UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10263

GuideStone Funds

(Exact name of registrant as specified in charter)

2401 Cedar Springs Road

Dallas, TX 75201-1407

(Address of principal executive offices) (Zip code)

Harold R. Loftin, Esq.

GuideStone Financial Resources of the Southern Baptist Convention

2401 Cedar Springs Road

Dallas, TX 75201-1407

(Name and address of agent for service)

Registrant’s telephone number, including area code: 214-720-4640

Date of fiscal year end: December 31

Date of reporting period: June 30, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

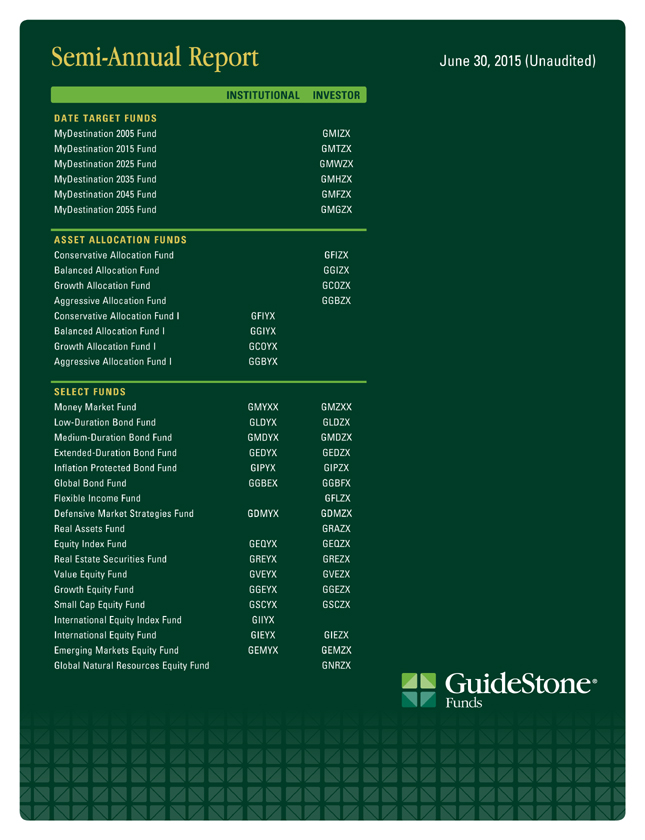

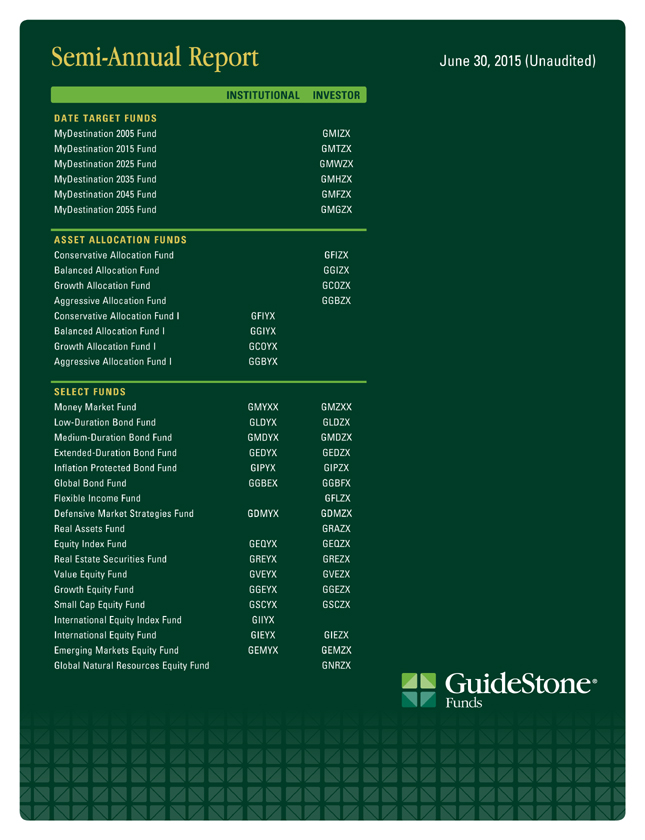

Semi-Annual Report June 30, 2015 (Unaudited) INSTITUTIONAL INVESTOR DATE TARGET FUNDS MyDestination 2005 Fund GMIZX MyDestination 2015 Fund GMTZX MyDestination 2025 Fund GMWZX MyDestination 2035 Fund GMHZX MyDestination 2045 Fund GMFZX MyDestination 2055 Fund GMGZX ASSET ALLOCATION FUNDS Conservative Allocation Fund GFIZX Balanced Allocation Fund GGIZX Growth Allocation Fund GCOZX Aggressive Allocation Fund GGBZX Conservative Allocation Fund I GFIYX Balanced Allocation Fund I GGIYX Growth Allocation Fund I GCOYX Aggressive Allocation Fund I GGBYX SELECT FUNDS Money Market Fund GMYXX GMZXX Low-Duration Bond Fund GLDYX GLDZX Medium-Duration Bond Fund GMDYX GMDZX Extended-Duration Bond Fund GEDYX GEDZX Inflation Protected Bond Fund GIPYX GIPZX Global Bond Fund GGBEX GGBFX Flexible Income Fund GFLZX Defensive Market Strategies Fund GDMYX GDMZX Real Assets Fund GRAZX Equity Index Fund GEQYX GEQZX Real Estate Securities Fund GREYX GREZX Value Equity Fund GVEYX GVEZX Growth Equity Fund GGEYX GGEZX Small Cap Equity Fund GSCYX GSCZX International Equity Index Fund GIIYX International Equity Fund GIEYX GIEZX Emerging Markets Equity Fund GEMYX GEMZX Global Natural Resources Equity Fund GNRZX

GuideStone Funds

Privacy Notice

NOTICE CONCERNING YOUR PRIVACY RIGHTS

This notice will provide you with information concerning our policies with respect to non-public personal information that we collect about you in connection with the following financial products and services provided and/or serviced by the entities listed below: individual retirement accounts (“IRAs”) and/or personal mutual fund accounts.

The confidentiality of your information is important to us, as we recognize that you depend on us to keep your information confidential, as described in this notice.

We collect non-public personal information about you with regard to your IRA and/or mutual fund accounts from the following sources:

| | • | | Information we receive from you on applications or other forms; |

| | • | | Information about your transactions with us, our affiliates or others (including our third-party service providers); |

| | • | | Information we receive from others, such as service providers, broker-dealers and your personal agents or representatives; and |

| | • | | Information you and others provide to us in correspondence sent to us, whether written, electronic or by telephone. |

We may disclose such non-public personal financial information about you to one or more of our affiliates as permitted by law. An affiliate of an organization means any entity that controls, is controlled by or is under common control with that organization. GuideStone Funds, GuideStone Financial Resources of the Southern Baptist Convention, GuideStone Capital Management, LLC, GuideStone Resource Management, Inc., GuideStone Investment Services, GuideStone Trust Services, GuideStone Financial Services and GuideStone Advisors (collectively “GuideStone”) are affiliates of one another. GuideStone and Foreside Funds Distributors LLC do not sell your personal information to non-affiliated third parties.

We may also disclose any of the personal information that we collect about you to non-affiliated third parties as permitted by law. For example, we may provide your information to non-affiliated companies that provide account services or that perform marketing services on our behalf and to other financial institutions with whom we have joint marketing agreements. We restrict access to non-public personal information about you to those of our employees who need to know that information in order for us to provide products and services to you. We also maintain physical, electronic and procedural safeguards to guard your personal information.

These procedures will continue to remain in effect after you cease to receive financial products and services from us.

If you have any questions concerning our customer information policy, please contact a customer relations specialist at

1-888-GS-FUNDS (1-888-473-8637).

TABLE OF CONTENTS

This report has been prepared for shareholders of GuideStone Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current prospectus, which contains more complete information about the Funds. Investors are reminded to read the prospectus carefully before investing. The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.GuideStoneFunds.org. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Fund shares are distributed by Foreside Funds Distributors LLC, 400 Berwyn Park, 899 Cassatt Road, Suite 110, Berwyn, PA 19312.

1

LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present you with the 2015 GuideStone Funds Semi-Annual Report. This report reflects our unwavering commitment to integrity in financial reporting so you may stay fully informed of your investments. We trust that you will find this information valuable when making investment decisions.

For the fourth consecutive year, GuideStone Funds was recognized by the Lipper Fund Awards. Ranking No. 1 out of 44 eligible funds, the Extended-Duration Bond Fund was recognized again as the Best Fund Over 3 Years and, ranking No. 1 out of 41 eligible funds, as the Best Fund Over 5 Years in the Corporate Debt A-Rated Funds category for the Fund’s performance ending November 30, 2014.

We continue to work diligently to enhance the products and services to our shareholders. Several examples of our ongoing commitment are noted below:

GuideStone Funds restructures fees. In May, we launched a restructuring of our fees to help simplify and clarify the fee structure of our funds. This resulted in an overall fee reduction in several funds, including the MyDestination Funds® family.

