Fourth Quarter and Fiscal Year 2013

Prepared Remarks February 6, 2014

Jonathan Bush, Chairman & Chief Executive Officer

Tim Adams, Senior Vice President & Chief Financial Officer

About These Remarks

The following commentary is provided by management in conjunction with the fourth quarter and full year 2013 earnings press release issued by athenahealth, Inc. (“athenahealth” or “we”). These remarks represent management’s current views on our financial and operational performance and are provided to give investors and analysts more time to analyze and understand our performance in advance of the earnings conference call. These prepared remarks will not be read on the conference call. A complete reconciliation between generally accepted accounting principles “GAAP” and non-GAAP results, as well as a summary of supplemental metrics and definitions, is provided in the tables following these prepared remarks.

Earnings Conference Call Information

To participate in our live conference call and webcast, please dial 877-853-5645 (or 408-940-3868 for international calls) using conference code No. 30311330, or visit the Investors section of our web site at www.athenahealth.com. A replay will be available for one week following the conference call at 855-859-2056 (and 404-537-3406 for international calls) using conference code No. 30311330. A webcast replay will also be archived on our website.

Safe Harbor and Forward-Looking Statements

These remarks contain forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including statements reflecting management’s expectations for future financial and operational performance and operational expenditures, expected growth, and business outlook; statements regarding our research and development efforts and product offering and upgrade plans and timelines; the benefits of and anticipated operational results from our service offerings and demands for our service offerings; the further integration of our services and the resulting benefits; changes in the types of providers and health care entities we serve and the range of tasks we perform for clients; our sales, marketing and partnering activities and plans; the integration of Epocrates and building of new functionalities such as the Drug Monograph Alerts and Secure Text Messaging and integration of existing functionality with our EHR; customer and client behavior and preferences, and implementation of services for new clients and deals; our market position and awareness among physicians; the potential for cross-sales among service offerings and sales involving multiple services; our implementation pipeline and expectations on new deals and network growth; the expansion of the number of users of our services; our plans and readiness in regard to ICD-10 and Stage 2 of Meaningful Use; changes in the industry, including an increased emphasis on coordinated care; the creation of a sustainable market for health information exchange, an ecosystem of developers and third-party service providers, and a national health IT network; our progress and plans on the athenaX project, athenaCoordinator Enterprise offering, and population health services; and statements found under our “Reconciliation of Non-GAAP Financial Measures to Comparable GAAP Measures” section of these remarks. Forward-looking statements may often be identified with words such as “we expect”, “we anticipate”, “upcoming” or similar indications of future expectations. These statements are neither promises nor guarantees, and are subject to a variety of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those contemplated in these forward-looking statements. In particular, the risks and uncertainties include, among other things: our fluctuating operating results; our variable sales and implementation cycles, which may result in fluctuations in its quarterly results; risks associated with the acquisition and integration of companies and new technologies, including those related to our ability to successfully scale the athenaCoordinator® services, those related to our ability to integrate the services and offerings of Epocrates and realize the expected benefits such as increased awareness among physicians of our overall services and offerings; risks associated with our ability to realize the expected benefits from the purchase of the Arsenal on the Charles campus in Watertown, Massachusetts; risks associated with our expectations regarding our ability to maintain profitability; the impact of increased sales and marketing expenditures, including whether

1

increased expansion in revenues is attained and whether impact on margins and profitability is longer term than expected; changes in tax rates or exposure to additional tax liabilities; the highly competitive industry in which we operate and the relative immaturity of the market for our service offerings; and the evolving and complex governmental and regulatory compliance environment in which we and our clients operate. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to update or revise the information contained in these remarks, whether as a result of new information, future events or circumstances, or otherwise. For additional disclosure regarding these and other risks faced by us, see the disclosures contained in our public filings with the Securities and Exchange Commission (“SEC”), available on the Investors section of our website at www.athenahealth.com and on the SEC’s website at www.sec.gov.

Use of Non-GAAP Financial Measures

These remarks contain non-GAAP financial measures, as defined by SEC Regulation G. The GAAP financial measure most directly comparable to each non-GAAP financial measure used or discussed, and a reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure, are included following these prepared remarks or can be found within our fourth quarter and full year 2013 earnings press release in the Investors section of our web site at www.athenahealth.com.

Opening Remarks

We made great strides this year in advancing our vision of becoming the nation’s health information backbone. We acquired Epocrates, the mobile health leader, and now have access to an established, loyal network of over one million health care providers. We added approximately 6,000 sender nodes and over 3,000 receiver nodes and are well on our way toward building an economically sustainable market for health information exchange. We continue to see strong market demand for our differentiated cloud-based services and added over 10,000 providers onto athenaNet® during 2013 bringing our total providers to 50,212. We have exited 2013 with significant momentum and remain well positioned for growth in 2014 and beyond. As discussed at our Annual Investor Summit on December 12, 2013, our strategic priorities are: 1) transform the caregiver user experience; 2) enable full clinical integration; 3) equip caregivers to win at alternative reimbursement; and 4) open athenaNet and build an ecosystem of partners. By executing against these initiatives, athenahealth will become the nation’s health information backbone and will continue to transform the U.S. health care marketplace.

Highlights from Q4 2013 are summarized below:

• | Grew consolidated revenue by 48% and core athenahealth revenue by 28% over Q4 2012 |

| • | Grew net new active physicians on athenaCollector® (2,094 physicians added), athenaClinicals® (987 physicians added), and athenaCommunicator® (4,186 physicians added) in Q4 2013 |

| • | Opened five new nerve centers dedicated to helping our clients go live on athenaNet as well as helping them remain healthy and successful using our services for years to come |

| • | Brought more than 1,000 Ascension providers live in Indianapolis in November 2013 using our new nerve centers |

| • | Signed 6 additional athenaClaritySM - Population Health Management deals (now being incorporated into our athenaCoordinator service offering) and expanded our population health management service to 6 states |

| • | Completed implementations at Integris (athenaCollector, athenaCommunicator, and athenaCoordinator - Financial and Operations Management (formerly athenaClarity) and Prospira PainCare (athenaOne®) |

| • | Grew physician awareness of athenahealth from 31% in 2012 to 39% in 2013 and C-suite awareness from 35% in 2012 to 44% in 2013 |

2

| • | Won five 2013 Best in KLAS awards including the 2013 Best in KLAS Overall Software Vendor and the 2013 Best in KLAS Overall Physician Practice Vendor |

| • | Rated “Best Mobile App for Healthcare professionals” (Epocrates Rx® for iPad) by Medical Marketing & Media in October 2013 |

| • | Named #1 “Most Important Mobile Medical App” (Epocrates) by Modern Healthcare readers for the second year in a row |

Results Overview

athenahealth’s top line results for the fourth quarter and fiscal year (“FY”) 2013 reflect solid revenue growth:

| • | Total revenue: |

| ◦ | $171.6 million in Q4 2013, representing 48% growth over $116.3 million in Q4 2012 |

| ▪ | athenahealth-branded revenue was $149.0 million in Q4 2013, representing 28% growth |

| ▪ | Epocrates-branded revenue was $18.9 million |

| ▪ | Other revenue consisting of third-party tenant revenue was $3.7 million |

| ◦ | $595.0 million in FY 2013, representing 41% growth over $422.3 million in FY 2012 |

| ▪ | athenahealth-branded revenue was $532.9 million in FY 2013, representing 26% growth |

▪ | Epocrates-branded revenue was $52.4 million |

▪ | Other revenue consisting of third-party tenant revenue was $9.7 million |

Our bottom line results for Q4 and FY 2013, consistent with our growth strategy, demonstrate strong sales, marketing, and research and development investments, and a focus on operating efficiencies:

| • | Non-GAAP Adjusted Gross Profit: |

| ◦ | $113.7 million, or 66.2% of total revenue, in Q4 2013, an increase of 54% over $73.7 million, or 63.4% of total revenue, in Q4 2012 |

| ◦ | $374.7 million, or 63.0% of total revenue, in FY 2013, an increase of 42% over $264.4 million, or 62.6% of total revenue, in FY 2012 |

| • | GAAP selling and marketing expense: |

| ◦ | $37.9 million, or 22.1% of total revenue, in Q4 2013, an increase of 38% over $27.6 million, or 23.7% of total revenue, in Q4 2012 |

| ◦ | $149.5 million, or 25.1% of total revenue, in FY 2013, an increase of 43% over $104.3 million, or 24.7% of total revenue, in FY 2012 |

| • | GAAP research and development expense: |

| ◦ | $16.3 million, or 9.5% of total revenue, in Q4 2013, an increase of 76% over $9.3 million, or 8.0% of total revenue, in Q4 2012 |

| ◦ | $57.6 million, or 9.7% of total revenue, in FY 2013, an increase of 71% over $33.8 million, or 8.0% of total revenue, in FY 2012 |

