SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

OGLEBAY NORTON COMPANY

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: N/A |

| | (2) | | Aggregate number of securities to which transaction applies: N/A |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| | (4) | | Proposed maximum aggregate value of transaction: N/A |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount previously paid: N/A |

| | (2) | | Form, Schedule or Registration Statement No.: N/A |

PROXY STATEMENT DATED MARCH 19, 2003

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 30, 2003

You are cordially invited to attend the Annual Meeting of Shareholders of Oglebay Norton Company. The Annual Meeting will be held at The Forum Conference and Education Center, 1375 East Ninth Street, Cleveland, Ohio, on Wednesday, April 30, 2003, at 10:00 a.m., Cleveland, Ohio time. At the Annual Meeting, we will ask you to:

| | • | | elect nine Directors for a one year term expiring in 2004; |

| | • | | consider a proposal to amend and restate Oglebay Norton’s Code of Regulations; and |

| | • | | transact any other business that may properly come before the Annual Meeting. |

The Board of Directors fixed the close of business on March 12, 2003 as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting, or at any postponement or adjournment of the Annual Meeting. Shareholders of record may vote their shares by using the Internet or the telephone or by marking their votes on the enclosed proxy card, signing and dating it and mailing it in the enclosed envelope. Instructions for voting by using the Internet or the telephone are set forth on the enclosed proxy card.

Oglebay Norton’s Proxy Statement is attached to this Notice. We are also mailing our Report to Shareholders and our Annual Report on Form 10-K for the year ended December 31, 2002 to you with this Notice.

The Board of Directors unanimously recommends a vote FOR each of the nine Directors listed on pages 3 through 5 of this Proxy Statement and FOR approval of the proposed amendment and restatement of the Code of Regulations.

YOUR VOTE IS IMPORTANT

Please vote by using the Internet or the telephone or by signing and dating your proxy card and returning it in the enclosed envelope.

By Order of the

Board of Directors

ROCHELLE F. WALK

Vice President and

Secretary

March 19, 2003

This Proxy Statement is first being mailed to shareholders on or about March 19, 2003.

OGLEBAY NORTON COMPANY

North Point Tower

1001 Lakeside Avenue, 15th Floor

Cleveland, Ohio 44114-1151

(216) 861-3300

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 30, 2003

Oglebay Norton is providing this Proxy Statement to you in connection with the solicitation of proxies by the Board of Directors for use at the Annual Meeting of Shareholders to be held on April 30, 2003, and at any postponement or adjournment of the Annual Meeting. We anticipate that the mailing of this Proxy Statement and accompanying form of proxy to shareholders will begin on or about March 19, 2003. The date of this Proxy Statement is March 19, 2003.

Purpose of the Annual Meeting

The purpose of the Annual Meeting is to consider two proposals:

| | • | | Proposal 1—To elect nine Directors to the Board of Directors for a term of one year expiring in 2004. The nominees for Directors, with information about each of them, are set forth below under the heading “Proposal 1—Election of Directors.” |

| | • | | Proposal 2—To approve an amendment and restatement of Oglebay Norton’s Code of Regulations to clarify and update existing provisions. A description of the proposed amendments are set forth below under the heading “Proposal 2—Amendment and Restatement of Regulations.” |

Additionally, at the Annual Meeting shareholders will hear reports and transact any other business that may properly come before the Annual Meeting, including any postponement or adjournment of the meeting.

Voting Rights and Proxy Information

Record Date; Quorum; Required Vote. The Board of Directors of Oglebay Norton fixed the close of business on March 12, 2003 as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting, or any postponement or adjournment of the Annual Meeting. As of March 12, 2003, 5,001,203 common shares of Oglebay Norton were outstanding. Each common share of Oglebay Norton is entitled to one vote.

A majority of the common shares of Oglebay Norton issued and outstanding and entitled to vote must be represented in person or by proxy at the Annual Meeting for a quorum to be present for purposes of transacting business. A quorum being present, the Director nominees who receive the greatest number of votes will be elected as Directors. Approval of the proposal relating to the amendment and restatement of the Code of Regulations requires the favorable vote of a majority of the issued and outstanding shares of Oglebay Norton entitled to vote at the meeting. Abstentions and broker non-votes (shares held by brokers in street name that are not entitled to vote at the meeting due to the absence of specific instructions) are counted in determining votes present at the meeting. An abstention or broker non-vote has the same effect as a vote against a Director nominee or a proposal because each abstention or broker non-vote is one less vote for a Director nominee or in favor of a proposal.

Cumulative Voting. In the election of Oglebay Norton’s Directors, you may cumulate your votes. Cumulative voting allows you to cast a number of votes equal to the number of Directors to be elected multiplied by the number of votes to which your shares are entitled. You may cast all of your votes for one nominee or

1

distribute your votes among two or more nominees. Cumulative voting is permitted only if a shareholder gives notice in writing to the President, a Vice President or the Secretary of Oglebay Norton at least 48 hours in advance of the Annual Meeting and an announcement is made at the beginning of the meeting by the President, Secretary or the shareholder who gave the notice. No shareholder has advised Oglebay Norton that such shareholder intends to cumulate votes at the Annual Meeting.

Proxies. All common shares of Oglebay Norton represented at the Annual Meeting by properly appointed proxies will be voted in accordance with the instructions on the proxies. If no instructions are given, proxies will be voted FOR the election as Directors of the nominees listed under the heading “Proposal 1—Election of Directors.” If cumulative voting is in effect, shares represented by each properly appointed proxy card will be voted on a cumulative basis, with the votes distributed among the nominees in accordance with the judgment of the persons named in the proxy card. However, the persons named in the proxy card will not vote any shares cumulatively for nominees for whom authority to vote was withheld. Proxies without instructions will also be voted FOR the approval of the proposal to amend and restate Oglebay Norton’s Code of Regulations listed under heading “Proposal 2—Amendment and Restatement of Regulations.” Oglebay Norton has no knowledge of any other matters to be presented at the Annual Meeting. If other matters properly come before the Annual Meeting, the persons named on the proxies will vote on these matters in accordance with their best judgment.

If you give a proxy pursuant to this solicitation, you may revoke the proxy at any time before it is voted. You may revoke your proxy by:

| | • | | delivering a written notice of revocation dated later than the proxy to the Secretary of Oglebay Norton (at the address included on page 1 of this Proxy Statement); |

| | • | | properly appointing another proxy for the same shares and delivering it to the Secretary of Oglebay Norton; or |

| | • | | attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not by itself revoke your proxy). |

Oglebay Norton will pay the cost of preparing and mailing its proxy materials to the shareholders of Oglebay Norton in connection with the Annual Meeting. Oglebay Norton will also pay for the cost of soliciting proxies, including a fee of approximately $6,500 payable to Georgeson & Company Inc. In addition to the solicitation of proxies by the use of the mails, Oglebay Norton may solicit the return of proxies in person and by telephone, telecopy or email. Through Georgeson & Company Inc., Oglebay Norton will request brokerage houses, banks and other custodians, nominees and fiduciaries to forward soliciting material to the beneficial owners of shares and will reimburse them for their expenses.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Oglebay Norton’s Board of Directors currently has nine members. The Board is not classified, and each Director elected at the Annual Meeting will serve a one year term, expiring at the Annual Meeting in 2004, and until a successor is elected and qualified. The biographies of each of the Director nominees standing for election are included below. One of Oglebay Norton’s current directors, John D. Weil, will not stand for re-election. Proxies cannot be voted for a greater number of persons than the number of nominees contained in this Proxy Statement.The Board of Directors of Oglebay Norton recommends a vote FOR each of Malvin E. Bank, William G. Bares, James T. Bartlett, Albert C. Bersticker, John N. Lauer, Madeleine W. Ludlow, Michael D. Lundin, William G. Pryor and Judith A. Wolfe as Directors whose term in office will expire in 2004.

If any of these nominees become unavailable, it is intended that the proxies will be voted as the Board of Directors determines. Oglebay Norton has no reason to believe that any of the nominees will be unavailable. The nine nominees receiving the greatest number of votes will be elected as Directors.

