Effective October 15, 2005, for a term of one year, the Company has obtained insurance policies in respect of indemnification of directors and officers. The scope of these policies is similar to coverage under prior policies held by the Company.

The following table sets forth information showing compensation paid or accrued by the Company and its subsidiaries during each of the Company’s last three fiscal years for the Chief Executive Officer (“CEO”) and the four other most highly compensated executive officers of the Company at the end of the last completed fiscal year (collectively, the “named executive officers”).

(1) Restricted common shares were awarded to the named individuals and the amounts reported in the Summary Compensation Table represent the market value at the date of grant calculated by multiplying the closing price of common stock on the date granted by the number of shares or units awarded. On an individual basis, the aggregate number of restricted shares and share units and the market value of such shares held as of December 30, 2005 was as follows: (i) Mr. Milchovich: 516,148.65 shares with a value of $18,983,947, (ii) Mr. Cherry: 232,266.80 shares with a value of $8,542,773, (iii) Mr. La Duc: 104,520.05 shares with a value of $3,844,247, (iv) Mr. della Sala: 102,126.80 share units with a value of $3,756,224 and (v) Mr. Ganz: 17,417 shares with a value of $640,597.

With the exception of Mr. Milchovich, one-third of the restricted shares vested on December 31, 2005, and the remaining two-thirds vest on December 31, 2006. Mr. Milchovich’s shares vest on October 22, 2006. With the exception of Mr. della Sala, who was awarded share units, these shares are subject to voting and dividend rights upon grant.

(2) During 2005, the Company discontinued its program for providing company vehicles to certain eligible employees. At such point in 2005 when an employee’s vehicle lease expired, the employee received an increase in his or her salary equal to the previous annual vehicle lease allocation (“Lease Allocation”). Included in Mr. Milchovich’s salary for 2005 is $16,610 attributable to the increase for the Lease Allocation.

(3) In accordance with Mr. Milchovich’s Employment Agreement with the Company, he received the following grossed-up payments: $13,466 for country club membership fees and dues, and $3,536 for tax preparation fees. He also received reimbursement of $3,209 for telecommunications for business use in his home. The Company pays an annual premium of $1,108 for an $800,000 life insurance policy for the benefit of Mr. Milchovich’s beneficiaries as long as Mr. Milchovich is an employee of the Company. Mr. Milchovich will receive any cash surrender value under this policy. Mr. Milchovich’s personal use of a Company vehicle in 2005 was valued at $7,113.

(4) Pursuant to an amendment to Mr. Milchovich’s Employment Agreement dated January 22, 2003, whereby the Company agreed to monetize his retirement benefit, as further described under “Employment Agreements”, Mr. Milchovich received $866,000 in four quarterly installments of $216,500 each. The Company also made a $9,450 match on Mr. Milchovich’s employee 401(k) contribution.

(5) In accordance with Mr. Milchovich’s Employment Agreement with the Company, he received a grossed-up payment of $32,164 for country club membership fees and dues. He also received reimbursement of $2,016 for telecommunications for business use in his home. The Company pays an annual premium of $1,108 for an $800,000 life insurance policy for the benefit of Mr. Milchovich’s beneficiaries as long as Mr. Milchovich is an employee of the Company. Mr. Milchovich will receive any cash surrender value under this policy. Mr. Milchovich’s personal use of a Company vehicle in 2004 was valued at $17,070.

(6) On October 6, 2004, Mr. Milchovich was awarded 774,222.65 restricted common shares pursuant to the Foster Wheeler Ltd. Management Restricted Stock Plan, and non-statutory stock options to acquire 1,151,512 common shares pursuant to the Foster Wheeler Ltd. 2004 Stock Option Plan. One-third of these shares and one-third of the options vested on

40

October 22, 2005, and the remaining two-thirds of the shares and the options will vest on October 22, 2006.

(7) Pursuant to an amendment to Mr. Milchovich’s Employment Agreement dated January 22, 2003, whereby the Company agreed to monetize his retirement benefit, as further described under “Employment Agreements”, Mr. Milchovich received $866,000 in four quarterly installments of $216,500 each. The Company also made a $9,225 match on Mr. Milchovich’s employee 401(k) contribution.

(8) In January 2004, the Compensation Committee and the Board of Directors approved a pool of bonus compensation to a group of approximately forty corporate wide employees, from which the employees would be paid a bonus which was contingent upon the occurrence of certain events. These bonuses related to performance in 2003. One-third of the bonus was paid upon completion of the exchange offer. Mr. Milchovich received the one-third portion ($524,160) on September 29, 2004. He received the remaining two-thirds portion ($1,048,320) in August 2005 after the Company attained two consecutive fiscal quarters of positive earnings. Other corporate officers also received bonus awards.

(9) In accordance with Mr. Milchovich’s Employment Agreement with the Company, he received the following grossed-up payments: (i) $37,022 for country club membership fees and dues, and (ii) $6,390 for reimbursement of legal fees in connection with his employment contract. Personal use of a Company vehicle was $15,610. He also received reimbursement of $2,800 for telecommunications for business use in his home. The Company pays an annual premium of $1,108 for an $800,000 life insurance policy for the benefit of Mr. Milchovich’s beneficiaries as long as Mr. Milchovich is an employee of the Company. Mr. Milchovich will receive any cash surrender value under the policy.

(10) On March 25, 2003, Mr. Milchovich received $293,600 from the Company as the first payment pursuant to a retention award granted by the Board of Directors on February 28, 2003 to encourage a group of twenty four highly performing employees to remain with the Company. On January 6, 2004, he received the second part of the award in the amount of $681,400, which was contingent upon his continued employment with the Company on December 31, 2003. Also, pursuant to an amendment to Mr. Milchovich’s Employment Agreement dated January 22, 2003, whereby the Company agreed to monetize his retirement benefit, as further described under “Employment Agreements”, Mr. Milchovich received the gross amount of $1,082,500 and three quarterly lump sum payments of $216,500 each. The Company made a $9,000 match on Mr. Milchovich’s employee 401(k) contribution.

(11) During 2005, the Company discontinued its program for providing company vehicles to certain eligible employees. At such point in 2005 when an employee’s vehicle lease expired, the employee received an increase in his or her salary equal to the previous annual vehicle lease allocation (“Lease Allocation”). Included in Mr. Cherry’s salary for 2005 is $4,530 attributable to the increase for the Lease Allocation.

(12) In accordance with Mr. Cherry’s Employment Agreement with the Company, he received a grossed up payment of $29,857 for moving expenses in connection with his relocation to New Jersey. His personal use of a Company vehicle in 2005 was valued at $14,593.

41

(13) In April 2005, Mr. Cherry received $450,000 pursuant to the Key Employee Retention Program (“KERP”). The KERP was implemented to retain key employees during the restructuring period. It provided for certain key employees to receive a percentage of their base salary, in effect as of the date of the KERP letter, (in Mr. Cherry’s case it was 100%) provided the employee did not voluntarily leave the Company prior to March 31, 2005. In addition, the Company made a $9,450 match on Mr. Cherry’s employee 401(k) contribution.

(14) Mr. Cherry received $9,813 for financial planning/tax preparation. His personal use of a Company vehicle in 2004 was valued at $14,071. Mr. Cherry also received a $756 update for Group term life insurance.

(15) On October 6, 2004, Mr. Cherry was awarded 232,266.80 restricted common shares pursuant to the Foster Wheeler Ltd. Management Restricted Stock Plan, and non-statutory stock options to acquire 345,453 common shares pursuant to the Foster Wheeler Ltd. 2004 Stock Option Plan. One-third of these shares and one-third of the options vested on December 31, 2005, and the remaining two-thirds of the shares and the options will vest on December 31, 2006.

(16) The Company made a $9,225 match on Mr. Cherry’s employee 401(k) contribution.

(17) In accordance with Mr. Cherry’s Employment Agreement with the Company, he received the following grossed up payments in connection with his relocation to New Jersey: (i) $113,764 for temporary living expenses, and (ii) $46,102 for travel expenses. The Company incurred the cost of $6,542 on his behalf for shipment of household goods. His personal use of a Company vehicle in 2003 was valued at $16,277.

(18) The Company made a $9,000 match on Mr. Cherry’s employee 401(k) contribution.

