CAUTIONARY STATEMENT This presentation and the oral statements made in connection herewith contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this presentation and the oral statements made in connection herewith are forward-looking statements made in good faith by CenterPoint Energy, Inc. (“CenterPoint Energy” or the “Company”) and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995, including statements concerning CenterPoint Energy’s expectations, beliefs, plans, objectives, goals, strategies, future operations, events, financial position, earnings, growth, costs, prospects, capital investments or performance or underlying assumptions (including future regulatory filings and recovery, liquidity, capital resources, balance sheet, cash flow, capital investments and management, financing costs and rate base or customer growth) and other statements that are not historical facts. You should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “target,” “will,” or other similar words. The absence of these words, however, does not mean that the statements are not forward-looking. Examples of forward-looking statements in this presentation include statements about the performance of Enable Midstream Partners, LP (“Enable”), including reductions to distributions on its common units and the amount thereof, our targeted reduction to our quarterly common stock dividend, 2020 capital spending and 2020 O&M expense, our utility earnings contribution and utility earnings payout ratio, the impact of COVID-19, our transition to become core utility focused, including the percentage of earnings therefrom and CAGR growth, our proposed sales of Infrastructure Services and Energy Services, regulatory actions, our credit quality, among other statements. We have based our forward-looking statements on our management’s beliefs and assumptions based on information currently available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include but are not limited to the timing and impact of future regulatory, legislative and IRS decisions, financial market conditions, future market conditions, economic and employment conditions, customer growth, Enable’s performance and ability to pay distributions and other factors described in CenterPoint Energy’s Form 10-K for the year ended December 31, 2019 under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Certain Factors Affecting Future Earnings” and in other filings with the SEC by the Company, which can be found at www.centerpointenergy.com on the Investor Relations page or on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov. A portion of slide 3 is