- TRAW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1/A Filing

Traws Pharma (TRAW) S-1/AIPO registration (amended)

Filed: 11 Jul 13, 12:00am

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on July 11, 2013

Registration No. 333-189358

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Onconova Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 2834 (Primary Standard Industrial Classification Code Number) | 22-3627252 (I.R.S. Employer Identification Number) |

375 Pheasant Run

Newtown, PA 18940

(267) 759-3680

(Address, including zip code and telephone number, including

area code, of registrant's principal executive offices)

Ramesh Kumar, Ph.D.

President and Chief Executive Officer

Onconova Therapeutics, Inc.

375 Pheasant Run

Newtown, PA 18940

(267) 759-3680

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| David S. Rosenthal, Esq. James J. Marino, Esq. Dechert LLP 1095 Avenue of the Americas New York, New York 10036 (212) 698-3500 | Andrew S. Williamson, Esq. Brent B. Siler, Esq. Brian F. Leaf, Esq. Cooley LLP 11951 Freedom Drive Reston, Virginia 20190 (703) 456-8000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee(3) | ||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.01 par value per share | 5,307,692 | $14.00 | $74,307,688 | $10,136 | ||||

| ||||||||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 11, 2013

PRELIMINARY PROSPECTUS

4,615,385 Shares

Onconova Therapeutics,��Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. We are selling 4,615,385 shares of common stock in this offering. We currently expect the initial public offering price to be between $12.00 and $14.00 per share of common stock.

We have granted the underwriters an option to purchase up to 692,307 additional shares of common stock to cover over-allotments.

We have applied to list our common stock on the NASDAQ Global Market under the symbol "ONTX."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 11.

We are an "emerging growth company" under applicable Securities and Exchange Commission rules and will be eligible for reduced public company reporting requirements. See "Summary—Implications of Being an Emerging Growth Company."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Public Offering Price | $ | $ | |||||

Underwriting Discounts(1) | $ | $ | |||||

Proceeds to Onconova Therapeutics, Inc. (before expenses) | $ | $ | |||||

Baxter Healthcare SA, one of our stockholders and collaborators, and our chairman of the board of directors, as well as certain other of our existing stockholders, including certain of our directors, have indicated an interest in purchasing up to an aggregate of $26.0 million of shares of our common stock in this offering at the initial offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, less or no shares in this offering to any of these stockholders, and any of these stockholders may determine to purchase more, less or no shares in this offering. The underwriters will receive the same underwriting discount on any shares purchased by these stockholders as they will on any other shares sold to the public in this offering.

The underwriters expect to deliver the shares to purchasers on or about , 2013 through the book-entry facilities of The Depository Trust Company.

| Citigroup | Leerink Swann |

Piper Jaffray

Janney Montgomery Scott

, 2013

We are responsible for the information contained in this prospectus. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus.

| | Page | |

|---|---|---|

Summary | 1 | |

Risk Factors | 11 | |

Special Note Regarding Forward-Looking Statements and Industry Data | 48 | |

Use of Proceeds | 50 | |

Dividend Policy | 50 | |

Capitalization | 51 | |

Dilution | 53 | |

Selected Consolidated Financial Data | 55 | |

Management's Discussion and Analysis of Financial Condition and Results of Operations | 56 | |

Business | 85 | |

Management | 122 | |

Executive and Director Compensation | 131 | |

Certain Relationships and Related Party Transactions | 149 | |

Principal Stockholders | 154 | |

Description of Capital Stock | 157 | |

Shares Eligible for Future Sale | 161 | |

Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of our Common Stock | 164 | |

Underwriting | 168 | |

Legal Matters | 175 | |

Experts | 175 | |

Where You Can Find More Information | 175 | |

Index to Consolidated Financial Statements | F-1 |

This summary highlights certain information about us and this offering contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our common stock, you should read the entire prospectus carefully, including "Risk Factors" beginning on page 10 and the consolidated financial statements and related notes included in this prospectus.

Unless the context indicates otherwise, as used in this prospectus, the terms "Onconova," "Onconova Therapeutics," "we," "us," "our," "our company" and "our business" refer to Onconova Therapeutics, Inc.

Overview

We are a clinical-stage biopharmaceutical company focused on discovering and developing novel small molecule drug candidates to treat cancer. Using our proprietary chemistry platform, we have created an extensive library of targeted anti-cancer agents designed to work against specific cellular pathways that are important to cancer cells. We believe that the drug candidates in our pipeline have the potential to be efficacious in a wide variety of cancers without causing harm to normal cells. We have three clinical-stage product candidates and six preclinical programs.

