December 12, 2013

athenahealth, Inc. 6th Annual Investor Summit – December 12, 20132 Dana Quattrochi Director, Investor Relations

athenahealth, Inc. 6th Annual Investor Summit – December 12, 20133 Rob Cosinuke, SVP, Chief Marketing Officer & President of Epocrates Abbe Don, VP, User Experience Jeremy Delinsky, SVP, Chief Technology Officer 3. Ramp Strategy Discussion Jonathan Bush, President, Chairman & CEO 1. Opening Remarks Tim Adams, SVP, Chief Financial Officer 2. Financial Discussion Dr. Todd Rothenhaus, VP, Chief Medical Officer 4. Care Continuum Strategy Discussion 5. Client Panel Discussion Paul Merrild, VP, National Accounts 6. Management Q&A and Closing Remarks Jonathan Bush, President, Chairman & CEO

athenahealth, Inc. 6th Annual Investor Summit – December 12, 20134 This presentation contains forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements reflecting athenahealth, Inc. (the “Company”) management’s expectations for: future financial and operational performance; expected growth, including anticipated revenues, profitability, and service subscriptions; market trends and business outlook (e.g., the shift toward alternative reimbursement); the anticipated benefits of the Company’s service offerings and plans and timelines for developing and expanding those offerings (e.g., UX improvements, ICD-10 readiness, a light EHR, and secure messaging); marketing and sales plans, strategies, and trends (e.g., network referrals); the integration of the Company’s services, acquisitions, and operations; and cultural, operational, and organizational goals and initiatives (e.g., care coordination and ecosystem development), as well as statements found under the Company’s reconciliation of Non-GAAP financial measures included within this presentation. Such statements do not constitute guarantees of future performance, are neither promises nor guarantees, and are subject to a variety of risks and uncertainties, many of which are beyond the Company’s control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. In particular, the risks and uncertainties include, among other things: the Company’s fluctuating operating results; the Company’s variable sales and implementation cycles; risks associated with its expectations regarding its ability to maintain profitability; the impact of increased sales and marketing expenditures, including whether increased expansion in revenues is attained and whether impact on margins and profitability is longer term than expected; changes in tax rates or exposure to additional tax liabilities; the highly competitive and rapidly changing industry in which the Company operates; and the evolving and complex governmental and regulatory compliance environment in which the Company and its clients operate. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to update or revise the information contained in this presentation, whether as a result of new information, future events or circumstances, or otherwise. For additional disclosure regarding these and other risks faced by the Company, see the disclosures contained in its public filings with the Securities and Exchange Commission, available on the Investors section of the Company’s website at http://www.athenahealth.com and on the SEC's website at http://www.sec.gov.

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 In the Company’s earnings releases, conference calls, slide presentations, or webcasts, the Company may use or discuss non-GAAP financial measures as defined by SEC Regulation G. The GAAP financial measure most directly comparable to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, is available within this presentation and within the Company’s public filings with the Securities and Exchange Commission, available on the Investors section of the Company’s website at http://www.athenahealth.com. 5

athenahealth, Inc. 6th Annual Investor Summit – December 12, 20136

Jonathan Bush Chairman, President & CEO

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 To be medical care givers’ most trusted service, helping them do well by doing the right thing.MISSION An information backbone that helps make health care work as it should. VISION CULTURE Each of us is a teacher and learner, in it for the mission. 8

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 And our strategic priorities remain the same for 2014 9

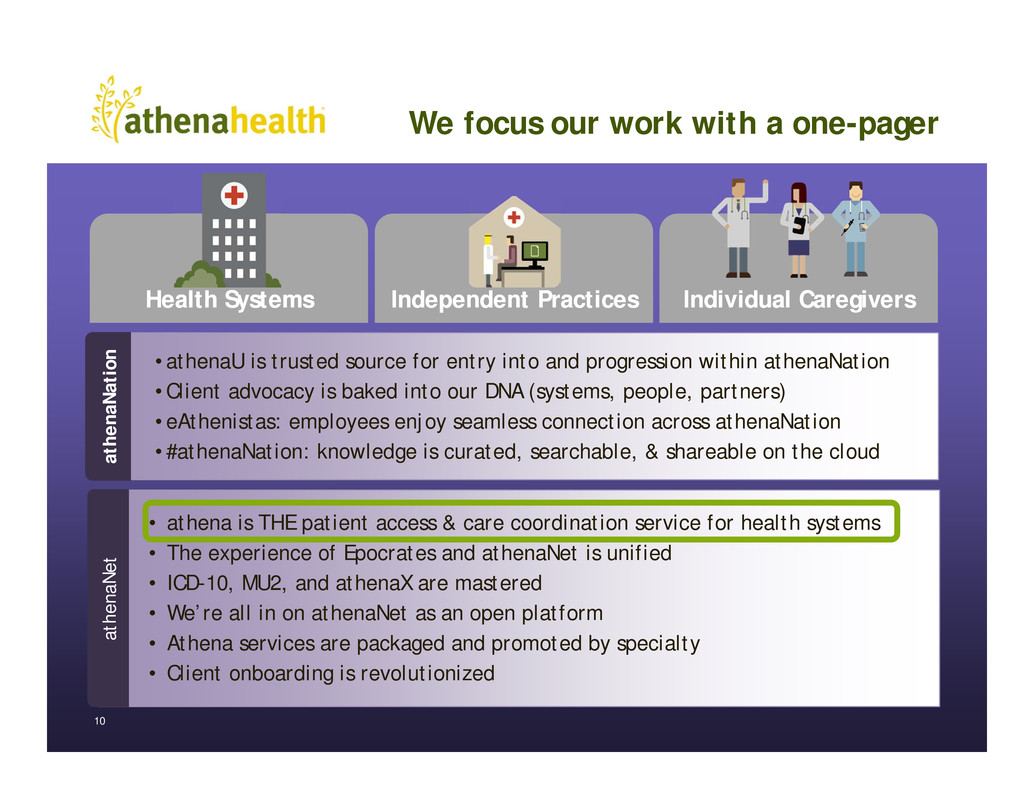

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 • athenaU is trusted source for entry into and progression within athenaNation • Client advocacy is baked into our DNA (systems, people, partners) • eAthenistas: employees enjoy seamless connection across athenaNation • #athenaNation: knowledge is curated, searchable, & shareable on the cloud 10 Health Systems Independent Practices Individual Caregivers • athena is THE patient access & care coordination service for health systems • The experience of Epocrates and athenaNet is unified • ICD-10, MU2, and athenaX are mastered • We’re all in on athenaNet as an open platform • Athena services are packaged and promoted by specialty • Client onboarding is revolutionized a t h e n a N a t i o n a t h e n a N a t i o n a t h e n a N e t a t h e n a N e t We focus our work with a one-pager

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013Wayne Gretzky (not athenahealth)11

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201312

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201313

athenahealth, Inc. 6th Annual Investor Summit – December 12, 20131414

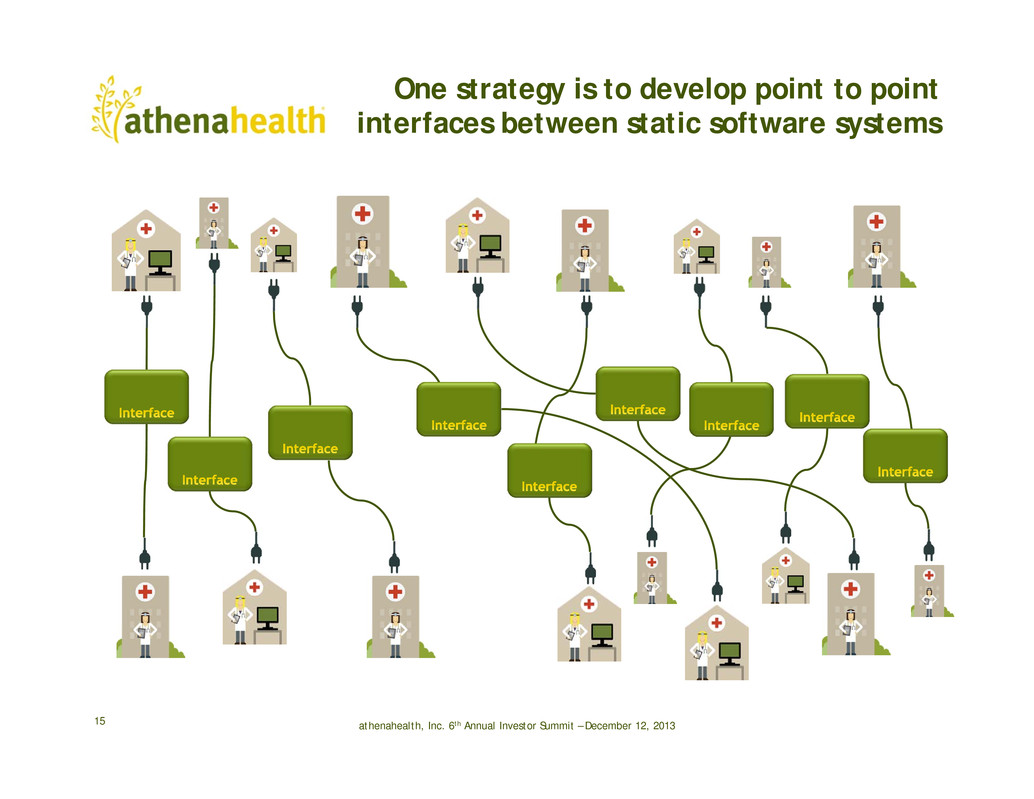

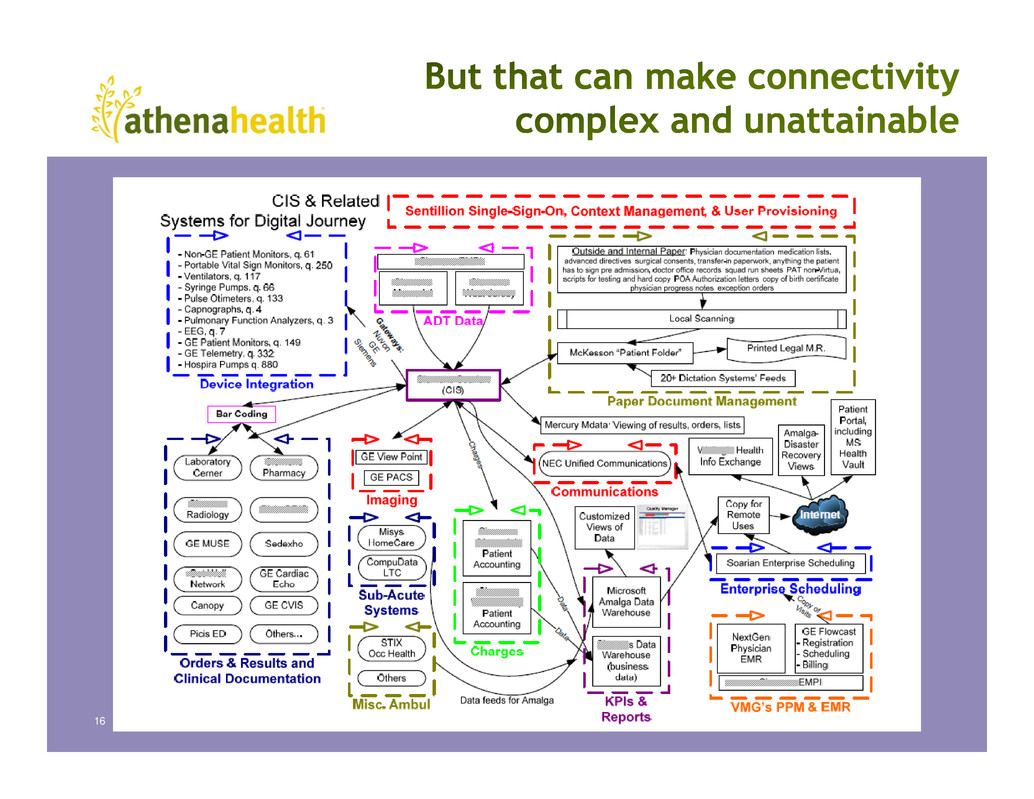

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 One strategy is to develop point to point interfaces between static software systems 15

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201316

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Another strategy is the biosphere…but you can’t buy everyone In most health systems, 50-80% of hospital admissions come from non-employed physicians 17

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201318

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 But instead – let’s be the best in the world at connectivity across the continuum 19

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Virtually ALL NEW Health Information Solutions are cloud based 20

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 AND, Best in KLAS says it all… Cardiology Document Management Emergency Department Homecare Oncology PACS Speech Recognition Anesthesia Pharmacy Budgeting Cardiology Hemodynamics Clinical Decision Support Clinical Procedure Documentation ECG Data Management Infection Control Laboratory Mammography Treatment Planning 21

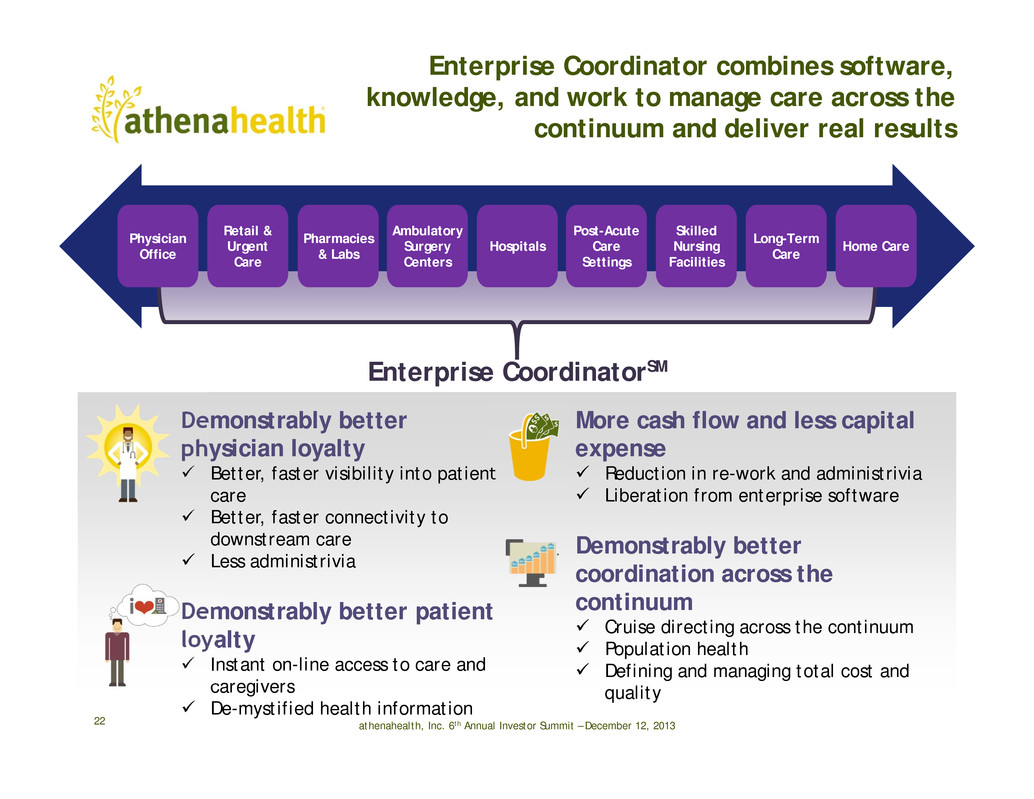

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Enterprise Coordinator combines software, knowledge, and work to manage care across the continuum and deliver real results 22 Enterprise CoordinatorSM More cash flow and less capital expense Reduction in re-work and administrivia Liberation from enterprise software Demonstrably better coordination across the continuum Cruise directing across the continuum Population health Defining and managing total cost and quality Demonstrably better physician loyalty Better, faster visibility into patient care Better, faster connectivity to downstream care Less administrivia Demonstrably better patient loyalty Instant on-line access to care and caregivers De-mystified health information Physician Office Retail & Urgent Care Ambulatory Surgery Centers Hospitals Post-Acute Care Settings Skilled Nursing Facilities Long-Term Care Home Care Pharmacies & Labs

23

athenahealth, Inc. 6th Annual Investor Summit – December 12, 20132424

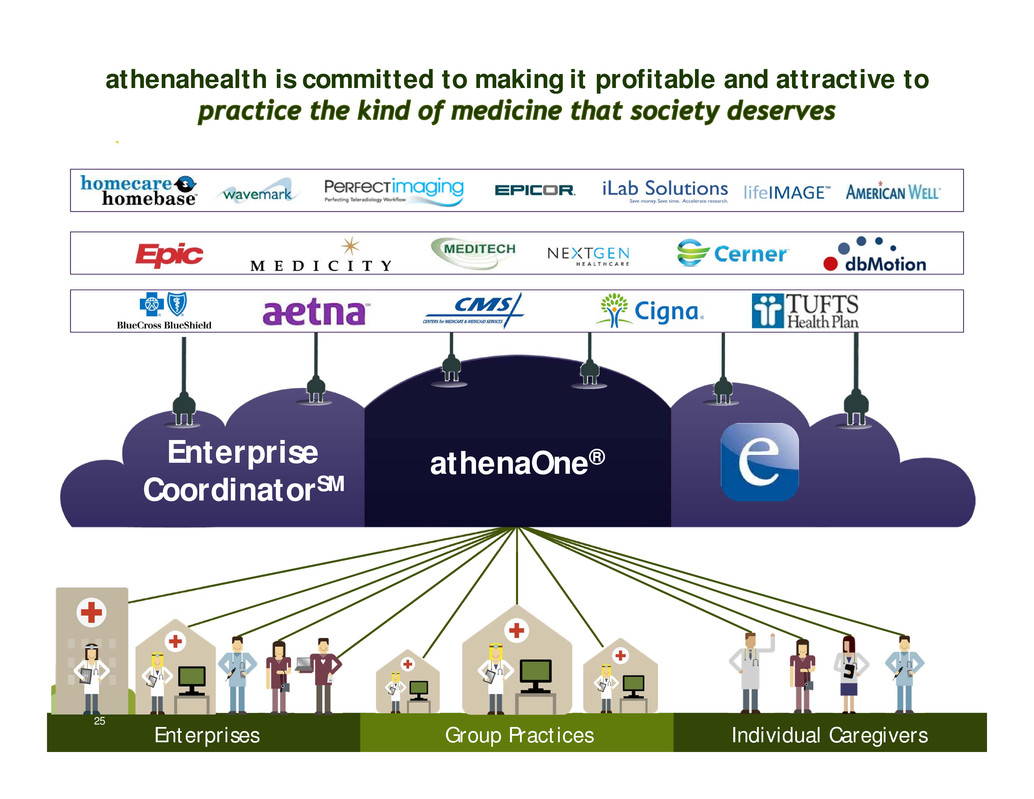

Group Practices Individual CaregiversEnterprises athenaOne®Enterprise CoordinatorSM athenahealth is committed to making it profitable and attractive to 25

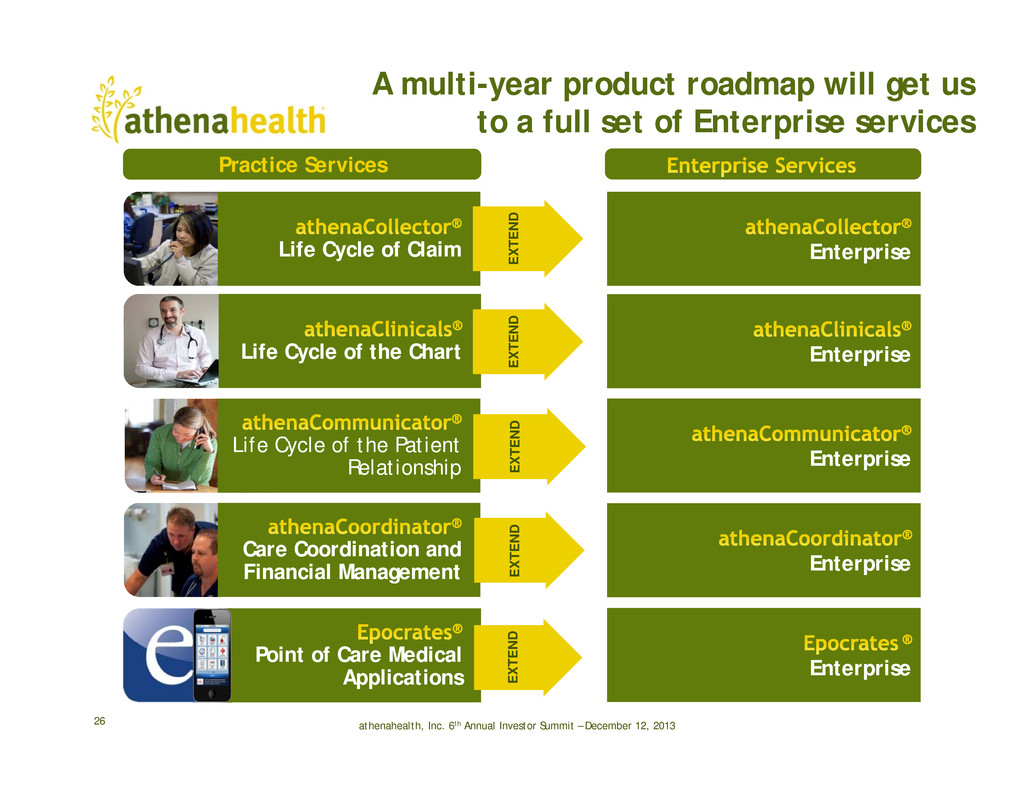

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Point of Care Medical Applications Practice Services Life Cycle of Claim Life Cycle of the Patient Relationship Life Cycle of the Chart Care Coordination and Financial Management Enterprise Enterprise Enterprise Enterprise Enterprise E X T E N D E X T E N D E X T E N D E X T E N D E X T E N D A multi-year product roadmap will get us to a full set of Enterprise services 26