Nominees for Term Expiring in 2004

Name

| | Age

| | Principal Occupation, Business Experience and Other Directorships

| | Director Since

|

Malvin E. Bank | | 72 | | Chairman, Metropolitan Bank & Trust Company and Metropolitan Financial Corp., General Counsel, The Cleveland Foundation, a charitable organization serving Greater Cleveland. Previously, a Partner with Thompson Hine LLP, a law firm, for more than five years. | | 1977 |

|

William G. Bares | | 61 | | Chairman of the Board and Chief Executive Officer, since January 2003, Chairman of the Board, President and Chief Executive Officer, from April 1996 to January 2003, President and Chief Executive Officer, from January 1996 to April 1996, and President and Chief Operating Officer, from 1987 to 1995, of The Lubrizol Corporation, Cleveland, Ohio, a high performance fluid technologies company. Mr. Bares also serves on the Boards of Directors of Applied Industrial Technologies, Inc. and KeyCorp. | | 1982 |

|

James T. Bartlett | | 66 | | Advising Director, since 2002, and Managing Director, for more than five years until 2002, of Primus Venture Partners, Inc., Cleveland, Ohio, and fund manager for Primus Capital Fund and Primus Capital Funds II, III, IV and V, venture capital limited partnerships, for more than five years. Mr. Bartlett also serves on the Boards of Directors of Keithley Instruments, Inc. and The Lamson & Sessions Co., is President of the Board of Trustees of the Cleveland Museum of Art and is a trustee of Berea College. | | 1996 |

3

Name

| | Age

| | Principal Occupation, Business Experience and Other Directorships

| | Director Since

|

|

Albert C. Bersticker | | 68 | | Retired since May 1, 1999, Chairman of the Board, from January 1, 1999 until May 1, 1999, Chairman and Chief Executive Officer, from January 1, 1996 to December 31, 1998, and President and Chief Executive Officer, from May 1991 to December 1995, of Ferro Corporation, a producer of specialty coatings, plastics, electronic materials, chemicals and ceramics. Mr. Bersticker also serves on the Board of Directors of Brush Engineered Materials Inc., and is Treasurer and on the Board of Trustees of St. Johns Medical Center in Jackson, Wyoming. | | 1992 |

|

John N. Lauer | | 64 | | Chairman of the Board, since July 1998, Chief Executive Officer, from January 1, 1998 to December 4, 2002, and President, from January 1, 1998 to November 1, 2001, of Oglebay Norton; retired private investor and Ph.D. student, from 1994 to December 1997; President and Chief Operating Officer, The B.F. Goodrich Company, a chemical and aerospace company, from 1990 to 1994. Mr. Lauer also serves on the Boards of Directors of Diebold, Incorporated and Menasha Corporation. | | 1998 |

|

Madeleine W. Ludlow | | 48 | | President and Chief Executive Officer, since April 2001, President, from January 2001 to April 2001, and Senior Vice President and Chief Financial Officer, from July 2000 to January 2001, of Cadence Network, Inc., a privately held cost management company; Vice President and Chief Financial Officer, from February 1999 to July 2000, of Cinergy Corporation, an electric and gas utility company; President, Energy Commodities Business Unit, from April 1998 to February 1999, and Vice President and Chief Financial Officer, from April 1997 to April 1998, of Cinergy Corporation, a public utility company. Ms. Ludlow was Vice President of the Public Service Enterprise Group, a public utility company, from 1992 to 1997. | | 1999 |

|

Michael D. Lundin | | 43 | | President and Chief Executive Officer, since December 4, 2002, President and Chief Operating Officer, from November 1, 2001 to December 4, 2002, of Oglebay Norton; Vice President of Michigan Operations and President of Michigan Limestone Operations, Inc., from April 2000 through October 2001, and President of Michigan Limestone Operations Limited Partnership for more than five years and up until the partnership was acquired by Oglebay Norton. | | 2001 |

4

Name

| | Age

| | Principal Occupation, Business Experience and Other Directorships

| | Director Since

|

|

William G. Pryor | | 63 | | Retired since August 1, 2002, President, from April 1993 to August 1, 2002, of Van Dorn Demag Corporation, a manufacturer of plastic injection molding equipment; President and Chief Executive Officer of Van Dorn Corporation (predecessor to Van Dorn Demag Corporation), from January 1, 1992 to April 20, 1993. Mr. Pryor also serves on the Board of Directors of Oxis International, Inc. | | 1997 |

|

Judith A. Wolfe | | 49 | | President since March 2001, and Vice President from 1996 to March 2001, of Forest City Finance Corporation, a wholly owned subsidiary of Forest City Enterprises, Inc., a diversified real estate company. Ms. Wolfe is a member of the Board of Trustees of El Barrio, Inc., a non-profit organization that provides services to the Hispanic community. Ms. Wolfe is a CPA (inactive). | | NA |

Board and Committee Attendance

The Board met six times during 2002, including regularly scheduled and special meetings. Each Director attended at least 75% of all of the 2002 meetings of the Board and of those committees on which such Director served.

Structure/Committees of the Board

The Board of Directors establishes broad corporate policies and oversees the overall performance of Oglebay Norton. However, it is not involved in day-to-day operations. Directors are kept informed of Oglebay Norton’s business through discussions with the Chief Executive Officer and other officers, by reviewing quarterly analyses and reports, and by participating in Board and committee meetings.

In 1999, the Board designated a non-employee “Lead Director” to act as the Director liaison between the Board and Oglebay Norton management. The Board named Mr. Bersticker as initial Lead Director, and has approved Mr. Bersticker to continue to serve as Lead Director until the 2004 Annual Meeting of Shareholders or his resignation or the appointment of his successor.

During 2002, the Board had three standing committees. From time to time, the Board of Directors also creates temporary subcommittees to address specific issues facing Oglebay Norton. In January 2003, the Board realigned its committees and now has four standing committees. The Board’s standing committees, as they existed in 2002 and as currently in existence, are described below.

Executive Committee. This committee existed in 2002 and continues in existence now. The current members of the Executive Committee are Ms. Ludlow (Chairwoman) and Messrs. Bares, Bartlett, Bersticker, Lauer and Lundin. The Executive Committee may exercise all of the authority of the Board of Directors subject to specific resolutions of the Board and provisions of Ohio law. The Executive Committee meets only if a meeting is called by its Chairwoman. The Executive Committee did not meet during 2002.

Audit Committee. The Audit Committee is comprised solely of Directors who are independent directors under NASDAQ’s existing corporate governance standards, and no member of Oglebay Norton management is a

5

member of the committee. The current members of the Audit Committee are Mr. Bartlett (Chairman), Ms. Ludlow and Messrs. Bersticker and Pryor. This committee amended its charter on February 18, 2003. A copy of the amended charter is attached as Appendix A to this Proxy Statement. The purpose of the Audit Committee is to conduct reviews and investigate matters, make recommendations, hold discussions and take other actions regarding the preparation of financial statements and the audit of financial results, including retention of external audit firms, internal controls and processes, good business practices and procedures, legal compliance and other matters concerning the financial health of Oglebay Norton. The predecessor to the Audit Committee, which was the Audit and Compliance Committee, met four times during 2002.

Governance and Nominating Committee. The Governance and Nominating Committee is comprised solely of Directors who are independent directors under NASDAQ’s existing corporate governance standards, and no member of Oglebay Norton management is a member of the committee. The current members of the Governance and Nominating Committee are Mr. Bares (Chairman), Ms. Ludlow and Messrs. Bank and Bersticker. Effective as of January 13, 2003, the Governance and Nominating Committee adopted a written charter. The purpose of the Governance and Nominating Committee is to conduct reviews, investigations and evaluations, make recommendations, develop policies or guidelines and take other actions regarding Oglebay Norton Board composition, effectiveness and succession, regulatory and legal compliance, and governance and conduct matters.

The Governance and Nominating Committee will consider nominees for the Board of Directors submitted by shareholders. Recommendations by shareholders should include the following information:

| | • | | the nominee’s name, age and business and residence addresses; |

| | • | | the nominee’s principal occupation and qualifications to serve as a director; |

| | • | | a list of companies of which the nominee is an officer or director; |

| | • | | a statement on whether the nominee is a United States citizen; |

| | • | | the number of common shares of Oglebay Norton owned by the nominee; |

| | • | | the name of the recommending shareholder; and |

| | • | | the nominee’s written consent to be nominated. |

Nominations should be mailed to: Chairman, Governance and Nominating Committee, c/o Rochelle F. Walk, Vice President, General Counsel and Secretary, Oglebay Norton Company, North Point Tower, 1001 Lakeside Avenue, 15th Floor, Cleveland, Ohio 44114-1151.

The predecessor to the Governance and Nominating Committee, which was the Compensation, Organization and Governance Committee, met five times in 2002.

