ZION OIL & GAS, INC.

6510 Abrams Rd., Suite 300

Dallas, Texas 75231

July 23, 2010

VIA EDGAR

H. Roger Schwall

Assistant Director

United States Securities and Exchange Commission

Division of Corporation Finance

Washington, D. C. 20549-4628

| | Re: | Zion Oil & Gas, Inc. |

| | | Form 10-K for Fiscal Year Ended December 31, 2009 |

| | | Filed March 16, 2010 |

| | | File No. 1-33228 |

Dear Mr. Schwall:

This letter is in response to the comment letter from the Securities and Exchange Commission (“Commission”) dated July 9, 2010 (the “Comments”), relating to the above referenced Form 10-K for the Fiscal Year Ended December 31, 2009 (the “10-K”) filed by Zion Oil & Gas, Inc. (“Zion” or the "Company") on March 16, 2010.

Zion is setting forth below the responses to the Comments received from your office.

Response to Comments

General

1. We note the prospectus supplements pursuant to Rule 424(b)(3) and Rule 424(b)(5) dated April 28, 2010. We are unable to locate unqualified legality opinions for these securities offerings covered by the Shelf registration Statement field on Form s-3, file number 333-164563, declared effective on April 16, 2010. Please file the unqualified opinions in a Form 8-K or by post effective amendment or advice. For guidance, please refer to Question 212.05 of the Securities Act Rules Compliance and Disclosure Interpretations, available on our website at http://www.sec.gov/divisions/corpfin/cfguidance.shtml.

Response

The unqualified legality opinion was filed by way of a current report on Form 8-K on July 14, 2010.

