UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

|

| (Name of Registrant as Specified in Its Charter) |

| |

BALCH HILL PARTNERS, L.P. BALCH HILL CAPITAL, LLC SIMON J. MICHAEL MARTIN COLOMBATTO MICHAEL CORNWELL ROBERT R. HERB MARK SCHWARTZ DILIP SINGH BERNARD XAVIER |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 6, 2012

BALCH HILL PARTNERS, L.P.

__________, 2012

Dear Fellow Stockholder:

Balch Hill Partners, L.P., a Delaware limited partnership, and the other participants in this solicitation (collectively, “Balch Hill” or “we”) are the beneficial owners of an aggregate of 4,352,876 shares of common stock, par value $0.001 per share, of PLX Technology, Inc., a Delaware corporation (the “Company”), representing approximately 9.7% of the shares of common stock outstanding. For the reasons set forth in the attached Proxy Statement, we believe that the Board of Directors of the Company is not acting in the best interests of the Company’s stockholders. We are therefore seeking your support at the annual meeting of stockholders scheduled to be held at _________ located at ___________________, on ________, 2012 at ____ _.m., local time, including any adjournment or postponement thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”), for the following:

| | 1. | To elect Balch Hill’s slate of director nominees to serve on the Company’s Board of Directors in opposition to the Company’s director nominees until the 2013 annual meeting of stockholders or until their successors are elected and qualified; |

| | 2. | To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; |

| | 3. | To vote on a non-binding basis on the compensation of the executive officers named in the Summary Compensation Table, as disclosed in the Company’s proxy statement for the Annual Meeting; and |

| | 4. | To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD proxy card today. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished to the stockholders on or about __________, 2012.

If you have already voted for the incumbent management slate you have every right to change your vote by signing, dating and returning a later dated GOLD proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Okapi Partners LLC, which is assisting us, at their address and toll-free numbers listed below.

Thank you for your support,

Simon J. Michael

Balch Hill Partners, L.P.

If you have any questions, require assistance in voting your GOLD proxy card, or need additional copies of Balch Hill’s proxy materials, please contact Okapi Partners at the phone numbers or email listed below.

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Call Toll-Free at: (877) 566-1922 E-mail: info@okapipartners.com

Contact: Bruce H. Goldfarb/Patrick McHugh/Geoff Sorbello |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 6, 2012

2012 ANNUAL MEETING OF STOCKHOLDERS

OF

PLX TECHNOLOGY, INC.

_________________________

PROXY STATEMENT

OF

BALCH HILL PARTNERS, L.P.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

Balch Hill Partners, L.P., a Delaware limited partnership (the “BH LP”), and the other participants in this solicitation (collectively, “Balch Hill” or “we”) are significant stockholders of PLX Technology, Inc., a Delaware corporation (“PLX” or the “Company”). We believe that the Board of Directors of the Company (the “Board”) is not acting in the best interests of the Company’s stockholders. We are seeking your support for the election of our director nominees to the Board at the annual meeting of stockholders scheduled to be held at _________ located at ___________________, on _______, 2012 at ____ _.m., local time, including any adjournments or postponements thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”), for the following:

| | 1. | To elect Balch Hill’s director nominees, Martin Colombatto, Michael Cornwell, Robert R. Herb, Simon J. Michael, Mark Schwartz, Dilip Singh and Bernard Xavier (each a “Nominee” and, collectively, the “Nominees”), to serve as directors of the Company until the 2013 annual meeting of stockholders or until their successors are elected and qualified, in opposition to the Company’s incumbent directors; |

| | 2. | To ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; |

| | 3. | To vote on a non-binding basis on the compensation of the executive officers named in the Summary Compensation Table, as disclosed in the Company’s proxy statement for the Annual Meeting; and |

| | 4. | To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. |

This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed GOLD proxy card may only be voted for our Nominees and does not confer voting power with respect to the Company’s nominees. If elected, our Nominees will constitute the entire Board.

BH LP, Balch Hill Capital, LLC (“BH LLC”) and Simon J. Michael (collectively, with BH LP and BH LLC, the “BH Parties”) and the Nominees are members of a group formed in connection with this proxy solicitation and are deemed participants in this proxy solicitation.

The Company has set the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting as _________, 2012 (the “Record Date”). The mailing address of the principal executive offices of the Company is 870 W. Maude Avenue, Sunnyvale, California 94085. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were __________ shares of Common Stock, par value $0.001 per share (the “Shares”), outstanding and entitled to vote at the Annual Meeting. As of the Record Date, the BH Parties and the Nominees owned an aggregate of 4,352,876 Shares, which represents approximately 9.7% of the Shares outstanding. We intend to vote such Shares FOR the election of the Nominees, FOR the ratification of the appointment of BDO USA, LLP, as described herein, and in a manner consistent with the recommendation of Institutional Shareholder Services Inc. (“ISS”), a leading proxy advisory firm, with respect to the advisory vote on executive compensation, as described herein.

THIS SOLICITATION IS BEING MADE BY BALCH HILL AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH WE ARE NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

WE URGE YOU TO SIGN, DATE AND RETURN THE GOLD PROXY CARD IN FAVOR OF THE ELECTION OF OUR NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE FOR EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting

This Proxy Statement and GOLD proxy card are available at

_____________________________

IMPORTANT

Your vote is important, no matter how few Shares you own. We urge you to sign, date, and return the enclosed GOLD proxy card today to vote FOR the election of our Nominees.

| | · | If your Shares are registered in your own name, please sign and date the enclosed GOLD proxy card and return it to Balch Hill c/o Okapi Partners LLC (“Okapi Partners”) in the enclosed postage-paid envelope today. |

| | · | If your Shares are held in a brokerage account or bank, you are considered the beneficial owner of the Shares, and these proxy materials, together with a GOLD voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your Shares on your behalf without your instructions. |

| | · | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our independent Nominees only on our GOLD proxy card. So please make certain that the latest dated proxy card you return is the GOLD proxy card.

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Call Toll-Free at: (877) 566-1922 E-mail: info@okapipartners.com

Contact: Bruce H. Goldfarb/Patrick McHugh/Geoff Sorbello |

BACKGROUND TO THE SOLICITATION

The following is a chronology of events leading up to this proxy solicitation:

| | · | Throughout November and December 2011, Mr. Michael had several conversations with management regarding the potential opportunities in storage for PCI Express. Mr. Michael believed that this opportunity could allow PLX to be acquired for a significant premium, as a number of storage related companies (for example, SandForce, Inc.) had recently been acquired at healthy multiples of revenues. |

| | · | On January 30, 2012, Mr. Michael had a dinner meeting with Ralph Schmitt, the Company’s Chief Executive Officer, in which they discussed the opportunities for the Company’s PCI Express switches and the Company’s 10 Gigabit Ethernet business acquired through Teranetics, Inc. (“Teranetics”). |

| | · | On February 7, 2012, the BH Parties filed a Schedule 13D with the Securities and Exchange Commission (the “SEC”) disclosing that it believed management should seek a buyer for the Company to take advantage of the market interest in the Company’s PCI Express switches, and particularly its Gen3 switches. The BH Parties also disclosed an ownership of approximately 9.7% of the outstanding Shares. |

