SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x Preliminary Proxy Statement | ¨ Confidential, for Use of the Commission | |||

¨ Definitive Proxy Statement | ||||

¨ Definitive Additional Materials | ||||

¨ Soliciting Material Pursuant to § 240.14a-12 |

XenoPort, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

PRELIMINARY COPIES—SUBJECT TO COMPLETION

3410 Central Expressway

Santa Clara, California 95051

NOTICE OF THE 2014 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON , , 2014

To the Stockholders of XenoPort, Inc.:

NOTICEISHEREBYGIVEN that the 2014 annual meeting of stockholders of XENOPORT, INC., a Delaware corporation, will be held on , , 2014 at 8:00 a.m., local time, at the company’s offices located at 3410 Central Expressway, Santa Clara, California 95051 for the following purposes:

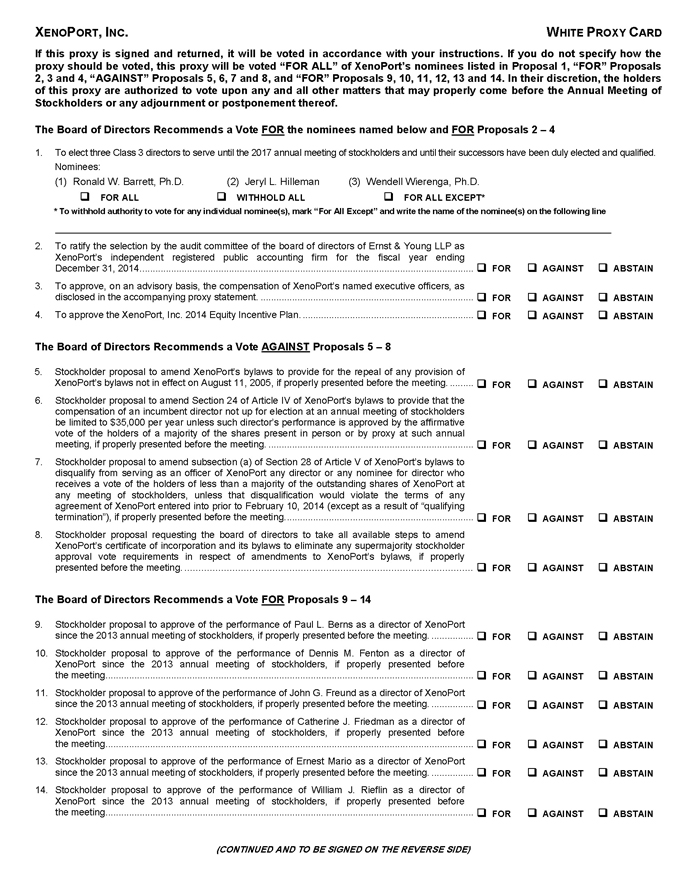

| 1. | To elect three Class 3 directors to serve until the 2017 annual meeting of stockholders and until their successors have been duly elected and qualified. |

| 2. | To ratify the selection by the audit committee of the board of directors of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2014. |

| 3. | To approve, on an advisory basis, the compensation of XenoPort’s named executive officers, as disclosed in the proxy statement accompanying this notice. |

| 4. | To approve the XenoPort, Inc. 2014 Equity Incentive Plan. |

| 5. | To consider a stockholder proposal to amend XenoPort’s bylaws to provide for the repeal of any provision of XenoPort’s bylaws not in effect on August 11, 2005, if properly presented before the 2014 annual meeting. |

| 6. | To consider a stockholder proposal to amend Section 24 of Article IV of XenoPort’s bylaws to provide that the compensation of an incumbent director not up for election at an annual meeting of stockholders be limited to $35,000 per year unless such director’s performance is approved by the affirmative vote of the holders of a majority of the shares present in person or by proxy at such annual meeting, if properly presented before the 2014 annual meeting. |

| 7. | To consider a stockholder proposal to amend subsection (a) of Section 28 of Article V of XenoPort’s bylaws to disqualify from serving as an officer of XenoPort any director or any nominee for director who receives a vote of the holders of less than a majority of the outstanding shares of XenoPort at any meeting of stockholders, unless that disqualification would violate the terms of any agreement of XenoPort entered into prior to February 10, 2014 (except as a result of “qualifying termination”), if properly presented before the 2014 annual meeting. |

| 8. | To consider a stockholder proposal requesting the board of directors to take all available steps to amend XenoPort’s certificate of incorporation and its bylaws to eliminate any supermajority stockholder approval vote requirements in respect of amendments to XenoPort’s bylaws, if properly presented before the 2014 annual meeting. |

| 9. | To consider a stockholder proposal to approve of the performance of Paul L. Berns as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting. |

| 10. | To consider a stockholder proposal to approve of the performance of Dennis M. Fenton as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting. |

| 11. | To consider a stockholder proposal to approve of the performance of John G. Freund as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting. |

| 12. | To consider a stockholder proposal to approve of the performance of Catherine J. Friedman as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting. |

| 13. | To consider a stockholder proposal to approve of the performance of Ernest Mario as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting. |

| 14. | To consider a stockholder proposal to approve of the performance of William J. Rieflin as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting. |

| 15. | To conduct any other business properly brought before the 2014 annual meeting. |

We refer to Proposals 5 through 14 as the “Clinton Group Proposals,” Proposals 5 through 7 as the “Clinton Group Bylaw Proposals,” Proposal 8 as the “Clinton Group Supermajority Vote Proposal,” and Proposals 9 through 14 as the “Clinton Group Director Performance Proposals.”

These items of business are more fully described in the proxy statement accompanying this notice.

The board of directors has fixed the close of business on April 15, 2014 as the record date for the determination of stockholders entitled to notice of, and to vote at, this annual meeting and at any postponement or adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on , 2014 at 8:00 a.m., local time, at XenoPort’s Offices Located at 3410 Central Expressway, Santa Clara, California 95051

The proxy statement and annual report to stockholders are available at

www.ViewOurMaterial.com/XNPT

We have received notice from one of our stockholders, the Clinton Relational Opportunity Master Fund L.P. (which we refer to in this proxy statement as the “Clinton Group”), stating that it intends to nominate its own slate of three director nominees for election as directors, as well as to present the Clinton Group Proposals for approval, at the 2014 annual meeting. We do not endorse the election of any of the Clinton Group nominees for director and recommend that you vote FOR XenoPort’s nominees. In addition, we do not favor the presentation or submission to a vote at the 2014 annual meeting of any of the Clinton Group Proposals. However, to show support for our board and to ensure that all of our directors receive the compensation to which they are entitled, we recommend that you vote in favor of each of the Clinton Group Director Performance Proposals. You may receive proxy solicitation materials from the Clinton Group or other persons or entities affiliated with the Clinton Group, including an opposition proxy statement or gold proxy card. We are not responsible for the accuracy of any information provided by or relating to the Clinton Group or its nominees contained in solicitation materials filed or disseminated by or on behalf of the Clinton Group or any other statements the Clinton Group may make. We urge you not to sign or return any gold proxy card sent to you by the Clinton Group. The only proposals presented by the Clinton Group that we recommend you vote FOR are the Clinton Group Director Performance Proposals (Proposals 9 through 14).

In selecting the director nominees that we are proposing for election in the attached proxy statement, your board of directors has focused on selecting a diverse group of experienced board candidates with strong credentials and relevant industry expertise who will work together constructively to execute XenoPort’s strategic plan for delivering long-term growth and stockholder value. Your board of directors is pleased to nominate for election as directors the three persons named in Proposal 1 in the attached proxy statement and on the enclosedWHITE proxy card.