Organization and Compensation Committee. The Organization and Compensation Committee is comprised solely of Directors who are independent directors under NASDAQ’s existing corporate governance standards, and no member of Oglebay Norton management is a member of the committee. The current members of the Organization and Compensation Committee are Mr. Bersticker (Chairman), Messrs. Pryor and Bartlett, and Ms. Ludlow. The purpose of the Organization and Compensation Committee is to conduct reviews and evaluations, make recommendations, establish, implement and administer programs and plans, oversee regulatory compliance, prepare and issue reports and take other actions regarding executive and director compensation, executive officer performance and equity and other incentive or severance matters. The predecessor to the Organization and Compensation Committee, which was the Compensation, Organization and Governance Committee, met five times in 2002.

6

Report of Audit Committee

The Audit Committee oversees Oglebay Norton’s financial reporting process as well as Oglebay Norton’s ethical and legal conduct relating to financial reporting on behalf of the Board of Directors. In performing its functions, the committee acts in an oversight capacity and relies on the work and assurances of Oglebay Norton’s management and independent auditors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls, as well as setting and implementing policy and training with respect to ethical and legal conduct. In fulfilling its oversight responsibilities, the committee reviewed the audited financial statements in the annual report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements, and met with management and reviewed management reports with respect to ethical and legal conduct. The committee reviewed with Oglebay Norton’s counsel the legal and regulatory matters that may have a material impact on the financial statements. The members of the committee are independent, as that term is defined under Rule 4200 of the National Association of Securities Dealers’ listing standards.

The committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of Oglebay Norton’s accounting principles and such other matters as are required to be discussed with the committee under auditing standards generally accepted in the United States as set forth in the Codification of Statements on Auditing Standards. In addition, the committee has discussed with the independent auditors the auditors’ independence from management and Oglebay Norton, including the matters in the written disclosures and letter required by the Independence Standards Board, and considered the compatibility of non-audit services with the auditors’ independence.

The committee discussed with Oglebay Norton’s internal and independent auditors the overall scope and plans for their respective audits. The committee meets with the internal and independent auditors, with and without management present, to discuss the results of their audits, their evaluations of Oglebay Norton’s internal controls and the overall quality of Oglebay Norton’s financial reporting. The Audit and Compliance Committee, the predecessor to the Audit Committee, met four times in 2002. The committee recommended to the Board of Directors the engagement of Ernst & Young LLP as Oglebay Norton’s independent auditors for 2003 and reviewed the experience and qualifications of the key partners and managers. The committee also discussed with Ernst & Young LLP the quality of Oglebay Norton’s financial and accounting personnel.

The committee reviewed the existing charter following the adoption of the Sarbanes-Oxley Act of 2002 and recommended changes that were approved by the Board of Directors on February 18, 2003. A copy of the amended charter, which the Board of Directors has adopted, is attached as Appendix A to this Proxy Statement.

Fees paid or accrued by Oglebay Norton for audit and other services provided by Ernst & Young LLP for the year ended December 31, 2002 were as follows:

Annual Audit Fees

Fees for the audit of Oglebay Norton’s financial statements for fiscal year 2002 and the reviews of the financial statements included in Oglebay Norton’s Forms 10-Q for fiscal year 2002 totaled $392,000.

Financial Information Systems Design and Implementation Fees

No fees were paid by Oglebay Norton in fiscal year 2002 with respect to the above captioned services.

All Other Fees

All other fees paid by Oglebay Norton in fiscal year 2002 totaled $124,479, including audit related services of $84,479 and non-audit services of $40,000 (related to state and local taxes). Audit related services generally include fees for services in connection with employee benefit plan audits, consultations concerning new financial accounting and reporting standards and registration statements filed with the Securities and Exchange Commission.

The provision of these services by the independent auditors in 2002 were compatible with maintaining the auditors’ independence.

7

In reliance on the reviews and discussions referred to above, the committee recommended on February 18, 2003 to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

James T. Bartlett, Chair

Madeleine W. Ludlow

Albert C. Bersticker

William G. Pryor

February 18, 2003

Compensation of Directors

Directors who are not employees of Oglebay Norton receive a fee of $12,000 per year and $900 for each Board and committee meeting attended, including meetings of non-standing subcommittees, except for committee chairs who receive $1,200 for each committee meeting they chair. Non-employee Directors also receive an annual award of 800 common shares of Oglebay Norton under the Oglebay Norton Company Director Stock Plan, except for the Lead Director who receives 1,100 shares annually. Directors are reimbursed for expenses they incur in attending Board and committee meetings.

In 1998, the stockholders approved the Oglebay Norton Company Director Fee Deferral Plan. The Director Fee Deferral Plan, which was amended and restated effective January 1, 2002, permits non-employee Directors to defer all or part of the cash portion of their compensation into:

| | • | | share units based upon the market price of Oglebay Norton’s common shares at the date on which the cash computation otherwise would have been paid; or |

| | • | | an account as deferred cash which is credited with a market rate of interest. |

Amounts deferred into share units receive a 25% matching credit by Oglebay Norton, including a 25% matching credit for deferred dividend equivalents, but amounts deferred as cash do not receive any matching credit.

Beginning in 2002, Directors are also able to defer part or all of their annual award of common shares under the Director Stock Plan on the same terms as provided in the Director Fee Deferral Plan.

See “Officer Agreements—Employment Agreement with Mr. John N. Lauer” for information on the employment agreement between Oglebay Norton and John N. Lauer, the Chairman of the Board of Directors.

8

PROPOSAL 2

AMENDMENT AND RESTATEMENT

OF REGULATIONS

Shareholders are being asked to approve an amendment and restatement of Oglebay Norton’s Regulations to clarify and update various provisions. In particular, these changes:

| | • | | permit increased use of communications equipment in meetings of shareholders and in providing notices and proxies; and |

| | • | | enhance the Board’s ability to administer routine functions and decision-making processes. |

Electronic Communications. Under Ohio’s General Corporation Law, as recently revised, shareholder meetings need not be held at a physical location. Instead, meetings may be held in “cyberspace” through means of communications equipment that permits shareholders or their proxies to participate in the meeting and to vote on matters submitted to the shareholders. The proposed amendments to the Regulations would permit communications equipment to be used for shareholder meetings. Oglebay Norton presently intends to continue to hold shareholder meetings at a physical location. However, if this proposal is approved, Oglebay Norton may in the future permit shareholders to join those meetings using communications equipment in accordance with Ohio law. The proposed amendments resulting from this change affect Sections 3 and 4 of the Regulations.

In addition to using communications equipment to facilitate shareholder meetings, changes in Ohio law have modernized the means through which corporations and their shareholders may provide notices. In addition to personal delivery and mail, notices may now be given via overnight delivery service or other means of communications equipment authorized by a shareholder, which would include facsimile or email if so authorized. The proposed amendments resulting from this change would enable us and our shareholders to communicate via such methods, and affect Sections 7 and 38 of the Regulations.

The proposed amendments clarify that the Board of Directors may fix the place, if any, of any special meeting of the shareholders of Oglebay Norton. This allows meetings to be held in cyberspace or at a physical location. Currently, the Regulations do not identify who may fix the place of such a meeting. This proposed amendment affects Section 9 of the Regulations.

Ohio law was previously modernized to allow for shareholders to deliver proxies through not only a writing, but also a verifiable communication authorized by the shareholder. Any transmission that creates a record capable of authentication, including, but not limited to, electronic mail and telephonic transmissions, is permitted. Although the current Regulations do not prohibit these alternative forms of proxy submission, the proposed amendments clarify that Oglebay Norton’s shareholders are entitled to deliver proxies through means other than a writing. The proposed amendment resulting from this change affects Section 6 of the Regulations.

Changes are also proposed to the Regulations to permit meetings of directors through the use of communications equipment to the extent permitted under Ohio law. Ohio law now permits directors’ meetings to be conducted using any form of communications equipment that permits directors not physically present to hear the proceedings, such as web-based or radio-wave based transmission equipment, rather than only telephones. The recent changes in Ohio law also permit a director to receive notices of meetings by means of email or other communications equipment to the extent authorized by that director. Approval of this proposal would enable the Directors to take advantage of these conveniences. The proposed amendments resulting from these changes affect Sections 15 and 38 of the Regulations.

Board Committees. In addition to the changes in the Ohio General Corporation Law described above, Ohio law allows committees of the Board of Directors to consist of only one member. The proposed amendments change the Regulations to conform to the change in law on this matter. The proposed amendment resulting from this change affects Section 19 of the Regulations.

9

Principal Place of Business. The proposed amendments provide the Directors with the power to change Oglebay Norton’s principal place of business from Cleveland, Ohio through an amendment to the Articles of Incorporation. Ohio law was recently revised to permit the Board of Directors to adopt such an amendment to the Articles of Incorporation. Although Oglebay Norton currently has no plans to move its principal offices from Cleveland, the current Regulations could preclude the Board of Directors from exercising their judgment to do so in the future. This proposed amendment affects Section 1 of the Regulations.