| • | GAAP general and administrative expense: |

3

| ◦ | $22.3 million, or 13.0% of total revenue, in Q4 2013, versus $15.0 million, or 12.9% of total revenue, in Q4 2012 |

| ◦ | $99.8 million, or 16.8% of total revenue, in FY 2013, versus $57.0 million, or 13.5% of total revenue, in FY 2012 |

| • | Non-GAAP Adjusted EBITDA: |

| ◦ | $46.6 million, or 27.2% of total revenue, in Q4 2013, an increase of 72% from $27.1 million, or 23.3% of total revenue, in Q4 2012 |

| ◦ | $116.5 million, or 19.6% of total revenue in FY 2013, an increase of 28% over $90.9 million, or 21.5% of total revenue, in FY 2012 |

| ◦ | Non-GAAP Adjusted Operating Income: |

| ◦ | $34.1 million, or 19.9% of total revenue, in Q4 2013, an increase of 73% from $19.7 million, or 16.9% of total revenue, in Q4 2012 |

| ▪ | Non-GAAP Adjusted Operating Income excludes $0.4 million of integration costs relating to the acquisition of Epocrates which closed on March 12, 2013 |

| ▪ | Core athenahealth Non-GAAP Adjusted Operating Income was $29.6 million |

| ▪ | Epocrates Non-GAAP Adjusted Operating Income was $2.8 million |

| ▪ | Other Non-GAAP Adjusted Operating Income was $1.7 million |

| ◦ | $74.0 million, or 12.4% of total revenue in FY 2013, an increase of 13% over $65.5 million, or 15.5% of total revenue, in FY 2012 |

| ▪ | Non-GAAP Adjusted Operating Income excludes $9.0 million of integration and transaction costs relating to the acquisition of Epocrates which closed on March 12, 2013, and the purchase of the Arsenal on the Charles campus in Watertown, Massachusetts which closed on May 10, 2013 |

| ▪ | Non-GAAP Adjusted Operating Income excludes a $2.5 million gain related to the early termination of the Arsenal on the Charles lease |

▪ | Core athenahealth Non-GAAP Adjusted Operating Income was $69.4 million |

| ▪ | Epocrates Non-GAAP Adjusted Operating Income was $0.1 million |

▪ | Other Non-GAAP Adjusted Operating Income was $4.4 million |

| • | Non-GAAP Adjusted Net Income: |

| ◦ | $22.1 million, or $0.57 per diluted share, in Q4 2013, an increase of 105% from $10.8 million, or $0.29 per diluted share, in Q4 2012 |

| ◦ | $44.3 million, or $1.16 per diluted share, in FY 2013, an increase of 19% from $37.2 million, or $1.00 per diluted share, in FY 2012 |

| ◦ | Our full year non-GAAP effective tax rate of 37% was lower than we anticipated primarily due to better than expected research and development tax credits. This lower non-GAAP effective tax rate increased our Non-GAAP Adjusted Net Income per Diluted Share for FY 2013 by approximately $0.08 |

We measure our performance based on a balanced scorecard model. We believe that this framework is an excellent report card for our performance for the current year and that it measures the key performance indicators required for long-term success. The table below shows the scorecard results for Q1 2013, Q2 2013, Q3 2013, Q4 2013 and FY 2013. For certain metrics (i.e., Client DAR, Provider Documentation

4

Time, and Days of Client Work), our goal is to improve our performance by effectively reducing the scorecard metrics results throughout the year. Please note that all financial and operational metrics results relate to core athenahealth (i.e., excluding Epocrates, Arsenal on the Charles, and intercompany eliminations).

| Q1 2013 Results | Q2 2013 Results | Q3 2013 Results | Q4 2013 Results | FY 2013 Results | |||||||||||

| Stability (15% weight) | |||||||||||||||

| Headcount - Role Vacancy | 4.1 | % | 2.8 | % | 4.1 | % | 1.5 | % | 3.1 | % | |||||

| Corporate Citizenship | 89 | % | 92.2 | % | 91.6 | % | 93.2 | % | 91.5 | % | |||||

| Employee Engagement | 4.0 | 4.1 | 4.1 | 4.1 | 4.1 | ||||||||||

| Stability Results | 86 | % | 113 | % | 88 | % | 137 | % | 106 | % | |||||

| Performance (25% weight) | |||||||||||||||

| Client Days in Accounts Receivable (“DAR”) | 37.6 | 37.0 | 38.4 | 38.0 | 37.8 | ||||||||||

| Total Automation Rate | 61.7 | % | 62.5 | % | 63.1 | % | 64.8 | % | 63.0 | % | |||||

| Client Collection Rate | 96.3 | % | 96.0 | % | 95.5 | % | 95.5 | % | 95.8 | % | |||||

| Performance Results | 96 | % | 96 | % | 93 | % | 94 | % | 95 | % | |||||

| Satisfaction (25% weight) | |||||||||||||||

| Provider Documentation Time | 5.1 | 5.2 | 5.1 | 5.1 | 5.1 | ||||||||||

| Days of Client Work | 7.1 | 7.4 | 7.6 | 7.4 | 7.4 | ||||||||||

| Client Satisfaction | 88.2 | % | 88.0 | % | 88 | % | 87.7 | % | 88.0 | % | |||||

| athenaClinicals Penetration | 29.7 | % | 31.7 | % | 33.3 | % | 34.4 | % | 32.3 | % | |||||

| Satisfaction Results | 102 | % | 98 | % | 96 | % | 95 | % | 98 | % | |||||

| Financial (35% weight) | |||||||||||||||

| Bookings (a) | (a) | (a) | (a) | (a) | (a) | ||||||||||

| Total Revenue ($M) | $ | 120.1 | $ | 129.5 | $ | 134.3 | $ | 149.0 | $ | 532.9 | |||||

| Non-GAAP Adjusted Operating Income ($M) | $ | 9.1 | $ | 11.1 | $ | 19.6 | $ | 29.6 | $ | 69.4 | |||||

| Financial Results | 91 | % | 130 | % | 89 | % | 81 | % | 97 | % | |||||

| Total Results | 94 | % | 111 | % | 92 | % | 96 | % | 98 | % | |||||

| (a) | Since the bookings metric contains highly sensitive data, we do not disclose all of the specific performance measures and targets, because we believe that such disclosure would result in serious competitive harm. |

We believe that our underlying drivers of long-term success remain strong as supported by the following metric results:

• | Employee Engagement at 4.1 out of 5.0 in Q4 2013, versus goal of 4.1 and Q4 2012 actual result of 4.1 |

• | Average Client DAR of 38.0 days in Q4 2013, shy of our goal of 36.0 days and below our Q4 2012 actual result of 36.4 days |

• | Total Automation Rate of 64.8% in Q4 2013, shy of our goal of 71.5% |

• | Client Collection Rate of 95.5% in Q4 2013, mostly in line with our goal of 96.0% |

5

• | Provider Documentation Time per Appointment of 5.1 minutes in Q4 2013, versus goal of 5.0 minutes and Q4 2012 actual result of 5.0 minutes |

• | Days of Client Work of 7.4 days in Q4 2013, versus goal of 6.5 days |

• | Client Satisfaction of 87.7% in Q4 2013, versus goal of 85.0% and Q4 2012 actual result of 87.2% |

• | athenaClinicals penetration of 34.4% in Q4 2013, shy of our goal of 37.5% |

athenahealth’s client base continues to expand while client adoption of other services in the athenahealth service suite grows. As our client base expands outside the traditional ambulatory market, we believe that total active providers, or nodes, on our network will become a more appropriate metric to use in measuring our market share. During Q4 2013:

| • | 79% of all new athenaCollector deals included athenaClinicals, compared to 82% in Q4 2012 |

• | 72% of all new athenaCollector deals included athenaClinicals and athenaCommunicator, compared to 67% in Q4 2012. Additionally, 72% of all new athenaOne deals sold during Q4 2013 also included athenaCoordinator Core, compared to 56% in Q4 2012 |

• | Net new physicians and providers added sequentially to the network were as follows: |

| athenaCollector | athenaClinicals | athenaCommunicator | ||||||||||||

| Active physicians and providers: | Physicians | Providers | Physicians | Providers | Physicians | Providers | ||||||||

| Beginning balance as of 9/30/13 | 33,764 | 47,195 | 11,401 | 15,483 | 17,330 | 23,024 | ||||||||

| Net new additions | 2,094 | 3,017 | 987 | 1,322 | 4,186 | 5,336 | ||||||||

| Ending balance as of 12/31/13 | 35,858 | 50,212 | 12,388 | 16,805 | 21,516 | 28,360 | ||||||||

| Sequential growth % | 6 | % | 6 | % | 9 | % | 9 | % | 24 | % | 23 | % | ||

| • | Net new physicians and providers added to the network since Q4 2012 were as follows: |

| athenaCollector | athenaClinicals | athenaCommunicator | ||||||||||||

| Active physicians and providers: | Physicians | Providers | Physicians | Providers | Physicians | Providers | ||||||||

| Beginning balance as of 12/30/12 | 28,011 | 39,752 | 7,949 | 10,926 | 10,153 | 14,065 | ||||||||

| Net new additions | 7,847 | 10,460 | 4,439 | 5,879 | 11,363 | 14,295 | ||||||||

| Ending balance as of 12/31/13 | 35,858 | 50,212 | 12,388 | 16,805 | 21,516 | 28,360 | ||||||||

| Y/Y growth % | 28 | % | 26 | % | 56 | % | 54 | % | 112 | % | 102 | % | ||

athenaCollector network performance metrics were as follows for Q4 2013:

• | $3,285,027,602 posted in total client collections, up 29.3% from Q4 2012 |

• | 25,435,690 total claims submitted, up 26.8% from Q4 2012 |

• | 83.3% electronic remittance advice (“ERA”) rate, up 1.6 points from 81.7% at Q4 2012 |

• | 93.9% first pass resolution (“FPR”) rate, down 0.3 points from 94.2% at Q4 2012 |

6

Revenue Discussion

Q4 2013 revenue reached $171.6 million and grew by 48% (or $55.3 million) over Q4 2012. athenahealth-branded revenue for Q4 2013 was $149.0 million and grew by 28% over prior year. Q4 2013 also represents our 56th quarter of consecutive revenue growth for the core business. Our total revenue of $595.0 for FY 2013 grew by 41% (or $172.7 million ) over FY 2012. athenahealth-branded revenue for FY 2013 grew by 26% over FY 2012.

| Q4 2013 | Q4 2012 | Y/Y Growth% | ||

| athenahealth-branded | $149.0 | $116.3 | 28 | % |

| Epocrates-branded | $18.9 | $0.0 | n/a | |

| Other | $3.7 | $0.0 | n/a | |

| Consolidated | $171.6 | $116.3 | 48 | % |

| FY 2013 | FY 2012 | Y/Y Growth% | ||

| athenahealth-branded | $532.9 | $422.3 | 26 | % |

| Epocrates-branded | $52.4 | $0.0 | n/a | |

| Other | $9.7 | $0.0 | n/a | |

| Consolidated | $595.0 | $422.3 | 41 | % |

In terms of trends in our recurring revenue base, same-store analysis of claims created—a proxy for physician office utilization—indicates that physician office activity in Q4 2013 increased modestly over physician office activity during Q4 2012. In addition, as seen in prior years, our analysis also showed an increase in physician office activity in Q4 2013 compared to Q3 2013.

Claim activity is typically higher in Q4 due to flu diagnosis. However, as it relates to flu trends, flu vaccines made up a slightly smaller portion of the claim volume as compared to Q4 2012. Analysis by our athenaResearch team, who has been monitoring the nation’s flu activity since November 2013, showed that the 2013-2014 flu season is running at levels roughly 30% lower than last year’s national level. We will continue to monitor flu activity during Q1 2014 to determine how the 2013-2014 flu patterns continue to track against the 2012-2013 season.

Non-GAAP Adjusted Gross Margin Discussion

Our Non-GAAP Adjusted Gross Margin was 66.2% for Q4 2013, up approximately 280 basis points from 63.4% in Q4 2012. Our Non-GAAP Adjusted Gross Margin was 63.0% for FY 2013, up from 62.6% in FY 2012. One of our goals is to improve gross margin on a service-line basis each year. As previously discussed, the expansion of our newer service offerings, such as athenaCoordinator, will serve as a headwind to total company margin expansion until these new services become more automated and scalable.

Balance Sheet and Cash Flow Highlights

As of December 31, 2013, we had cash and cash equivalents of $65.0 million and outstanding indebtedness of $223.8 million. Operating cash flow was $93.3 million for the twelve months ended December 31, 2013, up 33% from $70.2 million for the twelve months ended December 31, 2012. Our capital expenditures, including capitalized software development, were $24.7 million (or 14.4% of total revenue) in Q4 2013 and $67.4 million (or 11.3% of total revenue) in FY 2013.

7

Product Development Discussion

Product development at athenahealth is organized around the goal of being the best in the world at getting medical caregivers paid for doing the right thing. In order to fulfill this goal, we deliver services backed by cloud-based software, proprietary knowledge, and robust back-office services.

2013 Best in KLAS awards

athenahealth won five 2013 Best in KLAS¹ awards. As rated by thousands of health care providers across the United States, athenahealth is now rated #1 in the following categories:

| • | 2013 Best in KLAS Overall Software Vendor |

| • | 2013 Best in KLAS Overall Physician Practice Vendor |

| • | 2013 Best in KLAS Practice Management Service, athenaCollector, for the 1-10 and 11-75 physician segments |

| • | 2013 Best in KLAS Patient Portal, athenaCommunicator |

The Overall Software Vendor award recognizes athenahealth for having the highest average score for across three products - athenaClinicals, athenaCollector, and athenaCommunicator. The Overall Physician Practice Vendor award recognizes athenahealth as the health care IT vendor with the highest average score for its Ambulatory EMR (athenaClinicals) and Practice Management service (athenaCollector) across all segments. The overall awards speak to the strength of our athenaOne services across all segments (1-10 physicians, 11-75 physicians, and 75+ physicians).

athenaCollector service offering

athenaCollector is our cloud-based medical billing and practice management solution. It is the foundation of our service portfolio and entered general availability in 2000.

The athenaCollector team continues to prepare for the next big change in health care compliance, the International Statistical Classification of Diseases and Related Health Problems, 10th Revision (“ICD-10”). In order to ensure a smooth transition for our clients, we are building a host of tools to help them prepare for ICD-10. During Q4 2013, we launched our ICD-10 readiness center on athenaNet, which provides detailed guidance, tools, and instructions on what our clients need to do to prepare for the October 2014 transition. Our clients have just completed phase 1 (November 2013 to January 2014) of our ICD-10 change management process. During this phase, our clients learned more about ICD-10, reviewed how the new code set affects their practices and began to familiarize themselves with the ICD-10 codes using the new ICD-10 search tool. As we move into phase 2 (February 2014 to May 2014), our clients will begin to actively monitor their readiness. Our clients will be able to practice dual-coding claims, review the dual coded claims and adjust workflows, as necessary, to facilitate ICD-10 compliance. We remain the only player in the industry to guarantee physicians a smooth transition to ICD-10. athenahealth’s ICD-10 readiness center demonstrates our unique ability to help our clients thrive and profit through change.

athenaClinicals service offering

athenaClinicals is our cloud-based electronic health record (“EHR”) management service. It entered general availability in 2006 and was made available as a stand-alone service in 2010.

Our vision is to become the nation’s health information backbone and ultimately support the full continuum of care. The foundation underlying this vision is the ability to exchange clinical information.

_____________________________________________________________________________________

| ¹ | “2013 Best in KLAS Awards: Software & Services,” January, 2014. © 2014 KLAS Enterprises, LLC. All rights reserved. www.KLASresearch.com |

8

Therefore, enabling full clinical integration remains one of our top strategic priorities for 2014. The progress we have achieved with athenaClinicals informs both our vision and our confidence. Our software and service approach continues to garner industry recognition and continues to deliver industry-leading results with our Meaningful Use (“MU”) performance. Our best in breed EHR continues to be validated by trusted third-party researchers like KLAS. athenaClinicals was ranked as the most usable EHR among major ambulatory EHR vendors by industry-leading research firm KLAS in its 2013 Ambulatory EHR Usability report. athenaClinicals also received #1 KLAS ranking in the 2013 Ambulatory EMR Performance Report for the 1-10 physician segment, receiving top marks for delivering on customer expectations and releasing consistent product enhancements while maintaining high service levels. We were also gratified to learn that athenaClinicals was ranked the #2 Ambulatory EHR in the 1-10 and 11-75 physician segments. We remain the only HIT vendor to guarantee MU Stage 1 and Stage 2 attestation. Today, all of our athenaClinicals clients are using the 2014 Certified Complete EHR and our goal is to get all of our eligible athenaClinicals providers attested for Stage 2 MU well in advance of the ICD-10 transition.

Our athenaX project or the new athenaNet user experience represents another major advancement in redefining the physician’s experience with an EHR. Alpha testing progressed as planned with a small cohort of alpha providers and their clinical staff able to learn the system in a matter of minutes and successfully document encounters using this more streamlined workflow. As a result of our success, we moved to beta testing for internal medicine in December 2013 and plan to make the service generally available to internists and pediatricians in 2014. Our goal is to have approximately 50% of our athenaClinicals providers using the new workflow by the end of 2014. We will roll-out this new streamlined encounter by specialty and plan to make it available to all athenaClinicals providers by 2015.

The progress we are making with the athenaNet user experience is also critical in advancing our goal of supporting the full continuum of care. We are building a network facesheet on the foundation provided by this project. The network facesheet will become the window into the entire patient record, including inpatient care. The network facesheet is a critical component of our new athenaCoordinator Enterprise service that we are launching this year.

athenaCommunicator service offering

athenaCommunicator is our cloud-based patient communication management service. It entered general availability in 2010 and, at this time, requires adoption of athenaCollector or athenaClinicals.