| | · | On February 21, 2012, Mr. Michael met with Ralph Schmitt, the Company’s Chief Executive Officer, D. James Guzy, the Chairman of the Board, and directors Thomas J. Riordan and Michael J. Salameh. At this meeting, Mr. Michael expressed his view that PLX’s acquisition strategy had failed, resulting in significant destruction of stockholder value. Mr. Michael also expressed his belief that the core PCI Express business was very promising and that ongoing industry transitions, particularly in storage and networking, were making the PCI Express business increasingly valuable and that the best vehicle for realizing that value was through a sale of the Company. In response, the Company’s representatives indicated that they did not intend to pursue a sale of the Company and instead intended to remain focused on the Company’s 10 Gigabit Ethernet business. |

| | · | On March 7, 2012, BH LP delivered a letter to the Company nominating the Nominees for election to the Board at the Annual Meeting. |

| | · | Throughout March 2012, Mr. Michael had several conversations with management regarding BH LP’s nomination of the Nominees for election to the Board at the Annual Meeting. |

| | · | On March 13, 2012, BH LP delivered a letter to the Board stating that it was deeply concerned by the Company’s ill-advised and poorly executed acquisition strategy and believed urgent change was required at the Board level. |

| | · | On March 15, 2012, BH LP delivered a letter to the Board demanding to inspect certain books and records of the Company, including the Company’s stockholder list. |

| | · | On March 16, 2012, Mr. Michael had a conference call with Ralph Schmitt to discuss whether BH LP would be amenable to entering into settlement discussions. |

| | · | On March 21, 2012, BH LP sent a letter to the Board indicating that it would be amenable to entering into settlement discussions to avoid a protracted proxy fight, if, as a precondition to entering into such discussions, such settlement would include the retirement of D. James Guzy. |

| | · | On March 23, 2012, Mr. Michael attended a previously scheduled charity event as a guest of Ralph Schmitt. Arthur Whipple, the Chief Financial Officer of PLX, was also in attendance. Mr. Schmitt was reluctant to discuss the Board’s reaction to Mr. Michael’s March 21st letter, but indicated that the letter had not been well received. |

| | · | On March 24, 2012, BH LP sent a second letter to the Board clarifying that that it would enter into settlement discussions with the Company but that it expected that any settlement should include the retirement of D. James Guzy, rather than as a precondition to entering into settlement discussions. |

| | · | On March 26, 2012, the Company responded to BH LP’s demand letter and agreed to provide the materials requested. |

| | · | On April 2, 2012, Mr. Michael received an email correspondence from Ralph Schmitt indicating that he had been advised and asked to suspend all discussions with Mr. Michael until the Company posted its earnings release. Mr. Schmitt indicated that they should reconvene discussions in a few weeks. Accordingly, BH LP has been forced to commence a proxy solicitation to effect change. |

REASONS FOR OUR SOLICITATION

We are one of the largest stockholders of the Company. Collectively, we own in the aggregate a total of 4,352,876 Shares, representing approximately 9.7% of the issued and outstanding Shares. As significant stockholders of the Company, we have one simple goal – to maximize the value of the Shares for all stockholders.

We are soliciting your support to elect our Nominees at the Annual Meeting because we have little confidence in the Board as currently composed to end the erosion of stockholder value and to realize full value for the Company’s core assets. Specifically, we are concerned that the current Board cannot adequately address the following serious issues:

| | · | The Company’s poor share price performance; |

| | · | The Company’s poor operating performance; |

| | · | The Company’s ill-advised acquisition strategy; |

| | · | The Company’s questionable compensation strategy; and |

| | · | The Company’s unwillingness to seriously explore strategic alternatives. |

We do not believe these concerns will be remedied unless the Board is reconstituted with independent directors. Our Nominees are committed to exercising their independent judgment in all matters before the Board and, if elected, they will work constructively to address these concerns and to ensure that the best interests of all stockholders are served. Subject to their fiduciary duties, the Nominees would focus on improving the Company’s operating performance and would explore all strategic alternatives, including a possible sale of the Company.

We believe the Company has experienced poor share price performance.

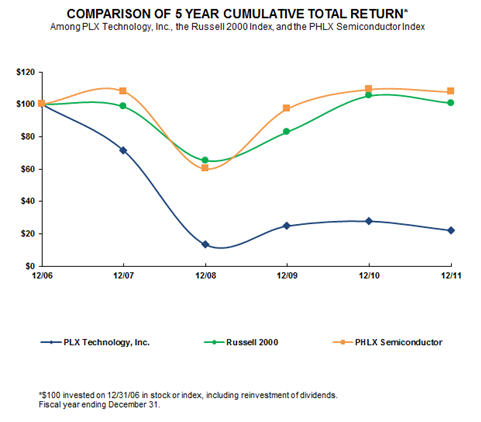

We are concerned with the Company’s dismal absolute and relative stock price performance. As shown in the charts below, the Shares have severely underperformed the Russell 2000 Index and the Philadelphia Semiconductor Index for the past five years.

| | | Cumulative Total Return | |

| | | 12/06 | | | 12/07 | | | 12/08 | | | 12/09 | | | 12/10 | | | 12/11 | |

| PLX Technology, Inc. | | | 100.00 | | | | 71.32 | | | | 13.19 | | | | 24.77 | | | | 27.68 | | | | 22.01 | |

| Russell 2000 | | | 100.00 | | | | 98.43 | | | | 65.18 | | | | 82.89 | | | | 105.14 | | | | 100.75 | |

| Philadelphia Semiconductor | | | 100.00 | | | | 107.88 | | | | 60.06 | | | | 97.21 | | | | 109.11 | | | | 107.58 | |

We are concerned with the Company’s poor operating performance.

We believe the Company’s poor stock price performance is due, in large part, to the Company’s weak operating performance. In order for PLX to achieve acceptable operating results, we believe the Company must be restructured to significantly reduce overall costs. Under this Board’s supervision, operating expenses have significantly exceeded gross profit, resulting in net losses in each of the past four fiscal years.

We believe the acquisition of Teranetics has further weakened the Company, by costing the Company approximately $4.0 million in pre-tax operating profits in each fiscal quarter since its acquisition in October 2010.

The following table, derived from the Company’s public filings, illustrates the Company’s declining performance after the acquisition of Teranetics in October 2010.

| | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | (In thousands) | |

| Net revenues | | $ | 29,721 | | | $ | 30,234 | | | $ | 27,786 | | | $ | 28,079 | | | $ | 30,745 | | | $ | 31,076 | | | $ | 25,889 | |

| Cost of revenues | | | 12,232 | | | | 12,307 | | | | 11,450 | | | | 12,074 | | | | 13,445 | | | | 13,537 | | | | 10,594 | |

| Research and development | | | 8,234 | | | | 7,605 | | | | 12,374 | | | | 12,860 | | | | 13,574 | | | | 11,661 | | | | 11,141 | |

| Selling, general and administrative | | | 6,701 | | | | 6,570 | | | | 6,986 | | | | 7,125 | | | | 6,678 | | | | 6,856 | | | | 6,707 | |

| Income (loss) from operations | | | 1,905 | | | | 2,594 | | | | (9,095 | ) | | | (9,045 | ) | | | (5,881 | ) | | | (4,122 | ) | | | (4,462 | ) |

| Provision (benefit) for income taxes | | | 264 | | | | 1,445 | | | | (1,515 | ) | | | 21 | | | | 30 | | | | 62 | | | | 33 | |

| Net income (loss) | | $ | 1,689 | | | $ | 1,148 | | | $ | (7,632 | ) | | $ | (9,132 | ) | | $ | (6,012 | ) | | $ | (4,226 | ) | | $ | (4,434 | ) |

The following table, derived from the Company’s public filings, illustrates Teranetic’s Network PHY Revenue (in thousands) and as a percentage of net revenues since its acquisition in October 2010:

| | |

| | | | | | | | |

| Network PHY Revenue | -- | -- | $1,020* | $1,751 | $580 | $1,313 | $1,035* |

| As a percentage of net revenues | -- | -- | 3.7% | 6.2% | 1.9% | 4.2% | 4% |

* Estimated based on information provided in the Company’s earnings releases and other public filings.

