3rd QUARTER 2018 INVESTOR CALL November 8, 2018 Exhibit 99.2

This presentation and the oral statements made in connection herewith contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this presentation and the oral statements made in connection herewith are forward-looking statements made in good faith by CenterPoint Energy, Inc. (“CenterPoint Energy” or the “Company”) and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995, including statements concerning CenterPoint Energy’s expectations, beliefs, plans, objectives, goals, strategies, future operations, events, financial position, earnings, growth, costs, prospects, capital investments or performance or underlying assumptions (including future regulatory filings and recovery, liquidity, capital resources, balance sheet, cash flow, capital investments and management, financing costs and rate base or customer growth) and other statements that are not historical facts. You should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “target,” “will,” or other similar words. The absence of these words, however, does not mean that the statements are not forward-looking. Examples of forward-looking statements in this presentation include statements about our intentions with respect to our pending acquisition of Vectren Corporation (“Vectren”) (the “Merger”) (including potential commercial opportunities and cost savings, the anticipated transaction timeline and the anticipated sources of funds for the remaining Merger consideration), Enable Midstream Partners, LP’s (“Enable”) anticipated achievement of its 2018 Net Income Attributable to Common Units guidance and its forecasted 2019 Net Income Attributable to Common Units guidance, our growth and guidance (including earnings, dividend and core operating income growth and expected momentum of commercial businesses), future financing plans (including no issuances of equity in 2019 or 2020 anticipated and potential bank refinancing related to CenterPoint Energy Midstream), capital resources and expenditures (including expected increases to rate base investment relative to the previous five-year plan, pipe replacement and customer growth), our anticipated regulatory filings and projections (including the Freeport Master Plan Project), Energy Services’s guidance operating income target for 2018 and anticipated topics for the Q4 2018 earnings call, among other statements. We have based our forward-looking statements on our management’s beliefs and assumptions based on information currently available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Risks Related to the Merger Important factors that could cause actual results to differ materially from those indicated by the provided forward-looking information include risks and uncertainties relating to: (1) the risk that CenterPoint Energy or Vectren may be unable to obtain regulatory approvals required for the proposed transactions, or that required regulatory approvals or agreements with other parties interested therein may delay the proposed transactions or may be subject to or impose adverse conditions or costs, (2) the occurrence of any event, change or other circumstances that could give rise to the termination of the proposed transactions or could otherwise cause the failure of the proposed transactions to close, (3) the risk that a condition to the closing of the proposed transactions may not be satisfied, (4) the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted relating to the proposed transactions, (5) the receipt of an unsolicited offer from another party to acquire assets or capital stock of Vectren that could interfere with the proposed transactions, (6) the timing to consummate the proposed transactions, (7) the costs incurred to consummate the proposed transactions, (8) the possibility that the expected cost savings, synergies or other value creation from the proposed transactions will not be realized, or will not be realized within the expected time period, (9) the risk that the companies may not realize fair values from properties that may be required to be sold in connection with the merger, (10) the credit ratings of the companies following the proposed transactions, (11) disruption from the proposed transactions making it more difficult to maintain relationships with customers, employees, regulators or suppliers and (12) the diversion of management time and attention on the proposed transactions. The foregoing list of factors is not all inclusive because it is not possible to predict all factors. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include but are not limited to the timing and impact of future regulatory, legislative and IRS decisions, financial market conditions, future market conditions, economic and employment conditions, customer growth, Enable’s performance and ability to pay distributions and other factors described in CenterPoint Energy’s Form 10-K for the year ended December 31, 2017 under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Certain Factors Affecting Future Earnings,” CenterPoint Energy’s Form 10-Q for the quarter ended March 31, 2018 under “Risk Factors” and in other filings with the Securities and Exchange Commission (“SEC”) by the Company, which can be found at www.centerpointenergy.com on the Investor Relations page or on the SEC’s website at www.sec.gov. Slide 10 and portions of slides 11 and 21 are derived from Enable’s investor presentation as presented during its Q3 2018 earnings call dated November 7, 2018. This slide is included for informational purposes only. The content has not been verified by us, and we assume no liability for the same. You should consider Enable’s investor materials in the context of its SEC filings and its entire investor presentation, which is available at http://investors.enablemidstream.com. This presentation contains time sensitive information that is accurate as of the date hereof (unless otherwise specified as accurate as of another date). Some of the information in this presentation is unaudited and may be subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investor Relations page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel, corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information we post on our website. Cautionary Statement

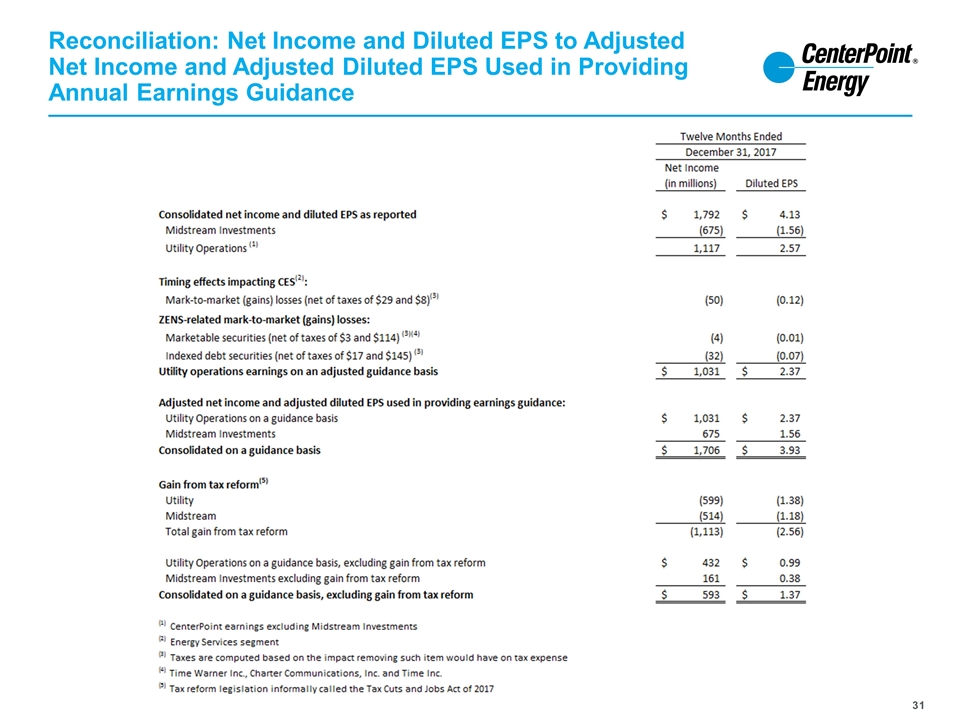

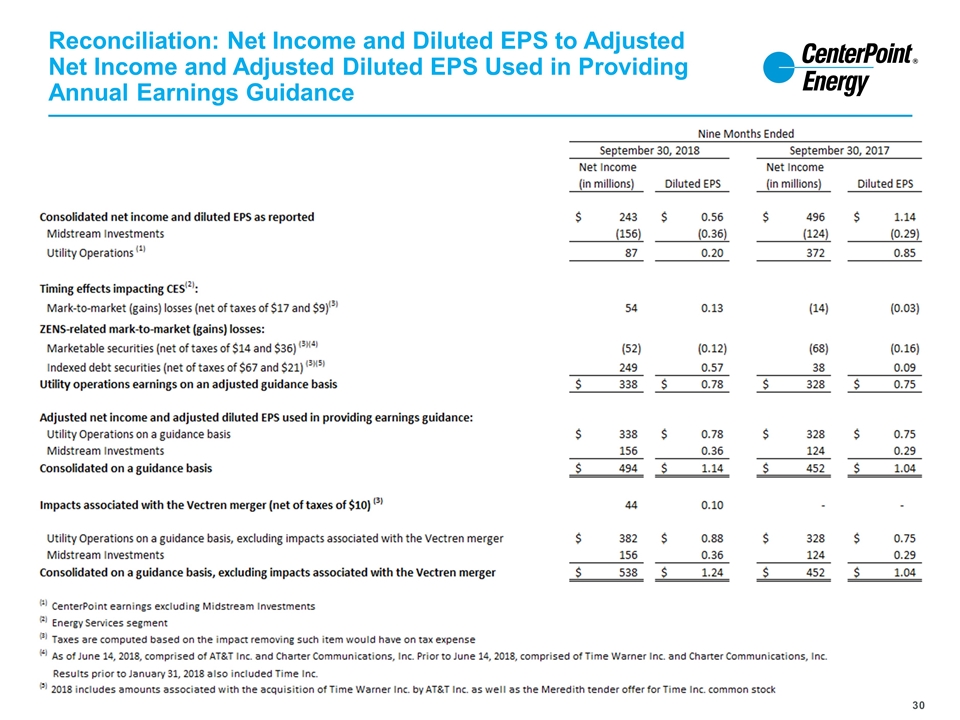

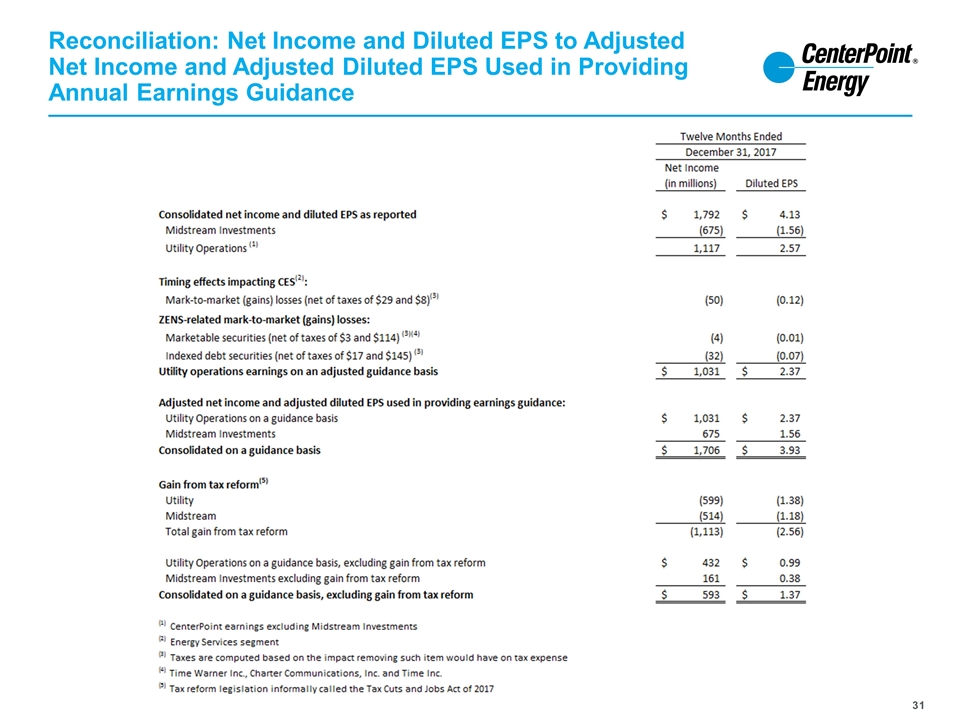

Additional Information Use of Non-GAAP Financial Measures In addition to presenting its financial results in accordance with generally accepted accounting principles (“GAAP”), including presentation of net income and diluted earnings per share, the Company also provides guidance based on adjusted net income and adjusted diluted earnings per share, which are non-GAAP financial measures. Additional Non-GAAP financial measures used by the Company include utility earnings per share and core operating income. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure. The Company’s adjusted net income and adjusted diluted earnings per share calculation excludes from net income and diluted earnings per share, respectively, the impact of ZENS and related securities and mark-to-market gains or losses resulting from the Company’s Energy Services business. The Company’s guidance does not currently reflect impacts associated with the pending merger with Vectren. The Company’s utility earnings per share calculation includes all earnings except those related to Midstream Investments (but includes the Enable Series A Preferred Units). The Company’s core operating income calculation excludes the transition and system restoration bonds from the Electric Transmission and Distribution business segment, the mark-to-market gains or losses resulting from the Company’s Energy Services business and income from the Other Operations business segment. A reconciliation of net income and diluted earnings per share to the basis used in providing 2018 guidance is provided in this presentation on slides 29–31. The Company is unable to present a quantitative reconciliation of forward-looking adjusted net income and adjusted diluted earnings per share because changes in the value of ZENS and related securities and mark-to-market gains or losses resulting from the Company’s Energy Services business are not estimable. Management evaluates the Company’s financial performance in part based on adjusted net income, adjusted diluted earnings per share, utility earnings per share and core operating income. We believe that presenting these non-GAAP financial measures enhances an investor’s understanding of the Company’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results across periods. Management believes the adjustments made in these non-GAAP financial measures exclude or include items, as applicable, to most accurately reflect the Company’s business performance. These excluded or included items, as applicable, are reflected in the reconciliation tables on slides 28–31. The Company’s adjusted net income, adjusted diluted earnings per share, utility earnings per share and core operating income non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, net income, diluted earnings per share, utility earnings per share and core operating income, which respectively are the most directly comparable GAAP financial measures. These non-GAAP financial measures also may be different than non-GAAP financial measures used by other companies. 2018 Earnings Per Share Guidance Assumptions CenterPoint Energy’s 2018 earnings per share guidance is inclusive of Enable’s net income guidance of $375–$445 million as stated during Enable’s Q3 2018 earnings call on November 7, 2018. The guidance range also assumes ownership of 54% of the common units representing limited partner interests in Enable and includes the amortization of CenterPoint Energy’s basis differential in Enable and effective tax rates. CenterPoint Energy does not include other potential Enable impacts on guidance, such as any changes in accounting standards or unusual items. Further, the guidance range considers utility operations performance to date and certain significant variables that may impact earnings, such as weather, throughput, commodity prices, effective tax rates, financing activities (other than those to fund the pending merger with Vectren), and regulatory and judicial proceedings to include regulatory action as a result of recent tax reform legislation. In providing this guidance, CenterPoint Energy uses a non-GAAP financial measure of adjusted diluted earnings per share that does not consider other potential impacts, such as changes in accounting standards or unusual items, earnings or losses from the change in the value of the ZENS securities and the related stocks or the timing effects of mark-to-market accounting in the Company’s Energy Services business. The Company’s guidance does not currently reflect impacts associated with the pending merger with Vectren.

