Utilities of combination

DESCRIPTION OF UTILITIES

Number of Annual

Utility Customers Energy Sales

Black Hills Power 65,000 3.1 million MWH

Cheyenne Light (electric) 39,0000.9 million MWH

Cheyenne Light (gas) 33,0008.1 BCF

Subtotal, existing 137,000 4.0 million MWH

8.1 BCF

Colorado Electric ( ) 93,0002.0 million MWH

Colorado Gas ( ) 68,000 7.1 BCF

Kansas Gas ( ) 108,00022.5 BCF

Nebraska Gas ( ) 198,00018.0 BCF

Iowa Gas ( ) 149,000 27.3 BCF

Subtotal, new 616,000 2.0 million MWH

74.9 BCF

Total, combined 753,000 6.0 million MWH

83.0 BCF

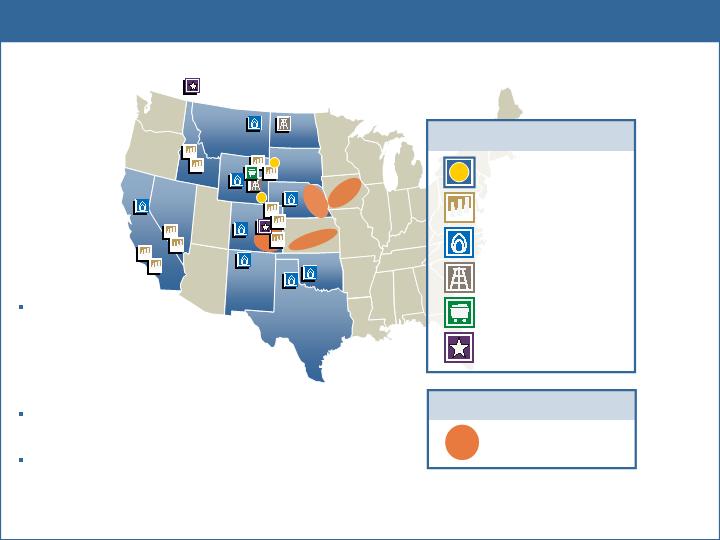

Seven adjoining states in

Midwest and Rockies with

similar demographics and

business environments

Proximity should permit some

consolidation of administrative

functions while retaining

quality of service

Cheyenne

Light

WY

CO

NE

KS

IA

Rapid City

Black Hills Power

SD

MT

– 9 –

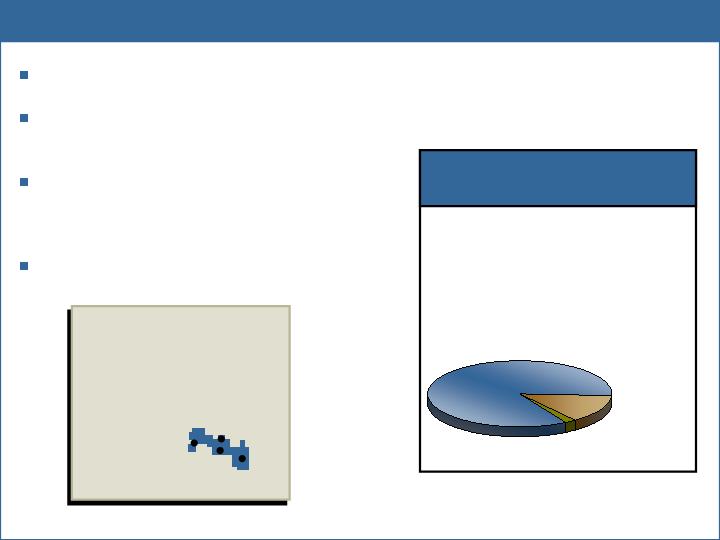

COLORADO ELECTRIC FACTS

(2005)

