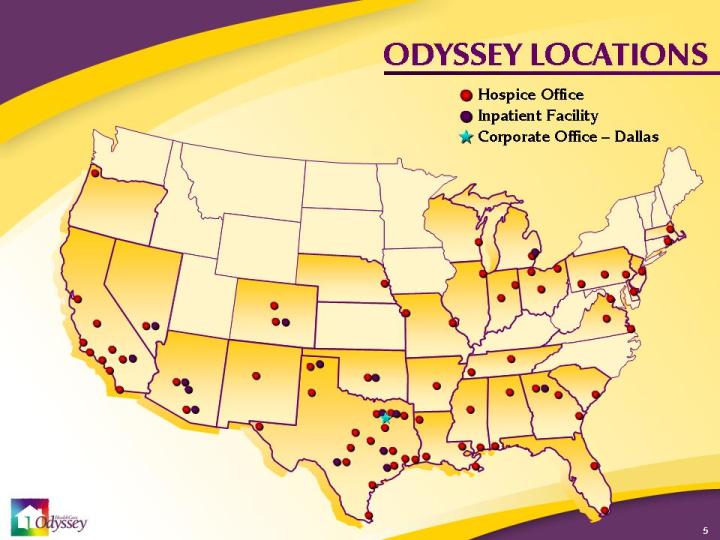

5 ODYSSEY LOCATIONS Hospice Office Inpatient Facility Corporate Office – Dallas

6 COMBINED LOCATIONS Odyssey Locations Hospice Office Inpatient Facility Corporate Office – Dallas VistaCare Locations Hospice Office Inpatient Facility

7 WHAT IS HOSPICE? More cost effective Services provided primarily in home Provides quality of life for terminal patients and families Focus on physical, emotional and spiritual

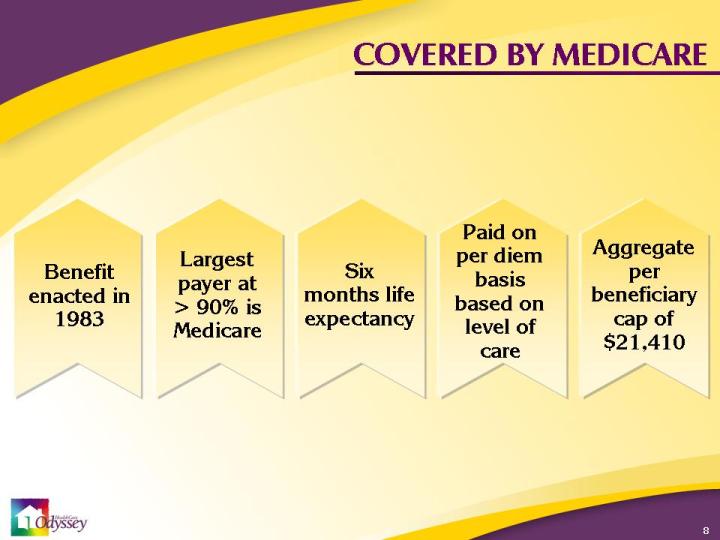

8 COVERED BY MEDICARE Benefit enacted in 1983 Aggregate per beneficiary cap of $21,410 Largest payer at > 90% is Medicare Six months life expectancy Paid on per diem basis based on level of care