The athenaCommunicator product development team continues to make progress on several important initiatives aimed to drive patient engagement and improve patient access. During Q4 2013, we launched enhanced patient self-scheduling capabilities, released the next generation of the GroupCall service and successfully rolled out the patient engagement workflows required by MU Stage 2. In addition to Stage 2 readiness, we are actively exploring unique and innovative ways to drive adoption of the patient portal and to help our clients satisfy the patient engagement requirements. For example, we are promoting our mobile patient portal launched in Q4 2012 and are now seeing over 50% of patient portal usage happening via mobile technology. In addition, we are monitoring portal adoption, developing patient-friendly marketing materials and partnering with our clients to establish best practices to effectively engage their patients. To this end, we added several MDP technology partners including Medical Web Experts, Practis, WebToMed and Vistaprint to help our clients promote their practice and boost patient engagement with printed collateral and expert website development. We are also introducing a new component of our patient engagement service that focuses on population health. We are currently beta testing the new population health campaigns which will enable our clients to successfully stratify patients, identify care gaps, boost schedule density, and improve health outcomes. These clinically-driven campaigns will engage and activate patients and improve the role they play in their health. These

9

capabilities will become a critical component of our new athenaCoordinator Enterprise service offering that we plan to launch in 2014.

Key Metrics as of Q4 2013:

• | Provider adoption rate of 56%, as compared to 49% in Q3 2013 and 35% in Q4 2012. |

• | athenaCommunicator delivered over 21.9 million automated messages during Q4 2013 across our active patient base of over 16 million patients. |

• | Patient portal adoption has increased by 19% since Q3 2013 to 2.5 million patients registered as of Q4 2013. |

• | athenaCommunicator collected over $10.3 million in self-pay collections during Q4 2013 via the patient portal and our live operator service, an increase of 129% over the Q4 2012 self-pay collections of $4.5 million. |

athenaCoordinator service offering

Our care coordination service offerings include athenaCoordinator Core and athenaCoordinator Plus. athenaCoordinator Core is a cloud-based order transmission service for all receiver types and physicians using athenaClinicals. athenaCoordinator Plus is our cloud-based care coordination service for order transmission, insurance pre-certification, and patient pre-registration among physicians and hospitals, surgical centers, and imaging centers. athenaCoordinator Plus entered general availability in 2011 following the acquisition of Proxsys LLC, and the athenaCoordinator Core service offering entered general availability in 2012.

Beginning in 2014, our athenaCoordinator service offering also includes our financial and operations management and our population health management services. These services are the result of the integration of Anodyne Health Partners, Inc. (financial and operations management) and Healthcare Data Services (population health management) acquisitions. athenahealth acquired Anodyne Health Partners, Inc. in October of 2009 and acquired Healthcare Data Services LLC in October of 2012. The union of these services provides visibility into the financial and clinical health of the health care network, helping health care organizations manage both networks of caregivers and populations of patients. By harmonizing data across practice management systems, EHRs, and claims systems, athenaCoordinator provides health care organizations with a single source of truth.

We continue to make strides towards building a two-sided market in health care by growing both our sender and our receiver bases. In a little over two years, we have added almost 3,500 active receiver nodes and almost 7,000 active sender nodes onto our network. As of December 2013, 7.1% of all orders are being sent in-network and our goal is to double this rate in 2014. We will continue to analyze the athenaClinicals order volumes to target and grow our core receiver network.

The athenaCoordinator product development team has also been working on several initiatives aimed at improving care coordination. As discussed last quarter, athenaCoordinator clients on athenaClinicals now have the ability to exchange patient records directly in athenaNet. The ordering physician can send portions of the patient’s chart electronically, including medication history, problem lists, vaccinations, and allergies directly into the receiving physician’s medical record. Over 1,900 orders have been shared since the launch of this new functionality in October 2013. We also recently launched a new feature that embeds medical necessity checks on all outbound Medicare lab orders. This feature enables our clients to inform patients of their financial responsibility and assists the ordering physician in meeting all of the Medicare medical necessity requirements.

10

Looking forward, the athenaCoordinator team will shift its focus towards launching our new athenaCoordinator Enterprise service. As discussed at our Annual Investor Summit on December 12, 2013, athenaCoordinator Enterprise is a cloud-based, clinical integration service that targets and manages transitions of care throughout a health system. This new service marks our first big step into the inpatient setting. Through this service, health systems will be able to identify patients in need of care or adjustments in care, engage in proactive outreach to those patients, and coordinate their experience across the care continuum. athenaCoordinator Enterprise is a combination of existing and expanded functionality from athenaCoordinator, athenaCollector, athenaCommunicator, and Epocrates, along with a new feature: the Network Facesheet. Jonathan Porter, our Vice President of Product Strategy for athenaClarity will oversee product strategy and product management for athenaCoordinator Enterprise starting in 2014.

athenaCoordinator - Financial and Operations Management and Population Health Management service offerings (formerly athenaClarity service offering)

As mentioned above, beginning in 2014, our athenaCoordinator service offering includes our financial and operations management and our population health management services. These services turn insight into action, guiding data-driven decision-making at the point of care.

The team remains focused on closing deals, building a robust pipeline, and bringing signed deals live onto our network. Demand for our population health management service has continued to be very strong. We signed six additional population health deals during Q4 2013, resulting in a total of fourteen deals closed in 2013. Two of the deals signed in Q4 2013 were with Hudson Headwaters Health Network in New York and Medical Professional Services, Inc. in Connecticut which represent additional proof points of our continued expansion of this service offering outside of Massachusetts. During 2013, our population health client base grew from ten risk-bearing entities in Massachusetts to twenty-four risk-bearing entities across six states. While our population health management service will become a critical component of our new athenaCoordinator Enterprise service offering, this service can still be sold as a stand alone service in 2014.

Epocrates service offerings

Epocrates is recognized for developing the #1 medical application among U.S. physicians for clinical content, practice tools, and health industry engagement at the point of care. Epocrates has established a loyal network of more than one million health care professionals, including approximately 50 percent of U.S. physicians, who routinely use its intuitive solutions to help streamline workflow and improve patient care. For more information, please visit www.epocrates.com. Epocrates was acquired by athenahealth on March 12, 2013.

We remain singularly focused on keeping Epocrates the #1 source of content for helping caregivers make efficient and confident decisions. The Manhattan Research Taking the Pulse® U.S. 2013 annual study recently ranked Epocrates as the top smartphone and tablet app among U.S. physicians. During Q4 2013, Epocrates Rx for iPad was named Medical Marketing & Media’s “Best Mobile App for Healthcare Professionals” and Epocrates was named the most important health care app by readers of Modern Healthcare for the second year in a row. Repeatedly the top app on physician’s mobile devices, we look to build on Epocrates’ powerful position and to help shape the future of mHealth. This year, we plan to extend clinical decision support through the EHR, add clinician care coordination through secure text messaging, and improve patient outcomes through all of our services. As discussed during our Annual Investor Summit on December 12, 2013, Epocrates will be our leading clinician-facing brand, serving as the awareness and educational on-ramp for introducing athenahealth and our services. In addition, Epocrates Enterprise will be a significant component of the athenaCoordinator Enterprise service offering and part of our overall strategy to support the full continuum of care. The combination of Epocrates’ user base and evolving apps and athenahealth’s cloud-based services makes us more capable of competing and winning in a market where connectivity and competition are ultimately needed and preferred.

11

Business Development Update

More Disruption Please

Our MDP program continues to advance our mission to help caregivers by ensuring we partner with some of the health care industry’s most innovative companies. Unlike other health care partnership programs, our MDP program provides qualified, high-quality companies access to both our cloud-based platform of HIT services and our growing nationwide provider network. Through this differentiated program, athenahealth will continue to introduce new services and accelerate the introduction of high-value innovation via the cloud. Entering 2013, our goal was to grow the user base to 100 accounts across 20 Technology partners by year end. We surpassed this goal. As of today, we have 21 Technology partners and 51 Clinical Exchange partners featured on the athenahealth Marketplace. All 21 Technology partners, including the 4 ICD-10 partners, are generally available to athenahealth’s client base and over 150 accounts are live on the services offered via the athenahealth Marketplace. The capabilities found in the athenahealth Marketplace include mobile charge capture, ICD-10 training, transcription, speech-to-text, scheduling, medical website design, medical record requests, contract management and more. During 2014, the MDP team will begin to formally track the impact that our MDP partners have on key client performance metrics such as charge entry lag, provider documentation time, and portal adoption. For example, workflow management company Entrada has successfully reduced documentation time for physicians while appointment scheduling firm iTriage has increased schedule density for practices. To learn more about our MDP program and partnership opportunities and to explore the athenahealth Marketplace, please visit www.athenahealth.com/disruption.