Annual sales volume 1,980GWh

Power generation 102MW

Power contracts 285 MW

Customers 93,000

Annual customer growth >3%

Customer mix

Residential

87%

Commercial

12%

Industrial

1%

Fountain

Pueblo

Rocky

Ford

Cañon

City

Colorado

Colorado electric properties

Territory is experiencing strong population

and load growth

Current RFP seeks 225 MW baseload and

140 MW intermediate and peaking energy

supply beginning in 2013

Potential to construct new coal-fired

power plant and to utilize our Colorado

gas-fired plants to serve long-term needs

and foster off-system sales opportunities

100% fuel and purchased power

pass-through

– 10 –

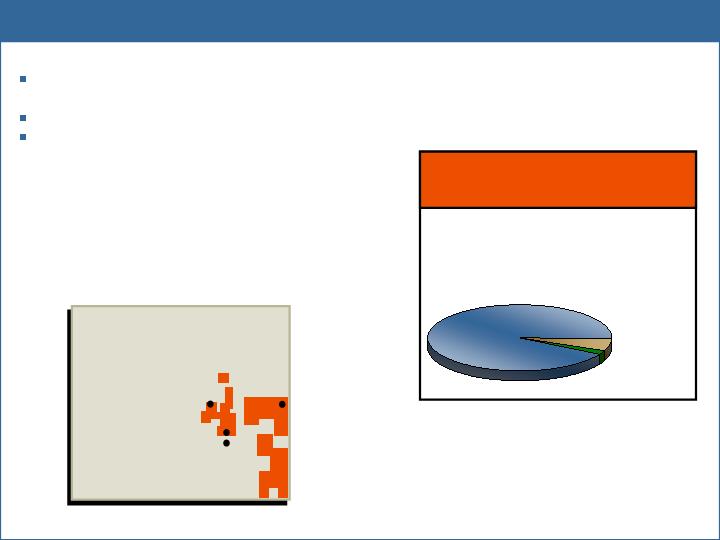

COLORADO GAS FACTS

(2005)

Annual sales volume 7Bcf

Customers 68,000

Annual customer growth >3%

Customer mix

Residential

94%

Commercial

6%

Industrial

1%

Colorado

Fountain

Pueblo

Burlington

Castle Rock

Colorado gas properties

Territory experiencing strong

population and customer growth

Proximity to existing Black Hills operations in Colorado

100% fuel pass-through

– 11 –

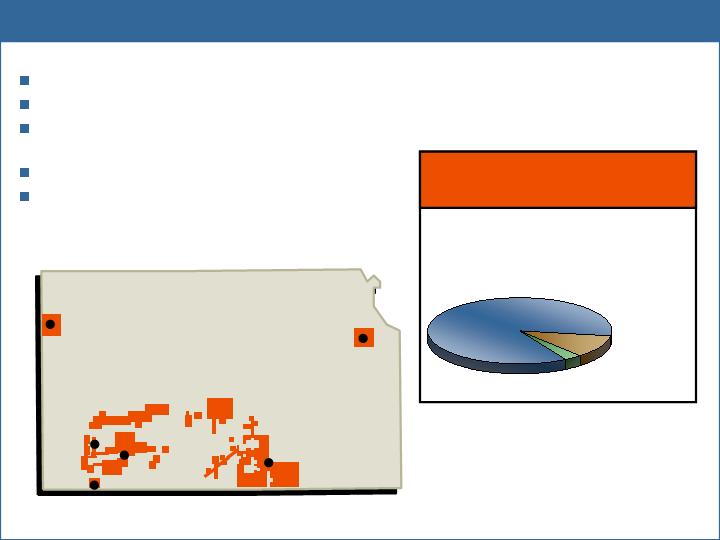

KANSAS GAS FACTS

(2005)

Annual sales volume 23Bcf

Customers 108,000

Annual customer growth < 1%

Customer mix

Residential

89%

Commercial

9%

Industrial

2%

Lawrence

Goodland

Wichita

Liberal

Garden

City

Dodge City

Kansas

Kansas gas properties

Stable customer counts

Stable cash flows

Rate case filed in November 2006

seeking $7.3 million increase

100% fuel cost pass-through

Other favorable regulatory treatment:

