SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

XenoPort, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | 5. | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

On May 29, 2014, XenoPort, Inc. (“XenoPort” or the “Company”) updated slides 7, 9, 11, 17, 19, 22 and 28 of the slide presentation entitled “The Right Strategy and Right Board to Build Stockholder Value” pertaining to certain proxy matters up for vote at XenoPort’s annual meeting scheduled for June 11, 2014 made to Institutional Shareholder Services, Inc. (“ISS”) on May 21, 2014 (the “ISS Presentation”). The updated version of the ISS Presentation was first used in investor presentations on May 29, 2014. A copy of the updated ISS Presentation is filed herewith as Exhibit 1.

|

The Right Strategy and Board to Build Stockholder Value © Copyright 2014 XenoPort, Inc. All rights reserved. NASDAQ:XNPT |

|

These slides and the accompanying oral presentation by XenoPort, Inc. contain forward-looking statements that involve risks and uncertainties, including statements relating to the commercial opportunity and value proposition for HORZIANT; potential future sales and commercialization activity for HORIZANT; the XP23829 clinical development program, including the initiation or conduct of planned or potential future clinical trials and regulatory submissions and the timing thereof; expected patent coverage; the anticipated sufficiency of XenoPort's cash reserves to fund its operations through 2015; and the therapeutic and commercial potential of XenoPort’s product candidates, including XP23829. XenoPort can give no assurance with respect to these statements, and we assume no obligation to update them. For detailed information about the risks and uncertainties that could cause actual results to differ materially from those implied by, or anticipated in, these forward-looking statements, please refer to the Risk Factors section of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 and filed with the SEC. 2 XenoPort Investor Presentation May 2014 Safe Harbor Language |

|

XenoPort, Inc., its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with XenoPort’s 2014 Annual Meeting of Stockholders. XenoPort has filed with the SEC and provided to its stockholders a definitive proxy statement and a WHITE proxy card in connection with such solicitation. XENOPORT STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS) AND THE ACCOMPANYING WHITE PROXY CARD, AND ANY OTHER RELEVANT DOCUMENTS WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Information regarding the names of XenoPort’s directors and executive officers and their respective interests in XenoPort by security holdings or otherwise is set forth in XenoPort’s definitive proxy statement for the 2014 Annual Meeting of Stockholders, filed with the SEC on April 22, 2014, including Appendix B thereto. The definitive proxy statement (and amendments or supplements thereto) and the accompanying WHITE proxy card, and any other relevant documents and other material filed by XenoPort with the SEC, are or will be available for no charge at the SEC’s website at www.sec.gov and at XenoPort’s investor relations website at http://investor.xenoport.- com/index.cfm. Copies may also be obtained free of charge by contacting XenoPort Investor Relations by mail at 3410 Central Expressway, Santa Clara, California 95051 or by telephone at (408) 616-7200. Additional Information Additional Information 3 XenoPort Investor Presentation May 2014 |

|

Clinton’s Agenda Clinton’s Agenda Clinton expressed disagreement with XenoPort Board’s capital allocation decisions Proposed in October 2013 and continues to recommend that XenoPort stop the commercialization of HORIZANT Insists that XenoPort focus all of its resources on XP23829, a compound that has yet to enter clinical studies in patients Insists that Board replace CEO 4 XenoPort Investor Presentation May 2014 |

|

Agenda Agenda XenoPort overview Creating value in HORIZANT ® XP23829 development execution Monetizing/creating opportunity for other assets XenoPort’s Board recommendations 5 XenoPort Investor Presentation May 2014 |

|

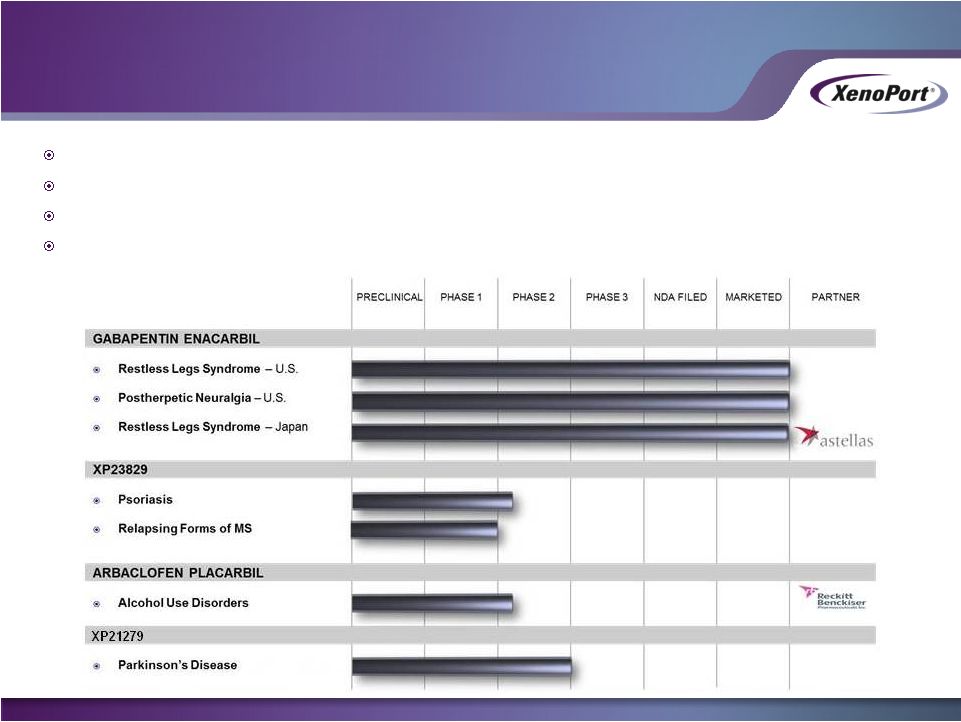

Background on XenoPort Background on XenoPort Founded in 1999; IPO in 2005 92 full-time employees at December 31, 2013 Developed innovative biology/chemistry platform to improve drug efficacy, tolerability, compliance Discovered and developed 4 patented mid/late stage or marketed compounds XenoPort Investor Presentation May 2014 7 |