Client Base Discussion

The total number of physicians who have gone live on athenaCollector, our core service offering, is the metric we currently use to define our client base and market share. However, as our client base expands outside the traditional ambulatory market, total active providers—or nodes on our network—will become a more appropriate metric used to define our client base and market share. Annual growth in total revenue continues to outpace growth in our physician base. We believe that this trend will continue as athenaClinicals and athenaCommunicator are included in a growing portion of new deals and adoption of these services spreads across our existing client base.

During Q4 2013, 79% of all new athenaCollector deals included athenaClinicals, down slightly from 82% in Q4 2012. 72% of all new athenaCollector deals included athenaCommunicator and athenaClinicals. Additionally, 72% of all new athenaOne deals also included athenaCoordinator Core. The athenaOne rate of 72% in Q4 2013 compares to 67% in Q4 2012. Among “live” (i.e., implemented and active) athenaCollector clients, adoption of athenaClinicals and athenaCommunicator continues to grow rapidly and resulted in continued growth to our installed base across all of our service offerings.

12

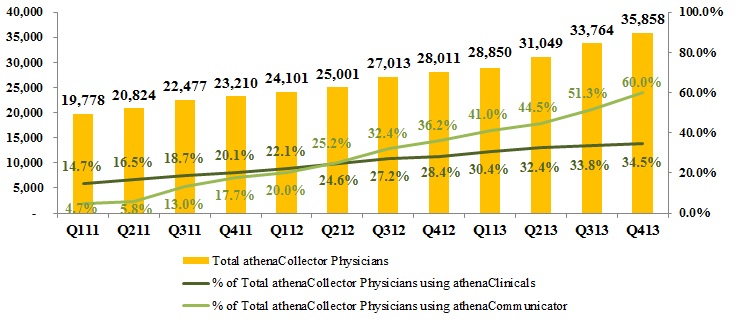

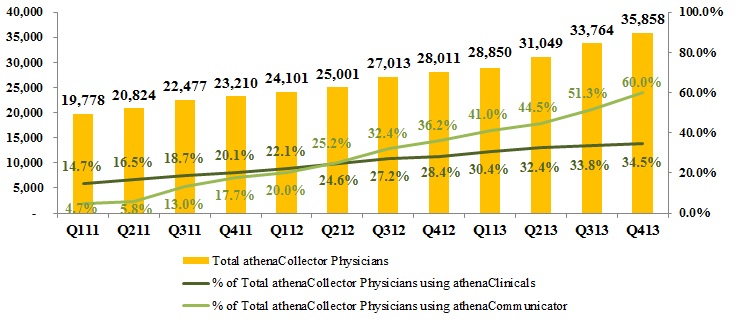

athenahealth Service Offering Adoption

athenaCollector Clients

During Q4 2013, total active physicians on athenaCollector grew by 28% year-over-year, to 35,858. On a sequential basis, we added 2,094 net new active physicians on athenaCollector, versus 998 in Q4 2012. Our quarterly net new physician additions may vary widely due to the number and size of clients that go live in a particular quarter. Furthermore, our larger clients can be more complex and take longer to go live, particularly if our clients request a more phased implementation approach. Total active providers on athenaCollector grew by 26% year-over-year, to 50,212. On a sequential basis, we added 3,017 net new active providers on athenaCollector, versus 1,607 in Q4 2012.

athenaClinicals Clients

We continue to experience rapid growth in client adoption of athenaClinicals. Total active physicians live on athenaClinicals grew by 56% year-over-year, to 12,388. On a sequential basis, we added 987 net new active physicians on athenaClinicals, versus 609 in Q4 2012. This equates to an overall adoption rate of 35% of total athenaCollector physicians, up from 28% in Q4 2012. Total active providers on athenaClinicals grew by 54% year-over-year, to 16,805. On a sequential basis, we added 1,322 net new active providers on athenaClinicals, versus 864 in Q4 2012. We expect the athenaClinicals client base to increase over time due to cross-selling within our existing base and growth in the volume of athenaOne deals.

athenaCommunicator Clients

Our athenaCommunicator client base is also growing rapidly. Total active physicians live on athenaCommunicator grew by an impressive 112% year-over-year, to 21,516. On a sequential basis, we added a record 4,186 net new active physicians on athenaCommunicator, versus 1,414 in Q4 2012. This equates to an overall adoption rate of 60% of total athenaCollector physicians, up from 36% in Q4 2012. Total active providers on athenaCommunicator grew by 102%, to 28,360. On a sequential basis, we added a record 5,336 net new providers on athenaCommunicator, versus 1,916 in Q4 2012. We expect the athenaCommunicator client base to increase over time due to cross-selling within our existing base and growth in the volume of athenaOne deals.

New Deals

On October 17, 2013, we announced that Hospital Physician Partners will deploy athenaCollector, athenaCommunicator, and athenaClarity in pursuit of streamlined collections, improved patient communications, and system-wide business intelligence. Hospital Physician Partners is an industry leader

13

in emergency department and hospitalist program staffing and management. Hospital Physician Partners contracts with over 2,000 providers. Hospital Physician Partners is expected to go-live by means of a phased implementation starting in 2014.

On October 23, 2013, we announced that Rush Health has endorsed athenaCollector and athenaClinicals for its more than 300 affiliated private physician members.

On January 21, 2014, we announced that Medical Professional Services selected our cloud-based Population Health Management offering to improve care quality and coordination across its growing network of providers and patients. Medical Professional Services is one of Connecticut’s largest multi-specialty Independent Physician Associations, with over 450 physician and mid-level providers, including primary care physicians, medical and surgical specialists, and hospital-based physicians. Medical Professional Services is expected to go-live in Q1 2014.

Client Implementations

Our publicly disclosed implementation pipeline includes the following status updates as of February 6, 2014:

• | INTEGRIS Health (~300 physicians, ~400 providers) went live on athenaCollector, athenaCommunicator, and athenaCoordinator - Financial and Operations Manager (formerly athenaClarity) in October 2013. |

| • | Prospira PainCare (~20 physicians, ~50 providers) began a phased implementation on our full suite of services, including athenaCoordinator - Financial and Operations Manager (formerly athenaClarity) in September 2013 and the remaining providers went fully live in December 2013. |

| • | Riverside Medical Group (~300 physicians, ~400 providers) went live on athenaCollector in January 2014. |

• | Health Management Associates (~900 physicians, ~1,200 providers) continued the phased implementation on our full suite of services and brought a few small waves live during Q4 2013 and Q1 2014. As of Q4 2013, approximately 98% of the physicians are live on athenaCollector and athenaCommunicator and approximately 63% are live on athenaClinicals. We fully expect the implementation to be completed shortly after the pending transaction with Community Health Systems stabilizes. |

• | Ascension Health Alliance (over 4,000 providers) is expected to go live on athenaCollector, athenaCommunicator, and athenaCoordinator - Financial and Operations Management (formerly athenaClarity) by means of a phased implementation. Ascension Health Alliance brought the first wave of over 1,000 providers live in November 2013. |

| • | Hallmark Health is expected to go live on athenaCoordinator - Population Health Management (formerly athenaClarity) in Q1 2014. |

| • | CaroMont Health is expected to go live on athenaCoordinator - Population Health Management (formerly athenaClarity) in Q1 2014. |

| • | Children’s Integrated Care Organization is expected to go live on athenaCoordinator - Population Health Management (formerly athenaClarity) in Q1 2014. |

| • | Marquette Physician Practices (~200 physicians, ~250 providers) is expected to go live on athenaCollector, athenaCommunicator, and athenaCoordinator - Financial and Operations Management (formerly athenaClarity) in Q2 2014. |

Marketing and Selling Discussion

Marketing Update

The athenahealth marketing organization encompasses our growth and sales operations, event and partner marketing, inside sales agents (“ISAs”), advertising, corporate communications, and product marketing teams. This organization executes in-market investments in an effort to generate new business opportunities for athenahealth.

14

We continue to invest in various growth initiatives with a specific focus on awareness-building and lead generation activities. The marketing team has had success in tailoring our marketing initiatives and creating athenaNet branded content to drive awareness among physicians, practice managers, and C-suite executives. More importantly, the marketing team has started to build upon the brand awareness, familiarity and trust that Epocrates has established across its clinical mobile user base. As expected, the Epocrates acquisition played a major role in elevating athenahealth’s national awareness in 2013. This year, awareness of athenahealth has reached all-time highs at both the physician and C-suite levels. Physician awareness of athenahealth increased eight points from 31% in 2012 to 39% in 2013 and C-suite awareness jumped nine points from 35% in 2012 to 44% in 2013. While the improvement in our awareness scores is positive news, we are striving to translate this increased awareness into greater familiarity with our services.

Selling Update

The athenahealth sales organization includes all quota-carrying sales representatives, as well as our sales team leaders, channel sales team, and sales training and development organization.