Institutional Class shares for Inflation Protected Bond, Global Bond and Real Estate Securities Funds launched May 1.

As part of our ongoing commitment to maximize the benefit for our shareholders and maintain consistency with industry practices, GuideStone Funds launched Institutional Class shares in these three Funds. Shareholders who are eligible for Institutional Class shares can now purchase shares of these three Funds at a reduced fee structure. If you are an Institutional Class shareholder who holds Investor Class shares of any of these Funds, please contact GuideStone Funds regarding these Institutional Class offerings.

International Equity Index Fund launched June 1. Available to those investors eligible for the Institutional share class, the International Equity Index Fund, under normal market conditions, will invest substantially all (at least 80%) of its total assets in the equity securities included in the MSCI EAFE Index in weightings that approximate the relative composition of the securities contained in the MSCI EAFE Index, within the guidelines established by GuideStone Funds. This Fund is passively managed, which means it will buy and hold securities until changes are made in the holdings of the MSCI EAFE Index. The Fund may be suitable to investors who seek higher, long-term rates of return, can accept significant short-term fluctuations in account value and want to diversify their portfolio with international stocks.

We invite you to learn more about the continued success of GuideStone Funds and the various investment options available by visiting our website, GuideStoneFunds.com, or contacting us at 1-888-GS-FUNDS (1-888-473-8637). Thank you for choosing to invest in GuideStone Funds.

Sincerely,

John R. Jones, CFA

President

2

Lipper, a Thomson Reuters company, provides independent insight on global collective investments, including mutual funds, retirement funds, hedge funds, fund fees and expenses to the asset management and media communities. Lipper is the world’s leading fund research and analysis organization, covering more than 213,000 share classes and more than 117,000 funds in more than 61 registered for sale (RFS) universes. It provides the free Lipper Leader ratings for mutual funds registered for sale in more than 30 countries. Lipper Fund Awards are based on Lipper Ratings for Consistent Return (Effective Return), which reflect a fund’s historical risk-adjusted total returns relative to funds in the same Lipper Global Classification. Classification averages are calculated with all eligible share-classes for each eligible classification. The calculation periods extend over 36, 60 and 120 months. The highest Lipper Leader for Consistent Return (Effective Return) value within each eligible classification determines the fund classification winner over three, five or 10 years. The Institutional Class of the GuideStone Extended Duration Bond Fund won the 2014 Lipper Funds Awards for 3-year and 5-year periods in the Corporate Debt A-Rated category. Additional information is available at lipperweb.com.

3

FROM THE CHIEF INVESTMENT OFFICER

Matt L. Peden, CFA

Amid the zero interest rate policy environment, the U.S. posted negative economic growth as measured by Gross Domestic Product (“GDP”) in the first quarter of the year, but many rationalized this was temporary for several reasons including a very harsh winter on the east coast and port strikes on the west coast. Reports of U.S. economic growth were better in the second quarter as consumer spending, housing and employment gains all improved. Economists are projecting moderate, positive economic growth in the U.S. for the remainder of the year.

In the midst of this improving economic backdrop, the capital markets continued to anticipate that the Federal Reserve (“Fed”) would implement its first rate hike in the second half of 2015 in its effort to begin the rate normalization process. The Fed has telegraphed that the timing of the initial rate hike will be data dependent as they would like to see further improvement in the areas of wage growth and core inflation. On a global basis, there was a divergence in monetary policies with the U.S. ending its quantitative easing (“QE”) program (fourth quarter of 2014) and looking to begin normalizing rates this year. In contrast, other major central banks, such as Europe and Japan, were implementing further QE and accommodative policies in their efforts to stimulate their respective economies. During the first six months, the U.S. dollar appreciated versus the basket of foreign currencies given the U.S.’s stronger economic growth and the relative yield advantage in the U.S. Treasury market versus other sovereign bond yields. Other major economic concerns during the year’s first half were the downward pressure on oil prices, the continued deterioration in Greece and its ability to remain in the Euro and China’s economic slowdown and stock market correction.

| | | | | | | | | | |

|

As of 06/30/15 | |

| | | 2nd Quarter | | | | | 1 Year | |

U.S. Stocks | | | 0.28% | | | | | | 1.23% | |

Non-U.S. Stocks | | | 0.62% | | | | | | 5.52% | |

Bonds | | | (1.68)% | | | | | | (0.10)% | |

Commodities | | | 4.66% | | | | | | (1.56)% | |

Commodity Producers (Equities) | | | (1.51)% | | | | | | (6.31)% | |

Real Estate Investment Trust (Equities) | | | (10.02)% | | | | | | (5.69)% | |

TIPS | | | (1.06)% | | | | | | 0.34% | |

U.S. Treasury yields rose during the first half of the year, specifically in the second quarter, upon signs of improving economic growth and somewhat tighter core inflation. During the second quarter, yields on the 10-year and 30-year U.S. Treasuries increased from the levels of 1.92% and 2.54% to 2.35% and 3.12%, respectively. The rising interest rate environment in the second quarter made it a difficult environment for bond returns given the inverse relationship between bond prices and yields. The broad U.S. Bond market, as measured by the Barclays U.S. Aggregate Bond Index, posted a second quarter return of -1.68%, bringing the year-to-date return to -0.10%. The worst performing area of the bond market has been long-duration U.S. Treasuries given their high price sensitivity to changes in interest rates.

U.S. Equity markets generated mixed returns during the second quarter and for the first six months of the year. The S&P 500® Index, a measure of the broad U.S. equity market, generated a second quarter return of 0.28%, bringing its year-to-date return to 1.23%. In general, U.S. stocks have been trading at valuations considered at or slightly higher than historical averages; thus, more emphasis will be placed on corporate earnings for further price appreciation. While corporate earnings remain strong, the growth in earnings has slowed as they have been under pressure due to a strong U.S. dollar, lower earnings from the energy sector and the lack of pricing flexibility for top-line revenue growth. For the first six months of the year, the best performing area of the U.S. equity market has been small cap growth stocks, which posted a year-to-date return of 8.74%, as measured by the Russell 2000® Growth Index.

Non-U.S. stocks, both developed and emerging markets, generally outpaced their U.S. stock counterparts. The MSCI EAFE Index, the proxy for non-U.S. developed market stocks, posted a second quarter return of 0.62% and a year-to-date return of 5.52%. The MSCI Emerging Markets Index posted a second quarter return of 0.69%, bringing its year-to-date return to 2.95%. Non-U.S. stocks, in general, have benefited during the year from accommodative monetary policies and more attractive valuations. There are several issues that warrant a great deal of attention in the non-U.S. markets over upcoming months. First is Greece and its ability (or willingness) to stay within the Euro. Many expect this issue to be contained to Greece, but if Greece does exit the Euro, watch closely for contagion to other countries such as Portugal, Spain and Italy. The “spreading” of the pressure on the financial and economic systems is the issue, not Greece’s economy, which by itself, is immaterial. Second is China. China has been a meaningful contributor to global economic growth and a big user of commodities. There are reports and indications of slowing economic growth in conjunction with high debt levels. Additionally, the Chinese equity market experienced a meaningful correction as many speculators recently exited the market.

Overall, we expect higher volatility in asset prices with the increasing probability of greater macro-economic dislocations and events (such as Greece and/or China). While both asset classes (equities and bonds) are considered expensive, equities appear to offer a better risk/return tradeoff compared to bonds, although bonds will continue to play an important role in well diversified portfolios. Diversification and patience will be key for investors going forward.

4

We sincerely thank you for investing in GuideStone Funds and the trust you have placed with us. While some of the events in the market place today have been creating uncertainty, we want you to know that the implementation of our investment process is certain and consistently applied. We seek to add value for our clients in times of volatility, looking to take advantage of market dislocations.

Lastly, we welcome questions and comments. For additional commentary on the capital markets and information on GuideStone Funds, we invite you to visit our website, GuideStoneFunds.com. Please consider our website a central resource for your investment information.