|

$122.5 million of cash, cash equivalents and short-term investments at 3/31/14 Operations expected to be funded through 2015 Additional $25 million in non-dilutive cash expected in 2014 associated with licensing agreement announced 5/15/14* No debt All financial data as of March 31, 2014. 8 *Subject to antitrust clearance of transaction XenoPort Investor Presentation May 2014 Financials |

|

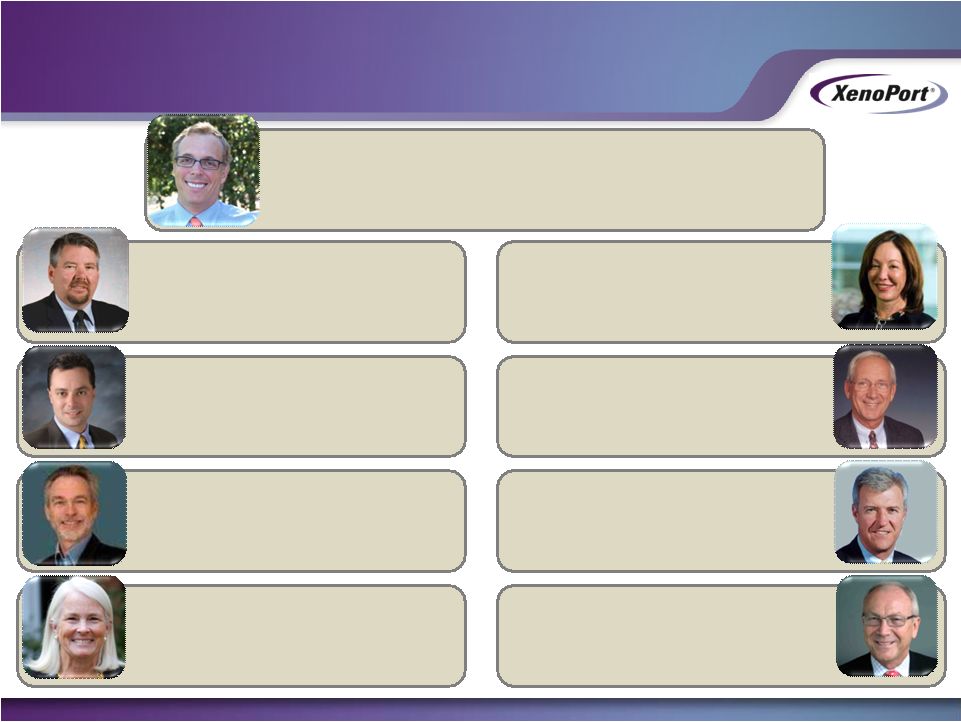

9 Ronald W. Barrett, Ph.D. Chief Executive Officer Founder, former Chief Scientific Officer. More than 25 years of executive management and R&D experience in the pharmaceutical industry, Glaxo, Affymax, Abbott. Richard Kim, M.D. Senior VP, Chief Medical Officer More than a decade of experience in both clinical development and medical affairs, including head of the MS therapeutic area at Elan and global medical director, medical affairs at Biogen Idec. Greg Bates, D.V.M. Senior VP, Regulatory Affairs and Quality 25 years regulatory affairs experience, Pharmacyclics, Otsuka, Genentech, Syntex. Vincent Angotti Executive VP and Chief Operating Officer Over 20 years sales, marketing, operations experience. Relaunched numerous drugs as executive at Reliant Pharma. Operations roles at Novartis. William Harris Chief Financial Officer Over 25 years finance experience. CFO at Coulter (acquired by Corixa Corp). Senior level finance positions at Gilead. MBA, Santa Clara University. Dave Savello, Ph.D. Senior VP of Development Operations Over 30 years broad pharma industry experience. Executive roles in R&D, operations, regulatory at Cardinal Health, Guilford, Glaxo, Boehringer Ingelheim and 3M Company. Gianna M. Bosko Senior VP, Chief Legal Officer and Secretary ~20 years industry experience. Previously at Cooley LLP, general corporate and securities law. J.D., University of Chicago Law School. XenoPort Investor Presentation May 2014 Experienced Management Team |

|

10 9 highly-qualified and proven leaders 8 independent directors 3 new directors have joined the Board over the past 5 years Average tenure of 8.7 years versus average of ~10.1 years for the S&P 500, ~10.8 years for the S&P 1500, ~10.7 years for the S&P MidCap index and ~11.5 years for the S&P SmallCap index¹ 22 Board meetings held in 2013 as part of efforts to oversee XenoPort’s strategy, to monitor progress, to consider strategic options and to build stockholder value 1 Source: ISS, “Director Tenure and Corporate Governance Features,” By Rob Yates, March 25, 2014. XenoPort Investor Presentation May 2014 XenoPort’s Current Board Members are Independent, Qualified and Active |

|

John Freund, M.D., Lead Independent Director Managing Director: Skyline Ventures Partner: Chancellor Capital (INVESCO). Morgan Stanley Venture Partners Co-founder: Intuitive Surgical Former Executive: Acuson Jeryl Hilleman, Audit Committee Chair Ernest Mario, Ph.D.* Dennis Fenton, Ph.D.* Catherine Friedman Paul Berns Compensation Committee Chair Ronald Barrett, Ph.D. Wendell Wierenga, Ph.D. William Rieflin* Currently CEO at XenoPort Former R&D Executive: Glaxo, Affymax Currently CEO at Anacor Former CEO: Allos, Bone Care Former Commercial Executive: Abbott, BASF, BMS Former Amgen EVP worldwide operations, manufacturing, process development and quality Former Managing Director and Head of West Coast Healthcare Practice for Morgan Stanley Currently CFO at Ocera. Former CFO: Amyris, Symx, Geron, Cytel Former CEO: Capnia, Reliant, Intrabiotics, ALZA, Glaxo Currently CEO at NGM Biopharma Former President/COO: XenoPort;Tularik Former CEO: Syrrx Former Senior R&D Executive at Santarus, Ambit, Neurocrine, Park Davis, UpJohn 11 XenoPort Investor Presentation May 2014 *Directors added in past 5 years Board with Proven Records, Relevant Experience and Broad Skill Sets |