The sales team delivered another year of 30% bookings growth as three out of our four sales groups achieved or exceeded their 2013 bookings goals. The sales team is now focused on delivering another 30% bookings growth year. To help achieve our growth goal, we continue to equip our sales teams with additional weapons to help attract prospects and close deals. During 2014, our ever-expanding arsenal will include secure text messaging, athenaX, and athenaCoordinator Enterprise. While we will remain focused on broadening and deepening our services to support individual caregivers and group practices, both independent and employed, athenaCoordinator Enterprise represents our first big step to address the needs of health systems. We believe this strategy positions us for continued growth in 2014 and beyond.

As of December 31, 2013, we have a total of 126 quota-carrying sales representatives, up 11% from last year. The number of quota-carrying sales representatives for our enterprise national accounts team has nearly doubled from 8 in 2012 to 15 in 2013. Starting in 2014, our direct sales force will be divided into three groups: the enterprise team, which is dedicated to serving the very largest managed care organizations, as well as those with high growth potential; the group team, which is dedicated to medical practices with seven to 150 physicians; and the small group team, which is dedicated to medical practices with one to six physicians.

15

Stock-Based Compensation Expense, Amortization of Purchased Intangible Assets, Summary of Cash Balance, Reporting by Business and Reconciliation of Non-GAAP Financial Measures

athenahealth, Inc.

STOCK-BASED COMPENSATION

(Unaudited, in thousands)

Set forth below is a breakout of stock-based compensation impacting the Consolidated Statements of Income for the three and twelve months ended December 31, 2013, and 2012:

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||||

| Stock-based compensation charged to Consolidated Statements of Income: | |||||||||||||||

| Direct operating | $ | 2,160 | $ | 1,547 | $ | 7,778 | $ | 5,619 | |||||||

| Selling and marketing | 2,848 | 2,312 | 12,057 | 7,717 | |||||||||||

| Research and development | 991 | 306 | 4,238 | 3,213 | |||||||||||

| General and administrative | 2,925 | 2,553 | 18,575 | 10,687 | |||||||||||

| Total stock-based compensation expense | 8,924 | 6,718 | 42,648 | 27,236 | |||||||||||

| Amortization of capitalized stock-based compensation related to software development (1) | 347 | 257 | 1,027 | 257 | |||||||||||

| Total | $ | 9,271 | $ | 6,975 | $ | 43,675 | $ | 27,493 | |||||||

| (1) | In addition, for the three and twelve months ended December 31, 2013, $0.5 million and $2.2 million, respectively, of stock-based compensation was capitalized in the line item Capitalized Software Costs in the Consolidated Balance Sheet for which $0.3 million and $1.0 million respectively, of amortization was included in the line item Depreciation and Amortization Expense in the Consolidated Statements of Income. The amount of stock-based compensation related to capitalized software development costs in prior periods was not significant. |

16

athenahealth, Inc.

AMORTIZATION OF PURCHASED INTANGIBLE ASSETS

(Unaudited, in thousands)

Set forth below is a breakout of amortization of purchased intangible assets impacting the Consolidated Statements of Income for the three and twelve months ended December 31, 2013, and 2012:

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||

| Amortization of purchased intangible assets allocated to: | 2013 | 2012 | 2013 | 2012 | |||||||||||

| Direct operating | $ | 2,777 | $ | 1,100 | $ | 10,617 | $ | 3,359 | |||||||

| Selling and marketing | 2,419 | — | 7,261 | — | |||||||||||

| Total amortization of purchased intangible assets | $ | 5,196 | $ | 1,100 | $ | 17,878 | $ | 3,359 | |||||||

athenahealth, Inc.

CASH, CASH EQUIVALENTS, AND AVAILABLE-FOR-SALE INVESTMENTS

(Unaudited, in thousands)

Set forth below is a breakout of total cash, cash equivalents, and available-for-sale investments as of December 31, 2013, and December 31, 2012:

| December 31, 2013 | December 31, 2012 | ||||||

| Cash, cash equivalents | $ | 65,002 | $ | 154,988 | |||

| Short-term investments | — | 38,092 | |||||

| Total | $ | 65,002 | $ | 193,080 | |||

17

athenahealth, Inc.

REVENUE AND NON-GAAP ADJUSTED OPERATING INCOME BY BUSINESS

(Unaudited, in thousands)

Set forth below is a breakout of revenue and “Non-GAAP Adjusted Operating Income” by business for the three and twelve months ended December 31, 2013 and 2012:

| Three months ended | Twelve months ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Revenue: | ||||||||||||||||

| Business services: | ||||||||||||||||

| athenahealth | $ | 143,624 | $ | 112,581 | $ | 510,857 | $ | 408,496 | ||||||||

| Epocrates | 18,905 | — | 52,380 | — | ||||||||||||

| Implementation and other: | ||||||||||||||||

| athenahealth | 5,406 | 3,723 | 22,029 | 13,775 | ||||||||||||

| Other | 3,644 | — | 9,737 | — | ||||||||||||

| Total revenue | $ | 171,579 | $ | 116,304 | $ | 595,003 | $ | 422,271 | ||||||||

| Three months ended | Twelve months ended | |||||||||||||||

| December 31, | December 31, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| Non-GAAP Adjusted Operating Income: | ||||||||||||||||

| athenahealth | $ | 29,636 | $ | 19,699 | $ | 69,441 | $ | 65,479 | ||||||||

| Epocrates | 2,773 | — | 82 | — | ||||||||||||

| Other | 1,710 | — | 4,439 | — | ||||||||||||

| Total Non-GAAP Adjusted Operating Income | 34,119 | 19,699 | 73,962 | 65,479 | ||||||||||||

| Stock-based compensation expense | 8,924 | 6,718 | 42,648 | 27,236 | ||||||||||||

| Integration and transaction costs | 397 | — | 9,024 | — | ||||||||||||

| Amortization of capitalized stock-based compensation related to software development | 347 | 257 | 1,027 | 257 | ||||||||||||

| Gain on early termination of lease | — | — | (2,468 | ) | — | |||||||||||

| Amortization of purchased intangible assets | 5,196 | 1,100 | 17,878 | 3,359 | ||||||||||||

| Total operating income | 19,255 | 11,624 | 5,853 | 34,627 | ||||||||||||

| Other (expense) income | (1,183 | ) | 17 | (3,622 | ) | 251 | ||||||||||

| Income before income tax (provision) benefit | 18,072 | 11,641 | 2,231 | 34,878 | ||||||||||||

| Income tax (provision) benefit | (4,927 | ) | (5,701 | ) | 363 | (16,146 | ) | |||||||||

| Net income | $ | 13,145 | $ | 5,940 | $ | 2,594 | $ | 18,732 | ||||||||

18

athenahealth, Inc.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO COMPARABLE GAAP MEASURES

(Unaudited, in thousands, except per share amounts)

The following is a reconciliation of the non-GAAP financial measures used by us to describe our financial results determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”). An explanation of these measures is also included below under the heading “Explanation of Non-GAAP Financial Measures.”

While management believes that these non-GAAP financial measures provide useful supplemental information to investors regarding the underlying performance of our business operations, investors are reminded to consider these non-GAAP measures in addition to, and not as a substitute for, financial performance measures prepared in accordance with GAAP. In addition, it should be noted that these non-GAAP financial measures may be different from non-GAAP measures used by other companies, and management may utilize other measures to illustrate performance in the future. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP.

Please note that these figures may not sum exactly due to rounding.

Non-GAAP Adjusted Gross Margin

Set forth below is a presentation of the Company’s “Non-GAAP Adjusted Gross Profit” and “Non-GAAP Adjusted Gross Margin,” which represents Non-GAAP Adjusted Gross Profit as a percentage of total revenue.

| (unaudited, in thousands) | Three Months Ended | Twelve Months Ended | |||||||||||||

| December 31, | December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||||

| Total revenue | $ | 171,579 | $ | 116,304 | $ | 595,003 | $ | 422,271 | |||||||

| Direct operating expense | 62,852 | 45,208 | 238,672 | 166,886 | |||||||||||

| Total revenue less direct operating expense | 108,727 | 71,096 | 356,331 | 255,385 | |||||||||||

| Add: Stock-based compensation allocated to direct operating expense | 2,160 | 1,547 | 7,778 | 5,619 | |||||||||||

| Add: Amortization of purchased intangible assets allocated to direct operating expense | 2,777 | 1,100 | 10,617 | 3,359 | |||||||||||

| Non-GAAP Adjusted Gross Profit | $ | 113,664 | $ | 73,743 | $ | 374,726 | $ | 264,363 | |||||||

| Non-GAAP Adjusted Gross Margin | 66.2 | % | 63.4 | % | 63.0 | % | 62.6 | % | |||||||

19

Non-GAAP Adjusted EBITDA

Set forth below is a reconciliation of our “Non-GAAP Adjusted EBITDA” and “Non-GAAP Adjusted EBITDA Margin,” which represents Non-GAAP Adjusted EBITDA as a percentage of total revenue.