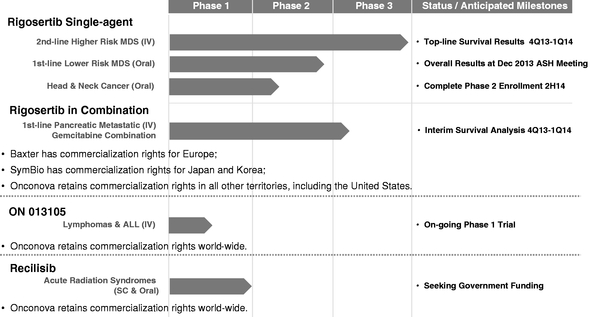

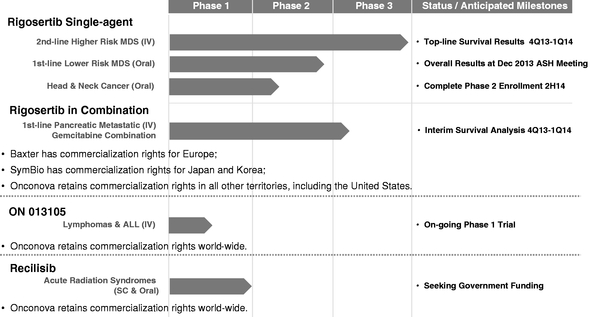

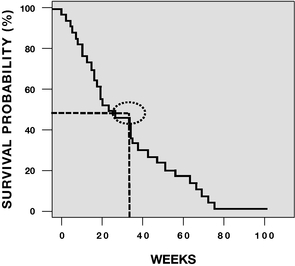

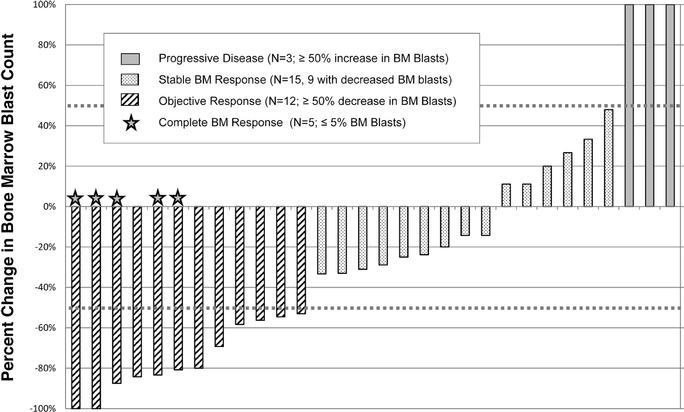

Rigosertib, our most advanced product candidate, is being tested in a number of ongoing Phase 2 and Phase 3 clinical trials. We are conducting a pivotal Phase 3 trial of rigosertib under a Special Protocol Assessment, or SPA, from the U.S. Food and Drug Administration, or FDA, for higher risk myelodysplastic syndromes, or MDS. We expect to report top-line overall survival results from this trial in the fourth quarter of 2013 or the first quarter of 2014. We are also evaluating rigosertib in a Phase 3 trial for metastatic pancreatic cancer, in two Phase 2 trials for transfusion-dependent lower risk MDS, and in a Phase 2 trial for head and neck cancers. We have tested rigosertib in more than 850 patients with solid tumors and hematological diseases. Rigosertib has been granted orphan drug status for MDS in both the United States and Europe as well as orphan drug status for pancreatic cancer in the United States. Baxter Healthcare SA, or Baxter, a subsidiary of Baxter International Inc., has commercialization rights for rigosertib in Europe and SymBio Pharmaceuticals Limited, or SymBio, has commercialization rights in Japan and Korea. We have retained development and commercialization rights to rigosertib in the rest of the world, including in the United States.

Rigosertib is an inhibitor of two important cellular signaling pathways: phosphoinositide 3-kinase, or PI3K, and polo-like kinase, or PLK, both of which are frequently over-active in cancer cells. PI3K signaling promotes the growth and survival of cells under stressful conditions, such as under low oxygen levels that are often found in tumors. By inhibiting the PI3K pathway in cancer cells, rigosertib promotes tumor cell apoptosis, or programmed cell death.

The PLK pathway has a critical role in maintaining proper chromosome organization and sorting during cell division. By modulating the PLK pathway, rigosertib stops cancer cells at late stages of the cell division cycle, which leads to chromosome disorganization and death in these cells. In normal cells, rigosertib pauses progression of the cell cycle in the early stages, without causing harm or death to these cells.

Due to this dual effect of inhibiting both the PI3K and PLK pathways, and thereby effecting both tumor cell survival and division, we believe that rigosertib has potential to treat a variety of cancer types, including hematological diseases and solid tumors.

1

We are testing both intravenous and oral formulations of rigosertib, referred to as rigosertib IV and rigosertib Oral, in clinical trials.

A provider of marketing analytics and data to the biopharmaceutical industry has estimated that, for 2011 in the United States, the diagnosed incidence of MDS was approximately 15,600 and the prevalence of MDS was approximately 52,000. According to the same marketing analytics firm, approximately 23% of MDS patients are estimated to fall into the categories of MDS characterized as higher risk.

To accelerate and broaden the development of rigosertib, we entered into a development and licensing agreement with Baxter in 2012 to commercialize rigosertib in Europe. In 2011, we entered into a licensing agreement with SymBio to commercialize rigosertib in Japan and Korea. We have retained development and commercialization rights to rigosertib in the rest of the world, including the

2

United States. We will explore a variety of alternatives for the commercialization of rigosertib in territories we currently retain, including direct commercialization, co-promotion or selective out-licensing of rights to a third party.

Our second clinical-stage product candidate,ON 013105, is in a Phase 1 trial in patients with relapsed or refractory lymphoma, including an aggressive form of non-Hodgkin's lymphoma identified as mantle cell lymphoma, or MCL, and acute lymphoid leukemia, or ALL. A critical defect in many cancer cells is the uncontrolled expression of cyclin D1, a protein essential for normal cell division. Cyclin D1 is over-expressed in several hematological diseases, including B-cell lymphomas, such as MCL. ON 013105 suppresses the accumulation of cyclin D1 in cancer cells. In 2011, we suspended enrollment in this Phase 1 trial because enrollment of patients was occurring slowly, and as a result, our inventory of ON 013105 clinical trial materials expired. We plan to restart enrollment in this trial with newly manufactured clinical trial materials at a new clinical trial site in the fourth quarter of 2013.

Our third clinical-stage product candidate,recilisib, is being developed in collaboration with the U.S. Department of Defense, or DoD, for acute radiation syndromes, or ARS. We have conducted animal studies and clinical trials of recilisib under the FDA's Animal Efficacy Rule, which permits marketing approval for new medical countermeasures for which human efficacy studies are not feasible or ethical, by relying on evidence from animal studies in appropriate animal models to support efficacy in humans. We have completed four Phase 1 trials to evaluate the safety and pharmacokinetics of recilisib in healthy human adult subjects using both subcutaneous and oral formulations. We have received orphan drug designation for recilisib for ARS in the United States.

The development status of our three clinical-stage product candidates is summarized below:

Clinical-Stage Product Candidates

In addition to our three clinical-stage product candidates, we are advancing six preclinical programs that target kinases, cellular metabolism or division.

We have broad-based capabilities that span drug discovery and clinical development, from medicinal chemistry and evaluation in biochemical, cell-based and animal models, through Phase 3 trials and regulatory filings in the United States, Europe and India. Our discovery program is based on a proprietary chemistry platform comprising more than 150 novel core chemical structures. Our

3

chemistry and screening approaches aim to discover new drug candidates that increase efficacy and help overcome resistance to therapy in cancer cells, while minimizing their toxicity to normal cells. Our intellectual property portfolio includes more than 100 issued patents and over 90 patent applications, either owned by us or licensed exclusively to us, including patents covering our most advanced product candidate, rigosertib. These patents and licenses cover composition-of-matter, process, formulations and method-of-treatment claims for our clinical-stage product portfolio.

Our Strategy

We are committed to delivering novel treatments to cancer patients. We are focused on discovering and developing targeted small molecule anti-cancer product candidates. The key components of our strategy are to:

4

several lead molecules in our preclinical pipeline. We intend to explore additional collaborations to further the development of these product candidates.

Risks Associated with Our Business

Our ability to implement our business strategy is subject to numerous risks and uncertainties. As a clinical-stage biopharmaceutical company, we face many risks inherent in our business and our industry generally. You should carefully consider all of the information set forth in this prospectus and, in particular, the information under the heading "Risk Factors," prior to making an investment in our common stock. These risks include, among others, the following:

Our Corporate Information

We were formed as Onconova Therapeutics, Inc., a corporation under the laws of the State of Delaware, in December 1998 and commenced operations in January 1999. Our primary executive offices are located at 375 Pheasant Run, Newtown, PA 18940 and our telephone number is (267) 759-3680. Our website address ishttp://www.onconova.com. The information contained in, or that can be accessed through, our website is not part of this prospectus.

