Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-281130

U.S. Retail Securitization 04 2.24.2025

Secret Free Writing Prospectus Registration Statement No. 333 - 281130 Ford Credit Auto Receivables Two LLC (the “depositor”) Ford Credit Auto Owner Trusts (the “issuer”) This document constitutes a free writing prospectus for purposes of the Securities Act of 1933. The depositor has filed a registration statement (including a prospectus) with the SEC for any offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuer and such offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, you may request that a copy of the prospectus be sent to you by calling 1 - 313 - 594 - 3495. 2 U.S. RETAIL SECURITIZATION

Overview U.S. RETAIL SECURITIZATION • Ford Credit has been originating retail installment sales contracts since 1959 and securitizing its retail contracts since 1988 • Ford Credit has had an active publicly - registered securitization program for retail contracts since 1989 and has issued asset - backed securities in more than 95 transactions under this program • Ford Credit offers retail asset - backed securities through various channels: - Publicly - registered transactions - Rule 144A transactions - Other private transactions • Collateral composition has trended in line with the industry and Ford Credit’s strategy - Securitized pools selected randomly from Ford Credit’s eligible portfolio - Receivables with original terms up to 84 months have been included in widely - distributed retail transactions since 2020 • Structural elements have remained consistent – minimal adjustments over the past 15 years 3

Originations and Share ▪ Ford Credit provides support for Ford and Lincoln dealers and customers through all business cycles ▪ Originations volume increasing, primarily reflecting higher Ford Credit financing share 4 U.S. RETAIL SECURITIZATION 668 514 485 627 637 2020 2021 2022 2023 2024 57% 48% 41% 52% 54% 2020 2021 2022 2023 2024 Number of Retail Receivables Originated (000) Financing Share* Retail Installment and Lease Avg. # of Contracts Outstanding (000) 2,132 2,010 1,865 1,882 1,986 * Retail Installment and lease share of Ford/Lincoln retail sales (excludes fleet sales)