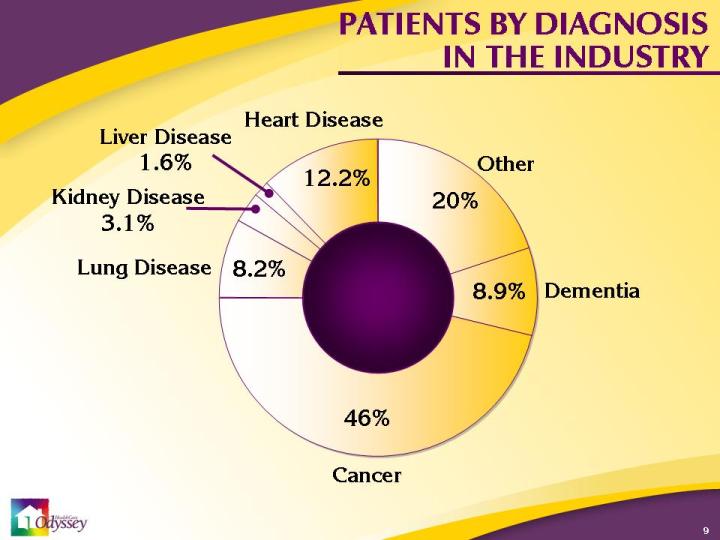

9 PATIENTS BY DIAGNOSIS IN THE INDUSTRY Heart Disease 12.2% 20% 8.9% 46% 8.2% Other Dementia Cancer Lung Disease Kidney Disease 3.1% Liver Disease 1.6%

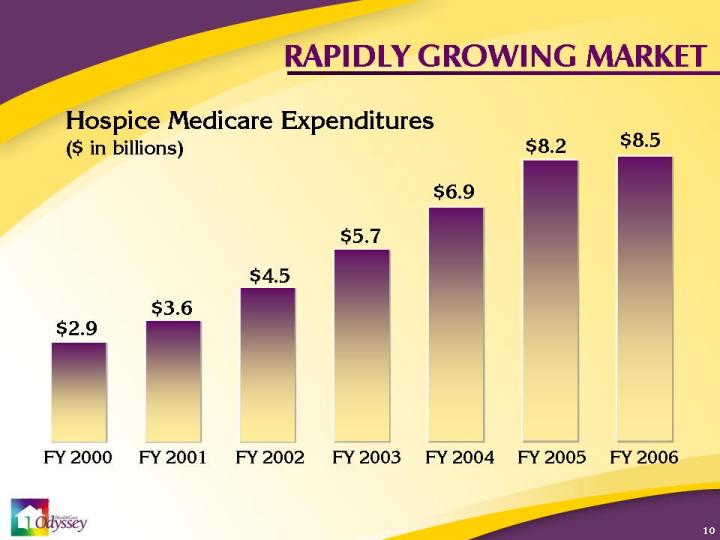

10 RAPIDLY GROWING MARKET Hospice Medicare Expenditures ($ in billions) $2.9 $3.6 $4.5 $5.7 $8.5 FY 2000 FY 2001 FY 2002 FY 2003 FY 2006 $6.9 FY 2004 $8.2 FY 2005

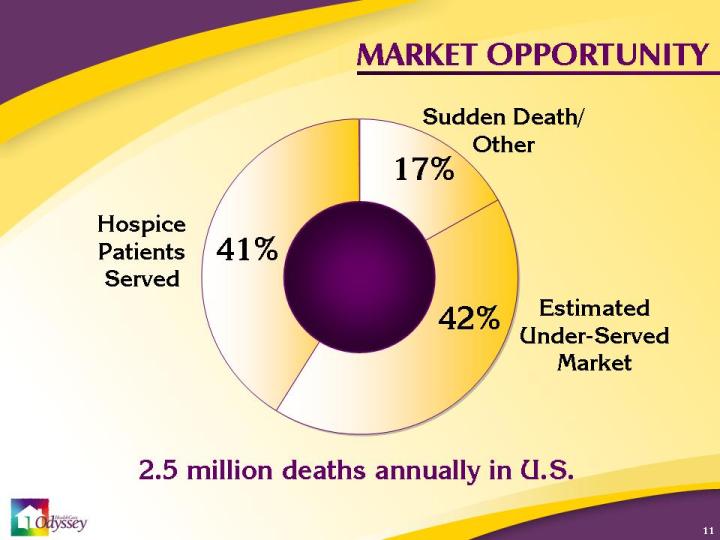

11 MARKET OPPORTUNITY Sudden Death/Other Hospice Patients Served 41% 2.5 million deaths annually in U.S. 42% Estimated Under-Served Market 17%