We have registered several U.S. trademarks, including Onconova Therapeutics, Inc. All other trademarks, trade names or service marks referred to in this prospectus are the property of their respective owners.

Implications of Being an Emerging Growth Company

We are an "emerging growth company," as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Act, or JOBS Act. As such,

5

we are eligible to take advantage of exemptions from various reporting requirements that are applicable to other public companies that are not "emerging growth companies" including, but not limited to:

We may choose to take advantage of some or all of the available exemptions. We have taken advantage of some of the reduced reporting burdens in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. We do not know if some investors will find our shares less attractive as a result of our utilization of these or other exemptions. The result may be a less active trading market for our shares and our share price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an "emerging growth company" can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an "emerging growth company" can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

We will remain an "emerging growth company" until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1.0 billion, (b) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our shares that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, (c) the date on which we have issued more than $1.0 billion in nonconvertible debt during the preceding three-year period or (d) the last day of our fiscal year containing the fifth anniversary of the date on which shares of our common stock become publicly traded in the United States.

6

THE OFFERING

Common stock offered by us | 4,615,385 shares | |

Common stock to be outstanding after this offering | 20,062,996 shares | |

Over-allotment option | 692,307 shares | |

Use of proceeds | We estimate that the net proceeds from this offering will be approximately $52.5 million, or approximately $60.9 million if the underwriters exercise their over-allotment option in full, assuming an initial public offering price of $13.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We expect to use the proceeds of this offering to fund the overall development of our product candidates, and for working capital and general corporate purposes. See "Use of Proceeds" for a more complete description of the intended use of proceeds from this offering. | |

Proposed NASDAQ Global Market symbol | ONTX | |

Risk factors | You should read the "Risk Factors" section of, and all of the other information set forth in, this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

Unless otherwise noted, the information in this prospectus assumes:

The number of shares of common stock to be outstanding after this offering is based on 15,447,611 shares of common stock outstanding as of March 31, 2013, after giving effect to the conversion of our outstanding shares of preferred stock into 12,838,127 shares of common stock, and excludes as of that date:

7

Baxter Healthcare SA, one of our stockholders and collaborators, and our chairman of the board of directors, as well as certain other of our existing stockholders, including certain of our directors, have indicated an interest in purchasing up to an aggregate of $26.0 million of shares of our common stock in this offering, or 2,000,000 shares at an assumed initial public offering price of $13.00 per share, which is the midpoint of the price range set forth on the cover page of this prospectus. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, less or no shares in this offering to any of these stockholders, and any of these stockholders may determine to purchase more, less or no shares in this offering.

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table summarizes our historical financial data as of the dates indicated and for the periods then ended. We have derived the following statement of operations data for the years ended December 31, 2011 and 2012 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the following statement of operations data for the three months ended March 31, 2012 and 2013 and balance sheet data as of March 31, 2013 from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future, and our interim period results are not necessarily indicative of results to be expected for a full year or any other interim period. The summary of our consolidated financial data set forth below should be read together with our consolidated financial statements and the related notes to those statements, as well as "Management's Discussion and Analysis of Financial Condition and Results of Operations," appearing elsewhere in this prospectus.

| | Year Ended December 31, | Three Months Ended March 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2011 | 2012 | 2012 | 2013 | |||||||||

Consolidated Statement of Operations Data: | |||||||||||||

Revenue | $ | 1,487,000 | $ | 46,190,000 | $ | 198,000 | $ | 1,116,000 | |||||

Operating expenses: | |||||||||||||

General and administrative | 6,436,000 | 15,707,000 | 2,460,000 | 3,346,000 | |||||||||

Research and development | 22,624,000 | 52,762,000 | 8,448,000 | 12,756,000 | |||||||||

Total operating expenses | 29,060,000 | 68,469,000 | 10,908,000 | 16,102,000 | |||||||||

Loss from operations | (27,573,000 | ) | (22,279,000 | ) | (10,710,000 | ) | (14,986,000 | ) | |||||

Change in fair value of warrant liability | 1,287,000 | 367,000 | (609,000 | ) | 14,000 | ||||||||

Interest expense | (19,000 | ) | (8,608,000 | ) | (21,000 | ) | — | ||||||

Other income, net | 11,000 | 608,000 | 541,000 | 127,000 | |||||||||

Net loss before income taxes expense | (26,294,000 | ) | (29,912,000 | ) | (10,799,000 | ) | (14,845,000 | ) | |||||

Income taxes | — | — | — | — | |||||||||

Net loss | (26,294,000 | ) | (29,912,000 | ) | (10,799,000 | ) | (14,845,000 | ) | |||||

Accretion of preferred stock | (4,020,000 | ) | (3,953,000 | ) | (1,231,000 | ) | (1,019,000 | ) | |||||

Net loss applicable to common stockholders | $ | (30,314,000 | ) | $ | (33,865,000 | ) | $ | (12,030,000 | ) | $ | (15,864,000 | ) | |

Per share information: | |||||||||||||

Net loss per share of common stock, basic and diluted(1) | $ | (14.18 | ) | $ | (15.35 | ) | $ | (5.53 | ) | $ | (6.08 | ) | |

Basic and diluted weighted average shares outstanding(1) | 2,137,403 | 2,206,888 | 2,173,553 | 2,607,406 | |||||||||

Pro forma net loss per share of common stock, basic and diluted(1) | $ | (2.36 | ) | $ | (0.96 | ) | |||||||

Basic and diluted pro forma weighted average shares outstanding(1) | 12,668,663 | 15,445,726 | |||||||||||

9

| | As of March 31, 2013 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | Actual | Pro Forma(2) | Pro Forma As Adjusted(3)(4) | |||||||

Consolidated Balance Sheet Data: | ||||||||||

Cash and cash equivalents | $ | 67,307,000 | $ | 67,307,000 | 119,807,000 | |||||

Total assets | 70,759,000 | 70,759,000 | 123,259,000 | |||||||

Total liabilities | 42,544,000 | 42,544,000 | 42,544,000 | |||||||

Accumulated deficit | (183,198,000) | (183,198,000) | (183,198,000 | ) | ||||||

Total stockholders' (deficit) equity | (174,119,000) | 28,215,000 | 80,715,000 | |||||||

10

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the other information contained in this prospectus, including our consolidated financial statements and the related notes appearing at the end of this prospectus, before making your decision to invest in shares of our common stock. We cannot assure you that any of the events discussed in the risk factors below will not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition and cash flows and our future prospects would likely be materially and adversely affected. If that were to happen, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Financial Position and Capital Needs

We have incurred significant losses since our inception and anticipate that we will continue to incur losses in the future.