Required Vote for Approval of Matters. The proposed amendments clarify that the required vote for any matter presented to the shareholders at a meeting will be as required by law or the Regulations (which is what the Regulations currently provide) or as required by Oglebay Norton’s Articles of Incorporation. This proposed amendment, which is intended to clarify that the Articles of Incorporation may contain provisions with respect to voting rights, affects Section 6 of the Regulations.

Date of Annual Meeting. The proposed amendments eliminate a fixed meeting date for the annual meeting of shareholders of Oglebay Norton, currently the last Wednesday in April in each year. If the proposal is approved, the date, time and place of the annual meeting of shareholders will be as designated by the Board of Directors. This proposed amendment affects Section 4 of the Regulations.

Use of Ballots. The proposed amendments eliminate the requirement that all elections of directors be held by ballot. If the proposal is approved, the shareholders will retain the right to demand the election of directors, or any other question before an annual meeting, be by ballot. This proposed amendment affects Sections 4 and 6 of the Regulations.

Required Board Approval of Director Pay. The proposed amendments eliminate the ability of the Board of Directors to delegate to officers the authority to establish the compensation of the Board for services to Oglebay Norton. With approval of the amendment, the affirmative vote of the majority of all Directors in office would be required to establish such compensation. This proposed amendment affects Section 20 of the Regulations.

Eliminate Requirement That President Be Director. The proposed amendments eliminate an existing requirement that the President of Oglebay Norton be a Director. This will permit greater flexibility to the Governance and Nominating Committee. This proposed amendment affects Section 21 of the Regulations.

Officer Compensation. The proposed amendments eliminate the requirement that the Board of Directors approve the compensation of all officers of Oglebay Norton. This change allows delegation of executive compensation entirely to a committee, which is consistent with the charter for the Organization and Compensation Committee, or in the case of junior officers, to management. The Board of Directors does not believe it necessary that the compensation of all officers be approved by the full Board of Directors. The Board of Directors retains the power to oversee and approve executive compensation. This proposed amendment affects Section 21 of the Regulations.

Officer Functions. The proposed amendments amend the description of duties of the President and Secretary of Oglebay Norton. As currently in force, the President must preside at all meetings of shareholders. Also, the Secretary must record all of the meetings of the shareholders, the Board of Directors and the Executive Committee. In each instance, Oglebay Norton proposes to allow the Board of Directors to designate another person to perform the relevant duties. The amendment would provide flexibility in events such as a vacancy in the position or, in the case of the Secretary, the desire of the Board to conduct a private session of the Board. These proposed amendments affect Sections 23 and 24 of the Regulations.

Record Dates. The Regulations currently provide for the method of setting a record date for determining the shareholders entitled to (a) notice of, and to vote at meetings, (b) receive dividend payments or rights, (c) exercise rights in respect of any change, conversion or exchange of shares and (d) consent to any action

10

necessitating such consent. As in effect, the Regulations mandate that the Board of Directors set a record date of not more than 50 days preceding the date of the relevant event. The proposed amendments increase the outside date for a record date to 60 days in accordance with what is allowed by Ohio law. This proposed amendment affects Section 33 of the Regulations.

Other Changes. In addition to amendments for the above reasons, the proposed amendments also:

| | • | | change the name of the company referenced on the Regulations to Oglebay Norton Company from ON Minerals Company, Inc., which was the name of the Ohio subsidiary used in Oglebay Norton’s 2001 holding company reorganization (this proposed amendment affects the title of the Regulations); |

| | • | | clarify that vacancies on the Board may be filled by the remaining Directors if the vacancy occurs not only by reason of death, resignation, disqualification or otherwise (which is what the Regulations currently provide) but also if the vacancy results from an increase in the size of the Board in accordance with the Regulations (this proposed amendment affects Section 14 of the Regulations); |

| | • | | correct certain typographical errors contained in the Regulations (this proposed amendment affects Sections 21 and 39 of the Regulations); |

| | • | | clarify that, in accordance with Ohio law, certificates representing Oglebay Norton’s common shares need be signed by any two of the Chairman, President or any Vice President on the one hand, and by the Treasurer, an Assistant Treasurer, the Secretary or an Assistant Secretary on the other hand (this proposed amendment affects Section 29 of the Regulations); |

| | • | | clarify that the proxy statement for an annual meeting of shareholders need state only the anticipated date of the next annual meeting, not the actual date (this proposed amendment affects Section 39 of the Regulations); and |

| | • | | clarify that references to specific sections of laws relevant to the Regulations also refer to such sections as they may be amended in the future (the proposed amendments resulting from these changes affect Sections 39 and 40 of the Regulations). |

A copy of the Regulations with the proposed additions and deletions described above is attached as Appendix B to this Proxy Statement.

The Board of Directors of Oglebay Norton unanimously recommends a vote

FOR adoption of the amendment and restatement of the Regulations.

11

BENEFICIAL OWNERSHIP OF OGLEBAY NORTON COMMON STOCK

The table below shows the number and percent of the outstanding shares of Oglebay Norton’s common shares beneficially owned on March 12, 2003 by each Director and Director nominee of Oglebay Norton, each executive officer named in the Summary Compensation Table included below and all Directors, Director nominees and executive officers as a group.

Name of Owner

| | Amount and Nature of Beneficial Ownership(1)

| | | Percentage of Outstanding Shares

| |

John D. Weil | | 692,085 | (2)(3) | | 13.8 | % |

200 North Broadway, Suite 825 | | | | | | |

St. Louis, Missouri 63102-2573 | | | | | | |

John N. Lauer | | 468,618 | (4) | | 8.7 | % |

13415 Shaker Blvd | | | | | | |

Shaker Heights, Ohio 44120 | | | | | | |

Malvin E. Bank | | 296,870 | (3)(5) | | 5.9 | % |

3900 Key Center | | | | | | |

127 Public Square | | | | | | |

Cleveland, Ohio 44114 | | | | | | |

William G. Bares | | 11,512 | (3) | | * | |

James T. Bartlett | | 46,819 | (3) | | * | |

Albert C. Bersticker | | 13,719 | (3) | | * | |

Madeleine W. Ludlow | | 10,779 | (3) | | * | |

William G. Pryor | | 11,662 | (3) | | * | |

Judith A. Wolfe | | 800 | (3) | | * | |

Michael D. Lundin | | 16,350 | (6) | | * | |

Julie A. Boland | | 3,246 | (6) | | * | |

Sylvie A. Bon | | 1,384 | (6) | | * | |

Ronald Compiseno | | 11,803 | (6) | | * | |

Michael J. Minkel | | 4,755 | (4)(6) | | * | |

Rochelle F. Walk | | 9,044 | (4)(6) | | * | |

Directors, nominees and executive officers as a group (15 persons) | | 1,598,646 | (3)(4)(6) | | 29.5 | % |

| * | | Represents less than 1% of the outstanding common shares of Oglebay Norton as of March 12, 2003. |

| (1) | | Except as otherwise stated in the notes below, beneficial ownership of the shares held by each individual consists of sole voting and investment power, or of voting power and investment power that is shared with the spouse and/or a child of that individual. |

| (2) | | Mr. Weil has shared voting and dispositive power as to 666,700 shares. Oglebay Norton has entered into a standstill agreement with John D. Weil that limits to 15% the percentage of Oglebay Norton’s common shares that Mr. Weil and his affiliates may own and contains restrictions on the sale and voting of such shares. |

| (3) | | Includes non-voting share units rounded to the nearest whole share calculated as of March 12, 2003, which each individual is entitled to pursuant to the Oglebay Norton Company Director Fee Deferral Plan: Bank—6,372 shares; Bares—7,712 shares; Bartlett—9,819 shares; Bersticker—9,819 shares; Ludlow—6,579 shares; Pryor—8,862 shares; and Weil—8,485 shares. Also includes 1,100 shares to be issued to Mr. Bersticker as Lead Director, and, with respect to each other individual other than Mr. Weil, 800 shares to be issued at the first meeting of the Board of Directors following the Annual Meeting pursuant to Oglebay Norton’s Director Stock Plan. |

| (4) | | Includes options which are or within 60 days of March 12, 2003 will become exercisable: Lauer—380,174 shares; Lundin—8,500 shares; Boland—2,500 shares; Bon—1,250 shares; Compiseno—9,438 shares; Minkel—1,750 shares; and Walk—6,563 shares. |

| (5) | | Mr. Bank’s shares include 284,548 shares held in various trusts, for which he and Key Trust Company of Ohio, N.A. are co-trustees. Mr. Bank has delegated to Key Trust dispositive power as to all such shares. As trustee, Mr. Bank has shared voting power (with Key Trust) as to 91,274 shares. |

| (6) | | Includes the following numbers of shares, rounded to the nearest whole share, beneficially owned as of March 12, 2003 under the Oglebay Norton Company Incentive Savings and Stock Ownership Plan by the following executive officers: Lundin—2,330 shares; Boland—246 shares; Bon—134 shares; Compiseno—1,635 shares; Minkel—2,330 shares; Walk—1,225 shares; and executive officers as a group—7,900 shares. |

12

The table below shows information with respect to all persons who, as of March 12, 2003, were known by Oglebay Norton to beneficially own more than five percent of the outstanding common shares of Oglebay Norton, other than Messrs. Weil, Lauer and Bank whose beneficial ownership of common shares of Oglebay Norton is shown above.