(19) In accordance with Mr. La Duc’s Employment Agreement with the Company, he received grossed up reimbursement of tax services in the amount of $3,226. Mr. La Duc’s personal use of a Company vehicle in 2005 was valued at $18,069.

(20) The Company made a $9,450 match on Mr. La Duc’s employee 401(k) contribution.

(21) Mr. La Duc commenced employment with the Company on April 14, 2004.

(22) John T. La Duc became Executive Vice President and Chief Financial Officer of the Company on April 14, 2004, and received a signing bonus in the amount of $166,250 on that date. He also received $173,500 which represents short term bonus compensation for 2004.

(23) In accordance with Mr. LaDuc’s Employment Agreement with the Company, he received the following grossed up payments in connection with his relocation to New Jersey: (i) taxable moving expenses in the amount of $87,510, which includes $12,088 for closing costs on a new home and other related costs, as well as a moving allowance in the amount of $21,635; and, (ii) an additional $2,788 of non-taxable moving expenses. Mr. LaDuc’s personal use of a Company vehicle in 2004 was valued at $6,260.

(24) On October 6, 2004, Mr. LaDuc was awarded 104,520.05 restricted common shares pursuant to the Foster Wheeler Ltd. Management Restricted Stock Plan, and non-statutory stock

42

options to acquire 155,454 common shares pursuant to the Foster Wheeler Ltd. 2004 Stock Option Plan. One-third of these shares and one-third of the options vested on December 31, 2005, and the remaining two-thirds of the shares and the options will vest on December 31, 2006.

(25) The Company made a $4,428 match to Mr. LaDuc’s employee 401(k) contribution.

(26) Mr. della Sala is the President and Chief Executive Officer of Foster Wheeler Italiana S.p.A. and Chairman and Chief Executive Officer of Foster Wheeler Continental Europe S.r.l. On June 23, 2005, he became the Chief Executive Officer of the Foster Wheeler Global Engineering and Construction Group of the Company and an “Executive Officer” of the Company. Mr. della Sala's compensation is paid in euros. For salary, conversion to U.S. dollars is calculated with a blended rate representing an average of the exchange rates through 2005. For bonus, the exchange rate on the date on which Mr. della Sala's bonus was approved by the Compensation Committee is used.

(27) On August 8, 2005, Mr. della Sala was awarded 20,000 restricted stock units pursuant to the Foster Wheeler Management Restricted Stock Plan, and non-statutory stock options to acquire 169,000 common shares pursuant to the Foster Wheeler Ltd. 2004 Stock Option Plan. One-third of these units and one-third of these options vested on December 31, 2005, and the remaining two-thirds of the share units and options will vest on December 31, 2006.

(28) Mr. Ganz joined the Company on October 10, 2005. His annual base salary is $425,000. Annual salary shown in the table reflects payment from October 10, 2005 to December 31, 2005 and includes the amount of $4,530 which is attributable to an increase in salary due to the discontinuance by the Company in 2005 of its program for providing company vehicles to certain eligible employees.

(29) Mr. Ganz received a $500,000 signing bonus in October 2005 when he joined the Company. $126,449 represents short term bonus compensation for 2005.

(30) On October 24, 2005 Mr. Ganz was granted 17,417 restricted shares pursuant to an Inducement Award as provided by his employment agreement. Mr. Ganz ‘s employment agreement provided for a grant of restricted stock valued at $521,645 based upon the market price of the common shares on October 7, 2005. In addition, Mr. Ganz was awarded non-statutory stock options, on October 10, 2005, to acquire 52,165 common shares pursuant to the Foster Wheeler Ltd. 2004 Stock Option Plan. One-third of these shares and one-third of these options vested on December 31, 2005, and the remaining two-thirds of the shares and options will vest on December 31, 2006.

43

Options Granted

Following is a table dealing with stock option grants which were made to named executive officers during the last completed fiscal year.

| | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | | Number of

Securities

Underlying

Options

Granted (#)* | | % of Total

Options

Granted to

Employees in

Fiscal Year* | | Exercise or

Base Price

($/Share)* | | Expiration

Date | | Grant Date

Present Value(1)

($) | |

| | |

| |

| |

| |

| |

| |

R.J. Milchovich | | | | 0 | | | | | 0 | % | | | | — | | | — | | | | | — | | |

B.H. Cherry | | | | 0 | | | | | 0 | % | | | | — | | | — | | | | | — | | |

J. T. La Duc | | | | 0 | | | | | 0 | % | | | | — | | | — | | | | | — | | |

U. della Sala | | | | 169,000 | | | | | 76 | % | | | $ | 23.20 | | | 08/07/2008 | | | | $ | 1,480,440 | | |

P. J. Ganz | | | | 52,165 | | | | | 24 | % | | | $ | 29.95 | | | 10/09/2008 | | | | $ | 565,990 | | |

| |

* | The named individuals were granted options pursuant to the Company’s 2004 Stock Option Plan. One-third of the options vested on December 31, 2005 and the remaining two-thirds vest on December 31, 2006. |

(1) Based on the Black-Scholes options pricing model, using the following assumptions:

| | |

| (i) | the option exercise price as shown in the table is the average of the high and the low price of the common shares on the date the option was granted. |

| (ii) | the dividend yield of the common shares was assumed to be zero, |

| (iii) | the expected term of the options is three years from the date of issue, |

| (iv) | the risk free rate of return for each option was determined based on the interest rate on the date that the option was granted, on Treasury securities with a maturity equal to the expected term of the option, and |

| (v) | the expected volatility of the common shares was calculated after consideration of (a) unadjusted historical volatility of Foster Wheeler’s common share pricing data for the period commensurate with the expected life of the options as of the date of option grant (b) the historical volatility of Foster Wheeler’s common share pricing data for the period commensurate with the expected life of the options as of the date of option grant, adjusted to remove the common share pricing date for the two-year period of restructuring activities commencing in January 2003, and (c) volatility of comparable “restructured” companies. |

| |

| The values shown are theoretical and do not necessarily reflect the actual values the recipients may eventually realize. Any actual value to the officer or other employee will depend on the extent to which market value of the Company’s common shares at a future date exceeds the exercise price. |

44

Aggregate Option Exercises

The following table sets forth, for the named individuals, the number of shares of Foster Wheeler common shares acquired upon option exercise during 2005, the value realized (spread between the market price on the date of exercise and the option price) as a result of such option exercises, and the number and value of unexercised options (both exercisable and unexercisable) as of December 30, 2005, under the 1995 Stock Option Plan of Foster Wheeler Inc., the Foster Wheeler Ltd. 2004 Stock Option Plan or inducement option grants.

| | | | | | | | | | | | | |

Name | | Shares

Acquired on

Exercise (#) | | Value

Realized ($) | | Number of Securities

Underlying Unexercised

Options at

December 30, 2005 (#)

Exercisable/

Unexercisable | | Value of Unexercised

In-the-Money Options at

December 30, 2005 ($)

Exercisable/

Unexercisable | |

R. J. Milchovich | | | 127,945 | | $ | 2,793,346 | | | 349,559/789,008 | | | $7,075,129/$20,801,273 | |

B. H. Cherry | | | 0 | | | 0 | | | 10,150/353,053 | | | $81,595/$9,411,598 | |

J. T. La Duc | | | 0 | | | 0 | | | 0/155,454 | | | 0/$4,206,119 | |

U. della Sala | | | 0 | | | 0 | | | 6,350/291,148 | | | $21,810/$5,541,673 | |

P. J. Ganz | | | 0 | | | 0 | | | 0/52,165 | | | 0/$338,290 | |

Long-Term Incentive Plans-Awards in Last Fiscal Year

No long-term incentive cash awards were granted by the Company for the fiscal year 2005. Presently, there is no plan which provides for long-term cash incentive awards.