Whether or not you plan to attend the 2014 annual meeting, please complete and sign the enclosedWHITE proxy card and return it in the enclosed addressed envelope (which is postage prepaid if mailed in the United States). Your promptness in returning theWHITE proxy card will assist in the expeditious and orderly processing of the proxy and will assure that you are represented at the annual meeting even if you cannot attend

the meeting in person. You may also vote by telephone or Internet by following the instructions on theWHITE proxy card. If you return yourWHITE proxy card or vote by telephone or Internet, you may nevertheless attend the annual meeting and vote your shares in person. Stockholders whose shares are held in the name of a broker or other nominee and who desire to vote in person at the meeting should bring with them a legal proxy.

Even if you have previously signed a proxy card sent to you by or on behalf of the Clinton Group, you have the right to change your vote by completing, signing and returning the enclosedWHITE proxy card in the addressed envelope provided or by following the instructions on theWHITE proxy card to vote by telephone or Internet. Only the latest proxy you submit will be counted.

We urge you to disregard any proxy card sent by or on behalf of the Clinton Group or any person other than XenoPort, Inc. Voting to withhold your vote with respect to the nominees on any proxy card that is circulated by the Clinton Group is not the same as voting for our director nominees, because a vote to withhold with respect to any of the nominees on an alternate proxy card will revoke any previous proxy submitted by you on theWHITE proxy card. Your vote is very important.

YOUR BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF XENOPORT’S DIRECTOR NOMINEES NAMED ON THE ENCLOSED WHITE PROXY CARD AND URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD SENT TO YOU BY OR ON BEHALF OF THE CLINTON GROUP OR TO VOTE FOR ANY OF THE CLINTON GROUP NOMINEES. YOUR BOARD ALSO RECOMMENDS A VOTE “FOR” PROPOSALS 2 THROUGH 4 AND 9 THROUGH 14, AND “AGAINST” PROPOSALS 5 THROUGH 8.

| By Order of the Board of Directors |

| GIANNA M. BOSKO |

| Secretary |

|

Santa Clara, California

April , 2014

If you have any questions, require assistance with voting yourWHITE proxy card,

or need additional copies of the proxy materials, please contact:

105 Madison Avenue

New York, NY 10016

proxy@mackenziepartners.com

(212) 929-5500 (Call Collect)

Or

TOLL-FREE (800) 322-2885

PRELIMINARY COPIES—SUBJECT TO COMPLETION

3410 Central Expressway

Santa Clara, California 95051

PROXY STATEMENT FOR THE 2014 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON , , 2014

Meeting Agenda

PROPOSALS | PAGE NUMBER | VOTING STANDARD | BOARD VOTE | |||

Election of Three Class 3 Directors | 12 | Plurality | For each XenoPort director nominee | |||

Management Proposals: | ||||||

Ratification of the selection of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2014 | 26 | Majority of shares present and entitled to vote | For | |||

Advisory approval of the compensation of XenoPort’s named executive officers as disclosed in this proxy statement | 28 | Majority of shares present and entitled to vote | For | |||

Approval of the XenoPort, Inc. 2014 Equity Incentive Plan | 30 | Majority of shares present and entitled to vote | For | |||

Stockholder Proposals (if properly presented): | ||||||

Proposals 5 through 7 | 45 | 66-2/3% of the outstanding shares | Against | |||

Proposal 8 | 50 | Majority of shares present and entitled to vote | Against | |||

Proposals 9 through 14 | 51 | Majority of shares present and entitled to vote | For | |||

1

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We have sent you this proxy statement and the enclosedWHITE proxy card because the board of directors of XenoPort, Inc. is soliciting your proxy to vote at the 2014 annual meeting of stockholders, referred to as the 2014 annual meeting, including any adjournments or postponements of the 2014 annual meeting. You are invited to attend the 2014 annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the 2014 annual meeting to vote your shares. Instead, you may simply complete, sign and return the enclosedWHITE proxy card or follow the instructions below to submit your proxy over the telephone or on the Internet.

We intend to mail this proxy statement and accompanyingWHITE proxy card on or about April , 2014 to all stockholders of record entitled to vote at the 2014 annual meeting.

How do I attend the 2014 annual meeting?

The 2014 annual meeting will be held on , , 2014 at 8:00 a.m., local time, at XenoPort’s principal executive offices located at 3410 Central Expressway, Santa Clara, California 95051. Directions to the 2014 annual meeting may be found at http://www.XenoPort.com/contact/directions.htm. Information on how to vote in person at the 2014 annual meeting is discussed below.

Who can vote at the 2014 annual meeting?

Only stockholders of record at the close of business on April 15, 2014 will be entitled to vote at the 2014 annual meeting. On this record date, there were shares of common stock outstanding and entitled to vote.

Stockholders of Record: Shares Registered in Your Name

If, on April 15, 2014, your shares were registered directly in your name with our transfer agent, Computershare Shareowner Services LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the 2014 annual meeting or vote by proxy. Whether or not you plan to attend the 2014 annual meeting, we urge you to fill out and return the enclosedWHITE proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If, on April 15, 2014, your shares were not held in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the 2014 annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the 2014 annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the 2014 annual meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are 14 matters scheduled for a vote:

| • | Election of three Class 3 directors to serve until the 2017 annual meeting of stockholders and until their successors have been duly elected and qualified; |

2

| • | Ratification of the selection of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2014; |

| • | Advisory approval of the compensation of XenoPort’s named executive officers, as disclosed in this proxy statement in accordance with the rules of the Securities and Exchange Commission, or SEC; |

| • | Approval of the XenoPort, Inc. 2014 Equity Incentive Plan, or the 2014 Plan; |

| • | Amending our bylaws to provide for the repeal of any provision of our bylaws not in effect on August 11, 2005, if properly presented before the 2014 annual meeting; |

| • | Amending Section 24 of Article IV of our bylaws to provide that the compensation of an incumbent director not up for election at an annual meeting of stockholders be limited to $35,000 per year unless such director’s performance is approved by the affirmative vote of a majority of the shares present in person or by proxy at such annual meeting, if properly presented before the 2014 annual meeting; |

| • | Amending subsection (a) of Section 28 of Article V of our bylaws to disqualify from serving as an officer of XenoPort any director or any nominee for director who receives a vote of the holders of less than a majority of the outstanding shares of the company at any meeting of stockholders, unless that disqualification would violate the terms of any agreement of the company entered into prior to February 10, 2014 (except as a result of “qualifying termination”), if properly presented before the 2014 annual meeting; |

| • | Consideration of a stockholder proposal requesting the board of directors to take all available steps to amend our certificate of incorporation and bylaws to eliminate any supermajority stockholder approval vote requirements in respect of amendments to XenoPort’s bylaws, if properly presented before the 2014 annual meeting; |

| • | Approve the performance of Paul L. Berns as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting; |

| • | Approve the performance of Dennis M. Fenton as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting; |

| • | Approve the performance of John G. Freund as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting; |

| • | Approve the performance of Catherine J. Friedman as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting; |

| • | Approve the performance of Ernest Mario as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting; and |

| • | Approve the performance of William J. Rieflin as a director of XenoPort since the 2013 annual meeting, if properly presented before the 2014 annual meeting. |

Will other candidates be nominated for election as directors at the 2014 annual meeting in opposition to the board’s nominees?