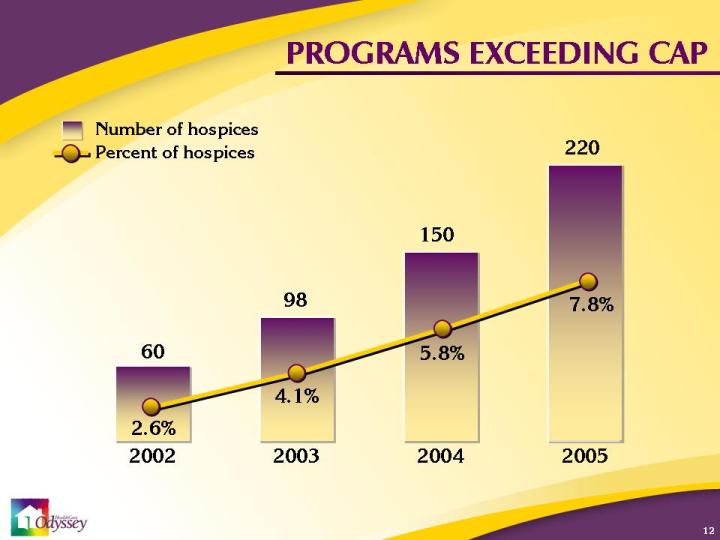

12 PROGRAMS EXCEEDING CAP 2002 2005 2003 Number of hospices Percent of hospices 220 2004 150 60 98 2.6% 4.1% 5.8% 7.8%

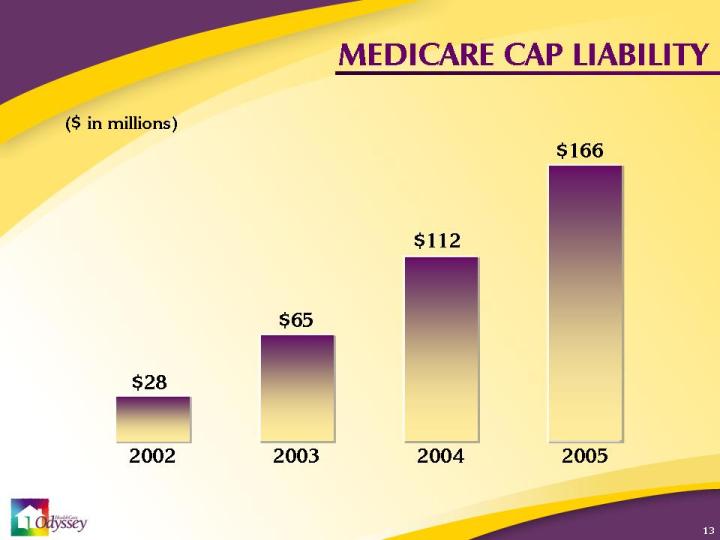

13 MEDICARE CAP LIABILITY 2002 2005 2003 ($ in millions) $166 2004 $112 $28 $65

14 GROWTH IN HOSPICE PROGRAMS 2002 2005 2003 (Number of hospices) 2,809 2004 2,580 2,286 2,401 2006 3,071

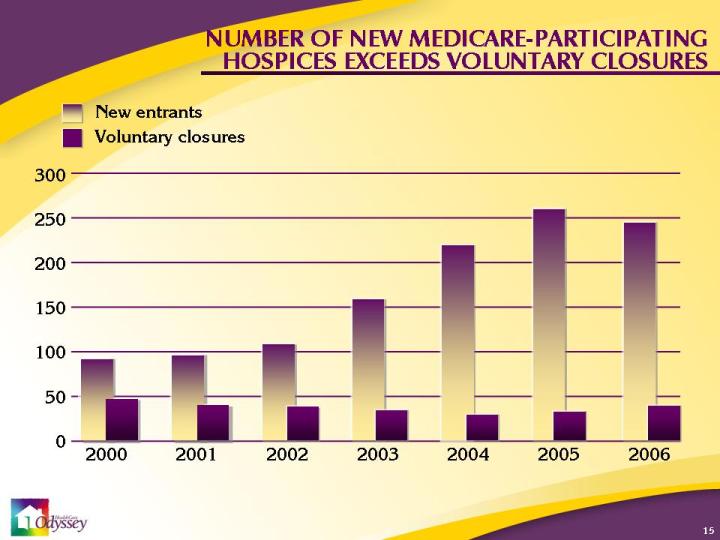

15 NUMBER OF NEW MEDICARE-PARTICIPATING HOSPICES EXCEEDS VOLUNTARY CLOSURES 2000 300 250 200 150 100 50 0 New entrants Voluntary closures 2001 2002 2003 2004 2005 2006