Defined Benefit Plans

The Company maintains a qualified non-contributory final average pay defined benefit Pension Plan for covered employees of the Company. On May 31, 2003, the Pension Plan was frozen and no further service or benefit accruals will occur. Annual payments under the Pension Plan will be made based on years of service as of May 31, 2003. Because annual payouts under the Pension Plan can be determined at this time with respect to each named executive officer, and because the Pension Plan payouts for other employees will not depend upon years of service at retirement, we have provided the information below. The following chart indicates the frozen service and annual qualified Pension Benefit on a Life Annuity basis, payable at normal retirement age of 65 for the officers listed.

| | | | |

Officer | | Years of Service Used to Calculate

Pension Payments | | Annual Pension Payment |

| |

| |

|

Raymond J. Milchovich

| |

Please see the pension benefit provided to Mr. Milchovich under “Employment Agreements”

|

Bernard H. Cherry | | No Pensionable Service or Benefit | | |

Peter J. Ganz | | No Pensionable Service or Benefit | | |

John T. La Duc | | No Pensionable Service or Benefit | | |

Umberto della Sala | | (1) | | (1) |

45

(1) Mr. della Sala’s terms of employment are governed by Italian law and a national collective bargaining agreement which is negotiated at a national level. He is not subject to a Foster Wheeler pension plan. Upon retirement he will receive a pension pursuant to Italian law. Normal age of retirement in Italy is age 65.

Employment Agreements

Share information in the following discussion has been adjusted for the 1–for–20 reverse share split (“Reverse Share Split”) which was approved by Shareholders on November 29, 2004.

Raymond J. Milchovich Employment Agreement

Mr. Milchovich entered into an employment agreement with the Company effective October 22, 2001, which expires on October 21, 2006. The Company expects a new employment agreement to be negotiated with Mr. Milchovich prior to this expiration date. Mr. Milchovich serves as Chairman, President and Chief Executive Officer of the Company. Pursuant to terms of the agreement, his salary is reviewed on each anniversary date with increases on such date or other agreed date to be not less than the average increase for the Company’s salaried workforce. On January 25, 2005, the Compensation Committee and the Board of Directors approved an Amendment to Mr. Milchovich’s Employment Agreement whereby his salary for 2005 was increased to $900,000 and the multiplier for the calculation of Mr. Milchovich’s Annual Bonus, as defined in the Employment Agreement, was changed from 80% to 100% effective for 2005.

Mr. Milchovich’s agreement, as amended, establishes an annual target bonus equal to 100% of base salary which will be payable should the Company achieve 100% of target objectives which are approved by the Compensation Committee of the Board of Directors. The 2005 objectives upon which the incentive plan is based include earnings, cash flow, bookings and other factors that impact the Company’s performance both near and longer term. If these objectives are exceeded, Mr. Milchovich may receive an award up to three times the aforementioned target. For the objectives used to determine Mr. Milchovich’s bonus for 2005, see the Compensation Committee Report on Executive Compensation.

Under the terms of his employment agreement, Mr. Milchovich received an option to purchase 65,000 common shares of the Company. These were granted at an exercise price of $99.70 and vest 20% each year over the term of the agreement. As indicated above, the foregoing number of options and the exercise price have been adjusted for the 1–for–20 Reverse Share Split which was approved by Shareholders on November 29, 2004. Pursuant to an amendment to the agreement dated September 13, 2002, additional options that would have been granted to Mr. Milchovich on the first and second anniversaries of his employment were accelerated and granted September 24, 2002. The amended grant provided for an option to purchase a number of shares such that the Black Scholes value of the option on the grant date equaled $5 million; provided that the number of shares was not less than 35,000 or more than 50,000. Based on the foregoing calculation, on September 24, 2002, Mr. Milchovich received an option to purchase 50,000 common shares of the Company at an exercise price of $32.80. Again, the number of options and the exercise price have been adjusted for the Reverse Share Split. A portion of the option representing one-forty-eighth (1/48) of the number of shares represented by such option vested on the date of grant and on the first day of each successive

46

month thereafter. The option exercise price was established by calculating the median of the high and low price of the Company’s common shares on the grant date.

Mr. Milchovich received a signing bonus in the amount of $500,000 on October 22, 2001. In the event he voluntarily terminated employment without “good” reason or was terminated by the Company for “cause” (both as defined in the agreement) prior to his first anniversary date, he would have been required to repay to the Company the after-tax amount of this payment. In addition, Mr. Milchovich received relocation assistance to the New Jersey area including an equity buyout related to his home so as to expedite the relocation process.

Mr. Milchovich’s agreement provides that the Company will pay to Mr. Milchovich a retirement benefit equal to the projected retirement benefit he would have received at the end of the five-year term had he remained with his previous employer less any benefit he actually receives from his previous employer at termination therefrom. Under the agreement, the total obligation of the Company was limited to $4.333 million, which was supported by a Letter of Credit funded 50% upon the effective date of the agreement and in quarterly increments thereafter. Pursuant to an amendment to the agreement dated January 23, 2003, the Company agreed to monetize the retirement benefit periodically during the life of Mr. Milchovich’s employment agreement. As a result, a single lump sum payment was made to Mr. Milchovich in the gross amount of $1,082,500 on February 6, 2003. Beginning on April 21, 2003, and on the twenty-first day of each calendar quarter thereafter, Mr. Milchovich has been receiving a lump sum payment of $216,500 less applicable withholding taxes. Under the amended agreement, the total future obligation of the Company as of December 31, 2005 is $866,000. In the event Mr. Milchovich’s employment is terminated prior to the fifth anniversary of the effective date of his employment contract by the Company with cause or by the executive without good reason, Mr. Milchovich shall promptly repay to the Company in a single lump sum payment the gross amount of the payments made to that date.

Upon termination of employment by the Company without cause, by Mr. Milchovich for good reason, or because of death or disability, Mr. Milchovich is entitled to receive a single lump sum payment of the unpaid balance of the Company’s obligation under the amended agreement and may immediately draw upon the letter of credit for the quarterly installment payment then due. In the event Mr. Milchovich separates from employment before the fifth anniversary of the date of this agreement, Mr. Milchovich’s employment is terminated with cause or Mr. Milchovich terminates his employment without good reason, Mr. Milchovich would be required to promptly repay the gross amount of the payments made to him in a single lump sum payment.

The agreement provides that in the event of termination during the term by the Company without cause or by the executive for good reason or by virtue of the executive’s death or by virtue of continuing disability, the Company will continue payments on a monthly basis for 24 months in an amount equal to the base salary plus the target bonus opportunity. In the case of disability, such payments would be offset by any insurance payments that may be due. Further, any granted but unexercised stock options shall become vested and exercisable for the period commencing the date of termination through the second anniversary thereof.

If Mr. Milchovich is terminated without cause during the 30 days commencing twelve months after a Change of Control, as defined in the agreement, he shall be entitled to a lump sum payment equal to three years’ salary plus target bonus, continuation of health and welfare benefits plus perquisites for a three-year period, vesting of any granted but unexercised stock

47

options with such options remaining exercisable through the second anniversary of termination, the payment for executive outplacement services, and a “gross up” payment to reimburse him for any excise tax which may be imposed as a result of such payment.

The Company and Mr. Milchovich executed an amendment to the employment agreement in July 2004, which provided that the equity-for-debt exchange offer, which was completed on September 24, 2004, would not be deemed a Change of Control for purposes of provisions relating to a termination of his employment for any reason during the 30-days following the twelve month anniversary of a Change of Control.

Employment Agreement for Bernard H. Cherry

Mr. Cherry entered into an employment agreement with the Company effective September 23, 2002, which expires upon the occurrence of his death, physical or mental disability or notice of termination for cause. Mr. Cherry will serve as President and Chief Executive Officer of Foster Wheeler North America Corp., (formerly Foster Wheeler Power Group, Inc.). Pursuant to the terms of the agreement, Mr. Cherry is entitled to a base salary to be reviewed by the Company on each anniversary date or other appropriate date when the salaries of executives at the executive’s level are normally reviewed. His base salary is currently $524,530.

Under the terms of the agreement, Mr. Cherry received an option to purchase 12,750 common shares of the Company on November 4, 2002. One-fifth of these options become exercisable after one year, two-fifths become exercisable after two years, three-fifths after three years, four-fifths after four years and all of the options are exercisable after five years from the date of grant. The exercise price was established by calculating the mean of the high and low price of the common shares on the date of grant. In addition, Mr. Cherry received an option to purchase 5,000 shares on December 23, 2003, priced at the fair market value on the first anniversary of the effective date pursuant to his employment agreement. Mr. Cherry’s option vests in quarterly increments with one-fourth of the option exercisable after one year, one-half exercisable after two years, three-fourths exercisable after three years, and all of the options exercisable after four years from the date of grant. Both of the above options expire ten years from the date of the grant.