Sincerely,

Matt L. Peden, CFA

Vice President - Chief Investment Officer

GuideStone Funds

| (1) | The Barclays U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment grade bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities. |

| (2) | The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. |

| (3) | The MSCI EM (Emerging Markets) Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey |

| (4) | The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. |

| (5) | The S&P 500® Index is an unmanaged index (with no defined investment objective) of common stocks, includes reinvestment of dividends and is a registered trademark of McGraw-Hill Co., Inc. The S&P 500® Index includes 500 of the largest stocks (in terms of market value) in the United States. |

5

About Your Expenses (Unaudited)

As a shareholder of the Funds, you incur ongoing costs, including advisory fees and to the extent applicable, shareholder services fees, as well as other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2015 to June 30, 2015.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | | | | | |

Actual | |

Fund | | Class | | Beginning

Account Value

01/01/15 | | | Ending

Account Value

06/30/15 | | | Annualized

Expense

Ratio (1) | | | Expenses

Paid During

Period (2) | |

MyDestination 2005 | | Investor | | $ | 1,000.00 | | | $ | 1,010.44 | | | | 0.25 | % | | $ | 1.25 | |

MyDestination 2015 | | Investor | | | 1,000.00 | | | | 1,011.99 | | | | 0.21 | | | | 1.05 | |

MyDestination 2025 | | Investor | | | 1,000.00 | | | | 1,013.14 | | | | 0.21 | | | | 1.04 | |

MyDestination 2035 | | Investor | | | 1,000.00 | | | | 1,018.11 | | | | 0.22 | | | | 1.09 | |

MyDestination 2045 | | Investor | | | 1,000.00 | | | | 1,022.00 | | | | 0.24 | | | | 1.18 | |

MyDestination 2055 | | Investor | | | 1,000.00 | | | | 1,022.22 | | | | 0.25 | | | | 1.27 | |

Conservative Allocation | | Investor | | | 1,000.00 | | | | 1,009.49 | | | | 0.20 | | | | 0.98 | |

Balanced Allocation | | Investor | | | 1,000.00 | | | | 1,008.54 | | | | 0.20 | | | | 1.00 | |

Growth Allocation | | Investor | | | 1,000.00 | | | | 1,016.38 | | | | 0.20 | | | | 1.02 | |

Aggressive Allocation | | Investor | | | 1,000.00 | | | | 1,029.16 | | | | 0.21 | | | | 1.05 | |

Conservative Allocation I | | Institutional | | | 1,000.00 | | | | 1,011.60 | | | | 0.18 | | | | 0.88 | |

Balanced Allocation I | | Institutional | | | 1,000.00 | | | | 1,009.60 | | | | 0.13 | | | | 0.65 | |

Growth Allocation I | | Institutional | | | 1,000.00 | | | | 1,017.12 | | | | 0.14 | | | | 0.71 | |

Aggressive Allocation I | | Institutional | | | 1,000.00 | | | | 1,030.92 | | | | 0.16 | | | | 0.79 | |

Money Market | | Institutional | | | 1,000.00 | | | | 1,000.21 | | | | 0.17 | | | | 0.86 | |

| | Investor | | | 1,000.00 | | | | 1,000.06 | | | | 0.21 | | | | 1.05 | |

Low-Duration Bond | | Institutional | | | 1,000.00 | | | | 1,011.33 | | | | 0.37 | | | | 1.85 | |

| | Investor | | | 1,000.00 | | | | 1,009.99 | | | | 0.58 | | | | 2.88 | |

Medium-Duration Bond | | Institutional | | | 1,000.00 | | | | 1,000.24 | | | | 0.45 | | | | 2.25 | |

| | Investor | | | 1,000.00 | | | | 998.54 | | | | 0.64 | | | | 3.16 | |

6

| | | | | | | | | | | | | | | | | | | | |

Actual | |

| | | | | | Beginning | | | Ending | | | Annualized | | | Expenses | |

| | | | | | Account Value | | | Account Value | | | Expense | | | Paid During | |

Fund | | Class | | | 01/01/15 | | | 06/30/15 | | | Ratio (1) | | | Period (2) | |

Extended-Duration Bond | | | Institutional | | | $ | 1,000.00 | | | $ | 959.07 | | | | 0.59 | % | | $ | 2.85 | |

| | | Investor | | | | 1,000.00 | | | | 956.31 | | | | 0.77 | | | | 3.76 | |

Global Bond (3) | | | Institutional | | | | 1,000.00 | | | | 978.67 | | | | 0.57 | | | | 0.95 | |

| | | Investor | | | | 1,000.00 | | | | 996.67 | | | | 0.79 | | | | 3.91 | |

Defensive Market Strategies (4) | | | Institutional | | | | 1,000.00 | | | | 1,013.46 | | | | 0.74 | | | | 3.67 | |

| | | Investor | | | | 1,000.00 | | | | 1,012.13 | | | | 0.99 | | | | 4.93 | |

Equity Index | | | Institutional | | | | 1,000.00 | | | | 1,010.17 | | | | 0.18 | | | | 0.90 | |

| | | Investor | | | | 1,000.00 | | | | 1,008.76 | | | | 0.39 | | | | 1.96 | |

Value Equity | | | Institutional | | | | 1,000.00 | | | | 1,007.36 | | | | 0.63 | | | | 3.11 | |

| | | Investor | | | | 1,000.00 | | | | 1,006.79 | | | | 0.89 | | | | 4.44 | |

Growth Equity | | | Institutional | | | | 1,000.00 | | | | 1,031.71 | | | | 0.79 | | | | 3.98 | |

| | | Investor | | | | 1,000.00 | | | | 1,030.11 | | | | 1.05 | | | | 5.28 | |

Small Cap Equity | | | Institutional | | | | 1,000.00 | | | | 1,048.21 | | | | 0.98 | | | | 4.97 | |

| | | Investor | | | | 1,000.00 | | | | 1,047.42 | | | | 1.20 | | | | 6.12 | |

International Equity Index (3) | | | Institutional | | | | 1,000.00 | | | | 973.00 | | | | 0.57 | | | | 0.45 | |

International Equity (4) | | | Institutional | | | | 1,000.00 | | | | 1,055.93 | | | | 1.13 | | | | 5.76 | |

| | | Investor | | | | 1,000.00 | | | | 1,054.88 | | | | 1.38 | | | | 7.02 | |

Emerging Markets Equity | | | Institutional | | | | 1,000.00 | | | | 1,003.30 | | | | 1.27 | | | | 6.32 | |

| | | Investor | | | | 1,000.00 | | | | 1,001.10 | | | | 1.50 | | | | 7.46 | |

Inflation Protected Bond (3) | | | Institutional | | | | 1,000.00 | | | | 982.70 | | | | 0.41 | | | | 0.68 | |

| | | Investor | | | | 1,000.00 | | | | 1,003.04 | | | | 0.63 | | | | 3.13 | |

Flexible Income | | | Investor | | | | 1,000.00 | | | | 1,025.77 | | | | 1.17 | | | | 5.89 | |

Real Assets | | | Investor | | | | 1,000.00 | | | | 994.60 | | | | 0.19 | | | | 0.95 | |

Real Estate Securities (3) | | | Institutional | | | | 1,000.00 | | | | 949.11 | | | | 0.92 | | | | 1.49 | |

| | | Investor | | | | 1,000.00 | | | | 971.72 | | | | 1.11 | | | | 5.45 | |

Global Natural Resources Equity | | | Investor | | | | 1,000.00 | | | | 976.95 | | | | 1.36 | | | | 6.65 | |

|

HYPOTHETICAL (assuming a 5% return before expenses) | |

| | | | | | Beginning | | | Ending | | | Annualized | | | Expenses | |

| | | | | | Account Value | | | Account Value | | | Expense | | | Paid During | |

Fund | | Class | | | 01/01/15 | | | 06/30/15 | | | Ratio (1) | | | Period (2) | |

MyDestination 2005 | | | Investor | | | $ | 1,000.00 | | | $ | 1,023.53 | | | | 0.25 | % | | $ | 1.26 | |

MyDestination 2015 | | | Investor | | | | 1,000.00 | | | | 1,023.73 | | | | 0.21 | | | | 1.06 | |

MyDestination 2025 | | | Investor | | | | 1,000.00 | | | | 1,023.75 | | | | 0.21 | | | | 1.04 | |

MyDestination 2035 | | | Investor | | | | 1,000.00 | | | | 1,023.70 | | | | 0.22 | | | | 1.09 | |

MyDestination 2045 | | | Investor | | | | 1,000.00 | | | | 1,023.61 | | | | 0.24 | | | | 1.18 | |

MyDestination 2055 | | | Investor | | | | 1,000.00 | | | | 1,023.52 | | | | 0.25 | | | | 1.27 | |

Conservative Allocation | | | Investor | | | | 1,000.00 | | | | 1,023.80 | | | | 0.20 | | | | 0.99 | |

Balanced Allocation | | | Investor | | | | 1,000.00 | | | | 1,023.79 | | | | 0.20 | | | | 1.00 | |

Growth Allocation | | | Investor | | | | 1,000.00 | | | | 1,023.77 | | | | 0.20 | | | | 1.02 | |

Aggressive Allocation | | | Investor | | | | 1,000.00 | | | | 1,023.74 | | | | 0.21 | | | | 1.05 | |

Conservative Allocation I | | | Institutional | | | | 1,000.00 | | | | 1,023.90 | | | | 0.18 | | | | 0.89 | |

Balanced Allocation I | | | Institutional | | | | 1,000.00 | | | | 1,024.13 | | | | 0.13 | | | | 0.66 | |

7

About Your Expenses (Unaudited) (Continued)

| | | | | | | | | | | | | | | | | | |

HYPOTHETICAL (assuming a 5% return before expenses) | |

| | | | | Beginning | | | Ending | | | Annualized | | | Expenses | |

| | | | | Account Value | | | Account Value | | | Expense | | | Paid During | |

Fund | | Class | | 01/01/15 | | | 06/30/15 | | | Ratio (1) | | | Period (2) | |

Growth Allocation I | | Institutional | | $ | 1,000.00 | | | $ | 1,024.07 | | | | 0.14 | % | | $ | 0.72 | |