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013Wayne Gretzky (and athenahealth)27

Tim Adams SVP, Chief Financial Officer

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Massive untapped market opportunity despite high growth 29 Recurring revenue and cash flow business model Operational improvement discipline across a wide portfolio Strong role played by founding team Strong financial support behind a culture of innovation ✔ ✔ ✔ ✔ ✔

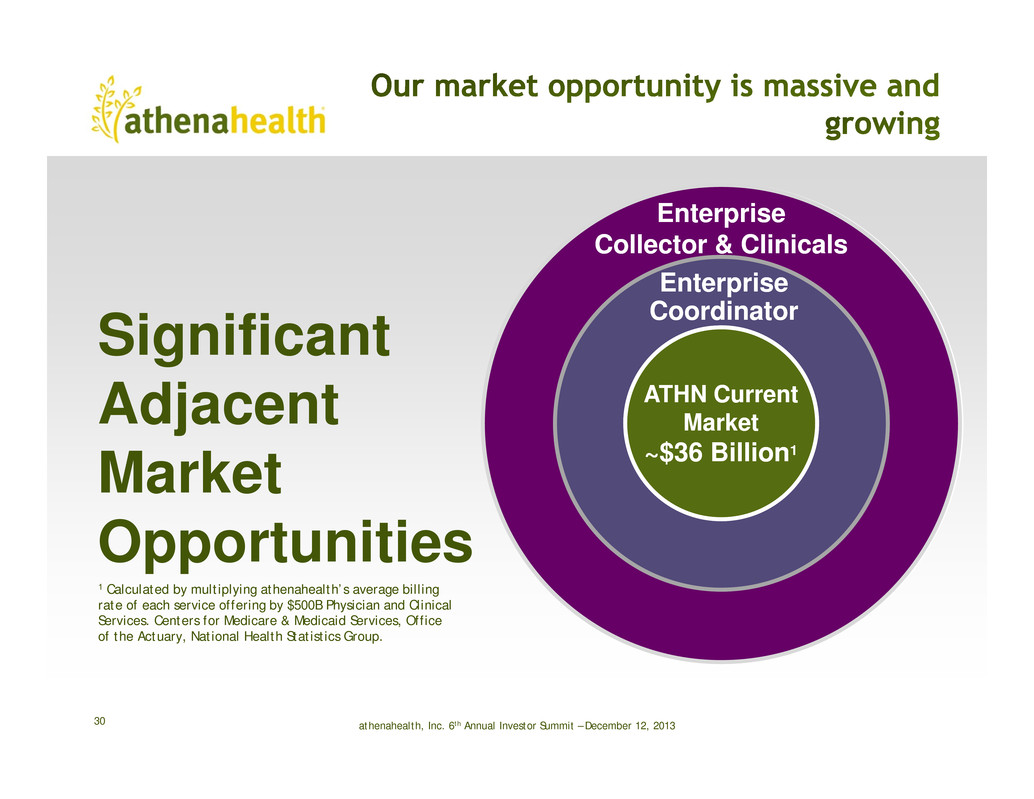

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201330 1 Calculated by multiplying athenahealth’s average billing rate of each service offering by $500B Physician and Clinical Services. Centers for Medicare & Medicaid Services, Office of the Actuary, National Health Statistics Group. Significant Adjacent Market Opportunities ATHN Current Market ~$36 Billion1 Enterprise Coordinator Enterprise Collector & Clinicals

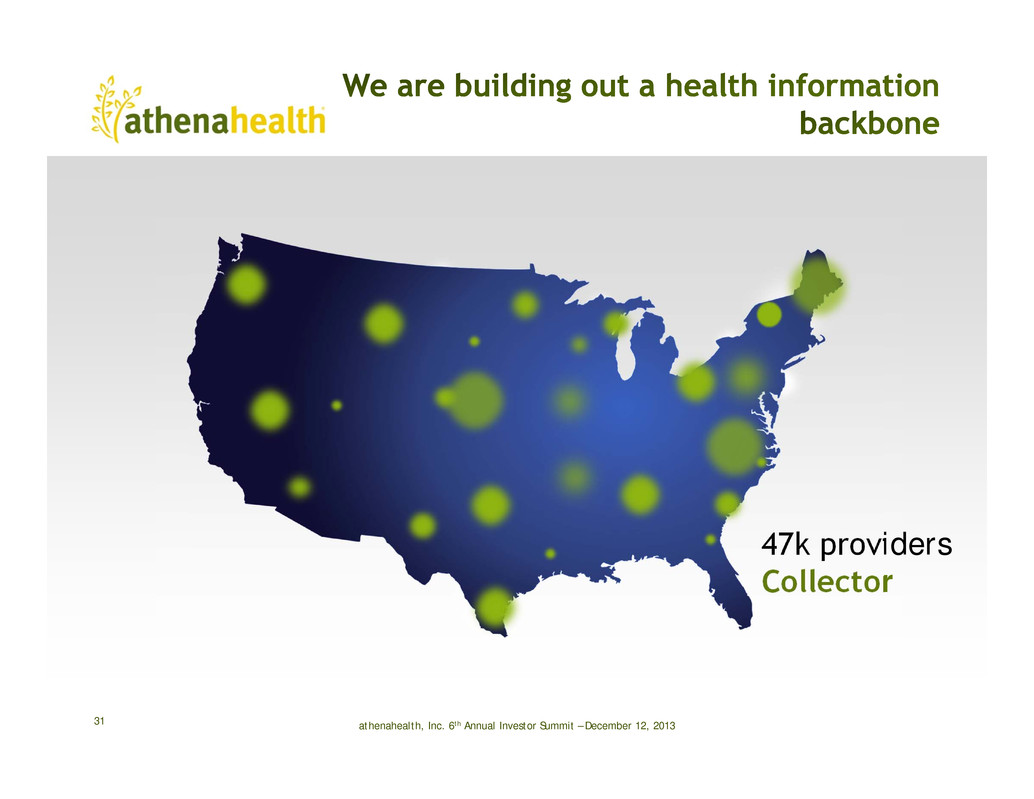

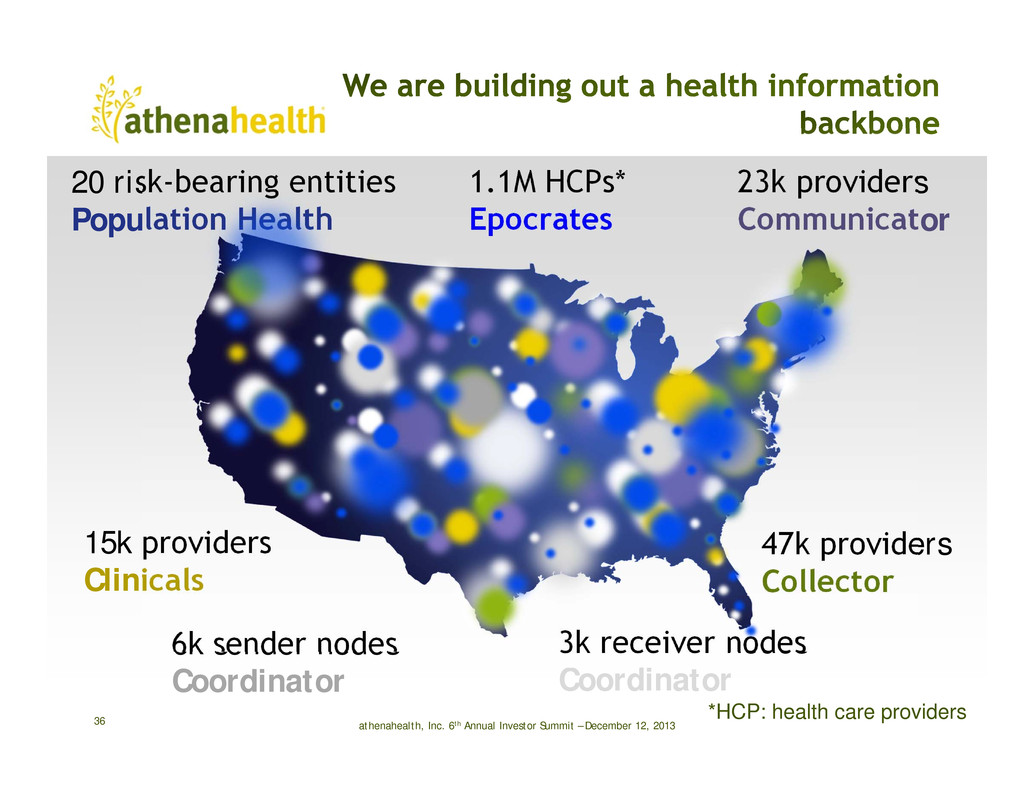

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201331 47k providers Collector

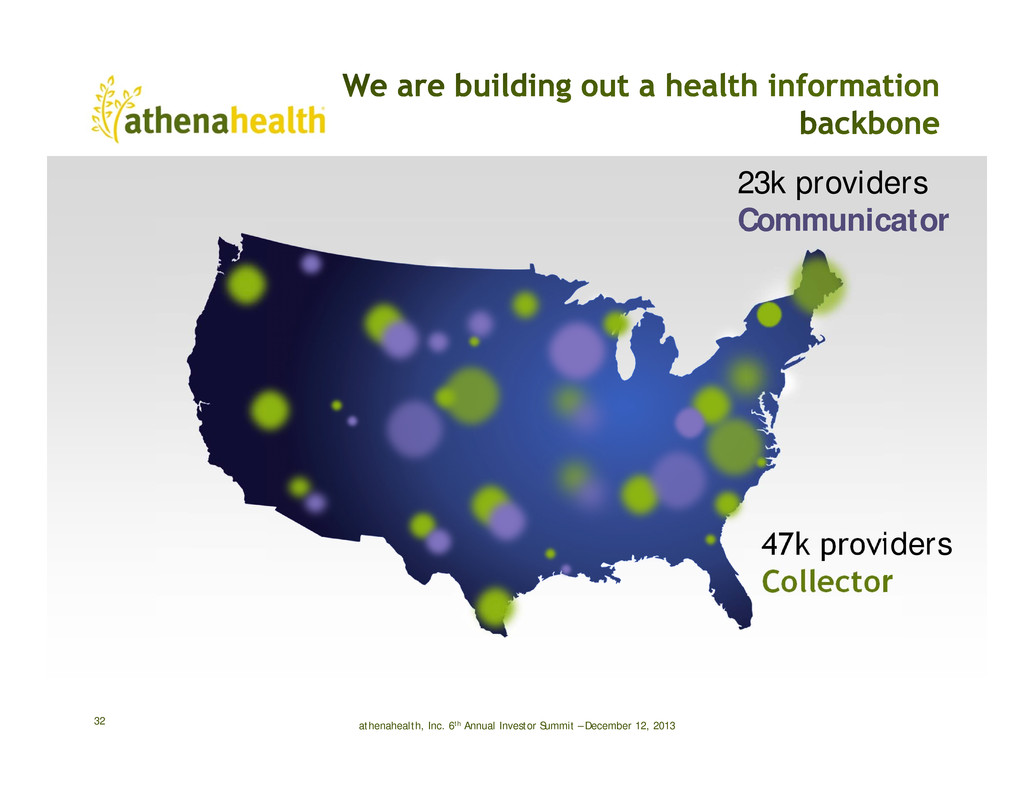

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201332 47k providers Collector 23k providers Communicator

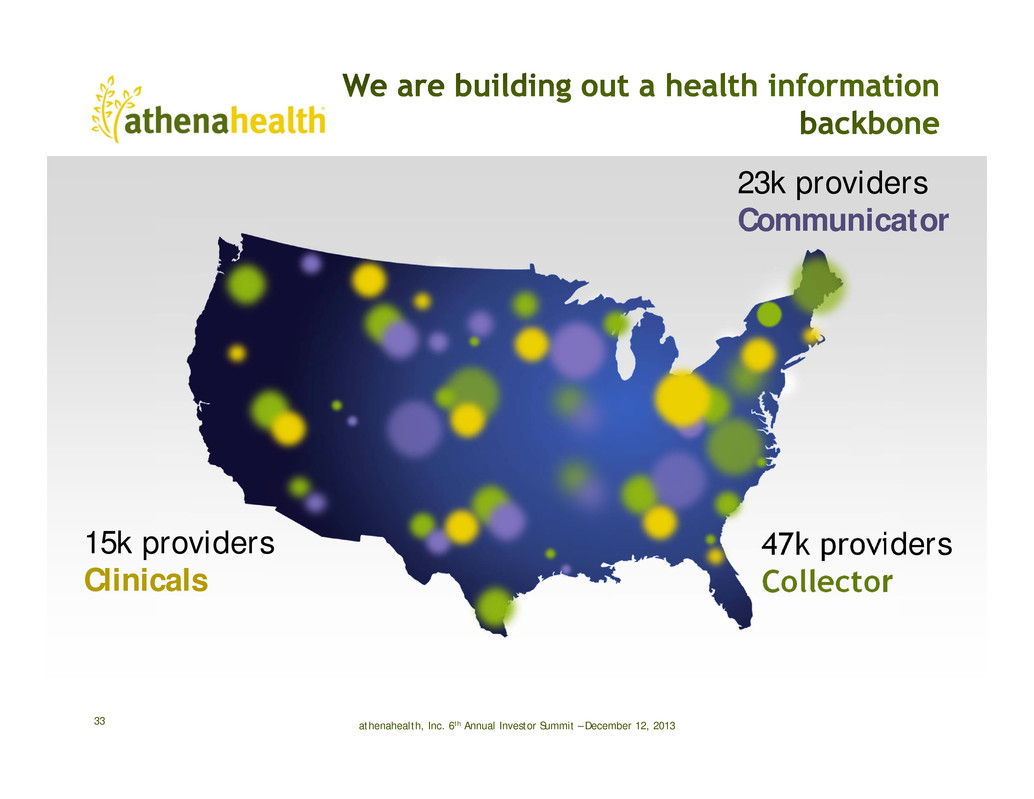

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201333 47k providers Collector 23k providers Communicator 15k providers Clinicals

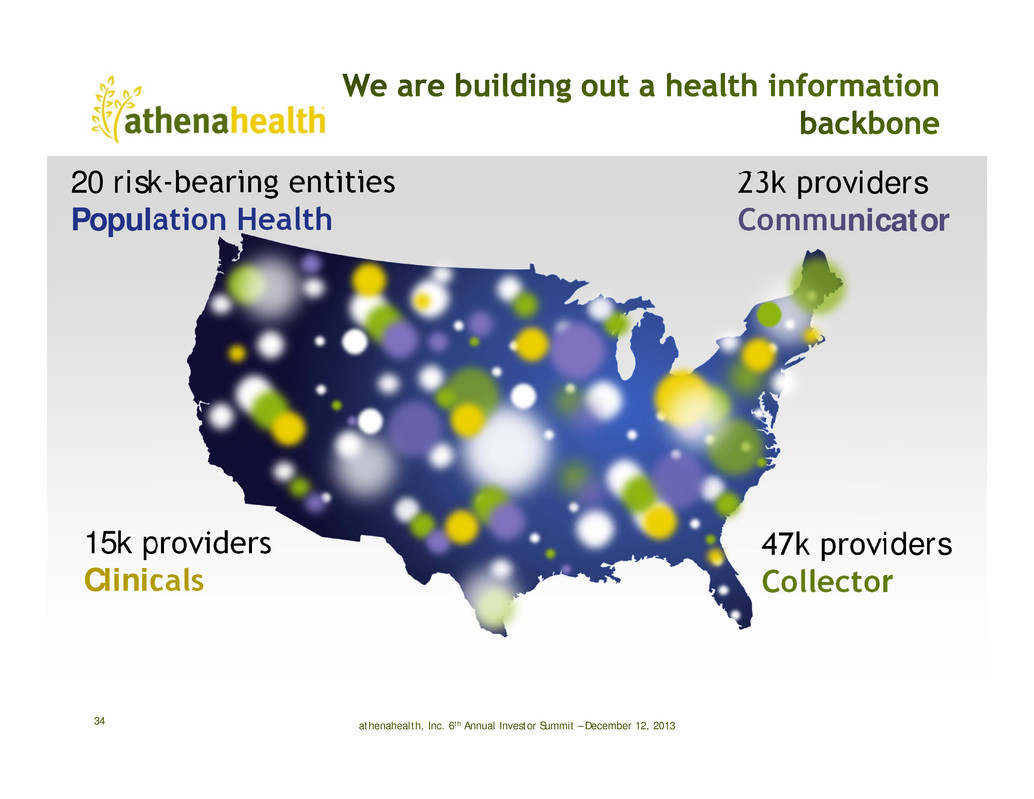

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201334 20 risk-bearing entities Population Health 47k providers Collector 23k providers Communicator 15k providers Clinicals

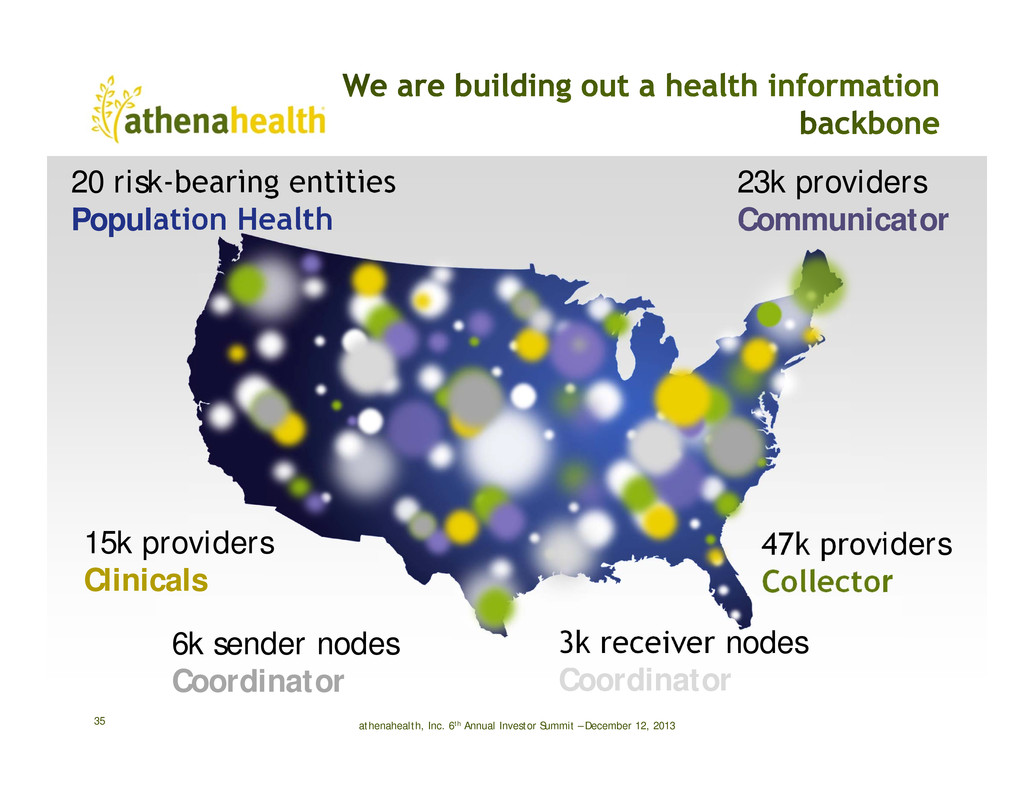

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201335 20 risk-bearing entities Population Health 47k providers Collector 23k providers Communicator 15k providers Clinicals 6k sender nodes Coordinator 3k receiver nodes Coordinator

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201336 20 risk-bearing entities Population Health 47k providers Collector 23k providers Communicator 15k providers Clinicals 6k sender nodes Coordinator 3k receiver nodes Coordinator 1.1M HCPs* Epocrates *HCP: health care providers