We believe the Company’s poor operating performance is a direct result of the Company’s ill-advised growth strategy and inability to integrate past acquisitions.

In January 2009, PLX acquired Oxford Semiconductor, Inc. (“Oxford”) by issuing approximately 9 million shares or approximately 32% of the Company’s then outstanding common stock. If valued today, the consideration to acquire Oxford would be in excess of $30 million. Yet, PLX recently sold its UK design team and certain other assets, comprising what we believe to be a large portion of what was originally acquired from Oxford, for only $2.2 million.

In October 2010, PLX acquired Teranetics. PLX paid a total consideration of $54 million comprised of cash, stock, and assumed debt for this 10 Gigabit Ethernet business with negligible revenues. This was at a time when PLX’s entire market capitalization was approximately $134 million immediately prior to the acquisition. Today, the 10 Gigabit Ethernet business is underperforming and consumes essentially all of PLX’s profits and cash flow.

Together, these two acquisitions have not only led to major equity dilution, but we estimate these acquisitions also consumed well in excess of $40 million in cash consideration, acquisition of debt, and operating losses. Since 2009, operating expenses have increased by more than 31%, which has destroyed profitability and eroded stockholder value.

We are concerned that the Company currently intends to continue its strategy of increasing scale through acquisitions. We believe this is a flawed strategy given the Company’s past failures to adequately integrate acquisitions as well as the premium valuations that the Company has paid and may pay in the future compared to where the Company is valued in the public market today.

We are further concerned that in order to deflect criticism, the Company may embark on an effort to “explore strategic options” but never follow through on that strategy.

We believe management’s ability to properly address the issues facing the Company is compromised by the misalignment between compensation and the Company’s performance.

We share the concerns of Glass Lewis & Co., a leading proxy advisory service (“Glass Lewis”), over the Company’s deficiency in linking executive pay to corporate performance. In the past four years, the Company received stunningly low grades by Glass Lewis for its executive compensation for paying more than its peers but performing worse than its peers:

We also share the concerns of ISS regarding the Board’s decision to reprice underwater options through a cash buyback without stockholder approval in 2009. By repricing underwater options, ISS rightly noted that “shareholders have lost trillions in their investments and do not have an opportunity to "reprice" their positions…[and] without shareholder approval of an option exchange program, the company does not provide the critical transparency needed for shareholders to determine the benefits of the company’s repricing terms and rationale at the time it takes such action.” Accordingly, ISS recommended that stockholders “WITHHOLD” their votes on the entire board at the 2009 annual meeting of stockholders and vote “AGAINST” the Company’s proposal to amend its Omnibus Stock Plan at the 2010 annual meeting of stockholders as a result of this options buyback program.

Our Nominees have the experience and qualifications necessary to make a difference.

Our Nominees are as follows:

Martin Colombatto has served as a director of ClariPhy Communications, Inc., a leading developer of highly integrated single chip optical transceivers for long haul and metro networking applications, and Luxtera Corp., a world leader in silicon photonics solutions providing inter- and intra-system connectivity for a variety of networking and data center applications, since November 2011 and January 2012, respectively. From March 2009 to November 2011, Mr. Colombatto acted as an angel investor. From January 2006 to March 2009, Mr. Colombatto served as Chairman and Chief Executive Officer of Staccato Communications, Inc. (“Staccato”), a leading supplier of Ultra Wideband radio silicon and software solutions. Prior to joining Staccato, Mr. Colombatto served as Vice President and General Manager of Broadcom Corporation’s Networking Business Unit. Mr. Colombatto received a B.S. in Engineering Technology from the California Polytechnic University, Pomona, where he serves as a member of the university’s National Development Counsel. Mr. Colombatto has over 30 years of experience in the semiconductor and electronics industry. Balch Hill believes that Mr. Colombatto’s expertise in networking, engineering, product development, sales & marketing, general management, and mergers & acquisitions will enable him to provide the Company with valuable financial and executive insights.

Michael Cornwell has served as Director of Technology & Strategy for Pure Storage, a developer of mid-range storage systems utilizing flash memory, since March 2011. Mr. Cornwell was a founding engineer of Pure Storage in December 2009. Prior to joining Pure Storage, Mr. Cornwell served as Lead Technologist for Flash Memory at Sun Microsystems from June 2007 to December 2009. From March 2002 to June 2007, Mr. Cornwell served as the Manager of Storage Engineering for the iPod division of Apple, Inc. In this role, Michael was instrumental in the adoption of NAND flash in Apple products including iPod and iPhone. Mr. Cornwell holds a B.A. in Computer Science from the University of California at Santa Cruz. Mr. Cornwell has 39 U.S. patents awarded in flash and other storage technologies. Balch Hill believes that Mr. Cornwell’s technology knowledge and experience will enable him to assist in the effective oversight of the Company.

Robert R. Herb has served as a Venture Partner at Scale Venture Partners, which has over $900 million of assets under management and invests in Information Technology companies across the United States, since July 2005. Mr. Herb was formerly an Executive Vice President and Chief Sales and Marketing Officer of Advanced Micro Devices, Inc. (“AMD”), a leading international semiconductor company. From 1983 to 2004, Mr. Herb served in a number of sales, marketing and general management positions with AMD. Since January 2005, Mr. Herb has served as an independent director of MIPS Technologies, Inc. (NASDAQ: MIPS), a provider of microprocessor intellectual property, serving on the Compensation and Nominating Committee and the Strategic Advisory Committee. In addition, Mr. Herb serves as a director of NComputing, a private, venture backed Desktop Virtualization company, Enpirion, a private, venture backed semiconductor/MEMS based power solutions company, Discera, a private, venture backed semiconductor/MEMS based timing solutions provider, and IMT, a private, venture backed MEMS manufacturing facility. Mr. Herb holds a B.S.E.E degree from the University of Illinois. Balch Hill believes that Mr. Herb’s technology acumen and leadership experience as the former Chief Sales and Marketing Officer of a global semiconductor company will enable him to assist in the effective oversight of the Company.

Simon J. Michael is the General Manager of Balch Hill Capital, LLC, an investment firm he founded in 1998. Mr. Michael has served as a director of Shocking Technologies, Inc., a private, venture backed developer of Voltage Switchable Dielectric™ (VSD™) materials, since August 2009. Mr. Michael has also served as a director of Webalo, Inc., a private provider of enterprise mobility software, since April 2009, serving as Chairman of the Compensation Committee since January 2010. Mr. Michael holds an MBA from Stanford University, and an AB from Dartmouth College. Balch Hill believes that Mr. Michael’s investment background and technology company experience will enable him to assist in the effective oversight of the Company.