We are a clinical-stage biopharmaceutical company. Investment in biopharmaceutical product development is highly speculative because it entails substantial upfront capital expenditures and significant risk that a product candidate will fail to gain regulatory approval or become commercially viable. We do not have any products approved by regulatory authorities for marketing and have not generated any revenue from product sales to date, and we continue to incur significant research, development and other expenses related to our ongoing operations. As a result, we are not profitable and have incurred losses in every reporting period since our inception in 1998. For the year ended December 31, 2012 and the three months ended March 31, 2013, we reported a net loss of $29.9 million and $14.8 million, respectively, and we had an accumulated deficit of $183.2 million at March 31, 2013.

We expect to continue to incur significant expenses and operating losses for the foreseeable future. We anticipate these losses to increase as we continue the research and development of, and seek regulatory approvals for, our product candidates, and potentially begin to commercialize any products that may achieve regulatory approval. We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. If any of our product candidates fail in clinical trials or do not gain regulatory approval, or if approved, fail to achieve market acceptance, we may never become profitable. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods.

We have a limited operating history, which may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

Our operations to date have been limited to organizing and staffing our company, acquiring product and technology rights, discovering novel molecules and conducting product development activities for our product candidates. We have not yet obtained regulatory approval for any of our product candidates. Consequently, any predictions about our future success, performance or viability may not be as accurate as they could be if we had a longer operating history or approved products on the market.

We currently have no source of product revenue and may never become profitable.

To date, we have not generated any revenues from commercial product sales. Our ability to generate revenue from product sales and achieve profitability will depend upon our ability to successfully commercialize products, including any of our current product candidates, or other product candidates that we may in-license or acquire in the future. Even if we are able to successfully achieve regulatory approval for these product candidates, we do not know when any of these products will

11

generate revenue from product sales for us, if at all. Our ability to generate revenue from product sales from our current or future product candidates also depends on a number of additional factors, including our ability to:

In addition, because of the numerous risks and uncertainties associated with product development, including that our product candidates may not advance through development or achieve the endpoints of applicable clinical trials, we are unable to predict the timing or amount of increased expenses, or when or if we will be able to achieve or maintain profitability. Even if we are able to complete the development and regulatory process for any product candidates, we anticipate incurring significant costs associated with commercializing these products.

Even if we are able to generate revenues from the sale of our products, we may not become profitable and may need to obtain additional funding to continue operations. If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and be forced to reduce our operations.

We are likely to require additional capital to fund our operations and if we fail to obtain necessary financing, we may be unable to complete the development and potential commercialization of our product candidates.

Our operations have consumed substantial amounts of cash since inception. We expect to continue to spend substantial amounts to advance the clinical development of our product candidates and launch and commercialize any product candidates for which we receive regulatory approval, including potentially building our own commercial organization. We believe that the net proceeds from this offering, together with existing cash and cash equivalents and interest thereon, will be sufficient to fund our projected operating requirements for at least the next 12 months. However, we will likely require additional capital for the further development and potential commercialization of our product candidates and may also need to raise additional funds sooner to pursue a more accelerated development of our product candidates.

Our forecast of the period of time through which our financial resources will be adequate to support our operations is a forward-looking statement and involves risks and uncertainties, and actual results could vary as a result of a number of factors, including the factors discussed elsewhere in this "Risk Factors" section. We have based this estimate on assumptions that may prove to be wrong, and

12

we could utilize our available capital resources sooner than we currently expect. Our future funding requirements, both near and long-term, will depend on many factors, including, but not limited to:

If we are unable to expand our operations or otherwise capitalize on our business opportunities due to a lack of capital, our ability to become profitable will be compromised.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until we can generate substantial revenue from product sales, if ever, we expect to seek additional capital through a combination of private and public equity offerings, debt financings, strategic collaborations and alliances and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of existing stockholders will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of existing stockholders. Debt financing, if available, may involve agreements that include restrictive covenants limiting our ability to take important actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through strategic collaborations and alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development or commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and stock price.

As has been widely reported, global credit and financial markets have been experiencing extreme disruptions over the past several years, including severely diminished liquidity and credit availability,

13

declines in consumer confidence, declines in economic growth, increases in unemployment rates and uncertainty about economic stability. There can be no assurance that further deterioration in credit and financial markets and confidence in economic conditions will not occur. Our general business strategy may be compromised by economic downturns and volatile business environment and unpredictable and unstable market conditions. If the current equity and credit markets deteriorate, or do not improve, it may make any necessary debt or equity financing more difficult to secure, more costly, or more dilutive. Failure to secure any necessary financing in a timely manner and on favorable terms could harm our growth strategy, financial performance and stock price and could require us to delay or abandon our business and clinical development plans. In addition, there is a risk that one or more of our current service providers, manufacturers and other partners may not survive these difficult economic times, which could directly affect our ability to attain our operating goals on schedule and on budget.

Risks Related to Our Business and Industry

Our future success is dependent primarily on the regulatory approval and commercialization of our product candidates, including rigosertib, which is currently undergoing Phase 3 clinical trials.

We do not have any products that have gained regulatory approval. Currently, our only clinical-stage product candidates are rigosertib, ON 013105 and recilisib, and rigosertib is our only late-stage product candidate.

As a result, our business is substantially dependent on our ability to obtain regulatory approval for, and, if approved, to successfully commercialize rigosertib and, to a lesser degree, ON 013105 and recilisib in a timely manner. We cannot commercialize product candidates in the United States without first obtaining regulatory approval for the product from the FDA; similarly, we cannot commercialize product candidates outside of the United States without obtaining regulatory approval from comparable foreign regulatory authorities. Before obtaining regulatory approvals for the commercial sale of any product candidate for a target indication, we must demonstrate with substantial evidence gathered in preclinical and well-controlled clinical studies, generally including two well-controlled Phase 3 trials, and, with respect to approval in the United States, to the satisfaction of the FDA, that the product candidate is safe and effective for use for that target indication and that the manufacturing facilities, processes and controls are adequate. Even if rigosertib or another product candidate were to successfully obtain approval from the FDA and comparable foreign regulatory authorities, any approval might contain significant limitations related to use restrictions for specified age groups, warnings, precautions or contraindications, or may be subject to burdensome post-approval study or risk management requirements. If we are unable to obtain regulatory approval for rigosertib in one or more jurisdictions, or any approval contains significant limitations, we may not be able to obtain sufficient funding or generate sufficient revenue to continue the development of ON 013105, recilisib, or any other product candidate that we may discover, in-license, develop or acquire in the future. Furthermore, even if we obtain regulatory approval for rigosertib, we will still need to develop a commercial organization, establish commercially viable pricing and obtain approval for adequate reimbursement from third-party and government payors. If we or our commercialization collaborators are unable to successfully commercialize rigosertib, we may not be able to earn sufficient revenues to continue our business.