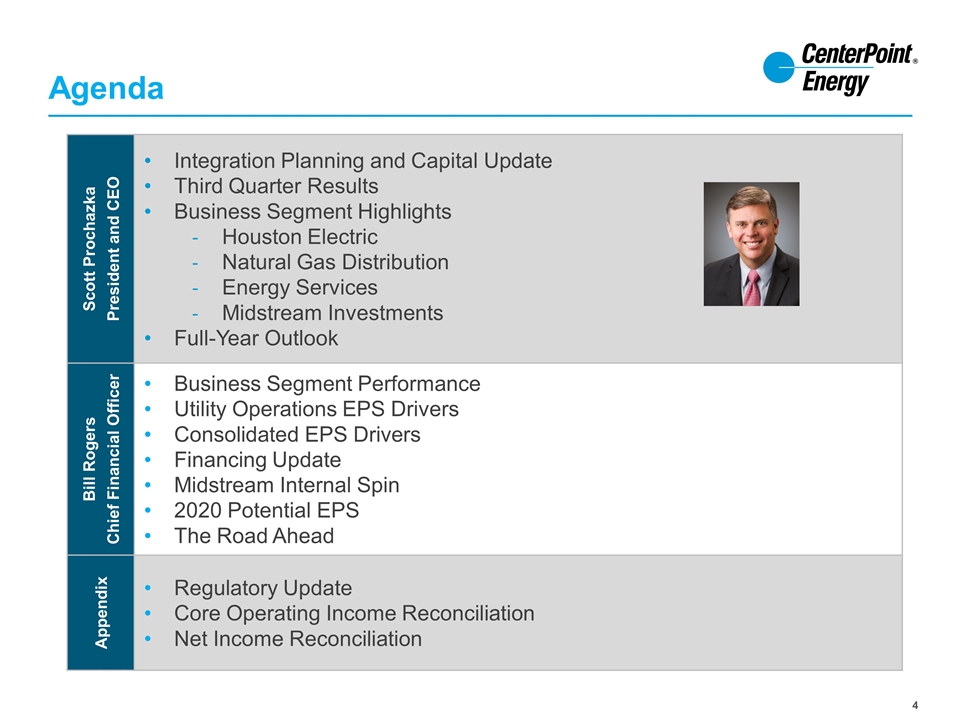

Scott Prochazka President and CEO Integration Planning and Capital Update Third Quarter Results Business Segment Highlights Houston Electric Natural Gas Distribution Energy Services Midstream Investments Full-Year Outlook Bill Rogers Chief Financial Officer Business Segment Performance Utility Operations EPS Drivers Consolidated EPS Drivers Financing Update Midstream Internal Spin 2020 Potential EPS The Road Ahead Appendix Regulatory Update Core Operating Income Reconciliation Net Income Reconciliation Agenda

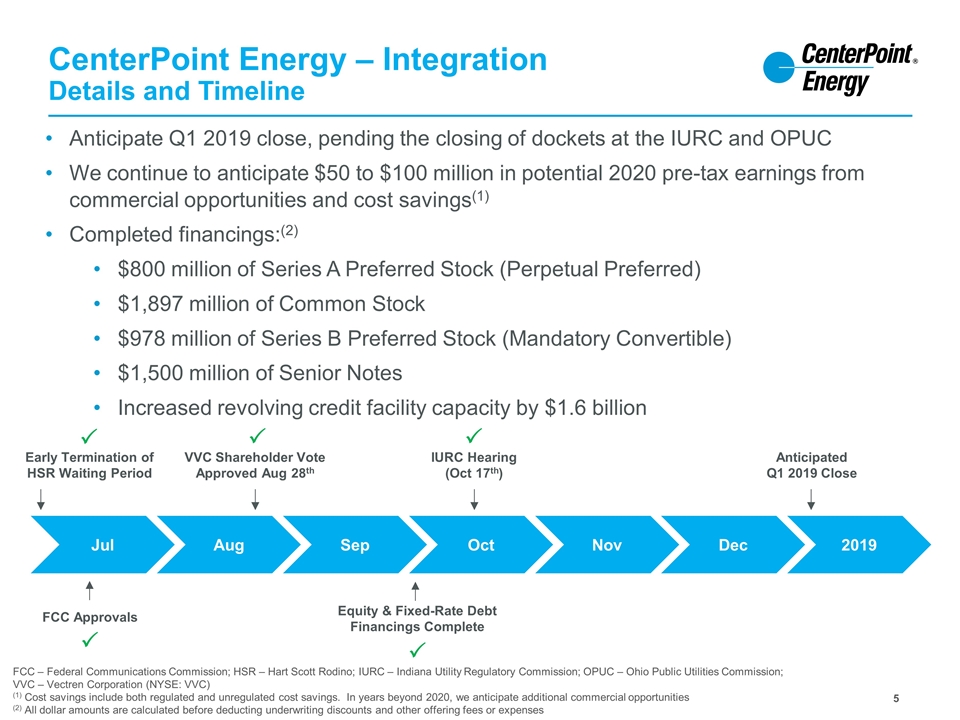

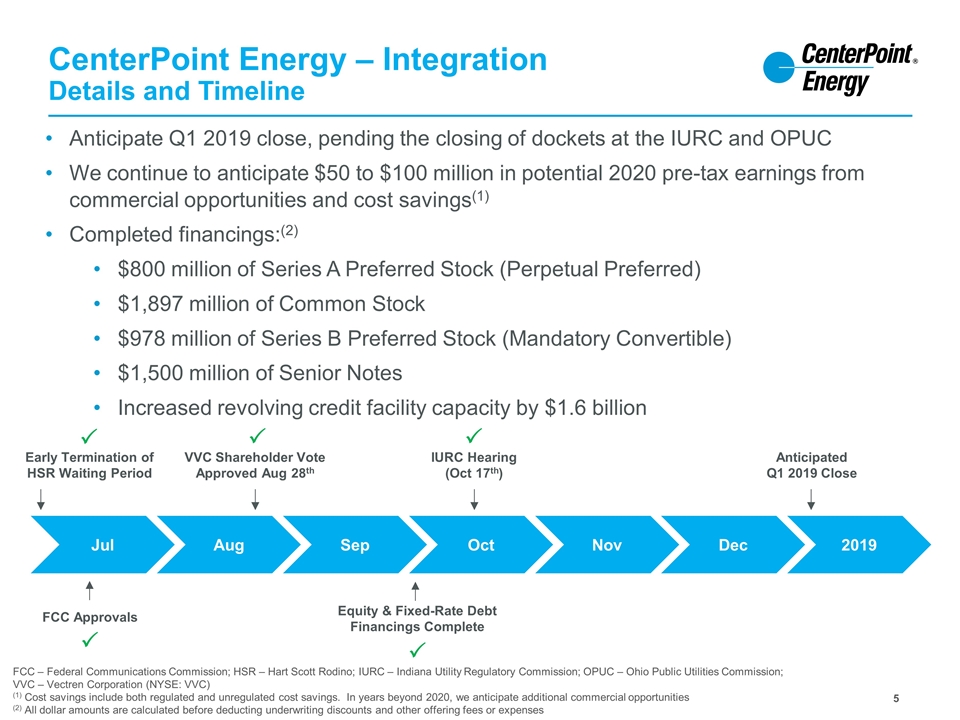

CenterPoint Energy – Integration Details and Timeline Anticipate Q1 2019 close, pending the closing of dockets at the IURC and OPUC We continue to anticipate $50 to $100 million in potential 2020 pre-tax earnings from commercial opportunities and cost savings(1) Completed financings:(2) $800 million of Series A Preferred Stock (Perpetual Preferred) $1,897 million of Common Stock $978 million of Series B Preferred Stock (Mandatory Convertible) $1,500 million of Senior Notes Increased revolving credit facility capacity by $1.6 billion FCC – Federal Communications Commission; HSR – Hart Scott Rodino; IURC – Indiana Utility Regulatory Commission; OPUC – Ohio Public Utilities Commission; VVC – Vectren Corporation (NYSE: VVC) (1) Cost savings include both regulated and unregulated cost savings. In years beyond 2020, we anticipate additional commercial opportunities (2) All dollar amounts are calculated before deducting underwriting discounts and other offering fees or expenses Aug Sep Oct Nov Dec 2019 Anticipated Q1 2019 Close Jul Early Termination of HSR Waiting Period VVC Shareholder Vote Approved Aug 28th IURC Hearing (Oct 17th) FCC Approvals Equity & Fixed-Rate Debt Financings Complete P P P P P

Capital Update Capital Investment Expected to Increase CenterPoint is currently developing the 2019 – 2023 capital plan; anticipate capital expenditures will increase 5 – 10% versus the 2018 – 2022 plan(1) Freeport Master Plan project costs of $250 million in the 2018 – 2022 plan; updated cost estimates range from $482 - $695 million Natural Gas Distribution is on track to replace all cast iron pipe in our systems in 2018; will continue to focus on bare steel and vintage plastic We continue to invest significant capital so that our system has sufficient capacity and is safe, resilient and reliable Houston continues to experience residential, commercial and industrial growth, requiring increased capital investment (1) We will not be reviewing or updating the Vectren capital expenditure plan until after we are one company

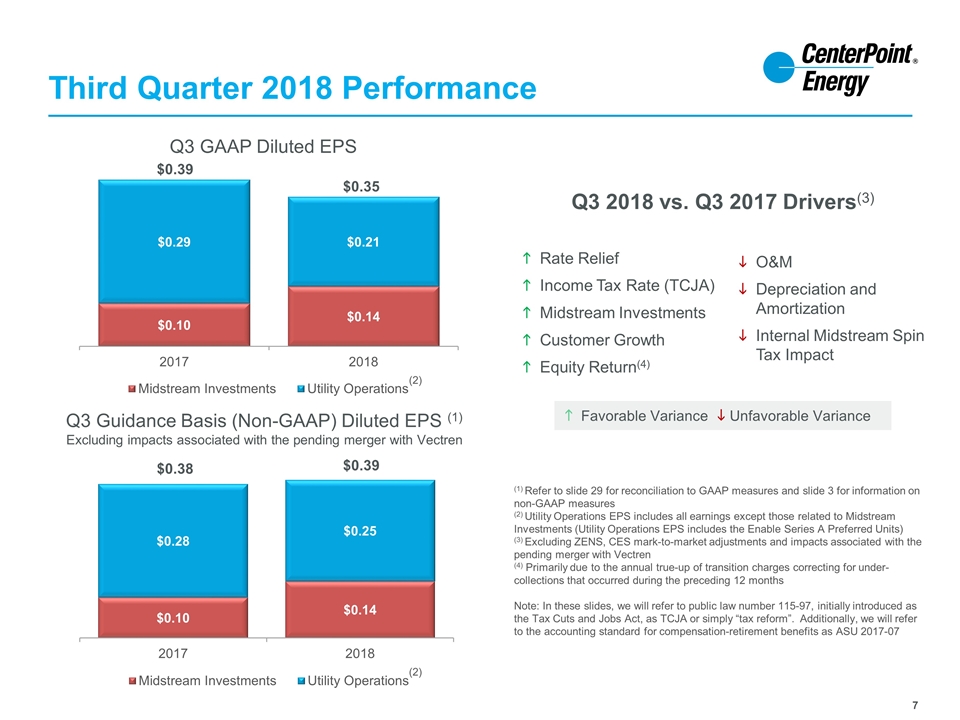

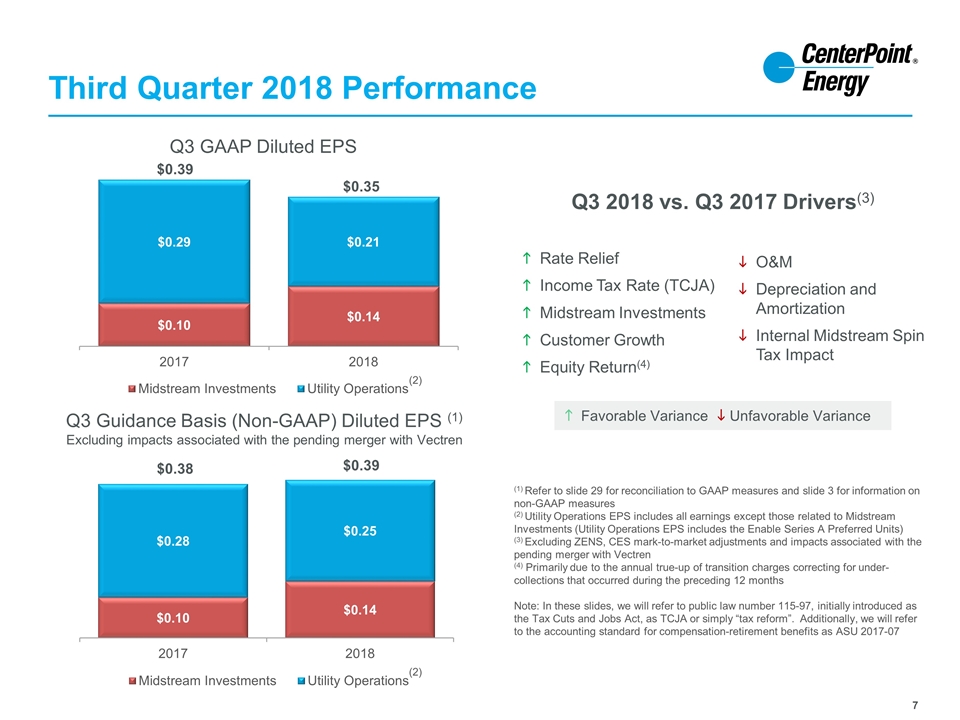

Third Quarter 2018 Performance (1) Refer to slide 29 for reconciliation to GAAP measures and slide 3 for information on non-GAAP measures (2) Utility Operations EPS includes all earnings except those related to Midstream Investments (Utility Operations EPS includes the Enable Series A Preferred Units) (3) Excluding ZENS, CES mark-to-market adjustments and impacts associated with the pending merger with Vectren (4) Primarily due to the annual true-up of transition charges correcting for under-collections that occurred during the preceding 12 months Note: In these slides, we will refer to public law number 115-97, initially introduced as the Tax Cuts and Jobs Act, as TCJA or simply “tax reform”. Additionally, we will refer to the accounting standard for compensation-retirement benefits as ASU 2017-07 Q3 2018 vs. Q3 2017 Drivers(3) h Favorable Variance i Unfavorable Variance Rate Relief Income Tax Rate (TCJA) Midstream Investments Customer Growth Equity Return(4) O&M Depreciation and Amortization Internal Midstream Spin Tax Impact Q3 Guidance Basis (Non-GAAP) Diluted EPS (1) Excluding impacts associated with the pending merger with Vectren Q3 GAAP Diluted EPS $0.39 $0.38 (2) $0.39 $0.35 (2)