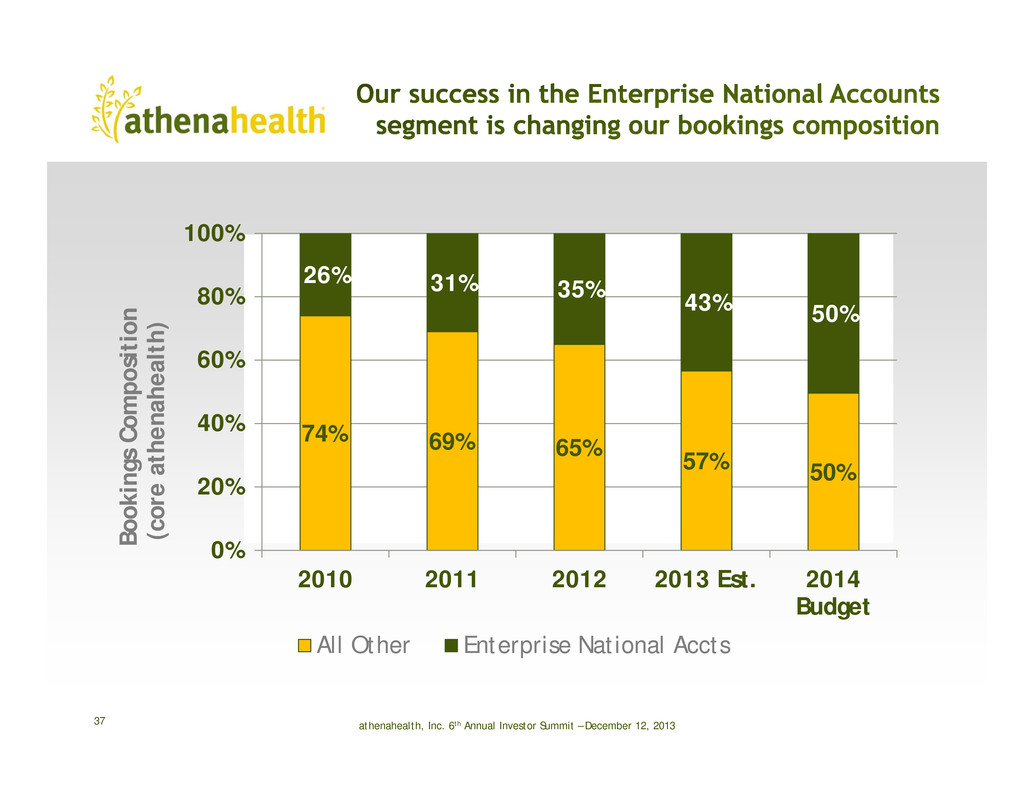

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 74% 69% 65% 57% 50% 26% 31% 35% 43% 50% 0% 20% 40% 60% 80% 100% 2010 2011 2012 2013 Est. 2014 Budget B o o k i n g s C o m p o s i t i o n ( c o r e a t h e n a h e a l t h ) All Other Enterprise National Accts 37

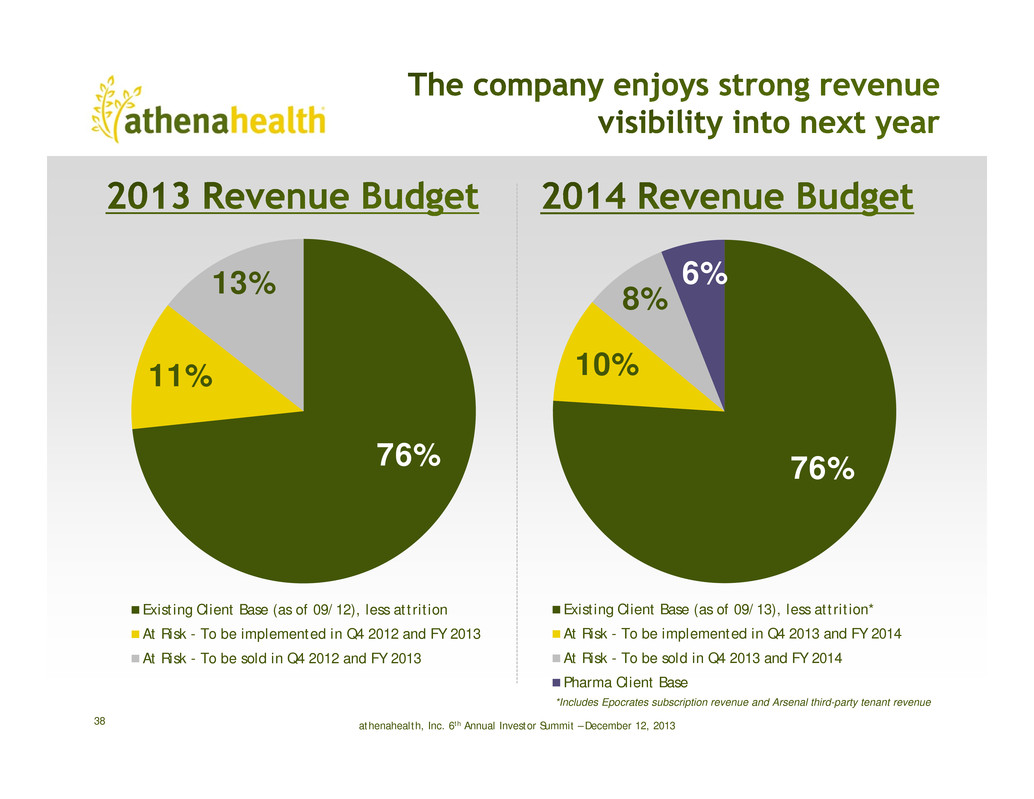

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201338 76% 10% 8% 6% Existing Client Base (as of 09/13), less attrition* At Risk - To be implemented in Q4 2013 and FY 2014 At Risk - To be sold in Q4 2013 and FY 2014 Pharma Client Base *Includes Epocrates subscription revenue and Arsenal third-party tenant revenue 76% 11% 13% Existing Client Base (as of 09/12), less attrition At Risk - To be implemented in Q4 2012 and FY 2013 At Risk - To be sold in Q4 2012 and FY 2013

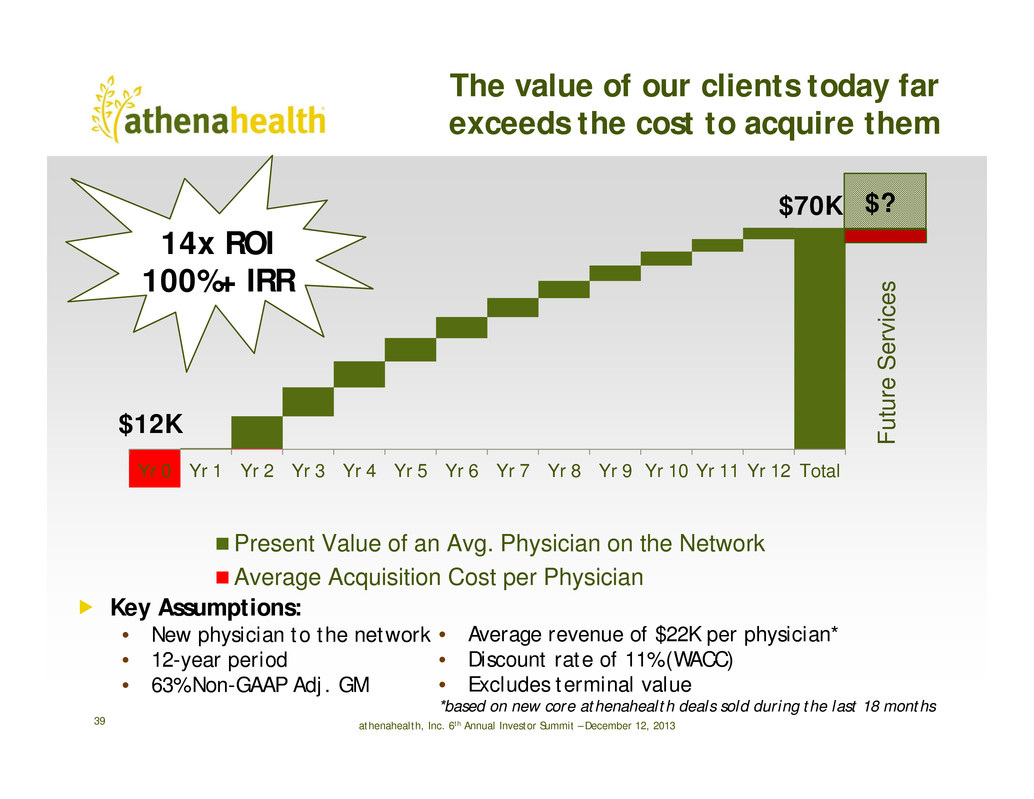

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 The value of our clients today far exceeds the cost to acquire them 39 • Average revenue of $22K per physician* • Discount rate of 11% (WACC) • Excludes terminal value *based on new core athenahealth deals sold during the last 18 months Key Assumptions: • New physician to the network • 12-year period • 63% Non-GAAP Adj. GM 100%+ IRR 14x ROI Yr 0 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Yr 7 Yr 8 Yr 9 Yr 10 Yr 11 Yr 12 Total Present Value of an Avg. Physician on the Network Average Acquisition Cost per Physician $12K $70K F u t u r e S e r v i c e s $?

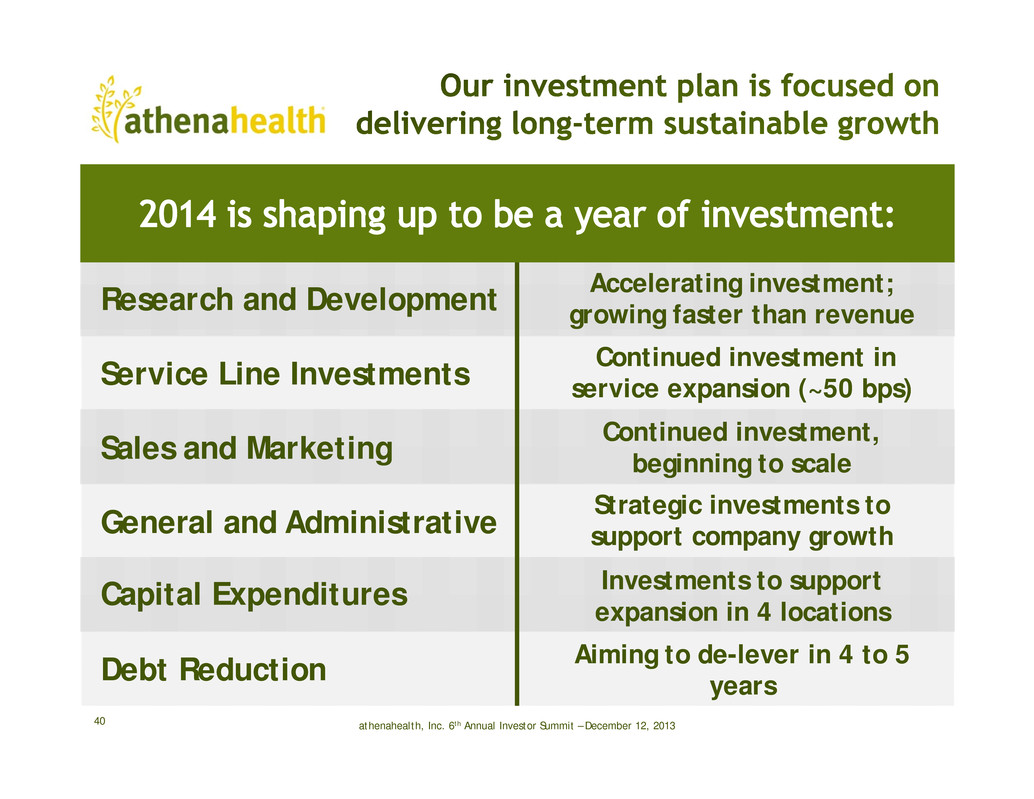

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201340 Research and Development Service Line Investments Sales and Marketing General and Administrative Capital Expenditures Debt Reduction Accelerating investment; growing faster than revenue Continued investment in service expansion (~50 bps) Continued investment, beginning to scale Strategic investments to support company growth Investments to support expansion in 4 locations Aiming to de-lever in 4 to 5 years

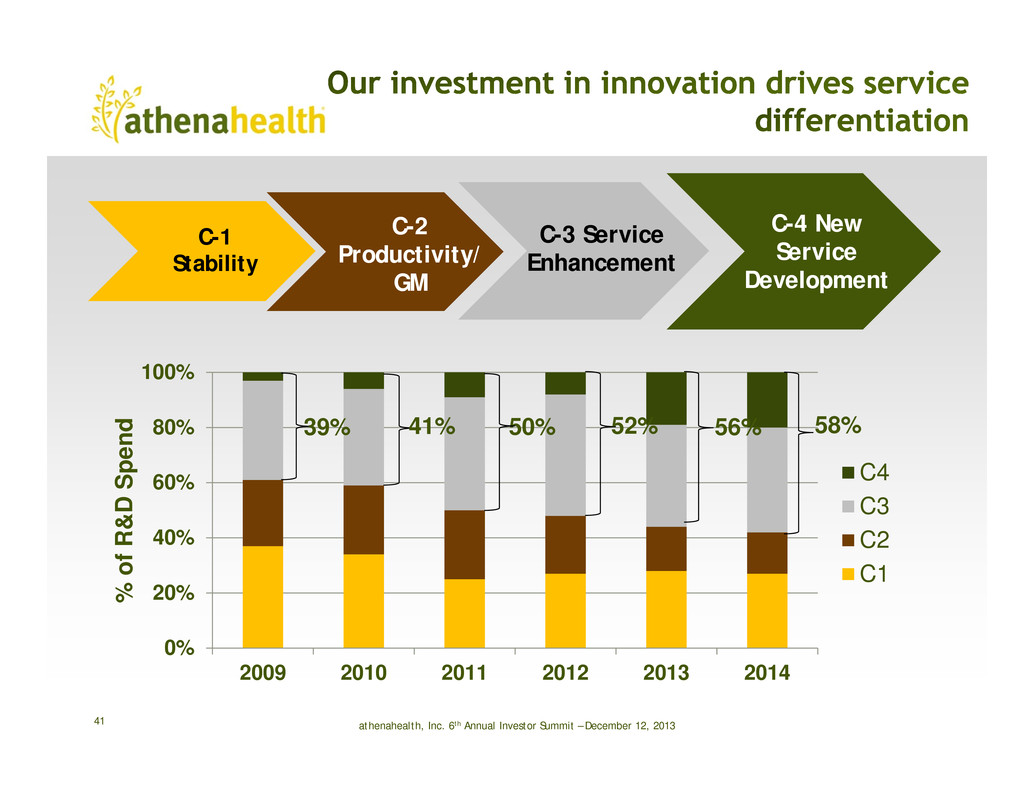

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201341 C-1 Stability C-2 Productivity/ GM C-3 Service Enhancement C-4 New Service Development 0% 20% 40% 60% 80% 100% 2009 2010 2011 2012 2013 2014 % o f R & D S p e n d C4 C3 C2 C1 39% 41% 50% 52% 56% 58%

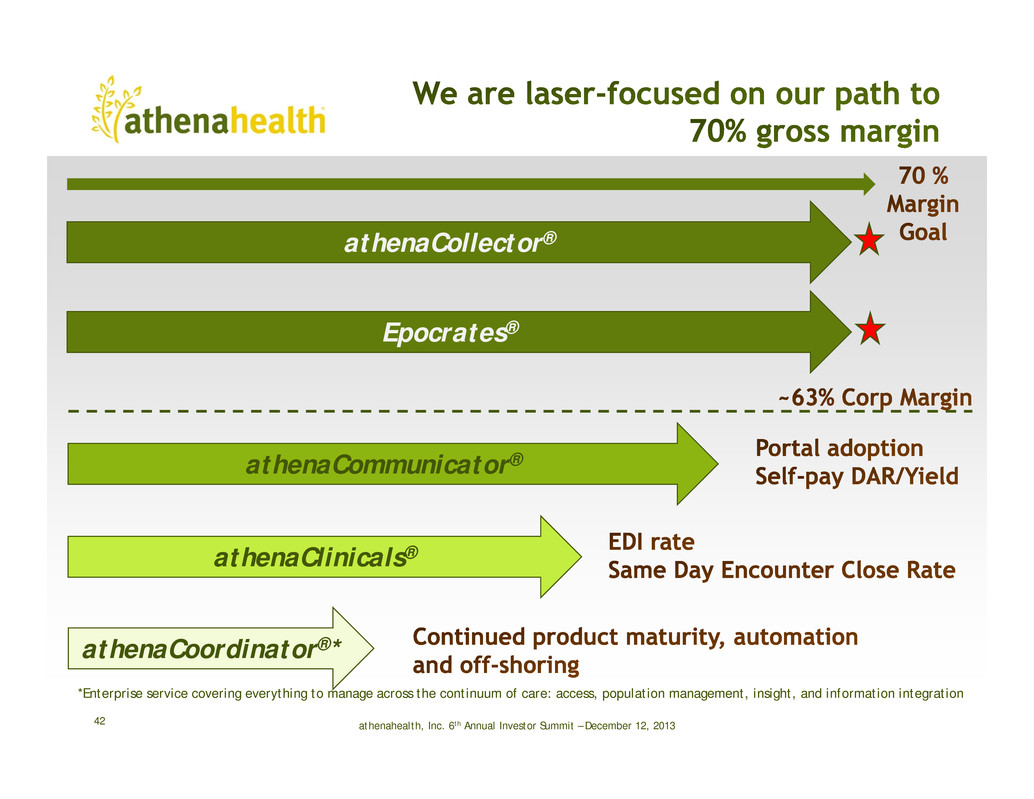

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 athenaCollector® athenaCommunicator® athenaClinicals® athenaCoordinator®* Epocrates® 42 *Enterprise service covering everything to manage across the continuum of care: access, population management, insight, and information integration

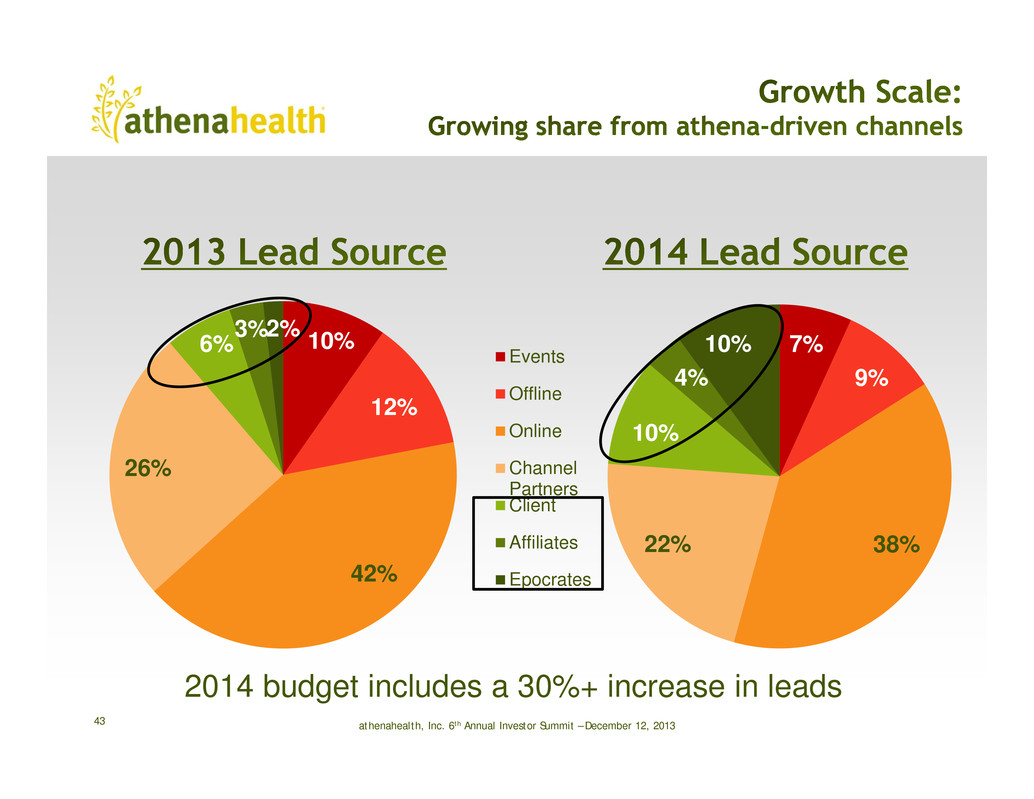

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 10% 12% 42% 26% 6% 3%2% 7% 9% 38%22% 10% 4% 10%Events Offline Online Channel Partners Client Affiliates Epocrates 43 2014 budget includes a 30%+ increase in leads

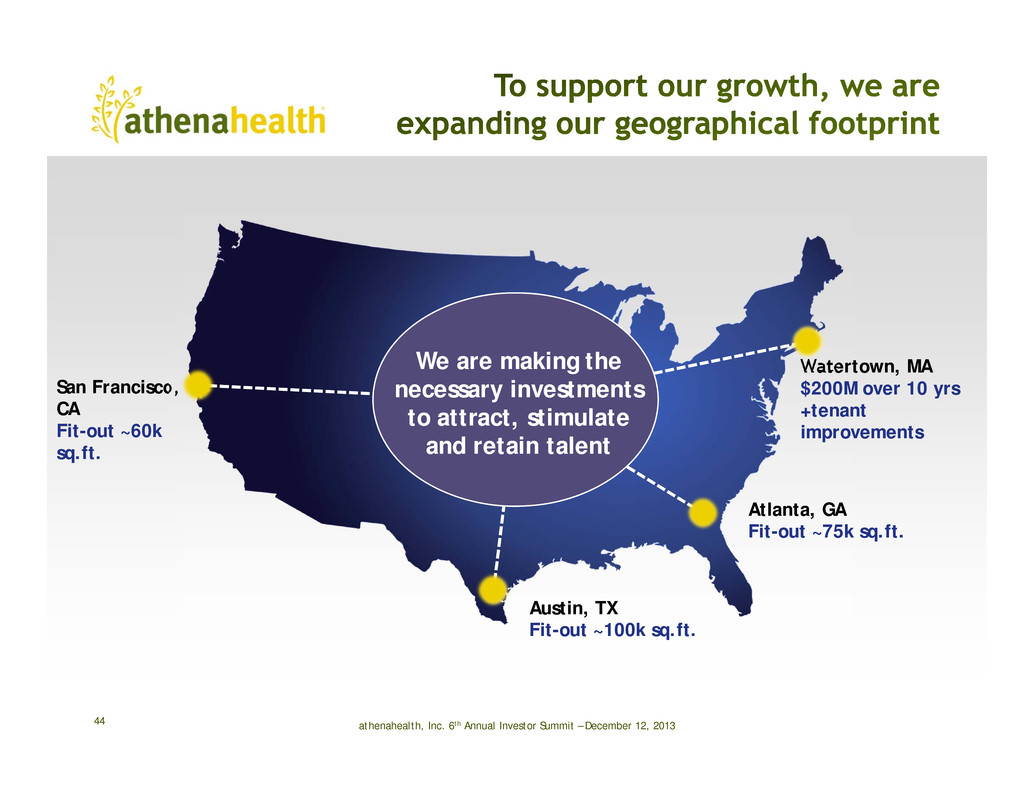

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201344 San Francisco, CA Fit-out ~60k sq.ft. Austin, TX Fit-out ~100k sq.ft. Watertown, MA $200M over 10 yrs +tenant improvements Atlanta, GA Fit-out ~75k sq.ft. We are making the necessary investments to attract, stimulate and retain talent