Mark Schwartz is currently retired. From March 2004 to April 2012, Mr. Schwartz was the Executive Vice President of Fabrinet (NYSE: FN), a provider of precision optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers. In addition, Mr. Schwartz had served as a member of the board of several wholly-owned subsidiaries of Fabrinet. Mr. Schwartz served as Chief Financial Officer of Fabrinet from March 2004 to March 2012 and as Secretary from May 2000 to March 2012. Mr. Schwartz also served as General Counsel of Fabrinet from 2000 to 2010. Mr. Schwartz holds a B.A. in Business Administration from the University of Miami and a JD from the University of San Diego. Balch Hill believes that Mr. Schwartz’s technology knowledge and corporate experience will enable him to assist in the effective oversight of the Company.

Dilip Singh has been an executive telecom consultant since October 1998. From July 2010 to December 2011, Mr. Singh served as the interim Chief Executive Officer of MRV Communications, Inc. (OTCQB: MRVC.PK), a provider of optical communications network infrastructure equipment and network management products, as well as network integration and managed services. From December 2008 to May 2009, Mr. Singh served as the Chief Executive Officer of Telia-Sonera Spice Nepal, the second largest wireless operator in Nepal. Prior to that, Mr. Singh served from October 2004 to November 2008 as the Chief Executive Officer and President of Telenity, a convergence applications, service delivery platform and value added services telecom software company. Mr. Singh served as a director of MRV Communications, Inc. from October 2010 to October 2011. Mr. Singh earned dual masters degrees in physics from the University of Jodhpur, and electronics and communication electrical engineering from the Indian Institute of Technology. Mr. Singh has 40 years of operational executive management experience with global major Fortune 500 telecom carriers, entrepreneurial experience with start ups and early stage telecom software companies, network equipment providers and a venture capital firm. Balch Hill believes that Mr. Singh’s extensive experience and knowledge in restructuring and building telecom companies will enable him to assist in the effective oversight of the Company.

Bernard Xavier has served as the Chief Executive Officer of Modesat, a provider of modem technology, since February 2012 and as the Managing Director of Pantek, a provider of cross-border mergers and acquisitions, since November 2011. Prior to joining Pantek, Mr. Xavier founded and served as Chief Executive Officer of Linear Silicon Solutions, a high performance ADC developer, from May 2009 until its acquisition by Microchip Technology in September 2011. Mr. Xavier founded and served as President and Chief Executive Officer of Quorum Systems, a start-up developing multi-mode radio frequency devices for next generation cellular handsets, from February 2001 until its acquisition by Spreadtrum Communications in January 2008. Mr. Xavier holds a PhD in microwave circuits from Brunel University in the UK. He has published over twenty papers in radio frequency IC design and previously served on the technical program committee of the MTT-S RFIC conference. Mr. Xavier has filed several patents in the area of semiconductor circuits and systems. Balch Hill believes that Mr. Xavier’s technology expertise and business experience will enable him to assist in the effective oversight of the Company.

Our Nominees have a specific vision for maximizing stockholder value and would evaluate all strategic alternatives, including a sale of the Company.

In addition to maintaining and growing the Company’s relationships with its partners, our Nominees would immediately strive to implement a strategy with a view towards improving results. Our Nominees would also, consistent with their fiduciary duties, evaluate all strategic alternatives available, including a full and fair process to sell the Company or other means to return significant capital to stockholders.

We believe that industry trends, particularly in storage and networking have created significant acquisition interest in the Company’s PCI Express business. Instead of continuing to devote significant resources to fund the Company’s underperforming 10 Gigabit Ethernet business, we believe the Company should focus on realizing value from its PCI Express business. We believe PCI Express has the potential to replace a large portion of both the SAS (Serial Attached SCSI) controller market and the HBA (Host Bus Adapter) market and become an enabler for an integrated rack solution. We further believe, however, that these attractive industry dynamics will also cause heightened competition in the future and that the Company may realize the greatest value through the sale of the Company to a larger, well-capitalized acquirer.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of seven directors whose terms expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our Nominees in opposition to the Company’s director nominees. Your vote to elect our Nominees will have the legal effect of replacing all incumbent directors of the Company with our Nominees.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. This information has been furnished to us by the Nominees. The Nominees are citizens of the United States of America. The nominations were made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company is set forth above in the section entitled “Reasons For Our Solicitation.”

Martin Colombatto (Age 53) has served as a director of ClariPhy Communications, Inc., a leading developer of highly integrated single chip optical transceivers for long haul and metro networking applications, and Luxtera Corp., a world leader in silicon photonics solutions providing inter- and intra-system connectivity for a variety of networking and data center applications, since November 2011 and January 2012, respectively. From March 2009 to November 2011, Mr. Colombatto acted as an angel investor. From January 2006 to March 2009, Mr. Colombatto served as Chairman and Chief Executive Officer of Staccato Communications, Inc., a leading supplier of Ultra Wideband radio silicon and software solutions. Prior to joining Staccato, Mr. Colombatto served as Vice President and General Manager of Broadcom Corporation’s Networking Business Unit. Mr. Colombatto received a B.S. in Engineering Technology from the California Polytechnic University, Pomona, where he serves as a member of the university’s National Development Counsel. The principal business address of Mr. Colombatto is 4130 Calle Isabella, San Clemente, California 92672.

Michael Cornwell (Age 37) has served as Director of Technology & Strategy for Pure Storage, a developer of mid-range storage systems utilizing flash memory, since March 2011. Mr. Cornwell was a founding engineer of Pure Storage in December 2009. Prior to joining Pure Storage, Mr. Cornwell served as Lead Technologist for Flash Memory at Sun Microsystems from June 2007 to December 2009. From March 2002 to June 2007, Mr. Cornwell served as the Manager of Storage Engineering for the iPod division of Apple, Inc. In this role, Michael was instrumental in the adoption of NAND flash in Apple products including iPod and iPhone. Mr. Cornwell holds a B.A. in Computer Science from the University of California at Santa Cruz. Mr. Cornwell has 39 U.S. patents awarded in flash and other storage technologies. The principal business address of Mr. Cornwell is c/o Pure Storage, 650 Castro Street, Suite 400, Mountain View, California 94041.

Robert R. Herb (Age 50) has served as a Venture Partner at Scale Venture Partners, which has over $900 million of assets under management and invests in Information Technology companies across the United States, since July 2005. Mr. Herb was formerly an Executive Vice President and Chief Sales and Marketing Officer of Advanced Micro Devices, Inc. (“AMD”), a leading international semiconductor company. From 1983 to 2004, Mr. Herb served in a number of sales, marketing and general management positions with AMD. Since January 2005, Mr. Herb has served as an independent director of MIPS Technologies, Inc. (NASDAQ: MIPS), a provider of microprocessor intellectual property, serving on the Compensation and Nominating Committee and the Strategic Advisory Committee. In addition, Mr. Herb serves as a director of NComputing, a private, venture backed Desktop Virtualization company, Enpirion, a private, venture backed semiconductor/MEMS based power solutions company, Discera, a private, venture backed semiconductor/MEMS based timing solutions provider, and IMT, a private, venture backed MEMS manufacturing facility. Mr. Herb holds a B.S.E.E degree from the University of Illinois. The principal business address of Mr. Herb is c/o Scale Venture Partners, 950 Tower Lane, Suite 700, Foster City, California 94404.