16 Management of Medicare cap STRATEGIC FOCUS

17 MANAGEMENT OF MEDICARE CAP Consolidation of programs Inpatient unit development Market for a more balanced patient mix Closed programs

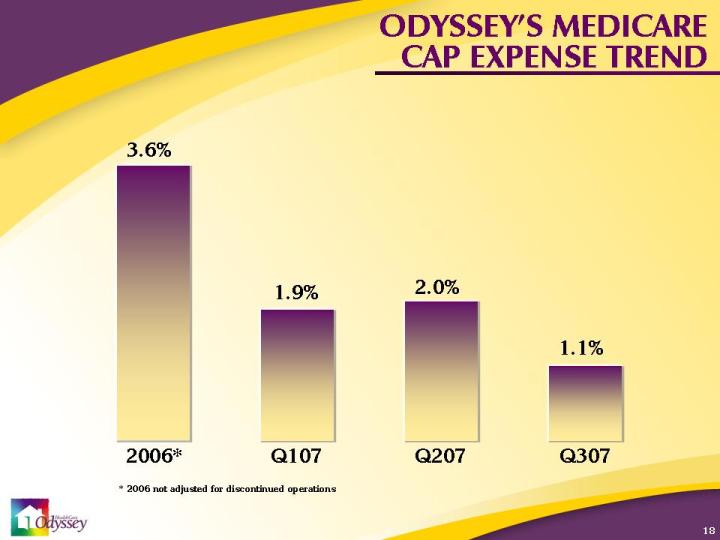

18 ODYSSEY’S MEDICARE CAP EXPENSE TREND 2006* Q307 Q107 1.1% Q207 2.0% 3.6% 1.9% * 2006 not adjusted for discontinued operations

19 Management of Medicare cap Strengthen senior management team STRATEGIC FOCUS

20 Added in the past two years . . . President and Chief Executive Officer, Robert Lefton Senior Vice President and Chief Financial Officer, Dirk Allison Senior Vice President and Chief Operating Officer, Craig Goguen STRENGTHEN SENIOR MANAGEMENT TEAM

21 Management of Medicare cap Strengthen senior management team Focus on existing footprint STRATEGIC FOCUS

22 GROWTH STRATEGY Growth Same store growth De Novos Acquisitions

23 Management of Medicare cap Strengthen senior management team Focus on existing footprint Rationalize existing portfolio STRATEGIC FOCUS

24 RATIONALIZE EXISTING PORTFOLIO Closed 11 programs Reasons for closure: Competitive position Market size Medicare cap

25 Management of Medicare cap Strengthen senior management team Focus on existing footprint Rationalize existing portfolio Implement more sophisticated sales and marketing strategy STRATEGIC FOCUS

26 IMPLEMENT MORE SOPHISTICATED SALES AND MARKETING STRATEGY Hired Regional Sales Manager Revamped CER bonus plan Developed detailed marketing plan for major markets

27 Management of Medicare cap Strengthen senior management team Focus on existing footprint Rationalize existing portfolio Implement more sophisticated sales and marketing strategy Inpatient program development STRATEGIC FOCUS