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201345 1 See non-GAAP reconciliation tables in the 12/11/13 press release Note: These estimates reflect the Company’s current operating plan as of December 12, 2013, and are subject to change as future events and opportunities arise. FISCAL YEAR 2013 EXPECTATIONS Annual Revenue $580 – $615 million Non-GAAP Adjusted Gross Margin1 63.0% – 64.0% Non-GAAP Adjusted Op Income1 $68 – $80 million Non-GAAP Adjusted Net Income per Diluted Share1 $1.05 – $1.15

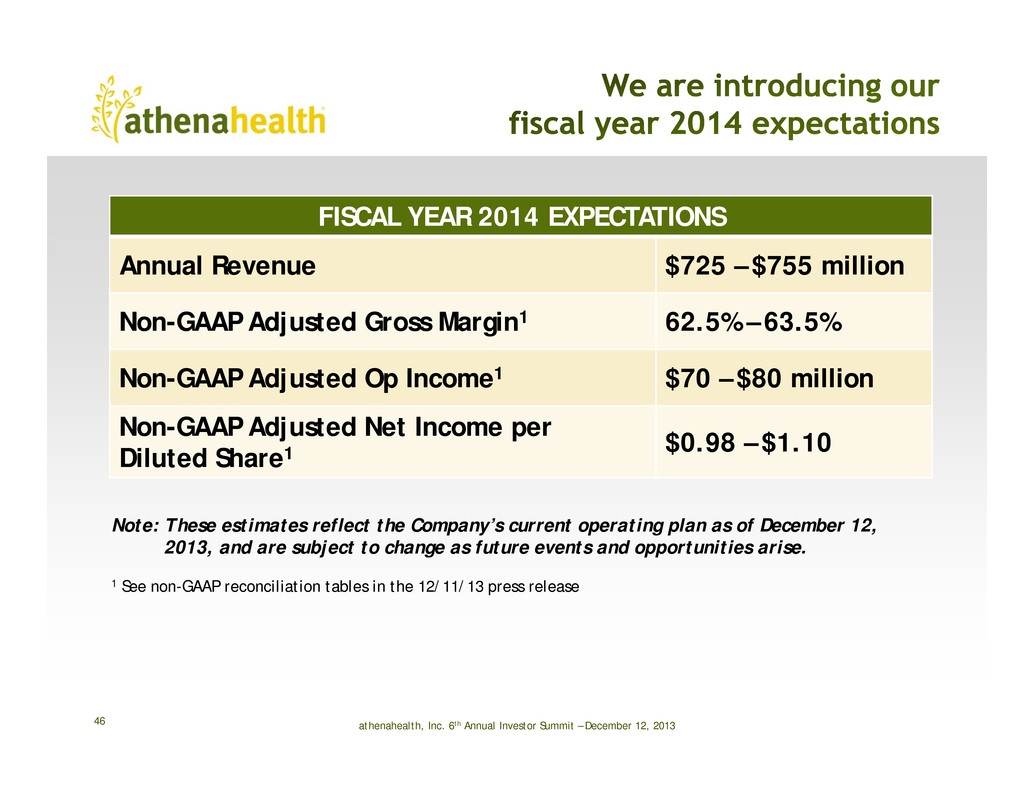

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201346 1 See non-GAAP reconciliation tables in the 12/11/13 press release Note: These estimates reflect the Company’s current operating plan as of December 12, 2013, and are subject to change as future events and opportunities arise. FISCAL YEAR 2014 EXPECTATIONS Annual Revenue $725 – $755 million Non-GAAP Adjusted Gross Margin1 62.5% – 63.5% Non-GAAP Adjusted Op Income1 $70 – $80 million Non-GAAP Adjusted Net Income per Diluted Share1 $0.98 – $1.10

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 In the Company’s earnings releases, conference calls, slide presentations, or webcasts, the Company may use or discuss non-GAAP financial measures as defined by SEC Regulation G. The GAAP financial measure most directly comparable to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, is available within this presentation and within the Company’s public filings with the Securities and Exchange Commission, available on the Investors section of the Company’s website at http://www.athenahealth.com. 47

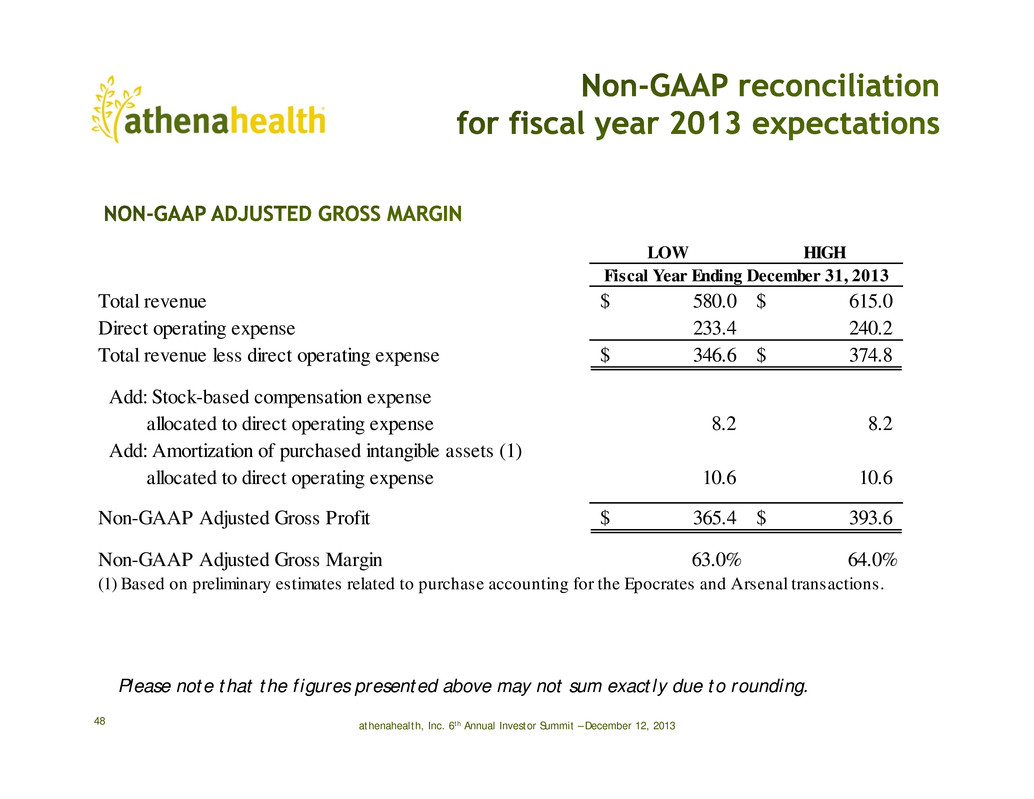

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201348 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH Total revenue 580.0$ 615.0$ Direct operating expense 233.4 240.2 Total revenue less direct operating expense 346.6$ 374.8$ Add: Stock-based compensation expense allocated to direct operating expense 8.2 8.2 Add: Amortization of purchased intangible assets (1) allocated to direct operating expense 10.6 10.6 Non-GAAP Adjusted Gross Profit 365.4$ 393.6$ Non-GAAP Adjusted Gross Margin 63.0% 64.0% (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. Fiscal Year Ending December 31, 2013

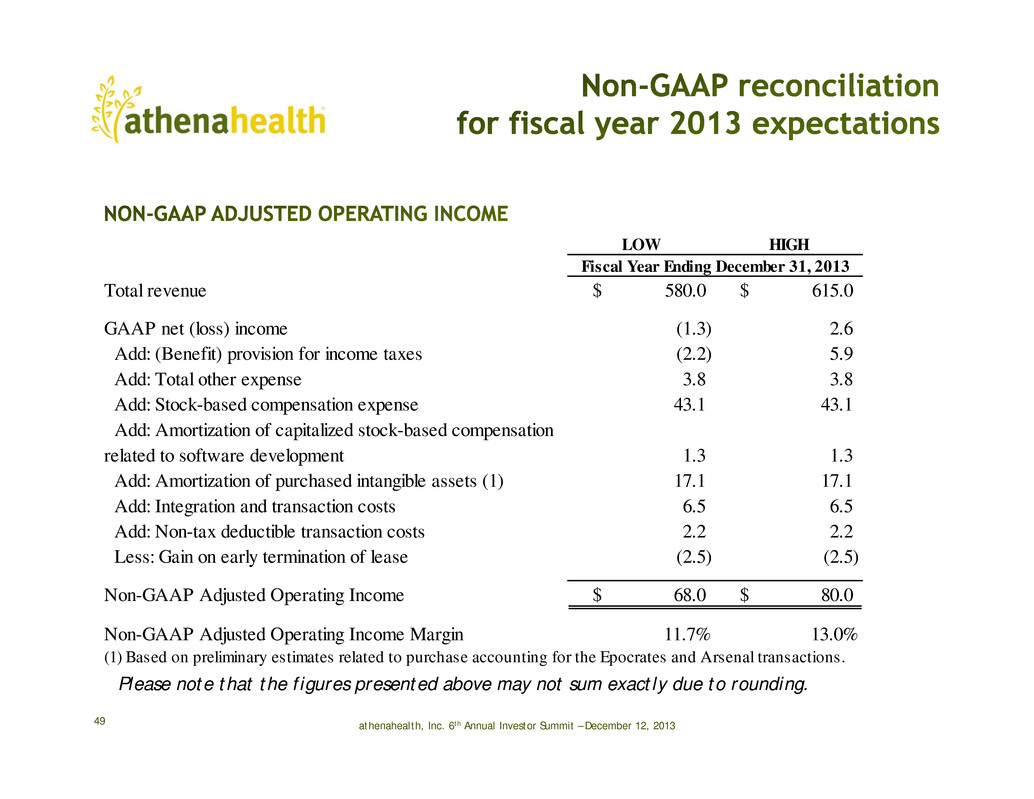

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201349 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH Total revenue 580.0$ 615.0$ GAAP net (loss) income (1.3) 2.6 Add: (Benefit) provision for income taxes (2.2) 5.9 Add: Total other expense 3.8 3.8 Add: Stock-based compensation expense 43.1 43.1 Add: Amortization of capitalized stock-based compensation related to software development 1.3 1.3 Add: Amortization of purchased intangible assets (1) 17.1 17.1 Add: Integration and transaction costs 6.5 6.5 Add: Non-tax deductible transaction costs 2.2 2.2 Less: Gain on early termination of lease (2.5) (2.5) Non-GAAP Adjusted Operating Income 68.0$ 80.0$ Non-GAAP Adjusted Operating Income Margin 11.7% 13.0% (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. Fiscal Year Ending December 31, 2013

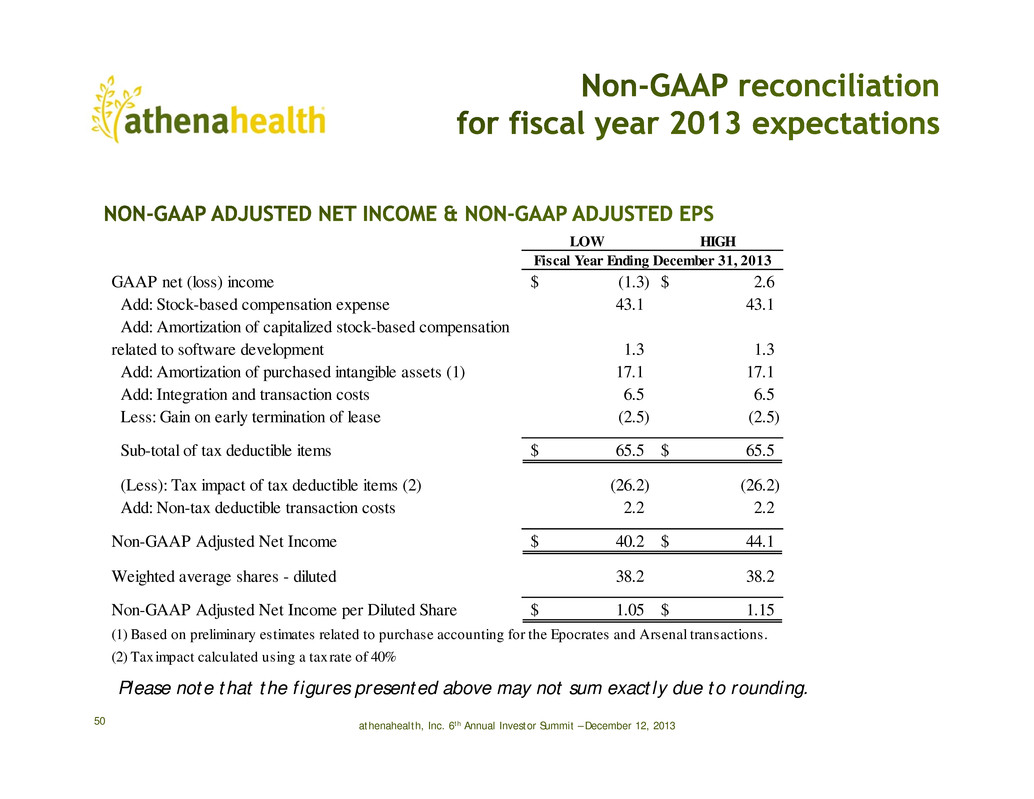

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201350 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH GAAP net (loss) income (1.3)$ 2.6$ Add: Stock-based compensation expense 43.1 43.1 Add: Amortization of capitalized stock-based compensation related to software development 1.3 1.3 Add: Amortization of purchased intangible assets (1) 17.1 17.1 Add: Integration and transaction costs 6.5 6.5 Less: Gain on early termination of lease (2.5) (2.5) Sub-total of tax deductible items 65.5$ 65.5$ (Less): Tax impact of tax deductible items (2) (26.2) (26.2) Add: Non-tax deductible transaction costs 2.2 2.2 Non-GAAP Adjusted Net Income 40.2$ 44.1$ Weighted average shares - diluted 38.2 38.2 Non-GAAP Adjusted Net Income per Diluted Share 1.05$ 1.15$ (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. (2) Tax impact calculated using a tax rate of 40% Fiscal Year Ending December 31, 2013

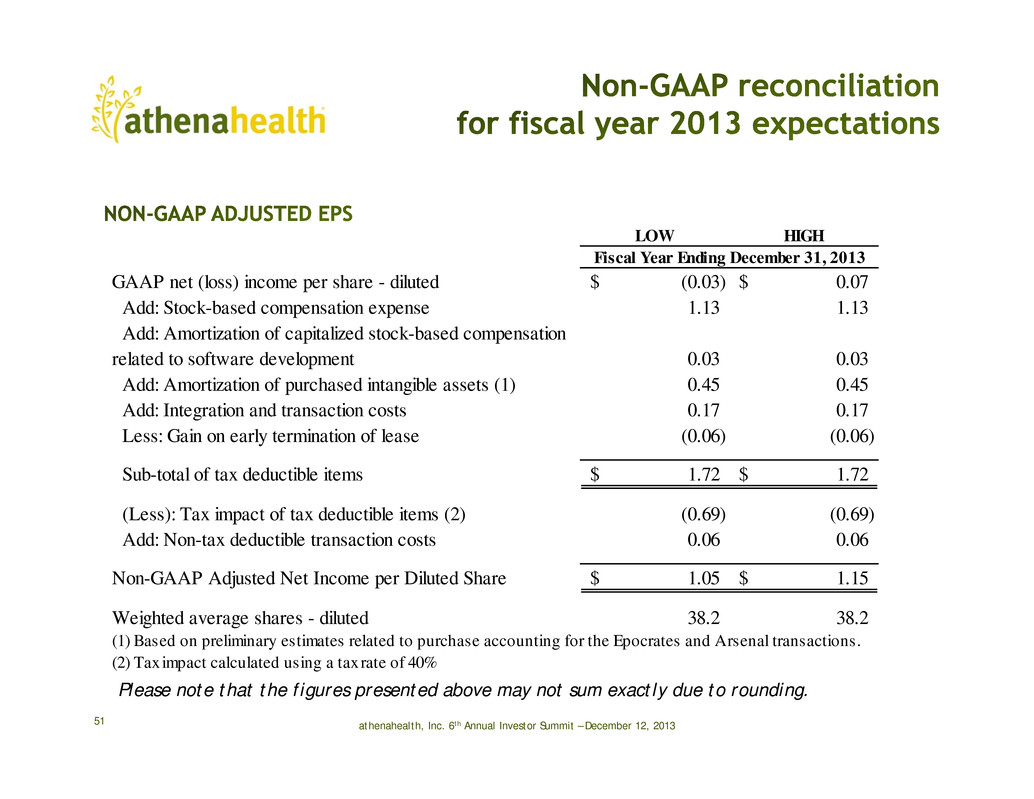

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201351 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH GAAP net (loss) income per share - diluted (0.03)$ 0.07$ Add: Stock-based compensation expense 1.13 1.13 Add: Amortization of capitalized stock-based compensation related to software development 0.03 0.03 Add: Amortization of purchased intangible assets (1) 0.45 0.45 Add: Integration and transaction costs 0.17 0.17 Less: Gain on early termination of lease (0.06) (0.06) Sub-total of tax deductible items 1.72$ 1.72$ (Less): Tax impact of tax deductible items (2) (0.69) (0.69) Add: Non-tax deductible transaction costs 0.06 0.06 Non-GAAP Adjusted Net Income per Diluted Share 1.05$ 1.15$ Weighted average shares - diluted 38.2 38.2 (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. (2) Tax impact calculated using a tax rate of 40% Fiscal Year Ending December 31, 2013

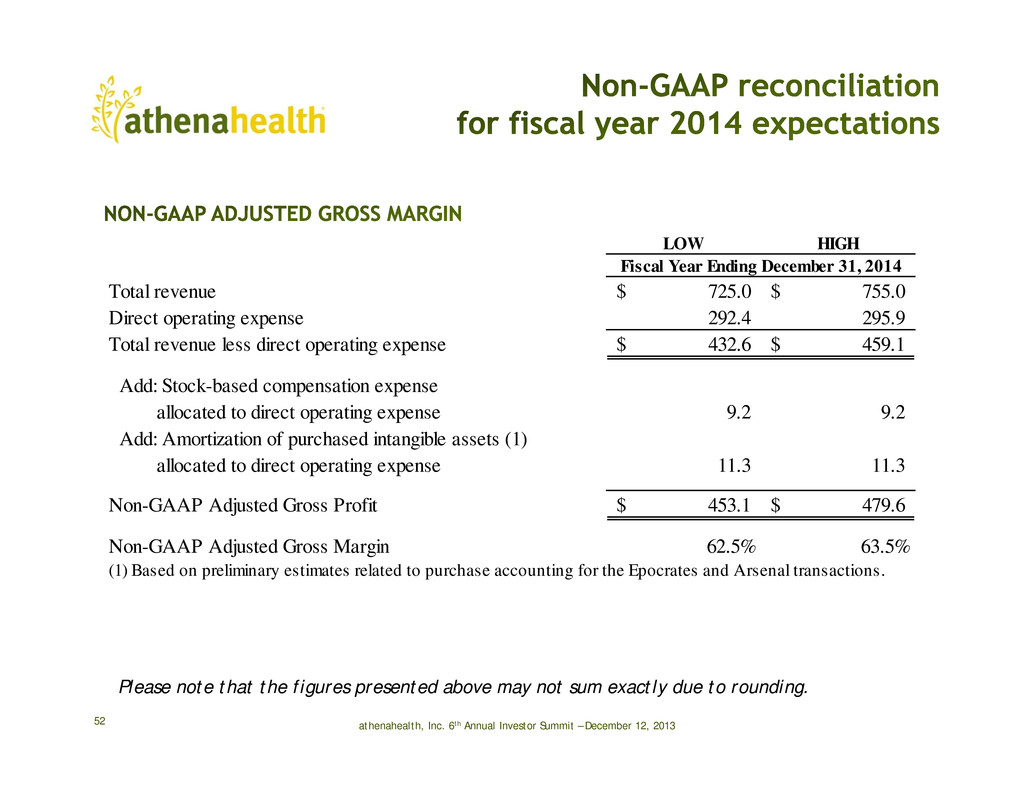

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201352 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH Total revenue 725.0$ 755.0$ Direct operating expense 292.4 295.9 Total revenue less direct operating expense 432.6$ 459.1$ Add: Stock-based compensation expense allocated to direct operating expense 9.2 9.2 Add: Amortization of purchased intangible assets (1) allocated to direct operating expense 11.3 11.3 Non-GAAP Adjusted Gross Profit 453.1$ 479.6$ Non-GAAP Adjusted Gross Margin 62.5% 63.5% (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. Fiscal Year Ending December 31, 2014