|

12 XenoPort Phase 3 Trials 4 trials 3 positive 1 negative • HORIZANT approved on the basis of successful Phase 3 program XenoPort Phase 2 Trials 11 trials 7 positive 4 negative • XP21279 study had trend to positive outcome that served as basis for FDA discussion resulting in agreement to move to Phase 3 but… Only 13% of small molecule drug candidates entering clinical development are approved. * and… * Dimasi et al., Clinical Pharmacology & Therapeutics 87, 272-277 (March 2010) XenoPort Investor Presentation May 2014 XenoPort Success Rate in Mid/Late Stage Trials Exceeds Industry Norms |

|

In response to HORIZANT Complete Response Letter • Moved rapidly to restructure around securing approval of HORIZANT and advancing its clinical-stage assets • Conserved resources • Reduced headcount by approximately 50% • Eliminated research function • CEO took voluntary pay cut • Spearheaded successful effort to get FDA to approve HORIZANT In response to AP MS spasticity Phase 3 trial results • Moved rapidly to shut-down ongoing AP program expenses and re-focused around two key assets: XP23829 and HORIZANT • Put XP21279 and AP on back burner as XP23829 believed to have higher value-creation potential • Successfully out-licensed AP May 15, 2014* 13 *Subject to antitrust clearance of transaction XenoPort Investor Presentation May 2014 Management and Board Have Made Tough Decisions in Response to Setbacks |

|

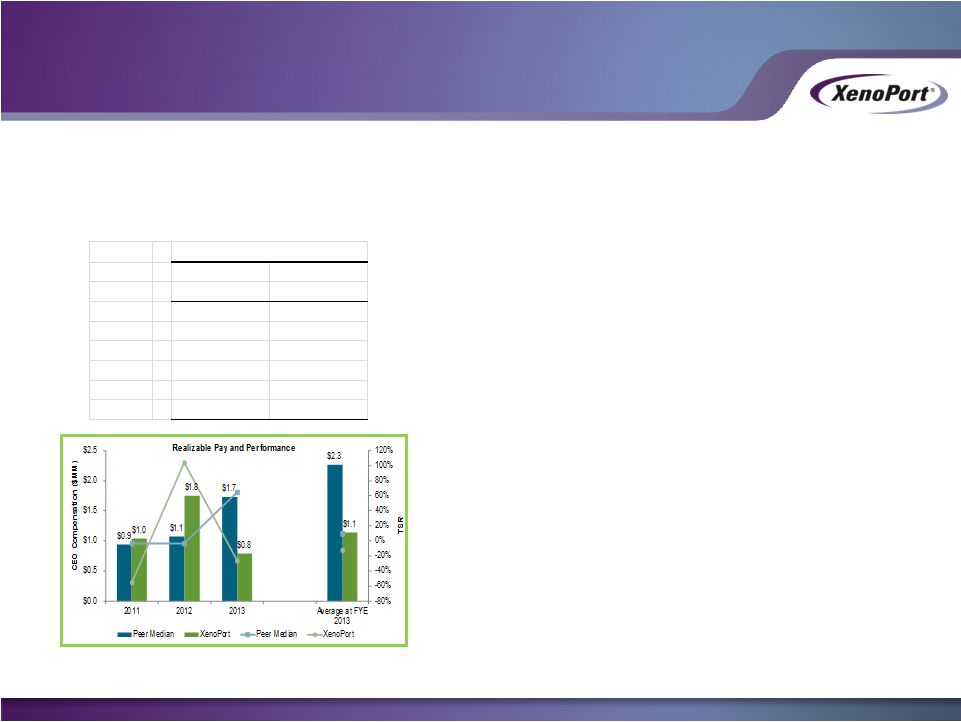

Pay for Performance Philosophy: CEO Compensation Aligned with Performance and Peers • Compensation composed of salary, cash bonus and long-term incentives • Pay-for-performance philosophy and practice * Minimum Corporate Goal performance required for any bonus payment * Performance-based equity grants in 2010 and 2014 Note: Realizable pay for each year is calculated as base salary and bonus / NEIP as disclosed in the Summary Compensation Table, plus the intrinsic value of equity awards granted during the year, based on FYE stock price; If payout is not disclosed, performance awards are assumed at target; Three year average is calculated as average cash compensation plus average intrinsic equity value, based on 2013 FYE stock price. • Average realizable compensation is <50% that of peers • Realizable compensation has increased and decreased appropriately with stock price performance • Equity awards generally weighted towards stock options -- only deliver value if the stock price increases Corp Bonus Base Salary Plan Cash 2008 500,000 $ Paid in RSU's 2009 500,000 $ 300,000 $ 2010 465,937 $ No Bonus 2011 458,522 $ 330,136 $ 2012 469,985 $ 444,136 $ 2013 500,000 $ No Bonus Cash Compensation XenoPort Investor Presentation May 2014 14 • 2008: Dr. Barrett requested and the Board agreed to pay bonus in stock to conserve cash • 2010: Dr. Barrett requested and the Board agreed to reduce salary Minimum Corporate Goal score was not met and no bonus paid • 2011: 280G gross-up benefit eliminated • 2013: Minimum Corporate Goal score was not met and no bonus paid • 2014: Dr. Barrett requested and the Board agreed to no increase in salary 50% of long-term incentive grant performance-based Stock ownership guidelines implemented for executives and Board |

|

Strategy to Build Stockholder Value 15 Advance development of XP23829 as potential treatment for psoriasis and/or relapsing forms of multiple sclerosis Build significant value for HORIZANT • Provide funding source to capture the most value for XP23829 • Potential revenue through out-licensing deal or through achieving profitability of commercial effort • Hedge risk inherent in XP23829 development Monetize other assets and create “additional shots on goal” through partnering We believe it would be imprudent to focus ONLY on XP23829, despite its potential. XP23829 is just entering Phase 2 studies and the biotechnology business has inherent risk. XenoPort Investor Presentation May 2014 |