| (unaudited, in thousands) | Three Months Ended | Twelve Months Ended | |||||||||||||

| December 31, | December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||||

| Total Revenue | $ | 171,579 | $ | 116,304 | $ | 595,003 | $ | 422,271 | |||||||

| GAAP net income | 13,145 | 5,940 | 2,594 | 18,732 | |||||||||||

| Add: Provision for (benefit) from income taxes | 4,927 | 5,701 | (363 | ) | 16,146 | ||||||||||

| Add: Total other expense (income) | 1,183 | (17 | ) | 3,622 | (251 | ) | |||||||||

| Add: Stock-based compensation expense | 8,924 | 6,718 | 42,648 | 27,236 | |||||||||||

| Add: Depreciation and amortization | 12,864 | 7,677 | 43,575 | 25,641 | |||||||||||

| Add: Amortization of purchased intangible assets | 5,196 | 1,100 | 17,878 | 3,359 | |||||||||||

| Add: Integration and transaction costs | 397 | — | 6,865 | — | |||||||||||

| Add: Non-tax deductible transaction costs | — | — | 2,159 | — | |||||||||||

| Less: Gain on early termination of lease | — | — | (2,468 | ) | — | ||||||||||

| Non-GAAP Adjusted EBITDA | $ | 46,636 | $ | 27,119 | $ | 116,510 | $ | 90,863 | |||||||

| Non-GAAP Adjusted EBITDA Margin | 27.2 | % | 23.3 | % | 19.6 | % | 21.5 | % | |||||||

Non-GAAP Adjusted Operating Income

Set forth below is a reconciliation of our “Non-GAAP Adjusted Operating Income” and “Non-GAAP Adjusted Operating Income Margin,” which represents Non-GAAP Adjusted Operating Income as a percentage of total revenue.

| (unaudited, in thousands) | Three Months Ended | Twelve Months Ended | |||||||||||||

| December 31, | December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||||

| Total revenue | $ | 171,579 | $ | 116,304 | $ | 595,003 | $ | 422,271 | |||||||

| GAAP net income | 13,145 | 5,940 | 2,594 | 18,732 | |||||||||||

| Add: Provision for (benefit) from income taxes | 4,927 | 5,701 | (363 | ) | 16,146 | ||||||||||

| Add: Total other expense (income) | 1,183 | (17 | ) | 3,622 | (251 | ) | |||||||||

| Add: Stock-based compensation expense | 8,924 | 6,718 | 42,648 | 27,236 | |||||||||||

| Add: Amortization of capitalized stock-based compensation related to software development | 347 | 257 | 1,027 | 257 | |||||||||||

| Add: Amortization of purchased intangible assets | 5,196 | 1,100 | 17,878 | 3,359 | |||||||||||

| Add: Integration and transaction costs | 397 | — | 6,865 | — | |||||||||||

| Add: Non-tax deductible transaction costs | — | — | 2,159 | — | |||||||||||

| Less: Gain on early termination of lease | — | — | (2,468 | ) | — | ||||||||||

| Non-GAAP Adjusted Operating Income | $ | 34,119 | $ | 19,699 | $ | 73,962 | $ | 65,479 | |||||||

| Non-GAAP Adjusted Operating Income Margin | 19.9 | % | 16.9 | % | 12.4 | % | 15.5 | % | |||||||

20

Non-GAAP Adjusted Net Income

Set forth below is a reconciliation of our “Non-GAAP Adjusted Net Income” and “Non-GAAP Adjusted Net Income per Diluted Share.”

| (unaudited, in thousands) | Three Months Ended | Twelve Months Ended | |||||||||||||

| December 31, | December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||||

| GAAP net income | $ | 13,145 | $ | 5,940 | $ | 2,594 | $ | 18,732 | |||||||

| Add: Stock-based compensation expense | 8,924 | 6,718 | 42,648 | 27,236 | |||||||||||

| Add: Amortization of capitalized stock-based compensation related to software development | 347 | 257 | 1,027 | 257 | |||||||||||

| Add: Amortization of purchased intangible assets | 5,196 | 1,100 | 17,878 | 3,359 | |||||||||||

| Add: Integration and transaction costs | 397 | — | 6,865 | — | |||||||||||

| Less: Gain on early termination of lease | — | — | (2,468 | ) | — | ||||||||||

| Sub-total of tax deductible items | 14,864 | 8,075 | 65,950 | 30,852 | |||||||||||

| Less: Tax impact of tax deductible items (1) | (5,946 | ) | (3,230 | ) | (26,380 | ) | (12,341 | ) | |||||||

| Add: Non-tax deductible transaction costs | — | — | 2,159 | — | |||||||||||

| Non-GAAP Adjusted Net Income | $ | 22,063 | $ | 10,785 | $ | 44,323 | $ | 37,243 | |||||||

| Weighted average shares - diluted | 38,645 | 37,420 | 38,257 | 37,133 | |||||||||||

| Non-GAAP Adjusted Net Income per Diluted Share | $ | 0.57 | $ | 0.29 | $ | 1.16 | $ | 1.00 | |||||||

| (1) | Tax impact calculated using a statutory tax rate of 40%. |

| (unaudited, in thousands) | Three Months Ended | Twelve Months Ended | |||||||||||||

| December 31, | December 31, | ||||||||||||||

| 2013 | 2012 | 2013 | 2012 | ||||||||||||

| GAAP net income per share - diluted | $ | 0.34 | $ | 0.16 | $ | 0.07 | $ | 0.50 | |||||||

| Add: Stock-based compensation expense | 0.23 | 0.18 | 1.11 | 0.73 | |||||||||||

| Add: Amortization of capitalized stock-based compensation related to software development | 0.01 | 0.01 | 0.03 | 0.01 | |||||||||||

| Add: Amortization of purchased intangible assets | 0.13 | 0.03 | 0.47 | 0.09 | |||||||||||

| Add: Integration and transaction costs | 0.01 | — | 0.18 | — | |||||||||||

| Less: Gain on early termination of lease | — | — | (0.06 | ) | — | ||||||||||

| Sub-total of tax deductible items | 0.38 | 0.22 | 1.72 | 0.83 | |||||||||||

| Less: Tax impact of tax deductible items (1) | (0.15 | ) | (0.09 | ) | (0.69 | ) | (0.33 | ) | |||||||

| Add: Non-tax deductible transaction costs | — | — | 0.06 | — | |||||||||||

| Non-GAAP Adjusted Net Income per Diluted Share | $ | 0.57 | $ | 0.29 | $ | 1.16 | $ | 1.00 | |||||||

| Weighted average shares - diluted | 38,645 | 37,420 | 38,257 | 37,133 | |||||||||||

| (1) | Tax impact calculated using a statutory tax rate of 40%. |

21

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with accounting principles generally accepted in the United States of America, or GAAP. However, management believes that, in order to properly understand our short-term and long-term financial and operational trends, investors may wish to consider the impact of certain non-cash or non-recurring items, when used as a supplement to financial performance measures in accordance with GAAP. These items result from facts and circumstances that vary in frequency and impact on continuing operations. Management also uses results of operations before such items to evaluate the operating performance of athenahealth and compare it against past periods, make operating decisions, and serve as a basis for strategic planning. These non-GAAP financial measures provide management with additional means to understand and evaluate the operating results and trends in our ongoing business by eliminating certain non-cash expenses and other items that management believes might otherwise make comparisons of our ongoing business with prior periods more difficult, obscure trends in ongoing operations, or reduce management’s ability to make useful forecasts. Management believes that these non-GAAP financial measures provide additional means of evaluating period-over-period operating performance. In addition, management understands that some investors and financial analysts find this information helpful in analyzing our financial and operational performance and comparing this performance to our peers and competitors.

Management defines “Non-GAAP Adjusted Gross Profit” as total revenue, less direct operating expense, plus (1) stock-based compensation expense allocated to direct operating expense and (2) amortization of purchased intangible assets allocated to direct operating expense, and “Non-GAAP Adjusted Gross Margin” as Non-GAAP Adjusted Gross Profit as a percentage of total revenue. Management considers these non-GAAP financial measures to be important indicators of our operational strength and performance of our business and a good measure of our historical operating trends. Moreover, management believes that these measures enable investors and financial analysts to closely monitor and understand changes in our ability to generate income from ongoing business operations.