Mr. Cherry’s employment agreement provided for an annual incentive bonus target of 70% of base salary up to a maximum of 210% of base salary based upon targeted business objectives as established by the Chief Executive Officer. In March 2005, the Compensation Committee approved an amendment to Mr. Cherry’s employment agreement whereby the annual incentive bonus target was changed from 70% of base salary to 85%, effective for 2005.

Mr. Cherry received a signing bonus in the amount of $500,000 on October 10, 2002. In the event he voluntarily terminated employment without “good” reason or was terminated by the Company for “cause” (both as defined in the agreement) prior to his first anniversary date, he would have been required to repay to the Company the after-tax amount of this payment.

Mr. Cherry is entitled to receive certain perquisites, including an allowance for an automobile, annual financial planning services, reimbursement on a one-time basis for legal expenses associated with estate planning, a facsimile machine at his home and an annual physical examination.

48

The agreement provides that in the event of any termination of Mr. Cherry’s employment, Mr. Cherry will be entitled to receive the following amounts: (a) Mr. Cherry’s annual base salary through the date of termination, (b) a balance of any earned but as yet unpaid annual bonus, (c) accrued but unpaid vacation pay, (d) any vested but not forfeited benefits to the date of termination under the employee benefit plans, (e) vested stock options, and (f) continuation of certain employee benefits.

In addition, the agreement provides that in the event of termination of employment during the term by the Company without cause or by Mr. Cherry for good reason, the Company will (a) continue payments on a monthly basis for twenty-four months in an amount equal to the base salary at the rate in effect on the date of termination (b) pay an annual cash incentive for the calendar year that includes Mr. Cherry’s Termination Date and the following calendar year equal to a percentage of the base salary which is the average percentage of base salaries paid as bonuses to the executives of the Company at Mr. Cherry’s level, (c) provide continued employee health and welfare benefit plan coverage for two years, and (d) provide career transition assistance. Further, in the event of termination of employment by the Company without cause or by Mr. Cherry for good reason within one year of the termination or retirement of the chairman of the Board of Directors who is chairman on the effective date, any granted but unexercised stock options shall become vested and exercisable for the period of two years commencing the date of termination.

The agreement provided for Mr. Cherry to receive relocation assistance to the New Jersey area.

Employment Agreement for John T. La Duc

Mr. La Duc entered into an employment agreement with the company effective April 14, 2004, which expires on April 14, 2007 or earlier upon the occurrence of his death, physical or mental disability, notice of termination for cause, resignation for good reason, termination without cause, or voluntary resignation. Mr. La Duc will serve as Executive Vice President and Chief Financial Officer and perform such duties consistent with the position. Pursuant to the terms of the agreement, Mr. La Duc is entitled to a base salary to be reviewed by the Company on each anniversary date or another appropriate date when the salaries of executives at the executive’s level are normally reviewed. Mr. La Duc’s current base salary is $464,000.

Mr. La Duc’s employment agreement provides for an annual incentive bonus target of 60% of base salary up to a maximum of 180% of base salary based upon targeted business objectives as established by the Chief Executive Officer. Mr. La Duc received a signing bonus in the amount of $166,250 on April 14, 2004. In the event he voluntarily terminated employment with the Company without good reason or was terminated by the Company for cause prior to his first anniversary date, he would have been required to repay the net, after-tax amount related to a $150,000 portion of the signing bonus.

The agreement also provides eligibility for annual stock option grants as determined by the Compensation Committee of the Board, restricted stock upon consummation of the equity-for-debt exchange offer (an award of such restricted stock was granted in 2004), and an annual five-week paid vacation period. Mr. La Duc is entitled to participate in the benefit plans of the company and is entitled to receive certain perquisites, including an allowance for an automobile,

49

annual financial planning services, reimbursement on a one-time basis for legal expense associated with estate planning, a facsimile machine for use at home and an annual physical examination.

The agreement also provides that in the event of any termination of Mr. La Duc’s employment, he will be entitled to receive the following amounts: (a) annual base salary through the date of termination, (b) a balance of any earned but as yet unpaid annual bonus, (c) accrued but unpaid vacation pay, (d) any vested but not forfeited benefits to the date of termination under the Company’s employee benefit plans, and (e) continuation of certain employee benefits pursuant to the terms of the Company’s employee benefit plans.

The agreement provides that in the event of termination of employment during the term by the Company without cause, or by Mr. La Duc for good reason, the Company will, in addition to paying the above amounts provide to Mr. La Duc, (a) the base salary at the rate in effect on the date of termination payable on a monthly basis for twenty-four months, (b) an annual cash incentive for the calendar year that includes Mr. La Duc’s Termination Date and the following calendar year equal to a percentage of the base salary which is the average percentage of base salaries paid as bonuses to the executives of the Company at Mr. La Duc’s level, (c) continued employee health and welfare benefit plan coverage for two years at active employee levels and costs, (d) removal of all restrictions from restricted stock, (e) vesting of stock options, and (f) career transition services not to exceed $8,000.

Employment Agreement for Peter J. Ganz

Mr. Ganz entered into an employment agreement with the company effective October 10, 2005, which terminates upon the occurrence of his death, physical or mental disability, notice of termination for cause, resignation for good reason, termination without cause, or voluntary resignation. Under the agreement, Mr. Ganz serves as Executive Vice President and General Counsel and is to perform duties consistent with this position. Mr. Ganz is entitled to a base salary to be reviewed by the Company on each anniversary date or another appropriate date when the salaries of executives at the executive’s level are normally reviewed. Mr. Ganz’s initial base salary under the agreement is $425,000.

Mr. Ganz’s employment agreement provides for an annual incentive bonus target of 70% of base salary up to a maximum of 210% of base salary based upon targeted business objectives as established by the Chief Executive Officer. Mr. Ganz received a signing bonus in the amount of $500,000 on October 10, 2005. In the event he voluntarily terminates employment with the Company without good reason or is terminated by the Company for cause prior to his first anniversary date, he is required to repay a pro-rata portion of the signing bonus based on the number of days he is employed.

The agreement also provides eligibility for annual stock option grants as determined by the Compensation Committee of the Board, a grant of restricted stock valued at $521,645 based on the market price of the common shares on October 7, 2005, and a grant of options for 52,165 common shares at an exercise price equal to the average of the high and low market prices for the common shares on October 7, 2005. One-third of the restricted stock vested on December 31, 2005 and the remaining two-thirds vests on December 31, 2006, subject to the terms of the restricted stock award agreement. The options have a term of three years and expire on October 9, 2008. One-third of the total number of shares subject to the options vested on December 31,

50

2005, and two-thirds of the total number of shares subject to the options shall vest and become exercisable on December 31, 2006. Mr. Ganz is entitled to participate in the benefit plans of the company and is entitled to receive certain perquisites, including an allowance for an automobile, annual financial planning services, reimbursement on a one-time basis for legal expense associated with estate planning, a facsimile machine for use at home and an annual physical examination.

The agreement also provides that in the event of any termination of Mr. Ganz’s employment, he will be entitled to receive the following amounts: (a) annual base salary through the date of termination, (b) a balance of any earned but as yet unpaid annual bonus, (c) accrued but unpaid vacation pay, (d) any vested but not forfeited benefits to the date of termination under the Company’s employee benefit plans, and (e) continuation of certain employee benefits pursuant to the terms of the Company’s employee benefit plans.

The agreement provides that in the event of termination of employment during the term by the Company without cause, or by Mr. Ganz for good reason, the Company will, in addition to paying the above amounts, provide to Mr. Ganz, (a) the base salary at the rate in effect on the date of termination payable on a monthly basis for twenty-four months, (b) an annual cash incentive for the calendar year that includes Mr. Ganz’s Termination Date and the following calendar year equal to a percentage of the base salary which is the average percentage of base salaries paid as bonuses to the executives of the Company at Mr. Ganz’s level, (c) continued employee health and welfare benefit plan coverage for two years at active employee levels and costs, (d) removal of all restrictions from restricted stock and (e) career transition services not to exceed $8,000.