Simon J. Michael (Age 52) is the General Manager of Balch Hill Capital, LLC, an investment firm he founded in 1998. Mr. Michael has served as a director of Shocking Technologies, Inc., a private, venture backed developer of Voltage Switchable Dielectric™ (VSD™) materials, since August 2009. Mr. Michael has also served as a director of Webalo, Inc., a private provider of enterprise mobility software, since April 2009, serving as Chairman of the Compensation Committee since January 2010. Mr. Michael holds an MBA from Stanford University, and an AB from Dartmouth College. The principal business address of Mr. Michael is c/o Balch Hill Capital, LLC, PO Box 7775, San Francisco, California 94120. See “Additional Participant Information” on page ___ for a description of certain litigation involving Mr. Michael.

Mark Schwartz (Age 45) is currently retired. From March 2004 to April 2012, Mr. Schwartz was the Executive Vice President of Fabrinet (NYSE: FN), a provider of precision optical, electro-mechanical, and electronic manufacturing services to original equipment manufacturers. In addition, Mr. Schwartz had served as a member of the board of several wholly-owned subsidiaries of Fabrinet. Mr. Schwartz served as Chief Financial Officer of Fabrinet from March 2004 to March 2012 and as Secretary from May 2000 to March 2012. Mr. Schwartz also served as General Counsel of Fabrinet from 2000 to 2010. Mr. Schwartz holds a B.A. in Business Administration from the University of Miami and a JD from the University of San Diego.

Dilip Singh (Age 63) has been an executive telecom consultant since October 1998. From July 2010 to December 2011, Mr. Singh served as the interim Chief Executive Officer of MRV Communications, Inc. (OTCQB: MRVC.PK), a provider of optical communications network infrastructure equipment and network management products, as well as network integration and managed services. From December 2008 to May 2009, Mr. Singh served as the Chief Executive Officer of Telia-Sonera Spice Nepal, the second largest wireless operator in Nepal. Prior to that, Mr. Singh served from October 2004 to November 2008 as the Chief Executive Officer and President of Telenity, a convergence applications, service delivery platform and value added services telecom software company. Mr. Singh served as a director of MRV Communications, Inc. from October 2010 to October 2011. Mr. Singh earned dual masters degrees in physics from the University of Jodhpur, and electronics and communication electrical engineering from the Indian Institute of Technology. Mr. Singh has 40 years of operational executive management experience with global major Fortune 500 telecom carriers, entrepreneurial experience with start ups and early stage telecom software companies, network equipment providers and a venture capital firm. The principal business address of Mr. Singh is 333 NE 21st Avenue, Apt. 1110, Deerfield Beach, Florida 33441.

Bernard Xavier (Age 47) has served as the Chief Executive Officer of Modesat, a provider of modem technology, since February 2012 and as the Managing Director of Pantek, a provider of cross-border mergers and acquisitions, since November 2011. Prior to joining Pantek, Mr. Xavier founded and served as Chief Executive Officer of Linear Silicon Solutions, a high performance ADC developer, from May 2009 until its acquisition by Microchip Technology in September 2011. Mr. Xavier founded and served as President and Chief Executive Officer of Quorum Systems, a start-up developing multi-mode radio frequency devices for next generation cellular handsets, from February 2001 until its acquisition by Spreadtrum Communications in January 2008. Mr. Xavier holds a PhD in microwave circuits from Brunel University in the UK. He has published over twenty papers in radio frequency IC design and previously served on the technical program committee of the MTT-S RFIC conference. Mr. Xavier has filed several patents in the area of semiconductor circuits and systems. The principal business address of Mr. Xavier is c/o Modesat, 10815 Rancho Bernardo Road Suite 102, San Diego, California 92127. See “Additional Participant Information” on page ___ for a description of certain litigation involving Mr. Xavier.

On March 7, 2012, each of the BH Parties and the Nominees (collectively, the “Group”) entered into a Joint Filing and Solicitation Agreement pursuant to which, among other things, (a) they agreed to the joint filing on behalf of each of them of statements on Schedule 13D, and any amendments thereto, with respect to the securities of the Company, (b) they agreed to solicit proxies or written consents for the election of the Nominees to the Board at the Annual Meeting (the “Solicitation”), and (iii) BH LP agreed to pay directly all pre-approved expenses incurred in connection with the Solicitation.

As of the date hereof, Mr. Colombatto may be deemed to beneficially own 6,900 Shares held in trust for the benefit of his child who shares the same household, Mr. Cornwell directly owns 13,836 Shares, Mr. Herb directly owns 1,000 Shares, Mr. Schwartz directly owns 1,000 Shares, Mr. Michael directly owns 15,000 Shares, Mr. Singh directly owns 1,000 Shares, and Mr. Xavier directly owns 1,270 Shares. In addition, Mr. Michael may be deemed to beneficially own the Shares directly owned by BH LP by virtue of his position as the sole manager of BH LLC, general partner of, and investment adviser to, BH LP. Each of the Nominees, as a member of a “group” for the purposes of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with the other members of the Group may be deemed to beneficially own the Shares owned by the other members of the Group. Each of the Nominees specifically disclaims beneficial ownership of such Shares that he does not directly own, except to the extent of his pecuniary interest therein. For information regarding purchases and sales during the past two years by the Nominees and by the members of the Group of securities of the Company that may be deemed to be beneficially owned by the Nominees, see Schedule I.

On March 7, 2012, BH LP entered into letter agreements with each of the Nominees (other than Mr. Michael) pursuant to which it agreed to indemnify each of the Nominees (other than Mr. Michael) from and against claims arising from the Solicitation and any related transactions.

On March 7, 2012, BH LP entered into compensation letter agreements with each of the Nominees (other than Mr. Michael) pursuant to which it agreed to pay each of the Nominees (other than Mr. Michael) (i) $5,000 in cash as a result of the submission by BH LP of its nomination of the Nominees to the Company and (ii) $5,000 in cash upon the filing of a definitive proxy statement with the Securities and Exchange Commission by BH LP relating to the Solicitation. Pursuant to the compensation letter agreements, each of the Nominees (other than Mr. Michael) has agreed to use the after-tax proceeds from such compensation to acquire securities of the Company (the “Nominee Shares”) at such time that each of the Nominees (other than Mr. Michael) shall determine, but in any event no later than 14 days after receipt of such compensation. If elected or appointed to serve as a director of the Board, each of the Nominees (other than Mr. Michael) agrees not to sell, transfer or otherwise dispose of any Nominee Shares within two (2) years of his election or appointment as a director; provided, however, in the event that the Company enters into a business combination with a third party, each of the Nominees (other than Mr. Michael) may sell, transfer or exchange the Nominee Shares in accordance with the terms of such business combination.