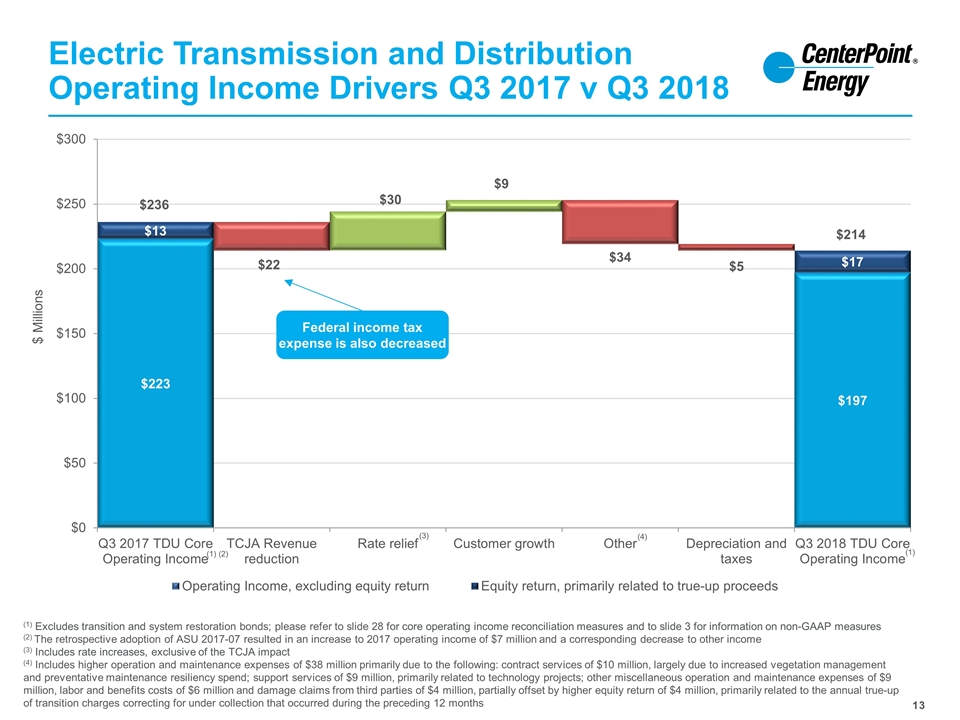

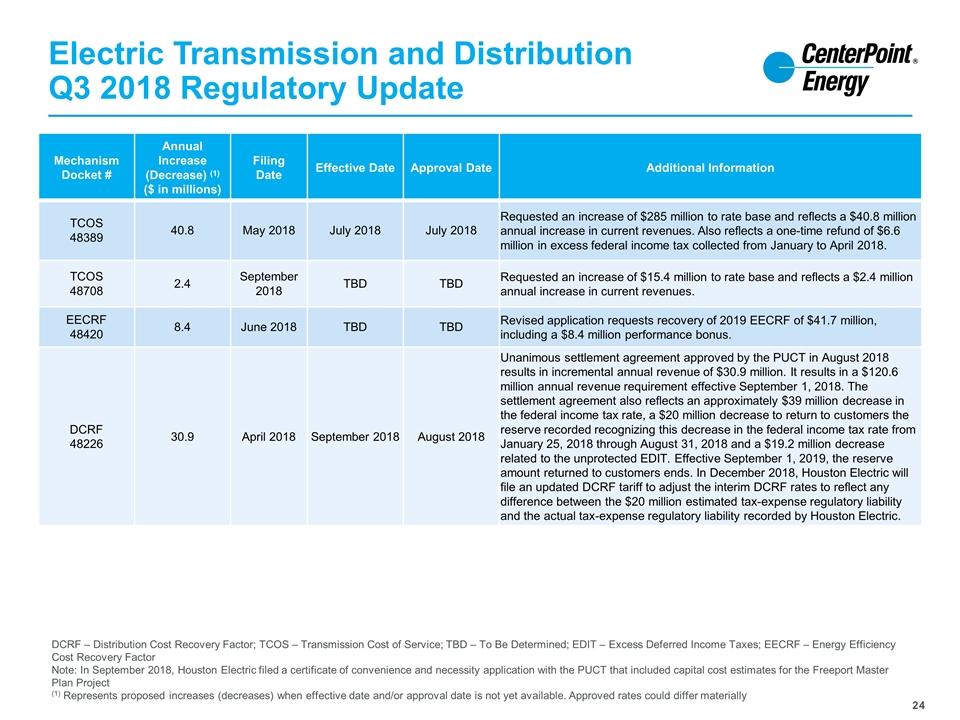

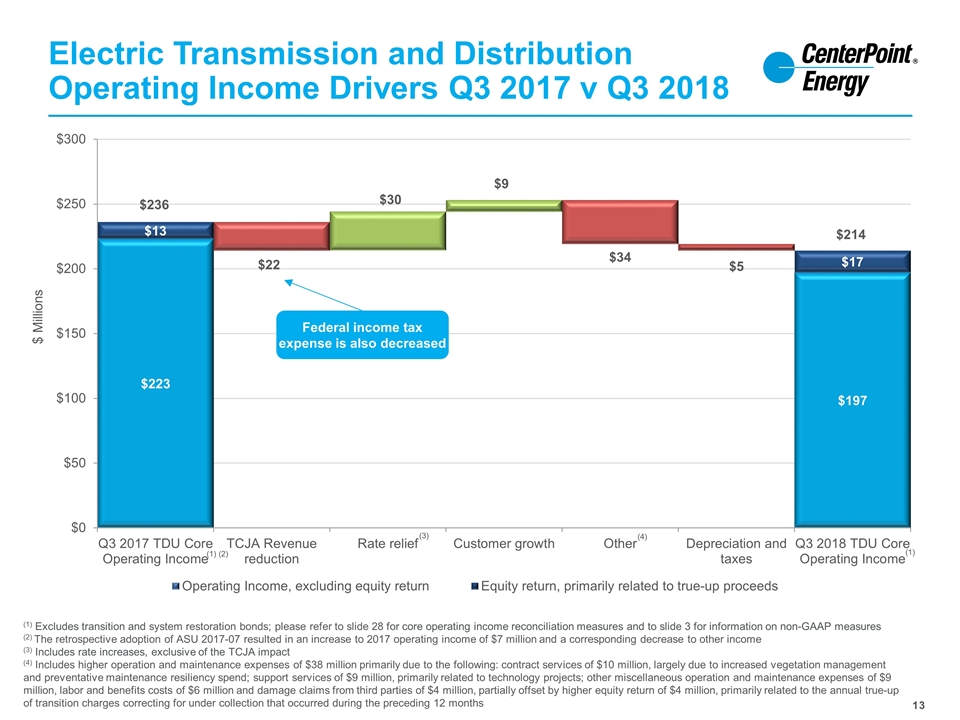

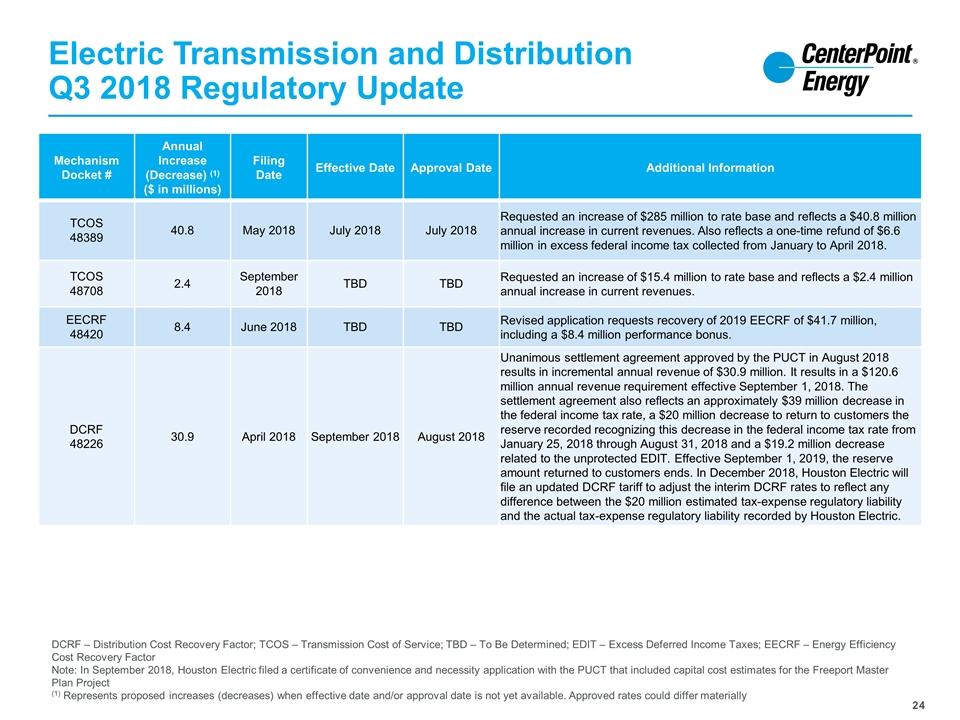

Electric Transmission and Distribution Highlights(1) TDU core operating income was $214 million in Q3 2018 compared with $236 million in Q3 2017, in line with our expectations More than 39,000 electric customers added year-over-year TCOS annual increase of $41 million effective as of July 2018 DCRF unanimous settlement includes annual increase of $31 million effective as of September 2018 Freeport Master Plan Project CCN application filed with the PUCT in September 2018 seeking approval at a current estimated cost range of $482 - $695 million(2) Note: Please see slide 24 for full detail on regulatory filings PUCT – Texas Public Utility Commission; DCRF – Distribution Cost Recovery Factor; TCOS – Transmission Cost of Service; CCN – Certificate of Convenience and Necessity (1) Refer to slide 28 for core operating income reconciliation measures and to slide 3 for information on non-GAAP measures (2) For more information on the Freeport project, please visit: https://www.centerpointenergy.com/en-us/corporate/about-us/bailey-jones-creek