Umberto della Sala - Italian Law and National Collective Bargaining Agreements

For the salary, bonus and other compensation paid to Mr. della Sala, see the Summary Compensation Table. We have entered into a letter agreement with Mr. della Sala providing that he is to serve as a Manager for the Company. Many terms of Mr. della Sala’s employment are mandated by Italian law and a national collective bargaining agreement which is negotiated at a national level, beyond the control of any particular employer, between the unions of a particular business sector and the employers’ association in the applicable sector. Italy’s National Collective Contract of Employment for Upper Managers in Manufacturing and Service Companies (the “Agreement”), effective January 1, 2004, terminates on December 31, 2008. It provides, among other things, that:

| | |

| • | executives are entitled to minimum gross monthly salary and salary increases related to length of service; |

| • | executives’ yearly salaries are paid in 13 installments; |

| • | executives are not subject to working time schedules or overtime rules; |

| • | executives are entitled to 35 days of vacation per year; |

| • | for justified reasons, executives are entitled to an unpaid leave period; |

| • | in case of illness, the executives are entitled to maintain their position for a period of up to 12 months, during which they will receive their full salary (with the cost being fully borne by the employer); |

| • | executives are entitled to mandatory paid maternity leave; |

| • | executives are entitled to insurance coverage for on- and off-duty accidents; and |

51

| | |

| • | executives are entitled to indemnification for any civil and criminal liabilities incurred by the executives in the performance of their employment activities. |

In addition, the Agreement provides that following a merger, executives are entitled to resign without notice for three months from the date of the merger, regardless of any detriment in their working conditions.

The Agreement also regulates the severance benefits payable upon any termination of employment by the employer, as generally described below:

| | |

| • | If there is a termination for cause, the executive would not be entitled to any notice period, but he would be entitled to receive severance compensation. Cause would include events such as theft, riots and serious insubordination. |

| | |

| • | If there is a termination other than for “cause,” the executive would be entitled to a notice period. The notice period is equal to eight months for executives having a seniority of up to two years, and it is increased in proportion to seniority up to a maximum of 12 months for executives having more than 10 years of seniority. |

| | |

| • | If there is a termination without cause or “justified reasons” under Italian law, the executive might challenge the dismissal in court. If the termination of the employment relationship is deemed unlawful by a court, the executive may be awarded damages up to a maximum amount of 22 months’ salary. An executive is never entitled to reinstatement, regardless of the cause of termination. |

Change-in-Control Arrangements

Other than the provisions which have been outlined for Mr. Milchovich and Mr. della Sala, the Company entered into change of control employment agreements (the “Agreements”) with Messrs. Bernard H. Cherry, Peter J. Ganz and John T. La Duc. The Agreement with Mr. Cherry was entered into on November 4, 2002. The agreement with Mr. Ganz was entered into on October 10, 2005. The agreement with Mr. La Duc was entered into on April 14, 2004. The Agreements provide that if, within three years of a “change of control”, as defined in the Agreements, Foster Wheeler Inc. terminates an Executive’s employment other than for “cause” (defined as failure to perform the Executive’s duties or engaging in illegal or gross misconduct) or disability or if the Executive terminates employment for “good reason,” (defined as diminution of duties or responsibilities, Foster Wheeler Inc.’s failure to compensate the Executive, a change in workplace, Foster Wheeler Inc.’s purported termination of the Agreements or failure to comply with the Agreements), the Executive will be entitled to receive a lump sum cash payment of the following amounts: (a) the Executive’s base salary through the date of termination, plus (b) a proportionate annual bonus, plus (c) unpaid deferred compensation and vacation pay. Messrs. Cherry, Ganz and La Duc will also be entitled to receive a lump sum cash payment of three times the sum of the Executive’s base salary and the highest annual bonus.

The Agreements also provide for a five-year continuation of certain employee welfare benefits and a lump sum payment equal to the actuarial value of the service credit under Foster Wheeler Inc.’s qualified retirement plans the Executive would have received if the Executive had remained employed for three years after the date of the Executive’s termination. Foster Wheeler Inc. will also provide the Executive with outplacement services. Finally, the Executive may

52

tender restricted stock (whether vested or not) in exchange for cash. However, if any payments to the Executive, whether under the Agreements or otherwise, would be subject to the “golden parachute” excise tax under Section 4999 of the Internal Revenue Code of 1986, as amended, Foster Wheeler Inc. will make an additional payment to put the Executive in the same after-tax position as if no excise tax had been imposed. Any legal fees and expenses arising in connection with any dispute under the Agreements will be paid by Foster Wheeler Inc. In addition, these Agreements also provide that after termination of employment with the Company, the Executives will not, without the prior written consent of the Company, disclose any secret or confidential information, knowledge or data relating to the Company to anyone other than the Company and persons designated by the Company.

Under the 1995 Stock Option Plan of Foster Wheeler Inc., the Executive has the right to surrender his or her options to Foster Wheeler Inc. and receive, in cash, the difference between the fair market value of the shares covered by the options and the exercise price of the options.

Under the 2004 Stock Option Plan and the Management Restricted Stock Plan and related agreements, the vesting of options and restricted shares accelerates so that the Executive will be able to exercise or acquire 100 percent of the shares then unvested immediately prior to consummation of the transaction.

Compensation Committee Interlocks and Insider Participation

The following directors have served on the Compensation Committee since January 1, 2005: Joseph J. Melone, Chairman, Diane Creel and James D. Woods. None of the members of the Compensation Committee are former or current officers or employees of Foster Wheeler or any of its subsidiaries.

53

Equity Compensation Plan Information

The following table sets forth, as of December 30, 2005, the number of securities outstanding under each of our stock option plans, the weighted-average exercise price of such options, and the number of options available for grant under such plans. The following table also sets forth, as of December 30, 2005, the number of restricted stock units granted pursuant to our Management Restricted Stock Plan.

| | | | | | | | | | | | |

Plan category | | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights | | Weighted average

exercise price of

outstanding options,

warrants and rights

($) | | Number of securities

remaining available for

future issuance

(excluding securities

reflected in column

(a)) | |

| |

| |

| |

|

|

| | (a) | | (b) | | (c) | |

Equity compensation plans approved by security holders | | | | | | | | | | | | |

| | | | | | | | | | | | |

1995 Stock Option Plan | | | | 211,877 | | $ | 244.29 | | | | 49,698 | |

| | | | | | | | | | | | |

Directors Stock Option Plan | | | | 10,250 | | $ | 374.29 | | | | 8,200 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Directors Deferred Compensation Program | | | | — | | $ | 0.00 | | | | 12,321 | |

| | | | | | | | | | | | |

Equity compensation plans not approved by security holders | | | | | | | | | | | | |

| | | | | | | | | | | | |

Raymond J. Milchovich (1) | | | | 115,000 | | $ | 70.61 | | | | — | |

| | | | | | | | | | | | |

Bernard H. Cherry (2) | | | | 17,750 | | $ | 28.19 | | | | — | |

| | | | | | | | | | | | |

M.J. Rosenthal & Associates, Inc. (3) | | | | 12,500 | | $ | 37.60 | | | | — | |

| | | | | | | | | | | | |

2004 Stock Option Plan (4) | | | | 2,929,133 | | $ | 10.59 | | | | 610,287 | |

| | | | | | | | | | | | |

Management Restricted Stock Plan (Units)(5) | | | | 578,567 | | $ | 0.00 | | | | 28,221 | |

| | | | | | | | | | | | |

| |

|

|

| |

|

| |

|

|

|

|

Total | | | | 3,875,077 | | $ | 27.70 | | | | 708,727 | |

| |

|

|

| |

|

| |

|

|

|

|

(1) Under the terms of his employment agreement, Mr. Milchovich received an option to purchase 65,000 of our common shares on October 22, 2001. This option was granted at an exercise price of $99.70 and vests 20% each year over the five-year term of the agreement. Pursuant to an amendment to his employment agreement dated September 13, 2002, additional options that would have been granted to Mr. Milchovich on the first and second anniversaries of his employment were accelerated and granted September 24, 2002. The amended grant was for an option to purchase a number of shares such that the Black-Scholes value of the option on the

54

grant date equaled $5 million; provided that the number of shares was not less than 35,000 or more than 50,000. Based on such calculation, Mr. Milchovich received an option to purchase 50,000 of our common shares at an exercise price of $32.80. A portion of the option representing one-forty-eighth (1/48) of the number of shares represented by such option vested on the date of grant and on the first day of each successive month thereafter. The option exercise price is equal to the median of the high and low price of our common shares on the grant date. Each option has a term of 10 years from the date of grant.