Name of Owner

| | Amount and Nature of Beneficial Ownership

| | | Percentage of Outstanding Shares

| |

Key Trust Company of Ohio, N.A., as Trustee | | 351,794 | (1) | | 7.0 | % |

127 Public Square | | | | | | |

Cleveland, Ohio 44114 | | | | | | |

Douglas N. Barr | | 289,040 | (2) | | 5.8 | % |

1400 Bank One Building | | | | | | |

600 Superior NE | | | | | | |

Cleveland, Ohio 44114-2652 | | | | | | |

Robert I. Gale, III | | 285,260 | (3) | | 5.7 | % |

17301 St. Clair Avenue | | | | | | |

Cleveland, Ohio 44110 | | | | | | |

Dimensional Fund Advisors Inc. | | 314,156 | (4) | | 6.3 | % |

1299 Ocean Avenue, 11th Floor | | | | | | |

Santa Monica, California 90401 | | | | | | |

State Street Research & Management Company | | 297,200 | (5) | | 5.9 | % |

One Financial Center, 30th Floor | | | | | | |

Boston, Massachusetts 02111-2690 | | | | | | |

| (1) | | As of December 31, 2002, based upon information contained in a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2003, KeyCorp, as the parent holding company of KeyBank National Association and McDonald Investments, Inc., has sole voting power as to 76,071 shares and shared voting power as to 270,823 shares. KeyCorp also has sole dispositive power as to 80,310 shares and shared dispositive power as to 227,411 shares. |

| (2) | | As of December 31, 2002, based upon information contained in a Schedule 13D filed with the Securities and Exchange Commission on May 2, 1997, Mr. Barr has sole voting and dispositive power as to 400 of these shares. Mr. Barr, as a trustee, has shared voting and dispositive power as to 57,200 of these shares and, together with Mr. Robert I. Gale III, shared voting and dispositive power as to 230,440 of these shares. |

| (3) | | As of December 31, 2002, based upon information contained in a Schedule 13D filed with the Securities and Exchange Commission on May 2, 1997, Mr. Gale has sole voting and dispositive power as to 54,820 shares, 4,198 shares of which he owns individually and 50,622 shares of which he holds as trustee. Together with Mr. Douglas N. Barr, Mr. Gale shares voting and dispositive power as to 230,440 of these shares. |

| (4) | | As of December 31, 2002, based upon information contained in a Schedule 13G filed with the Securities and Exchange Commission on January 30, 2001, Dimensional Fund Advisors Inc. has sole voting and dispositive power as to all of the shares it holds. |

| (5) | | As of December 31, 2002, based upon information contained in a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2003, State Street Research & Management Company (“State Street”), an Investment Adviser registered under Section 203 of the Investment Advisers Act of 1940, has sole voting and dispositive power as to all of the shares its holds. State Street disclaims beneficial ownership of all such shares. |

13

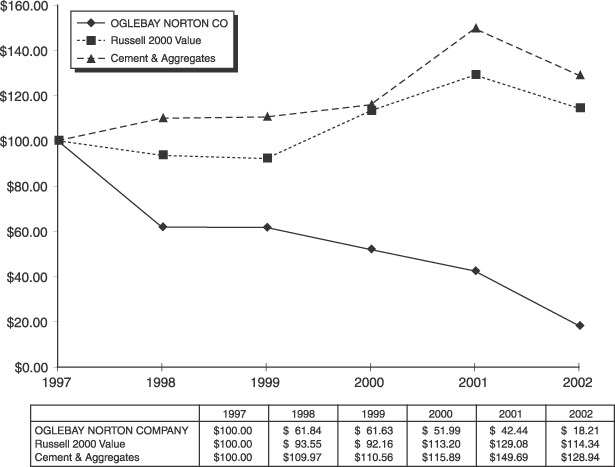

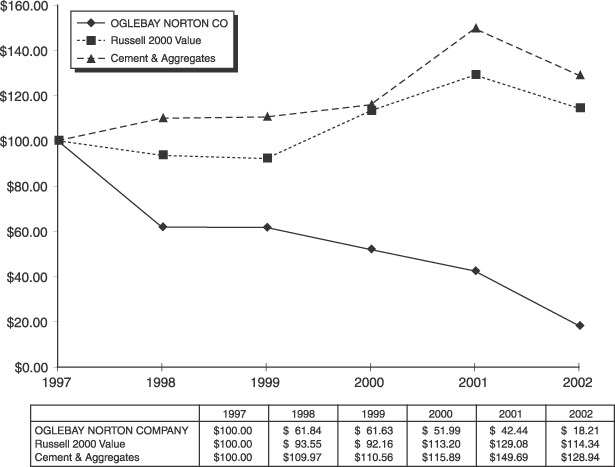

PERFORMANCE GRAPH

The graph below compares the five year cumulative return from investing $100 on December 31, 1997 in each of Oglebay Norton common shares, the Russell 2000 Value Index and the Value Line Cement and Aggregates Index. All indices were calculated by Value Line, an independent third-party in the business of publishing information for investors. (1)

| (1) | | Assumes $100 invested at the close of trading on December 31, 1997 in Oglebay Norton common shares, the Russell 2000 Value Index, and the Value Line Cement and Aggregates Index, and the reinvestment of all dividends. |

Source: Value Line, Inc.

14

COMPENSATION OF EXECUTIVE OFFICERS

Report of the Organization and Compensation Committee on Executive Compensation

Oglebay Norton’s Board of Directors has delegated to its Organization and Compensation Committee general responsibility for executive compensation matters, including responsibility for executive compensation actions to be taken by a committee of “outside directors,” as defined in the Treasury Regulations promulgated under Section 162(m) of the Internal Revenue Code, and “non-employee directors,” as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934. None of the Organization and Compensation Committee members is a former or current officer or employee of Oglebay Norton or any of its subsidiaries.

During 2002, Mr. John N. Lauer served as Oglebay Norton’s Chief Executive Officer until December 4, 2002. During 2002, his compensation was based on an Employment Agreement entered into on December 17, 1997. The predecessor to the Organization and Compensation Committee, the Compensation, Organization and Governance Committee, negotiated the terms of the agreement on behalf of Oglebay Norton. The compensation arrangements in the Employment Agreement tied Mr. Lauer’s compensation directly to the performance of Oglebay Norton over the term of Mr. Lauer’s employment. In particular, his compensation was tied to the price of Oglebay Norton’s common shares. Oglebay Norton did not pay Mr. Lauer a salary during his tenure as Chief Executive Officer with Oglebay Norton. Instead, the primary elements of his compensation under the Employment Agreement were:

| | • | | a grant of 25,744 restricted common shares of Oglebay Norton; |

| | • | | a grant of a “performance option” to purchase 380,174 additional common shares of Oglebay Norton; and |

| | • | | an annual bonus of up to $200,000 per year based upon the performance of Oglebay Norton during the year. For the calendar year 1999, the Board determined to increase the annual bonus cap to $250,000. |

The Organization and Compensation Committee determined that these compensation arrangements were appropriate because the ultimate compensation package provided to Mr. Lauer depended in large part upon the ultimate value achieved by Oglebay Norton under Mr. Lauer’s management. The Organization and Compensation Committee believes that the direct, largely stock-based relationship between performance and reward was in the best interest of Oglebay Norton and its shareholders. The terms of Mr. Lauer’s Employment Agreement, including the amendment to his agreement executed in connection with his resignation as Chief Executive Officer, are discussed more fully below under the heading “Officer Agreements—Employment Agreement with Mr. John N. Lauer.”