Management defines “Non-GAAP Adjusted EBITDA” as the sum of GAAP net income before provision for (benefit) from income taxes, total other (income) expense, stock-based compensation expense, depreciation and amortization, amortization of purchased intangible assets, integration costs, transaction costs, and gain on early termination of lease and “Non-GAAP Adjusted EBITDA Margin” as Non-GAAP Adjusted EBITDA as a percentage of total revenue. Management defines “Non-GAAP Adjusted Operating Income” as the sum of GAAP net income before provision for (benefit) from income taxes, total other (income) expense, stock-based compensation expense, amortization of capitalized stock-based compensation related to software development, amortization of purchased intangible assets, integration costs, transaction costs, and gain on early termination of lease and “Non-GAAP Adjusted Operating Income Margin” as Non-GAAP Adjusted Operating Income as a percentage of total revenue. Management defines “Non-GAAP Adjusted Net Income” as the sum of GAAP net income before stock-based compensation expense, amortization of capitalized stock-based compensation related to software development, amortization of purchased intangible assets, integration costs, transaction costs, gain on early termination of lease and any tax impact related to these items, and “Non-GAAP Adjusted Net Income per Diluted Share” as Non-GAAP Adjusted Net Income divided by weighted average diluted shares outstanding. Management considers all of these non-GAAP financial measures to be important indicators of our operational strength and performance of our business and a good measure of our historical operating trends, in particular the extent to which ongoing operations impact our overall financial performance.

Management excludes each of the items identified below from the applicable non-GAAP financial measure referenced above for the reasons set forth with respect to that excluded item:

22

• | Stock-based compensation expense and amortization of capitalized stock-based compensation related to software development — excluded because these are non-cash expenditures that management does not consider part of ongoing operating results when assessing the performance of our business, and also because the total amount of the expenditure is partially outside of our control because it is based on factors such as stock price, volatility, and interest rates, which may be unrelated to our performance during the period in which the expenses are incurred. |

• | Amortization of purchased intangible assets — purchased intangible assets are amortized over their estimated useful lives and generally cannot be changed or influenced by management after the acquisition. Accordingly, this item is not considered by management in making operating decisions. Management does not believe such charges accurately reflect the performance of our ongoing operations for the period in which such charges are incurred. |

• | Integration costs — integration costs are the severance and retention bonuses for certain employees relating to the Epocrates acquisition. Accordingly, management believes that such expenses do not have a direct correlation to future business operations, and therefore, these costs are not considered by management in making operating decisions. Management does not believe such charges accurately reflect the performance of our ongoing operations for the period in which such charges are incurred. |

• | Transaction costs — transaction costs are non-recurring costs related to specific transactions. Accordingly, management believes that such expenses do not have a direct correlation to future business operations, and therefore, these costs are not considered by management in making operating decisions. Management does not believe such charges accurately reflect the performance of our ongoing operations for the period in which such charges are incurred. |

• | Gain on early termination of lease — gain on early termination of lease is a non-recurring gain related to the early termination of the Arsenal on the Charles lease. Accordingly, management believes that this gain does not have a direct correlation to future business operations, and therefore, this gain is not considered by management in making operating decisions. Management does not believe such gain accurately reflects the performance of our ongoing operations for the period in which such gain is recorded. |

23

Supplemental Metrics and Definitions

| Fiscal Year 2012 | Fiscal Year 2013 | ||||||||||||||||||

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | ||||||||||||

| Client Base | |||||||||||||||||||

| Total Physicians on athenaCollector | 24,101 | 25,001 | 27,013 | 28,011 | 28,850 | 31,049 | 33,764 | 35,858 | |||||||||||

| Total Providers on athenaCollector | 33,923 | 35,409 | 38,145 | 39,752 | 40,937 | 43,858 | 47,195 | 50,212 | |||||||||||

| Total Physicians on athenaClinicals | 5,331 | 6,151 | 7,340 | 7,949 | 8,776 | 10,058 | 11,401 | 12,388 | |||||||||||

| Total Providers on athenaClinicals | 7,402 | 8,558 | 10,062 | 10,926 | 12,139 | 13,818 | 15,483 | 16,805 | |||||||||||

| Total Physicians on athenaCommunicator | 4,820 | 6,306 | 8,739 | 10,153 | 11,840 | 13,831 | 17,330 | 21,516 | |||||||||||

| Total Providers on athenaCommunicator | 6,800 | 8,642 | 12,149 | 14,065 | 16,296 | 18,762 | 23,024 | 28,360 | |||||||||||

| Client Performance | |||||||||||||||||||

| Client Satisfaction | 86.3 | % | 89.8 | % | 87.2 | % | 87.2 | % | 88.2 | % | 88 | % | 88 | % | 87.7 | % | |||

| Client Days in Accounts Receivable (“DAR”) | 40.0 | 38.2 | 37.6 | 36.4 | 37.6 | 37.0 | 38.4 | 38 | |||||||||||

| First Pass Resolution (“FPR”) Rate | 91.3 | % | 92.9 | % | 93.7 | % | 94.2 | % | 93.9 | % | 94.2 | % | 94.1 | % | 93.9 | % | |||

| Electronic Remittance Advice (“ERA”) Rate | 78 | % | 77.7 | % | 79.8 | % | 81.7 | % | 81.8 | % | 82.8 | % | 82 | % | 83.3 | % | |||

| Total Claims Submitted | 17,839,150 | 17,467,447 | 17,706,432 | 20,055,715 | 20,732,485 | 21,691,357 | 22,903,118 | 25,435,690 | |||||||||||

| Total Client Collections ($) | 2,081,686,428 | 2,259,202,690 | 2,302,527,259 | 2,540,153,162 | 2,566,960,419 | 2,836,765,406 | 2,974,736,918 | 3,285,027,602 | |||||||||||

| Total Working Days | 62 | 64 | 63 | 62 | 61 | 64 | 64 | 62 | |||||||||||

| Employees | |||||||||||||||||||

| Direct | 1,080 | 1,192 | 1,282 | 1,363 | 1,426 | 1,438 | 1,460 | 1,533 | |||||||||||

| Sales & Marketing | 295 | 315 | 341 | 353 | 426 | 455 | 464 | 473 | |||||||||||

| Research & Development | 292 | 357 | 375 | 402 | 526 | 587 | 651 | 677 | |||||||||||

| General & Administrative | 187 | 196 | 205 | 222 | 275 | 278 | 290 | 284 | |||||||||||

| Total Employees | 1,853 | 2,060 | 2,202 | 2,339 | 2,652 | 2,758 | 2,865 | 2,966 | |||||||||||

| Quota Carrying Sales Force | |||||||||||||||||||

| Total Quota Carrying Sales Representatives | 105 | 109 | 112 | 114 | 114 | 119 | 120 | 126 | |||||||||||

| Supplemental Metrics Definitions | |

| Client Base | |

| Total Physicians on athenaCollector | The number of physicians that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. Examples of physicians include Medical Doctors (“MD”) and Doctors of Osteopathic Medicine (“DO”). |

| Total Providers on athenaCollector | The number of providers, including physicians, that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. Examples of non-physician providers are Nurse Practitioners (“NP”) and Registered Nurses (“RN”). |

| Total Physicians on athenaClinicals | The number of physicians that have rendered a service through the athenaClinicals platform which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. |

| Total Providers on athenaClinicals | The number of providers, including physicians, that have rendered a service through the athenaClinicals platform which generated a medical claim that was billed during the last 91 days on the athenaCollector platform. |

| Total Physicians on athenaCommunicator | The number of physicians that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform and whose practice is actively using athenaCommunicator. |

| Total Providers on athenaCommunicator | The number of providers, including physicians, that have rendered a service which generated a medical claim that was billed during the last 91 days on the athenaCollector platform and whose practice is actively using athenaCommunicator. |

| Client Performance | |

| Client Satisfaction | The percentage of athenaCollector clients who chose 4 or 5 on a scale of 1 to 5 when asked if they would recommend athenahealth to a trusted friend or colleague. These responses are generated from a “client listening” survey that the company conducts for its client base twice per year. |

| Client Days in Accounts Receivable (“DAR”) | The average number of days that it takes outstanding balances on claims to be resolved, e.g. paid, for clients on athenaCollector. Clients that have been live less than 90 days are excluded, as well as clients who are terminating services. |

| First Pass Resolution (“FPR”) Rate | Approximates the percentage of primary claims that are favorably adjudicated and closed after a single submission during the period. Currently, the FPR rate is calculated on a monthly basis, and certain practices are excluded (e.g. those that have been live for less than 90 days). |

| Electronic Remittance Advice (“ERA”) Rate | Remittance refers to the information about payments (a/k/a explanations of benefits) received from insurance companies during the period. The ERA rate reflects the percentage of total charges that were posted using electronic remittance. |

| Total Claims Submitted | The number of claims billed through athenaNet during the period. |

| Total Client Collections | The dollar value of collections posted on behalf of clients during the period. |

| Total Working Days | The total number of days during the quarter minus weekends and U.S. Post Office holidays. |

| Employees | |

| Direct | The total number of full time equivalent individuals (“FTEs”) employed by the Company to support its service operations as of quarter end. This team includes production systems, enrollment services, paper claim submission, claim resolution, clinical operations, professional services, account management, and client services. |

| Sales & Marketing | The total number of FTEs employed by the Company to support its sales and marketing efforts as of quarter end. This team includes sales representatives, business development staff and the marketing team. |

| Research & Development | The total number of FTEs employed by the Company to support its research and development efforts as of quarter end. This team includes product development and product management. |