(2) Under the terms of his employment agreement, Mr. Cherry received an option to purchase 12,750 of our common shares on November 4, 2002. This option was granted at an exercise price of $29.80 and vests 20% per year on each anniversary date of grant. One-fifth of these options become exercisable after one year, two-fifths become exercisable after two years, three-fifths after three years, four-fifths after four years and all of the options are exercisable after five years. Mr. Cherry also received an option to purchase 5,000 of our common shares on December 23, 2003 under the terms of his employment agreement. This option will vest one-fourth on each anniversary date of grant and be fully exercisable after four years from the date of grant. The exercise price is equal to the mean of the high and low price of our common shares on the first anniversary of his employment agreement effective date at a price of $24.10. Each option has a term of 10 years from the date of grant.

(3) Under the terms of the consulting agreement with M.J. Rosenthal & Associates, Inc. on May 7, 2002, we granted a nonqualified stock option to purchase 12,500 of our common shares at a price of $37.60 with a term of 10 years from the date of grant. The exercise price is equal to the mean of the high and low price of our common shares on the date of grant. The option is exercisable on March 31, 2003. The option, to the extent not then exercised, shall terminate upon any breach of certain covenants contained in the consulting agreement.

(4) Under the terms of the 2004 Stock Option Plan, adopted by the Board of Directors in September 2004, management was granted stock options to purchase approximately 43,103 preferred shares at an exercise price of $9.378 per common share on October 6, 2004. Such options expire on October 5, 2007. One third of the options issued to management vested in the fourth quarter of 2005, and the balance are scheduled to vest during the fourth quarter of 2006. On November 29, 2004, our shareholders approved the grant of options under the 2004 Stock Option Plan to purchase approximately 413 preferred shares to each of our non-employee directors at an exercise price of $9.378 per common share. Such options expire on October 5, 2007. The non-employee director options vested on December 31, 2005. On November 29, 2004, each option under the 2004 Stock Option Plan to purchase preferred shares granted to management and the non-employee directors automatically converted to an option to purchase 65 common shares at an exercise price of $9.378 per common share.

On August 8, 2005, Mr. della Sala was issued options under the 2004 Stock Option Plan to purchase 169,000 common shares at an exercise price of $23.20 per common share. Such options expire on August 7, 2008. One third of the options vested in the fourth quarter of 2005, and the balance are scheduled to vest during the fourth quarter of 2006. On October 10, 2005, Mr. Ganz was issued options under the 2004 Stock Option Plan to purchase 52,165 common shares at an exercise price of $29.95 per common share. Such options expire on October 9, 2008. One third of the options vested in the fourth quarter of 2005, and the balance are scheduled to vest during the fourth quarter of 2006. On November 8, 2005, each of our non-employee directors were issued options under the 2004 Stock Option Plan to purchase 7,343 common

55

shares at an exercise price of $29.675 per common share. Such options expire on September 30, 2010. The non-employee director options vest in one-twelfth increments until fully vested on September 30, 2006.

(5) Under the terms of the Management Restricted Stock Plan, adopted by the Board of Directors in September 2004, management was issued restricted common share awards, of which 531,899 were in the form of restricted share units, on October 6, 2004. The restricted share units do not have voting rights. Each restricted share unit will convert into an unrestricted common share upon vesting. The restricted awards provide that issued units may not be sold or otherwise transferred until restrictions lapse. One third of the restricted awards vested in the fourth quarter of 2005 and the balance are scheduled to vest during the fourth quarter of 2006. On November 29, 2004, our shareholders approved the grant of 18,065 restricted share units to each of our non-employee directors. The restricted share units awarded to non-employee directors vested on December 31, 2005.

On August 8, 2005, Mr. della Sala was issued 20,000 restricted common share units in accordance with the Management Restricted Stock Plan. One-third of the award vested in the fourth quarter of 2005 and the balance is scheduled to vest in the fourth quarter of 2006. On November 8, 2005, our non-employee directors were issued 8,603 restricted common share units in accordance with the Management Restricted Stock Plan. The award vests on September 30, 2006.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Mr. Victor A. Hebert is an attorney with the law firm of Heller Ehrman White & McAuliffe LLP and served as a director of Foster Wheeler Ltd. during 2003 until his resignation in November 2003. The law firm of Heller Ehrman White & McAuliffe was appointed to serve as the Company’s General Counsel in connection with the retirement of the Company’s general counsel, Thomas R. O’Brien. Mr. Hebert on behalf of Heller Ehrman was selected to lead the Company’s legal team and was the Assistant Secretary from November 10, 2003 until February 10, 2005 when Heller Ehrman ceased to serve as the general counsel and Mr. Hebert ceased to be the Assistant Secretary. The Company made payments to Heller Ehrman in the amount of $307,406 for all legal services provided by Heller Ehrman to the Company in 2005.

56

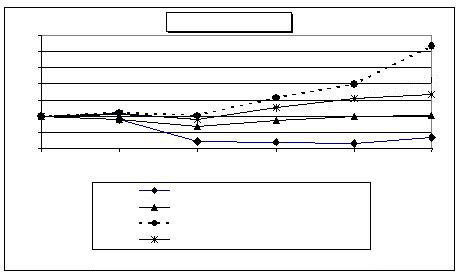

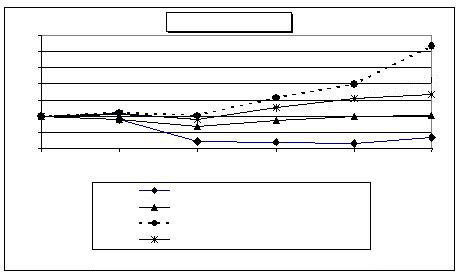

PERFORMANCE GRAPH

The stock performance graph below shows how an initial investment of $100 in Foster Wheeler common shares would have compared over a five-year period with an equal investment in (1) the S&P 500 Index and (2) an industry peer group index that consists of several companies (the “Peer Group”).

We have replaced the S&P Small Cap 600 Index, used in previous years, with the S&P 500 Index because we are no longer part of the S&P Small Cap 600 Index, and we believe that we are no longer considered to be a small cap stock. Pursuant to SEC rules, the performance graph includes data for the S&P Small Cap 600 Index.

Total Shareholder Return

$0

$50

$100

$150

$200

$250

$300

$350

Dec00

Dec01

Dec02

Dec03

Dec04

Dec05

FOSTER WHEELER

S&P 500

PEER GROUP

S&P SMALLCAP 600

In the preparation of the line graph, we used the following assumptions: (i) $100 was invested on December 29, 2000 in Foster Wheeler common shares, the S&P 500 Index, the S&P Small Cap 600 Index, and the Peer Group, (ii) dividends were reinvested, and (iii) the investment is weighted on the basis of market capitalization.

| | | | | | | | | | | | | | | | | | |

| | Years Ending | |

| | | |

| | Dec. 00 | | Dec. 01 | | Dec. 02 | | Dec. 03 | | Dec. 04 | | Dec. 05 | |

| |

| |

| |

| |

| |

| |

| |

Foster Wheeler (1) | | 100 | | 89.99 | | | 23.65 | | | 21.54 | | | 15.26 | | | 35.36 | | |

S&P 500 | | 100 | | 89.11 | | | 68.30 | | | 87.06 | | | 97.95 | | | 102.76 | | |

Peer Group (2) | | 100 | | 111.10 | | | 101.39 | | | 156.87 | | | 198.00 | | | 314.72 | | |

S&P Small Cap 600 (3) | | 100 | | 107.43 | | | 90.83 | | | 125.96 | | | 154.82 | | | 166.71 | | |

57

(1) In 2004, the Company completed an equity-for-debt exchange offer in which it issued common shares, preferred shares, warrants to purchase shares and new notes in exchange for certain of its outstanding debt securities and trust securities, and also completed a 1–for–20 reverse share split which was approved by Shareholders on November 29, 2004. The Company issued additional common shares in 2005 by completing two additional equity-for-debt exchanges.