|

Existing Stockholders Participated in January 2014 Financing XenoPort regularly meets with stockholders and potential new investors XenoPort Board members met with majority of top 15 stockholders in January 2014 prior to financing to get feedback on Clinton’s demands and XenoPort’s strategy Majority of largest stockholders participated in subsequent financing 16 XenoPort Investor Presentation May 2014 |

|

Industry Analysts are Supportive of the Actions XenoPort is Taking on HORIZANT 17 Permission to use quotes was neither sought nor obtained. XenoPort Investor Presentation May 2014 Industry analysts recognize the value potential of HORIZANT We continue to see HORIZANT ($2.7 million in revenues in Q4 2013) as contributing modestly to XNPT valuation. However, if XNPT continues to execute well, we believe HORIZANT could become a profitable business unit and a modest contributor of cash.” – Ladenberg, 2/27/14 Management has developed a new marketing strategy that shows initial signs of bearing fruit. The company has deployed 40 field representatives into 40 territories, and the team has already begun to outperform the marketing effort put forth by GSK.” – Jefferies, 4/21/14 “Horizant sales were $3M for the quarter with prescription trends continuing to provide some reflection of XNPT’s successful focused re-launch, and … its trajectory should enable the drug to be cash flow positive.” – Wells Fargo, 5/09/14 “HORIZANT appears to be generating positive momentum in markets where XNPT is focused…. We believe HORIZANT revenues will continue to grow….” – Leerink, 5/11/14 |

|

Creating Value in HORIZANT ® (gabapentin enacarbil) Extended-Release Tablets |

|

19 HORIZANT – Discovered and Developed by XenoPort for RLS prior to 2007 Former Partner Launches HORIZANT Former Partner Experiences Stockout XenoPort Initiates HORIZANT Commercialization 2010 2007 2008 2009 2011 2012 2013 2014 XenoPort and Former Partner Enter Into Licensing Agreement Receive CRL From FDA FDA Approves HORIZANT for Moderate-to-Severe Primary RLS in Adults XenoPort Initiates Dispute Process FDA Approves HORIZANT for Management of PHN In Adults XenoPort Reacquires HORIZANT Rights HORIZANT Agreement Terminated Please review the full prescribing and safety information for HORIZANT. The most common adverse reactions of HORIZANT in RLS patients: somnolence/sedation and dizziness, and in PHN patients: somnolence, dizziness and headache. RLS NDA Accepted XenoPort Investor Presentation May 2014 We Re-Launched HORIZANT Less Than a Year Ago |

|

Over 5 million adults suffer from moderate-to-severe primary restless legs syndrome (RLS) >6 million annual prescription Widespread use of dopamine agonists Growing awareness of issues related to dopamine agonist use in treatment of RLS Sources: RLS Prevelance-NINDs, NIH, Sleep Medicine, Volume 14, No. 7 , 2013, Mayo Clinic Proceedings, Volume 88, No. 9, 2013, Sleep, Vol. 35, No. 8, 2012 20 XenoPort Investor Presentation May 2014 Moderate-to-Severe Primary RLS Market Opportunity in U.S. |

|

Only non-dopamine agonist approved for treatment of moderate-to-severe primary RLS in adults Proven effective in relieving RLS symptoms HORIZANT is “not interchangeable with other gabapentin products” (FDA Label) Convenient once-a-day dosing No titration to approved dose Shows no evidence of augmentation, rebound or impulse control disorders Please review the full prescribing and safety information for HORIZANT. The most common adverse reactions of HORIZANT in RLS patients: somnolence/sedation and dizziness, and in PHN patients: somnolence, dizziness and headache. 21 XenoPort Investor Presentation May 2014 HORIZANT Is Differentiated for RLS |

|

International RLS Study Group Task Force recommends that alpha-2- delta ligands should be considered for first-line treatment for patients with RLS Willis Ekbom Disease Foundation Medical Advisory Board revised consensus statement on the management of RLS recommending alpha-2-delta ligands should be considered for initial treatment for patients with RLS American Academy of Sleep Medicine identified gabapentin enacarbil as the only alpha-2-delta ligand with high level of evidence of efficacy for patients with RLS RLS Treatment Guidelines Revised Since HORIZANT Approval 22 HORIZANT is the only product in the alpha-2-delta ligand class approved for treatment of RLS. Please review the full prescribing and safety information for HORIZANT. The most common adverse reactions of HORIZANT in RLS patients: somnolence/sedation and dizziness, and in PHN patients: somnolence, dizziness and headache. XenoPort Investor Presentation May 2014 |

|

Results from damage that occurs to the peripheral nerve fibers during a shingles outbreak Pain associated with PHN can be very intense About 200,000 patients suffer from PHN in the U.S. Clear unmet medical need • Only ~30% of patients receive 50% reduction in PHN pain with gabapentin, the most widely used agent to treat PHN Sources: Decision Resources, Inc. 2010, Neurontin Product Label 23 XenoPort Investor Presentation May 2014 Postherpetic Neuralgia (PHN) |

|

Simple dosing • Three days at 600 mg once a day • 4 th day at approved 600 mg twice daily Effective at one week Pharmacokinetic differentiation • High bioavailability (75%) • Sustained 24-hour gabapentin blood levels (Peak/Trough = 1.5) • “Not interchangeable with other gabapentin products” (FDA label) Pivotal trial showed 42% of PHN patients experienced 50% pain intensity score from baseline 24-hour pain reduction Approved for PHN by FDA but never launched by former partner Please review the full prescribing and safety information for HORIZANT. The most common adverse reactions of HORIZANT in RLS patients: somnolence/sedation and dizziness, and in PHN patients: somnolence, dizziness and headache. Patients with renal insufficiency require a modified dose." 24 XenoPort Investor Presentation May 2014 HORIZANT is Differentiated for PHN |