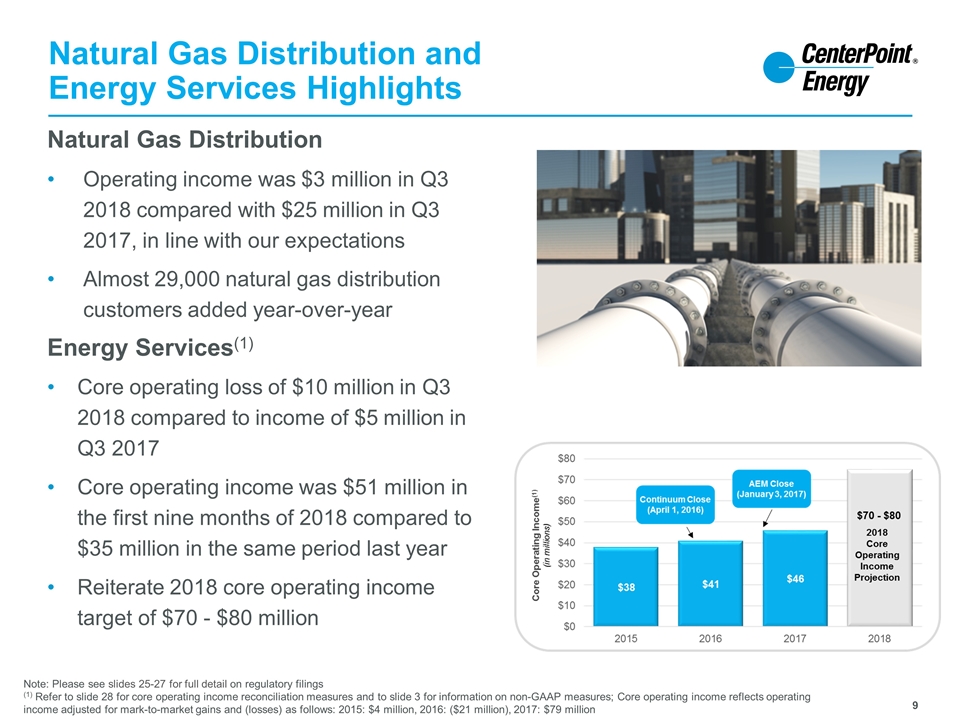

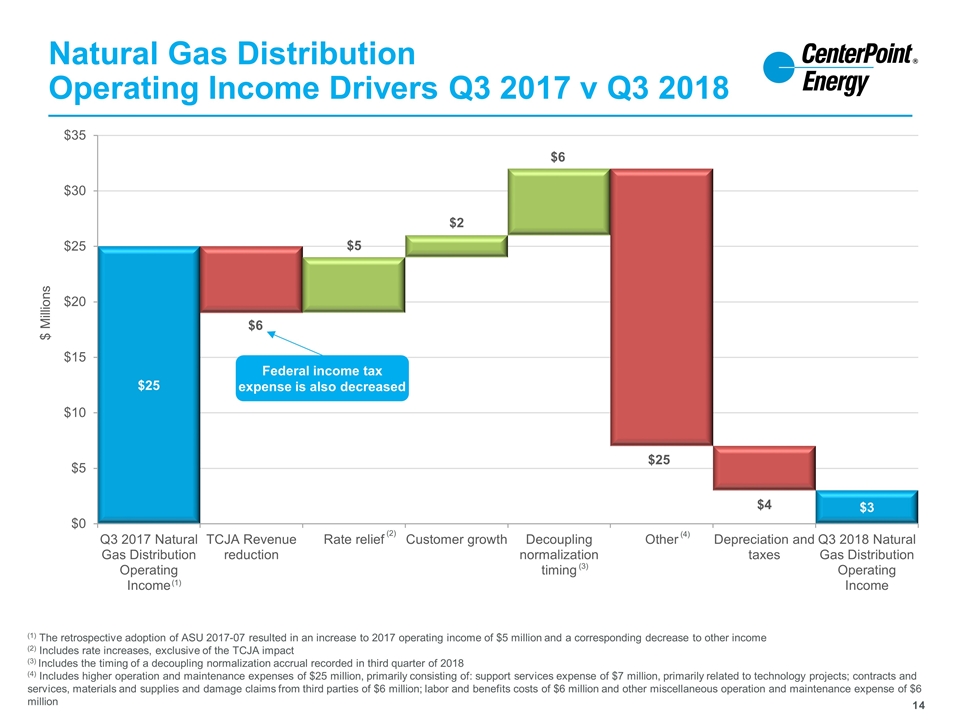

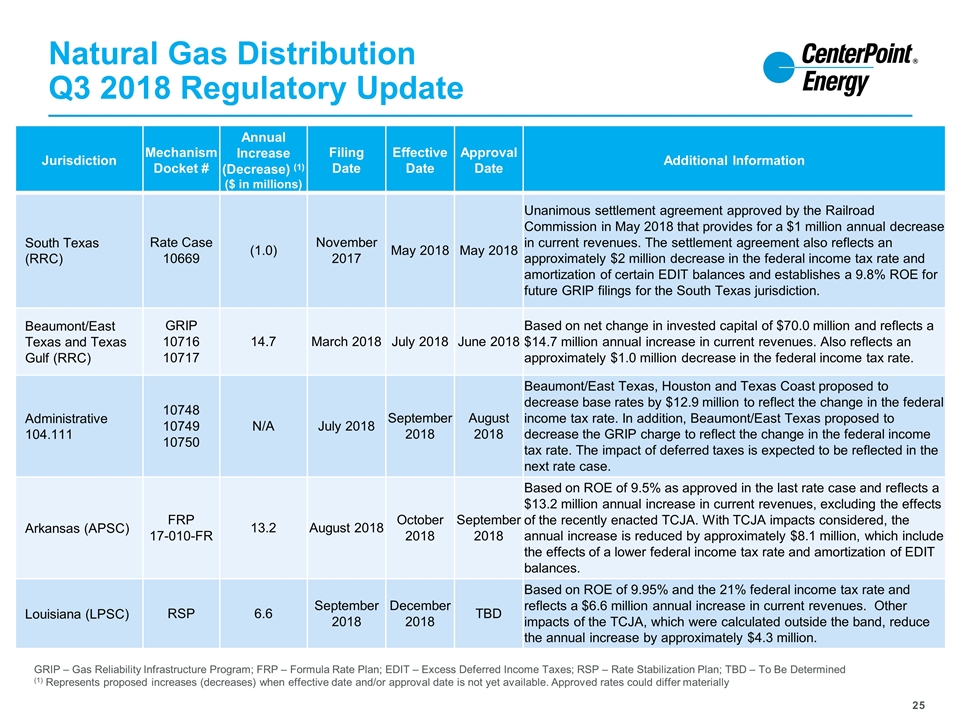

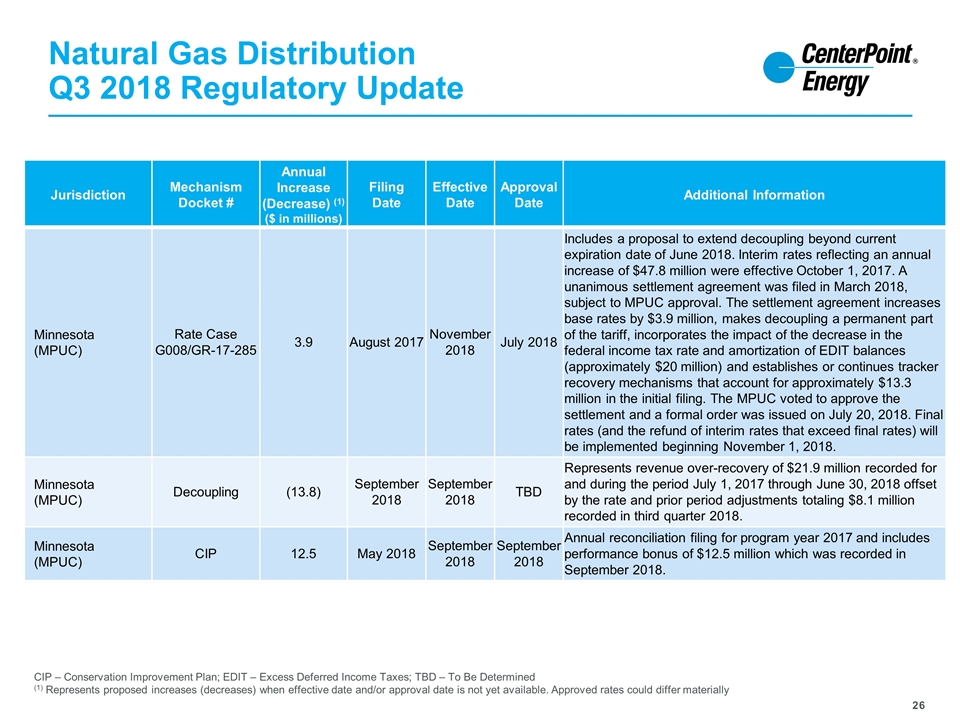

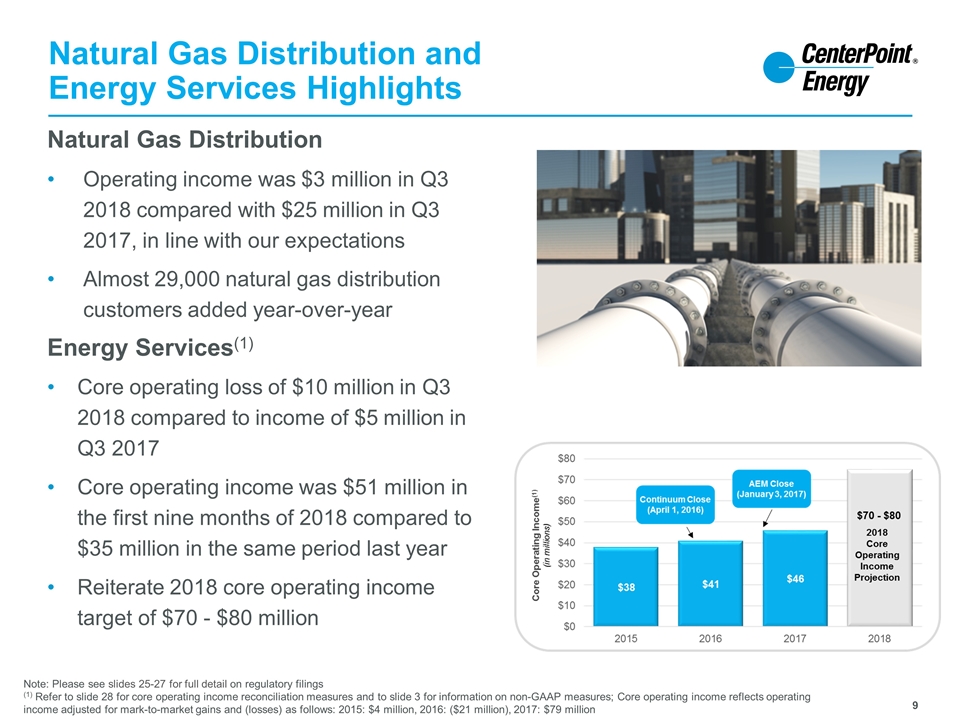

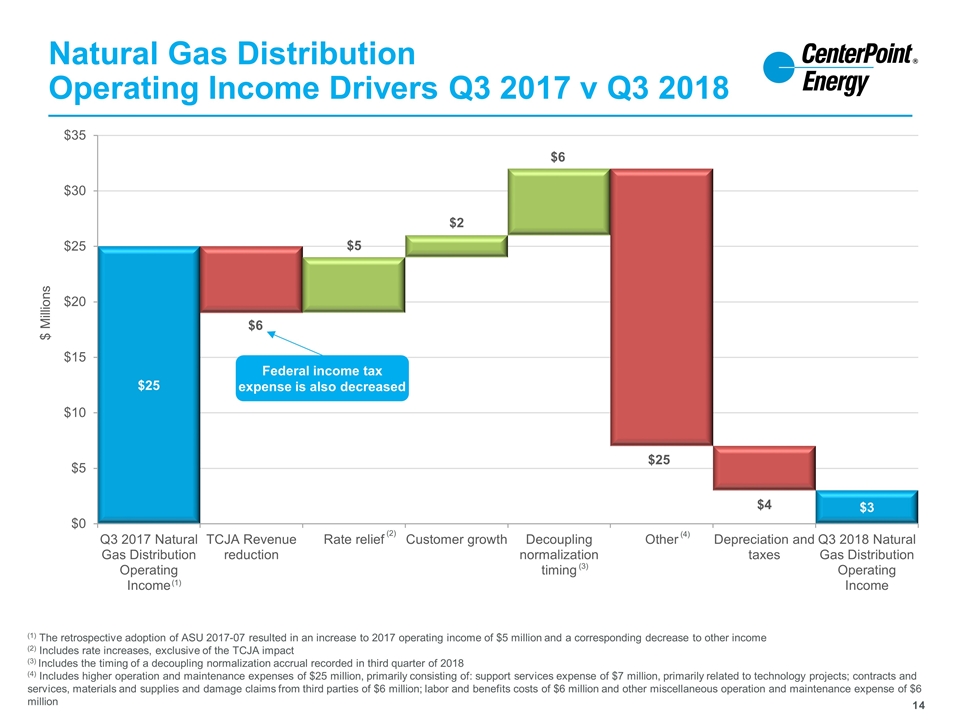

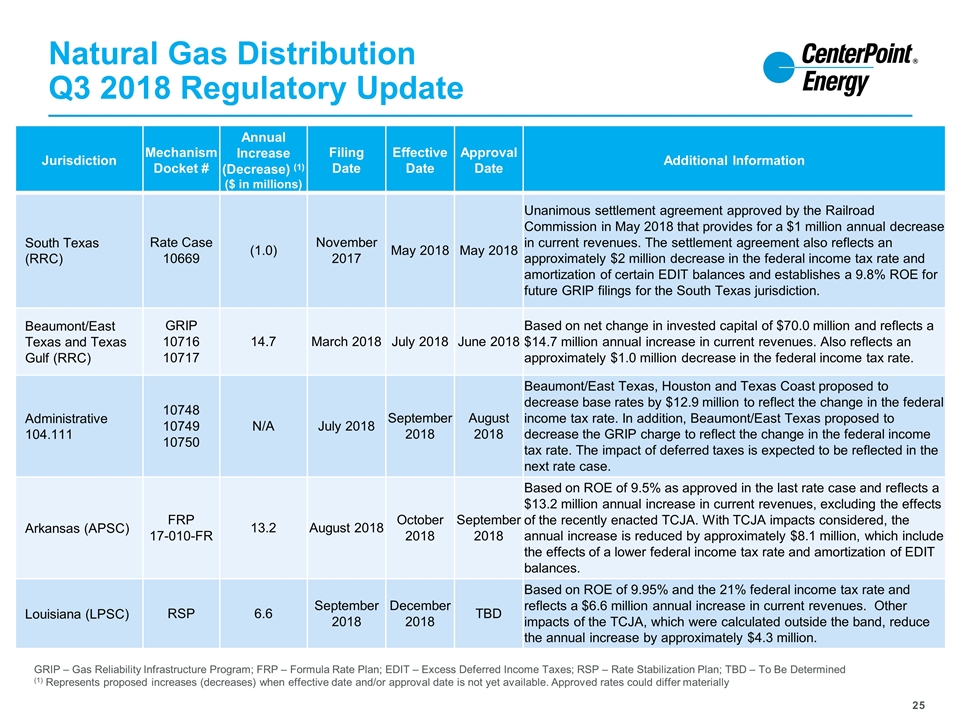

Natural Gas Distribution and Energy Services Highlights Natural Gas Distribution Operating income was $3 million in Q3 2018 compared with $25 million in Q3 2017, in line with our expectations Almost 29,000 natural gas distribution customers added year-over-year Energy Services(1) Core operating loss of $10 million in Q3 2018 compared to income of $5 million in Q3 2017 Core operating income was $51 million in the first nine months of 2018 compared to $35 million in the same period last year Reiterate 2018 core operating income target of $70 - $80 million Note: Please see slides 25-27 for full detail on regulatory filings (1) Refer to slide 28 for core operating income reconciliation measures and to slide 3 for information on non-GAAP measures; Core operating income reflects operating income adjusted for mark-to-market gains and (losses) as follows: 2015: $4 million, 2016: ($21 million), 2017: $79 million

Midstream Investments Highlights Enable achieved record quarterly natural gas gathered, natural gas processed, natural gas liquids produced and crude oil gathered volumes(1) Enable anticipates performance at the upper end of the 2018 Net Income Attributable to Common Units range of $375 - $445 million Gulf Run Pipeline: designed to move up to 2.75 Bcf/d(2) of abundant U.S. natural gas supplies from two liquid hubs to growing liquefied natural gas (LNG) export markets on the Gulf Coast Received significant interest from prospective shippers during an open season that closed Oct. 26 and are currently in negotiations for binding commitments Closed acquisition of Velocity Holdings, LLC, an integrated crude oil and condensate gathering and transportation company in the SCOOP and Merge plays Forecasted 2019 Net Income Attributable to Common Units of $435 - $505 million Entered into new contractual commitments with ExxonMobil subsidiary XTO Energy Inc. for a substantial expansion of Enable’s Williston Basin crude and water gathering systems Source: All information is per Enable’s 3rd quarter 2018 earnings presentation dated November 7, 2018 (1) Since Enable’s formation in May 2013 (2) Billion cubic feet per day

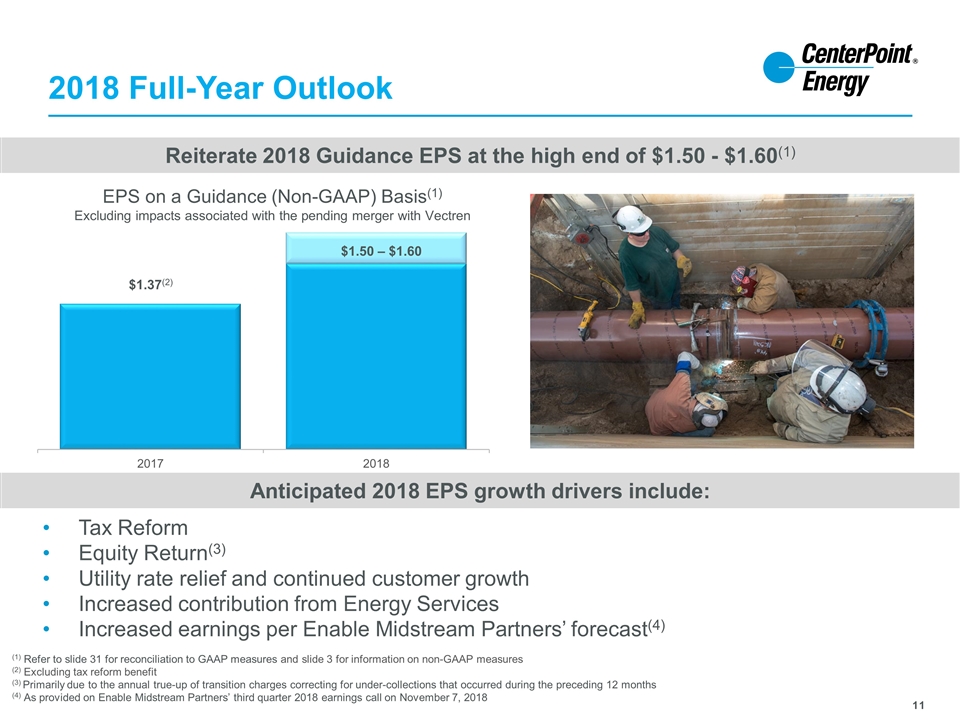

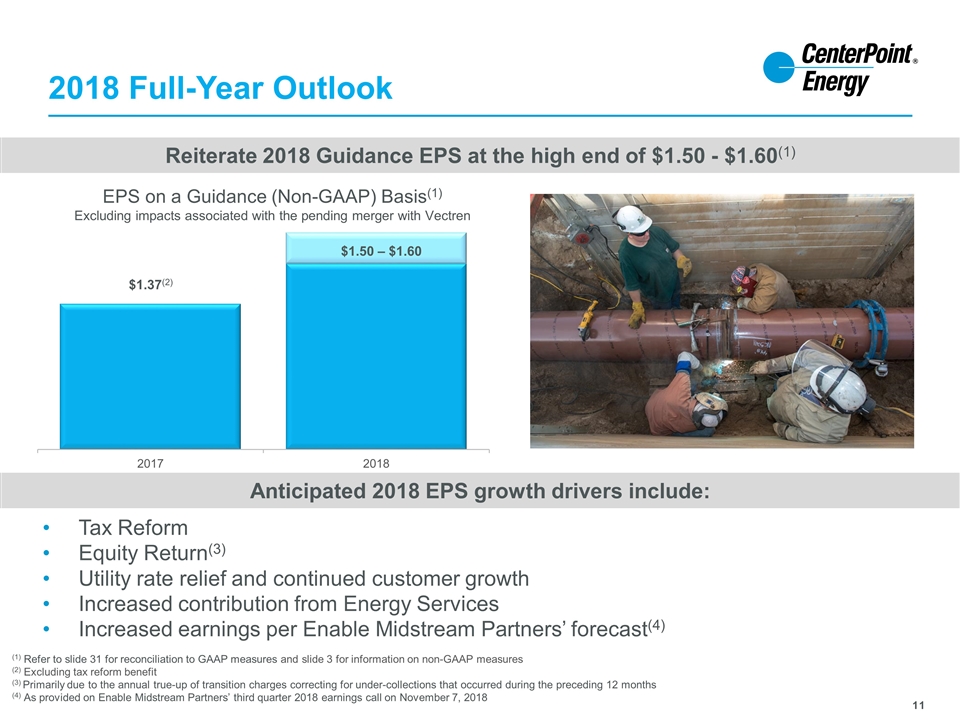

2018 Full-Year Outlook Tax Reform Equity Return(3) Utility rate relief and continued customer growth Increased contribution from Energy Services Increased earnings per Enable Midstream Partners’ forecast(4) Anticipated 2018 EPS growth drivers include: (1) Refer to slide 31 for reconciliation to GAAP measures and slide 3 for information on non-GAAP measures (2) Excluding tax reform benefit (3) Primarily due to the annual true-up of transition charges correcting for under-collections that occurred during the preceding 12 months (4) As provided on Enable Midstream Partners’ third quarter 2018 earnings call on November 7, 2018 Reiterate 2018 Guidance EPS at the high end of $1.50 - $1.60(1) $1.37(2) $1.50 – $1.60 EPS on a Guidance (Non-GAAP) Basis(1) Excluding impacts associated with the pending merger with Vectren

