EXHIBIT 99.1

ZION OIL & GAS PRESENTS UPDATED JOSEPH PROJECT SUMMARY

Caesarea, Israel - October 8, 2007.Today, Zion Oil & Gas, Inc. (Amex:ZN) of Dallas, Texas and Caesarea, Israel, released a summary of the current status of its oil and gas exploration related activities in Israel. The summary, which presents developments that have transpired during the past several months, is set out below and will be posted on Zion"s website,www.zionoil.com.The Company intends to update the summary from time to time to reflect new developments as they occur. Zion has named its project to explore for oil and gas in Israel, the "Joseph Project".

JOSEPH PROJECT SUMMARY

(as of October 8, 2007)

LICENSES

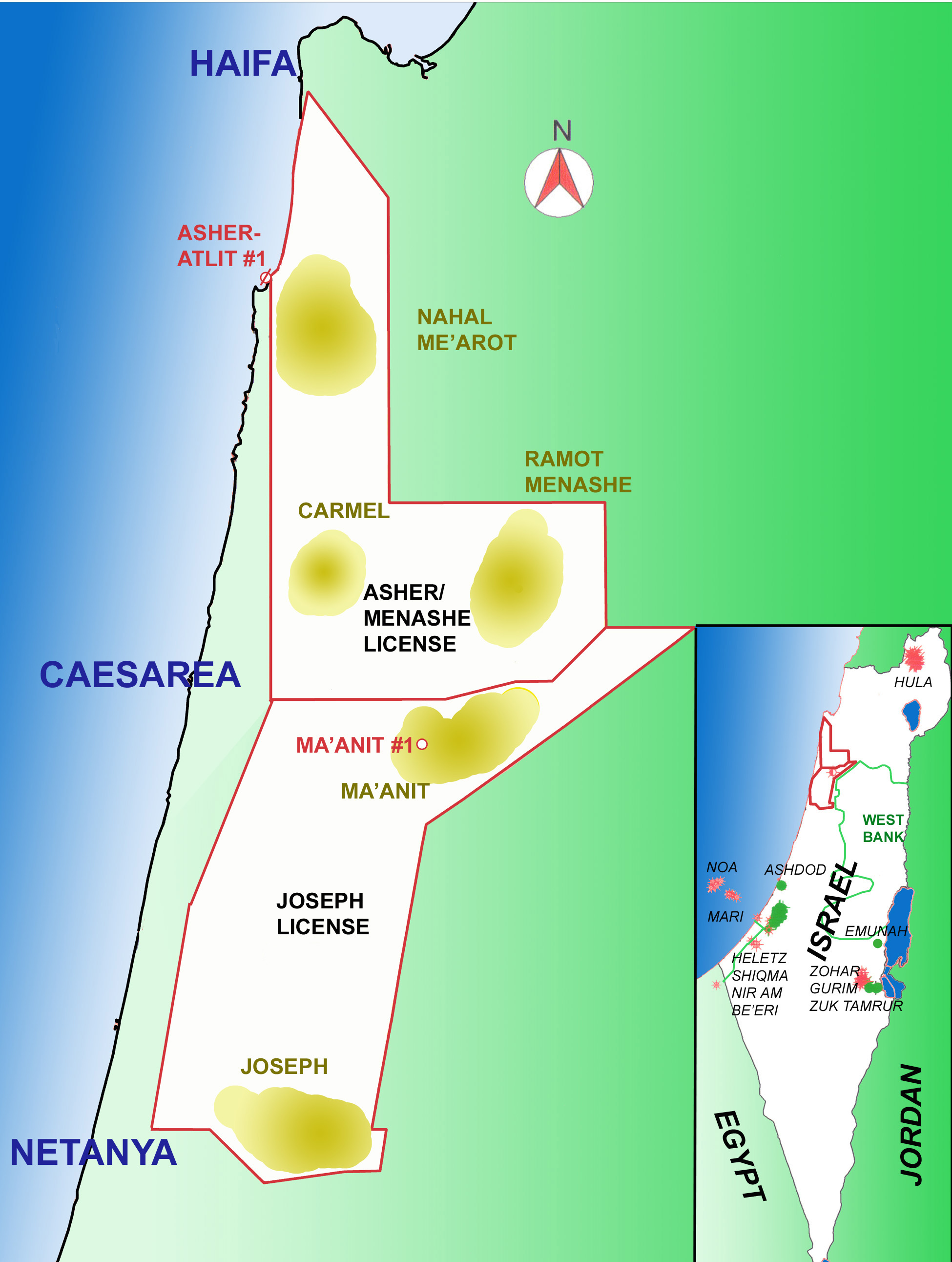

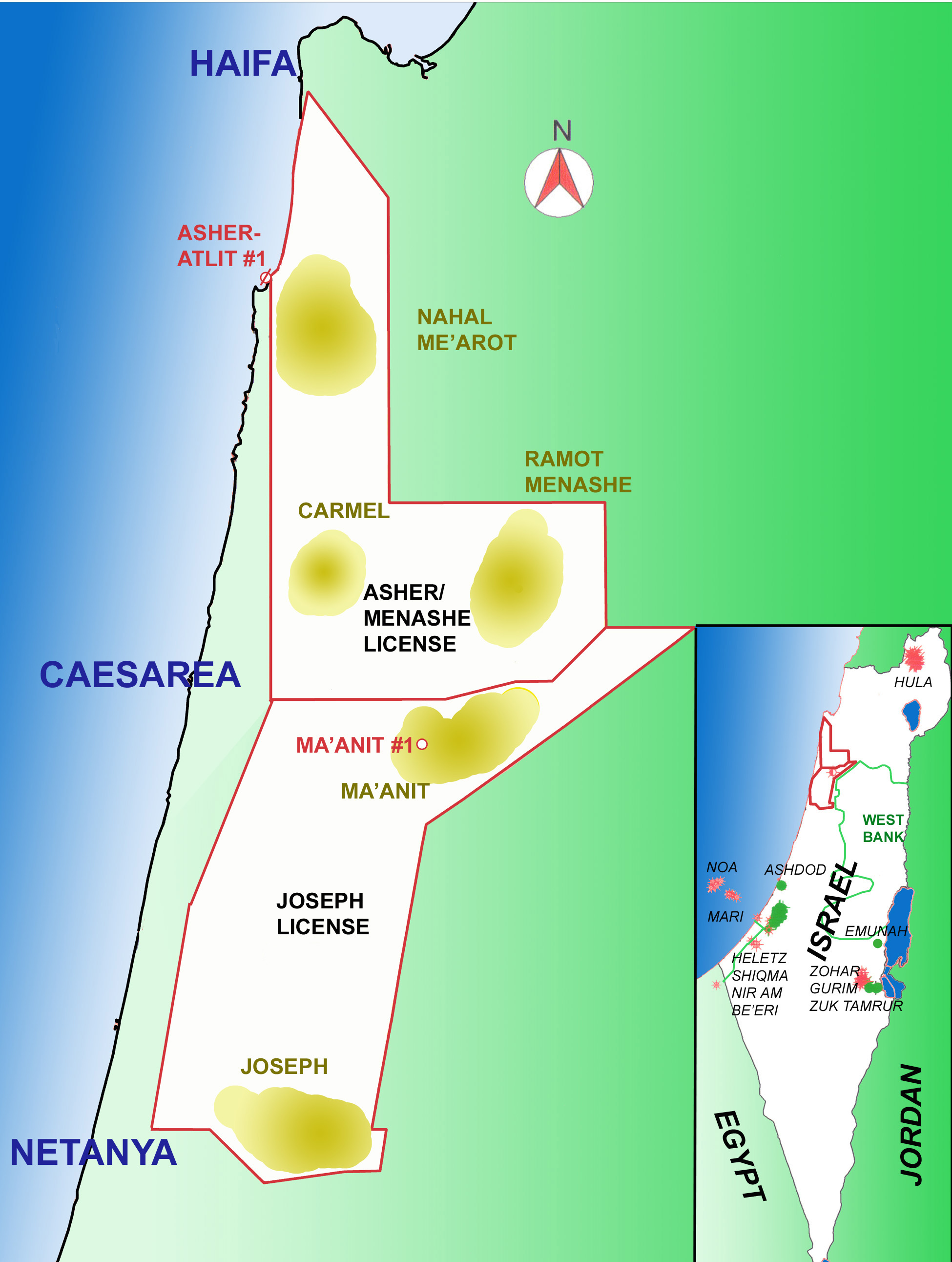

- Zion currently holds one 79,000 acre Petroleum Exploration License (the Asher-Menashe License) along the Israeli coastal plain and on the Mt. Carmel range, between Caesarea and Haifa. The License began on June 10th, 2007 and is for a three-year term, extendable to a maximum of seven years. Zion currently holds a 100% Working Interest and an 87.5% Net Revenue Interest in the License.(1) By the terms of the license, Zion must commence the drilling of a well by July 2009.

- Zion has been informed that the Israeli Petroleum Commission has recommended that the Petroleum Commissioner grant the company"s application for a second 83,000 acre Petroleum Exploration License (the Joseph License) located along the Israel coastal plain between Netanya on the south to the southern border of the Asher-Menashe License. Upon its grant, expected in mid-October, the Joseph License will cover much of the land that Zion previously held under the Ma"anit-Joseph License, which was relinquished on