Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

XNPT similar filings

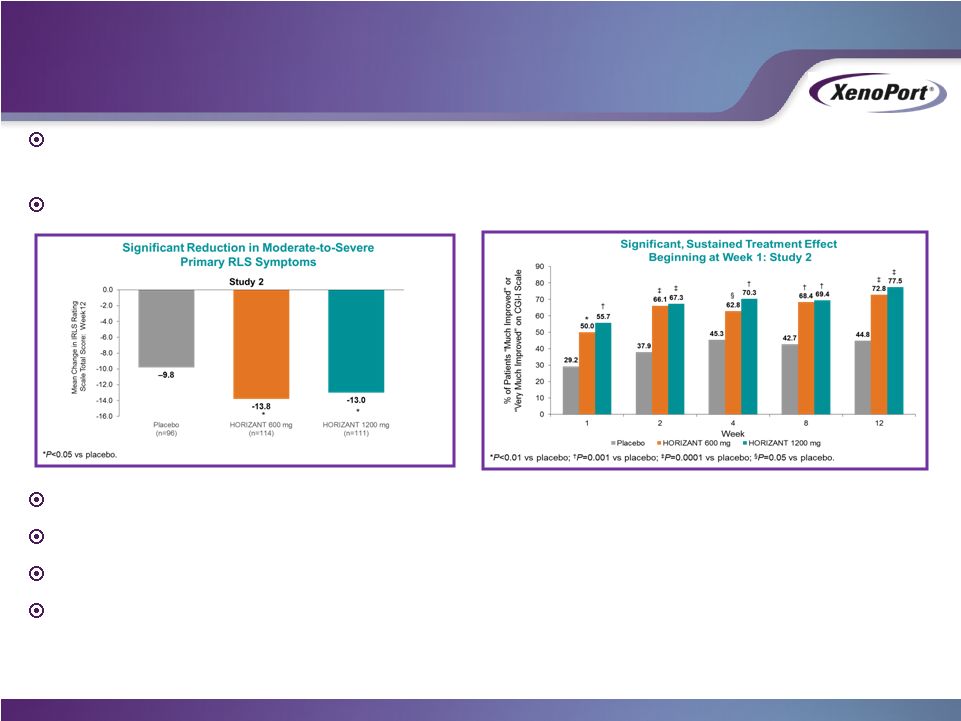

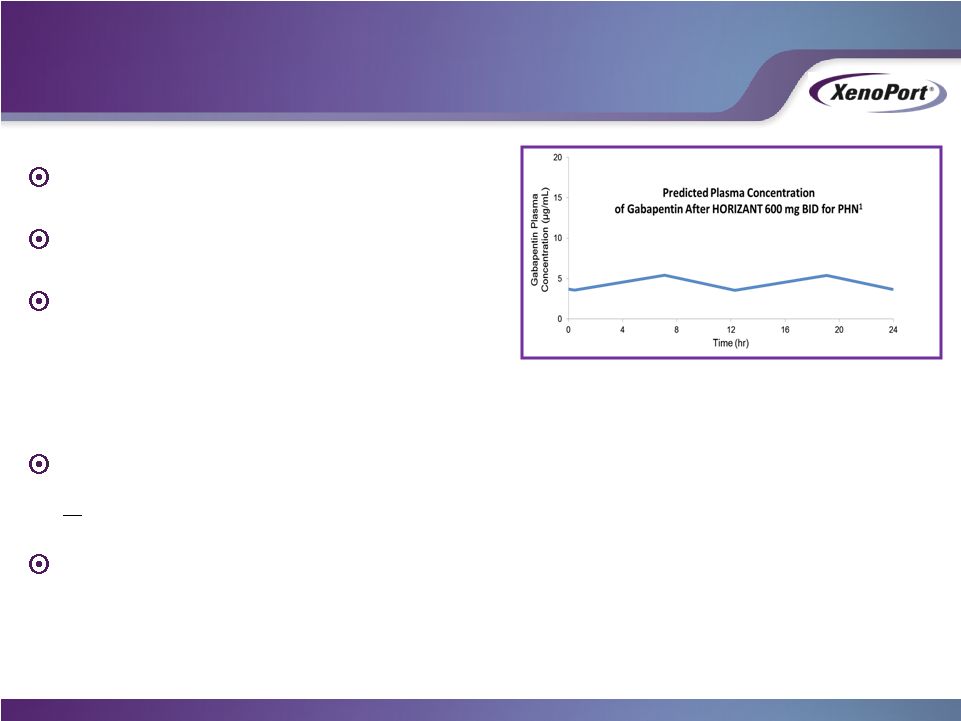

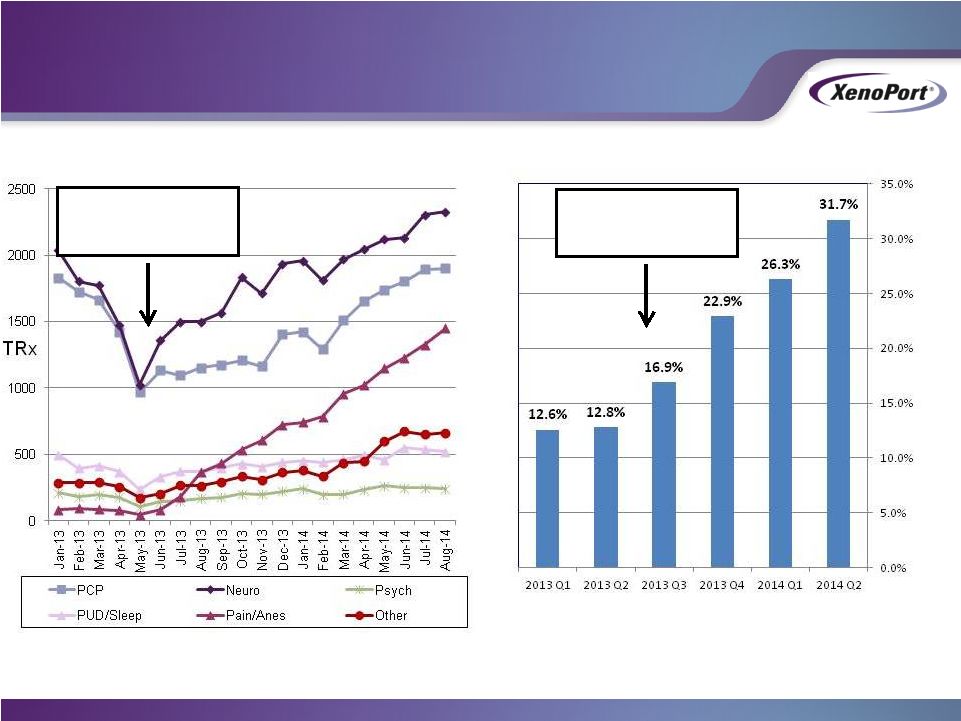

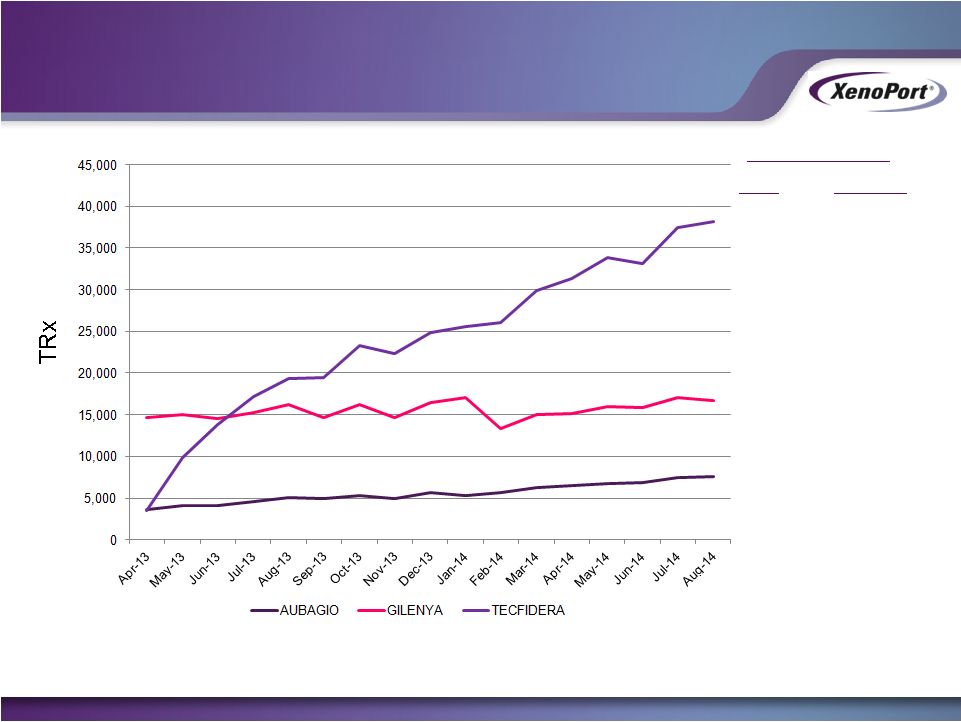

- 12 Jan 15 XenoPort Provides Highlights of HORIZANT Prescription Trends and Update on Development for Alcohol Use Disorder

- 26 Nov 14 Entry into a Material Definitive Agreement

- 4 Nov 14 XenoPort Reports Third Quarter Financial Results

- 16 Oct 14 Regulation FD Disclosure

- 6 Aug 14 XenoPort Reports Second Quarter Financial Results

- 24 Jun 14 Completion of Acquisition or Disposition of Assets

- 16 Jun 14 Departure of Directors or Certain Officers

Filing view

External links