Other than as stated herein, there are no arrangements or understandings between members of BH LP and any of the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees are a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Each Nominee presently is, and if elected as a director of the Company would be, an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, including Rule 5605(a)(2), and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

We do not expect that the Nominees will be unable to stand for election, but, in the event that such persons are unable to serve or for good cause will not serve, the Shares represented by the enclosed GOLD proxy card will be voted for substitute nominees, to the extent this is not prohibited under the Amended and Restated Bylaws of the Company (the “Bylaws”) and applicable law. In addition, we reserve the right to nominate substitute persons if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Nominees, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, Shares represented by the enclosed GOLD proxy card will be voted for such substitute nominees. We reserve the right to nominate additional persons, to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Balch Hill that any attempt to increase the size of the current Board constitutes an unlawful manipulation of the Company’s corporate machinery.

YOU ARE URGED TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED GOLD PROXY CARD.

PROPOSAL NO. 2

COMPANY PROPOSAL TO RATIFY APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Board has selected BDO USA, LLP to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012.

WE DO NOT OBJECT TO THE RATIFICATION OF THE APPOINTMENT OF BDO USA, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2012 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL NO. 3

COMPANY’S PROPOSAL TO VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to cast a non-binding advisory vote to approve the compensation of the Company’s named executive officers. The Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the stockholders of PLX Technology, Inc. approve the compensation of the executive officers named in the Summary Compensation Table, as disclosed in its proxy statement for the annual meeting of stockholders in 2012 pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the executive compensation tables and the related footnotes and narrative accompanying the tables).”

According to the Company’s proxy statement, your vote on this proposal is advisory and non-binding.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES CONSISTENT WITH THE RECOMMENDATION OF ISS WITH RESPECT TO THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Each Share is entitled to one vote. Stockholders who sold Shares before the Record Date (or acquire them without voting rights after the Record Date) may not vote such Shares. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such Shares after the Record Date. Based on publicly available information, we believe that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Shares.

Shares represented by properly executed GOLD proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees to the Board, FOR the ratification of the appointment of BDO USA, LLP, in a manner consistent with the recommendation of ISS with respect to the non-binding advisory vote on executive compensation, as described herein, and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting.

This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed GOLD proxy card may only be voted for our Nominees and does not confer voting power with respect to the Company’s nominees. You can only vote for the Company’s nominees by signing and returning a proxy card provided by the Company. The participants in this solicitation intend to vote all of their Shares in favor of the Nominees.

QUORUM; DISCRETIONARY VOTING

A majority of the issued and outstanding Shares entitled to vote, represented either in person or by proxy, is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Shares that are voted “WITHHOLD” in the election of directors or “ABSTAIN” on any other business matter will be treated as being present for purposes of determining the presence of a quorum. Shares held by brokers, banks or nominees (i.e. in “street name”) may not be voted by such brokers, banks or nominees on the proposal to elect directors or the proposal to approve the advisory resolution on executive compensation unless the beneficial owners of such Shares provide them with instructions on how to vote. Shares held by brokers, banks or nominees may be voted by such brokers, banks or nominees on the proposal to ratify the appointment of BDO USA, LLP if the beneficial owners of such Shares do not provide them with instructions on how to vote.

VOTES REQUIRED FOR APPROVAL

Vote required for the election of directors. According to the Company’s proxy statement, if a quorum is present, the candidates who receive the greatest number of votes cast at the Annual Meeting are elected. Under the plurality standard, the only votes that count when director votes are being tabulated are “FOR” votes. “WITHHOLD” votes have no effect.

Vote required for the ratification of the appointment of BDO USA, LLP and the approval of the advisory resolution on executive compensation. According to the Company’s proxy statement, if a quorum is present, the affirmative vote of a majority of the Shares present and entitled to vote at the Annual Meeting will be required to ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm and to approve the advisory resolution on executive compensation. Abstentions will not be included among the Shares that are considered to be present and voting and will have the same effect as a negative vote for these proposals.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Balch Hill in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement or to the Company at 870 W. Maude Avenue, Sunnyvale, California 94085 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Balch Hill in care of Okapi Partners at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding Shares. Additionally, Okapi Partners may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GOLD PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by BH LP. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

BH LP has entered into an agreement with Okapi Partners for solicitation and advisory services in connection with this solicitation, for which Okapi Partners will receive a fee not to exceed $100,000, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Okapi Partners will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. BH LP has requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. BH LP will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Okapi Partners will employ up to 25 persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by BH LP. Costs of this solicitation of proxies are currently estimated to be approximately $___________. BH LP estimates that through the date hereof its expenses in connection with this solicitation are approximately $___________. BH LP intends to seek reimbursement from the Company of all expenses it incurs in connection with this solicitation. BH LP does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

Each of BH LP, BH LLC, Simon Michael and the other Nominees are participants in this solicitation. The principal business of BH LP is investing in securities. The principal business of BH LLC is serving as the general partner of, and investment adviser to, BH LP. The principal occupation of Mr. Michael is serving as the sole manager of BH LLC. The address of each of BH LP, BH LLC and Mr. Michael is PO Box 7775, San Francisco, California 94120.

As of the date hereof, BH LP owned directly 4,312,870 Shares. BH LLC, as the general partner of, and investment adviser to, BH LP, may be deemed to beneficially own the 4,312,870 shares owned by BH LP. As of the date hereof, Mr. Michael owned directly 15,000 Shares and may be deemed to beneficially own the Shares owned directly by BH LP by virtue of his position as the sole manager of BH LLC.

Each participant in this solicitation, as a member of a “group” with the other participants for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own the Shares owned in the aggregate by the participants. Each participant in this solicitation disclaims beneficial ownership of the Shares he or it does not directly own, except to the extent of his or its pecuniary interest therein. For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

Mr. Michael, BH LP, and BH LLC (collectively, the “Defendants”) have each been named as a defendant in a pending civil action brought in the Court of Chancery of the State of Delaware by Shocking Technologies, Inc. (“STI”). Mr. Michael currently serves on the Board of Directors of STI (the “STI Board”) and BH LP is a stockholder in STI. STI claims Mr. Michael breached his fiduciary duty to STI and its stockholders by disclosing confidential information about STI and attempting to block or delay a capital investment into STI by an existing stockholder and other potential investors. STI claims that BH LP and the other Defendants aided and abetted Mr. Michael in breaching his fiduciary duties. STI also claims all Defendants have tortiously interfered with a prospective business relationship. STI seeks monetary damages from the Defendants and Mr. Michael’s removal from the STI Board. The fiduciary duty claims against Michael have been expedited and are set for trial in mid-April 2012. The Defendants deny all allegations made by STI, believe that the lawsuit is without merit, and intend to vigorously defend against the litigation. Michael and Balch Hill moved to dismiss certain claims in STI’s complaint for failure to state a claim, and a hearing on that motion occurred on March 26, 2012. The Court has not yet ruled on this motion.

The Defendants and other personal acquaintances of Mr. Michael are collectively the largest block of stockholders in STI. Mr. Michael was appointed to the STI Board as a representative of certain stockholders of STI. The Defendants believe that the civil action is in retaliation for the questions raised by Mr. Michael regarding STI’s corporate governance practices and management’s apparent missteps. Specifically, the Defendants believe that the lawsuit is in response to Mr. Michael’s concerns raised over the substantially enhanced compensation and severance package approved by the STI Board for the Chief Executive Officer of STI in exchange for additional director compensation, despite failing to meet projections and STI’s declining performance. The Defendants also believe that the lawsuit is in response to Mr. Michael’s efforts to press for an independent STI Board and to inform STI’s stockholders of his concerns regarding management’s misrepresentations and omissions and the failure of the STI Board to act in the best interests of stockholders.