Yes. The Clinton Group, a XenoPort stockholder, has notified us that it intends to nominate three persons for election as directors to the XenoPort board of directors at the 2014 annual meeting in opposition to the nominees recommended by XenoPort’s board. XenoPort’s board of directors does not endorse any nominee of the Clinton Group and unanimously recommends that you voteFOR ALL of the nominees proposed by XenoPort’s board by using theWHITE proxy card accompanying this proxy statement. The XenoPort board of directors strongly urges you not to sign or return any proxy card sent to you by the Clinton Group, which would be on a gold proxy card. If you have previously submitted a proxy card sent to you by the Clinton Group, you can revoke that proxy and vote for the XenoPort board’s nominees and on the other matters to be voted on at the 2014 annual meeting by using the enclosedWHITEproxy card and issuing a later-dated vote.

3

At the time this proxy statement was mailed, neither management nor the board of directors were aware of any other matters to be presented at the 2014 annual meeting other than those set forth in this proxy statement and in the notice accompanying this proxy statement.

What are the voting recommendations of the XenoPort board of directors?

XenoPort’s board of directors recommends that you vote your shares on yourWHITE proxy card as follows:

| • | “FOR ALL” three of XenoPort’s nominees to the board of directors named in this proxy statement (Proposal 1); |

| • | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent auditors for our fiscal year ending December 31, 2014 (Proposal 2); |

| • | “FOR” the approval, on an advisory basis, of the compensation of our named executive officers (Proposal 3); |

| • | “FOR” the approval of the 2014 Equity Incentive Plan (Proposal 4); |

| • | “AGAINST” the stockholder proposal submitted by the Clinton Group to amend our bylaws to provide for the repeal of any provision of our bylaws not in effect on August 11, 2005 (Proposal 5); |

| • | “AGAINST” the stockholder proposal submitted by the Clinton Group to amend our bylaws relating to board compensation (Proposal 6); |

| • | “AGAINST” the stockholder proposal submitted by the Clinton Group to amend our bylaws to disqualify from serving as an officer of XenoPort any director or any nominee for director who receives a vote of the holders of less than a majority of the outstanding shares of the company at any meeting of stockholders, unless that disqualification would violate the terms of any agreement of the company entered into prior to February 10, 2014 (except as a result of “qualifying termination”) (Proposal 7); |

| • | “AGAINST” the stockholder proposal submitted by the Clinton Group requesting the board of directors to take all available steps to amend our certificate of incorporation and bylaws to eliminate any supermajority stockholder approval vote requirements in respect of amendments to XenoPort’s bylaws (Proposal 8); |

| • | “FOR” the approval of the performance of Paul L. Berns as a director of XenoPort since the 2013 annual meeting (Proposal 9); |

| • | “FOR” the approval of the performance of Dennis M. Fenton as a director of XenoPort since the 2013 annual meeting (Proposal 10); |

| • | “FOR” the approval of the performance of John G. Freund as a director of XenoPort since the 2013 annual meeting (Proposal 11); |

| • | “FOR” the approval of the performance of Catherine J. Friedman as a director of XenoPort since the 2013 annual meeting (Proposal 12); |

| • | “FOR” the approval of the performance of Ernest Mario as a director of XenoPort since the 2013 annual meeting (Proposal 13); and |

| • | “FOR” the approval of the performance of William J. Rieflin as a director of XenoPort since the 2013 annual meeting (Proposal 14). |

XenoPort’s board of directors

strongly urges you not to sign or return any proxy card sent to you by the Clinton Group.

4

How do I vote?

You may either vote “For” each of the nominees to the board of directors or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the 2014 annual meeting, vote by proxy using the enclosedWHITE proxy card, vote by proxy over the telephone or vote by proxy on the Internet. Whether or not you plan to attend the 2014 annual meeting, we urge you to vote by submitting yourWHITE proxy to ensure that your vote is counted. You may still attend the 2014 annual meeting and vote in person even if you have already voted by proxy.

| • | To vote in person, come to the 2014 annual meeting and we will give you a ballot at the 2014 annual meeting. |

| • | To vote using the proxy card, simply complete, sign and date the enclosedWHITE proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the 2014 annual meeting, we will vote your shares as you direct. |

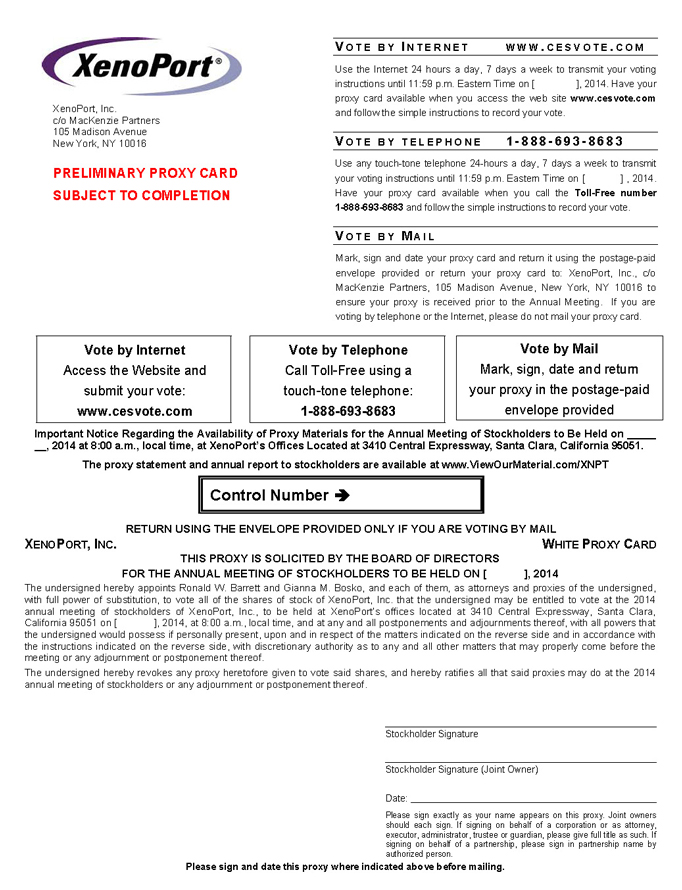

| • | To vote over the telephone, dial toll-free 1-888-693-8683 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 11:59 p.m., Eastern Time, on , 2014 to be counted. |

| • | To vote on the Internet, go to www.cesvote.com to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosedWHITE proxy card. Your vote must be received by 11:59 p.m., Eastern Time, on , 2014 to be counted. |

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received aWHITE proxy card and voting instructions with these proxy materials from that organization rather than directly from XenoPort. Simply complete and mail theWHITE proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the 2014 annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Telephone and Internet voting procedures are designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 15, 2014.

5

What should I do if I receive a proxy card from the Clinton Group?

The Clinton Group has notified us that it intends to nominate three individuals for election as directors to the XenoPort board of directors at the 2014 annual meeting in opposition to the nominees recommended by XenoPort’s board and to present ten stockholder proposals (referred to as the “Clinton Group Proposals”) at the 2014 annual meeting. If the Clinton Group proceeds with its alternative director nominations and Clinton Group Proposals, you may receive proxy solicitation materials from the Clinton Group, including an opposition proxy statement and gold proxy card. XenoPort is not responsible for the accuracy of any information contained in any proxy solicitation materials used by the Clinton Group or any other statements that it may otherwise make.