June 22, 2007 with the expiration of its seven-year term. Zion anticipates that the Joseph License will have an initial term of three years, extendable to a maximum of seven years. Zion"s Working and Net Revenue Interests in the Joseph License will be the same as its interests in the Asher-Menashe License. Under the Joseph License, it is expected that Zion will have to commence drilling a well by July 2009.

- In the event of a discovery, Zion will be entitled to convert the relevant portions of its licenses to 30-year production leases, extendable to 50 years.

[1] After payout the 87.5% NRI will be reduced by 6% for the two charitable trusts and 1.5% for an employee incentive pool. The resulting NRI will be 80.0%

GEOLOGY

- In order to understand and interpret the geology of the license areas, Zion"s staff of three geologists is using an Israeli country-wide seismic database together with SMT Kingdom software. The database consists of 219 seismic sections totaling 3,100 kilometers of coverage and also includes the stratigraphic sections from all of the wells drilled in Israel.

- Currently, Zion is developing four leads and one prospect in its license areas. Three of the leads are located in the Asher-Menashe License area and one lead and the prospect are in the Joseph License area. In the 4th quarter of 2007, the company anticipates acquiring an additional 60 kilometers of seismic in the Asher-Menashe License with the intent of upgrading two of the three leads into firm prospects.

- From studies conducted by Zion, the five areas under investigation, shown in the map below, appear to have a total potentially productive acreage in excess of 20,000 acres.