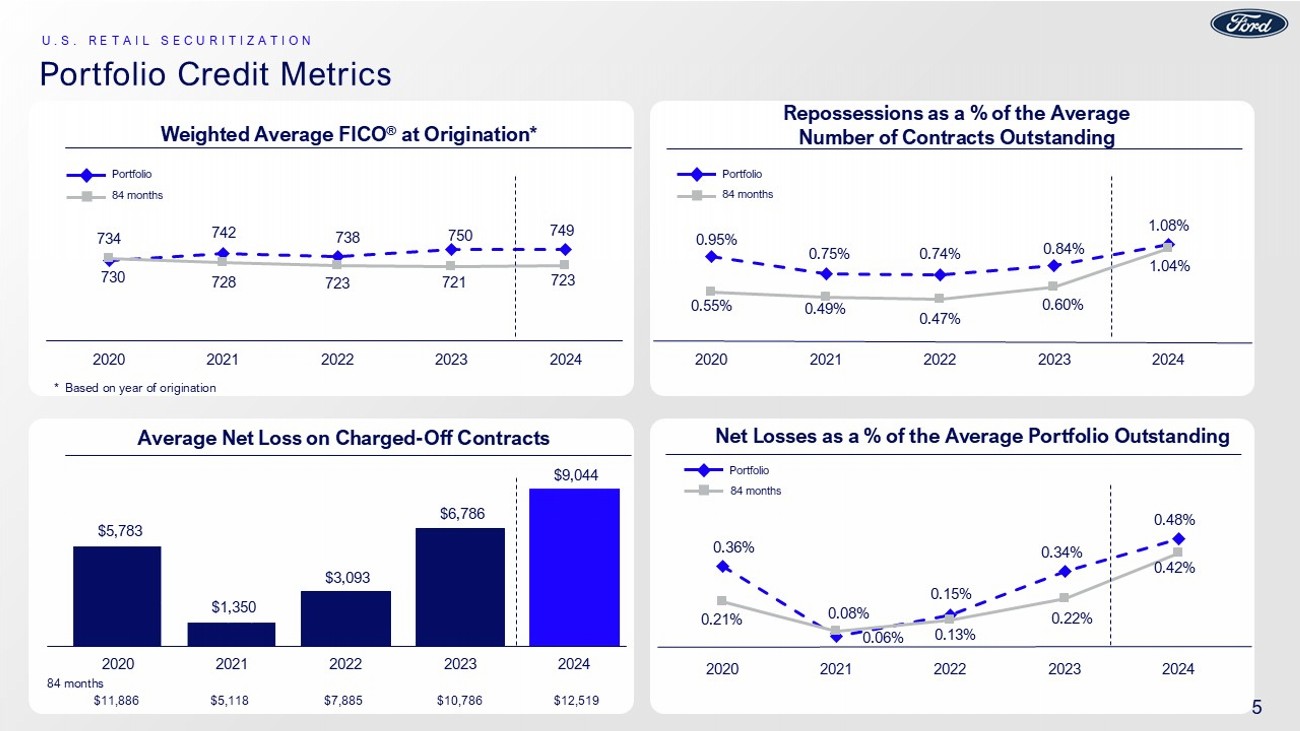

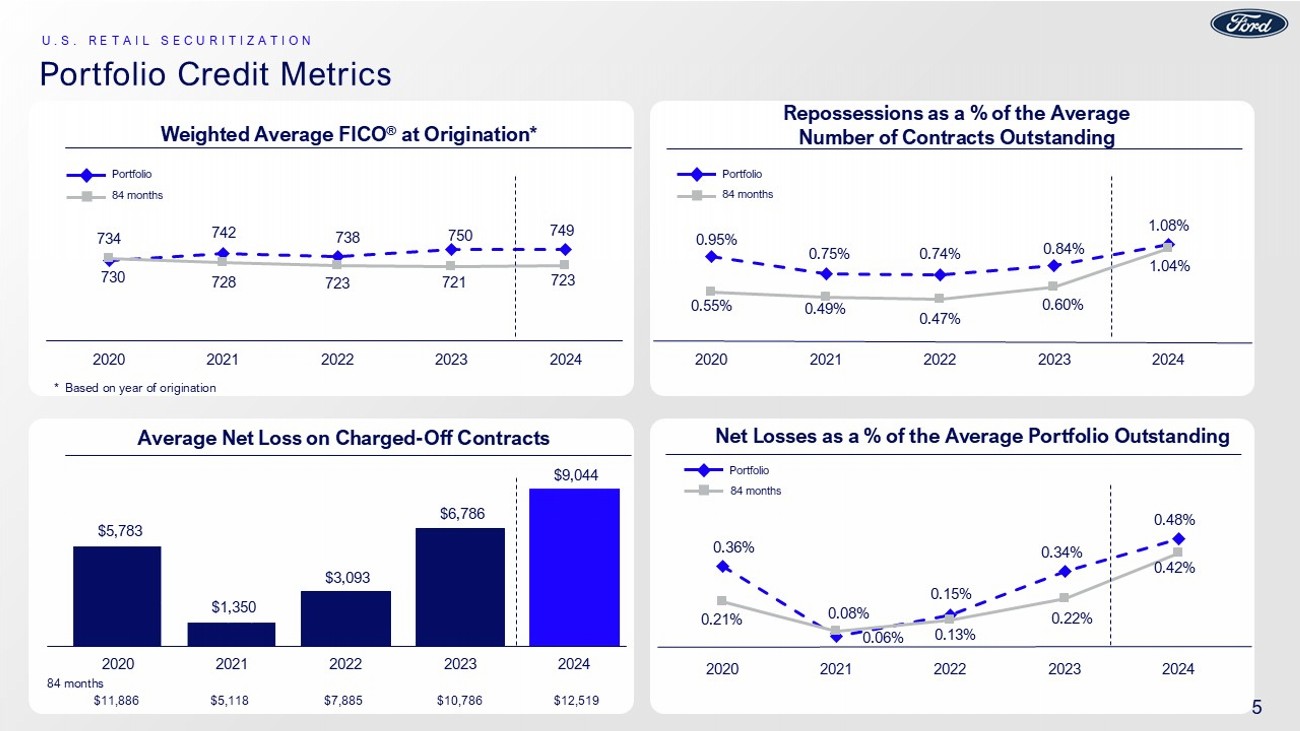

Weighted Average FICO ® at Origination* Average Net Loss on Charged - Off Contracts 730 742 738 750 749 734 728 723 721 723 2020 2021 2022 2023 2024 * Based on year of origination $5,783 $1,350 $3,093 $6,786 $9,044 2020 2021 2022 2023 2024 Repossessions as a % of the Average Number of Contracts Outstanding 0.36% 0.06% 0.15% 0.34% 0.48% 0.21% 0.08% 0.13% 0.22% 0.42% 2020 2021 2022 2023 2024 Net Losses as a % of the Average Portfolio Outstanding 84 months $11,886 $5,118 $7,885 $10,786 $12,519 Portfolio 84 months 84 months Portfolio 84 months Portfolio Portfolio Credit Metrics U.S. RETAIL SECURITIZATION 0.95% 0.75% 0.74% 0.84% 1.08% 0.55% 0.49% 0.47% 0.60% 1.04% 2020 2021 2022 2023 2024 5