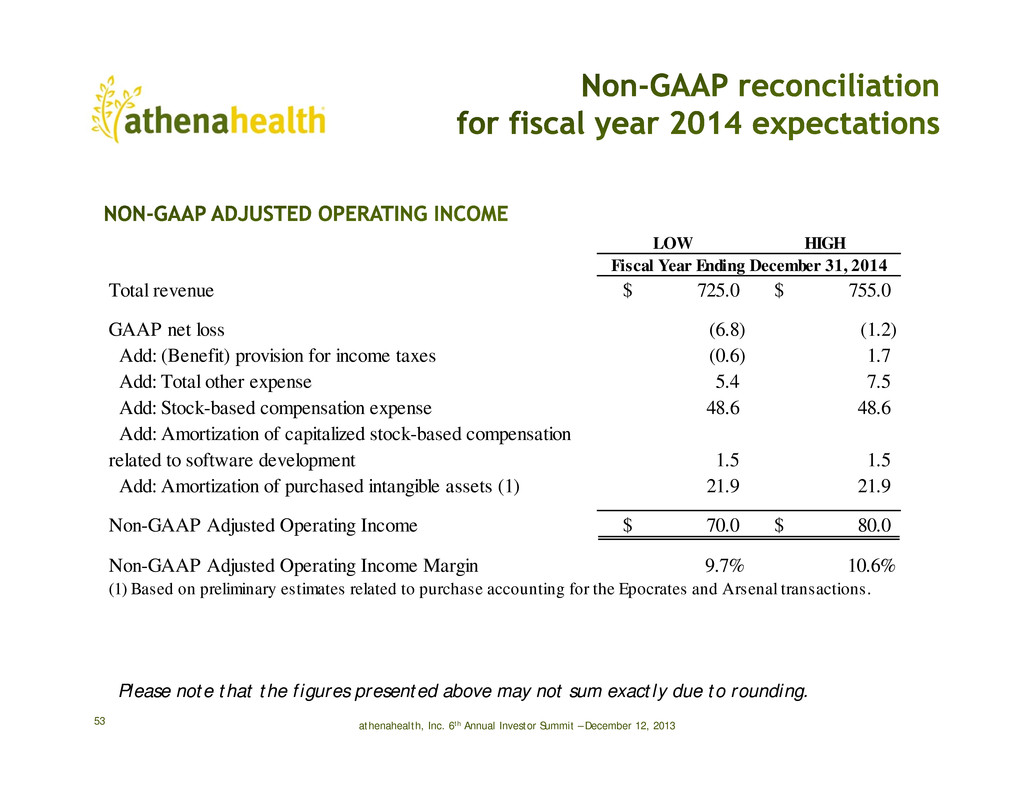

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201353 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH Total revenue 725.0$ 755.0$ GAAP net loss (6.8) (1.2) Add: (Benefit) provision for income taxes (0.6) 1.7 Add: Total other expense 5.4 7.5 Add: Stock-based compensation expense 48.6 48.6 Add: Amortization of capitalized stock-based compensation related to software development 1.5 1.5 Add: Amortization of purchased intangible assets (1) 21.9 21.9 Non-GAAP Adjusted Operating Income 70.0$ 80.0$ Non-GAAP Adjusted Operating Income Margin 9.7% 10.6% (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. Fiscal Year Ending December 31, 2014

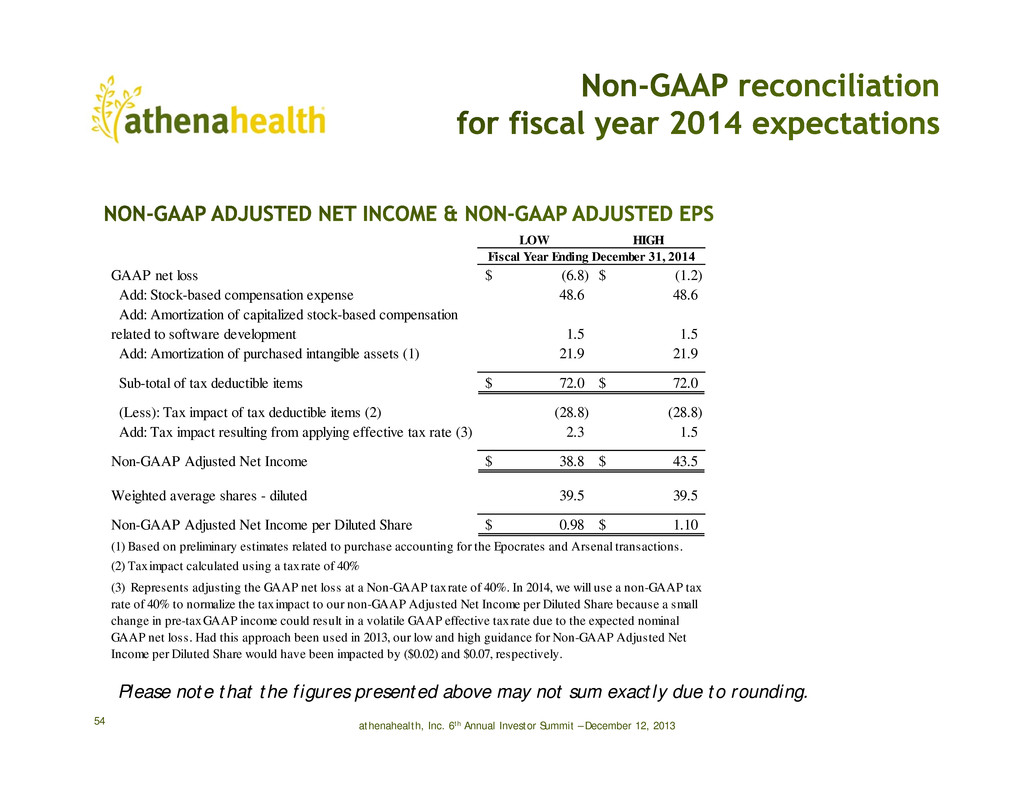

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201354 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH GAAP net loss (6.8)$ (1.2)$ Add: Stock-based compensation expense 48.6 48.6 Add: Amortization of capitalized stock-based compensation related to software development 1.5 1.5 Add: Amortization of purchased intangible assets (1) 21.9 21.9 Sub-total of tax deductible items 72.0$ 72.0$ (Less): Tax impact of tax deductible items (2) (28.8) (28.8) Add: Tax impact resulting from applying effective tax rate (3) 2.3 1.5 Non-GAAP Adjusted Net Income 38.8$ 43.5$ Weighted average shares - diluted 39.5 39.5 Non-GAAP Adjusted Net Income per Diluted Share 0.98$ 1.10$ (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. (2) Tax impact calculated using a tax rate of 40% Fiscal Year Ending December 31, 2014 (3) Represents adjusting the GAAP net loss at a Non-GAAP tax rate of 40%. In 2014, we will use a non-GAAP tax rate of 40% to normalize the tax impact to our non-GAAP Adjusted Net Income per Diluted Share because a small change in pre-tax GAAP income could result in a volatile GAAP effective tax rate due to the expected nominal GAAP net loss. Had this approach been used in 2013, our low and high guidance for Non-GAAP Adjusted Net Income per Diluted Share would have been impacted by ($0.02) and $0.07, respectively.

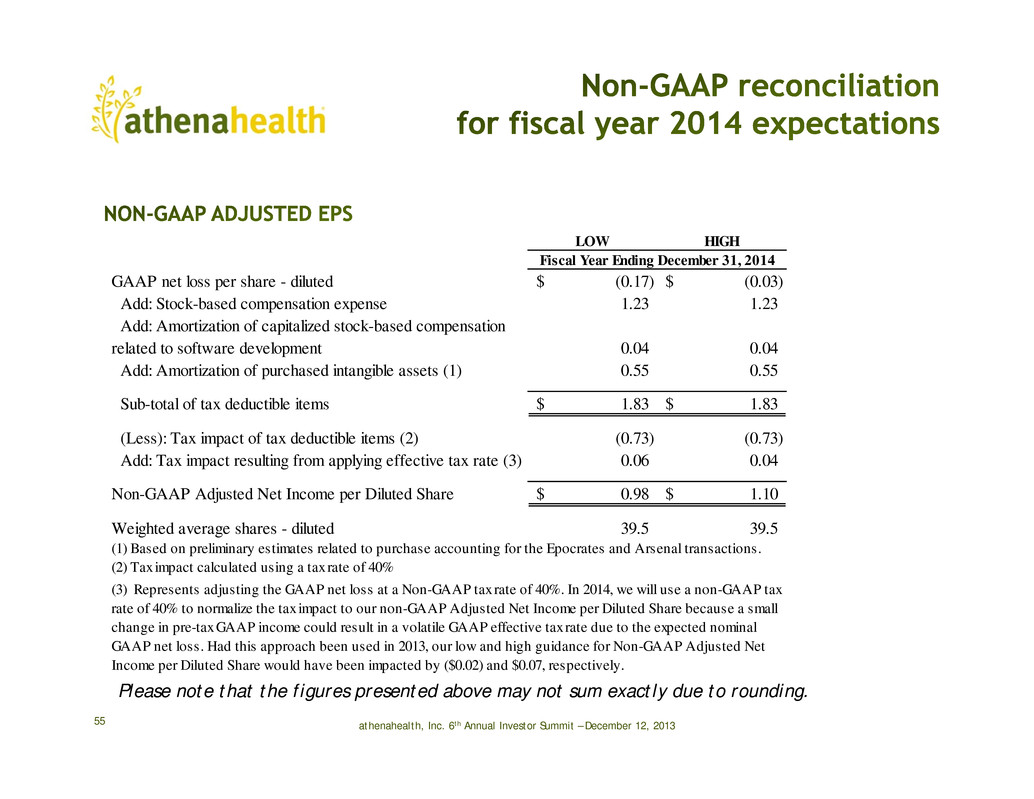

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201355 Please note that the figures presented above may not sum exactly due to rounding. LOW HIGH GAAP net loss per share - diluted (0.17)$ (0.03)$ Add: Stock-based compensation expense 1.23 1.23 Add: Amortization of capitalized stock-based compensation related to software development 0.04 0.04 Add: Amortization of purchased intangible assets (1) 0.55 0.55 Sub-total of tax deductible items 1.83$ 1.83$ (Less): Tax impact of tax deductible items (2) (0.73) (0.73) Add: Tax impact resulting from applying effective tax rate (3) 0.06 0.04 Non-GAAP Adjusted Net Income per Diluted Share 0.98$ 1.10$ Weighted average shares - diluted 39.5 39.5 (1) Based on preliminary estimates related to purchase accounting for the Epocrates and Arsenal transactions. (2) Tax impact calculated using a tax rate of 40% (3) Represents adjusting the GAAP net loss at a Non-GAAP tax rate of 40%. In 2014, we will use a non-GAAP tax rate of 40% to normalize the tax impact to our non-GAAP Adjusted Net Income per Diluted Share because a small change in pre-tax GAAP income could result in a volatile GAAP effective tax rate due to the expected nominal GAAP net loss. Had this approach been used in 2013, our low and high guidance for Non-GAAP Adjusted Net Income per Diluted Share would have been impacted by ($0.02) and $0.07, respectively. Fiscal Year Ending December 31, 2014

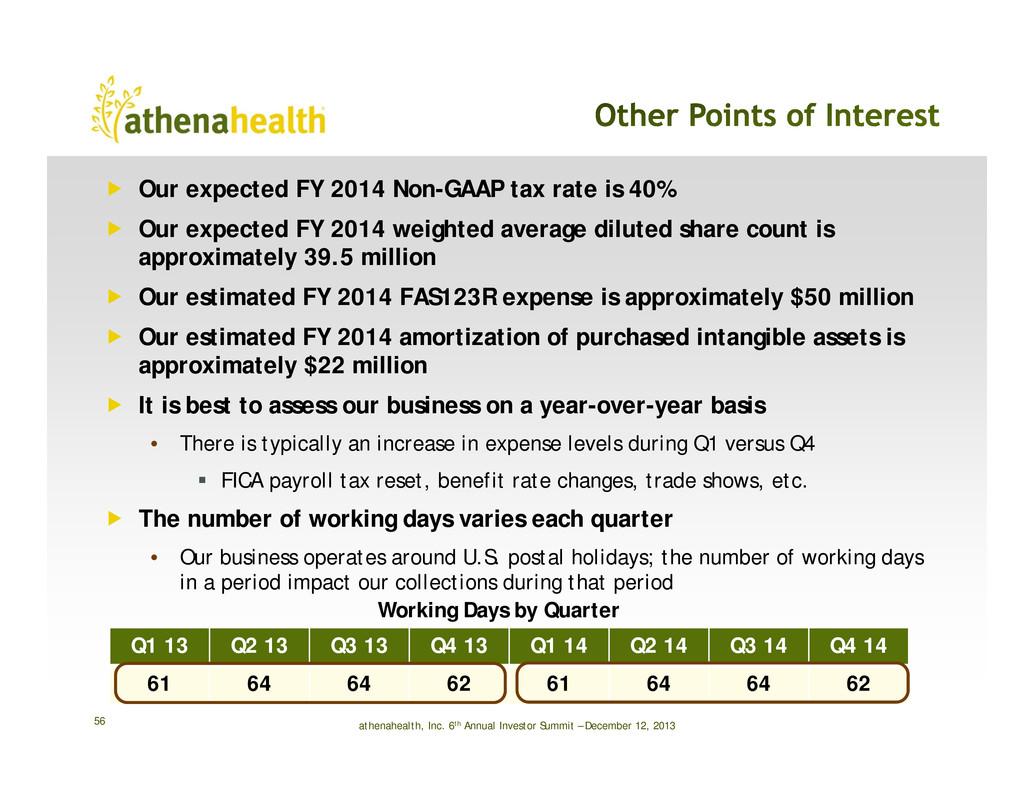

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201356 Our expected FY 2014 Non-GAAP tax rate is 40% Our expected FY 2014 weighted average diluted share count is approximately 39.5 million Our estimated FY 2014 FAS123R expense is approximately $50 million Our estimated FY 2014 amortization of purchased intangible assets is approximately $22 million It is best to assess our business on a year-over-year basis • There is typically an increase in expense levels during Q1 versus Q4 FICA payroll tax reset, benefit rate changes, trade shows, etc. The number of working days varies each quarter • Our business operates around U.S. postal holidays; the number of working days in a period impact our collections during that period Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 61 64 64 62 61 64 64 62 Working Days by Quarter

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 We thrive in change1 The CLOUD will win! We thrive in an environment of tight capital2 We thrive when connectivity and competition are needed3 57

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 58

Rob Cosinuke SVP, Chief Marketing Officer & President of Epocrates

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Traditionally we have described our growth strategy as a “Land War” 60 The Land War 60

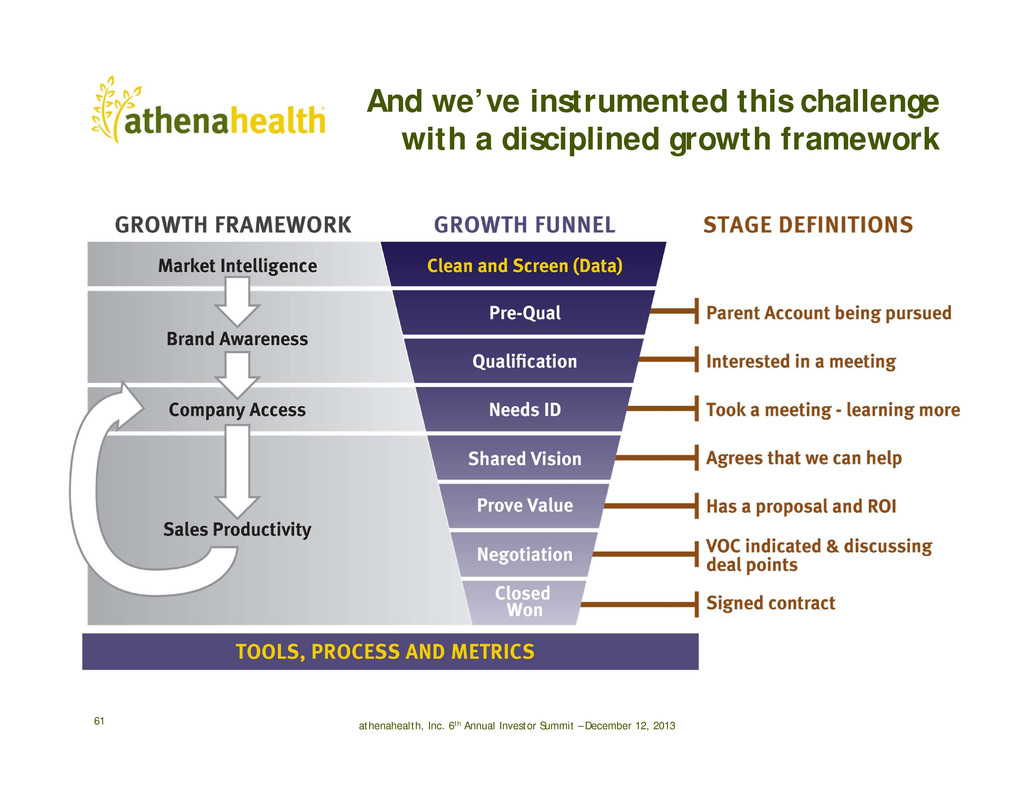

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 And we’ve instrumented this challenge with a disciplined growth framework 61

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Going forward, our Growth strategy will also emphasize building powerful brand bonds 62 Winning the Hearts and Minds 62

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 We will tap the hearts and minds of Individuals, and members of Groups and Enterprises 63 athenahealth’s Brand “Ecosystems” Preferred by Individuals: Personal Brand Preferred by informal networks/groups: Tribal Brand Preferred by formal networks/enterprises: Institutional Brand Epocrates Enterprise Coordinator Core athenaOne Enterprise Coordinator Epocrates

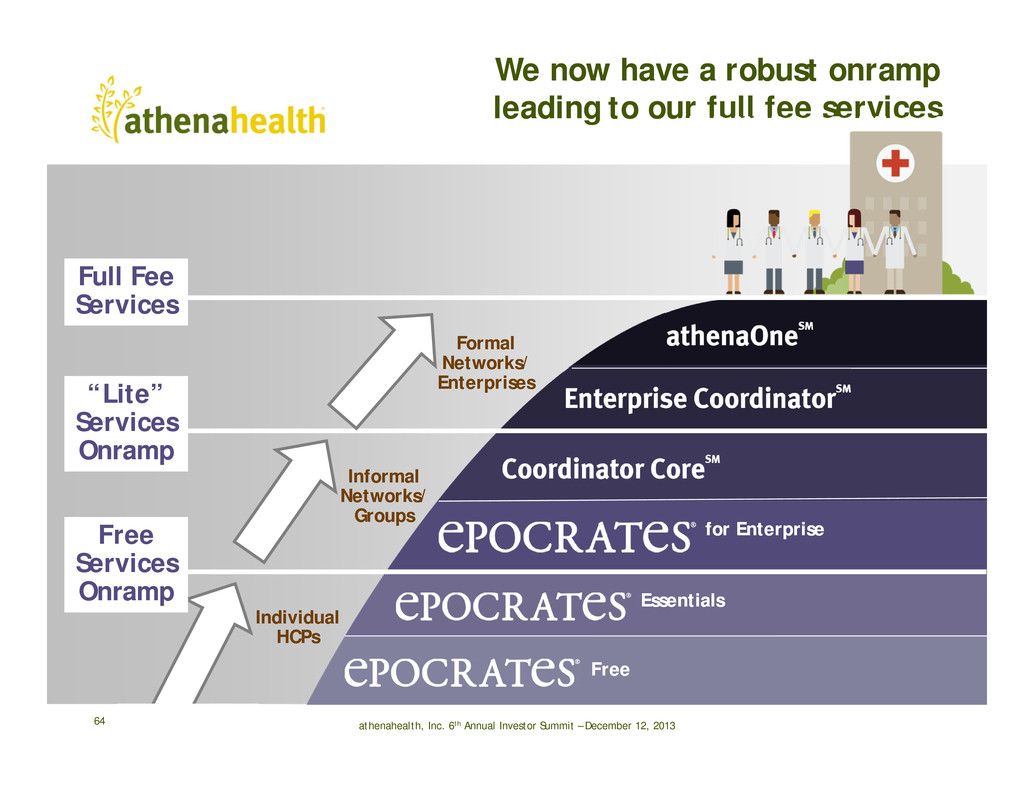

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 We now have a robust onramp leading to our full fee services “Lite” Services Onramp Full Fee Services 64 Individual HCPs Informal Networks/ Groups Formal Networks/ Enterprises Free Services Onramp Essentials for Enterprise Free

