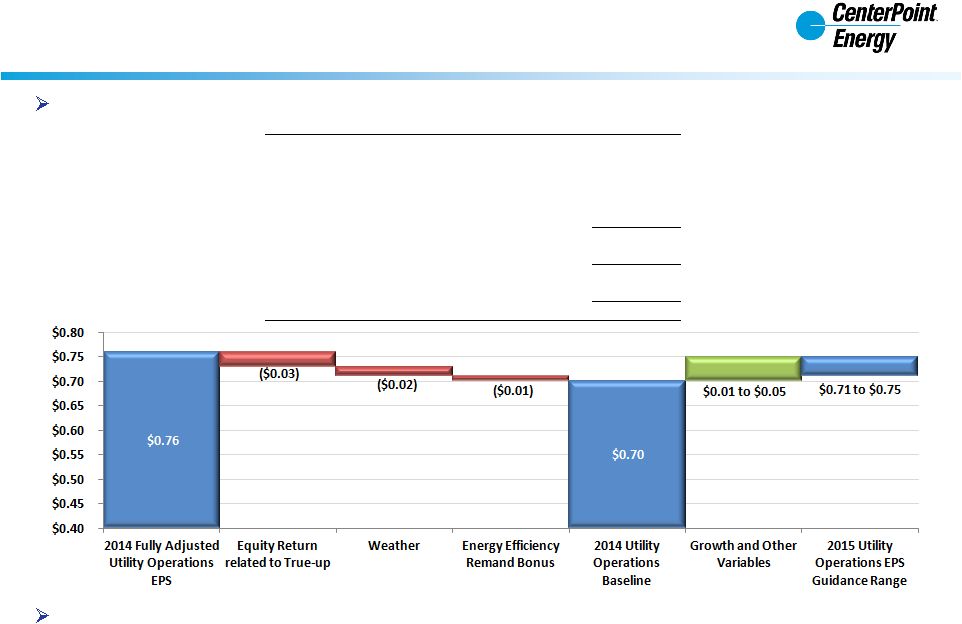

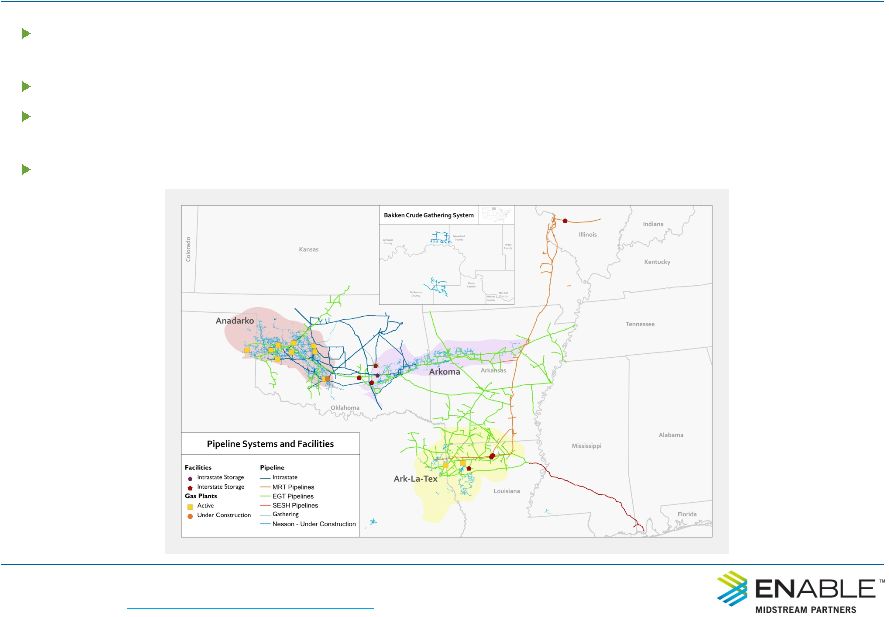

investors.centerpointenergy.com March 2015 Cautionary Statement 2 This presentation contains statements concerning our expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “will,” or other similar words. The absence of these words, however, does not mean that the statements are not forward-looking. We have based our forward-looking statements on our management's beliefs and assumptions based on information currently available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include but are not limited to the timing and impact of future regulatory, legislative and IRS decisions, financial market conditions, future market conditions, and other factors described in CenterPoint Energy, Inc.’s Form 10-K for the period ended December 31, 2014 under “cautionary statement regarding forward-looking information,” “Risk Factors” and “ – Liquidity and Capital Resources – Other Matters – Other Factors That Could Affect Cash Requirements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Certain Factors Affecting Future Earnings,” and in other filings with the SEC by CenterPoint Energy, which can be found at www.centerpointenergy.com on the Investor Relations page or on the SEC’s website at www.sec.gov . Slides 20 and 21 are extracted from Enable Midstream Partners, LP’s (“Enable Midstream”) investor presentation as presented at the Barclays Investment Grade Energy and Pipeline conference dated March 4, 2015. These slides are included for informational purposes only. The content has not been verified by CenterPoint Energy and CenterPoint Energy assumes no liability for the same. You should consider Enable Midstream’s investor materials in the context of their SEC filings and their entire investor presentation, which is available on their website at http://investors.enablemidstream.com/. This presentation contains time sensitive information that is accurate as of the date hereof. Some of the information in this presentation in unaudited and may be subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investors page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel, corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information we post on our website. Use of Non-GAAP Financial Measures In addition to presenting its financial results in accordance with generally accepted accounting principles (“GAAP”), CenterPoint Energy also provides guidance based on adjusted diluted earnings per share, which is a non-GAAP financial measure. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure. A reconciliation of diluted earnings per share to the adjusted basis used in providing guidance is provided in this presentation on slide 7. Management evaluates financial performance in part based on adjusted diluted earnings per share and believes that presenting this non-GAAP financial measure enhances an investor’s understanding of CenterPoint Energy’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results across periods by excluding items that Management does not believe most accurately reflect its fundamental business performance, which items include the items reflected in the reconciliation table on page 7 of this presentation. This non-GAAP financial measure should be considered as a supplement and complement to, and not as a substitute for, or superior to, the most directly comparable GAAP financial measure and may be different than non-GAAP financial measures used by other companies. |