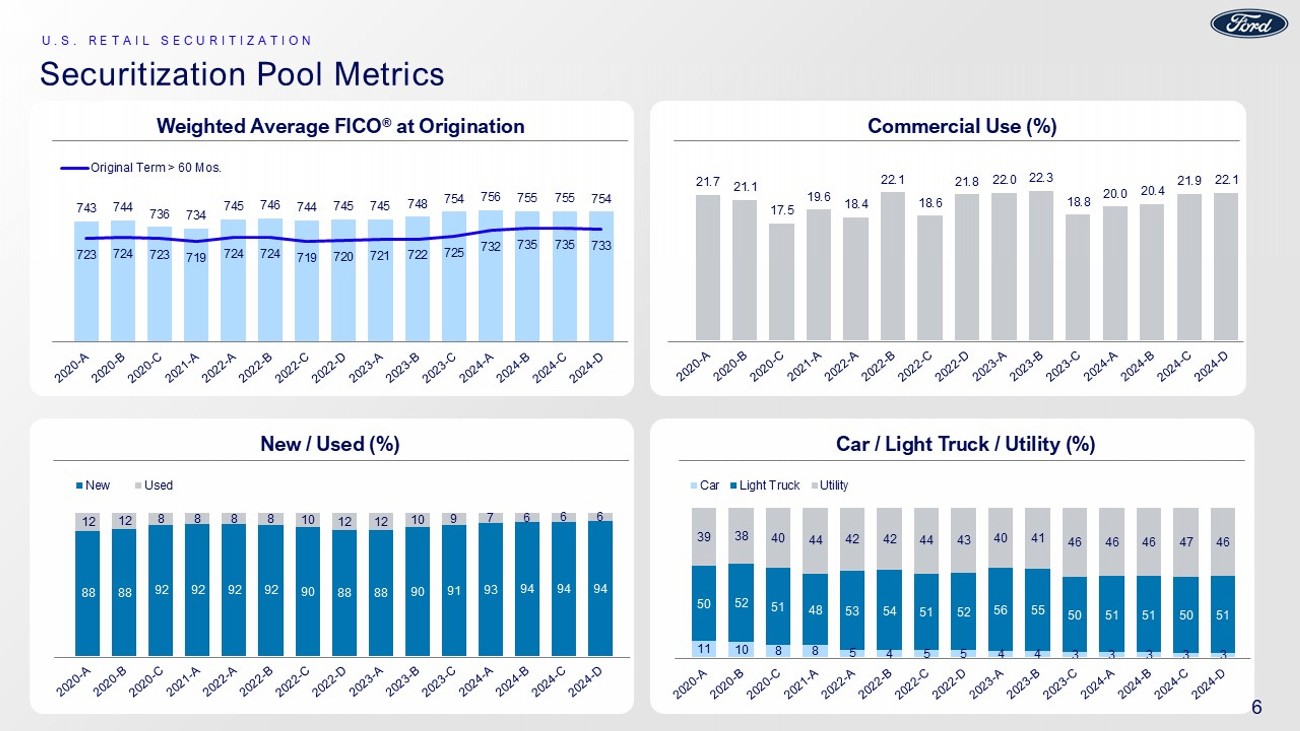

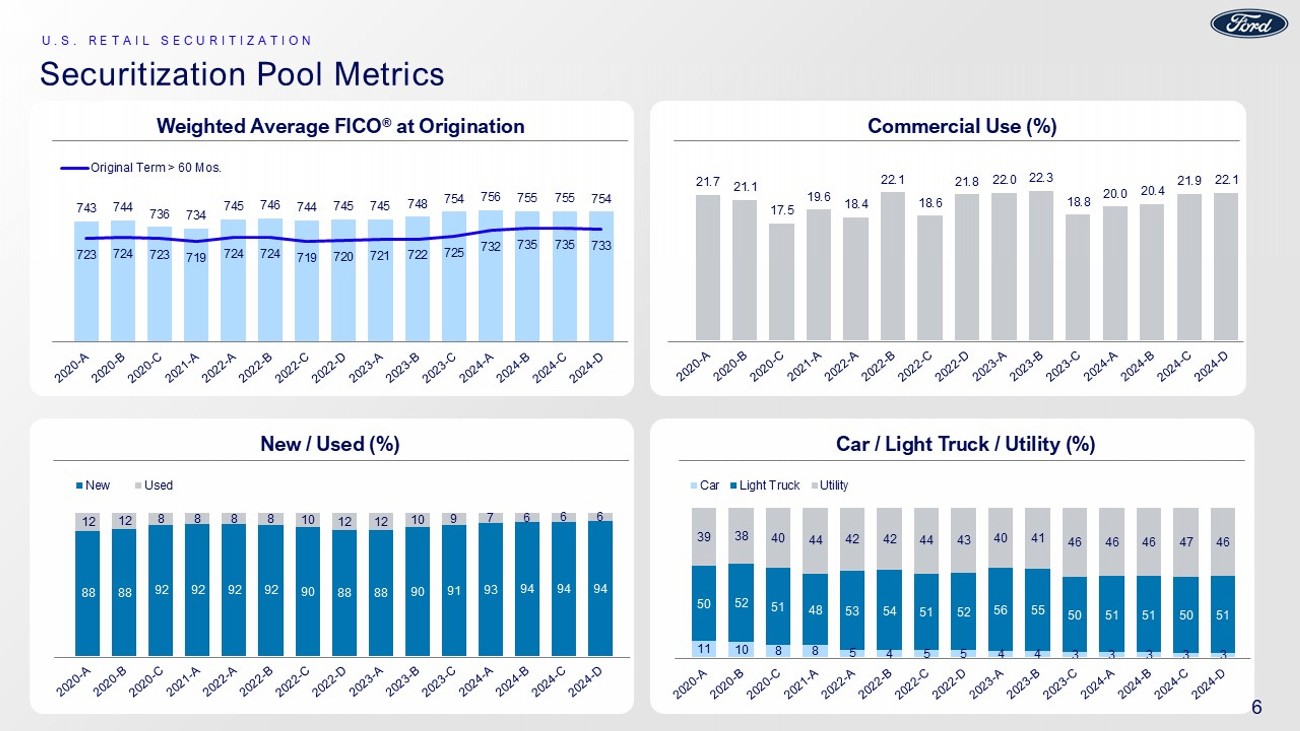

Secret Securitization Pool Metrics U.S. RETAIL SECURITIZATION 21.7 21.1 17.5 19.6 18.4 22.1 18.6 21.8 22.0 22.3 18.8 20.0 20.4 21.9 22.1 Commercial Use (%) 11 10 8 8 5 4 5 5 4 4 3 3 3 3 3 50 52 51 48 53 54 51 52 56 55 50 51 51 50 51 39 38 40 44 42 42 44 43 40 41 46 46 46 47 46 Car Light Truck Utility Car / Light Truck / Utility (%) 88 88 92 92 92 92 90 88 88 90 91 93 94 94 94 12 12 8 8 8 8 10 12 12 10 9 7 6 6 6 New Used New / Used (%) Weighted Average FICO ® at Origination 743 744 736 734 745 746 744 745 745 748 754 756 755 755 754 723 724 723 719 724 724 719 720 721 722 725 732 735 735 733 Original Term > 60 Mos. 6