(2) The following companies comprise the Peer Group: Fluor Corporation, Foster Wheeler Ltd., Jacobs Engineering Group Inc., Washington Group International, Inc. (formerly Morrison Knudsen), and McDermott International, Inc. On January 25, 2003, Washington Group International, Inc. emerged from Chapter 11 Bankruptcy protection and under the Plan of Reorganization Washington Group’s old common stock (WNGXQ) was canceled and new common stock was issued and distributed to lenders and creditors in accordance with the Plan. This group consists of companies that were compiled by the Company in 1996 and have been used since that time.

(3) On January 16, 2002, the Company was removed from the S&P Small Cap 600 Index. We will substitute this index with the S&P 500, a broad market equity index in future presentations.

58

PROPOSALS OF SHAREHOLDERS FOR THE 2007 ANNUAL MEETING

Under the bye-laws of Foster Wheeler, shareholders who wish to nominate persons for election to the Board of Directors must submit their nominations to the Company no later than December 5, 2006 to be considered at the 2007 Annual Meeting of Shareholders. Nominations must include certain information concerning the nominee and the proponent’s ownership of common shares of Foster Wheeler. SEC rules provide that if the Company changes the date of its 2007 Annual Meeting more than 30 days from the date of the 2006 Annual Meeting, this deadline will instead be a reasonable time before the Company begins to print and mail its proxy materials. Nominations not meeting these requirements will not be entertained at the annual meeting. The Secretary of Foster Wheeler Ltd. should be contacted in writing at Perryville Corporate Park, Clinton, New Jersey 08809-4000 to submit a nomination or to obtain additional information as to the proper form of a nomination.

A shareholder may otherwise propose business for consideration without seeking to have the proposal included in the Company’s proxy statement. For business to be properly brought before the 2007 Annual General Meeting, a shareholder must give timely notice thereof in proper written form to the Secretary of the Company. To be timely, a shareholder’s notice must be received by the Secretary at the Company’s principal executive offices not later than February 18, 2007. A shareholder’s notice to the Secretary must contain the matters specified in our bye-laws, a copy of which is filed as an exhibit to a Form 8-K dated November 29, 2004 as filed with the Securities and Exchange Commission on December 2, 2004. In addition, Bermuda law provides that Foster Wheeler Ltd. shareholders holding at least 5% of the total voting rights or 100 or more registered Foster Wheeler Ltd. shareholders together may require a proposal to be submitted to an annual general meeting if the proposal is deposited at the registered office of the Company not less than six weeks before the date of the meeting, unless the meeting is subsequently called for a date six weeks or less after the notice has been deposited. If timely notice is not given of a shareholder proposal, then the proxies named on the proxy cards distributed by Foster Wheeler for the annual meeting may use the discretionary voting authority granted them by the proxy cards if the proposal is raised at the meeting, whether or not there is any discussion of the matter in the proxy statement.

The Board of Directors is not aware of any matters that are expected to come before the annual meeting other than those referred to in this proxy statement. If other matters should properly come before the meeting, the persons named in the proxy intend to vote the proxies in accordance with their best judgment.

| | |

| | By Order of the Board of Directors |

| | LISA FRIES GARDNER |

April 6, 2006 | | Vice President and Secretary |

59

ANNEX A

PROPOSAL NO. 3

INCREASE IN AUTHORIZED NUMBER OF COMMON SHARES

SHAREHOLDER RESOLUTION

INCREASE OF AUTHORISED SHARE CAPITAL

RESOLVED:

That the authorised share capital of the Company be increased by 73,610,000 additional Common Shares of par value US$0.01 each.

ANNEX B

PROPOSAL NO. 4

FOSTER WHEELER LTD. OMNIBUS INCENTIVE PLAN

Annex B

| | Foster Wheeler Ltd. Omnibus Incentive Plan Effective _______________, 2006 | |

| | | |

| | | |

|

|

|

|

| | | | |

| Article 1. | Establishment, Purpose, and Duration | | 1 |

| | | | |

| Article 2. | Definitions | | 1 |

| | | | |

| Article 3. | Administration | | 9 |

| | | | |

| Article 4. | Shares Subject to This Plan and Maximum Awards | | 10 |

| | | | |

| Article 5. | Eligibility and Participation | | 12 |

| | | | |

| Article 6. | Stock Options | | 13 |

| | | | |

| Article 7. | Stock Appreciation Rights | | 16 |

| | | | |

| Article 8. | Restricted Stock and Restricted Stock Units | | 19 |

| | | | |

| Article 9. | Performance Units/Performance Shares | | 22 |

| | | | |

| Article 10. | Cash-Based Awards and Other Stock-Based Awards | | 25 |

| | | | |

| Article 11. | Forfeiture of Awards | | 28 |

| | | | |

| Article 12. | Transferability of Awards | | 29 |

| | | | |

| Article 13. | Performance Measures | | 29 |

| | | | |

| Article 14. | Director Awards | | 31 |

| | | | |

| Article 15. | Dividend Equivalents | | 31 |

| | | | |

| Article 16. | Beneficiary Designation | | 31 |

| | | | |

| Article 17. | Rights of Participants | | 32 |

| | | | |

| Article 18. | Change in Control | | 32 |

| | | | |

| Article 19. | Amendment, Modification, Suspension, and Termination | | 33 |

| | | | |

| Article 20. | Withholding | | 34 |

| | | | |

| Article 21. | Successors | | 34 |

| | | | |

| Article 22. | General Provisions | | 35 |

i

Foster Wheeler Ltd.

Omnibus Incentive Plan

|

Article 1.Establishment, Purpose, and Duration

1.1Establishment.Foster Wheeler Ltd., a Bermuda company (hereinafter referred to as the “Company”), establishes an incentive compensation plan known as the Foster Wheeler Ltd. Omnibus Incentive Plan (hereinafter referred to as the “Plan”), as set forth in this document. The Plan supercedes and replaces the Foster Wheeler Ltd. 1995 Stock Option Plan, the Directors Stock Option Plan, the 2004 Stock Option Plan, and the Management Restricted Stock Plan (the “Prior Plans”), except that the Prior Plans shall remain in effect until the awards granted under such plans have been exercised, forfeited, are otherwise terminated, or any and all restrictions lapse, as the case may be, in accordance with the terms of such awards.

This Plan permits the grant of Nonqualified Stock Options, Incentive Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Shares, Performance Units, Cash-Based Awards,and Other Stock-Based Awards.

This Plan shall become effective upon shareholder approval (the “Effective Date”) and shall remain in effect as provided in Section 1.3 hereof.

1.2Purpose of this Plan.The purpose of this Plan is to provide a means whereby designated Employees, Directors, and Third-Party Service Providers develop a sense of proprietorship and personal involvement in the development and financial success of the Company, and to encourage them to devote their best efforts to the business of the Company, thereby advancing the interests of the Company and its shareholders. A further purpose of this Plan is to provide a means through which the Company may attract able individuals to become Employees or serve as Directors or Third-Party Service Providers and to provide a means whereby those individuals upon whom the responsibilities of the successful administration and management of the Company are of importance, can acquire and maintain ownership of Shares, thereby strengthening their concern for the welfare of the Company.

1.3Duration of this Plan.Unless sooner terminated as provided herein, this Plan shall terminate ten (10) years from the Effective Date, e.g. on the day before the tenth (10th) anniversary of the Effective Date. After this Plan is terminated, no Awards may be granted but Awards previously granted shall remain outstanding in accordance with their applicable terms and conditions and this Plan’s terms and conditions. Notwithstanding the foregoing, no Incentive Stock Options may be granted more than ten (10) years after the earlier of: (a) adoption of this Plan by the Board, or (b) the Effective Date.