XenoPort’s board does not endorse any Clinton Group nominee and opposes Proposals 5, 6, 7 and 8 and unanimously recommends that you disregard any proxy card or solicitation materials that may be sent to you by the Clinton Group. Voting to “WITHHOLD” with respect to any of the Clinton Group’s nominees on its proxy card is NOT the same as voting for the XenoPort board’s nominees, because a vote to “WITHHOLD” with respect to any of the Clinton Group’s nominees on its proxy card will revoke any proxy you previously submitted. If you have already voted using the gold proxy card, you have the right to change your vote by voting via the Internet or by telephone by following the instructions on theWHITE proxy card, or by completing and mailing the enclosedWHITE proxy card in the enclosed pre-paid envelope. Only the latest validly executed proxy that you submit will be counted – any proxy may be revoked at any time prior to its exercise at the 2014 annual meeting by following the instructions under “Can I change my vote after submitting my proxy?” below. If you have any questions or require any assistance with voting your shares, please contact our proxy solicitor, MacKenzie Partners, Inc., toll free at (800) 322-2885 or collect at (212) 929-5500.

What if I return a proxy card but do not make specific choices?

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record and you do not specify your vote on each proposal individually when voting on the Internet or over the telephone, or if you sign and return aWHITE proxy card without giving specific voting instructions, then your shares will be voted “FOR ALL” three of XenoPort’s nominees named herein to the board of directors (Proposal 1); “FOR” the ratification of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 2); “FOR” the advisory approval of the compensation of our named executive officers (Proposal 3); “FOR” the approval of the 2014 Plan (Proposal 4); “AGAINST” each of the Clinton Group Bylaw Proposals (Proposals 5 through 7); “AGAINST” the Clinton Group Supermajority Vote Proposal (Proposal 8); and “FOR” each of the Clinton Group Director Performance Proposals (Proposals 9 through 14). If any other matter is properly presented at the 2014 annual meeting, your proxyholder (one of the individuals named on yourWHITE proxy card) will vote your shares using his or her best judgment.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other nominee, and you do not provide the broker or other nominee that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. See “What are ‘broker non-votes’?” below. We encourage you to provide voting instructions to the organization that holds your shares to ensure that your vote is counted on all 14 proposals.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. We have engaged the firm of MacKenzie Partners, Inc., or “MacKenzie,” to assist in the solicitation of proxies. Under the terms of its agreement, the services of MacKenzie include the distribution of materials to stockholders, providing information to stockholders (including direct contact with stockholders) from the materials prepared by us, analysis of beneficial ownership

6

of our securities and providing such other advisory services as we may request from time to time. We anticipate that we will pay MacKenzie a fee of approximately $350,000 plus expenses for these services, though the costs of this proxy solicitation process could be lower or higher than our estimate. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. XenoPort’s aggregate expenses, including those of MacKenzie, related to the solicitation in excess of those normally spent for an annual meeting as a result of the potential proxy contest and excluding salaries and wages of our officers and regular employees, are expected to be approximately $ , of which approximately $ has been spent to date. XenoPort has agreed to indemnify MacKenzie against certain liabilities relating to, or arising out of, their engagement.

Solicitations may also be made by personal interview, mail, telephone, facsimile, email, Twitter, other electronic channels of communication, or otherwise by directors, officers and other employees of XenoPort, but XenoPort will not additionally compensate its directors, officers, or other employees for these services. Appendix B sets forth information relating to certain of our directors, officers and employees who are considered “participants” in this proxy solicitation under the rules of the SEC by reason of their position or because they may be soliciting proxies on our behalf.

What does it mean if I receive more than one WHITE proxy card?

If you receive more than oneWHITE proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and return eachWHITE proxy card to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the 2014 annual meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may send a timely written notice that you are revoking your proxy to XenoPort’s Secretary at 3410 Central Expressway, Santa Clara, California 95051. |

| • | You may attend the 2014 annual meeting and vote in person. Simply attending the 2014 annual meeting will not, by itself, revoke your proxy. |

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of election appointed for the 2014 annual meeting, who will separately count: for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to the other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the tabulation of shares present in person or represented by proxy and entitled to vote and will have the same effect as “Against” votes on all proposals except the election of directors (Proposal 1). Broker non-votes will not be counted for purposes of determining the number of shares present in person or represented by proxy and entitled to vote with respect to a particular proposal. Thus, broker non-votes will not affect the outcome of the vote on any of the proposals other than the Clinton Group Bylaw Proposals (Proposals 5, 6 and 7). In the case of the Clinton Group Bylaw Proposals (Proposals 5, 6 and 7), broker non-votes will have the same effect as a vote “Against” Proposals 5, 6 and 7.

7

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the New York Stock Exchange, or NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors and executive compensation, including the advisory stockholder votes on executive compensation. Accordingly, the broker or nominee may not vote your shares with respect to the election of directors, the stockholder advisory vote on executive compensation, approval of the 2014 Plan or any of the Clinton Group Proposals, if you have not provided instructions, but may vote your shares on Proposal 2 (ratification of independent registered public accounting firm). We strongly encourage you to submit yourWHITE proxy and exercise your right to vote as a stockholder.

How many votes are needed to approve each proposal?

| • | For the election of directors, the three Class 3 nominees receiving the most “For” votes from the holders of shares present in person or represented by proxy and entitled to vote on the election of directors will be elected. Only “For” or “Withhold” votes will affect the outcome. Broker non-votes will have no effect. |

| • | To be approved, Proposal 2, the ratification of the selection of Ernst & Young LLP as XenoPort’s independent registered public accounting firm for the fiscal year ending December 31, 2014, must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2014 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposal 2. See Proposal 2 for more information regarding stockholder ratification. |

| • | To be approved, Proposal 3, the approval, on an advisory basis, of the compensation of XenoPort’s named executive officers, must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2014 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposal 3. See Proposal 3 for more information regarding stockholder advisory approval. |

| • | To be approved, Proposal 4, approval of the 2014 Plan, must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2014 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposal 4. See Proposal 4 for more information regarding stockholder approval. |

| • | To be approved, each of the Clinton Group Bylaw Proposals (Proposals 5, 6 and 7) must receive “For” votes from the holders of at least sixty-six and two-thirds percent (66-2/3%) of the voting power of all of the then-outstanding shares of the capital stock entitled to vote generally in the election of directors. If you “Abstain” from voting on any of the Clinton Group Bylaw Proposals, it will have the same effect as an “Against” vote. Broker non-votes will be counted for purposes of determining the number of the then-outstanding shares entitled to vote in the election of directors and will have the same effect as an “Against” vote. See Proposals 5, 6 and 7 for more information regarding stockholder approval. |

| • | To be approved, the Clinton Group Supermajority Vote Proposal (Proposal 8) must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2014 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposal 8. See Proposal 8 for more information regarding stockholder approval. |

8

| • | To be approved, each of the Clinton Group Director Performances Proposals (Proposals 9 through 14) must receive “For” votes from the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the 2014 annual meeting. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will not affect the outcome of the vote on Proposals 9 through 14. See Proposals 9 through 14 for more information regarding stockholder approval. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares are present at the 2014 annual meeting in person or represented by proxy. On the record date, there were shares outstanding and entitled to vote. Thus, the holders of at least shares of common stock must be present in person or represented by proxy at the 2014 annual meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the 2014 annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the 2014 annual meeting or a majority of shares present at the 2014 annual meeting in person or represented by proxy may adjourn the 2014 annual meeting to another date.

How can I find out the results of the voting at the 2014 annual meeting?