|

• Partner exited pain development which was a major part of HORIZANT life cycle planning • Led to former partner’s $3B settlement with U.S. Government • Corporate Integrity Agreement • New selling model for former partner (no individual incentives for sales) implemented on the day of HORIZANT launch • “Wasn’t aware of HORIZANT” • “Did not know enough about HORIZANT to decide” • “Did not know HORIZANT was approved” 25 XenoPort Investor Presentation May 2014 HORIZANT: What Went Wrong with Former Partner? Change in former partner’s CEO – HORIZANT champions departed Change in former partner’s development strategy Government investigation of former partner’s past marketing practices Six months after former partner’s launch, market research of targeted customers showed top three reasons for not prescribing HORIZANT: |

|

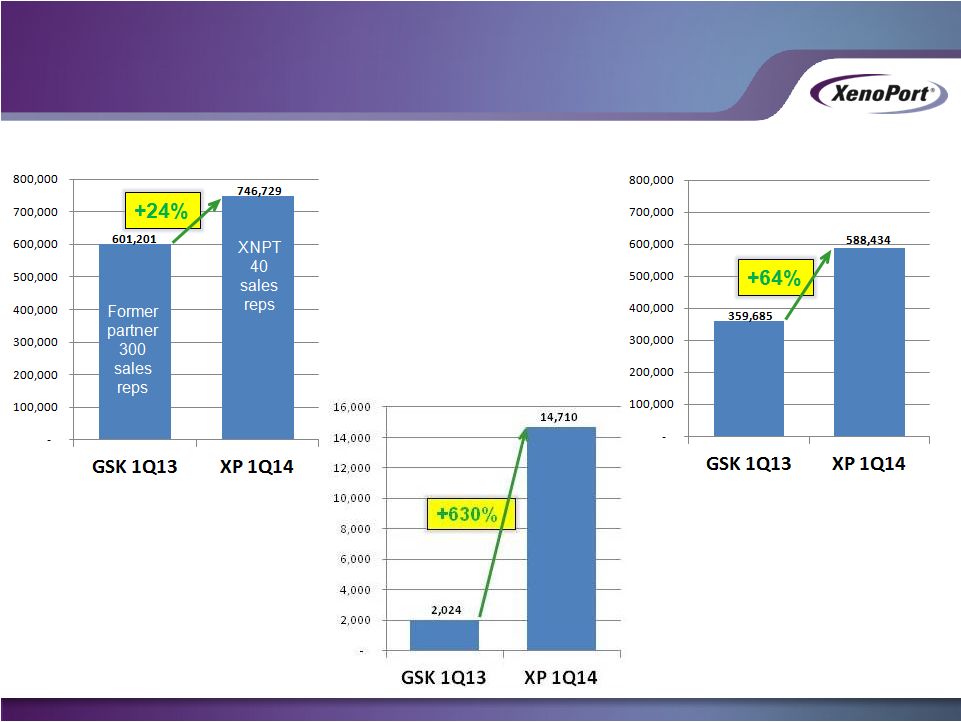

Strategy • Measure responsiveness quickly and efficiently • Build value in HORIZANT to provide strategic optionality (monetize or grow business) • Closely monitor results to make sure continued investment is warranted Tactics • Leverage $40 million and 50 metric tons of active ingredient acquired as part of settlement • Implement state-of-the-art promotional tools • Personal promotion and marketing efforts focused in 40 territories 26 • XenoPort sales specialists call on ~10% of the potential market • ~40 sales reps vs. former partner’s ~300 XenoPort Investor Presentation May 2014 XenoPort’s Initial Strategy Demonstrate that HORIZANT is Promotionally Responsive |

|

Solid HORIZANT Prescription Performance in 1Q 2014 27 National Prescribed Tablets XP Territories Prescribed Tablets Prescribed Tablets per Rep XenoPort Investor Presentation May 2014 |

|

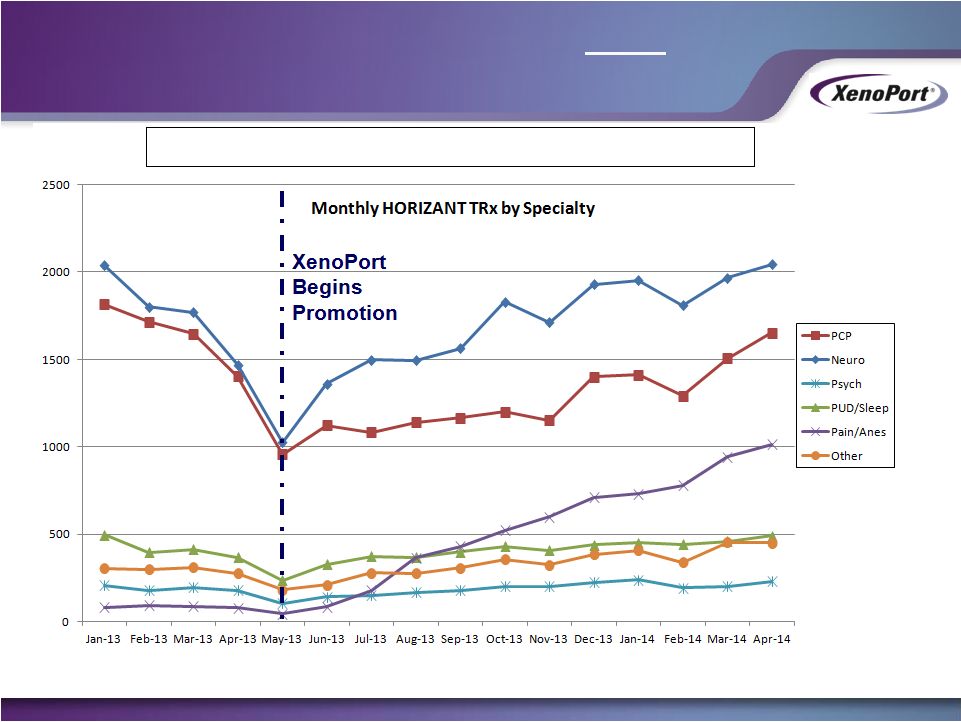

HORIZANT Prescription Growth Coming from XenoPort Promotion 28 XenoPort Promoted Territories Non-Promoted Territories Former Partner Stockout XenoPort Commercialization Begins Weekly HORIZANT Prescribed Tablets XenoPort Investor Presentation May 2014 |