Because the results of preclinical testing or earlier clinical studies are not necessarily predictive of future results, rigosertib, which is currently in Phase 3 clinical trials, or any other product candidate we advance into clinical trials may not have favorable results in later clinical trials or receive regulatory approval.

Success in preclinical testing and early clinical studies does not ensure that later clinical trials will generate adequate data to demonstrate the efficacy and safety of an investigational drug. A number of companies in the pharmaceutical and biotechnology industries, including those with greater resources and experience, have suffered significant setbacks in clinical trials, even after seeing promising results in

14

earlier clinical trials. Despite the results reported in earlier clinical trials for rigosertib and our other clinical-stage product candidates, we do not know whether the clinical trials we may conduct will demonstrate adequate efficacy and safety to result in regulatory approval to market any of our product candidates in any particular jurisdiction. If later-stage clinical trials do not produce favorable results, our ability to achieve regulatory approval for any of our product candidates may be adversely impacted.

Clinical drug development involves a lengthy and expensive process with an uncertain outcome.

Clinical testing is expensive, can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during the clinical trial process. Product candidates in later stages of clinical trials may fail to show the desired safety and efficacy traits despite having progressed through preclinical studies and early clinical trials.

We may experience delays in our ongoing or future clinical trials and we do not know whether planned clinical trials will begin or enroll subjects on time, need to be redesigned or be completed on schedule, if at all. For example, we experienced a clinical hold with our initial IND submission for recilisib based on the need to conduct additional toxicology studies and to revise quality requirements for manufacture of the drug product. While we do not anticipate any future such delays, there can be no assurance that the FDA will not put clinical trials of recilisib or any other of our product candidates on clinical hold in the future. Clinical trials may be delayed, suspended or prematurely terminated for a variety of reasons, such as:

15

Patient enrollment, a significant factor in the timing of clinical trials, is affected by many factors including the size and nature of the patient population, the proximity of subjects to clinical sites, the eligibility criteria for the trial, the design of the clinical trial, ability to obtain and maintain patient consents, risk that enrolled subjects will drop out before completion, competing clinical trials and clinicians' and patients' perceptions as to the potential advantages of the drug being studied in relation to other available therapies, including any new drugs that may be approved for the indications we are investigating. In 2011, we suspended enrollment in our Phase 1 trial of ON 013105 because enrollment of patients was occurring so slowly that our inventory of ON 013105 clinical trial material expired. We intend to restart enrollment in this trial with newly manufactured clinical trial materials at a new clinical trial site in the fourth quarter of 2013. Furthermore, we rely on CROs and clinical trial sites to ensure the proper and timely conduct of our clinical trials, and while we have agreements governing their committed activities, we have limited influence over their actual performance.

If we experience delays in the completion or termination of, any clinical trial of our product candidates, the commercial prospects of our product candidates will be harmed, and our ability to generate product revenues from any of these product candidates will be delayed. In addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval process and jeopardize our ability to commence product sales and generate revenues. In addition, many of the factors that could cause a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

The regulatory approval processes of the FDA and comparable foreign regulatory authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed.

The time required to obtain approval by the FDA and comparable foreign regulatory authorities is unpredictable, but typically takes many years following the commencement of preclinical studies and clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities. In addition, approval policies, regulations, or the type and amount of clinical data necessary to gain approval may change during the course of a product candidate's clinical development and may vary among jurisdictions. We have not obtained regulatory approval for any product candidate, and it is possible that none of our existing product candidates or any product candidates we may discover, in-license or acquire and seek to develop in the future will ever obtain regulatory approval.

16

Our product candidates could fail to receive regulatory approval from the FDA or a comparable foreign regulatory authority for many reasons, including:

The FDA or a comparable foreign regulatory authority may require more information, including additional preclinical or clinical data to support approval, which may delay or prevent approval and our commercialization plans, or we may decide to abandon the development program altogether. Even if we do obtain regulatory approval, our product candidates may be approved for fewer or more limited indications than we request, approval contingent on the performance of costly post-marketing clinical trials, or approval with a label that does not include the labeling claims necessary or desirable for the successful commercialization of that product candidate. In addition, if our product candidate produces undesirable side effects or safety issues, the FDA may require the establishment of Risk Evaluation Mitigation Strategies, or REMS, or a comparable foreign regulatory authority may require the establishment of a similar strategy, that may, restrict distribution of our products and impose burdensome implementation requirements on us. Any of the foregoing scenarios could materially harm the commercial prospects for our product candidates.

We have had limited interactions with foreign regulatory authorities. Approval by the FDA does not ensure approval by foreign regulatory authorities and approval by one or more foreign regulatory authorities does not ensure approval by regulatory authorities in other countries or by the FDA. However, a failure or delay in obtaining regulatory approval in one country may have a negative effect on the regulatory process in others. We may not be able to file for regulatory approvals and even if we file we may not receive the necessary approvals to commercialize our products in any market.

Our product candidates may cause undesirable side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following any marketing approval.

Undesirable side effects caused by our product candidates could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the FDA or other comparable foreign regulatory authority. For example, even though rigosertib IV and rigosertib Oral have generally been well tolerated by patients in our earlier-stage clinical trials, in some cases there were side effects, some of which were severe. The most common drug-related adverse side effects reported by at least 10% of the 79 patients enrolled in the four Phase 1 and 2 trials of rigosertib IV with MDS or acute myeloid leukemia, or AML, were

17

gastrointestinal, such as nausea and diarrhea, constitutional, such as fatigue, urinary, such as dysuria and hematuria, or the presence of red blood cells in the urine, or hematologic, such as anemia. These side effects were generally mild or moderate in severity. Drug-related side effects that were Grade 3 or Grade 4, meaning they were more than mild or moderate in severity, that were reported in two or more patients in the four studies were decreased red blood cells, decreased platelets, neutropenia, or decreased neutrophils, leukopenia, or decreased white blood cells, frequent urination, dysuria, low blood sodium, increased blood clotting time, fever, fatigue and diarrhea. In patients enrolled in our rigosertib Oral studies in MDS, the most common side effects were urinary disorders. In our rigosertib Oral Phase 1 MDS study, hematuria was the most frequent dose-limiting toxicity, although some patients did experience decreased appetite, diarrhea or nausea. The most severe side effects, seen in two patients, were neutropenia, which occurred at Grade 3 in one patient and Grade 4 in one other patient, as well as urinary tract infection, fainting and shortness of breath. None of these side effects required interruption of the trial.