Aggressive Allocation I | | Institutional | | | 1,000.00 | | | | 1,024.00 | | | | 0.16 | | | | 0.79 | |

Money Market | | Institutional | | | 1,000.00 | | | | 1,023.92 | | | | 0.17 | | | | 0.87 | |

| | Investor | | | 1,000.00 | | | | 1,023.73 | | | | 0.21 | | | | 1.06 | |

Low-Duration Bond | | Institutional | | | 1,000.00 | | | | 1,022.93 | | | | 0.37 | | | | 1.86 | |

| | Investor | | | 1,000.00 | | | | 1,021.89 | | | | 0.58 | | | | 2.90 | |

Medium-Duration Bond | | Institutional | | | 1,000.00 | | | | 1,022.51 | | | | 0.45 | | | | 2.28 | |

| | Investor | | | 1,000.00 | | | | 1,021.59 | | | | 0.64 | | | | 3.20 | |

Extended-Duration Bond | | Institutional | | | 1,000.00 | | | | 1,021.85 | | | | 0.59 | | | | 2.94 | |

| | Investor | | | 1,000.00 | | | | 1,020.90 | | | | 0.77 | | | | 3.89 | |

Global Bond (3) | | Institutional | | | 1,000.00 | | | | 1,005.50 | | | | 0.57 | | | | 2.86 | |

| | Investor | | | 1,000.00 | | | | 1,020.83 | | | | 0.79 | | | | 3.96 | |

Defensive Market Strategies (4) | | Institutional | | | 1,000.00 | | | | 1,021.10 | | | | 0.74 | | | | 3.69 | |

| | Investor | | | 1,000.00 | | | | 1,019.83 | | | | 0.99 | | | | 4.96 | |

Equity Index | | Institutional | | | 1,000.00 | | | | 1,023.89 | | | | 0.18 | | | | 0.90 | |

| | Investor | | | 1,000.00 | | | | 1,022.82 | | | | 0.39 | | | | 1.97 | |

Value Equity | | Institutional | | | 1,000.00 | | | | 1,021.65 | | | | 0.63 | | | | 3.14 | |

| | Investor | | | 1,000.00 | | | | 1,020.31 | | | | 0.89 | | | | 4.48 | |

Growth Equity | | Institutional | | | 1,000.00 | | | | 1,020.82 | | | | 0.79 | | | | 3.97 | |

| | Investor | | | 1,000.00 | | | | 1,019.52 | | | | 1.05 | | | | 5.27 | |

Small Cap Equity | | Institutional | | | 1,000.00 | | | | 1,019.88 | | | | 0.98 | | | | 4.91 | |

| | Investor | | | 1,000.00 | | | | 1,018.74 | | | | 1.20 | | | | 6.05 | |

International Equity Index (3) | | Institutional | | | 1,000.00 | | | | 1,001.14 | | | | 0.57 | | | | 2.83 | |

International Equity (4) | | Institutional | | | 1,000.00 | | | | 1,019.12 | | | | 1.13 | | | | 5.67 | |

| | Investor | | | 1,000.00 | | | | 1,017.88 | | | | 1.38 | | | | 6.91 | |

Emerging Markets Equity | | Institutional | | | 1,000.00 | | | | 1,018.40 | | | | 1.27 | | | | 6.39 | |

| | Investor | | | 1,000.00 | | | | 1,017.24 | | | | 1.50 | | | | 7.55 | |

Inflation Protected Fund (3) | | Institutional | | | 1,000.00 | | | | 1,006.33 | | | | 0.41 | | | | 2.03 | |

| | Investor | | | 1,000.00 | | | | 1,021.63 | | | | 0.63 | | | | 3.16 | |

Flexible Income | | Investor | | | 1,000.00 | | | | 1,018.91 | | | | 1.17 | | | | 5.88 | |

Real Assets | | Investor | | | 1,000.00 | | | | 1,023.83 | | | | 0.19 | | | | 0.96 | |

Real Estate Securities Fund (3) | | Institutional | | | 1,000.00 | | | | 1,003.79 | | | | 0.92 | | | | 4.57 | |

| | Investor | | | 1,000.00 | | | | 1,019.20 | | | | 1.11 | | | | 5.59 | |

Global Natural Resources Equity | | Investor | | | 1,000.00 | | | | 1,017.98 | | | | 1.36 | | | | 6.81 | |

| (1) | Expenses include the effect of contractual waivers by GuideStone Capital Management. The Date Target Funds’, Asset Allocation Funds’ and Real Assets Fund’s proportionate share of the operating expenses of the Select Funds is not reflected in the tables above. |

| (2) | Expenses are equal to the Fund’s annualized expense ratios for the period January 1, 2015 through June 30, 2015, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| (3) | Actual expense calculation for Institutional Class of Global Bond, Inflation Protected Bond and Real Estate Securities and Investor Class of International Equity Index are based on data since commencement of operations (May 1, 2015 and June 1, respectively) and Hypothetical Expense calculation for the share class assumes the share class has been in existence for 181 days, and are based on data since January 1, 2015. |

| (4) | The expense ratios for the Defensive Market Strategies Fund and the International Equity Fund include the impact of dividend and interest expense on securities sold short. |

8

ABBREVIATIONS, FOOTNOTES AND INDEX DEFINITIONS

INVESTMENT ABBREVIATIONS:

| | | | |

ADR | | — | | American Depositary Receipt |

CDO | | — | | Collateralized Debt Obligation |

CLO | | — | | Collateralized Loan Obligation |

CMBS | | — | | Commercial Mortgage-Backed Securities |

CONV | | — | | Convertible |

GDR | | — | | Global Depositary Receipt |

IO | | — | | Interest Only (Principal amount shown is notional) |

iTraxx | | — | | Rule based Credit Derivative Swap indices comprised of the most liquid names in each of their respective markets, Europe, Asia, Australia and Japan. |

LIBOR | | — | | London Interbank Offered Rate |

LLC | | — | | Limited Liability Company |

LP | | — | | Limited Partnership |

NVDR | | — | | Non-Voting Depository Receipt |

PCL | | — | | Public Company Limited |

PIK | | — | | Payment-in-Kind Bonds |

PLC | | — | | Public Limited Company |

PO | | — | | Principal Only |

REIT | | — | | Real Estate Investment Trust |

REMIC | | — | | Real Estate Mortgage Investment Conduit |

STEP | | — | | Stepped Coupon Bonds: Interest rates shown reflect the rates currently in effect. |

STRIP | | — | | Stripped Security |

TBA | | — | | To be announced |

TIPS | | — | | Treasury Inflation Protected Security. |

| | | | | | | | |

| | | Value of | | | Percentage of | |

Fund | | 144A Securities | | | Net Assets | |

Money Market | | $ | 529,905,554 | | | | 42.29 | % |

Low-Duration Bond | | | 198,753,796 | | | | 22.78 | |

Medium-Duration Bond | | | 102,914,812 | | | | 11.22 | |

Extended-Duration Bond | | | 19,659,853 | | | | 7.08 | |

Global Bond | | | 75,918,275 | | | | 18.51 | |

Defensive Market Strategies | | | 28,282,998 | | | | 4.72 | |

Small Cap Equity | | | 2 | | | | — | |

International Equity Index | | | 127,981 | | | | 0.12 | |

International Equity | | | 5,041,718 | | | | 0.38 | |

Emerging Markets Equity | | | 1,954,231 | | | | 0.62 | |

Inflation Protected Bond | | | | | | | | |

Flexible Income Fund | | | 5,042,487 | | | | 3.51 | |

INVESTMENT FOOTNOTES:

| | | | |

‡‡ | | — | | All or a portion of the security was held as collateral for open futures, options, securities sold short and/or swap contracts. |

@ | | — | | Illiquid. |

* | | — | | Non-income producing security. |

# | | — | | Security in default. |

§ | | — | | Security purchased with the cash proceeds from securities loaned. |

† | | — | | Variable rate security. Maturity date for money market instruments is the date of the next interest rate reset. |

W | | — | | Rates shown reflect the effective yields as of June 30, 2015. |

¥ | | — | | Affiliated fund. |

D | | — | | Security either partially or fully on loan. |

S | | — | | All or a portion of this position has not settled. Full contract rates do not take effect until settlement date. |