bad debt pass-through, decoupling and

weather normalization

– 12 –

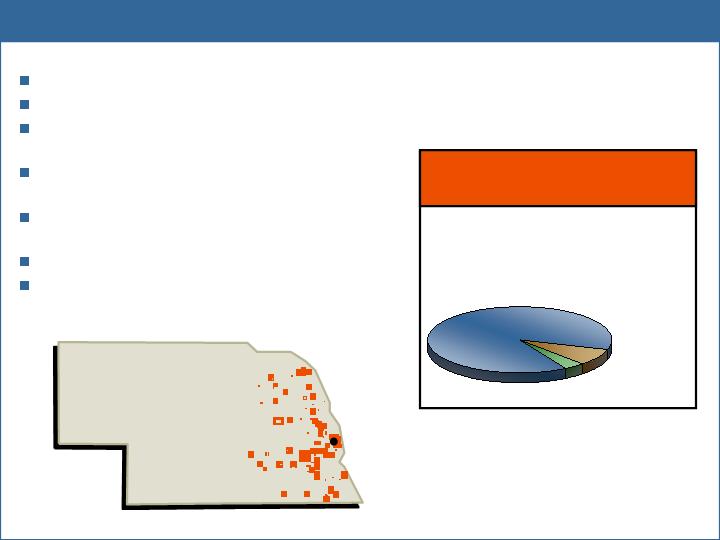

NEBRASKA GAS FACTS

(2005)

Annual sales volume 18Bcf

Customers 198,000

Annual customer growth < 1%

Customer mix

Residential

90%

Commercial

7%

Industrial – 3%

Nebraska gas properties

Stable customer counts

Attractive regulatory environment

Lincoln is also home to regional

customer service center

Omaha is headquarters for regional

gas operations center

Rate case filed in November 2006

seeking $16.3 million increase

100% fuel cost pass-through

Other favorable regulatory treatment:

bad debt pass-through and decoupling

York

Beatrice

Nebraska

Lincoln

Norfolk

Omaha

Blair

Columbus

Bellevue

Wayne

– 13 –

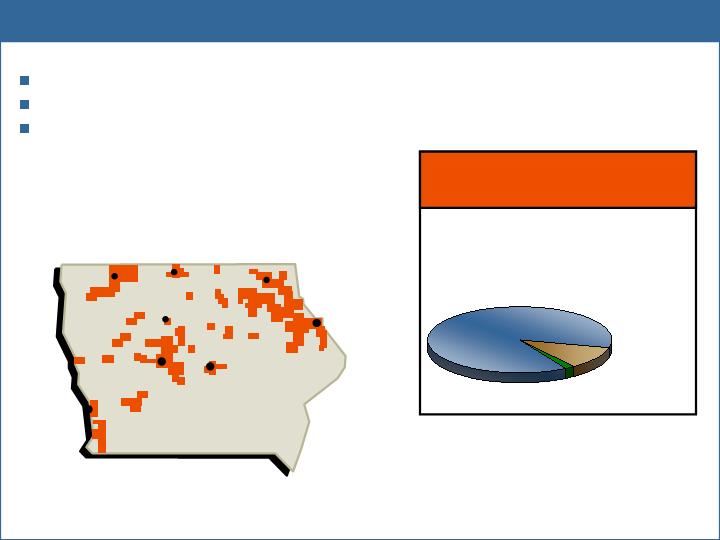

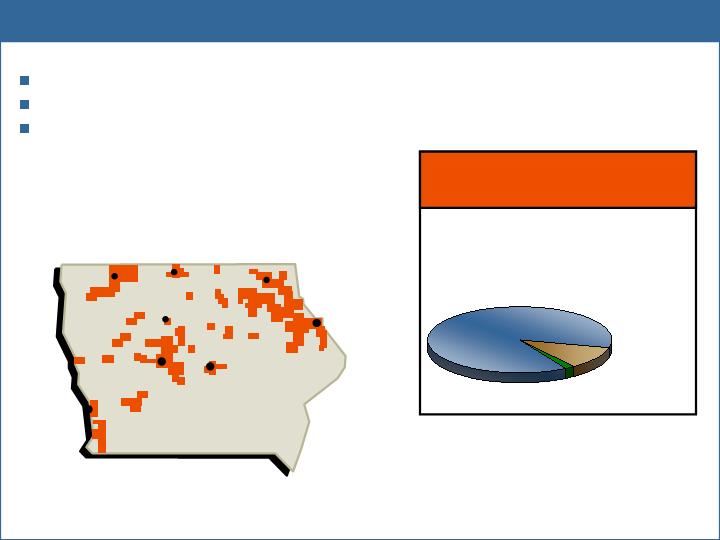

IOWA GAS FACTS

(2005)