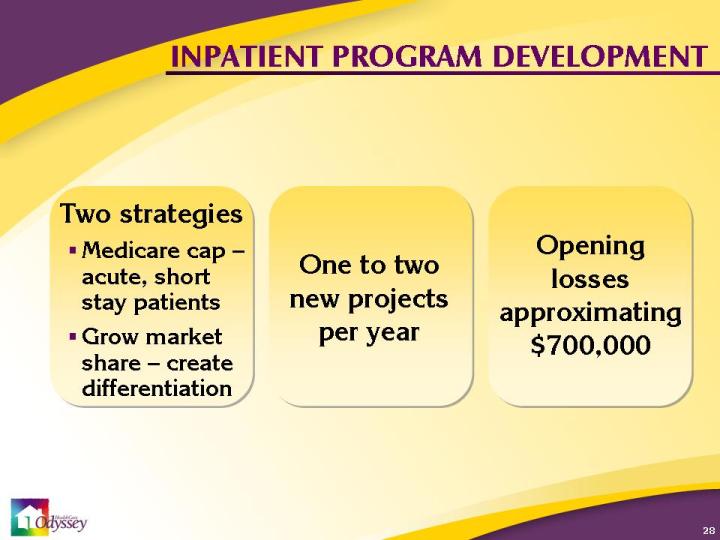

28 INPATIENT PROGRAM DEVELOPMENT Two strategies Medicare cap – acute, short stay patients Grow market share – create differentiation One to two new projects per year Opening losses approximating $700,000

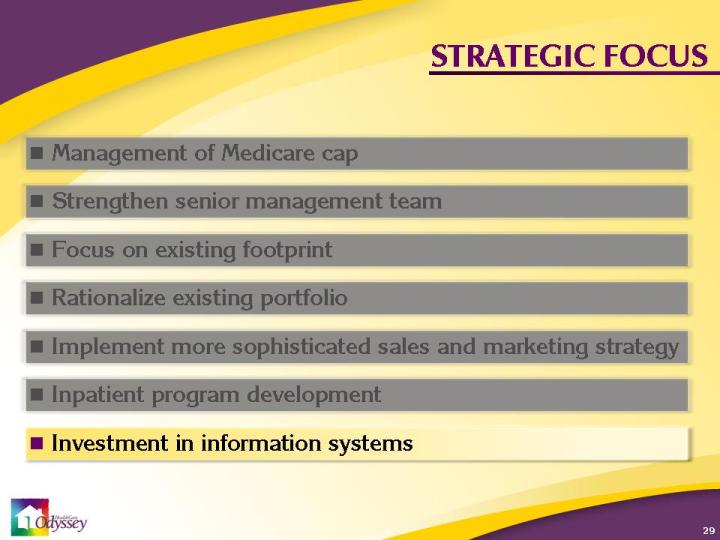

29 STRATEGIC FOCUS Management of Medicare cap Strengthen senior management team Focus on existing footprint Rationalize existing portfolio Implement more sophisticated sales and marketing strategy Inpatient program development Investment in information systems

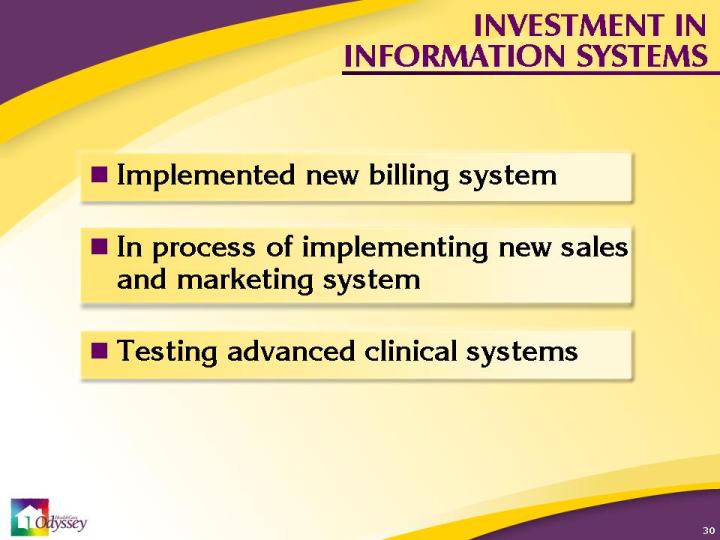

30 INVESTMENT IN INFORMATION SYSTEMS Implemented new billing system In process of implementing new sales and marketing system Testing advanced clinical systems