- The prospective geological horizons in the areas are in the Middle to Lower Triassic and the Upper Permian Section of the Paleozoic, during which geological periods all of the prospective areas were situated in what is believed to have been a high energy depositional environment.

- Based on its analysis, Zion believes that there are prospective hydrocarbon bearing intervals at depths between 12,500 feet and 18,000 feet and that, if successful, the primary hydrocarbons will be natural gas and condensate, with the possibility of oil.

DRILLING

- In 2005, Zion drilled the Ma"anit #1 well on the Ma"anit structure in the Joseph License area. Drilling breaks and shows of hydrocarbons were recorded from 12,000 to the total depth of 15,500 feet. Due to mechanical problems that prevented the company from isolating highly conductive water bearing zones from the tighter hydrocarbon bearing formations, the shows were never successfully tested and the well was abandoned in June 2007.

- The Ma"anit structure encompasses 7,400 acres and, compared to any other well in Northern Israel, the top of Triassic is over 1,600 feet higher, i.e. closer to the surface.

- Zion"s current plans are to re-enter the well and then "sidetrack" and drill directionally to a distance approximately 2,500 feet northeast of the present location by the time the well reaches its projected true vertical depth of 18,040 feet in the Permian section of the Paleozoic Age. The purpose of the well is both to appraise the apparent findings of the Ma"anit #1 in the Triassic and to test the deeper Permian horizons. The bottom hole location for the second well on the Ma"anit structure has been chosen in an attempt to maximize the chance of being in localized fracturing in the Permian section. This will be important for successful completion of the well at such an extreme depth.