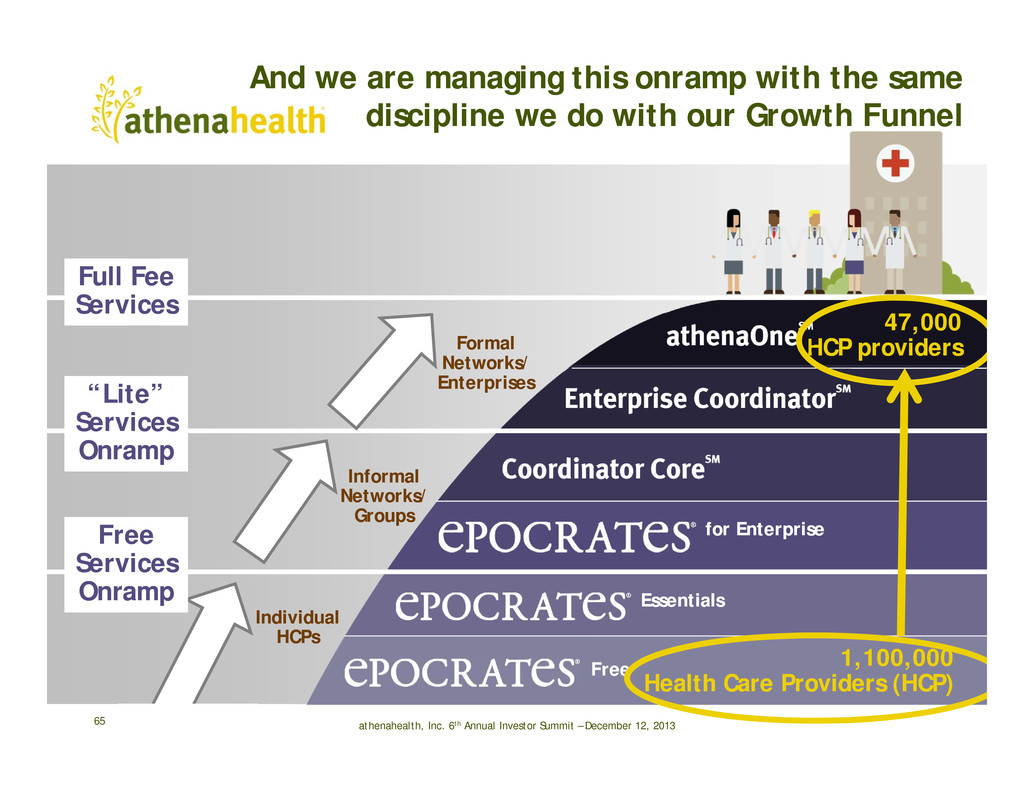

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 Essentials for Enterprise Individual HCPs Informal Networks/ Groups Formal Networks/ Enterprises And we are managing this onramp with the same discipline we do with our Growth Funnel 1,100,000 Health Care Providers (HCP) 47,000 HCP providers Free Free Services Onramp “Lite” Services Onramp Full Fee Services 65

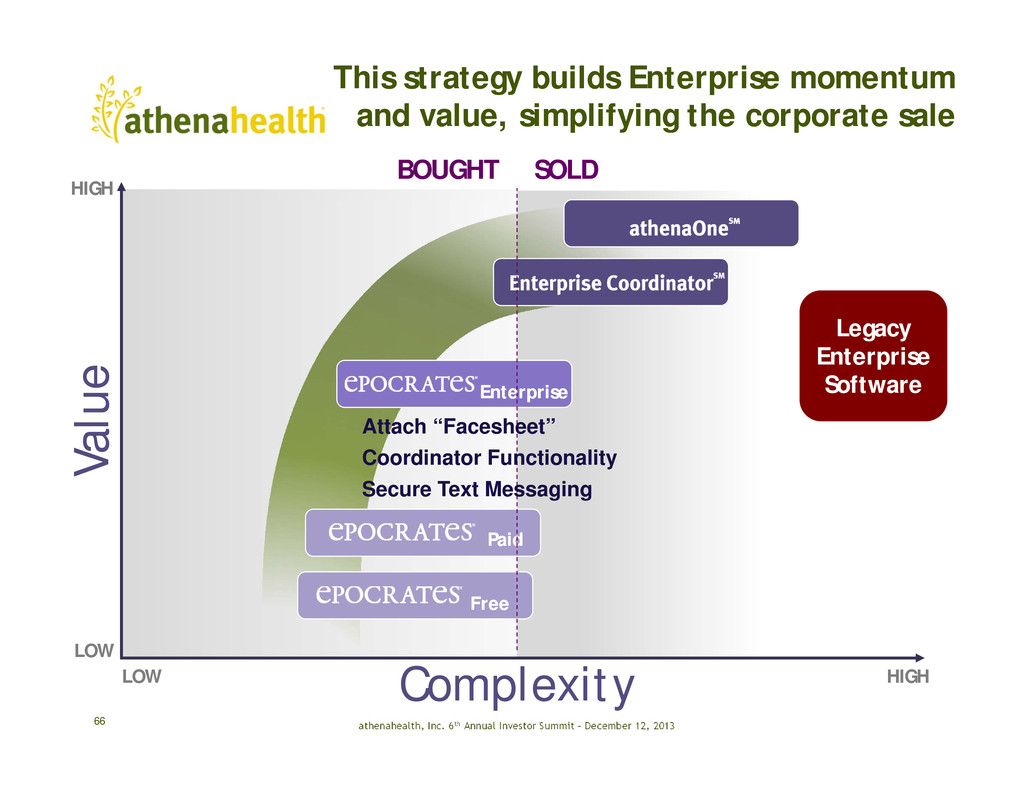

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 This strategy builds Enterprise momentum and value, simplifying the corporate sale 66 V a l u e Complexity LOW LOW HIGH HIGH BOUGHT SOLD Legacy Enterprise Software Free Paid Enterprise Secure Text Messaging Coordinator Functionality Attach “Facesheet”

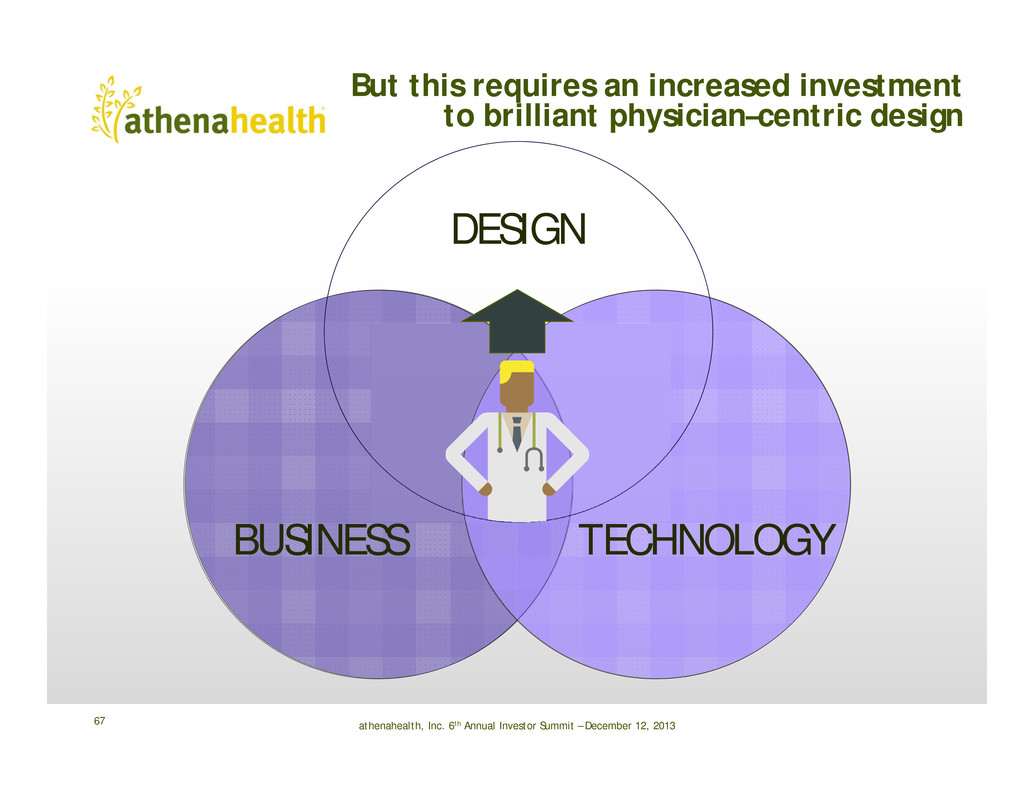

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 But this requires an increased investment to brilliant physician–centric design 67 DESIGN TECHNOLOGYBUSINESS

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 And we are already winning the battle for Hearts and Minds through great design… “most used & broadest reach” 68 #1 Patient Portal #1 EHR* #1 Practice Management* #1 In Usability “top app in medical practice”* “highest score 97/100” “king of all medical apps” Named #1 app for health care professionals by MM&M

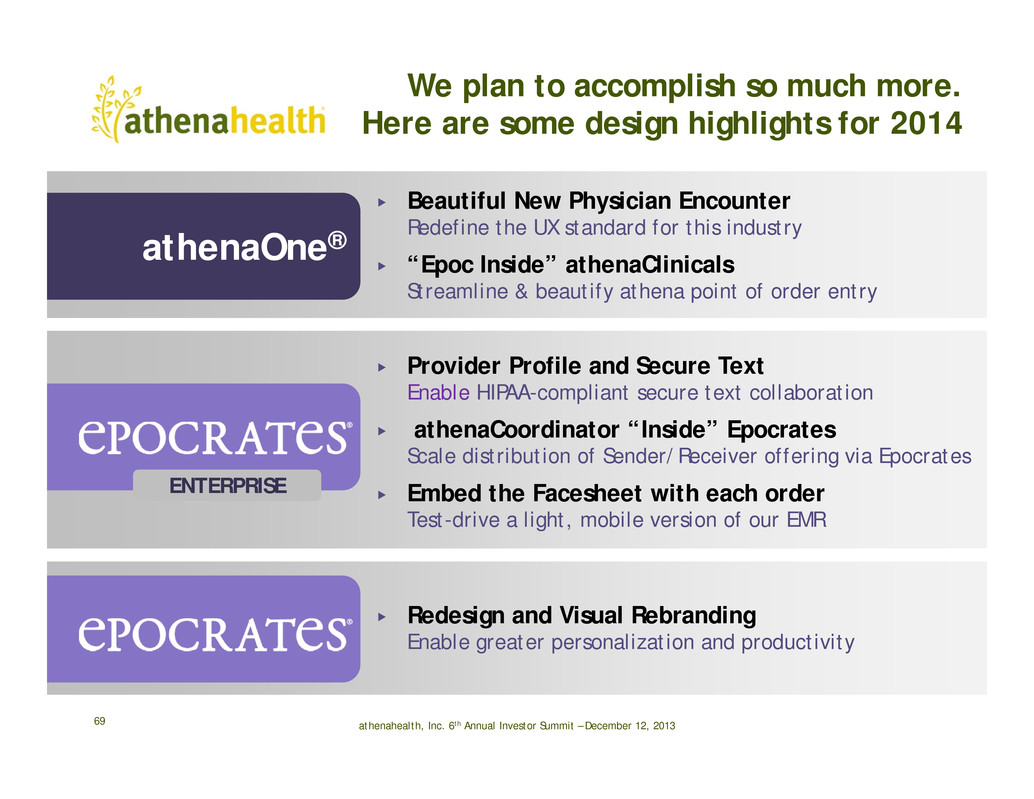

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 We plan to accomplish so much more. Here are some design highlights for 2014 69 athenaOne® ▶ Redesign and Visual Rebranding Enable greater personalization and productivity ▶ Beautiful New Physician Encounter Redefine the UX standard for this industry ▶ “Epoc Inside” athenaClinicals Streamline & beautify athena point of order entry ▶ Provider Profile and Secure Text Enable HIPAA-compliant secure text collaboration ▶ athenaCoordinator “Inside” Epocrates Scale distribution of Sender/Receiver offering via Epocrates ▶ Embed the Facesheet with each order Test-drive a light, mobile version of our EMR ENTERPRISE

Abbe Don VP, User Experience

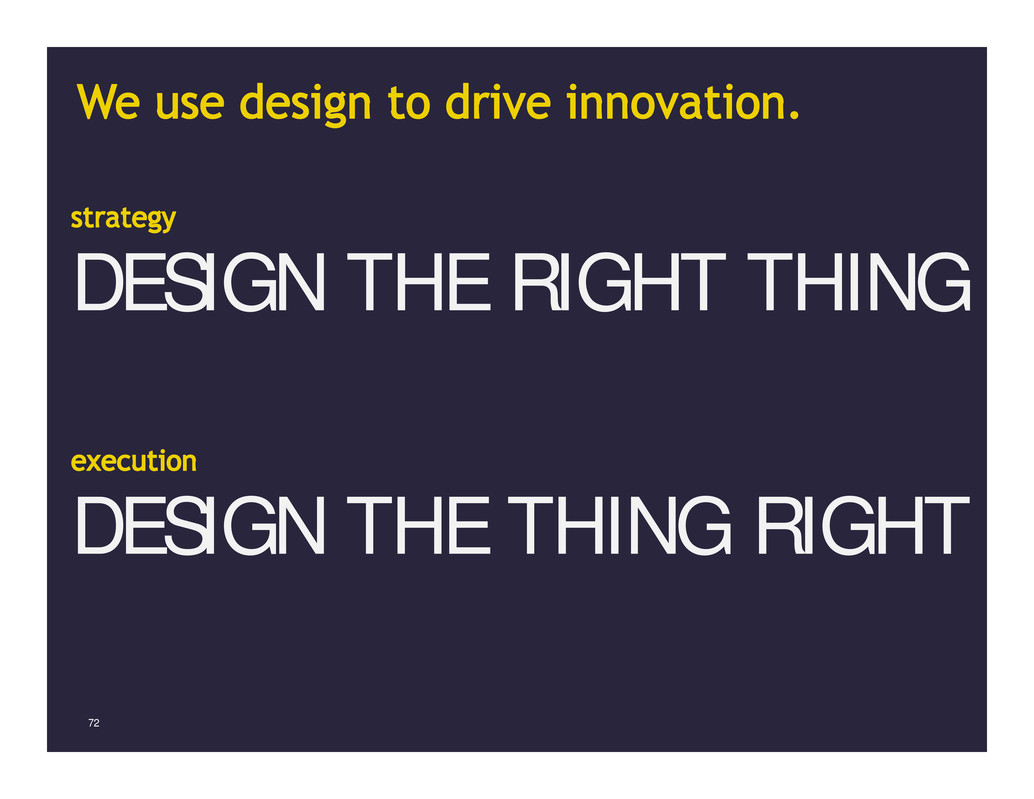

athenahealth, Inc. 71 DESIGN THE RIGHT THING 71

athenahealth, Inc. 72 DESIGN THE RIGHT THING DESIGN THE THING RIGHT 72

athenahealth, Inc. 73 Activate the care team Nurture better behavior Uphold the sanctity of the doctor-patient relationship Encourage achievement, not effort Inspire insights through trusted curation 73

athenahealth, Inc. 74 Accurate Scientifically accurate, rigorous research, good clinical judgment AE AA AC AU AR Current Current practice standards, timely information Unbiased Independent of commercial activities Relevant Physician focus, clinically significant Essential Necessary at point of care, concise74