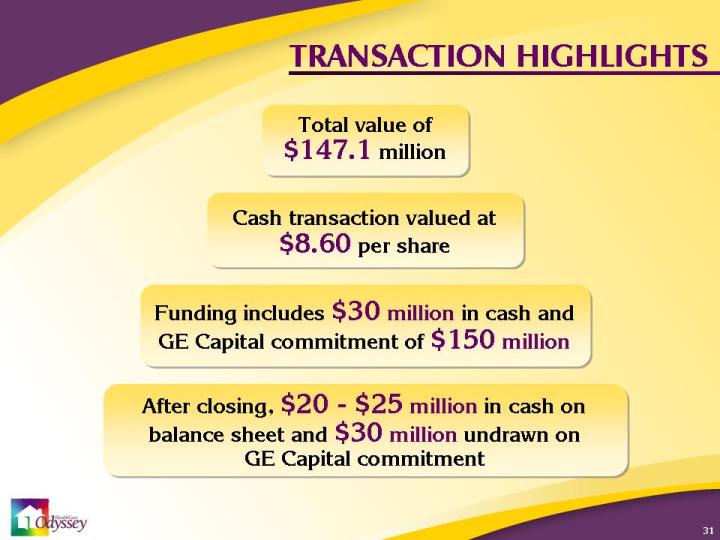

31 Total value of $147.1 million TRANSACTION HIGHLIGHTS Cash transaction valued at $8.60 per share Funding includes $30 million in cash and GE Capital commitment of $150 million After closing, $20 - $25 million in cash on balance sheet and $30 million undrawn on GE Capital commitment

32 COMBINED COMPANY $650 million in revenues 110 locations ADC of more than 12,000 30 states

33 VISTACARE TRANSACTION Expands leadership position Compatible organizations Strengthens existing markets Management experience with acquisitions and integration Reducing corporate overhead and closing corporate offices drives profitability Operational and Medicare cap improvements not required for success Neutral in 2008/accretive in 2009 Expected 2008 first quarter closing

35 2002 2003 2004 2006 2005 Q307 Q306 2001 NET REVENUE GROWTH FROM CONTINUING OPERATIONS CAGR = 25.1% $130.2 $194.3 $267.9 $333.3 $399.0 $369.2 $104.3 $100.2 ($ in millions)

36 ADMISSIONS FROM CONTINUING OPERATIONS 15,969 21,764 26,330 30,084 33,226 32,347 8,014 7,960 2001 2002 2003 2004 2006 2005 Q307 Q306