- Based on the results of the Ma"anit #1 well, the primary product of the planned second well, the Ma"anit-Rehoboth #2, is expected to be natural gas plus condensate. However, oil was seen on the pits while drilling the Ma"anit #1 well and some oil zones are possible.

- Preparations for drilling the Ma"anit-Rehoboth #2 well are continuing. However, the timing of the commencement of drilling the well is uncertain. This is because there is currently no drilling rig in Israel capable of drilling to either the Triassic or the Permian. Zion intends to import an appropriate drilling rig into Israel. In order to justify the importation costs, Zion, together with other on-shore operators, is considering a multi-well drilling program in which Zion may commit to the drilling of both the Ma"anit-Rehoboth well and possibly the first well on the Asher-Menashe License. This program would require Zion to raise additional financing and/or sell a portion of Zion"s rights in all or part of the Joseph Project. Please note there can be no certainty that Zion will be successful in raising the required additional funds.

- Due to the depth and slow bit penetration rates, dry hole drilling costs per well are estimated to be between $7 million and $9.5 million. Completed well costs are estimated to be between $9 million and $11 million.

MARKETS

- The natural gas market is developing in Israel following the offshore discovery of the Mari-B field in 2000, the construction of several natural gas-fired generating stations by the national electric company and the planned construction of several gas-fired IPPs and inside-the-fence plants by a number of large industrial users. The Israeli government is encouraging the power and industrial sectors to convert to natural gas and, jointly with the private sector, has completed most of the offshore underwater natural gas pipeline infrastructure intended to connect the newly discovered offshore gas fields to the markets in Israel; construction of the first phases of the onshore pipeline system has also been completed. It is believed that the electrical generating sector, together with the industrial, commercial, and future residential sectors when developed, should be able to absorb any gas discovery within a reasonable period. As the system is being developed we are seeing an upwa rd trend in the gas price now in the range of $3,500 to $4,500 per billion BTU. Tenders are currently being issued by the Israeli government for the establishment of LDCs (Local Distribution Companies) in several regions of the country and the Israeli government has announced its strategic need to find additional suppliers of natural gas for the anticipated significant expansion of the market.

- In the Ma"anit area, a market for approximately 2,500 mcfpd currently exists within 1,000 feet of the Ma"anit #1 wellsite. In conversation, representatives of the Israel Natural Gas Authority stated that a high-pressure transportation line from offshore line"s existing landfall at Hadera to Ma"anit is expected to be completed by the end of 2009. The cross-country, high-pressure gas transportation line currently in construction is expected to pass within 3,000 feet of the well sometime between 2011 and 2013. Entry into either of those pipelines would open the entire country to gas marketing from Zion"s license areas.

- Because Israel imports all of its crude oil needs and the markets for crude oil in Israel are the two oil refineries, no special marketing strategy need be adopted with regard to any oil that Zion may discover. Zion believes that it will have a ready local market for its oil at market prices, and will have the option of exporting to the international market.

FORWARD LOOKING STATEMENTS: Statements in this press release and the Joseph Project Summary that are not historical fact, including statements regarding license and lease rights and applications, exploration, development and drilling plans, future geophysical and geological data and interpretation and results of seismic surveys and data, generation of additional prospects and reserves, drilling locations, availability and costs of drilling rigs, timing and results of any wells, plans regarding and ability to raise additional capital, possible participation of operating partners, and other statements regarding future operations and results, financial results, opportunities, growth, business plans and strategies are forward-looking statements as defined in the "Safe Harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward looking statements are based on assumptions that are subject to significant known and unknown ris ks, uncertainties and other unpredictable factors, many of which are described in Zion"s periodic reports filed with the SEC and are beyond Zion"s actual control. These risks could cause Zion"s actual performance to differ materially from the results predicted by these forward-looking statements. Zion can give no assurance that the expectations reflected in these statements will prove to be correct and assumes no responsibility to update these statements.

Contact:

Ashley Chatman

Zion Oil & Gas, Inc.

6510 Abrams Rd., Suite 300

Dallas, TX 75231

214-221-4610

Email: ashley@zionoil.com