On December 4, 2002, Mr. Michael D. Lundin became Chief Executive Officer. As a result of his promotion, Mr. Lundin’s base salary was increased to $425,000, effective to November 1, 2002, and his annual bonus was increased to a maximum of $212,500 for 2003, with appropriate targets being achieved. Mr. Lundin’s other benefits are the same as those provided to Oglebay Norton’s other executive officers. The Organization and Compensation Committee determined that these arrangements were appropriate after consideration of Mr. Lundin’s contributions to Oglebay Norton and the level of salaries paid to Chief Executive Officers in companies whose sales and revenues are similar to those of Oglebay Norton. The remainder of this report describes the 2002 compensation of executive officers other than the Chief Executive Officer of Oglebay Norton.

The Organization and Compensation Committee seeks to compensate executive officers based upon their contributions to Oglebay Norton’s success, and specifically to reward officers who make significant contributions to Oglebay Norton’s short-term and long-term profitability. In 2002, the annual compensation packages of executive officers were comprised of an annual salary, an annual bonus and options to acquire common shares.

15

Annual Salary. The annual salaries of executive officers for 2002 were set by the predecessor to the Organization and Compensation Committee, the Compensation, Organization and Governance Committee, after consideration of Oglebay Norton’s financial performance and prospects, each executive officer’s contribution to Oglebay Norton’s performance in 2001, and the level of salaries paid to executives in comparable positions with companies whose sales and revenues are similar to those of Oglebay Norton.

Bonuses. Executive officers were eligible to receive cash bonuses with respect to 2002 under the Oglebay Norton Company Annual Incentive Plan (the “Plan”) pursuant to which the predecessor to the Organization and Compensation Committee, the Compensation, Organization and Governance Committee, established corporate, business unit and individual performance goals for the year. The corporate performance measure for 2002 under the Plan for executive officers was a combination of EBITDA (earnings before interest, taxes, depreciation and amortization), return on capital and earnings per share. The amount of the incentive award under the Plan, if any, to each participant is based on the participant’s target award level, weightings assigned to each corporate, business unit and individual performance measure applicable to the participant, and the achievement of financial measures.

Target awards are determined with reference to the participant’s base salary and range from 5% to 40% of base salary. Nominal awards in 2002 were capped at 250%. Based upon the extent to which the relevant goals were met during 2002, no awards for the year under the Plan were made to named executives. However, two executive officers, Ms. Julie A. Boland and Ms. Sylvie A. Bon, received one-time cash bonuses during 2002 as sign-on compensation, as well as guaranteed bonus payments under the Plan as inducements to hire.

Compliance with Section 162(m) of the Internal Revenue Code. The Organization and Compensation Committee has considered the potential impact of Section 162(m) of the Internal Revenue Code and the regulations thereunder (“Section 162(m)”). Section 162(m) generally disallows a tax deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for any individual who is either the Chief Executive Officer or one of the four other most highly compensated executive officers of the corporation, unless such compensation is “performance-based.” Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. At present, the performance option granted to Mr. Lauer is the only compensation element that provides a sufficiently large dollar amount of compensation to bring the Section 162(m) limit into play.

Oglebay Norton’s policy is to qualify, to the extent reasonable, its executive officers’ compensation for deductibility under Section 162(m); however, the Organization and Compensation Committee believes that its primary responsibility is to provide a compensation program that will attract, retain and reward the executive talent necessary for Oglebay Norton’s success. Consequently, the Organization and Compensation Committee recognizes that the loss of a tax deduction may be necessary in some circumstances.

ORGANIZATION AND

COMPENSATION COMMITTEE

Albert C. Bersticker, Chair

James T. Bartlett

Madeleine W. Ludlow

William G. Pryor

February 18, 2003

16

Summary Compensation Table

The table below shows individual compensation information for each of the individuals who served as Oglebay Norton’s Chief Executive Officer during 2002 and each other executive officer of Oglebay Norton.

| | | | | Long Term Compensation

| | |

| | | | | Annual Compensation

| | Awards

| | Payouts

| | |

Name and Principal Position(1)

| | Year

| | Salary ($)(2)

| | Bonus ($)(2)(3)

| | Other Annual Compensation ($)(4)

| | Restricted Stock Awards ($)

| | Securities Underlying Options (#)

| | LTIP Payouts ($)(5)

| | All Other Compensation ($)(6)

|

Michael D. Lundin | | 2002 | | 310,577 | | — | | — | | — | | 30,000 | | 167,633 | | 10,027 |

President and Chief | | 2001 | | 195,070 | | — | | 31,155 | | — | | 8,000 | | — | | 10,027 |

Executive Officer | | 2000 | | 107,195 | | 90,000 | | — | | — | | 10,500 | | — | | 4,288 |

|

John N. Lauer | | 2002 | | — | | — | | 35,211 | | — | | — | | — | | 55,000 |

Chairman of the Board | | 2001 | | — | | — | | 51,180 | | — | | — | | — | | 55,325 |

| | | 2000 | | — | | 200,000 | | 36,957 | | — | | — | | — | | 55,000 |

|

Julie A. Boland | | 2002 | | 219,808 | | 70,000 | | — | | — | | 22,000 | | — | | 2,865 |

Vice President, Chief | | 2001 | | — | | — | | — | | — | | — | | — | | — |

Financial Officer and | | 2000 | | — | | — | | — | | — | | — | | — | | — |

Treasurer | | | | | | | | | | | | | | | | |

|

Sylvie A. Bon | | 2002 | | 106,615 | | 24,651 | | — | | — | | 10,500 | | — | | 2,665 |

Vice President and Chief | | 2001 | | — | | — | | — | | — | | — | | — | | — |

Information Officer | | 2000 | | — | | — | | — | | — | | — | | — | | — |

|

Ronald Compiseno | | 2002 | | 160,000 | | — | | — | | — | | 5,000 | | — | | 11,750 |

Vice President-Human | | 2001 | | 154,500 | | — | | — | | — | | 3,750 | | — | | 11,762 |

Resources | | 2000 | | 150,000 | | 44,000 | | — | | — | | 3,750 | | — | | 14,913 |

|

Michael J. Minkel | | 2002 | | 139,654 | | — | | — | | — | | 5,000 | | — | | 5,981 |

Vice President-Sales and | | 2001 | | 120,700 | | 7,388 | | — | | — | | 1,500 | | — | | 4,667 |

Marketing | | 2000 | | 108,308 | | 5,019 | | 42,616 | | — | | 500 | | — | | 4,327 |

|

Rochelle F. Walk | | 2002 | | 175,000 | | — | | — | | — | | 5,000 | | — | | 8,809 |

Vice President, General | | 2001 | | 156,960 | | — | | — | | — | | 3,750 | | — | | 9,589 |

Counsel and Secretary | | 2000 | | 144,000 | | 42,000 | | — | | — | | 3,500 | | — | | 11,426 |

| (1) | | Mr. Lundin was appointed Chief Executive Officer on December 4, 2002. Mr. Lauer served as Chief Executive Officer until December 4, 2002. Ms. Boland joined Oglebay Norton in January 2002. Ms. Bon joined Oglebay Norton in May 2002. |

| (2) | | Includes amounts deferred in 2002 by the named executives under the Oglebay Norton Capital Accumulation Plan for salary earned in 2002 or bonus earned in 2001: Bon—$3,808; and Minkel—$20,320. Includes amounts deferred in 2001 by the named executives for salary earned in 2001 or bonus earned in 2000: Lauer—$182,635; Compiseno—$6,537; and Walk—$42,724. Includes amounts deferred in 2000 by the named executives for salary earned in 2000 or bonus earned in 1999: Lauer—$230,463; Compiseno—$21,042; and Walk—$42,181. Includes amounts deferred in 2002, 2001 and 2000, respectively, by the named executives under the Oglebay Norton Incentive Savings and Stock Ownership Plan: Lundin—$10,500, $10,500 and $8,576; Boland—$5,731, $0 and $0; Bon—$5,064, $0 and $0; Compiseno—$11,000, $10,500 and $10,500; Minkel—$9,778, $9,333 and $8,653; and Walk—$10,731, $8,400 and $8,400. |

| (3) | | Includes, for Julie A. Boland and Sylvie A. Bon, one-time cash bonuses awarded in 2002 as sign-on compensation. |

| (4) | | Represents non-cash moving expense benefits and “gross-up” for taxes in respect of payments by Oglebay Norton to the named executives for moving expenses and life insurance premiums. Also includes non-cash compensation for imputed income on personal use of company owned vehicles and cell phones and company paid membership fees and dues. For 2002, includes personal benefits exceeding 25% of the total personal benefits for Mr. Lauer of $28,905 for taxes in respect of life insurance premiums. For 2001, includes personal benefits exceeding 25% of the total personal benefits for the named executives as follows: Lauer—$18,903 for cell phone usage and $28,958 for taxes in respect of life insurance premiums; and Lundin—$28,147 for relocation. For 2000, includes personal benefits exceeding 25% of the total personal benefits for the named executives as follows: Lauer—$33,638 for taxes in respect of life insurance premiums; and Minkel—$42,616 for relocation expenses. |