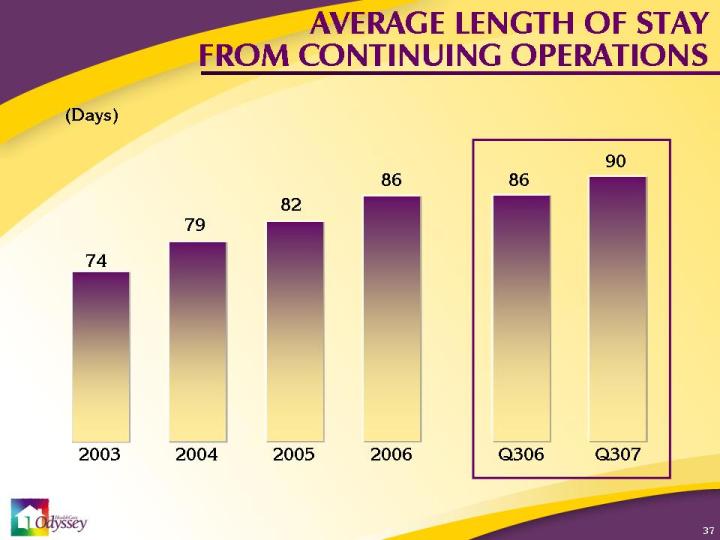

37 AVERAGE LENGTH OF STAY FROM CONTINUING OPERATIONS 74 79 82 86 90 86 2003 2004 2006 2005 Q307 Q306 (Days)

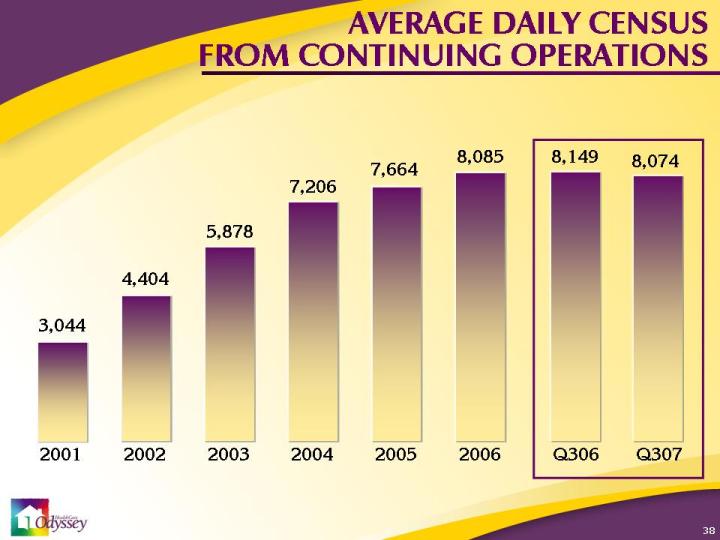

38 AVERAGE DAILY CENSUS FROM CONTINUING OPERATIONS 3,044 4,404 5,878 7,206 8,085 7,664 8,074 8,149 2001 2002 2003 2004 2006 2005 Q307 Q306

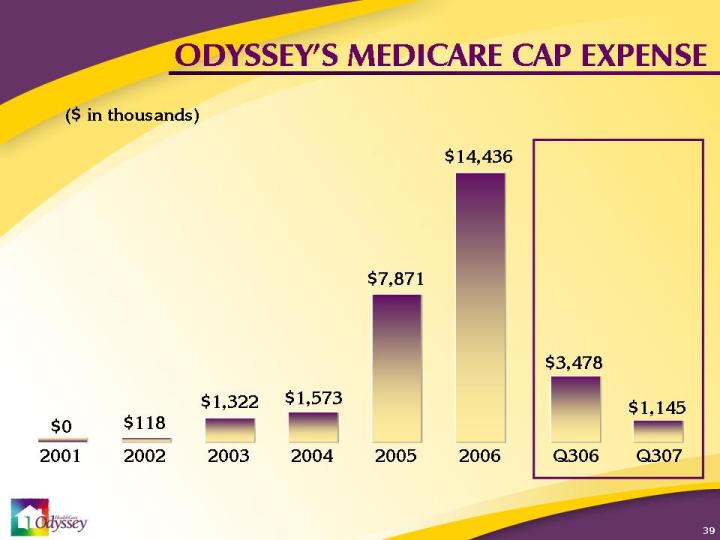

39 ODYSSEY’S MEDICARE CAP EXPENSE $0 $118 $1,322 $1,573 $14,436 $7,871 $1,145 $3,478 2001 2002 2003 2004 2006 2005 Q307 Q306 ($ in thousands)

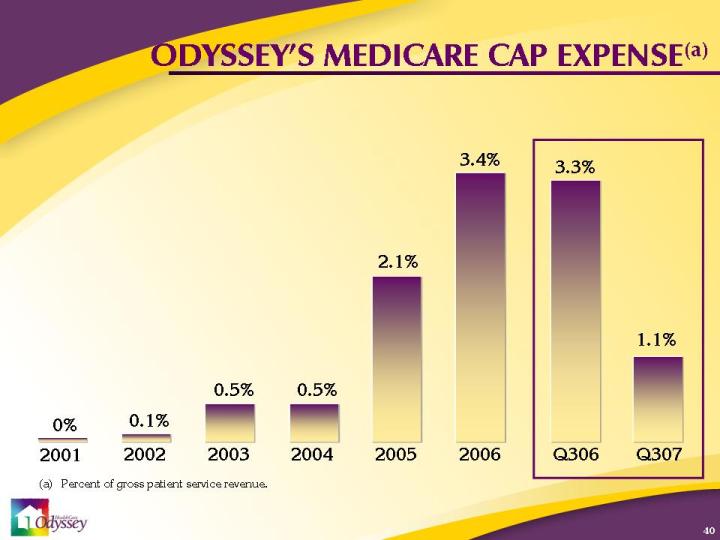

40 ODYSSEY’S MEDICARE CAP EXPENSE(a) 0% 0.1% 0.5% 0.5% 3.4% 2.1% 1.1% 3.3% 2001 2002 2003 2004 2006 2005 Q307 Q306 (a) Percent of gross patient service revenue.