Final voting results will be published in a current report on Form 8-K that we expect to file within four business days following the 2014 annual meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the 2014 annual meeting, we intend to file a Form8-K disclosing preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by the close of business on December , 2014, to XenoPort’s Secretary at 3410 Central Expressway, Santa Clara, California 95051, and you must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended. However, if our 2015 annual meeting of stockholders is not held between , 2015 and , 2015, then the deadline will be a reasonable time prior to the time we begin to print and send our proxy materials.

If you wish to submit a proposal that is not to be included in next year’s proxy materials or nominate a director, you must provide specified information to XenoPort’s Secretary at 3410 Central Expressway, Santa Clara, California 95051 between the close of business on , 2015 and the close of business on , 2015, unless the date of our 2015 annual meeting of stockholders is before , 2015 or after , 2015, in which case such proposals shall be submitted no earlier than the close of business on the date 120 days prior to the 2015 annual meeting, and no later than the close of business on the later of (i) 90 days before the 2015 annual meeting of stockholders or (ii) ten days after notice of the date of the 2015 annual meeting is first publicly given. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. The chair of the 2015 annual meeting of stockholders may determine, if the facts warrant, that a matter has not been properly brought before the meeting and, therefore, may not be considered at the meeting. The proxy solicited by the board of directors for the 2015 annual meeting of stockholders will confer discretionary voting authority with respect to any proposal presented by a stockholder at that meeting for which XenoPort has not been provided with timely notice. In addition, if the stockholder proposal is timely and in accordance with XenoPort’s bylaws, the proxy solicited will confer discretionary voting authority with respect to the proposal if the stockholder does not comply with the requirements of Rule 14a-4(c)(2) promulgated under the Securities Exchange Act of 1934, as amended.

9

What proxy materials are available on the Internet?

This proxy statement and our 2013 annual report to stockholders are available atwww.ViewOurMaterial.com/XNPT.

BACKGROUND OF SOLICITATION

On September 26, 2013, representatives of the Clinton Group participated in a phone call with representatives of XenoPort to discuss a variety of topics relating to XenoPort.

On October 15, 2013, XenoPort received a letter from Gregory T. Taxin of the Clinton Group expressing his views on XenoPort.

On October 15, 2013, XenoPort issued a statement announcing receipt of the letter from the Clinton Group, expressing appreciation for stockholder input and stating that the board of directors would continue to review all aspects of XenoPort’s business.

On November 18, 2013, representatives of the Clinton Group participated in a phone call with representatives of XenoPort to discuss concerns that the Clinton Group had raised in the October 15, 2013 letter and to provide updated information to the Clinton Group related to XenoPort’s publicly-announced third quarter financial results.

On December 13, 2013, Dr. John G. Freund and Dr. Dennis Fenton, two of XenoPort’s directors, met with representatives of the Clinton Group, including Mr. Taxin, to discuss Mr. Taxin’s concerns and XenoPort’s strategies.

On December 16, 2013, Mr. Taxin, on behalf of the Clinton Group, sent a letter to Dr. Freund in which Mr. Taxin expressed his views on XenoPort’s strategy and certain corporate governance matters.

On December 20, 2013, Dr. Freund sent a letter to Mr. Taxin confirming receipt of Mr. Taxin’s letter, reiterating the commitment of the board of directors and the management team to enhance stockholder value, including through the execution of current strategy to commercialize HORIZANT.

On January 12, 2014, Dr. Ronald Barrett, XenoPort’s chief executive officer, contacted Mr. Taxin and offered to discuss XenoPort’s recent press release regarding business and performance updates and to meet with Mr. Taxin again for further discussions. Mr. Taxin never responded to Dr. Barrett’s invitation.

On February 10, 2014, Mr. Taxin, on behalf of the Clinton Group, sent a letter to XenoPort notifying it that the Clinton Group intended to present, at the 2014 annual meeting, the Clinton Group Proposals and nominate three persons for election to the board of directors.

On February 13, 2014, XenoPort’s outside counsel called counsel for the Clinton Group to try and discern Mr. Taxin’s ultimate goal in proposing a proxy contest.

On February 14, 2014, Clinton Group’s counsel called XenoPort’s outside counsel and indicated that Mr. Taxin was unwilling to discuss the issue through legal counsel but suggested a meeting with two of XenoPort’s board members.

On February 18, 2014, in light of the expense and disruption that would result from any proxy contest, Dr. Freund (in person) and Ms. Catherine J. Friedman, one of our directors (by telephone), met with Mr. Taxin to discuss Mr. Taxin’s letter, during which Mr. Taxin presented the terms of a confidential settlement proposal.

10

Dr. Freund and Ms. Friedman indicated to Mr. Taxin that they would discuss the terms of the proposal with the board of directors after which they would respond to his proposal.

On February 21, 2014, Dr. Freund and Ms. Friedman had a second meeting (by telephone) with Mr. Taxin to further discuss his letter and to attempt to reconcile their respective views and offered a revised settlement proposal.

On February 27, 2014, Dr. Freund and Ms. Friedman had a third meeting (by telephone) with Mr. Taxin to further discuss his letter and to attempt to reconcile their respective views, and Mr. Taxin offered a modified settlement proposal.

On March 4, 2014, Dr. Freund and Ms. Friedman had a fourth meeting (by telephone) with Mr. Taxin to further discuss his letter, offer a modified settlement proposal and attempt to reconcile their respective views. Mr. Taxin did not respond to the modified settlement proposal.

As a result, no agreements or understandings resulted from these conversations.

11

PROPOSAL 1

ELECTION OF DIRECTORS

Our amended and restated certificate of incorporation, as amended, and bylaws provide that the board of directors shall be divided into three classes, each class consisting, as nearly as possible, of one third of the total number of directors, and with each class having a three-year term. Vacancies on the board of directors may be filled only by persons elected by a majority of the remaining directors. A director elected by the board of directors to fill a vacancy in a class shall serve for the remainder of the full term of that class and until the director’s successor is elected and qualified. This applies to vacancies created by an increase in the authorized number of directors or by the death, resignation, disqualification or removal of a director.

Our board of directors presently has nine members, and there are no vacancies. There are three directors in Class 3, the class whose term of office expires in 2014. Each of Ronald W. Barrett, Ph.D., Jeryl L. Hilleman and Wendell Wierenga, Ph.D., is currently a Class 3 director of XenoPort who was previously elected to the board of directors by the stockholders and was recommended for re-election to the board of directors by the nominating and corporate governance committee of the board of directors. If elected at the 2014 annual meeting, each of these three nominees would serve until the 2017 annual meeting of stockholders and until his or her successor is elected and has qualified, or until the director’s death, resignation or removal. Each of these three nominees is submitted for re-election to the board of directors on theWHITE proxy card.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the 2014 annual meeting. The persons named as proxies on theWHITE proxy card intend to vote the proxies “FOR ALL” three of XenoPort’s nominees named below unless you indicate on theWHITE proxy card a vote to “WITHHOLD” your vote with respect to any of these nominees. Cumulative voting is not permitted. In the event that any nominee named below should become unavailable for election as a result of an unexpected occurrence, the proxies will be voted for the election of a substitute nominee or nominees proposed by the nominating and corporate governance committee of the board of directors. If any such substitute nominee(s) are designated, we will file an amended proxy statement andWHITE proxy card that, as applicable, identifies the substitute nominee(s), discloses that such nominee(s) have consented to being named in the revised proxy statement and to serve if elected, and includes biographical and other information about such nominee(s) as required by the rules of the Securities and Exchange Commission. Each nominee named below has consented to being named as a nominee in this proxy statement and has agreed to serve if elected, and our board of directors has no reason to believe that any such nominee will be unable to serve.