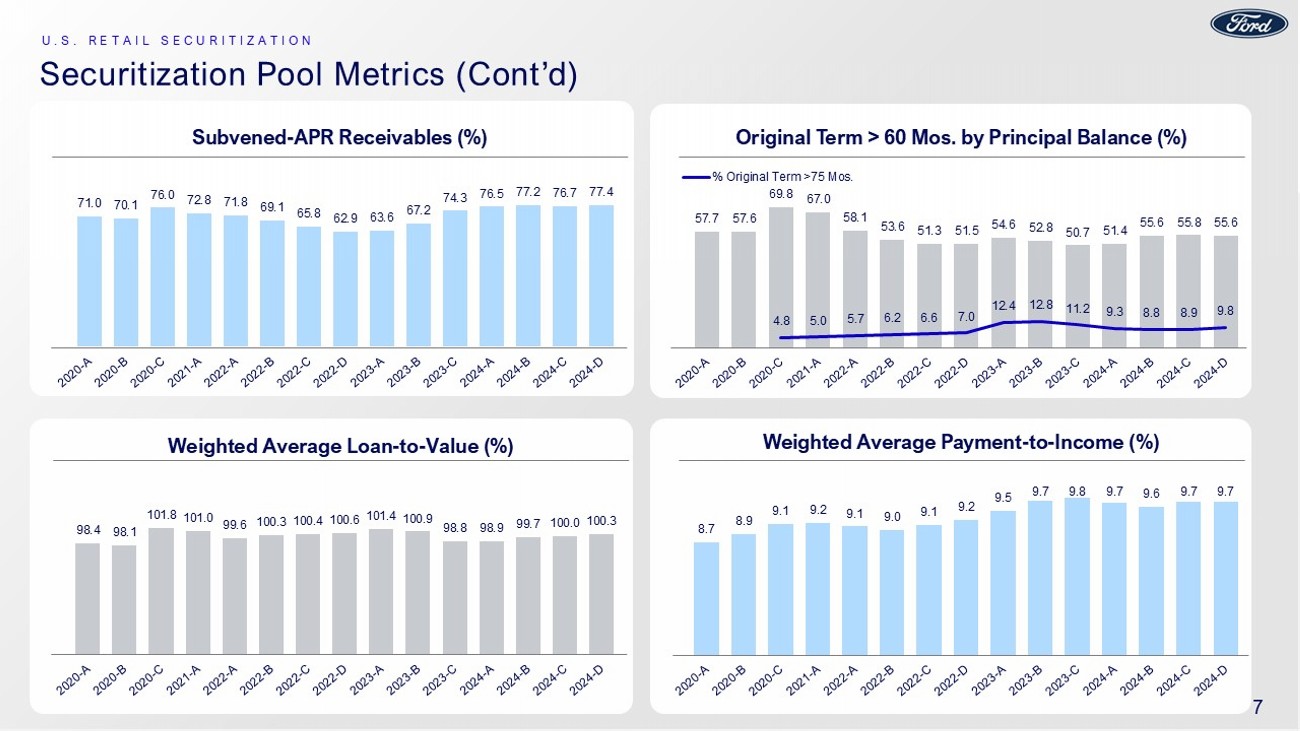

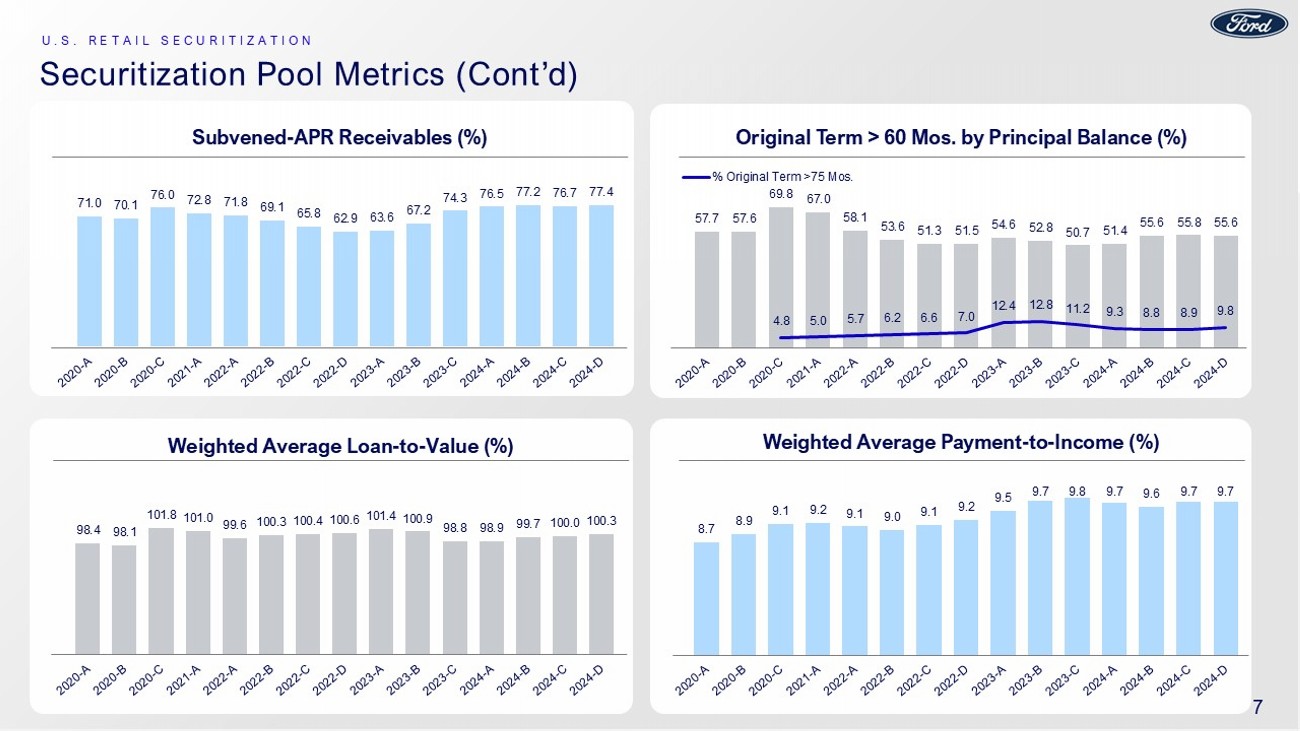

Secret Securitization Pool Metrics (Cont’d) U.S. RETAIL SECURITIZATION Subvened - APR Receivables (%) 71.0 70.1 76.0 72.8 71.8 69.1 65.8 62.9 63.6 67.2 74.3 76.5 77.2 76.7 77.4 Original Term > 60 Mos. by Principal Balance (%) 57.7 57.6 69.8 67.0 58.1 53.6 51.3 51.5 54.6 52.8 50.7 51.4 55.6 55.8 55.6 4.8 5.0 5.7 6.2 6.6 7.0 12.4 12.8 11.2 9.3 8.8 8.9 9.8 % Original Term >75 Mos. Weighted Average Loan - to - Value (%) 98.4 98.1 101.8 101.0 99.6 100.3 100.4 100.6 101.4 100.9 98.8 98.9 99.7 100.0 100.3 Weighted Average Payment - to - Income (%) 8.7 8.9 9.1 9.2 9.1 9.0 9.1 9.2 9.5 9.7 9.8 9.7 9.6 9.7 9.7 7