Scott Prochazka President and CEO Integration Planning and Capital Update Third Quarter Results Business Segment Highlights Houston Electric Natural Gas Distribution Energy Services Midstream Investments Full-Year Outlook Bill Rogers Chief Financial Officer Business Segment Performance Utility Operations EPS Drivers Consolidated EPS Drivers Financing Update Midstream Internal Spin 2020 Potential EPS The Road Ahead Appendix Regulatory Update Core Operating Income Reconciliation Net Income Reconciliation Agenda

Electric Transmission and Distribution Operating Income Drivers Q3 2017 v Q3 2018 (1) Excludes transition and system restoration bonds; please refer to slide 28 for core operating income reconciliation measures and to slide 3 for information on non-GAAP measures (2) The retrospective adoption of ASU 2017-07 resulted in an increase to 2017 operating income of $7 million and a corresponding decrease to other income (3) Includes rate increases, exclusive of the TCJA impact (4) Includes higher operation and maintenance expenses of $38 million primarily due to the following: contract services of $10 million, largely due to increased vegetation management and preventative maintenance resiliency spend; support services of $9 million, primarily related to technology projects; other miscellaneous operation and maintenance expenses of $9 million, labor and benefits costs of $6 million and damage claims from third parties of $4 million, partially offset by higher equity return of $4 million, primarily related to the annual true-up of transition charges correcting for under collection that occurred during the preceding 12 months $236 $214 (1) (2) (1) (4) Federal income tax expense is also decreased (5) (3)

Natural Gas Distribution Operating Income Drivers Q3 2017 v Q3 2018 (1) The retrospective adoption of ASU 2017-07 resulted in an increase to 2017 operating income of $5 million and a corresponding decrease to other income (2) Includes rate increases, exclusive of the TCJA impact (3) Includes the timing of a decoupling normalization accrual recorded in third quarter of 2018 (4) Includes higher operation and maintenance expenses of $25 million, primarily consisting of: support services expense of $7 million, primarily related to technology projects; contracts and services, materials and supplies and damage claims from third parties of $6 million; labor and benefits costs of $6 million and other miscellaneous operation and maintenance expense of $6 million (2) (4) (1) Federal income tax expense is also decreased (3)

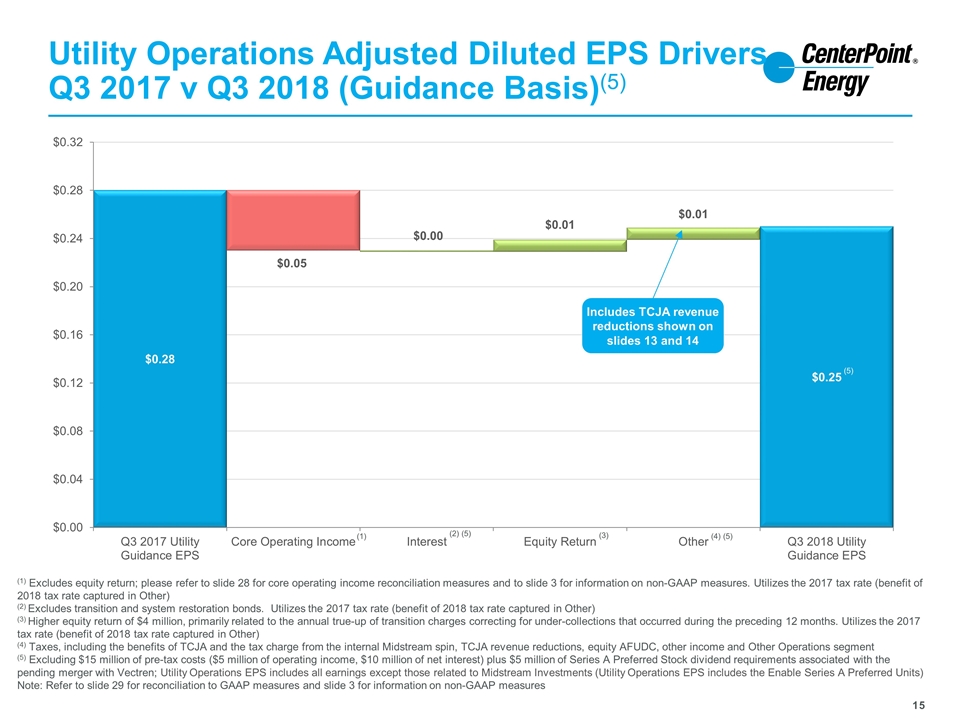

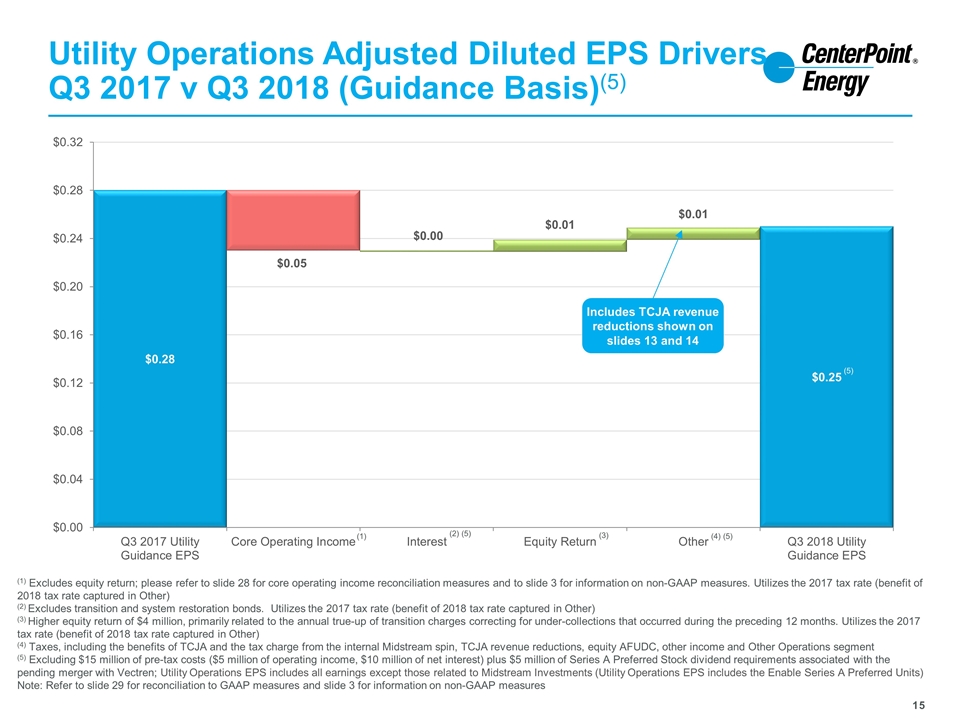

Utility Operations Adjusted Diluted EPS Drivers Q3 2017 v Q3 2018 (Guidance Basis)(5) (1) Excludes equity return; please refer to slide 28 for core operating income reconciliation measures and to slide 3 for information on non-GAAP measures. Utilizes the 2017 tax rate (benefit of 2018 tax rate captured in Other) (2) Excludes transition and system restoration bonds. Utilizes the 2017 tax rate (benefit of 2018 tax rate captured in Other) (3) Higher equity return of $4 million, primarily related to the annual true-up of transition charges correcting for under-collections that occurred during the preceding 12 months. Utilizes the 2017 tax rate (benefit of 2018 tax rate captured in Other) (4) Taxes, including the benefits of TCJA and the tax charge from the internal Midstream spin, TCJA revenue reductions, equity AFUDC, other income and Other Operations segment (5) Excluding $15 million of pre-tax costs ($5 million of operating income, $10 million of net interest) plus $5 million of Series A Preferred Stock dividend requirements associated with the pending merger with Vectren; Utility Operations EPS includes all earnings except those related to Midstream Investments (Utility Operations EPS includes the Enable Series A Preferred Units) Note: Refer to slide 29 for reconciliation to GAAP measures and slide 3 for information on non-GAAP measures (1) (2) (5) (3) (4) (5) Includes TCJA revenue reductions shown on slides 13 and 14 (5)

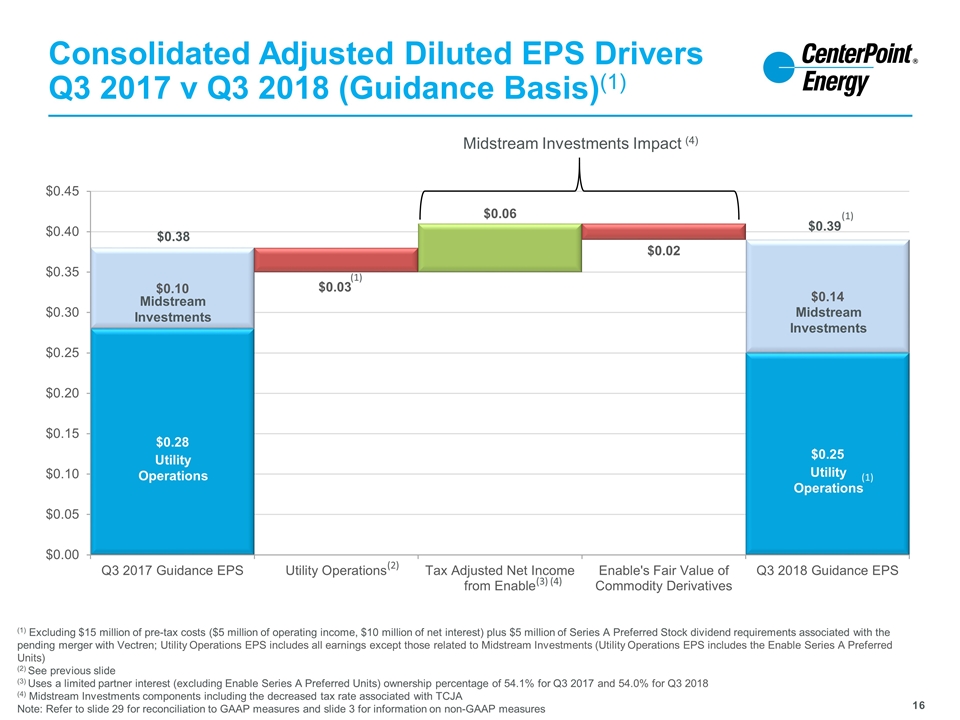

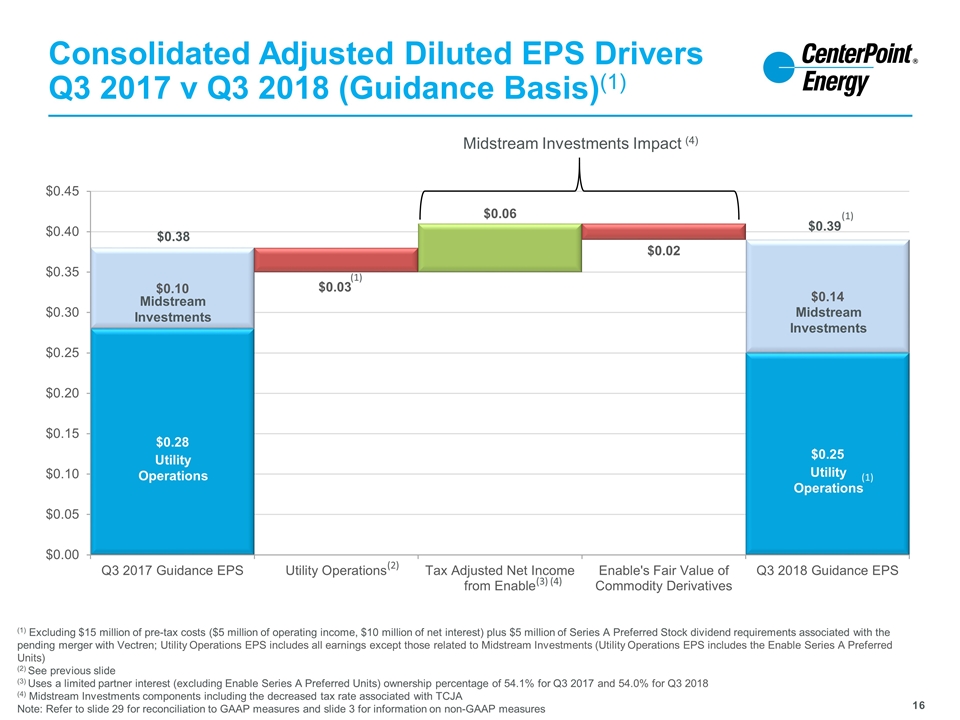

Utility Operations Midstream Investments $0.38 $0.39 Midstream Investments Utility Operations (1) Excluding $15 million of pre-tax costs ($5 million of operating income, $10 million of net interest) plus $5 million of Series A Preferred Stock dividend requirements associated with the pending merger with Vectren; Utility Operations EPS includes all earnings except those related to Midstream Investments (Utility Operations EPS includes the Enable Series A Preferred Units) (2) See previous slide (3) Uses a limited partner interest (excluding Enable Series A Preferred Units) ownership percentage of 54.1% for Q3 2017 and 54.0% for Q3 2018 (4) Midstream Investments components including the decreased tax rate associated with TCJA Note: Refer to slide 29 for reconciliation to GAAP measures and slide 3 for information on non-GAAP measures (1) (3) (4) Midstream Investments Impact (4) (2) (1) (1) Consolidated Adjusted Diluted EPS Drivers Q3 2017 v Q3 2018 (Guidance Basis)(1)