The nominating and corporate governance committee seeks to assemble a board of directors that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, the nominating and corporate governance committee has identified and evaluated the three director nominees named below in the broader context of the board of directors’ overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that the nominating and corporate governance committee views as critical to the effective functioning of our board of directors. In selecting these three director nominees, as well as the remaining current directors, the nominating and corporate governance committee focused on selecting a diverse group of experienced board candidates and members with strong credentials and relevant industry expertise who will work together constructively to execute our strategic plan for delivering long-term growth and stockholder value. Our board of directors is pleased to nominate for election as directors the three persons named in this proposal and on the enclosedWHITE proxy card.

The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each of Dr. Barrett, Ms. Hilleman and Dr. Wierenga, our director nominees, and of each director whose term will continue after the 2014 annual meeting, that led the nominating and corporate governance committee and the board of directors to believe such director or nominee should continue to serve on our board of directors.

12

CLASS 3 NOMINEESFOR ELECTIONFORA THREE-YEAR TERM EXPIRINGATTHE 2017 ANNUAL MEETING

Ronald W. Barrett, Ph.D.

Ronald W. Barrett, Ph.D., age 58, is one of our founders and has served as our chief executive officer since September 2001. He served as our chief scientific officer from 1999 to 2001. Dr. Barrett has been a director since August 1999. From 1989 to 1999, he held various positions at Affymax Research Institute, a company employing combinatorial chemistry and high-throughput target screening for drug discovery, the most recent of which was senior vice president of research. Glaxo Wellcome plc, a pharmaceutical company, acquired Affymax Research Institute in 1995. Glaxo Wellcome subsequently merged with SmithKline Beecham plc, a pharmaceutical company, in 2000 to form GlaxoSmithKline plc, a pharmaceutical company. Prior to Affymax Research Institute, Dr. Barrett was a molecular pharmacologist in the Neuroscience Group at Abbott Laboratories, a healthcare company, from 1986 to 1989. Dr. Barrett received a B.S. from Bucknell University and a Ph.D. in pharmacology from Rutgers University. Dr. Barrett is a member of the board of directors of Concert Pharmaceuticals, Inc., a publicly-traded biopharmaceutical company.

The nominating and corporate governance committee and the board of directors believe that Dr. Barrett’s extensive experience with the company as a founder and through his long tenure as chief executive officer, brings necessary historic knowledge and operational continuity to the board of directors. The nominating and corporate governance committee also believes that, as result of his long tenure with the company in scientific and executive positions, Dr. Barrett brings to the board of directors key scientific expertise, corporate development and investor relations experience and substantial leadership skills.

Jeryl L. Hilleman

Jeryl L. Hilleman, age 56, has been a member of our board of directors since January 2005. She is chief financial officer at Ocera Therapeutics, Inc., a clinical-stage biopharmaceutical company. Prior to joining Ocera in September 2013, Ms. Hilleman provided independent financial and strategic consulting for biotech and cleantech companies. From January 2008 to May 2012, she was chief financial officer of Amyris Biotechnologies, Inc., a company specializing in synthetic biology. Prior to joining Amyris, she was executive vice president and chief financial officer of Symyx Technologies, Inc., a company specializing in high-throughput experimentation for the discovery of materials, from 1997 to June 2007. Prior to joining Symyx in 1997, Ms. Hilleman served as vice president finance and chief financial officer of two public biotechnology companies, Geron Corporation and Cytel Corporation, which merged with Epimmune Inc. in 1999. Ms. Hilleman received an A.B. from Brown University and an M.B.A. from the Wharton Graduate School of Business.

The nominating and corporate governance committee and the board of directors believe that Ms. Hilleman’s significant experience as a chief financial officer of several public biotechnology companies provides valuable financial and audit expertise, particularly in light of Ms. Hilleman’s role as chairperson of the audit committee of the board of directors. As a result of her tenure as chairperson of the audit committee, Ms. Hilleman also provides valuable historic knowledge and continuity with respect to the company’s interactions with the SEC regarding complex accounting matters. The nominating and corporate governance committee further believes that Ms. Hilleman’s educational background and public company experience provides her with significant expertise in: (i) oversight of preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the company’s financial statements, including complex cost accounting and revenue recognition matters; and (ii) understanding internal controls and procedures for financial reporting as applicable for a company of our size and in our industry.

Wendell Wierenga, Ph.D.

Wendell Wierenga, Ph.D., age 66, has been a member of our board of directors since 2000. From June 2011 to March 2014, he served as executive vice president, research and development at Santarus, Inc., a specialty

13

pharmaceutical company that was acquired by Salix Pharmaceuticals, Inc. in January 2014. Prior to joining Santarus in June 2011, he was executive vice president of research and development at Ambit Biosciences, Inc., a biopharmaceutical company engaged in the discovery and development of small-molecule kinase inhibitors, since January 2007. Dr. Wierenga served as executive vice president of research and development at Neurocrine Biosciences, Inc., a biopharmaceutical company developing therapeutics for neuropsychiatric, neuroinflammatory and neurodegenerative diseases, from 2003 to 2007. From 2000 to 2003, Dr. Wierenga was chief executive officer of Syrrx, Inc., a company focused on small-molecule drug compounds that was acquired by Takeda Pharmaceutical Company Limited in 2004. Prior to joining Syrrx, from 1990 to 2000, he was senior vice president of worldwide pharmaceutical sciences, technologies and development at Parke-Davis, a division of Warner Lambert Co., a pharmaceutical company. Pfizer Inc., a research-based pharmaceutical company, acquired Warner Lambert in 2000. Prior to Parke-Davis, Dr. Wierenga worked at Upjohn Co., later Pharmacia & Upjohn, Inc., a pharmaceutical and biotechnology company, for 16 years in various positions, including executive director of discovery research. Pfizer acquired Pharmacia & Upjohn, then named Pharmacia Corp., in 2002. Dr. Wierenga received a B.S. from Hope College and a Ph.D. in chemistry from Stanford University. From 1996 to 2013, Dr. Wierenga served as a member of the board of directors of Onyx Pharmaceuticals, Inc., a publicly-traded biotechnology company that was acquired by Amgen Inc. in 2013. Dr. Wierenga is currently a member of the boards of directors of Ocera Therapeutics, Inc., Cytokinetics, Inc., Concert Pharmaceuticals, Inc. and Apricus Biosciences, Inc., publicly-traded biopharmaceutical companies.

The nominating and corporate governance committee and the board of directors believe that Dr. Wierenga’s significant pharmaceutical research, clinical development and regulatory experience provide valuable scientific and technical expertise to the board of directors. Dr. Wierenga has served, or currently serves, as a member of the boards of directors of numerous other publicly-traded biopharmaceutical companies, providing appropriate perspective and extensive familiarity with financial and operations management, risk oversight, business strategy and governance matters. Dr. Wierenga also brings executive leadership experience to the board of directors.