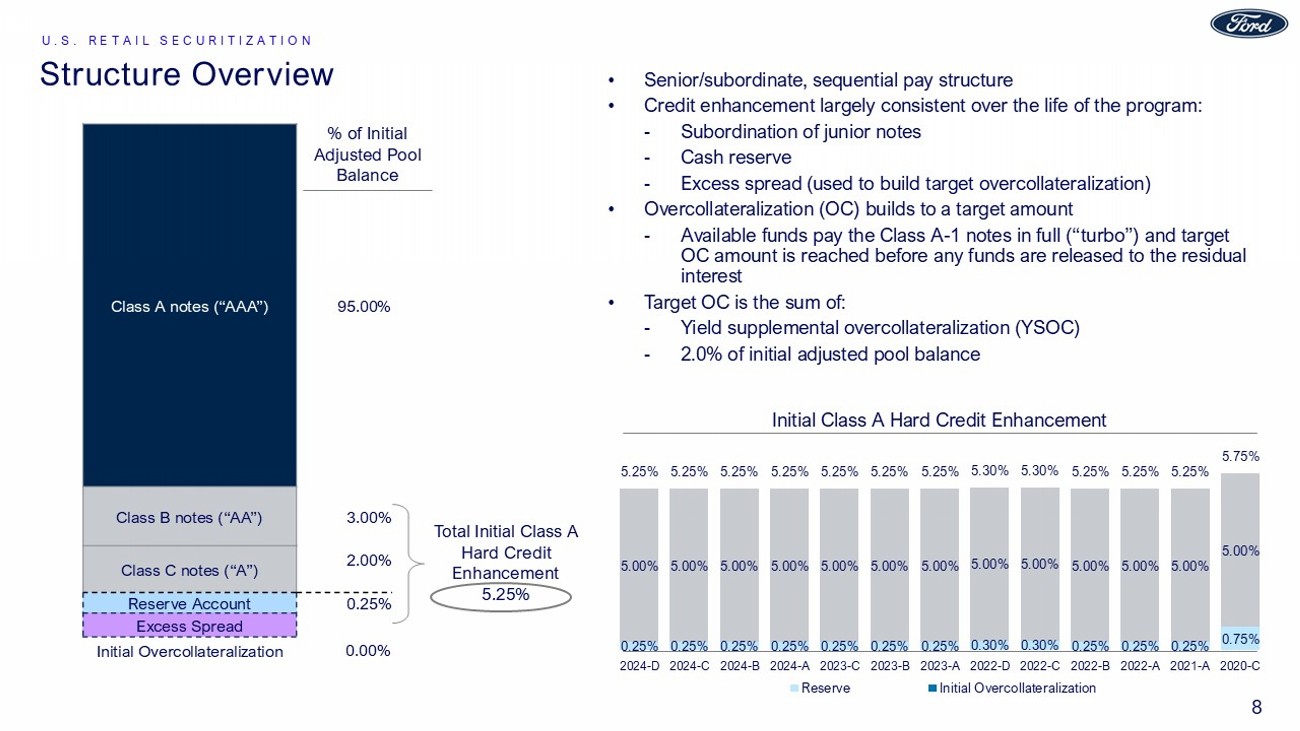

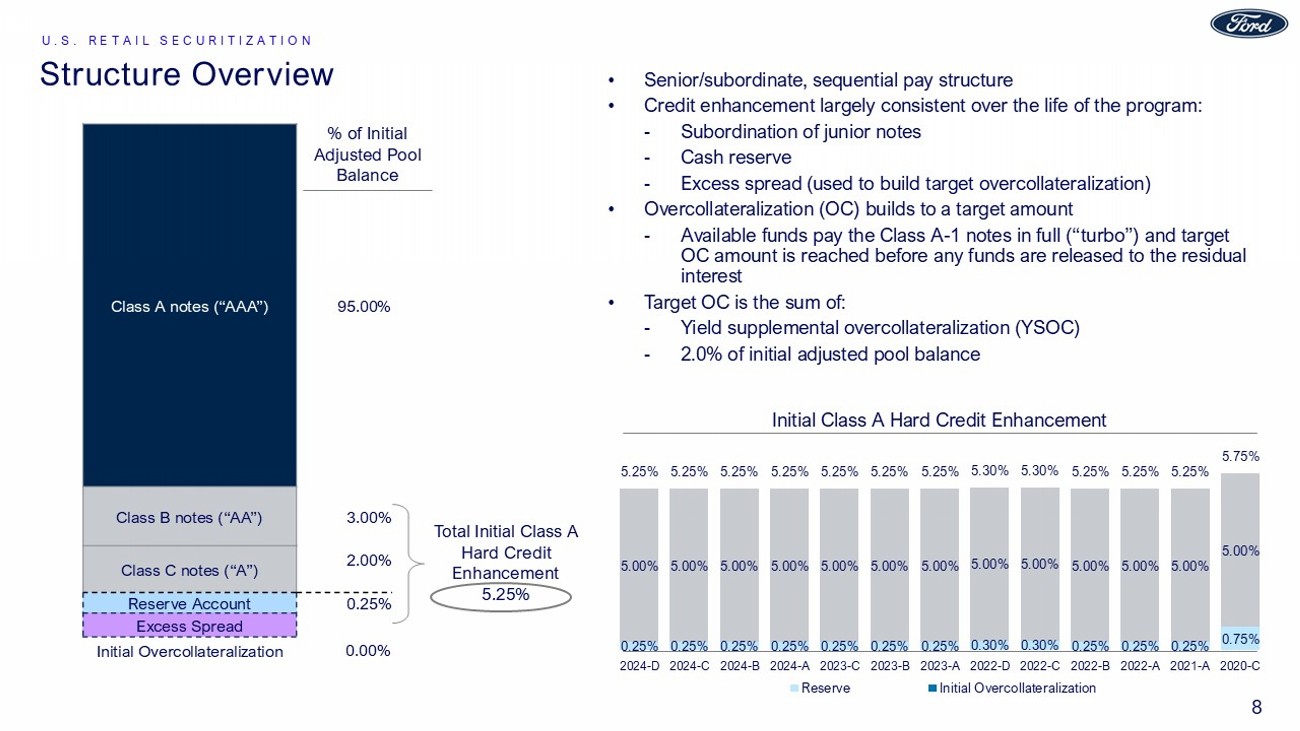

Structure Overview • Senior/subordinate, sequential pay structure • Credit enhancement largely consistent over the life of the program: - Subordination of junior notes - Cash reserve - Excess spread (used to build target overcollateralization) • Overcollateralization (OC) builds to a target amount - Available funds pay the Class A - 1 notes in full (“turbo”) and target OC amount is reached before any funds are released to the residual interest • Target OC is the sum of: - Yield supplemental overcollateralization (YSOC) - 2.0% of initial adjusted pool balance Initial Class A Hard Credit Enhancement 95.00% Class A notes (“AAA”) 3.00% Class B notes (“AA”) 2.00% Class C notes (“A”) 0.25% Reserve Account Excess Spread % of Initial Adjusted Pool Balance Initial Overcollateralization 0.00% Total Initial Class A Hard Credit Enhancement 5.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.30% 0.30% 0.25% 0.25% 0.25% 0.75% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.25% 5.25% 5.25% 5.25% 5.25% 5.25% 5.25% 5.30% 5.30% 5.25% 5.25% 5.25% 5.75% 2024-D 2024-C 2024-B 2024-A 2023-C 2023-B 2023-A 2022-D 2022-C 2022-B 2022-A 2021-A 2020-C Reserve Initial Overcollateralization U.S. RETAIL SECURITIZATION 8