As a result of these side effects or further safety or toxicity issues that we may experience in our clinical trials in the future, we may not receive approval to market any product candidates, which could prevent us from ever generating revenues or achieving profitability. Results of our trials could reveal an unacceptably high severity and prevalence of side effects. In such an event, our trials could be suspended or terminated and the FDA or comparable foreign regulatory authorities could order us to cease further development of or deny approval of our product candidates for any or all targeted indications. The drug-related side effects could affect patient recruitment or the ability of enrolled subjects to complete the trial or result in potential product liability claims.

Additionally, if any of our product candidates receives marketing approval, and we or others later identify undesirable side effects caused by such product, a number of potentially significant negative consequences could result, including:

Any of these events could prevent us from achieving or maintaining market acceptance of the particular product candidate, if approved.

Even if our product candidates receive regulatory approval, they may still face future development and regulatory difficulties.

Even if we obtain regulatory approval for a product candidate, it would be subject to ongoing requirements by the FDA and comparable foreign regulatory authorities governing the manufacture, quality control, further development, labeling, packaging, storage, distribution, safety surveillance, import, export, advertising, promotion, recordkeeping and reporting of safety and other post-market information. The safety profile of any product will continue to be closely monitored by the FDA and comparable foreign regulatory authorities after approval. If the FDA or comparable foreign regulatory authorities become aware of new safety information after approval of any of our product candidates, they may require labeling changes or establishment of a REMS or similar strategy, impose significant restrictions on a product's indicated uses or marketing, or impose ongoing requirements for potentially

18

costly post-approval studies or post-market surveillance. For example, the label ultimately approved for rigosertib, if it achieves marketing approval, may include restrictions on use.

In addition, manufacturers of drug products and their facilities are subject to continual review and periodic inspections by the FDA and other regulatory authorities for compliance with current good manufacturing practices, or cGMP, and other regulations. If we or a regulatory agency discover previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product, the manufacturing facility or us, including requiring recall or withdrawal of the product from the market or suspension of manufacturing. If we, our product candidates or the manufacturing facilities for our product candidates fail to comply with applicable regulatory requirements, a regulatory agency may:

The occurrence of any event or penalty described above may inhibit our ability to commercialize our products and generate revenue.

Advertising and promotion of any product candidate that obtains approval in the United States will be heavily scrutinized by the FDA, the Department of Justice, or the DOJ, the Office of Inspector General of the Department of Health and Human Services, or HHS, state attorneys general, members of Congress and the public. Violations, including promotion of our products for unapproved or off-label uses, are subject to enforcement letters, inquiries and investigations, and civil and criminal sanctions by the FDA. Additionally, advertising and promotion of any product candidate that obtains approval outside of the United States will be heavily scrutinized by comparable foreign regulatory authorities.

In the United States, engaging in impermissible promotion of our products for off-label uses can also subject us to false claims litigation under federal and state statutes, which can lead to civil and criminal penalties and fines and agreements that materially restrict the manner in which we promote or distribute our drug products. These false claims statutes include the federal False Claims Act, which allows any individual to bring a lawsuit against a pharmaceutical company on behalf of the federal government alleging submission of false or fraudulent claims, or causing to present such false or fraudulent claims, for payment by a federal program such as Medicare or Medicaid. If the government prevails in the lawsuit, the individual will share in any fines or settlement funds. Since 2004, these False Claims Act lawsuits against pharmaceutical companies have increased significantly in volume and breadth, leading to several substantial civil and criminal settlements based on certain sales practices

19

promoting off-label drug uses. This growth in litigation has increased the risk that a pharmaceutical company will have to defend a false claim action, pay settlement fines or restitution, agree to comply with burdensome reporting and compliance obligations, and be excluded from the Medicare, Medicaid and other federal and state healthcare programs. If we do not lawfully promote our approved products, we may become subject to such litigation and, if we are not successful in defending against such actions, those actions could compromise our ability to become profitable.

Failure to obtain regulatory approval in international jurisdictions would prevent our product candidates from being marketed abroad.

In order to market and sell our products in the European Union and many other jurisdictions, including Japan and Korea, we must obtain separate marketing approvals and comply with numerous and varying regulatory requirements. The approval procedure varies among countries and can involve additional testing. The time required to obtain approval may differ substantially from that required to obtain FDA approval. The regulatory approval process outside the United States generally includes all of the risks associated with obtaining FDA approval. In addition, in many countries outside the United States, it is required that the product be approved for reimbursement before the product can be approved for sale in that country. We may not obtain approvals from regulatory authorities outside the United States on a timely basis, if at all. Approval by the FDA does not ensure approval by regulatory authorities in other countries or jurisdictions, and approval by one regulatory authority outside the United States does not ensure approval by regulatory authorities in other countries or jurisdictions or by the FDA. We may not be able to file for marketing approvals and may not receive necessary approvals to commercialize our products in any market. If we are unable to obtain approval of any of our product candidates by regulatory authorities in the European Union, Japan, Korea or another country, the commercial prospects of that product candidate may be significantly diminished and our business prospects could decline.

Recently enacted and future legislation, including potentially unfavorable pricing regulations or other healthcare reform initiatives, may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and affect the prices we may obtain.

The regulations that govern, among other things, marketing approvals, coverage, pricing and reimbursement for new drug products vary widely from country to country. In the United States and some foreign jurisdictions, there have been a number of legislative and regulatory changes and proposed changes regarding the healthcare system that could prevent or delay marketing approval of our product candidates, restrict or regulate post-approval activities and affect our ability to successfully sell any product candidates for which we obtain marketing approval.

In the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, or Medicare Modernization Act, changed the way Medicare covers and pays for pharmaceutical products. The legislation expanded Medicare coverage for drug purchases by the elderly and introduced a new reimbursement methodology based on average sales prices for physician administered drugs. In recent years, Congress has considered further reductions in Medicare reimbursement for drugs administered by physicians. The Centers for Medicare and Medicaid Services, the agency that runs the Medicare program, also has the authority to revise reimbursement rates and to implement coverage restrictions for some drugs. Cost reduction initiatives and changes in coverage implemented through legislation or regulation could decrease utilization of and reimbursement for any approved products, which in turn would affect the price we can receive for those products. While the Medicare Modernization Act and Medicare regulations apply only to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates. Therefore, any reduction in reimbursement that results from federal legislation or regulation may result in a similar reduction in payments from private payors.