17

| (5) | | The amount will be paid in cash in 2003 for the payout earned for the period from 1999 to 2002 under the Oglebay Norton Company 1999 Long-Term Incentive Plan. |

| (6) | | Includes contributions by Oglebay Norton during 2002, 2001 and 2000, respectively, for the named executives under Oglebay Norton’s Incentive Savings and Stock Ownership Plan: Lundin—$5,250, $5,250 and $4,288; Boland—$2,865, $0 and $0; Bon—$2,532, $0 and $0; Compiseno—$5,500, $5,250 and $5,250; Minkel—$4,889, $4,667 and $4,327; and Walk—$5,366, $4,200 and $4,200. Includes contributions by Oglebay Norton during 2002, 2001 and 2000, respectively, for the named executives under the Oglebay Norton Capital Accumulation Plan: Bon—$133, $0 and $0; Compiseno—$0, $262 and $3,413; Minkel—$1,092, $0 and $0; and Walk—$0, $1,946 and $3,783. Also includes payments by Oglebay Norton for life insurance premiums for 2002, 2001 and 2000, respectively: Lundin—$4,777, $4,777 and $0; Lauer—$55,000, $55,325 and $55,000; Compiseno—$6,250, $6,250 and $6,250; and Walk—$3,443, $3,443 and $3,443. |

Stock Option Grants in 2002

The predecessor to the Organization and Compensation Committee approved the 2002 Stock Option Plan to enable Oglebay Norton to attract and retain key members of management, provide incentives and reward performance and ensure that the interests of key members of management are aligned with the shareholders’ interests. The 2002 Stock Option Plan was approved by the shareholders of Oglebay Norton at the 2002 Annual Meeting. The maximum number of common shares of Oglebay Norton subject to awards granted under the 2002 Stock Option Plan is 500,000 shares, with no more than 125,000 shares to be awarded in any single year. Stock option awards may be incentive stock options, which are stock options that meet the requirements for qualification under Section 422 of the Internal Revenue Code of 1986, as amended, or non-qualified stock options which are stock options that do not qualify as incentive stock options. The exercise price of a stock option will be at or above the closing price of the common shares of Oglebay Norton on the date of grant. Stock options will be exercisable for a period not to exceed ten years from the date of grant. The Organization and Compensation Committee will determine when the right to exercise stock options vests for each participant granted an award. The options have no value unless Oglebay Norton’s stock price appreciates and the recipient satisfies the applicable vesting requirements. In the event of a “change in control,” unless otherwise determined by the Organization and Compensation Committee, all stock options then outstanding will become fully exercisable as of the date of the change in control. All other terms, conditions and restrictions with respect to each award will be determined by the Organization and Compensation Committee.

Prior to receiving the approval of the shareholders of Oglebay Norton of the 2002 Stock Option Plan, several grants in early 2002 were made under the Oglebay Norton Company 1999 Long-Term Incentive Plan, which is described more fully under “Officer Agreements—Long-Term Incentive Plans—1999 LTIP.”

18

The table below shows the stock options granted during 2002 to the executive officers listed in the Summary Compensation Table shown above and the potential realizable value of those grants (on a pre-tax basis) determined in accordance with Securities and Exchange Commission rules. The information in this table shows how much the named executive officers may eventually realize in future dollars under two hypothetical situations: if the stock gains 5% or 10% in value per year, compounded over the ten-year life of the options. These are assumed rates of appreciation and are not intended to forecast future appreciation of Oglebay Norton’s common shares. Also included in this table is the increase in value to all common shareholders of Oglebay Norton using the same assumed rates of appreciation.

For perspective, in ten years, one common share of Oglebay Norton valued at $15.12, $13.00 and $8.85 on January 2, 2002, May 1, 2002 and November 1, 2002 (the grant dates), respectively, would be worth $24.36, $20.94 and $14.26, respectively, assuming the hypothetical 5% compounded growth rate, or $39.22, $33.72 and $22.96, respectively, assuming the hypothetical 10% compounded growth rate.

Option Grants in Last Fiscal Year

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1)

|

Name

| | Number of Shares Underlying Options Granted(#)(2)

| | % of Total Options Granted to Employees in 2002(3)

| | Exercise Price ($/sh)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

M.D. Lundin | | 30,000 | | 23% | | 8.85 | | 11/1/2012 | | | 162,221 | | | 423,207 |

J.N. Lauer | | — | | — | | — | | — | | | — | | | — |

J.A. Boland | | 10,000 | | 8% | | 15.12 | | 1/2/2012 | | | 92,383 | | | 241,013 |

| | | 12,000 | | 9% | | 8.85 | | 11/1/2012 | | | 64,888 | | | 169,283 |

S.A. Bon | | 5,000 | | 4% | | 13.00 | | 5/1/2012 | | | 39,715 | | | 103,610 |

| | | 5,500 | | 4% | | 8.85 | | 11/1/2012 | | | 29,740 | | | 77,588 |

R. Compiseno | | 5,000 | | 4% | | 8.85 | | 11/1/2012 | | | 27,037 | | | 70,535 |

M.J. Minkel | | 5,000 | | 4% | | 8.85 | | 11/1/2012 | | | 27,037 | | | 70,535 |

R.F. Walk | | 5,000 | | 4% | | 8.85 | | 11/1/2012 | | | 27,037 | | | 70,535 |

Increase in value to all common stockholders(4) | | $ | 28,889,486 | | $ | 75,367,989 |

| (1) | | Calculated over a ten-year period representing the life of the options. |

| (2) | | The options vest 25% each year commencing on the first anniversary of the grant date. The options also vest if the employee retires and is otherwise entitled to a normal, early or shutdown pension under Oglebay Norton’s Pension Plan. In that event, the retired employee may exercise the options within two years from the date of retirement, but not beyond the option expiration date. |

| (3) | | Percentage based on the total number of options granted (128,750) during 2002. |

| (4) | | Calculated using a price of $9.50 per share for Oglebay Norton’s common shares, the weighted-average grant date closing price of the above described grants, and the total number of common shares of Oglebay Norton outstanding on December 31, 2002 (4,978,051 shares). |

19

Long-Term Incentive Plans

The following table sets forth information concerning awards to the executive officers listed in the Summary Compensation Table shown above during fiscal year 2002, and estimated payouts in the future, under the 2002 Long-Term Incentive Plan of Oglebay Norton.

Long-Term Incentive Plans — Awards in Last Fiscal Year

Name

| | Number of Shares, Units or Other Rights ($ or #)

| | | Performance or Other Period Until Maturation or Payout

| | Estimated Future Payouts Under Non-Stock Price-Based Plans

|

| | | | Threshold ($ or #)

| | Target ($ or #)

| | Maximum ($ or #)

|

M.D. Lundin | | (1 | ) | | 1/1/2002-12/31/2004 | | $ | 50,198 | | $ | 200,790 | | $ | 401,580 |

J.N. Lauer | | (1 | ) | | 1/1/2002-12/31/2004 | | | 115,310 | | | 461,240 | | | 922,480 |

J.A. Boland | | (1 | ) | | 1/1/2002-12/31/2004 | | | 29,976 | | | 119,905 | | | 239,810 |

S.A. Bon | | (1 | ) | | 1/1/2002-12/31/2004 | | | 15,917 | | | 63,668 | | | 127,336 |

R. Compiseno | | (1 | ) | | 1/1/2002-12/31/2004 | | | 14,851 | | | 59,405 | | | 118,810 |

M.J. Minkel | | (1 | ) | | 1/1/2002-12/31/2004 | | | 10,779 | | | 43,116 | | | 86,232 |

R.F. Walk | | (1 | ) | | 1/1/2002-12/31/2004 | | | 18,102 | | | 72,409 | | | 144,818 |

| (1) | | Under the 2002 Long-Term Incentive Plan participants are eligible for awards paid in cash for performance against targets which are based on Oglebay Norton’s performance over multiple-year periods. The Board of Directors sets the performance measures at the beginning of each year during the performance period and assigns a weighting to each measure. In 2002, the targeted levels of performance for named executives consisted of: EBITDA (earnings before interest, taxes, depreciation and amortization) of $77 million, return on capital of 8% and earnings per share of $0.00 (breakeven). |