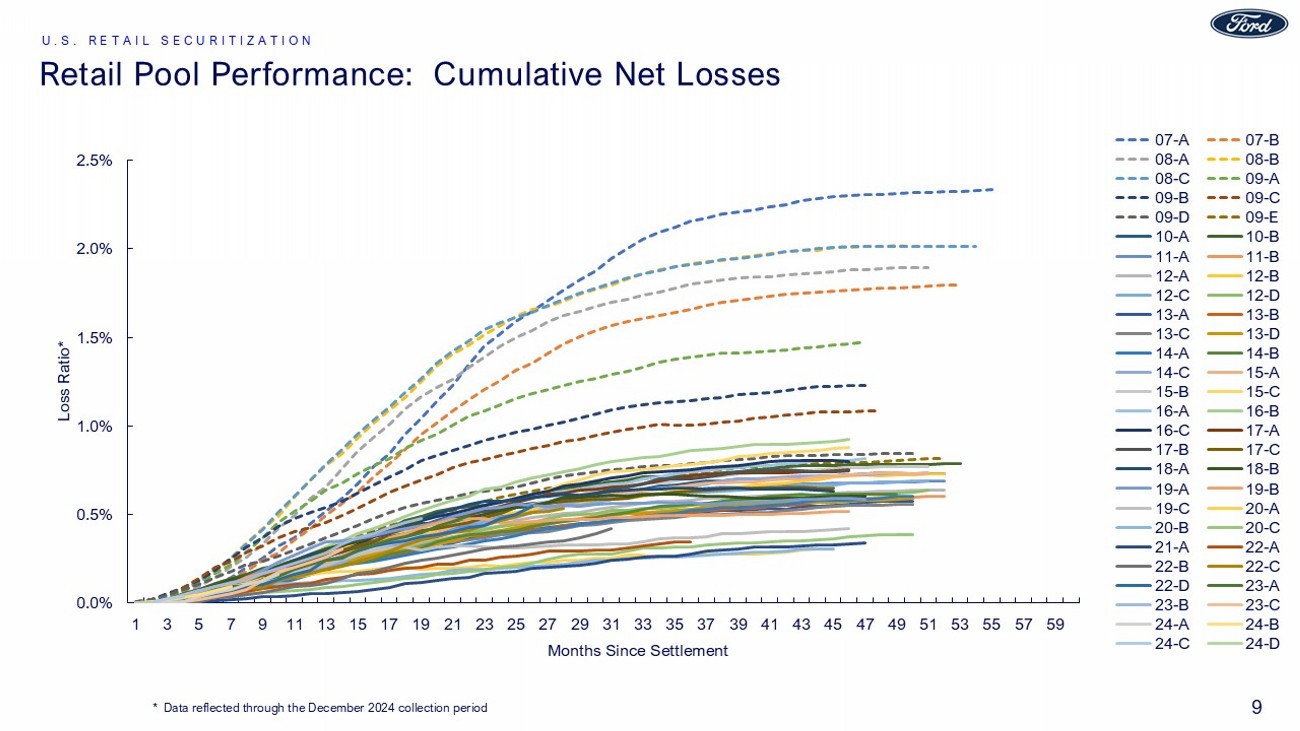

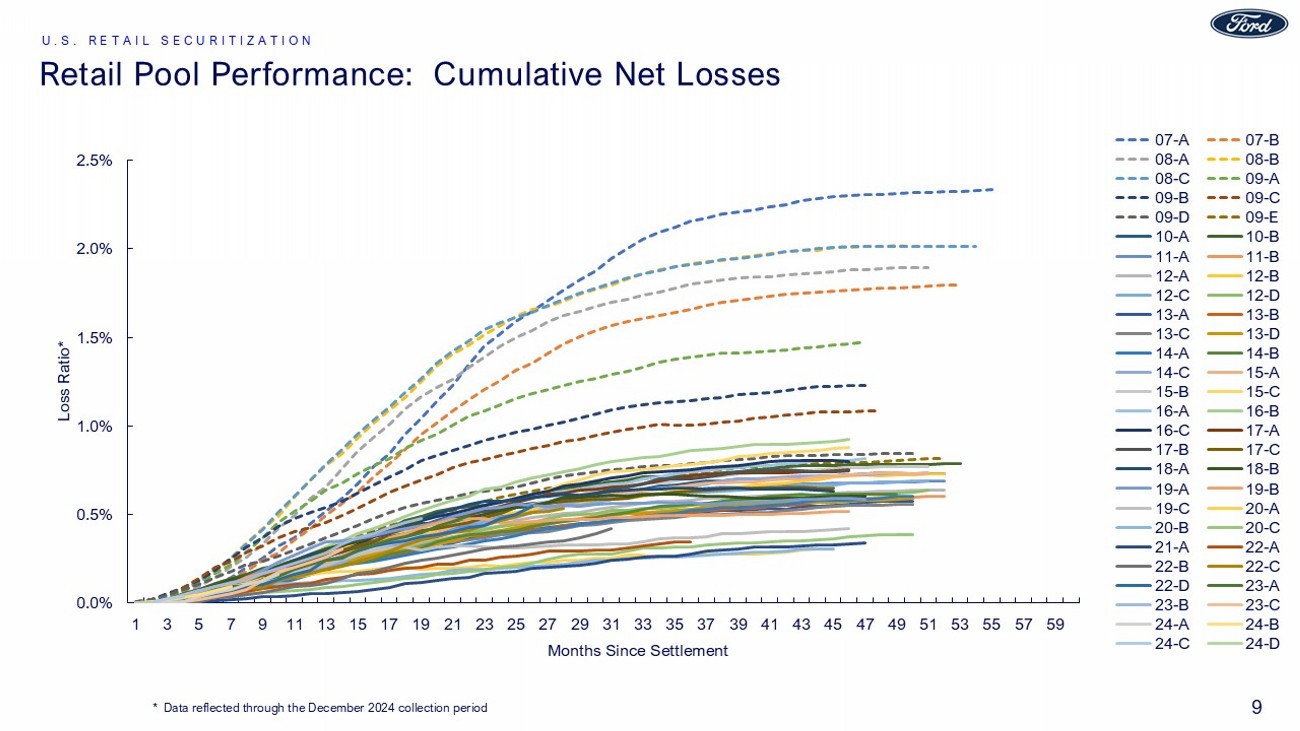

Retail Pool Performance: Cumulative Net Losses U.S. RETAIL SECURITIZATION 9 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 53 55 57 59 Loss Ratio* Months Since Settlement 07-A 07-B 08-A 08-B 08-C 09-A 09-B 09-C 09-D 09-E 10-A 10-B 11-A 11-B 12-A 12-B 12-C 12-D 13-A 13-B 13-C 13-D 14-A 14-B 14-C 15-A 15-B 15-C 16-A 16-B 16-C 17-A 17-B 17-C 18-A 18-B 19-A 19-B 19-C 20-A 20-B 20-C 21-A 22-A 22-B 22-C 22-D 23-A 23-B 23-C 24-A 24-B 24-C 24-D * Data reflected through the December 2024 collection period

U.S. Retail / Lease Origination And Servicing Strategy 03

Origination Process • Dealers submit credit applications and proposed financing terms electronically to Ford Credit • Ford Credit obtains a credit report for the applicant(s) and uses its proprietary origination system to complete compliance and other checks, including fraud alerts and ID variations • Credit decisions are made electronically or by an analyst and returned electronically to dealers • The origination process is not governed by strict limits and is judgment - based, using well - established purchasing guidelines and control processes to support consistent credit decisions • Purchase quality guidelines set portfolio targets for lower and marginal quality contracts • Risk factor guidelines are applicable to specific application attributes including affordability measures such as payment - to - income and debt - to - income ratios, LTV, FICO ® score and term - For less creditworthy applicants or if there is a discrepancy in the information provided by the applicant, the credit analyst may verify the identity, employment, income, residency and other applicant information using Ford Credit’s procedures before making a decision • Credit analysts’ decisions are reviewed regularly to ensure they are consistent with origination standards and credit approval authority 11 U.S. RETAIL / LEASE ORIGINATIONS AND SERVICING STRATEGY