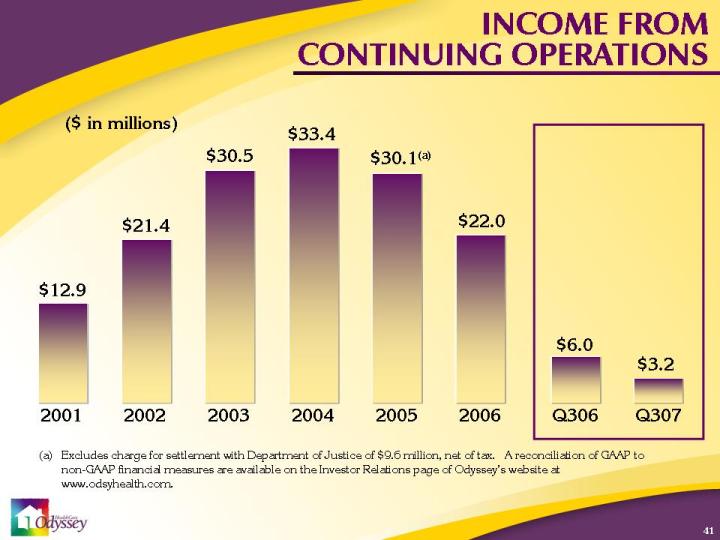

41 INCOME FROM CONTINUING OPERATIONS (a) Excludes charge for settlement with Department of Justice of $9.6 million, net of tax. A reconciliation of GAAP to non-GAAP financial measures are available on the Investor Relations page of Odyssey’s website at www.odsyhealth.com. $30.1(a) $12.9 $21.4 $30.5 $33.4 $22.0 $3.2 $6.0 2001 2002 2003 2004 2006 2005 Q307 Q306 ($ in millions)

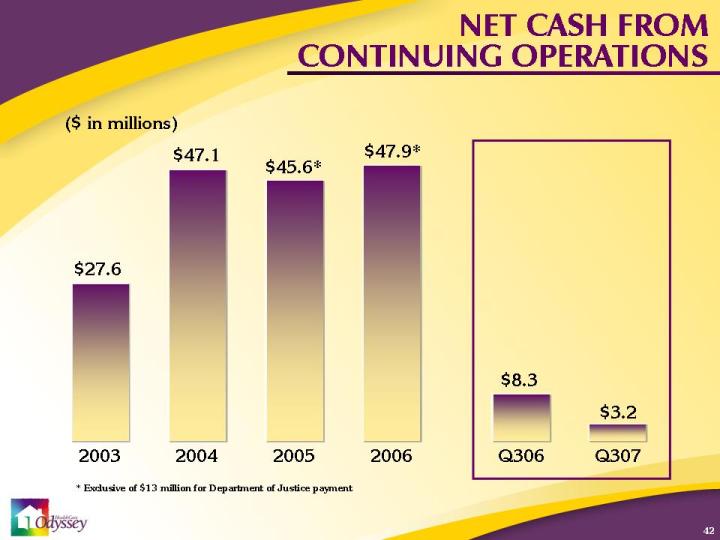

42 NET CASH FROM CONTINUING OPERATIONS * Exclusive of $13 million for Department of Justice payment $27.6 $47.1 $45.6* $47.9* $8.3 $3.2 2003 2004 2006 2005 Q307 Q306 ($ in millions)

43 Growing recognition of end of life services Aging population assures increased demand VistaCare acquisition adds scale and expands leadership position Strong balance sheet/cash surplus Compelling operating/growth strategy Experienced management team with strong integration and operating background VALUE PROPOSITION

44 “To Serve All People During the End of Life’s Journey”