Article 2. Definitions

Whenever used in this Plan, the following terms shall have the meanings set forth below, and when the meaning is intended, the initial letter of the word shall be capitalized:

| | (a) | “Affiliate”shall mean any corporation or other entity (including, but not limited to, a partnership or a limited liability company) that is affiliated with the Company through stock or equity ownership or otherwise, and is designated as an Affiliate for purposes of this Plan by the Committee. |

| |

| | (b) | “Annual Award Limit”or“Annual Award Limits”have the meaning set forth in Section 4.3. |

| |

| | (c) | “Applicable Laws”means the legal requirements relating to the administration of equity plans or the issuance of share capital by a company, including under the laws of Bermuda, applicable U.S. state corporate laws, U.S. federal and applicable state securities laws, other U.S. federal and state laws, the Code, any stock exchange rules and regulations that may from time to time be applicable to the Company, and the applicable laws, rules and regulations of any other country or jurisdiction where Awards are granted under the Plan, as such laws, rules, regulations, interpretations and requirements may be in place from time to time. |

| |

| | (d) | “Award”means, individually or collectively, a grant under this Plan of Nonqualified Stock Options, Incentive Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Shares, Performance Units, Cash-Based Awards, or Other Stock-Based Awards, in each case subject to the terms of this Plan. |

| |

| | (e) | “Award Agreement”means either: (i) a written agreement entered into by the Company and a Participant setting forth the terms and provisions applicable to an Award granted under this Plan, or (ii) a written or electronic statement issued by the Company to a Participant describing the terms and provisions of such Award, including in each case any amendment or modification thereof. The Committee may provide for the use of electronic, Internet, or other non-paper Award Agreements, and the use of electronic, Internet, or other non-paper means for the acceptance thereof and actions thereunder by a Participant. |

| |

| | (f) | “Beneficial Owner”or“Beneficial Ownership”shall have the meaning ascribed to such term in Rule 13d-3 of the General Rules and Regulations under the Exchange Act. |

| |

| | (g) | “Board”or“Board of Directors”means the Board of Directors of the Company. |

| |

| | (h) | “Cash-Based Award”means an Award, denominated in cash, granted to a Participant as described in Article 10. |

| |

| | (i) | “Cause”means, unless otherwise specified in an applicable employment agreement between the Company and a Participant (for the avoidance of doubt, employment agreements entered into with Affiliates or Subsidiaries of the Company shall not be deemed to be employment agreements with the Company), with respect to any Participant: |

| |

| | | (i) | Conviction of a felony; |

| |

| | | (ii) | Actual or attempted theft or embezzlement of Company, any Subsidiary, or any Affiliate assets; |

| |

| | | (iii) | Use of illegal drugs; |

| |

2

| | | (iv) | Material breach of an employment agreement between the Company, Affiliate or Subsidiary, as the case may be, and the Participant that the Participant has not cured within thirty (30) days after the Company, Affiliate or Subsidiary, as applicable, has provided the Participant notice of the material breach which shall be given within sixty (60) days of the Company’s, Affiliate’s or Subsidiary’s, as applicable, knowledge of the occurrence of the material breach; |

| |

| | | (v) | Commission of an act of moral turpitude that in the judgment of the Committee can reasonably be expected to have an adverse effect on the business, reputation, or financial situation of the Company, any Subsidiary, or any Affiliate and/or the ability of the Participant to perform his or her duties; |

| |

| | | (vi) | Gross negligence or willful misconduct in performance of the Participant’s duties; |

| |

| | | (vii) | Breach of fiduciary duty to the Company, any Subsidiary, or any Affiliate; or |

| |

| | | (viii) | Willful refusal to perform the duties of the Participant’s titled position. |

| | | | |

| | (j) | “Change in Control”means, unless otherwise specified in an applicable employment agreement between the Company and a Participant (for the avoidance of doubt, employment agreements entered into with Affiliates or Subsidiaries of the Company shall not be deemed to be employment agreements with the Company), |

| | | | |

| | | (i) | The acquisition by any individual, entity, or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act) (a “Person”) of Beneficial Ownership of voting securities of the Company where such acquisition causes such Person to own twenty percent (20%) or more of the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of Directors (the “Outstanding Company Voting Securities”), provided, however, that for purposes of this paragraph (i), the following acquisitions shall not be deemed to result in a Change in Control: (A) any acquisition directly from the Company or any corporation or other legal entity controlled, directly or indirectly, by the Company, (B) any acquisition by the Company or any corporation or other legal entity controlled, directly or indirectly, by the Company, (C) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any corporation or other legal entity controlled, directly or indirectly, by the Company, or (D) any acquisition by any corporation pursuant to a transaction that complies with clauses (A), (B), and (C) of paragraph (iii) below; and provided, further, that if any Person’s Beneficial Ownership of the Outstanding Company Voting Securities reaches or exceeds twenty percent (20%) as a result of a transaction described in clause (A) or (B) above, and such Person subsequently acquires Beneficial Ownership of additional voting securities of the Company, such subsequent acquisition shall be treated as an acquisition that causes such Person to own twentypercent (20%) or more of the Outstanding Company Voting Securities; |

| | | | |

| |

3

| | | (ii) | Individuals who, as of the date hereof, constitute the Board (such individuals, the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the date hereof whose election, or nomination for election by the Company’s shareholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board; |

| |

| | | (iii) | The consummation of a reorganization, merger, amalgamation or consolidation or sale or other disposition of all or substantially all of the assets of the Company (“Business Combination”) or, if consummation of such Business Combination is subject to the consent of any government or governmental agency, the obtaining of such consent (either explicitly or implicitly by consummation); excluding, however, such a Business Combination pursuant to which (A) all or substantially all of the individuals and entities who were the Beneficial Owners of the Outstanding Company Voting Securities immediately prior to such Business Combination beneficially own, directly or indirectly, more than sixty percent (60%) of, respectively, the then outstanding shares of common stock and the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the corporation resulting from such Business Combination (including, without limitation, a corporation that as a result of such transaction owns the Company or all or substantially all of the Company’s assets either directly or through one or more subsidiaries) in substantially the same proportions as their ownership, immediately prior to such Business Combination of the Outstanding Company Voting Securities, (B) no Person (excluding any (x) corporation owned, directly or indirectly, by the Beneficial Owner of the Outstanding Company Voting Securities as described in clause (A) immediately preceding, or (y) employee benefit plan (or related trust) of the Company or such corporation resulting from such Business Combination, or any of their respective subsidiaries) Beneficially Owns, directly or indirectly, twenty percent (20%) or more of, respectively, the then outstanding shares of common stock of the corporation resulting from such Business Combination or the combined voting power of the then outstanding voting securities of such corporation except to the extent that such ownership existed prior to the Business Combination, and (C) at least a majority of the members of the board of directors of the corporation resulting from such Business Combination were members of the Incumbent Board at the time of the execution of the initial agreement, or of the action of the Board, providing for such Business Combination; or |

| |

| | | (iv) | Approval by the shareholders of the Company of a complete liquidation or dissolution of the Company. |

| |

4

| | (k) | “Change-in-Control Price”means the highest price per Share offered in conjunction with any transaction resulting in a Change in Control (as determined in good faith by the Committee if any part of the offered price is payable other than in cash) or, in the case of a Change in Control occurring solely by reason of events not related to a transfer of Shares, the highest Fair Market Value of a Share on any of the thirty (30) consecutive trading days ending on the last trading day before the Change in Control occurs. |

| |

| | (l) | “Code”means the U.S. Internal Revenue Code of 1986, as amended from time to time. For purposes of this Plan, references to sections of the Code shall be deemed to include references to any applicable regulations thereunder and any successor or similar provision, as well as any applicable interpretative guidance issued related thereto. |

| |

| | (m) | “Committee”means the Compensation Committee of the Board or a subcommittee thereof, or any other committee designated by the Board to administer this Plan. The members of the Committee shall be appointed from time to time by and shall serve at the discretion of the Board. If the Committee does not exist or cannot function for any reason, the Board may take any action under the Plan that would otherwise be the responsibility of the Committee. |

| |

| | (n) | “Company”means Foster Wheeler Ltd., a Bermuda company, and any successor thereto as provided in Article 21 herein. |

| |

| | (o) | “Covered Employee”means any key Employee who is or may become a “Covered Employee,” as defined in Code Section 162(m), and who is designated, either as an individual Employee or class of Employees, by the Committee within the shorter of: (i) ninety (90) days after the beginning of the Performance Period, or (ii) twenty-five percent (25%) of the Performance Period has elapsed, as a “Covered Employee” under this Plan for such applicable Performance Period. |

| |

| | (p) | “Director”means any individual who is a member of the Board of Directors of the Company and who is not an Employee. |

| |