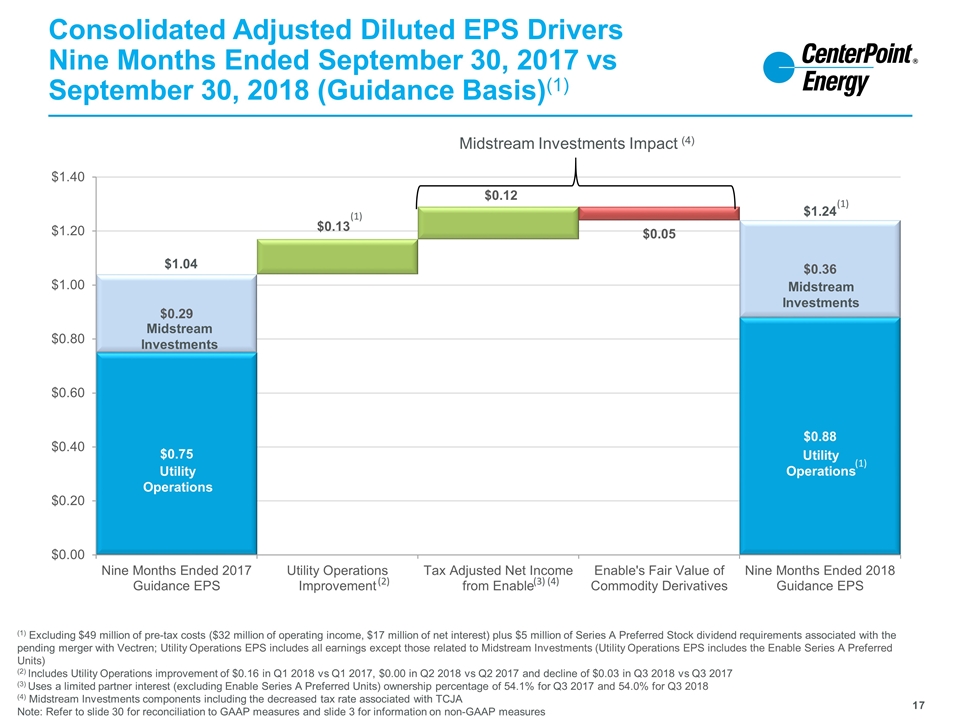

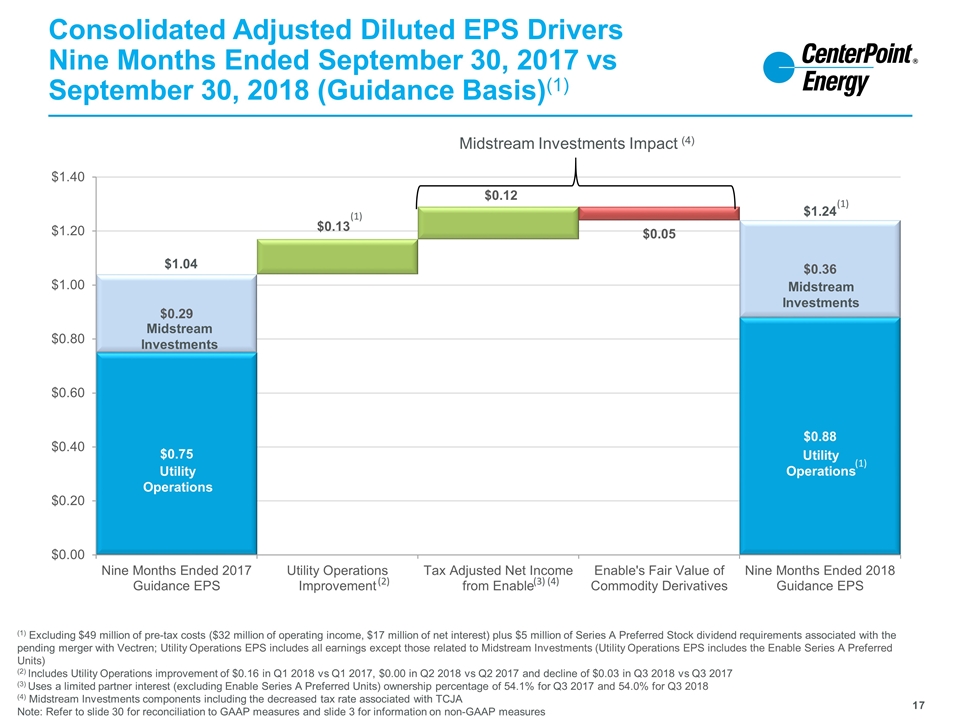

Consolidated Adjusted Diluted EPS Drivers Nine Months Ended September 30, 2017 vs September 30, 2018 (Guidance Basis)(1) Utility Operations Midstream Investments $1.04 $1.24 Midstream Investments Utility Operations (1) Excluding $49 million of pre-tax costs ($32 million of operating income, $17 million of net interest) plus $5 million of Series A Preferred Stock dividend requirements associated with the pending merger with Vectren; Utility Operations EPS includes all earnings except those related to Midstream Investments (Utility Operations EPS includes the Enable Series A Preferred Units) (2) Includes Utility Operations improvement of $0.16 in Q1 2018 vs Q1 2017, $0.00 in Q2 2018 vs Q2 2017 and decline of $0.03 in Q3 2018 vs Q3 2017 (3) Uses a limited partner interest (excluding Enable Series A Preferred Units) ownership percentage of 54.1% for Q3 2017 and 54.0% for Q3 2018 (4) Midstream Investments components including the decreased tax rate associated with TCJA Note: Refer to slide 30 for reconciliation to GAAP measures and slide 3 for information on non-GAAP measures (1) (3) (4) Midstream Investments Impact (4) (2) (1) (1)

Recent Financings and The Road Ahead

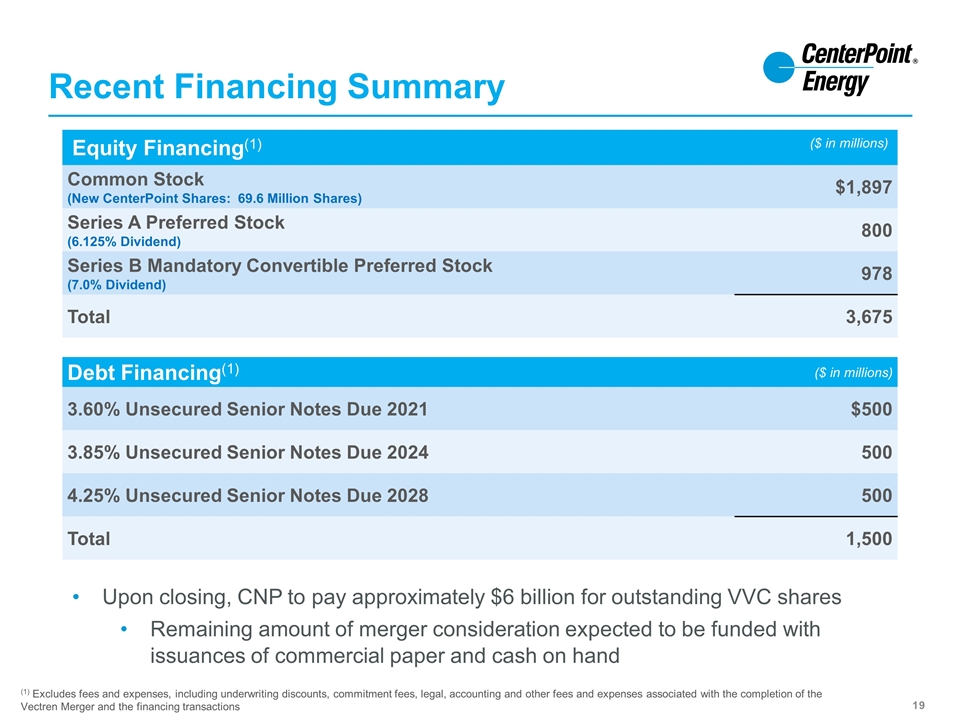

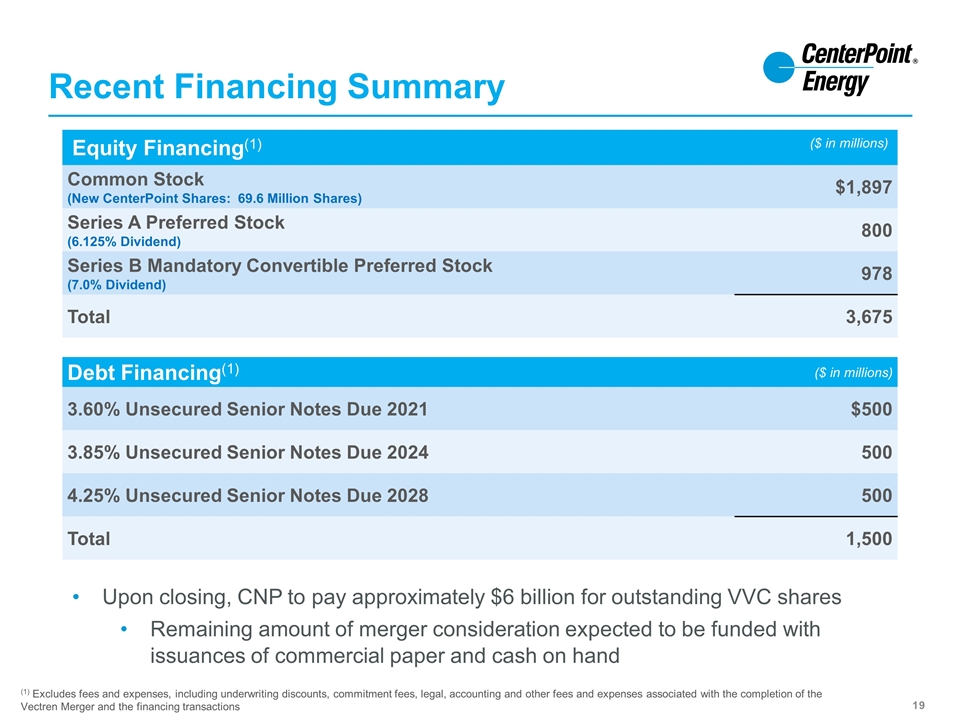

Recent Financing Summary Debt Financing(1) ($ in millions) 3.60% Unsecured Senior Notes Due 2021 $500 3.85% Unsecured Senior Notes Due 2024 500 4.25% Unsecured Senior Notes Due 2028 500 Total 1,500 Equity Financing(1) ($ in millions) Common Stock (New CenterPoint Shares: 69.6 Million Shares) $1,897 Series A Preferred Stock (6.125% Dividend) 800 Series B Mandatory Convertible Preferred Stock (7.0% Dividend) 978 Total 3,675 Upon closing, CNP to pay approximately $6 billion for outstanding VVC shares Remaining amount of merger consideration expected to be funded with issuances of commercial paper and cash on hand (1) Excludes fees and expenses, including underwriting discounts, commitment fees, legal, accounting and other fees and expenses associated with the completion of the Vectren Merger and the financing transactions

CenterPoint Energy Midstream (CNP Midstream) CenterPoint completed the internal spin in September Moody’s and Fitch upgraded CERC’s credit rating as a result of the spin to Baa1 and BBB+, respectively CenterPoint exploring bank refinancing of current $900 million internal loan from the holding company to CNP Midstream Recognized non-cash tax impact, reducing EPS by $0.02

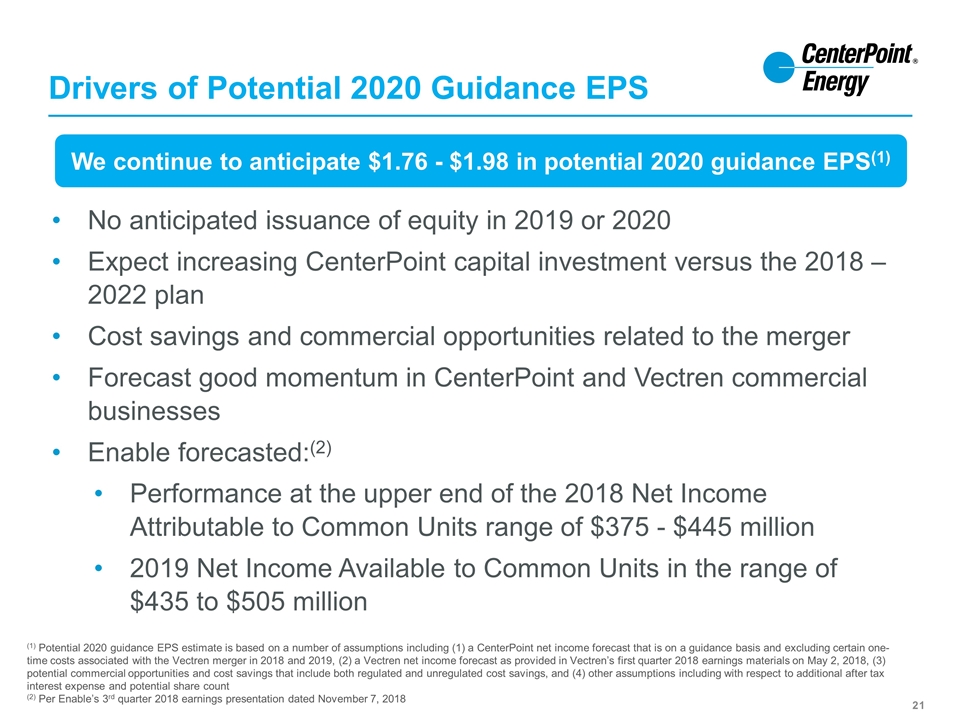

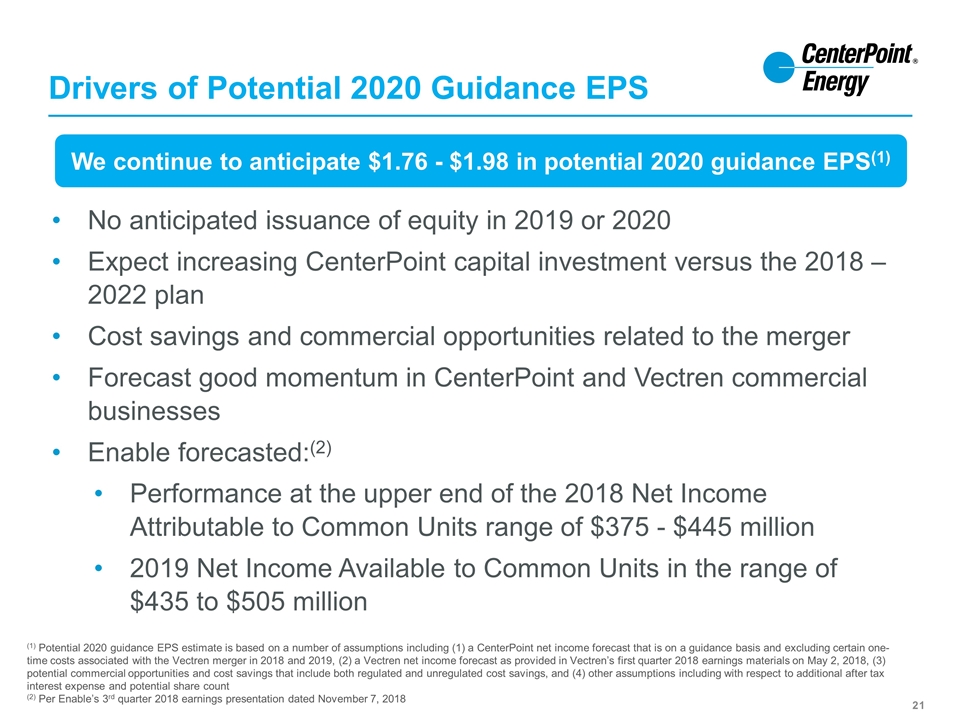

Drivers of Potential 2020 Guidance EPS No anticipated issuance of equity in 2019 or 2020 Expect increasing CenterPoint capital investment versus the 2018 – 2022 plan Cost savings and commercial opportunities related to the merger Forecast good momentum in CenterPoint and Vectren commercial businesses Enable forecasted:(2) Performance at the upper end of the 2018 Net Income Attributable to Common Units range of $375 - $445 million 2019 Net Income Available to Common Units in the range of $435 to $505 million We continue to anticipate $1.76 - $1.98 in potential 2020 guidance EPS(1) (1) Potential 2020 guidance EPS estimate is based on a number of assumptions including (1) a CenterPoint net income forecast that is on a guidance basis and excluding certain one-time costs associated with the Vectren merger in 2018 and 2019, (2) a Vectren net income forecast as provided in Vectren’s first quarter 2018 earnings materials on May 2, 2018, (3) potential commercial opportunities and cost savings that include both regulated and unregulated cost savings, and (4) other assumptions including with respect to additional after tax interest expense and potential share count (2) Per Enable’s 3rd quarter 2018 earnings presentation dated November 7, 2018