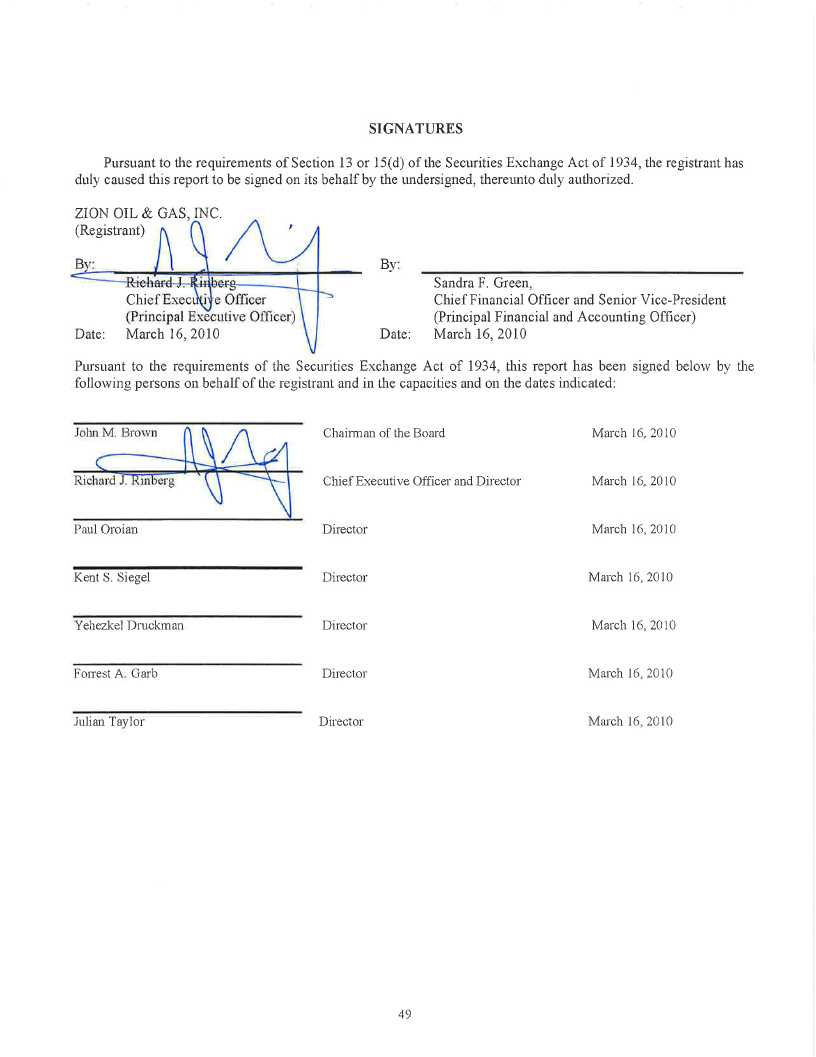

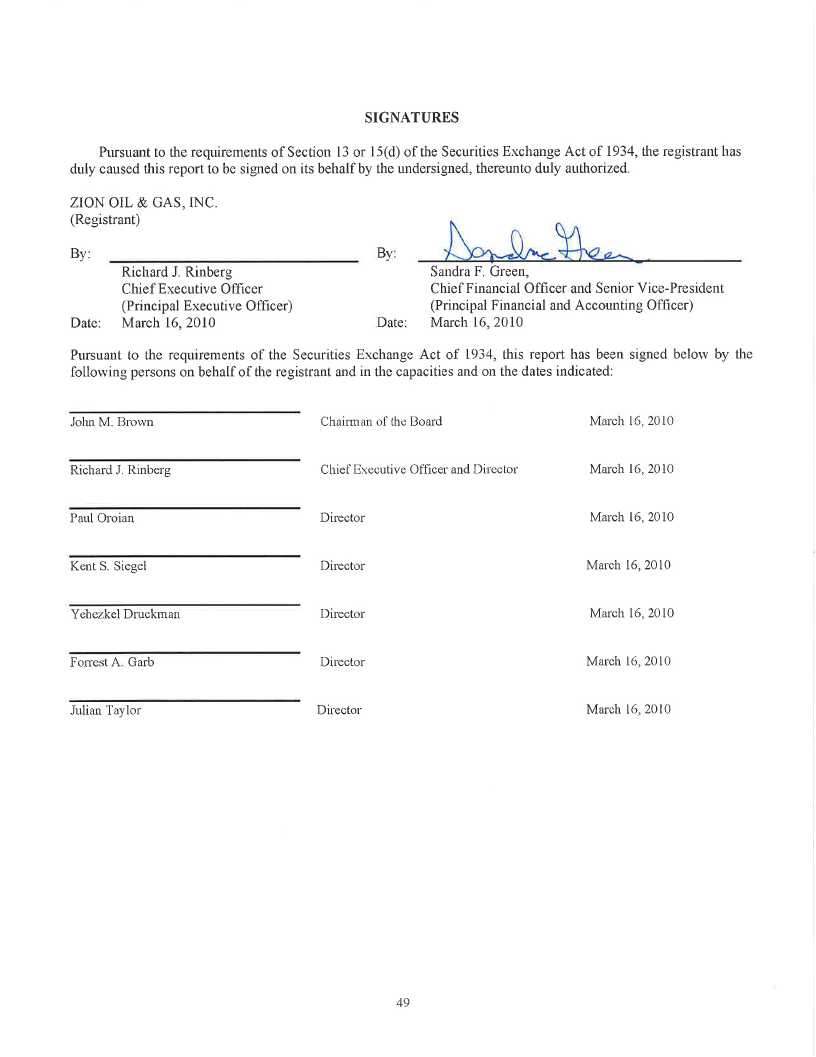

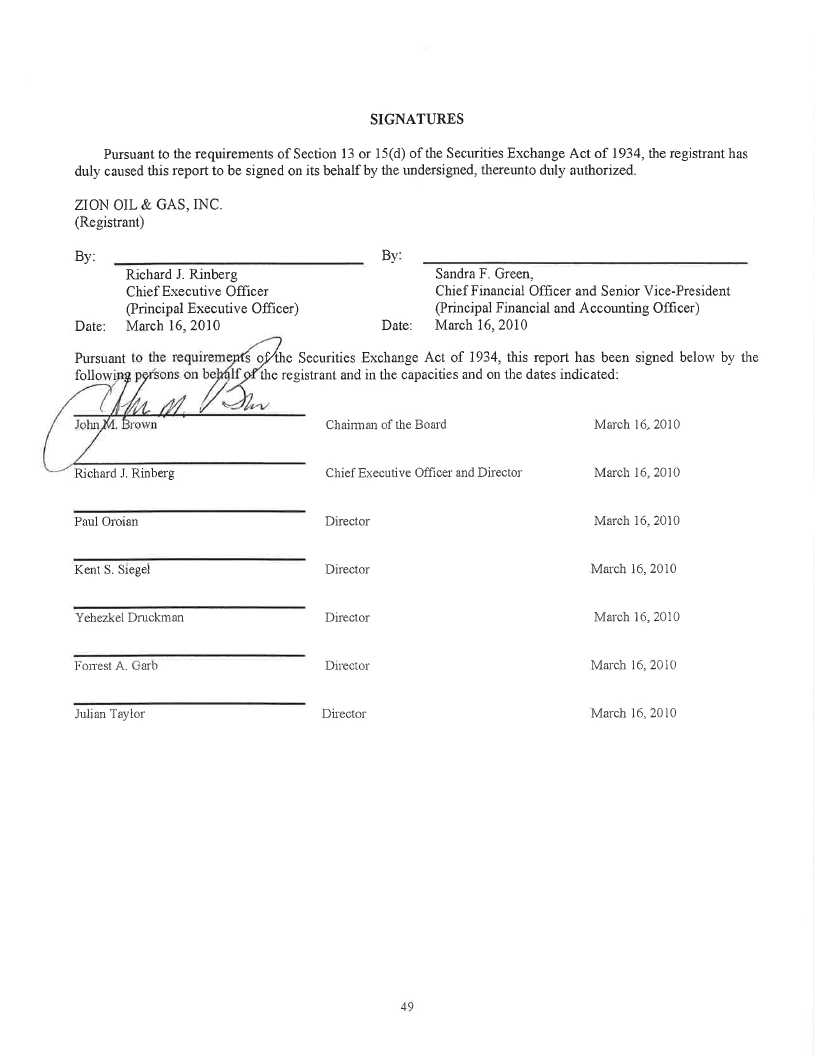

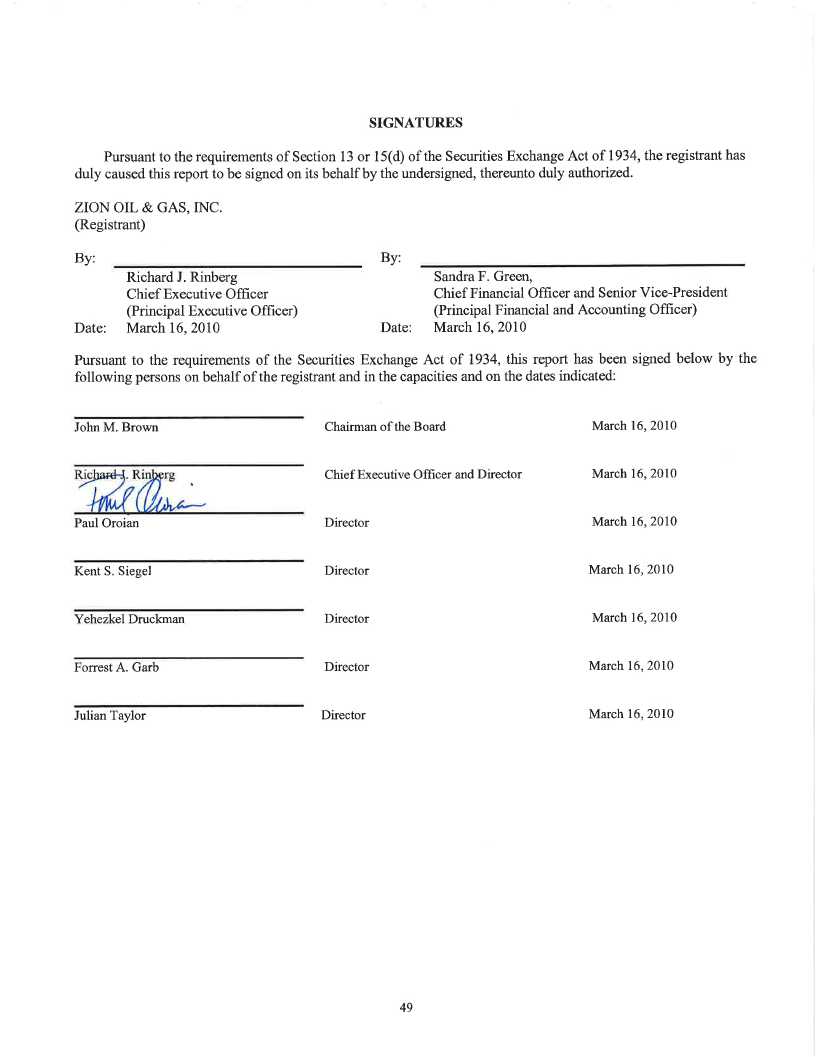

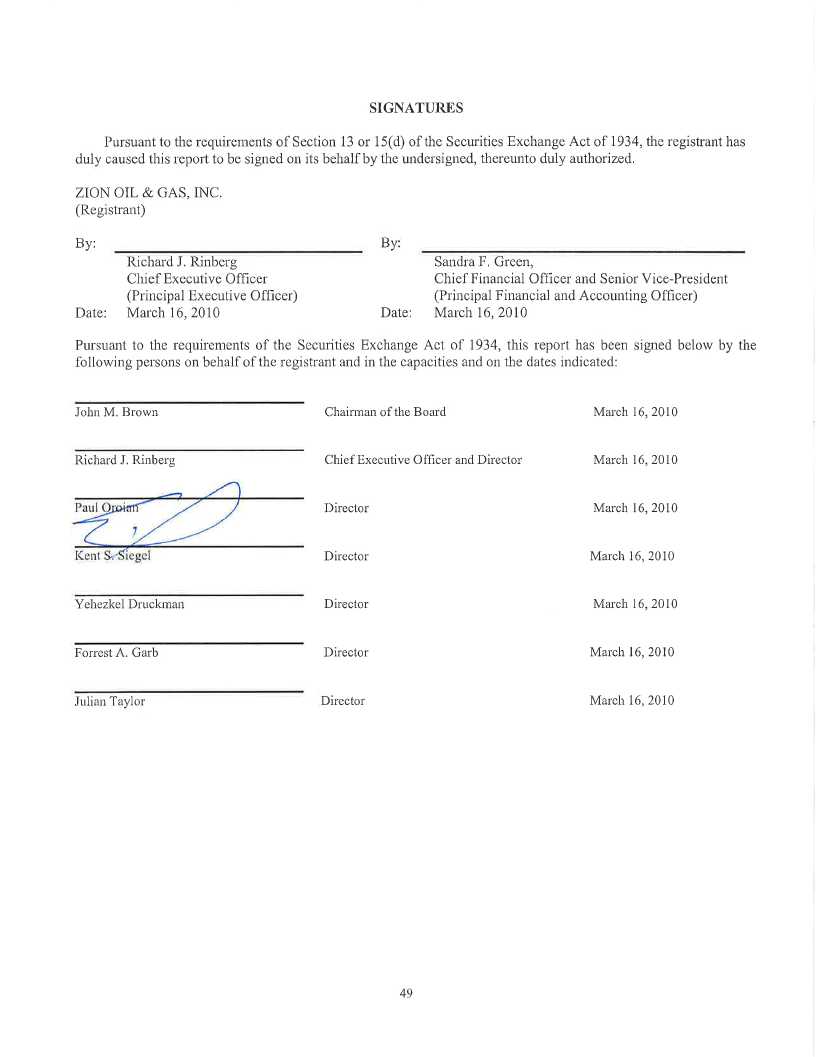

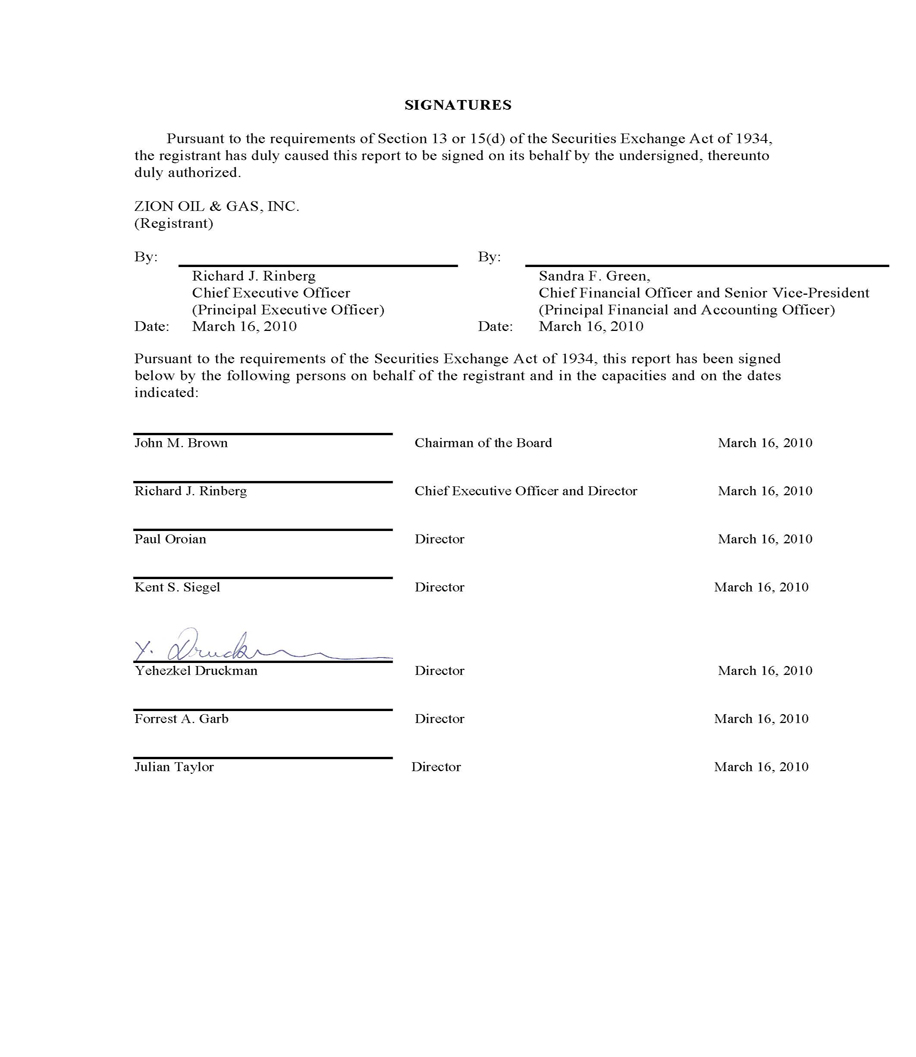

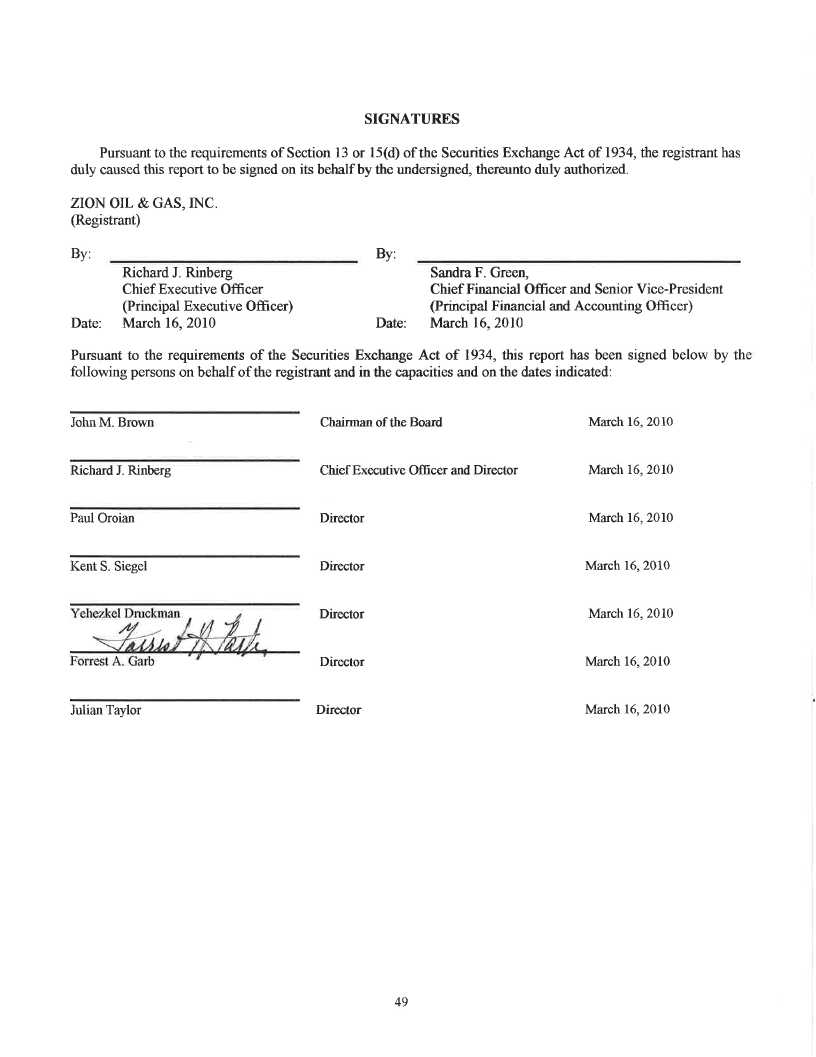

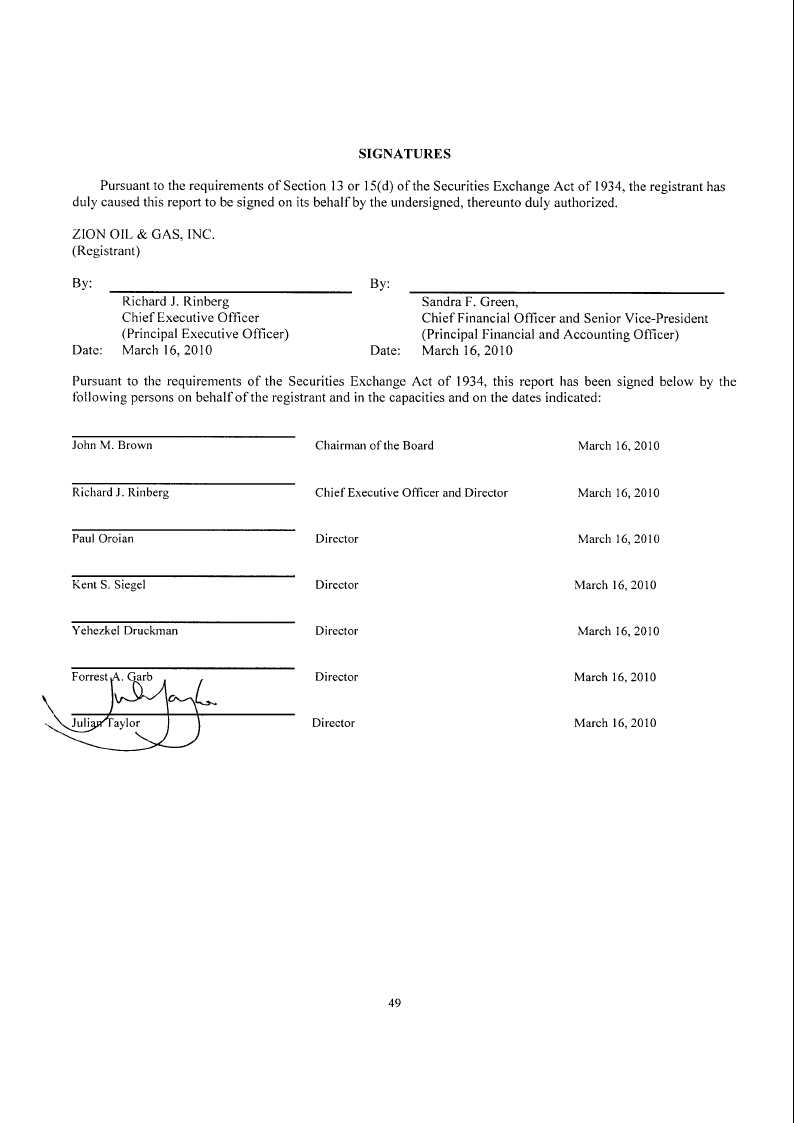

2. The signature blocks for your directors and officers are missing conformed signatures. Please provide us with a photocopy of the manually signed signature page dated March 16, 2010.

Response

The conformed signatures were inadvertently omitted. We are attaching photocopies of the manually signed signature pages.

3. In future filings, please include a signature block for Ms. Green to sign in her individual capacity as your principal financial officer and your principal accounting officer, as opposed to (or in addition to) the signature block in which she signs for the company. Refer to General Instruction D.2 to Form 10-K.

Response

In future filings, Zion will include a signature block for its principal financial and accounting officer in his/her individual capacity, as well as a signature block on behalf of the Company.

We trust that the above responds to all of your comments.

The Company hereby acknowledges that it is responsible for the adequacy and accuracy of the disclosure in the filing, that staff comments, or changes to disclosure in response to staff comments, do not foreclose the Commission from taking any action with respect to the filing and that the Company may not assert staff comments as a defense in any proceeding initiated by the Commission under the federal securities laws of the United States.

| | Sincerely, |

| | |

| | /s/ Richard J. Rinberg |

| | Richard J. Rinberg |