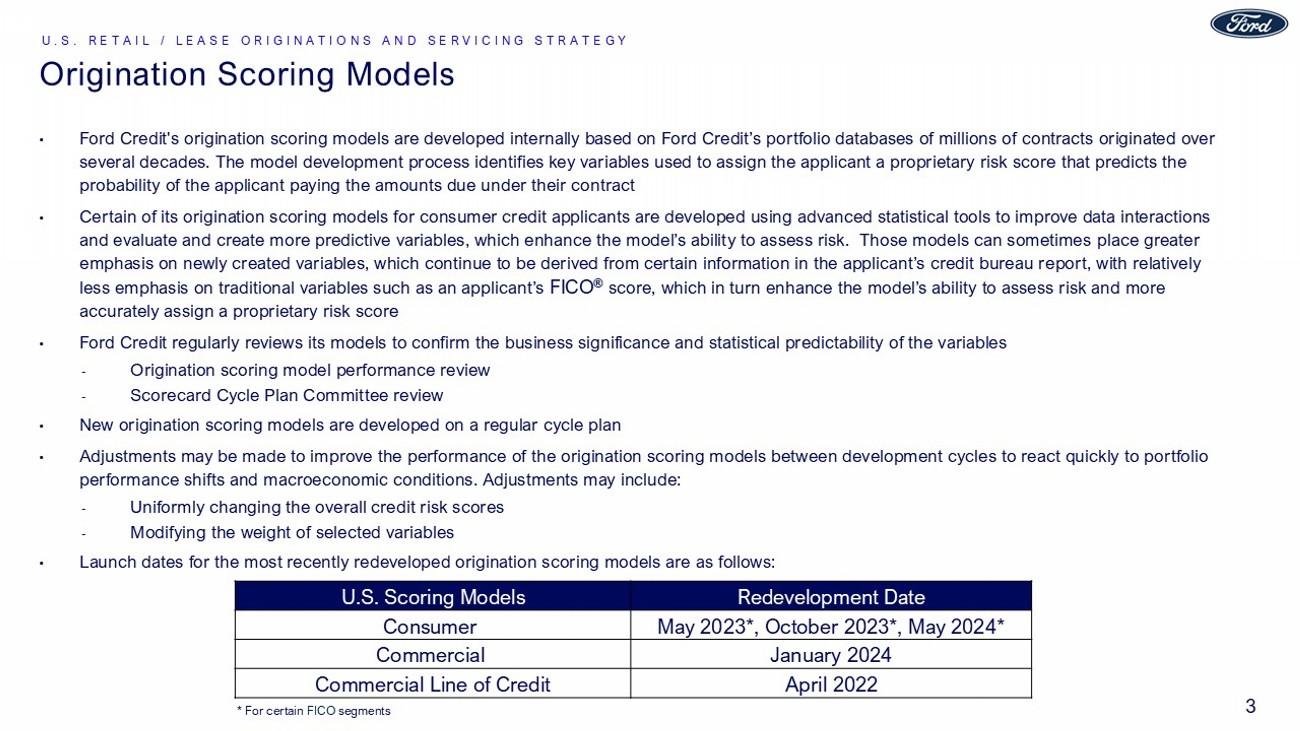

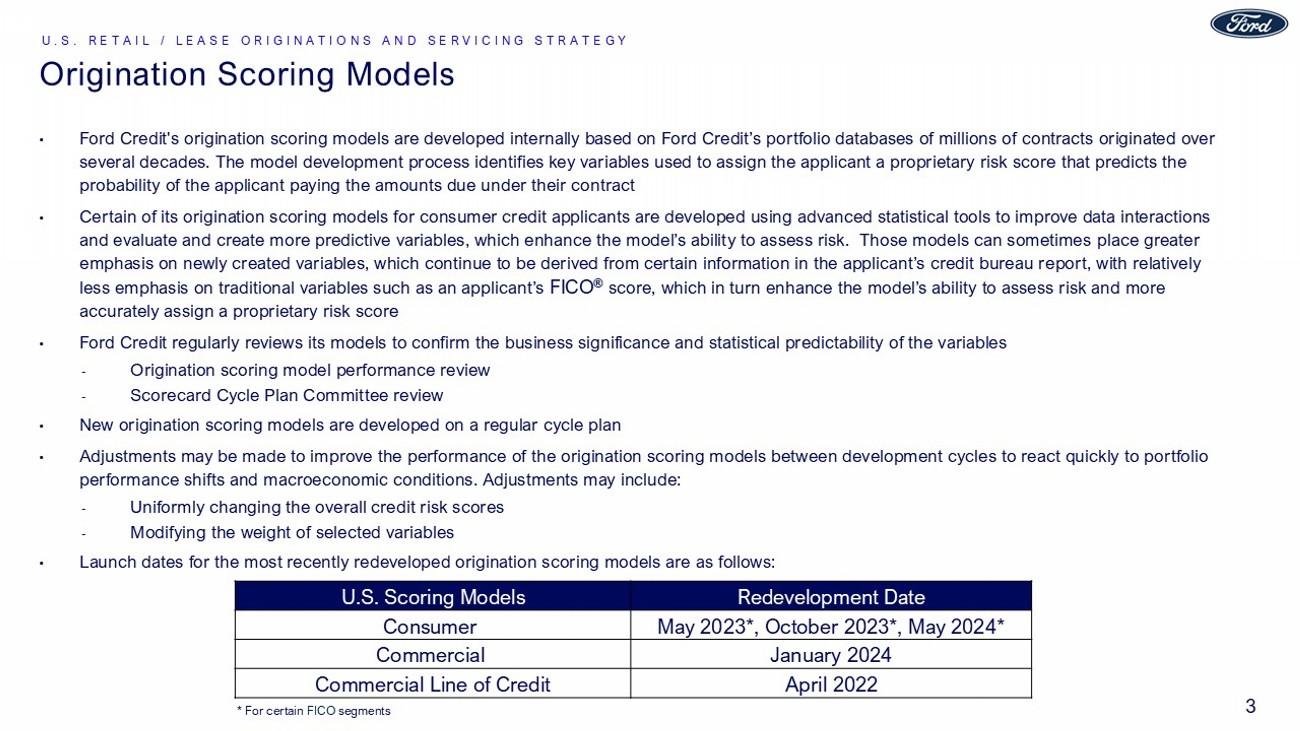

Origination Scoring Models • Ford Credit's origination scoring models are developed internally based on Ford Credit’s portfolio databases of millions of c ont racts originated over several decades. The model development process identifies key variables used to assign the applicant a proprietary risk score th at predicts the probability of the applicant paying the amounts due under their contract • Certain of its origination scoring models for consumer credit applicants are developed using advanced statistical tools to im pro ve data interactions and evaluate and create more predictive variables, which enhance the model’s ability to assess risk. Those models can sometimes place greater emphasis on newly created variables, which continue to be derived from certain information in the applicant’s credit bureau r epo rt, with relatively less emphasis on traditional variables such as an applicant’s FICO ® score, which in turn enhance the model’s ability to assess risk and more accurately assign a proprietary risk score • Ford Credit regularly reviews its models to confirm the business significance and statistical predictability of the variables - Origination scoring model performance review - Scorecard Cycle Plan Committee review • New origination scoring models are developed on a regular cycle plan • Adjustments may be made to improve the performance of the origination scoring models between development cycles to react quic kly to portfolio performance shifts and macroeconomic conditions. Adjustments may include: - Uniformly changing the overall credit risk scores - Modifying the weight of selected variables • Launch dates for the most recently redeveloped origination scoring models are as follows: 12 Redevelopment Date U.S. Scoring Models May 2023*, October 2023*, May 2024* Consumer January 2024 Commercial April 2022 Commercial Line of Credit * For certain FICO segments U.S. RETAIL / LEASE ORIGINATIONS AND SERVICING STRATEGY