derived from Enable’s press release dated April 1, 2020. The information in this slide is included for informational purposes only. The content has not been verified by us, and we assume no liability for the same. You should consider Enable’s investor materials in the context of its SEC filings and its entire investor presentation, which is available at http://investors.enablemidstream.com. This presentation contains time sensitive information that is accurate as of the date hereof (unless otherwise specified as accurate as of another date). Some of the information in this presentation is unaudited and may be subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investor Relations page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel, corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information we post on our website. 2

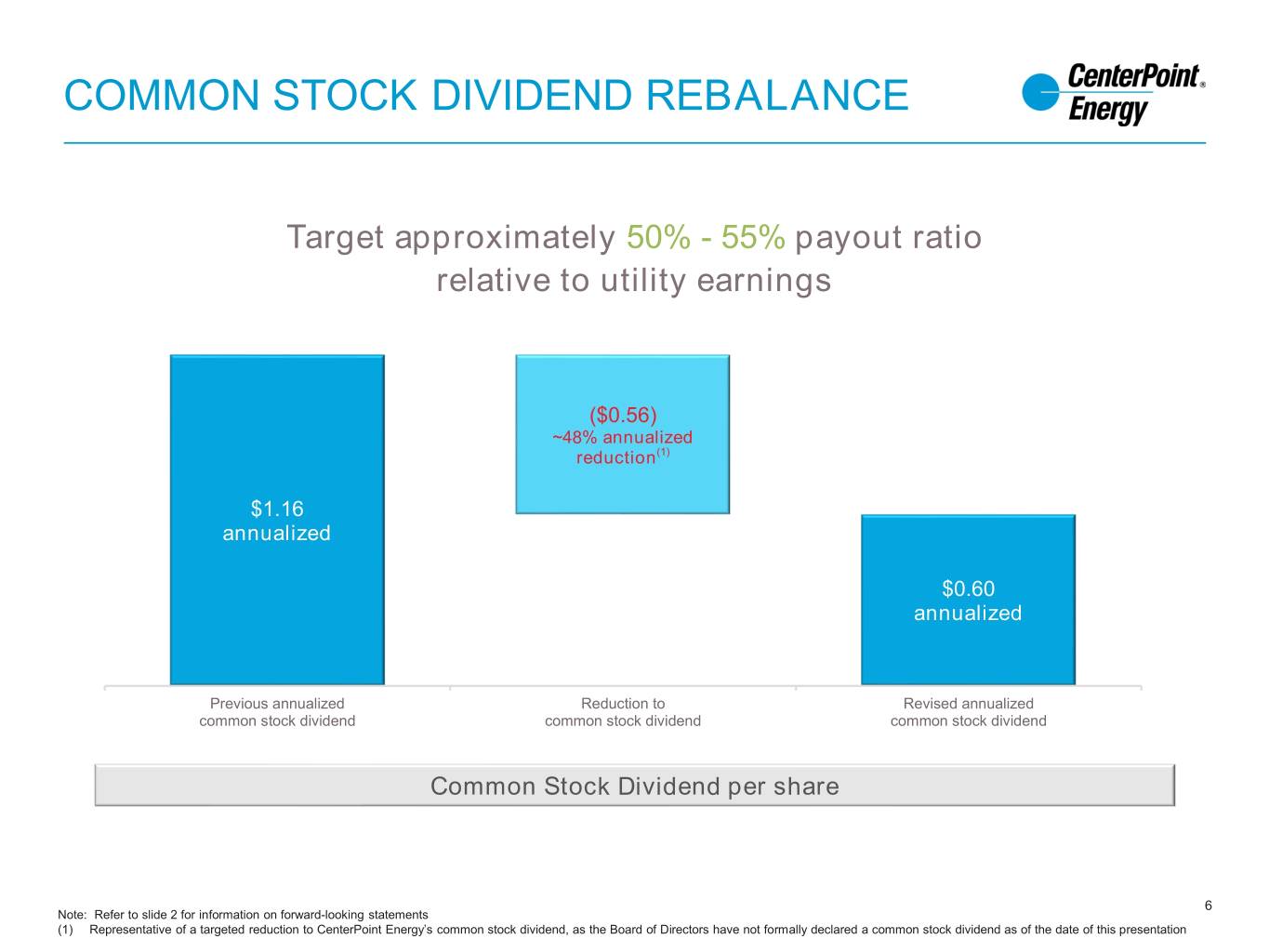

REDUCTION TO ANNUAL CASH DISTRIBUTION FROM MIDSTREAM INVESTMENTS • Enable Midstream Partners, LP (Enable) announced a reduction to its annual LP common unit distributions • Enable’s 50% reduction in distributions results in approximately $155 million of lower annualized cash flow to CNP relative to CNP’s 2020 financial plan of ~$310 million in distributions described on the Q4 earnings call • To adjust for the reduction in cash flow and strengthen its financial position, CNP expects to take the following measures intended to maintain solid investment grade credit quality: – Targeted reduction in CNP’s quarterly common stock dividend from $0.2900 per share(1) to $0.1500 per share(1), targeting approximately 50% - 55% utility earnings payout ratio – Approximately $40 million target reduction in 2020 O&M expense(2) – Approximately $300 million(3) reduction in anticipated 2020 utility capital investment from $2.6 billion to $2.3 billion; CNP will continue to target 5-year total capital investment of approximately $13 billion Note: Refer to Enable’s press release dated April 1, 2020 for further detail. (1) Representative of a targeted reduction to CenterPoint Energy’s common stock dividend, as the Board of Directors have not formally declared a common stock dividend as of the date of this presentation (2) Inclusive of Houston Electric, Indiana Electric Integrated and Natural Gas Distribution business segments. Excluding certain merger costs, utility costs to achieve, severance and amounts with revenue offsets 3 (3) Deferrals by business unit are estimated at the following levels: Houston Electric - $120 - $130 million; Indiana Electric Integrated - $12 - $13 million; Natural Gas Distribution - $150 million; Other - $15 million