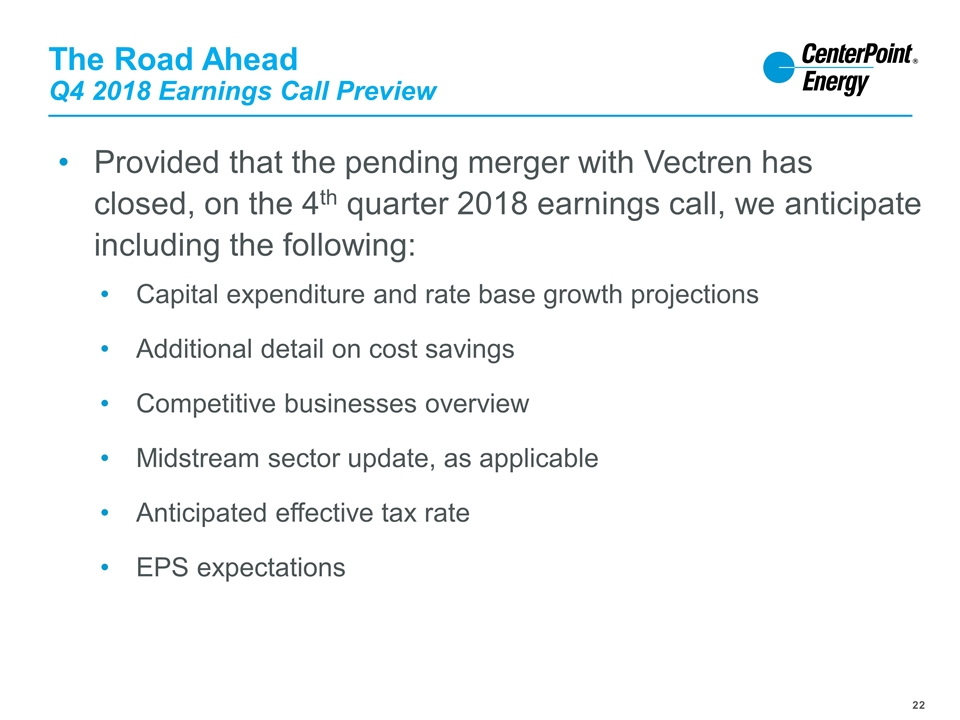

The Road Ahead Q4 2018 Earnings Call Preview Provided that the pending merger with Vectren has closed, on the 4th quarter 2018 earnings call, we anticipate including the following: Capital expenditure and rate base growth projections Additional detail on cost savings Competitive businesses overview Midstream sector update, as applicable Anticipated effective tax rate EPS expectations

Agenda Scott Prochazka President and CEO Integration Planning and Capital Update Third Quarter Results Business Segment Highlights Houston Electric Natural Gas Distribution Energy Services Midstream Investments Full-Year Outlook Bill Rogers Chief Financial Officer Business Segment Performance Utility Operations EPS Drivers Consolidated EPS Drivers Financing Update Midstream Internal Spin 2020 Potential EPS The Road Ahead Appendix Regulatory Update Core Operating Income Reconciliation Net Income Reconciliation

Electric Transmission and Distribution Q3 2018 Regulatory Update Mechanism Docket # Annual Increase (Decrease) (1) ($ in millions) Filing Date Effective Date Approval Date Additional Information TCOS 48389 40.8 May 2018 July 2018 July 2018 Requested an increase of $285 million to rate base and reflects a $40.8 million annual increase in current revenues. Also reflects a one-time refund of $6.6 million in excess federal income tax collected from January to April 2018. TCOS 48708 2.4 September 2018 TBD TBD Requested an increase of $15.4 million to rate base and reflects a $2.4 million annual increase in current revenues. EECRF 48420 8.4 June 2018 TBD TBD Revised application requests recovery of 2019 EECRF of $41.7 million, including a $8.4 million performance bonus. DCRF 48226 30.9 April 2018 September 2018 August 2018 Unanimous settlement agreement approved by the PUCT in August 2018 results in incremental annual revenue of $30.9 million. It results in a $120.6 million annual revenue requirement effective September 1, 2018. The settlement agreement also reflects an approximately $39 million decrease in the federal income tax rate, a $20 million decrease to return to customers the reserve recorded recognizing this decrease in the federal income tax rate from January 25, 2018 through August 31, 2018 and a $19.2 million decrease related to the unprotected EDIT. Effective September 1, 2019, the reserve amount returned to customers ends. In December 2018, Houston Electric will file an updated DCRF tariff to adjust the interim DCRF rates to reflect any difference between the $20 million estimated tax-expense regulatory liability and the actual tax-expense regulatory liability recorded by Houston Electric. DCRF – Distribution Cost Recovery Factor; TCOS – Transmission Cost of Service; TBD – To Be Determined; EDIT – Excess Deferred Income Taxes; EECRF – Energy Efficiency Cost Recovery Factor Note: In September 2018, Houston Electric filed a certificate of convenience and necessity application with the PUCT that included capital cost estimates for the Freeport Master Plan Project (1) Represents proposed increases (decreases) when effective date and/or approval date is not yet available. Approved rates could differ materially

Natural Gas Distribution Q3 2018 Regulatory Update Jurisdiction Mechanism Docket # Annual Increase (Decrease) (1) ($ in millions) Filing Date Effective Date Approval Date Additional Information South Texas (RRC) Rate Case 10669 (1.0) November 2017 May 2018 May 2018 Unanimous settlement agreement approved by the Railroad Commission in May 2018 that provides for a $1 million annual decrease in current revenues. The settlement agreement also reflects an approximately $2 million decrease in the federal income tax rate and amortization of certain EDIT balances and establishes a 9.8% ROE for future GRIP filings for the South Texas jurisdiction. Beaumont/East Texas and Texas Gulf (RRC) GRIP 10716 10717 14.7 March 2018 July 2018 June 2018 Based on net change in invested capital of $70.0 million and reflects a $14.7 million annual increase in current revenues. Also reflects an approximately $1.0 million decrease in the federal income tax rate. Administrative 104.111 10748 10749 10750 N/A July 2018 September 2018 August 2018 Beaumont/East Texas, Houston and Texas Coast proposed to decrease base rates by $12.9 million to reflect the change in the federal income tax rate. In addition, Beaumont/East Texas proposed to decrease the GRIP charge to reflect the change in the federal income tax rate. The impact of deferred taxes is expected to be reflected in the next rate case. Arkansas (APSC) FRP 17-010-FR 13.2 August 2018 October 2018 September 2018 Based on ROE of 9.5% as approved in the last rate case and reflects a $13.2 million annual increase in current revenues, excluding the effects of the recently enacted TCJA. With TCJA impacts considered, the annual increase is reduced by approximately $8.1 million, which include the effects of a lower federal income tax rate and amortization of EDIT balances. Louisiana (LPSC) RSP 6.6 September 2018 December 2018 TBD Based on ROE of 9.95% and the 21% federal income tax rate and reflects a $6.6 million annual increase in current revenues. Other impacts of the TCJA, which were calculated outside the band, reduce the annual increase by approximately $4.3 million. GRIP – Gas Reliability Infrastructure Program; FRP – Formula Rate Plan; EDIT – Excess Deferred Income Taxes; RSP – Rate Stabilization Plan; TBD – To Be Determined (1) Represents proposed increases (decreases) when effective date and/or approval date is not yet available. Approved rates could differ materially

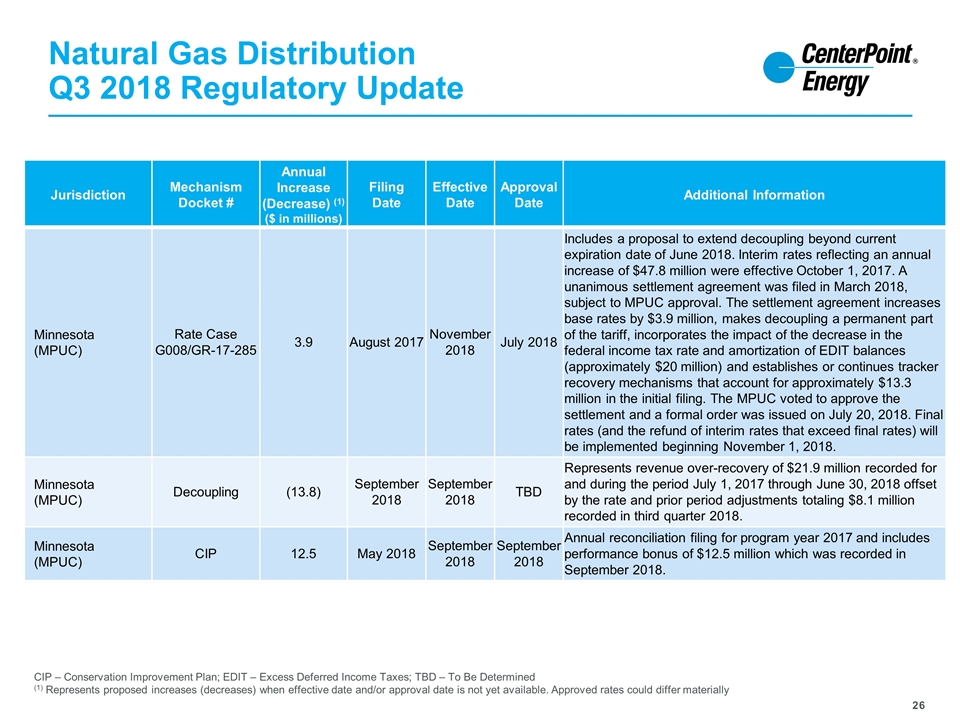

Natural Gas Distribution Q3 2018 Regulatory Update Jurisdiction Mechanism Docket # Annual Increase (Decrease) (1) ($ in millions) Filing Date Effective Date Approval Date Additional Information Minnesota (MPUC) Rate Case G008/GR-17-285 3.9 August 2017 November 2018 July 2018 Includes a proposal to extend decoupling beyond current expiration date of June 2018. Interim rates reflecting an annual increase of $47.8 million were effective October 1, 2017. A unanimous settlement agreement was filed in March 2018, subject to MPUC approval. The settlement agreement increases base rates by $3.9 million, makes decoupling a permanent part of the tariff, incorporates the impact of the decrease in the federal income tax rate and amortization of EDIT balances (approximately $20 million) and establishes or continues tracker recovery mechanisms that account for approximately $13.3 million in the initial filing. The MPUC voted to approve the settlement and a formal order was issued on July 20, 2018. Final rates (and the refund of interim rates that exceed final rates) will be implemented beginning November 1, 2018. Minnesota (MPUC) Decoupling (13.8) September 2018 September 2018 TBD Represents revenue over-recovery of $21.9 million recorded for and during the period July 1, 2017 through June 30, 2018 offset by the rate and prior period adjustments totaling $8.1 million recorded in third quarter 2018. Minnesota (MPUC) CIP 12.5 May 2018 September 2018 September 2018 Annual reconciliation filing for program year 2017 and includes performance bonus of $12.5 million which was recorded in September 2018. CIP – Conservation Improvement Plan; EDIT – Excess Deferred Income Taxes; TBD – To Be Determined (1) Represents proposed increases (decreases) when effective date and/or approval date is not yet available. Approved rates could differ materially