|

29 Former Partner Never Launched for PHN Indication Please review the full prescribing and safety information for HORIZANT. The most common adverse reactions of HORIZANT in RLS patients: somnolence/sedation and dizziness, and in PHN patients: somnolence, dizziness and headache. Patients with renal insufficiency require a modified dose." XenoPort Investor Presentation May 2014 Physicians Now Receiving RLS AND PHN Promotional Messages |

|

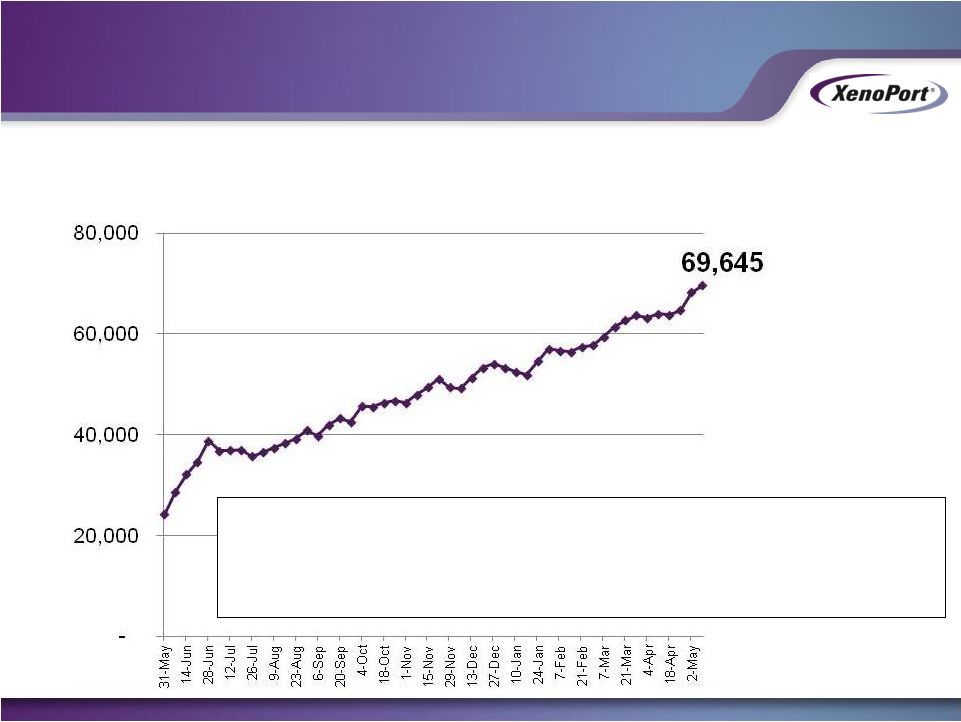

30 4-Week Rolling Average - HORIZANT Prescribed Tablets May 31, 2013 to May 9, 2014 XenoPort Investor Presentation May 2014 69,645 tablets at current WAC price = $489,125 / week Achieved with 40 sales reps promoting to physicians that represent ~10% of the potential market HORIZANT Gross Demand Sales at ~$25 Million Annualized Run Rate and Ramping |

|

31 Our focused effort has demonstrated promising promotional responsiveness HORIZANT is now appropriately priced to be competitive with branded peers • Prescriptions remain robust after price increases • This value has accrued to XenoPort stockholders because we still own the product HORIZANT has patent protection through 2026 HORIZANT current annualized run rate is ~$25 million and ramping HORIZANT’s poor performance by former partner is explainable • We believe XenoPort is building significant value in an asset whose value was not apparent to the external world when re-acquired. • We believe it would be imprudent to discontinue HORIZANT when value creation curve remains steep. XenoPort Investor Presentation May 2014 HORIZANT Summary |

|

XP23829 Development Execution |

|

FUMADERM (mixture of dimethylfumarate and monoethyl fumarate salts) • Approved in 1990s and widely used for the treatment of psoriasis in Germany TECFIDERA (dimethylfumarate) • Approved in March 2013 in the United States and February 2013 in EU for the treatment of relapsing forms of MS • Q1 2014 TECFIDERA revenues were $506 million ($460 million in U.S.; $46 million in sales outside the U.S.) XP23829 has novel chemical structure that produces the same active metabolite as TECFIDERA (dimethylfumarate) 33 XenoPort Investor Presentation May 2014 Background: Fumaric Acid Ester Products |

|

Lower incidence/less severe GI side effects and flushing • Improved compliance; fewer treatment failures Onset and/or magnitude of efficacy • Earlier onset of immunomodulation Reduced dosing frequency • Once a day rather than twice (TECFIDERA) or three times (FUMADERM) daily 34 XenoPort Investor Presentation May 2014 Potential Advantages and Areas of Differentiation |

|

Completed numerous preclinical studies Most studies included DMF for comparison Animals studies demonstrated less gastric irritation Phase 1 data has demonstrated favorable pharmacokinetic and pharmacodynamic effects Included direct comparison with TECFIDERA Demonstrated appropriate MMF exposure Demonstrated immune biomarker effects with once-a-day dosing Preparing to initiate a Phase 2 clinical trial in patients with moderate-to- severe plaque psoriasis by mid-2014 35 • Early-stage development proceeds in a step-wise fashion and is less costly than later-stage development. • XenoPort has aggressively invested in XP23829 by including DMF and TECFIDERA in studies to assess potential for differentiation. XenoPort Investor Presentation May 2014 Ramping Investment in XP23829 Appropriate for its Stage of Development |