20

In March 2010, President Obama signed into law the Patient Protection and Affordable Care Act and the Health Care and Education Affordability Reconciliation Act of 2010, or the Affordable Care Act, a sweeping law intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against fraud and abuse, add new transparency requirements for healthcare and health insurance industries, impose new taxes and fees on pharmaceutical and medical device manufacturers and impose additional health policy reforms. The Affordable Care Act expanded manufacturers' rebate liability to include covered drugs dispensed to individuals who are enrolled in Medicaid managed care organizations increased the minimum rebate due for innovator drugs from 15.1% of average manufacturer price, or AMP, to 23.1% of AMP and capped the total rebate amount for innovator drugs at 100% of AMP. The Affordable Care Act and subsequent legislation also changed the definition of AMP. Furthermore, the Affordable Care Act imposes a significant annual, nondeductible fee on companies that manufacture or import certain branded prescription drug products. Substantial new provisions affecting compliance have also been enacted, which may affect our business practices with healthcare practitioners, and a significant number of provisions are not yet, or have only recently become, effective. Although it is too early to determine the effect of the Affordable Care Act, it appears likely to continue the pressure on pharmaceutical pricing, especially under the Medicare program, and may also increase our regulatory burdens and operating costs.

In addition, other legislative changes have been proposed and adopted since the Affordable Care Act was enacted. More recently, on August 2, 2011, the President signed into law the Budget Control Act of 2011, which, among other things, creates the Joint Select Committee on Deficit Reduction to recommend to Congress proposals in spending reductions. The Joint Select Committee did not achieve a targeted deficit reduction of at least $1.2 trillion for the years 2013 through 2021, triggering the legislation's automatic reduction to several government programs. This includes aggregate reductions to Medicare payments to providers of up to 2% per fiscal year, starting in 2013. On January 2, 2013, President Obama signed into law the American Taxpayer Relief Act of 2012, which, among other things, reduced Medicare payments to several providers and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. These new laws may result in additional reductions in Medicare and other healthcare funding, which could have a material adverse effect on our customers and accordingly, our financial operations. Legislative and regulatory proposals have been made to expand post-approval requirements and restrict sales and promotional activities for pharmaceutical products. We cannot be sure whether additional legislative changes will be enacted, or whether the FDA regulations, guidance or interpretations will be changed, or what the impact of such changes on the marketing approvals of our product candidates, if any, may be.

In the United States, the European Union and other potentially significant markets for our product candidates, government authorities and third-party payors are increasingly attempting to limit or regulate the price of medical products and services, particularly for new and innovative products and therapies, which has resulted in lower average selling prices. Furthermore, the increased emphasis on managed healthcare in the United States and on country and regional pricing and reimbursement controls in the European Union will put additional pressure on product pricing, reimbursement and usage, which may adversely affect our future product sales and results of operations. These pressures can arise from rules and practices of managed care groups, judicial decisions and governmental laws and regulations related to Medicare, Medicaid and healthcare reform, pharmaceutical reimbursement policies and pricing in general.

Some countries require approval of the sale price of a drug before it can be marketed. In many countries, the pricing review period begins after marketing or product licensing approval is granted. In some foreign markets, prescription pharmaceutical pricing remains subject to continuing governmental control even after initial approval is granted. As a result, we might obtain marketing approval for a product candidate in a particular country, but then be subject to price regulations that delay our commercial launch of the product, possibly for lengthy time periods, which could negatively impact the

21

revenues we are able to generate from the sale of the product in that particular country. Adverse pricing limitations may hinder our ability to recoup our investment in one or more product candidates even if our product candidates obtain marketing approval.

Laws and regulations governing international operations may preclude us from developing, manufacturing and selling certain product candidates outside of the United States and require us to develop and implement costly compliance programs.

As we expand our operations outside of the United States, we must comply with numerous laws and regulations in each jurisdiction in which we plan to operate. The creation and implementation of international business practices compliance programs is costly and such programs are difficult to enforce, particularly where reliance on third parties is required.

The Foreign Corrupt Practices Act, or FCPA, prohibits any U.S. individual or business from paying, offering, authorizing payment or offering of anything of value, directly or indirectly, to any foreign official, political party or candidate for the purpose of influencing any act or decision of the foreign entity in order to assist the individual or business in obtaining or retaining business. The FCPA also obligates companies whose securities are listed in the United States to comply with certain accounting provisions requiring the company to maintain books and records that accurately and fairly reflect all transactions of the corporation, including international subsidiaries, and to devise and maintain an adequate system of internal accounting controls for international operations. The anti-bribery provisions of the FCPA are enforced primarily by the DOJ. The Securities and Exchange Commission, or the SEC, is involved with enforcement of the books and records provisions of the FCPA.

Compliance with the FCPA is expensive and difficult, particularly in countries in which corruption is a recognized problem. In addition, the FCPA presents particular challenges in the pharmaceutical industry, because, in many countries, hospitals are operated by the government, and doctors and other hospital employees are considered foreign officials. Certain payments to hospitals in connection with clinical studies and other work have been deemed to be improper payments to government officials and have led to FCPA enforcement actions.

Various laws, regulations and executive orders also restrict the use and dissemination outside of the United States, or the sharing with certain non-U.S. nationals, of information classified for national security purposes, as well as certain products and technical data relating to those products. Our expanding presence outside of the United States will require us to dedicate additional resources to comply with these laws, and these laws may preclude us from developing, manufacturing, or selling certain products and product candidates outside of the United States, which could limit our growth potential and increase our development costs.

The failure to comply with laws governing international business practices may result in substantial penalties, including suspension or debarment from government contracting. Violation of the FCPA can result in significant civil and criminal penalties. Indictment alone under the FCPA can lead to suspension of the right to do business with the U.S. government until the pending claims are resolved. Conviction of a violation of the FCPA can result in long-term disqualification as a government contractor. The termination of a government contract or relationship as a result of our failure to satisfy any of our obligations under laws governing international business practices would have a negative impact on our operations and harm our reputation and ability to procure government contracts. The SEC also may suspend or bar issuers from trading securities on U.S. exchanges for violations of the FCPA's accounting provisions.

22

Even if we are able to commercialize our product candidates, the products may not receive coverage and adequate reimbursement from third-party payors, which could harm our business.