As discussed below, the board’s nominating and corporate governance committee is charged with the delegated responsibilities for identifying, reviewing and evaluating candidates to serve as directors; reviewing, evaluating and considering the recommendation for nomination of incumbent directors for re-election to the board; and assessing the performance of XenoPort’s board of directors and its committees and of individual directors. When considering a candidate for director, the nominating and corporate governance committee considers all of the relevant qualifications of the candidate, including such factors as:

| • | the candidate’s relevant expertise upon which to be able to offer advice and guidance to management; |

| • | having sufficient time to devote to XenoPort’s affairs; |

| • | demonstrated excellence in his or her field; |

| • | having relevant financial or accounting expertise; |

| • | having the ability to exercise sound business judgment; |

| • | having the commitment to rigorously represent the long-term interests of XenoPort’s stockholders; |

| • | whether the board candidates will be independent for purposes of the Nasdaq listing standards; |

| • | current needs of the board of directors and XenoPort; and |

| • | a broad range of diversity considerations, including individual backgrounds and skill sets, professional experiences and other factors that contribute to the board of directors having an appropriate range of expertise, talents, experiences and viewpoints. |

Based on the evaluation of the board of directors and the board’s nominating and corporate governance committee of each of Dr. Barrett, Ms. Hilleman and Dr. Wierenga, and an evaluation of each of the nominees proposed by the Clinton Group against the factors and principles XenoPort uses to select nominees for director, the board of directors and its nominating and corporate governance committee concluded that it is in the best

14

interest of XenoPort and its stockholders for each of the proposed nominees listed above to continue to serve as a director of XenoPort. Further, the board of directors values greatly the knowledge and insights of each of the nominees concerning XenoPort’s operations, industry and long-term strategies that the nominees have gained through their board service at XenoPort and desires to retain that knowledge and insights through the nominees continued board service.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR ALL” OF THE NOMINEES NAMED ABOVE.

CLASS 1 DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2015 ANNUAL MEETING

Dennis M. Fenton, Ph.D.

Dennis M. Fenton, Ph.D., age 62, has been a member of our board of directors since August 2009. Dr. Fenton is the owner and chief executive officer of Fenton and Associates, a biotechnology consulting firm. From 1982 to 2008, Dr. Fenton held numerous positions, including executive roles in process development, manufacturing, sales and marketing and research and development, at Amgen, Inc., a biotechnology company. From 2000 to 2008, Dr. Fenton was executive vice president responsible for worldwide operations, manufacturing, process development and quality. From 1995 to 2000, Dr. Fenton was senior vice president of operations, and from 1992 to 1995, Dr. Fenton was senior vice president of sales, marketing and process development for Amgen. Dr. Fenton received a B.S. in biology from Manhattan College and a Ph.D. in microbiology from Rutgers University. Dr. Fenton previously served as a member of the board of directors of Genzyme Corporation, a publicly-traded biotechnology company, from 2010 to 2011. Dr. Fenton is currently a member of the boards of directors of Dendreon Corporation, a publicly-traded biotechnology company; Hospira, Inc., a publicly-traded pharmaceutical company; and Kythera Biopharmaceuticals, Inc., a publicly-traded pharmaceutical company focused on the aesthetic medicine market.

The nominating and corporate governance committee and the board of directors believe that Dr. Fenton’s 26 years of experience, including numerous leadership positions at Amgen, a high-growth biotechnology company, brings a range of experience important to the board of directors. In particular, the nominating and corporate governance committee believes that Dr. Fenton’s experience in development, operations and sales and marketing is very valuable to the board of directors as we pursue commercialization of our product and product candidates.

Catherine J. Friedman

Catherine J. Friedman, age 53, has been a member of our board of directors since September 2007. Ms. Friedman has been an independent financial consultant serving private and public companies in the life sciences industry since 2006. Prior to that, Ms. Friedman held numerous positions over a 23-year investment banking career with Morgan Stanley & Co., an investment banking company, including managing director from 1997 to 2006 and Head of West Coast Healthcare and Co-Head of the Biotechnology Practice from 1993 to 2006. Ms. Friedman received a B.A. from Harvard College and an M.B.A. from the University of Virginia Darden School of Business. Ms. Friedman is a member of the boards of directors of EnteroMedics Inc., a publicly-traded medical device company focused on obesity management, and GSV Capital Corp., a publicly-traded investment fund.

The nominating and corporate governance committee and the board of directors believe that Ms. Friedman’s 23 years of experience as a leading investment banker in the life sciences industry provides important industry and financial expertise. The nominating and corporate governance committee believes that Ms. Friedman’s extensive experience with company financing and capital market access are of particular importance as we continue to finance our operations.

Ernest Mario, Ph.D.

Ernest Mario, Ph.D., age 75, has been a member of our board of directors since June 2012. Dr. Mario is executive chairman of the board of directors of Capnia, Inc., a privately-held pharmaceutical company, and a

15

partner with Pappas Ventures, a venture capital firm. From April 2003 to August 2007, Dr. Mario served as chairman of the board and chief executive officer of Reliant Pharmaceuticals, Inc., a privately-held pharmaceutical company. Prior to joining Reliant, he was the chairman and chief executive officer of IntraBiotics Pharmaceuticals, Inc., a biopharmaceutical company, and its predecessor, Apothogen, Inc., from January 2002 to April 2003. From 1997 to 2001, Dr. Mario served as chairman and chief executive officer of ALZA Corporation, a pharmaceutical company, and as co-chairman and chief executive officer of ALZA from 1993 to 1997. From 1992 to 1993, Dr. Mario served as deputy chairman of Glaxo Holdings plc., a pharmaceutical company, and as chief executive from 1989 to 1993. Dr. Mario received a Ph.D. and an M.S. in physical sciences from the University of Rhode Island and a B.S. in pharmacy from Rutgers University. Dr. Mario previously served as a member of the boards of directors of IntraBiotics Pharmaceuticals, Inc. from 2002 to 2007; Pharmaceutical Product Development, Inc., a publicly-traded contract research organization, from 1993 to 2011; Maxygen, Inc., a publicly-traded biotechnology company, from 1997 to 2013; and Vivus, Inc., a publicly-traded biopharmaceutical company, from 2012 to 2013. Dr. Mario is currently a member of the boards of directors of Boston Scientific Corporation, a publicly-traded medical device company; Celgene Corporation, a publicly-traded biopharmaceutical company; Chimerix Inc., a publicly-traded drug discovery company; Kindred Biosciences, Inc., a publicly-traded specialty pharmaceutical company; and TONIX Pharmaceuticals Holding Corp, a publicly-traded specialty pharmaceutical company.

The nominating and corporate governance committee and the board of directors believe that Dr. Mario’s qualifications to serve on our board of directors include his strong executive leadership experience including his experience as a chief executive officer. In addition, Dr. Mario has successfully led several pharmaceutical companies over the last several decades. He has extensive experience in financial and operations management, risk oversight, quality and business strategy as a result of this experience as well as his prior service on public company boards.

CLASS 2 DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2016 ANNUAL MEETING

Paul L. Berns

Paul L. Berns,age 47, has been a member of our board of directors since November 2005. He is president and chief executive officer of Anacor Pharmaceuticals, Inc., a pharmaceutical company. Prior to joining Anacor in March 2014, Mr. Berns was a self-employed consultant to the pharmaceutical industry. From March 2006 to August 2012, he served as president, chief executive officer and a member of the board of directors of Allos Therapeutics, Inc., a biopharmaceutical company, which was acquired by Spectrum Pharmaceuticals, Inc. in August 2012. From 2002 to 2005, Mr. Berns was chief executive officer, president and a director of Bone Care International, Inc., a specialty pharmaceutical company that was acquired by Genzyme Corporation in 2005. From 2001 to 2002, Mr. Berns served as vice president and general manager of the Immunology, Oncology and Pain Therapeutics business unit of Abbott Laboratories, a pharmaceutical company. He served as vice president, marketing of BASF Pharmaceuticals-Knoll, a pharmaceutical company, from 2000 to 2001. From 1990 to 2000, Mr. Berns held various positions, including senior management roles, at Bristol-Myers Squibb Company, a pharmaceutical company. Mr. Berns received a B.S. from the University of Wisconsin. Mr. Berns is a member of the boards of directors of Jazz Pharmaceuticals plc and Cellectar Biosciences, Inc., publicly-traded specialty pharmaceutical companies, and Anacor Pharmaceuticals, Inc., a publicly-traded pharmaceutical company.