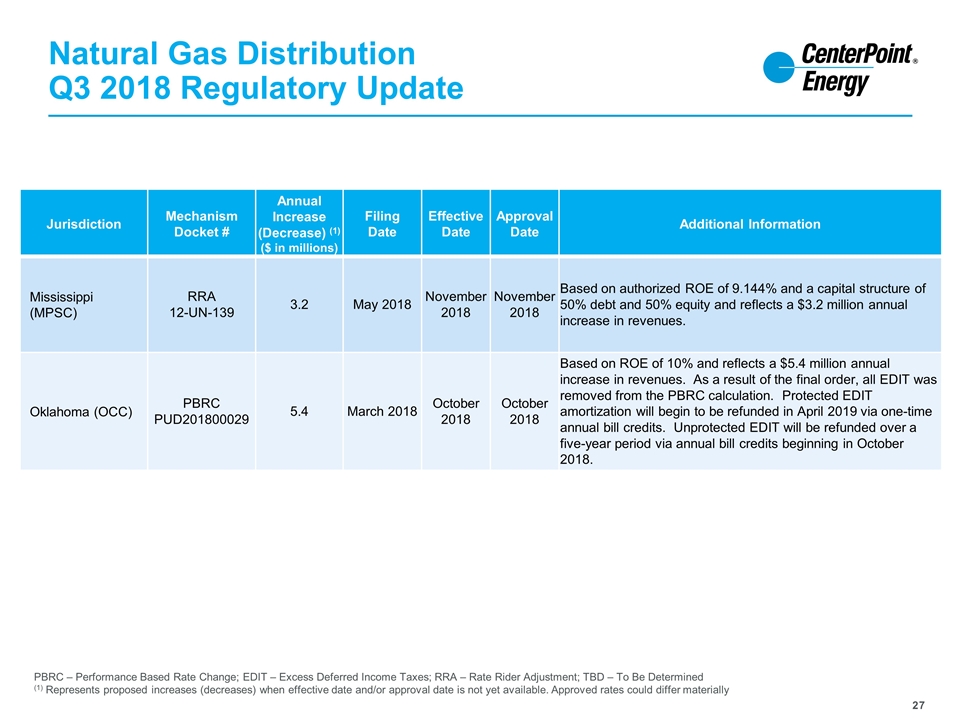

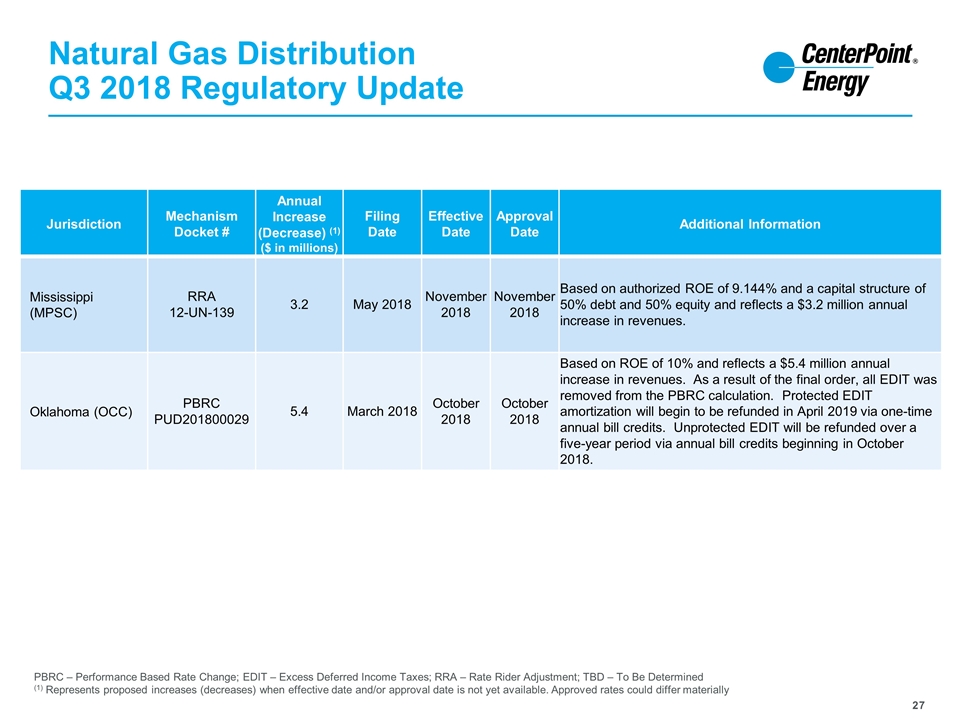

Natural Gas Distribution Q3 2018 Regulatory Update Jurisdiction Mechanism Docket # Annual Increase (Decrease) (1) ($ in millions) Filing Date Effective Date Approval Date Additional Information Mississippi (MPSC) RRA 12-UN-139 3.2 May 2018 November 2018 November 2018 Based on authorized ROE of 9.144% and a capital structure of 50% debt and 50% equity and reflects a $3.2 million annual increase in revenues. Oklahoma (OCC) PBRC PUD201800029 5.4 March 2018 October 2018 October 2018 Based on ROE of 10% and reflects a $5.4 million annual increase in revenues. As a result of the final order, all EDIT was removed from the PBRC calculation. Protected EDIT amortization will begin to be refunded in April 2019 via one-time annual bill credits. Unprotected EDIT will be refunded over a five-year period via annual bill credits beginning in October 2018. PBRC – Performance Based Rate Change; EDIT – Excess Deferred Income Taxes; RRA – Rate Rider Adjustment; TBD – To Be Determined (1) Represents proposed increases (decreases) when effective date and/or approval date is not yet available. Approved rates could differ materially

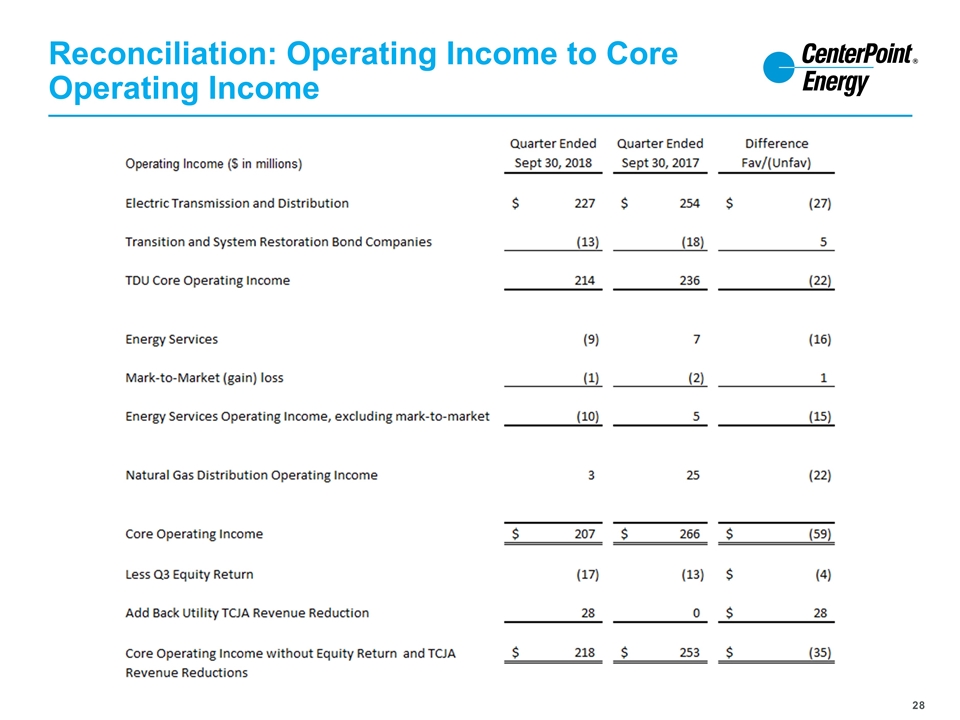

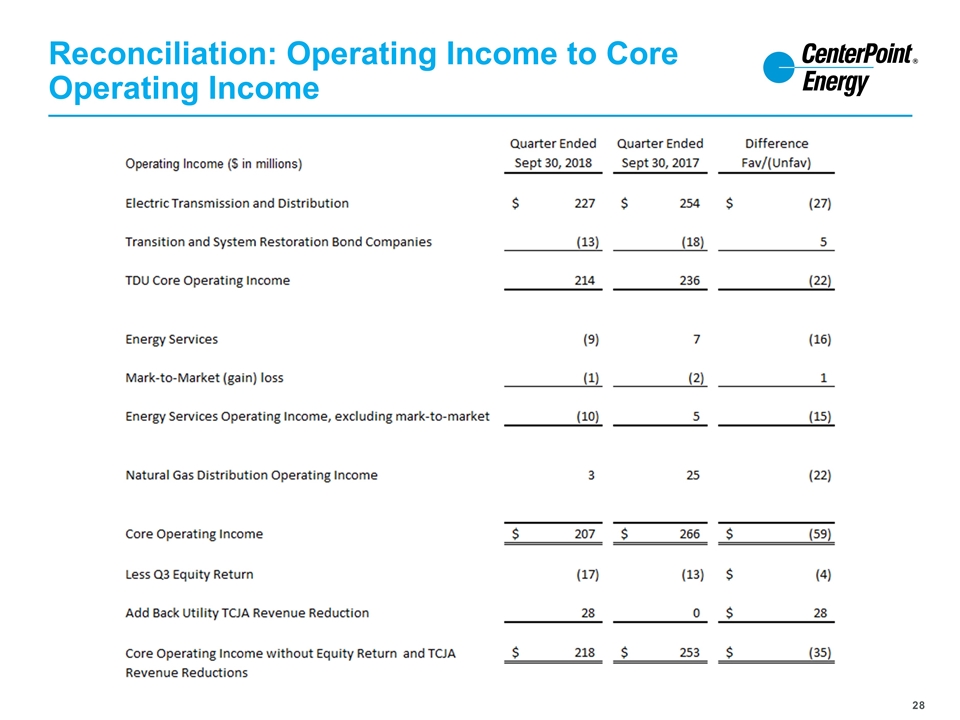

Reconciliation: Operating Income to Core Operating Income

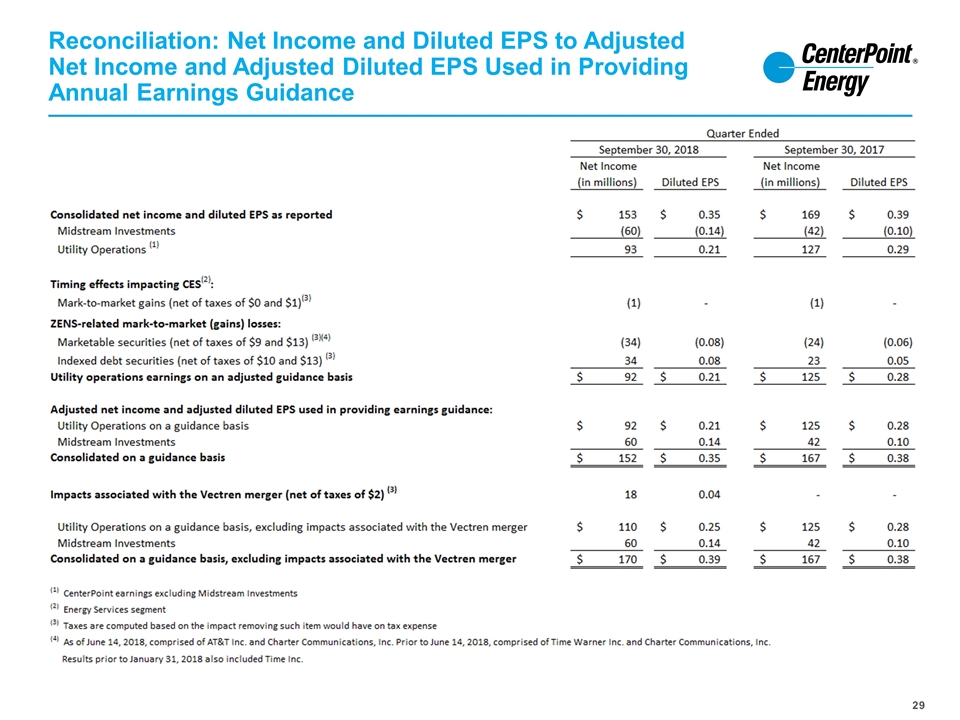

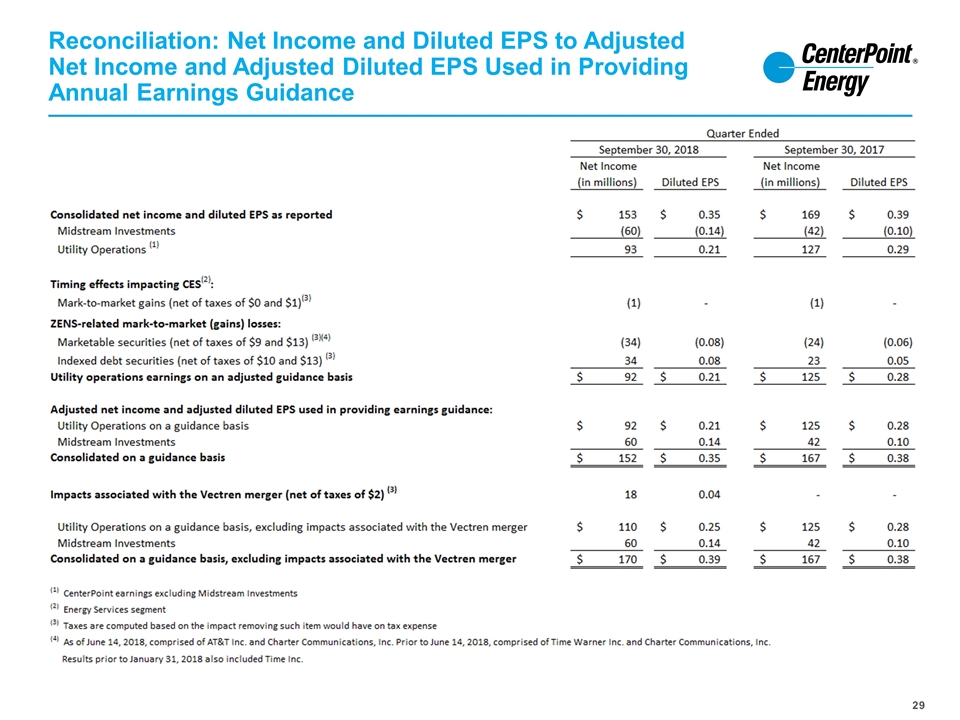

Reconciliation: Net Income and Diluted EPS to Adjusted Net Income and Adjusted Diluted EPS Used in Providing Annual Earnings Guidance

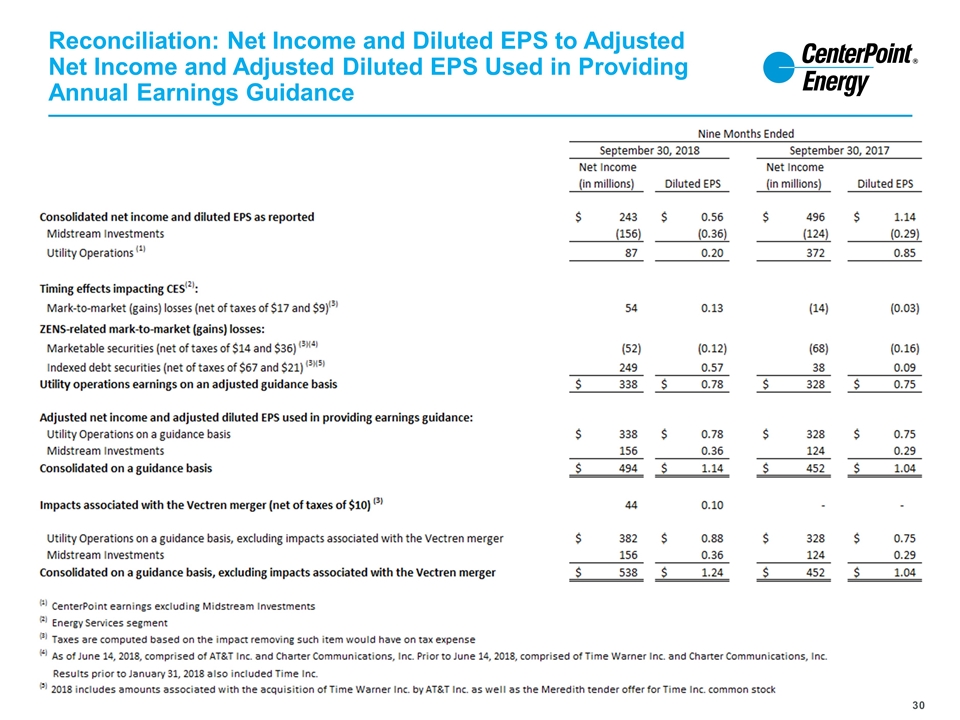

Reconciliation: Net Income and Diluted EPS to Adjusted Net Income and Adjusted Diluted EPS Used in Providing Annual Earnings Guidance

Reconciliation: Net Income and Diluted EPS to Adjusted Net Income and Adjusted Diluted EPS Used in Providing Annual Earnings Guidance