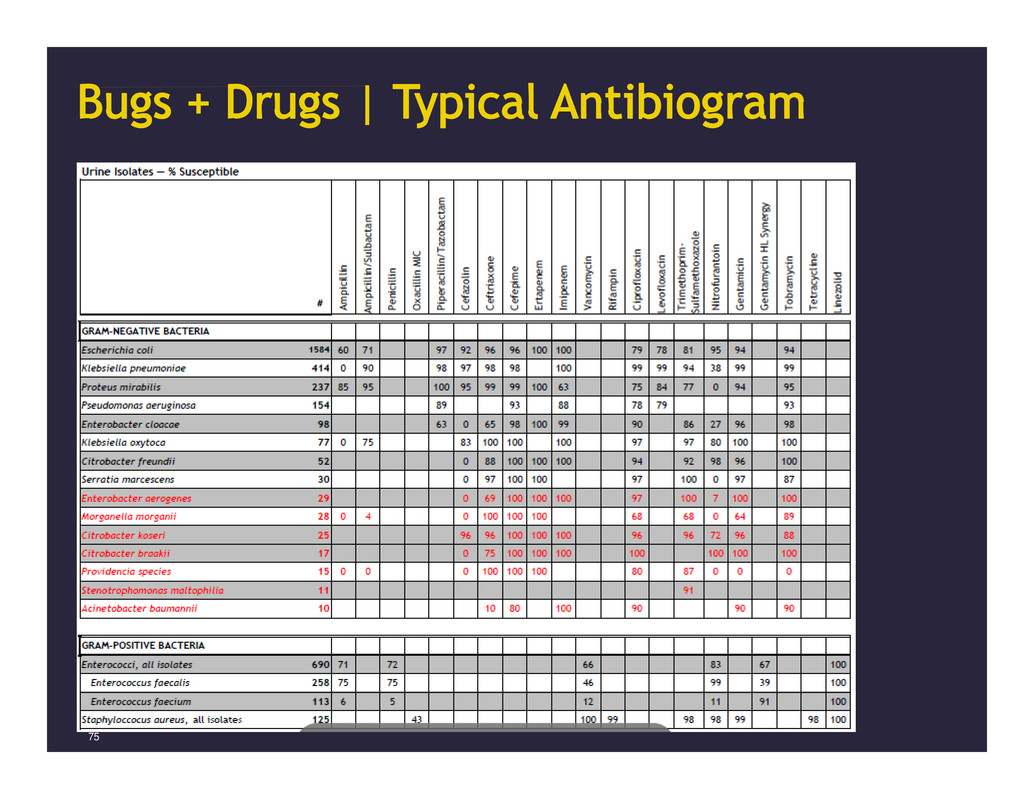

athenahealth, Inc. 7575 75

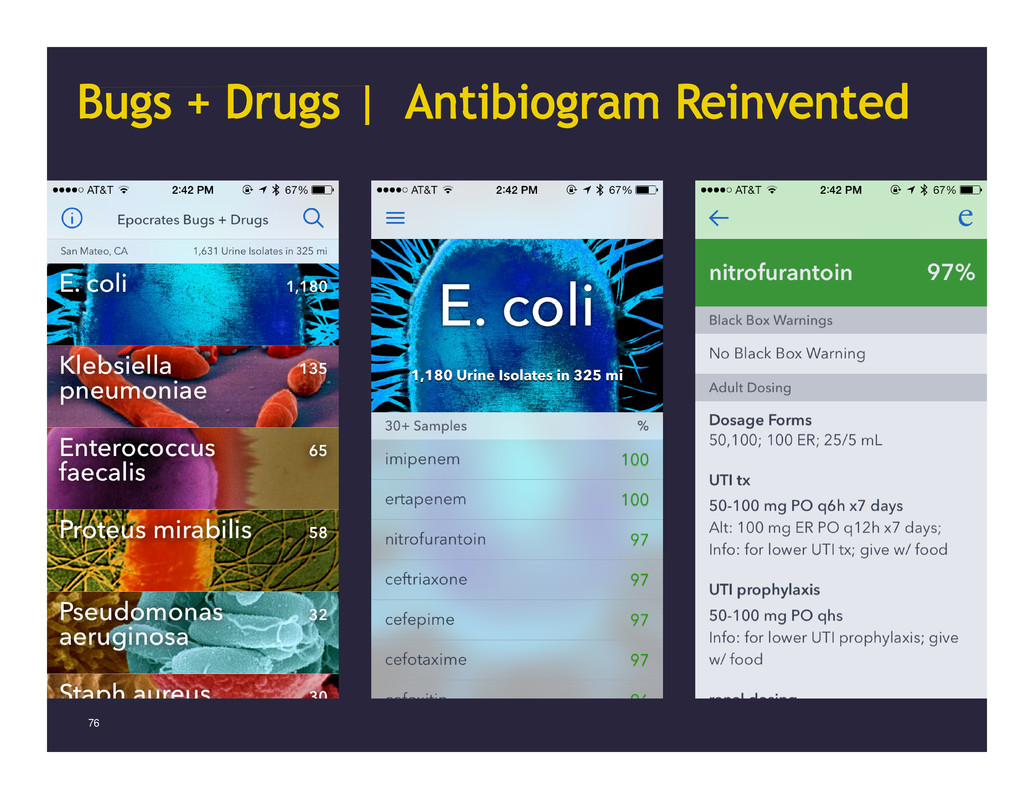

athenahealth, Inc. 7676

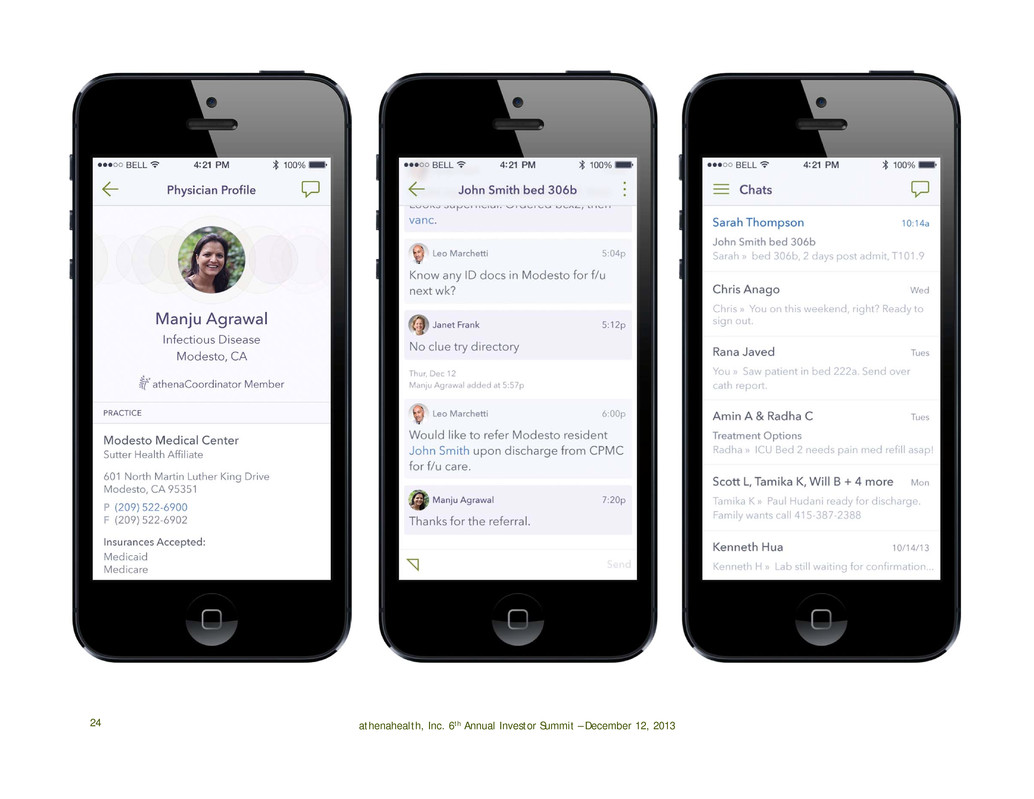

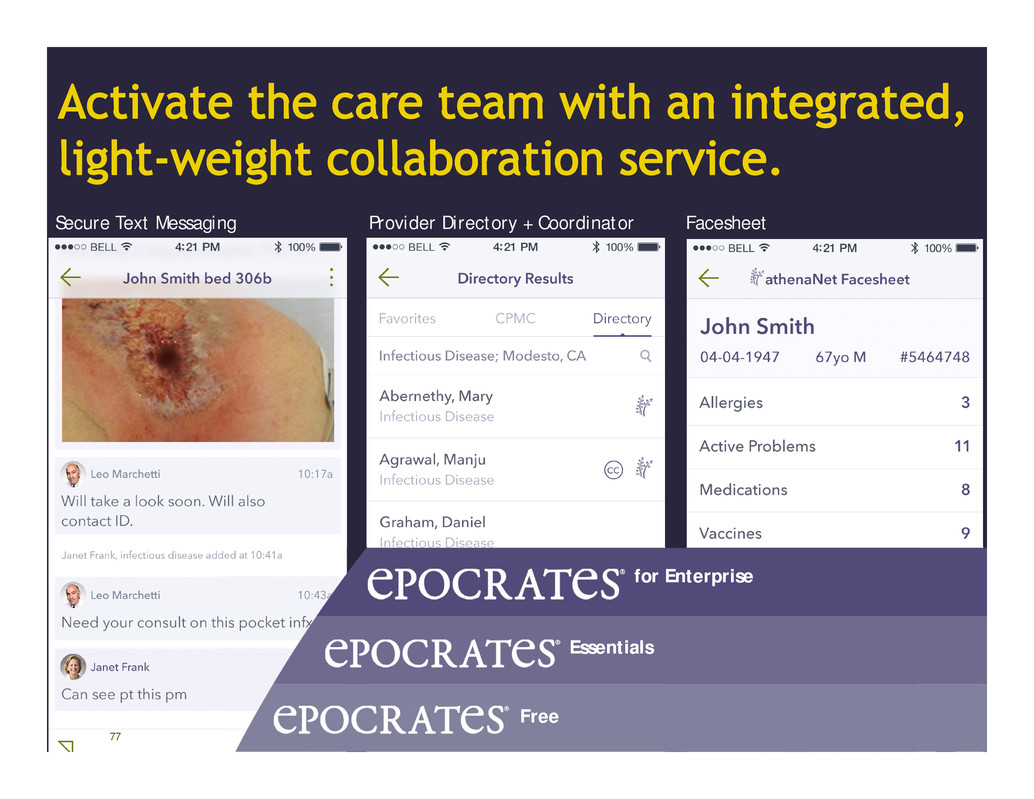

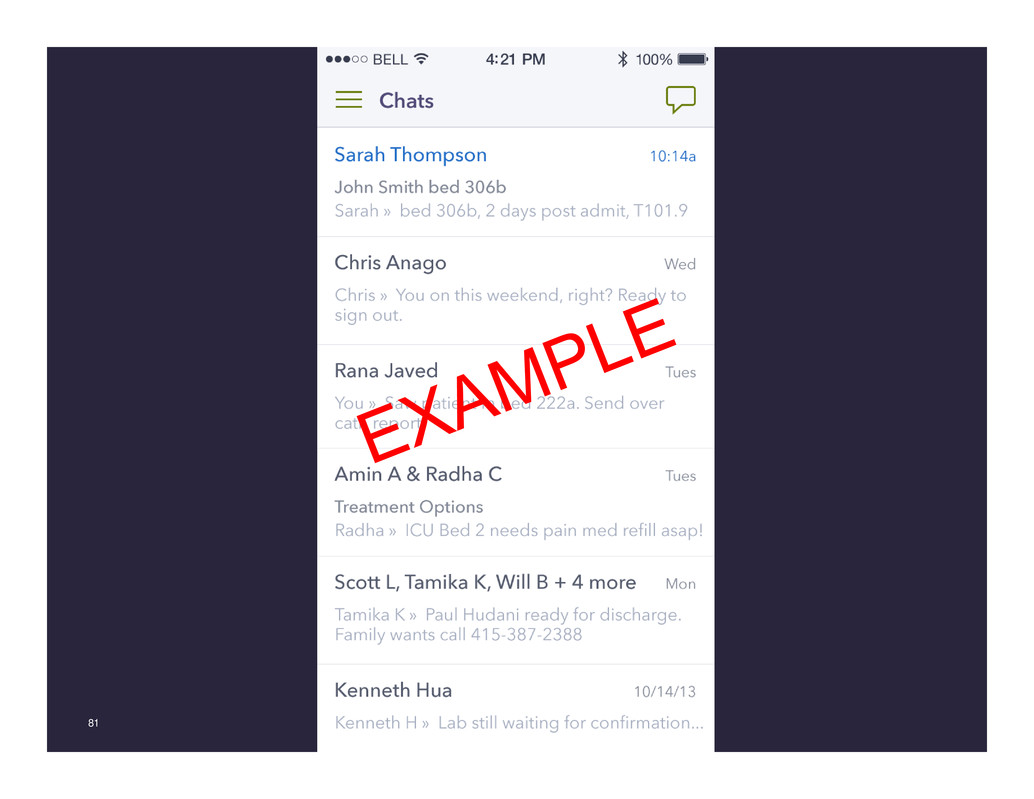

athenahealth, Inc. 7777 Essentials for Enterprise Free Secure Text Messaging Provider Directory + Coordinator Facesheet 77

athenahealth, Inc. 7878 In-patient Care Team San Francisco, CA Private Practice MDs Modesto, CA Albert Chan Family Medicine Manju Agrawal Infectious Disease Sarah Thompson Medical Surgical Nurse Leo Marchetti Hospitalist Janet Frank Infectious Disease 78

athenahealth, Inc. 7979

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201380

athenahealth, Inc. 8181

Jeremy Delinsky SVP, Chief Technology Officer

athenahealth, Inc. 83

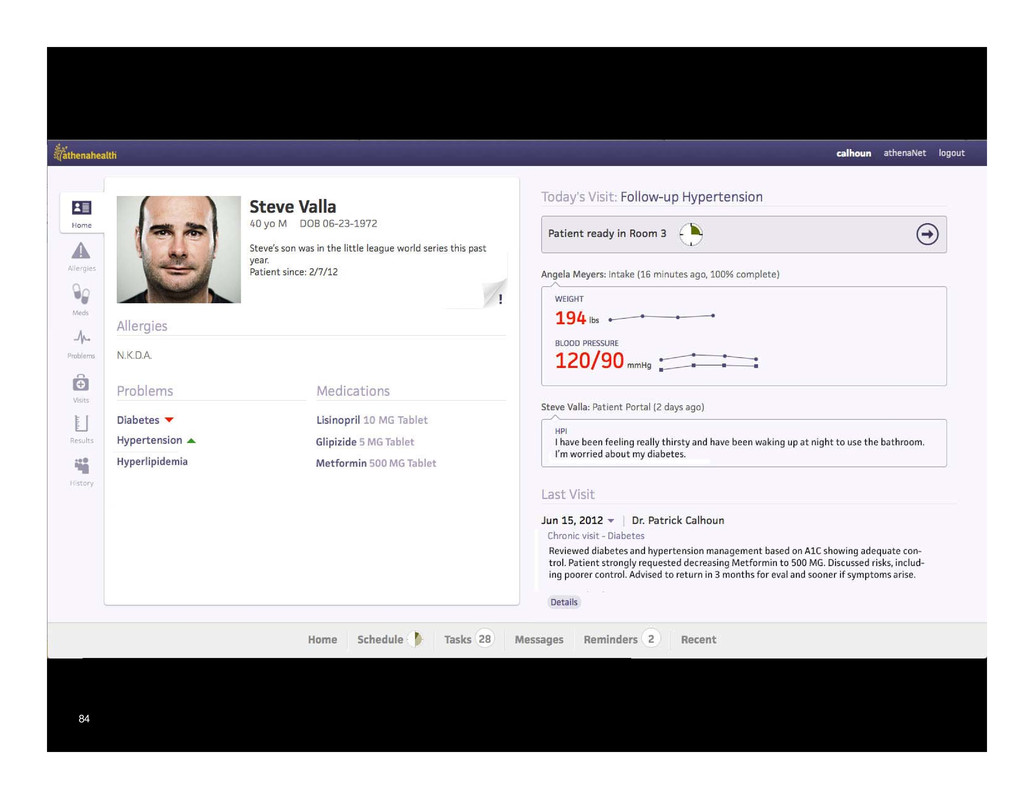

84

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201385

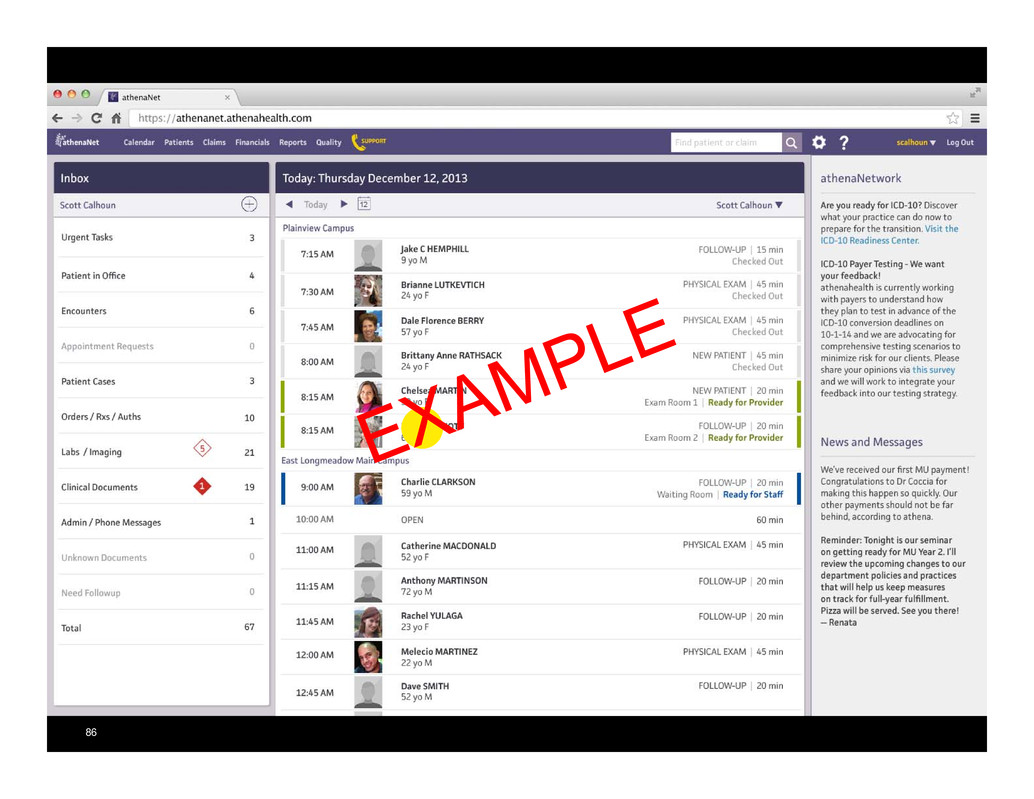

86

Todd Rothenhaus Chief Medical Officer

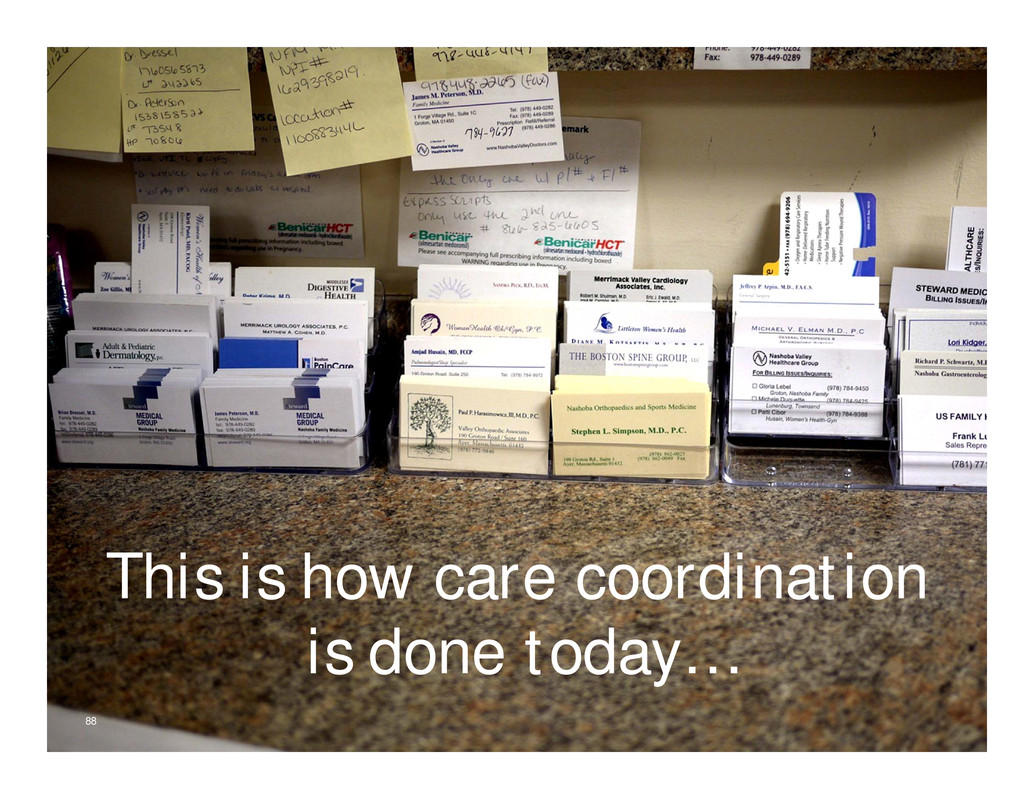

The old way of getting a referral 88 This is how care coordination is done today… 88

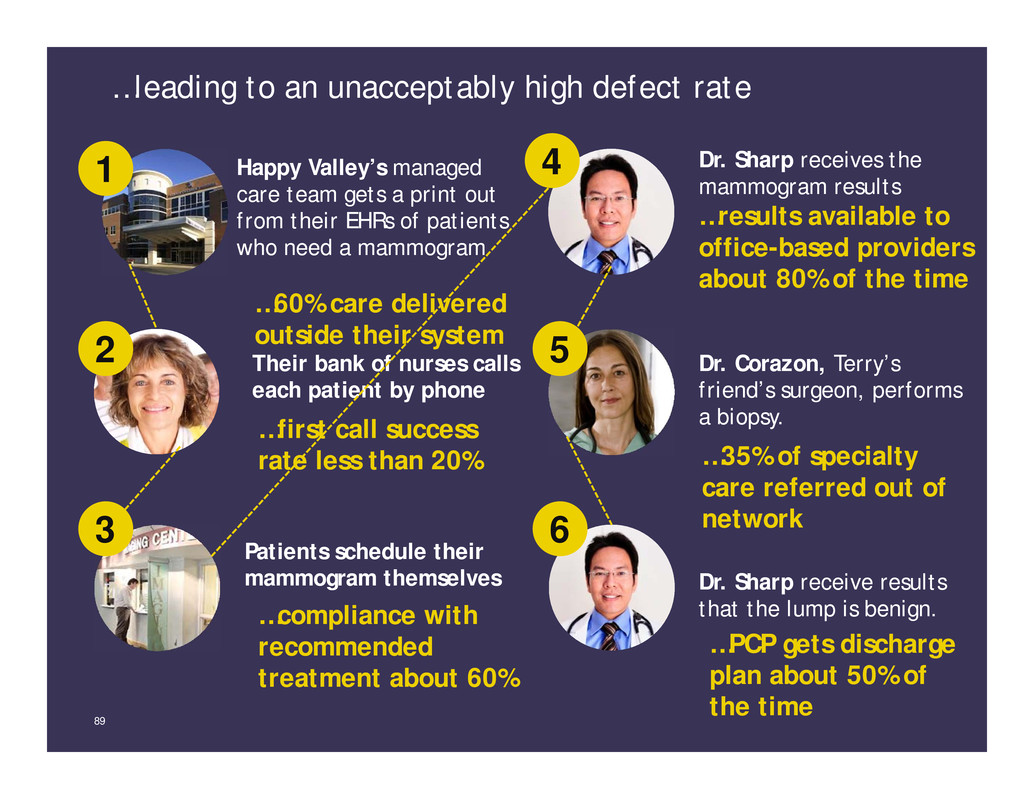

…leading to an unacceptably high defect rate Patients schedule their mammogram themselves 3 Dr. Sharp receives the mammogram results 4 5 Dr. Corazon, Terry’s friend’s surgeon, performs a biopsy. 6 Dr. Sharp receive results that the lump is benign. Happy Valley’s managed care team gets a print out from their EHRs of patients who need a mammogram 1 2 Their bank of nurses calls each patient by phone …60% care delivered outside their system …first call success rate less than 20% …35% of specialty care referred out of network …PCP gets discharge plan about 50% of the time 89 …compliance with recommended treatment about 60% …results available to office-based providers about 80% of the time

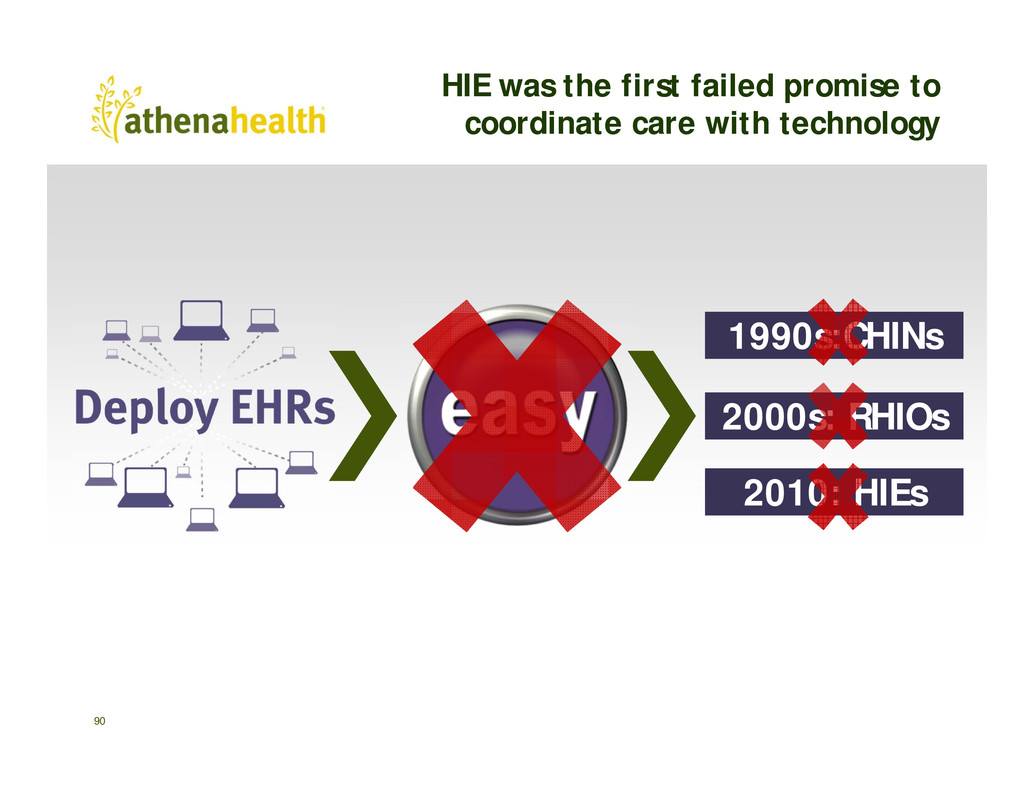

90 1990s:CHINs 2000s: RHIOs 2010: HIEs HIE was the first failed promise to coordinate care with technology