The nominating and corporate governance committee and the board of directors believe that Mr. Berns’ experience as a chief executive officer of Bone Care International and Allos Therapeutics provides significant operational and pharmaceutical industry leadership experience to the board of directors. In particular, Mr. Berns guided Allos Therapeutics through a period that included U.S. Food and Drug Administration approval of Allos’ first product.

John G. Freund, M.D.

John G. Freund, M.D., age 60, has been a member of our board of directors since 1999 and our lead independent director since July 2008. He has been a managing director of Skyline Ventures, a venture capital firm

16

specializing in healthcare companies, since 1997. From 1995 to 1997, Dr. Freund was a managing director in the private equity group at Chancellor Capital Management, a private capital investment firm. AMVESCAP plc, an investment services company, acquired Chancellor Capital Management in 1998 and renamed the division INVESCO Private Capital. In 1995, he co-founded Intuitive Surgical, Inc., a medical device company. From 1988 to 1994, he held various positions at Acuson Corp., a maker of ultrasound equipment, including executive vice president. Siemens Corp. acquired Acuson in 2000. Prior to Acuson, Dr. Freund was a general partner of Morgan Stanley Venture Partners, a venture capital management firm, from 1987 to 1988. From 1982 to 1988, Dr. Freund was at Morgan Stanley & Co., an investment banking company, where he was a co-founder of the Healthcare Group in the Corporate Finance Department. He received a B.A. from Harvard College, an M.D. from Harvard Medical School and an M.B.A. from Harvard Business School. Dr. Freund was a member of the boards of directors of The New Economy Fund, a U.S.-registered investment fund, from 2000 to 2009; Sirtris Pharmaceuticals, Inc., at the time a publicly-traded pharmaceutical company, from 2004 to 2008; Hansen Medical, Inc., a publicly-traded company specializing in medical robotics, from 2002 to 2010; MAP Pharmaceuticals, Inc., a publicly-traded company developing inhalation-based pharmaceuticals, from 2004 to 2011; and MAKO Surgical Corp., a publicly-traded company that designs and sells an advanced robotic-arm solution, together with proprietary implants for orthopedic knee procedures, from 2008 to 2013. Dr. Freund is currently a member of the boards of directors of SMALLCAP World Fund, Fundamental Investors, Inc. and The Growth Fund of America, Inc., each of which are U.S.-registered investment funds; and Tetraphase Pharmaceuticals, Inc. and Concert Pharmaceuticals, Inc., each of which are publicly-traded pharmaceutical companies.

The nominating and corporate governance committee and the board of directors believe that Dr. Freund’s 30 years of healthcare venture capital investing, healthcare investment banking and management of healthcare companies provide significant and extensive industry expertise. Dr. Freund has served as a director of the company since 1999, bringing historic knowledge and continuity to the board of directors. Dr. Freund has served, or currently serves, as a member of the boards of directors of numerous other pharmaceutical or medical device companies, providing appropriate perspective and extensive familiarity with compensation and financial matters.

William J. Rieflin

William J. Rieflin, age 54, has been a member of our board of directors since September 2010. In September 2010, Mr. Rieflin was appointed chief executive officer and a member of the board of directors of NGM Biopharmaceuticals, Inc., a pharmaceutical company focused on metabolic diseases. Mr. Rieflin previously served as our president from 2004 to September 2010. From 1996 to 2004, he held various positions with Tularik Inc., a biotechnology company focused on the discovery and development of product candidates based on the regulation of gene expression, including executive vice president, administration, chief financial officer, general counsel and secretary. Amgen Inc. acquired Tularik in 2004. Mr. Rieflin received a B.S. from Cornell University, an M.B.A. from the University of Chicago Graduate School of Business and a J.D. from Stanford Law School. Mr. Rieflin is a member of the board of directors of Anacor Pharmaceuticals, Inc., a publicly-traded pharmaceutical company.

The nominating and corporate governance committee and the board of directors believe that Mr. Rieflin brings to the board substantial experience with the company, given his past role as our president, and extensive leadership skills, industry knowledge and operational expertise from his numerous positions as a biotechnology company executive.

CORPORATE GOVERNANCE AND BOARD MATTERS

INDEPENDENCEOFTHE XENOPORT BOARD

As required under The NASDAQ Stock Market LLC, or Nasdaq, listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. Our board of directors consults with our counsel to ensure that the board’s determinations are consistent

17

with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time. Consistent with these considerations, our board of directors has affirmatively determined that all of our directors are independent directors within the meaning of the applicable Nasdaq listing standards, except for Ronald W. Barrett, Ph.D., our chief executive officer, and William J. Rieflin, our former president. In addition, our board of directors has determined that each member of our audit committee, compensation committee and nominating and corporate governance committee is an independent director within the meaning of the applicable Nasdaq listing standards and SEC rules.

INFORMATION REGARDINGTHE XENOPORT BOARD

Corporate Governance Guidelines

Our board of directors has adopted Corporate Governance Guidelines to ensure that the board of directors has the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the principles that the board of directors will follow with respect to board member responsibilities, board of directors composition and selection, board of directors meetings and involvement of senior management, succession planning and board of directors committees and compensation. The Corporate Governance Guidelines were adopted by the board of directors to, among other things, reflect changes to the Nasdaq listing standards and SEC rules adopted to implement provisions of the Sarbanes-Oxley Act of 2002. The Corporate Governance Guidelines may be viewed on our website at www.XenoPort.com under the section entitled “Investors/Corporate Governance.”

Meetings

During 2013, our board of directors held 22 meetings, including telephonic meetings, and acted by unanimous consent seven times. All directors attended at least 85% of the aggregate of the meetings of the board of directors and of the committees on which they served that were held during the period for which they were a director or a committee member. As required under applicable Nasdaq listing standards, in fiscal 2013, our independent directors met ten times in regularly scheduled executive sessions at which only independent directors were present. Although we do not have a formal policy regarding attendance by members of the board of directors at our annual meetings of stockholders, directors are encouraged to attend the annual meeting of XenoPort stockholders. All directors attended the 2013 annual meeting of stockholders in person or via telephonic conference.

Leadership Structure

Our board of directors does not currently have a formally-appointed chairman or other formal leadership structure that would allow one director to entirely shape the work of the board of directors. Dr. Freund has been appointed as our lead independent director, with authority and responsibility to: (i) in conjunction with the chief executive officer, establish meeting agendas; (ii) preside over meetings of the independent directors; (iii) preside over any portions of meetings of the full board of directors at which the evaluation or compensation of the chief executive officer is presented or discussed; (iv) preside over any portions of meetings of the full board of directors at which the performance of the board of directors is presented or discussed; and (v) coordinate the activities of the other independent directors. We believe that having a lead independent director separate from our chief executive officer reinforces the independence of the board of directors in its oversight of the business and affairs of the company. In addition, we believe that having a lead independent director creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the board of directors to monitor whether management’s actions are in the best interests of the company and its stockholders. As a result, we believe that having a lead independent director can enhance the effectiveness of the board of directors as a whole.

18

Risk Oversight