+ | | — | | Security is valued at fair value by the Valuation Committee (see Note 1 in Notes to Financial Statements). As of June 30, 2015, the total market values and percentages of net assets for Fair Valued securities by fund were as follows: |

| | | | | | | | |

Fund | | Value of

Fair

Valued

Securities | | | Percentage of

Net Assets | |

Low-Duration Bond | | $ | — | | | | — | % |

Medium-Duration Bond | | | 19,893,430 | | | | 2.17 | |

Global Bond | | | 3,159,573 | | | | 0.77 | |

Defensive Market Strategies | | | 5,305,736 | | | | 0.89 | |

Small Cap Equity | | | 2 | | | | — | |

International Equity Index | | | 3,585 | | | | — | |

International Equity | | | 106,427 | | | | 0.01 | |

Emerging Markets Equity | | | 1,035,065 | | | | 0.33 | |

Real Estate Securities Fund | | | 340,589 | | | | 0.13 | |

Global Natural Resources Fund | | | 605,284 | | | | 0.21 | |

9

ABBREVIATIONS, FOOTNOTES AND INDEX DEFINITIONS

FOREIGN BOND FOOTNOTES:

| | | | |

(A) | | — | | Par is denominated in Australian Dollars (AUD). |

(B) | | — | | Par is denominated in Brazilian Real (BRL). |

(C) | | — | | Par is denominated in Canadian Dollars (CAD). |

(E) | | — | | Par is denominated in Euro (EUR). |

(K) | | — | | Par is denominated in Norwegian Krone (NOK). |

(M) | | — | | Par is denominated in Mexican Pesos (MXN). |

(P) | | — | | Par is denominated in Polish Zloty (PLN). |

(T) | | — | | Par is denominated in Turkish Lira (TRL). |

(U) | | — | | Par is denominated in British Pounds (GBP). |

(V) | | — | | Par is denominated in Dominican Peso (DOP). |

(W) | | — | | Par is denominated in South Korean Won (KRW). |

(X) | | — | | Par is denominated in Colombian Peso (COP). |

(Z) | | — | | Par is denominated in New Zealand Dollars (NZD). |

COUNTERPARTY ABBREVIATIONS:

| | | | |

BAR | | — | | Counterparty to contract is Barclays Capital. |

BNP | | — | | Counterparty to contract is BNP Paribas. |

BOA | | — | | Counterparty to contract is Bank of America. |

CITI | | — | | Counterparty to contract is Citibank NA London. |

CITIC | | — | | Counterparty to contract is Citicorp. |

CITIG | | — | | Counterparty to contract is Citigroup. |

CME | | — | | Counterparty to contract is Chicago Mercantile Exchange. |

CS | | — | | Counterparty to contract is Credit Suisse International. |

DEUT | | — | | Counterparty to contract is Deutsche Bank AG. |

GSC | | — | | Counterparty to contract is Goldman Sachs Capital Markets, LP. |

HKSB | | — | | Counterparty to contract is Hong Kong & Shanghai Bank. |

HSBC | | — | | Counterparty to contract is HSBC Securities. |

JPM | | — | | Counterparty to contract is JPMorgan Chase Bank. |

MLCS | | — | | Counterparty to contract is Merrill Lynch Capital Services, Inc. |

MSCS | | — | | Counterparty to contract is Morgan Stanley Capital Services. |

RBC | | — | | Counterparty to contract is Royal Bank of Canada. |

RBS | | — | | Counterparty to contract is Royal Bank of Scotland. |

SC | | — | | Counterparty to contract is Standard Chartered PLC. |

SS | | — | | Counterparty to contract is State Street Global Markets. |

UBS | | — | | Counterparty to contract is UBS AG. |

WEST | | — | | Counterparty to contract is Westpac Pollock. |

10

ABBREVIATIONS, FOOTNOTES AND INDEX DEFINITIONS

INDEX DEFINITIONS:

The Bank of America Merrill Lynch 1-3 Year Treasury Index is composed of all U.S. Treasury notes and bonds with maturities greater than or equal to one year and less than three years.

The Barclays Global Aggregate Bond Index — Unhedged provides a broad-based measure of the global investment grade fixed-rate debt markets.

The Barclays U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable and dollar denominated. The index covers the U.S. investment grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

The Barclays U.S. Corporate High Yield – 2% Issuer Capped Index is an issuer-constrained version of the Barclays U.S. Corporate High Yield Index that measures the market of U.S. dollar denominated, non-investment grade, fixed-rate, taxable corporate bonds. The index follows the same rules as the uncapped index but limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro rata basis.

The Barclays U.S. Long-Term Credit Bond Index is composed of a subset of the Barclays U.S. Credit Bond Index covering all corporate, publicly issued, fixed-rate, nonconvertible U.S. debt issues rated at least Baa with at least $50 million principal outstanding and maturity greater than 10 years.

The Barclays U.S. Long-Term Government Bond Index is composed of securities in the long (more than 10 years) range of the Barclays U.S. Government Index and is composed of a subset of the Barclays Credit Bond Index covering all corporate, publicly issued, fixed-rate, nonconvertible U.S. debt issues rated at least Baa with at least $50 million principal outstanding and maturity greater than 10 years.

The Barclays U.S. TIPS Index measures the performance of the U.S. Treasury Inflation Protected Securities (“TIPS”) market and includes TIPS with one or more years remaining until maturity with total outstanding issue size of $500 million or more.

The Bloomberg Commodity Index provides a broadly diversified representation of commodity markets as an asset class. The index is made up of exchange-traded futures on physical commodities and represents 20 commodities, which are weighted to account for economic significance and market liquidity. Weighting restrictions on individual commodities and commodity groups promote diversification.

The Citigroup 3-Month Treasury Bill Index is an unmanaged index that is generally representative of 3-month U.S. Treasury bills, consisting of an average of the last 3-month U.S. Treasury bill issues.

The CMBX Indexes are a group of indices made up of 25 tranches of commercial mortgage-backed securities (CMBS), each with different credit ratings.

The Dow Jones CDX Indexes are a series of indices that track North American and emerging market credit derivative indexes. This family of indices comprises a basket of credit derivatives that are representative of certain segments such as North American investment grade credit derivatives (NA.IG), high yield (NA.HY), and emerging markets (NA.EM).

The Dow Jones U.S. Select Real Estate Securities IndexSM is an unmanaged, broad-based, market capitalization-weighted index comprised of publicly traded REITs and real estate operating companies, not including special purpose or healthcare REITs. It is comprised of major companies engaged in the equity ownership and operation of commercial real estate.

The FTSE EPRA/NAREIT Developed Index is designed to track the performance of listed real estate companies and REITS worldwide. By making the index constituents free-float adjusted, liquidity, size and revenue screened, the series is suitable for use as the basis for investment products, such as derivatives and Exchange Traded Funds (“ETFs”).

The iTraxx Indexes are a group of international credit derivative indices that are monitored by the International Index Company (IIC). iTraxx indices cover credit derivatives markets in Europe, Asia and Australia.

The JPMorgan Emerging Markets Bond Index Plus is a traditional, market-capitalization weighted index comprised of U.S. dollar denominated Brady bonds, Eurobonds and traded loans issued by sovereign entities.

The MSCI ACWI (All Country World Index) Ex-U.S. Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed (excluding U.S.) and emerging markets.

The MSCI Commodity Producers Index is a free float-adjusted market capitalization index designed to reflect the performance of the three underlying commodity markets: energy, metals and agricultural products.

11

ABBREVIATIONS, FOOTNOTES AND INDEX DEFINITIONS

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. The MSCI EAFE Index consists of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

The MSCI EM (Emerging Markets) Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index consisted of the following 21 emerging market country indices: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in mining for gold and silver. The index is calculated and maintained by the American Stock Exchange.

The Russell 1000® Growth Index is a large-cap index consisting of those Russell 1000® Index securities with greater-than-average growth orientation. Companies in this index tend to exhibit higher price-to-book and price-to-earnings-ratios, lower dividend yields and higher forecasted growth values than the value universe.

The Russell 1000® Value Index is a large-cap index consisting of those Russell 1000® Index securities with a less-than-average growth orientation. Companies in this index tend to exhibit lower price-to-book and price-to-earnings ratios, higher dividend yields and lower forecasted growth values than the growth universe.

The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure that larger stocks do not distort the performance and characteristics of the actual small-cap opportunity set.

The Russell 3000® Index is composed of 3,000 large companies. This portfolio of securities represents approximately 98% of the investable U.S. equity market.

The S&P 500® Index is an unmanaged index (with no defined investment objective) of common stocks, includes reinvestment of dividends, and is a registered trademark of McGraw-Hill Co., Inc. The S&P 500® Index includes 500 of the largest stocks (in terms of market value) in the United States.

The S&P/LSTA U.S. B- Ratings and Above Loan Index is a daily total return index that tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included in the S&P/LSTA U.S. B- Ratings and Above Loan Index represent a broad cross section of leveraged loans syndicated in the United States, including dollar-denominated loans to overseas issuers.

The WTI Crude Oil Subindex Total Return index is a single commodity subindex of the Bloomberg CI composed of futures contracts on crude oil. It reflects the return of underlying commodity futures price movements only and is quoted in USD.