|

Lymphocyte reductions require further exploration • Psoriasis Phase 2 study is designed to establish whether XP23829 differs from FUMADERM/TECFIDERA and to assess the potential benefits and risks if different TECFIDERA’s patents likely to be challenged • Generic DMF could enter the market and “raise the bar” for a second generation product MS and psoriasis markets will be crowded by earliest potential XP23829 launch date • Nine approved drugs in U.S. for relapsing forms of MS • Generic MS treatments may reach market as early as this year and change pricing dynamics • Seven approved drugs in U.S. for moderate-to-severe plaque psoriasis • Five compounds in Phase 3 development • Two oral drugs (apremilast and tofacitinib) expected to enter market in next year 36 We believe it would be imprudent to focus ONLY on this mid-stage asset, despite its potential. XenoPort Investor Presentation May 2014 XP23829 has Inherent Risk, Like All Drug Candidates |

|

Monetizing/Creating Opportunity for Other Assets |

|

Exclusive world-wide rights granted to Reckitt Benckiser Pharmaceuticals announced on May 15, 2014¹ Initial development focus: Alcohol Use Disorder $20 million up-front plus $5 million on technology transfer completion Up to $70 million in development and regulatory milestones Up to $50 million in commercial milestones Tiered double-digit royalty payments up to mid-teens on a percentage basis on potential future net sales in the U.S. High single-digit royalty payments on potential future sales outside the U.S. 38 1 Subject to antitrust clearance of transaction Significant value for an asset that Wall Street had recently valued at $0. XenoPort Investor Presentation May 2014 AP Agreement Creates Value for XenoPort Stockholders |

|

XenoPort’s Board Recommendations |

|

June 2013: Clinton began buying and selling XenoPort shares. October 2013: Clinton issues public letter attacking performance and leadership, and demanding replacement of XenoPort’s CEO. Fall – Winter 2013: Members of XenoPort’s Board and management have conference calls, in-person meetings and written exchanges with Clinton to understand and share views. Clinton fails to meet XenoPort’s request for the financial analysis offered in Clinton’s October letter. January 2014: Clinton does not respond to management’s offer to review HORIZANT progress and public guidance on potential time to reach profitability. February 2014: Clinton provides notice of intent to nominate competing slate of director candidates and present other proposals at Annual Meeting. XenoPort Board Engagement with Clinton XenoPort Board Engagement with Clinton 40 XenoPort Investor Presentation May 2014 |

|

February 2014: Members of XenoPort’s Board engage in multiple discussions with Clinton in an effort to reach a resolution and avoid a costly and disruptive proxy battle. March 2014: Clinton does not respond to XenoPort’s modified settlement proposal. April 2014: Clinton reduced his position and reportedly now holds 1.6% of XenoPort stock.¹ XenoPort Board Engagement with Clinton (con’t) XenoPort Board Engagement with Clinton (con’t) 41 1) Clinton Definitive Proxy, Filed 4/25/14 • XenoPort’s Board attempted to constructively engage with Clinton to no avail. • The Board is open to stockholder feedback and is committed to doing what is in the best interest of all stockholders. XenoPort Investor Presentation May 2014 |

|

Clinton’s Agenda for Capital Allocation Clinton’s Agenda for Capital Allocation Could Destroy Value Could Destroy Value Now is the worst time to abandon HORIZANT commercialization • Investment in commercial operations is complete • Investments in marketing initiatives and programs are largely committed • Positive trajectory of sales is increasing the value of a partnership or divestiture of HORIZANT HORIZANT could generate meaningful non-dilutive revenue to fund further advances of XP23829 development Diverting funding from HORIZANT to XP23829 will not accelerate its development Putting all eggs in one basket is a risky strategy in an inherently risky industry 42 XenoPort Investor Presentation May 2014 |

|

Clinton’s Agenda to Replace XenoPort CEO and Two Clinton’s Agenda to Replace XenoPort CEO and Two Highly-Qualified Directors Could Destroy Value Highly-Qualified Directors Could Destroy Value Clinton Agenda: replace the CEO Dr. Barrett has played, and will continue to play, a pivotal role in executing XenoPort’s strategy Clinton has not identified or proposed an alternative CEO. Dismissing current CEO would create a void in the leadership on critical initiatives: Initiating by mid-year and conducting a Phase 2 trial for XP23829 Driving education and appropriate use of HORIZANT Engaging in discussions with potential strategic partners Clinton Agenda: replace three Board members: Dr. Barrett, Ms. Hilleman and Dr. Wierenga Replacing these three XenoPort directors removes experience and expertise that are essential to XenoPort’s future success 43 XenoPort Investor Presentation May 2014 |

|

Director Nominees Provide Expertise Director Nominees Provide Expertise Critical to XenoPort’s Success Critical to XenoPort’s Success Ronald W. Barrett, Ph.D. Chief Executive Officer of XenoPort since 2001 20+ years of executive management experience in the pharmaceutical industry Chief Scientific Officer of XenoPort from 1999 to 2001 Various positions at Affymax Research Institute, the most recent of which was Senior Vice President of Research Dr. Barrett’s leadership and strategic direction have led to the discovery and development of our novel product candidates (including XP23829) and have enabled XenoPort to evolve from a research-based company to an integrated company with development and commercialization capabilities. 44 XenoPort Investor Presentation May 2014 |

|

Director Nominees Provide Expertise Director Nominees Provide Expertise Critical to XenoPort’s Success Critical to XenoPort’s Success Jeryl L. Hilleman Chair of XenoPort Audit Committee 30+ years of finance, marketing and investment experience and an impressive history of executive leadership 20+ years as CFO of both private and public companies Ms. Hilleman’s considerable expertise in finance and accounting allows her to provide important guidance and direction to XenoPort in relation to its finance, compliance and auditing needs, as demonstrated by her work in helping to successfully navigate the accounting complexities and SEC interactions associated with the re-acquisition of HORIZANT. Her knowledge of XenoPort’s financials would be difficult to replace. 45 XenoPort Investor Presentation May 2014 |