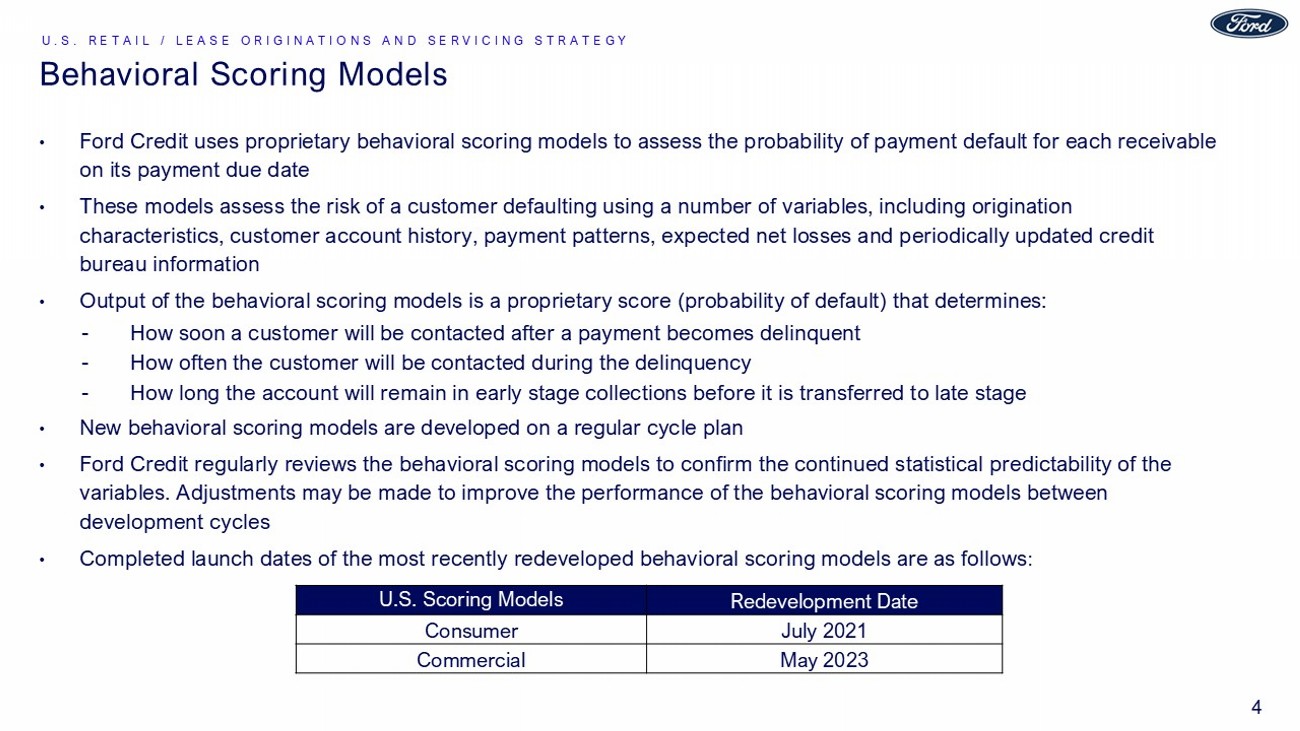

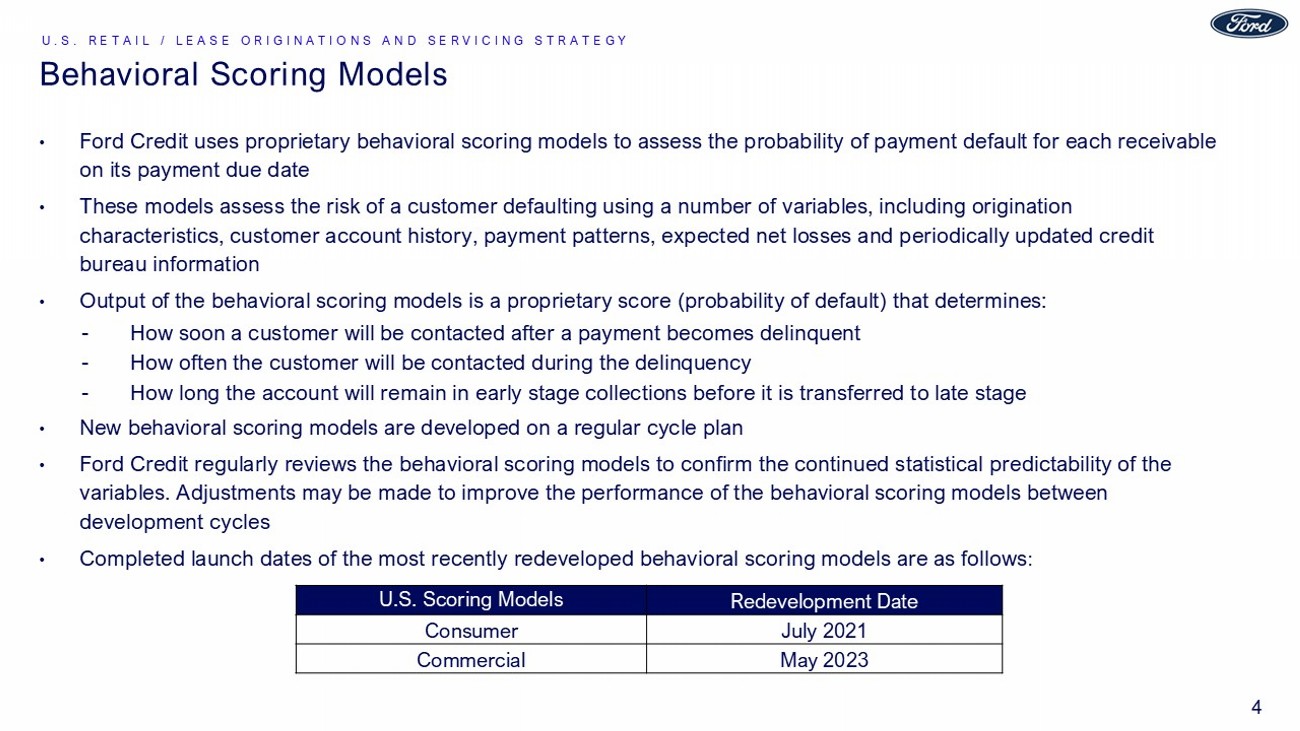

Behavioral Scoring Models • Ford Credit uses proprietary behavioral scoring models to assess the probability of payment default for each receivable on its payment due date • These models assess the risk of a customer defaulting using a number of variables, including origination characteristics, customer account history, payment patterns, expected net losses and periodically updated credit bureau information • Output of the behavioral scoring models is a proprietary score (probability of default) that determines: - How soon a customer will be contacted after a payment becomes delinquent - How often the customer will be contacted during the delinquency - How long the account will remain in early stage collections before it is transferred to late stage • New behavioral scoring models are developed on a regular cycle plan • Ford Credit regularly reviews the behavioral scoring models to confirm the continued statistical predictability of the variables. A djustments may be made to improve the performance of the behavioral scoring models between development cycles • Completed launch dates of the most recently redeveloped behavioral scoring models are as follows : 13 Redevelopment Date U.S . Scoring Models July 2021 Consumer May 2023 Commercial U.S. RETAIL / LEASE ORIGINATIONS AND SERVICING STRATEGY