12

| | |

| MYDESTINATION 2005 FUND | | |

| SCHEDULE OF INVESTMENTS | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

MUTUAL FUNDS — 100.0% | | | | | | | | |

GuideStone Money Market Fund

(Institutional Class)¥ | | | 1,665,719 | | | $ | 1,665,719 | |

GuideStone Low-Duration Bond Fund

(Institutional Class)¥ | | | 4,267,372 | | | | 36,101,970 | |

GuideStone Medium-Duration Bond Fund

(Institutional Class)¥ | | | 1,404,488 | | | | 9,648,835 | |

GuideStone Global Bond Fund

(Institutional Class)¥ | | | 244,659 | | | | 2,405,003 | |

GuideStone Defensive Market Strategies Fund

(Institutional Class)¥ | | | 835,269 | | | | 9,714,178 | |

GuideStone Equity Index Fund

(Institutional Class)¥ | | | 330,311 | | | | 2,986,007 | |

GuideStone Value Equity Fund

(Institutional Class)¥ | | | 339,099 | | | | 3,004,415 | |

GuideStone Growth Equity Fund

(Institutional Class)¥ | | | 275,677 | | | | 3,035,199 | |

GuideStone Small Cap Equity Fund

(Institutional Class)¥ | | | 111,292 | | | | 1,040,584 | |

GuideStone International Equity Fund

(Institutional Class)¥ | | | 312,977 | | | | 3,486,564 | |

GuideStone International Equity Index Fund

(Institutional Class)*¥ | | | 179,386 | | | | 1,745,422 | |

GuideStone Emerging Market Equity Fund

(Institutional Class)¥ | | | 154,362 | | | | 1,407,780 | |

GuideStone Inflation Protected Bond Fund

(Investor Class)*¥ | | | 916,910 | | | | 9,379,992 | |

GuideStone Flexible Income Fund

(Investor Class)¥ | | | 471,994 | | | | 4,658,585 | |

GuideStone Real Estate Securities Fund

(Institutional Class)¥ | | | 94,404 | | | | 916,661 | |

GuideStone Global Natural Resources Equity Fund

(Investor Class)¥ | | | 232,417 | | | | 1,773,340 | |

Credit Suisse Commodity Return Strategy Fund* | | | 325,085 | | | | 1,911,499 | |

| | | | | | | | |

Total Mutual Funds

(Cost $96,804,816) | | | | | | | 94,881,753 | |

| | | | | | | | |

TOTAL INVESTMENTS — 100.0%

(Cost $96,804,816) | | | | | | | 94,881,753 | |

Other Assets in Excess of Liabilities — 0.0% | | | | | | | 7,775 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 94,889,528 | |

| | | | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | | | |

| | | % | |

Fixed Income Select Funds | | | 52.5 | |

U.S. Equity Select Funds | | | 20.9 | |

Real Return Select Funds | | | 17.6 | |

Non-U.S. Equity Select Funds | | | 7.0 | |

Credit Suisse Commodity Return Strategy | | | 2.0 | |

| | | | |

| | | 100.0 | |

| | | | |

See Notes to Financial Statements.

13

MYDESTINATION 2005 FUND

SCHEDULE OF INVESTMENTS (Continued)

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2015, in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| | | | | | | | | Level 2 | | | Level 3 | |

| | | Total | | | Level 1 | | | Other Significant | | | Significant | |

| | | Value | | | Quoted Prices | | | Observable Inputs | | | Unobservable Inputs | |

Assets: | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | $ | 94,881,753 | | | $ | 94,881,753 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Assets — Investments in Securities | | $ | 94,881,753 | | | $ | 94,881,753 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Other Financial Instruments*** | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (11,092 | ) | | $ | (11,092 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Liabilities — Other Financial Instruments | | $ | (11,092 | ) | | $ | (11,092 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

14

| | |

| MYDESTINATION 2015 FUND | | |

| SCHEDULE OF INVESTMENTS | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

MUTUAL FUNDS — 99.9% | | | | | | | | |

GuideStone Money Market Fund

(Institutional Class)¥ | | | 7,802,100 | | | $ | 7,802,100 | |

GuideStone Low-Duration Bond Fund

(Institutional Class)¥ | | | 7,617,461 | | | | 64,443,717 | |

GuideStone Medium-Duration Bond Fund

(Institutional Class)¥ | | | 9,204,817 | | | | 63,237,092 | |

GuideStone Extended-Duration Bond Fund

(Institutional Class)¥ | | | 1,754,679 | | | | 7,281,917 | |

GuideStone Global Bond Fund

(Institutional Class)¥ | | | 2,325,516 | | | | 22,859,821 | |

GuideStone Defensive Market Strategies Fund

(Institutional Class)¥ | | | 7,510,856 | | | | 87,351,256 | |

GuideStone Equity Index Fund

(Institutional Class)¥ | | | 2,832,693 | | | | 25,607,546 | |

GuideStone Value Equity Fund

(Institutional Class)¥ | | | 2,919,430 | | | | 25,866,148 | |

GuideStone Growth Equity Fund

(Institutional Class)¥ | | | 2,377,904 | | | | 26,180,723 | |

GuideStone Small Cap Equity Fund

(Institutional Class)¥ | | | 1,085,147 | | | | 10,146,124 | |

GuideStone International Equity Fund

(Institutional Class)¥ | | | 2,746,910 | | | | 30,600,574 | |

GuideStone International Equity Index Fund

(Institutional Class)*¥ | | | 1,543,826 | | | | 15,021,424 | |

GuideStone Emerging Market Equity Fund

(Institutional Class)¥ | | | 1,330,683 | | | | 12,135,826 | |

GuideStone Inflation Protected Bond Fund

(Investor Class)*¥ | | | 4,784,233 | | | | 48,942,705 | |

GuideStone Flexible Income Fund

(Investor Class)¥ | | | 2,482,998 | | | | 24,507,188 | |

GuideStone Real Estate Securities Fund

(Institutional Class)¥ | | | 502,503 | | | | 4,879,303 | |

GuideStone Global Natural Resources Equity Fund

(Investor Class)¥ | | | 1,231,876 | | | | 9,399,212 | |

Credit Suisse Commodity Return Strategy Fund* | | | 1,684,137 | | | | 9,902,727 | |

| | | | | | | | |

Total Mutual Funds

(Cost $509,820,834) | | | | | | | 496,165,403 | |

| | | | | | | | |

TOTAL INVESTMENTS — 99.9%

(Cost $509,820,834) | | | | | | | 496,165,403 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 291,747 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 496,457,150 | |

| | | | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | | | |

| | | % | |

U.S. Equity Select Funds | | | 35.3 | |

Fixed Income Select Funds | | | 33.3 | |

Real Return Select Funds | | | 17.7 | |

Non-U.S. Equity Select Funds | | | 11.6 | |

Credit Suisse Commodity Return Strategy | | | 2.0 | |

| | | | |

| | | 99.9 | |

| | | | |

See Notes to Financial Statements.

15

MYDESTINATION 2015 FUND

SCHEDULE OF INVESTMENTS (Continued)

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2015, in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| | | | | | | | | Level 2 | | | Level 3 | |

| | | Total | | | Level 1 | | | Other Significant | | | Significant | |

| | | Value | | | Quoted Prices | | | Observable Inputs | | | Unobservable Inputs | |

Assets: | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | $ | 496,165,403 | | | $ | 496,165,403 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Assets — Investments in Securities | | $ | 496,165,403 | | | $ | 496,165,403 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Other Financial Instruments*** | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (89,494 | ) | | $ | (89,494 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Liabilities — Other Financial Instruments | | $ | (89,494 | ) | | $ | (89,494 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

16

| | |

| MYDESTINATION 2025 FUND | | |

| SCHEDULE OF INVESTMENTS | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

MUTUAL FUNDS — 99.9% | | | | | | | | |

GuideStone Money Market Fund

(Institutional Class)¥ | | | 11,103,324 | | | $ | 11,103,324 | |

GuideStone Low-Duration Bond Fund

(Institutional Class)¥ | | | 5,266,504 | | | | 44,554,626 | |

GuideStone Medium-Duration Bond Fund

(Institutional Class)¥ | | | 9,940,293 | | | | 68,289,813 | |

GuideStone Extended-Duration Bond Fund

(Institutional Class)¥ | | | 4,181,602 | | | | 17,353,646 | |

GuideStone Global Bond Fund

(Institutional Class)¥ | | | 4,061,836 | | | | 39,927,850 | |

GuideStone Defensive Market Strategies Fund

(Institutional Class)¥ | | | 10,429,515 | | | | 121,295,265 | |

GuideStone Equity Index Fund

(Institutional Class)¥ | | | 5,802,496 | | | | 52,454,567 | |

GuideStone Value Equity Fund

(Institutional Class)¥ | | | 5,944,324 | | | | 52,666,715 | |

GuideStone Growth Equity Fund

(Institutional Class)¥ | | | 4,809,037 | | | | 52,947,493 | |

GuideStone Small Cap Equity Fund

(Institutional Class)¥ | | | 2,371,616 | | | | 22,174,613 | |

GuideStone International Equity Fund

(Institutional Class)¥ | | | 5,593,030 | | | | 62,306,354 | |

GuideStone International Equity Index Fund

(Institutional Class)*¥ | | | 3,198,167 | | | | 31,118,168 | |

GuideStone Emerging Market Equity Fund

(Institutional Class)¥ | | | 2,761,201 | | | | 25,182,157 | |

GuideStone Inflation Protected Bond Fund

(Investor Class)*¥ | | | 2,879,820 | | | | 29,460,557 | |

GuideStone Flexible Income Fund

(Investor Class)¥ | | | 1,196,386 | | | | 11,808,331 | |

GuideStone Real Estate Securities Fund

(Institutional Class)¥ | | | 1,875,360 | | | | 18,209,748 | |

GuideStone Global Natural Resources Equity Fund (Investor Class)¥ | | | 2,606,281 | | | | 19,885,926 | |