|

Director Nominees Provide Expertise Director Nominees Provide Expertise Critical to XenoPort’s Success Critical to XenoPort’s Success Wendell Wierenga, Ph.D. 40 years of leadership of pharmaceutical and biopharmaceutical companies, including Executive leadership of pharmaceutical research, clinical development and regulatory functions for a number of national and multi-national corporations, including Santarus (acquired by Salix Pharmaceuticals for $2.6 B) and Syrrx (acquired by Takeda for $270M) Director of multiple publicly-traded biopharmaceutical companies, including Onyx Pharmaceuticals (acquired by Amgen for $10 B) Participated in the submission of 70+ Investigational New Drug applications and the filing of 16 New Drug Applications/Biologics License Applications, and 16 FDA-approved drug products Dr. Wierenga’s substantial R&D experience has contributed to the successful development of our pipeline and the approval of HORIZANT. His Board experience, including membership of compensation committees and involvement with M&A processes, provides unique value to the Board. 46 XenoPort Investor Presentation May 2014 |

|

The Right Strategy and Board to Execute The Right Strategy and Board to Execute and Deliver Long-Term Value and Deliver Long-Term Value XenoPort Is Committed to Realizing the Full Potential of its Assets and Acting in the Best Interests of XenoPort Stockholders. Our Board is active and engaged, and has the depth and diversity of skills and expertise needed to oversee the execution of XenoPort’s strategy We are making meaningful progress commercializing HORIZANT We are committed to optimizing the value of XP23829 Our Board has concluded that Clinton’s nominees add no relevant skills, experience or expertise that is not already well represented on the Board Our Board believes that Clinton’s nominees will push an uninformed agenda that could undermine the Board’s goal of maximally enhancing value of XenoPort through current investment in BOTH HORIZANT and XP23829 We Ask That You Vote FOR ALL the Board’s Director Nominees 47 XenoPort Investor Presentation May 2014 |

|

48 XenoPort Investor Presentation May 2014 HORIZANT ® (gabapentin enacarbil) Extended-Release Tablets INDICATIONS HORIZANT ® (gabapentin enacarbil) is a prescription medicine used to: treat adults with moderate-to-severe primary Restless Legs Syndrome (RLS). HORIZANT is not for people who need to sleep during the daytime and stay awake at night. manage pain from damaged nerves (postherpetic neuralgia) that follows healing of shingles (a painful rash that comes after a herpes zoster infection) in adults. IMPORTANT SAFETY INFORMATION Do not drive after taking your dose of HORIZANT until you know how it affects you, including the morning after you take it. Do not operate heavy machinery or do other dangerous activities until you know how HORIZANT affects you. HORIZANT can cause sleepiness, dizziness, slow thinking, and can affect your coordination. Ask your healthcare provider when it is okay to do these activities. Do not take other medicines that make you sleepy or dizzy while taking HORIZANT without talking to your healthcare provider. Taking HORIZANT with these other medicines may make your sleepiness or dizziness worse. HORIZANT may cause suicidal thoughts or actions in a very small number of people (about 1 in 500). Pay attention to any changes, especially sudden changes, in mood, behaviors, thoughts, or feelings. Call your healthcare provider right away if you have any of these symptoms, especially if they are new, worse, or worry you: thoughts or actions about suicide, self-harm, or dying; attempt to commit suicide new or worsening depression or anxiety; or feeling agitated new or worse restlessness or panic attacks new or worse trouble sleeping (insomnia); or irritability acting aggressive, being angry, or violent; acting on dangerous impulses an extreme increase in activity or talking (mania); other unusual changes in mood or behavior Do not stop taking HORIZANT without first talking to your healthcare provider. Suicidal thoughts or actions can be caused by things other than medicines. If you have these thoughts or actions, your healthcare provider may check for other causes. HORIZANT may cause a serious or life-threatening allergic reaction that may affect your skin or other parts of your body such as your liver or blood cells. You may or may not have a rash with these types of reactions. Call a healthcare provider right away if you have any of the following symptoms: skin rash, hives, fever, swollen glands that do not go away, swelling of your lips or tongue, yellowing of your skin or eyes, unusual bruising or bleeding, severe fatigue or weakness, unexpected severe muscle pain, or frequent infections. These symptoms may be the first signs of a serious reaction. A healthcare provider should examine you to decide if you should continue taking HORIZANT. HORIZANT: Important Safety Information |

|

49 XenoPort Investor Presentation May 2014 HORIZANT is not the same medicine as gabapentin (for example, Neurontin ® and Gralise ® ). HORIZANT should not be used in their place. Do not take these or other gabapentin products while taking HORIZANT. Before taking HORIZANT, tell your healthcare provider if you: have or have had kidney problems or are on hemodialysis have or have had depression, mood problems, or suicidal thoughts or behavior have or have had seizures have a history of drug abuse have any other medical conditions are pregnant or plan to become pregnant. It is not known if HORIZANT will harm your unborn baby. Talk to your healthcare provider if you are pregnant or plan to become pregnant while taking HORIZANT. You and your healthcare provider will decide if you should take HORIZANT while you are pregnant are breastfeeding or plan to breastfeed. Your body turns HORIZANT into another drug (gabapentin) that passes into your milk. It is not known if this can harm your baby. You and your healthcare provider should decide if you will take HORIZANT or breastfeed drink alcohol Do not drink alcohol while taking HORIZANT because it may increase the risk of side effects. Tell your healthcare provider about all the medicines you take, including prescription and non-prescription medicines, vitamins, and herbal supplements. Taking HORIZANT with certain other medicines can cause side effects or affect how well they work. Do not start or stop other medicines without talking to your healthcare provider. Do not stop taking HORIZANT without talking to your healthcare provider first. If you stop taking HORIZANT suddenly, you may develop side effects. The most common side effects of HORIZANT include dizziness, sleepiness, and headache. Tell your healthcare provider about any side effect that bothers you or does not go away. These are not all the possible side effects of HORIZANT. For more information, ask your healthcare provider or pharmacist. You are encouraged to report negative side effects of prescription drugs to the FDA. Visit www.fda.gov/medwatch, or call 1-800-FDA-1088. See Medication Guide. HORIZANT: Important Safety Information |