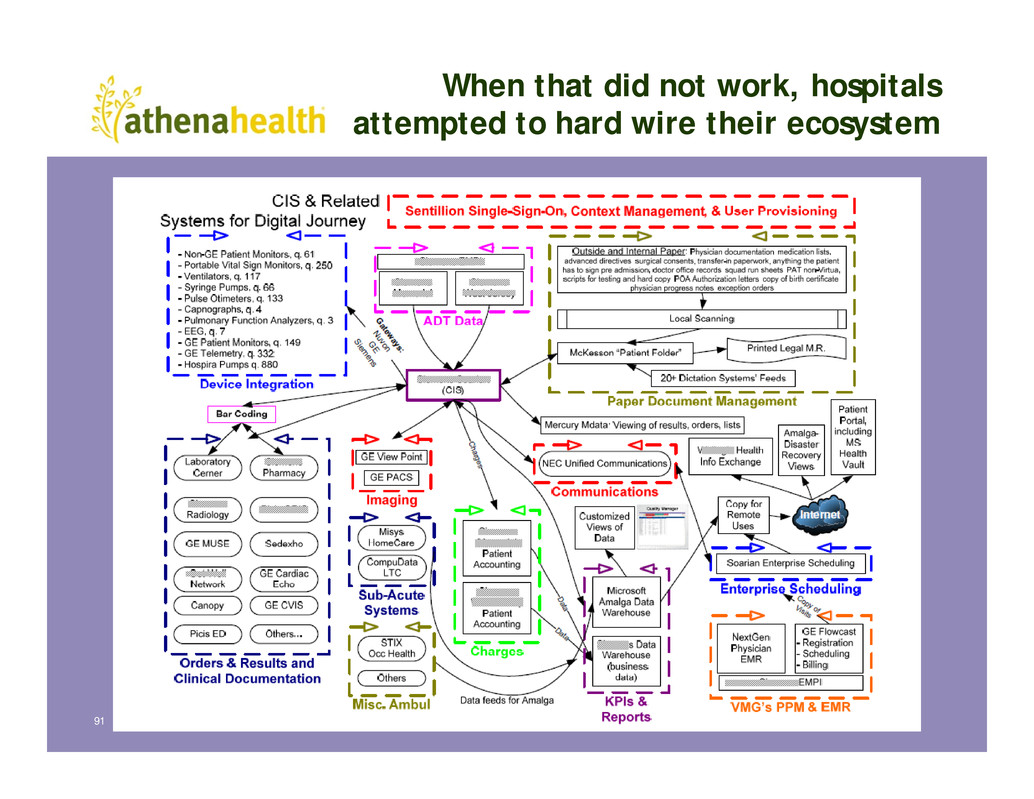

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 When that did not work, hospitals attempted to hard wire their ecosystem 91

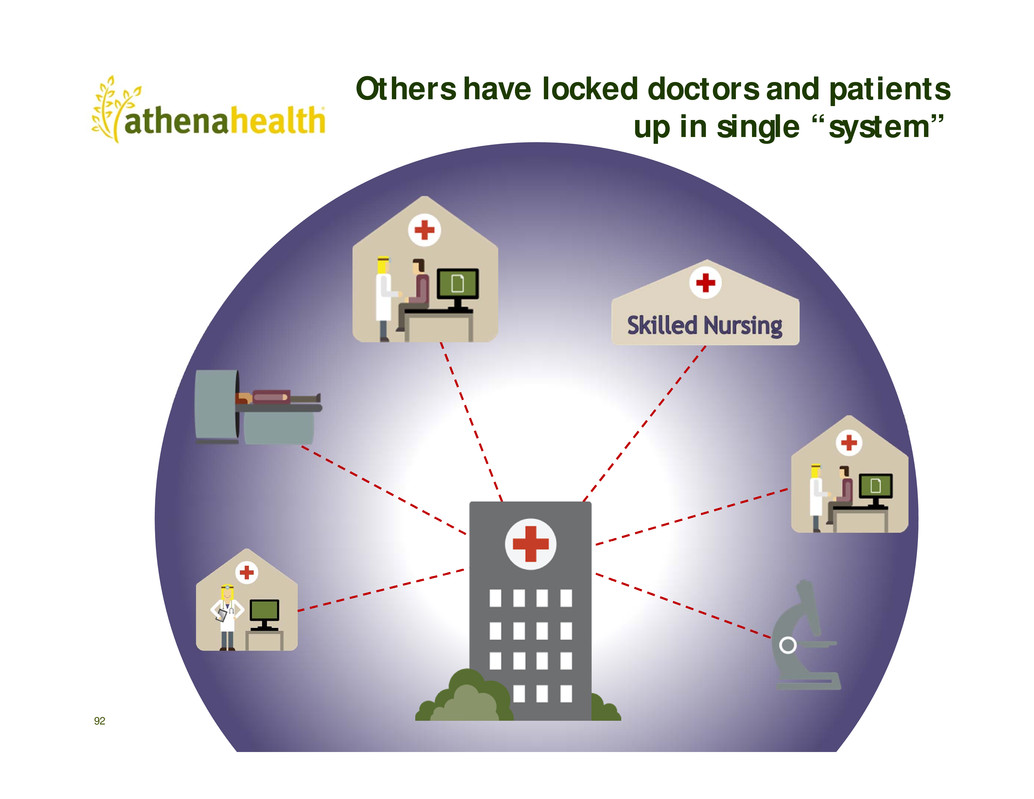

athenahealth, Inc. 6th Annual Investor Summit – December 12, 201392 Others have locked doctors and patients up in single “system”

Image Image Blurry Image Installing more software is nothing more than an invitation to do more work 93

An information backbone that helps make health care work as it should. 94

Meet Our Care Coordination Team… Terry Lang 48 years old Mother of two Happy Valley Health system Dr. Sharp Terry’s new PCP Dr. Corazon Surgeon Radiology Department 95

Health care working as it should Terry self-schedules a mammogram online with Happy Valleys radiology dept. 3 Dr. Sharp receives an abnormal results from the radiologist. Visits with Terry and refers her to a surgeon 4 5 Dr. Corazon, an in- network surgeon, performs a biopsy. 6 Dr. Sharp receive results that the lump is benign – closing the loop on care. Happy Valley’s population surveillance system finds Terry hasn’t had a mammogram in 3 years 1 2 Terry receives automated messages suggesting she make an apt. + better outcomes + patient volume + lower bad debt 96 + network retention + patient loyalty + physician loyalty

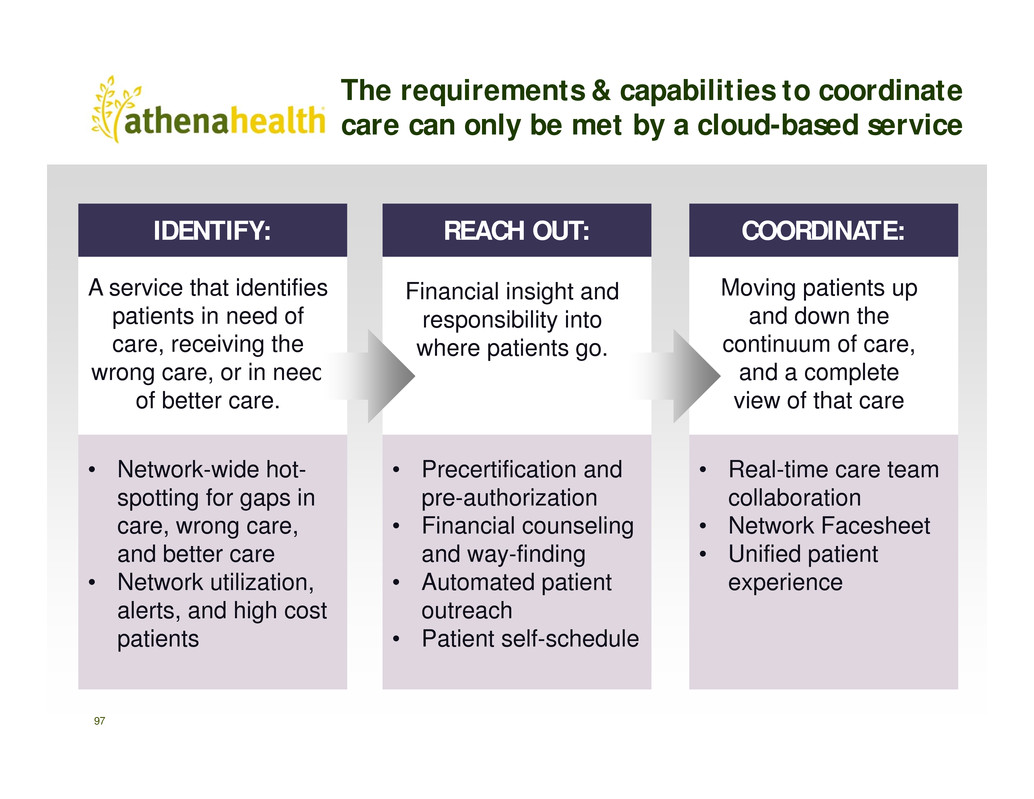

97 • Network-wide hot- spotting for gaps in care, wrong care, and better care • Network utilization, alerts, and high cost patients A service that identifies patients in need of care, receiving the wrong care, or in need of better care. IDENTIFY: • Precertification and pre-authorization • Financial counseling and way-finding • Automated patient outreach • Patient self-schedule Financial insight and responsibility into where patients go. REACH OUT: • Real-time care team collaboration • Network Facesheet • Unified patient experience Moving patients up and down the continuum of care, and a complete view of that care COORDINATE: The requirements & capabilities to coordinate care can only be met by a cloud-based service

Population surveillance to monitor gaps in care Happy Valley Health system 98

Population surveillance to monitor gaps in care Happy Valley Health system 99

Receives automated messages Terry Schedule appointments across health system Receive reminder calls or texts Message with providers across the health system 100

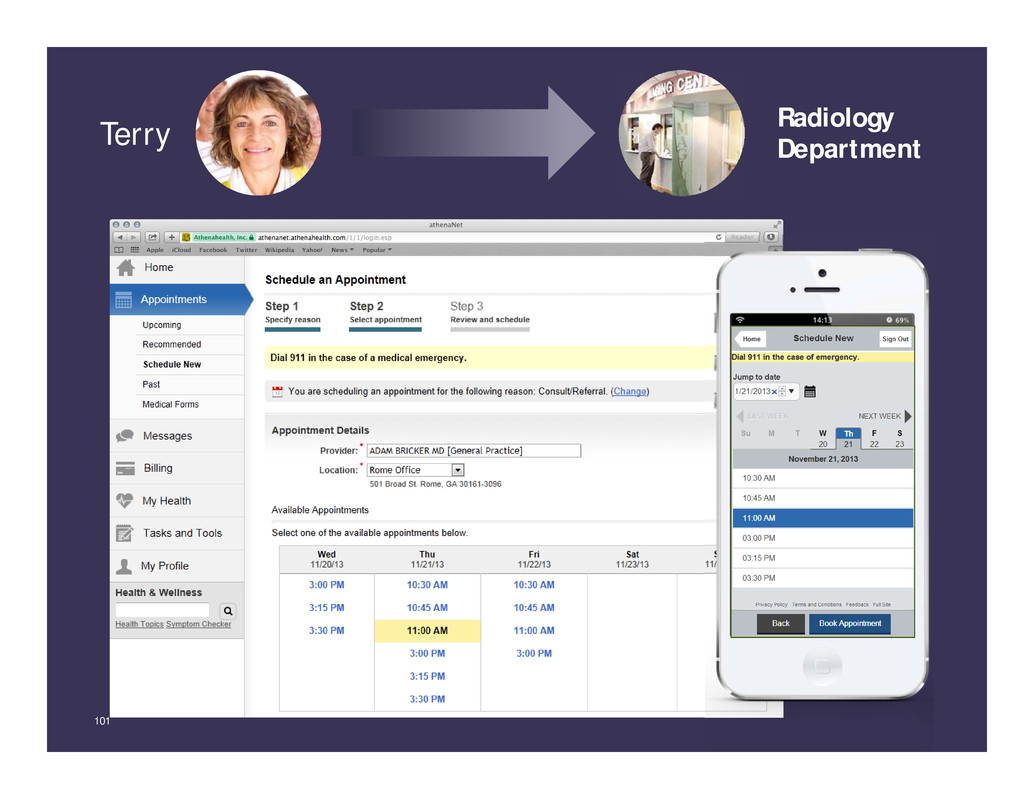

Terry Radiology Department 101

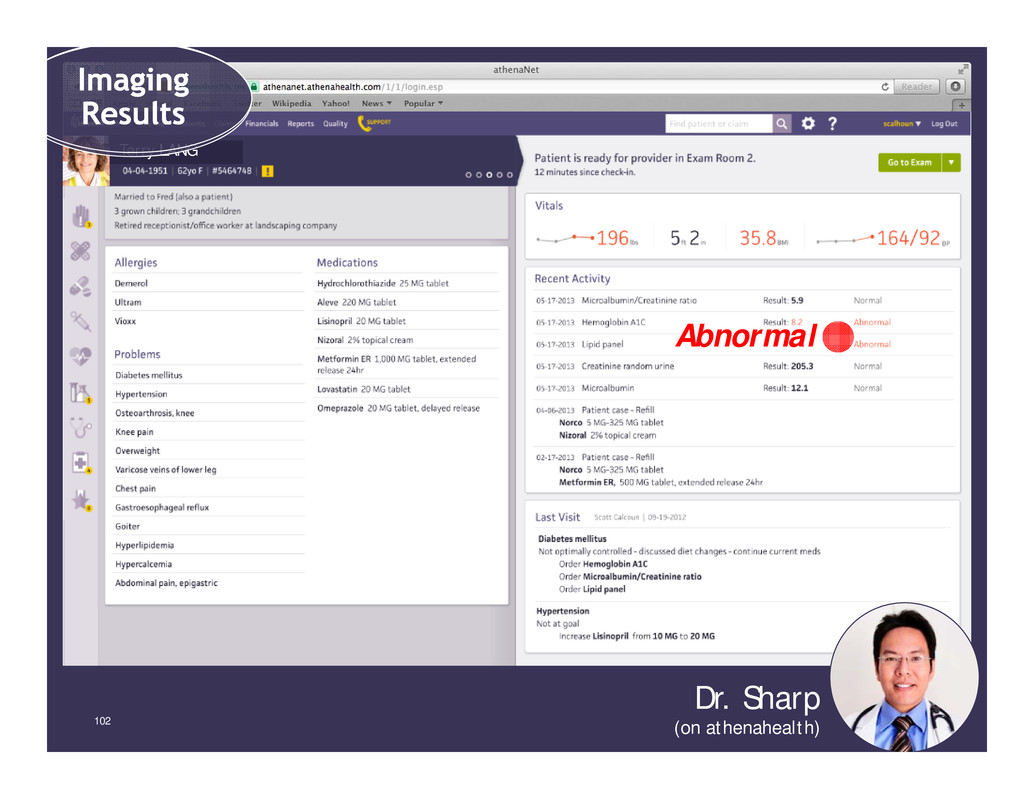

Terry LANG Dr. Sharp (on athenahealth)102 Abnormal

Terry LANG Dr. Sharp (on athenahealth)103

Woman on phone 104 Terry Receives financial obligation and payment options from an athenahealth representative 104

Dr. Corazon (on different EHR)105

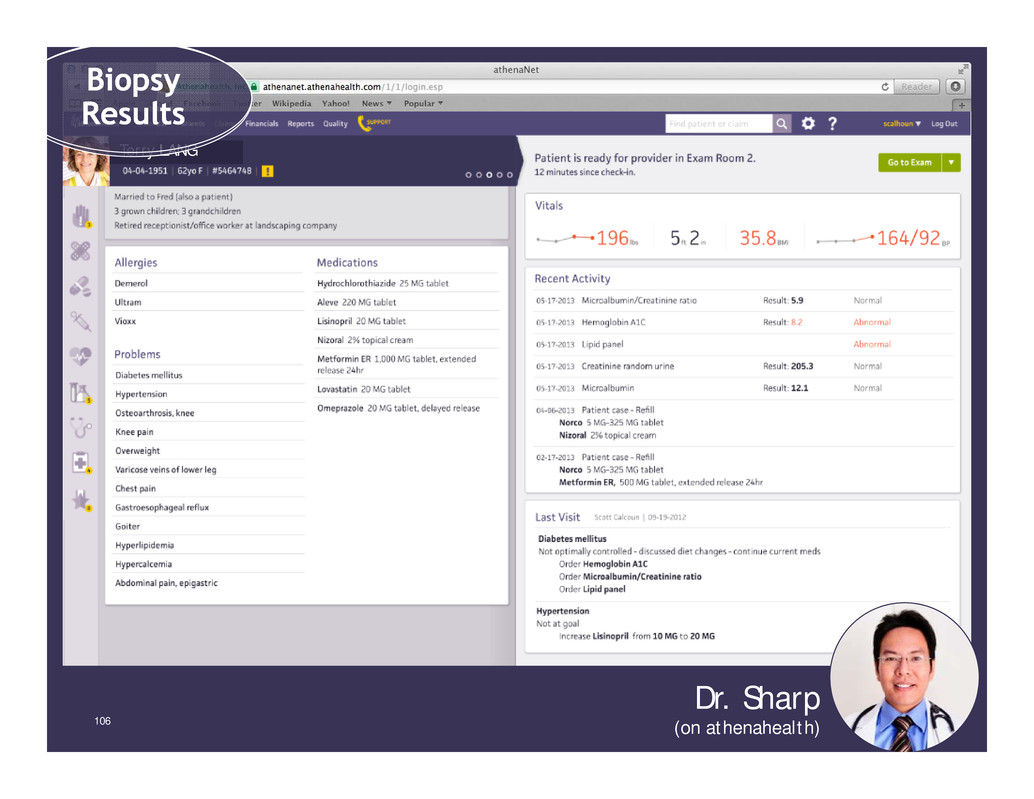

Terry LANG Dr. Sharp (on athenahealth)106

Everyone wins… Terry Lang - loves Happy Valley - better health - better care experience Happy Valley - happy docs - happy patients - lower costs Dr. Sharp - better quality - better care - lower costs Dr. Corazon - efficiency - access to information Radiology Department - less administrivia - more volume 107

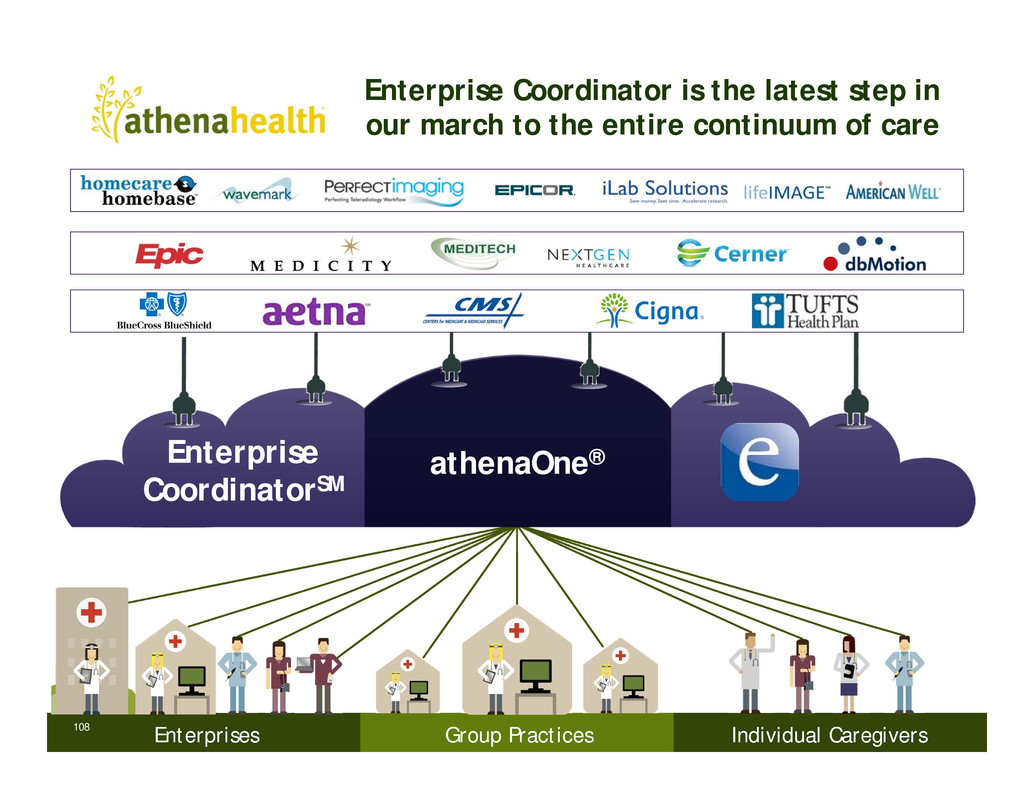

Enterprise Coordinator is the latest step in our march to the entire continuum of care Group Practices Individual CaregiversEnterprises athenaOne®Enterprise CoordinatorSM 108

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 athenahealth Panel Moderator Todd Rothenhaus, M.D. Chief Medical Officer Panelists Kyle Armbrester VP, Business Development David Harvey VP, Product Strategy Jonathan Porter VP, Product Strategy Coordinate Care Manage Quality and Cost Innovate, Grow, and Adapt 109

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 110

Paul Merrild VP, National Accounts

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013112 Paul Merrild VP, National Accounts Jeffrey Le Benger, M.D. Chairman & CEO Summit Medical Group AnnMargaret McCraw CEO Midlands Orthopaedics Michael Cantor, M.D., J.D. Chief Medical Officer New England Quality Care Alliance Michael Callum, M.D. President Steward Medical Group

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 113

Jonathan Bush Chairman, President & CEO

athenahealth, Inc. 6th Annual Investor Summit – December 12, 2013 We thrive in change1 The CLOUD will win! We thrive in an environment of tight capital2 We thrive when connectivity and competition are needed3 115

December 12, 2013