Mr. Michael has asserted counterclaims against STI and third-party claims against the other directors of STI for, among other claims, depriving stockholders of a majority-independent board, improperly approving executive compensation for STI’s Chief Executive Officer, and breaching their fiduciary duties to STI and its stockholders in an effort to obtain and maintain control of the STI Board.

OTHER MATTERS AND ADDITIONAL INFORMATION

Balch Hill is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which Balch Hill is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed GOLD proxy card will vote on such matters in their discretion.

STOCKHOLDER PROPOSALS

Stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 and intended to be presented at the Company’s 2013 annual meeting of stockholders must be received by the Company not later than _________, 2012 in order to be considered for inclusion in the Company’s proxy materials for that meeting.

For stockholder proposals to be considered properly brought before an annual meeting by a stockholder, the stockholder must have given timely notice in writing to the Secretary of the Company. To be timely for the Company’s 2013 annual meeting of stockholders, a stockholder’s notice must be delivered to or mailed and received by the Secretary of the Company at the principal executive offices of the Company between _________ and __________. A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) the name and record address of the stockholder proposing such business, (iii) the class and number of shares of the Company which are beneficially owned by the stockholder and (iv) any material interest of the stockholder in such business. Section 2.10 of the Bylaws requires stockholders to furnish to the Secretary of the Company additional information if a stockholder proposes to nominate candidates for election as directors at the annual meeting.

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the Company’s 2013 annual meeting of stockholders is based on information contained in the Company’s proxy statement. The incorporation of this information in this proxy statement should not be construed as an admission by Balch Hill that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING. THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. ALTHOUGH WE DO NOT HAVE ANY KNOWLEDGE INDICATING THAT ANY STATEMENT MADE BY IT HEREIN IS UNTRUE, WE DO NOT TAKE ANY RESPONSIBILITY FOR THE ACCURACY OR COMPLETENESS OF STATEMENTS TAKEN FROM PUBLIC DOCUMENTS AND RECORDS THAT WERE NOT PREPARED BY OR ON OUR BEHALF, OR FOR ANY FAILURE BY THE COMPANY TO DISCLOSE EVENTS THAT MAY AFFECT THE SIGNIFICANCE OR ACCURACY OF SUCH INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

BALCH HILL PARTNERS, L.P.

_____________, 2012

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

Shares of Common Stock Purchased / (Sold) | Date of Purchase / Sale |

BALCH HILL PARTNERS, L.P.

| 4,000 | | 01/18/2012 |

| 3,000 | | 01/17/2012 |

| 33,541 | | 01/13/2012 |

| 5,000 | | 01/12/2012 |

| 51,353 | | 01/11/2012 |

| 13,586 | | 01/10/2012 |

| 5,330 | | 01/09/2012 |

| 10,000 | | 01/06/2012 |

| 5,000 | | 01/04/2012 |

| 6,100 | | 12/27/2011 |

| 60,700 | | 12/23/2011 |

| 69,804 | | 12/22/2011 |

| 9,202 | | 12/21/2011 |

| 11,336 | | 12/20/2011 |

| 39,069 | | 12/19/2011 |

| 20,400 | | 12/15/2011 |

| 56,900 | | 12/14/2011 |

| 76,594 | | 12/13/2011 |

| 400 | | 12/12/2011 |

| (6,696) | | 11/30/2011 |

| (400) | | 11/22/2011 |

| (7,497) | | 11/18/2011 |

| (3,685) | | 11/16/2011 |

| (57,032) | | 11/15/2011 |

| (4,065) | | 11/14/2011 |

| (10,996) | | 11/03/2011 |

| (600) | | 11/01/2011 |

| (5,000) | | 10/28/2011 |

| (7,200) | | 10/27/2011 |

| 5,000 | | 10/25/2011 |

| (335) | | 10/25/2011 |

| (16,097) | | 10/24/2011 |

| (600) | | 10/21/2011 |

| (31,399) | | 10/19/2011 |

| (6,900) | | 10/11/2011 |

| (5,212) | | 10/06/2011 |

| (40,486) | | 10/05/2011 |

| (4,166) | | 10/03/2011 |

| (300) | | 09/27/2011 |

| (5,800) | | 09/15/2011 |

| (13,246) | | 09/14/2011 |

| (25,303) | | 09/13/2011 |

| (13,271) | | 08/31/2011 |

| (9,571) | | 08/30/2011 |

| 10,000 | | 08/26/2011 |

| (2,756) | | 08/26/2011 |

| (100) | | 08/24/2011 |

| 2,500 | | 08/23/2011 |

| (6,507) | | 08/23/2011 |

| 5,000 | | 08/22/2011 |

| 14,387 | | 08/19/2011 |

| 1,600 | | 08/08/2011 |

| 15,000 | | 08/05/2011 |

| (1,895) | | 08/01/2011 |

| (677) | | 07/28/2011 |

| (12,400) | | 07/27/2011 |

| (41,686) | | 07/26/2011 |

| (24,287) | | 07/25/2011 |

| (30,725) | | 07/22/2011 |

| (4,810) | | 07/21/2011 |

| (13,700) | | 07/20/2011 |

| (5,634) | | 07/19/2011 |

| (120,295) | | 07/18/2011 |

| 15,000 | | 07/15/2011 |

| (3,200) | | 07/14/2011 |

| (2,792) | | 07/13/2011 |

| 2,500 | | 07/08/2011 |

| (7,000) | | 07/01/2011 |

| 5,000 | | 06/21/2011 |

| 10,000 | | 06/10/2011 |

| 5,000 | | 06/08/2011 |

| 5,800 | | 06/07/2011 |

| 5,000 | | 06/02/2011 |

| 5,000 | | 05/18/2011 |

| 24,847 | | 05/17/2011 |

| 42,878 | | 05/16/2011 |

| 10,000 | | 05/13/2011 |

| 10,000 | | 05/12/2011 |

| 10,000 | | 05/11/2011 |

| 42,200 | | 05/10/2011 |

| 104,072 | | 05/09/2011 |

| 49,206 | | 05/06/2011 |

282,3491 | | 04/29/2011 |

20,0002 | | 04/26/2011 |

(20,000)3 | | 04/26/2011 |

| 19,160 | | 04/13/2011 |

1 Shares contributed by a limited partner to Balch Hill Partners, L.P. pursuant to its limited partnership agreement. 2 Represents purchase to cover short position.