20

RETIREMENT PLANS

Pension Plan

Excess and TRA Supplemental Benefit Retirement Plan

The table below shows the annual pension payable under the Oglebay Norton Company Pension Plan (the “Pension Plan”) and the Oglebay Norton Company Excess and TRA Supplemental Benefit Retirement Plan (the “Excess Benefit Retirement Plan”) at normal retirement age:

| | | Estimated Annual Benefit (Assuming Retirement on January 1, 2002)

|

| | | Years of Service

|

Remuneration

| | 10 Years

| | 15 Years

| | 20 Years

| | 25 Years

| | 30 Years

| | 35 Years

|

$ | 75,000 | | $ | 11,250 | | $ | 16,875 | | $ | 22,500 | | $ | 28,125 | | $ | 33,750 | | $ | 39,375 |

| 100,000 | | | 15,000 | | | 22,500 | | | 30,000 | | | 37,500 | | | 45,000 | | | 52,500 |

| 150,000 | | | 22,500 | | | 33,750 | | | 45,000 | | | 56,250 | | | 67,500 | | | 78,750 |

| 200,000 | | | 30,000 | | | 45,000 | | | 60,000 | | | 75,000 | | | 90,000 | | | 105,000 |

| 250,000 | | | 37,500 | | | 56,250 | | | 75,000 | | | 93,750 | | | 112,500 | | | 131,250 |

| 300,000 | | | 45,000 | | | 67,500 | | | 90,000 | | | 112,500 | | | 135,000 | | | 157,500 |

| 350,000 | | | 52,500 | | | 78,750 | | | 105,000 | | | 131,250 | | | 157,500 | | | 183,750 |

| 400,000 | | | 60,000 | | | 90,000 | | | 120,000 | | | 150,000 | | | 180,000 | | | 210,000 |

| 450,000 | | | 67,500 | | | 101,250 | | | 135,000 | | | 168,750 | | | 202,500 | | | 236,250 |

| 500,000 | | | 75,000 | | | 112,500 | | | 150,000 | | | 187,500 | | | 225,000 | | | 262,500 |

| 550,000 | | | 82,500 | | | 123,750 | | | 165,000 | | | 206,250 | | | 247,500 | | | 288,750 |

| 600,000 | | | 90,000 | | | 135,000 | | | 180,000 | | | 225,000 | | | 270,000 | | | 315,000 |

| 650,000 | | | 97,500 | | | 146,250 | | | 195,000 | | | 243,750 | | | 292,500 | | | 341,250 |

| 700,000 | | | 105,000 | | | 157,500 | | | 210,000 | | | 262,500 | | | 315,000 | | | 367,500 |

| 750,000 | | | 112,500 | | | 168,750 | | | 225,000 | | | 281,250 | | | 337,500 | | | 393,750 |

Benefits under the Pension Plan and the Excess Benefit Retirement Plan for eligible salaried employees are based on average annual compensation for the highest five years during the last 10 years of employment prior to retirement. Covered compensation is equal to total base pay and certain incentive compensation (including amounts deferred under the former long-term incentive plan), which is substantially the same as shown in the salary and bonus columns of the Summary Compensation Table shown above. The annual benefit is calculated by multiplying the participant’s average compensation by a factor of 1.5% and the participant’s years of covered service (but not below a minimum benefit unrelated to compensation). Benefits, which are paid in a straight life annuity form, are not subject to reduction for Social Security or other offset. Certain surviving spouse benefits are also available under the plans, as well as early retirement and facility shutdown benefits. The benefits table shown above has been prepared without regard to benefit limitations imposed by the Internal Revenue Code. The years of benefit service credited for executive officers named in the Summary Compensation Table are: Mr. Lundin—2.67 years; Mr. Lauer—4.0 years; Ms. Boland—1.0 year; Ms. Bon—0.67 year; Mr. Compiseno—4.25 years; Mr. Minkel—3.0 years; and Ms. Walk—4.58 years.

The Internal Revenue Code limits the benefits provided under the Pension Plan. The Excess Benefit Retirement Plan provides for the payment, out of Oglebay Norton’s general funds, of the amount that an eligible participant would have received under the Pension Plan but for the Internal Revenue Code limits. The above table, which does not reflect those limits, shows the total annual pension benefits payable under both the Pension Plan and the Excess Benefit Retirement Plan.

21

Supplemental Retirement Benefit Plan of John N. Lauer

Oglebay Norton has agreed to provide Mr. Lauer a supplemental retirement benefit plan providing him retirement benefits that, when added to any benefits payable to him under the Pension Plan, will equal the benefits he would have been entitled to under the Pension Plan if:

| | • | | his covered compensation throughout the period of his employment had included salary at the rate of $500,000 per year and an annual bonus equal to the higher of his actual bonus for the applicable year and $250,000; |

| | • | | he had been credited with ten years of service under the Pension Plan; and |

| | • | | there were no limits on the amount of covered compensation that could be taken into account in determining the benefit payable to him under the Pension Plan. |

If Mr. Lauer remains employed by Oglebay Norton through January 1, 2004 and receives maximum annual bonuses (i.e., $250,000), the aggregate retirement benefit payable to him under the Pension Plan and his supplemental plan will be the equivalent of an annual lifetime benefit of $112,500 per year.

Capital Accumulation Plan

Effective January 1, 2000, Oglebay Norton adopted its Capital Accumulation Plan. Under the Capital Accumulation Plan, certain management and highly compensated employees, who are limited in the amounts of salary and bonus they can defer pursuant to plans qualified pursuant to ERISA, may elect to defer receipt of salary, bonus and/or long term incentive compensation. Participants are permitted to defer up to 50% of their salary, up to 100% of their bonus and up to 100% of their long term incentive compensation, each in 10% increments, payable during the year. The Capital Accumulation Plan, which is not a qualified plan, provides for the payment, out of Oglebay Norton’s general funds, of the amount deferred, together with an amount of investment earnings, gains and/or losses, and expenses determined with reference to the performance of certain “deemed” investment options, as directed by the participant. The Capital Accumulation Plan also provides an amount equivalent to any benefit not provided to the participant under the Incentive Savings and Stock Ownership Plan by reason of the deferral of compensation under the Capital Accumulation Plan, although no duplication of benefits provided under any other Oglebay Norton arrangement is permitted. Deferred salary and bonus, and the investment gain or loss on the deferred salary and bonus, under the Capital Accumulation Plan are fully vested. In 2002, Oglebay Norton contributed the following amounts for the named executives: Ms. Bon—$133; and Mr. Minkel—$1,092. Benefits are distributed in cash following retirement, death, or other termination of service. Interim distributions prior to termination of service are also permitted, based on participant elections made sufficiently in advance and in the case of certain hardship situations. Following a “change in control,” participants will also have a limited period during which to elect immediate distribution of their deferred compensation accounts, subject, however to a partial forfeiture provision.

22

Equity Compensation Plan Information

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

| | | (a)(1) | | (b)(2) | | (c)(3) |

Equity compensation plans approved by security holders | | 746,224 | | $ | 27.82 | | 508,579 |

Equity compensation plans not approved by security holders(4) | | 1,500 | | $ | 37.00 | | — |

Total | | 747,724 | | $ | 27.84 | | 508,579 |

| (1) | | Represents outstanding options under the 2002 Stock Option Plan, 1999 LTIP and former LTIP. The options vest 25% each year commencing on the first anniversary of the grant date. The options also vest if the employee retirees and is otherwise entitled to a normal, early or shutdown pension under the Pension Plan. In that event, the retired employee may exercise the options within two years from the date of retirement, but not beyond the option expiration date. |

| (2) | | Calculated as the weighted-average of the exercise prices for each individual grant under all equity compensation plans of Oglebay Norton. |

| (3) | | Calculated as total options authorized by the shareholders of Oglebay Norton, less options issued, exercised, lapsed and forfeited. |

| (4) | | Represents options to purchase 1,500 shares at an exercise price of $37.00 per share issued outside of Oglebay Norton’s compensation plans to a former executive officer of Oglebay Norton. The options were issued while the individual was an executive officer of Oglebay Norton. The options remain exercisable until 2005. |

OFFICER AGREEMENTS

Employment Agreement with Mr. John N. Lauer

Mr. John N. Lauer served as our Chief Executive Officer until December 4, 2002. He currently serves as Chairman of the Board of Directors. Mr. Lauer’s compensation arrangements during the tenure of his employment as an executive officer of Oglebay Norton were governed by the Employment Agreement described below. In connection with Mr. Lauer’s resignation as Chief Executive Officer in December 2002, Mr. Lauer and Oglebay Norton executed an amendment to the Employment Agreement providing for a continued term of employment for Mr. Lauer with Oglebay Norton until January 4, 2004 and as further described below.