Annual sales volume 27Bcf

Customers 149,000

Annual customer growth < 1%

Customer mix

Residential

89%

Commercial

10%

Industrial

1%

Iowa gas properties

Stable customer counts and cash flows

100% fuel cost pass-through

Other favorable regulatory treatment:

bad debt pass-through, decoupling and

weather normalization

Newton

West Des Moines

Spencer

Council

Bluffs

Forest City

Decorah

Dubuque

Dennison

Webster City

Iowa

– 14 –

Strategic rationale

Significant scale and scope expansion for Black Hills from utilities and

operations to be acquired

Acquisition represents about 93,000 electric and 523,000 gas customers

Operational efficiency with new resources and larger customer base

Opportunity to advance Black Hills’ relationship-based business approach and

reputation for superior customer service and satisfaction

Opportunity to benefit from workforce innovation, adaptability and

business practices

Lower overall business risk

Expanded utility operations provide more stable cash flows with

more predictable capital needs

Diversifies regulatory and geographic exposure with opportunity to build

upon Black Hills’ successful regulatory relationship-based approach

– 15 –

Financial rationale

More stable and predictable financial results

Earnings per share break-even expected after a year of transitional costs following transaction, with

EPS accretion beginning in second full year

Positive cash flows from operations expected immediately

We are acquiring earnings-producing assets only, with stable service territories

in Kansas, Nebraska and Iowa, and with higher growth in Colorado

Constructive regulatory environments; gas cost pass-throughs;

weather-normalization mechanisms

Longer-term upside earnings potential from customer growth and possible power generation

construction and integration in Colorado

Our intention will be to mirror our strategy at Cheyenne Light, where

we will be integrating generation as a rate-base asset later this year

Current Aquila RFP seeks 225 MW baseload and 140MW intermediate

and peaking energy supply beginning in 2013, and increasing to

290 MW /190 MW, respectively, by 2022

Potential to construct new coal-fired power plant and to utilize our three

existing Colorado gas-fired plants to serve long-term needs

– 16 –

Financing the acquisition

Initial bridge financing

Commitment for bridge credit facility obtained from bank syndicate, including

ABN AMRO, Credit Suisse, BMO Capital Markets, and Union Bank of CA

Targeted permanent financing

Equity contribution through stock offering;

Mandatory convertible securities offering;

Unsecured corporate debt;

Internally generated cash resources

May fund certain amounts prior to closing based on market conditions.

Logic of financing strategy

Balanced combination of financing sources retains investment-grade

corporate credit rating while

Accelerating accretive cash flow and earnings per share results.

– 17 –

Summary

A sound transaction – strategically, operationally and financially

Attractive, stable, geographically diverse assets with stable or

growing customer bases

Balanced financing strategy with access to capital markets at reasonable rates

Accretive to EPS after one year of transition costs

Improvement in overall corporate risk profile

Expansion of retail footprint and addition of rate-base assets assure

stable, predictable cash flows and earnings

Low integration risk:

– Experience with retail operations and customer care

– Familiarity with demographics and business environments of new states

– Commitment to relationship-based regulatory processes

Upside potential with vertical integration of electric properties

We are expert planners, builders and operators of power plants

We understand transmission systems and regulatory processes in region

We are committed to remaining an investment-grade Company as we grow

to serve more customers and communities and to build more value for

investors in responsible, safe and environmentally conscious ways.

– 18 –

INVESTOR RELATIONS

Mark T. Thies, Executive Vice President & CFO

Dale Jahr, Director of Investor Relations

625 Ninth Street Rapid City, SD 57701

605 721 2326 djahr@bh-corp.com

Please visit our web site for

up-to-date investor news

and information:

www.blackhillscorporation.com

Click on “Investor Relations”

and follow instructions to review,

download or print press releases,

SEC documents, recent presentations,

annual report and other publications.

– 19 –