Credit Suisse Commodity

Return Strategy Fund* | | | 3,567,854 | | | | 20,978,983 | |

| | | | | | | | |

Total Mutual Funds

(Cost $726,285,316) | | | | | | | 701,718,136 | |

| | | | | | | | |

TOTAL INVESTMENTS — 99.9%

(Cost $726,285,316) | | | | | | | 701,718,136 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 511,246 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 702,229,382 | |

| | | | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | | | |

| | | % | |

U.S. Equity Select Funds | | | 42.9 | |

Fixed Income Select Funds | | | 25.8 | |

Non-U.S. Equity Select Funds | | | 16.9 | |

Real Return Select Funds | | | 11.3 | |

Credit Suisse Commodity Return Strategy | | | 3.0 | |

| | | | |

| | | 99.9 | |

| | | | |

See Notes to Financial Statements.

17

MYDESTINATION 2025 FUND

SCHEDULE OF INVESTMENTS (Continued)

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2015, in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| | | | | | | | | Level 2 | | | Level 3 | |

| | | Total | | | Level 1 | | | Other Significant | | | Significant | |

| | | Value | | | Quoted Prices | | | Observable Inputs | | | Unobservable Inputs | |

Assets: | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | $ | 701,718,136 | | | $ | 701,718,136 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Assets — Investments in Securities | | $ | 701,718,136 | | | $ | 701,718,136 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Other Financial Instruments*** | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (158,098 | ) | | $ | (158,098 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Liabilities — Other Financial Instruments | | $ | (158,098 | ) | | $ | (158,098 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

18

| | |

| MYDESTINATION 2035 FUND | | |

| SCHEDULE OF INVESTMENTS | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

MUTUAL FUNDS — 99.9% | | | | | | | | |

GuideStone Money Market Fund

(Institutional Class)¥ | | | 8,991,097 | | | $ | 8,991,097 | |

GuideStone Low-Duration Bond Fund

(Institutional Class)¥ | | | 387,280 | | | | 3,276,387 | |

GuideStone Medium-Duration Bond Fund

(Institutional Class)¥ | | | 3,036,735 | | | | 20,862,368 | |

GuideStone Extended-Duration Bond Fund

(Institutional Class)¥ | | | 941,673 | | | | 3,907,941 | |

GuideStone Global Bond Fund

(Institutional Class)¥ | | | 3,263,283 | | | | 32,078,071 | |

GuideStone Defensive Market Strategies Fund

(Institutional Class)¥ | | | 555,776 | | | | 6,463,676 | |

GuideStone Equity Index Fund

(Institutional Class)¥ | | | 5,214,569 | | | | 47,139,700 | |

GuideStone Value Equity Fund

(Institutional Class)¥ | | | 5,301,896 | | | | 46,974,800 | |

GuideStone Growth Equity Fund

(Institutional Class)¥ | | | 4,298,602 | | | | 47,327,609 | |

GuideStone Small Cap Equity Fund

(Institutional Class)¥ | | | 2,587,423 | | | | 24,192,403 | |

GuideStone International Equity Fund

(Institutional Class)¥ | | | 5,159,296 | | | | 57,474,555 | |

GuideStone International Equity Index Fund

(Institutional Class)*¥ | | | 2,957,834 | | | | 28,779,722 | |

GuideStone Emerging Market Equity Fund

(Institutional Class)¥ | | | 2,548,175 | | | | 23,239,357 | |

GuideStone Real Estate Securities Fund

(Institutional Class)¥ | | | 1,290,306 | | | | 12,528,867 | |

GuideStone Global Natural Resources Equity Fund

(Investor Class)¥ | | | 1,554,212 | | | | 11,858,638 | |

Credit Suisse Commodity

Return Strategy Fund* | | | 2,182,541 | | | | 12,833,343 | |

| | | | | | | | |

Total Mutual Funds

(Cost $403,517,326) | | | | | | | 387,928,534 | |

| | | | | | | | |

TOTAL INVESTMENTS — 99.9%

(Cost $403,517,326) | | | | | | | 387,928,534 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 500,952 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 388,429,486 | |

| | | | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | | | |

| | | % | |

U.S. Equity Select Funds | | | 44.3 | |

Non-U.S. Equity Select Funds | | | 28.2 | |

Fixed Income Select Funds | | | 17.8 | |

Real Return Select Funds | | | 6.3 | |

Credit Suisse Commodity Return Strategy | | | 3.3 | |

| | | | |

| | | 99.9 | |

| | | | |

See Notes to Financial Statements.

19

MYDESTINATION 2035 FUND

SCHEDULE OF INVESTMENTS (Continued)

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2015, in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| | | | | | | | | Level 2 | | | Level 3 | |

| | | Total | | | Level 1 | | | Other Significant | | | Significant | |

| | | Value | | | Quoted Prices | | | Observable Inputs | | | Unobservable Inputs | |

Assets: | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | $ | 387,928,534 | | | $ | 387,928,534 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Assets — Investments in Securities | | $ | 387,928,534 | | | $ | 387,928,534 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Other Financial Instruments*** | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (138,710 | ) | | $ | (138,710 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Liabilities — Other Financial Instruments | | $ | (138,710 | ) | | $ | (138,710 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

20

| | |

MYDESTINATION 2045 FUND SCHEDULE OF INVESTMENTS | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

MUTUAL FUNDS — 99.9% | | | | | | | | |

GuideStone Money Market Fund

(Institutional Class)¥ | | | 6,419,672 | | | $ | 6,419,672 | |

GuideStone Medium-Duration Bond Fund

(Institutional Class)¥ | | | 183,334 | | | | 1,259,507 | |

GuideStone Global Bond Fund

(Institutional Class)¥ | | | 1,767,284 | | | | 17,372,404 | |

GuideStone Equity Index Fund

(Institutional Class)¥ | | | 4,229,017 | | | | 38,230,313 | |

GuideStone Value Equity Fund

(Institutional Class)¥ | | | 4,303,996 | | | | 38,133,403 | |

GuideStone Growth Equity Fund

(Institutional Class)¥ | | | 3,496,288 | | | | 38,494,127 | |

GuideStone Small Cap Equity Fund

(Institutional Class)¥ | | | 2,313,633 | | | | 21,632,465 | |

GuideStone International Equity Fund

(Institutional Class)¥ | | | 4,301,741 | | | | 47,921,395 | |

GuideStone International Equity Index Fund

(Institutional Class)*¥ | | | 2,464,214 | | | | 23,976,805 | |

GuideStone Emerging Market Equity Fund

(Institutional Class)¥ | | | 2,105,531 | | | | 19,202,440 | |

GuideStone Real Estate Securities Fund

(Institutional Class)¥ | | | 930,124 | | | | 9,031,505 | |

GuideStone Global Natural Resources Equity Fund

(Investor Class)¥ | | | 1,157,731 | | | | 8,833,484 | |

Credit Suisse Commodity Return Strategy Fund* | | | 1,569,533 | | | | 9,228,853 | |

| | | | | | | | |

Total Mutual Funds

(Cost $290,982,189) | | | | | | | 279,736,373 | |

| | | | | | | | |

TOTAL INVESTMENTS — 99.9%

(Cost $290,982,189) | | | | | | | 279,736,373 | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 282,041 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 280,018,414 | |

| | | | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | | | |

| | | % | |

U.S. Equity Select Funds | | | 48.7 | |

Non-U.S. Equity Select Funds | | | 32.5 | |

Fixed Income Select Funds | | | 9.0 | |

Real Return Select Funds | | | 6.4 | |

Credit Suisse Commodity Return Strategy | | | 3.3 | |

| | | | |

| | | 99.9 | |

| | | | |

See Notes to Financial Statements.