| 53,845 | | 04/12/2011 |

| 45,000 | | 04/07/2011 |

| 15,000 | | 04/06/2011 |

| 5,000 | | 04/04/2011 |

| 5,000 | | 04/01/2011 |

| 43,454 | | 03/31/2011 |

| 6,125 | | 03/29/2011 |

| 35,000 | | 03/28/2011 |

| 43,013 | | 03/24/2011 |

| 12,049 | | 03/23/2011 |

| 5,000 | | 03/18/2011 |

| 3,000 | | 03/15/2011 |

| 20,000 | | 03/11/2011 |

| 20,000 | | 03/10/2011 |

| 51,476 | | 02/04/2011 |

| 300,000 | | 02/04/2011 |

| 32,100 | | 01/27/2011 |

| 100,000 | | 01/25/2011 |

| 1,400 | | 01/24/2011 |

| 10,000 | | 01/13/2011 |

| 10,000 | | 01/06/2011 |

| 8,817 | | 01/05/2011 |

| 36,492 | | 12/28/2010 |

| 12,142 | | 12/23/2010 |

| 30,738 | | 12/17/2010 |

| 50,000 | | 12/13/2010 |

| 20,900 | | 12/10/2010 |

| 34,052 | | 12/09/2010 |

| (20,000) | | 11/03/2010 |

| (20,000) | | 10/27/2010 |

| (8,856) | | 10/25/2010 |

| (14,111) | | 10/21/2010 |

| (9,809) | | 10/20/2010 |

| (11,733) | | 10/18/2010 |

| (43,871) | | 10/11/2010 |

| (30,114) | | 10/08/2010 |

| (64,325) | | 09/24/2010 |

| (111,238) | | 09/23/2010 |

| (4,033) | | 09/22/2010 |

| (100,000) | | 09/16/2010 |

| (15,000) | | 09/15/2010 |

| (1,100) | | 09/07/2010 |

| (3,724) | | 08/18/2010 |

| (1,900) | | 08/17/2010 |

| 10,000 | | 08/13/2010 |

| 2,869 | | 08/12/2010 |

| 64,074 | | 08/11/2010 |

| 27,590 | | 08/06/2010 |

| 20,000 | | 07/28/2010 |

| 600 | | 07/20/2010 |

| 23,414 | | 07/19/2010 |

| (5,000) | | 07/07/2010 |

| 5,000 | | 07/06/2010 |

| 15,900 | | 07/02/2010 |

| (10,000) | | 06/21/2010 |

| 20,000 | | 06/15/2010 |

| 10,000 | | 06/14/2010 |

| 11,233 | | 06/09/2010 |

| 9,401 | | 05/25/2010 |

| 700 | | 05/21/2010 |

| 44,400 | | 05/07/2010 |

| 15,766 | | 05/06/2010 |

| (10,000) | | 04/30/2010 |

| 7,100 | | 04/28/2010 |

| 20,000 | | 04/27/2010 |

| (40,000) | | 04/26/2010 |

| (2,488) | | 04/20/2010 |

| (5,494) | | 04/14/2010 |

| (10,000) | | 04/08/2010 |

| (20,000) | | 04/08/2010 |

SIMON J. MICHAEL

| (32,100) | | 05/02/2011 |

| (107,169) | | 04/28/2011 |

| (5,077) | | 04/15/2011 |

| (3,700) | | 03/25/2011 |

| (200) | | 03/24/2011 |

| (3,700) | | 03/21/2011 |

| (20,000) | | 03/18/2011 |

| (1,700) | | 03/11/2011 |

| (40,000) | | 03/10/2011 |

| (9,500) | | 03/09/2011 |

| (14,553) | | 03/07/2011 |

| (21,101) | | 03/04/2011 |

| (20,000) | | 03/03/2011 |

| 37 | | 03/23/2012 |

| 163 | | 03/23/2012 |

| 900 | | 03/23/2012 |

| 500 | | 03/23/2012 |

| 700 | | 03/23/2012 |

| 547 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 800 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 80 | | 03/22/2012 |

| 80 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 15 | | 03/22/2012 |

| 89 | | 03/22/2012 |

| 89 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 100 | | 03/22/2012 |

| 2,100 | | 03/22/2012 |

MICHAEL CORNWELL

| 12,500 | | 12/13/2011 |

| 1,336 | | 12/12/2011 |

ROBERT R. HERB

MARK SCHWARTZ

| 700 | | 3/26/2012 |

| 300 | | 3/26/2012 |

DILIP SINGH

BERNARD XAVIER

4 Represents Shares held in trust for the benefit of Mr. Colombatto’s child who shares the same household.

Schedule II

The following table is reprinted from the Company’s proxy statement filed with the Securities and Exchange Commission on ________________, 2012

IMPORTANT

Tell your Board what you think! Your vote is important. No matter how many Shares you own, please give us your proxy FOR the election of our Nominees by taking three steps:

| | · | SIGNING the enclosed GOLD proxy card, |

| | · | DATING the enclosed GOLD proxy card, and |

| | · | MAILING the enclosed GOLD proxy card TODAY in the envelope provided (no postage is required if mailed in the United States). |

If any of your Shares are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such Shares and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed GOLD voting form.

If you have any questions or require any additional information concerning this Proxy Statement, please contact Okapi Partners at the address set forth below.

OKAPI PARTNERS LLC 437 Madison Avenue, 28th Floor New York, N.Y. 10022 (212) 297-0720 Stockholders Call Toll-Free at: (877) 566-1922 E-mail: info@okapipartners.com

Contact: Bruce H. Goldfarb/Patrick McHugh/Geoff Sorbello |

GOLD PROXY CARD

PLX TECHNOLOGY, INC.

2012 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF BALCH HILL PARTNERS, L.P.

THE BOARD OF DIRECTORS OF PLX TECHNOLOGY, INC. IS NOT SOLICITING THIS PROXY

P R O X Y

The undersigned appoints Simon J. Michael and Geoffrey Sorbello, and each of them, attorneys and agents with full power of substitution to vote all shares of common stock of PLX Technology, Inc (the “Company”) which the undersigned would be entitled to vote if personally present at the 2012 Annual Meeting of Stockholders of the Company scheduled to be held at _________ located at ___________________, on _______, 2012 at ____ _.m., local time, including any adjournment or postponement thereof and any meeting which may be called in lieu thereof.

The undersigned hereby revokes any other proxy or proxies heretofore given to vote or act with respect to the shares of common stock of the Company held by the undersigned, and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Annual Meeting that are unknown to Balch Hill Partners, L.P. (“Balch Hill”) a reasonable time before this solicitation.

IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2 AND IN A MANNER CONSISTENT WITH THE RECOMMENDATION OF INSTITUTIONAL SHAREHOLDER SERVICES INC., A LEADING PROXY ADVISORY FIRM, WITH RESPECT TO PROPOSAL 3.

This Proxy will be valid until the sooner of one year from the date indicated on the reverse and the completion of the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting

Balch Hill’s Proxy Statement and this GOLD proxy card are available at

_____________________________

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

[X] Please mark vote as in this example

BALCH HILL RECOMMENDS A VOTE “FOR” THE NOMINEES LISTED IN PROPOSAL 1 AND “FOR” PROPOSAL 2. BALCH HILL MAKES NO RECOMMENDATION WITH RESPECT TO PROPOSAL 3.

1. | BALCH HILL’S PROPOSAL TO ELECT DIRECTORS: |

| | FOR ALL NOMINEES | WITHHOLD AUTHORITY TO VOTE FOR ALL NOMINEES | FOR ALL EXCEPT NOMINEE(S) WRITTEN BELOW |

| | | | |

Nominees: Martin Colombatto

Michael Cornwell

Robert R. Herb

Simon J. Michael

Mark Schwartz

Dilip Singh Bernard Xavier | [ ] | [ ] | [ ] ___________________ ___________________ ___________________ ___________________ |

2. | THE COMPANY’S PROPOSAL TO RATIFY THE APPOINTMENT OF BDO USA, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2012: |