Our ability to commercialize any products successfully will depend, in part, on the extent to which coverage and adequate reimbursement for these products and related treatments will be available from government health administration authorities, private health insurers and other organizations. Government authorities and third-party payors, such as private health insurers and health maintenance organizations, determine which medications they will cover and establish reimbursement levels. A primary trend in the U.S. healthcare industry and elsewhere is cost containment. Government authorities and third-party payors have attempted to control costs by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party payors are requiring that drug companies provide them with predetermined discounts from list prices and are challenging the prices charged for medical products. Third-party payors may also seek additional clinical evidence, beyond the data required to obtain marketing approval, demonstrating clinical benefits and value in specific patient populations before covering our products for those patients. We cannot be sure that coverage and adequate reimbursement will be available for any product that we commercialize and, if reimbursement is available, what the level of reimbursement will be. Coverage and reimbursement may impact the demand for, or the price of, any product candidate for which we obtain marketing approval. If reimbursement is not available or is available only at limited levels, we may not be able to successfully commercialize any product candidate for which we obtain marketing approval.

There may be significant delays in obtaining coverage and reimbursement for newly approved drugs, and coverage may be more limited than the purposes for which the drug is approved by the FDA or comparable foreign regulatory authorities. Moreover, eligibility for coverage and reimbursement does not imply that any drug will be paid for in all cases or at a rate that covers our costs, including research, development, manufacture, sale and distribution. Interim reimbursement levels for new drugs, if applicable, may also not be sufficient to cover our costs and may only be temporary. Reimbursement rates may vary according to the use of the drug and the clinical setting in which it is used, may be based on reimbursement levels already set for lower cost drugs and may be incorporated into existing payments for other services. Net prices for drugs may be reduced by mandatory discounts or rebates required by government healthcare programs or private payors and by any future relaxation of laws that presently restrict imports of drugs from countries where they may be sold at lower prices than in the United States. Third-party payors often rely upon Medicare coverage policy and payment limitations in setting their own reimbursement policies. Our inability to obtain coverage and profitable reimbursement rates from both government-funded and private payors for any approved products that we develop could have a material adverse effect on our operating results, our ability to raise capital needed to commercialize products and our overall financial condition.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell our product candidates, we may be unable to generate any revenue.

We do not currently have an organization for the sale, marketing and distribution of pharmaceutical products and the cost of establishing and maintaining such an organization may exceed the cost-effectiveness of doing so. In order to market any products that may be approved by the FDA and comparable foreign regulatory authorities, we must build our sales, marketing, managerial and other non-technical capabilities or make arrangements with third parties to perform these services. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, we may not be able to generate product revenue and may not become profitable. We will be competing with many companies that currently have extensive and well-funded sales and marketing operations. Without an internal commercial organization or the support of a third party to perform sales and marketing functions, we may be unable to compete successfully against these more established companies.

23

Our commercial success depends upon attaining significant market acceptance of our product candidates, if approved, among physicians, patients, healthcare payors and the major operators of cancer clinics.

Even if we obtain regulatory approval for any of our product candidates that we may develop or acquire in the future, the product may not gain market acceptance among physicians, healthcare payors, patients or the medical community. Market acceptance of any of our product candidates for which we receive approval depends on a number of factors, including:

If any of our product candidates are approved but fail to achieve market acceptance among physicians, patients, or healthcare payors, we will not be able to generate significant revenues, which would compromise our ability to become profitable.

Our relationships with customers and third-party payors will be subject to applicable anti-kickback, fraud and abuse and other healthcare laws and regulations, which could expose us to criminal sanctions, civil penalties, contractual damages, reputational harm and diminished profits and future earnings.

Healthcare providers, physicians and third-party payors will play a primary role in the recommendation and prescription of any product candidates for which we obtain marketing approval. Our future arrangements with third-party payors and customers may expose us to broadly applicable fraud and abuse and other healthcare laws and regulations that may constrain the business or financial arrangements and relationships through which we would market, sell and distribute our products. As a pharmaceutical company, even though we do not and will not control referrals of healthcare services or bill directly to Medicare, Medicaid or other third-party payors, federal and state healthcare laws and regulations pertaining to fraud and abuse and patients' rights are and will be applicable to our business. Restrictions under applicable federal and state healthcare laws and regulations that may affect our ability to operate include the following:

24

recommendation of, any good or service, for which payment may be made under a federal healthcare program such as Medicare and Medicaid;

Efforts to ensure that our business arrangements with third parties will comply with applicable healthcare laws and regulations will involve substantial costs. It is possible that governmental authorities will conclude that our business practices may not comply with current or future statutes, regulations or case law involving applicable fraud and abuse or other healthcare laws and regulations. If our operations are found to be in violation of any of these laws or any other governmental regulations that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, fines, imprisonment, exclusion from government funded healthcare programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations. If any physicians or other healthcare providers or entities with whom we expect to do business are found to not be in compliance with applicable laws, they may be subject to criminal, civil or administrative sanctions, including exclusions from government funded healthcare programs.

25

Our employees may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements, which could cause significant liability for us and harm our reputation.

We are exposed to the risk of employee fraud or other misconduct, including intentional failures to comply with FDA regulations or similar regulations of comparable foreign regulatory authorities, provide accurate information to the FDA or comparable foreign regulatory authorities, comply with manufacturing standards we have established, comply with federal and state healthcare fraud and abuse laws and regulations and similar laws and regulations established and enforced by comparable foreign regulatory authorities, report financial information or data accurately or disclose unauthorized activities to us. Employee misconduct could also involve the improper use of information obtained in the course of clinical trials, which could result in regulatory sanctions and serious harm to our reputation. We will adopt a code of conduct for our directors, officers and employees, or the Code of Conduct, which will be effective as of consummation of this offering, but it is not always possible to identify and deter employee misconduct, and the precautions we take to detect and prevent this activity may not be effective in controlling unknown or unmanaged risks or losses or in protecting us from governmental investigations or other actions or lawsuits stemming from a failure to be in compliance with such laws or regulations. If any such actions are instituted against us, and we are not successful in defending ourselves or asserting our rights, those actions could have a significant impact on our business and results of operations, including the imposition of significant fines or other sanctions.

We face substantial competition, which may result in others discovering, developing or commercializing products before or more successfully than we do.

The development and commercialization of new drug products is highly competitive. We face competition with respect to our current product candidates, rigosertib, ON 013105 and recilisib, and will face competition with respect to any product candidates that we may seek to develop or commercialize in the future, from major pharmaceutical companies, specialty pharmaceutical companies and biotechnology companies worldwide. There are a number of large pharmaceutical and biotechnology companies that currently market and sell products or are pursuing the development of products for the treatment of the disease indications for which we are developing our product candidates. Some of these competitive products and therapies are based on scientific approaches that are the same as or similar to our approach, and others are based on entirely different approaches. Potential competitors also include academic institutions, government agencies and other public and private research organizations that conduct research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and commercialization.