21

MYDESTINATION 2045 FUND

SCHEDULE OF INVESTMENTS (Continued)

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2015, in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| | | Total

Value | | | Level 1

Quoted Prices | | | Level 2

Other Significant

Observable Inputs | | | Level 3

Significant

Unobservable Inputs | |

Assets: | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | $ | 279,736,373 | | | $ | 279,736,373 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Assets — Investments in Securities | | $ | 279,736,373 | | | $ | 279,736,373 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Other Financial Instruments*** | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (102,065 | ) | | $ | (102,065 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Liabilities — Other Financial Instruments | | $ | (102,065 | ) | | $ | (102,065 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

22

| | |

MYDESTINATION 2055 FUND SCHEDULE OF INVESTMENTS | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| | | Shares | | | Value | |

MUTUAL FUNDS — 99.7% | | | | | | | | |

GuideStone Money Market Fund

(Institutional Class)¥ | | | 716,954 | | | $ | 716,954 | |

GuideStone Global Bond Fund

(Institutional Class)¥ | | | 164,803 | | | | 1,620,009 | |

GuideStone Equity Index Fund

(Institutional Class)¥ | | | 502,413 | | | | 4,541,817 | |

GuideStone Value Equity Fund

(Institutional Class)¥ | | | 512,203 | | | | 4,538,122 | |

GuideStone Growth Equity Fund

(Institutional Class)¥ | | | 416,002 | | | | 4,580,180 | |

GuideStone Small Cap Equity Fund

(Institutional Class)¥ | | | 282,077 | | | | 2,637,421 | |

GuideStone International Equity Fund

(Institutional Class)¥ | | | 503,326 | | | | 5,607,051 | |

GuideStone International Equity Index Fund

(Institutional Class)*¥ | | | 287,500 | | | | 2,797,375 | |

GuideStone Emerging Market Equity Fund

(Institutional Class)¥ | | | 249,670 | | | | 2,276,994 | |

GuideStone Real Estate Securities Fund

(Institutional Class)¥ | | | 109,308 | | | | 1,061,384 | |

GuideStone Global Natural Resources Equity Fund

(Investor Class)¥ | | | 138,634 | | | | 1,057,781 | |

Credit Suisse Commodity Return Strategy Fund* | | | 181,232 | | | | 1,065,646 | |

| | | | | | | | |

Total Mutual Funds

(Cost $33,769,584) | | | | | | | 32,500,734 | |

| | | | | | | | |

TOTAL INVESTMENTS — 99.7%

(Cost $33,769,584) | | | | | | | 32,500,734 | |

Other Assets in Excess of Liabilities — 0.3% | | | | | | | 99,547 | |

| | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 32,600,281 | |

| | | | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | | | |

| | | % | |

U.S. Equity Select Funds | | | 50.0 | |

Non-U.S. Equity Select Funds | | | 32.7 | |

Fixed Income Select Funds | | | 7.2 | |

Real Return Select Funds | | | 6.5 | |

Credit Suisse Commodity Return Strategy | | | 3.3 | |

| | | | |

| | | 99.7 | |

| | | | |

See Notes to Financial Statements.

23

MYDESTINATION 2055 FUND

SCHEDULE OF INVESTMENTS (Continued)

VALUATION HIERARCHY

The following is a summary of the inputs used, as of June 30, 2015, in valuing the Fund’s investments carried at fair value:

| | | | | | | | | | | | | | | | |

| | | Total

Value | | | Level 1

Quoted Prices | | | Level 2

Other Significant

Observable Inputs | | | Level 3

Significant

Unobservable Inputs | |

Assets: | | | | | | | | | | | | | | | | |

Investments in Securities: | | | | | | | | | | | | | | | | |

Mutual Funds | | $ | 32,500,734 | | | $ | 32,500,734 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Assets — Investments in Securities | | $ | 32,500,734 | | | $ | 32,500,734 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | |

Other Financial Instruments*** | | | | | | | | | | | | | | | | |

Futures Contracts | | $ | (10,115 | ) | | $ | (10,115 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Liabilities — Other Financial Instruments | | $ | (10,115 | ) | | $ | (10,115 | ) | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| *** | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swap contracts, which are valued at the unrealized appreciation (depreciation) on the investment. Details of these investments can be found in the Notes to Financial Statements. |

See Notes to Financial Statements.

24

(This page intentionally left blank)

25

| | |

| STATEMENTS OF ASSETS AND LIABILITIES | | June 30, 2015 (Unaudited) |

| | | | | | | | |

| | | MyDestination

2005 Fund | | | MyDestination

2015 Fund | |

Assets | | | | | | | | |

Investments in securities of unaffiliated issuers, at value | | $ | 1,911,499 | | | $ | 9,902,727 | |

Investments in securities of affiliated issuers, at value | | | 92,970,254 | | | | 486,262,676 | |

| | | | | | | | |

Total investments (1) | | | 94,881,753 | | | | 496,165,403 | |

Cash collateral for derivatives | | | 77,200 | | | | 271,000 | |

Receivables: | | | | | | | | |

Dividends | | | 58 | | | | 275 | |

Receivable from advisor | | | 2,691 | | | | — | |

Investment securities sold | | | 42 | | | | 304 | |

Fund shares sold | | | 16,551 | | | | 267,714 | |

Variation margin on financial futures contracts | | | 1,170 | | | | 7,676 | |

Prepaid expenses and other assets | | | 10,144 | | | | 12,161 | |

| | | | | | | | |

Total Assets | | | 94,989,609 | | | | 496,724,533 | |

| | | | | | | | |

Liabilities | | | | | | | | |

Payables: | | | | | | | | |

Investment securities purchased | | | — | | | | 86 | |

Fund shares redeemed | | | 59,381 | | | | 102,012 | |

Variation margin on financial futures contracts | | | 273 | | | | 4,258 | |

Accrued expenses: | | | | | | | | |

Investment advisory fees | | | — | | | | 25,252 | |

Shareholder servicing fees | | | 19,784 | | | | 102,747 | |

Other expenses | | | 20,643 | | | | 33,028 | |

| | | | | | | | |

Total Liabilities | | | 100,081 | | | | 267,383 | |

| | | | | | | | |

Net Assets | | $ | 94,889,528 | | | $ | 496,457,150 | |

| | | | | | | | |

Net Assets Consist of: | | | | | | | | |

Paid-in-capital | | $ | 91,687,962 | | | $ | 451,801,701 | |

Accumulated net investment income | | | 401,392 | | | | 2,314,928 | |

Undistributed net realized gain on investments and derivative transactions | | | 4,734,329 | | | | 56,085,446 | |

Net unrealized appreciation (depreciation) on investments and derivative transactions | | | (1,934,155 | ) | | | (13,744,925 | ) |

| | | | | | | | |

Net Assets | | $ | 94,889,528 | | | $ | 496,457,150 | |

| | | | | | | | |

Net Asset Value: | | | | | | | | |

$0.001 par value, unlimited shares authorized | | | | | | | | |

Net assets applicable to the Investor Class | | $ | 94,889,528 | | | $ | 496,457,150 | |

| | | | | | | | |

Investor shares outstanding | | | 8,907,337 | | | | 45,268,957 | |

| | | | | | | | |

Net asset value, offering and redemption price per Investor share | | $ | 10.65 | | | $ | 10.97 | |

| | | | | | | | |

| | | | | | | | |

(1) Investments in securities of unaffiliated issuers, at cost | | $ | 2,264,332 | | | $ | 11,946,400 | |

Investments in securities of affiliated issuers, at cost | | | 94,540,484 | | | | 497,874,434 | |

| | | | | | | | |

Total investments at cost | | $ | 96,804,816 | | | $ | 509,820,834 | |

| | | | | | | | |

See Notes to Financial Statements.

26

| | | | | | | | | | | | | | |

MyDestination

2025 Fund | | | MyDestination

2035 Fund | | | MyDestination

2045 Fund | | | MyDestination

2055 Fund | |

| | | | | | | | | | | | | | |

| $ | 20,978,983 | | | $ | 12,833,343 | | | $ | 9,228,853 | | | $ | 1,065,646 | |

| | 680,739,153 | | | | 375,095,191 | | | | 270,507,520 | | | | 31,435,088 | |

| | | | | | | | | | | | | | |

| | 701,718,136 | | | | 387,928,534 | | | | 279,736,373 | | | | 32,500,734 | |

| | 423,000 | | | | 358,900 | | | | 275,500 | | | | 37,000 | |

| | | | | | | | | | | | | | |

| | 397 | | | | 286 | | | | 208 | | | | 24 | |

| | — | | | | — | | | | — | | | | 6,642 | |

| | — | | | | — | | | | — | | | | — | |

| | 342,409 | | | | 310,161 | | | | 282,191 | | | | 94,362 | |

| | 17,760 | | | | 7,795 | | | | 13,901 | | | | 1,170 | |

| | 11,854 | | | | 11,815 | | | | 10,188 | | | | 7,058 | |

| | | | | | | | | | | | | | |

| | 702,513,556 | | | | 388,617,491 | | | | 280,318,361 | | | | 32,646,990 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | — | | | | — | | | | — | | | | 57 | |

| | 56,187 | | | | 60,465 | | | | 200,932 | | | | 21,377 | |

| | 6,901 | | | | — | | | | 5,226 | | | | — | |

| | | | | | | | | | | | | | |

| | 39,719 | | | | 17,683 | | | | 9,969 | | | | — | |

| | 145,016 | | | | 80,672 | | | | 58,222 | | | | 6,759 | |

| | 36,351 | | | | 29,185 | | | | 25,598 | | | | 18,516 | |

| | | | | | | | | | | | | | |